North America News

Wall Street Rallies for Eighth Straight Day; NASDAQ Leads

U.S. equity markets closed higher on Thursday, extending the S&P 500’s winning streak to eight sessions. Gains were broad-based, but tech-heavy NASDAQ led the charge.

Closing Levels:

- Dow Jones Industrial Average: +83.60 points (+0.21%) to 40,752.96

- S&P 500: +35.08 points (+0.63%) to 5,604.14

- NASDAQ Composite: +264.40 points (+1.52%) to 17,710.74

- Russell 2000: +11.74 points (+0.60%) to 1,975.86

Mega-cap tech drove the session higher. Meta Platforms surged 4.23% (+$23.21) to close at $572.21, while Microsoft gained a massive 7.63% (+$30.14) to finish at $425.40.

Apple Delivers Q2 Beats on Strong Product Sales, Announces $100B Buyback

Apple (AAPL) topped both earnings and revenue estimates in Q2 2025, driven by robust demand for new iPhones and iPads. The company also announced a $100 billion stock buyback and a 4% dividend hike.

Q2 2025 Results:

- Revenue: $95.36B

- Estimate: $94.59B → Beat

- YoY Growth: +5.1%

- EPS: $1.65

- Estimate: $1.63 → Beat

- YoY Growth: +8.6%

Segment Breakdown:

- iPhone: $46.84B vs. est. $46.17B (+2.3%)

- Boosted by iPhone 16e sales

- Mac: $7.95B vs. est. $7.92B (+10.4%)

- Driven by M4 MacBook Air refresh

- iPad: $6.40B vs. est. $6.07B (+8.5%)

- Helped by new iPad Air and Pro

- Wearables, Home & Accessories: $7.52B vs. est. $7.85B (−1.8%)

- Weaker global demand

- Services: $26.65B vs. est. $26.69B (+17.9%)

- Strong growth from App Store and iCloud

Geography:

- Greater China: $16.0B vs. est. $15.9B → Beat

- Modest growth despite stiff local competition

Capital Return:

- Dividend: Raised to $0.26/share

- Buyback: Authorized $100 billion in share repurchases

The quarter reflected strong execution across Apple’s hardware lines, while services continued to deliver double-digit growth. Some softness in wearables was noted, but overall, the report reassured investors about Apple’s resilience.

Amazon Beats on Q1 Revenue and EPS, But Shares Slide on Cautious Outlook

Amazon (AMZN) reported strong Q1 2025 earnings, exceeding analyst expectations on both revenue and profit. However, forward guidance disappointed, sending shares down nearly 5% in after-hours trading.

Q1 2025 Results:

- Revenue: $155.7 billion

- Estimate: $154.89 billion → Beat

- Earnings per Share (EPS): $1.59

- Estimate: $1.36 → Beat

Segment Performance:

- AWS (Cloud Services): $29.27B (+17% YoY)

- Online Stores: $57.41B (+5% YoY)

- Third-Party Seller Services: $36.51B (+5.5% YoY)

- Subscription Services: $11.72B (+9.3% YoY)

- Physical Stores: $5.53B (+6.4% YoY)

CEO Commentary:

Andy Jassy noted continued AWS acceleration and highlighted traction in generative AI products. “We’re continuing to make progress on a number of dimensions,” he said, “but perhaps none more so than the continued reacceleration in AWS growth.”

Forward Guidance (Q2 2025):

- Revenue Forecast: $159B–$164B

- Estimate: $161.62B

- Includes ~$10B FX headwind

- Operating Income: $3B–$17.5B

- Estimate: $17.82B

Despite solid current performance, investors were unsettled by softer-than-expected guidance amid macroeconomic pressures and uncertainty around global tariffs.

Strong After-Hours Earnings Across Tech, Biotech, and Platforms

Earnings reports released after the closing bell were largely positive, with several notable beats:

Motorola Solutions (MSI)

- EPS: $3.18 vs. $3.01 → Beat

- Revenue: $2.50B vs. $2.52B → Miss

Reddit (RDDT)

- EPS: $0.13 vs. $0.01 → Beat

- Revenue: $392.4M vs. $369.0M → Beat

- After-hours move: +17%

Live Nation Entertainment (LYV)

- EPS: -$0.32 vs. -$0.38 → Beat

- Operating Income: $115M vs. $75.4M est → Beat

- Revenue: $2.50B vs. $3.47B → Miss

Stryker Corp (SYK)

- EPS: $2.84 vs. $2.69 → Beat

- Revenue: $5.9B vs. $5.71B → Beat

- FY EPS Guidance: $13.20–$13.45 (in line with $13.33 est)

Airbnb (ABNB)

- EPS: $0.24 vs. $0.23 → Beat

- Revenue: $2.3B vs. $2.26B → Beat

Amgen (AMGN)

- EPS: $4.90 vs. $4.25 → Beat

- Revenue: $8.15B vs. $8.10B → Beat

Twilio (TWLO)

- Adj. EPS: $1.14 vs. $0.94 → Beat

- Revenue: $1.17B vs. $1.14B → Beat

- Adj. Operating Income: $213M

- Q2 Outlook: EPS $0.99–$1.04, Revenue $1.18B–$1.19B

- 2025 Organic Growth Target Raised: 7.5%–8.5%

Spirit AeroSystems (SPR)

- Adj. EPS: -$4.25 vs. -$1.14 → Miss

- Revenue: $1.52B vs. $1.74B → Miss

- Net Loss: $613M

- Operating Loss: $487M vs. est. $19.9M

- No guidance provided

U.S. Steel (X)

- Adj. EBITDA: $172M vs. $123.8M → Beat

- Adj. EPS: -$0.39 vs. -$0.45 → Beat

- Revenue: $3.73B vs. $3.63B → Beat

- Q2 EBITDA Outlook: $375M–$425M

Roku (ROKU)

- Revenue: $1.02B vs. $1.01B → Beat

- Gross Profit: $445M

- Acquisition: Roku to acquire streaming service provider Frndly TV

GoDaddy (GDDY)

- Revenue: $1.19B (in line)

- Net Income: $219.5M

- Bookings: $1.42B

- Free Cash Flow: $411.3M

- Q2 Revenue Outlook: $1.195B–$1.215B

- Stock Buyback: $3 billion authorized

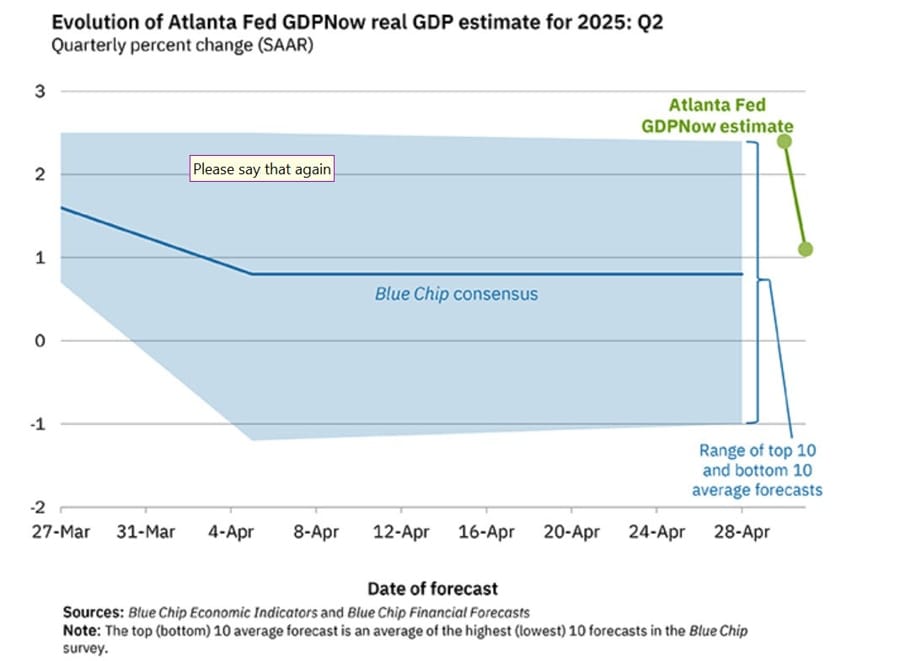

Atlanta Fed GDPNow Slashes Q2 Growth Forecast to 1.1%

After the Q1 GDP miss, the Atlanta Fed’s GDPNow model has sharply revised its Q2 growth forecast down to 1.1% from 2.4%.

Initial estimates are known to be volatile, but this significant downgrade underscores mounting concerns about weakening economic momentum heading into the summer.

In their own words:

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2025 is 1.1 percent on May 1, down from 2.4 percent on April 30. After this morning’s releases from the US Census Bureau and the Institute for Supply Management, the nowcast of second-quarter real personal consumption expenditures growth and real private fixed investment growth fell from 3.3 percent and 1.4 percent, respectively, to 1.9 percent and -0.7 percent.

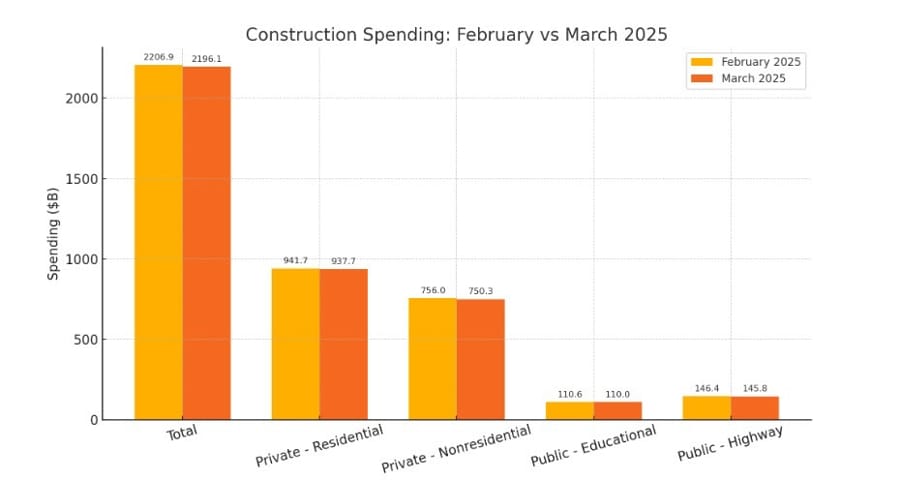

March U.S. Construction Spending Declines 0.5%, Missing Forecasts

Total construction spending in the U.S. dropped 0.5% in March, falling short of the +0.2% estimate. Spending totaled $2.196 trillion, down from $2.207 trillion in February.

Yearly trends:

- Up 2.8% from March 2024

- Year-to-date spending up 2.9% vs the same period last year

Breakdown:

- Private construction: $1.688T (down 0.6%)

- Residential: -0.4%

- Nonresidential: -0.8%

- Public construction: $508.1B (down 0.2%)

- Education projects: -0.6%

- Highway projects: -0.5%

Rising material costs, especially for steel and copper, drove a 0.5% increase in input prices for March. Ongoing tariff uncertainty added to delays and cautious investment planning.

ISM Manufacturing Data Falls to 48.7 in April, Below Expansion Line

The ISM’s U.S. manufacturing index dipped to 48.7 in April, missing the 50.0 benchmark that separates growth from contraction. Expectations had been for a lower 48.0 reading, so the print was slightly better than feared.

Details:

- Prices paid: 69.8 (vs 70.3 expected)

- Employment: 46.5 (up from 44.7)

- New orders: 47.2 (vs 45.2)

- Production: Down from 48.3

- Imports: Dropped below the 50 mark, signaling contraction

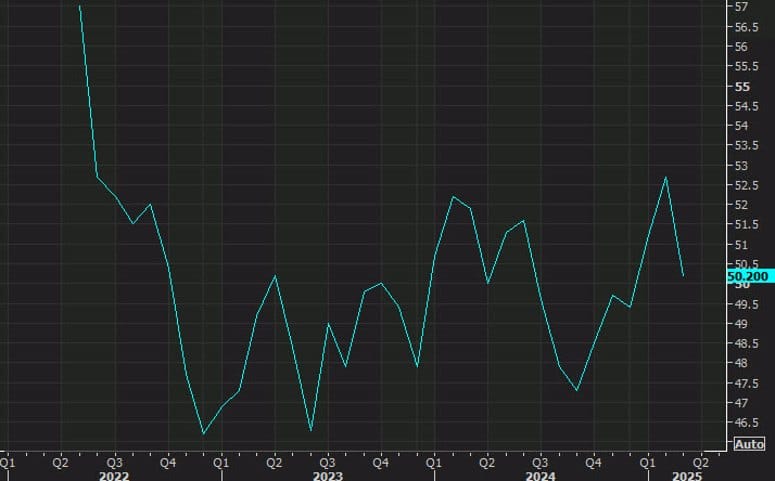

Final U.S. Manufacturing PMI Revised Down to 50.2 for April

The final April reading for the U.S. S&P Global manufacturing PMI was 50.2, down from the preliminary 50.7 figure, though still slightly above the 50.0 threshold signaling expansion.

Key insights:

- Business sentiment dropped to a 10-month low

- Concerns over U.S. trade policy direction weighed on outlooks

- Inventory of finished goods declined for a fifth straight month, with April showing the steepest drop this year

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence

“Manufacturing continued to flat-line in April amid worrying downside risks to the outlook and sharply rising costs. “Factory output fell for a second successive month as tariffs were widely blamed on a slump in export orders and curbed spending among customers more broadly amid rising uncertainty. “Although the survey saw some producers report evidence of beneficial tariff-related switching of customer demand away from imports, any such sales increase was countered by worries over tariff-related disruptions to supply chains and lost export sales. This served to drive business confidence about prospects in the year ahead down sharply to the gloomiest for 10 months. “Concerns have also spiked in terms of input costs, especially for imported materials and components, due to the triple whammy of tariff-related price hikes, supply shortages, and the weaker dollar. “Manufacturers are responding to these changing demand, supply and cost conditions by raising their selling prices and trimming headcounts to help protect their margins.”

U.S. Layoffs Drop Sharply in April But Still Up From Last Year

Challenger, Gray & Christmas reported 105,441 job cuts in April, a major drop from 275,240 in March. However, layoffs remain 63% higher than the same month in 2024.

So far in 2025, there have been 602,493 job losses—an 87% increase compared to the first four months of last year. A large chunk of these cuts (281,452) is tied to the DOGE sector’s massive downsizing.

U.S. Jobless Claims Rise But Surge Linked to New York

Initial jobless claims for the week ending April 26 came in at 241,000, exceeding the 224,000 estimate and matching the previous week’s total. Continuing claims also increased to 1.916 million from an expected 1.864 million.

Officials noted that the rise in claims was concentrated in New York State, pointing to an anomaly rather than a broad labor market deterioration.

Ford Sees April Sales Surge as Buyers Rush to Beat Tariffs

Ford’s April sales jumped 16.2% year-on-year, driven by a surge in internal combustion engine (ICE) and hybrid vehicle demand, as consumers hurried to make purchases ahead of expected tariff changes.

Breakdown:

- EV sales fell sharply, down 39%

- Hybrid sales increased by 29.6%

- ICE vehicles posted a solid gain of 17.5%

This spike underscores how tariff fears directly influenced consumer behavior and likely sets the stage for a demand slump later due to front-loaded purchases — a classic bullwhip effect in motion.

US Treasury Secretary Bessent on the economy: We expect to see GDP revised

- Comments on the economy now

- We expect to see GDP revised.

- GDP decline may have been due to inventory stocking of imports.

- US households consumption is strong.

- 2 year yields below Federal Funds Rate is signal that the Fed should cut rates.

- Our policies will bring down inflation.

Bessent: Trump-Zelensky meeting at Vatican went a long way to sealing minerals deal

- Remarks by US Treasury secretary, Scott Bessent

- Deal will allow Trump to negotiate with Russia on a stronger basis

- It can show Russia that there is no daylight between US and Ukraine goals

Former US Treasury Secretary Yellen: Trump tariffs to have ‘tremendously adverse’ impact

- Comments to the Financial Times

- Trump tariffs to have ‘tremendously adverse’ impact on the US economy.

- They ‘hobble’ companies that rely on critical minerals supplies from China.

- About 40% of goods imported into the country were inputs for domestic production.

- The odds for a recession have gone up.

- Tariffs could be particularly problematic for the US clean energy sector.

- We are highly dependent on China for most of the critical minerals that go into the clean energy technologies.

Tesla Sales Collapse Nearly 60% in France in April

April data from France showed Tesla’s new car registrations plunged 59.45% compared to the previous year, far worse than the broader market’s 5.64% decline. Year-to-date, Tesla sales are down 43.98%, while the overall French market is off 7.28%.

The dramatic drop came as Tesla announced plans to replace Elon Musk as CEO.

Tesla Board Quietly Begins Search for Musk’s Successor

The Wall Street Journal reports that Tesla’s board started exploring potential successors to Elon Musk last month. Directors have reportedly contacted executive search firms, initiating early-stage, informal discussions.

JB Straubel and other board members have also met with investors to offer reassurance. Tesla has yet to comment publicly. Concerns persist over Musk’s focus, given his leadership roles at Tesla, SpaceX, and elsewhere.

U.S. Defense Chief Issues Warning to Iran Over Red Sea Attacks

Defense Secretary Pete Hegseth warned Iran over its alleged support for Houthi attacks on shipping in the Red Sea, saying on social media: “You will pay the CONSEQUENCE at the time and place of our choosing.”

The statement came ahead of planned U.S.-Iran nuclear negotiations in Rome and followed a repost of a similar warning from former President Trump.

The U.S. military response has included:

- Over 1,000 airstrikes on Houthi targets since March

- Deployment of B-2 bombers to Diego Garcia

- Two U.S. aircraft carriers stationed in the region

- Redeployment of air defense systems from Asia to the Middle East

U.S. Senate Narrowly Defeats Symbolic Anti-Tariff Measure

A bipartisan measure in the U.S. Senate aimed at blocking Trump’s tariffs narrowly failed. The vote was mostly symbolic, with no realistic path through the House.

Ford Shuts Down Unified Vehicle Software Project

Ford has canceled its FNV4 software platform, which aimed to standardize software across EV and combustion models. Rising costs and delays led to the decision.

CEO Jim Farley’s California-based “skunkworks” EV group is now the focus for creating affordable, software-integrated vehicles. Despite the platform’s failure, high-profile engineer Doug Field remains at Ford.

The company has struggled with software fragmentation and high recall rates, falling behind competitors like Tesla and BYD with their integrated systems.

U.S. Trade Rep Confirms No Active Talks with China

U.S. Trade Representative Jamieson Greer confirmed that there are currently no official trade negotiations underway with China, despite political rhetoric suggesting otherwise.

U.S. and Ukraine Launch Reconstruction Investment Fund

The U.S. Treasury and Ukraine have signed a deal to establish a reconstruction investment fund, marking a significant step in postwar recovery planning.

The Treasury Department and U.S. International Development Finance Corporation will manage the program with Ukrainian counterparts. Officials emphasized the agreement as a long-term signal of U.S. support for a sovereign Ukraine, particularly to counter Russian influence.

Canadian Manufacturing PMI Drops to 45.3 in April

Canada’s manufacturing sector contracted further in April, with the S&P Global Manufacturing PMI falling to 45.3 from 46.3 the month before. This marks another month of below-50 readings, reflecting ongoing industrial weakness.

Commodities News

Gold Tumbles as Risk Sentiment Improves, Dollar Rallies

Gold prices declined sharply Thursday, shedding close to $70 or 2%, as traders shifted into risk assets. The yellow metal was last seen trading at $3,226 per ounce, as optimism grew around easing U.S. trade tensions and rate cut expectations.

Drivers of the Move:

- Trump administration removed some auto tariffs, boosting market confidence.

- Progress in negotiations with India, South Korea, and Japan helped lift sentiment.

- Reports indicated U.S. officials have re-engaged China to discuss trade.

- Investors bought dollars, dampening demand for safe havens like gold.

Macro Data Recap:

- Q1 2025 GDP: Contracted 0.3% (vs. expected +0.4%)

- Core PCE Inflation: Flat, maintaining a ~2% annual pace

- Initial Jobless Claims: Rose to 241K (vs. 224K expected)

While gold typically benefits from economic uncertainty, strong corporate earnings, easing trade fears, and signs of a resilient dollar flipped sentiment. Markets are now pricing in 90 basis points of Fed rate cuts, with attention turning to Friday’s Nonfarm Payrolls report.

Trump Issues Iran Oil Warning: Trade With Them, Lose U.S. Access

President Donald Trump issued a fresh warning Thursday, declaring that any nation purchasing oil from Iran will be barred from doing business with the U.S.

Markets reacted immediately:

- Oil prices ticked higher but remained slightly negative on the day

- Crude traded at $58.11, off by $0.06

- Daily high was $59.01, low touched $56.42

- April’s lowest intraday price was $55.15, and the low closing price was $58.15 on April 8 — the lowest since February 2021

Silver Drops Below $32.50, Risks Breaking Toward $30.00 Support

Silver continues its downward move for a third day, trading around $32.30 as it approaches the key 50-day EMA at $32.44.

Bearish indicators:

- 14-day RSI drops below 50, confirming negative bias

- Price is below both 9-day and 50-day EMAs

Support zone:

- $30.00 is the next likely support

- A break below this could test the April low of $28.00

Upside resistance remains at $32.72 and $34.59, the latter being the recent seven-month high.

Palladium and Platinum Prices Weaken at European Open

The Platinum Group Metals sector opened Thursday under pressure:

- Palladium (XPD) traded at $942.30 per ounce, down from $943.55

- Platinum (XPT) was at $962.05, sliding from $970.10 in the prior session

Weak sentiment continues to weigh on the rare metals market at the start of May.

Europe News

EU Offers to Boost U.S. Imports, Rejects 10% Tariff Proposal

European Union officials are prepared to buy up to €50 billion in U.S. goods to help close the trade gap — but they’re pushing back hard against any deal that includes a continued 10% tariff.

EU negotiator Maroš Šefčovič stressed that the bloc would not accept permanent high tariffs, and argued the actual trade deficit is overstated when services are properly accounted for.

Europe Quiet Amid Labor Day, But Markets Still Eye Busy Start to May

European trading activity is expected to stay muted on Thursday with most major financial centers closed for Labor Day. London markets remain open, but overall trading volumes will be lighter. Despite the holiday, volatility may not be off the table, as markets kick off a new month following an active April.

The U.S. dollar is holding onto recent gains across major currency pairs, continuing momentum from earlier in the week. Whether that strength was a result of month-end positioning remains an open question.

UK Manufacturing PMI Revised Up to 45.4 in April Final Reading

S&P Global’s final UK manufacturing PMI for April came in at 45.4, higher than the preliminary 44.0 and above March’s 44.9.

Despite the upward revision, the sector remains in contraction:

- New orders declined.

- Employment levels fell.

- Input costs surged to their highest level in 28 months.

The data reflects continued weakness in factory activity amid rising cost pressures.

Rob Dobson, Director at S&P Global Market Intelligence

“The start of the second quarter saw UK manufacturing buffeted by adverse global market conditions, rising cost pressures, deteriorating supply chains and increased trade uncertainty. April saw further contractions in output, new orders and exports, as well as a slump in business confidence to its lowest ebb since November 2022.

“Although domestic demand remains soft, overseas demand is especially weak. New export business fell at the quickest pace for nearly five years, with demand from clients in the US, Europe and mainland China all declining. Surveyed manufacturers noted that US tariff announcements were having a noticeable impact on global markets as trading partners adapt to increased trade volatility.

“Manufacturers are also seeing an increasingly harsh cost environment, with purchase price inflation hitting a 28-month high. Alongside general raw material price increases on global markets, UK producers are also facing domestic inflationary pressure from increases to National Insurance, minimum wages and the knock-on impact of the latter on higher pay grades. These increased costs are resulting in a combination of higher selling prices and cutbacks to non-essential spending on staffing and purchasing, potentially reinforcing the ‘rising costs, declining demand’ backdrop.”

UK Mortgage Approvals Slightly Miss in March, But Lending Bounces

The Bank of England reported 64,310 mortgage approvals in March, falling slightly short of the expected 64,800. February’s figure was revised down to 65,090 from an initial 65,480.

However, total net borrowing for mortgages rose sharply to £13.0 billion in March from £9.7 billion in February.

Meanwhile, net consumer credit came in at £0.9 billion—well below the £1.2 billion forecast and down from £1.3 billion the month before. Annual consumer credit growth eased to 6.1% from February’s 6.4%.

UK Business Confidence Hits Highest Since Late 2023

Business sentiment among UK executives improved in April, with the Institute of Directors’ confidence index rising to -51 from -58 in March. This marked the strongest reading since September 2023.

Key takeaways:

- Hiring intentions turned positive for the first time since September.

- Investment plans also showed an uptick.

- Survey conducted April 11–29, after a pause in new tariffs.

Chief economist Anna Leach noted ongoing concerns around U.S. trade policy and lingering budget-related cost pressures.

EU to Present New Trade Proposals to U.S. Amid Ongoing Tensions

The European Union is preparing to present updated trade proposals to U.S. negotiators next week, according to Bloomberg. Though specific measures remain undisclosed, the talks aim to resolve tariff and regulatory disagreements in a period of heightened trade friction.

U.S. Trade Representative Jamieson has signaled that any deal is still weeks away.

Asia-Pacific & World News

Treasury Secretary Bessent Pushes for Tariff Thaw with China

U.S. Treasury Secretary Scott Bessent emphasized the need to reduce tariff tensions with China, labeling the situation a “multi-step process.”

Bessent acknowledged that China’s economy is slowing and stressed the importance of rebalancing trade relations. He hinted that a reassessment of Trump’s Phase 1 trade deal may be on the table.

Key quotes:

- “We will bring down China’s unfair trade barriers.”

- “Every day and every week, we’re working to lessen tariff uncertainty.”

He also noted meetings with Japanese and Indonesian officials but confirmed he’s not currently involved in negotiations with the EU. Bessent also criticized European digital services taxes, vowing to counter them.

Nvidia CEO: AI Chip Race with China Is Extremely Close

Nvidia CEO Jensen Huang said China is nearly at parity with the U.S. in the race for dominance in AI chip technology.

Speaking in Washington, Huang stated, “China is right behind us,” emphasizing the narrowing gap. He raised concerns about restrictions targeting Nvidia’s H20 chips, with the company recently confirming in an SEC filing that it had received notice of coming export controls.

Huang also warned of the competitive rise of Huawei, calling it a “formidable” company and pushing for more U.S. government backing of the chip industry, including policy changes and expanded manufacturing support.

Australian Exports Rebound Sharply in March, Imports Decline

Australia recorded a trade surplus of AUD 6.9 billion in March 2025, beating expectations of AUD 3.2 billion.

March figures:

- Exports jumped 7.6% month-on-month (previous: -3.6%)

- Imports fell 2.2% (previous: +1.6%)

Australia’s Terms of Trade Shift as Import Prices Outpace Export Gains

In Q1 2025, Australia’s Export Price Index rose 2.1% quarter-on-quarter, slowing from 3.6% in the prior quarter. The Import Price Index, however, increased 3.3%, up significantly from 0.2% previously.

Monthly trade data for March:

- Exports +7.6% (MoM)

- Imports -2.2% (MoM)

Australian Manufacturing Growth Slows Slightly in April

The final S&P Global Manufacturing PMI for Australia stood at 51.7 in April 2025, slightly below the prior month’s 52.1. The preliminary reading had matched the final at 51.7, suggesting steady but moderating growth in the sector.

BOJ governor Ueda: says would expect US tariffs to be above the base 10% levied

- Remarks by BOJ governor, Kazuo Ueda, in his press conference

- Japan’s economy is recovery moderately, although some weakness is still seen

- Economic growth likely to moderate

- Economic, price projections could change vastly depending on how countries deal with US tariffs

- Must pay due attention to financial, FX markets and impact to Japan’s economy, prices

- Expected to keep raising rates if economy, prices move in line with projections

- But would expect underlying inflation to gradually pick up eventually

- Expect inflation, wage growth to slow down due to tariffs, slower growth

- Outlook is not as certain as it was before

- Timing of underlying inflation to achieve 2% goal will be somewhat delayed

- Appropriate to support the economy while maintaining easy monetary environment

- Will guide policy from a standpoint of sustainably, stably achieving price target

- Tariffs could negatively impact corporate profits and wage negotiations next year

- But it doesn’t mean we have to wait for all of that to make a policy decision

- Even when US tariffs are decided, the impact would be hard to read

- The outlook could be less accurate than before

- We can’t ignore US tariffs

- But also should not overemphasise their impact

- If US tariffs are zero or at low level, then quicker rate hike could be possible

- But no need to raise rates hastily when underlying inflation is stalling

Bank of Japan Holds Steady on Policy, Keeps Short-Term Rate at 0.5%

The Bank of Japan kept its monetary stance unchanged, maintaining its short-term interest rate target at 0.5%, as was broadly anticipated.

Updated inflation projections from the BOJ board included:

- Core CPI forecast for fiscal 2025: +2.2% (down from +2.4% in January)

- Fiscal 2026: +1.7% (previously +2.0%)

- Fiscal 2027: +1.9%

For core-core CPI (excluding food and energy), expectations are:

- Fiscal 2025: +2.3% (up from +2.1%)

- Fiscal 2026: +1.8% (down from +2.1%)

- Fiscal 2027: +2.0%

BoJ report: will continue to raise policy rate if economy, prices move in line with its forecast

- Japan’s economic growth likely to moderate

- Underlying consumer inflation likely to be at level generally consistent with 2% target in second half of projection period from fiscal 2025 through 2027

- Uncertainty surrounding Japan’s economy, prices remain high

- Must be vigilant to financial, FX market moves and their impact on economy, prices

- Risks to economic outlook skewed to downside

- Risks to inflation outlook skewed to downside

- Japan’s economy recovering moderately, although some weaknesses are seen

- Real interest rates are at significant low levels

- Will conduct monetary policy as appropriate from perspective of sustainably, stably achieving 2% inflation target

BOJ report on risks: trade policy recently announced in each jurisdiction is likely to push down domestic and overseas economies through various channels.

- Introduction of wide-ranging tariffs is expected to impact global trade activity, uncertainties regarding policies including tariffs are likely to have large impact on business, household sentiment, global financial, capital markets

- Import prices could rise, and push down domestic demand if disruptions in global logistics were to arise or moves to restructure supply chains were to take place and incur considerable costs

BOJ quarterly report: Important for BoJ to carefully examine factors such as developments in economic activity

- Important to judge whether the outlook will be realised without any preconception

- Extreme uncertain how trade and other policies in each jurisdiction will evolve

- Uncertain how overseas econimic activities and prices will react to them

- Japan’s financial system has maintained stability on the whole

- If disruptions in global logistics were to arise or moves to restructure supply chains were to take place and incur considerable costs, import prices could rise

- This could in turn push down domestic demand

- Households’ defensive attitudes toward spending could strengthen further, and this could push down the economy

- A prolonged period of high uncertainties regarding trade and otherpolicies in each jurisdiction could lead firms to focus more on cost cutting

- Moves to reflect price rises in wages could also weaken

Japan’s April Manufacturing PMI Falls to 48.7, Signaling Continued Contraction

The final reading of Japan’s Jibun Bank Manufacturing PMI for April 2025 came in at 48.7, slightly higher than March’s 48.4 and above the flash estimate of 48.5.

According to S&P Global’s Annabel Fiddes, manufacturers saw a sharper decline in new orders and export demand, leading to cutbacks in procurement and a cautious outlook for the year ahead. Business optimism fell to levels not seen since mid-2020, with firms citing trade uncertainty and weakening global demand.

South Korea’s Exports Beat Expectations in April, Driven by Chips and Steel

South Korea’s exports rose 3.7% year-over-year in April 2025, beating the forecast for a 2.0% decline. Imports fell 2.7%, less than the expected 7.0% drop. The trade surplus for the month totaled $4.88 billion, a slight decrease from March.

Key export drivers included:

- Semiconductor exports surged 17% (best gain in four months)

- Steel shipments remained strong

- Auto exports fell due to U.S. tariffs

Regionally:

- Exports to China rose 3.9%

- Shipments to the EU increased 18.4%

- Exports to the U.S. dropped nearly 7%

Crypto Market Pulse

Ethena Launches USDe on Telegram Through TON Integration

Ethena Labs is bringing its USDe synthetic stablecoin into the Telegram ecosystem by partnering with the TON Foundation. This allows users to send and use USDe through both custodial and non-custodial Telegram wallets.

Integration highlights:

- Supports TON Space (non-custodial)

- Enables payments and staking with up to 10% returns

- USDe is now live on over 20 blockchains via LayerZero’s OFT standard

The announcement sent Toncoin (TON) up 1.9% to $3.22 and Ethena’s token (ENA) up 3.5% to $0.033. The move could accelerate DeFi adoption on TON by making stablecoin tools available to Telegram’s billion-plus user base.

SUI Jumps 10% as 21Shares Files for ETF, Announces Partnership

SUI tokens rallied 10% after crypto asset manager 21Shares filed an S-1 with the SEC to launch a SUI ETF and revealed a partnership with the Sui Network.

The collaboration aims to:

- Develop new tokenized products

- Publish research

- Expand Sui’s presence in U.S. markets

SUI has surged over 20% in the past week and is now approaching $4, a level it hasn’t reclaimed since early February. This latest filing follows a prior application by Canary Capital and adds momentum to the push for altcoin ETFs.

Bitcoin Tops $96,000 After Brief Dip on GDP Contraction

Bitcoin bounced back above $96,000 on Thursday after slipping briefly in response to U.S. GDP data showing a Q1 contraction of 0.3%, missing the expected +0.4% growth.

The PCE Price Index came in hot at 3.7% (vs. 3.1% forecast), fueling stagflation fears. Risk-off sentiment dented crypto demand midweek, but the pullback proved short-lived.

Key points:

- Bitcoin supply in profit is now above 85.8%, nearing the 90% “euphoria” threshold.

- Spot ETF flows saw a minor outflow of $56.23 million Tuesday—first since April 17.

- Oil prices dropped below $60; U.S. consumer confidence plunged to 86, the lowest since May 2020.

Though institutional demand dipped, sentiment remains cautiously bullish if outflows stay modest.

Hyperliquid Inches Toward $20 Breakout As Open Interest Spikes

Hyperliquid (HYPE) is trading at $19.85, holding above the 100-day EMA at $18.41 and showing signs of strength after bouncing off a descending trendline. Bulls are eyeing a breakout above the $20 resistance.

Key technical signals:

- MACD remains bullish with green histogram bars.

- Supertrend flipped to “buy” in mid-April.

- Support holds firm at the 50-day EMA ($16.88).

Open interest has surged 13.7% to $625 million in the last 24 hours, hinting at new long positions. The long/short ratio sits at 1.1093, leaning slightly bullish. Liquidations hit $135,000, mostly on the short side.

A confirmed break of $20 could target the previous high at $24.

XRP Holds Above $2.20 as Ripple’s Bid for Circle Rejected

XRP is stabilizing near $2.21, with support holding at the 50- and 100-day EMAs. The MACD indicator shows continued bullish momentum, setting sights on $3.00 if key resistance levels break.

Meanwhile, Ripple made a $5 billion acquisition offer for stablecoin issuer Circle, which was rejected. Circle plans to go public instead and filed for an IPO in the U.S.

Ripple had hoped to expand its footprint in the stablecoin space, following its acquisition of Hidden Road for $1.25 billion. Hidden Road is set to use RLUSD for collateral and shift post-trade operations to the XRP Ledger.

The Day’s Takeaway

Day’s Takeaway: Key Market Trends & Developments

United States

- Wall Street Rally Continues

U.S. equities climbed for the eighth straight session. The S&P 500 rose 0.63% to 5,604.14, and the NASDAQ led with a 1.52% gain, buoyed by big tech. Microsoft surged 7.63%, and Meta added 4.23%. - Amazon Beats but Cautions

Amazon topped Q1 revenue ($155.7B vs. $154.89B est.) and EPS ($1.59 vs. $1.36), driven by strong AWS growth. But weak Q2 guidance spooked investors, and shares fell ~5% after hours. - Apple Impresses with Solid Quarter

Apple reported Q2 earnings of $1.65 per share and $95.36B in revenue, both ahead of estimates. iPhone, iPad, and Mac all beat forecasts. The board approved a $100B stock buyback and raised the dividend to $0.26. - ISM Manufacturing Contracts Again

The April ISM Manufacturing PMI came in at 48.7, still below the 50 threshold. Prices paid remained elevated at 69.8, while employment and new orders remained weak. - Construction Spending Misses

U.S. construction spending fell 0.5% in March, missing expectations. Private and public sector activity both declined amid higher material costs and tariff-related uncertainty.

Canada

- Factory Activity Slumps Further

April’s S&P Global Manufacturing PMI dropped to 45.3 from 46.3, highlighting persistent weakness in Canada’s industrial sector.

Commodities

- Gold Declines Sharply

Gold prices fell $70 intraday as risk appetite grew on easing trade tensions and firming expectations for Fed rate cuts. - Oil Rebounds Slightly

Crude recovered modestly to $58.11, after dipping to lows not seen since early 2021. Trump’s warning that countries buying Iranian oil would be barred from U.S. trade added some upward pressure. - Silver Slides Below $32.50

Silver broke under key technical levels, with downside momentum targeting the $30 zone. Bearish RSI and EMA signals suggest continued short-term weakness. - Palladium and Platinum Slip

Palladium traded at $942.30 and platinum at $962.05 during early European trading, both moving lower on broader metals pressure.

Europe

- Markets Closed for Labor Day

Most European markets were shut Thursday, leading to thinner flows. The euro area remained on watch for tariff discussions with the U.S., especially around the proposed 10% cap, which the EU has rejected. - EU Trade Offer Emerges

Brussels reportedly offered to import €50 billion in U.S. goods, arguing the actual transatlantic deficit is overstated when services are included. However, officials made clear a deal must eliminate the 10% tariff floor.

Asia

- Japan’s Market Watch

Tokyo markets stayed quiet amid holidays, but eyes remain on the yen and BOJ forecasts for 2025–2027 inflation, which suggest cooling pressures. - China Trade Watch

U.S. trade officials confirmed renewed contact with Beijing to discuss tariff rollbacks, offering a potentially significant shift in tone.

Crypto

- Bitcoin Breaks Past $96K

Bitcoin rebounded sharply after a brief post-GDP dip, now trading above $96,000. Over 85% of supply is in profit, nearing the 90% “euphoria” mark. - Hyperliquid (HYPE) Eyes Breakout

HYPE hovers just under $20 with strong open interest and bullish MACD signals. Traders are watching for a potential surge toward $24 if resistance breaks. - XRP Builds Base Above $2.20

XRP stabilized around $2.21, supported by EMAs. Ripple’s $5B bid for Circle was rejected, but market interest in stablecoin competition continues to rise. - Ethena Brings Stablecoin to Telegram

Ethena Labs announced a partnership with TON Foundation to deploy USDe across Telegram’s ecosystem. Toncoin and ENA both gained after the news. - SUI Jumps on ETF News

SUI rose 10% after 21Shares filed for an ETF and announced a strategic partnership with the Sui Network. The token is up 20% over the week.