North America News

U.S. Stocks Rebound to Close Higher, But Weekly Losses Mount

After a volatile session, U.S. stocks rebounded sharply, led by chipmakers and beaten-down tech stocks.

Closing Numbers:

✅ S&P 500: +0.55% (+31 points)

✅ Nasdaq: +0.7%

✅ Dow Jones: +0.5%

✅ Russell 2000: +0.65%

Weekly Performance:

❌ S&P 500: -3.1%

❌ Nasdaq: -3.5%

❌ Dow Jones: -2.4%

❌ Russell 2000: -4.0%

Market Takeaway: The bounce offers short-term relief, but volatility remains high amid tariff and interest rate uncertainties.

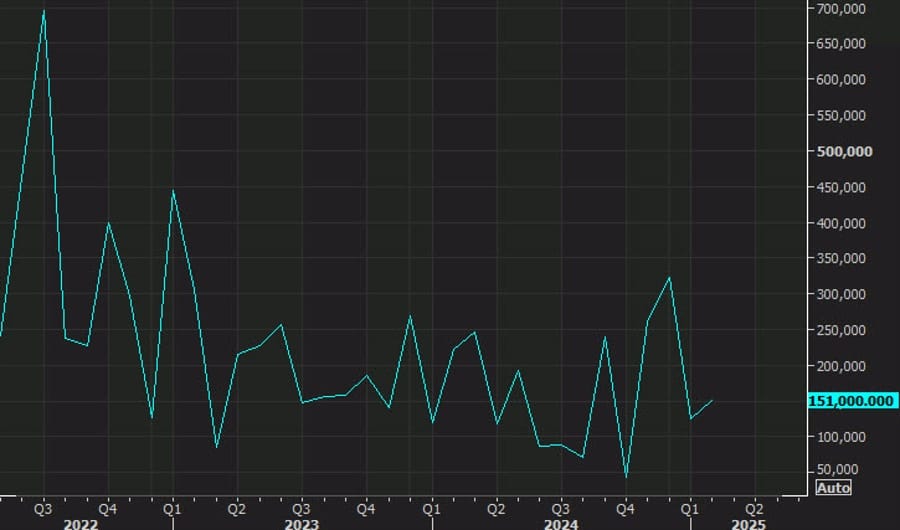

U.S. February Jobs Report: Non-Farm Payrolls Miss Expectations, Unemployment Rises

The U.S. economy added 151K jobs in February, falling short of the 160K estimate, while the unemployment rate rose to 4.1%, suggesting a slight cooling in the labor market.

Key Data Points:

- Non-Farm Payrolls: +151K (expected +160K) ❌

- Unemployment Rate: 4.1% (expected 4.0%) ❌

- Labor Force Participation Rate: 62.4% (prior 62.6%) ❌

- U6 Underemployment Rate: 8.0% (prior 7.5%) ❌

- Average Hourly Earnings (m/m): +0.3% (expected +0.3%) ✅

- Average Hourly Earnings (y/y): +4.0% (expected +4.1%) ❌

Sectoral Breakdown:

✅ Health care +52K

✅ Financial services +21K

✅ Local government +20K

✅ Construction +19K

✅ Transportation & warehousing +18K

❌ Hospitality -16K (restaurants: -28K)

❌ Professional services -2K (temp help: -12K)

Market Takeaway:

- Government hiring slowed significantly (+11K vs. +32K prior).

- Manufacturing jobs rose more than expected (+10K vs. +5K est.).

- Full-time employment dropped sharply (-1.19M).

- The household survey showed a massive -588K job loss, raising concerns about the report’s strength.

Morgan Stanley Cuts 2025 U.S. GDP Growth Forecast to 1.5%

Morgan Stanley has downgraded its 2025 U.S. GDP growth projection to 1.5% (from 1.9% prior), citing:

- Trade policy uncertainty from escalating tariffs.

- Slowing consumer spending.

- A weaker labor market.

The downward revision suggests the U.S. economy may face a tougher year than initially expected, with slower growth likely affecting corporate earnings and market sentiment.

CIBC: U.S. Jobs Report Solid, but Immigration & Tariffs Pose Risks

CIBC economists warn that while the February jobs report was solid, hidden risks remain.

Key Concerns:

- Hospitality sector layoffs (-16K) could be linked to tighter immigration policies.

- Lower participation rate (-0.2%) signals a shrinking labor force, which could drive up wages.

- Higher tariffs on China will push prices higher, pressuring the Fed.

CIBC’s Take:

“The underlying health of the U.S. economy is still OK, but the uncertainty from whipsawing policy we’ve seen this week is going to start showing up more gradually in the data.”

Upcoming Data to Watch:

- JOLTS Job Openings (Tuesday)

- CPI Inflation (Wednesday)

- Consumer Sentiment (Friday)

Fed’s Powell: No Urgency to Cut Rates Amid Trade Uncertainty

Speaking at the U.S. Monetary Policy Forum, Fed Chair Jerome Powell emphasized that the central bank is not in a hurry to adjust interest rates, given the high uncertainty surrounding Trump’s trade policies.

Key Takeaways:

- No rush to cut rates despite some inflationary pressures.

- Tariffs could lead to higher consumer prices, but the Fed is waiting for more data.

- Labor market remains stable, but consumer spending shows signs of weakening.

- Fed is open to maintaining restrictive policy for longer if inflation progress stalls.

Fed’s Bowman: Labor market and economic activity to become a larger factor in discussions

- Comments from the Fed Governor

- Labor market and economic activity will become a larger factor in Fed discussions going forward

- Structural changes since covid may have masked transmission of Fed policy to the economy

Fed’s Kugler: February jobs report was ‘a solid number’

- Fed’s Kugler predicts a steady monetary policy for some time based on recent inflation data, with upside risks to inflation and a balanced job market.

- Sees steady monetary policy ‘for some time’ on recent inflation data

- Strongly supported steady rate policy at January FOMC

- Future Fed policy changes will be driven by data

- There are important upside risks to inflation

- Flags big rise in some inflation expectations readings

- Inflation has been moving sideways for a while

- Job market has substantially rebalanced

- Wages are not a key driver of inflation pressures

- Hiring remains above the break-even level

- Watching very closely for any sudden jobs market changes

- Kugler does not expect government job cuts to show up suddenly

- Says she is paying a lot of attention to inflation expectations

- Critical to keep inflation expectations well anchored

- There is a high level of uncertainty of tariffs

- Uncertainty is difficult for all parts of the economy

Fed Williams: No sign of inflation expectations becoming unmoored

- Fed Pres. Williams speaking

New Fed Pres. Williams is speaking and says:

- No sign of inflation expectations becoming unmoored

- inflation expectations back to pre-pandemic levels.

- Data shows like before inflation shock its short-term expectations

- Still thinks that the new trading is lower than in the 1990s

Fed’s Bostic Warns Tariffs Will Push Prices Higher

Atlanta Fed President Raphael Bostic stated that Trump’s tariffs will introduce higher costs, which could lead to higher consumer prices and inflation.

Key Comments:

- Tariffs increase costs, which will eventually be passed on to consumers.

- The Fed must remain patient before adjusting policy.

- Business sentiment is improving in some areas (energy, deregulation) but remains uncertain overall.

- Inflation volatility is expected to continue.

Bostic emphasized that it may take months to understand the full impact of tariffs, delaying the Fed’s decision on rate cuts.

Canada: 40% of Exports to U.S. Are USMCA Compliant, Says Trade Minister

Canada’s Trade Minister Mary Ng stated that 40% of Canada’s exports to the U.S. meet USMCA compliance rules.

Key Points:

- Canada is nearing its goal of increasing non-U.S. exports by 50% by 2025.

- This highlights Canada’s efforts to diversify trade beyond the U.S. amid tariff concerns.

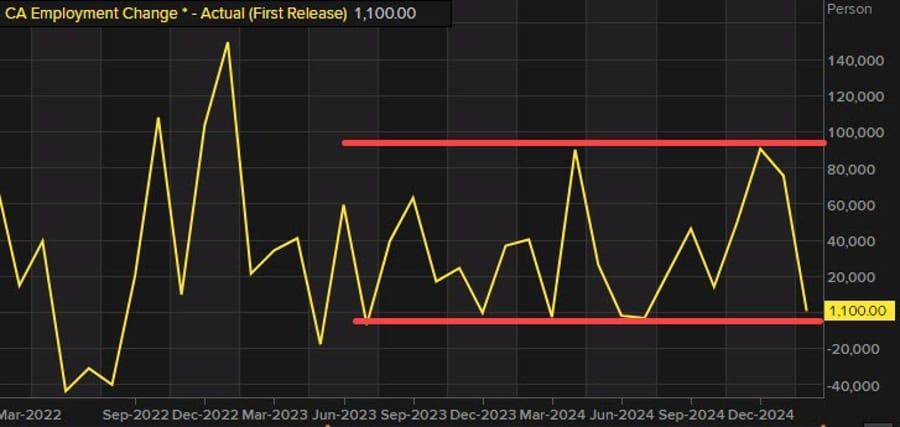

Canada’s February Jobs Report Disappoints with Just +1.1K Jobs Added

Canada’s labor market weakened significantly in February, with only +1.1K jobs added (vs. +20K expected).

Key Data:

- Unemployment Rate: 6.6% (expected 6.7%) ✅

- Full-Time Jobs: -19.7K ❌

- Part-Time Jobs: +20.8K ✅

- Wage Growth (Permanent Employees): 4.0% y/y (vs. 3.7% prior) ✅

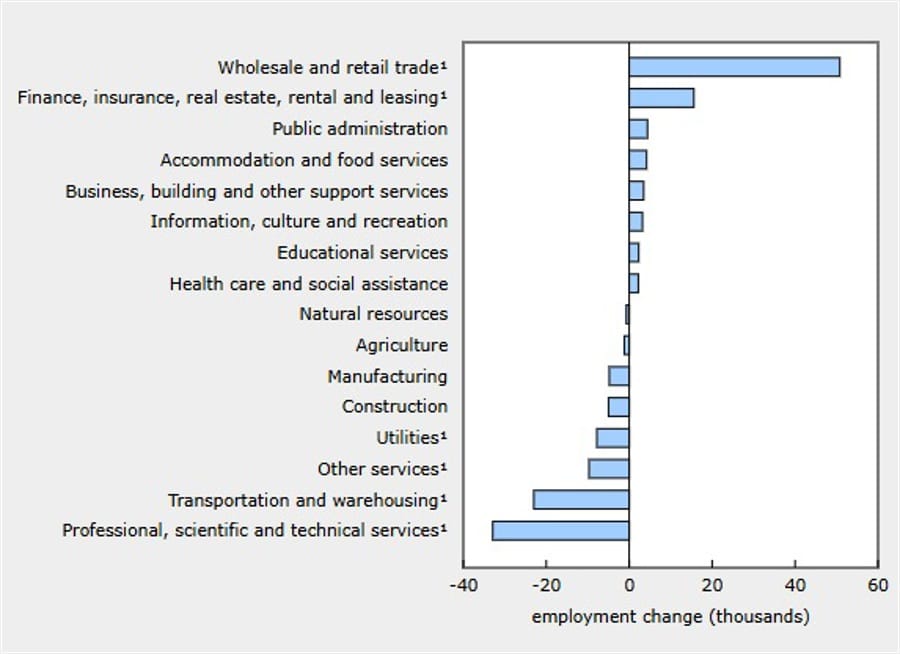

Sector Breakdown:

✅ Wholesale & Retail Trade: +51K

✅ Finance & Insurance: +16K

❌ Professional Services: -33K

❌ Transportation & Warehousing: -23K

Severe winter storms disrupted employment, impacting 429,000 workers.

Below is a look at the change by sector:

The number of employees in the private sector was little changed in February, following increases in December (+39,000; +0.3%) and January (+57,000; +0.4%). Public sector employment and self-employment were also both little changed in February.

Canada sets in place plans to toll US trucks heading in to Alaska from British Columbia

- British Columbia will prepare a law to give it the ability to levy fees on commercial trucks travelling from the United States through the province to Alaska

British Columbia premier David Eby with the announcement.

Adding that Canadians will not let up until the tariffs are taken off the table.

Canada will delay its 2nd wave of tariffs BUT will not remove the $30bn already in place

- This is in response to Trump’s latest reversal, Canada not being fooled into removing existing tariffs

Canada finance minister has announced that the country will delay its second wave of tariffs on $125bn of US prodcuts until April 2.

There was no indication that Canada is taking off the $30bn in tariffs already in place. Premier of Ontario, Doug Ford, who has been a sharp critic of the tariff attack from the US is not impressed with Trump’s pause, promises relentless response.

Mexico economy minister: We have to reach an agreement about steel and aluminum

- Comments from the Mexican economy minister

- Next week we will have meetings with the USTR team

- We will be announcing around $6.5B in private investments today

Commodities News

Gold Slips Below $2,910 as Fed Holds Steady on Rates

Gold prices fell on Friday as the U.S. dollar rebounded following the February Non-Farm Payrolls (NFP) report. The Federal Reserve signaled no urgency to cut interest rates, keeping pressure on gold.

Gold Price Update:

- Spot gold: $2,907 (-0.11%)

- Gold futures: $2,915

Key Market Factors:

✅ U.S. Jobs Data: The February NFP report showed 151K jobs added, slightly below expectations (160K), while the unemployment rate ticked up to 4.1%.

✅ Fed Policy Outlook: Chair Jerome Powell reiterated that rate cuts will not be rushed, citing inflation uncertainty and tariff-driven price risks.

✅ Geopolitical Factors:

- Ukraine-Russia ceasefire talks show some progress, reducing gold’s appeal as a safe-haven asset.

- Middle East tensions remain elevated, but Trump continues to pressure Hamas for hostage releases.

Central Bank Buying Trends:

- People’s Bank of China (PBoC): +10 tonnes of gold in early 2025.

- National Bank of Poland (NBP): +29 tonnes in Q1 2025, its largest purchase since 2019.

Oil Prices Spike After Trump Threatens Heavy Sanctions on Russia

Oil prices surged on Friday after President Trump threatened large-scale banking sanctions and tariffs on Russia in response to intensified fighting in Ukraine.

Trump’s Statement on Truth Social:

“Based on the fact that Russia is absolutely ‘pounding’ Ukraine on the battlefield right now, I am strongly considering large-scale Banking Sanctions, Sanctions, and Tariffs on Russia until a Cease Fire and FINAL SETTLEMENT AGREEMENT ON PEACE IS REACHED.”

Market Reaction:

- WTI crude surged past $68 per barrel before pulling back.

- Brent crude hit $73.50 amid concerns of supply disruptions.

- Energy stocks rallied as traders anticipated stricter export controls on Russian oil.

If Trump follows through on these threats, it could lead to higher global oil prices and further inflationary pressures on the U.S. economy.

Baker Hughes Rig Count: U.S. Down 1, Canada Down 14

The Baker Hughes Rig Count for the week ending March 8, 2025, showed a decline in both U.S. and Canadian rig activity as gas drilling slowed and oil production remained steady.

U.S. Rig Count: ⬇ 1 to 592

- Oil rigs: Unchanged at 486

- Gas rigs: ⬇ 1 to 101

- Miscellaneous rigs: Unchanged at 5

- Offshore rigs: ⬆ 1 to 14

Year-over-Year Comparison (U.S.):

- Total rigs down 30 (from 622)

- Oil rigs down 18, gas rigs down 14, miscellaneous rigs up 2

- Offshore rigs down 7

Canada Rig Count: ⬇ 14 to 234

- Oil rigs: ⬇ 7 to 170

- Gas rigs: ⬇ 7 to 64

- Miscellaneous rigs: Unchanged at 0

Year-over-Year Comparison (Canada):

- Total rigs up 9 (from 225)

- Oil rigs up 29, gas rigs down 20, miscellaneous unchanged

EU Natural Gas Prices Drop to 5-Month Low – Danske Bank

European natural gas prices fell to EUR 40/MWh, the lowest level since October 2024, as warmer weather and flexible storage management eased supply concerns.

Key Factors Behind the Drop:

✅ Mild Winter: Lower heating demand reduced gas consumption.

✅ High Storage Levels: Europe is ahead of schedule in refilling storage ahead of next winter.

✅ Oil & Coal Prices Decline: Broader energy market weakness contributed to lower gas prices.

Oil Prices Rebound as Russia’s Novak Suggests OPEC+ May Reverse Output Hike

Oil prices rose slightly after Russia’s Deputy PM Alexander Novak stated that OPEC+ could reverse planned production increases if necessary.

Market Reaction:

- WTI Crude settled at $66.36 (+$0.05, +0.08%)

- Low: $65.60 | High: $67.09

Key Developments:

- OPEC+ plans to unwind 2.2 million barrels per day of production cuts starting in April.

- Rising U.S. inventories (+3.6M barrels last week) weighed on prices.

- Trade war fears continue to impact oil demand outlook.

Novak stated:

“If there is an imbalance in the market, we can always play in the other direction.”

Europe News

Major European Indices Close Mixed as Markets React to Fed & Trade Tensions

European stocks ended the week with mixed results, as investors weighed Fed policy uncertainty and ongoing U.S. trade tensions.

Friday’s Closing Numbers:

- Germany’s DAX: -1.75% ❌

- France’s CAC: -0.94% ❌

- UK’s FTSE 100: -0.03% ❌

- Spain’s IBEX: +0.17% ✅

- Italy’s FTSE MIB: -0.48% ❌

Weekly Performance:

- Germany’s DAX: +2.03% ✅

- France’s CAC: +0.11% ✅

- UK’s FTSE 100: -1.47% ❌

- Spain’s IBEX: -0.68% ❌

- Italy’s FTSE MIB: +0.16% ✅

While the DAX posted strong weekly gains, other European markets were dragged down by concerns over slowing global trade.

Eurozone Q4 GDP Revised Higher to +0.2%

The Eurozone’s Q4 GDP was revised slightly higher to +0.2% q/q (from +0.1% prior estimate).

Key Takeaway:

- Despite the revision, economic momentum remains weak.

- Trade uncertainty and high inflation continue to weigh on growth.

This does not significantly change the outlook for the European Central Bank (ECB), which recently cut rates to support the economy.

Germany’s Industrial Orders Collapse by -7.0% in January

Germany’s January industrial orders plunged -7.0% m/m, far worse than the -2.8% expected.

Key Data:

- Previous month: Revised to +5.9% (from +6.9%)

- Aerospace, defense, and transport orders plunged -17.6%

- Manufacturing sector continues to weaken.

The sharp drop in orders raises concerns about Germany’s economic stability, especially with ongoing trade policy uncertainty in Europe.

France’s Trade Deficit Widens in January

France’s January trade deficit widened to -€6.5 billion, worse than December’s -€3.9 billion.

Key Data:

- Exports fell -4.5% m/m

- Imports rose +1.2% m/m

In 2024, France halved its annual trade deficit to €81 billion (from a record €162.6 billion in 2022). However, if Trump’s tariffs escalate, it could worsen trade conditions later in 2025.

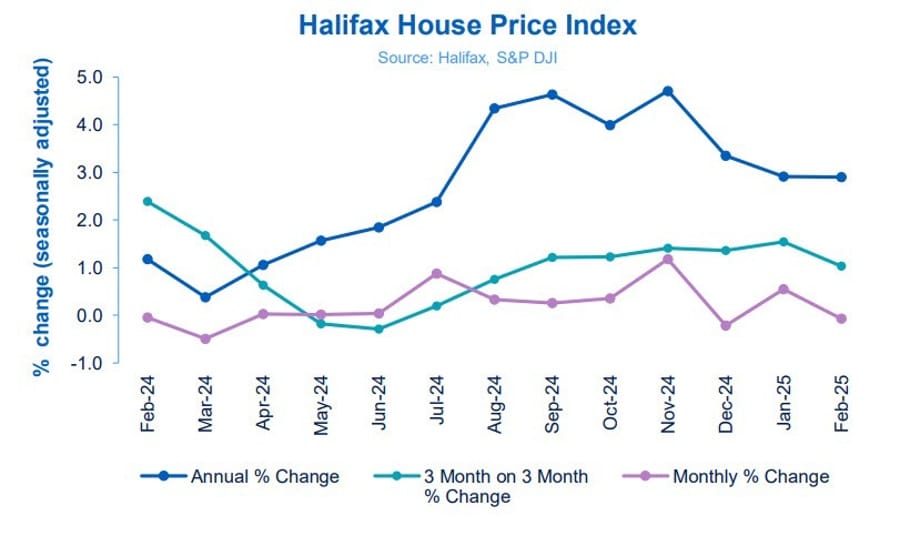

UK House Prices Fall Slightly Ahead of April Tax Changes

The Halifax House Price Index showed UK house prices declined slightly in February (-0.1%) as the market adjusted to upcoming stamp duty changes.

Key Data:

- Monthly Price Change: -0.1% (expected +0.3%)

- Annual Growth: +2.9%, unchanged from January

- Average UK House Price: £298,602

Market Reaction:

- Uncertainty over tax changes is impacting buyer demand.

- The decline is minor, but further weakness is possible in the coming months.

ECB’s Centeno: We are almost out of woods in this inflationary cycle

ECBs Centeno is on the wires saying:

- We are almost out of the woods in this inflationary cycle.

- ECB rate cuts are to continue until inflation converges to target.

Nomura say it expects only one more 25bp rate cut from the European Central Bank this year

- In June

- 25bps rate cut in June vs their previous projection of a cut in April and then June

Asia-Pacific & World News

China’s Export Growth Likely Slowed in Early 2025

China’s export growth likely weakened in the first two months of 2025 due to Lunar New Year disruptions and U.S. trade pressures.

Forecasts:

- Exports (y/y): Expected +5.0% (December was +10.7%)

- Imports (y/y): Expected +1.0%, maintaining the previous pace

- Trade Surplus: Expected $142.35 billion

If trade growth misses expectations, it could pressure China’s economy further and lead to stronger stimulus measures from Beijing.

China Inflation Data Expected to Show CPI Deflation in February

China will release its February Consumer Price Index (CPI) and Producer Price Index (PPI) data on Sunday, March 9 at 01:30 GMT (Saturday, March 8 at 21:30 US Eastern time).

Market Expectations:

- CPI (y/y): Expected -0.1% (January was +0.5%)

- PPI (y/y): Expected -2.5%, continuing 28 consecutive months of factory deflation

Background:

- CPI was in steady decline from August to December 2024, reflecting weak consumer demand, before a temporary rise in January due to Lunar New Year spending.

- PPI has remained negative for over two years, showing China’s industrial sector struggles continue despite government stimulus.

If deflation deepens, the People’s Bank of China (PBOC) may respond with further rate cuts or fiscal measures to support the economy.

China’s Trade Data Disappoints as Export Growth Slows Sharply

China’s January-February trade data came in weaker than expected, reflecting slower global demand and trade tensions with the U.S.

Key Figures:

- Trade Balance (USD): $170.5 billion surplus

- Exports (y/y): +2.3% (expected +5.0%, prior +10.7%) ❌

- Imports (y/y): -8.4% (expected +1.0%, prior +1.0%) ❌

Key Takeaways:

- Weaker-than-expected exports highlight cooling global demand.

- Imports fell sharply, suggesting China’s domestic economy is still weak.

- Trump’s trade policies and global economic uncertainty may further pressure China’s exports.

China says US tariffs are “groundless”, act of bullying

- Remarks by the Chinese commerce ministry

- US imposition of 20% tariffs on the basis of fentanyl is “groundless”

- It is a typical act of protectionism, unilateralism and bullying

- Urges US to correct wrong practices and to handle the problem objectively

- Calls on US to not blindly “shift the blame”

PBOC sets USD/ CNY reference rate for today at 7.1705 (vs. estimate at 7.2406)

- PBOC CNY reference rate setting for the trading session ahead.

PBoC injects 185bn yuan via 7-Day Reverse Repos at 1.5%

- 284.5n mature today

- Net drain is 99.5bn yuan

Chinese Foreign Minister Wang says abuse of fentanyl is an issue that the US has to solve

- Speaking on the sidelines of the National People’s Congress (NPC) in Beijing

Chinese Foreign Minister Wang is speaking on the sidelines of the National People’s Congress (NPC) in Beijing:

- The abuse of fentanyl is an issue that the US has to solve

He also addressed US-China relations:

- If one side exerts pressure, China will resolutely counter that

- The US and China have broad common interests and room for cooperation

- US should not unilaterally impose tariffs

Japan’s Finance Minister Kato – recently, there have been one-sided, rapid market moves

- Some verbal intervention from Kato here – yen is strengthening in response

- Recently, there have been one-sided, rapid market moves.

- It is important for currencies to move in a stable manner that reflects fundamentals.

- Appropriate action will be taken against excessive movements.

- Monetary policy decisions are up to the Bank of Japan.

Japan is preparing to officially declare an end to long-term deflation

- Says Economy Minister Ryosei Akazawa

Japan is preparing to officially declare an end to long-term deflation, according to Economy Minister Ryosei Akazawa. This marks a significant shift in the government’s economic outlook and could influence the timing of the Bank of Japan’s next interest rate hike. While inflation has stayed above the BOJ’s 2% target for nearly three years, the government had not previously made an official declaration, as it considers deflation to be a broader issue linked to weak wage growth and subdued consumption.

Akazawa stated that all four key indicators used to assess deflation:

- consumer prices,

- GDP deflator,

- unit labor costs,

- and the output gap

have turned positive. Notably, Japan’s output gap turned positive in the fourth quarter of last year for the first time in six quarters, indicating that demand is now exceeding the economy’s full capacity. He emphasized the importance of continued coordination between the BOJ and the government to ensure inflation remains sustainably above 2%.

While the BOJ ended its decade-long ultra-loose monetary policy and raised interest rates to 0.5% in January, the government has been cautious in officially declaring the end of deflation. Doing so could reduce justification for further fiscal stimulus but might also serve as a political advantage for the administration ahead of Japan’s upper house elections in July.

Crypto Market Pulse

Crypto Today: BTC Nears $90K as White House Summit Lifts XRP, ADA, and SOL

Crypto markets dipped by $17.4 billion but held firm as Trump’s White House Summit fueled gains for XRP, Cardano, and Solana.

Market Overview:

- Total crypto market cap: $2.87T (-4.8%)

- Bitcoin (BTC): $89,900 (+3.2%)

- Ethereum (ETH): $2,140 (-2.1%)

- XRP: $2.52 (+23%)

- Cardano (ADA): $0.80 (+7.5%)

- Solana (SOL): $142 (+4.3%)

Key Drivers:

✅ White House Summit: Trump’s meeting with crypto leaders sparks speculation on regulations.

✅ XRP withdrawals from Binance indicate long-term accumulation.

✅ Bitcoin ETF outflows: $134M out on Thursday, but investors still eyeing BTC’s $92K resistance.

Market Takeaway: Investors are cautious but optimistic as Trump’s crypto policies take shape.

Senator Warren Demands Crypto Policy Transparency from Trump’s Advisor

Senator Elizabeth Warren has urged David Sacks, Trump’s new crypto policy chief, to publicly disclose his financial holdings amid concerns over conflicts of interest.

Key Points:

- Sacks denies holding indirect crypto assets but confirms he liquidated all holdings before taking office.

- Warren calls for greater oversight on Trump’s crypto policies.

- Regulatory clarity remains a top issue in Washington.

Trump: U.S. Government Will Explore Additional Bitcoin Holdings

President Trump announced that the U.S. Treasury and Commerce Departments will study pathways to acquire more Bitcoin as part of his administration’s crypto policy.

Key Points from Trump’s Statement:

- U.S. will explore buying Bitcoin beyond its current legal forfeiture holdings.

- Operation Choke Point 2.0 (Biden’s anti-crypto policy) officially ended.

- White House will work with industry leaders on regulatory clarity.

XRP Traders Withdraw $130M from Binance Ahead of White House Summit

Ripple’s XRP price surged past $2.50, gaining 23% this week, as investors anticipate major crypto policy developments at the White House Summit.

Key Market Trends:

- XRP price: $2.52 (+23% weekly)

- Binance XRP reserves: -50M tokens (~$130M in outflows)

- Crypto traders moving assets off exchanges, signaling long-term accumulation.

Why Is XRP Rising?

✅ Ripple CEO Brad Garlinghouse confirmed to attend the White House Crypto Summit.

✅ Trump expected to unveil clearer crypto regulations and reserve strategies.

✅ Traders positioning for potential bullish policy announcements.

👉 Market Takeaway: The XRP rally could extend if regulatory clarity boosts institutional interest.

Trump Signs Executive Order for U.S. Bitcoin Reserve

President Donald Trump has officially signed an executive order establishing a U.S. Strategic Bitcoin Reserve.

Key Details:

- The reserve will be funded with Bitcoin seized through criminal and civil forfeiture.

- No new purchases of Bitcoin will be made by the U.S. government.

- The stockpile will be held indefinitely, with no plans to sell or liquidate.

- Treasury & Commerce secretaries may explore budget-neutral ways to acquire more BTC.

Market Reaction:

This move does not indicate active Bitcoin accumulation by the U.S. government, but it does signal growing acceptance of Bitcoin as a strategic asset.

The Day’s Takeaway

Day’s Takeaway: Key Market Trends & Developments

Today’s market action was driven by U.S. economic data, geopolitical tensions, Federal Reserve policy updates, and shifting crypto dynamics. Stocks rebounded from early losses, gold prices fell, oil markets saw volatility, and Bitcoin approached $90K amid renewed policy focus on crypto regulations.

U.S. Jobs Report: Solid but Warning Signs Emerge

- February Non-Farm Payrolls (NFP): +151K (vs. 160K expected)

- Unemployment Rate: 4.1% (vs. 4.0% expected)

- Wage Growth (YoY): +4.0% (vs. 4.1% expected)

- Labor Force Participation: 62.4% (⬇ from 62.6% prior)

🔹 Key Takeaways:

✅ Job market still growing, but federal layoffs and China tariffs could pressure hiring ahead.

✅ Wages rising in select industries (hospitality, retail, manufacturing), hinting at tight labor conditions.

✅ Fed Chair Powell reaffirmed a cautious stance on rate cuts, citing inflation uncertainty.

Market Impact:

📉 Gold fell as Powell suggested no urgent need for rate cuts.

📈 Stocks rebounded after an early selloff on labor market resilience.

Oil Markets Spike as Trump Threatens Heavy Sanctions on Russia

- Trump posted on Truth Social:

- Considering “large-scale banking sanctions and tariffs on Russia” unless a ceasefire agreement is reached in Ukraine.

- Oil prices surged as supply concerns grew.

Market Impact:

📈 Brent crude & WTI futures jumped on potential supply disruptions from sanctions.

📉 European stocks dipped as energy price volatility weighed on sentiment.

Morgan Stanley Cuts U.S. GDP Growth Forecast to 1.5% (from 1.9%)

- Cites rising trade war risks, tightening credit conditions, and slowing consumer demand.

- Lower growth outlook raises concerns about potential stagflation in late 2025.

📉 Market Reaction: U.S. Treasury yields fell slightly as recession fears resurfaced.

European Markets End Mixed; German DAX Drops 1.75%

- German DAX: -1.75% (biggest loser)

- France CAC: -0.94%

- UK FTSE 100: Flat

- Spain’s IBEX: +0.17% (modest gain)

🔹 Key Drivers:

- Uncertainty over EU trade policies amid Trump’s tariff escalation.

- Weaker-than-expected German industrial orders (-7.0%) raise concerns about manufacturing slowdown.

📉 Market Impact: European stocks under pressure; DAX saw worst drop in a month.

U.S. Stocks Rebound, But Weekly Losses Continue

📊 Closing Performance (March 8, 2025):

- S&P 500: +0.55% (+31 points)

- Nasdaq: +0.7%

- Dow Jones: +0.5%

- Russell 2000: +0.65%

📉 Weekly Losses:

- S&P 500: -3.1% (worst week since September)

- Nasdaq: -3.5%

- Dow Jones: -2.4%

- Russell 2000: -4.0%

🔹 Key Market Drivers:

✅ Tech stocks rebounded, led by chipmakers and beaten-down names.

✅ Fed policy uncertainty continues to weigh on investor sentiment.

✅ Dip-buying emerged as valuations became attractive.

Takeaway: Markets remain volatile, and next week’s CPI data will be critical for rate-cut expectations.

Bitcoin Nears $90K as Trump’s White House Summit Lifts XRP, ADA, SOL

- Total crypto market cap: $2.87T (-4.8%)

- Bitcoin (BTC): $89,900 (+3.2%)

- Ethereum (ETH): $2,140 (-2.1%)

- XRP: $2.52 (+23%)

- Cardano (ADA): $0.80 (+7.5%)

- Solana (SOL): $142 (+4.3%)

📌 Why the Crypto Rally?

✅ White House Crypto Summit boosted speculation on regulatory clarity.

✅ Ripple CEO confirmed to attend the summit, sparking XRP gains.

✅ Trump announced a U.S. strategic Bitcoin reserve.

Takeaway: Crypto markets remain bullish on policy shifts, but ETF outflows ($134M) weigh on sentiment.

Trump Announces U.S. Government Will Explore More Bitcoin Holdings

- Treasury & Commerce Departments tasked with finding pathways to acquire BTC.

- Trump officially ends “Operation Choke Point 2.0,” reversing anti-crypto banking restrictions.

📌 Market Takeaway: Bullish for Bitcoin adoption as the U.S. signals long-term crypto support.

Baker Hughes Rig Count: U.S. Down 1, Canada Down 14

📉 U.S. rig count: 592 (-1)

📉 Canada rig count: 234 (-14)

🔹 Key Trends:

✅ Oil rigs held steady, while gas drilling declined.

✅ Declining natural gas rigs suggest softer demand.

📌 Takeaway: Oil markets remain stable, but gas supply may tighten later in 2025.

Gold Falls Below $2,910 as Fed Holds Rates Steady

📉 Gold price: $2,907 (-0.11%)

📌 Why the Drop?

✅ Fed Powell signaled no urgency for rate cuts.

✅ Geopolitical tensions eased (Ukraine-Russia ceasefire talks).

✅ Higher U.S. bond yields reduced gold’s safe-haven appeal.

📌 Takeaway: Gold remains supported by central bank buying (China +10T, Poland +29T), but short-term profit-taking continues.

EU Gas Prices Hit 5-Month Low – Danske Bank

📉 Natural gas prices fell to EUR 40/MWh, the lowest since October 2024.

📌 Why the Drop?

✅ Mild winter = lower heating demand.

✅ Higher gas storage levels ease supply concerns.

📌 Takeaway: Lower energy costs could ease inflation in the Eurozone.

Final Takeaways: What to Watch Next Week

📌 Key Market Themes:

✅ U.S. CPI & PPI Inflation Data (March 12-14): Will inflation remain sticky?

✅ U.S. Retail Sales Report (March 14): Will consumer spending hold up?

✅ Fed Rate Expectations: Will Powell reinforce a “wait and see” approach?

✅ White House Crypto Summit Outcomes: Will policy announcements boost altcoins further?

✅ OPEC+ Oil Market Strategy: Will Trump’s sanctions force production cuts?

📌 Market Sentiment:

🔹 Equities: Volatile but dip-buying emerging in key sectors.

🔹 Bonds: Watching inflation data for rate-cut clarity.

🔹 Commodities: Gold consolidating, oil reacting to geopolitical risks.

🔹 Crypto: Holding strong as policy momentum builds.