North America News

U.S. Stocks Crater in Worst Week Since 2020 Pandemic Crash

U.S. stock markets collapsed on Friday, capping a brutal week as rising tariffs, recession fears, and Fed hawkishness triggered a broad risk-off move. The S&P 500 and NASDAQ both plunged nearly 6% on the day, marking their second straight session of heavy losses.

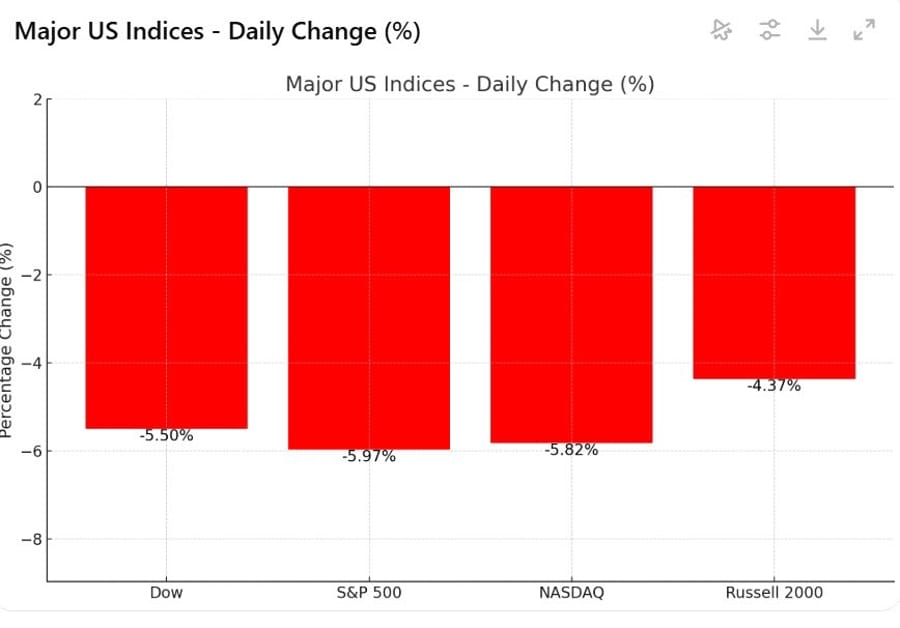

Friday’s Closing Numbers:

- Dow Jones: -2,231.07 points (-5.5%) to 38,314.86

- S&P 500: -322.44 points (-5.97%) to 5,074.05

- NASDAQ: -962.82 points (-5.82%) to 15,587.79

- Russell 2000: -83.51 points (-4.37%) to 1,827.03

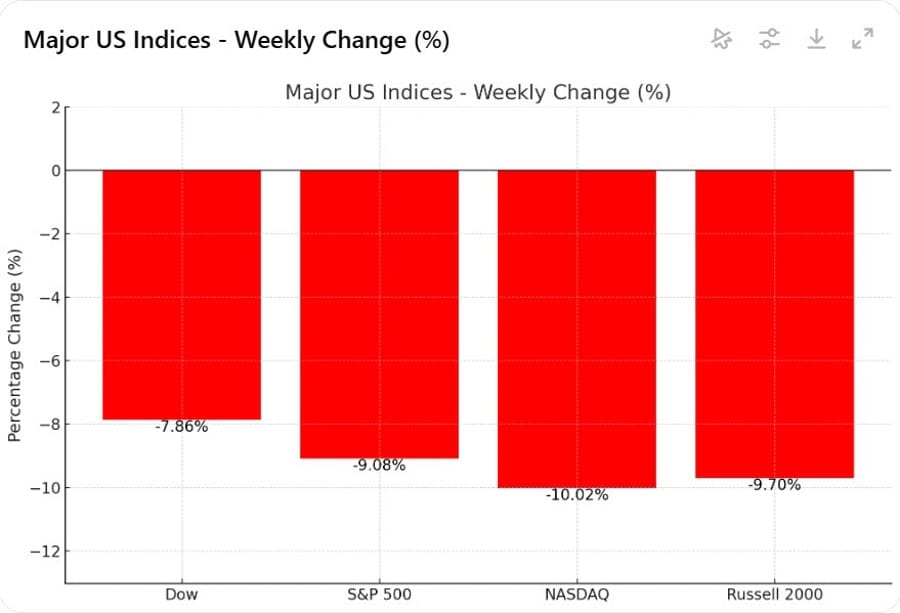

Weekly Performance (Worst Since March 2020):

- Dow: -7.86%

- S&P 500: -9.08%

- NASDAQ: -10.02%

- Russell 2000: -9.70%

Year-to-Date Losses Deepen:

- Dow Jones: -9.94%

- S&P 500: -13.73%

- NASDAQ: -19.28%

Magnificent 7 Stocks YTD:

- Tesla: -40.71%

- Apple: -24.77%

- Alphabet: -23.09%

- Amazon: -22.06%

- Nvidia: -29.77%

- Microsoft: -14.63%

- Meta: -13.80%

The selloff was triggered by escalating U.S.-China trade tensions, fears of persistent inflation, and a more hawkish Federal Reserve. Traders are now increasingly pricing in a recession scenario, further pressured by a deepening inversion of the U.S. yield curve. The pain was widespread, with high-growth tech names, small caps, and cyclicals all hit hard.

U.S. March Payrolls Surge to +228K, Unemployment Ticks Up

The U.S. economy added 228,000 jobs in March, well above the 135,000 expected. February’s print was revised down to +117,000 from +151,000. Unemployment rose slightly to 4.2% from 4.1% previously, with the unrounded rate at 4.1519%. The participation rate edged up to 62.5%, and the U6 underemployment rate dipped to 7.9% from 8.0%.

Wage growth matched expectations, with average hourly earnings up 0.3% m/m and 3.8% y/y. Weekly hours came in at 34.2.

Private payrolls increased by 209,000 vs 140,000 expected. Manufacturing added just 1,000 jobs vs 4,000 forecast. Government jobs rose by 19,000. The household survey showed an increase of 201,000 jobs, a rebound from the prior month’s -588,000. Full-time employment surged by 459,000 after a sharp drop of over 1.1 million previously.

Trump: Will sign executive order to keep TikTok open for 75 more days

- Pres. Trump will extend the deadline for the sale to US ownership

- Have made tremendous progress on TikTok deal

- I am signing an executive order to keep TikTok up and running for an additional 75 days

- He hopes to continue working in good faith with China

- we do not want TikTok to go dark

- We look forward to working with TikTok and China to close the deal

- I understand China is not very happy about our reciprocal tariff.

Powell: Bigger Tariffs Could Fuel Inflation, Slow Growth

Fed Chair Jerome Powell warned that larger-than-expected tariffs could lead to higher inflation and slower growth in remarks at the SABEW Conference in Virginia. He said it’s too early to determine the correct policy response, citing uncertainty around the scope and persistence of tariffs and potential retaliation.

Powell emphasized that while long-term inflation expectations remain anchored, there’s a clear risk of elevated unemployment and stickier inflation. He noted growing divergence between soft and hard economic data, as well as weaker business sentiment tied to policy uncertainty—particularly on trade.

Powell Q&A: People are still experiencing a high price level

- Comments from the Federal Reserve Chairman

- Inflation has come down quite a bit and we’re close to maximum employment

- Data has been solid, right through today’s jobs report

- What we’ve learned is that tariffs are higher than almost anyone expected but we don’t know where that comes to rest

- People expect us to tell the truth, and that’s what we intend to do

- We’re not responsible for trade, immigration or fiscal policy

- A year from now should be much lower as impact of Trump policies becomes clearer

- The two goals of the dual mandate may be in tension, but we’re not in a situation like the 1970s

- It feels like we don’t need to be in a hurry

- I fully intend to serve all of my term

- We are hearing from a lot of people waiting for clarity, I don’t know when that will come

- Uncertainty will decline

UBS Slashes U.S. GDP and S&P 500 Targets Amid Recession Risks

UBS Global Wealth Management now expects U.S. GDP to grow by less than 1% in 2025 and warns of a possible intra-year recession, with peak-to-trough contraction of around 1%. The bank has also downgraded its U.S. equities outlook, moving from “attractive” to “neutral.” It cut its year-end S&P 500 target for 2025 to 5,800, down from 6,400, citing increased recession risk, weaker consumer demand, and ongoing uncertainty tied to Trump’s tariffs and potential global retaliation.

Nomura Sees One Fed Cut in December, Revises 2025 Outlook

Nomura has changed its view on the U.S. Federal Reserve, now forecasting a single rate cut in December 2025. Previously, the firm had expected no cuts at all this year. The revision reflects the current divergence of opinion in markets, where some expect more aggressive easing while others see a prolonged pause. Nomura’s adjustment suggests that economic pressures are building just enough to force the Fed into action by year-end.

Stellantis to Lay Off 900 U.S. Workers, Pause Mexico and Canada Plants

Stellantis is laying off 900 workers at five U.S. facilities and pausing production at one plant each in Mexico and Canada in response to Trump’s newly announced tariffs. In a letter to employees, the automaker called the layoffs “temporary” but noted it is “continuing to assess the medium- and long-term effects of these tariffs.” The immediate moves reflect concern over rising costs and potential disruptions in cross-border production and supply chains.

Trump would consider deal where China approves TikTok sale in exchange for tariff relief

- Trump speaking

- Asked about tariffs and market response, Trump says ‘operation’ over, now it settles in

- Trump says he would consider deal where China approves TikTok sale in exchange for tariff relief

- Trump says open to tariff negotiations if other countries offer something phenomenal

- Trump, asked about firing of national security aides, says we sometimes let go of people we don’t like

- Trump confirms Russian envoy in US for talks

- Trump says he talked to Israel’s Netanyahu on Thursday; Israeli leader may visit US next week

- Trump says US close to TikTok deal, multiple investors involved

- Trump says Elon Musk can stay as long as he wants but may depart in a few months

- Trump says government efficiency work will continue after Musk departs

- Trump says he spoke to automaker executives on Thursday

- Trump says he thinks Iran wants direct talks

- Trump says he likes interest rates going down

Trump sued over China tariffs: legal challenge alleges abuse of emergency powers

- The lawsuit seeks a court order to block the tariffs’ enforcement and reverse changes to the U.S. tariff schedule.

- The suit claims Trump exceeded his legal authority by imposing tariffs under the International Emergency Economic Powers Act (IEEPA).

- It was filed in federal court in Florida and targets both the April 2 sweeping tariffs and those from February 1.

- The NCLA argues Trump has misused emergency powers, violated the Constitution’s separation of powers, and overstepped Congress’s authority on tariff policy.

- The lawsuit seeks a court order to block the tariffs’ enforcement and reverse changes to the U.S. tariff schedule.

- The White House has not yet commented on the case.

Morgan Stanley scraps 2025 Fed rate cut forecast, cites Trump tariffs and inflation risks

- Fed to hold rates steady through to March 2026

Morgan Stanley has withdrawn its forecast for a U.S. Federal Reserve rate cut in June, citing rising inflation risks stemming from Trump’s newly announced tariffs. The bank now expects the Fed to hold rates steady through to March 2026.

Trump announced sweeping tariffs on US imports on Wednesday, higher duties targeting dozens of countries. Morgan Stanley warned these measures could fuel “tariff-induced inflation,” making it unlikely the Fed will proceed with any rate cuts this year.

Previously, the Wall Street firm had anticipated a 25 basis point cut in June. However, with inflationary pressures now expected to remain elevated, the firm believes the Federal Open Market Committee (FOMC) will delay any policy easing until inflation stabilises.

IMF says US tariffs a ‘significant risk to global outlook’ at a time of sluggish growth

- Says need to avoid further harm

- Says U.S. tariff measures represent a ‘significant risk to the global outlook’ at a time of sluggish growth

- Says it is important to avoid steps that could further harm the world economy

- We appeal to the U.S. and its trading partners to work constructively to reduce tensions

Trump has fired NSA Director Timothy Haugh

- National Security Agency head

The National Security Agency (NSA) is the preeminent US wiretapping and cyber espionage service.

Washington Post reports that its director has been fired. This comes after Trump fired multiple administration officials, including at least three National Security Council staffers, on Thursday.

US manufacturing news – Whirlpool to lay off 651 workers

- That’s nearly a third of the company’s workforce of 2,000

Whirlpool Corp. will lay off 651 workers from its Amana manufacturing facility effective June 1

- Company cites reduced consumer demand for its refrigeration products

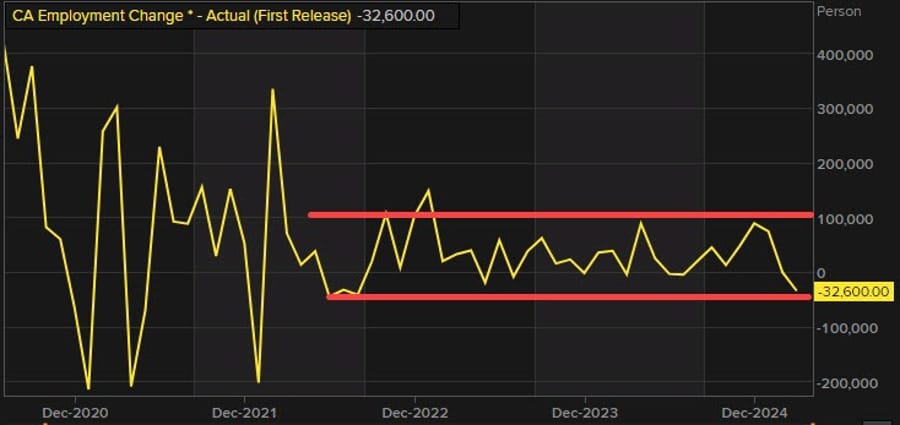

Canada March jobs data misses badly, unemployment ticks up to 6.7%

Canada lost 32.6K jobs in March, a sharp miss versus the +10K expected. This follows a flat February and ends a streak of three strong months of job growth from November to January. The unemployment rate rose to 6.7% from 6.6%, the first increase since November 2024. Full-time employment saw a significant drop of 62K jobs, while part-time jobs rose 29.5K.

Sector breakdowns show sharp declines in wholesale/retail trade (-29K) and information/culture/recreation (-20K), while gains came from ‘other services’ (+12K) and utilities (+4.2K). Ontario (-28K) and Alberta (-15K) saw job losses, while Saskatchewan added 6.6K jobs. Private sector employment fell by 48K, public sector and self-employment were little changed. Average hourly wages rose 3.6% y/y to $36.05.

Commodities News

Gold dives below $3,025 as Powell warns tariffs could drive persistent inflation

Gold fell 2.8% to $3,023/oz, extending its slide as Fed Chair Jerome Powell turned more hawkish in a Friday speech. He warned that the new tariffs could prolong inflation, adding that the Fed is in no rush to ease rates. That tone crushed expectations for near-term cuts and pushed the U.S. dollar higher (DXY +0.47% to 102.56).

Powell also acknowledged rising downside risks to the economy but emphasized the Fed’s need to avoid reacting to “one-time” price spikes that could turn into structural inflation.

Gold technicals:

- Key support near $3,000

- Next level: 50-day SMA at $2,937

- Further downside: $2,900

- Recovery targets: $3,100 to regain bullish footing

Crude oil collapses nearly 7.5% on OPEC+ surprise and tariff-driven growth fears

WTI crude settled at $61.99, down $4.96 (-7.40%) on Friday, its worst single-day drop in over a year. The plunge was driven by mounting fears of slower global growth amid escalating U.S.-China trade tensions and a larger-than-expected production hike from OPEC+. Starting May, the group will increase output by 411,000 bpd, fast-tracking three months’ worth of scheduled additions into one. For the week, oil fell 2.19%, its worst performance since March 2023.

Baker Hughes rig count shows Canada drops 10 rigs, U.S. down 2

The total U.S. rig count declined by 2 to 590, with oil rigs up 5 and gas rigs down 7. Year-over-year, the U.S. rig count is down 30. Canada saw a larger weekly drop, down 10 to 153 rigs, driven by a 9-rig decline in oil rigs. Despite the weekly drop, Canada’s rig count is still up 17 compared to a year ago.

Silver plunges over 6%, gives up March gains

Silver dropped to $31.20 per ounce, erasing all its March gains. The gold/silver ratio surged to 99, its highest since July 2020. Commerzbank notes that concerns over global growth, triggered by new U.S. tariffs, are weighing heavily on industrial silver demand. Platinum and palladium also fell, though less dramatically.

Copper falls as tariff fears weigh on global growth sentiment

Copper prices dropped sharply amid fears that Trump’s tariff moves will dampen global demand for industrial metals. While gold and base metals were exempted from the tariffs, broader growth concerns are dragging prices. ING analysts note that while China may step in with stimulus, the risk of an extended trade war is bearish for metals overall. Gold also dipped on profit-taking after hitting record highs earlier this week.

Goldman Sachs Cuts Oil Price Forecasts on Trade and OPEC+ Risks

Goldman Sachs has lowered its oil price outlook, citing rising global trade tensions and a modest increase in OPEC+ supply. The bank now sees Brent averaging $69 per barrel and WTI at $66 in 2025, down from previous projections. For 2026, Goldman expects Brent at $62 and WTI at $59—$4 below current forward curve averages. The December 2025 forecasts for both benchmarks were also trimmed by $5 each, to $66 and $62, respectively. Goldman cautioned that risks remain tilted to the downside, especially in 2026, as geopolitical and economic uncertainties weigh on demand.

Barclays Sees Downside Risk to $74 Brent Forecast Amid Trade Tensions

Barclays is warning that its $74 forecast for Brent crude in 2025 is under threat due to escalating trade tensions. Analysts say the global trade conflict sparked by Trump’s tariffs could weaken economic activity and oil demand, increasing downside pressure on prices. The sharp fall in Brent following the tariff announcement underlines how sensitive the oil market is to macroeconomic risks.

Oil Hits Multi-Year Lows as Supply Surges and Recession Fears Mount

WTI crude has fallen to its lowest level since May 2023, while Brent crude has slumped to prices not seen since November 2021. The drop comes amid a difficult macro backdrop: OPEC+ is raising output just as Trump’s tariff-driven trade policies heighten fears of a global slowdown. Recession concerns spiked after Wednesday’s surprise tariff announcement, triggering a wave of risk-off sentiment across markets. On the technical front, WTI is testing key 2023 support levels—if those break, a slide back toward $60 is in play.

Europe News

Germany March Construction PMI Falls Further to 40.3

Germany’s construction PMI dropped to 40.3 in March from 41.2 in February, showing deepening weakness in the sector. All three segments—residential, commercial, and civil—continue to contract. While there is some hope tied to planned infrastructure spending, it’s expected to take time to lift activity meaningfully. The data adds to signs that Germany’s broader economy remains under strain.

HCOB notes that:

“The sustained decline in activity in the construction sector may at first glance be surprising given the planned 500 billion euro special infrastructure fund. But of course it is much too early to expect a surge in growth just yet. What can be observed is that the index of future activity has jumped. However, it is still in the pessimistic zone, showing that companies are a bit sceptical about when and if the funds will actually be available. Things might look up once the coalition agreement is sorted and the new government is in place. The special fund is definitely a step in the right direction, giving companies some planning security and ensuring that public investment is not just a year-to-year decision.

“Across the board, things are not looking great. Residential construction, commercial real estate, and civil engineering all saw a faster decline in activity in March. Residential activity is under the most pressure, followed by commercial real estate. Civil engineering had shown some signs of stabilizing earlier this year but has taken another hit. However, this sector stands to benefit the most from the new infrastructure program. The approval of special funds means civil engineering companies can expect more follow-up projects, which should boost their willingness to maintain or expand their workforce and invest in new machinery. In fact, job cuts slowed sharply in March, hitting their lowest level since early 2023.

“The availability of subcontractors has risen again, indicating relatively low capacity utilization. This aligns with the 60% capacity utilization reported by Destatis. For once, this is good news for the German economy because it means that the planned increase in infrastructure spending will likely boost construction activity rather than just drive up prices. With the infrastructure fund decision, the conditions are in place for a recovery in the construction sector.”

Germany February Industrial Orders Flat, Miss Expectations

German industrial orders were flat in February, falling short of the +3.5% month-on-month increase expected. The prior reading was revised up from -7.0% to -5.5%. After a run of volatile data tied to large transport orders, February saw no major movement overall. Capital goods orders rose 1.5%, but that gain was erased by a 1.3% decline in intermediate goods and a steep 5.2% drop in consumer goods orders.

UK March Construction PMI at 46.4, Sector Still Contracting

UK construction activity remained in contraction in March, though the pace of decline eased. The S&P Global construction PMI came in at 46.4, above the expected 46.0 and up from February’s 44.6. Despite the slight improvement, all major subsectors—commercial, residential, and civil engineering—are still shrinking. A sharp drop in employment across the sector adds another red flag to the outlook.

S&P Global notes that:

“March data highlighted a challenging month for UK construction companies as sharply reduced order volumes continued to weigh on overall workloads.

“Civil engineering experienced the biggest setback as activity decreased to the greatest extent since October 2020. Survey respondents commented on subdued sales pipelines and a subsequent lack of infrastructure work to replace completed projects.

“Commercial work also saw a headwind from delayed decision-making on major projects, largely due to worries about the impact of rising global economic uncertainty. The downturn in residential construction activity nonetheless eased since February, providing a source of encouragement despite ongoing reports of sluggish demand conditions.

“Construction companies remained cautious about their year ahead growth prospects, as fewer sales conversions and a third successive monthly reduction in total new work hit confidence levels. Overall business optimism slipped to its lowest since October 2023. “A lack of new projects, alongside pressure on margins from rising payroll costs, led to hiring freezes and the non-replacement of departing staff in March. The net result was the fastest pace of job shedding across the construction sector for nearly four-and-a-half years.”

Switzerland March Unemployment Rate Rises to 2.8%

Switzerland’s seasonally adjusted unemployment rate rose to 2.8% in March, slightly above the 2.7% forecast and the prior month’s 2.7%, according to SECO data released on April 4. The uptick continues the gradual softening trend in the labor market following the post-Covid recovery, signaling a slower pace of hiring as momentum fades.

EU Trade commissioner Sepcovic: US tariffs are damaging and unjustified

- EU Trade Commissioner Sepcovic speaking on tariffs:

- Had frank talks with US officials over Pres. Trump tariffs

- He reiterated to United States US Commerce Secretary Lutnick that US tariffs are damaging and unjustified.

- On US tariffs that EU is committed to meaningful negotiations but also prepared to defend our interests.

- Will stay in touch with US on this issue

Nomura Now Expects ECB to Cut Rates in April and June

Nomura has updated its European Central Bank forecast, now expecting two 25-basis-point rate cuts—one in April and another in June. The bank had previously projected the ECB would hold off until June. The revised outlook aligns with market pricing, which puts the odds of an April cut at around 73%. However, markets are currently only pricing in a total of 50 bps in cuts by July, suggesting further easing later in the year is not yet fully expected.

Asia-Pacific & World News

China Responds With 34% Tariffs on All U.S. Goods, Effective April 10

China has announced a 34% tariff on all U.S. imports, effective April 10, in retaliation for Trump’s sweeping trade measures. The move also includes the addition of 16 U.S. entities to its export control list and new restrictions on rare earth-related exports. Risk sentiment took another hit on the headlines, with markets bracing for further retaliation and drawn-out negotiations. Beijing’s decision to match Washington’s aggression blow-for-blow signals that trade tensions are escalating rapidly, with wide-reaching implications for global supply chains and investor confidence.

Hong Kong and China market holiday Friday, April 4, 2025 – Ching Ming Festival

- Hong Kong and mainland China are on holiday for the Tomb Sweeping Festival, April 4 to 6 inclusive.

With mainland and Hong Kong markets out today, trading linked are also closed.

JPMorgan Raises Global Recession Risk to 60% on Tariff Shock

JPMorgan has increased its global recession risk estimate to 60%, up from 40%, following Trump’s sweeping tariff hikes. Analysts say the cumulative impact of the new levies represents a 22% increase in effective tax burden—on par with the largest U.S. tax hike since 1968. While the U.S. and global economies remain fundamentally solid, JPM warns that retaliation, supply chain disruptions, and falling business confidence could magnify the damage. The bank also flagged long-term supply-side issues from tighter immigration and persistent trade restrictions, even as it expects more policy responses in the coming months.

Heads up – Australia switches off daylight saving this weekend

- If you are trading Australian markets from offshore you may need to adjust your times

Australia ends daylight saving this weekend.

Clocks will be turned back an hour on Sunday, April 6.

ANZ forecasts Reserve Bank of Australia rate cuts in May, June and August 2025

- Market pricing for RBA rate cuts, as soon as May, have jumped

Forecasts for Reserve Bank of Australia interest rate cuts ramped higher in the wake of Trump’s tariff trade war announcement on Wednesday.

ANZ see the RBA cutting by 25bp at the next meeting, in May

RBNZ Expected to Cut Again on April 9 as Easing Cycle Continues

The Reserve Bank of New Zealand is expected to cut its official cash rate by 25 basis points to 3.50% on April 9, according to all 31 economists surveyed in a Reuters poll. It would mark the fifth consecutive cut since August 2024, totaling 175 basis points of easing as the central bank works to support a sluggish recovery from recession. Most economists expect another 25 bps cut in May, with the cash rate projected to reach 3.00% by Q3 2025. The RBNZ has already signaled cuts for April and May, maintaining a dovish stance relative to other central banks, as inflation remains within its 1%-3% target range.

Japan Household Spending Beats Expectations

Japan’s household spending in February declined 0.5% year-over-year, a softer fall than the expected -1.7%, and an improvement from January’s +0.8% gain. Month-over-month, spending jumped 3.5%, easily beating expectations for a 0.5% rise and recovering from the previous month’s -4.5% drop. The strong m/m rebound suggests domestic demand held up better than forecast, even as consumers face rising prices and broader economic uncertainty.

BOJ may hike rates in May or June next, says former policymaker

- Remarks by former BOJ policymaker, Makoto Sakurai

- BOJ will aim to raise rates to 1% under current rate hike cycle

- The next rate hike from 0.50% to 0.75% could happen either in May or June

- That will be followed up with a pause

Japan PM Ishiba: I want to set up a tariffs response headquarters soon

- Comments from Japanese PM Ishiba

- I want to set up a tariffs response headquarters soon.

- Trying to set up a phone call with Trump first.

- I was asked to have a call with Trump soon.

- Explained government measures on tariffs to party leaders.

BoJ Gov Ueda says US tariffs likely to exert downward pressure on Japan, global economies

- Bank of Japan Governor Ueda

- US tariffs likely to exert downward pressure on Japan, global economies

- Hard to say now how US tariffs will affect Japan’s price moves

- Will closely monitor US tariff impact on Japan, overseas economic and price developments in deciding monetary policy

- We will scrutinise data, including from hearings, available at the time of each policy meeting to gauge US tariff impact on Japan’s economy, prices

- We will guide monetary policy appropriately from standpoint of sustainably achieving 2% inflation target

- When external environment changes sharply, our growth and price forecasts will change, so will guide monetary policy accordingly in appropriate manner

- BOJ tankan showed some manufacturers saw hit from U.S. tariffs, sluggish Chinese & overseas demand

- March BOJ tankan also showed improvement in non-manufacturers’ business sentiment reflecting Japan’s moderate economic recovery

- Taken together, we see Japan business sentiment in good shape

- March tankan underscored our view Japan’s economy recovering moderately

- Due to survey period, March tankan may not have fully incorporated impact of US tariff announcements

BOJ dep gov Uchida says will raise rates if inflation rises and economy improves

- Basically a repeat of what the BoJ has been saying

Bank of Japan Deputy Governor Uchida

- Will raise interest rates if underlying inflation heightens against background of continued improvements in economy

- We will examine, without any preset idea, whether our economic, price forecasts laid out in our quarterly report will be achieved

- We will scrutinise at each meeting economic, price developments and risks including impact from U.S. tariffs

- Trump tariffs likely to put downward pressure on Japan, global economies

- There are various upside, downside impacts on prices that could come from Trump tariffs

- Trump tariffs could push down prices if they cool economy, but may push up prices via impact on global supply chains

- Trump tariffs could affect prices via market, FX moves

Japan considering an extra budget to address tariffs

- Also, Nissan ‘pause’ orders for some vehicles for US market

Japanese media (Asahi) says the Japanese government is considering what actions to take over the new tariffs, including an extra budget.

Nissan, meanwhile, says its pausing order for the US market for its Infiniti branded QX50 and QX55 vehicles.

South Korea Constitutional Court upheld President Yoon Suk Yeolhis impeachment

- This is over his attempt at martial law back in December

The political turmoil in South Korea caused financial market uncertainty.

Indeed, South Korea will hold a financial market discussion meeting later today. The Ministry of Finance, the Bank of Korea, and regulatory agencies will meet later.

Crypto Market Pulse

Bitcoin Holds Steady as Trump, Powell Clash Over Interest Rates

Bitcoin (BTC) held firm above $84,000 on Friday, showing resilience as U.S. stocks erased over $1.5 trillion in market value, and tensions rose between former President Donald Trump and Federal Reserve Chair Jerome Powell over interest rate policy.

Trump Calls Out Powell, Demands Rate Cuts

On Truth Social, Trump called on Powell to cut interest rates immediately, accusing him of being “always late” and “playing politics.” He argued that the timing was ideal to ease monetary policy amid rising trade tensions and tariffs, urging Powell to “change his image.”

The post dropped just minutes before Powell’s scheduled remarks at the Society for Advancing Business Editing and Writing conference in Virginia.

Powell Pushes Back: “Wait and See”

In his speech, Powell said the Fed would stay patient, maintaining a “wait and see” approach. He emphasized the need for clearer data before making any rate changes and warned that tariffs could lead to more persistent inflation.

Markets didn’t take it well.

- S&P 500: -5.97%

- Nasdaq 100: -6%

- Gold: -2.6%

- Silver: -8%

But Bitcoin held up, briefly reclaiming the $84,000 level. Other major tokens like XRP and Solana climbed 3% and 5%, respectively.

Bitcoin Begins to Decouple From Stocks

The crypto market’s relative stability suggests a weakening correlation between crypto and equities. This shift supports the idea that Bitcoin may be reclaiming its “digital safe haven” status — especially if U.S.-China trade tensions escalate into a prolonged conflict.

This isn’t the first time Bitcoin has followed this path. In early 2020, BTC crashed alongside stocks during the COVID panic, but it was one of the first assets to recover, quickly outpacing equities. A similar decoupling may be underway.

BTC has gained over 2% this week, while equities plunged — a divergence that mirrors mid-March 2020, when Bitcoin began outperforming during a market meltdown.

Key Level to Watch

For Bitcoin bulls, the critical level is $80,000. A decisive break below that support could invalidate the current safe-haven narrative and trigger a deeper correction.

But if BTC continues to hold ground while traditional markets falter, the asset could draw increased demand from investors looking to hedge against growing uncertainty and a more aggressive tariff regime.

Bitcoin risks $793M liquidation as China hits back with 34% tariffs

China announced 34% retaliatory tariffs on U.S. imports just two days after Trump’s fresh round of tariffs. Bitcoin responded with a sharp drop to $81,600 before rebounding. $91M in BTC longs were liquidated in the past 24 hours, and if price breaks below $81,000, another $793M in leveraged long positions could get wiped out, according to liquidation map data. The ongoing trade war is adding significant pressure across risk assets.

OKX fined $1.2M by Malta watchdog over AML failures

Malta’s Financial Intelligence Analysis Unit fined OKX’s European arm €1.05M ($1.2M) for violating anti-money laundering regulations. The fine stems from a failure to assess risks associated with its crypto offerings. OKX said it has addressed the issues identified and remains committed to compliance. The company holds a MiCA license, allowing it to operate across the EU.

The Day’s Takeaway

Day’s Takeaway: Key Market Trends & Developments

U.S. Markets suffered their worst week since the 2020 pandemic crash, with the S&P 500 and Nasdaq both down nearly 6% on Friday. Trade war fears, a hawkish Fed, and recession risks drove a broad selloff. March payrolls beat expectations (+228K), but Powell’s warning that tariffs could fuel inflation weighed heavily. JPMorgan now sees a 60% chance of global recession. UBS slashed its U.S. GDP and S&P 500 targets, citing weakening demand and rising uncertainty.

Canada Jobs data missed badly, with 32.6K jobs lost in March and unemployment ticking up to 6.7%. Full-time employment fell sharply, raising red flags for consumer strength. The Baker Hughes rig count dropped by 10, hinting at slower energy sector momentum. Wages rose 3.6% y/y, but growth is uneven across provinces and sectors.

Commodities Oil plunged over 7% on Friday as OPEC+ surprised with a larger supply hike and global growth fears deepened. WTI settled below $62, the lowest in over a year. Goldman and Barclays cut oil forecasts on trade concerns. Silver and copper also sold off sharply, with silver down 6%, erasing March’s gains. Gold dropped below $3,025 as Powell signaled a cautious Fed stance.

Europe Nomura now expects the ECB to cut rates in both April and June. Weak economic data reinforced the case: Germany’s industrial orders came in flat, and construction PMI fell further to 40.3. UK construction activity also remained in contraction, despite a slight rebound in the PMI. Switzerland’s jobless rate edged up to 2.8%.

Asia-Pacific Japan’s household spending showed resilience with a strong 3.5% m/m gain, beating expectations. The RBNZ is widely expected to cut rates again next week as its easing cycle continues. China escalated the trade war with a 34% tariff on U.S. goods and export controls, rattling markets.

Global JPMorgan raised the global recession probability to 60% due to Trump’s aggressive tariff policy. Economic confidence is sliding as businesses and investors brace for prolonged disruptions. UBS downgraded global growth forecasts and risk assets remain under pressure.

Crypto Despite the chaos in traditional markets, Bitcoin held firm above $84K, outperforming risk assets and signaling potential decoupling. A break below $81K could trigger nearly $800M in liquidations. OKX was fined $1.2M in Malta over AML failures but remains operational across the EU. Altcoins like XRP and Solana gained, showing crypto’s resilience amid macro volatility.