North America News

Markets Close Mixed After Wild Swings, NASDAQ Barely in the Green

U.S. stocks ended Monday’s volatile session mixed, as investors digested recession signals, global tariff fallout, and rate cut uncertainty. The NASDAQ managed to edge up 15.48 points (+0.10%) to close at 15,603.26, while the Dow and S&P 500 ended lower.

- Dow Jones: -349.26 points (-0.91%) to 37,965.60

- S&P 500: -11.83 points (-0.23%) to 5,062.25

Intra-day, the market saw extreme swings: the Dow was up 885 points at session highs and down 1,703 points at the lows. The S&P 500 dropped as low as 4,835, its weakest level since January 2024, before bouncing back to close above the psychological 5,000 mark — a modest technical win for bulls.

Volatility was driven by a cascade of macro pressures: tariff escalation, sliding oil and gold prices, and growing concerns about stagflation. Despite some buying in tech, the broad market remained cautious, with Fed signals and inflation data still on deck.

US March employment trends 109.03 vs 108.56 prior

The Conference Board’s employment trends index rose to 109.03 in March from a revised 108.56. While it’s a composite of previously released data, it offers a useful snapshot of labor market momentum.

White House Pushes for Global Burden-Sharing as Trade Pressures Mount

A senior White House advisor, Miran, laid out a five-point strategy aimed at reducing the cost of what the U.S. sees as its provision of global public goods — namely military security and the U.S. dollar’s reserve currency status. The comments come amid escalating trade tensions following President Trump’s tariff-heavy “Liberation Day” policy.

Miran argued that while these services create global prosperity, they come at a steep cost to American taxpayers, distort trade, and have contributed to the hollowing out of U.S. manufacturing. He pointed to 50 years of trade deficits as evidence that the global system is no longer self-correcting.

The five steps he proposed for other countries to “share the burden” are:

- Accept tariffs without retaliation, providing revenue to the U.S. Treasury.

- Open markets to U.S. exports, ending what he called “unfair trading practices.”

- Buy more U.S.-made defense goods, supporting jobs and military readiness.

- Build factories in the U.S., avoiding tariffs by producing domestically.

- Write direct checks to the Treasury, contributing to the cost of U.S. public goods.

Miran added that tariffs will serve a dual purpose: funding both tax cuts and deficit reduction. He framed the trade war as not just a negotiation tactic but a strategic rebalancing of the global economic order.

Larry Fink: Tariffs will drive inflation, recession likely underway

Blackrock CEO Larry Fink says the White House’s trade actions are more inflationary than markets expect.

- Sees no chance of 4–5 Fed rate cuts in 2025

- Believes US is “probably in a recession”

- Views downturn as a buying opportunity — but warns markets could fall another 20%

- “The economy is weakening,” Fink said at the Economic Club of New York

Trump threatens 50% tariffs on China if retaliation isn’t reversed

On Truth Social, Trump warned China to withdraw its new 34% retaliatory tariffs or face 50% tariffs from the US starting April 9.

“If China does not withdraw its 34% increase… the United States will impose ADDITIONAL Tariffs on China of 50%… All talks with China will be terminated.”

China’s current tariff rate is at 54%. Trump’s move would take that figure to a staggering 104%. The deadline is tomorrow.

Fed’s Kugler: Inflation expectations rising, investment stalling

Fed Governor Kugler says short-term inflation expectations have edged up, though long-run expectations remain anchored.

- Reinforced 2% inflation target

- Inflation seen as more damaging than current interest rates

- Uncertainty weighing heavily on business investment

- Tariff effects on consumer prices still unclear

Navarro: We are going to have a broad-based recovery in stocks

- Navarro on CNBC

- We’re going to get the Dow to 50,000

- We’re lowering oil prices

- China, Vietnam and German are going to have to engage in fiscal stimulus to reorient their economies

- Any talk of recession is ‘silly’ given expected tax cuts

- Market is trying to find its bottom

- The President will always listen on negotiations

- Vietnam says that when they go to zero tariffs, it means nothing to us

- Cites trans-shipments from China, IP theft, dumping, 10% VAT

- This ‘zero tariff’ thing is misdirection

- I see tariffs as a tax cut

Goldman Sachs: Recession Odds Rise to 45%, Cuts 2025 Growth Outlook

In its note “Countdown to Recession”, Goldman raises its 12-month U.S. recession probability from 35% to 45%, citing Trump-era tariff risks, tightening financial conditions, and weaker capex.

Goldman now sees Q4/Q4 GDP growth in 2025 at just 0.5%, slashed from previous projections. Their baseline assumes a 15pp increase in effective tariff rate—with potential for a 20pp hike if upcoming U.S. tariffs proceed as planned.

“If that scenario materializes,” Goldman warned, “we would revise our forecast to include a recession.”

Goldman Sachs: Fed May Cut Rates by Up to 200bps if Recession Hits

Goldman Sachs now expects the Fed to start cutting rates in June—one month earlier than its previous call. Under its base case (no recession), the Fed would deliver three consecutive 25bp cuts, taking the target range to 3.5%–3.75%.

But if the U.S. enters recession, Goldman sees a steeper easing path—up to 200bps over the next year. Adjusting for recession risk, its weighted forecast for 2025 cuts is now 130bps, up from 105bps. That brings GS in line with market pricing as of Friday’s close.

Billionaire investor Cooperman: bottom is not in yet, sell on strength

- Billionaire investor Leon Cooperman in an interview with CNBC

- The long term impact of tariffs is more inflation and less growth.

- It’s a mistake.

- Bottom is not in yet, sell on strength.

Leon Cooperman is the founder of Omega Advisors. The fund averaged 14.6% annual returns since inception outperforming the S&P 500.

Recent tariffs will likely increase inflation – Jamie Dimon

- JP Morgan CEO, Jamie Dimon, remarks in his annual letter to shareholders

- Tariffs to also cause many to consider greater probability of recession

- US economy had at least until recently, continued to be resilient

- Consumers are still spending but there is some recent weakening

- The economy is facing considerable turbulence

- The potential positives are tax reform and deregulation

- The potential negatives are tariffs, trade war, ongoing sticky inflation, high fiscal deficits, still rather high asset prices and volatility

- We are likely to see inflationary outcomes

- Whether or not the menu of tariffs causes a recession remains in question

- But it will slow down growth

- The quicker all of this is resolved, the better because some negative effects increase cumulatively over time and would be hard to reverse

Druckenmiller: ‘I do not support tariffs exceeding 10%’

Druckenmiller very rarely interacts on twitter, but he did post on tariffs:

In response to a video on X of the CNBC interview with Druckenmiller from January, the veteran investor wrote: “I do not support tariffs exceeding 10% which I made abundantly clear in the interview you cite.”

Trump shrugs off stock market collapse – “sometimes you have to take medicine”

- Trump comments from his plane

Trump said on Sunday that “sometimes you have to take medicine” when asked about recent market volatility, insisting he was not deliberately trying to trigger a selloff.

Speaking to reporters aboard Air Force One, Trump made clear he would not agree to any deal with China unless the trade deficit is addressed.

He also noted that he had spoken with European and Asian leaders about the tariffs introduced by his administration.

ICYMI – JPMorgan forecasts US recession in late 2025 as Trump tariffs bite

- Via a note from JPM

JPMorgan expects the U.S. economy to slip into recession in the second half of 2025, as the effects of Trump’s tariff policy begin to weigh on growth.

Michael Feroli, the bank’s chief U.S. economist, anticipates a mild two-quarter contraction beginning in the third quarter. JPMorgan projects GDP will:

- shrink by 1.0% in Q3

- and by 0.5% in Q4, marking a technical recession.

- For the full year, Feroli’s team sees U.S. economic output declining 0.3%.

“The impact of the renewed tariffs is likely to build over time, tightening financial conditions and dampening business investment,” Feroli said in the bank’s latest outlook.

The forecast comes amid rising concern that protectionist trade measures could disrupt supply chains, raise input costs, and weigh on consumer sentiment — all of which could reverse the momentum that has underpinned U.S. economic resilience in recent quarters.

JPMorgan’s view places it among the more bearish on Wall Street, with other major banks still split on whether the U.S. will manage a soft landing or face a downturn.

BOC business outlook: Sentiment weakens, recession fears grow

The Bank of Canada’s Q1 Business Outlook Survey shows a significant deterioration in business sentiment, with uncertainty widespread.

- Q1 indicator: -2.14 vs -1.16 in Q4

- 32% of firms expect a recession within 12 months, up from 15%

- Future sales indicator falls to +22 from +30

- Hiring intentions and investment plans are subdued

Separately, the consumer survey shows 5-year inflation expectations climbing to 3.39% from 2.99%. The survey was conducted from Feb 6–26, so it may not fully capture recent developments.

Commodities News

Gold Falls Below $3,000 as Strong Dollar and Tariff Fears Rattle Markets

Gold prices tumbled below $3,000 per ounce on Monday, dropping over 2% to trade around $2,971, the lowest level since mid-March. The sell-off came amid renewed risk-off sentiment, a surging U.S. dollar, and fears of a global recession tied to escalating trade tensions.

The U.S. Dollar Index (DXY) rose to 103.29, while 10-year Treasury yields jumped to 4.15%, as investors sought safety in the greenback rather than precious metals.

The Trump administration refuted rumors of a 90-day pause in tariffs, labeling the reports “fake news.” Instead, reciprocal tariffs remain in play, with China’s 34% duty on U.S. imports further fanning recession fears.

Gold was also pressured by surging real yields, with TIPS (Treasury Inflation-Protected Securities) showing a 14 basis point increase to 1.967%.

Looking ahead, traders are eyeing key macro data including FOMC minutes, CPI, and PPI later this week. The path of inflation expectations and potential rate cuts remains highly uncertain, especially as new tariffs add upward pressure on prices.

Crude Oil Settles at $60.70, Lowest Since April 2021

Crude oil prices settled at $60.70 on Monday, falling $1.29 or -2.08%, and marking the lowest close since April 2021. The commodity has dropped 20% since President Trump’s April 2 “Liberation Day” announcement, which introduced steep tariffs on many U.S. trading partners and raised fresh concerns about global economic growth and inflation.

Further pressure came from OPEC+, which announced on Thursday it would accelerate the rollback of voluntary production cuts, bringing an additional 411,000 barrels per day to market next month. The timing of the increase, combined with the growing macroeconomic uncertainty, has added significant downward momentum.

On the technical front, oil broke below a key swing area between $63.61 and $65.29, specifically the 50% midpoint at $64.71. Staying below this threshold keeps the bears in control and sets the stage for more downside. The intraday low of $58.97 is now a crucial level to watch. A break below that could open the door to further selling as trader sentiment deteriorates.

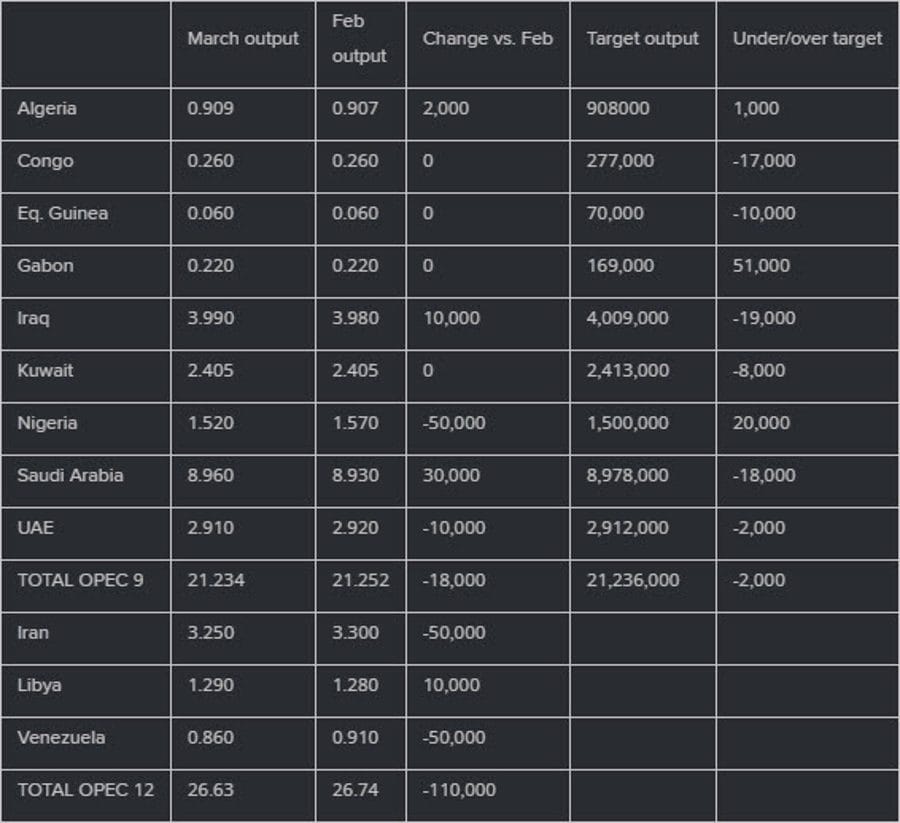

OPEC output down 110K bpd in March

OPEC output fell by 110,000 barrels per day in March, according to a Reuters survey, despite plans to increase production.

- Nigeria, Iran, and Venezuela saw declines

- Saudi Arabia, Iraq, and UAE were at or below quotas

- Drop may explain why OPEC+ sought to ramp up production amid market volatility

Energy: Oil drops on demand fears and tariff shock – ING

Oil had its worst week since October 2023, falling sharply on tariff fallout.

- Brent fell nearly 11%, hitting the mid-$60s

- Traders were blindsided by the timing and size of tariffs

- Market is now pricing in a 1 million b/d hit to demand for 2025

- Drilling slowdown expected in the US — WTI prices are below break-even for many producers

- Dallas Fed Survey suggests breakeven for new wells is around $65/bbl

Metals tank as global growth fears mount – ING

Metals were hammered by escalating trade tensions and fears of a broader economic slowdown.

- Copper fell over 6% on the LME — its worst drop in five years

- COMEX copper dropped more than 8%

- Nickel fell 6%, hitting lows not seen since 2020

China’s 34% retaliatory tariffs, combined with its role as the top metals consumer, intensified concerns over global demand.

Deutsche Bank raises gold forecast, stays bullish into 2026

Deutsche Bank now sees gold averaging $3,139 in 2025 and $3,700 in 2026, citing recession risk and global uncertainty. That’s up from earlier forecasts of $2,725 and $2,900, respectively.

“We conclude that the bull case for gold remains strong despite this week’s correction,” the firm said, now expecting a Q4 2025 price of $3,350/oz.

China Buys More Gold for Fifth Straight Month

China continued building its gold reserves in March:

- $229.59B vs. $208.64B in February

- 73.70 million troy oz vs. 73.61 million in February

- FX reserves rose to $3.241T from $3.227T

The steady accumulation of gold suggests Beijing is hedging currency risks and diversifying amid escalating geopolitical tensions.

Europe News

Eurozone Feb retail sales +0.3% m/m vs +0.4% expected

- Prior: -0.3% (revised to 0.0%)

All categories posted gains: - Food: +0.3%

- Non-food: +0.3%

- Fuel: +0.2%

Retail data signals modest consumer resilience across the bloc.

Eurozone April Sentix confidence -19.5 vs -10.0 expected

- Prior: -2.9

Investor morale plunged to its lowest level since October 2023, driven by tariff-related uncertainty. This is the second-largest drop in Sentix history, only behind the Ukraine war shock.

Germany Feb trade surplus €17.7B vs €17.0B expected

- Prior: €16.0B

- Exports: +1.8% m/m

- Imports: +0.7% m/m

Germany’s trade surplus widened slightly, driven by stronger exports—particularly to the U.S., which rose 8.5% m/m to €14.2B.

Germany Feb industrial production -1.3% m/m vs -0.8% expected

- Prior: -2.0%

- Energy output: -0.6%

- Construction: -3.2%

Ex-energy and construction, IP declined 0.5%. Breakdown:

- Intermediate goods: -0.4%

- Consumer goods: -3.0%

- Capital goods: +0.2%

The data shows continued weakness across manufacturing sectors.

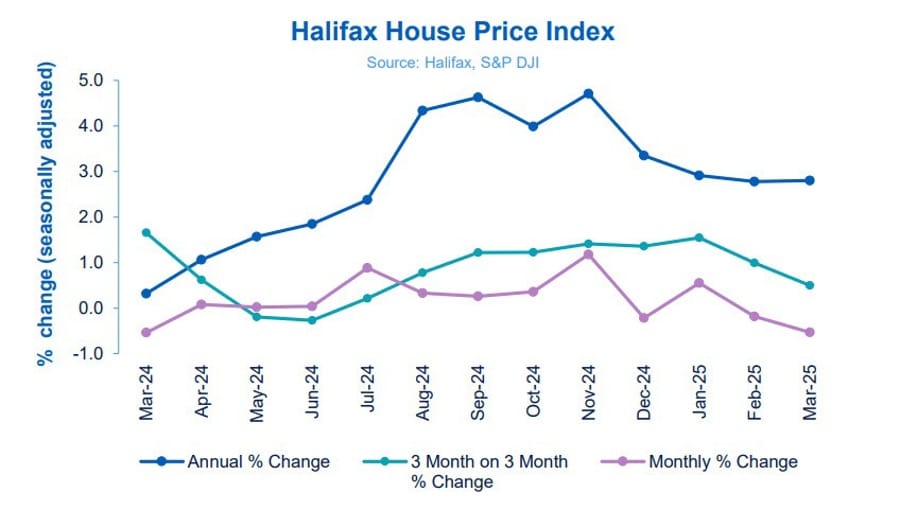

UK March Halifax house prices -0.5% m/m vs +0.1% expected

- Prior: -0.1% (revised to -0.2%)

UK house prices dipped more than expected in March, according to Halifax. The surprise drop points to continued fragility in the housing market, likely reflecting high mortgage rates and affordability constraints.

Halifax noted that: “House prices rose in January as buyers rushed to beat the March stamp duty deadline. However, with those deals now completing, demand is returning to normal and new applications slowing. Our customers completed more house sales in March than in January and February combined, including the busiest single day on record. Following this burst of activity, house prices, which remain near record highs, unsurprisingly fell back last month.”

SNB sight deposits drop, franc strength in focus

- Total deposits (Apr 4): CHF 443.7B vs CHF 451.2B prior

- Domestic deposits: CHF 433.4B vs CHF 441.7B prior

The decline in Swiss National Bank sight deposits may point to less intervention to weaken the franc. Watch this space for signs of potential SNB policy shifts.

EU proposes response to US steel tariffs

- Proposals from the European Commission

- Proposes counter-tariffs on range of US imports at 25% in response to US steel documents

- 25% tariff to take place from May 16

These headlines are from a document cited by Reuters.

EU’s Sefcovic: We have offered the US zero-for-zero tariffs on cars and industrial goods

- Comments from Sefcovic

- The EU remains open to and strongly prefers talks but we will not wait endlessly

- Timing of counter measures on tariffs cannot be delayed

- At this stage we are not willing to discuss what instruments we would use or the reasons why, our response is gradual

EU’s Von Der Leyen: We are ready for a good deal but ready to take counter measures

- Comments from Von Der Leyen

- We are ready to negotiate with the US on tariffs

- Will set up an import surveillance tax

- We will strengthen single market in response to US tariffs

- We will focus like a laser beam on the 83% of global trade that is beyond the USA

German economy minister: EU is in a strong position to respond to US tariffs

- Remarks by German economy minister, Robert Habeck

- US is under pressure on tariffs, not the EU

- Talks of reciprocal tariffs are simply false

- We must respond calmly but firmly

Spain’s Economy Minister: Must send signal that we are open to negotiate with US

- Spain economy minister Cuerpo on BBG TV

- Spain has introduced safety net in response to tariffs.

- EU won’t be naive in regard to US tariffs.

- There needs to be US leg to safety net to citizens.

- Can’t take any instruments off the table on retaliation.

- Must send signal that we are open to negotiate with US.

Ireland’s trade minister Harris: The EU has been very clear it is up for a deal

- Comments from Ireland’s trade minister Simon Harris

- The EU has been very clear it is up for a deal.

- All EU action aimed at creating environment to get US admin to the table.

EU commissioner for industrial strategy says response to US tariffs will be proportionate

- Remarks by Stéphane Séjourné, the EU commissioner for prosperity and industrial strategy

- EU will have united position on this

- List of products in EU response to US tariffs will be announced in coming days

- Europe also has cards up its sleeve to put pressure on the US

ECB’s Stournaras: Tariffs are a deflationary measure for the euro area

- Remarks by ECB policymaker, Yannis Stournaras, to the FT

- Tariffs are definitely a deflationary measure

- US policies are worse than expected, creating global policy uncertainty

- A notable adverse impact on growth could lead to activity being much weaker than expected

- That will in turn drag inflation below our targets

- No comment if the latest developments call for a 50 bps rate cut in April

- Full transcript (may be gated)

Asia-Pacific & World News

China indices plunge, CSI 300 and Shanghai down over 7%

Chinese equities suffered a brutal session:

- CSI 300: -7.1% (biggest drop since Oct 2024)

- Shanghai Comp: -7.3% (worst since Feb 2020)

Sentiment was salvaged late in the day by reports that China’s sovereign fund stepped in to support the market. Meanwhile, the Hang Seng remains down over 12% with less than an hour to the close.

China may accelerate stimulus to counter US tariffs

China is reportedly considering frontloading stimulus to support domestic consumption in response to newly announced U.S. tariffs. Bloomberg, citing sources familiar with the matter, says policymakers met over the weekend to discuss economic stabilization efforts.

Some measures were already in the pipeline before the tariffs, but discussions have now broadened to include a potential acceleration in rollout. Final decisions on scope and timing haven’t been made, and plans remain subject to change.

Regulators also reviewed details for a market stabilization fund—a move that suggests potential state intervention to support equities. In short: signs of the “plunge protection team” reactivating.

Goldman: China to Ease Fiscally to Offset Tariff Drag

GS expects more fiscal easing from China to counter the estimated 0.7pp GDP drag from new U.S. tariffs. The bank cut its 2025 earnings growth forecast for China from 9% to 7%.

It also downgraded Taiwan to underweight, citing high exposure to U.S. exports, supply chain sensitivity, and overall market vulnerability.

People’s Daily: China May Cut RRR Soon

An opinion piece in state-owned People’s Daily flagged potential easing by the PBOC. A Reserve Requirement Ratio (RRR) cut—and possibly a policy rate cut—may be in play to support the economy. While not official guidance, such commentary often foreshadows actual moves.

Mizuho: PBOC Won’t Allow Sharp Yuan Devaluation

Despite renewed pressure on the CNY/CNH amid rising U.S.-China tensions, Mizuho expects the PBOC to avoid sharp devaluation.

Vishnu Varathan (Head of Macro, Asia ex-Japan) says Beijing’s recent move—34% tariffs on U.S. goods + rare-earth export restrictions—signals a harder line in trade policy. Some depreciation may be tolerated to offset economic stress, but the PBOC is unlikely to risk financial instability.

“The PBOC will not desire or pursue a sharp depreciation, as it risks undermining capital market confidence,” Varathan noted.

PBOC sets USD/ CNY reference rate for today at 7.1980 (vs. estimate at 7.3162)

- There is some speculation the PBOC will sharply devalue the yuan

Australia Treasurer Chalmers says fall in AUD on concerns over China, and 4 RBA cuts

- Australia is in the midst of an election campaign, so Chalmers promising 4 rate cuts from the RBA is a little self-serving

- Fall in Australian dollar largely as a result of concerns about Chinese economy

- Also reflects the fact that markets are now expecting around four interest rate cuts in Australia this calendar year

RBNZ Shadow Board recommends a rate cut this week

- Most central banks are too timid to act early, the RBNZ is not one of them

- The NZIER Monetary Policy Shadow Board recommends the Reserve Bank of New Zealand (RBNZ) cut the Official Cash Rate (OCR) by 25 basis points to 3.50 percent in the upcoming April Monetary Policy Review.

Japan: Real Wages Decline Again in February

Japan’s real wages fell 1.2% y/y in February, following a revised -2.8% in January. Despite a 3.1% rise in nominal wages, elevated inflation (4.3% y/y) continues to erode purchasing power.

- Special payments surged +77.4% y/y

- Overtime pay rose +2.2%

- Regular pay slowed to +1.6% (from 2.1%)

Looking ahead, wage growth may pick up post-April. Japan’s largest union (Rengo) reported companies agreed to an average +5.4% pay hike in 2025—the biggest in over 30 years.

Japan’s PM and Cabinet Secretary comments seek to dilute market damage

- Plenty of “looking closely at” types of jaw boning

Japan’s top officials signaled growing concern over the potential fallout from U.S. tariffs, with Chief Cabinet Secretary Yoshimasa Hayashi saying Tokyo is monitoring financial markets “with a sense of urgency” and will carefully assess Washington’s claims regarding non-tariff barriers.

Speaking to reporters, Hayashi emphasized that any removal of such barriers must avoid harming Japanese society, underscoring the sensitivity of the ongoing trade discussions.

Prime Minister Shigeru Ishiba echoed the message, stating that Japan is reviewing the non-tariff issues raised by the U.S., while defending Japan’s trade practices. “Japan has created the biggest investment and jobs in the United States and has never done anything unfair,” Ishiba said.

The coordinated messaging highlights Tokyo’s intent to manage growing economic tensions, as U.S. tariffs are expected to have a significant impact on Japan-U.S. economic relations.

Japan finance minister Kato says closely watching market moves

- Just generic comments from Kato here, nothing substantial.

- No comment on market levels

- Will act appropriately against market moves

- Closely watching market moves with a high sense of urgency

Crypto Market Pulse

Crypto Suffers $1.4B Liquidation on ‘Black Monday’ as Trump Hardens Trade Stance

The global crypto market took a major hit Monday, losing $300 billion in value as BTC, ETH, XRP, and SOL led a sweeping sell-off. The sector’s total market cap fell 10.8%, driven by $1.4 billion in derivatives liquidations and rising geopolitical tension.

The trigger: President Trump confirmed on Sunday there will be no further negotiations with China, citing the need to fix the U.S. trade imbalance first. This hardened stance followed China’s 34% retaliatory tariff announcement, marking a sharp escalation in the trade war.

Bitcoin (BTC) dropped another 3% to around $78,950, following a 6% loss Sunday — its worst day since early March. Ethereum (ETH) saw the steepest derivatives wipeout, losing $419.2 million, while XRP and Solana (SOL) posted losses of $74.5 million and $70.5 million, respectively.

Adding to the turmoil, the FTX bankruptcy estate rejected over 400,000 claims worth $2.5 billion, citing KYC failures. These rejections could delay or reduce recoveries for many affected users. FTX says it still has $11.4 billion ready to distribute to verified creditors.

The sharp market downturn raises new doubts about crypto’s resilience in times of global economic tension, particularly when major trade partners weaponize tariffs.

Binance’s CZ Tapped as Strategic Advisor by Pakistan Crypto Council

Changpeng Zhao (CZ), founder of Binance, has been appointed strategic advisor to the newly formed Pakistan Crypto Council (PCC), signaling Pakistan’s deeper push into digital assets. CZ will advise on regulatory frameworks, infrastructure, and crypto education.

His appointment followed a meeting with high-ranking Pakistani officials, including Finance Minister Senator Muhammad Aurangzeb, the State Bank, and the Securities & Exchange Commission.

“The opportunity to leverage Web3 for financial freedom and economic empowerment in Pakistan is unlike anywhere else,” said Jawad Ashraf, CEO of Vanar Chain and partner of the Pakistan Blockchain Institute. He highlighted Pakistan’s young population — 60% under age 30 — and its growing pool of Web3 developers.

CZ will assist both public and private sectors in building a compliant and scalable crypto ecosystem. His experience with other governments, including a recent MoU with Kyrgyzstan, gives him a track record in helping countries build out blockchain infrastructure.

This move positions Pakistan as a potential emerging player in the global crypto space, especially as it works to balance regulation with innovation.

Peter Schiff taunts Saylor as Bitcoin stalls, Strategy pauses buys

Bitcoin (BTC) held around $79,000 on Monday after a turbulent weekend. Strategy has paused its BTC purchases since March 31, according to Walter Bloomberg.

- BTC dipped to a new 2025 low of $74,500 over the weekend

- Peter Schiff warned Michael Saylor of potential further losses if BTC drops toward Strategy’s average purchase price of $68,000

- Strategy holds 528,185 BTC valued at over $7.67B but hasn’t bought more since the end of March

Saylor remains publicly bullish, but the pause in purchases is fueling speculation. Schiff’s taunt:

“You better back up the truck with borrowed money today and go all in.”

Bitcoin Dips Below $78K, ETH Sub-$1,600

Crypto remains under pressure alongside broader risk-off sentiment.

- BTC briefly fell under $78,000

- ETH dropped below $1,600

Despite the selloff, signs of stabilization are emerging. Risk appetite remains cautious—momentum traders still prefer “sell the rip” over “buy the dip.” Scalpers active both sides.

The Day’s Takeaway

Day’s Takeaway: Key Market Trends & Developments

United States

- Markets whipsawed: The Dow swung nearly 2,600 points intraday before closing down 349. S&P dipped modestly; NASDAQ eked out a gain. Volatility remains high.

- Trade war escalation: Trump confirmed there will be no negotiations with China, putting markets on edge. Tariff threats and retaliation continue to drive risk sentiment.

- White House seeks global cost-sharing: A senior advisor outlined a five-point strategy demanding other nations contribute more toward the “cost” of U.S. global services — via tariffs, arms purchases, and investment.

- Bond yields spike: 10-year yield jumped to 4.15%. Real yields are climbing, pressuring risk assets and gold alike.

- Recession watch: Despite the Fed’s upcoming minutes and CPI/PPI data, markets are already trading on fears of stagflation, not just inflation.

Canada

- TSX Composite under pressure: Commodity-heavy index dragged lower by falling oil and gold. Broader equity weakness mirrors global risk aversion.

- Loonie slips: CAD softens against the USD as global investors flee to dollar safety.

- Macro exposure: With Canada heavily reliant on U.S. trade and global commodities, the knock-on effects of U.S.-China tensions are particularly acute for Canadian markets.

Commodities

- Gold tumbles: Fell below $3,000/oz for the first time since March. Strong dollar and rising real yields killed its safe-haven bid.

- Oil drops: Energy markets also felt the heat, with growth fears outweighing supply risks. Brent and WTI both declined amid broader de-risking.

- Broad-based commodity retreat: Industrial metals and agricultural futures were mostly red as global demand expectations faltered under trade war fears.

Europe

- Muted equity reaction: European markets were closed before the full weight of U.S. market swings hit, but futures suggest a weaker open ahead.

- ECB in a bind: With inflation not fully under control, the ECB faces a stagflation dilemma if global trade disruptions deepen.

- Trade exposure: Europe is caught in the crossfire of U.S.-China tensions — unable to stay neutral, but wary of taking sides.

Asia

- China retaliates hard: 34% tariff on U.S. goods kicks in, matching Trump’s new round. Markets bracing for supply chain disruptions and FDI reconfigurations.

- Japan, South Korea slump: Both markets took hits as investors pulled risk. Export-heavy economies like SK and Japan are highly sensitive to trade headlines.

- CNY under pressure: The Chinese yuan remains soft, adding to inflation export concerns globally.

Rest of World

- Emerging markets rattled: Capital outflows accelerate as USD strength and higher U.S. yields suck liquidity from EM assets.

- Pakistan steps into spotlight: Taps Binance’s CZ as crypto advisor — signaling intent to build a compliant, national-scale Web3 infrastructure.

- Crypto and inflation hedge talk fading: As real yields rise and fiat strengthens, traditional inflation hedge narratives are being questioned.

Crypto

- ‘Black Monday’ for crypto: $1.4B in liquidations. BTC, ETH, XRP, and SOL all got crushed. Market lost $300B in total value.

- No immunity to macro: Crypto clearly moved in line with risk assets. Derivative markets saw massive unwinds. ETH led liquidations with over $419M.

- FTX fallout continues: Estate rejects 400K+ claims worth $2.5B — mostly due to KYC failures. Meanwhile, it says it still has $11.4B to pay out verified creditors.

- Narrative watch: Crypto has yet to prove its safe haven thesis in times of geopolitical crisis or systemic shocks.