North America News

U.S. Equity Markets Suffer Worst Day Since 2020

Stock markets were hit hard by trade war fears, with indices recording their worst declines in years:

- S&P 500: -4.8% (worst since June 2020)

- Nasdaq Composite: -6.0% (worst since March 2020)

- Dow Jones Industrial Average: -4.0%

- Russell 2000: -6.4% (worst since June 2020)

The Russell 2000 is now down 20% from its highs, marking official bear market territory. Many major stocks saw steep declines:

- Apple: -10%

- Amazon: -9%

- Meta: -8.7%

- Tesla: -5.7%

- Best Buy: -17.6%

- Shopify: -20.2%

- Ralph Lauren: -16.5%

- United Airlines: -15.4%

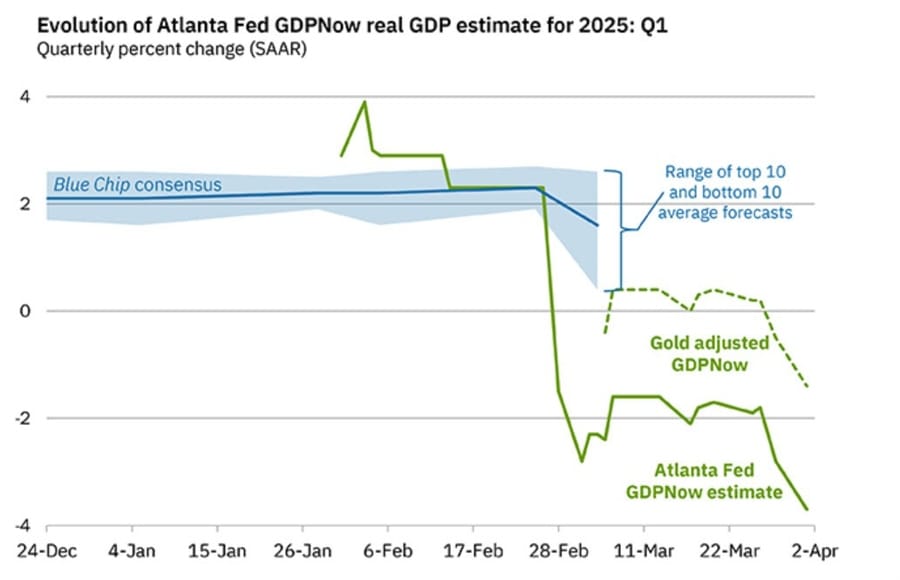

Atlanta Fed GDPNow Estimate Improves, but Growth Remains Negative

The Atlanta Fed’s GDPNow model has revised its U.S. economic growth estimate to -2.8%, an improvement from the previous forecast of -3.7%. Adjusting for gold imports and exports, the growth estimate improves further to -0.8% from -1.4%. While the numbers show a slight recovery, the overall outlook remains negative.

In their own words:

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2025 is -2.8 percent on April 3, up from -3.7 percent on April 1. The alternative model forecast, which adjusts for imports and exports of gold as described, is -0.8 percent. After today’s and yesterday’s releases from US Census Bureau, the US Bureau of Economic Analysis, and the Institute for Supply Management, both the standard model’s and the alternative model’s forecasts of first-quarter real final sales to private domestic purchasers growth increased from 0.4 percent to 1.4 percent.

US ISM Services PMI Misses Expectations

The ISM Services Index for March fell to 50.8, missing the expected 53.0 and down from 53.5 in February.

Breakdown of key components:

- Employment: 46.2 (vs. 53.9 prior) – indicates contraction.

- New orders: 50.4 (vs. 52.2 prior) – slowing demand.

- Prices paid: 60.9 (vs. 62.6 prior) – still elevated but easing slightly.

- Business activity: 55.9 (vs. 54.4 prior) – moderate improvement.

- New export orders: 45.8 (vs. 52.1 prior) – sharp decline.

This signals weaker expansion in the services sector, with employment and export orders showing notable declines.

Comments in the report:

- “Restaurant sales and traffic have improved in the past month overall. Valentine’s Day typically starts an improved seasonal trend that was consistent this year. We remain optimistic about the coming months, despite recent news of possible recession and tariffs that have not played out yet.” [Accommodation & Food Services]

- “Starting to see effect of aluminum tariff. These costs will be passed on to customers.” [Construction]

- “Patient volumes continue to exceed forecast, leading to increased revenues and an improved financial outlook. Supply chains continue to operate effectively and few categories — including IV solutions — are showing signs of duress. Labor outlook is improving, with reliance on travel staff continuing to recede. Outlook for the duration of the quarter is favorable.” [Health Care & Social Assistance]

- “The tariffs have caused issues in the groundwood paper market especially. With a large amount of groundwood imported from Canada to the U.S., the tariffs and resulting delays have caused havoc with the supply chain and deliveries. U.S. mills are getting backlogged and late from the additional tonnage they’ve taken on.” [Information]

- “New equipment purchases have slowed down over the last month due to the uncertainty of the new administration and cancellation of certain aspects of the Inflation Reduction Act.” [Other Services]

- “We are seeing some loosening in the U.S. economy related to hiring and people retention. Quality candidates are available, and employee turnover is decreasing. Competitive pressure for goods and services is increasing as suppliers seek organic increases in revenue.” [Professional, Scientific & Technical Services]

- “Government budget cuts and layoffs are negatively impacting our operations.” [Public Administration]

- “We are still holding back some money for emergency use in case the new administration targets grant usage and puts a hold on current spending.” [Transportation & Warehousing]

- “We’re expecting price increases in the near future due to tariffs on several commodity-based contracts, including waterworks items.” [Utilities]

- “Tariff confusion and the variety of ways that suppliers are responding have had a strong effect on our purchasing decisions this month, causing us to shift spend and in some cases buy in advance of reported tariffs.” [Wholesale Trade]

US Services PMI Rises Slightly

The final US S&P Global Services PMI for March was 54.4, slightly above the preliminary 54.3 and significantly higher than February’s 51.0.

This indicates continued expansion in the services sector.

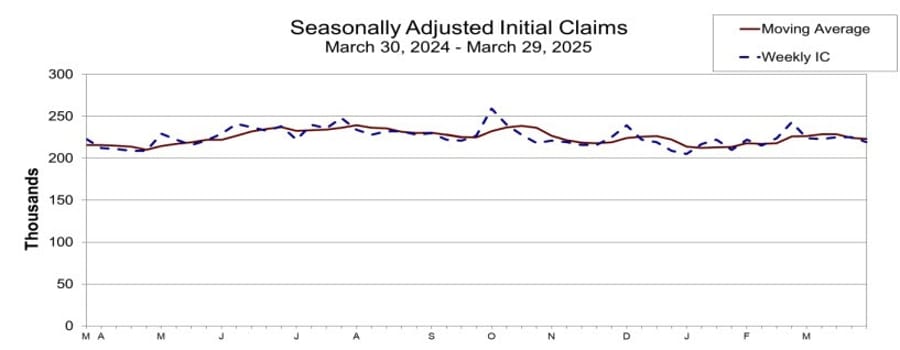

US Jobless Claims Below Expectations

Weekly initial jobless claims came in at 219,000, lower than the 225,000 forecast.

Key jobless data:

- Prior week: 224,000 (revised to 225,000).

- 4-week moving average: 223,000 (previously 224,250).

- Continuing claims: 1.903 million (vs. 1.870 million expected).

Largest increases in claims:

- Kentucky (+915), Oregon (+577), New York (+544), Tennessee (+429), Missouri (+392).

Largest decreases in claims:

- Michigan (-4,040), California (-1,826), Texas (-1,774), Mississippi (-1,764), Pennsylvania (-565).

US Job Cuts Surge in March

The latest report from Challenger, Gray & Christmas, Inc. shows that US employers announced 275,240 planned layoffs in March, marking a 60% increase from February’s 172,020. This is the highest level since the pandemic-driven recession.

Key highlights:

- Q1 layoffs totaled 497,052, the highest since Q1 2009.

- Over 280,000 layoffs in the past two months were tied to federal workers and contractors.

- DOGE-related government workforce reductions were the primary driver of the spike.

Without these government layoffs, the month would have been relatively quiet in terms of job cuts.

US Trade Deficit Narrows Slightly

The US trade deficit came in at -$122.7 billion, slightly better than the expected -$123.5 billion.

- The previous month’s deficit was revised to -$130.7 billion from an initial estimate of -$131.4 billion.

Fed’s Cook sees more emphasis on upside inflation risks

- Comments from the Fed’s Cook

- Sees growth slowing, inflation progress to stall on tariffs

- Sees more emphasis on upside inflation risks

- Appropriate to maintain current policy for now while watching data

- Now is time for Fed to be patient but attentive

- Fed policy is well positioned to respond to changes in the economy

- Inflation data already showing impact of tariffs

- Is watching for evidence tariffs driving persistent increase in price pressures

- Uncertainty heightened by economic outlook, government policy shifts

- Is watching for evidence for trouble on longer-term inflation expectations

- Reduced uncertainty, easing inflation would facilitate rate cuts

- Economy has entered a period of uncertainty

Fed Vice Chair Jeffeson: No need to be in a hurry on policy rate adjustments

- First comments from a Fed member since tariffs. Fed Chair Powell speaks tomorrow

- No need to be in a hurry on policy rate adjustments

- Current policy rate well-positioned to deal with risks, uncertainties

- Could retain current policy restraint for longer, or ease policy, depending on inflation progress and job market

- Policy rate is now somewhat restrictive

- Labor market solid, well-balanced

- Latest data shows inflation moving sideways

- Longer-term inflation expectations remain consistent with 2% goal

- Rise in goods inflation partly due to trade policy; drop in housing services inflation could help counter

- Economy solid, but heightened uncertainty among consumers, businesses tied to trade policy

- If uncertainty worsens, economic activity may be constrained

- Negative sentiment often does not translate to slowdown in actual activity

- Recent signs that consumer spending may be weakening

- Anticipate some modest labor market softening this year

- Vigilant on spillovers from federal government layoffs to other sectors

- still substantial uncertainty around trade

- uncertainty can weigh on spending, investment decisions.

- Will be important to take our time and think about impact.

- When assessing policy changes, I try to focus on collective policies, including physical, immigration, regulation.

- Net effect of all policies that influence view on monetary policy.

- Don’t want to overreact to what may be proposed today

Lutnick: I don’t think there will be exemptions

- Comments from the Commerce Secretary on CNBC

- In the long-term, you need to expect US markets to do really well

- All the policies of the US were designed to make the world rich and us poor

- I don’t think there will be exemptions, will not be effective for countries to retaliate against Trump tariffs

- Countries need to change their rules to allow US agricultural products in

- We’re talking with all major trading countries, US products are going to have to be sold there

- People think it’s all about tariffs, it’s about non-tariff trade barriers

- You’re going to see tariff rates decline, you’re going to see all these markets open to us

- USMCA is still in place

- Why do electronics need to be made in Taiwan, why can’t they be made with robotics in the USA

Deutsche Bank warns of a dollar confidence crisis

- They have been keeping at this for a while now in the past few weeks

Deutsche is saying that amid the latest developments, there is a risk that major shifts in capital flow allocations take over from currency fundamentals. In turn, that will produce “disorderly” moves in the currencies market and trigger a confidence crisis in the US dollar.

“We would caution that if the dollar decline accelerates, it would be a highly unwelcome development for global central banks. The last thing the ECB wants is an externally imposed disinflationary shock from a loss in dollar confidence and a sharp appreciation in the euro on top of tariffs. Expect pushback. We are in the midst of dramatic regime change in markets.”

Barclays warns of strong possibility of a US recession this year

- The firm sees a “high risk” of a recession in the US economy

Barclays is warning that current economic signals are pointing towards serious challenges ahead for the US economy. Adding that all of this makes the risk of a downturn much more likely in the coming months. As such, they are expecting US GDP growth for this year to slow to 0.1% on a quarter-on-quarter basis.

Fed’s Kugler warns of prolonged impacts of tariffs on inflation

- Rolling announcements, possible retaliation, impact on expectations all to hit CPI

Federal Board Governor Kugler in Q&A now:

- Fed does not comment on administration policies but looks at how it will impact mandates for prices and jobs

- There may be reasons why tariffs have more prolonged effects

- Tariffs on aluminum for example effect almost every sector of the economy through supply chains, will take longer to filter through

- Rolling announcements, possible retaliation, impact on expectations could also yield a more prolonged effect on inflation

- Reallocation effects could produce more inflation if the U.S. invests in areas where it does not have a comparative advantage

- US is not in a stagflationary environment, but Fed is paying close attention to slowdown and prices

- Right now there is more upside of inflation, some signs of a slowdown in the future

- May take time for the real economy to respond to tariffs, consumers frontloading purchases could support consumption for now

JP Morgan say Trump tariffs the largest tax increase since 1968 , US recession risk higher

- JPMorgan warns tariffs could tip US economy toward recession

JPMorgan economists cautioned on Wednesday that the sweeping tariff measures announced today could significantly disrupt U.S. economic momentum, raising the risk of a near-term recession. On a static basis, the newly unveiled policy is estimated to generate just under $400 billion in revenue — equivalent to roughly 1.3% of GDP — making it the largest tax increase since the Revenue Act of 1968.

In a note to clients, the bank projected that the measures could add between 1.0% and 1.5% to personal consumption expenditures (PCE) inflation in 2025, with the bulk of the upward pressure on prices likely to materialise in the second and third quarters.

Such a sharp rise in consumer prices would erode household purchasing power, potentially pushing real disposable income growth into negative territory during the middle quarters of the year. In turn, real consumer spending — the engine of U.S. economic growth — could contract, bringing the economy dangerously close to recessionary conditions.

Crucially, JPMorgan emphasised that this forecast does not yet incorporate the potential drag from falling exports and reduced investment spending, both of which are likely to come under further pressure. Reports of retaliatory actions from U.S. trading partners have already begun to surface, adding to the downside risks.

The bank also flagged the uncertainty surrounding the scope and duration of the tariffs, as well as the confusion in how the measures have been communicated. This could further weigh on business sentiment and capital expenditure, which were already softening in the face of tighter financial conditions.

While some degree of retrenchment in investment could help narrow the savings-investment gap and the current account deficit, JPMorgan noted that the near-term economic costs may outweigh any potential rebalancing benefits.

The bank said it would revisit its forecasts later this week as more clarity emerges around the policy’s implementation and global response.

UBS warns full tariffs could push US inflation to 5%

UBS estimates that if the full slate of proposed tariffs is permanently implemented, U.S. inflation could rise to around 5%, as import costs filter through to consumer prices.

Canada’s Carney announces retaliatory measures against US autos

- Carney makes a tariff announcement

- Canada will impose 25% tariffs on all vehicles imported from the US that are not compliant with USMCA

- Will develop framework for auto producers to avoid counter-tariffs, as long as they maintain their production and investment in Canada

- Tariffs will not affect auto parts and will not affect vehicle content from Mexico

- Every single dollar raised — about $8 billion — will go to auto workers and affected companies

- We will fight these tariffs until they are removed

- We would react energetically to any new US tariffs

- Until the pain caused by tariffs becomes impossible for the Trump admin, I do not believe they will change direction

- Not at this time planning to co-ordinate a response with other countries

Canada Reports Unexpected Trade Deficit

Canada’s trade balance fell to -$1.52 billion in February, a sharp contrast to the expected $3.55 billion surplus.

- Exports: $70.11 billion (down from $74.21 billion).

- Imports: $71.63 billion (up from $71.08 billion).

The weaker trade balance reflects lower global demand for Canadian goods.

Canada will respond to the U.S. tariffs on Thursday, says PM Carney

- Canadian Prime Minister Carney:

- Says Trump’s tariff announcement has preserved a number of important elements of our relationship

- Says we are going to fight these tariffs with countermeasures

- Says we will act with purpose and with force

Commodities News

Gold Falls Below $3,100 Amid Market Chaos

Gold prices dropped over 1.25% to $3,095 as traders took profits following Trump’s announcement. Despite initial gains from safe-haven demand, heavy selling pushed gold below key technical levels.

Market Movers

- Asian gold producers surged amid haven demand.

- The CME FedWatch Tool now sees a 21.5% chance of a rate cut in May and a higher probability of a cut in June.

- Treasury Secretary Scott Bessent indicated tariffs could be lifted if companies relocate production to the U.S.

Oil Prices Under Pressure Amid Global Trade Tensions

WTI crude dropped more than 3%, briefly trading below $70 per barrel, as global risk assets suffered following Trump’s tariff measures. The new base tariff of 10% on all imports—escalating to 34% for China and 20% for the EU—has raised concerns over weakening global demand.

OPEC+ is expected to bring an additional 138,000 barrels per day back into the market this month as part of a gradual rollback of previous supply cuts. However, some members must still compensate for past overproduction, which could offset new supply increases.

The latest EIA report revealed a bearish picture, with U.S. crude inventories rising by 6.17 million barrels last week. A drop in exports (-728,000 b/d) and an increase in imports (+271,000 b/d) contributed to the buildup. Refinery utilization also fell to 86%.

Silver Plunges Below $32 on ‘Buy the Rumor, Sell the News’ Reaction

Silver prices tumbled nearly 5% during North American trading hours, testing support below $32.00. The selloff followed President Trump’s announcement of sweeping reciprocal tariffs, which triggered fears of a weakening industrial demand outlook for the metal.

Market Reaction

Leading up to the tariff announcement, silver had been rallying alongside gold as investors bet on inflationary pressures and slowing economic growth. However, the actual tariff announcement prompted traders to cash out, reinforcing the classic “buy the rumor, sell the news” phenomenon.

Fears of a U.S. economic slowdown have also weighed on the dollar, pushing the U.S. Dollar Index (DXY) to a six-month low near 101.30. Concerns over declining industrial silver demand—particularly in China’s electronics, EV, and solar industries—have further pressured prices.

Technical Analysis

Silver’s sharp decline follows a failed attempt to break past the upper boundary of an ascending triangle pattern near $34.87. The price has dropped below the 20-day exponential moving average (EMA) at $33.35, signaling a short-term bearish trend. The 14-day Relative Strength Index (RSI) sits near 40.00; if it breaks lower, bearish momentum could intensify. Key support lies at $30.82, with resistance at $34.87.

OPEC+ Increases Oil Production More Than Expected

OPEC+ has agreed to boost oil output by 411,000 barrels per day (bpd) in May, exceeding the originally planned 135,000 bpd increase.

- The decision follows a two-hour meeting among ministers.

- OPEC+ will reconvene on May 5 to determine June production levels.

The move signals the bloc’s commitment to stabilizing oil markets amid shifting global demand.

Crude Oil Pressured by Global Growth Fears

Crude oil prices declined sharply following Trump’s tariff announcement, as markets priced in the risk of slower global economic growth impacting demand.

Technical analysis suggests crude oil broke below key resistance at $72.00, with potential further downside unless buyers step in at support levels. The market remains uncertain, balancing short-term trading strategies against broader macroeconomic risks.

OPEC+ reportedly not expected to change oil output policy today

- The ministerial talks have begun, according to sources from Reuters

And no change to policy is expected.

Europe News

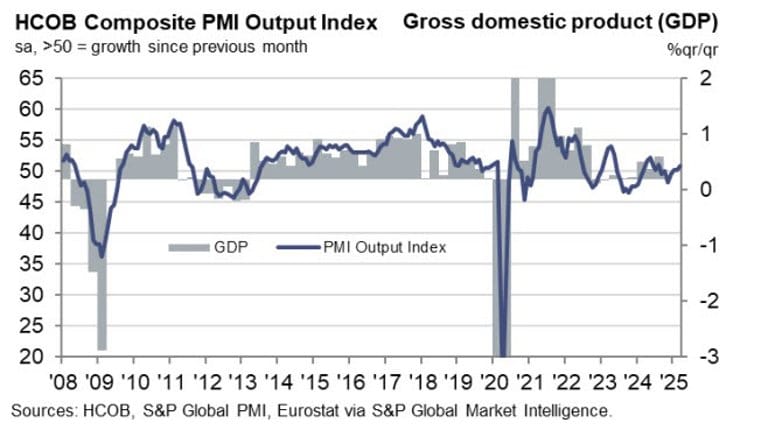

Eurozone Services Sector Sees Marginal Growth in March

The Eurozone’s final Services PMI edged up to 51.0 in March from the preliminary 50.4, slightly improving from February’s 50.6. The Composite PMI stood at 50.9, up from the prior 50.2.

The data suggests continued stagnation in the region’s economy. While some uplift is expected from German spending, concerns persist that Trump’s tariffs could negatively impact the economic outlook in the coming year.

HCOB notes that:

“You can’t really call it growth anymore in the Eurozone’s service sector. Once again, the index is hovering only slightly above the 50-point expansion threshold. New business has even seen a small drop for the second month running, and backlogs of work are continuing their downward trend. In Germany, we’ll likely soon see some indirect boosts in the services sector due to increased spending on infrastructure and defense. But for the Eurozone as a whole, the service sector could face tougher times. That said, rising real wages could help stimulate private consumption, which would especially benefit service providers.

“Inflationary pressures in the service sector eased in March after trending upwards over the past few months. Costs are still rising at a decent clip, but not as rapidly as before. Meanwhile, service providers are holding back on price hikes more than they have in recent months. However, there’s no all-clear for the European Central Bank (ECB) yet since inflation remains historically high. On top of that, the ECB is pointing to increased uncertainty. So, the ongoing debate within the ECB about whether and at what pace to further cut interest rates is pretty understandable.

“At the end of last year, it looked like the Eurozone was heading into a recession, but things have somewhat stabilized at the start of this year. For instance, the Composite PMI was in growth territory for the third consecutive month, albeit just barely. However, US tariffs could quickly throw the Eurozone’s economy off course again. That’s why the fiscal package planned by the Eurozone’s largest economy, which is mainly aimed at supporting the defense and construction industries but could also indirectly benefit the service sector, is a welcome counterweight. It significantly reduces the risk of a downturn across the entire Eurozone.”

Eurozone Producer Prices Rise Slightly in February

Eurozone’s Producer Price Index (PPI) increased by 0.2% month-on-month in February, slightly above the expected 0.1%. The annual PPI rose by 3.0%, in line with expectations.

Price changes by sector:

- Intermediate goods: +0.4%

- Energy: +0.2%

- Capital goods: +0.2%

- Non-durable consumer goods: +0.1%

- Durable consumer goods: -0.1%

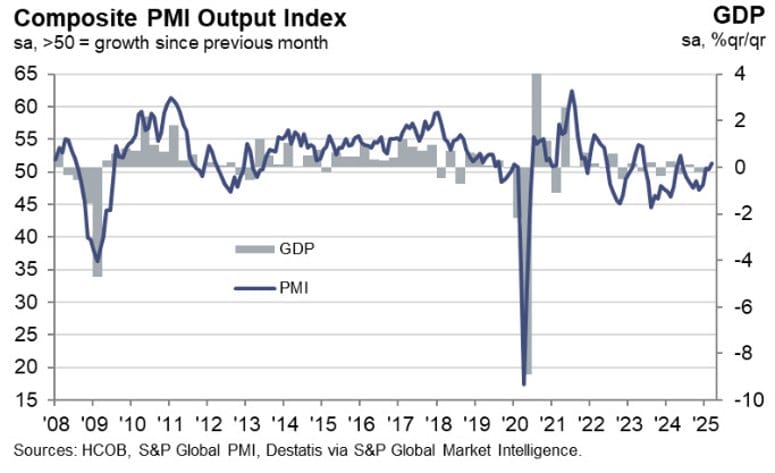

Germany’s Services PMI Holds at 50.9 in March

Germany’s final Services PMI stood at 50.9 in March, slightly higher than the preliminary 50.2 but down from the prior 51.1. The Composite PMI, however, reached a 10-month high at 51.3.

Key findings:

- Services activity hit a four-month low.

- Overall economic output showed signs of improvement.

- Inflation in input costs and output prices eased to five-month lows.

While growth remains fragile, the German economy shows resilience amid broader eurozone challenges.

Commenting on the PMI data, Dr. Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, said:

“The service sector seems to be losing momentum, though it was not exactly racing ahead before. Still, the near-stagnation that can now be observed in business activity should not be over-interpreted. Over the past couple of years, there have been several short phases where service providers dialled things back, only to bounce back into growth mode a few months later. The fact that hiring is still happening and confidence in future business activity has even ticked up suggests we are not looking at a long-term slump.

“Cost increases in the service sector have slowed down quite a bit. Lower fuel prices – especially important for transportation services – might have helped here. Plus, wages are not rising as much now that inflation has already been accounted for in recent years. This easing of cost inflation is also showing up in selling prices, which are climbing at a slower pace. It seems that some service providers are now more open to offering discounts, given the relatively weak demand.

“As for the debt brake reform and the special infrastructure reform, they are pretty much a non-event for the service sector, leaving no noticeable impact in the PMI survey aside from a slight uptick in business expectations. But it is worth noting that the lower and upper houses only voted on the constitutional changes toward the end of the survey period, and there was some uncertainty about whether they would get the necessary support. On a broader level, many service providers probably are not expecting a direct boost from the package, since the new funds are mainly earmarked for defence and civil engineering.

“However, it can be safely assumed that service providers who are involved in planning processes, for example, and who benefit from the usual multipliers – after all, the income created will be spent again – will also profit from the additional spending. We are optimistic that the impact will start showing in the second half of the year and become more pronounced in 2026.”

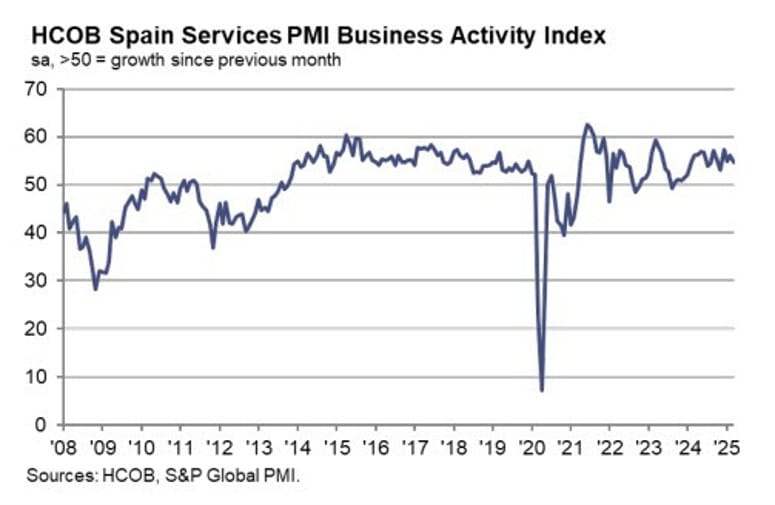

Spain’s Services Sector Growth Slows in March

Spain’s Services PMI dipped to 54.7 in March, missing the expected 55.5 and marking a slowdown from February’s 56.2. The Composite PMI also eased to 54.0 from 55.1.

Although business sentiment remains positive, cost pressures remain a concern. Input prices showed slight relief from February’s one-year high but are still elevated.

With new global trade policies shifting under Trump’s tariffs, the latest data may soon become less relevant in the broader economic landscape.

HCOB notes that:

“The Spanish private sector economy is growing sustainably but with a moderating pace in March, as the HCOB composite PMI posted at 54.0, down from 55.1 in February. The weaker overall performance is a result of softening growth in services and continued weakness in manufacturing. In the service sector, one can observe that business activity and incoming business growth remain comfortably high, although index values softened compared to the previous month. Nevertheless, overall services demand is constantly growing, with new export business even accelerating on the back of increased tourism inflows as panellists reported.

“Outstanding business growth moderated in the month which is in line with slower growth in business activity. Although this little softening is happening, service companies do not lose faith in their business, which is expressed in their willingness to further add to their staffing levels to take on higher sales. Business expectations are anchored slightly above long-term average for the year ahead already.

“After the slump in official inflation data there are also signs for disinflationary processes in our HCOB PMI price data. After three months of acceleration in input price inflation, which incorporates wages, the trend of acceleration ended, although still on an elevated level. Anecdotal evidence shows that labour costs is furthermore the key cost driver. Little changed on output price inflation, which is still posting above average in order to pass on costs to customers.”

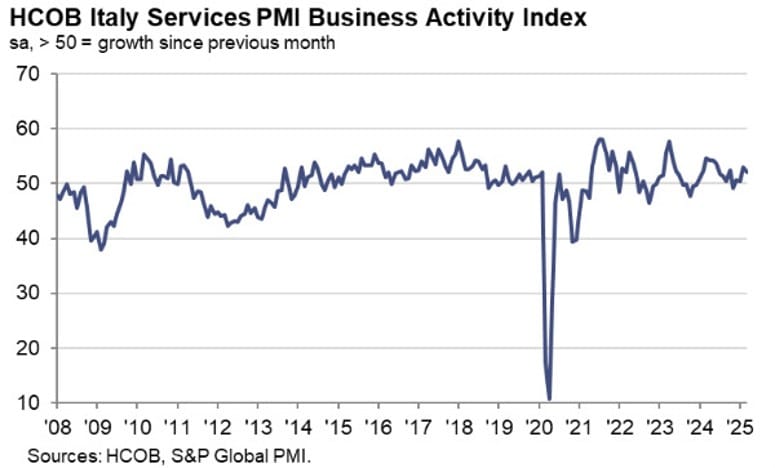

Italy’s Services PMI Declines to 52.0 in March

Italy’s Services PMI slipped to 52.0 in March, slightly below the anticipated 52.5 and down from February’s 53.0. The Composite PMI also fell to 50.5 from 51.9.

Key takeaways from the report:

- Business confidence declined as new work inflows softened.

- Export conditions showed signs of stabilizing.

- Operating expenses rose at the sharpest pace in nearly a year.

The report suggests a slowing recovery as firms grapple with cost increases and weaker demand.

Commenting on the final PMI data, Jonas Feldhusen, Junior Economist at Hamburg Commercial Bank, said:

“In March, Italy’s private sector economy exhibited signs of softening, as evidenced by the HCOB Composite Output Index, which hovered just above the critical growth threshold of 50. The economy continues to be buoyed by the services sector, while manufacturing remains in crisis state. Within the services sector, activity continued to expand compared to the previous month, albeit at a slightly decelerated pace.

“Service providers attributed the increase in output to a rise in incoming business, driven by recent client acquisitions. Overall, activity and demand in services appear to be aligning with long-term average trends, just new export business continued to decline as key market economic conditions remain weak. Nevertheless, the decline in international sales was the softest of an eight-month period.

“Services price inflation remains sticky. The ECB is closely watching the current developments with respect to service inflation, and the latest data coming from Italy will not be in their favour. Input prices in the services sector have accelerated for the fifth consecutive month, driven by a combination of rising wages, energy costs, and raw material prices. In response to these underlying price pressures, companies have managed to increase their charges, effectively passing on costs to clients.

“Looking ahead, a greater proportion of service providers anticipate growth in the coming year compared to those that forecast a fall. However, overall confidence levels have notably declined in March, reflecting concerns about future economic developments. This apprehension is likely due to the ongoing uncertainty surrounding US tariffs. Despite the weaker outlook and in an effort to keep on top of outstanding business, service providers continue to seek new staff, as the increase in workloads was sustained.”

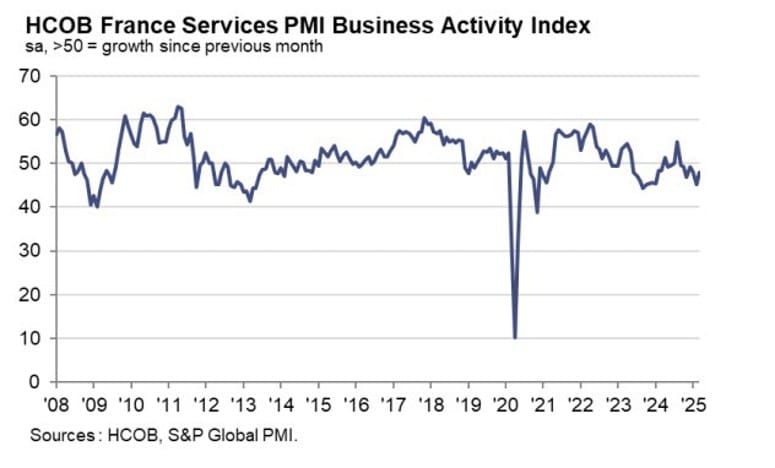

France’s Services PMI Improves but Remains in Contraction

France’s final Services PMI for March improved to 47.9, up from the preliminary estimate of 46.6 but still in contraction territory. The Composite PMI also rose to 48.0 from the preliminary 47.0.

Despite the improvement, the French economy continues to struggle with momentum, particularly after the post-Olympics boom in Q3 last year.

With new trade policies coming into play, these figures may have limited long-term significance in the market outlook.

HCOB notes that:

“The first quarter ends on a disappointing note for French service providers. Following a brief summer high in 2024, driven by the Olympic Games, business activity in France remained in recession territory in March 2025, according to the HCOB PMI. Despite a slight deceleration in the rate of contraction compared to the previous month, economic uncertainty and reduced demand continued to weigh on services activity, as reported by surveyed companies.

“Service price growth has somewhat moderated. Input prices resumed a disinflationary trajectory. Where input costs rose, wages were cited as the primary driver. Companies will hope that price pressures continue to ease amid significantly shrinking demand. This is because it is becoming increasingly difficult for businesses to pass costs onto customers, with the associated price index barely in growth territory.

“The sector’s outlook is dire. Both domestic and international order intakes continue to shrink, although the contraction in overall new orders slowed compared to the previous month. This slight improvement does little to mask the overall weak trend. Activity expectations for the next twelve months remain well below the long-term average. Unsurprisingly, companies are responding to the bleak outlook by downsizing their workforces.”

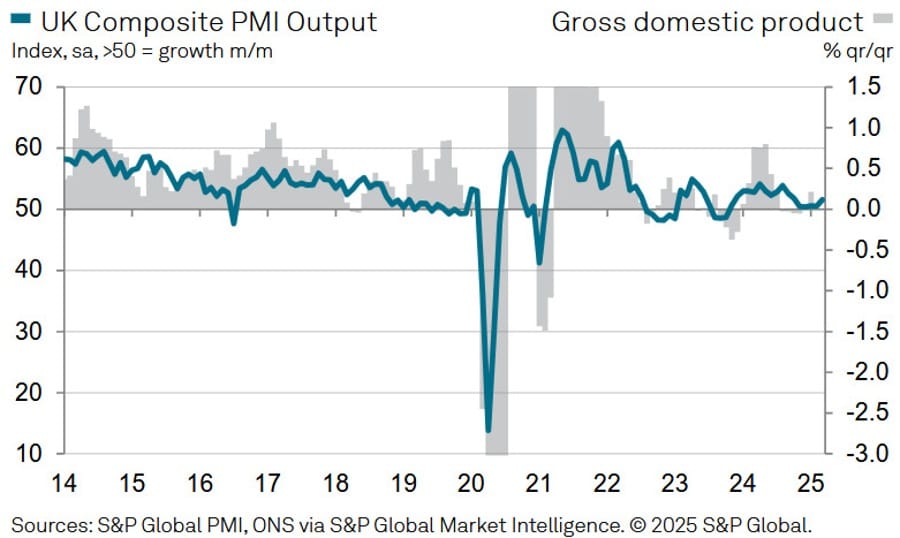

UK Services PMI Falls to 52.5 in March, Indicating Modest Growth

The UK’s final Services PMI for March came in at 52.5, slightly below the preliminary reading of 53.2 but above February’s 51.0. The final Composite PMI stood at 51.5, also lower than the expected 52.0 but up from the prior 50.5.

Key trends from the report include:

- Business activity in the services sector expanded modestly.

- New work increased for the first time in three months, though job cuts persisted.

- Input costs surged, primarily due to rising payroll expenses.

While the data indicates some level of growth, ongoing job reductions and elevated cost pressures suggest a challenging operating environment for businesses.

Tim Moore, Economics Director at S&P Global Market Intelligence, said:

“March data revealed an acceleration in UK service sector growth to its fastest since August 2024 as a renewed upturn in new orders helped to boost overall business activity.

“However, the subsequent modest recovery in private sector output has been sustained by a relatively narrow segment of the UK economy, primarily technology and financial services. Transportation, leisure and hospitality firms reported weak business conditions in March, while the manufacturing sector saw its fastest drop in production since October 2023.

“Service providers reported a range of constraints on growth, including stretched household budgets, risk aversion among corporate clients and rising geopolitical uncertainty. Service businesses also remained cautious about the near-term outlook, with optimism still among the lowest seen over the past two years. Worries about increasing wages and the impact of forthcoming US tariffs were the most cited challenges in March.

“A combination of subdued order books and elevated input cost inflation led to cautious recruitment policies. Job cuts have now been recorded for six months in a row, reflecting a sustained period of hiring freezes and redundancies.

“The survey’s inflation trackers for the service economy were again much stronger than seen in the decade prior to the pandemic. Efforts by suppliers to pass on higher payroll costs were widely reported as a factor leading to increasing prices charged in March.”

Swiss Inflation Holds Steady in March at 0.3%

Switzerland’s inflation rate remained stable in March, with the Consumer Price Index (CPI) rising by 0.3% year-on-year, slightly below the 0.5% increase that analysts had anticipated.

Core CPI, which excludes volatile items such as food and energy, remained unchanged at 0.9% year-on-year.

Despite stable inflation, market participants believe the Swiss National Bank (SNB) is unlikely to adjust its policy for the rest of the year. However, Trump’s recent tariff policies have pushed the Swiss franc higher, which could pose challenges for inflation control. The SNB must carefully balance exchange rate stability with its broader monetary policy objectives.

Macron Calls for Stronger EU Response to US Tariffs

French President Emmanuel Macron warned that Europe must take a “more massive” approach in response to the US’s latest tariffs.

- He criticized the US for not accounting for digital services in its trade balance calculations.

- Indirect effects of tariffs could boost Asian exports to Europe.

- Macron argues the tariffs will weaken the US economy and consumers.

- He emphasized that a unified EU response is crucial to counter US trade measures.

Macron also linked decarbonization efforts to reducing Europe’s trade deficit.

German Chancellor Scholz: Europe will respond appropriately and proportionately

- German Chancellor commenting on Trump’s tariffs

- Europe will respond appropriately and proportionately.

- Trump’s decision on tariffs is fundamentally wrong.

- Entire world economy will suffer from this.

- Even if we did nothing in response, the tariffs will cause problems for the US economy.

- There are intricate supply chains that you can’t simply sever.

- It would be a serious economic error.

ECB accounts: Uncertainty calls for caution in policy-setting and especially communication

- The ECB releases its monetary policy accounts of the 5-6 March meeting

- It was argued that it was no longer possible to be confident that monetary policy was restrictive

- It was suggested that the balance was increasingly shifting towards the transmission of rate cuts

- Replacing “monetary policy remains restrictive” with “monetary policy is becoming meaningfully less restrictive” was widely seen as a reasonable compromise

- Likely shocks on the horizon, including from escalating trade tensions, and uncertainty more generally, risked significantly weighing on growth

- These factors could increase the risk of undershooting the inflation target in the medium-term

- Recent appreciation of the euro and the decline in energy prices, together with the cooling labour market and well-anchored inflation expectations, mitigated concerns about upside risks to inflation more generally

- It was argued that being prudent in the face of uncertainty did not necessarily equate to being gradual in adjusting the interest rate

ECB’s Nagel: The ECB will have to reassess the situation

- Bundesbank Chief Nagel is speaking

- The ECB will have to reassess the situation.

- US tariffs threaten global economic stability.

- Tariffs will put monetary policy progress to the test.

ECB’s Stournaras: US tariffs not an obstacle to April rate cut

- Remarks by ECB policymaker, Yannis Stournaras

- US tariffs will impact economic growth

- US tariffs to negatively impact euro area GDP growth rate by 0.3% to 0.4% in first year

- The inflation path remains unchanged

“We are ready in this trade war”, says France

- France says there will likely be a first response in mid-April to Trump’s tariffs

- Will respond along with Europe to Trump’s tariffs

- Could target digital services in reciprocal measures

- First response likely to be in mid-April, then another one in late April

- Fairly certain Trump tariffs will have a recessionary impact in certain areas

European Commission President von der Leyen says US tariffs a major blow to world economy

- European Commission President von der Leyen responding to trump’s tariffs

- US tariffs are a major blow to the world economy

- The consequences will be dire for millions of people around the world

- All businesses will suffer

- There seems to be no order in the disorder

- Agrees with Trump that others are taking unfair advantage of the current rules

- EU has always been ready to negotiate with the US

- Preparing for further counter measures on US tariffs if negotiations fail

- We are ready to respond

- We are preparing further package of measures to protect our interests

- Many feel let down by our old ally

SNB’s Tschudin: US tariffs on Switzerland surprisingly high

- Remarks by SNB policymaker, Petra Tschudin

- Exchange rate reaction hard to predict

- See some risks for Swiss economy due to tariffs

Asia-Pacific & World News

Fitch Downgrades China’s Credit Rating to ‘A’

Fitch Ratings downgraded China’s sovereign credit rating to ‘A’, with a stable outlook, citing concerns over rising deficits and economic slowdown.

- China’s government deficit is expected to rise to 8.4% of GDP in 2025, up from 6.5% in 2024.

- GDP growth is projected to slow to 4.4% in 2025, from 5.0% in 2024.

- Tariffs and a broader global slowdown continue to weigh on China’s economy.

China’s finance ministry called the downgrade biased and inaccurate, arguing it does not fully reflect the country’s economic fundamentals.

China’s Services Sector Growth Reaches Three-Month High in March

China’s services sector experienced a boost in March, with the Caixin/S&P Global Services PMI rising to 51.9, up from 51.4 in February. This marks the highest level in three months, fueled by an increase in domestic demand and a rise in new business. The pace of new orders grew at its fastest rate since December.

The latest figures align with the official PMI, which showed a modest increase to 50.3 from 50.0, signaling a fragile yet ongoing recovery in the world’s second-largest economy. However, uncertainties loom, particularly with the new U.S. tariff policies. Former President Trump has implemented a 10% baseline tariff on all imports and a hefty 54% levy on Chinese goods, posing risks to exports, investment, and overall business sentiment. Analysts caution that these trade restrictions could dampen the manufacturing sector and impact employment, especially in services, which accounts for nearly half of China’s workforce and over 56% of GDP.

Despite solid demand, employment in the services sector declined at the fastest pace in nearly a year, attributed to both voluntary resignations and cost-driven layoffs. While businesses faced rising input costs, they refrained from passing these increases onto consumers, resulting in the sharpest drop in output charges in six months.

Overall, business confidence remains positive, with firms optimistic that domestic policy measures will support sustained growth. However, economists stress the need for stronger and more proactive policies to counterbalance external challenges and safeguard the recovery.

China’s Commerce Ministry says will take countermeasures on Trump’s tariffs

- China Commerce Ministry:

- China firmly opposes US tariffs and will resolutely take countermeasures to safeguard its rights and interests

- China urges the US to immediately cancel unilateral tariff measures and properly resolve differences with trading partners through equal dialogue

- Many trading partners have expressed strong dissatisfaction and clear opposition

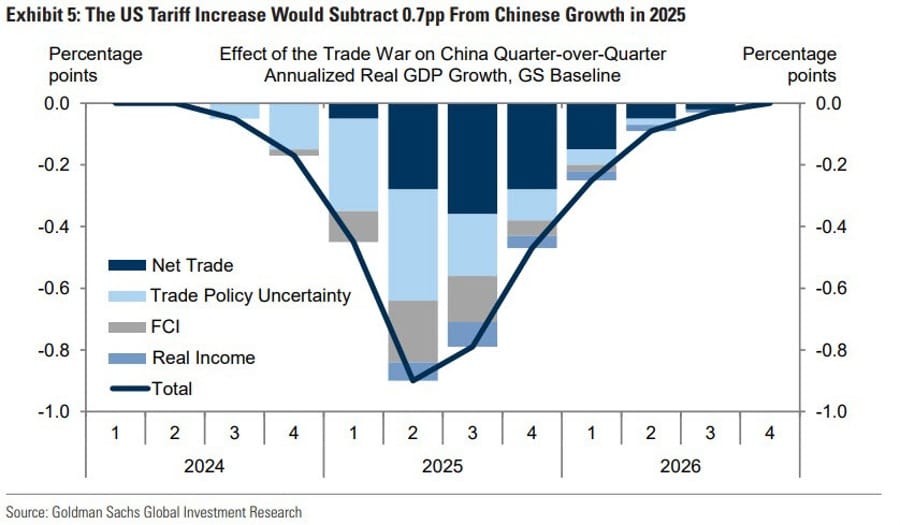

Goldman Sachs estimates latest tariffs to weigh on China’s GDP growth by a further 1%

- That will take their estimate for the total drag on the Chinese economy to 1.7%

That being said, they are still maintaining their forecast for China’s full year 2025 GDP growth at 4.5%. I’m not sure how their estimate works on that but okay. This was their previous baseline forecast in November last year:

JPM: Tariff shock weighs on markets, but China and Hong Kong equities show resilience

- Growth scare is feeding into expectations of more Federal Reserve rate cuts by year end

The latest wave of tariff announcements by Trump is likely to put short-term pressure on risk assets, including equities in both the U.S. and Asia, according to Tai Hui, Chief Market Strategist for Asia Pacific at J.P. Morgan Asset Management.

Hui notes that investor concerns are shifting from inflation to the risk of an economic slowdown, prompting a rotation into safe-haven assets such as government bonds. Despite this, equity markets in Hong Kong and mainland China have shown resilience, underpinned by expectations of fresh policy support from Beijing and continued earnings growth, particularly in sectors linked to China’s expanding AI industry.

Hui warns that persistent tariffs could fuel inflationary pressures, as U.S. manufacturers face obstacles in scaling up production. Rising supply chain costs may ultimately be passed on to consumers, adding to inflation risks over time.

In a counterintuitive market reaction, the U.S. dollar weakened and Treasury yields held steady following news of retaliatory tariffs, suggesting that investors are more focused on the inflationary implications than the broader economic fallout.

Market pricing also reflects growing expectations of monetary easing: the overnight indexed swap (OIS) rate for the U.S. dollar implies an 80% probability of a Fed rate cut in June, with investors anticipating three 25-basis-point cuts by year-end.

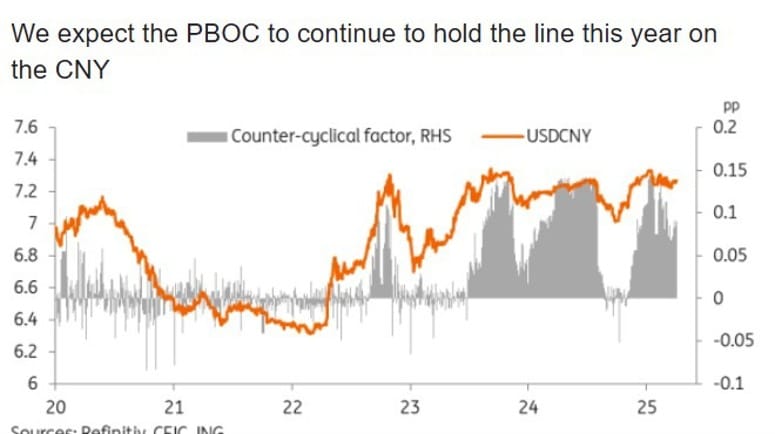

Trump’s 54% tariffs bring China close to ‘worst case’ scenario, PBOC easing soon

- Expects the PBOC to cut interest rates by 30 basis points and lower the reserve requirement ratio (RRR) by 100 basis points

Former U.S. President Donald Trump’s decision to raise tariffs on Chinese imports to 54% — a move that combines a newly imposed 34% reciprocal tariff with a prior 20% levy — brings the trade relationship closer to the “worst case scenario” outlined during his campaign, according to analysts at ING. Tariffs on certain goods, including electric vehicles, are expected to climb even higher.

With this abrupt escalation, ING warns that the risk of a forceful retaliatory response from China has increased significantly. The move comes at a time when China is grappling with deflationary pressures and slowing growth, prompting speculation that the People’s Bank of China (PBOC) may soon deliver its first policy easing of the year.

ING now expects the PBOC to cut interest rates by 30 basis points and lower the reserve requirement ratio (RRR) by 100 basis points in 2025, with room for further action if needed. The central bank had previously signalled a readiness to ease policy when appropriate.

On the currency front, ING notes that the latest tariff shock will likely add downward pressure on the yuan (CNY) in the short term, as markets assess both the direct economic impact and rising expectations for monetary easing. However, the bank maintains that the PBOC is unlikely to pursue deliberate currency devaluation as a response to the trade measures.

Instead, ING believes the central bank will stay committed to maintaining a stable exchange rate, suggesting that the USDCNY will continue to exhibit low volatility. The bank’s base case remains a trading band of 7.00 to 7.40 for the remainder of the year.

PBOC sets USD/ CNY reference rate for today at 7.1889 (vs. estimate at 7.2532)

- PBOC CNY reference rate setting for the trading session ahead.

Deutsche Bank: there will be a straight-forward FX adjustment. Watch China’s next move

- Deutsche Bank on what the tariffs mean in the FX market and their focus on China

Deutsche Bank is out with a quick note on the tariffs:

Quick summary of President Trump’s announcements: tariffs on the American continent are lower than expected, European tariffs are as expected, tariffs on Asia significantly higher than expected. There should be a straightforward FX re-adjustment between Asia FX (weak) and Latam FX + CAD (strong) in coming days.

Going forward, they are watching for whether China will allow yuan devaluation or will try to negotiate away the 20% fentanyl portion of the tariffs.

The negative global spillover to the rest of the world in coming days will largely be determined by the extent to which China allows the policy-determined USD/CNY to move materially above 7.20 or decides to do more fiscal stimulus instead.

ICYMI – China will raise the retail prices of gasoline and diesel from today

- The move is based on based on recent changes in international oil prices

China will increase retail prices of gasoline and diesel starting Thursday, following recent rises in international crude oil prices, according to the National Development and Reform Commission (NDRC).

The price of gasoline will rise by 230 yuan (approximately USD 32) per tonne, while diesel will increase by 220 yuan per tonne.

The NDRC has called on major state-owned oil companies — including CNPC, Sinopec, and CNOOC — along with other refineries, to maintain steady production and ensure smooth distribution in order to support stable fuel supply.

Under China’s pricing system, domestic fuel prices are adjusted in line with global oil price movements.

Australia’s Trade Surplus Narrows in February as Exports Decline

Australia posted a trade surplus of AUD 2.968 billion in February, significantly below market expectations of AUD 5.6 billion and down from the prior month’s AUD 5.62 billion surplus.

Exports saw a sharp 3.6% decline on a month-over-month basis, reversing the previous month’s 1.3% gain. In contrast, imports rose by 1.6% following a 0.3% contraction in January.

The latest trade data suggests a softening in external demand, which, coupled with potential global economic headwinds, may put further pressure on Australia’s trade outlook in the coming months.

Reserve Bank of Australia – Tariffs could have a chilling effect on business investment

- Reserve Bank of Australia Financial Stability Review

- US tariff uncertainty poses substantial headwinds to global growth.

- Tariffs could have a chilling effect on business investment and consumer spending.

- Risk of disorderly correction in global asset prices, putting pressure on non-bank lenders.

- Hedge funds particularly vulnerable to repricing of risk due to highly leveraged positions.

- US tariffs on China may necessitate further policy stimulus from Beijing.

- Global slowdown, particularly in China, could spill over into Australia.

- Risk aversion could increase financing costs and cause liquidity strains.

- Australian financial system well placed in the event of a severe global downturn.

- Strong financial position of most households and banks limits the risk of widespread disruption.

- Australian banks well capitalised and able to absorb large loan losses.

- Important that bank lending standards remain sound and are not relaxed.

- Budget pressures pervasive across Australian households, but expected to ease a little.

- Wary that lower interest rates could encourage households to take on excessive debt.

RBC says rising global trade uncertainty may push RBA to turn more dovish

- Reserve Bank of Australia next meeting is May 19 and 20

RBC’s Su-Lin Ong says the direct impact of Trump’s 10% tariff on Australia is likely limited, but broader trade and investment uncertainty could prompt a more dovish stance from the RBA.

While the central bank’s cautious tone this week points to a gradual easing cycle, Ong notes that escalating global risks may increase the chances of deeper or earlier cuts, challenging RBC’s current base case for two more rate reductions in May and August.

Japan’s Services Sector Stagnates as PMI Drops to 50.0

Japan’s services industry slowed in March, with the Jibun Bank/S&P Global Services PMI falling to 50.0 from 53.7 in February. Though this is an improvement over the preliminary estimate of 49.5, it signals stagnation, as the reading marks the threshold between expansion and contraction.

The data suggests that earlier momentum in the sector is fading, with firms reporting weaker market conditions. While new orders continued to grow, the pace slowed for the second consecutive month, reaching its lowest level since November. Export orders remained positive, primarily supported by demand from China and Taiwan, though growth in this segment also eased.

Business confidence dipped to its lowest point since January 2021, reflecting concerns over labor shortages, an aging workforce, and global trade uncertainties—particularly in light of Trump’s recent tariff measures.

Cost pressures intensified, with input price inflation hitting a 19-month high, driven by increased expenses in labor, materials, and fuel, as well as currency fluctuations. Meanwhile, output prices—what businesses charge customers—fell to a five-month low, reflecting weaker pricing power.

The broader economic picture is also concerning. Japan’s composite PMI, which includes both services and manufacturing, dropped to 48.9, indicating the sharpest contraction in over two years and marking the first overall decline since October.

Japan PM Ishiba: US tariffs are extremely unfortunate

- Remarks by Japan prime minister, Shigeru Ishiba

- Shares serious concern whether US tariffs are compatible with trade agreements

- Will continue to demand US to reconsider tariff measures

- Will not hesitate to directly approach US president Trump if appropriate

Japan Trade Minister Muto has spoken with US Commerce Secretary Lutnick

- Will ask US strongly to exempt Japan from tariff measures

- Held online meeting with US Commerce Secretary.

- Told US Secretary new US tariffs would bring negative impact on US economy as well.

- Told US counterpart new tariffs announcement is “extremely regrettable.”

- Need to analyse content and examine impact on Japan economy.

- Will ask US strongly to exempt Japan from tariff measures.

- Will establish task force to provide information and grasp the impact.

- Share strong concerns whether US tariff measures are in line with WTO agreement.

- US Commerce Secretary asked me to look into the details of new tariff measures during our call.

- Told US counterpart tariff measures are not beneficial for both Japan and US.

- Will consider various options for what is best for Japan.

- Told us counterpart that tariff measures could discourage Japan companies’ US investment

Crypto Market Pulse

Crypto Market Struggles to Find Stability

Market Overview

The cryptocurrency market cap dipped below $2.65 trillion twice this past week, testing the critical $2.60 trillion support level seen last November. The ability to consolidate above this level previously marked the start of a rally, making it a crucial battleground for bulls and bears alike. However, with market capitalization retreating further from its 200-day moving average, institutional investors are likely reducing exposure, tilting the balance in favor of bears.

The Cryptocurrency Sentiment Index remained in “fear” territory throughout the week, closing at an “extreme fear” reading of 25—the lowest in over three weeks. However, this sentiment has not yet reached an oversold threshold that might signal a potential reversal, meaning sellers are still active.

Bitcoin briefly spiked to $88,000 following the announcement of new trade tariffs, only to fall back below $82,000 shortly after. This pattern of short-lived rallies has been consistent since mid-February, indicating a market struggling against major moving averages. Bitcoin’s failure to hold above the 200-day moving average, combined with a declining 50-day moving average, underscores continued bearish control.

Key Developments

- Nansen Analysis: The firm estimates a 70% probability that crypto markets will form a local bottom within the next two months amid global trade uncertainty.

- GameStop’s Strategic Shift: The company raised $1.5 billion through convertible notes, earmarking funds for Bitcoin purchases and corporate investments.

- Institutional Holdings: CryptoQuant reports that global companies accumulated 91,800 BTC (~$7.7 billion) in Q1 2025, but selling pressure from long-term holders and capital outflows from Bitcoin ETFs have hindered price appreciation.

- JPMorgan Warning: The 14 largest publicly traded Bitcoin mining firms in the U.S. lost 25% (~$6 billion) of their market capitalization in March, making it the worst month for miners since the start of the year.

- Circle’s IPO: The issuer of the USDC stablecoin has filed for an initial public offering with the SEC. Its Class A shares will be listed on the NYSE under the ticker CRCL.

XRP Analysis: Bearish Signals Point to 68% Potential Drop

XRP is facing increasing bearish pressure, trading at $2.04 after a 5.38% decline. The token is testing the critical $2 support level, with weak on-chain metrics suggesting further downside. If support fails, technical patterns indicate a potential drop to $0.62—a 68% crash.

Key Factors Driving the Decline:

- Trump’s Tariffs: The sweeping trade restrictions triggered $19 million in crypto liquidations, with XRP seeing $3.94 million in forced closures.

- Market Sentiment: The entire crypto sector lost 3% in market value, with most major assets in the red.

- Technical Weakness: A descending triangle pattern signals further downside, while the RSI at 38 suggests continued bearish momentum.

The Day’s Takeaway

Day’s Takeaway: Key Market Trends & Developments

United States

Markets experienced a brutal selloff, with the S&P 500 (-4.8%), Nasdaq (-6.0%), and Dow Jones (-4.0%) posting their worst losses since 2020. The Russell 2000 (-6.4%) officially entered bear market territory, down 20% from recent highs.

The sharp downturn came after President Trump’s sweeping reciprocal tariffs, which introduced a baseline 10% tariff on all imports and significantly higher levies on key trading partners—34% on China, 20% on the EU. Investors reacted by aggressively offloading stocks with major supply chain exposure to China and Southeast Asia, with consumer and tech giants like Apple (-10%), Amazon (-9%), and Meta (-8.7%) suffering.

The cryptocurrency sector saw additional pressure, with Bitcoin falling below $82K after briefly touching $88K following the tariff news. Risk assets broadly declined, while safe-haven flows into bonds pushed Treasury yields lower.

Market participants are now awaiting Friday’s Non-Farm Payrolls (NFP) report and Fed Chair Powell’s speech, which could provide further clues on the economy’s trajectory.

Canada

Canadian markets also took a hit, though they fared slightly better than their US counterparts. The Toronto Stock Exchange (TSX) declined, weighed down by energy and financials, as uncertainty over global trade and demand impacted sentiment.

Canada escaped Trump’s tariffs for now, which helped cushion the blow for domestic markets. However, concerns over oil prices and economic spillover effects kept investors cautious. Canadian dollar volatility increased, tracking fluctuations in commodities and global risk appetite.

Commodities

Gold & Silver

- Gold surged to an all-time high of $3,170/oz before retreating below $3,100 as profit-taking kicked in.

- Silver plummeted below $32, erasing recent gains, as investors cashed out following Trump’s tariff announcement. The industrial outlook for silver remains uncertain, particularly with China’s manufacturing sector under pressure from higher US tariffs.

Oil

- WTI crude fell over 3%, dipping below $70 per barrel, as fears of a global demand slowdown intensified.

- Trump’s tariffs exempted oil and natural gas, preventing a deeper selloff.

- OPEC+ held discussions on maintaining production cuts, but compliance issues remain. The cartel is set to bring back 138K b/d of supply this month while also dealing with past overproduction adjustments.

Europe

- European stocks plummeted in response to Trump’s tariffs, with the Euro Stoxx 50 down over 4%.

- The European Union faces a 20% tariff on its exports to the US, significantly impacting automakers, luxury goods, and industrials.

- ECB policymakers are now under pressure to consider easing measures as trade tensions increase recession risks.

- The Euro slid against the US dollar, though the weaker greenback helped soften the blow for European exporters.

Asia

- China’s markets tanked, with the Hang Seng down 5.2% and the Shanghai Composite losing 4.7%, as Trump’s 34% tariff on Chinese goods sent shockwaves through the region.

- Chinese tech stocks nosedived, as investors braced for further trade restrictions. Alibaba, Tencent, and JD.com all saw double-digit declines.

- The Japanese yen strengthened, reflecting a rush into safe-haven assets, while the Nikkei 225 dropped 3.8% amid concerns over declining exports.

- India also felt the heat, as Trump’s tariffs on key emerging markets raised fears of weaker demand for exports.

Rest of the World

- Emerging markets came under intense selling pressure, as investors fled riskier assets.

- Latin American currencies depreciated, with the Mexican peso and Brazilian real seeing sharp declines.

- Middle Eastern and African markets experienced capital outflows, driven by rising global uncertainty and weaker commodity prices.

Crypto Markets

- The total crypto market cap dipped below $2.65T, testing key support levels.

- Bitcoin (BTC) briefly spiked to $88K before tumbling back below $82K, marking another failed attempt to break out.

- XRP is at risk of a 68% collapse if it breaks below the critical $2 support level. On-chain indicators remain weak, with network activity declining.

- Crypto sentiment remains in “Extreme Fear”, at its lowest levels in weeks, deterring buyers from stepping in.

Final Thoughts

Markets are in turmoil following Trump’s tariffs, with US stocks posting their worst losses since the pandemic crash. Safe-haven assets like gold initially surged, but profit-taking quickly set in. Oil remains under pressure, while crypto struggles to find a bottom. The focus now shifts to the US NFP report and Powell’s speech, which could determine whether the market panic continues or stabilizes.