North America News

U.S. Stock Market Rises Ahead of Trump Tariff News

Major U.S. indices closed higher on Wednesday as investors positioned themselves ahead of President Trump’s trade policy announcement. The NASDAQ led gains with a 0.87% rise, followed by the S&P 500 at 0.67% and the Dow Jones up 0.56%.

Among the standout performers, Amazon’s stock surged 2% amid reports of a potential bid for TikTok’s U.S. operations. Meanwhile, Applovin shares climbed 2.72% following similar acquisition rumors. The positive momentum underscores investor optimism despite looming trade uncertainties.

As markets await further clarity on tariff measures, analysts anticipate continued volatility in equities and commodities, with traders closely watching economic indicators and Federal Reserve policy signals in the weeks ahead.

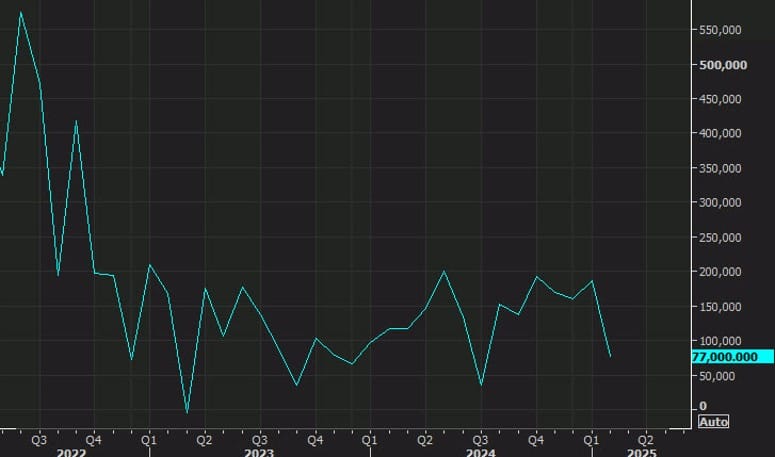

ADP March US Employment: 155K vs 115K Expected

The latest private payroll survey for March 2025 exceeded expectations, with employment rising by 155K compared to the forecasted 115K.

- Prior reading: 77K (revised to 84K)

- Goods-producing sector: +24K (previous: +42K)

- Service-providing sector: +132K (previous: +36K)

- Pay gains for job stayers: 4.6% (previous: 4.7%)

- Pay growth for job changers: 6.5% (previous: 6.7%)

ADP’s chief economist, Nela Richardson, commented that despite economic uncertainty, the data suggests positive growth across businesses of all sizes, though not in all sectors.

US February Factory Orders: 0.6% vs 0.5% Expected

The latest factory order figures for February surpassed expectations slightly, rising by 0.6% instead of the forecasted 0.5%.

- Prior reading: 1.7% (revised to 1.8%)

- Factory orders excluding transportation: +0.4% (previous: +0.3%)

- Durable goods orders: +1.0% (preliminary estimate: +0.9%)

- Durable goods excluding transportation: +0.7% (preliminary estimate: +0.7%, previous: +0.1%)

- Durable goods excluding defense: +0.8% (preliminary estimate: +0.8%, previous: +3.7%)

- Nondefense capital goods excluding aircraft: -0.2% (preliminary estimate: -0.3%, previous: +0.1%)

These numbers show slight improvement compared to earlier estimates.

Tesla Q1 Vehicle Deliveries Fall Short of Expectations

Tesla reported first-quarter vehicle deliveries of 336,681, falling below the consensus estimate of 377,000–380,000. This marks a 13% decline compared to the 386,810 units delivered in Q1 2024 according to the companies release.

The company also noted that its production reached 362,615 vehicles and stated that the ramp-up of the new Model Y remains on track. Tesla shares dropped 2.3% ahead of the announcement and continued declining afterward.

Sales figures from European markets further illustrate the slowdown, with March Tesla sales down 37% year-over-year in France and 64% in Sweden. Additional regional data is expected soon.

U.S. Mortgage Applications Drop Slightly in Late March

The Mortgage Bankers Association (MBA) reported a 1.6% decline in mortgage applications for the week ending March 28, following a 2.0% decrease in the prior week. The market index fell to 243.6 from 247.5, with refinancing activity particularly weak.

Additional details:

- Purchase index: 158.2 vs. 155.8 prior

- Refinance index: 710.4 vs. 752.4 prior

- 30-year mortgage rate: 6.70% vs. 6.71% prior

While purchase activity edged up slightly, the broader mortgage market remains subdued due to persistent high interest rates.

U.S. Implements Broad Tariffs Under Trump’s Trade Policy Shift

In a sweeping trade move, President Donald Trump has announced a new tariff structure aimed at revitalizing American manufacturing and strengthening the domestic economy.

Key Measures:

- A 10% tariff will be applied to all imported goods, regardless of origin.

- Foreign-manufactured automobiles will face a 25% tariff, a move expected to reshape the automotive industry and encourage domestic production.

“This marks the beginning of a new era for American industry,” Trump declared. “Factories will reopen, jobs will return, and prices will ultimately come down for consumers.”

The decision comes amid broader economic shifts as the administration seeks to curb trade imbalances and bolster domestic production. Analysts are closely watching how these tariffs will impact global trade dynamics and market reactions.

U.S. Senate Approves $1.5 Trillion Deficit Increase to Extend Trump Tax Cuts

The Senate budget committee has greenlit a $1.5 trillion increase in the federal deficit over the next decade to extend the Trump-era tax cuts set to expire at year-end. Lawmakers argue that keeping the tax cuts in place is crucial for economic growth, though critics warn of escalating fiscal pressures.

The decision could have significant implications for monetary policy, as the Federal Reserve weighs potential rate cuts amid concerns over slowing GDP growth. With mounting debt levels, investors are closely watching how the administration balances fiscal expansion with economic stability.

Amazon Reportedly Bidding for TikTok’s US Operations

The New York Times reports that Amazon is making a bid to acquire TikTok’s US business ahead of a Saturday deadline for the platform to restructure its ownership.

Amazon shares responded positively, rising $2.05 (1.07%) to $194.30, after touching a corrective low of $184.40 the previous day. Meanwhile, Meta shares dipped as low as $573.36 but later rebounded to $584, still down -0.36% for the day.

CNBC reports that a decision regarding TikTok’s future in the US could be announced soon.

Fed’s Goolsbee says strength of economy still there, but confidence almost cratering

Federal Reserve Bank of Chicago President Austan Goolsbee spoke in a Fox TV interview:

- Hard data on US economy still pretty solid

- If can get past this period of uncertainty, underlying strength of economy is still there

- Soft data looks very different from hard data

- Confidence is almost cratering

- Problem of tariffs is they are a supply shock

- Fear is if tariffs on imports jumps out of just imports and move into other costs, or people freak out and change behavior

- People don’t want to go back to the inflationary environment of 2021, 2022

Wells Fargo warns April 2 risks ‘not small’ , but express longer term optimism

- 3 reasons to remain constructive

Christopher Harvey, head of equity strategy at Wells Fargo Securities:

- says he remains optimistic about the long-term outlook for equities

- cautions investors against overlooking the potential fallout from the April 2 tariff announcement

He noted:

“We remain constructive on equities longer term given:

(1) potential monetary stimulus (i.e., 75+ bps of 2025 Fed rate cuts) starting by mid-year;

(2) anticipated tax bill movement (and possible enactment) this summer;

and (3) several uber-caps already look oversold (TSLA, AVGO, NVDA),”

“However, the risks are not small and recession is possible. We are worried most about the potential unintended consequences of aggressive tariff moves,”

Trump’s so-called “Liberation Day” unlikely to resolve U.S. tariff uncertainty

- The retaliation to follow deepens the unease

Trump’s so-called “Liberation Day” may do little to ease the deep uncertainty surrounding U.S. trade policy, warns Ethan Harris, former head of global economics at Bank of America and now an independent Fed watcher.

Trump speaks at 4pm US Eastern time (20:00 GMT) on Wednesday, April 2, 2025.

- Harris argues that the event is likely to be just another chapter in the prolonged U.S. trade conflict rather than a definitive turning point. Investors, businesses, and households hoping for clarity on tariffs may be disappointed

- even if the trade war were to end abruptly, Harris notes that the U.S. economy faces other headwinds, including potential fiscal tightening and slower job growth

- end of tariffs alone won’t reverse broader weakening tied to domestic policy shifts

As for retaliation, expect it:

- Harris points to activity at the World Trade Organization, where the U.S. has been the respondent in 168 trade disputes, compared with 135 cases where it acted as the complainant

- that imbalance, he suggests, underscores why retaliation from other countries is not only likely—but expected

Canada to avoid countertariffs that risk Canadian jobs, price hikes – Globe and Mail

- Canadain media report

Canada to avoid countertariffs that risk Canadian jobs, price hikes – Globe and Mail, citing two federal trade advisers.

- Canada won’t impose retaliatory tariffs on most US food and other basic necessities

Mexican Pres.: It will not impose tit-for-tat tariffs

Mexican president Sheinbaum:

- It will not impose tit-for-tat tariffs

- Mexico will gradually comply with US water treaty after criticism from US State Department

Commodities News

Gold Nears Record High as Markets Brace for Trump’s Trade Policy Shift

Gold prices continue their upward trajectory, trading at $3,122 per ounce as traders seek refuge in safe-haven assets ahead of President Trump’s tariff announcement. The metal has gained 23% since its post-election low, benefiting from dollar weakness and market uncertainty.

Trump is expected to unveil a new tariff framework, with options ranging from a flat 20% duty to a tiered structure based on country-specific trade balances. Analysts suggest that if the measures are less severe than anticipated, gold could see a short-term pullback. However, with inflation concerns and geopolitical instability still in play, bullion’s long-term outlook remains bullish.

Crude Oil Prices Edge Higher Despite Surging U.S. Inventories

Oil markets shrugged off an unexpected inventory buildup, with crude futures rising 0.72% to settle at $71.71 per barrel. The U.S. Energy Information Administration (EIA) reported a 6.2 million-barrel increase in crude stocks, far exceeding analyst expectations of a 2.1 million-barrel drawdown.

Despite this, supply concerns persist, particularly as OPEC+ continues to taper production cuts while geopolitical risks loom. President Trump’s threat of secondary tariffs on nations purchasing Russian oil has further heightened market uncertainty. Technical indicators suggest that oil’s next major move could be dictated by a break above the 200-day moving average at $72.66 or a drop below the 100-day moving average at $70.66.

Silver Surges Near $34 Amid Trump’s Tariff Plans

Silver prices climbed toward $34.00 as traders sought safe-haven assets ahead of a tariff announcement from President Trump.

- Trump plans to impose 20% tariffs on most imports

- Tariffs expected to pressure global and US economic growth

- Market focus also on upcoming ADP employment data for March (expected: 105K vs February’s 77K)

Technical Analysis:

- Silver is nearing the upper boundary of an Ascending Triangle near the October 22 high of $34.87.

- Key support is at $32.77 (March 6 high), with major resistance at $34.87.

- The 20-day EMA at $33.44 provides support.

- The 14-day RSI is approaching 60.00, a potential bullish signal.

U.S. Crude Oil Inventories Surge Beyond Expectations

The latest U.S. Energy Information Administration (EIA) report reveals a sharp increase in crude oil inventories, which jumped by 6.165 million barrels, significantly above the expected 2.116 million-barrel drawdown.

Other key petroleum stock data includes:

- Gasoline inventories: -1.551M vs. -1.720M expected

- Distillates: +264K vs. -1.013M expected

- Refinery utilization: -1.0% vs. +0.7% expected

Europe News

European Major Indices Close Lower but Recover from Lows

Most major European indices ended the trading session lower, though they recovered from deeper intraday losses. A summary of closing figures:

- Germany’s DAX: -164.90 points (-0.73%) at 22,375.09 (session low: -400.72 points)

- France’s CAC: -17.53 points (-0.22%) at 7,858.84 (session low: -83.39 points)

- UK’s FTSE 100: -26.32 points (-0.30%) at 8,608.49 (session low: -86.49 points)

- Spain’s Ibex: +53.19 points (+0.40%) at 13,350.20 (session low: -61.71 points)

- Italy’s FTSE MIB: -103.18 points (-0.27%) at 38,454.19 (session low: -514.59 points

German Economic Growth Outlook for 2025 Revised Downward

Germany’s banking association has downgraded its economic growth forecast for 2025 to just 0.2%, a significant reduction from its earlier projection of 0.7%. However, growth is expected to pick up to 1.4% in 2026, aided by government stimulus measures.

EU is planning emergency measures in reaction to tariffs

- EU is taking emergency steps in response to tariffs, with the ECB suggesting unconventional monetary policies may be needed to navigate the trade war.

Bloomberg is reporting:

- EU is reportedly planning emergency measures in reaction to tariffs

- Working short-term support proposals, alongside plans to advance competitiveness and reforming key sectors

- Measures will be dependent on US announcement

ECB’s Lagarde: Tariffs aren’t good for the global economy

- ECB President Christine Lagarde speaking

- Tariffs aren’t good for the global economy.

- Inflation is very close to target.

- There is still a bit of work to do on inflation.

- Predictability is in very short supply at the moment, we simply don’t know what US deal will be with the rest of the world.

- There is a lot less excitement about investing in the US at the moment, a stop and hold until there is more certainty.

ECB’s Rehn: Trade protectionism is a key risk to economic outlook

- Comments from ECB policymaker, Olli Rehn

- Trade protectionism is a key risk to economic outlook.

- The ECB is not pre-committing to a particular rate path.

- Disinflation is on track and growth outlook has weakened.

Asia-Pacific & World News

Barclays Predicts 30% Tariffs on China, 10% on Other Countries

Barclays has projected a significant hike in U.S. trade tariffs, anticipating a 30% duty on Chinese imports and a 10% levy on other trade partners. This would elevate the average U.S. tariff rate to 15%, marking a shift toward greater protectionism.

The bank forecasts a slowdown in global economic growth, with Europe expected to grow just 0.4% in Q4 2025, while China’s annual GDP growth is projected at 4.3%. Consumer sentiment is also likely to be affected, with increased job insecurity and inflation driving higher personal savings rates. Markets should prepare for a more cautious economic environment and heightened financial volatility in the coming year.

China Intensifies Military Drills Near Taiwan, Simulating Strikes on Land and Sea

For a second consecutive day, China has ramped up its military drills surrounding Taiwan, applying significant pressure on the island. The Chinese military announced that the latest exercises involve simulated strikes targeting both maritime and land positions to Taiwan’s east.

Additionally, Chinese forces are concentrating on “controlling and sealing off the air and sea zones” around Taiwan. The escalation comes after Taiwan’s President Lai referred to China as a “foreign hostile force” in a recent speech, prompting Beijing to respond with heightened military maneuvers.

China Imposes Restrictions on Domestic Firms Investing in the U.S.

Bloomberg reports that China has recently directed multiple branches of its top economic planning body, the National Development and Reform Commission (NDRC), to temporarily halt the registration and approval of domestic firms seeking to invest in the United States.

Despite these restrictions, there is no indication that China’s existing investments in the U.S. or its holdings of financial assets, such as U.S. Treasuries, will be affected. The move signals rising tensions between the two economic giants.

Click here for the full article

ICYMI – China’s new guidelines to boost financial support for tech innovation: key points

- China wants tech growth

Guidelines were jointly issued by China’s National Financial Regulatory Administration (NFRA), Ministry of Science and Technology and the National Development and Reform Commission to align financial services with national innovation goals:

- Targeted financial support: Emphasis on early-stage, long-term, and smaller-scale investments in core and advanced technologies, especially for small and micro-sized tech firms.

- Five-year goal: Banks and insurers are expected to develop a financial services framework that supports high-priority and emerging innovation sectors.

- Expanded tools and programs: Measures include increased tech-related credit, enhanced insurance coverage for innovation, venture capital pilot programs, and debt financing options.

- Loan flexibility: Proposals to extend loan terms up to five years for tech firms with longer business cycles, along with more flexible interest rates and repayment structures.

- IP financing ecosystem: Introduction of pilot programs to expand financial services linked to intellectual property, including valuation systems and IP-based lending.

- Insurance and capital markets: Encouragement for insurers to undertake long-term investments, launch private securities funds, and participate in venture capital to support “patient capital” for tech growth.

PBOC sets USD/ CNY mid-point today at 7.1793 (vs. estimate at 7.2663)

- PBOC CNY reference rate setting for the trading session

RBA’s Kent says will raise new OMO repo rate by 5bp to 10bp above cash rate target

- Reserve Bank of Australia Assistant Governor (Financial Markets)

Christopher Kent is Assistant Governor (Financial Markets) at the Reserve Bank of Australia.

- he is speaking on: “The RBA’s Monetary Policy Implementation System – Some Important Updates”

- at the KangaNews Debt Capital Market Summit, Sydney

Outlines some changes to repo rates, but assures us that the changes have no implications for the stance of the bank’s monetary policy.

Kent:

- To increase the price of all new Omo Repos by 5 basis points to 10 basis points over the cash rate target

- To introduce a seven-day term, in addition to the existing 28-day term, at each weekly Omo effective from April 9

- Changes have no implications for the stance of monetary policy

Australia’s Building Permits Decline Less Than Expected in February

Australian building permit approvals saw a marginal decline of 0.3% month-on-month in February, far better than the anticipated 1.5% drop. On a yearly basis, permits surged by 25.7%, outpacing the previous 21.7% increase.

New Zealand’s February Building Permits Show Mixed Trends

New Zealand’s building permits rose 0.7% in February compared to the previous month’s 2.6% increase. However, on an annual basis, approvals plummeted 7.8%, a stark contrast to the prior year’s 10.6% growth.

ING says Japan rate rise expectations too low, sees BoJ neutral rate near 2%

- Near-term policy rate may top out around 1.25%

Analysts at ING believe markets are underestimating how far the Bank of Japan (BoJ) could eventually raise interest rates, citing signs of structural change in Japan’s economic landscape—including sustained wage growth and rising asset prices.

In a note this week, ING argued that while the near-term policy rate may top out around 1.25%, the BoJ’s longer-run “neutral” rate—the level at which monetary policy is neither stimulative nor restrictive—is likely closer to 2%. That’s above the midpoint of the BoJ’s own estimated range of 1.0% to 2.5%.

“It’s a non-consensus view, but we think a neutral rate around 2% is justified,” ING said. “We believe the probability of achieving the 2% inflation target on a sustainable basis is far higher than the market currently expects.”

ING points to two years of strong wage growth—around 5%—as a key signal of economic normalisation. In addition, rising land, property and equity prices, as well as shifting corporate price-setting behaviour, suggest Japan may finally be emerging from decades of entrenched deflation.

“The market tends to be overly pessimistic on the Japanese economy, and in consequence, heavily biased toward a dovish stance on rates,” the analysts wrote. “Just because Japan has been in deflation for decades doesn’t mean it can’t return to normal.”

If ING’s view plays out, tighter Japan-U.S. rate differentials may follow—potentially making fixed-rate investments more attractive and offering opportunities in currency and bond markets sensitive to policy divergence.

BoJ’s Ueda says US tariffs likely to push up US inflation in near term

Bank of Japan Governor Ueda:

- Depending on size of U.S. tariff hikes, it could have big impact on each country’s trade activity

- U.S. tariffs likely to push up U.S. inflation near-term, but could weigh on U.S. prices longer-term by cooling U.S. economic growth

- Another big question is how U.S. tariffs could affect household, corporate sentiment, when gauging tariff impact on global economy

- We will likely have more information on U.S. tariff policy when finance leaders gather for IMF/G20 meetings later this month, so likely to share views and debate approach among policymakers

BYD cuts prices in Japan – seeks to gain market share

- Tesla will be eyeing this move nervously

BYD has announced its first price cuts in the Japanese market, slashing the cost of its pure electric vehicles—including the popular Dolphin model—by around 300,000 yen (approximately US$2,000), according to Japanese media reports.

The move comes as Japan’s EV market faces stagnant growth. BYD aims to boost its market share through more aggressive pricing, signaling a strategic push to gain traction in one of the world’s more cautious EV markets.

South Korea’s Inflation for March 2025 Slightly Exceeds Expectations

Latest inflation data from South Korea shows a 2.1% year-on-year (y/y) increase for March, slightly surpassing the expected 2% rise. The month-on-month (m/m) increase was 0.2%, compared to the anticipated 0.18% gain, though lower than the previous month’s 0.3% rise.

The core inflation rate stands at 1.9% y/y, a modest increase from the prior 1.8% reading.

Crypto Market Pulse

Grayscale Introduces Bitcoin Options ETFs Aimed at Income Generation

Grayscale, a leading digital asset manager, has launched two new Bitcoin options-based ETFs—Grayscale Bitcoin Covered Call ETF (BTCC) and Grayscale Bitcoin Premium Income ETF (BPI). These funds are designed to generate income through covered call strategies, leveraging options trading on Grayscale’s existing Bitcoin ETFs.

BTCC focuses on writing call options close to Bitcoin’s spot price, providing investors with consistent premium income while capping potential upside gains. This approach makes it an attractive choice for income-focused investors seeking cash flow in a volatile crypto market.

Conversely, BPI adopts a more aggressive approach by writing options with strike prices significantly above Bitcoin’s current price. While it offers lower immediate income than BTCC, it retains greater potential for capital appreciation.

Grayscale’s move comes as Bitcoin remains range-bound, with investors adopting cautious positions in response to President Donald Trump’s latest tariff measures.

Bitcoin Stalls as Trump’s Tariff Plans Weigh on Market Sentiment

Bitcoin has struggled to break above the $90,000 threshold, trading within a narrow range as traders react to escalating global trade tensions. President Trump recently announced sweeping tariffs, including a 25% duty on imports from Mexico and Canada, alongside reciprocal tariffs on other international partners.

The market response has been risk-averse, with investors hesitating to take aggressive positions. This is reflected in weak crypto ETF inflows and the Crypto Fear and Greed Index remaining below 50 for over a month. The uncertainty surrounding trade policies has dampened Bitcoin’s momentum, contributing to its sideways price action.

Goldman Sachs: Yen Strengthens as Bitcoin Echoes Tech Market Weakness

Goldman Sachs has identified the Japanese yen as a primary hedge against growing U.S. trade and recession risks. BTC/JPY faced resistance at key trendline levels on Wednesday, as traders favored the yen’s stability amid broader economic uncertainties.

As the U.S. dollar weakens and market participants brace for potential rate cuts, Bitcoin’s price action appears increasingly aligned with tech sector performance. Analysts caution that further trade escalations could reinforce the yen’s safe-haven status, putting pressure on speculative assets like Bitcoin.

Bitcoin Breaks $87K Amid Liquidations in ETH and SOL Shorts

The cryptocurrency market cap dipped 1.2% in the last 24 hours to $2.82 trillion, but Bitcoin surged past $87,000, driven by fresh institutional buying and speculation over upcoming U.S. stablecoin legislation.

Liquidations in Ethereum (ETH) and Solana (SOL) shorts exceeded $235 million, adding to Bitcoin’s upward pressure. Traders are closely monitoring legislative developments in Congress, which could influence regulatory clarity for digital assets. Meanwhile, Bitcoin’s correlation with risk assets, including tech stocks, continues to be a point of focus for investors navigating market volatility.

Maker, Gala, and Polygon Lead Whale Transactions Amid Market Volatility

Whale transactions exceeding $100K surged for Maker (MKR), Gala (GALA), and Polygon (POL) over the past week, according to Santiment data. This comes amid concerns over the economic impact of Trump’s upcoming Liberation Day tariffs.

Other assets seeing increased whale activity include DeXe Protocol (DEXE), NEXO, OKB, Ethena Lab’s USDe, PayPal’s PYUSD, KuCoin’s KCS, and Fasttoken (FTN).

Crypto Market Overview:

- Maker (MKR) rose 4% to $1,364 in the last 24 hours, despite broad market caution.

- Bitcoin and altcoins remain largely stable as gold hit an all-time high of $3,149 per ounce.

- Analysts expect Bitcoin to consolidate between $88K and $75K amid tariff uncertainty.

Technical Outlook:

- Maker price range: $1,250 (support) to $1,450 (resistance)

- The 50 EMA, 100 EMA, and 200 EMA (ranging from $1,296 to $1,315) may act as key support levels.

As global markets brace for potential retaliatory tariffs, cryptocurrency volatility is expected to persist throughout April.

The Day’s Takeaway

Day’s Takeaway: Key Market Trends & Developments

United States

The U.S. market was dominated by President Trump’s sweeping 10% tariff on all imports and 25% duty on foreign-made automobiles, triggering volatility across industries. While major indices closed higher—NASDAQ up 0.87%, S&P 500 up 0.67%, and the Dow gaining 0.56%—investors remain cautious about potential trade disruptions. The Atlanta Fed’s GDP Now model forecasts Q1 2025 GDP contraction of 3.7%, reflecting economic uncertainty.

Meanwhile, hiring data signaled resilience in the job market, with the ADP report showing 155K private-sector jobs added in March, exceeding expectations. Factory orders also posted a 0.6% MoM increase, though momentum slowed compared to January.

Canada

Canada braces for economic ripples following U.S. tariff decisions, particularly in the auto sector, as the 25% duty on foreign vehicles threatens Canadian exports. The Bank of Canada is closely monitoring potential disruptions, with policymakers weighing possible rate adjustments if trade pressures intensify.

Commodities

- Gold remains near all-time highs at $3,122/oz, bolstered by investor demand amid trade tensions and a weaker U.S. dollar.

- Crude oil futures settled at $71.71 (+0.72%), despite an unexpected 6.2M barrel build in U.S. crude inventories. Geopolitical risks, including OPEC+ supply adjustments and sanctions on Iran and Venezuela, continue to shape market sentiment.

Europe

Markets in Europe edged lower as concerns over U.S. trade policy weighed on sentiment. Barclays projected a 30% tariff on Chinese imports and 10% on other countries, which could dampen European export activity. The bank also lowered Q4 2025 growth expectations for the Eurozone to 0.4%, citing protectionist risks.

Asia

Asian markets remained mixed, with Japan’s yen strengthening as a preferred safe-haven asset. Goldman Sachs noted yen demand rising against the U.S. dollar, as investors hedge against trade-related economic risks. Meanwhile, Chinese growth projections for 2025 have been revised down to 4.3%, reflecting the anticipated impact of tariffs.

Rest of the World

Emerging markets are bracing for potential capital outflows as global investors weigh risk-off strategies. Mexico and Canada face uncertainty as their previous tariff exemptions expire. Meanwhile, oil-producing nations like Russia and Saudi Arabia are closely monitoring U.S. energy sanctions and OPEC+ output adjustments.

Cryptocurrency

Bitcoin remained range-bound, trading just under $90,000, as investors turned risk-averse amid trade policy shifts. The launch of Grayscale’s Bitcoin options ETFs (BTCC & BPI) marks a strategic move to provide income-focused investment options in the crypto space. Meanwhile, institutional demand for BTC remains strong, with fresh acquisitions influencing market movements.