Market Performance Overview

The stock market rally continued this week as global equity markets posted five straight days of gains. Key indices surged, driven by optimism following the provisional U.S.-China trade deal, which slashed reciprocal tariffs from over 100% to manageable levels. This significant geopolitical shift eased concerns for globally exposed sectors.

Key Index Performances:

- Dow Jones: +0.78% to 42,854.74

- S&P 500: +0.79% to 5,958.38 (3.2% below all-time high)

- Nasdaq Composite: +0.52% to 19,211.10

- TSX Composite: +0.29% to 25,971.93

- FTSE 100: +0.59% to 8,684.56

Industrials and technology stocks led the rally, although only 62% of S&P 500 companies trade above their 50-day moving averages—suggesting selective strength in the market.

Fundamental Drivers of the Rally

1. U.S.-China Trade Deal

The provisional U.S.-China trade deal reduced immediate downside risk. Key highlights include:

- Lowered tariffs

- Increased Chinese agricultural imports

- Intellectual property protections

- Currency stability assurances

“While the deal doesn’t solve every issue, it removes a major overhang,” said Paul Christopher, Wells Fargo Investment Institute.

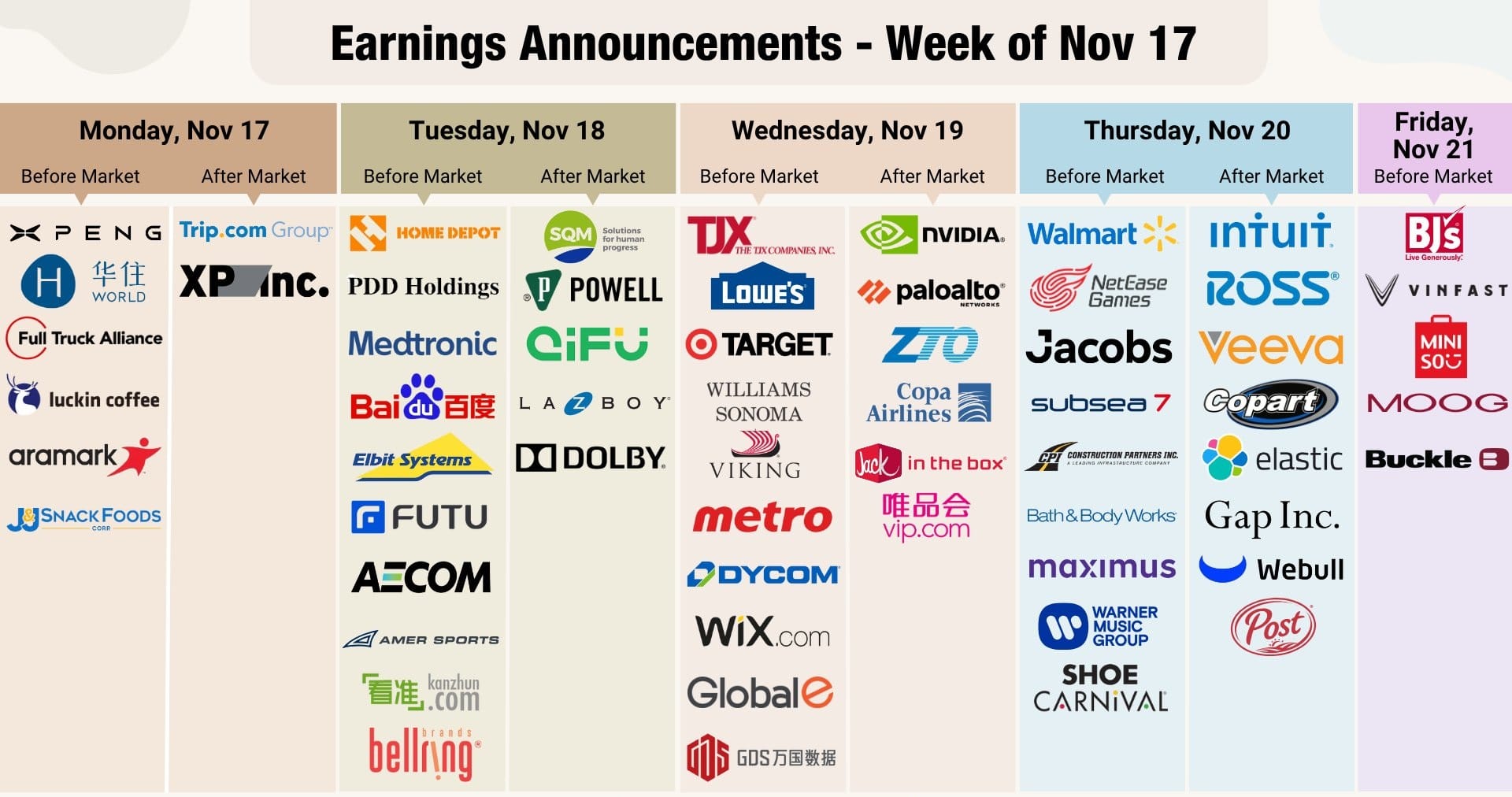

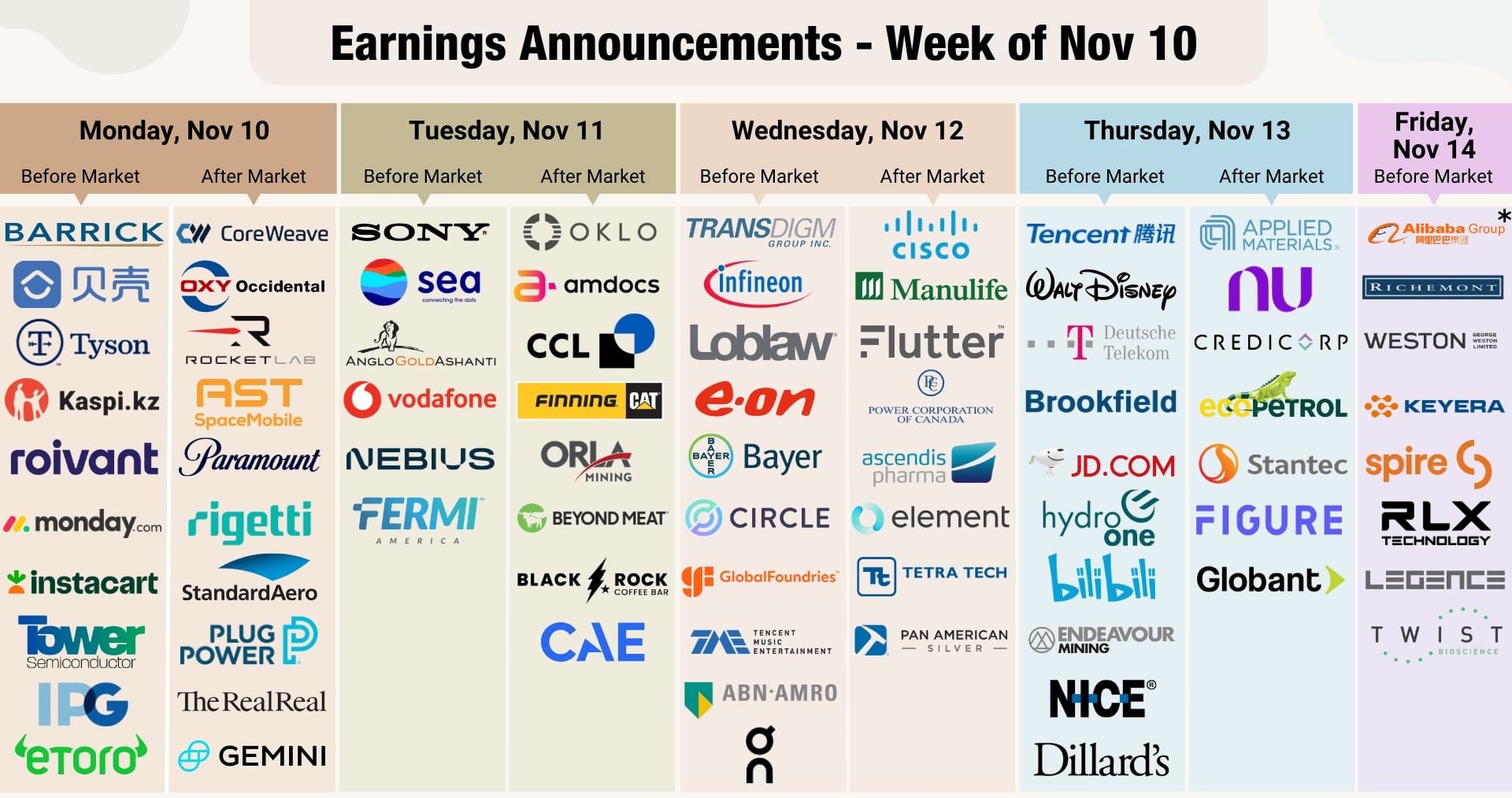

2. Corporate Earnings 2025

The Q1 earnings season has been a bright spot in the May 2025 stock rally, with 72% of S&P 500 firms beating expectations. Standout performers:

- UnitedHealth Group: +6.05% — Medicare Advantage growth

- Fiserv: +5.29% — Fintech demand surge

- Humana: +4.08% — Healthcare services expansion

Earnings growth for Q1 now stands at 8.2% YoY, nearly double the 4.3% estimated at the quarter’s start.

Federal Reserve Policy Outlook

Investors are parsing commentary from Fed officials for clues on rate direction. Scheduled appearances this week include:

- Raphael Bostic (Atlanta Fed): Market dynamics discussion

- Lorie Logan (Dallas Fed): Treasury markets

- John Williams (NY Fed): U.S. outlook

Futures markets reflect expectations of one 25-bps rate cut by year-end—highlighting the Fed’s tightrope walk between inflation and growth.

Sector-Specific Analysis

1. Technology Sector

The tech rally is underpinned by:

- Expanding AI infrastructure

- Cloud computing boom

- Semiconductor recovery

Nvidia’s new Shanghai R&D hub signals the industry’s global resilience despite lingering geopolitical frictions.

2. Energy Markets

Crude oil advanced +1.20%, supported by:

- Trade deal optimism

- Seasonal demand rise

- OPEC+ compliance

However, potential re-entries of Iran and Venezuela into global supply chains could temper upside momentum.

3. Retail Sector Outlook

Investors eye upcoming earnings to gauge consumer durability:

- Home Depot: Contractor demand vs. DIY slump

- Target: Tariff impact on discretionary buys

- Lowe’s: Housing market sensitivity

Canadian Market Developments

1. Energy Sector M&A

Strathcona Resources launched a hostile C$5.93B bid for MEG Energy, a move that could create Canada’s 5th-largest oil producer. Analysts cite synergies across oil sands operations as a major incentive.

2. China Emerges as Major Crude Buyer

Thanks to the expanded Trans Mountain pipeline, China is now Canada’s largest crude buyer. This shift underscores:

- U.S. trade policy backlash

- Asian energy demand

- Canada’s market diversification strategy

Key Economic Indicators

| Indicator | Forecast | Prior |

|---|---|---|

| Manufacturing PMI | 50.5 | 50.2 |

| Services PMI | 51.5 | 50.8 |

| Jobless Claims | 230K | 229K |

| Existing Home Sales | 4.1M | 4.02M |

The University of Michigan consumer survey revealed:

- Sentiment decline to 50.8

- 1-year inflation expectations at 7.3%, the highest since 1981

- Housing starts fell by 2.1% MoM

Risks and Opportunities

Risks:

- Fragile trade deal enforcement

- Persistent inflation deterring Fed rate cuts

- Slower earnings growth trajectory

- Heightened geopolitical instability

Opportunities:

- Rotation into value stocks

- International diversification

- Attractive bond yields

- Select cyclical sector exposure

Technical Analysis

The S&P 500 is approaching a critical resistance zone near 5,975.

- RSI: 62 (nearing overbought)

- MACD: Positive but flattening

- Support: 5,850

- Breakout target: 6,147

- Downside risk: Retest of 5,750 if breakout fails

Investor Takeaways

- Stay diversified amid gains

- Focus on quality companies with pricing power

- Watch Fed speeches for rate clues

- Favor select cyclical plays over blanket exposure

- Rebalance portfolios to protect profits

Conclusion: Cautious Optimism in the May 2025 Stock Rally

The May 2025 stock rally, though impressive, demands selective investing. While the U.S.-China trade deal and corporate earnings have supported the surge, risks remain—from inflation stickiness to global tensions. Investors should prioritize fundamentals, diversify across asset classes, and remain attentive to macro developments for sustained success.