North America News

NASDAQ Posts Worst Day Since January 27, Major Indices Down YTD

Closing Market Performance:

- Dow Jones: -193.62 points (-0.45%) at 43,239.50

- S&P 500: -94.49 points (-1.59%) at 5,861.57

- NASDAQ: -530.84 points (-2.78%) at 18,544.42

- Russell 2000: -34.5 points (-1.59%) at 2,139.65

Biggest Losers:

- Nvidia: -8.48%, worst drop since DeepSeek announcement.

- Palantir: -5.10%

- Meta: -2.29%

- Microsoft: -1.80%

- Amazon: -2.62%

- Tesla: -3.04%, nearing 200-day moving average ($278.14).

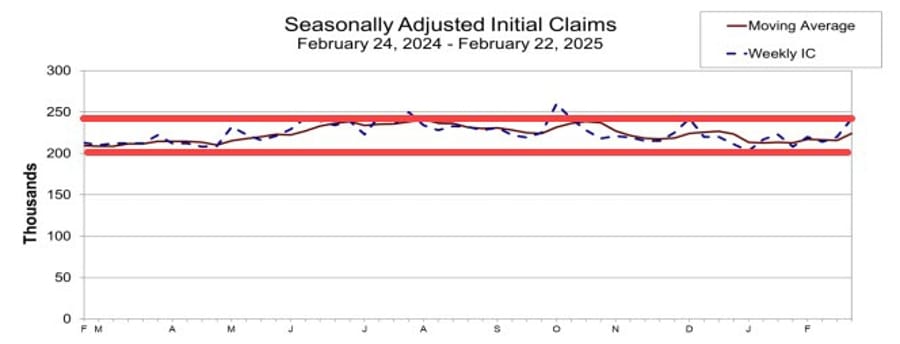

US Initial Jobless Claims Jump to 242K (vs 221K Estimate)

- Prior: 219K (revised to 220K)

- 4-Week Moving Average: 224.0K (previously 215.5K)

- Continuing Claims: 1.862M (expected 1.872M)

- Highest initial jobless claims since early October.

US Q4 GDP Second Reading Matches Expectations

- Q4 GDP: +2.3% (expected +2.3%)

- Q3 GDP was +2.8%

- Consumer Spending: +4.2% (unchanged from advance)

- Final Sales: +3.2% (unchanged from advance)

- Inflation Measures:

- GDP Deflator: +2.4% (expected +2.2%)

- Core PCE: +2.7% (expected +2.5%)

- PCE Prices: +2.4% (expected +2.3%)

- PCE Services ex-Energy/Housing: +3.5% (Q3: +3.3%)

- Contributors:

- Consumption: +2.79% (slightly lower than +2.82% advance)

- Government Spending: +0.49% (advance: +0.42%)

- Net International Trade: +0.12% (advance: +0.04%)

- Inventories: -0.81% (improvement from -0.93% advance)

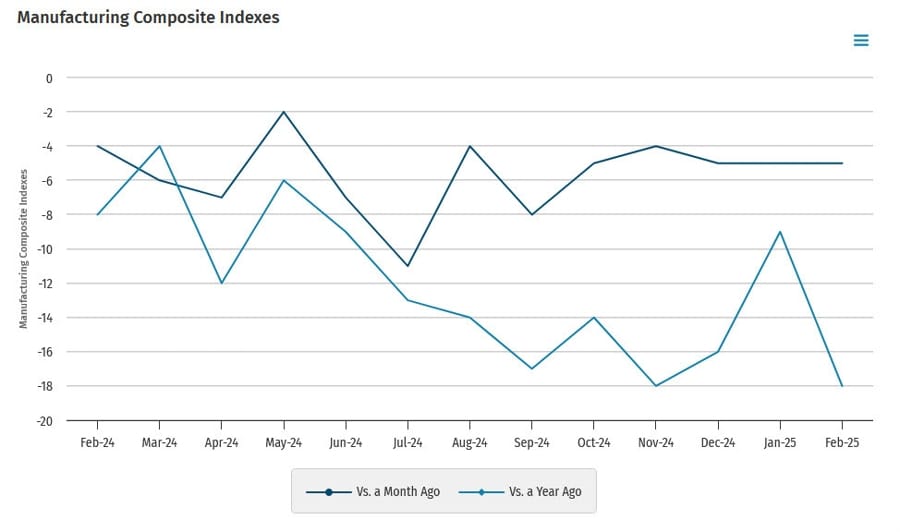

KC Fed Manufacturing Index Improves Slightly

- KC Fed Manufacturing Index: -5 (prior -9)

- Composite Index: -5 (unchanged)

Comments from the report:

- Cold weather disruptions: “Couldn’t ship freezables for days, backlog being cleared this week.”

- Concerns over imported capital equipment costs.

- Machinery manufacturing demand down 30% for Q1 & Q2 2025 vs. 2024.

- Material costs rising, forcing businesses to pass along increases to consumers.

- Uncertainty in manufacturing making business planning difficult.

- Anticipation of financial strain leading to credit concerns and cash margin increases.

US January Durable Goods Orders Beat Expectations

- Headline: +3.1% (expected +2.0%)

- Prior revised to -1.8% (from -2.2%)

- Nondefense Capital Goods Orders ex-Air: +0.8% (expected +0.3%)

- Prior revised to +0.2% (from +0.5%)

- Ex-Transportation: 0.0% (expected +0.3%)

- Ex-Defense: +3.5% (prior -1.8%)

US January Pending Home Sales Hit Record Low

- Pending Home Sales M/M: -4.6% (expected -1.3%)

- Prior: -5.5%

- Pending Home Sales Index: 70.6 (prior 74.2) – all-time low

- Transactions Y/Y: -5.2% (prior -5.0%)

- Home Prices Y/Y: +4.7%

Weekly Update on Interest Rate Expectations (G8 FX)

Rate Cuts by Year-End:

- Fed: 55 bps (96% probability of no change at the next meeting)

- ECB: 83 bps (96% probability of a rate cut at the next meeting)

- BoE: 57 bps (91% probability of no change at the next meeting)

- BoC: 50 bps (60% probability of no change at the next meeting)

- RBA: 52 bps (84% probability of no change at the next meeting)

- RBNZ: 63 bps (94% probability of a rate cut at the next meeting)

- SNB: 39 bps (99% probability of a rate cut at the next meeting)

Rate Hikes by Year-End:

- BoJ: 34 bps (98% probability of no change at the next meeting)

Fed’s Hammack: Rates Likely to Stay Steady for Some Time

- Inflation risks remain; further easing is uncertain.

- Inflation progress has slowed and remains uneven.

- Seeks clear evidence of inflation nearing 2% before supporting cuts.

- Patient approach allows monitoring of labor market conditions.

- Current policy is not meaningfully restrictive, with broad financial conditions still accommodative.

Fed’s Harker: Policy Still Restrictive, Keeping Pressure on Inflation

- Fed’s policy remains restrictive enough to maintain downward pressure on inflation.

- Willing to react if needed, but emphasizes patience in monetary decisions.

- Progress toward 2% inflation target has slowed.

- Cautions against acting on a single month’s data.

- Maintains optimism on economic outlook.

Fed’s Schmid: Concern Growing Over Rising Inflation Expectations

- KC Fed President expresses caution over inflation trends.

- Recent increase in inflation expectations is a concern.

- Uncertainty could weigh on growth, but Fed must prioritize inflation control.

- Balance sheet should continue shrinking as much as possible.

- Core inflation may need to be redefined, as food prices now behave like other goods.

WH Adviser: Tariff Study Due April 1

Comments from White House Senior Adviser Kevin Hassett

- A study on tariffs will be released on April 1.

- Trump will decide next steps after reviewing the study.

IRS to Shut Down 120 Offices Under Efficiency Measures

The U.S. General Services Administration, per a Washington Post report, has outlined a plan to close over 120 IRS offices. The initiative aligns with White House efforts to streamline federal operations and reduce costs.

U.S. Commerce Secretary Sets April 2 as Key Reciprocal Tariff Date

Commerce Secretary Howard Lutnick stated that April 2 will serve as the baseline date for reciprocal tariff policies, emphasizing concerns over Chinese vehicle imports and broader U.S.-China trade relations.

California Considers Further Minimum Wage Hike for Fast-Food Workers

The California Fast Food Council is debating a potential increase in the state’s $20 minimum wage for fast-food workers. A cost-of-living adjustment of up to 70 cents is under review, with discussions set for April or May, though no immediate vote is expected.

Trump Executive Order Pushes Government Efficiency Initiative

Donald Trump has issued an executive order requiring agencies to justify federal spending on contracts, grants, and travel expenses, as part of a broader efficiency drive.

Trump Confirms Additional 10% Tariff on China, Canada/Mexico Tariffs Still On

- Trump clarified his stance via Truth Social after previous contradictory statements.

- Canada and Mexico tariffs remain in place, despite earlier mention of a delay to April 2.

- An additional 10% tariff on Chinese goods will take effect on March 4.

- Justification: Drug trade concerns involving China, Mexico, and Canada.

Commodities News

Gold Drops Over 1% as Trump’s Tariff Comments Cause Uncertainty

- Gold faced heavy selling pressure, extending losses past 1%.

- Trump’s contradictory tariff statements added confusion.

- Profit-taking intensified, squeezing out recent gold buyers.

- Despite falling U.S. yields, bullion lost support ahead of U.S. trading session.

- Trump confirmed a 25% tariff on Europe but lacked specifics.

Market Movers:

- Nvidia earnings: Sales beat estimates at $43B, but tighter margins raised concerns.

- Fedwatch Tool: 33% probability of rate cut in June.

- US Q4 GDP second reading expected at 2.3%.

- Core PCE expected at 2.5%, unchanged from prior estimate.

OPEC+ Hesitant on April Oil Output Hike

- Reuters reports: OPEC+ considering delaying the planned April oil output hike due to sanctions and tariff uncertainties.

- Russia and UAE favor proceeding with the hike.

- Saudi Arabia and other members advocate for a delay.

US Copper Prices Surge Amid Tariff Speculation – ING

- Trump orders US Commerce Department to investigate copper tariffs.

- LME vs. COMEX price divergence:

- LME copper: +8% YTD

- COMEX copper: +14% YTD

- Potential 25% tariff could widen arbitrage spread (~$900/t currently).

- US copper production covers only 5% of global supply, making domestic substitution difficult.

European Natural Gas Prices Plunge on Peace Deal Speculation – ING

- TTF prices down 6.7%, lowest since mid-December.

- Market pricing in possible Russia-Ukraine peace deal.

- Investment funds selling aggressively: Net long positions reduced by 27.4TWh last week.

- Storage levels at 40% capacity, increasing reliance on LNG imports.

- Potential resumption of Russian pipeline gas to Europe could reshape the market outlook.

Gold Slides as Trump’s Tariff Comments Create Uncertainty

- President Trump issued unclear and contradicting tariff statements, pressuring bullion.

- Strong selling squeezed out recent buyers despite lower U.S. yields.

- Trump confirmed 25% tariffs on Europe’s autos and other sectors but lacked details.

- Market Focus:

- Nvidia (NVDA) earnings: Mixed outlook, with a slight sales beat but tighter profit margins due to the new Blackwell chip rollout.

- Fed rate cut probability: CME Fedwatch shows 33% chance rates remain unchanged in June.

- Upcoming U.S. data: Second GDP reading (Q4) expected to hold at 2.3%.

Trafigura Identifies U.S. Policy as Biggest Upside Risk for Oil Prices

Ben Luckock, head of oil trading at Trafigura Group, highlighted U.S. foreign policy toward Iran as the most significant risk to global crude prices. Key insights:

- Iran’s oil exports have surged, but a potential return of Donald Trump to the White House could increase tensions and market volatility.

- The growing “shadow fleet” of tankers transporting oil from Russia, Iran, and Venezuela remains a crucial factor in global supply.

- Despite uncertainties, overall oil supply stability may help cushion potential shocks.

Citi Predicts 25% U.S. Tariff on Copper Imports by Q4 2025

Citi forecasts that the U.S. will impose a 25% tariff on copper imports following an executive order by Donald Trump to investigate copper trade. Expected impacts:

- Pre-tariff stockpiling may temporarily drive up copper prices.

- Reciprocal trade measures from Canada and Mexico could accelerate tariff implementation.

- The review covers raw ore, refined metal, alloys, scrap, and finished products, with final decisions anticipated by November 2025.

Europe News

DAX Leads European Equity Markets Lower

Closing changes in Europe:

- Stoxx 600: -1.0%

- German DAX: -1.2%

- France CAC: -0.7%

- UK FTSE 100: +0.2%

- Spain IBEX: -0.6%

- Italy FTSE MIB: -1.6%

Eurozone February Final Consumer Confidence Improves Slightly

Latest Data from the European Commission – February 27, 2025

- Consumer Confidence: -13.6 (prelim: -13.6)

- Prior: -14.2

- Economic Confidence: 96.3 (expected 96.0)

- Prior: 95.2 (revised to 95.3)

- Industrial Confidence: -11.4 (expected -12.0)

- Prior: -12.9 (revised to -12.7)

- Services Confidence: 6.2 (expected 6.8)

- Prior: 6.6 (revised to 6.7)

- Euro area economic sentiment hit its highest level since September, but services sector weakness is a concern.

Eurozone January M3 Money Supply Growth Remains Stable

Latest Data from ECB – February 27, 2025

- M3 Money Supply Y/Y: +3.6% (expected +3.8%)

- Prior: +3.5%

- Narrower M1 aggregate (currency in circulation and overnight deposits) grew 2.7% in January (from 1.8% in December).

Spain February Preliminary CPI Matches Expectations

Latest Data from INE – February 27, 2025

- CPI Y/Y: +3.0% (expected +3.0%)

- Prior: +2.9%

- HICP Y/Y: +2.9% (expected +2.8%)

- Prior: +2.9%

- Core annual inflation eased to 2.1% (from 2.4% in January), reinforcing expectations for an ECB rate cut.

Switzerland Q4 GDP Meets Expectations

Latest Data from SECO – February 27, 2025

- GDP Q/Q: +0.2% (expected +0.2%)

- Prior: +0.4%

- GDP Y/Y: +1.5% (expected +1.6%)

- Prior: +2.0%, revised to 1.9%

- Growth was driven by both industry and the services sector, with consumption and investment contributing positively.

Economists Expect ECB Rate Cut Next Week, Divided on June Outlook

- Reuters survey: All 82 economists expect a rate cut on March 6

- 55 of 82 economists forecast a cut to 2.00% by June (vs. 46 of 77 in January survey)

ECB Accounts: Services Inflation Key to Outlook

- Disinflation process on track.

- Near-term inflation expected to remain above target.

- Confidence increasing in a timely and sustained convergence.

- Risks:

- High uncertainty over energy and food prices.

- Strong labor market and wage growth require caution.

- Potential impact of U.S. trade policies.

- Outlook:

- Baseline projections remain unchanged.

- Services inflation and wage growth expected to slow.

- Some downside risks materializing, but a consumption-driven recovery is still plausible.

- Deposit facility rate at 3.00% may now be close to neutral territory.

British Pound Under Pressure Amid Strong USD and Weak UK Services Sector

The British pound (Cable) faced heavy selling in Asia trade, weighed down by:

- A broadly strong U.S. dollar.

- A weak UK services sector outlook, as per the Confederation of British Industry’s (CBI) latest survey:

- Profitability among business and professional firms dropped to -37, the steepest decline since August 2020.

- Underlying demand remains weak, with businesses struggling against rising employment costs.

Asia-Pacific & World News

No Intense Talks to Avert China Tariffs, Retaliation Likely – WSJ

- WSJ reports no intensive discussions on how China can avoid further U.S. tariffs beyond the initial 10% increase.

- Beijing has not offered a deal to curb fentanyl-related chemical exports.

- Unlike Canada and Mexico, China prefers a broader trade negotiation with Trump.

- China likely to retaliate rather than make concessions on fentanyl alone.

Foreign Investors Maintain Confidence in China’s Market – AmCham Report

A report by the American Chamber of Commerce in South China (AmCham) affirms that China remains a top investment destination. Findings include:

- 58% of surveyed foreign companies rank China among their top three investment priorities.

- 76% of foreign firms plan to reinvest in China, with U.S. firms showing an 11-percentage-point increase in reinvestment intentions compared to last year.

- Factors driving investment include China’s large consumer market, robust supply chain infrastructure, and policy initiatives supporting foreign businesses.

PBoC Deputy Governor Supports Special Treasury Bonds to Strengthen Banks

Deputy Governor Lu Lei of the People’s Bank of China (PBoC) emphasized the importance of issuing special treasury bonds to help major state-owned banks bolster their Common Equity Tier 1 (CET1) capital. Strengthening reserves would:

- Enhance risk management.

- Provide financial support for economic sectors like technology and manufacturing.

- Advance policy and development banking reforms.

China’s “Two Sessions” Begin March 4: Key Economic Expectations

China’s annual parliamentary meetings, the “Two Sessions,” commence on March 4, starting with the Chinese People’s Political Consultative Conference, followed by the National People’s Congress.

What to Watch:

- The Consumer Price Index (CPI) target is expected to be lowered to around 2% from 3%.

- Additional stimulus measures may be announced, though implementation could be deferred until the second half of the year.

- Expansion of bond sale quotas for both sovereign and local government financing.

- GDP growth target likely to remain “around 5%.”

China Tightens Oversight on Capital Flows Amid Yuan Pressures

China is ramping up scrutiny on overseas investments by domestic firms and the use of proceeds from Hong Kong share sales, as pressure on the yuan persists. Key highlights:

- Chinese banks sold the highest amount of foreign exchange to clients since July 2023, reflecting strong demand for foreign currency.

- Goldman Sachs reports significant capital outflows in January.

- RBC Capital Markets notes weak domestic demand and low interest rates as major structural challenges for the yuan.

- China’s state-owned banks have been active in selling dollars to stabilize the currency.

China Evergrande Appoints Liquidators for Tianji Holding

China Evergrande Group has appointed liquidators for its subsidiary Tianji Holding following a winding-up order from Hong Kong’s High Court. Trading in Evergrande shares remains suspended, underscoring the company’s ongoing financial struggles. Investors and creditors are advised to exercise caution.

PBOC sets USD/ CNY reference rate for today at 7.1740 (vs. estimate at 7.2561)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injects 215bn yuan via 7-day RR, sets rate at 1.5%

- 125bn yuan mature today

- net injection is 90n yuan

CBA: China’s Policies Could Support AUD, NZD, and Yuan

According to Commonwealth Bank of Australia (CBA), next week’s National People’s Congress in China could impact currency markets:

- China may introduce fiscal measures to counter U.S. tariffs, potentially boosting AUD, NZD, and CNH.

- Trade war concerns stemming from Donald Trump’s policy stance continue to weigh on the Australian dollar.

RBA’s Hauser: Labor Market Tightness Challenges Inflation Management

RBA Deputy Governor Andrew Hauser highlighted:

- Positive inflation trends but stressed the need for sustained improvements.

- The labor market’s tightness as a key inflationary challenge.

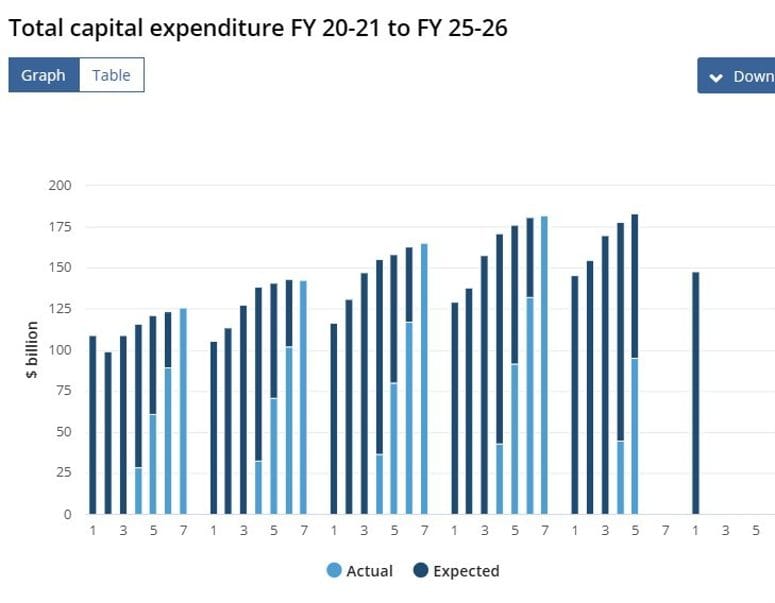

Australia’s Q3 Capital Expenditure Falls Short of Expectations

Australian Q3 private capital expenditure (capex) data disappointed:

- Headline capex declined -0.2% q/q (vs. expected +0.8%).

- Plant and machinery capex fell -0.8% (prior +1.1%).

- Building capex rose +0.2% (prior +1.1%).

- 2024-25 investment estimate increased 3.2% to $183.4 billion.

- 2025-26 investment estimate rose 1.8% to $148.0 billion.

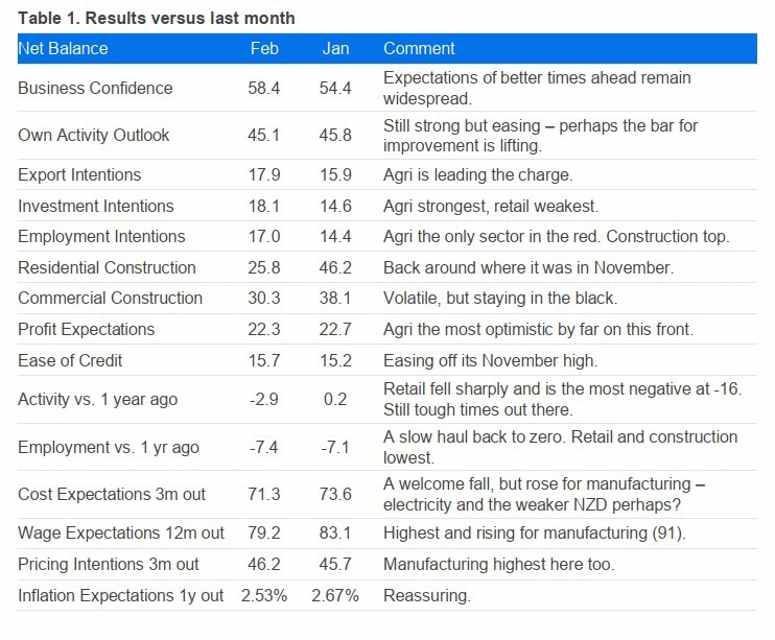

New Zealand Business Confidence Rises in February

ANZ’s latest survey showed improved business confidence in New Zealand:

- Confidence rose to +58.4% (vs. +54.4% in January).

- Business activity outlook dipped slightly to +45.1% (vs. +45.8%).

- Inflation expectations eased from 2.7% to 2.5%.

BOJ’s Ueda: Monetary Policy Decisions Will Depend on US Trade Policies

- Concerns over US tariff policy and global response creating uncertainty for central banks.

- Key points from Ueda:

- US policy impact on markets, economy, and prices will dictate BOJ’s future monetary decisions.

- Ongoing scrutiny of tariffs and global trade developments is necessary.

Japan’s Vice Finance Minister Dismisses Concerns Over Yen Strength

Atsushi Mimura, Japan’s vice finance minister, sees the yen’s recent rise as aligned with economic fundamentals, citing:

- Strong GDP growth.

- 4% inflation in January.

- Market expectations for continued BOJ tightening.

Info comes via Reuters (gated).

Seven & i Holdings Abandons Management Buyout Plan After Itochu’s Withdrawal

Seven & i Holdings, the parent company of 7-Eleven, has dropped its management buyout (MBO) efforts after Itochu Corporation decided against participating due to limited synergies and potential conflicts of interest. The firm continues to explore strategic alternatives, including a proposal from Canada’s Alimentation Couche-Tard, but faces U.S. antitrust challenges.

Crypto Market Pulse

Ethereum Faces Pressure at $2,200 Despite Pectra Upgrade Moving Forward

- Ethereum price: $2,270

- Pectra upgrade on track, despite issues on Holesky testnet.

- Sepolia testnet deployment set for March 5; Mainnet upgrade expected in April.

- Key Pectra features include:

- Sponsored transactions.

- Gas fee payments with ERC-20 tokens.

- Improved wallet recovery options.

- Increased staking balance per node from 32 ETH to 2,048 ETH.

- Ethereum ETFs recorded $94.3M in outflows, longest streak since November.

- $2,200 support critical—failure could trigger a drop toward $1,500.

Litecoin Whales Move 84M LTC Amid Trump-Fueled Market Dip

- Litecoin price: +24% in last 24 hours.

- Whales moved 84.8M LTC Tuesday, capitalizing on Trump’s tariff-driven dip.

- Institutional accumulation rising ahead of potential Litecoin ETF launch.

- Strong demand pushing price toward $132, though bears aim to test $120 support.

- Litecoin outperforms broader crypto market, which remains bearish.

FBI Seeks Crypto Industry Help to Track Bybit Hack Funds

- FBI requested help in tracking $1.5 billion stolen from Bybit by North Korean hackers (TraderTraitor group).

- Published a list of Ethereum addresses linked to stolen assets.

- Hack attributed to North Korea-linked Lazarus Group.

- Stolen funds being laundered across multiple blockchains before conversion to fiat.

Ether, XRP Drop 5% as Crypto Sell-Off Continues

- XRP, BNB, ADA, and DOGE fell up to 4%.

- Over $600 million in bullish futures liquidated.

- New York Fed study: Trump’s tariffs on Chinese imports have had a greater-than-expected economic impact.

- Ether (ETH) dropped 7% in the past 24 hours, extending a multi-day decline.

- Bitcoin (BTC) fluctuated between $82,500 – $89,000, staging a slight recovery to $86,000.

The Day’s Takeaway

Day’s Takeaway: Key Market Trends & Developments

United States: Mixed Economic Signals Amid Fed Caution

- Inflation & Fed Policy:

- Fed officials Hammack and Harker signaled a prolonged hold on interest rates, citing slow progress toward the 2% inflation target and accommodative financial conditions.

- Inflation expectations remain a concern, reinforcing the Fed’s cautious stance.

- Economic Data:

- US Q4 GDP second reading held steady at +2.3%, with consumption and government spending contributing positively.

- January durable goods orders rose +3.1% (expected +2.0%), with strong non-defense capital goods orders.

- Pending home sales hit an all-time low, with a -4.6% decline in January, signaling continued weakness in the housing market.

- Initial jobless claims jumped to 242K, the highest level since early October.

- Market Performance:

- NASDAQ posted its worst day since January 27 (-2.78%), dragged by an 8.48% slump in Nvidia despite strong earnings.

- S&P 500 and Dow Jones also ended lower, reflecting investor concerns over Fed policy, tariffs, and earnings guidance.

- Trade & Tariffs:

- Trump reaffirmed a 10% additional tariff on Chinese goods starting March 4 and confirmed Canada/Mexico tariffs will proceed.

- No progress in negotiations between the US and China, with Beijing expected to retaliate.

Commodities: Tariffs Fuel Uncertainty, Gold & Oil Under Pressure

- Gold:

- Fell over 1% as Trump’s contradictory tariff statements created uncertainty.

- Profit-taking intensified despite lower US Treasury yields.

- Oil & OPEC+:

- OPEC+ is hesitant about moving forward with an April output hike, as sanctions and tariff uncertainties cloud demand expectations.

- Russia and UAE favor proceeding, while Saudi Arabia and others push for a delay.

- Copper:

- COMEX copper surged on tariff speculation, with prices up 14% YTD vs 8% on LME.

- The US Commerce Department is investigating import tariffs, which could further widen the price spread.

- Natural Gas:

- TTF European gas prices dropped 6.7%, nearing their lowest levels since December.

- Market factoring in a potential Russia-Ukraine peace deal, which could lead to resumed Russian pipeline gas exports to Europe.

Europe: Markets Decline Amid ECB Speculation & Economic Concerns

- Equities:

- DAX led European losses (-1.2%), while Stoxx 600 (-1.0%) and CAC 40 (-0.7%) also closed lower.

- FTSE 100 (+0.2%) outperformed as energy and financial stocks held up.

- Central Bank Expectations:

- ECB expected to cut rates on March 6, with economists divided on further easing by June.

- Eurozone money supply growth stabilized at +3.6% Y/Y, with M1 showing a notable uptick.

- Manufacturing & Sentiment:

- KC Fed manufacturing index improved slightly to -5 but highlighted rising material costs and business uncertainty.

- Eurozone consumer confidence improved to -13.6, its highest since September, though industrial confidence remained weak.

Rest of the World: BOJ & China Policy Uncertainty Linger

- Japan:

- BOJ Governor Ueda stressed policy decisions will depend on US tariff impacts.

- Yen remains volatile as markets anticipate potential BOJ tightening.

- China:

- No significant discussions on avoiding further tariffs, with Beijing expected to retaliate.

- Foreign investment confidence remains strong, with 76% of firms planning reinvestment.

- Emerging Markets:

- Brazil and India remain attractive for foreign investors, as central banks consider rate cuts to boost economic growth.

- Commodity-exporting economies like Australia face volatility amid tariff uncertainties.

Crypto: Ethereum & Litecoin Diverge as Market Stays Cautious

- Ethereum:

- Pectra upgrade remains on track despite Holesky testnet issues.

- ETH price at $2,270, testing $2,200 support; failure could lead to $1,500 downside.

- Ethereum ETFs saw $94.3M outflows, the longest streak since November.

- Litecoin:

- LTC price surged 24%, defying broader crypto weakness.

- Whale movements of 84.8M LTC suggest institutional accumulation ahead of a potential ETF launch.

- Broader Market:

- Bitcoin remains volatile between $82,500 and $89,000.

- XRP, SOL, and ADA under pressure as sentiment remains risk-off.

Final Takeaway:

Markets are grappling with Fed uncertainty, tariff risks, and volatile economic data. While US and European central banks remain cautious, global investors are closely watching China’s response to new tariffs. Commodities and equities continue to face turbulence, while crypto markets show a mix of weakness and resilience in selective assets like Litecoin.