North America News

Stocks Close Strong: NASDAQ Ends Week Up 6.73%

U.S. stocks wrapped up a four-day win streak, erasing Monday’s steep losses. The NASDAQ led with a weekly gain of 6.73%, buoyed by tech strength and tariff détente optimism.

Friday’s closing numbers:

- Dow +20.10 pts (+0.05%) to 40,113.50

- S&P 500 +40.44 pts (+0.74%) to 5,525.21

- NASDAQ +216.90 pts (+1.26%) to 17,382.94

Weekly gains:

- Dow +2.48%

- S&P +4.59%

- NASDAQ +6.73%

Top performers:

- Palantir +19.88%

- Robinhood +19.72%

- Trump Media +18.83%

- Tesla +18.06%

- SoFi +17.21%

- MicroStrategy +16.26%

- Shopify +16.10%

- Micron +15.92%

- Super Micro +15.76%

- Nio +14.35%

- Netflix +13.20%

- CrowdStrike +13.11%

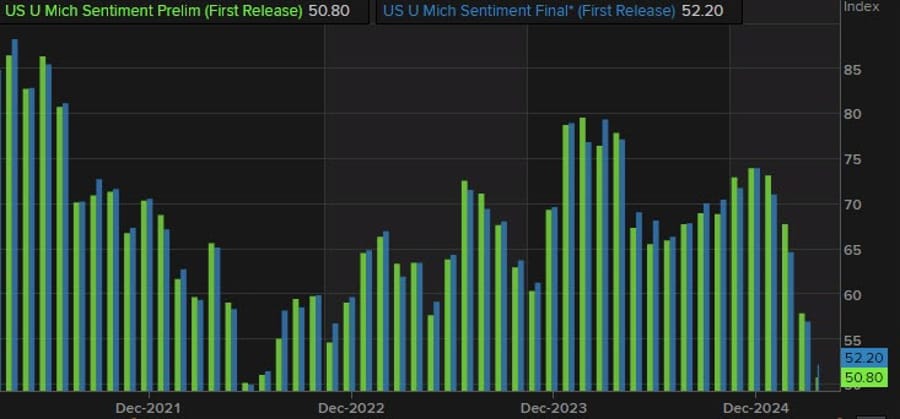

Consumer Sentiment Beats Forecasts, But Inflation Worries Linger

The University of Michigan’s final sentiment index for April rose to 52.2, beating the expected 50.8, though still below March’s 57.0 reading.

Breakdown:

- Current conditions: 59.8 (vs 56.5 expected)

- Expectations: 47.3 (vs 47.1 forecast)

- 1-year inflation expectations surged to 6.5% from 5.0%

- 5-year inflation outlook remained at 4.4%

While sentiment improved from the preliminary reading, elevated inflation expectations point to persistent anxiety among consumers despite relatively strong hard data.

Fed Survey Flags Trade Tensions as Top Financial Risk

The Federal Reserve’s latest Financial Stability Report identifies global trade risks as the most cited threat to the U.S. financial system. Survey respondents flagged tariff escalation, fiscal debt sustainability, and foreign divestment from U.S. assets as growing concerns.

Key takeaways:

- Stablecoins still pose run risks.

- Hedge fund leverage is at historic highs.

- Treasury and equity market liquidity deteriorated in April but remained functional.

- CRE prices may be stabilizing.

- Some respondents said incremental tariffs may cause only modest disruption—but the overall mood is cautious as policy uncertainty grows.

Trump: China Tariffs Stay Unless U.S. Gains Concessions

President Trump reiterated on Friday that the U.S. will not remove tariffs on Chinese imports unless Beijing makes meaningful concessions. He called the possibility of “opening up China” a major win and said, “We will set the tariff.”

He also noted progress in the Iran situation and again defended tariffs as a successful policy tool. “People are starting to understand how good tariffs are,” he said.

FT: Sources Say Xi Has Not Called Trump

According to a report by the Financial Times, sources familiar with the matter in both Washington and Beijing say President Xi has not contacted Trump, contrary to the former president’s recent claims.

This marks yet another contradiction between Trump’s trade commentary and signals from the Chinese government, raising doubts over the current state of U.S.-China engagement.

USTR Greer: U.S. in Ongoing Technical Trade Talks with Japan, Others

U.S. Trade Representative Greer said the administration is actively engaged in technical discussions with Japan and other partners to improve reciprocal trade arrangements.

Greer emphasized that while talks are progressing, any major decisions—like altering the 10% tariff on imports—would ultimately rest with President Trump, who continues to float “alternative arrangements” for compliant countries.

Trump Claims Xi Called Him, Hints at 50% Tariffs and Upcoming Deals

In a Time Magazine interview, former President Donald Trump made several headline-grabbing claims:

- Says Chinese President Xi has called him, and that his team is in active talks with China to strike a deal

- Would consider it a “win” if U.S. tariffs on China hit 50% within a year

- Believes Crimea will stay with Russia

- Downplayed market concerns during April’s bond selloff

- Predicts Saudi Arabia will join the Abraham Accords

- Denies Bessent or Lutnick influenced his 90-day tariff pause

- “Loves” the idea of taxing the wealthy

- Claims to have closed 200 deals, with announcements coming over the next 3–4 weeks

- Won’t call Xi unless Xi calls him first

- Supports a ban on congressional stock trading

Market reaction to the supposed Xi call was muted, as Chinese officials have repeatedly denied any such contact—a sign of growing skepticism toward Trump’s tariff narrative.

Fed’s Kashkari: I’m worried about layoffs but not seeing them yet

- Comments from the Minneapolis Fed President

- I’m worried that with the uncertainty, businesses will do layoffs

- Not seeing an uptick in layoffs yet

- Some businesses say they are scenario planning for potential layoffs if uncertainty lasts

- A resolution of trade frictions would relieve uncertainty, would be optimistic

Canada Retail Sales Drop in February, March Rebound Expected

Canadian retail sales fell 0.4% in February, matching expectations. In volume terms, sales were also down 0.4%, with declines recorded in seven provinces.

Highlights:

- Excluding autos, sales rose 0.5% (vs -0.4% expected)

- Quebec posted the steepest provincial drop at -0.9%, with Montreal metro area down 2.5%

- February’s auto-adjusted figure was revised down slightly

- Advance data for March shows a 0.7% rebound

Details:

- Sales were down in four of nine subsectors and were led by decreases at motor vehicle and parts dealers

- Motor Vehicle and Parts Dealers:

- Overall sales decreased by -2.6% in February.

- All four store types within this subsector saw declines.

- New car dealers led the drop with a -3.0% decrease, marking a second consecutive monthly decline.

- Automotive parts, accessories, and tire retailers also fell by -1.6%.

- Gasoline Stations and Fuel Vendors:

- Sales increased by +0.3% in February, marking the fifth consecutive monthly gain.

- In volume terms, sales rose +0.8%.

Core retail sales ex Auto details:

- Core Retail Sales:

- Increased +0.5% in February.

- Food and Beverage Retailers:

- Sales rose +2.8%, driving much of the core retail growth.

- Supermarkets and other grocery retailers (excluding convenience stores) increased +3.7%, rebounding from a -3.2% decline in January.

- Beer, wine, and liquor retailers contributed with a +2.3% increase.

- General Merchandise Retailers:

- Sales were up +1.2% in February.

- Furniture, Home Furnishings, Electronics, and Appliances Retailers:

- Experienced the largest decline among core retail categories with a -2.9% decrease

Commodities News

Gold Falls Below $3,300 as Tariff Optimism Wanes, Dollar Holds Firm

Gold prices tumbled 1.6% on Friday to $3,294, surrendering Thursday’s gains despite softer Treasury yields and a dip in the U.S. Dollar Index. Risk appetite faded after President Trump reiterated he won’t lift tariffs on China without concessions, cooling market optimism sparked by reports of China considering limited tariff exemptions.

The University of Michigan’s April sentiment data added to the cautious tone, showing one of the weakest consumer readings since the 1970s. Gold remains technically bullish, but if buyers don’t reclaim $3,300 soon, a test of $3,250 or even $3,167 is on the table. Traders now look ahead to next week’s key U.S. data: GDP, ISM, JOLTS, and Nonfarm Payrolls.

Crude Oil Weekly Wrap: Settles at $63.02, Dips on the Week

Crude oil futures closed at $63.02 on Friday, up $0.23 or 0.37% on the day. Despite the modest uptick, prices declined 1.03% over the week. Oil traded in a wide range, hitting a high of $64.83 and a low of $61.05. Last Friday, crude settled at $63.68, making this week a slight step back as the market remains locked in a tug-of-war between supply signals and macroeconomic uncertainty.

Baker Hughes Weekly Rig Count: U.S. Inches Up, Canada Falls

The latest Baker Hughes data shows the U.S. rig count increased by 2 to 587 this week. Oil rigs rose by 2 to 483, gas rigs ticked up by 1 to 99, while miscellaneous rigs declined by 1 to 5. Year-over-year, the U.S. rig count is down by 26 rigs.

Offshore rigs remain unchanged at 13, still 4 fewer than a year ago.

In Canada, the total rig count dropped by 6 to 128, as oil rigs fell by 6 to 81 while gas rigs held steady at 47. Despite the weekly drop, the Canadian count is still 10 rigs higher than this time last year.

Commerzbank: Gold Slips But Safe-Haven Demand Remains Intact

Gold briefly fell below $3,300 per ounce after Trump toned down his rhetoric on tariffs and Fed Chair Powell. However, Commerzbank analysts say safe-haven demand remains strong due to ongoing economic uncertainty and the potential for U.S. rate cuts.

Both Fed Governor Waller and Cleveland Fed President Hammack hinted that cuts could come as early as June, depending on labor market trends. If incoming data reflects weakness linked to tariffs, gold could see renewed upside.

Kazakhstan’s OPEC+ Role in Doubt as Output Dispute Grows

Kazakhstan’s continued overproduction threatens unity within OPEC+. Commerzbank notes the country has regularly exceeded its quota and is unlikely to implement the deeper cuts some members are now pushing for.

Frustration is growing among other OPEC+ nations, with possible additional hikes on the table for June. If Kazakhstan remains non-compliant, the alliance may reassess its membership.

Brent Oil Climbs Above $68 on Trade Optimism, Iran Sanctions

Brent crude prices hit a multi-week high above $68 per barrel, buoyed by easing trade war fears and renewed sanctions on Iran’s oil exports. The recovery follows a sharp April drop to 4-year lows.

Markets are watching OPEC+ closely as the group meets in early May to consider a fresh output increase. A surprise production hike could pressure prices next week.

Silver Drops to $33 on Trade Truce Hopes

Silver fell to around $33 per ounce on Friday as hopes for a U.S.-China trade deal reduced safe-haven demand. Investors interpreted China’s move to consider tariff relief on select U.S. imports as a signal that tensions may be cooling.

Still, conflicting messages from Trump and Beijing have left the outlook murky. Technically, silver remains bullish above its 20-day EMA ($32.60), but a pullback toward $30.90 support remains possible if investor sentiment sours.

Europe News

Europe Closes Strong; DAX Sees Best Week Since Jan 2023

Major European stock indices closed higher, both on the day and for the week, with Germany’s DAX posting its strongest weekly performance in over a year.

Day gains:

- DAX: +0.78%

- CAC 40 (France): +0.48%

- FTSE 100 (UK): +0.06%

- Ibex (Spain): +1.32%

- FTSE MIB (Italy): +1.47%

Weekly change:

- DAX: +4.86% (best since Jan 2023)

- CAC 40: +3.48%

- FTSE 100: +1.69%

- Ibex: +3.37%

- FTSE MIB: +3.8%

Optimism was largely driven by easing U.S.-China tensions and better-than-expected macro data across the bloc.

France Business Confidence Dips Despite Manufacturing Uptick

France’s business confidence index fell to 96 in April, down from 97, according to INSEE.

Breakdown by sector:

- Manufacturing sentiment improved to 99 (from 96)

- Services confidence ticked up to 98 (from 97)

Despite these gains, overall sentiment slipped due to deteriorating retail trade conditions. A slight uptick in the employment outlook (up to 97 from 96) helped soften the blow but wasn’t enough to lift the headline index.

UK Retail Sales Beat Expectations in March

UK retail sales rose 0.4% m/m in March, surprising to the upside against expectations for a 0.4% decline. On a year-over-year basis, sales increased 2.6%, also beating the 1.8% forecast.

Key breakdown:

- Sales excluding autos and fuel:

- +0.5% m/m (vs -0.4% expected)

- +3.3% y/y (vs +2.2% expected)

- February figures were revised slightly lower

Stronger demand for clothing and outdoor items helped offset a dip in supermarket sales. Still, volumes remain 0.3% below pre-pandemic levels.

UK Consumer Confidence Weakens Further in April

The UK GfK Consumer Confidence Index dipped to -23 in April, worse than the expected -22, and down from -19 in March.

The survey tracks how UK residents feel about their personal finances and the broader economic outlook. Despite improving macro data in some areas, confidence is being eroded by persistent cost-of-living concerns and uncertainty around interest rates.

EU Commissioner Dombrovski reiterates that EU willing to reach mutually agreeable solution with the US

EU Commissioner Dombrovski is on the wires saying:

- Had cordial and candid meeting with United States Treasury Secretary Scott Bessent

- Reiterates that the EU is going to reach a mutually agreeable solution with US on tariffs.

- He also emphasized the need for continued support for Ukraine

BOE Greene: we are not sure if weakness in UK economy is demand or supply

- BOE Greene speaking on the economy:

- We are not sure if weakness in UK economy is caused by demand or supply

- She is more worried about supply, really week productivity growth.

- There are concerns about impact of the government budget changes.

- We have no idea what US tariffs will look like when the dust settles.

- We are seeing in output gap open up which should bring inflation back to target.

- UK’s labor market has been weakening pretty slowly, but we should see wage growth, down.

ECB’s Holzmann: Next policy steps are completely open

- Remarks by ECB policymaker, Robert Holzmann

- Next policy steps are completely open.

- Tariff net impact so far rather disinflationary.

- I see economic scars even if tariffs are lowered.

SNB’s Schlegel: Economic slowdown in Switzerland cannot be ruled out

- SNB Chairman Martin Schlegel speaking

- Economic slowdown in Switzerland cannot be ruled out.

- Trade policy situation is creating high uncertainty for all countries, including Switzerland.

- Price stability cannot prevent trade policy related uncertainty, but still very important.

- Trade policy could fragment global economy.

- Main instrument is interest rate, but we can also use forex interventions to influence monetary conditions.

Asia-Pacific & World News

Chinese Embassy: No Trade Talks with U.S., Calls Out Misinformation

The Chinese Embassy issued a sharp statement denying any ongoing trade negotiations with the U.S., directly contradicting comments from President Trump earlier in the week.

The embassy urged the U.S. to “stop creating confusion” and reiterated that no official talks are taking place.

The rebuttal follows similar denials from China’s Foreign Ministry, further discrediting claims of behind-the-scenes tariff discussions. The news has added to market skepticism surrounding the timeline and substance of any U.S.-China dealmaking.

AmCham China: Tariff Review Underway, But No Policy Yet

Michael Hart, president of AmCham China, said there are signs that both the U.S. and China are reviewing tariffs, but no official announcements have been made.

- Some member companies have reported goods entering tariff-free in the past week

- Exclusion lists are reportedly being drafted

- The Chinese Commerce Ministry and the U.S. Department of Commerce are both said to be actively involved in reviewing tariff policies

China Foreign Ministry Denies U.S. Tariff Talks

Contradicting claims made by President Trump, China’s Foreign Ministry said no consultations or negotiations are taking place with the U.S. on tariffs.

The ministry added it wasn’t aware of any specific product exemptions and directed questions to the relevant agencies. The comment cooled market optimism that had followed Trump’s suggestion of a thaw in trade tensions just a day earlier.

China Finance Minister: Trade Wars Are Slowing Global Recovery

China’s Finance Minister said the world economy still lacks sufficient momentum, pointing to tariff and trade disputes as a key drag on both economic and financial stability.

Speaking at the same G20 gathering, he called for:

- Enhanced multilateral cooperation

- A push to reform the global economic and financial system

- Greater investment in Africa’s development

PBOC Governor: Trade Tensions Threaten Global Growth

Speaking at the G20 in Washington, PBOC Governor Pan Gongsheng warned that ongoing trade frictions are undermining supply chains and global growth momentum.

Key comments:

- Called for stronger international dialogue and policy coordination

- Emphasized the need for a more stable and efficient financial system

- Reiterated that China’s economy is recovering well, with financial markets stable

- Confirmed commitment to a moderate and accommodative monetary policy

China Politburo reaffirms to cut RRR and interest rates in a timely manner

- Comments by the China Politburo after their meeting earlier today

- To maintain abundant liquidity and strengthen support for the real economy

- Will create structural monetary policy tolls and new policy-based instruments to expand consumption

- Will focus on stabilising employment, market expectations

- Necessary to increase income of low and middle-income groups

- Will accelerate the integration of domestic and foreign trade

- Necessary to continuously improve policy toolbox to stabilise employment, economy

- Will implement established policies early

- To introduce reserve policies in a timely manner according to changes in the situation

- Will continue to make efforts to prevent and resolve risks in key areas

- Will speed up to implement more proactive, effective macro policies

China Mulls Limited Tariff Relief on Select US Imports

China is reportedly considering tariff exemptions on a small group of US imports, according to Bloomberg.

Items under review include:

- Medical devices

- Industrial chemicals like ethane

- Aircraft leasing arrangements

Separately, a Caijing report noted exemptions have already been applied to eight semiconductor-related tariff codes, confirmed by several Chinese tech firms.

While the list is narrow, markets view it as a signal that Beijing could use targeted relief to manage inflation without broadly unwinding its trade stance.

It’s a holiday in Australia and New Zealand

Malaysia Open to Trade Talks With U.S.

Malaysia’s Trade Minister said the country is willing to engage with the U.S. on narrowing the trade deficit.

Key talking points:

- Open to negotiating on non-tariff barriers

- Exploring a bilateral trade agreement

- Focused on maintaining balanced, secure, and mutually beneficial trade flows

The minister also emphasized the need to protect technological security while keeping communication lines open.

Tokyo Inflation Jumps Above 3% for First Time Since July 2023

Japan’s Tokyo CPI excluding fresh food rose 3.4% year-on-year in April, beating the 3.2% forecast and marking the first reading above 3% since mid-2023.

- Headline CPI climbed 3.5% y/y, up from 2.9% in March

- Core-core CPI (ex food and energy): +2.0% y/y, up sharply from 1.1%

- Month-on-month, core-core prices rose 0.7%, nearly doubling March’s 0.4%

The jump suggests price pressures are regaining momentum, potentially complicating the Bank of Japan’s cautious policy stance.

Ueda: Uncertainty regarding global economy rising, must scrutinize impact on business

- Comments from the Bank of Japan Governor

- Uncertainty regarding global economy heightening

- Must scrutinize impact on business confidence

- We will scrutinize without pre-conception whether our forecast will materialize looking at various data that will become available

- We will look at various data, particularly those related to how tariffs affect economy

- Wants to focus on sustainably, stably achieving BOJ’s 2% inflation target

Japan’s Ishiba: Decided on a package of measures to deal with US tariffs

- Comments from Ishiba

- Instructed cabinet members to do the utmost to aid SME’s that will be affected

- Includes stronger support for corporate financing

- Subsidies to lower gasoline price by 10 yen per litre

- Three months for electricity bill compensation

- Financed by a reserve fund already earmarked for gasoline subsidies so it won’t affect the budget

Japan’s finance minister Kato met with Scott Bessent today

- Finance minister Kato:

- Kato told Bessent that US tariffs are deeply regretful

- The US and Japan to communicate closely on FX

- No talk with Bessent on whether recent FX moves are disorderly

Thai Commerce Minister: Thailand will eventually be able to negotiate tariffs with the US

- The markets expectations continue to point towards eventually positive resolutions

- Thailand will eventually be able to negotiate tariffs with the US, get the most benefits.

- Exports may be bumpy but not bad this year.

- US officials satisfied with Thailand taking steps to tackle circumvention.

- Thailand to keep good relations with both US and China.

- Hope negotiations with US won’t take long to reach agreements.

- Thai exports can replace some Chinese shipments in US market.

Crypto Market Pulse

Crypto Today: SUI Pops 20%, BTC Clears $95K

The total crypto market cap surged $300 billion Friday, breaking back above $3 trillion as Bitcoin spiked past $95,000 for the first time since February.

SUI led the altcoin charge, jumping 20% to reclaim $3.70 before slipping to $3.50. Its rise is backed by a 15.8% jump in Total Value Locked. Pudgy Penguins (PENGU) also ripped higher, gaining 47.5% on the day amid growing NFT traction. Ethereum held gains near $1,784.

Crypto headlines:

- PayPal & Coinbase expand PYUSD stablecoin rollout with fee-free redemptions and DeFi integration.

- SEC drops its lawsuit against Dragonchain, reflecting a shift under its new Crypto Task Force.

- Paradigm invests $50M in Nous Research, valuing the decentralized AI firm at $1B.

SUI Rallies 72% Weekly, Outpaces All Top 100 Cryptos

SUI surged over 20% on Friday to cross $3.70, extending its weekly gain to 72% and outperforming all other top 100 cryptocurrencies. The spike followed improving sentiment in global markets and renewed optimism around U.S.-China trade relations.

Sui’s total value locked (TVL) jumped 16% in 24 hours to $1.8 billion, bolstered by DeFi integrations with Babylon Labs and Lombard Protocol. As more liquidity flows into Sui-based platforms, investor enthusiasm appears to be driven by genuine usage growth, not just hype.

Profit-taking remains a risk, especially if macro sentiment shifts or investors begin rotating into other altcoins.

Shiba Inu Snaps Losing Streak With April Bounce

Shiba Inu (SHIB) is trading above $0.000014, marking a 14.4% return so far this month and reversing a three-month losing streak. SHIB’s on-chain activity continues to grow, with active wallet addresses reaching an all-time high of 1.4 million.

The rebound follows a brutal Q1 that saw negative returns in January (-10.9%), February (-26.1%), and March (-11.1%). April’s recovery could indicate a sentiment shift in the meme coin space.

ARK Invest Projects Bitcoin Could Hit $2.4M by 2030

ARK Invest has significantly raised its bullish case for Bitcoin, projecting a potential price of up to $2.4 million by 2030. The new target reflects an updated model focused on circulating supply and growing institutional demand.

The firm’s base case puts BTC at $1.2 million, while the bear scenario sees a floor around $500,000. Analysts cite declining exchange balances as a sign of long-term investor confidence. BTC currently trades near $94,000.

The Day’s Takeaway

Day’s Takeaway: Key Market Trends & Developments

United States

Markets Close Strong: The major U.S. stock indices wrapped the week with a four-day win streak. The NASDAQ surged 6.73% for the week, the S&P 500 gained 4.59%, and the Dow rose 2.48%. Tech led the rebound with big gains in Tesla, Palantir, and MicroStrategy.

Fed Flags Trade Risk: The Fed’s latest Financial Stability Report named global trade tensions the most-cited risk to the financial system. Concerns also included sovereign debt sustainability, policy uncertainty, and hedge fund leverage reaching historic highs.

Canada

Retail Sales Flat: February retail sales fell 0.4%, matching expectations. Ex-auto sales rose 0.5%, but sales declined in seven provinces. Quebec led the drop with a 2.5% fall in Montreal.

Rig Count Falls: The Baker Hughes rig count for Canada dropped by 6 to 128. Oil rigs declined, while gas rigs held steady. Compared to last year, Canada’s count is up 10 rigs.

Equities Track U.S. Gains: Canadian markets followed Wall Street’s rally, though political uncertainty and trade friction with the U.S. remain overhanging risks.

Commodities

Gold Slips Below $3,300: Gold reversed earlier gains, closing at $3,294. A firm dollar and Trump’s refusal to ease China tariffs without concessions soured sentiment. Traders are watching next week’s U.S. data slate, including GDP and jobs.

Crude Oil Ends Lower for Week: WTI crude settled at $63.02, up 0.37% on the day but down 1.03% on the week. The high was $64.83, low $61.05. Traders weighed OPEC+ uncertainty and global demand signals.

Silver Drops Toward $33: Silver slid more than 1.5% on hopes of U.S.-China tariff relief. Conflicting signals between Washington and Beijing kept investors cautious. Technical support lies at $32.60, with key resistance at $34.60.

Europe

Markets End Strong Week: European equities closed higher across the board. Germany’s DAX rose 4.86% for its best week since January 2023. Spain’s IBEX outperformed Friday with a 1.32% jump.

Data Recap: France’s business confidence dipped slightly to 96, while UK retail sales beat expectations at +0.4% m/m in March. UK consumer confidence slipped to -23.

Political & Trade Focus: European leaders are watching the U.S.-China situation closely. The ECB is still expected to cut rates in June amid disinflation and weak demand.

Asia

China & U.S. Messaging Clash: Trump claimed a call with Xi Jinping, but Beijing denied any ongoing talks. Confusion has left markets skeptical of any real progress.

Tariff Adjustments Eyed: China is reportedly considering removing tariffs on certain U.S. medical and industrial goods. Semiconductor-related products have already seen exemptions.

Japan Inflation Jumps: Tokyo’s core CPI rose to 3.4% y/y in April, the first reading above 3% since July 2023. Inflation excluding food and energy rose 2.0% y/y, indicating underlying price pressures.

Rest of the World

Malaysia Open to Trade Talks: The Malaysian trade minister expressed willingness to negotiate with the U.S. on reducing trade imbalances, suggesting openness on tech and non-tariff issues.

Kazakhstan Tests OPEC+ Discipline: Despite pledging cooperation, Kazakhstan’s overproduction and reluctance to cut further are straining the group’s unity.

G20 Warnings on Fragmentation: Chinese officials at the G20 warned that trade wars and global economic fragmentation are damaging supply chains and recovery momentum.

Crypto

Bitcoin Hits $95K: BTC surged to $95,200 — its highest in 60 days — after Trump announced a call with Xi. Market cap crossed $3 trillion briefly, fueled by renewed risk appetite.

SUI Leads Altcoin Rally: SUI soared 20% Friday, bringing its weekly gain to 72%. TVL rose to $1.8B, driven by DeFi partnerships with Babylon Labs and Lombard Protocol.

NFTs Back in Focus: Pudgy Penguins spiked 47.5% amid fresh merch drops and rising community traction.

SEC Softens Stance: The SEC dropped its case against Dragonchain, signaling a shift in enforcement under the newly formed Crypto Task Force.

Stablecoin Momentum: PayPal and Coinbase deepened their partnership to push PayPal’s PYUSD in retail and DeFi markets, offering 1:1 redemptions and zero-fee transactions.