North America News

Stock Market Wrap: Treasuries Decline, Dow Slips 103 Points

Key Indices Performance:

- Dow Jones: -102.90 points (-0.23%) to 44,443.18

- Nasdaq: -54.30 points (-0.27%) to 19,972.47

- S&P 500: -0.87 points (-0.01%) to 6,113.76

- 10-Year Treasury Yield: +7bps to 4.54%

- 2-Year Treasury Yield: +4bps to 4.30%

Market Overview:

- The S&P 500 continues to flirt with all-time highs, but conviction remains weak due to a lack of major catalysts.

- Mega-cap stocks showed mixed performance, contributing to indecisiveness in broader markets.

- Treasury yields moved higher, reflecting shifting market expectations around Federal Reserve policy.

- Industry Leaders: Energy, Materials, Industrials, Utilities, Financials, Information Technology

- Laggards: Communication Services, Consumer Discretionary, Healthcare

Notable Earnings Movers:

- Analog Devices (ADI): +2.4%

- Etsy (ETSY): +0.1%

- Garmin (GRMN): +0.2%

Key Economic Events Tomorrow:

- MBA Mortgage Index (Prior: 2.3%)

- January Housing Starts (Prior: 1.499M; Estimate: 1.4M)

- Building Permits (Prior: 1.483M; Estimate: 1.46M)

U.S. Housing Market Sentiment Drops to Lowest Level Since December

The NAHB Housing Market Index for February fell sharply to 42 (expected: 47), marking a significant decline from January’s revised 47 reading.

- Current single-family home sales dropped to 46 (from 50).

- Prospective buyer traffic weakened further, falling to 29 (from 32).

- Sales expectations for the next six months plunged by 13 points to 46, reflecting uncertainty in the market.

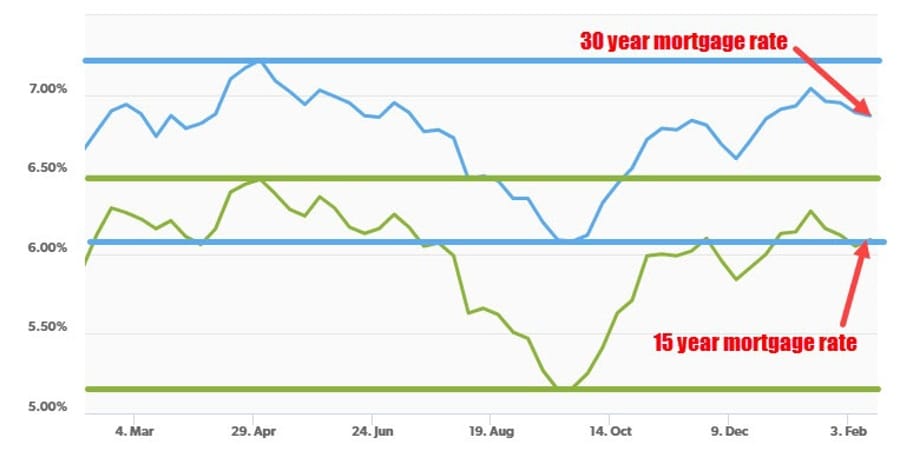

Looking at the trends in the mortgage rates they are near the highs over the last year.

Key Takeaways:

- 26% of homebuilders cut prices in February, down from 30% in January, signaling fewer price reductions but continued challenges.

- The average price reduction remained at 5%, with sales incentives also declining slightly to 59% (from 61%).

- Regional declines were sharpest in the Northeast (48 from 65), while the West index fell to its lowest level since early 2024.

The housing market slowdown is attributed to higher mortgage rates, affordability concerns, and weakening demand, raising questions about how soon the sector may stabilize.

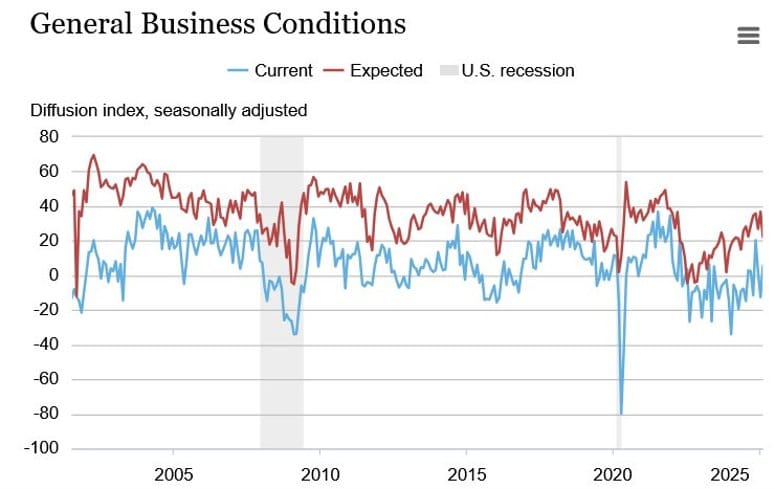

Empire State Manufacturing Index Surges, but Optimism Wanes

The Empire State Manufacturing Survey for February 2025 came in significantly stronger than expected, rising to 5.7 from -12.6 last month (forecast was -1.0).

- New orders and shipments expanded at a moderate pace, while delivery times lengthened slightly.

- Employment levels declined, signaling some softening in the labor market.

- Input prices rose at the fastest rate in two years, adding to inflationary concerns.

- Despite the improvement in current conditions, optimism for the next six months declined sharply, reflecting uncertainty in the economic outlook.

Silver Lake Nears Deal for Intel’s Altera Unit Amid Breakup Speculation

Intel’s stock surged 13% today, driven by speculation that private equity firm Silver Lake is acquiring a stake in its Altera unit.

Background:

- Intel bought Altera in 2015 for $16.7 billion in an all-cash deal.

- Silver Lake, known for deals with Dell, Alibaba, and Broadcom, has been rumored to be involved since January.

- The breakup rumors have fueled a 40% rally in Intel’s stock over the past week.

Implications:

- If Silver Lake invests in Altera, it could signal Intel’s willingness to spin off or restructure divisions.

- Intel’s market cap stands at $115 billion, with ongoing pressure to boost shareholder value through asset sales or reorganization.

Toyota Orders $1.5B in U.S. Batteries Ahead of Tariff Changes

Toyota is securing U.S. production contracts, placing a $1.5 billion order with LG’s U.S.-based battery plant, according to Bloomberg.

This move comes ahead of Trump’s reciprocal tariffs, which are set to take effect in April.

- The U.S. tariff strategy will penalize countries that impose VAT taxes on U.S. exports or subsidize domestic industries.

- Companies can avoid tariffs by moving production to the U.S. or buying from U.S.-based suppliers, as Toyota has done.

Implications:

- Other automakers and electronics firms may shift sourcing strategies to reduce tariff exposure.

- The move reflects the broader impact of trade policy on corporate decision-making, especially in EV and clean energy sectors.

Fed’s Daly: No Rush to Cut Rates, Economy in a “Good Place”

San Francisco Fed President Mary Daly reinforced that interest rates will remain restrictive until the Fed sees clear and sustained progress on inflation.

- Inflation is declining but remains volatile, with Daly stressing that the Fed doesn’t want to ease prematurely.

- Labor market and GDP growth are solid, but uncertainty remains over the impact of the new administration’s policies.

- No firm commitment on whether additional rate cuts will happen in 2025, with Daly saying the Fed needs more information before making further adjustments.

- California wildfires are unlikely to impact national GDP, though insurance claims could have long-term effects.

U.S. and Russia Move Forward with Ukraine Peace Talks, Zelensky Responds

U.S. Secretary of State Marco Rubio confirmed that the U.S. and Russia have agreed to reestablish diplomatic functionality in Washington and Moscow, marking an early step in efforts to resolve the ongoing Ukraine conflict.

- Rubio emphasized that “no one is being sidelined,” acknowledging that all involved parties must agree to any resolution.

- U.S. National Security Advisor Waltz stated that discussions will cover territorial matters and security guarantees, with Trump pushing for a swift resolution.

- No date has been set for a Trump-Putin meeting, though talks are expected to continue.

Russian Foreign Minister Sergei Lavrov called the talks “useful”, confirming that:

- The U.S. and Russia have agreed to appoint envoys for continued negotiations.

- There will be an effort to remove diplomatic barriers and create conditions to restore cooperation.

- Moscow has made it clear that any NATO troop deployment in Ukraine is unacceptable.

Meanwhile, Ukrainian President Zelensky criticized the talks, arguing that negotiations “should not happen behind our backs.”

- He emphasized that Ukraine must be included in discussions, expressing concerns over the lack of direct involvement.

- Following the talks, Zelensky canceled his planned visit to Saudi Arabia, rescheduling it for March 10.

Saudi Arabia is positioning itself as a key mediator, with Crown Prince Mohammed bin Salman maintaining strong ties with Russia while balancing diplomatic engagement with the West.

Fed’s Waller: Disinflation to Resume, Rate Cuts Likely This Year

Federal Reserve Governor Christopher Waller reaffirmed expectations for further rate cuts in 2025, despite recent inflationary surprises.

Key points from his remarks:

- Inflation Risks: The January CPI report was disappointing, but Waller suggested seasonal adjustments may have skewed the data.

- Growth & Labor Market: Economic growth remains solid, and the job market is holding up well.

- Policy Stance: While the Fed is closely monitoring data, Waller expects disinflation to resume, allowing for a gradual easing of monetary policy.

Notably, he dismissed concerns over tariffs driving inflation, arguing that their impact on prices is likely to be modest and temporary.

While markets continue to price in rate cuts by mid-year, Waller’s comments suggest the Fed will remain cautious, ensuring inflation remains firmly on a downward path before taking action.

US-Russia Talks in Saudi Arabia End Without Immediate Breakthrough

A 4.5-hour meeting between US and Russian officials in Saudi Arabia concluded with a businesslike atmosphere, but no concrete agreements.

- Russia’s foreign policy aide, Yuri Ushakov, described the discussions as serious and comprehensive.

- While the possibility of a Putin-Trump meeting was discussed, no immediate plans were finalized.

- Russia indicated that further dialogue on Ukraine depends on Putin’s decision on next steps.

The talks signal ongoing diplomatic engagement, but the path to de-escalation remains uncertain. Markets will monitor developments closely for any shifts in geopolitical risk sentiment.

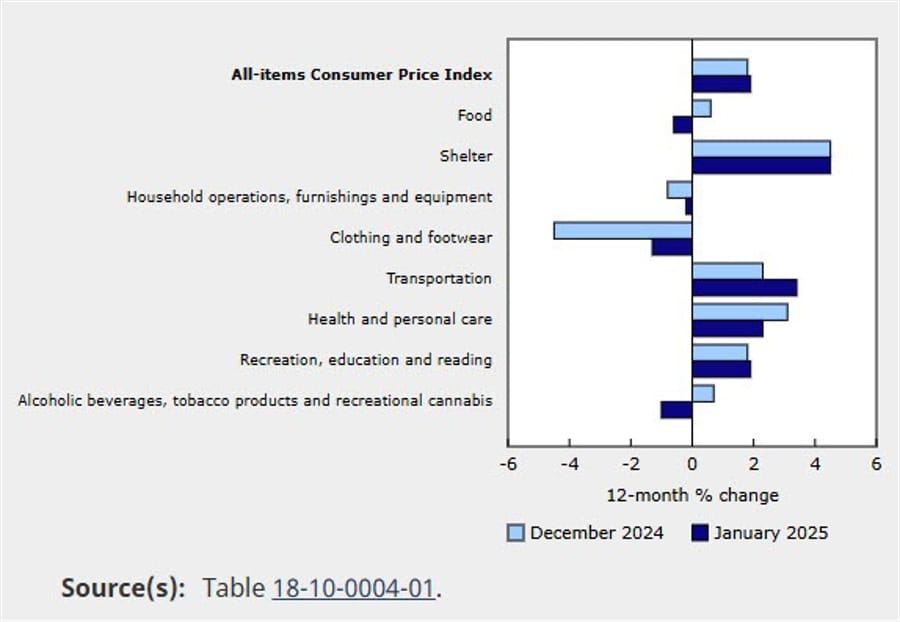

Canada’s Inflation Holds at 1.9% as Energy Prices Rise

Canada’s Consumer Price Index (CPI) remained steady at 1.9% YoY in January, matching estimates.

- Month-over-month CPI rose 0.1%, in line with expectations, while core CPI climbed 0.4%, up from a -0.3% decline in December.

- Core CPI YoY accelerated to 2.1% (from 1.8%), with the trimmed and median CPI both rising to 2.7%.

Key Drivers:

- Energy prices surged 5.3% YoY, led by an 8.6% increase in gasoline costs.

- Food prices fell 0.6% YoY, marking the first annual decline since 2017.

- Restaurant food prices saw a record drop of 5.1%, reflecting government tax breaks.

- Alcoholic beverage prices declined 3.6% YoY, extending December’s 1.3% fall.

A look at the gainers and losers by sector shows:

Market Impact:

- Money markets now price in 8 bps of rate cuts for the next Bank of Canada meeting, down from 11 bps before the release.

- Expectations for year-end cuts now stand at 41 bps, as traders assess whether the BoC will ease further.

Commodities News

Gold Nears Record Highs as Trade Uncertainty Drives Demand

Gold rallied 1% on Tuesday, reaching $2,933, fueled by:

- Trump’s tariff policies, which have rattled global markets.

- Goldman Sachs’ $3,100 price target, projecting a 9% upside by year’s end.

- Surging central bank demand, with purchases increasing 54% YoY.

Federal Reserve Impact:

- Fed policymakers remain cautious on inflation, with San Francisco Fed President Mary Daly emphasizing the need to maintain restrictive policy.

- Fed Governor Christopher Waller downplayed inflation risks from tariffs, suggesting they will have only a temporary impact on prices.

- Markets are pricing in 39bps of Fed rate cuts in 2025, down slightly from previous expectations.

Upcoming Data to Watch:

- FOMC Meeting Minutes (Wednesday)

- Housing Starts & Building Permits

- Initial Jobless Claims

- S&P Global Flash PMIs

Silver Rallies to $32.50 Despite Fed’s Hawkish Stance

Silver rebounded strongly, climbing near $32.50, despite:

- Fed officials signaling rates will remain high for longer, which generally weighs on precious metals.

- Growing optimism around Russia-Ukraine peace talks, reducing safe-haven demand.

- Easing concerns over Trump’s reciprocal tariffs, as the details remain unclear.

Market Sentiment:

- Fed Governor Michelle Bowman stressed the need for “greater confidence” that inflation is under control before considering any rate adjustments.

- Trump’s tariff plan may not take effect before April, giving trading partners time to negotiate, reducing immediate economic disruption.

Copper Retreats from Three-Month Highs as Market Adjusts to U.S. Tariff Risks

Copper prices pulled back after hitting a three-month high, as short-covering on the LME and tariff-related uncertainty caused volatility.

Market Drivers:

- U.S. President Trump has threatened copper tariffs, though implementation may take longer than aluminum and steel tariffs.

- Traders are shifting metal from LME warehouses to the U.S., creating a temporary supply squeeze.

- The Comex-LME copper spread hit a record $1,200/t last week, but has since fallen to above $900.

Outlook:

- The U.S. imports 45% of its copper, with Chile (35%) and Canada (26%) as top suppliers.

- If tariffs are enacted, they could reduce copper demand, especially with U.S. and Chinese growth slowing.

Europe News

European Markets Close Higher, German DAX Hits Record High

European equities advanced on Tuesday, with Germany’s DAX leading gains and closing at a new all-time high.

Final Market Numbers:

- German DAX: +0.26% to 22,863.24

- France’s CAC 40: +0.21% to 8,206.57

- UK FTSE 100: -0.01% to 8,766.74

- Spain’s Ibex 35: +0.98% to 13,143.91

- Italy’s FTSE MIB: +0.59% to 58,554.14

While the UK’s FTSE 100 lagged slightly, sentiment across European markets remains positive, driven by corporate earnings optimism and expectations of eventual ECB rate cuts.

Germany’s ZEW Sentiment Improves, Current Conditions Remain Weak

The ZEW Economic Sentiment Index for Germany showed a stronger-than-expected improvement, rising to 26.0 in February from 10.3 previously (above the expected 20.0).

However, the current conditions index remains deeply negative, printing at -88.5, though slightly better than the projected -90.0.

The sharp jump in forward-looking sentiment suggests optimism over improving economic conditions in the months ahead, but near-term weakness remains a challenge. Investors will be watching whether Germany’s industrial sector can stabilize amid global uncertainties.

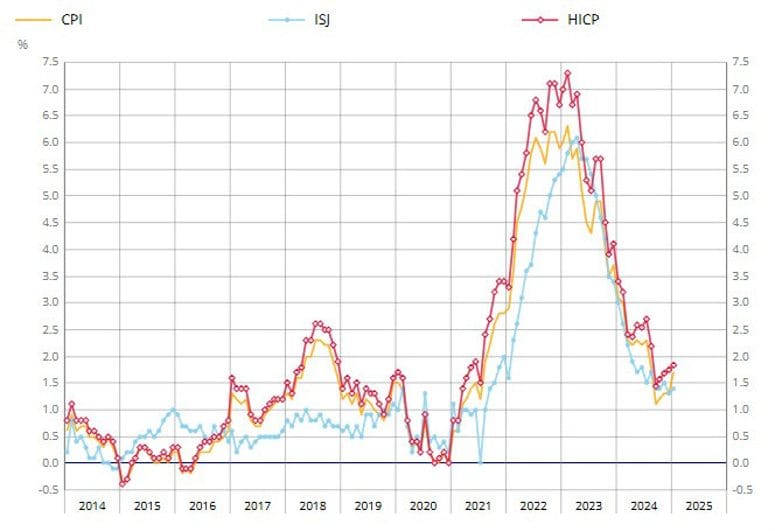

French Inflation Holds Steady in January, Services Costs Edge Higher

Final French inflation data for January confirmed year-on-year HICP at 1.8%, in line with preliminary estimates. The broader CPI index also stood at 1.7% y/y, reflecting a modest increase from December’s 1.3%.

A key driver was a rise in services prices, which climbed 2.5% y/y compared to 2.2% in the previous month. Core inflation ticked slightly higher as a result, moving from 1.3% to 1.4%.

While inflation remains low compared to historical levels, the slight uptick in services prices may attract attention from ECB policymakers, who have expressed concerns about persistent core inflation pressures in the eurozone.

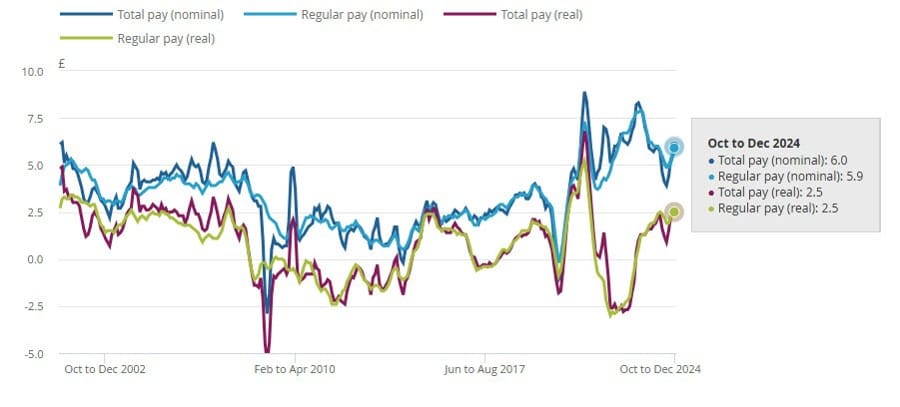

UK Job Market Shows Resilience as Unemployment Holds Steady

The latest UK labor market data showed better-than-expected employment growth, with 107,000 jobs added in December (vs. 48,000 expected).

- The ILO unemployment rate held steady at 4.4%, slightly better than the forecasted 4.5%.

- Wage growth remained strong, with average weekly earnings rising 6.0% y/y, exceeding expectations.

- January payrolls improved, adding 21,000 jobs, recovering from December’s revised -14,000.

The stability in employment and wage gains suggests resilience in the UK labor market, adding complexity to BOE rate cut expectations.

ECB’s Cipollone: Rate Policy Remains the Primary Tool for Monetary Adjustments

European Central Bank policymaker Piero Cipollone reinforced that interest rates remain the primary instrument for shaping the ECB’s monetary stance.

- He acknowledged that quantitative tightening (QT) is also playing a role in influencing financial conditions.

- Cipollone suggested that rate decisions should account for the effects of balance sheet reduction, ensuring that overall tightening is neither excessive nor inadequate.

With markets expecting ECB rate cuts later this year, policymakers are balancing the need to address growth concerns while keeping inflation under control.

ECB’s Holzmann: Core Inflation Remains a Key Concern

ECB policymaker Robert Holzmann warned that core inflation and services inflation remain problematic, suggesting that monetary easing will not be rushed.

- He emphasized that rate cuts cannot replace economic strategy, implying that structural policies are needed to support growth.

- Holzmann also noted that the March rate decision will depend on data, reinforcing the ECB’s cautious approach.

- As rates approach neutral levels, policymakers will find it increasingly difficult to justify further reductions.

With inflationary risks still present, Holzmann’s remarks align with other ECB officials advocating patience on rate cuts.

BOE’s Bailey: UK Faces Weak Growth and Heightened Uncertainty

Speaking at a panel discussion in Brussels, Bank of England Governor Andrew Bailey emphasized the challenging economic environment facing the UK.

- He reiterated that the “careful” approach in recent policy decisions reflects the high level of uncertainty in global markets.

- The UK economy continues to struggle with weak growth, reinforcing expectations that the BOE may need to adjust its policy stance cautiously.

With inflation moderating but economic headwinds persisting, Bailey’s remarks suggest the BOE remains reluctant to signal imminent rate cuts, keeping the focus on incoming data.

Asia-Pacific & World News

China Calls for Peace Talks, Defends Palestinian Governance

China’s Finance Minister Wang reiterated Beijing’s support for peace talks in Ukraine, saying all diplomatic efforts should be encouraged.

On the Middle East, Wang stated:

- The Gaza Strip and West Bank belong to the Palestinian people and should not be used as bargaining chips in global politics.

- China advocates for Palestinian self-governance, stressing that any post-conflict resolutions should ensure sovereignty for Palestinian leadership.

China’s geopolitical stance continues to emphasize diplomatic engagement and regional stability, though its economic ties with Russia remain a concern for Western allies.

Goldman Sachs Raises 12-Month Target for Chinese Equities

Goldman Sachs has upgraded its outlook for Chinese equities, citing potential gains from AI-driven productivity and improving investor sentiment.

- MSCI China Index Target: Raised to 85 (previously 75).

- CSI 300 Index Target: Increased to 4,700 (up from 4,600).

- AI Adoption Boost: Expected to increase earnings per share (EPS) by 2.5% per year over the next decade.

- Potential Portfolio Inflows: China’s equity market could attract over $200 billion in fresh capital if confidence improves.

However, Goldman cautioned that forceful policy stimulus is still necessary to counteract macroeconomic imbalances. Risks include:

- AI-related regulatory concerns and data privacy issues.

- Lingering trade tensions and export restrictions imposed by Western governments.

- Deflationary pressures that could weigh on corporate profitability.

Despite these risks, the improving growth trajectory and AI-driven expansion potential could help revive investor confidence in Chinese markets.

Xi Jinping Reaffirms Commitment to Private Sector Growth

Chinese President Xi Jinping has called for greater support for private enterprises, emphasizing their critical role in driving economic modernization.

In a high-profile speech, Xi underscored the private sector’s vast potential, highlighting key priorities:

- Ensuring fair market access and reducing regulatory barriers.

- Enhancing financing options to lower borrowing costs for businesses.

- Providing stronger legal protections for entrepreneurs and corporate entities.

- Encouraging private firms to align with national strategic objectives in areas like technology and infrastructure.

Xi’s remarks come amid heightened economic uncertainty in China, as slowing growth, trade tensions, and weak investor sentiment weigh on the outlook. The speech signals Beijing’s intent to shore up confidence in the private sector, which has faced increasing scrutiny in recent years.

China’s State Planner Pledges Stronger Support for Private Firms

The National Development and Reform Commission (NDRC)—China’s top economic planning body—has outlined new measures to bolster private enterprise growth, aiming to address challenges such as high financing costs and restricted market access.

Key initiatives include:

- Accelerating the implementation of the Private Economy Promotion Law to enhance regulatory transparency.

- Easing entry barriers for businesses by revising China’s negative market access list.

- Encouraging private firms to participate in major national projects, particularly in areas like security, infrastructure, and industrial upgrades.

The NDRC stressed that China’s economic, political, and social environment remains highly favorable for private sector expansion, signaling Beijing’s efforts to restore business confidence and stimulate investment.

PBOC sets USD/ CNY mid-point today at 7.1697 (vs. estimate at 7.2538)

- PBOC CNY reference rate setting for the trading session ahead.

In open market operations:

- PBOC injects 489.2 billion yuan via 7-day reverse repos at 1.50% vs prior 1.50%

RBA’s Bullock: Inflation Progress Encouraging, But Risks Remain

Following the Reserve Bank of Australia’s (RBA) 25bp rate cut, Governor Michele Bullock provided key insights into the decision:

- High rates have been effective, but it’s too soon to declare victory on inflation.

- The cut was a difficult decision, with debate on both sides, reflecting cautious optimism over inflation progress.

- Further easing will depend on wage trends, services disinflation, and housing price stability.

- The policy stance remains restrictive, meaning inflation pressure should continue to ease.

While markets are pricing in further cuts, Bullock was less confident, highlighting uncertainty over the neutral rate and inflation trajectory.

RBA Cuts Rates by 25bps, Signals Cautious Approach to Easing

The Reserve Bank of Australia (RBA) has initiated its long-awaited rate-cutting cycle, lowering the cash rate by 25 basis points to 4.1%—its first reduction since November 2020. This move follows an extended period of restrictive policy, with rates held at 4.35% since the last hike in November 2023.

Despite the cut, the central bank struck a measured tone, noting that while inflation is easing faster than anticipated, risks remain. The RBA emphasized its commitment to returning inflation sustainably to the 2-3% target range, acknowledging that premature easing could derail disinflation progress.

Key Takeaways from the RBA’s Statement:

- Inflation & GDP Trends: Q4 inflation was softer than expected, and economic growth remains subdued.

- Labor Market Strength: The job market remains tighter than previously estimated, though there may be spare capacity elsewhere in the economy.

- Interest Rate Outlook: Forecasts assume a gradual path lower, with the cash rate projected at 4.0% by June 2025 and 3.6% by year-end.

- External Risks: The RBA cited US trade policies as a key global risk, warning that rising tariffs could tighten financial conditions globally.

While markets had fully priced in this widely expected cut, the RBA’s cautious messaging has tempered expectations of an aggressive easing cycle. The central bank signaled that future rate adjustments will be data-dependent, keeping investors focused on inflation trends and labor market conditions in the coming months.

Australian Consumer Confidence Hits 2025 Low Following RBA Rate Cut

Consumer sentiment in Australia has weakened further, with the ANZ-Roy Morgan Consumer Confidence Index dropping to 85.1—its lowest level this year—down from 86.7 the previous week.

The decline comes despite the RBA’s rate cut, suggesting that households remain cautious amid economic uncertainty. With higher borrowing costs, sluggish wage growth, and persistent inflation concerns, Australians appear reluctant to increase discretionary spending.

The latest confidence figures will likely reinforce concerns over weak domestic demand, keeping policymakers on alert for signs of further economic slowing.

Japan’s Finance Minister Sees Encouraging Signs in Q4 GDP Data

Japanese Finance Minister Shunichi Kato expressed optimism over the country’s economic trajectory, citing stronger-than-expected Q4 GDP growth as a sign of resilience in domestic demand.

The remarks come after data showed Japan’s economy expanded by 2.8% annualized in Q4, outpacing market expectations of 1.0% growth. Kato emphasized that steady private consumption and external demand were key drivers, suggesting that Japan’s recovery is gaining traction despite global headwinds.

With inflation holding above target and the labor market remaining relatively strong, speculation is mounting over the Bank of Japan’s next policy move, with some analysts anticipating a shift away from ultra-loose monetary settings later this year.

BOJ’s Ueda Acknowledges Policy Communication Challenges

Bank of Japan Governor Kazuo Ueda admitted that previous BOJ guidance may have lacked clarity, particularly during last summer’s market volatility.

- He attributed some of the turbulence to concerns over US economic weakness, which heightened uncertainty in global markets.

- While the BOJ remains committed to its policy framework, recent stronger-than-expected economic data may prompt a shift toward normalization in the coming months.

With speculation growing over a potential policy adjustment, markets will be watching the BOJ’s next moves closely.

Crypto Market Pulse

Bitcoin Holds $94K–$98K Range Amid ETF Outflows and Neutral Market Sentiment

Bitcoin (BTC) remains rangebound between $94,000 and $98,000, with traders waiting for a catalyst to drive the next move.

Key Developments:

- ETF Outflows: Bitcoin ETFs saw $585.6 million in net outflows last week, breaking a six-week inflow streak of $5 billion.

- Macro Factors: Uncertainty around a U.S. Bitcoin Reserve, a hawkish Fed, and FTX repayments starting this week have capped BTC gains.

- Federal Reserve Shift? Fed Governor Christopher Waller downplayed concerns about trade tariffs fueling inflation, which could support risk assets like Bitcoin if reflation fears ease.

- Market Sentiment: The Bitcoin Fear & Greed Index sits at 47 (neutral), signaling a wait-and-see approach from traders.

Technical Outlook:

- BTC is testing trendline support from October, with $94K as key short-term support. A break below could see a move to $91.5K or $85K.

- A push above $98.8K and $100K would signal renewed upside, targeting $105K–$109.5K.

Ethereum Drops 4% as Whales Cash Out Over $1 Billion

Ethereum (ETH) fell 4% to $2,620, weighed down by whale profit-taking and overall crypto market consolidation.

Whale Activity & Market Sentiment:

- 400K ETH ($1B) was redistributed in the past two days, per Santiment data.

- $77M in realized profits from whale sales hit a one-week high, triggering the decline.

- Despite selling, exchange withdrawals have surged, with 740K ETH moved into private wallets—suggesting continued long-term confidence.

ETH Price Forecast:

- ETH is consolidating between $2,500 and $2,850, mirroring Bitcoin’s lack of momentum.

- Support at $2,560 is key—a breakdown could lead to further declines.

- 30% chance of ETH hitting $3,000 before Q1 ends, per options data.

Chainlink (LINK) Fails to Break $20 Resistance, Drops 6% Amid Bitcoin Weakness

Chainlink’s (LINK) price declined 6%, falling to $17.8 as bulls struggled to push past the $20 resistance level.

Key Market Trends:

- Whale accumulation remains strong, with the top 1,000 Chainlink investors acquiring $28 million worth of LINK since February 3.

- The Real World Asset (RWA) tokenization sector remains robust, with seven of the top ten RWA projects maintaining weekly gains.

- Bitcoin’s stagnation near $95,800 has weighed on market momentum, leading to a broader altcoin cooldown.

While Chainlink has benefitted from institutional interest in on-chain financial data, declining trading volumes and capital rotation strategies suggest further volatility ahead.

The Day’s Takeaway

Day’s Takeaway: Key Market Trends & Developments

Today’s markets saw a mix of consolidation, policy shifts, and geopolitical maneuvering. While equities wavered, gold surged, and cryptos struggled, key economic and political events set the tone for the coming days.

🔹 Stock Market Recap: Mixed Sentiment Amid Treasury Losses

- Dow: -103 pts (-0.23%) | S&P 500: -0.01% | Nasdaq: -0.27%

- Treasury Yields: 10-yr up 7bps (4.54%) | 2-yr up 4bps (4.30%)

- Mega-caps mixed, with a lack of conviction keeping the S&P 500 near all-time highs.

- Earnings in focus: ADI, ETSY, GRMN trade up ahead of their reports.

Key Takeaway: Higher bond yields are weighing on equities, and markets remain cautious ahead of FOMC minutes and housing data tomorrow.

🔹 Gold & Silver Rally on Trade Uncertainty & Central Bank Demand

- Gold:+$2,933 (+1%), approaching record highs, fueled by:

- Trump’s tariffs sparking safe-haven demand

- Goldman Sachs raising its year-end target to $3,100

- Surging central bank purchases (+54% YoY)

- Silver: +$32.50, rebounding despite Fed’s hawkish stance and easing geopolitical risks.

- Fed Outlook: Officials downplayed tariff-driven inflation risks but remained firm on keeping policy restrictive.

Key Takeaway: Gold continues to benefit from market uncertainty, but Fed’s rate stance will dictate future price action.

🔹 Crypto Markets: Bitcoin & Ethereum Struggle Amid ETF Outflows

- Bitcoin:$96K, stuck in a $94K-$98K range as ETF demand weakens.

- BTC ETFs saw $585.6M outflows last week, snapping a 6-week inflow streak.

- Fed’s hawkish stance + slow Bitcoin Reserve progress = lower institutional demand.

- Fear & Greed Index at Neutral (47) → Market awaiting a fresh catalyst for direction.

- Ethereum:$2,620 (-4%), as whales cash out $1B in profits.

- 30% chance for ETH to hit $3,000 before Q1 ends.

- Exchange withdrawals signal long-term bullishness, but short-term pressure remains.

Key Takeaway: Crypto remains rangebound, and a stronger macroeconomic signal or renewed ETF inflows will be needed to trigger a breakout.

🔹 Geopolitics & Economic Policy: Russia-US Talks, Trade Uncertainty, Fed Outlook

- Russia-US Peace Talks Progressing

- US Sec of State Rubio: Teams will be appointed to formalize negotiations.

- Lavrov: Talks were “useful,” agreed to appoint envoys, but NATO troops in Ukraine remain a red line.

- Zelensky Frustrated: “No backroom deals,” calls for Ukraine’s direct involvement.

- Trump’s Economic Pressure on Ukraine:

- Reportedly demanding $500B in resource revenues, forcing Kyiv into a tough position.

- US Tariff Uncertainty Continues

- Markets reassessing inflation impact as Fed officials remain cautious.

- Trump’s reciprocal tariffs could reshape global trade flows, with Toyota already adjusting by sourcing US-made batteries.

Key Takeaway: Geopolitical tensions are shifting, but uncertainty around tariffs and economic policy remains a wildcard for global markets.

🔹 Other Market Developments

- Housing Market Weakness: US NAHB Housing Index (42 vs. 47 expected) → Lower homebuilder confidence.

- Copper & Industrial Metals Retreat: Tariff fears cooling after initial spike.

- European Equities Rally: DAX hits a new record, while UK FTSE lags (-0.01%).

🔹 Final Thoughts

- Equities lack conviction, bond yields climbing.

- Gold & silver benefiting from trade uncertainty, but Fed remains a hurdle.

- Crypto stagnant; ETF outflows + lack of bullish momentum keep BTC/ETH in consolidation.

- Geopolitics in flux → US-Russia peace talks, Ukraine’s economic dilemma, and global trade shifts are all in focus.

As we head into tomorrow, FOMC minutes, US housing data, and central bank commentary will be key drivers.