North America News

Market Selloff: Big Tech & AI Stocks Lead Declines

U.S. stocks had a rough day but recovered slightly before the close. The NASDAQ dropped 3.07%, at one point down more than 4%. Here’s how major indexes closed:

- Dow: -1.73%

- S&P 500: -2.24%

- NASDAQ: -3.07%

- Russell 2000: -1.03%

Biggest losers were AI and tech names:

- Robinhood (HOOD): -7.69%

- AMD: -7.35%

- NVIDIA: -6.87%

- Palantir: -5.73%

- Tesla: -4.93%

- Apple: -3.89%

- Meta: -3.68%

- Microsoft: -3.66%

This was driven by rising oil prices, high bond yields, and geopolitical concerns.

20-Year Treasury Auction Sees Strong Demand, Yields 4.810%

The US Treasury auctioned off $13 billion worth of 20-year bonds at a high yield of 4.810%, slightly below the 4.814% “when issued” level ahead of the auction.

Key auction stats:

- Tail: -0.4 basis points (vs. 6-month avg. +0.8 bps)

- Bid-to-cover ratio: 2.63x (vs. avg. 2.56x)

- Direct bidders: 12.32% (below avg. 17.9%)

- Indirect bidders: 70.68% (above avg. 66.8%)

- Dealers: 16.99% (above avg. 15.3%)

The auction was well received, with strong indirect demand signaling ongoing international appetite.

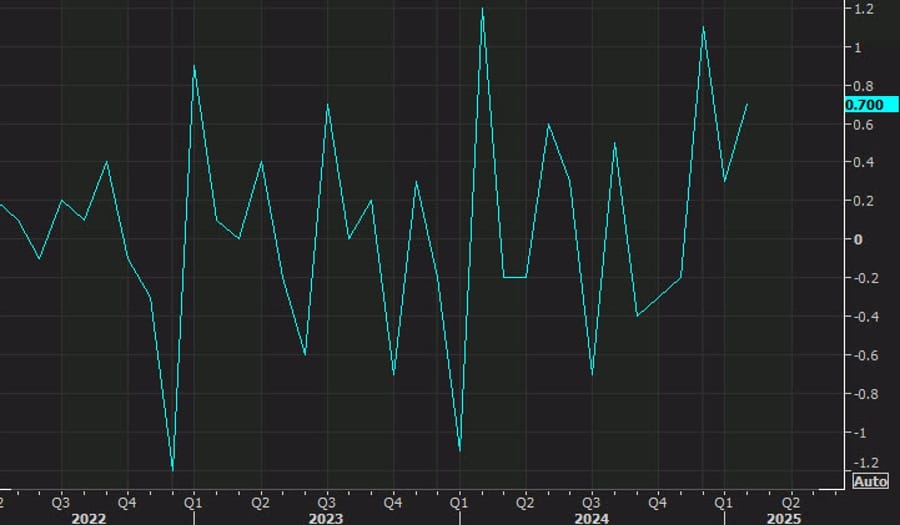

Atlanta Fed GDPNow Estimate Ticks Up Slightly, Still Negative for Q2

The Atlanta Fed’s GDPNow model nudged its Q2 growth estimate higher, now showing a contraction of 2.2% as of April 9, compared to a prior reading of -2.4%.

One adjustment in the model came from factoring in revised trade data related to gold imports and exports, improving that component’s estimate to -0.1% from -0.2%. While the upward revision is modest, it still reflects a Q2 outlook deep in negative territory.

In their own words

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2025 is -2.2 percent on April 16, up from -2.4 percent on April 9. The alternative model forecast, which adjusts for imports and exports of gold, is -0.1 percent. After recent releases from the US Census Bureau, the US Bureau of Labor Statistics, and the Federal Reserve Board of Governors, both the standard model’s and the alternative model’s nowcasts for first-quarter real personal consumption expenditures growth increased from 0.7 percent to 1.4 percent.

US Retail Sales Outpace Forecasts With Broad-Based Gains in March

Retail sales surged 1.4% in March, topping the 1.3% estimate and rebounding sharply from February’s revised 0.2% increase.

Breakdown:

- Ex-autos: +0.5% (vs. +0.3% expected)

- Control group: +0.4% (vs. +0.6% forecast, prior revised to +1.3%)

Category highlights:

- Motor vehicles & parts: +5.3%

- Building supplies & garden equipment: +3.3%

- Food service & bars: +1.8%

- Furniture: -0.7%

- Gas stations: -2.5%

Auto sales drove the bulk of the strength, but gains were visible across a range of sectors.

US Business Inventories Rise 0.2% in February, Sales Jump Over 1%

February data showed a 0.2% month-over-month increase in US business inventories, in line with estimates. Retail inventories excluding autos were up just 0.1%, down from 0.5% in January.

Key figures:

- Total inventories: $2.59 trillion (vs. $2.585 trillion in January)

- Sales (distributive trade + manufacturers): $1.921 trillion, +1.2% m/m, +3.6% y/y

- Inventories-to-sales ratio: 1.35 (vs. 1.37 in February 2024)

All figures are seasonally adjusted and exclude price changes. The sales jump signals strong demand despite slower inventory builds.

US Industrial Production Falls in March, Led by Autos and Energy

Industrial production slipped 0.3% in March, slightly worse than the -0.2% consensus. The prior month’s figure was revised up to +0.8% from +0.7%.

- Y/Y production: +1.34% (vs. +1.44% in February)

- Ex-auto and parts: -0.4% (vs. +0.4% prior)

- Capacity utilization: 77.8% (vs. 78.0% forecast)

- Manufacturing output: +0.3%, matching estimates

The data point to some softness in industrial activity, especially outside of the manufacturing core.

US Home Builder Sentiment Edges Higher in April, But Future Sales Outlook Drops

The NAHB Housing Market Index came in at 40 for April, slightly above the forecast of 37. While this marks an improvement from March’s 39 reading, the underlying data was mixed.

- Single-family homes: 45 (up from 43)

- Buyer traffic: 25 (up from 24)

- Sales expectations: 43 (down from 47)

Regional readings were uneven:

- Northeast: 43 (down from 47)

- Midwest: 43 (up from 38)

- South: 38 (down from 39)

- West: 35 (up from 34)

US Mortgage Activity Slumps as Rates Climb Back Up

Mortgage demand in the US pulled back sharply for the week ending April 11, with total applications falling 8.5%, according to data from the Mortgage Bankers Association. That’s a sharp reversal from the 20% surge the week before.

- Market index: 267.5 (down from 292.3)

- Purchase index: 164.2 (down from 172.7)

- Refinance index: 841.9 (down from 961.4)

- 30-year fixed mortgage rate: 6.81% (up from 6.61%)

While the jump in rates wasn’t massive, it was enough to slow both home purchases and refinancing after last week’s spike. With rate volatility high, housing data is likely to stay choppy for a while.

Empire State Manufacturing Survey Signals Decline in Future Outlook

The Empire State Manufacturing Survey’s future general business conditions index fell to -7.4 in April, marking its second-lowest level in over two decades. This decline reflects growing pessimism among firms, with expectations of slight decreases in new orders and shipments in the coming months. Additionally, capital spending plans remain flat, while input and selling prices are anticipated to rise, and supply availability is expected to worsen over the next six months.

Fed Chair Powell: We’re in Uncharted Waters, Will Move Cautiously

Federal Reserve Chair Jerome Powell, speaking in Chicago, said the Fed is in a good position to wait before making major policy moves, given the high level of uncertainty.

Main takeaways:

- Q1 growth likely slowed, but economy still resilient

- Inflation is running slightly above 2%, PCE inflation at 2.3%

- Recent tariffs came in higher than expected, adding to inflation risks

- Business and household sentiment are deteriorating

- Labor market remains balanced and not inflationary

- No modern precedent for tariff levels this high—not even Smoot-Hawley

- Fed could face tension between inflation and employment goals later this year

- Markets remain orderly; Fed ready to backstop global liquidity if needed

World Bank Engaged in Talks With US Over Ongoing Support

World Bank President Ajay Banga says discussions with the US government remain productive as the institution prepares its next strategic steps.

Key remarks:

- Foreign aid is a temporary tool—not a long-term solution

- A stable regulatory environment is needed to draw private investment into developing countries

- A broad-based energy strategy—including gas, solar, wind, nuclear, hydro, and geothermal—is being finalized for board approval in June

- Uncertainty remains around how much the US and EU will contribute to the IDA

The World Bank continues to position itself as a bridge between financial aid and long-term sustainable development strategies.

Customs Says $500 Million Collected From New Trump Tariffs—Far From Claimed $2 Billion Daily

US Customs and Border Protection has collected over $500 million under President Trump’s newest tariff measures, according to a statement provided to CNBC.

This figure falls significantly short of Trump’s public claim that the government is raking in $2 billion per day from the tariffs. The gap highlights growing questions over the actual impact and revenue generated by the tariff escalation.

Fed’s Hammack: Sees a ‘strong case’ to hold policy steady for now

- Comments from Hammack

- Policy patience will allow the Fed to gather more data on the economy

- Fed in position to take time and assess

- Beings slow and reacting correctly is better than going too fast

- If job market holds and inflation rises, a more restrictive path is needed

- IF growth falters and inflation eases, Fed could cut even more quickly

- Will take time to gauge impact of tariffs on the economy

- More work to do to get inflation to 2%

- It is not appropriate to respond to every twist and turn of markets.

- Focuses on how markets impact economy, not focused on asset prices per se.

- It’s going to take time to see how trade policies impact economy.

- ‘Right thing’ might be to stay on hold for now, steady policy is ‘active choice’.

- When things are uncertain better to think about scenarios over forecasts.

- Sustained tariff battles could create more extended pressures.

- Goes into every Fed meeting with an open mind.

- Key for Fed is to keep inflation expectations contained

- Hearing lots of uncertainties from businesses about the economy

- Trade policies up to elected officials, feds navigate impact of those policies.

- Recent market moves are somewhat unusual, hard to interpret.

- Market-based inflation expectations are well behaved.

- It looks like inflation expectations are reasonably close to desired levels.

White House Threatens China With Tariffs Up to 245%

A White House fact sheet confirms that Chinese exports to the US are now subject to tariffs as high as 245%, a response to China’s retaliatory stance in the ongoing trade battle.

Beijing has already dismissed Washington’s latest moves, saying trade between the two countries had lost economic rationale even before the newest round of tariff hikes. China’s response remains unchanged: it will not be coerced by threats.

US Chip Equipment Makers Brace for $1B+ Hit From Tariffs

US chip manufacturing giants like Applied Materials, Lam Research, and KLA Corp are staring down a combined $1 billion in annual losses due to new tariffs under Trump’s trade policy.

Each company is expected to take a roughly $350 million annual hit, according to internal estimates. The data comes via Reuters.

China Looks to Canada for Oil as US Trade Fallout Deepens

As tensions with the US worsen, China is turning to Canada to secure more long-term oil supplies. Canada’s vast reserves offer an appealing alternative, provided export infrastructure, such as pipelines to the Pacific, can be scaled up.

The report highlights growing Canadian support for such projects, driven by economic opportunity and a shared frustration with Washington’s trade policy. China, meanwhile, is actively pursuing new commodity partnerships as it reshapes its trade dependencies.

Bank of Canada Holds Rates Steady at 2.75%, Warns on Trade Risks

The Bank of Canada left its benchmark rate unchanged at 2.75% on April 17, matching the market’s base-case expectation.

- Odds going into the decision: 58% for a hold, 42% for a cut

- Central bank notes increased volatility and weakening consumer and business sentiment

- Growth outlook deteriorating due to global trade disruptions

- Businesses scaling back hiring and investment

- Inflation remains a primary focus

Despite softer growth signals, the BOC’s tone leaned slightly hawkish, emphasizing the need to maintain price stability.

BOC’s Macklem: Caution Is Key as Canada Faces US Trade Chaos

Bank of Canada Governor Tiff Macklem said the economic picture remains murky as the country navigates an unstable trade environment shaped by US tariffs.

Key points:

- The BOC is staying flexible and responsive

- No forward guidance for now, due to elevated uncertainty

- Tariff impact still playing out—too early for rate cuts

- Toronto housing market has seen a sharp drop in activity

- Business confidence and consumer sentiment are under pressure

- Macklem heads to IMF meetings soon, hoping for more policy clarity

Deputy Governor Rogers added that financial markets remain functional but cautioned that housing remains a weak spot.

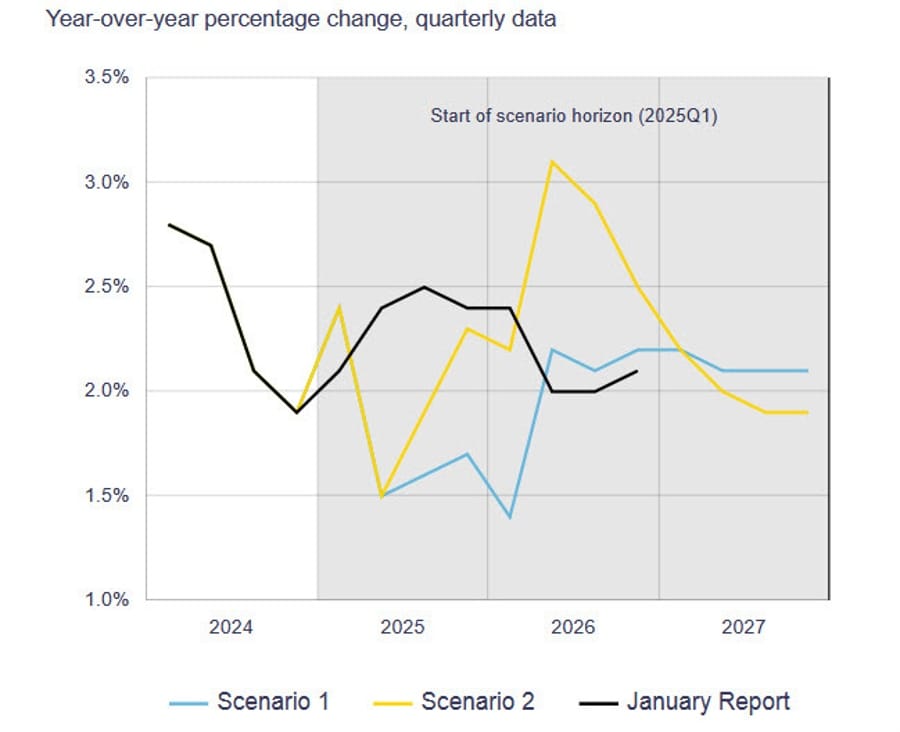

Bank of Canada Outlines Two Tariff Scenarios in New MPR

In its updated Monetary Policy Report, the Bank of Canada ditched the usual base-case forecast and instead presented two contrasting scenarios to account for extreme tariff uncertainty.

Scenario 1 – Tariff De-escalation:

- GDP growth:

- 2024: 1.5%

- 2025: 1.6%

- 2026: 1.4%

- 2027: 1.7%

- Inflation (CPI):

- 2024: 2.4%

- 2025: 1.8%

- 2026: 2.0%

- 2027: 2.1%

Scenario 2 – Global Trade War Intensifies:

- GDP growth:

- 2024: 1.5%

- 2025: 0.8%

- 2026: -0.2%

- 2027: 1.6%

- Inflation (CPI):

- 2024: 2.4%

- 2025: 2.0%

- 2026: 2.7%

- 2027: 2.0%

In the harsher outcome, the economy enters a four-quarter recession, with average GDP shrinking 1.2% in late 2025 and early 2026. The scenario assumes sweeping US tariffs—up to 25% on a wide range of imports from China, Canada, Mexico, and others.

Commodities News

Gold Surges to Record High, US Dollar Slips

Gold prices jumped to an all-time high above $3,330/oz, as lower bond yields and a weaker U.S. Dollar pushed demand higher.

What’s driving the move:

- US retail sales rose 1.4% in March, with 4.6% YoY growth, pointing to strong consumer demand.

- Trump administration launched a probe into possible tariffs on critical mineral imports, spooking markets.

- China escalated trade tensions by imposing licensing requirements on rare earth exports.

- Despite some signs of diplomacy, China insists any talks require “mutual respect” and fewer threats.

Impact on the dollar:

- The USD weakened, with the DXY index trending lower.

- Even with strong economic data, inflation fears and trade risks have put pressure on dollar demand.

- The weaker USD supports gold as a safe haven, especially during geopolitical and trade-driven uncertainty.

Bottom line: The combination of inflation concerns, trade war risks, and falling yields created a perfect storm for gold bulls. At the same time, the dollar’s strength looks shaky despite strong U.S. data.

Oil Prices Jump, US Threatens Iran Oil Exports

Crude oil settled at $62.47, up 1.86%, after U.S. Treasury Secretary Scott Bessent said the U.S. is ready to cut Iran’s energy exports to zero, citing support for terrorist groups.

If WTI closes above $62.64, technical indicators suggest a rally toward $65.69 or even $67.81 is possible.

EIA: US Crude Stocks Climb Slightly, Fuel Inventories Fall Sharply

US crude inventories rose by 515,000 barrels last week, in line with the expected 507,000-barrel build, according to EIA data for the week ending April 11.

Other figures:

- Gasoline: -1.958 million barrels (vs. -1.595M expected)

- Distillates: -1.851 million barrels (vs. -1.180M expected)

- Refinery utilization: -0.4% (vs. +0.4% expected)

Fuel supplies dropped more than forecast, while overall crude saw only a slight build. Refinery activity also contracted.

Fresh US Sanctions Hit Iran’s Oil Tanker Fleet

Despite earlier optimism surrounding Iran nuclear negotiations, the US has imposed a new wave of sanctions targeting Iranian oil tankers, according to a Treasury Department release.

The change in the talks’ location was also criticized by Iran’s foreign minister, who called it a misstep that signals a lack of sincerity from Washington. In the energy markets, WTI crude rose nearly $1 on the news.

Gold Breaks Through $3,300 as Bull Run Accelerates

Gold prices surged above the $3,300 mark, continuing their rapid rise amid mounting geopolitical and economic uncertainty.

As of now, gold is up over 2% on the day, trading at around $3,306. It’s been just a week since the metal was still under $3,000. Year-to-date, gold has gained 26% and is on track to potentially exceed its total performance from 2024. The ongoing tariff war and global instability continue to drive investor demand.

Palladium Edges Up, Platinum Dips as PGM Market Opens Mixed

The market for Platinum Group Metals (PGMs) opened Wednesday on mixed footing in Europe:

- Palladium (XPD/USD): $976.90/oz, slightly up from $976.80

- Platinum (XPT/USD): $960.85/oz, down from the prior $962.55 close

Both metals are trading within tight ranges, with palladium showing slight gains while platinum loses ground early in the session.

JPMorgan Turns Bearish on Base Metals, Cites Tariff Fallout

JPMorgan has revised its short-term outlook on base metals, citing falling demand and rising global recession risks linked to tariff-related economic slowdowns.

Revised forecasts for Q2 2025:

- Copper: $8,300/MT

- Aluminum: $2,200/MT

- Nickel: $14,000/MT

- Zinc: $2,500/MT

Weaker demand from Asia (excluding China) and lower EV-related consumption are major drags.

ANZ Raises Gold Price Forecast Amid Market Uncertainty

ANZ has increased its six-month gold price forecast to $3,200 per ounce, citing strong tailwinds from escalating geopolitical and trade tensions, easing monetary policy, and robust central bank buying. Gold prices have surpassed the significant $3,000 mark, setting new highs as investors seek safe-haven assets amid economic concerns fueled by U.S. tariff policies.

Private Oil Data Shows Inventory Build, Contrary to Expectations

Private oil inventory data showed an unexpected rise in crude stockpiles:

- Crude: +2.4 million barrels (vs. -1.68 million expected)

- Gasoline: -3 million

- Distillates: -3.2 million

- Cushing: -349,000

- SPR: +300,000

Europe News

Eurozone Final CPI for March Holds at 2.2% Year-Over-Year

Eurostat’s final inflation data for March confirmed an annual CPI increase of 2.2%, matching the earlier preliminary reading and slightly below February’s 2.3%.

Core inflation held steady at 2.4% year-over-year, in line with preliminary estimates but down from 2.6% in the prior month. The figures suggest a continued, if slow, easing of price pressures across the euro area.

Eurozone February Current Account Surplus Expands to €33.1 Billion

The Eurozone recorded a much stronger current account surplus in February, with the headline figure rising to €33.1 billion—up sharply from €13.2 billion in January.

The seasonally adjusted surplus came in even higher, at €34.3 billion. Goods and services both contributed positively, posting monthly surpluses of €34 billion and €14 billion, respectively. These gains were offset in part by deficits of €10 billion in secondary income and €3 billion in primary income.

UK Inflation Slows Slightly in March, Keeps Rate Cut Bets Alive

UK CPI for March came in at 2.6% year-over-year, just below the expected 2.7% and down from February’s 2.8%. Core CPI matched forecasts at 3.4%, easing from the prior reading of 3.5%.

The numbers are broadly in line with expectations and support market bets that the Bank of England could cut rates as early as next month. Notably, core services inflation dropped from 5.0% in February to 4.7%, pointing to a cooling trend in domestic price pressures.

Asia-Pacific & World News

Fitch Slashes Global Growth Outlook as Trade War Intensifies

Fitch Ratings has lowered its 2025 global GDP forecast by 0.4 percentage points, with cuts of 0.5pp each for the US and China. It now sees:

- US growth: 1.2% in 2025, slowing to 0.4% YoY in Q4

- China: Below 4% growth for both 2025 and 2026

- Global GDP: Under 2% for 2025—excluding pandemic years, the weakest since 2009

- Eurozone: Below 1% growth

The forecast also includes a $5/barrel cut to 2025 Brent oil prices (now $65), a rise in US inflation above 4%, and a warning that policy uncertainty is stifling investment, consumer confidence, and equity markets.

Fitch expects the Fed to wait until Q4 to begin rate cuts, while deeper easing is anticipated from the ECB and EM central banks.

ANZ Cuts China’s 2025 GDP Forecast to 4.2% Amid Tariff Headwinds

ANZ has lowered its 2025 GDP forecast for China to 4.2%, down from its earlier estimate of 4.8%, citing increased economic pressure from US tariffs.

Looking ahead to 2026, the bank now expects 4.3% growth, slightly below its prior forecast of 4.5%. While this revised projection is still relatively optimistic, it stands in contrast to more conservative views from other firms. UBS currently sees China’s 2025 growth at just 3.4%, and Goldman Sachs expects 4.0%.

China May Request Extra Engines on Airbus Jet Orders Amid Boeing Freeze

China is reportedly considering a request that Airbus supply any new commercial aircraft with an additional set of engines, according to Bloomberg.

The move appears to reinforce China’s continuing rejection of Boeing as diplomatic tensions with the US escalate. Meanwhile, Beijing and Brussels are increasingly aligning on trade and industrial policy—underscoring the old idea that “the enemy of my enemy is my friend.”

Nomura Joins Others in Cutting China 2025 GDP Outlook to 4%

Nomura has trimmed its growth outlook for China in 2025, now projecting GDP to rise 4.0%—a step down from its previous 4.5% forecast. The revision puts Nomura in line with several other banks adjusting expectations amid mounting economic challenges.

Here’s where major institutions now stand on China’s 2025 GDP:

- ANZ: 4.2% (previously 4.8%)

- Citi: 4.2% (previously 4.7%)

- Goldman Sachs: 4.0% (previously 4.5%)

- Morgan Stanley: 4.2% (previously 4.5%)

- UBS: 3.4% (previously 4.0%)

Report: Nvidia Withheld Info From Chinese Clients on Chip Export Rules

According to a Reuters report, Nvidia failed to notify some key clients in China about newly imposed US export restrictions on its H20 chips—even though the company was informed of the changes nearly a week in advance.

US authorities reportedly told Nvidia on April 9 that licenses would be required to export H20 chips to China. However, Nvidia’s China-based sales staff may have been left out of the loop, and major Chinese cloud service providers were still expecting deliveries by the end of the year, unaware of the looming export ban.

Tesla Freezes China-to-US Parts Shipments Amid Soaring Tariffs

Tesla has put a halt to shipping parts for its upcoming Cybercab and Semi truck models from China to the US. The decision follows a spike in tariffs imposed by the Trump administration, which ramped duties up to 145%.

Originally, Tesla had budgeted for a 34% tariff, but the sudden escalation made the shipments financially unviable. This setback could delay production targets for both the robotaxi and Semi, which were key elements in Tesla’s 2026 growth plan. Tesla has also paused orders for its Model S and X due to China’s retaliatory trade measures.

China Open to Talks—But Wants Trump to Show Respect and Get Organized

According to Bloomberg, China is willing to resume dialogue with the US—but on the condition that Trump demonstrates respect and appoints a clear point person to lead discussions.

Beijing also wants more consistency from the US administration and is asking for talks to directly address core concerns, including issues related to Taiwan and the ongoing sanctions.

China to US: Stop the Threats, Start Acting Like a Partner

China’s Foreign Ministry issued a sharp rebuke to the latest US actions, calling on Washington to halt its use of pressure tactics and threats.

In the statement, officials emphasized that if the US is genuinely interested in dialogue, it must abandon its strategy of “maximum pressure.” Reports have surfaced suggesting the Trump administration is leveraging trade talks with other nations to isolate Beijing—a strategy China says undermines efforts toward constructive engagement.

China Q1 GDP Shows Mixed Picture – Quarterly Miss, Yearly Beat

China’s economy grew 1.2% in Q1 compared to the previous quarter, falling short of the 1.4% projection and down from 1.6% in Q4. On a year-over-year basis, though, GDP expanded by 5.4%, beating the 5.1% forecast and matching the prior quarter’s growth.

This data underscores a split narrative: solid annual performance, but a disappointing quarterly slowdown, hinting at uneven recovery dynamics.

China’s March Data Blows Past Expectations in Industrial Output and Retail

China’s economic data for March came in much stronger than analysts had forecast. Industrial output surged by 7.7% year-on-year, handily beating the expected 5.9% and up from 5.9% in February. Retail sales also came in hot, rising 5.9% against an expected 4.2%, and improving from the prior 4.0%.

Other notable data points:

- Fixed Asset Investment (YTD YoY): +4.2% (vs. 4.1% expected)

- YTD Industrial Output (YoY): +6.5% (up from 5.9%)

The strong performance across key sectors reinforces confidence in the underlying momentum of China’s recovery, even as external pressures mount.

Nvidia Hit by US Ban on Chip Sales to China, Faces $5.5B Charge

Nvidia is facing a major financial hit after the US government banned the sale of its H20 chips to China indefinitely. The company expects to incur a $5.5 billion charge this quarter as a result.

Following the announcement, Nvidia shares dropped sharply in after-hours trading, hitting their downside limit.

Morgan Stanley Slashes 2025 Forecasts for Key Asian Equity Benchmarks

Morgan Stanley has dialed back its year-end 2025 projections for a handful of major Asian stock indexes. The downgrade comes amid weaker global and emerging market growth estimates and updated foreign exchange assumptions. According to the bank, upside from current valuations appears limited, and the short-term picture leans negative.

Here are the updated targets:

- TOPIX: Now forecast at 2,600 (was 3,000)

- Hang Seng Index: Cut to 20,800 (down from 24,000)

- Hang Seng China Enterprises Index: Reduced to 7,700 (previously 8,600)

- CSI 300 Index: Revised to 3,830 (from 4,200)

Morgan Stanley’s new base case reflects a more cautious tone, pointing to slower growth trajectories in Asia and across other emerging economies.

China’s New Home Prices Dip Slightly Less in March

China’s property market showed a slight improvement in March. New home prices fell by just 0.08% month-over-month, compared to a 0.1% drop in February. On a year-over-year basis, prices declined 4.6%, a marginal improvement from the 4.8% drop previously recorded.

While the market is still under pressure, the latest data suggests that price declines may be slowing.

Hong Kong Halts US-Bound Goods in Protest Over Tariff Rules

Hongkong Post will no longer accept parcels containing goods destined for the United States. The move is in direct response to a US decision to eliminate duty-free treatment for such items and impose higher tariffs starting May 2.

Calling the US measures “unreasonable” and “bullying,” Hong Kong authorities said they refuse to collect any tariffs on America’s behalf and are suspending the affected postal services indefinitely.

China Responds to US Tariffs, Accuses Washington of Economic Sabotage

Chinese officials have come out swinging against the latest US tariffs, calling them a blow to global trade norms and WTO rules. A senior official from China’s statistics bureau argued that protectionism is spreading rapidly and undermining the global economic system.

Despite acknowledging that the increased US tariffs will create near-term stress on China’s trade and broader economy, Beijing maintains that its long-term economic outlook remains intact. The government says it has ample tools at its disposal to counter external headwinds and insists it will still hit its growth targets. China also signaled a shift toward more aggressive macroeconomic policy this year.

U.S. Plans to Leverage Tariff Negotiations to Isolate China

The U.S. government is reportedly seeking to use ongoing tariff negotiations with over 70 countries to limit China’s involvement in their economies. Treasury Secretary Scott Bessent aims to encourage trading partners to restrict Chinese goods from entering their markets in exchange for concessions on reciprocal tariffs.

PBOC sets USD/ CNY reference rate for today at 7.2133 (vs. estimate at 7.3272)

- PBOC CNY reference rate setting for the trading session ahead.

In open market operations (OMOs), the bank injects 104.5bn yuan in 7 day reverse repos today at an unchanged rate of 1.5%

- 118.9bn mature today

- thus a net drain of 14.4bn yuan

Australia’s Leading Index Cools as Tariff Uncertainty Bites

The March reading for Australia’s Westpac Leading Index slowed to 0.6% from 0.9% the month before, signaling that the pace of growth is starting to ease.

While commodity strength and interest rates are still supporting growth, new cracks are forming—particularly in confidence levels and financial markets. Tariff uncertainty stemming from the US-China spat is beginning to seep into forward-looking indicators, and further softening is expected.

ANZ forecasts the RBNZ will cut its cash rate to 2.5% by October 2025

- Reserve Bank of New Zealand

Japan’s Machinery Orders Surpass Expectations in February

Japan posted a surprise gain in core machinery orders for February, a key metric for gauging future capital spending.

- Year-on-Year: +1.5% (expected -0.9%)

- Month-on-Month: +4.3% (expected +1.2%)

These figures mark a strong recovery from January’s 3.5% decline and point to solid momentum in investment.

Japan’s April Tankan Shows Recovery in Sentiment, But Storm Clouds Ahead

Japan’s latest Reuters Tankan survey revealed a rebound in manufacturing sentiment in April, with the index climbing to +9 from -1. However, businesses are wary of upcoming US tariff hikes.

Manufacturers expect sentiment to drop back to zero by July. The non-manufacturing index rose to +30 in April, up from +25, but that too is projected to fall to +21 in the coming months. Auto and machinery sectors are particularly concerned as export orders fall and pricing pressures mount from cheap Chinese imports.

Bank of Japan Governor Ueda says may need policy response to Trump tariffs

- Bank of Japan Governor Ueda in Japanese media (Sankei)

- May need policy response but will decide appropriately in line with changing developments, when asked about BOJ response if U.S. tariff policy puts downward pressure on Japan’s economy

- Will scrutinise without any pre-conception impact of U.S. tariff policy on Japan’s economy, as is already affecting corporate, household confidence

- Expect domestic food inflation to moderate, real wages to stablise in positive territory from middle of this year

- See both upside, downside risks to price outlook

Crypto Market Pulse

Crypto Update: Market Cautious, Tron Bucks Trend

- Total market cap: ~$2.7 trillion

- Bitcoin: Holding above $84,000, acting as a stabilizing force

- Ethereum: Dropped below $1,600, down 3.1%

- Tron (TRX): Up 2.3%, only top-10 gainer

Why Tron is rising:

- Surge in stablecoin transactions, especially USDT

- Traders using it for low-fee capital movement during market stress

- Tron’s rise signals defensive rotation, while Ethereum’s decline suggests concern over high DeFi fees and usage

Metaplanet Buys More Bitcoin, While Coinbase Warns of “Crypto Winter”

- Metaplanet raised $10M via zero-interest bonds to buy Bitcoin. Bonds mature October 2025.

- Coinbase Institutional warns of bearish signs:

- Total crypto cap (excluding BTC) down sharply

- Slump in VC funding

- BTC and COIN50 index both fell below 200-day moving averages

This shift hints at a broader cooling across altcoins and risky crypto segments.

Chainlink (LINK): Whale Selling Spikes, Risks Below $10

- LINK down to $12.15, with whale wallets offloading

- Active addresses fell 66% since February (from 9,400 to 3,200)

- Technical support at $10.00 could be retested

- RSI trending lower, bearish momentum building

- If selling continues, $8.10 is the next major support

Still, a falling wedge pattern on the chart suggests a possible reversal to $15.17—but only if bulls break resistance with volume.

Trump’s Next Crypto Venture? A Monopoly-Style Video Game

President Trump may be preparing to launch a real estate-themed crypto video game—possibly inspired by Monopoly Go—according to a Fortune report.

Sources close to the project say the game will allow users to earn in-game currency and build digital cities. The release is reportedly planned for late April. Trump’s past ventures include “Trump: The Game” in 1989, an NFT collection, and a meme coin, all linked to crypto enthusiast Bill Zanker.

While the White House hasn’t confirmed the report, concerns are already surfacing about potential conflicts of interest as Trump continues to back multiple crypto initiatives through his family and business ties.

The Day’s Takeaway

Day’s Takeaway: Key Market Trends & Developments

United States – Sharp Selloff, Volatility Creeps In

- Major indexes sank, with the NASDAQ down -3.07%, S&P 500 off -2.24%, and Dow down -1.73%. There was a modest rebound late in the session, but the mood remained bearish.

- Big tech was hit hard: Apple (-3.89%), Microsoft (-3.66%), Meta (-3.68%), and Nvidia (-6.87%) all dropped sharply.

- Robinhood (-7.69%) and AMD (-7.35%) led the biggest losers.

- Yields remain elevated: The 10-year yield fell to 4.27% but is still well above April’s 3.86% low. Last week, yields surged 50 basis points before easing.

- Retail Sales beat expectations at +1.4% MoM in March, suggesting resilient consumer demand.

Canada – Market Mirrors US Weakness

- Canadian markets followed the U.S. trend lower, weighed down by weakness in tech, energy, and financials.

- No major economic data releases today, but oil-linked names were volatile following geopolitical headlines.

- Loonie was stable, mildly supported by rising oil prices.

Commodities – Safe Havens Shine, Oil Jumps

- Gold surged past $3,330/oz — new all-time highs — on weaker USD, lower yields, and geopolitical risks.

- Crude oil (WTI) jumped 1.86% to $62.47, lifted by U.S.-Iran tensions. A close above $62.64 could trigger a move toward $65.69 (20-day SMA).

- Metals and critical minerals were in focus after U.S. floated possible tariffs and China added rare earth export licenses, escalating trade tensions.

Europe – Tariff Talk, Weak Sentiment

- European markets were down, reacting to:

- US chip export restrictions

- Tensions over critical minerals

- Gold strength signaling rising risk aversion

- Eurozone data was mixed, and concerns are rising about slowing industrial momentum amid worsening trade dynamics with the U.S. and China.

Asia – China Surprises, But Risks Linger

- China Q1 GDP came in strong at +5.4% YoY, beating expectations.

- Retail sales and industrial production were also better than forecast, giving the economy a boost.

- However, sentiment remains cautious due to:

- Escalating trade tensions with the U.S.

- New export controls on rare earth minerals

- Ongoing restrictions on semiconductor imports/exports

Rest of the World – Mixed Cues

- Emerging markets saw outflows amid risk-off mood and rising demand for USD-denominated safety.

- Some rotation into safe-haven assets.

- Global equity softness reflected uncertainty over U.S. policy shifts and commodity-driven inflation risks.

Crypto – Defensive Rotation & Panic Signs

- Bitcoin held above $84,000, providing a temporary floor for the market.

- Ethereum plunged below $1,600, down 3.1%, losing market share as traders rotated out due to rising gas fees and DeFi uncertainty.

- Tron stood out, rising 2.3%, thanks to its role in stablecoin transaction volume, especially USDT. Its low fees and utility made it a safe port in a storm.

- Metaplanet (Japan) raised $10M in zero-interest bonds to buy more BTC, doubling down on its long-term bet.

- Coinbase Institutional warned of a potential new crypto winter, with VC activity slowing and the broader COIN50 index falling below its 200-day MA.

- Chainlink (LINK) continues to slide, active addresses down 72% since December. Whale selling pressure is mounting, with price nearing critical $10 support.