North America News

Nasdaq Leads US Stocks Higher as Tech Rallies on Trade Optimism

US equity markets closed with solid gains on Tuesday, driven by renewed optimism around US-China trade talks and a tech sector rebound. The Nasdaq outperformed, rising 0.63%, with chipmakers leading the charge.

Closing snapshot:

- Dow Jones: +105.11 points (+0.25%) to 42,866.87

- S&P 500: +32.93 points (+0.55%) to 6,038.81

- Nasdaq Composite: +123.75 points (+0.63%) to 19,714.99

Tech & chip stocks surged:

- Intel soared 7.95% despite no news—likely driven by aggressive call option activity.

- Micron added 2.88%, AMD climbed 1.24%, and Nvidia advanced 0.93%.

Other strong performers included:

- Tesla, rebounding 5.67%

- Stellantis, up 4.72%

- Schlumberger, gaining 4.09%

- Whirlpool, up 4.02%

- Target, adding 3.56%

Hopes for a breakthrough in trade relations with China helped lift sentiment, offsetting recent concerns around interest rates and inflation data due later in the week.

US Treasury’s $58B 3-Year Note Auction Draws Tepid Demand

The US Treasury auctioned $58 billion in 3-year notes on Tuesday, with the results pointing to lukewarm investor interest.

- High Yield: 3.972%

- When-Issued Yield (WI): 3.968%

- Tail: +0.4 basis points (slightly weaker than the 6-month average of +0.5 bps)

- Bid-to-Cover Ratio: 2.52x, below the 6-month average of 2.62x

Participation Breakdown:

- Dealers: 15.19% (vs. 15.1% avg.)

- Directs (domestic): 18.03% (vs. 18.7% avg.)

- Indirects (foreign buyers): 66.78% (vs. 66.2% avg.)

Overall, a below average auction, with a modest tail and slightly below-average demand across key buyer segments.

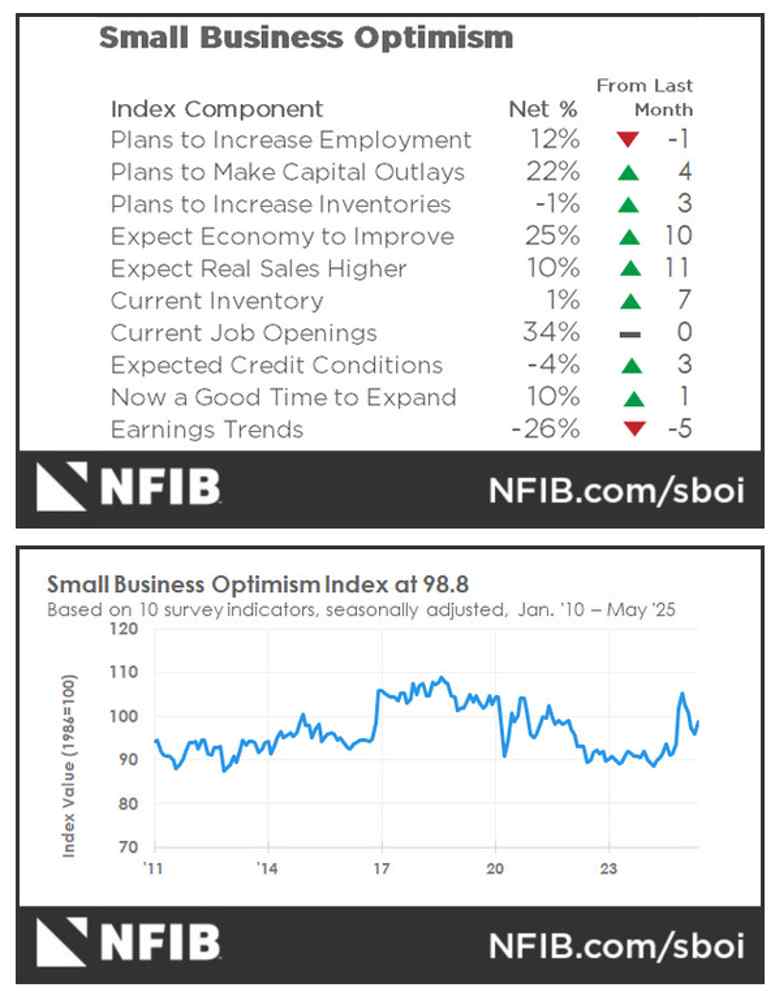

Small Business Optimism in US Jumps to Highest Level Since 2022

The NFIB Small Business Optimism Index climbed to 98.8 in May, up from 95.8 and topping forecasts for 95.9. That brings it slightly above the long-run average of 98, with improved expectations for business conditions and sales driving the gains.

The index’s measure of uncertainty rose two points to 94. Notably, 18% of owners cited taxes as their top concern—the highest share since late 2020. That aligns with a broader narrative of policy anxieties ahead of the US election cycle.

NFIB Chief Economist Bill Dunkelberg said: “Although optimism recovered slightly in May, uncertainty is still high among small business owners. While the economy will continue to stumble along until the major sources of uncertainty are resolved, owners reported more positive expectations on business conditions and sales growth.”

Bessent might shift from Treasury to Fed chair – report

- Bloomberg reports that Bessent is a candidate

The race to replace Jerome Powell hasn’t truly kicked off yet but there is some positioning in the background. Treasury Secretary Scott Bessent has emerged as a candidate, according to Bloomberg.

Powell’s term doesn’t end until May 2026 and he was nominated (by Trump) on November 2, 2017 so the timeline is still long.

The report says that ‘a growing chorus’ is enrcouring Trump to pick Bessent and there is ‘a small list’ of candidates under consideration. The favorite has been Kevin Warsh, who is noted as a candidate.

Other candidates whose names have previously been floated for Fed chair include Kevin Hassett, the White House’s National Economic Council director, Christopher Waller, a Fed governor, and former World Bank President David Malpass.

Fed Seen Cutting Rates by September, Two Total Cuts in 2025

According to a Reuters poll, 59 of 105 economists now anticipate the Fed will begin cutting rates in Q3, most likely in September. A majority also expect two rate cuts in total this year.

Growth projections were steady: 1.4% for 2025 and 1.5% for 2026. However, political pressure is mounting. The Trump administration is pushing for deeper cuts and more aggressive stimulus, aiming to push growth closer to 3%.

Morgan Stanley Stands by Tesla Despite Political Noise

Morgan Stanley reaffirmed its Overweight rating on Tesla, maintaining a price target of $410 despite the latest political drama involving Elon Musk and Donald Trump.

Analysts brushed off concerns about EV tax incentives and argued Tesla’s real value lies in its leadership across AI, energy, and automation. While the recent rally was partly fueled by optimism around Musk focusing back on Tesla’s core business, the political fallout could impact sentiment.

Still, the firm sees Tesla’s innovation moat as deep enough to weather short-term distractions.

Deutsche Bank: Stubbornly High Fed Rates Pose Default Risk to US Borrowers

Deutsche Bank warned that persistent high interest rates in the US could start biting more aggressively into corporate credit markets. While defaults so far have been limited and manageable, the bank sees trouble brewing.

With inflation still sticky and fiscal policy uncertainty rising, default risk among lower-rated issuers is expected to climb. Deutsche forecasts the speculative-grade default rate could reach 5.5% by mid-2026—the highest since 2012.

That scenario hinges on whether the Fed continues delaying rate cuts in response to stronger-than-expected economic data and global volatility.

Goldman and JPMorgan Diverge on Risks, but Both Signal Confidence in US Stocks

Goldman Sachs says investors are favoring cyclical and growth-driven stocks over defensive plays, signaling increased faith in the economic recovery. However, they caution that sentiment is being fueled more by soft data—surveys and expectations—than hard economic figures.

“If optimism built on soft data holds, equities could maintain momentum even if hard data weakens,” Goldman noted.

Meanwhile, JPMorgan raised its S&P 500 target, indicating its confidence in continued upside, despite mounting concerns about macro headwinds.

Commodities News

Gold Holds Steady as Market Weighs Trade Optimism vs. Geopolitical Risk

Gold prices traded sideways on Tuesday as traders balanced growing optimism around US-China trade negotiations with renewed geopolitical tensions over Iran’s nuclear program. The metal hovered above key support near $3,300 as the US Dollar held firm.

Progress in the second day of London-based trade talks between US and Chinese officials—featuring Treasury Secretary Scott Bessent and China’s Vice Premier He Lifeng—helped boost market risk appetite, strengthening the Dollar and capping Gold’s upside.

However, comments from Iranian lawmakers accusing the US and Israel of manipulating nuclear diplomacy, along with former President Trump’s warning of potential military retaliation, lent support to the safe-haven asset.

Macro context:

- China’s exports to the US fell 35% YoY in May, the steepest drop since early 2020

- Rare earths release: Signs suggest China may ease export controls, a move critical for US tech and defense sectors

- US labor data: Friday’s NFP showed 139K jobs added vs. 130K expected, bolstering economic resilience

The data, alongside Fed rate expectations, have traders eyeing Wednesday’s CPI report. A softer print could support Gold, while stronger inflation may extend the Dollar rally and weigh further on the non-yielding metal.

According to CME FedWatch Tool:

- Markets see no rate cut through July

- 54.7% chance of a 25bps cut in September remains in play

Crude Oil Draw Smaller Than Forecast in API Weekly Data

A private sector survey showed US crude oil stockpiles fell last week, though the drop was much smaller than anticipated, with gasoline and distillates showing sizeable builds. The report comes ahead of official data from the EIA due Wednesday.

API Inventory estimates (w/e June 7):

- Crude: -370,000 barrels (vs. +700,000 expected)

- Gasoline: +2.969 million barrels

- Distillates: +3.712 million barrels

- Cushing hub: -728,000 barrels

- SPR (Strategic Petroleum Reserve): +300,000 barrels

The modest draw in crude and hefty builds in refined products may weigh on oil prices if confirmed by the EIA report. However, broader market sentiment remains supported by improving US-China trade dynamics and strengthening demand expectations.

WTI Breaks Above $64 as Trade Talks Boost Demand Sentiment

WTI crude prices pushed higher on Tuesday, topping $64 per barrel for the first time in weeks, as investors responded to signs of progress in the US-China trade negotiations.

The energy market was further buoyed by better-than-expected US small business optimism in May, with the NFIB index showing signs of increasing domestic energy demand.

Comments from US Commerce Secretary Howard Lutnick added fuel to the rally. “Talks are progressing well and may extend beyond today,” he said, as reported by Reuters. President Trump also expressed confidence, citing “good reports” from the London meetings.

All eyes now turn to the American Petroleum Institute’s (API) inventory report due later Tuesday for additional confirmation of tightening US supply conditions.

EIA Trims 2026 US Oil Output Forecast, Sees Plateau Ahead

The US Energy Information Administration (EIA) now expects oil output in 2026 to slightly decline compared to 2025—signaling a potential top in domestic production.

- 2025 Output: Unchanged at 13.42 million barrels per day (mbpd)

- 2026 Output: Cut to 13.37 mbpd (down from 13.49 mbpd)

- US Oil Demand (2025): Lowered to 20.4 mbpd from 20.5 mbpd

- Global Oil Demand (2025): Revised down to 103.5 mbpd

- Global Oil Supply (May 2025): Estimated at 104.24 mbpd

The EIA attributed the softer outlook to falling rig counts and weaker oil prices. “Rig activity dropped more than expected last month,” the agency noted, adding that output is likely to decline gradually through Q4 2026.

EU Eyes Lower Russian Oil Price Cap in 18th Sanctions Package

The European Commission is proposing to reduce the oil price cap on Russian crude from $60 to $45 as part of its latest sanctions package. The move would coincide with additional restrictions targeting energy and banking sectors, including Nord Stream infrastructure.

Brent crude is currently trading near $67.26, and the existing price cap has faced criticism for weak enforcement. The proposed changes aim to tighten the pressure as the bloc escalates its economic stance against Moscow.

Crude Oil Builds Momentum, Breaks Past Resistance with $72 in View

Crude oil extended its rally, clearing the $64 resistance zone and breaking a long-standing downtrend line. The next major target is the $72 level, as traders respond to a more constructive global demand outlook.

Bearish supply news has repeatedly been shrugged off, suggesting sentiment has turned. Supportive factors include easing global financial conditions, anticipated Trump-era deregulation, and the fading threat of trade wars.

Technicals confirm the bullish structure: the market now tracks along an ascending trendline, with dips likely to be bought. A clean break below that line could drag prices back toward $62.

Oil Supported by US-China Trade Progress, Iran Talks Stall

Oil prices edged higher as optimism around US-China trade talks spilled into commodity markets. ING analysts noted that discussions are advancing, with the US signaling a willingness to loosen tech export restrictions in exchange for rare earth access.

On the other hand, nuclear talks with Iran are going nowhere. Tehran continues to insist on its right to enrich uranium, which Washington won’t accept—keeping geopolitical risk alive.

Chinese crude imports slipped to 11 million barrels per day in May, down 5.7% from April. Seasonal refinery maintenance was a key factor.

In gasoil markets, backwardation surged to nearly $16/tonne. Speculator positioning also climbed, as open interest hit record highs—suggesting strong hedging activity and tight near-term supply.

China Continues Gold Accumulation, Copper Trade Mixed

The People’s Bank of China added 60,000 troy ounces of gold in May, bringing total reserves to 73.83 million ounces. This marks the seventh consecutive monthly increase.

On the metals trade front:

- Copper: Unwrought copper imports dropped 2.9% MoM and 16.2% YoY in May, totaling 427.2 kt.

- Copper Concentrates: Fell 18% MoM but are still up 7% YTD at 12.4 mt.

- Iron Ore: Imports dipped 3.8% YoY in May, totaling 98.1 mt. Cumulative YTD volume is down 5.3%.

- Aluminium: Exports fell 5.1% YoY to 2.4 mt.

- Steel Products: Exports rose 8.6% YoY, totaling 48.5 mt through May.

Europe News

Eurozone Investor Mood Turns Positive, Germany Leads Sentiment Rebound

Sentix’s latest survey showed a surprise rebound in Eurozone investor sentiment, with the index rising to +0.2 in June—far ahead of the -6.0 consensus and a solid recovery from May’s -8.1.

Germany was the standout, with its sub-index climbing to -5.9, the most optimistic reading since March 2022. Expectations jumped 10.5 points to 14.3, reflecting fading concerns over the Trump tariff shock and a more hopeful outlook for the region’s economy.

Swiss Sight Deposits Slip to Lowest Level Since February

The Swiss National Bank reported a decline in total sight deposits for the week ending June 6, with balances falling to CHF 438.1 billion—down from CHF 444.9 billion the week prior. Domestic sight deposits came in at CHF 426.3 billion, also down from CHF 434.3 billion.

This marks the lowest reading since late February, hinting at a possible shift in liquidity conditions. While the drop isn’t dramatic, it breaks a stretch of relative stability. Markets will be watching future prints closely for signs of potential SNB policy moves.

UK Job Market Softens Further as Wages Ease Slightly

UK unemployment held steady at 4.6% in April, matching forecasts. However, payrolls fell by 109,000—the largest drop since May 2020.

Average weekly earnings rose 5.3% including bonuses (down from a revised 5.6%) and 5.2% excluding bonuses.

Employment increased by 89,000, beating expectations but still below the prior month’s 112,000. The softening labor picture could give the Bank of England more room to consider easing later this year, especially as wage growth finally begins to cool.

UK Retail Spending Slows Sharply as Bills and Inflation Bite

UK retail sales growth ground to a near halt in May, climbing just 1% year-over-year, down sharply from April’s 7%, according to the British Retail Consortium. Like-for-like sales grew only 0.6%, their weakest pace since November 2024.

KPMG’s Linda Ellett pointed to rising household bills and waning discretionary budgets as key factors. Barclays’ own consumer data showed similar trends, with overall spending up just 1% y/y and consumer confidence slipping by three points to 67%.

A 6% energy price cap hike in April added further stress to household budgets, casting a shadow over future consumption trends.

ECB’s Vujcic says no need to discuss a rate cut until September

- The ECB is nearing the end of the line

ECB’s Vujcic said they can wait until September to even discuss a further move in an interview with Bloomberg TV.

“We feel that we are now in a very good position,” he said. “It’s worth now waiting to get more data and in my view, to get another projection before we decide where we want to go and hopefully by that time get more clarity on the on the trade relationships.”

Part of the patience is that central bankers want to see what happens with the US trade war as that could be a swing factor. Rate cuts also happen with a lag and the ECB has now cut 8 times. Still, there are some real risks to growth and there are reasons to think inflation will come down further, including from Vujcic.

“The two main reasons why we saw that disinflation are energy prices and the exchange rate,” he said. “It’s very volatile and this is also what we have to have in mind.”

ECB’s Villeroy: We will remain pragmatic going forward on rates

- Remarks by ECB policymaker, Francois Villeroy de Galhau

- Will go according to the data flow

- Will be as agile as necessary

- Policy and inflation are now in a favourable zone

- But that doesn’t mean that the ECB is static

ECB’s Rehn: We will take decisions meeting by meeting

- Remarks by ECB policymaker, Olli Rehn

- Must avoid complacency over inflation outlook

- Must focus on keeping inflation expectations at 2%

Asia-Pacific & World News

World Bank Trims 2025 Global Growth Forecast, Warns of Weakest Decade in 60+ Years

The World Bank has revised its 2025 global growth forecast downward by 0.4 percentage points, citing mounting economic headwinds across advanced and emerging economies.

- Global Growth (2025): Now seen at 2.4%

- US: Forecast cut by 0.9 pp to 1.4%

- Eurozone: Downgraded to 0.7% from 1.0%

- Advanced Economies: Trimmed to 1.2% from 1.7%

- Emerging & Developing Economies: Reduced to 3.8% from 4.1%

- China: Left unchanged at 4.5%, with the Bank noting Beijing has “ample fiscal room”

The World Bank also cut its 2026 global outlook by 0.4 percentage points. It warned that the 2020s could end up marking the slowest decade for global growth in more than 60 years.

China Signals Stronger EU Ties as US Tensions Linger

China’s Vice President Han Zheng emphasized Beijing’s intent to deepen cooperation with the EU during meetings in France, including a sit-down with President Emmanuel Macron.

The Chinese Foreign Ministry said Han reiterated China’s readiness to broaden engagement across new sectors with Europe. At the UN Ocean Conference, Han highlighted China’s plans for multilateral environmental collaboration, particularly in support of small island and developing nations.

His presence was also framed as a gesture of support for both the UN and France, amid broader diplomatic recalibrations in light of US trade tensions.

Nomura expects a rebound in China’s US-bound exports in June

- Nomura:

Nomura expects a rebound in China’s U.S.-bound exports in June, citing a surge in container bookings and freight rates as signs of a recovery following recent trade disruptions.

- The logistics network, disrupted by a near trade embargo, is expected to take several weeks to normalize, contributing to a delayed but stronger pickup in exports.

- Risks remain, with Nomura warning of a potential pullback once the current 90-day tariff suspension expires in mid-August.

- Despite the short-term rebound, the bank maintains a cautious full-year outlook, forecasting export growth to slow to around 0% in 2025, down from 5.8% last year, with exports expected to weigh on GDP.

PBOC sets USD/ CNY reference rate for today at 7.1840 (vs. estimate at 7.1853)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 198.6bn yuan via 7-day reverse repos at 1.40%

- 454.5bn yuan mature today

- net drain is 255.9bn yuan

Australian Consumer Sentiment Rebounds, But Pessimism Persists

Westpac’s consumer sentiment index rose by 0.5% in June to 92.6, up slightly from May’s 92.1. Though improved, the reading remains below 100—meaning pessimists still outnumber optimists.

Year-on-year, sentiment is up 10.8%. The survey summary credits falling inflation and anticipated rate cuts as positives, but notes that slow domestic growth and global trade tensions continue to weigh on household confidence.

Notably, consumers showed stronger intent to spend as the cost-of-living pressure eased, although overall risk aversion remained elevated.

Australian Business Confidence Rises Despite Conditions Slipping to Multi-Year Low

In May 2025, Australia’s business confidence bounced back into positive territory, rising to +2 from April’s -1, according to NAB’s latest survey. However, business conditions deteriorated sharply, slipping to 0—down from +2 last month and well below the long-run average of +6.

This marks the lowest reading for conditions in four and a half years. Sub-index data show:

- Sales: +5, down from +6

- Employment: Flat at 0, down from +4

- Profitability: Held steady at -4

NAB chief economist Sally Auld

- “By industry, the persistent weakness in retail business conditions and confidence aligns with the softer-than-expected pick-up in consumption over Q1”

- “Our measures of profitability and trading conditions are notably weaker in retail than other industries”

- ‘Overall, this survey highlights that business conditions remain weak amid ongoing profitability pressures and soft demand, with signs of a further softening in labour demand.’

- “We will watch whether there is a more sustained softening in labour demand, with the employment index easing to below average levels”

NZ Finance Minister Presses RBNZ to Scrap Long Policy Break

New Zealand Finance Minister Nicola Willis is pushing for a revamp of the Reserve Bank of New Zealand’s meeting calendar. She wants the central bank to hold rate-setting meetings eight times per year—up from the current six.

Currently, the RBNZ takes a 12-week summer break with no meetings, a schedule Willis argues is out of step with other major central banks. Treasury advice supports the move, citing improved policy responsiveness.

The RBNZ hasn’t officially commented but has noted it can call unscheduled meetings if needed.

Japan PM Ishiba, US President Trump to hold bilateral talks on the sidelines of G7 summit

- The summit will take place from June 15 to 17 in Canada.

Japan PM Ishiba, US President Trump to hold bilateral talks on the sidelines of G7 summit in Canada.

Japanese media, Kyodo, with the report.

Japan Finance Minister Kato says will conduct fiscal policy appropriately

- Kato says need a variety of investors to hold Japanese Government Bonds

- Says will appropriately conduct fiscal policy

- Need for a variety of investors to hold JGBs

- Need to broaden investors in Japanese Government Bonds

- Need to start promoting domestic ownership of JGBs

Now (via Reuters):

- Japanese Finance Minister Kato said on Tuesday that the government will conduct appropriate debt management policies while communicating closely with market participants.

- Tokyo may cut super-long bond issuance and explore buybacks to manage rising yields.

- “It’s important for the government to make efforts to ensure a variety of investors buy and own government bonds, at a time when the Bank of Japan tapers its bond purchases,” Kato said

- Reuters reported on Monday that the government is considering buying back some super-long bonds it issued at low interest rates, on top of an expected government plan to trim issuance of super-long bonds in the wake of sharp rises in yields.

Bank of Japan Governor Ueda says Bank has limited room to support growth with rate cuts

- Bank of Japan Governor Ueda cutting the legs out from the yen

- If economy, prices come under strong downward pressure, BOJ has limited room to underpin growth with rate cuts with short-term rate still at 0.5%

- Underlying inflation still below 2%

- BOJ keeping real interest rate negative so underlying inflation achieves 2%, and keeps inflation sustainably and stably at 2%

- We will raise interest rates if we have enough confidence that underlying inflation nears 2% or moves around 2%

Crypto Market Pulse

XRP Falters Despite Ripple’s $5M APAC Blockchain Expansion

XRP’s upward momentum took a pause Tuesday, falling 2% to $2.27, despite Ripple announcing a $5 million funding boost for blockchain research across the Asia-Pacific region.

The new funding will expand Ripple’s University Blockchain Research Initiative (UBRI) across six countries, including:

- South Korea: $1.1M grant to Korea University

- Japan: Renewed partnership with Kyoto University, $1.5M allocated

- Singapore: $3M to Nanyang Technological University, partnered with NUS

- Taiwan & Australia: Newly added grant recipients

Despite rising Open Interest (+5%) and a surge in volume to $5.2B, XRP remains under pressure. Technical indicators like RSI are flat at the midpoint, and the token is struggling to stay above key EMAs. A break below $2.25 could trigger a fall toward the $2.08 level.

Meta Eyes $15B Stake in Scale AI, Boosting AI Token Market

Meta is reportedly closing in on a $15 billion deal for a 49% stake in Scale AI, a leading data-labeling startup valued at $30 billion. The move would further cement Meta’s ambition to lead in AI innovation.

The acquisition would give Meta greater control over one of the most critical aspects of AI training: data labeling and model evaluation. Scale AI’s CEO, Alexandr Wang, is expected to take a leading role in Meta’s new AI research division focused on superintelligence.

Crypto tokens in the AI space surged on the news:

- AIOZ Network (AIOZ) and Akash Network (AKT) led gains

- Sector Market Cap: ~$30B

- Top Tokens: Bittensor (TAO), Internet Computer (ICP), Near Protocol (NEAR)

Meta’s broader AI investment strategy is set to hit $72 billion, with infrastructure taking up the largest chunk.

Bitcoin Clears Resistance, Sets Stage for Potential All-Time High

Bitcoin broke through a major resistance level, igniting bullish momentum and putting new record highs in sight. The breakout follows easing trade tensions and improving global growth sentiment, which have fueled broader risk appetite.

Three risks remain: potential failure of Trump’s tax plan, renewed tariff battles after July, or a CPI shock that reignites hawkish Fed bets. The US CPI data due tomorrow could be a key trigger. A cooler print may support further gains, while a hot number could send BTC back toward the $100,000 level.

Technical charts now show BTC riding a clear uptrend. Pullbacks into the trendline could offer re-entry for bulls, while bears will be eyeing a break below that support.

Cardano’s DeFi Push with Cardinal Protocol Doesn’t Boost Price Past $0.70

Cardano (ADA) stalled below $0.70 despite the debut of its Cardinal Protocol—the network’s first Bitcoin-focused DeFi platform. ADA recovered from $0.62 but failed to maintain momentum, trailing behind Ethereum and Bitcoin in performance.

The Cardinal Protocol enables wrapped BTC via NFTs using Bitcoin Ordinals, offering instant redemption and smart contract integration. Unlike most Bitcoin bridges, Cardinal doesn’t rely on third-party liquidity and employs advanced verification tools like MUSIG2 and Mithril.

Though the tech has promise, the ADA price failed to respond, reflecting potential investor hesitation or profit-taking amid broader market rotation.

TRX Defies Slumping TVL with Breakout Toward $0.32

Tron (TRX) posted gains for a second straight day, rising over 1% despite a significant drop in Total Value Locked (TVL) across its ecosystem. TVL on the network has fallen from $6.51 billion to $4.91 billion this month, largely due to declining lending activity.

Open Interest in TRX derivatives is climbing, hinting at speculative momentum even as DeFi engagement declines. The divergence between token price and TVL has persisted through 2024 and could continue to support the rally if sentiment holds.

Ether Gains Momentum, S&P Rallies on Trade Optimism

Bitcoin has lagged behind both the S&P 500 and Ethereum as capital rotated into ETH and US stocks. Ethereum ETFs saw $812 million in inflows over the past two weeks, marking the biggest surge of the year.

Meanwhile, concerns over stablecoin regulation and political entanglement—particularly Donald Trump’s growing association with crypto—have weighed on Bitcoin sentiment.

That said, renewed accumulation by Strategy, which now holds 582,000 BTC worth nearly $64B, helped revive Bitcoin’s rally. Correlation with risk assets like the S&P 500 has also rebounded as market sentiment improves on US-China trade progress.

Bitcoin is nearing its all-time high of $112K. A breakout would likely trigger new inflows and extend the bull trend.

The Day’s Takeaway

United States

- Stocks Finish Higher, Led by Nasdaq:

US markets closed firmly in the green. The Nasdaq climbed 0.63% to 19,714.99, with the S&P 500 up 0.55% and the Dow gaining 0.25%. Tech stocks led the rally, supported by optimism over US-China trade talks. Intel surged nearly 8%, and Tesla rebounded 5.67%. - Small Business Optimism Beats Expectations:

The NFIB Small Business Index rose to 98.8 in May, above forecasts. Owners grew more optimistic about future conditions, though concerns about taxes rose to their highest level since 2020. - World Bank Cuts US Growth Forecast:

The World Bank lowered its 2025 US growth outlook to 1.4%, down 0.9 percentage points. The 2026 forecast was also trimmed amid global economic downgrades. - Treasury Auction Shows Soft Demand:

A $58B auction of 3-year notes drew a high yield of 3.972%, with a slight positive tail and weaker-than-average bid-to-cover ratio. Domestic and foreign demand was steady but uninspired. - Fed Rate Cut Expectations Shift to Q3:

A Reuters poll found 59 of 105 economists expect the Fed to start easing in September, with most anticipating two cuts in 2025. Growth is forecast at 1.4% for the year.

Commodities

- WTI Oil Prices Lifted by Trade Hopes:

Crude prices rose for a fourth consecutive session, breaking above $64.00. Progress in US-China trade talks helped drive demand optimism, lifting sentiment across the energy sector. - Gold Holds Steady Ahead of CPI and Amid Iran Tensions:

Gold remained near $3,300 as traders weighed improving US-China trade dialogue against rising nuclear concerns with Iran. The US Dollar held firm, with CPI data expected to guide short-term direction. - API Shows Smaller-Than-Expected Crude Draw:

Private inventory data showed a 370K-barrel decline in crude stocks (vs. +700K expected), with large builds in gasoline and distillates. Cushing stocks fell by 728K barrels. - EIA Trims 2026 US Oil Production Outlook:

The agency held its 2025 forecast at 13.42 mbpd but cut 2026 to 13.37 mbpd due to falling rig activity and weaker prices. Global demand was also revised slightly lower.

Europe

- Eurozone Investor Confidence Turns Positive:

The Sentix index rebounded to +0.2 in June, beating expectations. Germany’s sub-index hit a two-year high at -5.9, suggesting post-tariff recovery in sentiment. - EU Pushes for Tighter Russian Oil Cap:

The European Commission proposed lowering the Russian oil price cap to $45 from $60 in its 18th sanctions package, adding pressure to Russian energy revenues.

Asia

- World Bank Cuts Asia Growth Forecasts, Keeps China Steady:

While China’s 2025 outlook stayed at 4.5%, the broader emerging Asia forecast was cut to 3.8% from 4.1%, signaling a more cautious view on regional growth.

Crypto

- Ripple Deepens Investment in APAC:

Ripple committed $5 million to blockchain research grants across six countries, including South Korea, Japan, Singapore, Taiwan, and Australia. Despite the move, XRP struggled to maintain upward momentum as risk appetite faded. - Bitcoin Clears Resistance with Eyes on CPI:

BTC broke through key resistance levels and is approaching all-time highs. A soft US CPI reading could fuel further gains, while a hot print may trigger a correction. - Cardano’s BTC DeFi Launch Fails to Impress Traders:

ADA unveiled its Cardinal Protocol for wrapped Bitcoin DeFi, but price action remains capped below $0.70, with technicals showing consolidation. - TRX Rallies Despite TVL Collapse:

Tron extended its rally, though its Total Value Locked fell sharply. Rising open interest suggests derivatives-driven bullish momentum despite weaker fundamentals. - Meta’s AI Deal Sparks Token Surge:

Meta’s proposed $15B investment in Scale AI boosted sentiment in AI-focused tokens like AIOZ and AKT. The sector now boasts a combined $30B market cap. - ETH Outshines BTC as ETF Inflows Surge:

Ethereum ETFs saw $812M in inflows over two weeks, while Bitcoin lagged amid political noise and regulatory questions. Strategy’s BTC accumulation remains a bullish anchor.