North America News

Markets Deliver Crushing Reversal as Tariff Hardline Backfires

Headline:

Stocks Collapse as White House Brags About 104% Tariffs, Market Loses Faith in Policy Direction

The stock market gave up massive early gains Tuesday, closing sharply lower as investors reacted to the White House’s confirmation that 104% tariffs on Chinese goods will take effect at midnight.

The Nasdaq Composite fell 335 points (-2.01%), but that undersells the drama: it was up 713 points at session highs. The S&P 500 dropped 1.57% (-79.48 pts), after being up 205 points. The Dow closed down 320.01 points, after a stunning 1,461-point intraday gain.

The catalyst? WH Press Secretary Levitt proudly confirmed the tariff escalation, delivering the message with what traders described as “tone-deaf confidence.”

Investor optimism around a short-term trade resolution evaporated. The market is increasingly worried the administration is prioritizing ideology over economic practicality. “There’s no plan here except ‘build everything in the U.S., or else,’ and Wall Street sees through it,” one strategist noted.

All 11 S&P sectors flipped red by the close. Materials (-3.0%) and Consumer Discretionary (-2.5%) led losses. Even tech darlings got hit hard: Apple fell 5.0%, and NVIDIA, down 1.4%, had been up over 8% earlier in the day.

Treasury markets also reversed hard. The 10-year yield jumped 11 bps to 4.26%, after dipping to 4.17% earlier.

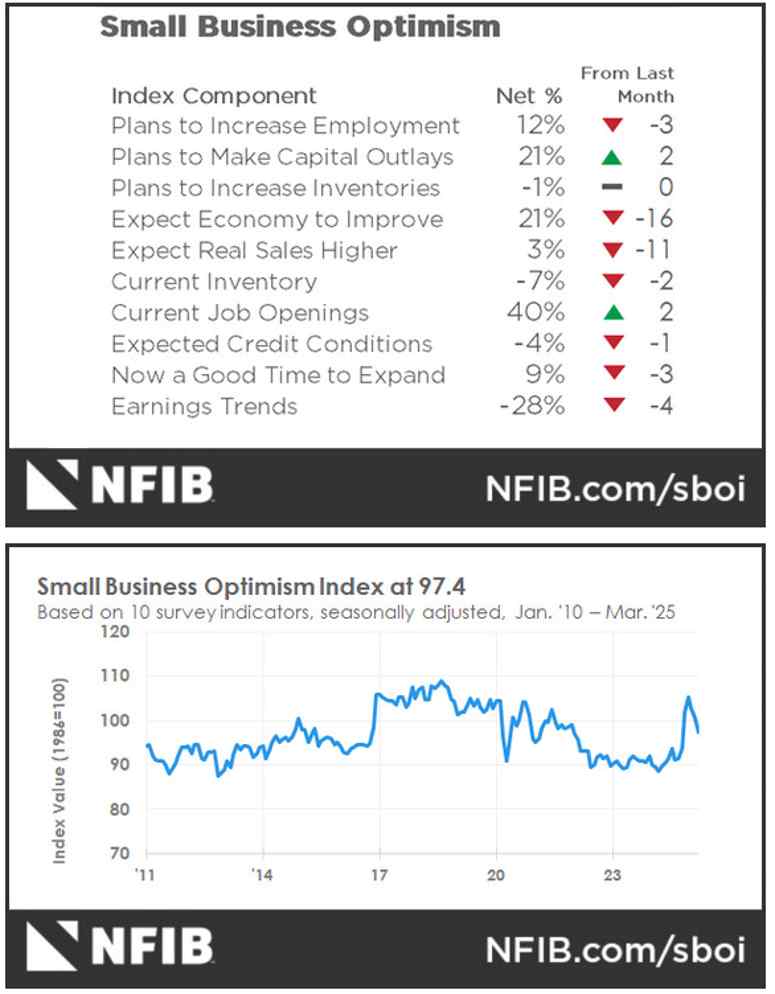

There were no major data points besides the NFIB Small Business Optimism Index, which fell to 97.4, down from 100.7 in February — a further sign confidence is cracking.

YTD Performance:

- Nasdaq Composite: -20.9%

- S&P 500: -15.3%

- Dow Jones: -11.5%

- Russell 2000: -21.1%

- S&P Midcap 400: -17.9%

Tuesday’s message from the market? Economic nationalism might sell politically — but the market’s not buying it.

Poor Demand for U.S. 3-Year Notes as Auction Tails

The U.S. Treasury’s $58 billion auction of 3-year notes came in weak.

High yield was 3.784%, above the 3.76% WI level. The bid-to-cover ratio fell to 2.47x from a six-month average of 2.62x.

Domestic buyers accounted for just 6.2% (vs 19.3% avg), while international demand rose to 73%. Dealers were left holding more than usual at 20.7%.

Overall: A soft auction with low U.S. participation and a clear demand premium.

U.S. Small Business Optimism Falls More Than Expected in March

The NFIB small business optimism index dropped to 97.4 in March, well below the 101.3 expected and down from 100.7 in February.

NFIB Chief Economist Bill Dunkelberg said uncertainty from new policies is weighing on sentiment.

“Small business owners are adjusting expectations,” he said, noting lowered sales growth outlooks amid the policy shake-up.

Fed’s Goolsbee: Tariffs Are Hitting Harder Than Expected

Chicago Fed President Austan Goolsbee warned that tariffs are proving more damaging than the Fed’s earlier models suggested.

He highlighted uncertainty over how fast costs are passed to consumers, potential bankruptcies among suppliers, and tanking sentiment.

He noted businesses are hesitant to invest amid policy volatility, and consumer anxiety is growing. “The Fed has to take the longer view,” he said, even as economic conditions deteriorate.

USTR Greer Downplays Tariff Inflation, Eyes China Uranium Ban

U.S. Trade Rep. Greer pushed back on concerns that tariffs cause consumer inflation, citing the Trump-era experience.

He dismissed Wall Street’s job-loss projections as status quo bias and said the Commerce Department is considering a Section 232 probe into critical minerals.

A possible ban on Chinese uranium imports is also being discussed.

His tone: tariffs may not hurt consumers directly, but the broader trade shift is real.

Trump Highlights South Korea Trade Talks, Awaits Call from China

Trump posted on Truth Social touting a “great call” with South Korea’s Acting President. He mentioned key topics like tariffs, LNG deals, and military cost-sharing.

He hinted at upcoming negotiations with China, saying “we are waiting for their call” and framing the process as “one-stop shopping” for U.S. trade goals.

The post suggests Trump is publicly inviting China to re-engage.

Fed’s Daly: We have time to tread slowly and carefully on policy

- Daly says policy is modestly restrictive

- We have time to tread slowly and carefully on policy

- Fed policy is in a very good place

- Don’t have complete clarity on tariffs

- Important to stay steady and think about the net effect of administration’s slate of changes

- A little concerned inflation may pick back up from tariffs

- Businesses are optimistic about growth

- CEOs feel uncertain

Morgan Stanley Trims U.S. Growth Outlook to 0.8%, Stops Short of Recession Call

Morgan Stanley has cut its 2025 U.S. GDP forecast to 0.8%, down from 1.5%.

The firm still doesn’t expect a recession, but admits the line between weak growth and contraction is getting thinner.

“Risks are rising,” the note said, “but we’re not forecasting a full downturn yet.”

US Bessent: Tariff negotiations are the result of massive inbound calls, not markets

- US Treasury Secretary, Scott Bessent in a CNBC interview

- Tariff negotiations are the result of massive inbound calls, not markets.

- On VAT tax with Europe everything is on the table.

- Trump will be personally involved in negotiations.

- Tariffs will be a melting ice cube if successful.

- Have discussed which country to prioritise.

- If there are solid proposals, we can end up with good deals.

- As part of calculus with deals, some part of tariffs may stay on.

- China’s escalation was a big mistake.

- I was not involved in the calculations of the numbers.

- Trump is committed to fixing trade imbalances.

Gundlach: “No Way” Trump Pulls Back Now

DoubleLine’s Jeff Gundlach doesn’t believe Trump will back off. In a CNBC interview, he said:

- The bond market is going through a painful deleveraging.

- Forced selling is happening—and not done yet.

- The Fed won’t cut but may expand the balance sheet.

- Recession odds are rising.

- Long yields could climb even in a recession.

- Tariff escalation is here to stay: “No way” Trump delays.

BoA Cuts S&P 500 Target, Warns of 10% Earnings Hit

Bank of America now sees 2025 S&P 500 earnings falling by 10% due to tariffs—9% from U.S.-China friction, and 1% from Canadian retaliation.

The bank cut its year-end S&P 500 target to 5,600, with a projected trading range of 4,000–7,000 due to heightened uncertainty and rising discount rates.

Bessent says expects no trade deals by April 9, tariffs to hit then

- US Treasury Secretary Bessent is one of Trump’s minions

Treasury Secretary Scott Bessent

- says the U.S. will not likely have any trade deals in place by April 9th

- thus will not avoid the retaliatory tariffs going into effect

US Chamber of Commerce weighing a lawsuit to block new Trump global tariffs

- Arguing that Trump is improperly using emergency powers

The U.S. Chamber of Commerce is weighing a potential lawsuit against the Trump administration in a bid to block a new round of global tariffs set to take effect Wednesday.

Pressured by major corporate members, the Chamber may argue that President Trump improperly used emergency powers under the International Emergency Economic Powers Act (IEEPA) to justify the measures. Fearing retaliation, many businesses are reluctant to speak out directly and are instead pushing trade associations to take the lead.

Proposed U.S. shipping rules could disrupt trade and ports, industry warns – From April 17

- Steep fees—up to US$1.5 million per port call—on vessels made in China or owned by carriers with such ships

The U.S. Trade Representative is expected to introduce steep fees—up to $1.5 million per port call—on vessels made in China or owned by carriers with such ships, starting April 17. In response, ocean carriers may skip smaller U.S. ports or shift capacity to other trade lanes entirely.

This could hurt jobs and raise costs for businesses relying on ports like Seattle, Oakland, and Baltimore, while overloading major hubs like LA and New York. A separate rule would require 15% of U.S. exports to ship on American-made, U.S.-crewed vessels within seven years—despite the country having just 23 such small, domestically focused ships.

Critics warn the plan could undermine U.S. exporters, worsen supply chain issues, and conflict with the broader goal of re-industrializing the economy.

Canada’s March Ivey PMI Falls to 51.3, Points to Slower Growth

Canada’s Ivey PMI slipped to 51.3 in March from 55.3 in February, indicating a slowdown in business activity.

The non-seasonally adjusted figure rose to 55.6 from 53.6, showing some month-to-month variation, but overall momentum appears to be fading.

Commodities News

Silver Spikes to $30.50 on Rising U.S.-China Trade War Tensions

Silver rallied to near $30.50 on Tuesday as investors sought safety amid worsening trade war rhetoric between the U.S. and China.

Trump threatened a 104% tariff on Chinese goods after Beijing hit U.S. imports with a 34% retaliatory tariff. China’s Commerce Ministry vowed to “fight to the end,” stoking fears of prolonged conflict.

While silver’s safe-haven appeal strengthened, its industrial demand outlook weakened, as China — the world’s manufacturing hub — plays a key role in EVs, electronics, and solar, all major silver-consuming sectors.

Technical indicators show silver remains below its 200-day EMA at $30.70, with key support at $26.45 and resistance at $32.00. The upcoming March CPI data will be crucial in shaping silver’s next move.

Copper Slides 15% Since April 2, Market Turns Bearish

Copper prices have plunged over 15% since April 2, with tariff-driven demand fears and excessive long positioning on COMEX fueling the sell-off, according to Commerzbank’s Barbara Lambrecht.

The price recovered some ground Tuesday but still closed 10% down. At the Cesco copper conference in Chile, sentiment was mixed: Cochilco took a cautious view, citing trade risks, while state producer Codelco remained optimistic, reporting a slight Q1 output increase and reaffirming its 1.4M ton annual target.

The correction follows a period of overheated bullish positioning, now cooling fast as U.S.-China tensions threaten global demand.

OPEC+ Maintains Output Plan, Oversupply Fears Loom

OPEC+ is sticking to its planned 411,000 bpd production increase in May, despite recent price pressure and signs of weakening demand.

At its latest JMMC meeting, the group focused only on compliance and overproduction corrections, asking members to submit adjustment plans by April 15.

No mention was made of adjusting the upcoming production hike, increasing the risk of short-term oversupply, according to Commerzbank’s Carsten Fritsch. The next full OPEC+ meeting is scheduled for May 28, though an emergency session could be called.

Netanyahu: Only U.S.-Led Destruction of Iran’s Nuclear Program Is Acceptable

Israeli PM Benjamin Netanyahu took an ultra-hawkish stance on Iran, saying only a U.S.-executed demolition of Iran’s nuclear facilities would satisfy Israeli security concerns.

“If that doesn’t happen, a military option must be used,” he said in a video released by his office.

Markets have largely ignored this, but the risk of conflict in the Middle East may be underestimated.

US energy Sec Wright heads to Middle East for a 2 week visit

- Saudi Arabia, Qatar, UAE on the itinerary

U.S. Energy Secretary Chris Wright will visit the UAE, Saudi Arabia, and Qatar for nearly two weeks,

- focusing on global energy stability, U.S. investment opportunities, and lowering production costs.

The trip follows President Trump’s announcement of direct talks with Iran and comes amid low oil prices and rising global trade tensions. Wright will meet regional leaders, tour energy sites, and discuss potential investments and energy cooperation.

Europe News

France February Trade Deficit Widens More Than Expected

France’s trade deficit rose to €7.87 billion in February, worse than the €5.85 billion expected, according to data from the Finance Ministry.

The prior month’s deficit was revised slightly to €6.49 billion from €6.54 billion. Exports were largely unchanged, while imports rose 2.4% month-over-month on a seasonally adjusted basis, widening the gap.

German Economic Institute Slashes 2025 Growth Forecast to Just 0.1%

Germany’s GDP outlook just got gloomier. The German Economic Institute has cut its 2025 forecast from +0.8% to a barely-there +0.1%, according to Reuters.

It’s another signal that Europe’s largest economy is being hit hard by global trade tensions and weak internal demand.

UBS Cuts Eurozone 2025 Growth Forecast to 0.5%

UBS has slashed its 2025 Eurozone GDP forecast from 0.9% to 0.5%, citing fallout from U.S. tariffs and slowing global trade.

Germany is expected to take the biggest hit, while France is seen as relatively insulated.

With tariffs starting to bite, more cuts to global growth forecasts are likely. Despite current pressures, UBS notes that Europe held up better than expected last year—a small silver lining.

JPMorgan Expects Four Straight ECB Rate Cuts, Sees Terminal at 1.50%

JPMorgan is going against consensus, predicting the ECB will cut rates at each of its next four meetings, bringing the deposit rate to 1.50% by September.

The current market expectation is for around 64 basis points of easing by then. JPMorgan argues that the economic drag from Trump’s trade war could wipe 1.5 percentage points off Eurozone GDP by the end of 2026, forcing the ECB to act more aggressively.

Italy’s PM Meloni: Will be in Washington on April 17 to discuss tariffs with Pres. Trump

Italy’s Prime Minister Meloni:

- Will be in Washington on April 17 to discuss tariffs with Pres. Trump.

- Italy’s government plans to use €14 billion in EU post Covid funds to help firms cope with negative impact of US tariff

- Plans to use €11 billion in cohesion funds to offset the impact of US tariff policy.

EU’s von der Leyen Talks Trade With China’s Premier

European Commission President Ursula von der Leyen held a phone call with Chinese Premier Li Qiang, calling for a negotiated solution to trade tensions sparked by U.S. tariffs.

She described the current climate as “widespread disruption” and raised concerns about trade diversion, especially in oversupplied sectors.

Both sides acknowledged the need to avoid further escalation.

ECB’s Nagel: Global growth prospects have deteriorated massively

- Bundesbank Chief Nagel is speaking

- Global growth prospects have deteriorated massively.

- At the upcoming meeting we will make responsible decisions.

- Europe must stand closer together.

- Monetary policy in Europe will play its part in this.

- Financial market volatility will likely persist.

ECB’s Simkus: 25 bps rate cut needed in April

- Remarks by ECB policymaker, Gediminas Šimkus

- 25 bps rate cut needed in April.

- US tariff announcement warrants more accomodative monetary policy.

- We need to move to a less restrictive policy stance.

- Worsening of trade tensions can be deflationary in the medium term.

- Policy is currently still more restrictive rather than neutral.

- Even with another cut, will still only be at the upper bound of neutral interval.

- US tariffs announcement much more disappointing that anticipated.

- Undershooting risk already up before April 2, must carefully monitor.

- In the medium term, undershooting or being at target is more probable than overshooting.

- In June, let’s see what has changed since April, then decide whether to cut again.

- I see no need to talk about 50 bps. That would be too much. We are not behind the curve.

ECB’s de Guindos: We are in a moment of anxiety and uncertainty

- Remarks by ECB vice president, Luis de Guindos

- We are in a moment of anxiety and uncertainty.

- I’m relatively optimistic US tariffs are a wake up call for Europe.

UK’s Reeves: Our first priority is not to create more trade barriers, but to reduce them

- Comments from UK’s Finance Minister Rachel Reeves

- Our first priority is not to create more trade barriers, but to reduce them.

- Nothing is off the table on tariffs.

- I will be meeting US Treasury Secretary Bessent shortly.

- Trump tariffs will have huge implications for the world economy, as seen in global markets.

- Fiscal rules are non-negotiable.

- I will hold talks with Indian Finance Minister as we hope to secure a trade deal with India.

Asia-Pacific & World News

Global Bank Chiefs Huddle on Tariff Fallout

Top bank executives from BofA, Barclays, Citi, and HSBC held emergency weekend talks about the economic chaos sparked by Trump’s latest tariff blitz, according to Sky News.

The call focused on worsening liquidity, falling asset prices, and growing fears of a global downturn. Markets have been in freefall as the U.S.-China trade war spirals.

Citi Slashes China 2025 Growth Forecast to 4.2%

Citi has lowered its China growth projection for 2025 to 4.2%, down from 4.7%, warning that U.S. tariffs could cut Chinese exports by over 15% this year.

This comes as Beijing aims for a 5% GDP target and prepares countermeasures to cushion the hit.

The downgrade underscores how hard external shocks are pressing on China’s already strained recovery.

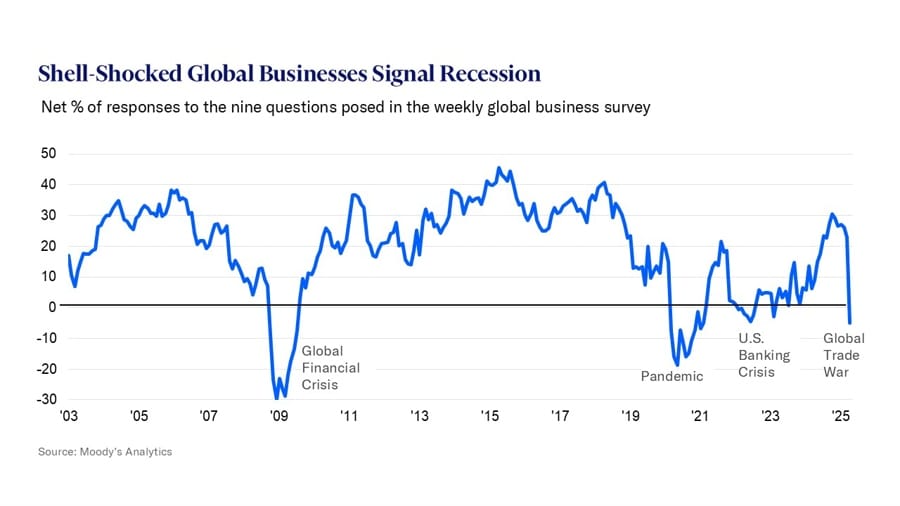

Moody’s: Tariff Shock Crashes Global Business Confidence

Moody’s says business confidence has collapsed to levels only seen during the 2008 crisis, COVID crash, and the 2023 U.S. banking turmoil.

For just the fourth time in 20+ years of surveys, every single business sentiment metric turned negative. Chief Economist Mark Zandi warns that unless confidence rebounds fast, a global recession is likely. Probability now: 60%.

Chinese State Firms Ramp Up Stock Purchases

Chinese state firms are piling into stocks and ETFs to halt the market slide.

China Chengtong Holdings and China Reform Holdings (Guoxin) announced major investments, following Huijin’s lead. Guoxin will inject 80 billion yuan (US$10.95B), with a focus on tech and SOEs.

The buying spree follows a brutal Monday session that saw the Shanghai Composite drop 7%. Other firms like China Electronics Technology Group also plan share buybacks to restore confidence.

China to Raise Insurance Fund Allocations to Equities

China’s financial regulator announced a policy shift to let more insurance money flow into the stock market.

The State Administration of Financial Regulation will raise the cap on equity asset allocations, ease restrictions on long-term savings for the elderly, and optimize oversight to better support the economy and capital markets.

Chengtong to Boost Stock and ETF Holdings

China’s state-owned investment firm Chengtong said it will increase its equity and ETF holdings to help stabilize markets.

The company emphasized its faith in China’s long-term growth and said it would focus on state firms and tech plays. It joins a coordinated state push to prevent deeper market turmoil.

PBoC Pledges Support for China’s Market via Huijin

The People’s Bank of China said it will provide lending support to sovereign wealth fund Huijin if needed, signaling direct central bank backing for China’s struggling stock market.

The move comes as Huijin and other state actors step in with large-scale equity purchases to halt a sharp selloff sparked by the U.S.-China tariff standoff.

Huijin Vows to Stabilize Markets, Increase Long-Term Stock Buying

Central Huijin, China’s sovereign fund, promised to act as a market stabilizer and step up long-term investments in domestic equities.

In a Monday statement, the fund called A-share valuations “attractive” and said it would continue deploying patient, long-term capital. The move comes amid a 7% plunge in the Shanghai Composite driven by global trade fears.

China Warns U.S. Over “Blackmail” Tariffs

China’s Commerce Ministry blasted the U.S. over new tariff threats, calling them “a mistake on top of a mistake.”

In a strongly worded statement, Beijing said it would never accept the “blackmail nature” of the U.S. and vowed firm countermeasures if Washington proceeds with the proposed 50% tariffs.

The ministry urged the U.S. to “immediately correct its wrong practices” and cancel all unilateral tariffs, warning that China will “follow it to the end” if the U.S. escalates.

PBOC sets USD/ CNY reference rate for today at 7.2038 (vs. estimate at 7.3321)

- PBOC CNY reference rate setting for the trading session ahead … edging higher (weaker for the yuan)

Australia Consumer Sentiment Plunges in April

Australia’s Westpac-Melbourne Institute Consumer Sentiment Index fell 6% in April to 90.1, from 95.9 in March.

It’s a sharp reversal from last month’s 4% gain. With the index now well below 100, pessimists clearly outnumber optimists—suggesting consumer nerves are fraying amid global tensions.

Australia Business Confidence Slides Pre-Tariffs

Australia’s business confidence dropped to -3.0 in March from -1.0 the month before, according to NAB’s latest survey.

Business conditions, which measure actual activity, edged higher to 4.0 from 3.0. But the data were collected before the recent spike in trade tensions, meaning April could show deeper cracks.

Deutsche Bank is now forecasting a 50bp RBA rate cut in May

- Reserve Bank of Australia next meet on May 19 and 20

Deutsche Bank is now forecasting a 50bp RBA rate cut in May.

The chaos spawned by Trump’s tariff attacks will no doubt prompt a few more such calls in the days and weeks to come.

RBNZ May Cut Rates More Than Expected as Trade War Fears Mount

Markets expect the Reserve Bank of New Zealand to cut its official cash rate by 25 basis points to 3.50% on Wednesday. But deepening global turmoil is raising the odds of a bigger, 50 basis point move.

A Reuters poll of 31 economists, conducted before the recent selloff, unanimously forecast a 25 bps cut. Since August, the RBNZ has already slashed rates by 175 bps to combat weak growth and rising unemployment.

With inflation sitting at 2.2% in Q4—well within the RBNZ’s 1–3% target—former Governor Adrian Orr said in February there was room to ease further. Traders are now betting on up to 100 bps of cuts this year.

The New Zealand dollar, up 5.3% in 2025 until recently, has come under pressure as markets reel from Trump’s tariff escalation. A surprise 50 bps cut could actually lift NZD if it restores confidence.

Bessent says Japan’s non-tariff trade barriers are quite high

- Bessent is US Treasury Secretary Bessent

- Says he has not seen a trade offer from Japan

- Expects Japan to get priority in negotiations because they came forward early

- Japan’s non-tariff barriers are quite high

- We are at maximum tariff levels

- It is my hope that through good negotiations, tariff levels will come down for countries that don’t retaliate

Japan to tap Economy Minister Akazawa for U.S. trade talks: FNN

Prime Minister Shigeru Ishiba will nominate Economy Minister Ryosei Akazawa to lead tariff negotiations with the United States, FNN reported Tuesday.

In other tariff/Japan news, Japan finance minister Kato will set up task forces at finance ministry, Financial Services Agency to deal with issues over U.S. tariffs

Crypto Market Pulse

XRP Slips 3% Despite Ripple’s $1.25B Hidden Road Deal

Ripple announced on Tuesday it will acquire prime brokerage firm Hidden Road for $1.25 billion, aiming to expand its institutional footprint. The move will allow Hidden Road to integrate RLUSD as collateral and leverage the XRP Ledger for post-trade settlement.

Despite the strategic significance, XRP dropped 3% on the day to $1.86, as broader macro pressures weighed heavier than deal optimism.

Ripple stated the acquisition reflects its push to bring institutional-grade infrastructure to crypto. Hidden Road, founded in 2018, services over 300 institutional clients and processed more than $3 trillion in transactions last year. The deal is pending regulatory approval.

The announcement comes just weeks after Ripple and the SEC reached a settlement, ending a multi-year legal standoff.

DOJ Shuts Down Crypto Enforcement Unit, Shifts to Crime-Focused Strategy

The U.S. Department of Justice has dissolved its National Cryptocurrency Enforcement Team (NCET), redirecting focus from regulating crypto platforms to prosecuting criminal abuse.

Deputy Attorney Todd Blanche informed staff that the DOJ will no longer pursue cases against crypto exchanges, wallets, or mixing services unless tied to fraud, terrorism, or organized crime.

The move reflects the Trump administration’s pivot toward pro-crypto policy, reversing the previous strategy of “regulation by prosecution.” Blanche instructed prosecutors to close non-compliant cases and focus on protecting investors, not targeting infrastructure.

The NCET had previously led key cases, including Tornado Cash, Binance, and North Korean crypto laundering schemes.

Apollo Invests Seven Figures in Blockchain RWA Platform Plume

Private equity giant Apollo Global Management has made a seven-figure investment in Plume, a blockchain protocol focused on real-world assets (RWAs). The funding will help Plume scale its infrastructure and expand access to tokenized alternatives.

Plume’s Ethereum-compatible chain supports over 18 million wallets and 200 protocols, targeting tokenization of instruments like bonds, carbon credits, and collectibles.

Apollo’s digital assets head Christine Moy said the investment reflects Apollo’s commitment to “programmable finance” and broader access to institutional-grade products. The partnership underscores growing institutional interest in the RWA space, projected by Ripple/BCG to reach $18.9 trillion by 2033.

The Day’s Takeaway

Day’s Takeaway: Key Market Trends & Developments

United States

- Markets Reverse Sharply Lower

Major U.S. indices closed in the red after a dramatic intraday reversal. Early optimism gave way to risk-off sentiment following confirmation from the White House that 104% cumulative tariffs on Chinese goods will take effect at midnight.- S&P 500: -1.57%, back below the 5,000 level

- Nasdaq: -2.01%, erasing a 700+ point rally

- Dow: -0.9%, after peaking +1,400 intraday

- Tariffs Take Center Stage

WH press secretary’s confident remarks about new tariffs triggered widespread selling, with investors growing increasingly concerned about the economic and earnings impact of trade policy hardening. - Bond Market Wobbles

A poor 3-year Treasury auction saw direct domestic demand collapse to just 6.2%, well below average. International buyers stepped in (73%), but not without a yield concession. The 10-year yield rose to 4.26%, reflecting inflation and supply fears. - Fed Sounding the Alarm

Fed’s Goolsbee said tariffs are hitting harder than modeled, causing business anxiety and weakening sentiment. The Fed is unsure how to respond to what now appears to be a persistent supply shock. - DOJ Pivots on Crypto

The Department of Justice disbanded its crypto enforcement unit, refocusing efforts away from industry crackdowns and toward criminal use cases. This aligns with the broader Trump administration pivot toward pro-digital asset policies. - Corporate Caution Mounts

Small business optimism (NFIB Index) fell to 97.4, a three-point drop from last month. Business owners cite uncertainty around new policy priorities and trade disruptions.

Canada

- Ivey PMI Shows Slowing Momentum

March Ivey PMI fell to 51.3, down from 55.3 in February, indicating a slower pace of expansion in the private sector. The non-seasonally adjusted print was slightly better at 55.6. - Market Sensitivity Rising

Canada remains heavily exposed to global trade risks, commodity pricing swings, and spillovers from U.S. economic policy, especially given the softening demand outlook in key export markets.

Commodities

- Oil Faces Supply-Demand Imbalance

OPEC+ confirmed it will proceed with its planned May production increase of 411,000 bpd. Without new cut commitments, Commerzbank warns of a short-term oversupply risk. Prices remain under pressure. - Silver Surges on Safe-Haven Demand

Silver climbed to $30.50, boosted by U.S.-China trade war escalation. The metal’s safe-haven appeal outweighed weakness in its industrial use case. All eyes are on Thursday’s U.S. CPI for the next catalyst. - Copper Suffers a Sharp Correction

Copper dropped over 15% since April 2, as overheated positioning met a sudden macro repricing. Despite a minor rebound, bearish sentiment dominates. The mood at Cesco Chile is mixed — long-term demand solid, but near-term risks mounting.

Europe

- ECB Policy Path Recalibrated

JPMorgan now expects four consecutive ECB cuts, bringing the terminal rate to 1.50% by September. This deviates from the market’s baseline of ~64bps of easing by then. The bank sees a 1.5pp GDP drag from the Trump trade war by end-2026. - Germany Slips Toward Stall Speed

Germany’s Economic Institute cut its 2025 GDP forecast to just +0.1%, down from +0.8%. High exposure to global trade makes it particularly vulnerable. - France Trade Data Disappoints

February trade deficit widened to €7.87B, above the expected €5.85B. Imports rose 2.4% while exports stagnated. - EU-China Talks Emphasize De-escalation

EC President von der Leyen urged China to pursue a negotiated resolution to avoid trade diversion and escalation, following a call with Premier Li Qiang.

Asia-Pacific

- China Growth Outlook Downgraded

Citi cut China’s 2025 GDP forecast to 4.2% (from 4.7%), citing potential for a 15% hit to exports from U.S. tariffs. Beijing had originally targeted 5% growth. - Australia Data Weakens

- Business Confidence (March) fell to -3.0

- Consumer Sentiment (April) dropped 6% to 90.1

Sentiment was captured before the latest wave of global trade volatility, indicating further softness ahead.

- New Zealand Rate Decision on Deck

RBNZ is widely expected to cut 25bps Wednesday, but growing expectations point to a possible 50bps cut, especially as the NZD weakens on tariff fallout.

Rest of World

- Netanyahu Talks Tough on Iran

The Israeli PM said any Iran nuclear deal must include the complete destruction of facilities — hinting at military action if diplomacy fails. Markets have largely ignored the headline, but geopolitical risk may be underpriced. - Private Capital Eyes Blockchain Infrastructure

Apollo Global invested seven figures in Plume, a modular blockchain focused on real-world asset tokenization. This adds to momentum in institutional adoption of programmable alternatives.

Crypto & Digital Assets

- XRP Slips 3% Despite $1.25B Hidden Road Acquisition

Ripple announced the acquisition of Hidden Road to expand institutional access and embed its RLUSD stablecoin and XRPL ledger. However, XRP fell to $1.86 as broader macro stress overwhelmed the bullish narrative. - DOJ Ends Crypto Crackdown Unit

The National Cryptocurrency Enforcement Team (NCET) has been shut down. The DOJ will no longer pursue cases against exchanges and mixers unless linked to criminal activity. This marks a major regulatory shift under the Trump administration. - Real-World Asset Momentum Grows

Plume’s deal with Apollo, and bullish forecasts for tokenized asset markets (projected $18.9T by 2033), signal a clear trend toward institutional blockchain infrastructure.