North America News

US Stock Indices Close Sharply Lower for the Day and Week

Major US stock indices ended the session in the red, with tech stocks leading the decline as the Nasdaq fell -1.36%. The Dow and S&P 500 also dropped nearly -1%, marking their second consecutive weekly loss.

Closing Market Performance – Friday’s Sell-Off

- Dow Jones: -444.23 points (-0.90%), closing at 44,303.40

- S&P 500: -57.58 points (-0.95%), closing at 6,025.99

- Nasdaq Composite: -268.59 points (-1.36%), closing at 19,523.40

- Russell 2000: -27.41 points (-1.19%), closing at 2,279.70

Weekly Performance – Second Straight Week of Losses

- Dow Jones: -0.54%

- S&P 500: -0.24%

- Nasdaq Composite: -0.53%

- Russell 2000: -0.35%

Market Drivers & Outlook

- Tech stocks faced the steepest losses, dragging the Nasdaq lower.

- Rising bond yields and macroeconomic uncertainty weighed on investor sentiment.

- Earnings season continues next week, with key reports from McDonald’s, Shopify, Coca-Cola, and Moderna, which could set the tone for broader market direction.

With equities struggling for momentum, traders will look to economic data, Fed policy signals, and corporate earnings for further market direction.

US consumer credit for December $40.85B vs $12.35B estimate

- US consumer credit for December

- Prior month -$7.49 B revised to -$5.37%

- US consumer credit for December came in higher than expected at $40.85B vs $12.35 B est.

- Revolving credit +$22.9B vs -$13.9B last month

- Nonrevolving credit +$18.0B vs +$8.5 B last month

US February prelim UMich consumer sentiment 67.8 vs 71.1 expected

- The first look at February US consumer sentiment from the University of Michigan

- Lowest reading since July 2024

- Prior was 71.1

- Current conditions 68.7 vs 73.0 expected

- Expectations 67.3 vs 70.0 expected

- 1-year inflation 4.3% vs 3.3% prior

- 5-year inflation 3.3% vs 3.2% prior

US January non-farm payrolls +143K vs +170K expected

- The US jobs report for January 2025

- Two-month net revision: +100K versus -8K prior

- Unemployment rate: 4.0% versus 4.1% expected

- Unrounded unemployment rate: 4.0113% versus 4.0855% prior

- Prior unemployment rate: 4.1%

- Participation rate: 62.6% versus 62.5% prior

- U6 underemployment rate: 7.5% versus 7.5% prior

- Average hourly earnings (m/m): +0.5% versus +0.3% expected and +0.3% prior

- Prior avg hourly earnings: +0.3%

- Average hourly earnings (y/y): +4.1% (4.06% unrounded) versus +3.8% expected and +3.9% prior (revised to +4.1%)

- Average weekly hours: 34.1 versus 34.3 expected and 34.3 prior (revised to 34.2)

- Change in private payrolls: +111K versus +141K expected and +223K prior

- Change in manufacturing payrolls: +3K versus -2K expected and -13K prior

- Government jobs: +32K versus +33K prior

- Full-time jobs: +234K versus +87K prior

- Benchmark revision to 2024 -589K vs -675K expected

Key Earnings Releases for the Week Starting February 10

As earnings season continues, next week will feature reports from major companies across multiple sectors. While Amazon has already reported, Nvidia remains the last of the Magnificent 7 yet to announce earnings, scheduled for February 26. In the meantime, attention turns to consumer, healthcare, and tech giants, including McDonald’s, Shopify, Coca-Cola, and Moderna.

Earnings Schedule – Large-Cap Highlights

📅 Monday (Feb 12)

🔹 Before Open: McDonald’s

📅 Tuesday (Feb 13)

🔹 Before Open: Shopify, Coca-Cola, Humana, BP, AutoNation

🔹 After Close: Supermicro, Upstart, DoorDash, Lyft

📅 Wednesday (Feb 14)

🔹 Before Open: CVS Health, Biogen

🔹 After Close: Reddit, AppLovin, Robinhood, Dutch Bros, Albemarle

📅 Thursday (Feb 15)

🔹 Before Open: Datadog, John Deere, Crocs

🔹 After Close: Coinbase, Twilio, DraftKings, Applied Materials, Airbnb, Palo Alto Networks

📅 Friday (Feb 16)

🔹 Before Open: Moderna

Market Focus:

- McDonald’s and Coca-Cola will provide insights into consumer spending trends amid inflationary pressures.

- Shopify and Airbnb are key indicators of e-commerce and travel demand in early 2024.

- Moderna and Biogen will be closely watched for biotech sector strength and developments in vaccine & drug innovation.

- Coinbase and Robinhood earnings will offer a view into crypto market activity after a volatile start to the year.

Investors will be looking for forward guidance and macroeconomic signals from these earnings, as broader market sentiment continues to be shaped by inflation data, interest rate expectations, and geopolitical risks.

Fed’s Kugler: Jan jobs report shows US labor market is healthy

- Comments from Kugler

- Jobs report shows neither weakening nor overheating

- Recent progress on inflation is slow and uneven

- Sees considerable uncertainty on economic effects of new policy proposals

- Continued productivity gains would help Fed attain goals,

- Will watch developments closely and assess data

- Stable labor market gives the Fed time to make decisions

- Not at 2% inflation makes sense to hold rates steady

- Wants to make sure inflation progress continues

- The economy is resilient and the labor market is healthy

- INflation rate has gone sideways and firmed

- Watching money markets closely as the balance sheet shrinks

- Need to see continued slowing of inflation to feel comfortable about cutting rates

- Concern that not getting as much help with goods inflation

- Good news is that housing inflation came down in Q4

- The neutral rate has gone up some, but not as much as some others think it has

- We are not quite at the neutral rate yet

Fed’s Kashkari: The market may be taking the signal that the neutral rate is higher

- Comments from the Fed’s Kashkari

- Around 40% of the move higher in 10s since Sept is inflation compensation

- Around 60% is real rates

- The market may be taking the signal that the neutral rate is higher

- Could also be because of fiscal deficits

- The most important number in the jobs report is 4.0% unemployment rate

- The feedback that I’m getting is that the economy is strong

- The economy is in a good place, we want to keep it there while getting inflation all the way back to our target

- We will wait until we get more information on taxes, tariffs, immigration

- The last 9 months of inflation was very good

- I don’t know why we would need to see why we would keep rates here if inflation comes down

- I would expect Fed funds to be modestly lower this year

- We might not get inflation all the way back to 2% this year because of mechanics

Fed’s Goolsbee: What’s happening in long-term rates is more the Treasury’s purview

- Comments from the Chicago Fed President

- I think it will take longer than year-end to get to neutral level

- As inflation comes down we can commensurately cut the policy rate

- We will feel our way down to neutral

- Over the next 12-18 months, the policy rate will be ‘a fair bit below’ current levels.

Fed’s Logan: Says 2025 choice is to resume cutting soon, or to hold ‘for quite some time’

- Federal Reserve Bank of Dallas President Lorie Logan

- Choices in 2025 boil down to resuming rate cuts ‘soon’ or holding rates steady for ‘quite some time.’

- Near-2% inflation with a labor market holding steady would not necessarily allow the Fed to cut rates soon.

- A rise in inflation would signal monetary policy has more to do.

- A cooling labor market or demand could be evidence that it’s time to cut rates.

- Trade policy and volatile financial conditions add to uncertainties.

- The Fed’s rate path should be guided by the need to keep inflation expectations well-anchored.

- Estimates of the real neutral rate in the US vary widely, but most have moved up substantially since the pandemic.

- It will always be important to take broad financial conditions into account when setting monetary policy.

- suggesting that the Federal Open Market Committee (FOMC) could either resume rate cuts soon

- or maintain current levels for an extended period.

“In some scenarios, it will soon be appropriate to resume reducing the federal funds rate target range,” Logan said. “In other scenarios, we’ll need to hold rates at least at the current level for some time.”

She also highlighted reasons why the Fed might opt to keep rates steady, even if inflation approaches the central bank’s 2% target.

“What if inflation comes in close to 2% in coming months? While that would be good news, it wouldn’t necessarily allow the FOMC to cut rates soon, in my view,” she noted.

Logan argued that if economic growth remains solid and inflation remains controlled, it would be difficult to justify calling current monetary policy “meaningfully restrictive.”

“In choosing a path, we should be guided by the need to maintain well-anchored inflation expectations,” she emphasized.

UBS expect the Fed to resume rate cuts later in 2025

- Say policy is restrictive

UBS expects the Federal Reserve to resume rate cuts later this year, despite its recent decision to hold rates steady. The U.S. central bank kept rates unchanged last week for the first time since beginning its easing cycle in September, citing persistently elevated inflation and a resilient labour market.

However, UBS analysts anticipate that inflation will moderate toward the Fed’s 2% target by mid-year, creating conditions for further rate reductions. Fed Chair Jerome Powell also indicated that monetary policy remains “meaningfully” above the neutral rate, suggesting room for additional easing.

Bank for International Settlements warns of economic risks amid Trump policy uncertainties

- BIS head Agustín Carstens

BIS warns of economic risks, central bank challenges amid Trump policy uncertainties

The Bank for International Settlements (BIS) has issued a warning about the economic and financial risks stemming from U.S. President Donald Trump’s trade policies and deregulation efforts. BIS head Agustín Carstens highlighted concerns over trade tensions, fiscal policy, regulation, immigration, and broader geopolitical uncertainties.

Carstens warned that heightened policy uncertainty could weigh on economic growth, as businesses delay investment and households postpone major purchases. Financial markets may also experience increased volatility, with significant currency and asset price fluctuations, particularly impacting Canada, Mexico, and China.

He noted that exchange rate depreciation could drive inflation higher, urging central banks to remain focused on price stability. Loose fiscal policies and rising debt levels could further fuel inflation and put financial stability at risk, he cautioned.

Carstens also pointed to the risk of growing divergence between U.S. interest rates and those of other major economies. With U.S. growth outpacing much of the world, differences in central bank policies could influence capital flows, exchange rates, and global financial conditions.

The BIS, a key forum for central banks and host of the Basel Committee for Banking Supervision, is particularly concerned about Trump’s policies undermining global financial regulations, raising fears of a regulatory race to the bottom, especially in Europe.

Reuters: Canada PM Trudeau says Pres Trump talk about absorbing Canada is real

- Trump desire is linked to the countries rich natural resources

- Prime Minister Justin Trudeau stated that U.S. President Donald Trump’s suggestion of absorbing Canada is “a real thing” and linked to Canada’s rich natural resources.

- Trudeau made the comments during a closed-door meeting with business and labor leaders discussing Trump’s tariff threats on Canadian imports.

- The remarks were mistakenly broadcast through a loudspeaker and first reported by the Toronto Star.

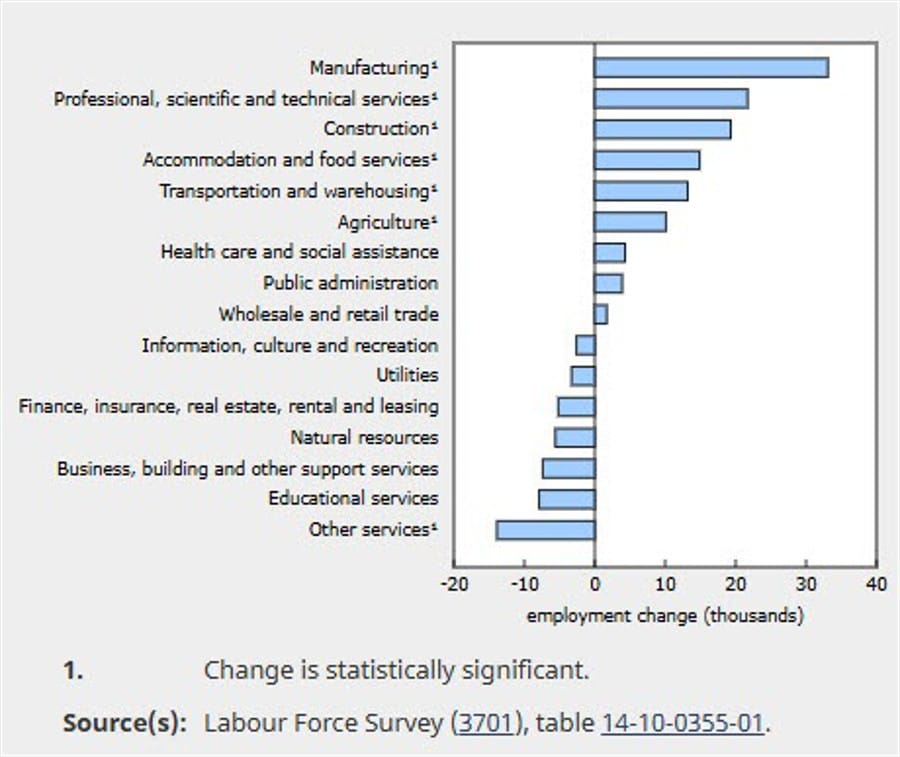

Canada January employment change 76.0K vs 25.0K estimate

- Canada jobs report for January 2025

- Prior month 90.9K (was expecting 25.0 K). Revised sharply higher to 179.1 K

- Employment change 76.0K vs 25.0 K estimate. This is the 3rd consecutive monthly gain following increases in December (+91,000; +0.4%) and November (+44,000; +0.2%).

- Unemployment rate 6.6% versus 6.8% estimate. Last month 6.7%

- Full time employment 35.2K vs 57.5K last month revised sharply higher to 171.8K

- Part-time employment 40.9K vs 33.5 K last month revised lower to 7.1K

- Participation rate 65.5% vs 65.1% last month.

Looking at wages:

- Average hourly wages: +3.5% YoY in January (+$1.23 to $35.99), slowest since April 2022.

- Previous wage growth: 4.0% in December, 4.2% in November, ~5.0% through late 2022-2024.

- Permanent employees: +3.7% YoY ($36.83).

- Temporary employees: +2.5% YoY ($28.65).

Employment gains in January were led by:

- Manufacturing: +33K (+1.8%) in January, mainly in Ontario (+11K), Quebec (+9.7K), and British Columbia (+8.7K); little YoY change.

- Professional, Scientific & Technical Services: +22K (+1.1%) in January; +66K (+3.4%) YoY.

- Construction: +19K (+1.2%) in January; +58K (+3.6%) YoY.

- Accommodation & Food Services: +15K (+1.3%) in January.

- Transportation & Warehousing: +13K (+1.2%) in January.

- Agriculture: +10K (+4.4%) in January.

- Other Services: -14K (-1.8%) in January.

BOC Gov Macklem says Trump’s tariff threats weighing on business, household confidence

- Bank of Canada Governor Macklem

- The world looks increasingly shock-prone.

- As 2025 begins, we are facing new uncertainty with a shift in policy direction in the United States.

- President Donald Trump’s threats of new tariffs are already affecting business and household confidence, particularly in Canada and Mexico.

- The longer this uncertainty persists, the more it will weigh on economic activity in our countries.

- If significant broad-based tariffs are indeed imposed, they will test the resilience of our economies in the short run and reduce long-run prosperity.

- In a world with more structural change and more negative supply shocks, central banks will be faced with harder choices.

- These hard choices will lead to central banks being called ineffective or criticized, and some will challenge our independence.

- We need to remain evidence-based, technocratic, and professional, and free of political influence.

Commodities News

Gold Climbs Amid US-China Trade Tensions and Mixed US Jobs Data

Gold extended gains on Friday, trading at $2,862 (+0.24%), as escalating US-China trade tensions and a weaker-than-expected Nonfarm Payrolls (NFP) report fueled safe-haven demand.

Trade War Concerns Boost Gold’s Appeal

President Donald Trump’s renewed tariff threats—expected to be announced next week—prompted investors to hedge against market uncertainty, further strengthening gold’s safe-haven status. Weekend developments on trade could increase flows into gold, sustaining its upside momentum.

US Jobs Data: Mixed Signals for the Fed

While January’s NFP report came in weaker than expected at 143K jobs added (vs. 170K forecast), the Unemployment Rate dropped from 4.1% to 4.0%, signaling labor market resilience. This data suggests the Federal Reserve (Fed) may remain cautious on rate cuts, keeping markets on edge.

Fed Officials Weigh In

- Minneapolis Fed President Kashkari suggested rates could be “modestly lower.”

- Chicago Fed President Goolsbee acknowledged solid jobs data but warned the pace of rate cuts would be slower and uncertain.

- Fed Governor Adriana Kugler highlighted inflation concerns, reinforcing the case for holding rates steady.

Gold Rises Alongside a Stronger US Dollar

Despite gold’s climb, the US Dollar Index (DXY) gained 0.32%, reaching 108.04, after touching a daily low of 107.51. Money markets now price in 39 basis points of Fed rate cuts in 2025, slightly lower than previous expectations.

With geopolitical risks and Fed uncertainty driving sentiment, gold remains well-positioned for further gains. Traders will watch tariff updates and Fed policy cues for near-term direction.

Crude Oil Futures Settle at $71 Amid Demand Optimism

Crude oil futures closed at $71 per barrel on Friday, rising $0.39 (+0.55%), as renewed optimism over energy demand provided support. However, for the week, oil prices declined by -2.12%, reflecting broader market consolidation.

Labor Market Data Lifts Oil Prices

West Texas Intermediate (WTI) crude climbed to around $70.80 following the latest US Nonfarm Payrolls (NFP) report. While job additions came in weaker than expected at 143K for January, key labor market indicators remained resilient:

- Unemployment rate: Held steady at 4.0%, in line with expectations.

- Wage growth: Increased 0.5% MoM, with the YoY figure rising to 4.1% (above the 3.9% forecast).

- Labor force participation: Ticked up to 62.6%, reinforcing expectations of steady economic activity and energy consumption.

Technical Outlook: Key Levels to Watch

WTI crude is currently testing resistance at $71.00 per barrel. A break above this level could open the door for further gains, while immediate support lies at $70.00. Traders will continue to monitor macroeconomic data and geopolitical developments for further direction.

Silver Pulls Back from Weekly Highs, Drops Below $32.00

Silver prices retreated over 1% on Friday, falling from a weekly high of $32.64 to trade at $31.82, as rising US Treasury yields and a stronger US Dollar weighed on the metal.

Market Drivers: Bond Yields & US Dollar Strength

- US Treasury yields surged, reducing demand for non-yielding assets like silver.

- The US Dollar remained firm, limiting silver’s upside after the release of mixed US jobs data.

- Nonfarm Payrolls (NFP) came in at 143K, missing expectations, but the Unemployment Rate fell to 4.0%, signaling labor market resilience.

Technical Outlook: Key Support & Resistance Levels

📉 Downside Risks:

- Key support levels lie at $31.10 and $31.00, near crucial moving averages.

- A break below $31.00 could trigger further downside pressure.

📈 Upside Potential:

- Consolidation is likely between $31.00 and $32.60, with resistance at $33.00.

- A move above $32.60 could open the door for another test of recent highs.

With silver under pressure from macroeconomic forces, traders will closely watch bond yields, Fed policy expectations, and USD strength for near-term direction.

Copper: No reasonable scenario to catalyze CTA buying activity – TDS

Copper prices continue to rally, but our advanced positioning analytics suggest that no reasonable scenario for prices will catalyze CTA buying activity over the coming sessions, TDS’s Senior Commodity Strategist Daniel Ghali notes.

Buying to remain modest at best

“A big uptape could lead to some buying activity by this time next week, but our estimates suggest it would remain modest at best, which ultimately places the onus on other cohorts to keep prices from finding a local top.”

“Discretionary trader participation has also picked up lately, suggesting the latest strength in prices may be supported by additional buying activity from this cohort, but our estimates suggest it has now grown to its highest levels since the squeeze on the Comex Copper arb last year.”

Gold Price Forecast: UBS Boosts Target to $3000 Amidst Global Uncertainty

- Gold a valuable hedge against uncertainty

Via a note from UBS (the bank’s Wealth Management area) on their outlook for gold.

- Analysts at the bank say that the price is above their long-term forecast of US$2850 and is above their estimate of fair value

- And add that gold is showing its worth as a store of value and a hedge against uncertainty

- They have boosted their forecast to US$3000 over the next 12 months

In brief on reasoning:

- If they happen, US tariffs on Canada & Mexico are unlikely to last long.

- See a gradual increase in US tariffs on China to 30%.

- Gold will continue to be supported by uncertainty, global rate cuts, and investor demand.

Europe News

EU to offer lower tariffs on US car imports in effort to make a deal with Trump

- EU will offer to cut tariffs to 2.5%

Bernd Lange, who heads the trade committee in the European parliament spoke with the Financial Times and said the bloc was willing to lower its 10% import tax on cars “closer” to the 2.5% charged by the US in an effort to avoid a trade war.

“We can try to have a deal before escalating costs and tariffs,” Lange said. The bloc would offer to buy more liquefied natural gas and military equipment from the US, “plus also look to lower tariffs for cars”, he told the FT.

Germany December industrial production -2.4% vs -0.6% m/m expected

- Latest data released by Destatis – 7 February 2025

- Prior +1.5%; revised to +1.3%

The drop in December owes much to a decline in production in the automotive industry, which was down 10.0% compared to the month before. Excluding energy and construction, the headline reading is much worse with the decline being 3.3% compared to November. As a whole last year, German industrial production is seen down 4.5% compared to 2023.

Germany December trade balance €20.7 billion vs €17.0 billion expected

- Latest data released by Destatis – 7 February 2025

- Prior €19.7 billion

For the year itself, the German trade balance scored a surplus of €241.2 billion. Exports were seen down 1.0% and imports down 2.8% compared to the year 2023. These are the seasonally adjusted figures.

France December trade balance -€6.6 billion vs -€7.1 billion expected

- Latest data released by the French MOF – 7 February 2025

- Prior -€7.1 billion

The trade deficit narrowed slightly at the end of last year as exports fell by 0.4% while imports grew slightly by 0.1% on the month. Overall, the French trade balance stood at -€81.0 billion in 2024.

UK January Halifax house prices +0.7% vs +0.2% m/m expected

- Latest data released by Halifax – 7 February 2025

- Prior -0.2%

With the increase in January, the average property price in the UK moves up to a new record high of £299,138. Halifax notes that “affordability is still a challenge for many would-be buyers, but the market’s resilience is noteworthy”. On an annual basis though, house price growth slowed to +3.0%, the slowest rate since July last year.

ECB’s de Guindos: Inflation to start converging to 2% target in the spring

- Remarks by ECB vice president, Luis de Guindos

- Services inflation remains the top concern

- A prudent approach to monetary policy is needed

Meanwhile, ECB chief economist Lane is also out with some comments as per below:

- 2% inflation target is to be achieved fairly soon

- January services inflation was softer than expected

- It is best not to focus too much on neutral rate

ECB’s Vujčić: Market bets on three rate cuts are not unreasonable

- Remarks by ECB policymaker, Boris Vujčić

- Don’t see a recession right now, sees a gradual recovery

- Expects inflation, including services, to come down

- Already have wage moderation, expect that to continue

- March and April will be key for a clearer picture on rate path

- Tariff threats are a great source of uncertainty

- But US tariffs won’t immediately trigger a 50 bps rate cut

BOE’s Pill: There is an ongoing disinflation process in the UK

- BOE chief economist, Huw Pill, backs the rate cut yesterday

- But we cannot declare that the job is done

- Need to maintain some degree of policy restriction to squeeze out price pressures

- Other measures of pay growth are easing but still a bit too high

- This is a reason for caution and carefulness in loosening policy

Asia-Pacific & World News

China gold reserves seen increasing again to start the new year

- The buying spree continues

At the end of January, China gold reserves was seen at 73.45 million million fine troy ounces. That is a step up from December, where it held 73.29 million fine troy ounces in gold reserves. In terms of value, the January reserves stood at $206.53 billion as compared to $191.34 billion in December.

PBOC sets USD/ CNY reference rate for today at 7.1699 (vs. estimate at 7.2780)

- PBOC CNY reference rate setting for the trading session ahead.

PBoC Injects 183.7bn yuan via 7-Day Reverse Repos at 1.5%

- 284bn mature today

- net drains 100.3bn yuan in Open Market Operations

TD Securities on RBA rate cuts, inflation remains key driver

- The RBA statement is due on February 18

Via a note from TD Securities from a few days ago ICYMI, analysts there suggest that recent activity data does not indicate an urgent need for the Reserve Bank of Australia (RBA) to cut interest rates. While some market participants focus on labour market conditions, TD Securities emphasizes that inflation remains the primary factor influencing the timing of the RBA’s first rate cut.

Despite expectations for rate reductions, analysts see no need for the central bank to push the cash rate below neutral levels. As a result, they forecast a total of 75 basis points in cuts this year, bringing the cash rate down to 3.60%.

Japan data: December Household Spending YoY +2.7% (vs. expected: 0.2%, previous: -0.4%)

- More encouragement for the Bank of Japan on its rate hiking path ahead

Japan data is stunningly good, a surge in spending:

December Household Spending YoY +2.7%

- expected: 0.2%, previous: -0.4%

December Household Spending MoM +2.3%

- expected: -0.5%, previous: 0.4%

IMF’s Gopinath says support Bank of Japan moving gradually

- Says services inflation remains under 2%

Gita Gopinath is the First Deputy Managing Director of the International Monetary Fund (IMF):

- We support the Bank of Japan’s approach of moving gradually and being data-dependent in raising interest rates.

- There are positive signs that Japan’s inflation is moving durably toward the 2% target.

- Japan’s services inflation remains below the 2% target, which is why it remains appropriate for the Bank of Japan to maintain an accommodative monetary policy.

- It’s still too early to provide a precise analysis of the consequences of Trump’s trade tariffs.

- The Bank of Japan is likely to raise interest rates again this year and could see them reach levels deemed neutral to the economy by the end of 2027.

- The IMF estimates Japan’s neutral interest rate to be in the range of 1-2%.

- Japan’s economy is expected to expand by 1.1% this year, supported by a continued recovery in wage growth that is bolstering domestic demand.

- Further rate hikes by the Bank of Japan should be gradual and flexible to ensure a sustained pickup in domestic demand.

- Risks to Japan’s economic growth are skewed to the downside, as heightened uncertainty and geopolitical fragmentation weigh on global growth.

- Rises in foreign market volatility could affect domestic liquidity conditions in Japan, potentially triggering spillover effects.

- As interest rates rise, the cost of servicing Japan’s large public debt is expected to double by 2030.

- The IMF welcomes Japan’s continued commitment to a flexible exchange rate regime.

Nissan Seeks New Partnerships After Honda Merger Talks Fail

- Nissan now chasing collaborations with technology firms

Nissan is exploring new partnership opportunities following the collapse of merger discussions with Honda, with Taiwan’s Foxconn emerging as a potential candidate.

The automaker walked away from talks after Honda proposed making Nissan a subsidiary—a move CEO Makoto Uchida opposed. Now, Nissan is seeking collaborations, particularly with technology firms, as it navigates challenges from electric vehicles, software-driven cars, and rising competition from Chinese automakers. Foxconn, the world’s largest contract electronics manufacturer, had previously approached Nissan for a partnership but was turned down. The company’s electric vehicle division is led by Jun Seki, a former Nissan senior executive.

The Reserve Bank of India (RBI) cut its key repo rate by 25bp, to 6.25%

- The first cut since May 2020.

The Reserve Bank of India (RBI) reduced its key repo rate by 25 basis points to 6.25%, the first cut since May 2020.

- The move aims to stimulate the sluggish economy, which is projected to grow at its slowest pace in four years.

- Monetary Policy Committee (MPC) – The six-member panel (three RBI officials, three external members) voted unanimously for the rate cut while maintaining a neutral policy stance.

- India’s economy is expected to grow 6.4% this fiscal year, below initial projections, with weaker manufacturing and corporate investment weighing on growth. Next year’s growth is forecast in the 6.3%-6.8% range.

- Inflation Trends – Retail inflation remains above the 4% target but eased to a four-month low of 5.22% in December, creating room for rate easing.

Crypto Market Pulse

Bitcoin Shows Weakness as Bears Target $90,000

Bitcoin (BTC) continued its decline on Friday, trading around $97,000 after losing nearly 5% in the last three days. Weak network activity and upcoming FTX repayments are adding to concerns about short-term volatility.

Bitcoin Network Activity Hits Yearly Low

- The CryptoQuant weekly report highlights that on-chain activity has dropped to its lowest level in a year, signaling potential weakness in demand.

- Traders are keeping a close watch on FTX’s creditor repayments, beginning February 18, which could trigger market volatility.

Trump’s Tariffs Shake the Crypto Market

- Bitcoin plummeted to $91,231 earlier in the week after President Trump implemented tariffs on imports from China, Canada, and Mexico.

- However, after negotiations, Mexico and Canada agreed to pause tariffs for 30 days, allowing BTC to recover above $101,300 on Monday.

Crypto Market Liquidations Surge

- The price drop led to $1.72 billion in total crypto liquidations, with $373 million in BTC alone.

- Bybit CEO Ben Zhou suggested that real total liquidations could be between $8–$10 billion, much higher than reported figures.

FTX Repayments Could Spark Further Volatility

- Starting February 18, FTX will begin repaying creditors with claims under $50,000.

- The collapsed exchange had an estimated $11.2 billion in debt, with payouts expected to total $16.5 billion as it raises funds through asset sales.

- This event could increase BTC price fluctuations as funds re-enter the market.

Technical Outlook: Key BTC Levels to Watch

📉 Bearish Targets:

- $90,000 remains a key psychological level if selling pressure continues.

📈 Potential Recovery:

- A move above $100,000 could restore bullish momentum, depending on market conditions.

With geopolitical risks, FTX repayments, and macroeconomic uncertainty, Bitcoin remains at risk of further downside in the short term.

Will Vitalik Buterin Quit? Ethereum’s Future in Question as Whales Sell Off

Ethereum (ETH) continues to face downward pressure, hovering around $2,700 on Friday as whale sentiment shifts and large investors reduce their holdings. Speculation over Vitalik Buterin’s role in the Ethereum Foundation added to market uncertainty, but the Ethereum co-founder has firmly denied plans to quit.

Buterin Rejects “Degen Casino” Model, Commits to Ethereum

- Buterin responded to criticism from VC firms and crypto experts, opposing the idea of a “PvP KOL degen casino” approach, which focuses on gambling-like speculation instead of enterprise blockchain utility.

- His comments came amid community frustration over ETH sales by the Ethereum Foundation, which some traders argue contribute to selling pressure.

On-Chain Data Shows Whales Are Dumping ETH

- Whale sentiment turned bearish, with large wallet investors cutting Ethereum exposure.

- ETH holdings in wallets worth over $10M dropped 17% last week, from $379.36B to $312.93B.

- Mid-sized wallets ($1M–$10M) also saw holdings fall from $35.38B to $29.51B over the same period.

Ethereum’s Technical Outlook & Investor Sentiment

- Ethereum is testing a key support level at $2,700 after an extended multi-month decline.

- Large wallet investors remain cautious about short-term recovery, with on-chain data suggesting reduced confidence.

While Buterin remains committed to Ethereum’s vision, whale outflows and market sentiment will dictate ETH’s near-term trajectory. Traders are closely watching on-chain activity, Foundation-related sales, and macroeconomic factors for further direction.

The Day’s Takeaway

Day’s Takeaway: Market Insights & Developments

US Stock Markets Extend Declines for Second Straight Week

- Dow (-0.90%), S&P 500 (-0.95%), and Nasdaq (-1.36%) closed sharply lower on Friday, capping a second consecutive week of losses.

- Tech stocks led the downturn, while rising bond yields and macro uncertainty weighed on sentiment.

- Next week’s earnings reports from McDonald’s, Shopify, Coca-Cola, and Moderna could be pivotal for market direction.

Gold Gains on Trade War Fears & Fed Uncertainty

- Gold rose to $2,862 (+0.24%) as Trump’s tariff threats increased safe-haven demand.

- US NFP data missed expectations (143K jobs), but a drop in Unemployment Rate (4.0%) signals labor market resilience.

- Fed officials remained cautious, reinforcing uncertainty over the pace of rate cuts.

Bitcoin Struggles as Bears Eye $90K, FTX Repayments Loom

- BTC traded near $97,000, down 5% in three days, with network activity hitting a one-year low.

- Trump’s tariffs triggered a sharp drop to $91,231 earlier this week, but a temporary tariff pause with Mexico and Canada allowed BTC to recover.

- FTX creditor repayments (starting Feb 18) could inject further volatility.

Ethereum Faces Selling Pressure as Whales Reduce Holdings

- Vitalik Buterin denied quitting Ethereum Foundation, despite criticism from VC firms and traders.

- Whale sentiment turned bearish, with wallets holding $10M+ in ETH dropping holdings by 17% last week.

- ETH remains near key support at $2,700, with investor caution persisting.

Silver Retreats Below $32 as Yields Rise

- Silver fell over 1% to $31.82, reversing from a weekly high of $32.64.

- Rising US Treasury yields and a stronger dollar weighed on the metal.

- Technical levels suggest consolidation between $31.00 and $32.60, with resistance at $33.00.

Crude Oil Rises to $71 but Ends the Week Down 2.12%

- WTI crude settled at $71 (+0.55%) as US jobs data supported demand optimism.

- Trump’s push to increase pressure on Iran had little impact, as the market focused on tariffs and inventory data.

- Saudi Arabia raised official selling prices (OSPs) for March, supporting prices.

Copper Prices Continue Rally, But CTA Buying Remains Limited

- Discretionary trader participation has surged, keeping copper prices elevated.

- TDS strategist Daniel Ghali notes that CTA (Commodity Trading Advisors) buying remains unlikely in the near term.

- Without sustained momentum from other market participants, copper could find a local top.

Final Thoughts:

Markets remain highly reactive to macroeconomic shifts, with tariffs, central bank policies, and corporate earnings driving volatility. While gold and oil found support, crypto struggles with weak network activity and liquidation risks, and equities are bracing for another critical earnings week.