North American News

US Equities Face Early Month Setback as Markets Open with a Loss

- US Equities Experience Mild August Selling; Investors Remain Cautious

- S&P 500 -0.3%

- Nasdaq Comp -0.4%

- Russell 2000 -0.4%

New York Fed multivariate core trend inflation guage falls to 2.9% in June from 3.2%

- Core inflation reading from the New York Fed

The New York Fed’s “multivariate core trend” rate of inflation is their attempt to capture the underlying trend of prices and it fell to 2.9% y/y in June from a downwardly revised 3.2% in May. It’s now at the lowest two-and-a-half years.

Persistence in both housing and services ex-housing inflation was dominated by the sector-specific component of the trend, the NY Fed said.

Atlanta Fed GDPNow Q3 growth estimate rises to 3.9% from 3.5%

- It’s just at the very beginning but off to a strong start

The Atlanta Fed GDPNow model estimate for Q3 growth rose to 3.9% from 3.5% after data today.It is the 2nd estimate for the quarter given recent data. Last week Q2 growth came in at 2.4%. That was right on the Atlanta Fed estimate going into the release.IN the 1st quarter the Atlanta Fed model estimated 1.1% growth and that was also right on the announced Q1 advanced GDP growth forecast.

The increase was helped by increases in PCE, equipment, non-residential structures, residential investment exports, imports after the ISM manufacturing and construction spending data this morning.

US final July S&P Global manufacturing PMI 49.0 vs 49.0 prelim

- US PMI from S&P Global

- Prior was 46.3

- Despite a sharp fall in backlogs of work as new orders dropped, companies expanded employment at a faster rate amid greater confidence in the outlook for output.

- New export orders fell for the fourteenth month running

US July ISM manufacturing PMI 46.4 vs 46.8 expected

- ISM manufacturing PMI for July 2023 highlights

- Prior report 46.0

- ISM Manufacturing PMI 46.4 versus 46.8 expected

- Prices paid 42.6 vs 42.8 expected. Last month 41.8

- Employment 44.4 vs 48.0 expected. Last month 48.1

- New orders 47.3 vs 45.6 prior

US June construction spending +0.5% vs +0.6% expected

- US construction spending for July 2023

- US construction spending for June % versus 0.9% expected

- total construction spending $1,938.4 billion versus $1,929.6 billion last month

- Construction spending year on year +3.5% vs +2.4% prior

- private construction +0.5% vs +1.1% prior

- residential construction +0.9% vs +2.2% prior

- nonresidential construction 0.0% vs +0.3% prior

Credit Agricole: Resilient US data and soft landing narrative to bolster USD strength

- The soft landing narrative and positive economic data are boosting the USD, creating opportunities for pro-cyclical currencies and higher-risk investments.

Key Points:

- Soft Landing Revisited: The beginning of the week sees the ‘soft landing’ narrative reemerging, driven by data-centric forward guidance from both the Fed and the ECB, and the US’s better-than-projected economic data. A soft landing scenario implies that economic downturns will be mild, and recoveries will be swift, minimizing economic shocks.

- FX Impacts: The scenario is seen as favoring pro-cyclical and higher-yielding currencies due to eased global financial conditions and enhanced risk sentiment. Such a backdrop would typically suggest a bearish outlook for the USD, given a reduced demand for safe-haven assets.

- USD’s Strong Stance: Contrary to conventional expectations, Credit Agricole postulates that the USD might flourish under a soft landing framework. The bank stresses that robust US data combined with a peaking Fed cycle could accentuate the allure of USD assets. Furthermore, the USD’s significant rate appeal could position it as a sought-after carry investment currency.

- Market Positions and Relative Value: Current FX market trends show a short stance on the USD when compared to the EUR, GBP, and CHF. Both EUR/USD and GBP/USD seem to be trading at premiums compared to their short-term intrinsic worth.

- Anticipation from Upcoming Data: The bankanticipates that the impending US economic data releases for the weekcould further enhance the attractiveness of the USD across the board.

JOLTs job openings for June 9.582M versus 9.610M estimate

- The JOLTs job openings for June 2023 details

- Prior month 9.824M (lower than the 9.935M estimate). Prior month revise to 9.616M

- Job Openings 9.582M vs 9.610M estimate

- The rate of job openings was also unchanged at 5.8%.

- The number of hires in June decreased to 5.9 million (-326,000), while the hire rate was little changed at 3.8%.

- The decrease in hires was seen in durable goods manufacturing (-54,000) and finance and insurance (-54,000)

- Total separations, including quits, layoffs and discharges, and other separations, decreased in June to 5.6 million (-288,000).

- The rate of separations was little changed at 3.6%

- The number of quits decreased to 3.8 million (-295,000) and the quit rate to 2.4%.

- The number of quits decreased in retail trade (-95,000), health care and social assistance (-75,000), and construction (-51,000).

- Quits increased in arts, entertainment, and recreation (+20,000).

Details show:

- Industries with increased job openings included health care and social assistance (+136,000) and state and local government excluding education (+62,000).

- Industries with decreased job openings included transportation, warehousing, and utilities (-78,000), state and local government education (-29,000), and federal government (-21,000).

- Decreased separations were seen in retail trade (-134,000), health care and social assistance (-84,000), and durable goods manufacturing (-54,000). Separations increased in professional and business services (+129,000).

- The number of layoffs and discharges in June was unchanged at 1.5 million, with the rate remaining at 1.0%.Layoffs and discharges increased in professional and business services (+112,000) and decreased in durable goods manufacturing (-26,000) and in wholesale trade (-26,000).

- Other separations, including retirements, deaths, disability, and transfers to other locations of the same firm, remained the same in June at 339,000.

- In June, establishments with 1 to 9 employees saw a decrease in their quit rates and an increase in their other separation rates. Establishments with more than 5,000 employees saw increases in their quit rates.

Traders also tend to watch things like the quits rate for the strength of the jobs market. if the quits rate moves higher it is indicative of workers feeling confident about finding another job. Looking at the chart of the quits rate below, it has moved back lower and toward the level pre-pandemic. Although still high relative to historical levels, there are some signs that workers are not so anxious to quit their jobs (and get another easily).

US 10-year yields break 4%

- We were here last week

Aside from the psychological value, 4% isn’t meaningful. We were above it on Friday for a time, so it’s not particularly new. However if you zoom out and look at the weekly chart, a pair of highs come in at 4.09% and those are critical. There’s also been a consolidation pattern below 4.338% since October and the danger is that it resolves to the upside.

US 30 year yield rises to the highest level this year

- Yield rises to 4.115%

The US 30 year yield has risen to the highest level this year. The yield reached 4.115%. That took out the high yield from July 10 which reached 4.086%. The yield is trading at the highest level since November 10.

For the day, the yield is up about 9 basis points on the day.

Fed’s Goolsbee: Any rate cut would be ‘far out in the future’

- Markets fully expected Fed will bring inflation down

- JOLTS data looks consistent with strong labor market moving to a more balanced phase

- FOMC d ecisions are ‘close calls’ for him as Fed tries to manage transition

- Need to see sustained, steady progress on inflation. I’m ‘closet optimistic’

Fed’s Bostic: We are in a phase where there is some risk of overtightening

- Comments from the Atlanta Fed President

- Baseline is no rate cuts until the second half of 2024 at earliest

- Inflation is unacceptably high but there has been significant progress

- Data consistent with ‘orderly slowdown’

- We are in a phase where there is some risk of overtightening

- says he would have ‘grudgingly’ voted for a rate hike in July

- If progress on inflation stalls, I would be comfortable contemplating a rate hike

Canada July S&P Global manufacturing 49.6 vs 48.8 prior

- Canada July 2023 S&P Global manufacturing index

- Prior was 48.8

- Job cuts were more prominent

- July’s survey revealed a fifth straight monthly fall in new orders

Commenting on the latest survey results, Paul Smith, Economics Director at S&P Global Market Intelligence said:

“July’s PMI results offered a rather mixed bag on the performance of the Canadian manufacturing sector. On the one hand, there was a welcome return to output growth, following two successive months of contraction. However, concurrently there was another, admittedly small, drop in new orders as firms continued to signal a high degree of market uncertainty and reluctance amongst clients to commit to new work.

“Moreover, there was an intensification of pricepressures as firms reported a myriad of inflationaryfactors in July. However, amid reports of growingmarket competition and with vendors seemingly havingsufficient capacity to easily cope with demand, inflation rates remain broadly under control and well down on levels seen around the turn of the year.”

Commodities

Silver’s advance halts and finds support at the 20-day SMA

- XAG/USD retreated more than 1% towards the $24.20 area, still holding the 20-day SMA.

- USD is strong after the release of June’s JOLTS Job Opening and the ISM Manufacturing PMI.

- Rising US Treasury yields are not allowing metals to find demand.

On Tuesday, Silver spot price significantly dropped, mainly due to the USD strength. Attention is on labour market data released as investors are modelling their expectations towards the next Federal Reserve meeting. Meanwhile, the greenback trades strong agains most of its rivals, with the USD DXY index rising towards the 102.30 area.

Private oil survey data shows huge headline crude draw, MUCH larger than expected

- API Inventory Moves

Crude -15.4 million vs. -900,000 exp.

Gasoline -1.68 million

Distillates -512,000

Cushing -1.76 million

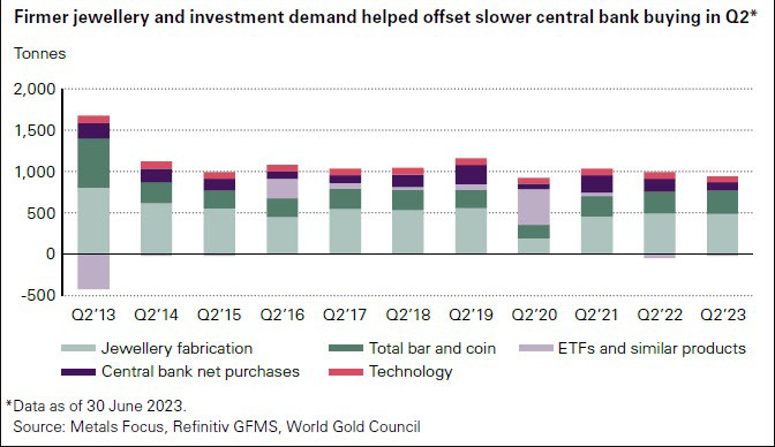

Gold demand pulls back in Q2 as central banks slow down on buying – WGC

- The latest report from the World Gold Council (WGC)

In 2022, gold demand rose to its highest in 11 years owing much to the biggest central bank purchases on record. And despite a slowdown in buying by central banks in Q2 this year (102.9 metric tons) compared to that of last year (158.6 metric tons), the purchases in the first half of 2023 (386.9 metric tons) is still more than any January to June period in the data going back to 2000.

So, yes there might be some slowing in demand in the last quarter. However, the overall picture still shows that buying activity is rampant and with major central banks set to move towards a period of cutting interest rates once the inflation picture restores itself, there is reason to believe that gold demand may still ramp up further in the years ahead.

EU News

A negative start for the European equity markets for August

- Major indices all move to the downside today

The major European indices are off to a bad start for the month of August. All are lower on the day and closing near the lows for the day.The declines are led by Spain’s Ibex which fell -1.44%.

A snapshot of the closing levels shows:

- German DAX -1.26%

- France’s CAC -1.22%

- FTSE 100 -0.43%

- Spain’s Ibex -1.44%

Eurozone June unemployment rate 6.4% vs 6.5% expected

- Latest data released by Eurostat – 1 August 2023

- Prior 6.5%; revised to 6.4%

Eurozone July final manufacturing PMI 42.7 vs 42.7 prelim

- Latest data released by HCOB – 1 August 2023

- Prior 43.4

UK July final manufacturing PMI 45.3 vs 45.0 prelim

- Latest data released by S&P Global – 1 August 2023

- Prior 46.5

UK July Nationwide house prices -0.2% vs -0.2% m/m expected

- Latest data released by UK Nationwide Building Society – 1 August 2023

- Prior +0.1%

Germany July unemployment change -4k vs 20k expected

- Latest data released by the Federal Employment Agency – 1 August 2023

- Prior 28k

- Unemployment rate 5.6% vs 5.7% expected

- Prior 5.7%

Germany July final manufacturing PMI 38.8 vs 38.8 prelim

- Latest data released by HCOB – 1 August 2023

- Prior 40.6

France July final manufacturing PMI 45.1 vs 44.5 prelim

- Latest data released by HCOB – 1 August 2023

- Prior 46.0

Italy July manufacturing PMI 44.5 vs 44.2 expected

- Latest data released by HCOB – 1 August 2023

- Prior 43.8

Spain July manufacturing PMI 47.8 vs 48.3 expected

- Latest data released by HCOB – 1 August 2023

- Prior 48.0

Other News

China reportedly asked banks to delay dollar purchases to ease pressure on yuan

- Reuters reports, citing two people with direct knowledge of the matter

It is being said that China’s currency regulators have in recent weeks asked some commercial banks to either reduce or delay their dollar purchases. This is an informal instruction (of course, naturally) that was meant to slow down the pace of depreciation in the Chinese yuan.

One source added that regulators were even adamant that banks should put off any dollar purchases under their proprietary trading accounts. There has been some stabilisation of sorts in the yuan since the middle of July but if this is all intended just to slow down the drop, it will eventually come one way or another. Indirectly, this is something to watch out for the aussie and kiwi in case there are any spillover effects moving forward.

China June 2023 Caixin / S&P Global Manufacturing PMI 49.2 (prior 50.5)

China July Caixin Manufacturing PMI comes in at 49.2, slipping into contraction for the first time in 3 months

- expected 50.3 prior 50.5

Comments from the report, in brief:

- Both manufacturing supply and demand contracted.

- new export orders fell sharply in July, the lowestsince September

- manufacturing job market continued to deteriorate, though the contraction was marginally smaller than in the second quarter

- gauges for prices remained weak, with the reading for input costs and output prices coming in below 50 for the fourth and fifth consecutive months, respectively.Deflationary pressure continued to build.

- The July Politburo meeting highlighted that the current economy faces new difficulties and challenges, and that the external environment is complex and severe. The meeting emphasized the need to actively expand domestic demand and let consumption play a fundamental role in driving economic growth. In terms of policies, guaranteeing employment, stabilizing expectations and increasing household income should still be the top priorities. At present, monetary policy only has limited effect on boosting supply. An expansionary fiscal policy that targets demand should be prioritized.

UBS have eyes on China’s Caixin Services PMI for Politburo stimulus action

So far the July PMIs from China have been disappointing

- The nation’s Politburo hinted at the potential for more measures to boost spending on “bigticket” items like autos, electronic goods, and home appliances was highlighted, along with further support for service consumption.

- In our view more detail on stimulus is now needed.

- A weak reading from the Caixin Services Purchasing Managers’ Index for July would further underline the need for more action to support growth.

RBA leaves cash rate unchanged at 4.10% for a second straight meeting

- The latest monetary policy decision by the RBA – 1 August 2023

- Prior 4.10%

- The decision to hold rates unchanged provides further time to assess the impact of the increase in interest rates to date and the economic outlook

- Inflation in Australia is declining but is still too high

- Household consumption growth is weak

- Conditions in the labour market remain very tight, although they have eased a little

- Returning inflation to target within a reasonable timeframe remains the priority

- Recent data are consistent with inflation returning to the 2–3% target range over the forecast horizon

- The outlook for household consumption is an ongoing source of uncertainty

- Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe, but that will depend upon the data and the evolving assessment of risks

Australian housing finance data for June, home loans value -1% (expected +1.8%)

Investment housing finance +2.6% m/m

- prior +6.2%

Owner-occupied housing finance -2.8% m/m

prior +4.0%

Japan’s economy minister says the BOJ YCC decision intended to help sustainability of easing

Japan economy minister Goto:

- BOJ’s Friday decision was meant to increase the sustainability of monetary easing by making YCC more flexible

- does not think the decision of the Bank of Japan on Friday was a shift in monetary easing stance

Cryptocurrency News

Litecoin price coils less than 1,000 blocks away from the LTC halving event

- Litecoin price sustained above key support at $90, with the LTC halving event closing in.

- The altcoin is less than 1,000 blocks away from the halving that is set to occur at block height 2,520,000.

- LTC dolphin and shark addresses have aggressively accumulated LTC since June 14, in anticipation of a possible post-halving price rally.

Litecoin is inching closer to the most anticipated event, its halving, scheduled to occur on August 2.The altcoin’s price sustained above the $90 psychological barrier, ahead of the mining reward being slashed in half.

LTC halvings have typically resulted in a price rally in the altcoin. LTC holders and large wallet investors anticipate a similar outcome this time around and have consistently accumulated the token since mid-June 2023.

FTT price fails to sustain 25% gains despite FTX confirming plans to relaunch the crypto exchange

- FTT price sprinted 25%, recording an intra-day high of $1.679 following the news of FTX exchange’s plans to relaunch.

- The surge was unsustainable, correcting almost 80% to test the 50-day EMA.

- The fall comes amid speculation of FTX’s Sam Bankman-Fried involvement in BALD rug pull.

FTT price recorded massive gains in the early hours of August 1, but the rally proved unsustainable as the network still inspires skepticism following the implosion of Sam Bankman-Fried’s crypto empire, FTX, in November. The surge happened as chatter on BALD meme coin dominated Crypto X following a voluminous rug pull that saw almost $70 million in Ether (ETH) disappear.

FTT price rally proves unsustainable

FTT price surged 25% to record an intra-day high of $1.679 on August 1. The surge constituted a 115% climb from its range low at $0.774. Nevertheless, it turned out to be premature, correcting almost immediately to the current price of $1.361, denoting an 80% whitewash of the day’s gains.

Follow our recently launched pages. Join our community and never miss a beat in the dynamic world of trading.

https://www.facebook.com/BilalsTechLtd

https://www.linkedin.com/company/bilals-tech/