North American News

US Equities Continue Impressive Run with Strong Monthly Gains; Value Stocks Lead the Charge

- Closing changes for the main US market indexes

July was a strong month for US equities that closed out with some modest gains:

- S&P 500 +0.2%

- Nasdaq Comp +0.2%

- DJIA +0.3%

- Russell 2000 +1.0%

On the month:

- S&P 500 +3.1

- Nasdaq Comp +4.0%

- DJIA +3.35%

- Russell 2000 +6.0%

Dallas Fed manufacturing business index -20.0 vs -23.2 prior

- Dallas-area manufacturing survey from the Dallas Fed

- Production -4.8 vs -4.8 prior

- New orders -18.1 vs -16.6 prior

- Shipments -2.2 vs -17.0 prior

- Employment +10.0 vs +2.2

- Company outlook -16.9 vs -10.7

The comments in the report are often insightful:

Chemical manufacturing

- The chemical industry in general is in a slump currently.

Computer and electronic product manufacturing

- Interest hikes obviously significantly affect industrial production. We are seeing it across the board in 12 different segments of our industry.I wish the Federal Reserve would look at theindustrial side and start cutting interest rates slowly. How much does the industrial backbone of this country have to suffer to lower inflation? We know the effect of interest [actions] does have a lag in economic results—why not prevent a recession by starting to lowerinterest rates now, rather than creating havoc in manufacturing?

- We continue to be concerned by all of the talk of a recession.We aren’t seeing that reflected in reduced customer demand yet. We intend to make significant capital investments over the next six months to expand capacity and reduce our unit costs, as we hope to gain market share in the event of a recession.

Fabricated metal product manufacturing

- We have the biggest backlog of projects ever. We are not able to expand due to the difficulty in hiring workers for the plant.

- Supply constraints are improving, but there are still some ongoing challenges.

Machinery manufacturing

- The summer doldrums are real … at least they are this month. Order interest has declined significantly, and order entry has slowed to a crawl. We’re bidding smaller jobs now than we have in 24 months.Raw material prices have eased, but so have selling prices to the pointof creating margin erosion.

- We are seeing a slight increase in business; however, we will have to see if this trend will continue.

Paper manufacturing

- Our industry is down approximately 6 to 7 percent for four quarters in a row.

Primary metal manufacturing

- High interest rates are hurting some businesses like real estateand commercial construction. Other industries like transportation are still good.The Federal Reserve needs to stop rate increases to letbusinesses and consumers settle down.

Printing and related support activities

- We are very fortunate to have some nice large jobs in the plant right now that are keeping us busy when many in our industry, including our competitors, are slow right now. We see our activity staying pretty strong into the fall, so we are fortunate. We had hoped to not have to raise prices but are having pressure from others to hire away our workers, so we are implementing wage increases that need to be covered by raising prices again.

Textile product mills

- Our manufacturing of home goods, like mattress components, comforters and pillows, has decreased. Talking to suppliers and customers, the consensus of the bedding industry outlook continues to look bleak. High interest rates appear to be the main driver, as home sales are weak, and the associated new-mattress purchase that is known in our industry to go hand in hand is not happening. We have had to downsize the company three times in the past nine months—from three production sites to one.

Hedge funds de-risk in July to close to record levels – Goldman Sachs

- Goldman Sachs Prime Brokerage report for July

Goldman Sachs Prime Brokerage report for July shows:

- Hedge funds have been de-risking in July at levels that are close to record levels for the past decade.

- The de-risking by hedge funds in July has been mainly attributed to short covering.

- Long/short hedge funds experienced nine consecutive days of negative returns before July 28, which is the longest streak since January 2017.

- Long/short hedge funds are expected to face the worst monthly alpha drawdown in July since May 2022.

- Goldman Sachs indicates “signs of capitulation are starting to emerge” in their recent prime brokerage report.

Amazon and Apple to lead the earnings releases this week

- A look at the major earnings releases for the week starting July 31

The earnings season continues with Apple and Amazon leading the charge this week.They will release their earnings after the market close on Thursday.The Nasdaq index has seen an increase of nearly 36.8% this year, while the S&P 500’s is up 19.3%.More than half of the companies listed on the S&P 500 had reported their second-quarter earnings by Friday, with 78.7% of them surpassing analysts’ expectations, reported by Reuters.

The major companies reporting this week by data include:

Monday, July 31

- Sofi

Tuesday, August 1

- Uber

- Pfizer

- Caterpillar

- Merck

- Altria

- AMD

- Starbucks

Wednesday, August 2

- CVS

- Humana

- Kraft Heinz

- PayPal

- Shopify

- Qualcomm

- Unity

Thursday, August 3

- Warner Bros. Discovery

- ConocoPhillips

- Expedia

- Moderna

- Amazon

- Apple

- Coinbase

- Airbnb

- Draft King’s

Fed’s Goolsbee: Last six months have shown we can bring down inflation without jobs lost

- Comments from the Chicago Fed President

- So far we’ve been able to walk the golden path

- The bank problems ‘have been the dog that’s not barking’

- We have been disproving people with a stable Phillips curve mindset

- This has been a strange business cycle, so normal tradeoffs don’t apply

- Asked about a rate hike, says he’s ‘not a fan of tying our hands before the data’

- Notes openness to reading data ahead of Sept

- Getting inflation down without higher unemployment ‘would be a triumph’

Commodities

Silver rises and threatens $25.00

- XAG/USD rose more than 1% and jumped near $24.70.

- The USD trades flat, allowing precious metals to advance.

- JOLTs Job openings, ADP and NFP from the US from July reports are the week’s highlights.

On Monday, the XAG/USD saw significant gains, mainly by a positive market mood and a relatively weak USD. That being said, markets may see volatility during the week as the US will release key labour market data that will affect the bets on the next Federal Reserve (Fed) decisions.

According to the consensus, July saw a decline in job creation, while hourly wages and the unemployment rate held steady. In that, the direction of the US labour market will be crucial for investors, as Chair Powell noted last week that the decision to set the next interest rate will only be based on new data. In addition, he added that to normalise inflation, the Fed expects “some” softening of the labour market.

WTI crude oil futures settles at $81.80

- Up $1.22 or 1.51%

The price of WTI crude oil futures are settling at $81.80. That’s up $1.22 or 1.51%

Although Chinese PMI data was week, they later gave assurances of upcoming consumption support from Chinese government departments.

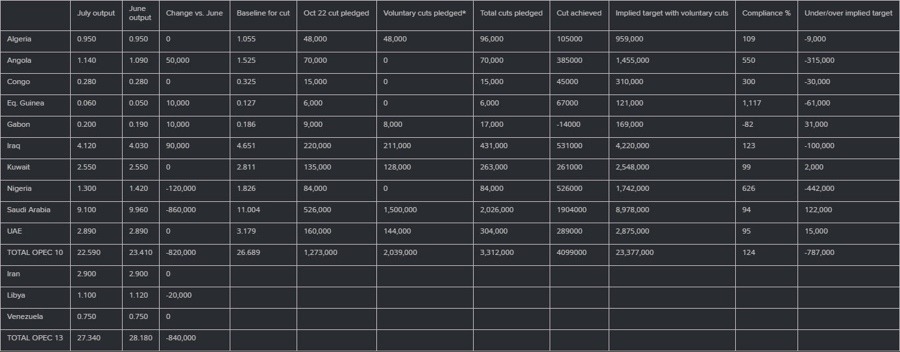

Reuters monthly OPEC poll revealed a fall in July output by 840,000 BPD to 27.34 million BPD.

US EIA revises May oil demand nearly 1 million barrels per day higher. Goldman sees $93

- Goldman Sachs sticks to $93 Brent call

On the final day of each month the US Energy Information Administration releases monthly demand figures and they continue to stress that the weekly data can’t be trusted.

Today’s report pegs US total demand at 20.776m bpd in May using monthly data, that’s up 973,000 bpd from the 19.803m bpd using the weekly data.

As for Goldman Sachs, their latest note estimates that global oil demand hit an all-time high of 102.8m bpd in July.They also revised estimates for 2023 demand higher by 550k bpd mostly due to the US and India.

The next big question is what Saudi Arabia does with its 500k bpd voluntary cut we should find out this week. Goldman’s base case is an extension through Sept but that it’s halved in October.

Overall they see a 1.8 million barrel per day global deficit in H2, drawing down inventories. They maintain a $93/barrel brent target for H2.

OPEC production fell 840K bpd in July – survey

- Reuters’ benchmark secondary sources survey

WTI crude oil is up another $1.07 today as it builds towards a sixth-consecutive week of gains. It’s trading at $81.61 and near the highs of the day after Reuters’ survey of OPEC production showed a drop of 860K bpd.

The bulk of that is the 500kbpd Saudi voluntary cut, which has been extended through August (but not yet Sept) and the Saudi cut isn’t a surprise. The bigger twist is from Nigeria, where output fell 120k bpd due to a potential leak at a Shell export terminal and a brief stoppage due to a protest.

In total, Angola and Nigeria are both producing far below quotas with the UAE and Saudis producing slightly above.

This survey doesn’t include Russia but indications are that they have lowered exports in July as promised, or are headed in that direction.

Chile’s copper output falls 0.9% y/y as supply shortfall nears

- New data from Chile’s stats agency

On Friday, state copper company Codelco cut its 2023 output forecast to 1.31-1.35 million metric tons from 1.35-1.45 million previously. That’s after several production halts and because grades are falling.

In a related story, the FT this weekend outlined a looming supply shortage in electricity cables and converter stations, with orders being pushed out four years or more.

To be clear, there’s no shortage of copper at the moment and some mines are coming online this year and next; but around mid-decade there is a strong case that there will be undersupply. Given that it takes about 10 years to bring a copper mine online, the chances of an upside supply surprise are virtually nil.

EU News

European equity close: Italy leads modest gainers as the FTSE MIB breaks out

- Closing changes in Europe on July 31

Closing changes today:

- Stoxx 600 +0.2%

- German DAX flat

- FTSE 100 +0.1%

- French CAC +0.4%

- Italy MIB +0.6%

- Spain IBEX -0.2%

On the month:

- Stoxx 600 +2.2%

- German DAX +2.0%

- FTSE 100 +2.4%

- French CAC +1.5%

- Italy MIB +5.1%

- Spain IBEX +0.8%

Eurozone Q2 preliminary GDP +0.3% vs +0.2% q/q expected

- Latest data released by Eurostat – 31 July 2023

- Prior -0.1%

- GDP +0.6% vs +0.5% y/y expected

- Prior +1.0%

Eurozone July preliminary CPI +5.3% vs +5.3% y/y expected

- Latest data released by Eurostat – 31 July 2023

- Prior +5.5%

- Core CPI +5.5% vs +5.4% y/y expected

- Prior +5.5%

UK June mortgage approvals 54.66k vs 49.00k expected

- Latest data released by the BOE – 31 July 2023

- Prior 50.52k; revised to 51.14k

- Net consumer credit £1.7 billion vs £1.3 billion expected

- Prior £1.1 billion

SNB total sight deposits w.e. 28 July CHF 490.1 bn vs CHF 489.3 bn prior

- Latest data released by the SNB – 31 July 2023

- Domestic sight deposits CHF 479.3 bn vs CHF 478.5 bn prior

Italy Q2 preliminary GDP -0.3% vs 0.0% q/q expected

- Latest data released by Istat – 31 July 2023

- Prior +0.6%

Germany June import price index -1.6% vs -0.7% m/m expected

- Latest data released by Destatis – 31 July 2023

- Prior -1.4%

Germany June retail sales -0.8% vs +0.2% m/m expected

- Latest data released by Destatis – 31 July 2023

- Prior +0.4%

Germany’s warning of five tough years could be a backbreaker for the euro

- The economy minister is telling you what’s going to happen

Sometimes politicians say the quiet things out loud.

That happened this weekend with German Economy Minister Robert Habeck, who warned that Germany faces five difficult years due to deindustrialization from high energy prices.

Germany is already in a recession and its centered on industrial companies, that are wilting and cutting production.

“We have a major transformational period ahead of us until 2030,” during which time Germany would move from a traditional, fossil fuel-dependent industrial base to green energies like hydrogen, Habeck said.

The deficit rules are currently suspended because of covid and that will probably continue through 2024 but at some point, they need to end. How hard the periphery countries want to push at that point, will determine what comes next for Germany and the eurozone economy. Germany’s political situation is also tough with deficit hawks still holding huge sway in a fragmented system.

Habeck put it bluntly:

“The question is: Do we borrow money or do we no longer have industry?”

Other News

Japan ruling party heavyweight says BOJ policy tweak could pour could water on the economy

- Remarks by Japan LDP senior lawmaker, Hiroshige Seko

- BOJ decision could pour could water on the economy, needs high attention

- Policy tweak sends a message to finally exit from easing policy

Core inflation likely to gradually slow towards year-end – BOJ quarterly report

- The BOJ comments in its latest report on the outlook for the economy and prices – 31 July 2023

- Japan’s economy is likely to continue recovering moderately for the time being

- The rate of increase in CPI is likely to decelerate

- But it is projected to accelerate again moderately as the output gap improves and as medium- to long-term inflation expectations and wage growth rise

- There are extremely high uncertainties for Japan’s economic activity and prices

- The balance of risks to economic activity are skewed to the downside

- Risks to prices are skewed to the upside

Japan July consumer confidence index 37.1 vs 36.2 prior

- Latest data released by the Japan Cabinet Office – 31 July 2023

That’s another improvement in Japan consumer morale and that’s a positive sign for the economy at least even as we head into Q3. Price expectations continue to decrease, with 92.8% of households expecting prices to be higher for the year ahead – down 0.4% from June.

Cryptocurrency News

Worldcoin price could bleed with German watchdog’s investigation, amidst allegations of fake KYC in Africa

- Bavarian state regulator is the lead authority investigating the Worldcoin project under the EU’s data protection rules according to Reuters.

- Chinese reporter investigates likely fake Worldcoin KYCs in Africa.

- WLD price trades at $2.336, 128% below it’s all-time high of $5.278 on Binance.

Worldcoin (WLD), the project launched by OpenAI’s Sam Altman, is under investigation by German watchdog, Bavarian state regulator. According to a Reuters report, the authority has been investigating Worldcoin for a year.

A Chinese reporter shared details of fake Worldcoin KYC in Africa and shared the story of a source involved in the KYC scam. WLD price is likely to suffer a correction in response to the rising number of allegations and investigations by authorities worldwide.

SEC sues Richard Heart, founder of Hex, for raising $1 billion by offering unregistered securities

- The Securities and Exchange Commission filed the lawsuit claiming Richard Heart violated Securities laws.

- Heart reportedly touted Hex investments as a pathway to “grandiose wealth.”

- SEC recently stated to Coinbase CEO Brian Armstrong that every crypto asset other than Bitcoin is a security.

The Securities and Exchange Commission (SEC) continued its crypto crackdown in Q3 but decided to go after an influencer and entrepeuner over a company. Interestingly, the lawsuit filing came hours after reports of Coinbase CEO, Brian Armstrong, claiming that the SEC stated to them that, except for Bitcoin, every crypto asset is a Security.

SEC charges Richard Heart for violating Securities laws

The SEC sued the popular crypto content creator, Richard Heart, founder of Hex and Pulsechain, on Monday. Per the reported filing, the crypto advocate has violated Securities laws by raising $1 billion through unregistered offers and the sale of crypto assets.

According to the SEC lawsuit, Heart seems to have engaged in three separate offerings – Hex, PulseChain and PulseX. According to SEC, each of them is a crypto asset security created and managed by Richard Heart.

Follow our recently launched pages. Join our community and never miss a beat in the dynamic world of trading.

https://www.facebook.com/BilalsTechLtd

https://www.linkedin.com/company/bilals-tech/