North American News

Major US stock indices closing lower on the day

- NASDAQ index gives up gains after Apple’s WWDC23 event

The major US stock indices are closing lower. The Dow Industrial Average led the way with a decline of 0.6%. The NASDAQ index which was higher for most of the day gave up its gains as the Apple WWDC23 event was working toward its close.Apple shares are closing down $-1.41 or -0.78% at $179.52.Intraday the high price reached $184.93 which was a new all-time high.

The NASDAQ index is up 6 straight weeks.

The closing levels are showing:

- Dow industrial average fell -199.72 points or -0.59% at 33563.05

- S&P index fell -8.56 points or -0.20% at 4273.82

- NASDAQ index fell -11.35 points or -0.09% at 13229.42

The smaller Russell 2000 index tumbled -1.32% on the day.

Apple shares are closing down $-1.35 or -0.75% at $179.58 after its WWDC23 event where they introduced the Apple Vision Pro headset.

Apple and Disney announced a partnership for the Vision Pro. It’s shares are up $0.24 or 0.26% and $90.96 after trading as high as $91.71.

Unity software was also announced as a partner for app development for the Vision Pro. It’s shares rose $5.27 or 17% to $36.27. It’s shares traded as high as $39.45.

Unity Software shares soar as Apple announces partnership to bring apps to Vision Pro

- Shares up over 20%

Apple shares are down around $1.45 or -0.82% $179.43 after their WWDC23 event where they introduce the Vision Pro VR product.

Looking at U shares, the 2023 high price reached $42.99 back on February 15. The 2022 high price reached $136.60 on January 12, 2022 and its all-time high price was way up at $210.

In trading today, the price moved above both its 100 and 200 day moving averages which comes in at $31.04 and $32.36 respectively.Technically, it would take a move back below those levels to tilt the technical bias back to the downside (risk level for long’s looking for more upside potential off the partnership) . The price had not been above the 200 day moving average since February 22, 2023.

From the recent earnings:

- Unity, the video game software developer, reported a 56% year-over-year increase in quarterly revenue.

- The company recorded a net loss of $254 million (or 67 cents per share), compared to a net loss of $178 million (or 60 cents per share) in the same period the previous year.

- Comprehensive losses for the quarter amounted to $251 million, compared to $182 million in the same period last year.

- The company forecasted its second-quarter revenue to be between $510 million and $520 million, surpassing analyst estimates of $509 million.

- Unity’s full-year revenue is expected to be between $2.08 billion and $2.20 billion.

- The company was founded in 2004 and provides developers with tools to create 3D games across various platforms.

- Unity expects to grow faster than its competitors in 2023, claiming to be “well-positioned” to benefit from AI with four existing applications and services supporting the technology.

- As part of its commitment to “excellence in execution,” the company plans to cut about 600 jobs, or 8% of its workforce, to position itself for “long-term and profitable growth.”

- The company believes these decisions will lead to stronger long-term profitability.

US ISM May services index 50.3 vs 52.2 expected

- ISM services data for May 2023

- Prior was 51.9

- employment index 49.2 versus 50.8 prior

- new orders index 52.9 versus 56.1 expected

- prices paid index 56.2 versus 59.6 prior — lowest since May 2020

- new export orders 59.0 versus 60.9 last month

- imports 50.0 versus 51.3 last month

- backlog of orders 40.9 versus 49.7 last month

- inventories 58.3 versus 47.2 last month

- supplier deliveries 47.7 versus 48.6 last month

- inventory sentiment 61.0 versus 48.9 last month

US April factory orders 0.4% versus 0.8% expected

- US April 2023 factory order data

- Prior +0.4% (was revised from 0.9% in the preliminary)

- Revised to +0.6%

- Factory orders April 0.4% vs 0.8% expected

- Factory orders Ex transportation -0.2% versus -0.7% last month.

- Durable goods orders (revised) 1.1% versus 1.1% preliminary.

- Last month +3.3%

- Durable goods ex-defense -0.7% versus -0.6% preliminary. Last month +3.2%

- Durable goods ex-transportation -0.3% vs -0.2% preliminary. Last month +0.3%

- Nondefense capital goods ex-air 1.3% vs 1.4% preliminary. Last month -0.6%

S&P Global final May US services PMI 54.9 vs 55.1 prelim

- The final PMIs for the US from S&P Global

- Fourth consecutive increase

- Best services reading in 13 months

- Prelim was 55.1

- Prior was 53.6

- Composite PMI 54.3 vs 54.5 prelim

- Prior composite 53.4

- Both input and output price inflation softened

US May employment trends 116.15 vs 116.18 prior

- Employment trends data from The Conference Board

- Prior was 116.18

Commodities

Silver cuts some of its losses back above the 100-DMA

- XAG/USD reclaims the 100-day EMA at $23.47 after dipping to a daily low, showcasing a subtle comeback.

- Despite the recovery, the market remains neutral to downward biased as XAG/USD fails to reconquer the April 25 daily low.

- Technical indicators suggest a battle between sellers and incoming buyers, hinting at volatility in the XAG/USD market.

XAG/USD stages a comeback though it remains slightly below its opening price, reclaimed the 100-day Exponential Moving Average (EMA) at $23.47 after hitting a daily low of $23.25.

WTI crude oil futures settles at $72.15

- Marginal gains after Saudi Arabia announces production cuts for the summer

The price of WTI crude futures are selling at $72.15. That is up $0.41 or 0.57%. The high price reached $75.06. The low price was at $72.02. The gains from the weekend Saudi Arabia production cut were erased.

Looking at the daily chart, the high price today extended toward the falling 100 day moving average. That level comes in at $75.66. The high price got within $0.60 of that level but backed off into the close.

Saudi Arabia to make 1m bpd production cut, others to extend cuts through 2024

- OPEC+ makes a splash

OPEC+ wants higher oil prices.

Saudi Arabia will make a further voluntary oil production cut while others — including Russia — will continue with voluntary cuts through 2024, rather than the current plan to reevaluate at the end of 2023.

Starting in July, Saudi Arabia will cut production by 1 million barrels per day.That’s currently just for one month, but Saudis energy minister said it could be extended (likely based on where prices are).

For other OPEC members, baselines have been be adjusted for 2024 and that means lower ceilings for Angola and Nigeria. However it should be noted that neither Angola, nor Nigeria is currently producing anywhere near quotas.

The next OPEC meeting was set for November 26 but the group always maintains flexibility to call new meetings.

The output target for 2024 is 40.46 but note that the UAE’s baseline was moved up by 200k bpd. So while I believe their voluntary cuts still apply, they will be able to pump from a higher baseline.

Overall, 2024 targets are now about 1.4 mbpd lower than current.

Many in the market already see crude balances tightening significantly in H2 as driving season picks up, aviation demand improves and Asian economies grow.

Few in the market expected OPEC to make any move, though there were some murmurs late last week.WTI crude closed Friday at $71.74 and Brent at $76.13.How much further it rises will depend on how much production Saudi Arabia curbs for 2023.

However the extension of cuts through 2024 is also materially bullish further out, though there will be some that doubt OPEC discipline. But those doubts probably only matter at prices above $90, when there’s a large incentive to break ranks.

Here were May production levels:

Bottom line here:

- 2023 global production lowered by 1 mbpd in July via Saudis for one month (maybe more)

- OPEC+ voluntary cuts extend through all of 2024

EU News

Down day for the European major indices

- Losses across the board in the major European indices

The major European indices are closing lower on the day.

- German DAX -0.54%

- France CAC -1.0%

- UK’s FTSE 100 -0.12%

- Spain’s Ibex -0.31%

- Italy’s FTSE MIB -0.90%

ECB’s Lagarde: No clear evidence that underlying inflation has peaked

- Comments from the ECB President

- Price pressures remain strong

- Underlying inflationary pressures remain high

- Wages pressures have strengthened further

- Decisions will continue to be based on incoming data

- Our rate hikes are being transmitted forcefully to financing conditions

- Full effects of our monetary policy measures are starting to materialize

- Effects of our policy can be expected to strengthen in coming years

- It is very likely we will stop all reinvestment in APP

ECB’s Nagel: Several more rate hikes are still necessary

- Comments from the German ECB member

- Not certain rates will peak this summer

- Put rate must be held until there is no doubt that inflation is returning to 2% in near term

- Underlying price pressure remain far too high, showing little sign of abating

- Cautiously optimistic about German growth prospects over the rest of the year

Eurozone April PPI -3.2% vs -3.1% m/m expected

- Latest data released by Eurostat – 5 June 2023

- Prior -1.6%; revised to -1.3%

- PPI +1.0% vs +1.4% y/y expected

- Prior +5.9%; revised to +5.5%

Eurozone June Sentix investor confidence -17.0 vs -15.1 expected

- Latest data released by Sentix – 5 June 2023

- Prior -13.1

Eurozone May final services PMI 55.1 vs 55.9 prelim

- Latest data released by HCOB – 5 June 2023

- Prior 56.2

- Composite PMI 52.8 vs 53.3 prelim

- Prior 54.1

Spain May services PMI 56.7 vs 56.9 expected

- Latest data released by HCOB – 5 June 2023

- Prior 57.9

France May final services PMI 52.5 vs 52.8 prelim

- Latest data released by HCOB – 5 June 2023

- Prior 54.6

- Composite PMI 51.2 vs 51.4 prelim

- Prior 52.4

Italy May services PMI 54.0 vs 57.0 expected

- Latest data released by HCOB – 5 June 2023

- Prior 57.6

- Composite PMI 52.0 vs 54.0 expected

- Prior 55.3

UK May final services PMI 55.2 vs 55.1 prelim

- Latest data released by S&P Global – 5 June 2023

- Prior 55.9

- Composite PMI 54.0 vs 53.9 prelim

- Prior 54.9

SNB total sight deposits W.E. 2 June CHF 519.0 bn vs CHF 516.7 bn prior

- Latest data released by the SNB – 5 June 2023

- Domestic sight deposits CHF 504.5 bn vs CHF 505.2 bn prior

Switzerland May CPI +2.2% vs +2.2% y/y expected

- Latest data released by SECO – 5 June 2023

- Prior +2.6%

- Core CPI +1.9% y/y

- Prior +2.2%

Germany May final services PMI 57.2 vs 57.8 prelim

- Latest data released by HCOB – 5 June 2023

- Prior 56.0

- Composite PMI 53.9 vs 54.3 prelim

- Prior 54.2

Germany April trade balance €18.4 billion vs €16.0 billion expected

- Latest data released by Destatis – 5 June 2023

- Prior €16.7 billion

Morgan Stanley expects ECB to end rate hikes in July

- The firm sees a peak in the cycle at 3.75%

That means two more rate hikes to go i.e. a 25 bps move in June and a similar one in July. That is consistent with the current market pricing, with a peak rate of 3.70% being priced in now.

A move in June and then July seems to be what policymakers are clearly hinting at but anything after will be highly subject to data developments in the next few months.

Other News

There are signs of de-dollarisation unfolding – JP Morgan

- A couple of interesting notes made by JP Morgan on the dollar’s standing

The firm argues that while overall dollar usage is still holding within historical estimates, the usage was more “bifurcated under the hood”. While the dollar’s share of traded currency volumes is just a little off record highs, at 88%, there are other evident signs of de-dollarisation elsewhere.

The firm notes that the dollar’s share as part of global central bank FX reserves has dropped to a record low of 58%.That number is still by far and out the largest in the world but it has been slipping, not really helped by the challenges the dollar is facing in dealing with the likes of Russia and China in particular.

An interesting thing to note in that pointer is that gold now comprises 15% of reserves as compared to just 11% five years ago.

Besides that, JP Morgan also highlighted a decline in the dollar’s role as part of global exports – in which the US share is now down to a record low of 9%.Meanwhile, for all the talk of countries wanting to be less dependent on China, their share has actually increased to a record high of 13%.

Going back to the first paragraph on traded currency volumes, the euro is the biggest loser there as its share shrunk by 8% in the last decade to a record low of 31%. The yuan is once again a winner in that category, rising to a record high of 7%.

However, JP Morgan says that the progress by Beijing to internationalise the yuan has been limited and that is unlikely to change much given the China’s capital controls.

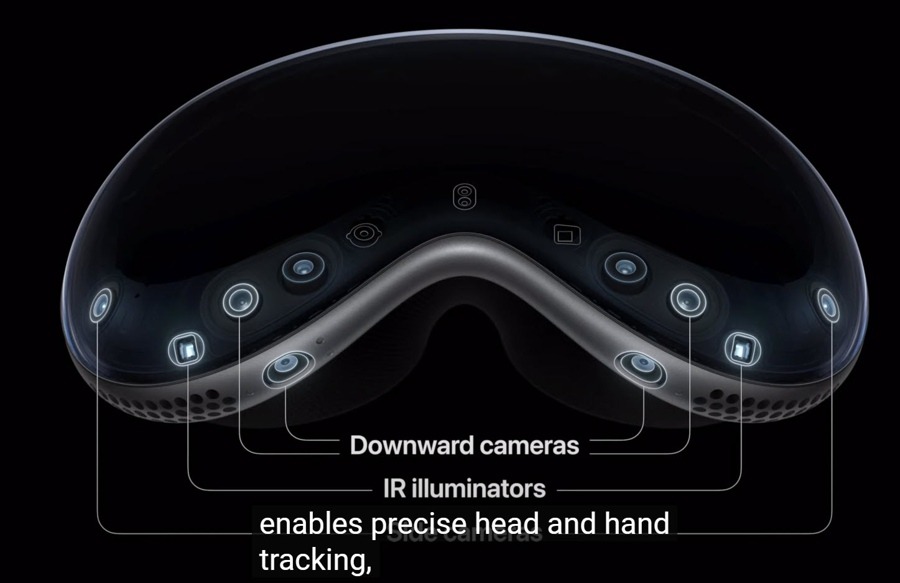

Apple introduces VisionPro VR glasses

The product – and advancement to their operating systems and other products – is impressive but it is still hard to see people immersing themselves in an alternative reality environment easily and affordably.

Having said that, Apple has a way of influencing and creating demand.

In doing so, they create an entire ecosystem that supports multi-products and applications.

Starting Price: $3499 and will be available next year and only to the US at first.

US is seeing increasing level of aggressiveness by China’s military

- Geopolitical risk from China

White House:

- US is seeing increasing level of aggressiveness by China’s military

- US prepared to address growing aggressiveness

- US once to see Beijing justify what it is doing with increased military intercepts

- Both recent Chinese intercepts occurred in international space

- It won’t be long before someone gets hurt

- US will continue to operate in international air and sea space

- US urges China to make better decisions

Morgan Stanley expects ECB to end rate hikes in July

- The firm sees a peak in the cycle at 3.75%

That means two more rate hikes to go i.e. a 25 bps move in June and a similar one in July. That is consistent with the current market pricing, with a peak rate of 3.70% being priced in now.

A move in June and then July seems to be what policymakers are clearly hinting at but anything after will be highly subject to data developments in the next few months.

Cryptocurrency News

SEC sues Binance Holding and Chairman Zhao. Bitcoin dips

- 13 charges filed by the SEC

The U.S. SEC has filed 13 charges against Binance, the largest global cryptocurrency exchange, and its founder, Changpeng Zhao. Binance is the largest crypto exchange.

Binance is accused of mishandling customer funds, lying to regulators, and misleading investors about its operational safeguards.The SEC alleges that Binance mixed billions of dollars in customer funds and secretly transferred them to a separate company controlled by Zhao.

This action follows a similar case by the Commodities Futures Trading Commission against Binance and Zhao, highlighting a broader regulatory clampdown in the crypto trading sector.

Binance Coin price crashes by 10% as SEC sues Binance and CEO Changpeng Zhao

- Binance Coin price fell to trade below $280 within the hour of the announcement of the SEC lawsuit.

- The Securities and Exchange Commission noted that the cryptocurrency exchange violated securities law.

- Binance CEO Changpeng Zhao responded to the claims with his standard “4”, suggesting FUD, fake news or attack.

Binance Coin price is facing the brunt of the bear market as the already persisting skepticism was flamed further today by the Securities and Exchange Commission (SEC). The regulatory body fired its shot against the world’s biggest cryptocurrency exchange and its CEO, bringing the native token BNB to a multi-month low.

Follow our recently launched pages. Join our community and never miss a beat in the dynamic world of trading.

https://www.facebook.com/BilalsTechLtd

https://www.linkedin.com/company/bilals-tech/