Q1 2025 earnings reports are front and center this week as major players across tech, finance, healthcare, and consumer sectors release results that could shape the market’s next move. From Netflix and TSMC to Goldman Sachs and Citigroup, the calendar is packed with high-impact reports investors can’t afford to ignore.

In this pillar guide, we break down all the key earnings by day, spotlight standout names, and provide updates on when the “Magnificent Seven” will release their Q1 results. This guide breaks down the daily earnings schedule, company expectations, investor sentiment, and key market themes — plus, we preview the earnings dates for the “Magnificent Seven” tech giants.

- Monday, April 14

- Tuesday, April 15

- Wednesday, April 16

- Thursday, April 17

- Magnificent Seven Earnings

- Market Outlook

- Final Word

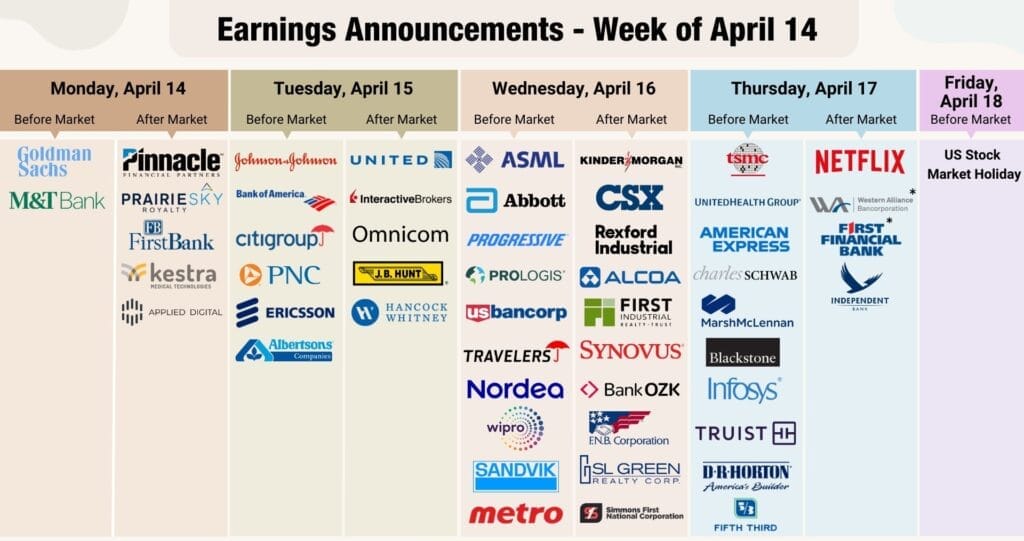

Earnings Calendar: April 14–17, 2025

Monday, April 14

Before Market Open:

- Goldman Sachs (GS)

EPS Estimate: $12.71 | Revenue: $15.21B (▼52.7% YoY)

Goldman’s earnings are expected to fall sharply, and the stock has been trading below key technical levels. A muted quarter may reflect broader investment banking weakness. - M&T Bank

After Market Close:

- Applied Digital (APLD)

EPS Estimate: -$0.11 | Revenue: $63.57M (▲46.7% YoY)

The company continues to grow revenue but remains unprofitable. Traders are expecting a large move, with the stock significantly below its 200-day moving average. - FirstBank

- Pinnacle Financial Partners

Tuesday, April 15

Before Market Open:

- Bank of America (BAC)

EPS Estimate: $0.81 | Revenue: $26.74B (▼44.4% YoY)

Despite the decline, bullish sentiment surrounds BAC as investors focus on improving credit quality and loan growth. - Citigroup (C)

EPS Estimate: $1.84 | Revenue: $21.14B (▼51.8% YoY)

The stock has seen moderate investor optimism ahead of earnings, with analysts pointing to leaner operations and better-than-expected trading activity. - Johnson & Johnson (JNJ)

EPS Estimate: $2.57 | Revenue: $21.66B (▲1.3% YoY)

J&J remains a stable player in the healthcare space. Modest growth is expected, but guidance on consumer health will be key. - PNC Financial

- Albertsons

- Ericsson

After Market Close:

- United Airlines (UAL)

EPS Estimate: $0.80 | Revenue: $13.49B (▲7.6% YoY)

The airline has struggled recently, with the stock down over 40% since its last earnings. Any sign of margin compression could hurt broader travel sector sentiment. - Interactive Brokers

- J.B. Hunt

Wednesday, April 16

Before Market Open:

- ASML (ASML)

EPS Estimate: $6.12 | Revenue: $8.08B (▲40.7% YoY)

ASML continues to benefit from demand for advanced lithography machines used in semiconductor manufacturing. Analysts expect strong growth and upbeat forecasts. - US Bancorp

- Abbott

- Progressive

- Travelers

- Prologis

After Market Close:

- Alcoa

- CSX

- Kinder Morgan

Thursday, April 17

Before Market Open:

- Taiwan Semiconductor (TSMC)

EPS Estimate: $2.02 | Revenue: $25.20B (▲33.5% YoY)

TSMC is expected to post robust growth as demand for AI chips remains high. Despite a 28% decline since last earnings, sentiment remains bullish. - UnitedHealth Group (UNH)

EPS Estimate: $7.27 | Revenue: $111.01B (▲11.2% YoY)

UNH is a bellwether for the healthcare sector. The stock has gained momentum recently, and investors are focused on revenue mix and cost management. - Huntington Bank

- American Express

After Market Close:

- Netflix (NFLX)

EPS Estimate: $5.74 | Revenue: $10.54B (▲12.5% YoY)

With subscriber numbers stabilizing and pricing strategies evolving, Netflix is expected to post a strong quarter. The stock remains above its 200-day moving average.

Magnificent Seven: Earnings Dates for Q1 2025

These tech giants often set the tone for the broader market. Here’s when they report:

| Company | Ticker | Earnings Date |

|---|---|---|

| Tesla | TSLA | April 22, 2025 |

| Apple | AAPL | May 1, 2025 |

| Alphabet | GOOGL | April 29, 2025 |

| Microsoft | MSFT | April 30, 2025 |

| Amazon | AMZN | April 24, 2025 |

| Meta | META | April 30, 2025 |

| Nvidia | NVDA | May 28, 2025 |

Market Outlook: Themes and Sentiment

This week’s Q1 2025 earnings reports cover nearly every major sector and come at a time of mixed economic signals. Here’s what to watch:

- Streaming & Subscriptions: Netflix is expected to post strong results. Analyst sentiment is bullish, but high expectations raise the bar.

- Semiconductors: TSMC and ASML continue to benefit from AI and advanced chip demand.

- Financials: Despite revenue declines, Bank of America and Citigroup are expected to outperform—investors will focus on loan growth and margin commentary.

- Healthcare: UnitedHealth and Johnson & Johnson are showing resilience, but guidance will be key.

- Transportation: United Airlines faces weak expectations after a rough run since its last earnings.

Takeaways for Traders and Investors

- Expect volatility: Options markets are pricing in big moves for multiple names—especially Netflix, ASML, and TSMC.

- Use this week’s results to gauge sector strength, especially in finance, tech, and healthcare.

- Keep an eye on guidance, not just the headline numbers—markets are increasingly forward-looking.

Final Word

This week’s Q1 2025 earnings reports are more than routine updates — they’re market-moving events. Investors are watching not just the headline numbers but also guidance and commentary on economic conditions. With major names across sectors reporting, this week will set the tone heading into May.

Expect elevated volatility, rapid post-earnings moves, and a clearer picture of which sectors are leading or lagging as Q2 begins.