A Market Shift Driven by Titans and Policy

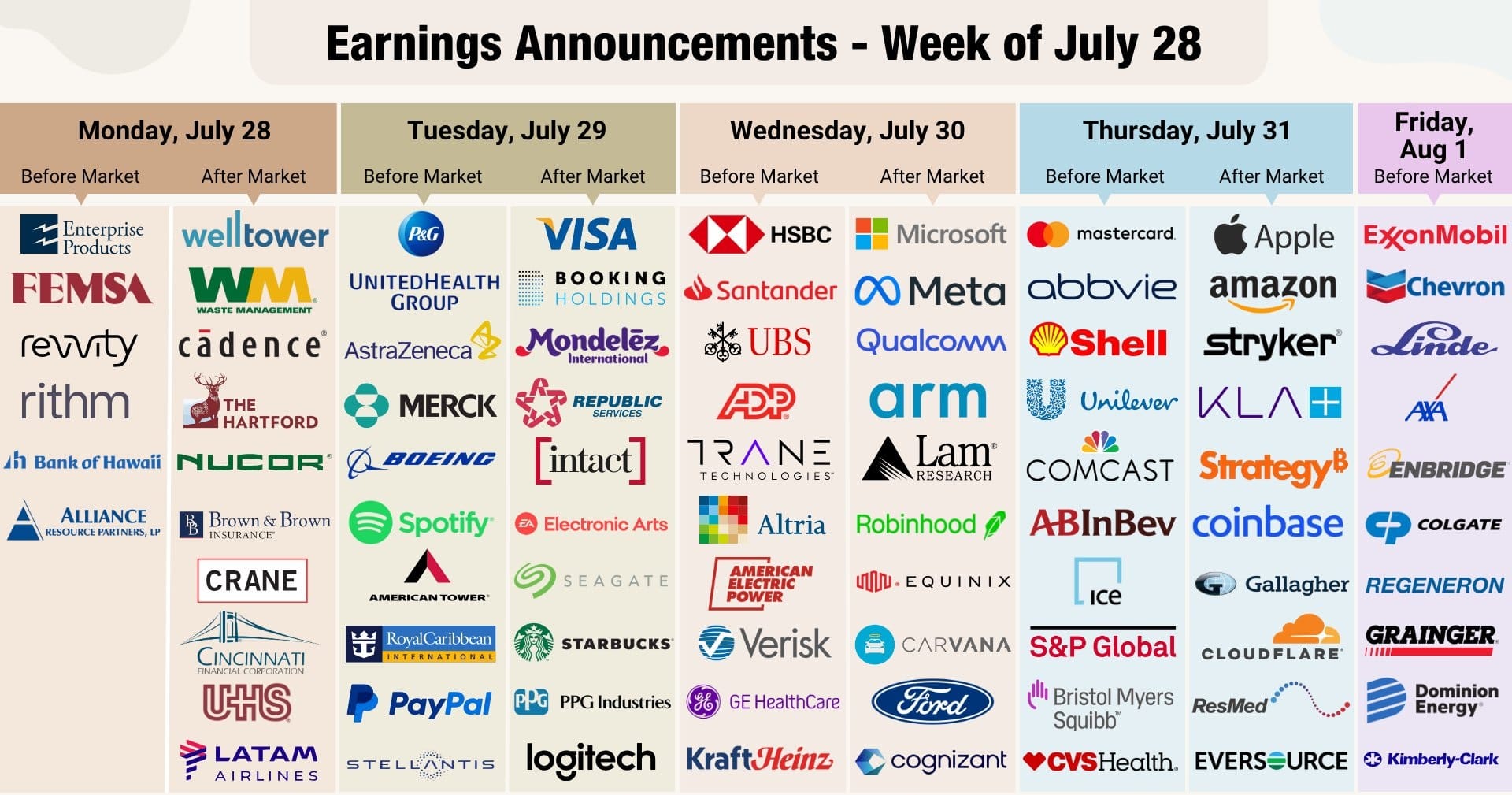

Market Shift isn’t just a buzzword this week—it’s the defining theme. The week of July 28th is a powerful convergence of tech earnings from Apple, Amazon, and other MAG7 leaders, coupled with a pivotal Federal Reserve interest rate decision and critical economic indicators.

Every investor, institutional or retail, must prepare for a market shift that could recalibrate not only stock prices but also portfolio strategy and macroeconomic expectations heading into Q3.

Apple and Amazon Earnings: Pressure on the MAG7

This week features earnings from several mega-cap giants, but none more impactful than Apple and Amazon. As two core pillars of the MAG7, their results will offer crucial insight into consumer demand, AI monetization, and margin resilience.

Apple (AAPL)

- Earnings Date: Thursday, After Market Close

- Expected EPS: $1.42 | Revenue: $88.53B

- Focus: iPhone sales in China, Services revenue, Vision Pro rollout, and AI roadmap.

Amazon (AMZN)

- Earnings Date: Thursday, After Market Close

- Expected EPS: $1.33 | Revenue: $162.17B

- Focus: AWS momentum, retail margins, advertising revenue, and AI-enhanced logistics.

These tech earnings are not isolated—they’re central to broader index performance, ETF flows, and institutional exposure. A strong beat from both names could reinforce confidence in tech leadership, sustaining the current market shift trend.

The Fed’s Decision and Its Ripple Effect

The Federal Reserve’s interest rate decision—scheduled for Wednesday—will be as closely watched as any earnings report.

- Consensus: No rate change (holding at 4.50%–4.75%)

- Focus: Chair Powell’s tone on inflation, employment softening, and possible future cuts.

Investors should focus on:

- Forward Guidance: Clarity on potential easing in late 2025.

- Market Repricing: Bond yields and equity volatility may spike post-press conference.

- Impact on Growth Stocks: Tech and consumer discretionary sectors are especially rate-sensitive.

The market shift narrative hinges on whether the Fed signals prolonged tightening—or opens the door to a pivot.

Economic Indicators: Jobs, GDP, Inflation

The economic calendar adds further weight to the week’s volatility.

Key Releases:

- Nonfarm Payrolls (Friday): Expecting +103K vs. +147K prior

- Unemployment Rate: Slight uptick to 4.2%

- Average Hourly Earnings: +0.3% MoM; wage pressures still monitored

- Q2 GDP (Wednesday): Forecast +2.5% rebound

- Core PCE (Thursday): Fed’s preferred inflation gauge; +0.3% MoM expected

These indicators will act as the macro backdrop to tech earnings, validating or challenging the market shift narrative.

How MAG7 Performance Influences Broader Market Indices

The MAG7 (Apple, Amazon, Microsoft, Meta, Alphabet, Tesla, Nvidia) now account for over 30% of S&P 500 weighting. Their earnings, guidance, and stock reactions influence:

- S&P 500 Index & ETFs: Passive funds mirror their moves.

- Quant Models & Algos: React to earnings surprise metrics and guidance language.

- Options Flow: Institutional hedging and leverage spike around these names.

A strong showing could drive momentum inflows, particularly in large-cap growth ETFs like QQQ, SPYG, or XLK. Conversely, a post-earnings fade could lead to broad de-risking.

Strategic Investor Positioning: What Portfolios Are Doing

Portfolio managers are entering this week hedged, cautious, or selectively long.

3 Hypothetical Model Scenarios:

📈 Growth-Favoring Allocation (Momentum Strategy)

- Overweight: Apple, Nvidia, Meta

- Fed Outlook: Soft landing scenario

- Reaction: Add exposure on earnings strength

🛡️ Defensive Rotation (Risk-Off Strategy)

- Overweight: Healthcare, Consumer Staples, Utilities

- Fed Outlook: Hawkish language continues

- Reaction: Reduce tech beta, add bonds

📊 Balanced Barbell (Hedge Strategy)

- Split Exposure: Tech (AAPL, MSFT) + Value (XOM, JPM)

- Fed Outlook: Data-dependent, uncertain

- Reaction: Use options to manage risk during volatility spikes

Investors must match allocation to Fed messaging + earnings reactions, especially in a week dominated by market shift catalysts.

Interplay Between Micro and Macro Catalysts

Why This Week Matters:

- Fed vs. Forward Earnings: Are corporate executives more optimistic than Powell?

- Labor Market vs. Consumer Spend: Can jobs data support Apple’s and Amazon’s demand story?

- Inflation vs. Margins: Will sticky inflation show up in corporate cost structures?

Every datapoint interacts, forming a feedback loop that either reinforces or disrupts current market positioning.

Conclusion: Prepare for the Market Shift

This week is not just another earnings season checkpoint. It’s a full-scale market shift event. The outcomes from Apple, Amazon, and the Fed will dictate not just headlines—but flows, valuations, and momentum for weeks to come.