Market Commotion is dominating headlines as the global financial landscape reels from escalating trade tensions and unpredictable policy signals. This week’s economic uncertainty is amplified by renewed tariff threats, volatile Treasury yields, and mixed economic data. Our stock market outlook explores the latest developments, upcoming economic events, and key earnings reports to help investors prepare for the road ahead.

Market Recap: Stocks Tumble on Renewed Tariff Threats

Wall Street closed sharply lower on Monday, May 27, 2025, as former President Trump reignited the trade war impact with a 50% tariff proposal on European Union imports. Major indexes posted notable declines:

- Dow Jones Industrial Average (DJIA): –0.61% to 41,603.07

- S&P 500: –0.67% to 5,802.82

- Nasdaq Composite: –1.00% to 18,737.21

- Weekly Nasdaq Loss: –2.47%

Key Drivers Behind Market Volatility

1. Trade War Escalation

Trump’s 50% tariff threat against the EU and a proposed 25% levy on iPhones reignited fears of a long-drawn trade war, affecting investor sentiment globally.

2. Treasury Yield Volatility

The 10-year Treasury yield fell to 4.509%, reflecting investor fears of slowing growth and rising deficits.

3. Flight to Safe Havens

Gold surged 2.02% to $3,360.60 per ounce as investors sought shelter from market turmoil.

4. Oil Prices Recover

Brent crude climbed to $64.85 per barrel ahead of Memorial Day, driven by stockpiling from U.S. buyers.

Economic Data in Focus: Durable Goods & Confidence Index

Tuesday’s Key Reports:

- Durable Goods Orders (April):

Forecasted to plunge 8.2% after March’s 9.2% surge.

Ex-transportation orders expected to dip 0.1%, indicating weak business investment. - Consumer Confidence (May):

Expected to inch up to 86.5 from 86.0, suggesting cautious optimism amid inflationary pressure.

Implications:

A significant dip in durable goods orders could signal weakening industrial momentum, adding to the current economic uncertainty.

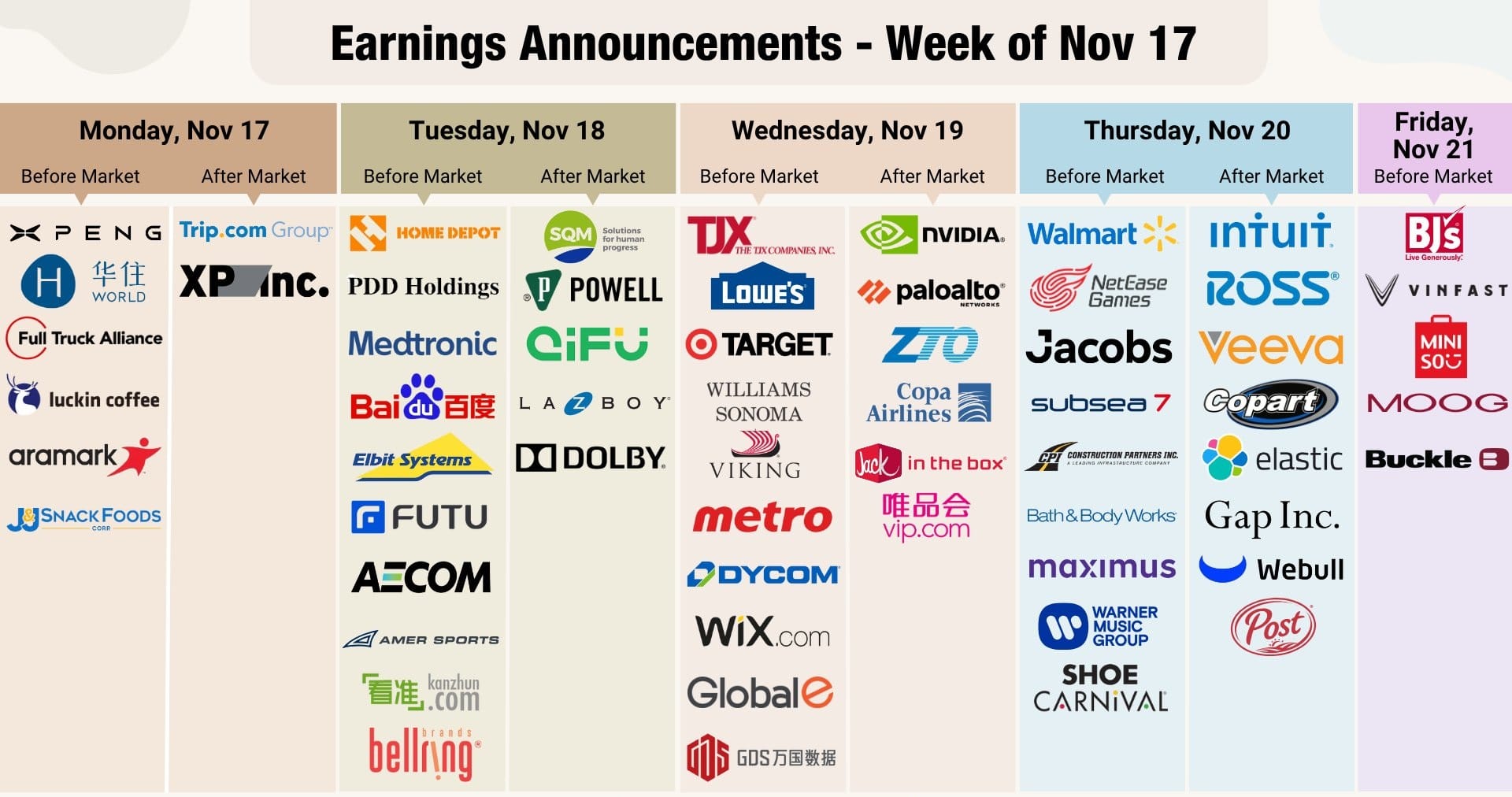

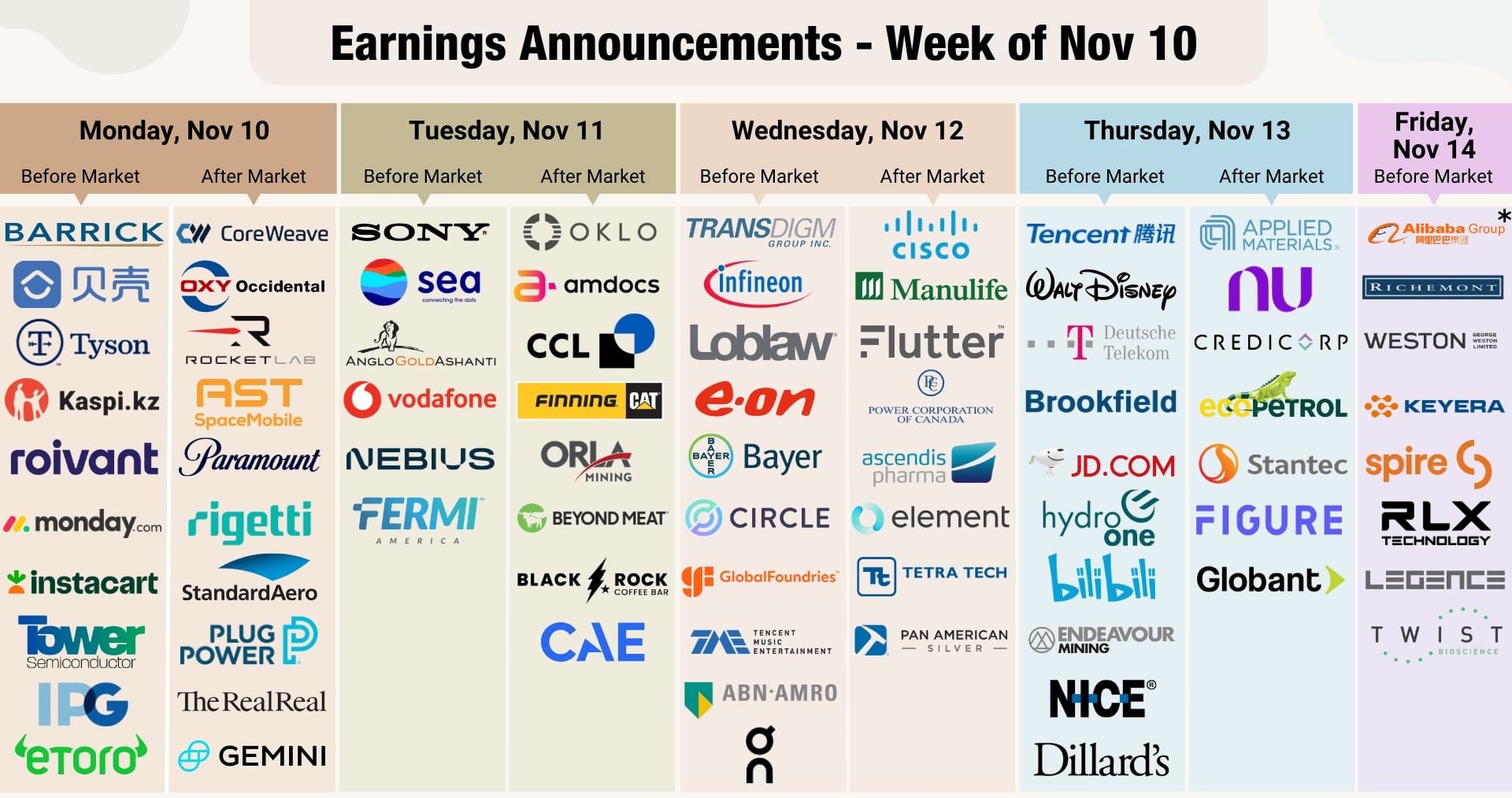

Corporate Earnings: AI Tech and Retail Under Watch

Technology Sector:

- Nvidia (Wed): Anticipated 65.9% YoY revenue surge. Investors eye AI chip demand amid U.S.-China tensions.

- Salesforce (Wed): Modest growth expected; focus on AI platform “Agentforce.”

- Dell (Thurs): Likely boosted by AI server demand.

Retail Sector:

- Macy’s (Wed): Same-store sales likely down due to inflation.

- Costco (Thurs): Expected resilience thanks to bulk-buying trends.

- Kohl’s (Thurs): Struggles from e-commerce competition.

Energy & Materials:

- Exxon vs. Hess (Mon): Court hearing on Chevron’s $53B acquisition.

- Freeport-McMoRan: Rises 3.45% amid strong copper prices.

Federal Reserve Outlook: Key Speakers to Watch

Fed officials are set to influence the weekly financial forecast with key speeches:

- Neel Kashkari (Tues/Wed): Expected to address inflation risks tied to trade policy.

- John Williams (Tues): May provide clarity on Fed’s near-term stance.

- Austan Goolsbee (Thurs): Focused on labor market dynamics.

Market Implications:

Hawkish commentary could delay expected rate cuts, driving up long-term yields.

Global Markets Snapshot

Canada:

- TSX up 0.10%, led by energy and materials.

- March retail sales rose 0.8%; April forecast: +0.5%.

- Bank earnings (RBC, BMO, National) in focus for loan-loss trends.

Europe & Asia:

- Euro Stoxx 50: –0.96% on tariff fears.

- Nikkei: +0.47%

- Hang Seng: +0.24%

Commodities and Currency Trends

- Gold: $3,360.60 (+2.02%) – safe-haven buying

- Copper: $4.84 (+4.16%) – sustained industrial demand

- EUR/USD: 1.1362 (+0.73%) – USD weakness despite EU risks

Key Risks to Watch This Week

- Trade War Impact: New tariffs could upend global supply chains.

- U.S. Debt Concerns: Rising yields reflect long-term fiscal instability.

- Weak Economic Indicators: Any slump in consumer or manufacturing data could spark further selloffs.

Conclusion: Navigating This Week’s Market Turmoil

Investors are bracing for a volatile week shaped by geopolitics, earnings, and inflation. AI-powered tech stocks like Nvidia offer a silver lining, but broader risks remain from trade war impacts and sticky inflation. A defensive, data-driven approach is essential during this high-uncertainty phase.