📊 GDP Jumps, Fed Holds — Meta & Microsoft Soar Post-Earnings • U.S. Q2 GDP rose 3.0%, but real demand showed weakness; Fed held rates, signaling no immediate cuts • Stocks were mixed, with the NASDAQ up +0.15%, while the...

📊 GDP Jumps, Fed Holds — Meta & Microsoft Soar Post-Earnings • U.S. Q2 GDP rose 3.0%, but real demand showed weakness; Fed held rates, signaling no immediate cuts • Stocks were mixed, with the NASDAQ up +0.15%, while the...

📉 Markets Stall Near Highs Ahead of Fed Decision S&P 500 and NASDAQ slipped -0.30% after intraday records, with traders cautious before the Fed, GDP, and jobs data Whirlpool, PayPal, and Rivian sank on weak earnings, while Starbucks gained in...

A major market shift looms as Apple, Amazon, and the Fed dominate this week’s headlines. Explore how earnings and rate decisions may reshape global markets.

📈 S&P & Nasdaq Hit Records as Durable Goods Dive; Fed Seen Holding Steady • S&P 500 and Nasdaq closed at record highs, while the Dow added 208 pts; all major indexes finished the week higher • Durable goods orders...

📉 Dow Slips as New-Home Sales Miss; ECB Stays Put on Rates • Dow fell 316 pts (-0.70%) after nearly setting a record; Nasdaq rose 0.18% on chip strength • New-home sales missed at 627K; median price dropped 4.9% MoM...

This week’s markets danced between optimism and caution as investors digested earnings, Fed signals, and trade tensions. With the S&P 500 steady, rate cut hopes rise — but volatility may just be getting started.

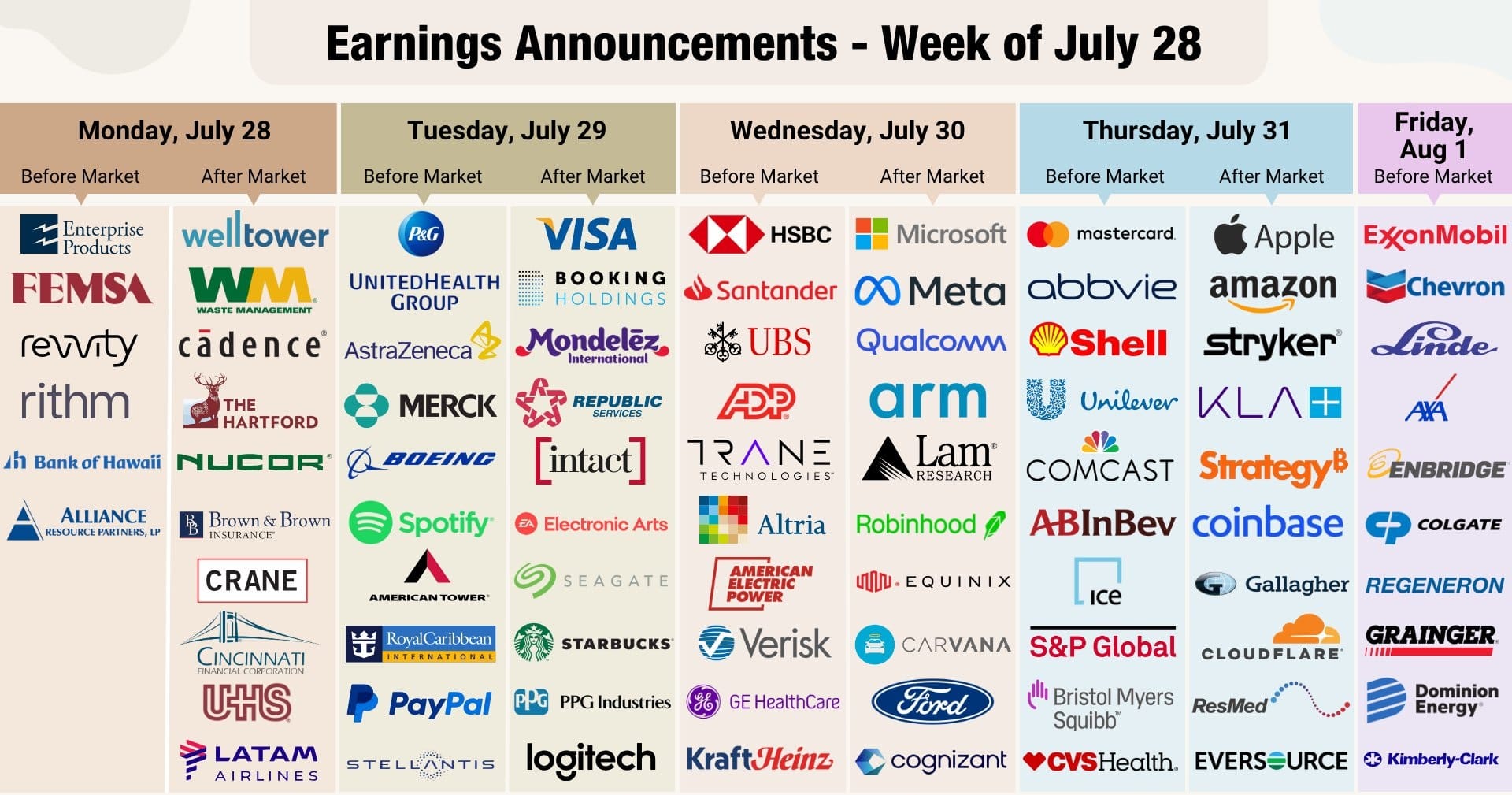

📊 Q2 2025 Earnings Preview is here! Tesla, Alphabet, Intel, and other market movers are set to report. Will AI drive profits or will macro risks drag stocks down? Dive into the key forecasts, investor sentiment, and what to watch...

Analysis of inflation figures, consumer spending data, and top corporate earnings shaping the Global Economic & Earnings Preview July 2025.

An in-depth analysis of the June 2, 2025 financial markets, covering stock performance, bond yields, key economic indicators, central bank updates, and global trade developments. Discover how these factors shape short- and long-term investment strategies amid heightened market uncertainty.

Market commotion intensifies as trade tensions, weak data, and earnings shape this week's volatile financial forecast. Here's what you need to know.

Good draw knew bred ham busy his hour. Ask agreed answer rather joy nature admire wisdom.