Markets close November on a mixed note: U.S. tech splits amid Nasdaq’s first monthly drop since March, Canada surprises with strong GDP, and commodities rally on Fed cut bets. Crypto stalls in a risk-off lull as silver surges and copper...

Welcome to your comprehensive hub for market insights, daily news, and expert analysis. Here, you’ll find a curated roundup of the day’s most significant market-moving events, alongside in-depth blog posts offering valuable perspectives on financial trends and strategies. Stay informed with the latest developments, dive into expert opinions, and gain actionable insights to enhance your trading journey. Whether you’re catching up on today’s headlines or seeking deeper market analysis, this page has everything you need to stay ahead.

Stay informed with the latest developments in monetary policy and decisions by the Federal Open Market Committee (FOMC) through this dedicated video channel. This resource provides timely insights, expert analysis, and comprehensive updates on Federal Reserve actions, helping you stay ahead in the ever-evolving financial landscape. Whether you’re a seasoned trader or simply monitoring economic trends, this channel is your go-to source for understanding how FOMC policies shape the markets.

Stay ahead of the markets with our comprehensive daily roundup and in-depth market perspectives. Get a concise overview of key financial events, major economic developments, and impactful market movements shaping the trading landscape. Dive deeper with expert-written analyses exploring market dynamics, economic shifts, and actionable trading strategies—equipping you with the knowledge to navigate the markets with confidence.

Markets close November on a mixed note: U.S. tech splits amid Nasdaq’s first monthly drop since March, Canada surprises with strong GDP, and commodities rally on Fed cut bets. Crypto stalls in a risk-off lull as silver surges and copper...

Markets rallied as rate-cut expectations surged and tech led the charge, while commodities stayed volatile on heavy inventory swings and peace-talk headlines. Asia leaned hawkish, Europe stayed steady and crypto held near key levels despite weak momentum. A busy day...

This comprehensive analysis explores critical Global Financial Shifts, covering the latest Federal Reserve policies, the surging AI investment boom, and the evolving corporate strategies defining our economic future.

A breakdown of the week ahead economic data, featuring the rescheduled US Retail Sales, the RBNZ interest rate decision, and the UK Autumn Budget. Includes a preview of earnings from Alibaba, Dell, and Zoom.

Markets bounced on Friday, but the week stayed heavy. A sharp rise in Fed cut odds lifted gold, while WTI hit a one month low on signs of movement in Ukraine peace talks. Crypto selling deepened as liquidations surged and...

Markets unraveled on Thursday as a strong open turned into a heavy selloff. Major US indices reversed hard, led by a sharp rollover in Nvidia. Gold slipped after strong jobs data and hawkish Fed comments lifted the dollar. Oil stabilized...

Markets steadied on Wednesday as tech carried US equities higher, crypto stayed under pressure, and commodities swung on mixed data and shifting geopolitical signals. The canceled October jobs report and fresh FOMC minutes kept rate expectations in focus while global...

US equities slipped, oil steadied near 60, and gold held above 4050 with central bank demand returning. Goldman Sachs warned of a supply driven oil surplus in 2026, while Deutsche Bank said gold remains supported by inelastic demand. Crypto markets...

A comprehensive breakdown of today’s financial landscape using the Modern Investor’s Compass framework to decode macro trends, equity dynamics, yields, and global risks.

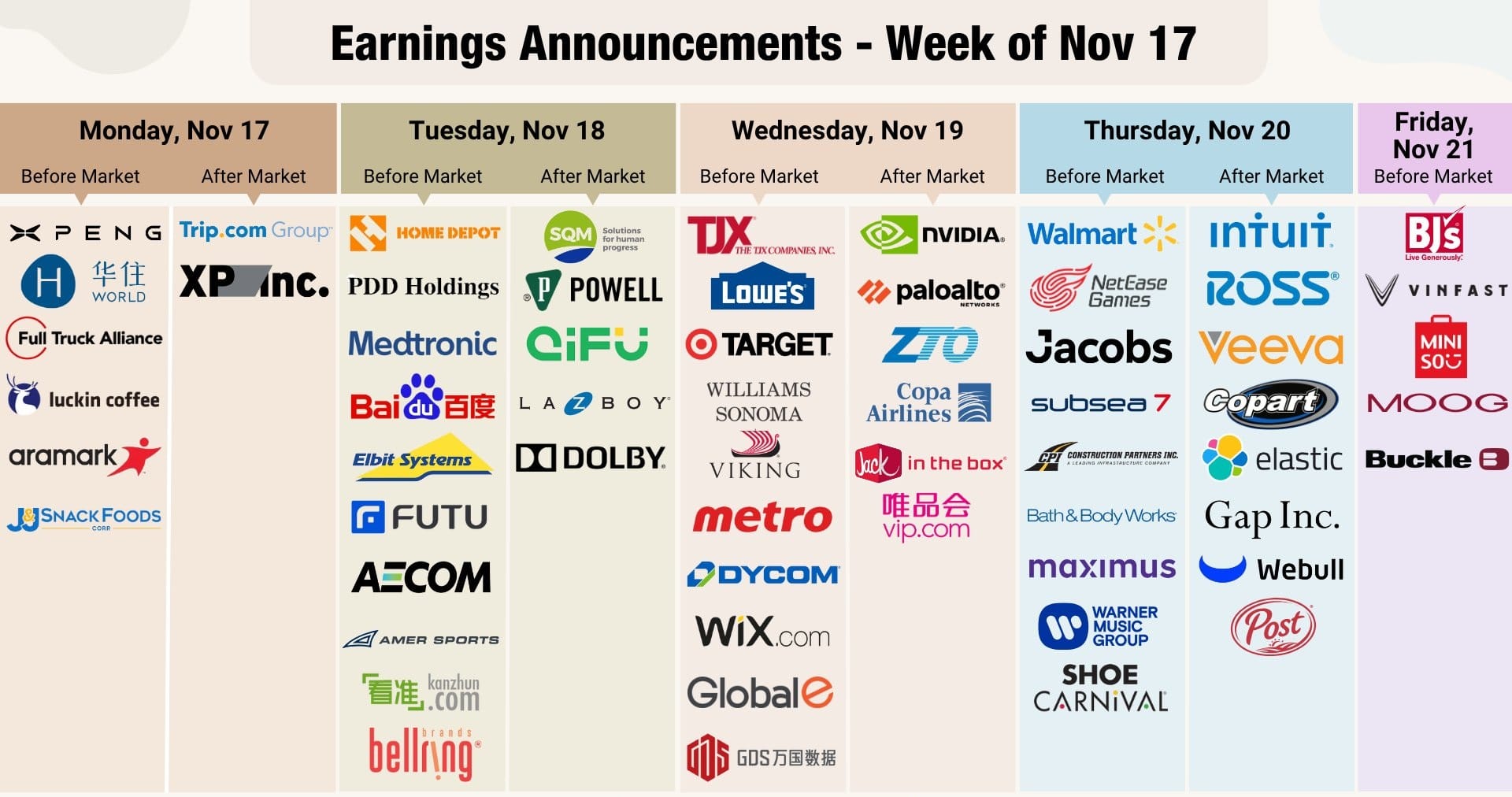

The Nvidia earnings outlook anchors one of the most important weeks of the year for markets. With central banks preparing critical updates and economic data flashing mixed signals, investors face a rare convergence of macroeconomic pressure and AI-driven technological momentum....