Introduction

The economic outlook and market forecast are increasingly being shaped not just by central bank policies and inflation trends, but by corporate earnings reports that reveal the underlying strength of consumer demand, technology adoption, and business investment. While monetary policy sets the framework, earnings provide the real-time pulse of the global economy.

This report focuses on how recent earnings from leading companies across retail, technology, and consumer goods are influencing investor sentiment, alongside key policy updates and inflation signals.

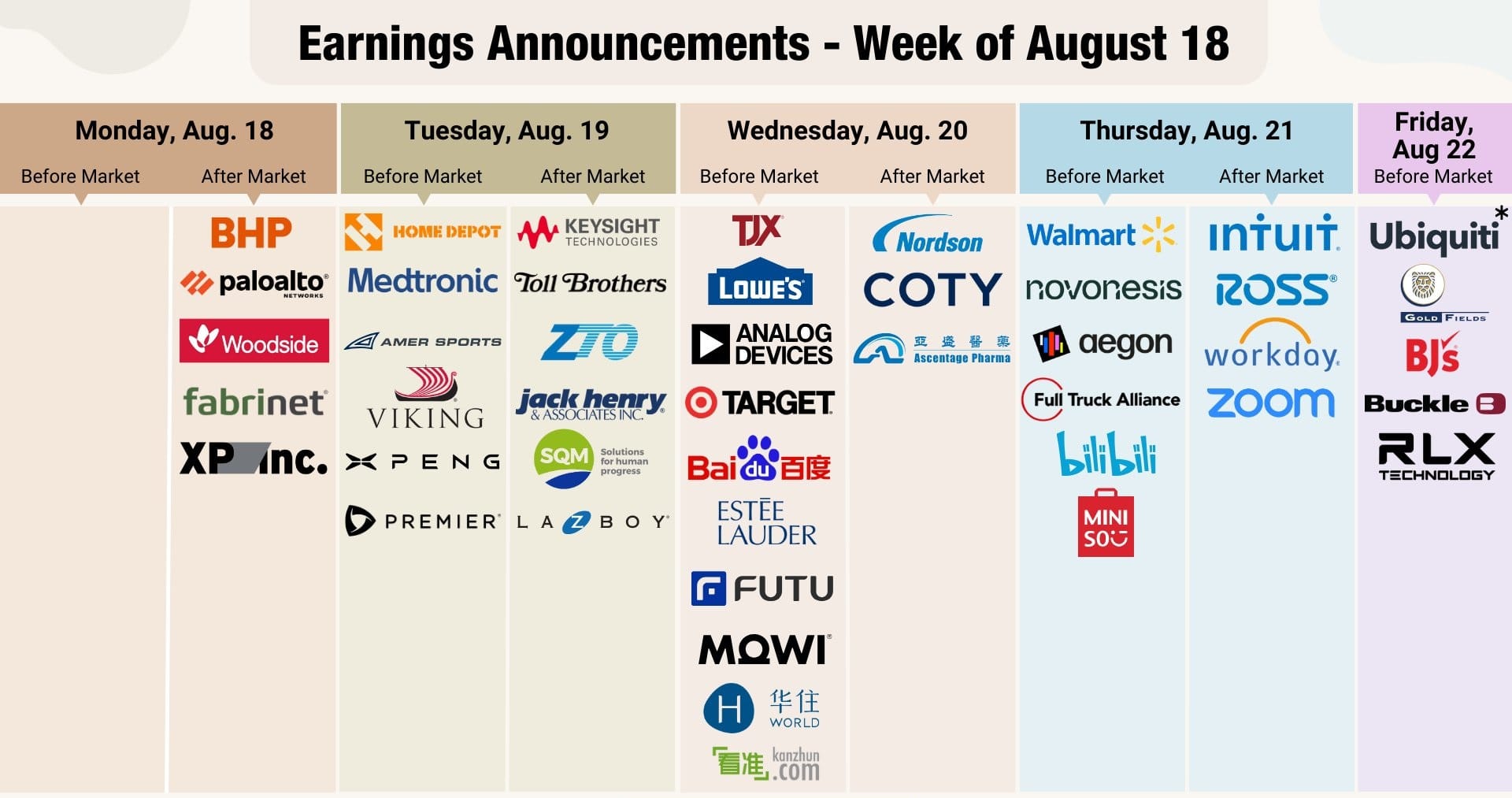

Corporate Earnings at the Center of the Market Forecast

Technology and Cybersecurity

- Palo Alto Networks (PANW) continues to capture cybersecurity demand. Earnings are closely watched for guidance on enterprise spending, margin control, and competitive pressures. Despite short interest rising, consistent revenue growth underscores the sector’s resilience.

- Zoom Communications (ZM) illustrates the transition from pandemic-driven growth to sustainable enterprise adoption. Profitability trends and client retention are crucial indicators for the market forecast in the digital economy.

Retail Leaders as Economic Barometers

- Walmart (WMT) and Home Depot (HD) remain vital barometers of consumer strength. Walmart highlights demand in discount retail and grocery, while Home Depot provides insights into housing-related spending and discretionary purchases.

- Target (TGT) reflects challenges in managing inventories and margins, offering clues about shifting consumer behavior and spending pressures.

Housing and Construction

- Toll Brothers (TOL) offers a window into the higher-end housing market, with mortgage rate volatility directly impacting demand for new builds. Its performance shapes investor expectations for the housing sector within the economic outlook.

Consumer Brands and Luxury

- Estée Lauder (EL) signals the state of global luxury demand, particularly in Asia. Weakness or recovery in Chinese consumption carries broader implications for global growth.

- Amer Sports (AS), with brands like Wilson, Salomon, and Arc’teryx, demonstrates how consumer preferences for active lifestyle products align with broader spending trends.

Central Bank Policy Updates: Setting the Backdrop

While earnings drive immediate sentiment, central bank policy updates establish the macro framework.

- The Federal Reserve uses the Jackson Hole Symposium to guide markets on its next moves, weighing inflation progress against labor market risks.

- The Reserve Bank of New Zealand and the Riksbank signal diverging approaches as growth slows but inflation remains elevated.

- The Bank of England faces a tightrope between easing inflation and sticky services costs.

- The People’s Bank of China holds rates steady, balancing domestic support with external trade tensions.

These policy signals determine liquidity conditions, currency moves, and risk appetite — but earnings dictate how those conditions filter into real business results.

Inflation Trends and Market Implications

The market forecast is also shaped by inflation data:

- Canada’s CPI highlights progress in disinflation but keeps the Bank of Canada cautious.

- UK inflation remains elevated, pressuring the Bank of England to delay easing.

- Japan’s CPI stays above target, raising questions about sustained policy normalization.

These inflation trends influence consumer behavior and business costs — directly visible in corporate earnings.

Investor Insights: What Earnings Reveal

- Consumer Spending Strength: Walmart and Target earnings show how inflation impacts everyday spending choices.

- Housing Signals: Toll Brothers earnings connect mortgage rates to demand for high-end homes.

- Tech and Cybersecurity: Palo Alto and Zoom earnings indicate how businesses prioritize security and communication investment.

- Luxury and Lifestyle: Estée Lauder and Amer Sports earnings capture shifts in global demand for premium goods.

For investors, the economic outlook is best understood through these earnings reports, which provide granular evidence of resilience, weakness, or transition across sectors.

Conclusion: Earnings Define the Economic Outlook

While central bank guidance and inflation trends create the backdrop, it is corporate earnings that bring clarity to the market forecast. They reveal how consumers and businesses are responding to higher rates, shifting prices, and evolving global conditions.

For investors, monitoring earnings across retail, technology, housing, and consumer brands is the most effective way to align strategies with the realities of the economic outlook.