North America News

Amazon’s Record Run Caps Strong Week for U.S. Stocks

Dow +40.75 at 47,562.66 | Nasdaq +143.81 at 23,724.98 | S&P 500 +17.86 at 6,840.19

U.S. equities ended a record-setting week on a high note Friday, led by Amazon’s powerful post-earnings rally that lifted the major averages well off their intraday lows.

The Nasdaq Composite (+0.6%) outperformed as mega-cap momentum continued, while the S&P 500 (+0.3%) and Dow Jones Industrial Average (+0.1%) notched modest gains.

Amazon (AMZN 244.22, +21.36, +9.58%) soared to fresh all-time highs after surpassing quarterly earnings expectations, fueled by a 20% acceleration in AWS revenue growth. Analysts responded swiftly — Tesley Advisory Group and Pivotal Research both raised their price targets to $300, citing sustained cloud strength and margin expansion.

The consumer discretionary sector (+4.1%) led all gainers, bolstered by Amazon’s surge and a strong advance in Tesla (TSLA 456.56, +16.46, +3.74%).

Elsewhere, Apple (AAPL 270.37, -1.03, -0.38%) edged lower despite an earnings beat, and NVIDIA (NVDA 202.49, -0.40, -0.20%) slipped slightly. The PHLX Semiconductor Index (+0.2%) managed a modest gain, helped by upbeat results from Western Digital (WDC 150.21, +12.08, +8.75%) and First Solar (FSLR 266.94, +33.36, +14.28%).

Netflix (NFLX 1,118.86, +29.86, +2.74%) also jumped after unveiling a 10-for-1 stock split, offsetting weakness in Meta Platforms (META 648.35, -18.12, -2.72%) and leaving Alphabet (GOOG 281.82, -0.08, -0.03%) essentially flat.

Market breadth improved notably — advancers outpaced decliners 4-to-3 on the NYSE and 7-to-5 on the Nasdaq after three sessions of negative breadth.

Energy stocks (+0.6%) gained alongside crude oil, as WTI settled up $0.39 (+0.6%) at $60.95 per barrel. Chevron (CVX 157.64, +4.11, +2.68%) outperformed following strong earnings, while Exxon Mobil (XOM 114.36, -0.34, -0.29%) dipped slightly.

At the other end, materials (-0.9%) and utilities (-0.8%) lagged.

Despite cautious remarks from several Fed officials, including Kansas City Fed’s Schmid and Dallas Fed’s Logan, who signaled hesitancy toward another December rate cut, equities held firm. According to the CME FedWatch Tool, the probability of a December cut fell to 65.0% (from 95.8% a week ago).

Treasuries ended mixed: the 2-year yield held steady at 3.61%, while the 10-year yield rose one basis point to 4.10%.

Performance Summary

- Friday: S&P +0.3%, Nasdaq +0.7%, Dow +0.1%, Russell 2000 +0.7%

- Weekly: S&P +0.7%, Nasdaq +2.2%, Dow +0.7%, Russell 2000 −1.2%

- October: S&P +2.3%, Nasdaq +4.7%, Dow +2.5%

- YTD: Nasdaq +22.9%, S&P +16.3%, Dow +11.8%, Russell 2000 +11.2%, MidCap 400 +4.0%

Fed’s Schmid Opposed Rate Cut, Citing Inflation Momentum

Federal Reserve official Jeffrey Schmid, who dissented against this week’s rate cut, said he opposed the move due to continued economic momentum and concerns that inflation remains high and potentially spreading.

Schmid said the labor market is broadly balanced and that small cuts would not fix structural pressures. “Financial conditions appear easy,” he noted, adding that premature easing could undermine the Fed’s commitment to its 2% inflation target.

Fed’s Logan: Would Have Preferred to Hold Rates

Dallas Fed President Lorie Logan said she would have preferred to hold rates this week, citing persistent inflation pressures.

Logan said inflation remains “too high” and could exceed 2% “for too much longer.” While the labor market is cooling, she said risks are balanced and the Fed retains tools to respond if weakness accelerates. She added that breakeven payroll growth has likely fallen to around 30,000 per month.

Fed’s Bostic: Supported Cut But Sees Ongoing Inflation Risks

Atlanta Fed President Raphael Bostic said he “eventually” supported this week’s rate cut, describing policy as still restrictive but appropriate given recent economic softness.

Bostic said the committee faces tension between its dual mandates and noted that half of current price pressures stem from tariffs. He welcomed Chair Powell’s “driving in the fog” analogy, saying the Fed must remain cautious as data evolve.

He emphasized that “every meeting is live,” and said the dot plot reflects a range of views rather than a policy path.

Fed’s Hammack: Would Not Have Cut Rates

Cleveland Fed President Beth Hammack said she would not have supported this week’s rate cut, citing little progress on inflation and only limited signs of labor market softness.

Hammack said policy is near neutral but “barely restrictive” and must stay tight to bring inflation back to 2%. She flagged continued strength in core services ex-housing and inflationary pressures from tariffs, electricity, and insurance.

“There’s still time before the December meeting,” she said, adding that the Fed remains data-dependent and open-minded to labor trends.

Trump Told Xi: Chip Sales Are “Between You and Nvidia”

CNBC’s Kristina Partsinevelos reports that former U.S. President Donald Trump told Chinese President Xi Jinping that chip sales are “between you and Nvidia,” amid speculation that Washington had approved limited AI chip exports to China.

Sources said Nvidia CEO Jensen Huang must still address antitrust and backdoor risks tied to its H20 chips. A new B30A chip reportedly launching mid-2026 will deliver only 50% of the performance of the upcoming Rubin line.

Analysts note U.S. officials fear that restricting chip sales could accelerate China’s domestic chip development and shift global leverage toward Beijing.

BlackRock Unit Among Lenders Hit by $500 Million Alleged Fraud

A BlackRock private-credit arm and several other lenders are seeking to recover more than $500 million after an alleged fraud in the U.S. private-credit market involving fabricated receivables.

The case, filed in August, accuses businessman Bankim Brahmbhatt of falsifying collateral linked to Broadband Telecom and Bridgevoice loans. He denies wrongdoing.

The alleged scheme, which also involved BNP Paribas as a financing partner, has deepened concerns over weak oversight in the $1.7 trillion private-credit sector. Analysts warn that rapid growth and poor transparency could amplify contagion risks if more cases emerge.

PIMCO: Powell Pushes Back on Market Cut Bets as Fed Ends QT

PIMCO said the Federal Reserve’s latest 25-basis-point cut to a 3.75%–4.00% range was expected, but Chair Jerome Powell’s effort to curb expectations for another December move was the key message.

Powell’s comment that further cuts are “not a foregone conclusion” reduced the market-implied odds of a December cut from above 90% to around 70%.

The Fed also said it will end quantitative tightening on December 1, citing scarce reserves, and begin reinvesting proceeds to maintain balance sheet size while shifting toward shorter-term Treasuries.

PIMCO said Powell’s caution reflects uncertainty amid the U.S. government shutdown and limited data. The firm expects one more cut this year but said the easing cycle will likely slow through 2026.

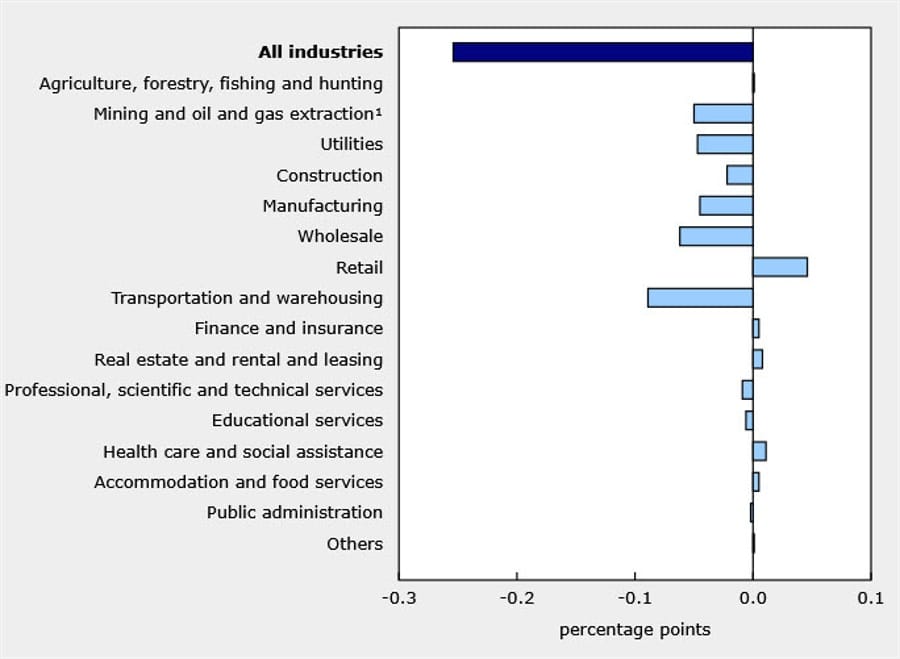

Canada August GDP Contracts 0.3%; September Estimate +0.1%

Canada’s economy contracted by 0.3% in August, weaker than expectations for flat growth, according to data released Friday by Statistics Canada.

A preliminary estimate points to a 0.1% rebound in September. August’s decline was broad-based, led by a 0.6% fall in goods-producing industries and a 0.1% dip in services.

Transportation and warehousing dropped 1.7%, weighed down by a flight attendant strike. Wholesale trade fell 1.2%, while mining, quarrying, and oil and gas extraction declined 0.7%. The utilities sector contracted 2.3% as drought conditions reduced hydroelectric output. Retail trade was a bright spot, rising 0.9%.

The prior month’s GDP was revised up to a 0.3% gain from 0.2%.

Canada’s PM Carney Targets Doubling Non-U.S. Exports in Ten Years

Canadian Prime Minister Mark Carney said his government aims to double non-U.S. exports over the next decade, describing the global economy as undergoing “one of the most profound changes since the fall of the Berlin Wall.”

Carney said the era of rules-based, liberalized trade and investment “is gone,” underscoring the need for Canada to diversify trade relationships amid shifting global dynamics.

Commodities News

Gold Slips Below $4,000 as Dollar Strengthens

Spot gold: $3,985 (−1.0%) | Second weekly decline

Gold prices retreated on Friday, falling below the $4,000 mark as investors reassessed the Federal Reserve’s cautious tone following its latest rate cut. Spot gold traded near $3,985, down 1% on the day and poised for its second consecutive weekly loss.

A firmer U.S. dollar and steady Treasury yields weighed on bullion, with traders scaling back expectations for a December rate cut. Fed Chair Jerome Powell emphasized that further easing is “not a foregone conclusion,” reiterating the committee’s data-dependent approach.

Improved global risk sentiment also reduced gold’s safe-haven appeal after a constructive meeting between President Trump and China’s President Xi helped ease trade tensions.

Technically, gold’s short-term trend is neutral to slightly bearish, but the long-term outlook remains constructive, supported by robust central bank demand, lingering geopolitical risks, and portfolio diversification flows.

WTI Rebounds as Traders Eye OPEC+ Output Decision

WTI crude +0.65% to $60.50/barrel | Third straight monthly loss expected

Oil prices rebounded modestly on Friday, with West Texas Intermediate (WTI) climbing to $60.50 per barrel (+0.65%), extending gains after two subdued sessions. Despite the uptick, crude remains on course for its third consecutive monthly decline, weighed by persistent oversupply concerns and cautious positioning ahead of the OPEC+ meeting on Sunday.

Reports from Reuters suggest that eight OPEC+ members are preparing to raise output by 137,000 barrels per day (bpd) in December, part of a strategy to reclaim lost market share. Meanwhile, Saudi exports hit a six-month high of 6.41 million bpd in August, and U.S. crude production reached a record 13.6 million bpd last week, according to the EIA.

These developments have largely offset bullish sentiment from new U.S. sanctions targeting Russian oil producers. Traders note that India’s IOC recently purchased multiple cargoes of Russian oil for December delivery through non-sanctioned intermediaries, underscoring Moscow’s ongoing export resilience.

Adding a geopolitical twist, President Trump announced that China agreed to buy U.S. energy, including oil and gas from Alaska — though analysts doubt this will significantly boost demand given China’s sluggish industrial recovery.

In short, while prices found short-term support ahead of OPEC+, the market’s structural outlook remains bearish as record U.S. output and resilient Russian supply continue to overshadow potential demand gains.

U.S. Rig Count Falls by 4; Canada Down 12 – Baker Hughes

The U.S. rig count fell by four to 546 in the latest Baker Hughes report. Oil rigs declined by six to 414, gas rigs rose by four to 125, and miscellaneous rigs dropped by two to seven.

Year-over-year, the U.S. count is down 39 rigs, with oil rigs 65 lower, gas rigs up 23, and miscellaneous rigs up three. Offshore rigs fell by two to 19 but remain three higher than a year ago.

In Canada, rigs dropped by 12 to 187, with oil rigs down 11 and gas rigs down one. The Canadian total is 26 lower than a year earlier.

Copper Supply Concerns Likely to Persist – Commerzbank

Despite a recent pullback from record highs, copper prices are unlikely to correct sharply in the near term, Commerzbank analysts Thu Lan Nguyen and Volkmar Baur said Friday.

Weak Chinese manufacturing and construction PMI readings haven’t yet affected industrial output, which continues to rise. A recent 10-point U.S. tariff reduction on Chinese imports could also support demand.

Meanwhile, Chile’s September mine output continued to decline, and metal production missed expectations. “Supply concerns are therefore likely to persist and limit downside potential,” the analysts wrote.

OPEC+ Likely to Approve December Supply Increase – ING

Oil prices are set to end the week lower as traders weigh U.S. sanctions on Russian crude, with ING analysts expecting OPEC+ to agree to another output increase at Sunday’s meeting.

The group is likely to add 137,000 barrels per day in December, which could reinforce a bearish outlook amid a projected surplus through 2026.

ING said China remains the only buyer capable of absorbing additional Russian flows if India reduces imports. Gasoil cracks remain firm near $30/bbl despite rising inventories in the ARA region.

Investor Demand Drives Gold to Record Q3 High – Commerzbank

Gold demand hit a record high in the third quarter, driven by strong investor inflows, according to Commerzbank analyst Barbara Lambrecht citing World Gold Council data.

ETF inflows totaled 222 tons, while bar and coin purchases exceeded 300 tons. Central banks bought 220 tons, up 28% from Q2 and 10% from a year ago, with two-thirds unreported by institution.

High prices have weighed on jewelry demand, particularly in India, where Q3 consumption fell 31% year-on-year to 118 tons. The WGC expects full-year central bank purchases between 750 and 900 tons—below recent peaks but still historically strong.

Russia Maintains Strong Oil Exports Despite Sanctions – Commerzbank

Russia’s seaborne oil exports remain resilient, averaging 3.56 million barrels per day last week, only slightly lower than the week before, Commerzbank’s Carsten Fritsch said, citing Bloomberg data.

The four-week average eased to 3.72 million bpd, just below its highest level since May 2023. Deliveries to China and India have declined in recent weeks, though data may be incomplete.

Fritsch said it is “too early” to attribute any slowdown to recent U.S. sanctions, noting that overall export volumes remain robust.

U.S. Natural Gas Futures Extend Rally on Cooler Weather – ING

U.S. natural gas December 2025 futures rose 3.7% on Thursday and extended gains Friday as forecasts turned cooler, ING analysts Ewa Manthey and Warren Patterson said.

Inventories rose by 74 bcf last week, matching expectations and exceeding the five-year average build of 67 bcf. “The market appears to be focused on weather-related demand rather than inventory levels,” ING noted.

U.S. Oil Inventories Drop Sharply – Commerzbank

U.S. crude oil inventories fell by 6.9 million barrels last week, the Department of Energy reported. Gasoline stocks dropped 5.9 million barrels, and distillates declined 3.4 million.

Commerzbank’s Carsten Fritsch said the drop was driven by weaker imports and stronger demand. Crude and distillate inventories now sit well below five-year averages, while gasoline stocks are only slightly under seasonal norms.

Oil prices rose modestly after the data, with declines largely anticipated following similar API figures.

Europe News

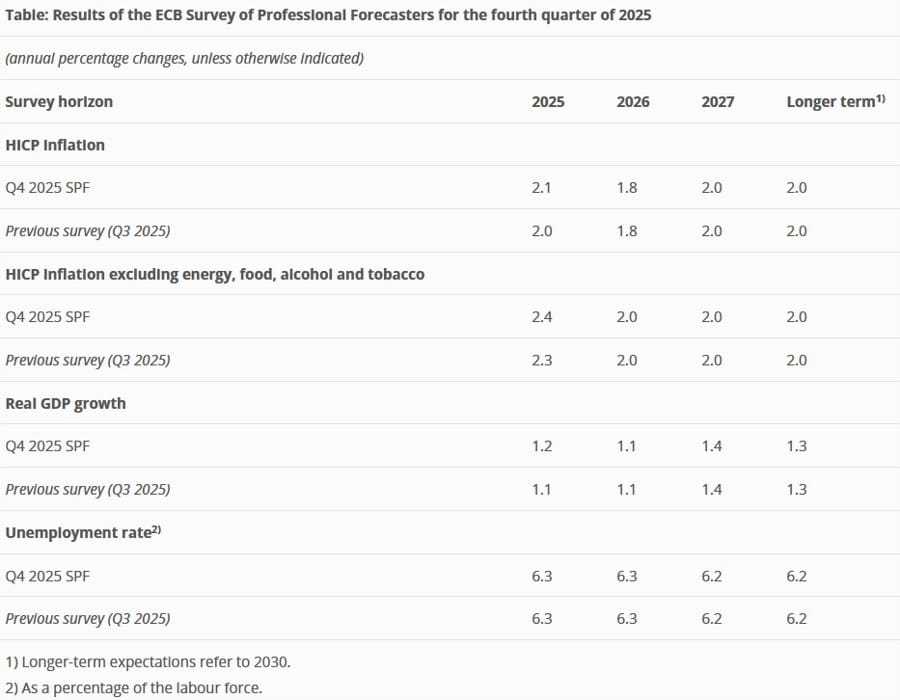

ECB Survey Shows Long-Term Inflation Expectations Steady at 2%

Long-term inflation expectations in the eurozone remained anchored at 2% in the ECB’s fourth-quarter survey of professional forecasters.

Respondents raised their 2025 HICP forecast by 0.1 percentage point to 2.1%, while 2026 and 2027 projections were unchanged at 1.8% and 2.0%, respectively.

Real GDP is expected to grow 1.2% in 2025, 1.1% in 2026, and 1.4% in 2027. The unemployment rate is forecast to average 6.3% in both 2025 and 2026, easing slightly to 6.2% in 2027.

Eurozone Inflation Holds at 2.1% in October; Core at 2.4%

Eurozone headline inflation came in at 2.1% in October, matching expectations and down slightly from 2.2% in September, according to preliminary Eurostat data.

Core CPI rose 2.4% year-on-year, just above forecasts for 2.3%, and unchanged from the prior month, indicating that underlying price pressures remain sticky even as headline inflation moderates.

From the agency:

Euro area annual inflation is expected to be 2.1% in October 2025, down from 2.2% in September according to a flash estimate from Eurostat, the statistical office of the European Union.

Looking at the main components of euro area inflation, services is expected to have the highest annual rate in October (3.4%, compared with 3.2% in September), followed by food, alcohol & tobacco (2.5%, compared with 3.0% in September), non-energy industrial goods (0.6%, compared with 0.8% in September) and energy (-1.0%, compared with -0.4% in September).

Germany Retail Sales Inch Up 0.2% in September, Matching Forecasts

German retail sales edged up 0.2% in September from the previous month, in line with expectations, data from Destatis showed Friday.

Year-on-year, sales were up just 0.2%, well below the 1.9% forecast, following a 1.8% increase in August. The numbers point to slowing consumer momentum as higher prices and uncertainty temper spending.

From the agency:

Sales in the retail trade in foodstuffs rose by both real and nominally by 0.3% in September 2025 compared to the previous month in both real and seasonally adjusted terms. Compared to the same month of September 2024, sales in food retailing recorded an increase of 0.2% in real terms and 2.9% in nominal terms.

In the retail trade in non-food products, calendar and seasonally adjusted sales fell by both real and nominal sales in September 2025 compared with the previous month by 0.6%. Compared to the same month of September 2024, sales here grew by 0.2% in real terms and by 1.1% in nominal terms.

In the Internet and mail order trade, sales in September 2025 recorded an increase in sales of 0.4% in real terms and 0.6% in nominal terms. Compared to the same month of September 2024, sales in the Internet and mail order trade grew by 3.7% in real terms and 4.4% in nominal terms.

France Inflation Slows to 0.9% in October, Slightly Below Estimates

France’s preliminary harmonised CPI rose 0.9% year-on-year in October, just below the 1.0% forecast, data from INSEE showed Friday.

Monthly inflation edged up 0.1%, matching expectations, after a 1.1% drop in September. The slower pace of price growth reflects easing energy costs and moderate consumer spending.

From the agency:

Over a year, the Consumer Price Index (CPI) should rise by 1.0% in October 2025, after +1.2% in September, according to the provisional estimate made at the end of the month. This slowdown in prices should be explained by a more sustained fall in prices of energy, driven by the decrease in those of gas and petroleum products, and by a slowdown in food prices. The prices of services should increase at the same rate than in September, like those of tobacco, and the prices of manufactured products should fall at a slightly faster rate than in the previous month.

Over one month, consumer prices should rise by 0.1% in October 2025, after ‑1.0% in September. This slight rise in prices should be explained by the increase in services prices, particularly in transport, and to a lesser extent in manufactured products prices. Conversely, prices of energy and food should fall slightly. Tobacco prices should be stable again over a month.

Italy Inflation Cools to 1.3% in October, Below Forecast

Italy’s preliminary harmonised CPI increased 1.3% year-on-year in October, missing expectations for 1.7%, data from ISTAT showed Friday.

The headline reading slowed from 1.8% in September, while core inflation held steady at 2.0%. The data point to easing consumer price pressures heading into year-end.

From the agency:

The slow down of the annual inflation rate was mainly due to the prices of Regulated energy products (from +13.9% to -0.8%), of Unprocessed food (from +4.8% to +1.9%) and, to a lesser extent, of Services related to transport (from +2.4% to +2.0%). At the opposite, an upward contribution to the inflation rate came from the prices of Services related to recreation, including repair and personal care (from +3.1% to +3.3%).

UK House Prices Rise 2.4% in October, Slightly Above Forecasts

UK house prices rose 2.4% year-on-year in October, just above expectations for a 2.3% gain, according to Nationwide Building Society data released October 31.

Prices increased 0.3% month-on-month, beating forecasts for no change, after a 0.5% rise in September. The figures suggest the housing market continues to recover gradually amid easing mortgage rates and resilient demand.

Commenting on the figures, Robert Gardner, Nationwide’s Chief Economist, said:

“October saw a slight rise in the rate of annual house price growth to 2.4%, from 2.2% in September. Prices increased by 0.3% month on month, after taking account of seasonal effects.

“The housing market has remained broadly stable in recent months, with house prices rising at a modest pace and the number of mortgages approved for house purchase maintained at similar levels to those prevailing before the pandemic struck.

“Against a backdrop of subdued consumer confidence and signs of weakening in the labour market, this performance indicates resilience, especially since mortgage rates are more than double the level they were before Covid struck and house prices are close to all time highs.

“Looking forward, housing affordability is likely to improve modestly if income growth continues to outpace house price growth as we expect. Borrowing costs are also likely to moderate a little further if Bank Rate is lowered again in the coming quarters.

“This should support buyer demand, especially since household balance sheets are strong – indeed, in aggregate the ratio of household debt to disposable income is at its lowest for two decades.

Switzerland Retail Sales Rebound 1.5% in September

Swiss retail sales rose 1.5% year-on-year in September, beating expectations for a 0.2% gain, according to the Federal Statistics Office.

That follows a revised 0.4% decline in August. While the improvement marks a strong rebound, analysts said the data won’t alter the Swiss National Bank’s policy outlook.

ECB Officials See Slightly Better Data but Maintain Caution

European Central Bank policymakers said recent economic data have shown modest improvement but continue to warrant caution given ongoing uncertainty.

Martin Kocher said some indicators since September were “slightly better,” though uncertainty remains high.

Olli Rehn said leaving rates unchanged was justified, citing balanced upside and downside risks to both growth and inflation. He added that the effects of tariffs remain unclear.

Georg Muller said the economic outlook has “gradually improved,” while Martins Kazaks described risks as “more balanced,” stressing that the ECB “shouldn’t be jumpy.”

Gediminas Simkus noted that medium-term projections remain aligned with the 2% inflation target and that markets are not expecting major policy shifts.

Nomura Says UK Gilts Offer Best Value in Europe

Nomura Asset Management is overweight UK government bonds, calling them the best-value play in Europe as inflation eases and yields stay elevated.

Yuji Maeda, the firm’s head of global fixed income, said 10-year gilt yields near 4.4% look attractive versus roughly 1.6% in Japan. He added that inflation and fiscal conditions are improving as the UK government eyes spending cuts and possible tax hikes.

Still, Maeda cautioned that debt challenges and Brexit fallout remain risks, though he expects gilts to outperform over the next year.

Goldman Sachs Warns Markets Underpricing ECB Rate-Cut Risk

Goldman Sachs said traders may be underestimating the potential for another European Central Bank rate cut as eurozone data stay uneven and inflation cools faster than expected.

The bank said growth momentum remains fragile, while fiscal stimulus in Germany may roll out more slowly than anticipated, damping near-term recovery prospects.

Goldman added that the ECB’s December forecasts will be pivotal. Should inflation projections undershoot, policymakers could consider another cut in the first half of 2026, even as officials urge patience.

Deutsche Bank Says Eurozone Strength Keeps ECB Doves Contained

Deutsche Bank’s chief European economist questioned the case for rate cuts, pointing to the eurozone’s resilience despite global uncertainty.

“Where’s the smoking gun for a rate cut?” he asked, noting that modest growth has persisted despite U.S. tariffs and geopolitical risks. That durability, he said, is limiting dovish pressure inside the ECB.

The remarks mirror the ECB’s cautious stance at its latest meeting, where policymakers acknowledged uneven growth and slowing inflation but showed little urgency to ease further.

Asia-Pacific & World News

Nvidia’s Huang Says China Market ‘Irreplaceable,’ Hopes to Sell Blackwell Chips

Nvidia CEO Jensen Huang said he hopes the company’s new Blackwell chips can be sold in China but added that the decision ultimately lies with President Donald Trump’s administration.

Huang noted that China already produces many of its own AI chips and that the country’s military has access to domestically made technology, suggesting Beijing’s recent block on Nvidia’s H20 chips reflects a desire for self-reliance.

He said AI is entering a decade-long buildout phase and called Korea a potential global hub for AI development. While disappointed by Nvidia’s falling China market share, Huang said the company will continue to grow globally, describing China as “a very large and irreplaceable market.”

China Factory Activity Contracts Again as PMI Falls to 49.0

China’s manufacturing PMI slipped to 49.0 in October, its seventh consecutive month below the 50 line and a six-month low.

The reading missed expectations for 49.6 and followed 49.8 in September. The non-manufacturing index held at 50.1, keeping the composite gauge at an even 50.0.

The data highlight lingering weakness in factory output despite modest stabilization in services.

China Adds 200 Billion Yuan Local Bond Quota to Boost Growth

China has approved an additional 200 billion yuan ($28 billion) in local government bond quotas to support investment and stabilize regional finances, the National Development and Reform Commission said.

The measure is part of a 500 billion yuan initiative to strengthen local balance sheets and fund infrastructure projects.

NDRC spokesperson Li Chao said the step reflects Beijing’s confidence in meeting 2025 economic targets and its readiness to roll out further support if needed.

PBOC sets USD/ CNY reference rate for today at 7.0880 (vs. estimate at 7.1171)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injects 355.1bn yuan at 1.40% via 7-day reverse repos

- injects net 187.1bn

Australian Producer Prices Jump 1% in Q3

Australia’s producer price index rose 1.0% quarter-on-quarter in Q3, accelerating from 0.2% previously. Prices were up 3.5% year-on-year versus 3.4% prior.

The ABS said gains were led by services and construction costs, with strong residential demand continuing to lift rents.

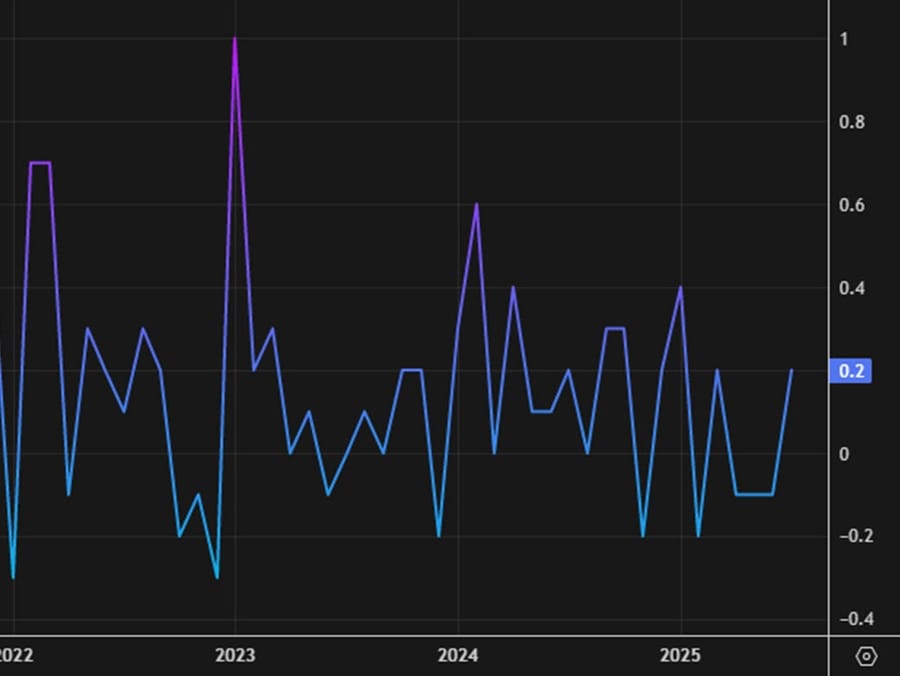

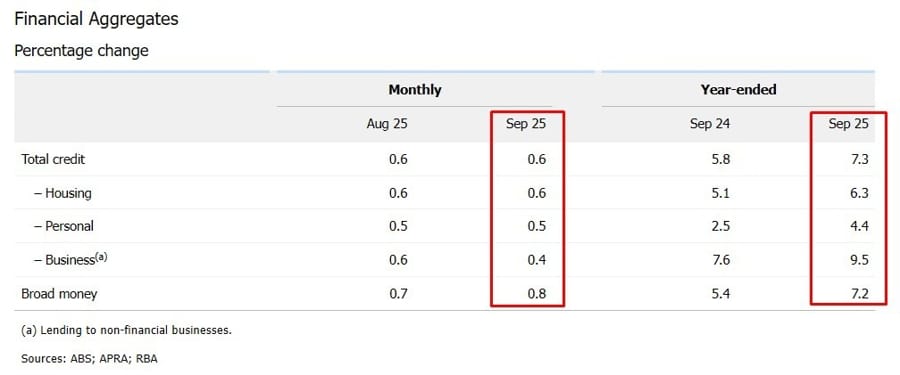

Australian Private Credit Growth Steady at 0.6% in September

Private sector credit in Australia rose 0.6% month-on-month in September, matching forecasts and the prior month’s pace.

Credit expanded 7.3% year-on-year, the fastest since January 2023, according to Reserve Bank of Australia data.

RBA Expected to Hold as Inflation Pushes Next Cut to 2026

The Reserve Bank of Australia is set to keep rates on hold at 3.60% next week, with stubborn inflation delaying any policy easing until mid-2026, according to a Reuters poll.

All 34 economists surveyed expect no change at the November 4 meeting. Inflation rose 3.2% year-on-year in Q3, with core prices up 1.0% on the quarter—well above the RBA’s forecast.

Governor Michele Bullock said the higher reading is a “material miss,” reinforcing expectations that rates will remain steady for an extended period despite rising unemployment at 4.5%.

ANZ Expects A$1.1 Billion Profit Hit from One-Off Charges

ANZ Group said its second-half profit will be reduced by about A$1.11 billion (US$721 million) after tax, due to restructuring, regulatory settlements, and other one-off adjustments.

The bank said the costs will be recorded in its second-half results later this year. While the provisions will cut into near-term earnings, ANZ said they are non-recurring and won’t affect its capital position or dividend outlook.

Investors will watch upcoming results for signs of cost discipline and whether the bank can stage a rebound in fiscal 2026 amid broader regulatory scrutiny across Australia’s banking sector.

RBNZ’s Gai: U.S. Tariffs a Negative Shock to New Zealand Demand

Reserve Bank of New Zealand policymaker Prasanna Gai said U.S. tariffs have dealt a negative demand shock to New Zealand’s small, trade-dependent economy, compounding existing headwinds.

Speaking in Melbourne, Gai said the impact of tariffs and global uncertainty has partly offset the RBNZ’s 300 basis points of rate cuts since August 2024.

With inflation now within the 1–3% target range, markets expect the central bank has scope to ease further if global weakness persists.

New Zealand Consumer Confidence Slips to 92.4 in October

New Zealand consumer sentiment weakened again in October, with the ANZ Roy Morgan Consumer Confidence Index sliding to 92.4 from 94.6 in September, staying well below the neutral 100 level that divides optimism from pessimism.

ANZ noted that confidence remains subdued even as other economic indicators show signs of stabilisation. The bank said a sustained reluctance to spend has weighed heavily on the retail sector.

Earlier this month, the Reserve Bank of New Zealand cut its policy rate by another 50 basis points, bringing total easing since August 2024 to 300 basis points as it grapples with weak demand and a fragile economy.

Japan’s UA Zensen Unions to Seek 6% Pay Hike in 2026 Negotiations

Japan’s UA Zensen labor federation said it will demand a 6% wage increase in next year’s “shunto” spring wage talks, Jiji Press reported. The group represents workers across textiles, retail, and related industries.

Bank of Japan Governor Kazuo Ueda said Thursday the central bank wants to assess early momentum from the 2026 wage round before deciding on future rate hikes. Markets now see the first BoJ increase no earlier than March 2026, with little expectation of any move next year.

Japan Housing Starts Fall 7.3% in September, Slightly Better Than Forecast

Japan’s housing starts dropped 7.3% year-on-year in September, slightly outperforming expectations for a 7.9% decline, according to data from the Ministry of Land, Infrastructure, Transport and Tourism released on October 31.

The fall compares with a 9.8% contraction in August. While the figures point to continued weakness in residential construction, the report is not seen as market-moving.

TD Securities: December BoJ Hike Still Possible Despite Caution

TD Securities said the Bank of Japan could still raise rates in December, even after Governor Kazuo Ueda’s cautious tone weakened the yen.

The BoJ left policy unchanged at 0.5%, with two dissenters again voting for a hike. TD said Ueda’s remark that action could come as the government finalizes its budget leaves a December move on the table.

The firm expects updated wage data before the next meeting to guide the BoJ’s decision, maintaining a December hike as its base case.

Tokyo CPI Tops Forecasts, Underscoring Sticky Inflation

Tokyo’s October consumer prices rose faster than expected, signalling persistent inflation pressures.

Headline CPI increased 2.8% year-on-year versus forecasts for 2.4%. Core CPI, excluding fresh food, also rose 2.8%, while the core-core measure, excluding both food and energy, matched that rate.

The data suggest price growth remains firm ahead of national figures due later this month.

Japan Jobless Rate Holds at 2.6%, Labor Market Still Tight

Japan’s unemployment rate held steady at 2.6% in September, matching August and slightly above the 2.5% forecast. The jobs-to-applicants ratio was unchanged at 1.20, indicating 120 openings per 100 applicants.

The figures point to a tight but stable labor market, giving the Bank of Japan little immediate reason to adjust policy ahead of its next meeting.

Japan Retail Sales Rise 0.5% y/y, Below Forecasts

Japan’s retail sales grew 0.5% year-on-year in September, short of expectations for 0.7%, after a 1.1% decline in August. On a monthly basis, sales rose 0.3%.

The modest rebound suggests consumption remains fragile amid higher living costs and muted wage growth.

Japan Industrial Output Beats Forecasts with 2.2% Gain

Japan’s industrial production rose 2.2% month-on-month in September, surpassing expectations for a 1.5% increase. Output was up 3.4% year-on-year after a 1.6% decline previously.

Manufacturers expect output to rise 1.9% in October before dipping 0.9% in November, suggesting uneven recovery momentum.

South Korea Industrial Output Falls 1.2% m/m in September

South Korea’s industrial production dropped 1.2% in September from August, missing expectations for a 0.1% rise, though output climbed 11.6% year-on-year, well above forecasts.

Service output grew 1.8% on the month after a 0.7% decline previously. Retail sales edged down 0.1%, extending signs of mixed momentum across sectors.

Trump–Korea Trade Deal Seen Boosting Kospi, Pressuring Won

President Donald Trump’s new trade deal with South Korea is expected to lift equities but weigh on the won as capital flows head toward the U.S.

The agreement cuts U.S. tariffs on Korean autos and parts to 15% from 25% and includes $350 billion in new Korean investments in the U.S. Analysts said the outflows could tighten domestic liquidity and weaken the won, which may slide toward ₩1,450 per dollar next year.

Still, investors cheered the clarity. The Kospi hit record highs, led by autos, shipbuilders, and chipmakers. Morgan Stanley and J.P. Morgan said reduced tariff uncertainty could push the index beyond 5,000 points over the next year.

Crypto Market Pulse

U.S. Investors Pull Back From Ethereum; Price Risks Drop to $3,500

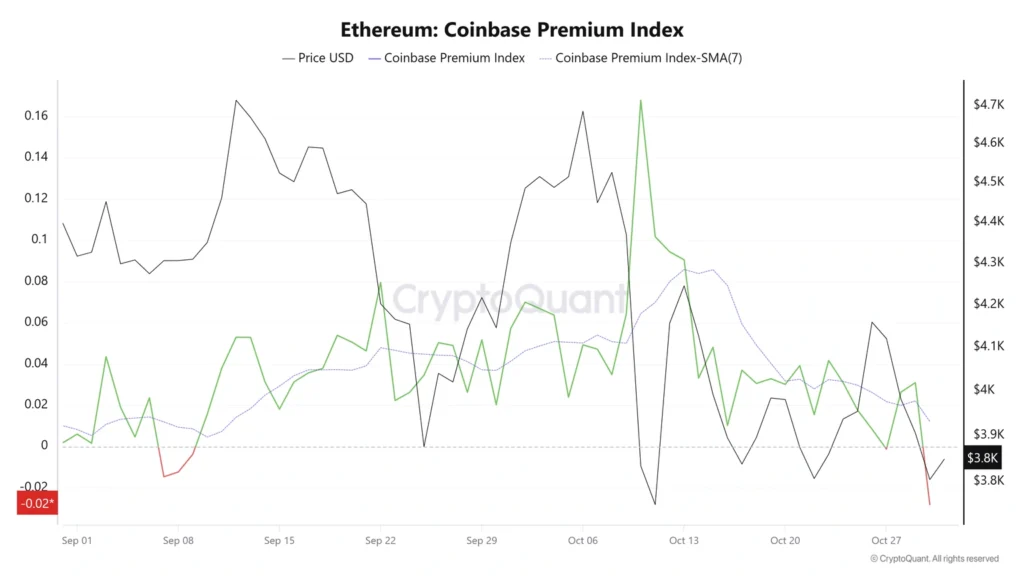

Ethereum (ETH) traded around $3,820 Friday, with weakening U.S. investor demand suggesting a possible decline toward $3,470 if prices fall below $3,700.

The Coinbase Premium Index turned negative at -2.8%, showing ETH trading cheaper on Coinbase than global averages. U.S. spot ETH ETFs have seen net outflows of 158,374 ETH since October 8, led by BlackRock’s ETHA fund.

CME futures basis fell to 3.0%, signaling reduced institutional exposure. Analysts say the phase reflects profit-taking, not accumulation.

Large wallets added 210,000 ETH this week, while open interest across exchanges rose to 12.4 million ETH before easing slightly Friday.

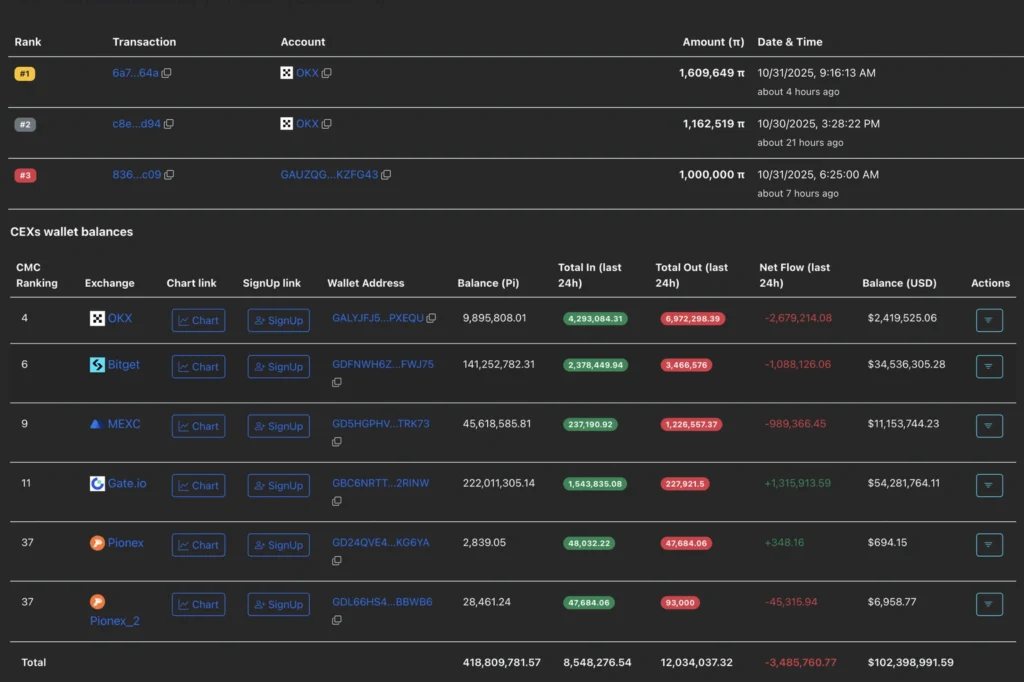

Pi Network Slips 2.5% as Whale Demand Fails to Offset Selling

Pi Network (PI) extended losses Friday, down 2.5% after a 3% decline the previous day, as large investor withdrawals outweighed rising demand from centralized exchange users.

Two major wallets withdrew 2.76 million PI in the last 24 hours, contributing to total CEX outflows of 3.48 million, PiScan data showed.

Pi Network Ventures announced an investment in AI firm OpenMind, which successfully ran image-recognition models on 350,000 active Pi Nodes. Despite the milestone, sentiment remained muted as price action failed to break above the 50-day EMA.

T3 Financial Crime Unit Freezes $300M in Illicit Crypto Assets

The T3 Financial Crime Unit — backed by Tether, TRON, and TRM Labs — said it has frozen $300 million in illicit funds since launching in late 2024, becoming a global model for crypto enforcement.

T3 coordinates seizures across five continents, including funds tied to “pig butchering” scams and organized crime networks. The group recently earned recognition from Brazil’s Federal Police for its role in Operation Lusocoin.

CEO Paolo Ardoino said Tether works with over 280 law enforcement agencies worldwide. The unit’s T3+ Global Collaborator Program, launched with Binance, has already helped freeze $6 million linked to fraud schemes.

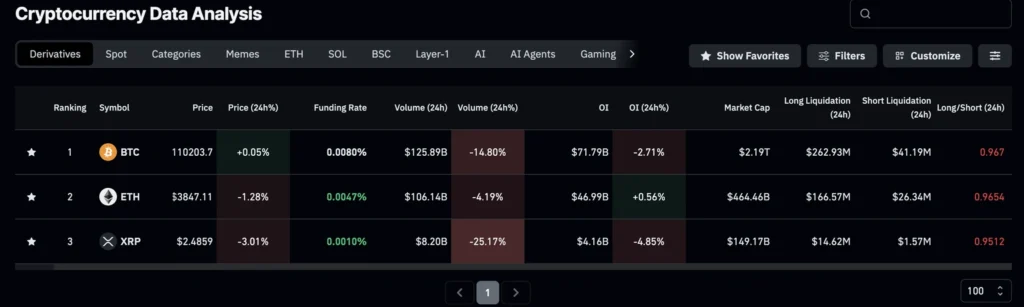

Crypto Market Rebounds; Bitcoin Holds $110K, Ethereum Stalls Below $3,900

Bitcoin (BTC) regained the $110,000 level Friday, rebounding after four straight days of losses. Ethereum (ETH) hovered below $3,900, while XRP climbed to $2.50.

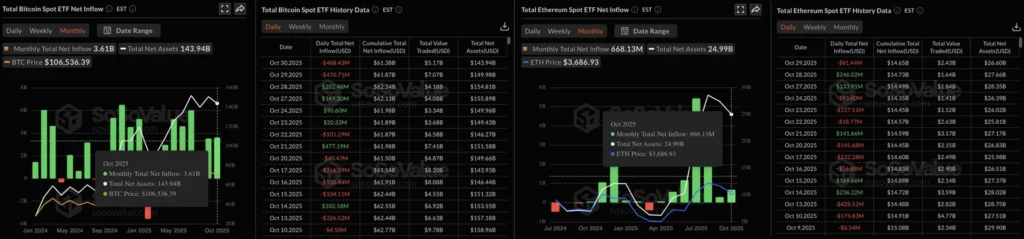

Retail futures open interest in BTC and XRP fell 3% and 5%, respectively, indicating lighter risk appetite. Institutional inflows into U.S. Bitcoin and Ethereum ETFs remain positive for October, at $3.61 billion and $668 million, though back-to-back outflows this week suggest waning confidence.

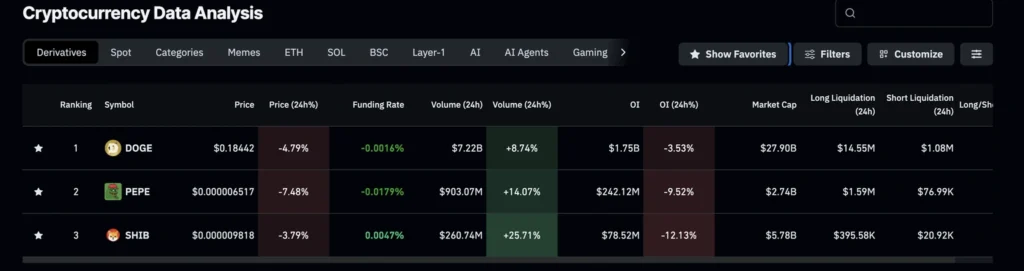

Meme Coins Under Pressure as Dogecoin, Shiba Inu, Pepe Test Supports

Meme coins extended losses Friday, with Dogecoin (DOGE), Shiba Inu (SHIB), and Pepe (PEPE) all testing key support levels amid a broader crypto pullback.

DOGE trades near $0.18 after forming a bearish “Death Cross,” with potential downside toward $0.142. SHIB rebounded slightly to retest $0.00001000, while PEPE held at $0.00000645 but risks further losses if that level breaks.

Open interest in DOGE, SHIB, and PEPE futures fell by 3%, 12%, and 9%, respectively, showing traders are reducing exposure as sentiment weakens.

The Day’s Takeaway

North America

U.S. Markets: Amazon Drives Record Week

U.S. equities ended higher Friday, with the Nasdaq (+0.6%) leading gains and all three major averages closing out a record-setting week. Amazon (AMZN) surged nearly 10% after posting strong earnings and AWS growth, pushing the consumer discretionary sector up 4.1%.

The Dow rose 0.1% to 47,562.66, the S&P 500 gained 0.3% to 6,840.19, and the Nasdaq Composite added 143.81 points to 23,724.98.

Apple and Nvidia slipped modestly, while Netflix jumped on a 10-for-1 stock split. Market breadth improved notably, with advancers outpacing decliners on both the NYSE and Nasdaq.

Despite cautious commentary from several Fed officials, equities held firm. The probability of a December rate cut fell to 65% from 95.8% a week earlier.

Treasury yields were little changed — the 2-year at 3.61% and 10-year at 4.10%.

Performance snapshot:

- Friday: S&P +0.3%, Nasdaq +0.7%, Dow +0.1%, Russell 2000 +0.7%

- Weekly: Nasdaq +2.2%, S&P +0.7%, Dow +0.7%

- October: Nasdaq +4.7%, S&P +2.3%

- YTD: Nasdaq +22.9%, S&P +16.3%, Dow +11.8%

Canada: August GDP Contracts

Canada’s economy contracted 0.3% in August, missing expectations for flat growth. The decline was broad-based, led by a 0.6% drop in goods-producing industries and a 0.1% dip in services.

Transportation and warehousing fell 1.7% amid a flight attendant strike, utilities dropped 2.3% on drought-related hydro losses, and mining and oil extraction declined 0.7%.

Retail trade was a rare bright spot, rising 0.9%.

A 0.1% rebound is expected for September.

Federal Reserve Split Widens

Several Fed officials voiced diverging views following this week’s rate cut:

- Jeffrey Schmid (Kansas City) opposed the cut, citing inflation momentum.

- Lorie Logan (Dallas) said she would have preferred to hold rates, warning inflation remains “too high.”

- Raphael Bostic (Atlanta) supported the cut but acknowledged persistent inflation risks.

- Beth Hammack (Cleveland) said she would not have cut, calling policy “barely restrictive.”

The range of comments underscores growing uncertainty about whether the Fed will ease again in December.

Trade & Tech: Trump Tells Xi “Chip Sales Are Between You and Nvidia”

CNBC reports former President Trump told China’s President Xi that AI chip sales are “between you and Nvidia,” suggesting limited export approvals.

Nvidia’s H20 chips remain under scrutiny for antitrust and security risks, while a new B30A chip due in 2026 is reportedly half as powerful as the upcoming Rubin line.

Analysts warn U.S. curbs could accelerate China’s domestic chip development.

Commodities

Oil: WTI Rebounds Ahead of OPEC+

WTI crude rose 0.65% to $60.50 on Friday, snapping a two-day slide. Traders anticipate OPEC+ will approve a 137,000 bpd supply hike at Sunday’s meeting.

Despite short-term gains, oil is set for a third monthly loss, pressured by record U.S. output (13.6 million bpd) and resilient Russian exports.

Saudi shipments hit a six-month high, while India continues buying Russian crude through intermediaries despite U.S. sanctions.

Baker Hughes Rig Count

- U.S. rigs: down 4 to 546 (oil −6, gas +4).

- Canada: down 12 to 187 (oil −11, gas −1).

U.S. rig totals are 39 lower year-over-year, while Canada’s are 26 lower.

Gold: Slips Below $4,000

Spot gold fell 1% to $3,985, marking its second straight weekly decline.

A stronger dollar and fading rate-cut bets weighed on prices, though central bank demand and geopolitical risks continue to support long-term strength.

Copper: Supply Concerns Persist

Commerzbank said supply tightness will likely persist due to falling Chilean output and steady industrial demand.

Weak Chinese PMI data hasn’t yet slowed production, and a U.S. tariff reduction on Chinese imports could bolster demand.

Analysts expect limited downside risk despite recent price pullbacks.

Russia: Exports Hold Strong

Russia’s seaborne exports averaged 3.56 million bpd, nearly unchanged from the prior week.

Commerzbank noted that despite U.S. sanctions, shipments remain robust, led by flows to Asia.

Europe

European markets were closed mixed, with traders eyeing upcoming ECB commentary and energy price moves.

Commerzbank noted strong gold and copper demand from European funds, offsetting weakness in industrial sectors.

Utility stocks underperformed on weaker gas prices.

Asia

Asian equities closed mostly higher ahead of China’s manufacturing PMI, with investors parsing mixed U.S.–China trade signals.

Reports of Trump–Xi talks and limited Nvidia chip export approval provided some optimism for tech shares.

However, weak factory data in China continues to weigh on sentiment, and analysts expect Beijing to maintain targeted support rather than large-scale stimulus.

Rest of World

Emerging market currencies were stable, supported by a softer U.S. dollar.

OPEC+ nations prepare to finalize December output changes amid diverging producer interests.

Latin American equities were steady, with Brazil’s Bovespa supported by commodity-linked sectors.

Crypto

Market Overview

Bitcoin (BTC) rebounded above $110,000, snapping a four-day slide.

Ethereum (ETH) held below $3,900, with U.S. ETF outflows signaling waning investor appetite.

Total U.S. ETF inflows for October remain positive — $3.61B for BTC, $668M for ETH — but outflows this week hint at profit-taking.

Ethereum Weakness

ETH faces downside risk toward $3,470 if it breaks $3,700, analysts warned.

Coinbase Premium Index turned −2.8%, suggesting lower U.S. demand versus global averages.

Pi Network

Pi Network (PI) dropped another 2.5%, extending a multi-day slide.

Despite new AI integration milestones, sentiment remains muted following large wallet withdrawals.

T3 Financial Crime Unit Freezes $300M

The T3 Financial Crime Unit, backed by Tether, TRON, and TRM Labs, said it has frozen $300 million in illicit funds since late 2024.

The initiative now coordinates with 280 law enforcement agencies globally and has helped seize assets tied to crypto fraud and organized crime.

Meme Coins Under Pressure

DOGE, SHIB, and PEPE all tested key supports Friday.

Open interest in meme coin futures fell across the board, signaling reduced speculative exposure.