North America News

U.S. Stocks Reverse Gains, Close Lower as Rate Worries and Yields Bite

Wall Street gave back strong early gains Thursday as surging Treasury yields and hawkish Fed sentiment rattled risk appetite. After rallying sharply, the Nasdaq erased a 327-point surge to close nearly flat, while the Dow shed 330 points (–0.74%), its worst day in nearly two weeks.

Final Index Moves:

- Dow: –330.30 (–0.74%) to 44,130.98

- S&P 500: –23.51 (–0.37%) to 6,339.39

- Nasdaq: –7.23 (–0.03%) to 21,122.45

- Russell 2000: –20.74 (–0.93%) to 2,211.64

Standouts:

- Meta soared +11.25% to $773.44 after blockbuster earnings.

- Microsoft rose +3.95% to $533.50.

- Apple (after hours): Q3 EPS $1.57 (beat), revenue $94.04B (beat). Stock up 1.83%.

- Coinbase slumped –4.29% after missing revenue/EBITDA estimates despite a huge EPS beat.

- Amazon beat top and bottom lines but fell –3.05% as AWS revenue slightly missed.

Macro Overview:

- Treasury yields rose on strong GDP and jobs data, tempering rate cut hopes.

- Fed still cautious. Markets now betting on fewer cuts, with Chair Powell signaling “data-dependent” stance.

- The US dollar strengthened, pressuring commodities and multinationals.

Sectors:

- Tech: Mixed. Meta, Microsoft, and AMD strong. Apple and Google cautious.

- Energy: Weighed down by oil price pullback.

- Financials & Payments: Visa and Mastercard jumped on upbeat results.

- Healthcare: Flat. UNH and Pfizer watched ahead of earnings.

- Chips: Nvidia and TSMC rallied on AI demand strength.

Thematic:

- Geopolitical jitters re-emerge as US-China tech tensions resurface.

- Ethereum ETF speculation rises after SEC review update.

- IPO pipeline remains cold amid macro uncertainty.

Takeaway: Strong earnings from big names couldn’t overcome macro headwinds. Rate sensitivity is back in focus ahead of Friday’s jobs report and more inflation data. Volatility likely to remain elevated.

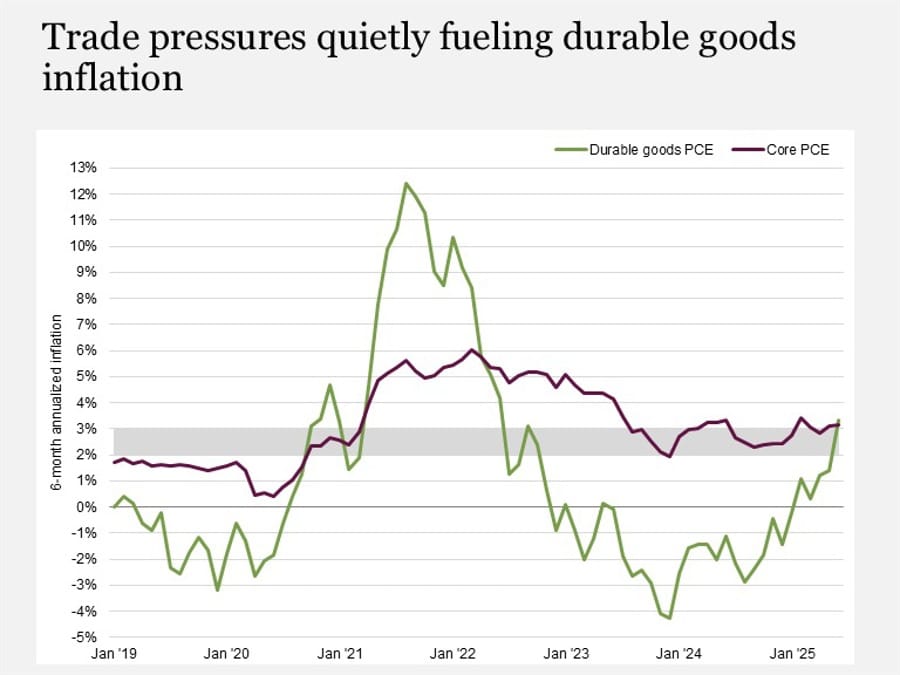

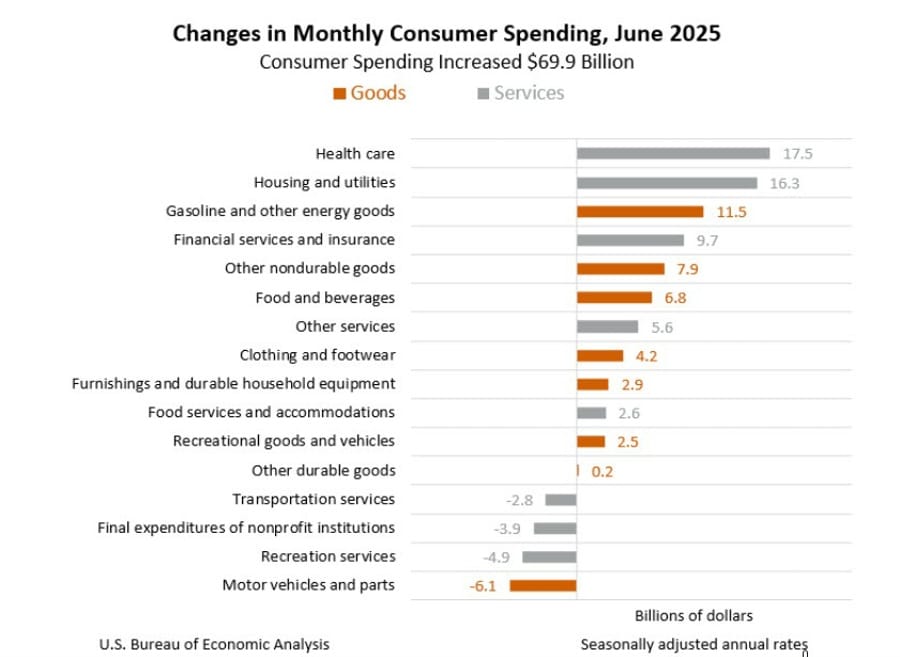

Pimco Warns of Inflation Ripples from Tariffs in Latest Core PCE Data

PIMCO says tariff-related inflation pressures are starting to show, even as the latest core PCE inflation figure came in close to expectations.

- June Core PCE: +0.26% m/m (vs. 0.3% est)

- Annual Core PCE: 2.8% YoY, unchanged

While the numbers appear stable, PIMCO sees warning signs—particularly in durable goods prices, which are more exposed to global trade disruptions. The firm says the 0.3% “rounded” increase may mark an inflection point in how tariffs feed into consumer prices.

PIMCO noted that many firms had previously absorbed cost increases, but recent data suggest pass-through effects are now gaining traction. Over the past six months, durable goods inflation has accelerated on an annualized basis, potentially setting up broader inflationary risk down the line.

As one of the world’s top bond managers, PIMCO’s inflation read-throughs are widely followed, and any uptick in tariff-induced pricing could influence Fed decision-making—particularly if it pushes inflation expectations above the “comfort zone.”

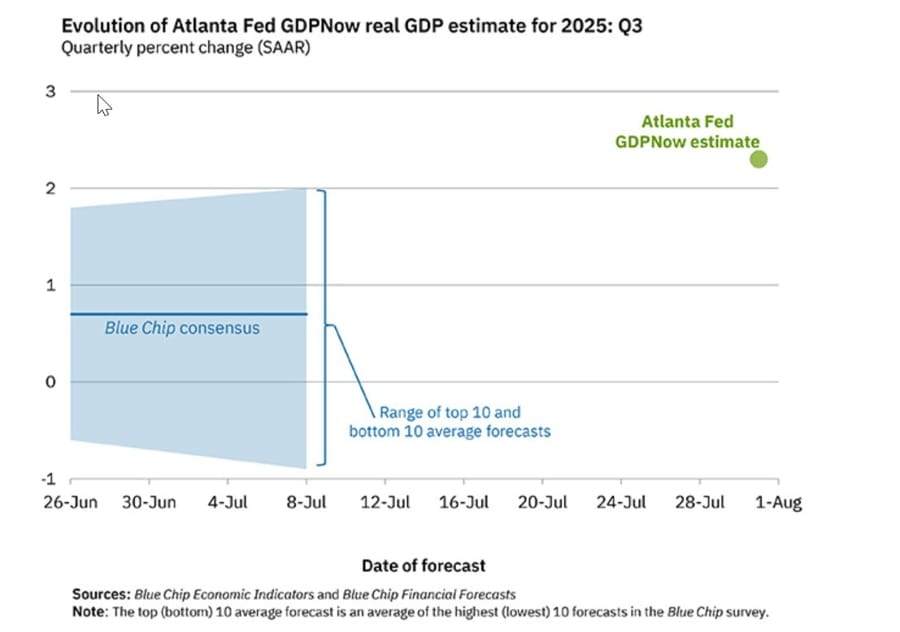

Atlanta Fed’s Q3 GDPNow Forecast Kicks Off at 2.3%

The Atlanta Fed’s GDPNow model projects 2.3% annualized GDP growth in Q3, after correctly estimating Q2 at 2.9% (actual was 3.0%). As of July 31, this is an early estimate with high volatility due to limited data—but the model continues to be a leading real-time gauge for U.S. growth.

U.S. 30-Year Mortgage Rate Drops to 6.72%, Offers Brief Relief

The U.S. 30-year fixed mortgage rate edged down to 6.72%, offering modest relief from earlier highs. Rates previously touched 7.04%, while the yearly low was 6.62%. The slight dip reflects a cooling home financing market amid cost pressure.

U.S. 30-Year Mortgage Rate Drops to 6.72%, Offers Brief Relief

The U.S. 30-year fixed mortgage rate edged down to 6.72%, offering modest relief from earlier highs. Rates previously touched 7.04%, while the yearly low was 6.62%. The slight dip reflects a cooling home financing market amid cost pressure.

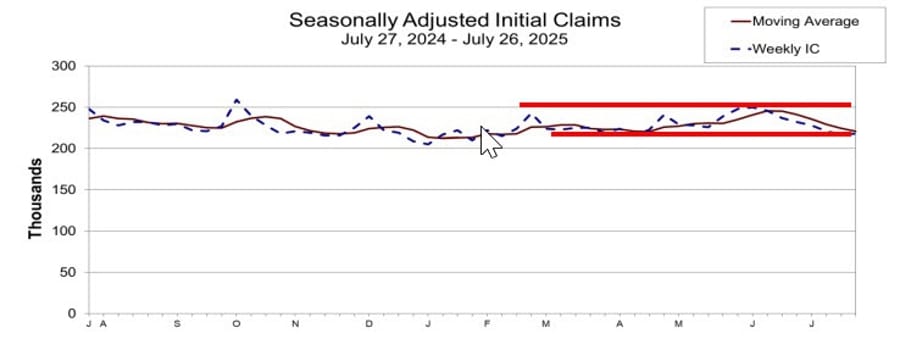

U.S. Initial Jobless Claims Remain Near Lows at 218K

U.S. jobless claims held steady, with initial claims at 218,000, slightly better than the 224,000 estimate. The four-week moving average ticked down to 221,000 from 224,500. Continuing claims dipped to 1.946 million, compared to 1.955 million prior, while the four-week average fell to 1.949 million. Chair Powell noted that supply and demand in the labor market remain balanced, keeping job conditions steady. Markets now await the official nonfarm payrolls report tomorrow.

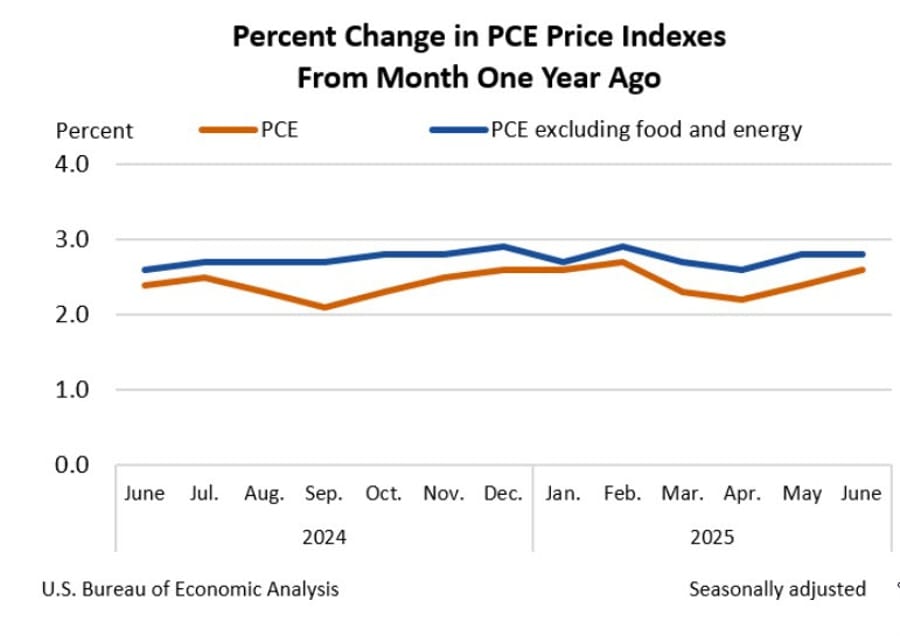

U.S. Core PCE Inflation at 2.8% in June Versus 2.7% Forecast

June’s core PCE inflation came in at 2.8% year-over-year, slightly above the 2.7% consensus. Monthly core inflation rose 0.3%, marginally above previous data. Excluding energy, food, and housing, headline PCE also gained 0.3%, while services inflation excluding shelter and energy came in at +0.2%. Overall PCE matched estimates: 2.6% y/y, with 0.3% m/m growth. Unrounded data showed 0.2805%, rounding up.

June personal income rose 0.3%, and disposable income also rose 0.3%, each up about $70 billion. Personal consumption edged up 0.1%, recovering from a revised -0.2% prior. The personal saving rate remained steady at 4.5%, equivalent to approximately $1.01 trillion saved for the month.

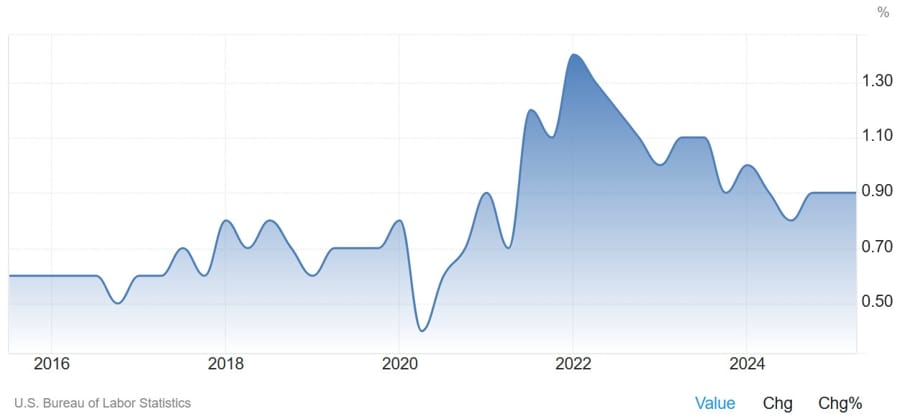

U.S. Q2 Employment Cost Index Surprises With 0.9% Rise

The Employment Cost Index—a comprehensive gauge of wage growth—rose by 0.9% in Q2, matching prior readings and topping the 0.8% estimate. Compensation per hour climbed 1.0%, while benefits rose 0.7% (down from 1.2%). Though released quarterly—and therefore less timely than average hourly earnings—the data suggests compensation costs remain elevated and under Fed scrutiny.

U.S. July Layoffs Surge to 62,075, Highest Since 2020

Challenger, Gray & Christmas reported 62,075 announced job cuts in July, a 140% increase year-over-year, and the largest July total since 2020. The four-year average is around 23,575, making this spike particularly notable.

Trump Sends Cease-and-Desist to Pharma CEOs Over Pricing

President Trump has demanded that 17 major pharmaceutical companies stop overpricing drugs in the U.S. compared to other countries. They must extend Most-Favored-Nation (MFN) pricing to Medicaid and all new drug launches, repatriate excess foreign profits, and use government tools to negotiate lower prices. Companies must comply by September 29, 2025, or face unspecified but forceful action. Targeted firms include Eli Lilly, Pfizer, GSK, and others.

WH Press Sec. New reciprocal tariffs take effect on Friday

- Moving in the right direction with China

- New reciprocal tariffs will take effect on Friday

- Countries that haven’t heard from them will hereby Executive Order or letter by tonight on tariffs

- Was a very successful meeting with South Korea

- They are moving in the right direction with China.

- Direct communication with counterparts continues

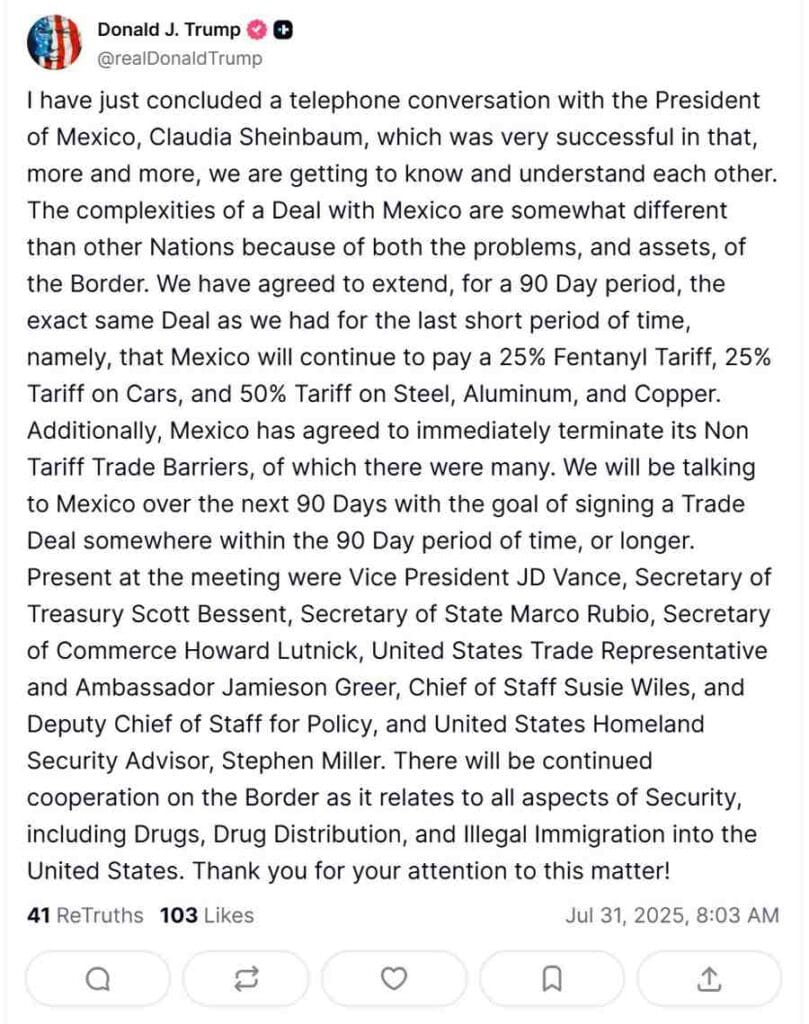

Trump Extends U.S.–Mexico Trade Pact for 90 Days After Productive Call

President Trump and Mexico’s President Sheinbaum agreed via phone to extend current trade terms for another 90 days, covering tariffs such as 25% on cars and fentanyl, and 50% on steel, aluminum, and copper. Mexico also pledged to remove existing non-tariff trade barriers immediately. U.S. officials including VP Vance and Treasury Secretary Bessent joined the call. Talks will continue towards a broader trade deal beyond the grace period.

US Treasury secretary Bessent: China are tough negotiators

- Remarks by Bessent on trade issues

- We pushed back on them quite a bit

- We have the makings of a deal

- Will speak to Trump later today about 12 August deadline with China

- Confident that it will be done

- I don’t know what’s going to happen on India

- It will be up to them (India), our trade team is frustrated

- We pulled down a lot of the non-tariff trade barriers for South Korea deal

JP Morgan’s Michele: September Rate Hold Likely as Fed Waits for Clarity

Bob Michele, head of fixed income at JPMorgan Asset Management, says the Federal Reserve is unlikely to cut rates at its September meeting. In an interview, he explained that while inflation has come down, it’s still running above target.

Michele emphasized the Fed’s “wait-and-see” posture, suggesting that markets should prepare for a more extended pause as the central bank continues to assess new data.

Trump to Attend ASEAN Summit in Malaysia, Raises Prospects of Trump‑Xi Meeting

Malaysian PM Anwar Ibrahim confirmed President Trump will attend the ASEAN Summit in Malaysia (Oct 26–28). A revised tariff rate for Malaysian imports is due tomorrow, signaling closer bilateral engagement.

With the U.S.–China trade truce set to expire around that time, the summit could open the door for a high-profile Trump‑Xi meeting, following China’s growing ASEAN outreach.

Trump Doubles Down on Trade Toughness in Remarks on Canada, India, Tariffs

President Trump declared that a U.S.–Canada trade deal will be “very hard” amidst U.S. plans to formally recognize a Palestinian state. He dismissed India’s trade behavior as “too high tariffs,” threatening a possible 25% tariff on Indian goods and criticizing their ties with Russia.

Additional announcements include:

- 50% tariffs on copper pipes and wiring to start Friday

- A softened approach to Brazil, excluding energy, aircraft, and juice from tariffs

- A 15% tariff on South Korean imports, tied to a new accord

Most notably, the ‘de minimis’ exemption is being removed starting August 29: shipments valued at or below $800 will now face duty.

Goldman Sachs: Sluggish Growth, Rising Yields, But Still Bullish on U.S. Stocks

Goldman Sachs sees U.S. GDP growth slowing to ~1% in 2025, weighed down by rising tariffs and softer consumer spending. Core inflation is projected at 3%, while long-end bond yields face upward pressure from deficit concerns.

Despite these headwinds, co-head of Global Banking & Markets Ashok Varadhan remains bullish on U.S. equities, expecting lower short-term rates and strong AI-driven earnings to offset macro softness.

Vice Chair Rob Kaplan added that fiscal stimulus and AI investment may provide temporary economic support even as long-term risks accumulate.

OpenAI Revenue Rockets to $12 Billion as ChatGPT Adoption Explodes

According to a report from The Information, OpenAI has reached a staggering $12 billion annualized revenue run rate, doubling its monthly intake in just seven months. The company is now bringing in around $1 billion per month, up from $500 million earlier in the year.

User engagement is surging as well—ChatGPT now boasts over 700 million weekly active users, showcasing its growing dominance across both personal and professional use cases. The figures reaffirm OpenAI’s status as a global AI powerhouse, especially in the conversational and generative AI space.

U.S. Secures Trade Agreements With Cambodia and Thailand

U.S. Commerce Secretary Lutnick confirmed in a Fox News interview that trade agreements have been finalized with both Cambodia and Thailand. While details were sparse, the announcements add to a string of trade negotiations underway between the U.S. and Southeast Asia.

Trump Announces South Korea Trade Pact, Avoids 25% Tariff Threat

President Trump announced a comprehensive trade deal with South Korea, avoiding a previously looming 25% tariff by locking in a 15% rate instead. The agreement, unveiled via Truth Social, includes several major components:

- $350 billion investment from South Korea into U.S.-based projects.

- $100 billion energy purchase agreement, primarily for LNG and other U.S. energy exports.

- Tariff-free access for U.S. goods including vehicles and agricultural products.

- A White House meeting is scheduled within two weeks between President Trump and President Lee Jae Myung of South Korea.

South Korean markets responded positively in early trade.

Mexican President Sheinbaum Praises Trade Agreement as Protective of USMCA

Mexico’s President Sheinbaum said the recent agreement with President Trump safeguards the USMCA framework, respects Mexican sovereignty, and facilitates investment. She confirmed no immediate face-to-face meeting is planned and emphasized that trade talks on sectors like tomatoes and steel will continue throughout the grace period.

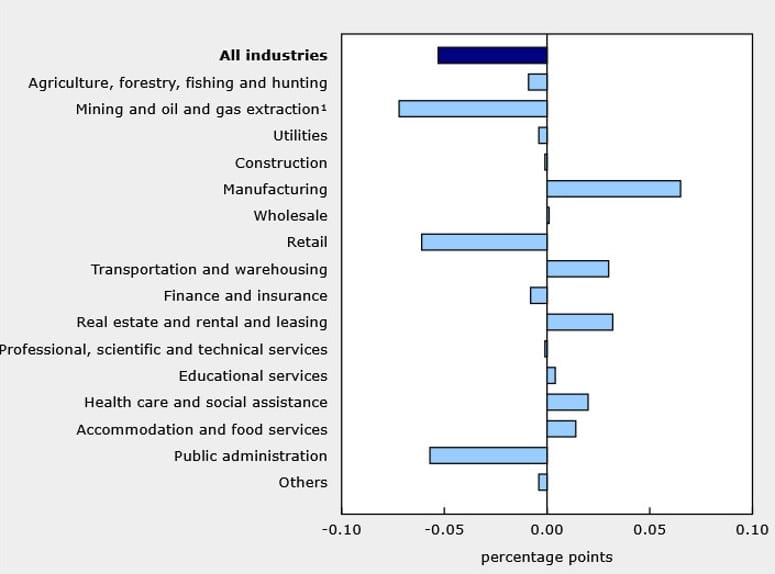

Canada Q2 GDP Flat Again, Advanced Estimate for June at +0.1%

Canada’s economy shrank 0.1% in May, in line with expectations, while the advance estimate for June shows recovery with +0.1% growth. Goods-producing sectors contracted—particularly mining and oil/gas extraction—but manufacturing posted gains. Service sectors stayed flat, with real estate and transport rising, while retail and public administration softened. Overall, 7 out of 20 industries expanded in May.

Brazil Keeps Benchmark Rate at 15.00%, Signaling Caution Ahead

The Central Bank of Brazil left its benchmark Selic rate at 15.00%, as widely expected. The unanimous decision signals a pause in tightening, with the committee now evaluating whether the current rate is sufficient for inflation control.

Officials emphasized that they will remain alert and flexible, prepared to resume hikes if inflation pressures reignite—particularly amid U.S. tariff developments.

Goldman Sachs Pegs U.S. Tariffs on Brazil at 30.8%

Goldman Sachs estimates that total effective U.S. tariffs on Brazilian imports will reach 30.8%, including all current and anticipated sectoral measures. The firm also warned that retaliatory tariffs from Brazil would pose a greater threat to inflation and GDP growth than the initial U.S. action.

Commodities News

Gold Bounces off July Lows Despite Firm Dollar, Fed Hold

Gold prices rebounded Thursday, up 0.61% to $3,296, after bouncing from month-to-date lows near $3,268. The move came despite a firm US dollar and the Fed holding its policy rate steady.

- Fed Rate: Held at 4.25–4.50% in a 9–2 vote

- Core PCE Inflation: Ticked up to 2.8% YoY

- Jobless Claims: Fell to 218K, indicating labor market strength

Fed Chair Powell maintained a cautious tone, pushing back on political pressure to cut rates. He reiterated that the Fed will remain data-driven and decide “meeting by meeting.”

The rebound in gold was partly technical, as prices had become oversold, but also driven by uncertainty around tariffs, especially ahead of the August 1 deadline for new trade measures. While the macro backdrop remains hawkish, traders are bracing for Friday’s NFP report, which could drive the next leg.

Outlook: As long as real yields stay sticky and the Fed resists easing, gold may stay rangebound. But any signs of softening data—or tariff-related shocks—could trigger a fresh safe-haven bid.

Copper Prices Collapse After Targeted 50% U.S. Tariffs

Copper tanked nearly 22% (−$1.22) following President Trump’s new 50% tariffs on semi-finished copper goods and derivative products, effective August 1, 2025. Surprisingly, refined copper, copper scrap, ores, concentrates, and mattes were excluded.

These exclusion details rattled markets. Copper futures plunged from a high near $5.95 to a low around $4.33, now bouncing around $4.37—well below the 100-day and 200-day moving averages at $4.94 and $4.63 respectively. Technical support lies at $4.35, with a deeper support zone between $3.92–$4.02. Failure to hold that could open a bigger downside extension.

ING: U.S. Copper Tariffs Send Comex Prices Down 19%

Copper suffered an 18–19% plunge after the White House outlined 50% tariffs on semi-finished copper products, effective August 1. Refined copper and concentrate remain excluded for now. ING warns that new tariffs—up to 30% in coming years—may still target refined copper, leading to long-term downside in price and arbitrage activity.

ING Warns of Secondary Tariff Fallout Impacting Oil & Indian Demand

Oil prices rallied more than 1% as threats of secondary tariffs on Russian imports put pressure on supply. India is a major concern, with reports of U.S. penalties looming over imports from India if it continues buying Russian energy. U.S. crude inventories rose +7.7M barrels, while gasoline fell -2.7M and distillates rose +3.6M, pointing to ample supply but persistent volatility.

ING: Funds Slash TTF Gas Net Longs as European Prices Rally

Funds cut their net long position in TTF natural gas by 32.8 TWh, bringing net exposure to 127.5 TWh. Despite the reduction, the recent spike in European gas prices suggests positioning may already be rebuilding, amid concerns about Russian energy flows and rising tariff risk.

Gold Loses Ground as Hawkish Rate Cues Tilt Sentiment

Gold extended its decline in response to an uptick in hawkish rate expectations, fueled by stronger U.S. data and a less dovish Fed. With the U.S. NFP report due tomorrow, gold’s near-term outlook remains cautious.

Charts show price moving toward support around $3,245, while a break below may open the way to $3,120. On the upside, resistance lies around $3,333, with further upside in a breakout toward $3,438. Despite short-term pressure, longer-term trends could remain constructive if real yields decline later.

Europe News

Mixed European Equities Close With France and Italy Underperforming

European markets closed mixed: Italy’s FTSE MIB dropped 1.56%, France’s CAC fell 1.14%, while Germany’s DAX slid 0.73%. The UK’s FTSE 100 dipped 0.05%, and Spain’s Ibex managed a small gain of 0.11%. Ten-year yields mostly ticked lower:

- Spain: 3.271% (–0.011 bps)

- Germany: 2.693% (–0.015 bps)

- France: 3.347% (–0.016 bps)

- UK: 4.572% (–0.024 bps)

- Italy: 3.535% (unchanged)

Eurozone Jobless Rate Holds at Record Low of 6.2%

Eurostat reported the unemployment rate at 6.2% in June, unchanged from a revised May reading. Despite economic softness, the job market remains resilient across the region, easing pressure on ECB policymaking.

Germany July CPI Climbs 2.0% in Line With Forecast

Germany’s headline CPI rose 2.0% y/y in July vs 1.9% expected. Month-on-month inflation was +0.3%. HICP came in at +1.8%, slightly below expectations. Core inflation remained steady at 2.7%, underscoring the ECB’s pause stance ahead of the September meeting.

Germany Import Prices Flat in June, Energy a Drag

Germany’s June import price index came in at 0.0% m/m, outperforming the expected –0.2%. Year-over-year, imports fell 1.4%, driven by a –13.6% decline in energy prices. Strip out energy, and import prices were down approximately 0.4%.

German Labor Market Resilient: July Unemployment Falls Short of Forecast

According to the Federal Employment Agency, Germany added just 2,000 jobs in July, well below the 15,000 expected, keeping the unemployment rate steady at 6.3%. While some softness may be emerging, the jobless rate remains firmly under control.

Inflation Across German Regions Paints Mixed Picture

CPI data from Bavaria, Saxony, Baden-Württemberg, and NRW show regional inflation hovering around +1.9% y/y. Saxony dipped to +1.9% from 2.2%, while Baden-Württemberg held at +2.3%. The core national CPI of +2.7% in June remains a concern for policymakers.

France July CPI Holds At 1.0%, HICP Beats Forecast Slightly

France’s July headline CPI remained at +1.0%, in line with expectations. Harmonized CPI (HICP) came in at +0.9%, just above the forecast of +0.8%. Core inflation, particularly service prices, remains firm, though the data is unlikely to prompt ECB action for now.

Italy July CPI HICP Matches Expectations at +1.7%

Italy’s preliminary inflation numbers came in at +1.7% y/y, matching forecasts. Coupled with the low eurozone jobless rate, the data reinforces ECB’s current wait-and-see approach. Rate cuts now seem unlikely, with dialogues on rate hikes beginning in 2026.

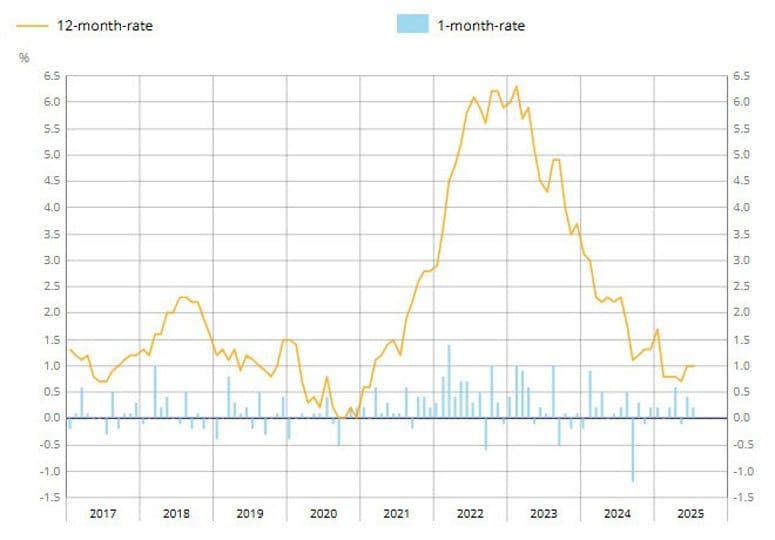

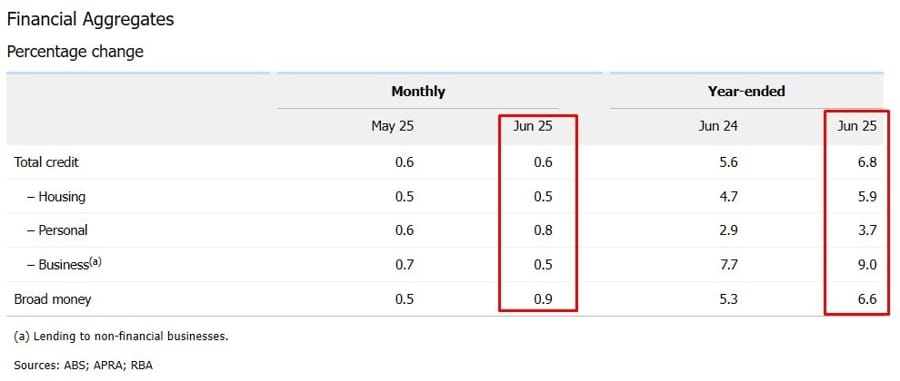

Swiss June Retail Sales Soar 3.8% vs 0.2% Forecast

Switzerland saw a +3.8% y/y jump in retail sales for June, far exceeding the 0.2% estimate. May’s data was revised upward to +0.3% from 0.0%, highlighting unexpectedly strong consumer activity.

The breakdown is as follows:

Barclays Drops September ECB Cut, Now Projects Only December Cut

Barclays has revised its outlook: the European Central Bank is no longer expected to cut rates in September. Earlier forecasts—anticipating two cuts in 2025, one in September and another in December—have been pared back. Barclays still anticipates a terminal deposit rate of 1.50%, supported by average U.S. tariffs of around 15% on EU imports and risks of slower medium-term inflation. While U.S. tariffs roughly align with those assumptions, Barclays removed its September cut call, leaving only a December easing in play.

Asia-Pacific & World News

Hong Kong Central Bank Intervenes Again to Defend Currency

The Hong Kong Monetary Authority intervened in FX markets once again, purchasing just under 4 billion HKD to support the local currency. The move followed broad U.S. dollar strength in response to a more neutral tone from the Fed, which has weighed on major global currencies, including the HKD.

Xinhua: Deep Issues Remain in U.S.-China Trade Talks

China’s state-run Xinhua news agency commented on the ongoing trade negotiations with the U.S., emphasizing that “deep-seated structural issues” persist. While China remains committed to resolving disputes through dialogue, it warned that a quick fix is unlikely.

The government reaffirmed its sincerity in the talks and expressed hope for a solution on tariffs, though it acknowledged that progress will be gradual.

China’s July Manufacturing PMI Falls to 49.3, Fourth Straight Month in Contraction

China’s official July manufacturing PMI slid further into contraction at 49.3, below the expected 49.7 and unchanged from the prior month’s 49.7. This marks the fourth consecutive month of contraction.

Export momentum appears to be fading and domestic demand remains weak. The non-manufacturing PMI barely held above expansion at 50.1, its lowest since November. The composite index came in at 50.2, down from 50.7.

China to Monitor Big Cash Transactions for Precious Metals and Gems

China is implementing tighter controls on high-value cash purchases of precious materials starting Friday. According to state media, any single or cumulative purchase exceeding 100,000 yuan (about $13,900 USD)—including foreign currency equivalents—for items like gold or diamonds must now be reported.

Banks and licensed dealers must submit these transaction records to the China Anti-Money Laundering Monitoring and Analysis Center within five business days. The move is aimed at improving transparency and tackling potential money laundering in sectors historically at risk.

PBOC sets USD/ CNY mid-point today at 7.1494 (vs. estimate at 7.2062)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 283.2bn yuan via 7-day reverse repos at 1.40%

- 331bn yuan mature today

- net 47.8bn yuan drain

RBA Dep Gov Hauser: Says the CPI data were very welcome

- Reserve Bank of Australia Deputy Governor Andrew Hauser

- CPI data were very welcome

- Trimmed mean dead in line with our forecasts

- Full impact of tariffs is yet to come

- This will be a real tax increase in the US

- Our forecasts were based on rates falling gradually toward 3.2%

- Models of neutral rate give very different answers, does not drive policy decisions

- the unemployment numbers were in line with our forecasts

- Unemployment is still very low

- the Australian labour market is still close to full employment

- Expects to see further recovery in consumer spending

- Consumer confidence is pretty weak

- weak productivity may lower speed limit of recovery

- If unemployment did rise sharply the RBA would have to react, but this is not our central forecast

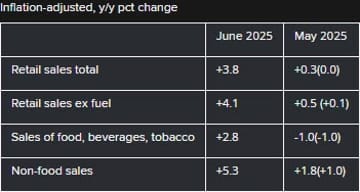

Australia June Private Sector Credit Beats Forecasts at +0.6% m/m

Data from the Reserve Bank of Australia showed private sector credit increased 0.6% month-over-month in June, topping expectations for a 0.5% gain. On a yearly basis, credit growth came in at +6.8%, slightly below the 6.9% pace previously recorded.

Business lending saw a modest pullback, while both housing and personal credit segments posted increases, signaling continued consumer strength.

Australia Retail Sales Jump 1.2% in June, Crushing Forecasts

Retail sales in Australia surged 1.2% m/m in June, far exceeding the 0.4% forecast and well above May’s 0.2% gain. On a quarterly basis, sales were up 0.3%, improving from 0.1% in the previous quarter.

The sharp monthly rebound highlights strong domestic demand and could influence Reserve Bank policy thinking.

Australian Building Permits Skyrocket 11.9% in June

Australia’s building approvals posted a massive +11.9% monthly increase in June, well above the +2.0% expectation and up from the +3.2% in May. On a yearly basis, permits rose 27.4%, compared to 6.5% previously.

The figure represents the strongest monthly growth since August 2022, driven largely by a spike in approvals for multi-unit dwellings like apartments.

Australian Terms of Trade Hit by Export Price Collapse

Australia’s Q2 2025 trade data revealed a significant downturn in terms of trade, with export prices falling 4.5% quarter-over-quarter, far worse than the -3.0% forecast. The prior quarter had seen a +2.1% gain.

On the import side, prices declined 0.8%, compared to expectations for a 0.5% drop and a prior -3.3% print. Overall, the figures paint a bleak picture for Australia’s trade sector this quarter.

Japan Eyes 15% U.S. Chip Tariff to Match EU-Level

According to Nikkei, Japanese trade officials are pushing for a 15% sectoral tariff on U.S. chip goods, aligning with the European Union’s rate. Trade negotiator Akazawa emphasized that this should serve as a credible negotiating anchor.

BOJ Holds Short-Term Rate at 0.5%, Upgrades Inflation Forecasts

The Bank of Japan maintained its short-term policy rate at 0.5%, a unanimous decision with no dissenting votes. The central bank raised its projections for inflation across the board:

- Core CPI (fiscal 2025): now +2.7%, up from +2.2%

- Core CPI (2026): +1.8% (prev. +1.7%)

- Core CPI (2027): +2.0% (prev. +1.9%)

For core-core CPI (excluding food & energy):

- Fiscal 2025: +2.8% (prev. +2.3%)

- 2026: +1.9% (prev. +1.8%)

- 2027: unchanged at +2.0%

The report noted inflation may slow with weaker growth, then gradually accelerate, targeting around 2% from 2025–27. Risks to inflation were described as balanced, while economic outlook risks tilted downside, especially due to trade uncertainty. The BOJ reaffirmed it will raise rates gradually if inflation and economic conditions evolve as forecast.

BOJ governor Ueda: US-Japan trade deal is great progress

- BOJ governor, Kazuo Ueda, remarks in his press conference

- Japan’s economy is recovering moderately albeit with some weakness

- Easy monetary conditions will support the economy

- Underlying inflation likely to stall but gradually accelerate

- Trade developments and impact on prices, overseas economies are highly uncertain

- Must pay attention to trade policies’ impact on financial market and Japan’s economy, prices

- US-Japan trade deal is a great progress

- US-Japan trade deal reduces uncertainty over economic outlook

- We are in a phase where impact from tariffs would become apparent though not sure about when

- Will look at the data to come out without any preconception

- Will make appropriate decision at each meeting while confirming risks, likelihood of our view on underlying inflation

- Underlying inflation is gradually rising, not in phase of stalling due to tariffs

- Likelihood of achieving our outlook has slightly heightened after trade deals were made

- The uncertainties surrounding that have also been lowered

- We are not behind the curve on rates

- Have to be mindful that policy rates remain at a low 0.50%

- Underlying inflation is strengthening but not yet sustainably hitting 2%

Japan Industrial Production Surges +1.7% in June, Reversing Prior Declines

Japan’s preliminary industrial output for June rose +1.7% m/m, defying forecasts for a -0.6% drop. The result marks a sharp turnaround from May’s -0.1% reading. On a yearly basis, output jumped +4.0%, compared to a prior decline of -2.4%.

Japan Retail Sales Rise 2.0% y/y in June, Exceeding Expectations

Japan’s June retail sales grew +2.0% y/y, outpacing the expected +1.8%. Month-on-month, sales rose +1.0%, recovering from May’s -0.2% decline. The result suggests consumer activity is improving in tandem with broader industrial gains.

Crypto Market Pulse

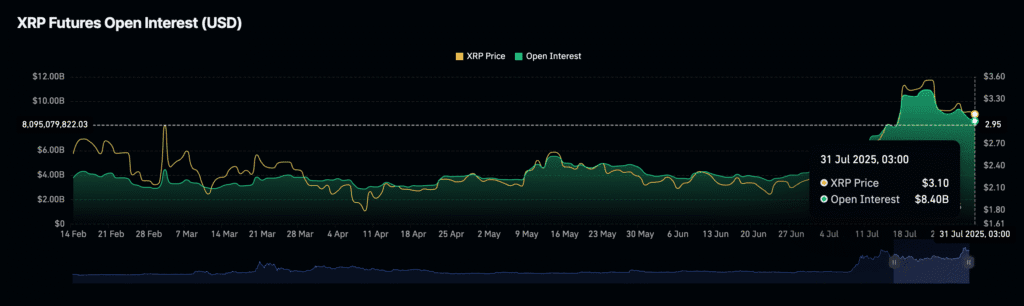

XRP Stalls Under $3.32 Resistance Ahead of Tariff-Driven Risk-Off Move

XRP slipped to $3.09, failing to break above $3.32 resistance. Indicators like a MACD sell signal and descending RSI suggest weakening momentum. Futures Open Interest has fallen 23% to around $8.4B, signaling eroding conviction ahead of looming reciprocal tariffs set for Friday. With trade tensions rising and Fed comments fueling caution, XRP struggled to regain its footing.

Meme Coins Rebound: PUMP, REKT & BRETT Lead Double-Digit Gains

Meme tokens are rallying: PUMP surged over 15%, REKT hit new highs, and BRETT bounced back strongly. PUMP trades at $0.0031, holding above its 50-period EMA and boosting bullish MACD signals. REKT topped at $0.000001233 before retracing to $0.000001096, while BRETT trades near $0.0565 with support at its 100-period EMA. All fit within a post-Fed risk-on sentiment pattern emerging across retail speculative assets.

Pi Network Price Slides Ahead of 160M Token Unlock, Integration Delay Weighs

Pi Network (PI) is under pressure, trading around $0.42, approaching its all-time low of $0.40. Around 161.6 million PI tokens will unlock in August—boosting supply by 2.09%—and the Onramp Money integration is delayed, both pressuring the price technically and sentiment-wise. Monthly unlocks historically trigger sell-offs as holders take profits. Market watchers are now cautioning that bullish reversals may not arrive until after the August unlock event.

Cardano (ADA) Eyes Wedge Breakout as $8.57M in Shorts at Risk

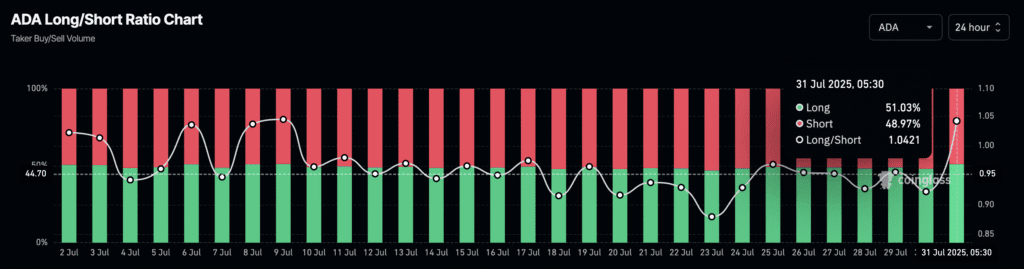

ADA is climbing toward $0.80, trading up nearly 3% today, and potentially breaking out of a falling wedge pattern. Long positions have surged, pushing the long-to-short ratio to 1.0421, the highest since July 9. Short positions totaling $8.57 million are concentrated at the $0.797 level, making them vulnerable. A move above those levels risks triggering short liquidations, which could amplify the bullish setup in ADA derivatives.

Bitcoin Consolidates Around $118.5K, Whale Buying & Regulation Signal Support

Bitcoin has traded in a tight $116K–$120K range for 16 days, holding near $118,500. Despite sideways price action, on-chain data shows rising accumulation by whale holders and record-low over-the-counter balances.

Institutional developments are boosting sentiment: the White House released its first crypto policy report, calling for SEC guidelines on tokenized assets and stablecoins. Meanwhile, Coinbase and JPMorgan reached a deal to link bank accounts directly to crypto wallets, eliminating reliance on aggregators like Plaid or MX. Traders see these steps as clarity drivers, helping to underpin BTC even amid flat technicals.

The Day’s Takeaway

North America

United States

- OpenAI Revenue Hits $12B Run Rate: OpenAI’s annualized revenue has doubled in seven months, reaching $12 billion—about $1 billion monthly. ChatGPT user base surged to 700 million weekly active users, underscoring mainstream AI adoption.

- Trump Secures South Korea Trade Pact: The deal locks in a 15% tariff rate (down from 25% threat) and includes a $350B investment in U.S. projects and $100B in LNG purchases. U.S. goods gain tariff-free access. Markets welcomed the announcement.

- Employment Cost Index Surprises: Q2 compensation costs rose 0.9%, slightly beating forecasts. Core PCE inflation in June came in at 2.8% YoY, above expectations, suggesting pricing pressures remain sticky.

- U.S. Layoffs Spike: July layoffs hit 62,075—the highest since 2020. Year-over-year increase is 140%, sparking labor market caution despite stable jobless claims at 218K.

- Trump Extends Mexico Trade Deal: A 90-day extension maintains current tariffs while negotiations continue. Both sides pledged to remove non-tariff barriers and deepen talks beyond the grace period.

- Markets Reverse Gains: Hawkish Fed sentiment and rising yields wiped out early equity rallies.

- Dow: –0.74%

- S&P 500: –0.37%

- Nasdaq: –0.03%

- Russell 2000: –0.93%

- Meta & Microsoft Shine: Meta soared +11.25% on strong earnings. Microsoft rose nearly 4%. Apple beat Q3 earnings and revenue after hours. Amazon and Coinbase slipped despite top-line beats.

- Mortgage Rates Dip Slightly: 30-year fixed mortgage dropped to 6.72%, easing from recent highs but still elevated.

Brazil

- Central Bank Holds at 15.00%: Decision signals caution. Potential for rate hikes if U.S. tariffs fuel inflation.

- Goldman Sachs Flags 30.8% U.S. Tariff Load: Brazil faces high U.S. tariff exposure. Retaliation could amplify inflation risks.

Mexico

- Trade Agreement Praised: President Sheinbaum says pact protects USMCA, removes non-tariff barriers. Talks on tomatoes, steel to continue.

Canada

- GDP Flat Again: Q2 stuck near 0%, with only a +0.1% estimate for June. Mining and oil/gas weighed on growth.

Commodities

- Gold Bounces Despite Hawkish Fed: Gold rebounded 0.61% to $3,296 after touching July lows. Rate hold, sticky inflation, and tariff uncertainty supported the rebound.

- Copper Plunges on 50% Tariff Hit: Semi-finished copper goods now face a 50% U.S. tariff starting Aug 1. Prices collapsed nearly 22%, from highs near $5.95 to lows around $4.33. Refined copper remains excluded—for now.

- ING Flags Oil Supply Risks: U.S. threats of secondary tariffs on Russian oil pressure supply. India’s purchases are under scrutiny, increasing volatility. U.S. crude inventories rose +7.7M barrels.

Europe

- Germany July CPI Matches at +2.0%: Core inflation held firm at 2.7%. Import prices flat m/m, though energy was a significant drag.

- Eurozone Jobless Rate Steady at 6.2%: Despite broader economic softness, labor markets remain resilient.

- France CPI & HICP In Line: July CPI held at 1.0%, HICP slightly beat at 0.9%. Core inflation driven by service sector strength.

- Italy July Inflation Hits Target: HICP at +1.7% y/y, matching forecasts.

- Barclays Drops September ECB Cut: Now expects just one December cut, citing U.S. tariff risk and inflation resilience.

- Equities Mixed:

- France CAC: –1.14%

- Italy FTSE MIB: –1.56%

- Germany DAX: –0.73%

- UK FTSE 100: –0.05%

- Spain Ibex: +0.11%

Asia

China

- PMI Falls to 49.3: Manufacturing contracted for the fourth straight month. Export momentum weak, domestic demand flat. Composite PMI slipped to 50.2.

- Cash Limits on Precious Materials: China will now monitor all single or cumulative purchases of over 100,000 yuan in gold, diamonds, and other precious goods. Dealers must report transactions within five days to anti-money laundering authorities.

- Xinhua Cautions on U.S. Trade Talks: Structural issues remain. Progress expected to be slow.

Japan

- Industrial Production Rebounds: June output jumped +1.7% m/m after May’s dip, and +4.0% y/y.

- Retail Sales Solid: Rose +2.0% y/y in June, with a +1.0% m/m recovery.

- BOJ Holds Rate, Hikes Inflation Outlook:

- 2025 Core CPI: +2.7% (up from 2.2%)

- 2026 Core CPI: +1.8%

- Gradual rate hikes possible if conditions align.

- Japan Targets 15% U.S. Chip Tariff: Seeks parity with EU tariffs amid escalating trade pressures.

Australia

- Retail Sales Surge: Jumped +1.2% m/m in June, triple the forecast. Strong domestic demand.

- Building Permits Soar: +11.9% m/m, strongest since Aug 2022. Driven by apartment approvals.

- Private Credit Beats: +0.6% m/m in June. Housing and personal credit up, business credit down.

- Terms of Trade Slump: Q2 export prices fell –4.5%. Overall trade outlook dimmed.

Crypto

- Bitcoin Holds $118.5K Zone: Sideways price action continues. Whale accumulation and regulation progress (Coinbase-JPMorgan link) offer support.

- Pi Network Drops Ahead of Unlock: Trading at $0.42. 160M tokens to unlock in August. Integration delay adds pressure.

- ADA Breakout Near: Cardano eyes wedge breakout toward $0.80. $8.57M in shorts vulnerable.

- XRP Slips Below $3.32 Resistance: Indicators show weakening momentum. Futures Open Interest down 23%.