North America News

Modest Gains Cap a Strong September for US Equities

US equities closed out September and Q3 on a firmer footing, with all three major indices ending near session highs after a choppy trading day.

- Dow Jones Industrial Average: +81.82 (0.2%) → 46,397.68

- Nasdaq Composite: +68.86 (0.3%) → 22,660.02

- S&P 500: +27.25 (0.4%) → 6,688.45

The month delivered solid returns across the board: S&P 500 (+3.5%), Nasdaq Composite (+5.6%), and DJIA (+1.9%).

Healthcare Leads; Energy Lags

Healthcare stocks led the charge (+2.5%) after President Trump announced Pfizer would cut US drug prices and sell select medications directly through a government-run site, TrumpRx.

- Pfizer (PFE): +6.8%

- Eli Lilly (LLY): +5.0%

- Merck (MRK): +6.8%

- Amgen (AMGN): +3.0%

These moves helped lift the sector back into positive territory for 2025.

Tech also supported the rally (+0.9%), closing out Q3 as the best-performing sector with a 13% quarterly gain. NVIDIA hit another record high (+2.6%), while the PHLX Semiconductor Index rose 0.9%, capping a 12.3% gain for September.

On the downside, energy (-1.1%) led sector laggards as crude oil fell 1.8% to $62.37/bbl. Consumer discretionary (-0.6%), communication services (-0.5%), and financials (-0.5%) also slipped.

Small Caps Underperform

The Russell 2000 and S&P Mid Cap 400 eked out only +0.1% gains, underperforming large caps despite dovish signals from the Fed and softer macro data that boosted expectations of further easing.

Economic Data Reinforces Fed Easing Expectations

- Consumer Confidence (Sept): 94.2 (vs. 97.8 prior) → weakest since April, with job availability sentiment at multi-year lows.

- Chicago PMI (Sept): 40.6 (vs. 41.5 prior) → contraction continues.

- FHFA Home Price Index (July): -0.1% MoM (vs. -0.2% prior).

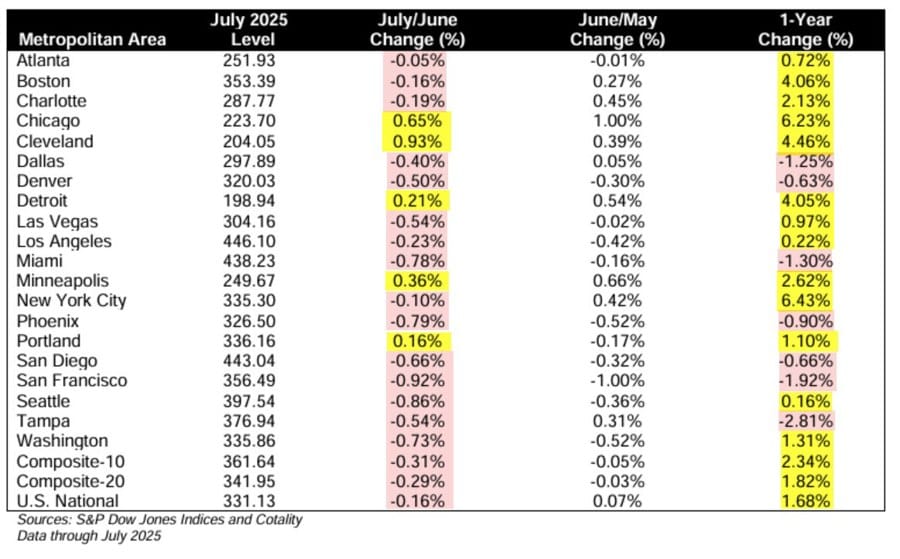

- S&P Case-Shiller Home Price Index (July): +1.9% YoY (vs. +2.2% revised June).

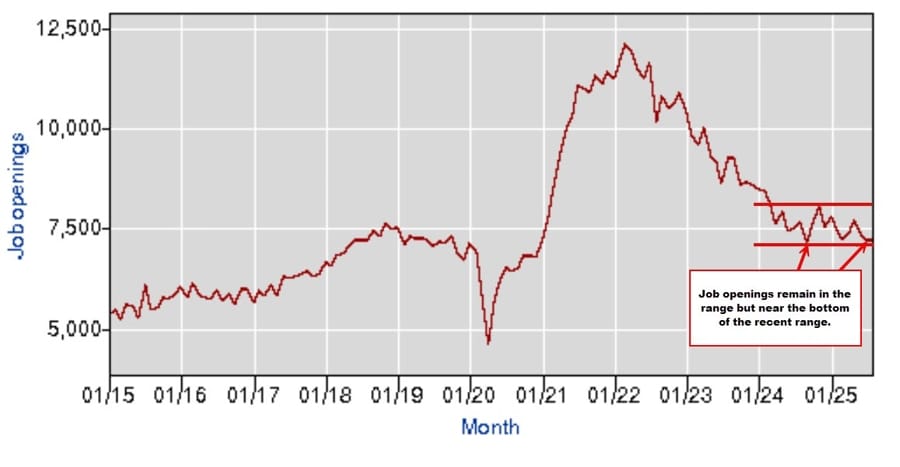

- JOLTS Job Openings (Aug): 7.23M (vs. 7.19M est., 7.21M prior).

The data reinforced bets on additional Fed cuts. CME FedWatch now shows a 96.7% probability of a 25bp cut in October and a 77.7% chance of another in December.

Fed Commentary Mixed

- Vice Chair Jefferson: Highlighted downside risks to jobs but lingering inflation concerns.

- Boston Fed’s Collins: Supported modest easing but said a restrictive stance remains appropriate.

- Chicago Fed’s Goolsbee: Downplayed labor market concerns.

Despite mixed tones, markets remain confident the Fed will ease further in 2025.

Looming Government Shutdown Adds Uncertainty

Funding expires at midnight with no resolution in sight. While markets appear calm, a shutdown would delay key data releases, complicating monetary policy assessment.

Treasury Yields End Mixed, Curve Steepens

Shorter maturities rallied, while longer tenors sold off modestly.

- 2-year yield: 3.62% (-1.6 bps)

- 5-year yield: 3.75% (+0.5 bps)

- 10-year yield: 4.15% (+1.3 bps)

- 30-year yield: 4.73% (+2.9 bps)

For September, the 2-year yield slipped 2 bps, while the 10-year fell 8 bps, reflecting easing expectations.

Year-to-Date Performance

- Nasdaq Composite: +17.3% YTD

- S&P 500: +13.7% YTD

- Russell 2000: +9.3% YTD

- DJIA: +9.1% YTD

- S&P Mid Cap 400: +4.6% YTD

US JOLTS Job Openings Beat Expectations

Job openings in August came in at 7.227M, slightly above the 7.185M forecast and higher than July’s revised 7.208M.

- Hires: 5.1M (3.2%), little changed.

- Separations: 5.1M (3.2%), broadly stable.

- Quits: 3.1M (1.9%), modest declines in food services and entertainment; rise in construction.

- Layoffs: 1.7M (1.1%), steady.

The data shows openings holding up despite softer overall labor demand, underscoring resilience in the job market.

US July CaseShiller Home Prices Show Cooling Trend

The July CaseShiller 20-city index rose 1.8% y/y, above expectations of 1.6%, but slower than the 2.2% gain in June. On a monthly basis, prices surprised to the upside, flat versus a -0.2% estimate (prior -0.3%).

Regionally, 15 of 20 major metros saw month-on-month declines, highlighting broad weakness even during the peak buying season. The steepest drops were in Washington, D.C. (-2.81%), San Francisco (-1.92%), Miami (-1.30%), and Dallas (-1.25%). Gains were led by New York (+6.43%), Chicago (+6.23%), Cleveland (+4.46%), and Detroit (+4.05%).

FHFA data showed July home prices down -0.1% m/m and up 2.3% y/y, a slowdown from the prior month’s revised 2.7%.

US Consumer Confidence Falls to Five-Month Low

The Conference Board’s consumer confidence index fell to 94.2 in September, below expectations of 96.0 and the weakest since April. August was revised higher to 97.8.

- Present situation: 125.4 (prior 131.2)

- Expectations: 73.4 (prior 74.8)

- Jobs hard-to-get: 19.1% (unchanged)

The board noted consumers’ views on business conditions and job availability worsened, consistent with a decline in job openings. Still, optimism about future income offered some offset.

Fed’s Collins: More Cuts Possible if Data Supports Easing

Boston Fed President Susan Collins said she supported the September rate cut and sees policy as still “modestly restrictive.” She noted inflation risks remain but upside pressures have eased, giving the Fed some flexibility.

Collins warned that the labor market looks fragile and tariffs could slow hiring, though productivity gains and AI adoption may offset some inflationary pressures. She emphasized that any further cuts in 2025 will depend on incoming data and insisted that Fed independence is essential as the outlook remains highly uncertain.

Fed’s Goolsbee: Labor Market Still Steady

Chicago Fed President Austan Goolsbee described the labor market as “steady,” with both hiring and firing rates unusually low. He said he hopes tariffs are just a one-off shock but admitted that if inflation proves persistent, the Fed would face a more difficult policy challenge.

Fed’s Jefferson: Labor Market Softening, Growth at Risk

Fed Vice Chair Philip Jefferson said the U.S. labor market is showing signs of stress and could weaken further without support.

Key points:

- Expects disinflation to resume after this year.

- Sees growth at ~1.5% for the rest of 2025.

- Warned that slowing labor force growth could reduce potential GDP.

- Neutral rate remains uncertain, though the last rate cut pushed policy closer to it.

- Balance sheet runoff is continuing “in an orderly way.”

- Stressed that the outlook is highly uncertain and decisions must be cautious.

Goldman Sachs: Jobs Data May Decide Equity–Bond Divide

Goldman Sachs says financial markets are split:

- Equities are betting on a smooth economic landing, with government-driven growth lasting into 2026.

- Bonds, meanwhile, are bracing for potential labor market weakness.

The divergence raises the stakes for upcoming jobs reports and other critical economic releases.

Goldman said investors in stocks trust the Fed can continue rate cuts without stalling growth, while bond traders see rising risks of a sharp employment downturn. “Each data release will be market-moving,” the bank emphasized.

Boeing Begins Work on 737 MAX Successor

According to the Wall Street Journal, Boeing has started early planning for a new narrow-body jet to eventually replace the troubled 737 MAX.

- CEO Kelly Ortberg has spoken with Rolls-Royce about potential engines.

- A new senior product chief was appointed in the commercial planes unit.

- Work has begun on designing a new flight deck.

The project remains in its infancy, but Boeing is seeking to regain ground lost to Airbus.

Trump Signs Tariffs on Lumber, Capped for EU and Japan

President Donald Trump signed a proclamation imposing new tariffs on lumber and wood products, effective October 14.

- 25% duty: Upholstered wooden products, cabinets, vanities.

- 10% tariff: Softwood timber and lumber.

- EU and Japan: Tariffs capped at 15%.

The White House framed the move as a national security measure within its broader trade policy.

UBS: Shutdown Won’t Stop Fed October Cut

UBS said a potential U.S. government shutdown—which would suspend official jobs, inflation, and unemployment data—should not derail the Federal Reserve’s plan to cut rates in October.

The bank argued that the Fed can rely on private-sector surveys and its own Beige Book to guide decisions. UBS expects the FOMC to deliver another 25 basis-point cut at its meeting on October 28–29, even without fresh government data.

Commodities News

Gold Breaks Above $3,800 for First Time – ING

Gold climbed above $3,800/oz for the first time, while silver hit its highest since May 2011, ING’s Ewa Manthey and Warren Patterson reported.

The rally reflects a weaker USD following President Trump’s budget talks with Congress ahead of a potential shutdown. A missed funding deal could delay key economic data, including jobs numbers.

Gold is up 45% year-to-date, driven by central bank buying, Fed rate cuts, ETF inflows, and geopolitical risks.

Crude Oil Settles Lower at $62.37

WTI crude futures fell $1.08 (-1.7%) to settle at $62.37. Prices traded between $62.03 and $63.26 on the day.

OPEC+ supply speculation drove the session, with initial reports of a 411K–500K bpd hike weighing on prices before OPEC’s rebuttal helped limit losses.

From a technical perspective, WTI remains below the 100-hour moving average ($64.67) and the 61.8% retracement ($63.71), keeping sellers in control. However, buyers defended the key swing area near $61.45–$61.94.

EU Gas Storage at 83%, Below 5-Year Average – ING

European natural gas prices weakened, with the TTF front-month settling 1.7% lower, ING analysts Ewa Manthey and Warren Patterson said.

Norwegian outages provided limited support, while weak Chinese LNG demand eased concerns heading into winter. EU LNG send-outs rose in September, offsetting August’s slump.

Storage stands just shy of 83% full, well below last year’s 94% and the 5-year average of 89%.

OPEC Pushes Back on Media Reports

Crude oil rebounded after OPEC dismissed reports of a planned 500,000 bpd output hike. The group said such claims were “wholly inaccurate and misleading,” stressing that ministerial discussions have not yet started.

Earlier, both Reuters and Bloomberg reported OPEC+ may consider hikes of 411,000 to 500,000 bpd in November, alongside the possible early return of the remaining 1.66M bpd in withheld supply. The conflicting headlines triggered volatility, with WTI bouncing off lows near $62.

Platinum Outperforms as Price Surges Past $1,600 – Commerzbank

Platinum has outpaced other precious metals, climbing nearly $200 (+16%) since last week, Commerzbank analyst Barbara Lambrecht noted.

“For the first time since April 2013, platinum trades above $1,600/oz. The sharp rally may raise doubts, but relative to gold, platinum remains historically cheap, sparking renewed buying interest,” Lambrecht said.

ETF inflows have also emerged, with platinum products tracked by Bloomberg seeing gains over the past five sessions. Still, overall holdings remain low, and a clear trend has yet to form.

OPEC+ Considering Output Hikes

Reports citing OPEC+ delegates say the group may discuss increasing production by 500k bpd per month over the next three months.

Market reaction was muted.

Oil prices remain stuck in a $61.80–66.00 range, with traders likely to keep playing the band until a breakout occurs. Despite recent volatility, OPEC+ has managed to maintain relative stability over the past few years.

Gold Rally Extends – Risks and Outlook

Gold has powered to fresh all-time highs, showing resilience despite headwinds from strong U.S. data, higher yields, and a firmer dollar.

- Fundamentals:

- Gold’s strength reflects expectations of falling real yields, with the Fed maintaining a dovish stance.

- In the near term, strong U.S. data could trigger hawkish repricing and corrections.

- Focus now shifts to the NFP report later this week.

- Technical (Daily): Buyers favor pullbacks to the major trendline, while sellers watch for breaks lower toward 3,120.

- Technical (4H): A pullback to the rising trendline offers a setup for buyers; a break lower could target 3,627.

- Technical (1H): Momentum remains bullish above the minor uptrend. A break could lead to a pullback toward 3,790 support.

Iranian Oil Defies Sanctions Amid Rising Demand – Commerzbank

Iranian oil supply has proven resilient despite renewed sanctions triggered by the nuclear deal’s snapback mechanism, Commerzbank’s Barbara Lambrecht noted.

Iran has boosted output by 1.4M bpd since 2020 lows, with China its key buyer and India showing new interest. An Indian delegation told US officials it would only cut Russian imports if allowed to import more from Iran and Venezuela.

Kpler tanker data shows fresh Iranian shipments heading to Turkey, Brazil, Taiwan, and the Middle East, underscoring the difficulty of enforcing sanctions.

Oil Slips as Iraq Exports Resume and OPEC+ Signals Hike – Commerzbank

Oil prices fell as Iraq resumed northern exports and OPEC+ prepared a modest November production increase, Commerzbank’s Barbara Lambrecht reported.

Saudi Arabia is keen to protect market share, and elevated prices add incentive. The anticipated increase is 137,000 bpd, smaller than feared, but it could still push supply beyond forecasts.

Gold Hits Record High on US Shutdown Fears – Commerzbank

Gold surged above $3,850/oz, reaching a fresh all-time high amid safe-haven demand linked to looming US government shutdown risks, Commerzbank’s Barbara Lambrecht said.

“ETF investors continue to jump on the bandwagon. Since early September, gold ETFs tracked by Bloomberg have added roughly 100 tons, lifting holdings nearly 20% from 2024’s summer lows,” she said.

The political standoff in Washington remains a key driver. “Shutdown threats aren’t new, but polarization makes this episode especially tricky,” Lambrecht warned.

Citi Cuts 2026 Brent Oil Outlook to $62

Citi has lowered its Brent crude forecast for 2026, now seeing prices at $62 per barrel, down from the earlier $65 projection.

The bank expects OPEC+ to roll back roughly 1.6 million barrels per day of output cuts, while strong supply growth outside the cartel will add further pressure.

Citi noted that Chinese stockpiling and inventory builds in OECD nations should provide a buffer, preventing a deeper price drop.

This outlook was reported by The Wall Street Journal.

Europe News

European Stocks End Higher

Major European indices closed the session with gains, led by Spain’s Ibex:

- DAX: +0.57%

- CAC 40: +0.19%

- FTSE 100: +0.54%

- Ibex: +1.04%

- FTSE MIB: +0.40%

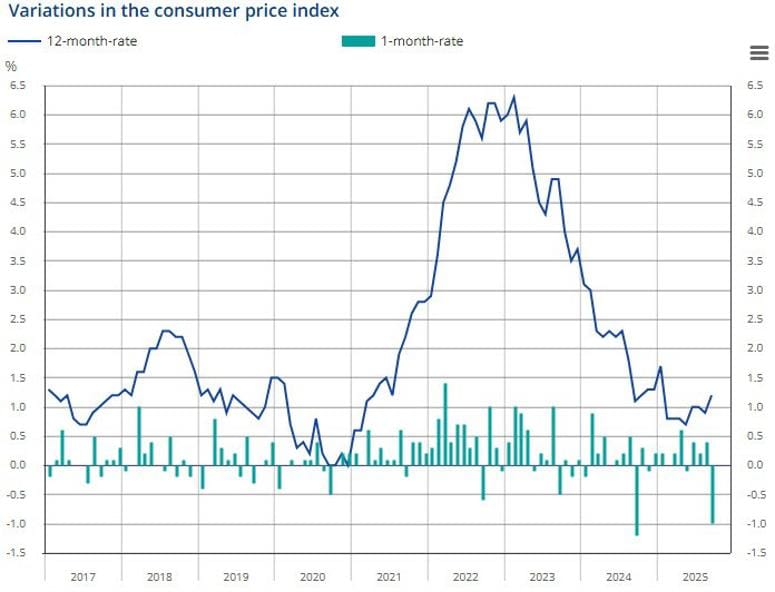

Germany September CPI Prints Above Forecast

Preliminary data showed German inflation ran hotter than expected in September:

- HICP y/y: +2.4% (exp. 2.2%, prior 2.1%).

- HICP m/m: +0.2% (exp. 0.1%, prior 0.1%).

- CPI y/y: +2.4% (exp. 2.3%, prior 2.2%).

- CPI m/m: +0.2% (exp. 0.1%, prior 0.1%).

- Core inflation: +2.8% (up from 2.7%).

The data reinforces the case for the ECB to temper dovish views, as price pressures remain firm.

German Unemployment Rises by 14,000 in September

The Federal Employment Agency reported that German unemployment increased by 14k in September (expected +8k).

- Unemployment rate: 6.3% (unchanged, matching forecast).

- The number of jobseekers rose to 2.976 million (SA), up from 2.957 million.

The increase highlights softening labor dynamics, though the headline rate remains stable.

Germany August Retail Sales Slip Again

German retail sales fell 0.2% m/m in August, undershooting expectations for a 0.6% increase, Destatis reported.

- July’s decline was revised up, from -1.5% to -0.5%.

- By category: food sales -0.6%, non-food -1.3%.

The figures underscore Germany’s prolonged consumption weakness, keeping pressure on household demand.

Germany Import Prices Down in August

Germany’s import price index declined 0.5% m/m in August (expected -0.2%), following July’s -0.4%.

- On a y/y basis, prices dropped 1.5%, versus a forecast of -1.4%.

- Energy imports were the key drag, falling 5.0% from July.

- Excluding energy, import prices were broadly flat both month-on-month and year-on-year.

France September CPI Eases Slightly

France’s preliminary CPI came in at +1.2% y/y in September, just below the +1.3% expected, according to INSEE.

- HICP: +1.1% (vs. +1.3% expected, prior +0.8%).

- National CPI prior: +0.9%.

- Services inflation: Rose to 2.4% (from 2.1%).

- Food inflation: Ticked up to 1.7% (from 1.6%).

Italy August PPI Falls

Italy’s producer price index dropped 0.6% m/m in August, reversing July’s +0.5%.

- Y/y: +0.2%, down sharply from +1.6%.

- Over the last three months, prices were up 0.4% compared with the previous period, driven by a 0.8% gain in domestic prices and a 0.5% drop in foreign markets.

The release is considered low-impact for markets.

Italy September CPI Holds Steady

Italy’s preliminary CPI rose 1.6% y/y in September, in line with August and just shy of the 1.7% forecast.

- HICP: +1.8% y/y (exp. 1.7%, prior 1.6%).

- Core inflation: Stable at 2.1% y/y.

This consistency should keep the ECB steady on policy for now.

UK Q2 GDP Confirmed at +0.3% q/q

Final figures from the ONS confirmed that UK GDP grew 0.3% in Q2, matching the preliminary estimate.

- YoY growth was revised slightly higher to +1.4% (from +1.2% prelim), compared with +1.3% prior.

- Q1 had been more robust at +0.7%, showing that momentum slowed heading into the middle of 2025.

UK Shop Prices Climb at Quickest Pace Since February

The British Retail Consortium (BRC) reported UK shop prices rose 1.4% year-on-year in September, the fastest pace since February 2024, up from 0.9% in August.

- Food inflation remains stubborn at 4.2%.

- Non-food deflation nearly disappeared, with prices down just 0.1%, compared with a 0.8% decline in August.

BRC’s Helen Dickinson said households are being squeezed by higher shopping bills, while rising wages and insurance costs add to pressures. She warned new levies in November’s budget would worsen the problem.

BoE context:

- Policymakers expect CPI to rise to 4% in September, double the 2% target.

- Officials remain split on whether weakening jobs will bring inflation down or if they need to slow rate cuts.

- Deputy Governor Dave Ramsden pointed to food, especially dairy and beef, as key drivers due to farm costs and a new packaging levy.

Market takeaways:

- Signs of sticky inflation could support sterling.

- Arguments strengthen for the BoE to move cautiously on easing.

- Retailers face mounting pressure from food costs and levies.

Switzerland KOF Index Rises in September

Switzerland’s KOF leading indicator climbed to 98.0 in September, beating expectations of 97.0.

- August’s reading was revised down to 96.2 from 97.4.

While sentiment improved, analysts said the overall outlook does little to shift the SNB’s policy stance.

ECB’s Lagarde: The risks to inflation appear quite contained in both directions

- Comments from Lagarde

- We are navigating a far more difficult environment than before, which we must also factor into our policy

- We are well placed to respond if the risks to inflation shift or if new shocks emerge that threaten our target

ECB’s de Guindos: The current level of interest rates is adequate

- Comments from the ECB’s Vice President, Luis de Guindos

- The current level of interest rates is adequate

- We will take further decisions meeting by meeting

BOE’s Mann: I believe an inflation-persistence scenario is playing out

- Comments from the BOE hawk

- We have more work to do when inflation expectations drift higher

- We are way above target on inflation and have been for a long time

- I believe an inflation-persistence scenario is playing out

- That does not mean I have no cuts in my horizon

SNB’s Chairman Schlegel: Inflation is expected to rise slightly in the coming quarters

- Comments from the SNB’s Chairman, Martin Schlegel

- Uncertainty remains high, SNB is monitoring the situation

- Indicators suggest a stable situation and moderate growth

- US pharma tariffs have raised downside risks a bit

Asia-Pacific & World News

China September Official PMI Mixed

China’s official PMI data (NBS):

- Manufacturing: 49.8 (expected 49.5, prior 49.4) → contraction for 6th straight month.

- Production index: 51.9 (+1.1).

- New orders: 49.7 (+0.2).

- Export orders: 47.8 (+0.6).

- Raw material prices: 53.2 (-0.1).

- Non-manufacturing: 50.0 (expected 50.3, prior 50.3).

- Composite: 50.6 (prior 50.5).

China September Private PMI Beats at 51.2

The Caixin/Rating Dog private survey showed a stronger-than-expected September reading:

- Manufacturing PMI: 51.2 (expected 50.3, prior 50.5) → fastest since March.

- New business expanded at the quickest pace since February.

- Export orders rose for the first time since March.

- Output saw the sharpest increase in three months.

- Inventories rose as firms rebuilt stocks.

- Input prices climbed, while selling prices edged lower.

- Job losses continued but at the slowest pace in six months.

- Services PMI: 52.9 (expected 52.3, prior 53.0).

- Composite PMI: 52.5 (prior 51.9).

PBOC Expected to Guide Rates Lower in Q4

The China Securities Journal reported that the People’s Bank of China will likely steer rates lower in Q4 to keep liquidity conditions ample.

- Chief economist Sun Binbin said October liquidity will resemble September’s but normalize as bond trading resumes and seasonal flows ease volatility.

- Governor Pan Gongsheng reaffirmed the PBOC will use a mix of tools to cut financing costs, stabilize the yuan, and sustain recovery.

- The Monetary Policy Committee stressed maintaining ample liquidity while encouraging banks to expand credit in line with growth and inflation goals.

Golden Week 2025: China and Hong Kong Market Closures

China’s Golden Week holiday will shut mainland financial markets from October 1 to 8, 2025, as National Day and Mid-Autumn Festival breaks overlap.

- Shanghai and Shenzhen exchanges will close for the entire eight-day stretch.

- Hong Kong will close markets on October 1 (National Day) and October 7 (post-Mid-Autumn Festival), while remaining open otherwise.

The holiday typically reduces trading activity across Asia, with liquidity thinning in equities, FX, and commodities as Chinese investors step back.

PBOC sets USD/ CNY mid-point today at 7.1055 (vs. estimate at 7.1166)

- PBOC CNY reference rate setting for the trading session ahead.

- PBOC injected 242.2bn yuan via 7-day reverse repos at 1.40%

RBA Holds Cash Rate at 3.60% in September Decision

The Reserve Bank of Australia kept the cash rate steady at 3.60% in its September 2025 meeting, a move widely expected by markets.

Key points from the policy statement:

- The decision was unanimous.

- The decline in underlying inflation has slowed, a shift from August’s assessment that inflation was continuing to moderate.

- Q3 inflation may run hotter than previously projected.

- Domestic demand is showing signs of recovery, with household consumption improving as real incomes rise.

- Financial conditions have eased, and labour markets remain steady but still a little tight.

- Globally, risks remain elevated despite extreme U.S. tariff scenarios looking less likely.

The RBA emphasized caution, opting for flexibility and data-dependence while monitoring how earlier rate cuts filter through the economy. Maintaining price stability and full employment remains the central objective.

RBA’s Bullock: Inflation Risks Balanced, Decisions Data-Driven

RBA Governor Michele Bullock said the board sees risks as “broadly balanced” following the September meeting.

Her key remarks:

- Inflation is within the target range but recent data hint at stronger pressures than forecast in August.

- The labour market remains resilient and the broader economy is in a “good spot.”

- Services inflation is proving sticky.

- The bank will take decisions meeting by meeting, including November’s, depending on incoming data.

- Policy is likely still restrictive, but it’s unclear if more cuts are needed.

- The RBA will not commit to a bias and emphasized caution in reading monthly CPI prints.

Bullock summed it up: further cuts are possible, or not, depending entirely on how the outlook evolves.

Australia August Private Sector Credit +0.6%

The Reserve Bank of Australia reported private sector credit rose 0.6% in August, matching expectations. July growth was 0.7%.

Australia August Building Permits -6.0%

Australian building permits fell 6.0% in August, slightly worse than the -5.5% forecast, but less steep than July’s -8.2% drop.

New Zealand Business Confidence Holds Steady

New Zealand’s ANZ survey showed business confidence at 49.6% in September, nearly unchanged from 49.7% in August.

But sentiment on firms’ own activity improved, jumping to 43.4%, the best in five months.

ANZ economist Sharon Zollner said the economy remains sluggish, but firms are looking more optimistic after years of post-COVID weakness.

Japan August Industrial Output Misses Expectations

Japan’s preliminary August industrial production fell 1.2% m/m, a sharper decline than the 0.8% drop expected.

- YoY: Down 1.3%, worse than July’s -0.4%.

- Forward forecasts: Output seen up 4.1% in September (prior 2.8%) and 1.2% in October (prior -0.3%).

Japan August Retail Sales Fall Unexpectedly

Japan’s retail trade disappointed in August:

- YoY: Down 1.1% (expected +1.0%, prior +0.3%).

- MoM (seasonally adjusted): Fell 1.1%, after July’s -1.6%.

BoJ September Meeting: Dissent Emerges, Yen Steady

The Bank of Japan’s September “Summary of Opinions” showed division among policymakers:

- Two members wanted an immediate rate hike.

- Others urged caution, citing the need for more data and risks of surprising markets.

- Some argued conditions are forming for resuming hikes, pointing to firm consumption and risks of inflation staying high.

- Concerns included U.S. tariffs, global headwinds, and prolonged food price increases.

Despite the debate, the yen barely moved, showing markets were unmoved by the internal split.

South Korea: Industrial Output Flat, Retail Sales Slide

South Korea posted mixed August data, according to Statistics Korea:

- Industrial production: Flat on the month after two gains; up 0.9% y/y (vs. 1.3% expected, well below July’s 5.0%).

- Retail sales: Down 2.4%, ending a two-month streak of increases.

- Facility investment: Fell 1.1%.

- Service sector output: Dropped 0.7%, reversing July’s 0.2% gain.

The data suggests momentum is fading across both consumption and investment.

Crypto Market Pulse

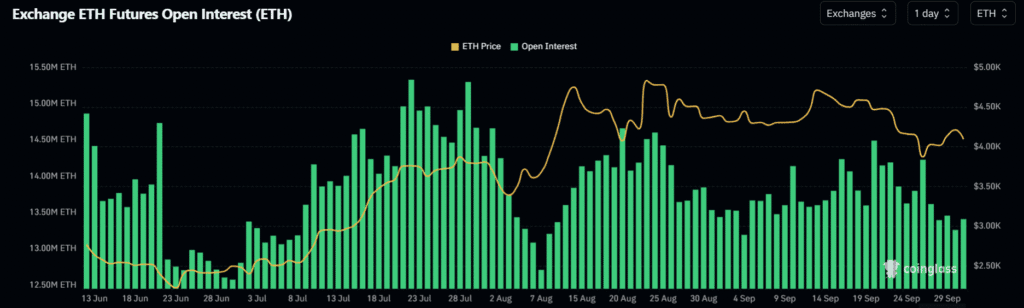

Ethereum Faces Resistance Despite $547M ETF Inflows

Ethereum traded near $4,120, down 1%, after failing to break a descending trendline despite strong ETF inflows.

US spot ETH ETFs saw $547M in net inflows Monday, the largest since mid-August, led by Fidelity ($202M) and BlackRock ($154M). Exchange withdrawals also outpaced deposits by 117,900 ETH, signaling bullish spot sentiment.

However, futures open interest remains subdued, showing traders reluctant to take leverage after last week’s liquidations.

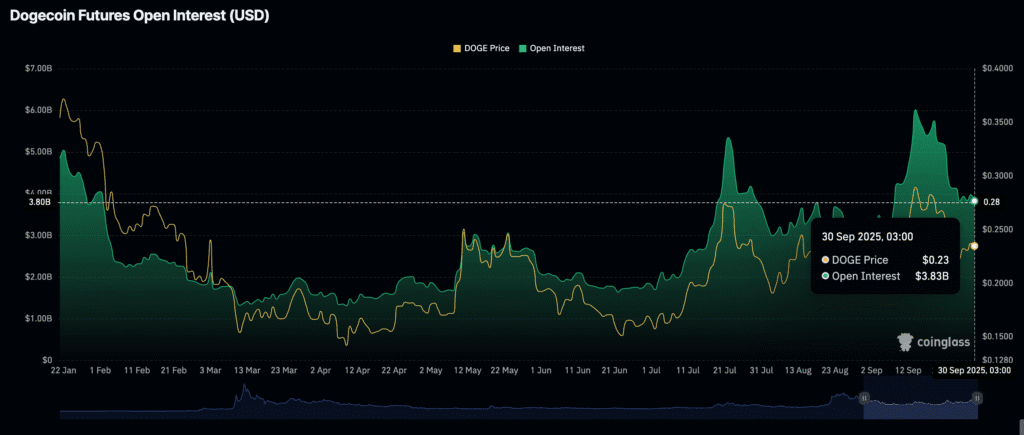

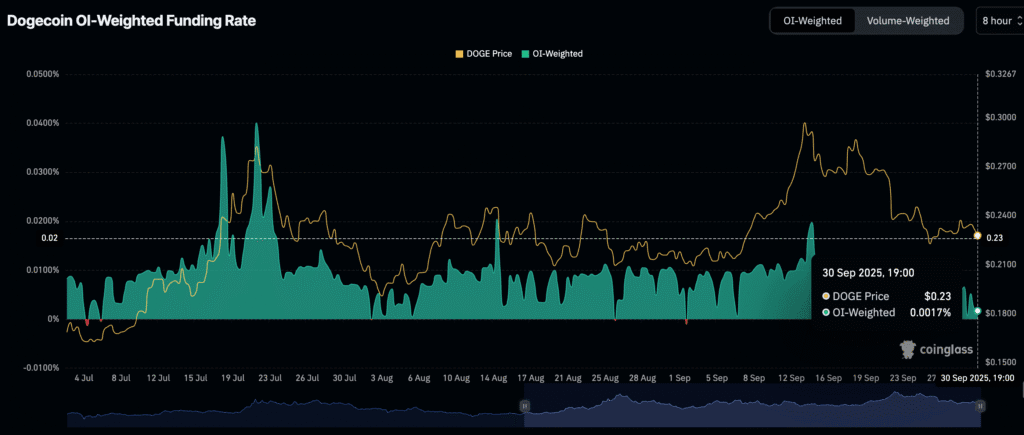

Dogecoin Faces Correction Risk Into October

Dogecoin slipped below $0.23 Tuesday, forming a rising wedge pattern that points to a possible drop toward $0.20.

Futures open interest has fallen from $6B (Sept. 14) to $3.83B, reflecting reduced trader conviction. Funding rates have also declined toward neutral, suggesting growing short positioning.

Weak retail demand and broader crypto volatility heighten downside risks.

Pi Network Risks Pullback Ahead of Token 2049

Pi Network (PI) slipped 1% Tuesday, with risks of another sell-off tied to co-founder Chengdiao Fan’s appearance at Token 2049 in Singapore.

Past events have triggered steep declines, including a 42% crash during Consensus 2025 and a 20% drop after a Seoul meetup in September.

Despite development milestones like the ongoing hackathon and migration to Stellar v23, investor skepticism remains high around public appearances.

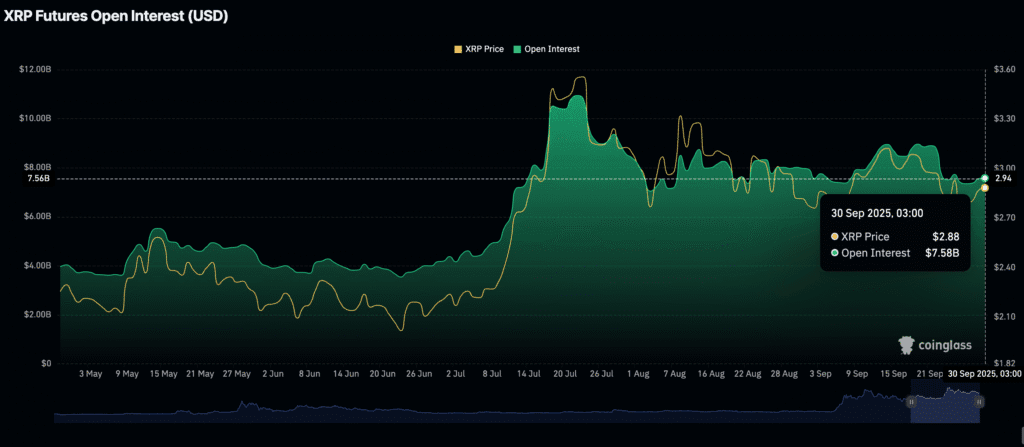

XRP Bulls Eye Breakout as Funding Rates Rise

XRP traded in a tight range between $2.83–$2.92, holding modest September gains of 2.76%.

Historical data shows mixed October performance, warning investors to rely on technical and macro drivers.

Open interest in XRP futures has dropped to $7.58B, down from $8.96B earlier this month. A rebound in OI could support a breakout above $3.00, while further weakness may cap gains.

BlackRock’s IBIT Overtakes Deribit in BTC Options

BlackRock’s iShares Bitcoin Trust (IBIT) has surpassed Deribit in BTC options open interest, hitting $38B vs. $32B, less than a year after launching.

IBIT also leads spot ETFs with $84B AUM and 770K BTC in holdings. Options OI totals 340K BTC, nearly half the ETF’s spot exposure, underscoring speculative leverage.

Together, IBIT and Deribit now control nearly 90% of global BTC options OI, signaling a structural shift toward regulated markets.

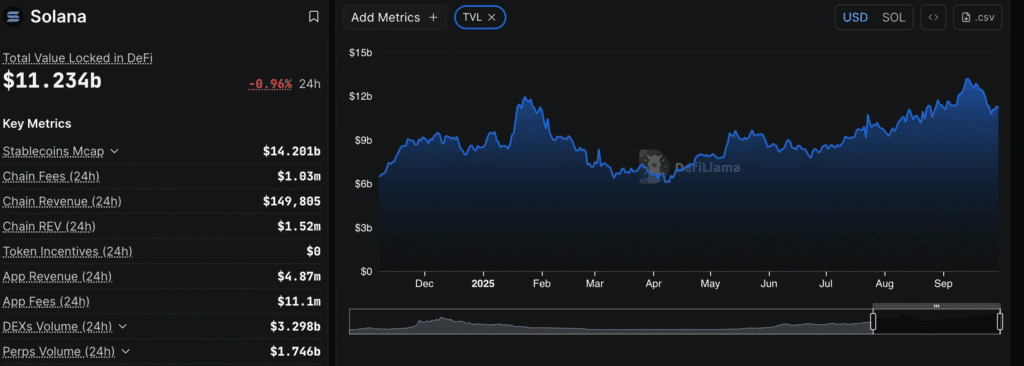

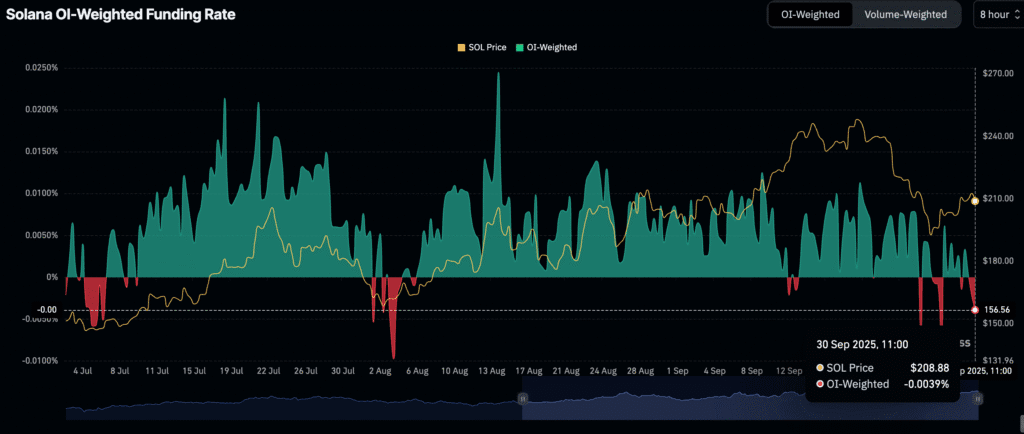

Solana Risks Sell-Off Below $200 as DeFi Weakens

Solana fell to $206, with technicals pointing to further downside if $200 support breaks.

DeFi total value locked (TVL) hit a record $13.22B in mid-September but dropped 15% to $11.23B as prices retreated. Staking withdrawals raise the risk of more selling.

Funding rates for SOL futures have flipped negative, showing a shift toward short positioning. A move below $200 could deepen losses, while a rebound above $220 is needed to stabilize sentiment.

The Day’s Takeaway

US — Market Snapshot (indices, Treasuries, key US data)

- Major indices (close):

- S&P 500 6,688.45 (+27.25, +0.4%)

- Nasdaq Composite 22,660.02 (+68.86, +0.3%)

- Dow Jones Industrial Average 46,397.68 (+81.82, +0.2%)

- Smaller-cap benchmarks: Russell 2000 +0.1%, S&P MidCap 400 +0.1% (both underperformed large caps).

- Treasury yields (close):

- 2-yr 3.62% (-1.6 bps)

- 5-yr 3.75% (+0.5 bps)

- 10-yr 4.15% (+1.3 bps)

- 30-yr 4.73% (+2.9 bps)

- YTD index performance: Nasdaq +17.3%, S&P 500 +13.7%, Russell 2000 +9.3%, DJIA +9.1%, S&P MidCap 400 +4.6%.

- Key US data today / recent:

- JOLTS (Aug): Job openings 7.227M (vs 7.185M est.; July revised 7.208M). Hires 5.1M; separations 5.1M; quits 3.1M; layoffs 1.7M.

- Consumer Confidence (Sept): 94.2 (vs 96.0 exp.; Aug revised to 97.8) — weakest since April; present situation and job-availability gauges weakened.

- Housing data: FHFA HPI (July) -0.1% MoM, +2.3% YoY (slowing); Case-Shiller 20-city (July) +1.8% YoY (flat MoM vs -0.2% est.; regional dispersion with 15/20 metros down MoM).

- Market context / drivers:

- September quarter ended with modest upside for equities after a choppy day; markets have pushed to price in additional Fed easing (CME FedWatch: very high odds of a 25bp cut in October).

- Fed commentary mixed: Vice-Chair Jefferson warned of downside job risks and upside inflation risks; Boston Fed’s Collins left the door open to further cuts if data supports easing; Chicago Fed’s Goolsbee sees a still-steady labour market.

- Government shutdown risk remains a wildcard — would delay key data releases and add policy uncertainty.

Commodities

- Oil & energy:

- WTI crude settled $62.37, down $1.08 (-1.7%); session range $62.03–$63.26. Technicals: below the 100-hour MA (~$64.67) and the 61.8% retracement (~$63.71); buyers defended swing area near $61.45–$61.94.

- OPEC+ headlines: conflicting reports. Reuters/Bloomberg said OPEC+ may weigh hikes of ~411k–500k bpd (monthly or phased), while OPEC later pushed back calling some media reports “inaccurate and misleading.” Citi trimmed its 2026 Brent forecast to $62/bbl (from $65), expecting about 1.6m bpd of cuts to be unwound and strong non-OPEC supply growth; Citi noted Chinese stockpiling and OECD inventory builds as partial support. UBS said a US shutdown would not stop the Fed from cutting in October, which indirectly affects oil sentiment via macro expectations.

- Iraq / northern exports resumed and modest OPEC+ production increases were signalled (Commerzbank flagged a likely 137k bpd November uptick as plausible), all pressuring the market.

- Precious metals:

- Gold: record highs — above $3,800/oz and pushing to ~$3,850/oz+ on safe-haven flows amid US shutdown fears and strong ETF inflows (ING / Commerzbank commentary). Gold YTD gains near ~45% (supported by central bank buying, expectations of rate cuts and ETF demand). Technical pullback levels and target zones discussed in research, but overall trend bullish while real yields fall.

- Platinum: standout performer — up roughly $200 (~16%) since last week to trade north of $1,600/oz, the strongest short-term move since 2013; early ETF inflows noted but holdings remain small (Commerzbank).

- Natural gas / LNG:

- EU gas: TTF front-month down ~1.7%, despite Norwegian outages; weaker Chinese LNG demand helping ease European winter supply worries. EU storage ~83% full, below last year (94%) and the 5-yr average (89%) — still a watch item heading into winter.

- Other: Chinese and macro demand signals (official and private PMIs) remain mixed — important for industrial commodities.

Europe

- Equities / markets: Major European indices closed higher: DAX +0.57%, CAC +0.19%, FTSE 100 +0.54%, Ibex +1.04%, FTSE MIB +0.40%.

- Inflation & prices:

- Germany (prelim Sept): HICP +2.4% YoY (exp 2.2%), m/m +0.2% — core inflation +2.8%. State readings show higher regional CPI (Bavaria 2.4%, NRW 2.3%, Saxony 2.3%, Baden-Wuerttemberg 2.7%). The print pushes back on any dovish ECB narrative.

- France (prelim Sept): CPI +1.2% YoY (slightly below expectations); HICP +1.1%; services inflation sticky at 2.4%, food inflation ticked up.

- Italy (prelim Sept): CPI +1.6% YoY, HICP +1.8%, core 2.1% — steady and ECB-friendly for now.

- Activity / prices:

- Germany retail sales (Aug): -0.2% MoM (miss); food -0.6%, non-food -1.3%.

- Germany import prices (Aug): -0.5% MoM, y/y -1.5% driven by energy; ex-energy essentially flat.

- Italy PPI (Aug): -0.6% MoM, y/y +0.2% (low market impact).

- Labour / sentiment: German unemployment rose +14k in Sept; rate steady at 6.3%. Switzerland KOF leading indicator beat expectations at 98.0.

- Market takeaways: regional inflation prints (esp. Germany) keep the ECB’s policy options more balanced and reduce room for complacent dovish bets.

Asia

- China: mixed PMIs — official manufacturing 49.8 (contraction but slightly better than expected), non-manufacturing 50.0, composite 50.6. Private/ Caixin PMI outperformed at 51.2 (manufacturing) and services 52.9, composite 52.5 — private survey signals firmer demand and inventory rebuilding. PBOC signalled willingness to guide rates lower in Q4 to support liquidity and financing costs, while the China Securities Journal and officials emphasised tools to stabilise growth and the yuan. Golden Week (Oct 1–8) will close mainland markets and mute regional liquidity; Hong Kong closed Oct 1 & Oct 7.

- Japan: August industrial production -1.2% MoM (prelim) (worse than expected) and YoY -1.3%; retail trade -1.1% YoY (miss). BoJ’s September Summary revealed dissent — two members favored an immediate hike, others urged patience; yen barely reacted.

- South Korea: August industrial output flat MoM, +0.9% YoY (below forecasts); retail sales -2.4%, facility investment -1.1%; services output down 0.7% — softening momentum across the economy.

- Australia: RBA held cash rate at 3.60% (unanimous); said decline in underlying inflation has slowed, domestic demand recovering but outlook uncertain; Governor Bullock flagged meeting-by-meeting decisions and no clear bias on cuts. Australian private sector credit +0.6% (Aug); building permits -6.0% (Aug).

- New Zealand: ANZ business confidence steady 49.6 (Sept) with improvements in firms’ own activity to 43.4%.

Rest of the World

- Global policy & trade:

- US tariffs / trade policy: Ongoing tariff shifts and trade policy developments are being monitored for inflation and supply-chain effects; markets view extreme tariff outcomes as unlikely but still materially adverse if they occur.

- US presidential administration: New lumber tariffs announced (effective Oct 14): 25% on some wooden furnished goods, 10% on softwood lumber, EU/Japan capped at 15% — flagged as national security action and will have sectoral trade impacts.

- Corporate / industry: Boeing has started early work on a next-generation single-aisle jet to replace the 737 MAX (WSJ) — very early stage but strategically important for commercial aerospace competition.

Crypto

- Market structure & flows:

- Ethereum (ETH): trading near $4,120 after a rejection at a descending trendline; $547M of net inflows into US spot ETH ETFs on Monday (largest since mid-Aug); exchange net outflows strong (~117,900 ETH), but futures open interest subdued — spot demand rising, leverage cautious.

- Bitcoin / BTC options: BlackRock’s IBIT has become the largest venue for BTC options open interest (~$38B vs Deribit $32B); IBIT holds 770k BTC and options OI ~340k BTC — signals institutional concentration and ETF-driven liquidity.

- XRP: trading $2.83–$2.92, OI down to $7.58B; funding / OI dynamics imply a marginally cautious derivatives market with conditional breakout potential.

- Dogecoin (DOGE): technicals weakening below $0.23; rising wedge pattern suggests downside toward $0.20 if support fails; OI fallen and funding moved lower.

- Solana (SOL): near $206, DeFi TVL fell from $13.22B peak to $11.23B; OI-weighted funding flipped negative — risk of deeper correction below $200 unless stabilised above $220.

- Pi Network (PI): remains fragile ahead of Token 2049; past founder appearances coincided with sharp sell-offs (Consensus 2025 drop 42%).

- Sentiment: ETF inflows and institutional product growth (IBIT, ETH spot ETFs) are re-shaping on-chain and derivatives liquidity; classic retail-driven altcoin fragility persists.