North America News

U.S. Stocks Close Mixed as Powell Disappoints Dovish Hopes; Meta, Microsoft Soar After Hours

Wall Street ended Wednesday in mixed territory, with the NASDAQ squeezing out a gain while the S&P 500 slipped for the second day in a row. Investor sentiment wavered after Fed Chair Jerome Powell gave no signal of a shift toward a September rate cut, tempering earlier market enthusiasm.

The tech-heavy NASDAQ led gains, recovering from losses to close up 0.15%, rising 31.38 points to 21,129.67. The S&P 500 edged down 7.96 points (-0.12%) to 6,362.90, while the Dow Jones Industrial Average lost 171.71 points (-0.3%), finishing at 44,461.28. The Russell 2000 small-cap index also declined, shedding 10.56 points (-0.47%) to 2,232.39.

After the close, Microsoft and Meta Platforms delivered standout earnings:

- Meta (META):

- EPS: $7.14 (vs. $5.85 expected)

- Revenue: $47.52B (vs. $44.87B expected)

- Stock jumped 9.05% in after-hours trading.

- Microsoft (MSFT):

- EPS: $3.65 (vs. $3.35 expected)

- Revenue: $76.44B (vs. $73.76B expected)

- Cloud revenue: $29.88B (beat)

- Personal Computing: $13.5B (beat)

- Productivity & Business: $33.1B (beat)

- Shares rose 6.5% after hours.

Both tech giants crushed Wall Street’s expectations, underlining the resilience of big tech despite macro headwinds and a cautious Fed outlook.

Market Recap: Yields Climb, Stocks Waver, Fed Keeps Traders Guessing

MACRO & FED WATCH

- Treasury yields moved higher after data showed strong U.S. labor market and consumer spending activity. The upbeat tone has pushed back expectations for a near-term rate cut, with investors increasingly cautious about the Fed’s next steps.

- The Fed’s tone remained guarded, reinforcing a “data-dependent” stance ahead of its next policy move. Robust GDP and durable goods reports sparked a surge in yields, pressuring stocks and creating cross-asset volatility.

- The U.S. dollar firmed up, weighing on commodities and putting pressure on multinational earnings outlooks.

CORPORATE EARNINGS & MOVES

- Apple (AAPL) traded lower ahead of earnings, with Wall Street watching iPhone demand, hardware outlook, and AI strategy.

- Alphabet (GOOGL) fell after missing key revenue estimates, despite strong YouTube and ad sales. Margins were hurt by AI and cloud investment.

- AMD (AMD) rallied on strong AI chip sales and a bullish 2025 outlook, boosting semiconductors.

- Boeing (BA) rebounded as it reaffirmed its jet production forecast and reassured on supply chains.

- Tesla (TSLA) remained volatile amid mixed EV sentiment and uncertainty around Cybertruck and autonomy plans.

- Microsoft (MSFT) remained steady, with analysts praising its diversified AI and cloud strength.

- General Electric (GE) posted solid results, driven by its energy and aerospace divisions.

- Visa (V) and Mastercard (MA) popped after beating expectations and reporting strong cross-border payment growth.

SECTOR SNAPSHOT

- Semiconductors rallied, with Nvidia (NVDA) and TSMC benefiting from AI momentum and global chip expansions.

- Energy stocks lagged as oil prices slipped on higher inventories and China demand concerns.

- Healthcare remained mixed; Pfizer (PFE) and UnitedHealth (UNH) are in focus with earnings due.

- Consumer discretionary split: Amazon (AMZN) gained on strong e-commerce and AWS news, while Home Depot (HD) and Lowe’s (LOW) fell on weak housing data.

REGULATORY & POLICY UPDATES

- The SEC is accelerating reviews of Ethereum ETFs, lifting sentiment around crypto. Coinbase (COIN) saw increased volume on regulatory headlines.

- Ongoing antitrust probes into Meta (META) and Amazon (AMZN) continue to loom over big tech, potentially raising volatility later this quarter.

INTERNATIONAL & GEOPOLITICS

- China-U.S. trade tensions resurfaced as new export controls were hinted at by Washington, putting pressure on chipmakers and Apple suppliers.

- European equities remain sluggish amid weak industrial output and ongoing recession fears.

IPOs & MARKET ENTRANTS

- New listings remain sparse, with only a few biotech and fintech companies debuting amid soft summer trading. Investors cite interest rate uncertainty and seasonal lulls.

Conclusion

Wall Street is on edge after Powell delivers a cautious message and macro data dampens rate cut hopes. Tech earnings are mixed—Alphabet underwhelms, AMD shines, and Meta/Microsoft crush expectations post-close. Rates, inflation, and regulation remain front and center, while traders brace for continued volatility across sectors.

U.S. Pending Home Sales Drop 0.8% in June

Pending home sales in the U.S. slipped 0.8% in June, missing the consensus forecast for a 0.3% increase. The index fell to 72.0, down from 72.6 in May. On a year-over-year basis, contract signings declined 2.8%, reversing the 1.1% rise seen previously.

NAR Chief Economist Lawrence Yun noted that even with a slight uptick in available listings, buyer activity remains sluggish. The Northeast saw a marginal increase despite leading in home price appreciation.

U.S. Q2 GDP Beats Forecasts, But Trade Skews the Picture

U.S. GDP expanded at an annualized 3.0% in Q2 2025, topping the 2.4% forecast. However, the details reveal a less robust domestic backdrop. The main lift came from a drop in imports, which improved the trade balance and added 0.5 percentage points to growth. Real final sales—the core measure of private domestic demand—only rose 1.2%, the lowest since late 2022.

GDP sales surged 6.3%, much stronger than the 2.5% projection and a major turnaround from the -3.1% in Q1. Consumer spending picked up modestly, increasing 1.4% compared to just 0.5% previously. Meanwhile, private investment remained soft. Residential investment contracted by roughly 10%, with only technology and IP showing strength.

Inflation indicators were mixed. Core PCE inflation registered at 2.5% (above the 2.3% estimate), while overall PCE came in at 2.1%, under the expected 2.9%. Stripped of food, energy, and housing, PCE rose 2.2%, down sharply from 3.5% the previous quarter.

The Atlanta Fed’s final GDPNow estimate jumped to 2.9% from 2.4% ahead of the report. Still, the headline growth figure was flattered by external trade and inventories, rather than strong underlying demand.

U.S. ADP Employment Data Beats Forecasts with 104K New Jobs

Private payrolls in the U.S. rose by 104,000 in July, above the 75,000 estimate and a significant turnaround from June’s 33,000 loss, according to ADP. Goods-producing jobs increased by 31,000, while services added 74,000. Wage growth held steady, with job stayers seeing 4.4% increases and job changers 7.0%, up from 6.8%. ADP said the data confirms continued labor market strength, with employers optimistic about consumer resilience.

U.S. Mortgage Applications Drop as Rates Hold Steady

U.S. mortgage applications fell 3.8% for the week ending July 25, reversing a 0.8% gain the prior week, according to MBA data. The market index dropped to 245.7 from 255.5. The purchase index slipped to 155.6, while the refinance index fell to 739.3. The average 30-year mortgage rate barely moved, inching down to 6.83% from 6.84%.

Fed Keeps Rates Steady at 4.25%–4.50%, With Two Dissenting Votes

The Federal Reserve left interest rates unchanged at 4.25% to 4.50% during its July meeting, in line with expectations. However, the vote wasn’t unanimous—Michelle Bowman and Christopher Waller both dissented, favoring a 25-basis-point cut.

The Fed acknowledged slower economic growth in the first half of the year, though it maintained that labor markets remain strong and inflation is still running above target. The statement reiterated the central bank’s dual focus on maximum employment and 2% inflation over the long term.

No signals were given regarding upcoming policy moves, but the Fed reaffirmed it would continue reducing its holdings of Treasuries and mortgage-backed securities. Officials emphasized they will remain “data-dependent” and adjust policy if risks to their mandates emerge.

Powell: Economy Solid, But Outlook Depends on Upcoming Data

In a press briefing after the FOMC decision, Fed Chair Jerome Powell struck a cautious tone, emphasizing that the Fed is still in “wait-and-see” mode. With two jobs and inflation reports due before the September meeting, Powell said the path forward will depend heavily on incoming data.

Key takeaways:

- The U.S. economy is growing at a moderate pace.

- Consumer spending has slowed but remains healthy.

- GDP is difficult to interpret due to swings in trade flows.

- Inflation is still above 2%, with tariffs starting to affect prices.

- Unemployment remains low, though job creation has slowed.

- The policy stance is “modestly restrictive” but not overly tight.

- No commitment was made for September; further data will guide decisions.

Powell noted that while the Fed is not actively considering a rate hike, it’s also not ready to declare the inflation fight over.

Powell’s Comments by Topic: Inflation, Growth, Labor, and Policy Flexibility

Here’s a breakdown of Powell’s post-FOMC remarks across key themes:

1. Economic Growth:

- The economy is fundamentally sound, with GDP and private domestic final purchases aligned with expectations.

- Slowing consumer spending is consistent with sustainable growth.

- Housing and trade-related sectors are still soft.

- The recent tax bill may offer a minor boost.

2. Inflation:

- Core inflation remains above the 2% target.

- Tariffs are contributing to price pressures in some categories.

- PCE inflation is tracking at 2.5%, core PCE at 2.7%.

- Long-term expectations remain anchored, but Powell warned of both upside and downside risks.

3. Labor Market:

- Unemployment is stable, but job growth has cooled, especially in the private sector.

- Labor supply and demand are converging.

- Powell emphasized the unemployment rate as the key metric to watch moving forward.

4. Policy Outlook:

- The Fed’s stance is slightly restrictive but flexible.

- No decision has been made for September.

- Two more rounds of economic data will shape the next move.

- The central bank is on track to complete its broader policy review by late summer.

5. Tariffs and Global Risk:

- Trade tensions are injecting new uncertainty into the inflation outlook.

- Tariff-related costs are starting to be passed through to consumers.

- Powell stressed the long-term risk of supply chain disruptions and inefficiencies.

6. Governance:

- The Fed will publish details of Waller’s and Bowman’s dissenting votes.

- Powell reaffirmed the importance of central bank independence and transparency.

- The Fed will not comment on the U.S. dollar; that role belongs to the Treasury.

Treasury Sec Bessett: Europe is a regulator morass. China model is beginning to implode

- Treasury Sec Bessent is speaking

- Europe is a regulatory morass

- Chinese economic model is beginning to implode

- people should not panic, if there are no deals by August 1

- He is not expecting a rate cut from the Fed today

US Hassett: GDP data shows strong growth

- Comments from the WH Senior Adviser, Kevin Hassett to CNBC

- Data shows imported goods prices dropped.

- Fed very data-dependent.

- I expect they will catch up soon.

- We at the White House 100% respect Fed independence.

- Tarriff revenue important for deficit reduction.

- Hopeful that India will open up its markets to us.

- EU and Japan deals will help with capital spending boom.

- A deal with India will be an absolute game changer for the global economy.

- We are looking at 4% growth for Q3.

- Will have additional info on the India penalty shortly.

- Still hope for progress with India.

On China trade:

- Trump to be briefed today.

- Trump will probably want changes before agreement announced.

- Ground is set for very positive developments.

Trump Reiterates August 1 Trade Deadline is Final

President Trump announced on Truth Social that the August 1 trade deadline will remain firm: “THE AUGUST FIRST DEADLINE IS THE AUGUST FIRST DEADLINE — IT STANDS STRONG, AND WILL NOT BE EXTENDED.” While major deals have been reached with several key partners, there’s skepticism over whether the arrangements—many still in draft form—will hold up. The broader trade landscape remains unsettled, including unresolved frictions with China.

JPMorgan: Lower Tariffs May Benefit Other Nations More Than U.S.

Lower tariffs on U.S. exports could unintentionally benefit other countries even more, thanks to WTO rules, JPMorgan economists say.

Under the Most Favored Nation principle, countries that lower tariffs on U.S. goods must do the same for all WTO partners. That means emerging markets could see larger trade gains than the U.S.

This unexpected distributional impact hasn’t been fully reflected in market forecasts, the note suggests.

BofA Sees Weak U.S. Jobs Data Coming

Bank of America projects a soft July jobs report, forecasting just 60,000 new nonfarm payrolls—far below the 100,000 consensus.

Economist Aditya Bhave warns investors not to overreact to the headline number, instead focusing on private-sector hiring (estimated at 85,000) and the unemployment rate (expected at 4.2%).

Any deviation, even a small one, could shift market tone. A 4.3% unemployment rate or higher might stoke fears of labor market weakness.

Fed Governor Waller May Break Ranks at FOMC

Federal Reserve Governor Christopher Waller could dissent at this week’s policy meeting, a rare move not seen since 1993. Alongside Governor Michelle Bowman, Waller—appointed under President Trump—has signaled support for interest rate cuts that align with Trump’s public stance.

According to the Wall Street Journal, such dissent might also serve Waller’s long-shot bid to succeed Jerome Powell as Fed Chair when his term ends. Waller insists any dissent must be based on solid reasoning, not just politics.

Still, critics warn that political posturing at the Fed risks long-term credibility.

Tesla Inks $4.3B Battery Supply Deal with LG Energy for U.S. Energy Storage

Tesla has secured a $4.3 billion agreement with LG Energy Solution to provide lithium iron phosphate (LFP) batteries for its American energy storage products—excluding its electric vehicles. Production will begin at LG’s U.S. facilities starting in August 2027.

This marks Tesla’s second high-profile South Korean partnership in July, following a $16.5 billion semiconductor contract with Samsung Electronics. Although LG previously disclosed a 5.9 trillion won LFP supply agreement in its filings, the customer was unnamed until now. The deal includes options for a multi-year extension and potential volume increases through additional negotiations.

The move supports LG’s broader push into the U.S. energy storage market, especially amid growing competition from Chinese manufacturers. LG began LFP battery output at its Michigan facility in May and aims to scale further via its Tennessee joint venture with General Motors.

Bank of Canada Holds Rates at 2.75%, Citing Global Uncertainty

The Bank of Canada left its benchmark rate at 2.75%, aligning with market expectations that had priced in around a 56% chance of a rate cut before year-end. The Bank Rate remains at 3%, and the deposit rate at 2.70%.

Acknowledging fluid global trade conditions, the central bank abandoned its typical GDP and inflation projections in the July Monetary Policy Report. Instead, it introduced three tariff-based scenarios: one reflecting current conditions, one assuming escalation, and one assuming easing.

While global trade has been relatively resilient, volatility from U.S. tariffs is clouding the outlook. In Canada, growth was strong in Q1 as exports surged ahead of expected trade barriers, but Q2 is likely to show a pullback. The BoC sees global growth slowing toward 2.5% by year-end before rebounding in 2026.

Macklem: Canada Faces Fragile Recovery, Tariff Risks Keep BoC Cautious

Bank of Canada Governor Tiff Macklem said the decision to hold interest rates was driven by high trade uncertainty, early signs of slowing growth, and sticky core inflation.

The Bank now sees Q2 output shrinking by 1.5%, following Q1’s export-driven expansion. Trade friction is dampening business confidence and consumer spending, though employment outside trade-exposed sectors remains strong.

Headline CPI sits just below 2%, largely due to the removal of the carbon tax, but core inflation has edged up to 2.5%, with shelter costs still high. Inflation expectations have eased among businesses but remain elevated among households. The Bank expects inflation to stay near target, with risks balanced—but warns that tariffs could tip prices higher or widen economic slack.

BoC Press Conference Highlights Inflation, Tariff Anxiety

At the post-decision press conference, BoC Governor Macklem and Deputy Governor Karen Rogers said that even a potential trade deal wouldn’t erase uncertainty. Macklem emphasized the Bank’s concern about sticky inflation and signaled a “meeting-by-meeting” approach moving forward.

Exports surged in Q1, but are expected to fall sharply in Q2. Growth is forecast to stabilize in Q3. Moderate consumption is expected to continue, but tariffs are dragging productivity and income. Macklem warned that the economy is operating less efficiently, and monetary policy will need to remain flexible to prevent inflation from flaring up again.

Chile Central Bank Cuts Key Rate by 25bps

Chile’s central bank reduced its benchmark interest rate from 5% to 4.75% in a unanimous decision.

Officials signaled the policy rate will continue trending toward neutral levels, with future decisions based on the evolving global economic landscape and inflation outlook. Ongoing trade tensions remain a key variable.

Commodities News

Gold Faces Resistance at $3,345 as Fed Stays Hawkish

Gold edged higher Wednesday as traders trimmed dollar positions ahead of the Fed’s latest rate decision and the upcoming U.S. GDP print. However, upside remains capped, with the yellow metal struggling to break above $3,345, a key technical resistance level.

Spot gold formed a bearish flag on the charts, with a downside target near $3,245 if the pattern completes. The precious metal is trading within recent ranges, supported only mildly by a softer dollar.

Strong U.S. macro data and forecasts for a robust Q2 GDP release have reinforced expectations that the Fed will stick to a “hawkish hold,” dampening gold’s short-term bullish momentum. Core inflation staying above target, plus a resilient labor market, are helping keep Treasury yields and the greenback elevated—both headwinds for gold.

Unless gold breaks above $3,360, current price action suggests more downside risk remains.

U.S. Crude Oil Inventories Jump Unexpectedly

Crude oil stockpiles rose sharply by 7.698 million barrels last week, defying expectations for a draw of 1.288 million barrels, according to EIA data. Gasoline inventories fell by 2.724 million barrels, while distillates climbed 3.635 million.

At Cushing, supplies increased by 690,000 barrels. U.S. oil production edged up to 13.314 million barrels per day, from 13.273 million the prior week.

TDS: CTAs Poised to Rebuild Long Positions in Gold

Gold markets appear set for a rebound as CTA (Commodity Trading Advisor) flows shift back toward buying, according to TD Securities strategist Daniel Ghali. After significant liquidation, CTA positioning is now skewed toward accumulation. ETF outflows from Chinese investors have reversed, and fresh inflows are gaining traction.

Ghali says CTA systems are entering a “reset” phase where recent price consolidation reduces the threshold for new buying triggers. Macro funds remain net short, likely reflecting short-term USD positioning.

With Gold holding above key technical levels, CTAs could rebuild long exposure in the near term, particularly if macro pressures persist.

Oil Prices Lifted by Sanctions Threats, But Upside May Be Capped

WTI and Brent crude moved higher on fresh sanctions risks and CTA-driven buying, but the rally could be limited by supply growth, says TDS’ Daniel Ghali.

With algorithms near max-long positions in WTI, room for further upside is narrowing. Brent still has some space for additional CTA inflows. Ghali sees prices easing post-summer, driven by rising OPEC+ output and stronger-than-expected U.S. production.

Market sentiment remains highly reactive to geopolitical events, but long-term fundamentals are shifting toward supply-side recovery.

Trump Threatens Sanctions as Russia Given 10-Day Peace Ultimatum

Oil prices surged more than 3.5% as President Trump issued a 10-day deadline for Russia to reach a peace deal with Ukraine. Failure to comply could trigger new sanctions and 100% secondary tariffs on nations importing Russian oil, according to ING analysts.

With Russia exporting over 7 million barrels per day, full tariffs would massively disrupt global flows. Buyers—especially U.S. allies—would likely reduce purchases, squeezing supply. Although OPEC+ could offset some of the shock by rolling back production cuts, the market would still face tightness.

Recent API data showed U.S. crude stocks rising by 1.5 million barrels. Cushing inventories rose 500,000 barrels. Gasoline fell 1.7 million, while distillates gained 4.2 million barrels.

Chinese Investors Exit Gold ETFs at Record Pace

In July, Chinese investors pulled about 3.2 billion yuan ($450 million) from domestic gold ETFs—including Huaan Yifu, Bosera, E Fund, and Guotai—shifting funds into equities instead.

The CSI 300 Index rose 5.5% during the month, its best performance since September, attracting retail investors away from gold, which has plateaued after a 25% rally earlier this year.

Analysts say investors are chasing gains in local stocks, especially as Beijing’s economic policies stabilize commodity sectors and support projects like the $167 billion hydropower development in Tibet. Nonetheless, net ETF flows in Shanghai and Shenzhen remain negative.

Europe News

European Stocks Edge Up, Led by Italy’s FTSE MIB

European markets closed mostly higher, with Italy’s FTSE MIB leading gains at +0.98%. Other closing levels included:

- German DAX: +0.19%

- France’s CAC: +0.06%

- UK FTSE 100: +0.01%

- Spain’s Ibex: +0.23%

European bond yields were mixed:

- Germany: +1.6 bps to 2.701%

- France: +2.3 bps to 3.366%

- UK: -2.2 bps to 4.597%

- Spain: Unchanged at 3.289%

- Italy: +0.6 bps to 3.543%

Eurozone Posts Slim Q2 Growth, Driven by France and Spain

The euro area economy edged up 0.1% in Q2, beating the expected flat reading. France and Spain led the gains, while Italy and Germany underperformed. Compared to a year earlier, GDP grew by 1.4%, outpacing the 1.2% forecast. Despite the modest expansion, the figure is unlikely to shift ECB policy, with more attention on the potential effects of the new U.S.-EU trade deal.

Eurozone Sentiment Indicators Improve in July

Final data for July shows Eurozone consumer confidence holding steady at -14.7, matching the preliminary reading and improving from June’s -15.3. Broader economic sentiment rose to 95.8, ahead of the 94.5 estimate. Industrial sentiment came in at -10.4 (better than -11.0 expected), while services sentiment climbed to 4.1, beating the 3.3 consensus. The data suggests a modest improvement in economic mood across the region.

Germany’s Q2 GDP Contracts Slightly as Industrial Slump Persists

Germany’s economy shrank by 0.1% in the second quarter, matching expectations and reversing a 0.4% expansion in Q1. The decline reflects ongoing weakness in the manufacturing sector, which has been under pressure for over a year. Despite the dip, improved fiscal signals have brightened the outlook slightly for Europe’s largest economy.

Germany Retail Sales Rebound Sharply in June

German retail sales jumped 1.0% in June, doubling the expected 0.5% increase. May’s data was also revised upward from -1.6% to -0.6%. Despite the rebound, the uptick follows months of lackluster performance. Year-over-year, retail turnover is up 4.9%. Food sales edged up 0.3%, while non-food sectors rose 1.4% month-on-month.

France Q2 GDP Beats Expectations, But Growth Driven by Inventories

France’s economy grew 0.3% in the second quarter, exceeding the 0.1% forecast. However, the breakdown reveals weak fundamentals: domestic demand was flat, and foreign trade detracted 0.2 percentage points. The only significant boost came from inventories, which contributed 0.5%. After a -0.1% print in Q1, the continued softness in internal demand remains a concern for the broader recovery.

Spain’s July CPI Moves Up to 2.7%, Matching HICP

Spain’s preliminary consumer inflation rate for July hit 2.7% year-over-year, slightly above the 2.6% expectation and up from 2.3% in June. Harmonized inflation (HICP) also clocked in at 2.7%, in line with forecasts. Core inflation rose to 2.3% from 2.2%. While inflation remains above the ECB’s comfort zone, the trend supports the central bank’s current pause on further rate cuts.

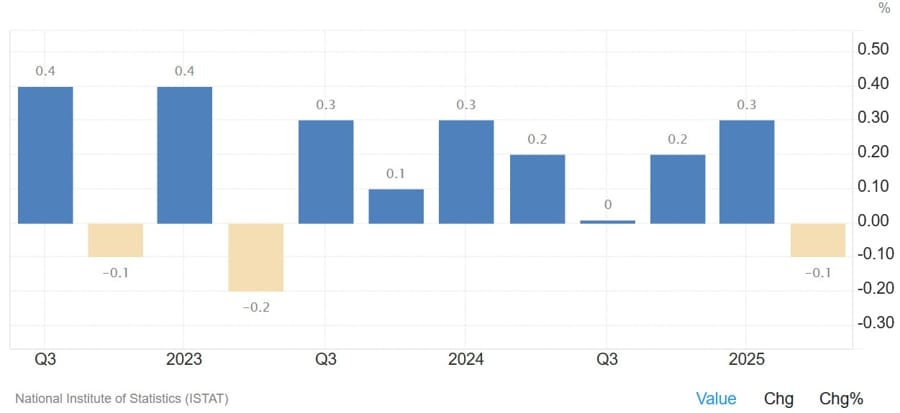

Italy’s Economy Unexpectedly Contracts in Q2

Italy’s GDP slipped 0.1% in the second quarter, missing the expected 0.1% gain. The prior quarter had posted a 0.3% increase. On an annual basis, growth slowed to 0.4%, below the 0.6% forecast. Sector data shows declines in agriculture and industry, while services made no impact. On the demand side, domestic activity added slightly, but net exports weighed on growth.

Swiss Investor Sentiment Turns Positive for First Time Since February

UBS and the CFA Society Switzerland reported a sharp turnaround in investor sentiment, with the index rising to +2.4 in July from -2.1 in June. This is the first time since February that optimism outweighed pessimism. Analysts point to fading expectations of further SNB rate cuts and improving economic prospects as key factors behind the shift.

Swiss KOF Indicator Surges Past Expectations

Switzerland’s KOF leading indicator climbed to 101.1 in July, beating the forecast of 97.5 and marking the strongest reading since March. The June figure was also revised upward to 96.3. The jump reflects improved sentiment likely driven by positive global trade signals and a more optimistic domestic outlook.

France finance minister: EU negotiation strategy may not have shown enough a vigour

- France has been against the deal

The France finance minister is on the wires saying:

- EU negotiation strategy may not have shown enough vigour

- it is incorrect to claim the UK secured a better deal than the EU

France has been more critical of the trade deal. Earlier French president Macron said:

- EU’s framework tariff trade deal with the US is unbalanced: it has some good aspects

- Expects further talks to come over EU’s framework of tariffs trade deal with the US.

- On EU -US framework, the trade deal says it is more important than ever before to speed up Europe’s move to become more sovereign.

- To be free, you need to be feared. We are not feared enough

- It is not the end of the story when talking about the framework of the EU -US trade deal

French finance minister says framework trade deal with US is best compromise possible

- Remarks by French finance minister, Eric Lombard

- The framework trade deal was the best possible compromise we could have found

- But continuing talks to try and get tariff exemptions for wines and spirits

Asia-Pacific & World News

China and U.S. Business Council Hold Economic Dialogue

China’s commerce minister hosted a delegation led by U.S.-China Business Council chair Rajesh Subramaniam in Beijing. Chinese officials welcomed more American investment and emphasized that decoupling is not a viable path. Both sides discussed U.S. business conditions in China and the future of bilateral trade. Beijing stressed that mutual respect and dialogue remain key to resolving economic disagreements.

President Xi Vows to Boost Consumption and Curb ‘Involution’

Chinese President Xi Jinping confirmed that expanding consumption and tackling ‘involution’ are central to the government’s agenda for the second half of 2025. Following the Politburo’s policy briefing, Xi reiterated these priorities—offering reassurance to investors despite a lack of detailed measures. The messaging suggests upcoming efforts to break inefficient cycles and stimulate demand more aggressively.

China Politburo Emphasizes Stability and Pro-Growth Policy

China’s Politburo reaffirmed that the country’s economic foundations are stable, following its latest high-level meeting. The leadership pledged to adopt a more proactive fiscal approach, boost domestic demand, and improve policy transparency and predictability. The focus areas include safeguarding employment, promoting consumption, addressing local government debt, and curbing excess capacity in key industries. The fourth plenum is scheduled for October.

China Finance Minister Promises More Fiscal Stimulus

China’s Finance Minister Lan Fo’an said the government will adopt more proactive fiscal policies to manage increasing economic uncertainty.

Lan identified two focus areas: stabilizing the property market and managing local government debt. His comments indicate a pivot toward supporting domestic consumption and ensuring fiscal flexibility as China contends with structural and global challenges.

The announcement may lift short-term investor sentiment, though longer-term gains will depend on execution and clarity on debt management strategies.

China Targets Strategic Industries with New Investment Fund Guidelines

China is tightening oversight of public investment funds to steer more capital into sectors crucial to its long-term development. Draft guidelines released by the National Development and Reform Commission (NDRC) propose stronger alignment between national and local funds.

The goal: channel state-backed venture capital into cutting-edge technologies and industries listed in China’s strategic catalogs, including sectors encouraged for foreign investment.

The NDRC emphasizes prioritizing industrial upgrades and resolving tech bottlenecks, part of a broader campaign to align public capital with national innovation and modernization efforts.

PBOC sets USD/ CNY central rate at 7.1441 (vs. estimate at 7.1742)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 309bn yuan via 7-day reverse repos at 1.40%

- 150.5bn yuan mature today

- net 158.5bn injection yuan

Massive 8.7 Earthquake Hits Eastern Russia

An 8.7-magnitude earthquake struck near Petropavlovsk-Kamchatsky, a remote city on Russia’s eastern coast. It’s the strongest global quake since 2011.

Tsunami alerts have been issued across the North Pacific, with wave heights between 3 and 4 meters reported along the Russian coastline.

Australia’s Q2 Inflation Comes in Soft, Rate Cut Likely

Australia’s headline CPI rose 2.1% year-over-year in Q2 2025, just under the expected 2.2%, while core inflation matched forecasts at 2.7%. This is the slowest pace of price growth in more than four years.

With the Reserve Bank of Australia set to meet on August 11–12, the data makes a 25bp interest rate cut almost certain.

New Zealand Business Confidence Ticks Up, But Sector Disparities Widen

New Zealand’s business confidence rose to 47.8% in July from 46.3% in June, while business activity dipped slightly to 40.6%.

According to the ANZ survey, conditions vary significantly by sector—agriculture is outperforming, but construction and retail are seeing renewed slumps. Forward-looking indicators show little change, suggesting businesses remain cautious.

UBS Warns Tariffs Still Threaten Global Growth

UBS says investors shouldn’t get too comfortable despite recent trade progress. Tariffs—still averaging 15% between the U.S., EU, and Japan—remain a drag on global growth.

Chief Investment Officer Ulrike Hoffmann-Burchardi warns inflation surprises or profit margin pressures could shift market sentiment quickly. The firm urges caution, noting that renewed trade tensions or economic shocks could reignite volatility.

BofA Boosts Forecast for Japan’s Topix and Nikkei

Bank of America has raised its year-end targets for Japan’s Topix and Nikkei indexes, now projecting 3,050 for the Topix (up from 2,850) and 43,000 for the Nikkei (up from 40,000).

The revision stems from three key drivers: the U.S.-Japan trade agreement, expected stimulus from Tokyo, and favorable market dynamics. While cyclical stocks may face some drag, BofA still sees room for market gains.

Currently, the Topix is at 2,917, and the Nikkei stands at 40,680.

Singapore Holds Monetary Policy Steady Amid Stable Inflation

The Monetary Authority of Singapore kept its policy unchanged at its July 30 meeting, maintaining the current rate of appreciation for the S$NEER policy band, along with its width and midpoint.

For 2025, core inflation and headline CPI are projected between 0.5% and 1.5%. MAS believes inflation pressures remain balanced, though global uncertainties could disrupt this outlook.

GDP growth is expected to cool in H2 after a strong first half, with full-year output likely hovering around potential. Risks include trade conflicts and financial volatility in 2026.

Samsung Reconsiders $7 Billion U.S. Chip Investment

Samsung Electronics is reportedly revisiting a $7 billion investment plan for a U.S.-based advanced packaging facility focused on high-bandwidth memory (HBM). The new site would sit next to Samsung’s existing fab in Taylor, Texas, reinforcing its role in the AI semiconductor supply chain.

Rival SK Hynix is also weighing a U.S. expansion with a potential DRAM production facility, complementing its upcoming Indiana advanced packaging site under the CHIPS Act.

These strategic shifts reflect broader efforts by South Korean chip giants to strengthen their U.S. presence amid a booming AI market and Washington’s push for domestic chip manufacturing.

Crypto Market Pulse

Ethereum Turns 10 as Price Holds Near $3,730 Support

Ethereum (ETH) marked its 10-year anniversary on Wednesday while maintaining support above $3,730. The milestone coincides with the token trading close to its 2025 highs, potentially setting up a push toward the psychological $4,000 level.

As the Federal Reserve’s rate decision looms, traders remain cautious of potential volatility. Still, ETH continues to attract institutional interest. Both 180 Life Sciences Corp and BTCS recently announced fundraising plans totaling over $2.4 billion, partly aimed at acquiring ETH for their treasury reserves.

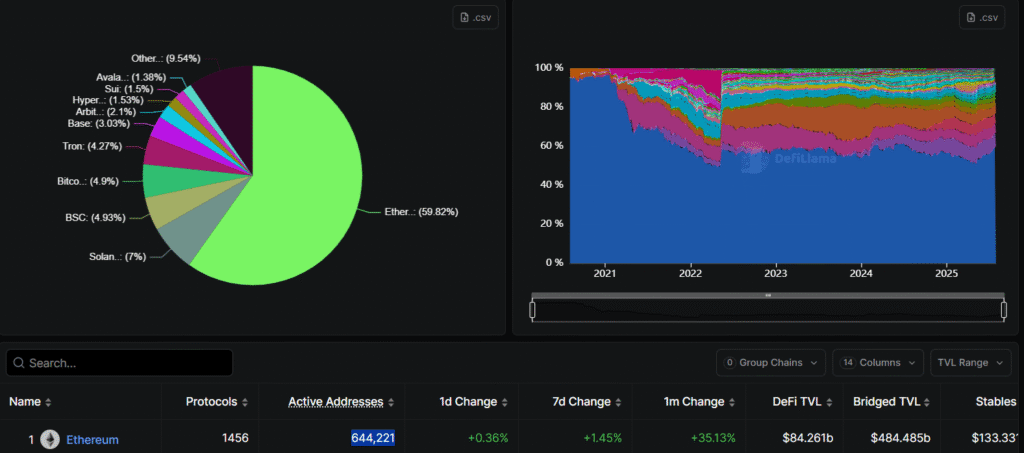

Launched in 2015, Ethereum has evolved into the backbone of decentralized applications, powering a wide range of use cases from DeFi to NFTs. According to DefiLlama, the network now supports 1,456 protocols, with over 644,000 active addresses and nearly 60% dominance in the DeFi space.

Analyst forecasts suggest ETH could range between $3,200 and $3,600 in August, with upside targets of $4,500 or even a potential retest of the all-time high at $4,868 by year-end.

XRP Holds $3.00 Level Ahead of U.S. Crypto Policy Release

XRP continues to trade above the $3.00 threshold despite growing volatility across the crypto market. Traders are bracing for both the upcoming Federal Reserve decision and a key policy report from the U.S. government expected to outline its stance on digital assets.

Although markets anticipate no change in interest rates (currently 4.25% to 4.50%), investor focus is on Fed Chair Jerome Powell’s guidance for future monetary policy. At the same time, a task force formed under President Trump is set to deliver a major report on stablecoins, tokenization, and regulatory clarity. Led by Bo Hines, the group includes Treasury Secretary Scott Bessent and SEC Chair Paul Atkins.

The report follows recent legislative moves, including the GENIUS Act signed into law and the CLARITY and Anti-CBDC Acts advancing in Congress. According to Jito Labs legal officer Rebecca Rettig, the report could serve as a regulatory blueprint for crypto’s role in the U.S. economy.

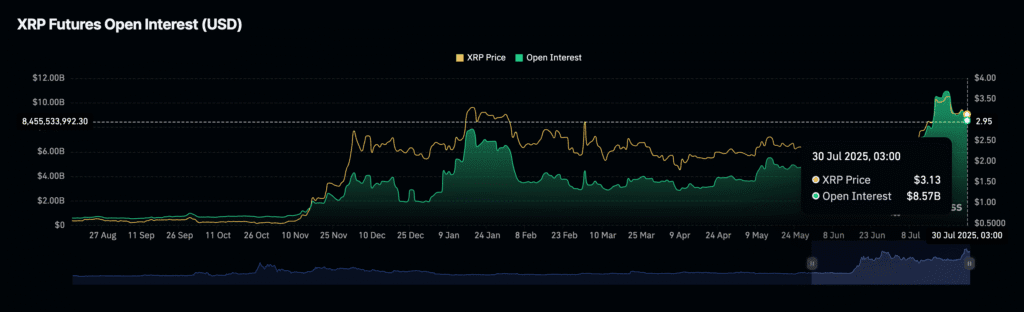

Despite holding its $3.00 floor, XRP has seen waning interest. Futures Open Interest dropped from $10.94B on July 22 to $8.57B, and volume fell sharply from $41.23B to $10.6B—signaling declining conviction in further upside. If momentum fails to return, XRP may struggle to defend its current support.

AI Tokens Drop as Bittensor, AIOZ Lead 13% Market Cap Slide

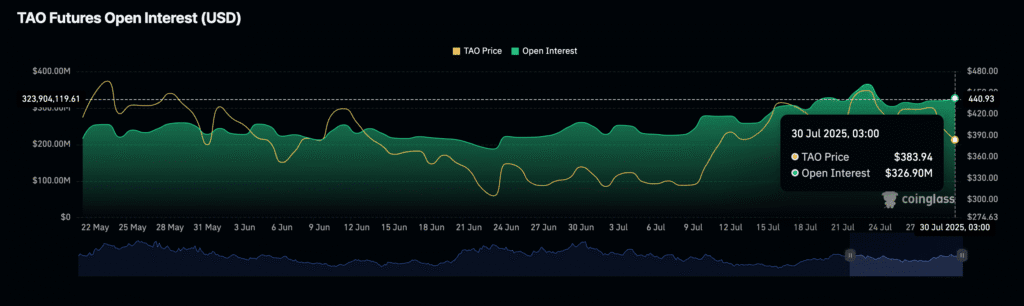

Bittensor (TAO) and other AI tokens are under pressure, with the entire AI token sector losing 13% of its market cap over the past week. TAO has dropped below key technical levels, including its 50-, 100-, and 200-day EMAs, and is currently trading around $368.

Market turbulence ahead of the Fed’s rate announcement has triggered a broad selloff in altcoins. TAO alone is down 7% over the past 24 hours and 17% for the week. Despite the decline, Open Interest in Bittensor futures is holding steady at $384 million, suggesting traders are still placing leveraged bullish bets.

Other AI tokens have also seen sharp losses. Virtuals Protocol fell 6.4% on the day and is down 27% on the week. AIOZ Network has shed 17% over the same period.

With the total AI crypto sector now worth around $28 billion, investors are watching closely to see if the July rally can recover amid macro headwinds and a new round of reciprocal tariffs set to go live in the U.S. this Friday.

PEPE Slides Nearly 5% as Whale Selling Hits Market Confidence

Memecoin PEPE dropped almost 5% in the past 24 hours, dragged down by heavy selling and rising exchange outflows. The token fell from $0.000012023 to $0.00001119, with trading volume spiking to 6.91 trillion tokens in a single hour.

Large holders (“whales”) reduced positions, with holdings declining 0.1% over the week, according to Nansen. Exchange balances fell 0.5%. Attempts to bounce at $0.000011525 failed amid weak buying interest, reinforcing the bearish outlook.

The broader memecoin sector, measured by the CDMEME Index, fell 6%, underperforming the CD20 benchmark’s 1.35% decline. Analysts see continued downside risk unless sentiment shifts or whale accumulation resumes.

SEC Approves In-Kind Creation for Crypto ETPs

The U.S. SEC has approved in-kind creation and redemption for crypto exchange-traded products, allowing participants to swap ETP shares directly for the underlying crypto rather than using cash.

SEC Chair Paul Atkins called it a move toward greater efficiency, and the change is expected to lower costs and improve liquidity—key factors for institutional adoption.

The Day’s Takeaway

United States

- GDP Surprise But With a Catch:

Q2 GDP came in hot at 3.0% vs. 2.4% expected, but most of the growth was driven by falling imports and inventory shifts. Real final sales, a cleaner measure of domestic demand, rose just 1.2%, the weakest since late 2022. Consumer spending increased 1.4%, while investment remained soft, especially in residential construction. - Fed Holds Rates, Signals No Immediate Pivot:

The Federal Reserve kept its benchmark rate at 4.25%–4.50%, with two dissenters (Waller and Bowman) pushing for a cut. Powell offered no guidance on future easing, reinforcing the Fed’s data-driven posture. Treasury yields rose as market hopes for a September cut dimmed. - Powell’s Messaging:

Powell emphasized a “solid” economic backdrop but acknowledged slowing consumer activity and stubborn inflation. He warned of ongoing tariff-related uncertainty and stressed the need to see more data before making future rate decisions. - Stock Market Recap:

- NASDAQ: +0.15%

- S&P 500: -0.12% (2nd day of losses)

- Dow: -0.3%

- Russell 2000: -0.47%

- Earnings Highlights:

- Meta Platforms: EPS $7.14 vs. $5.85 est. | Rev $47.52B vs. $44.87B

- Microsoft: EPS $3.65 vs. $3.35 est. | Rev $76.44B vs. $73.76B

Both stocks surged after hours, Meta +9.05%, Microsoft +6.5%.

- Corporate Movers:

- Alphabet fell after missing revenue targets.

- AMD soared on strong AI chip demand and raised 2025 guidance.

- Apple drifted lower pre-earnings.

- Tesla volatility persisted on mixed EV sentiment.

- Boeing, GE, Visa, and Mastercard posted solid performances across industrials and payments.

- Bond Market & FX:

Strong data and Fed caution drove Treasury yields higher and pushed the U.S. Dollar Index up, pressuring multinational earnings and commodity-linked trades.

Canada

- Bank of Canada Holds Rates at 2.75%:

The BoC paused again, citing global trade uncertainty and mixed domestic momentum. Q2 is likely to show a 1.5% contraction, after firms frontloaded exports in Q1. While inflation sits just under 2% due to the carbon tax repeal, core inflation has edged up to 2.5%. - BoC Press Conference:

Governor Macklem emphasized inflation risks from tariffs and warned of a permanently lower growth path if trade remains disrupted. The Bank is taking a meeting-by-meeting approach with no guidance for cuts.

Commodities

- Gold:

Gold attempted a rebound ahead of the Fed decision, but technical resistance around $3,345–$3,360 capped the upside. The metal is forming a bearish flag, with downside targets near $3,245, as strong U.S. data and a firm dollar weigh on sentiment. - Oil:

- Crude inventories surged by +7.698M barrels, defying expectations of a draw.

- Gasoline fell -2.724M, distillates rose +3.635M, and Cushing added +0.690M.

- Production ticked up to 13.314M bpd.

- Supply builds and China demand concerns pressured prices, though geopolitical risks kept volatility elevated.

Europe

- Mixed Market Close:

- FTSE MIB led with a +0.98% gain.

- DAX: +0.19%

- CAC 40: +0.06%

- FTSE 100: +0.01%

- IBEX: +0.23%

- Yields:

Bond yields across Europe were mixed, with German and French yields rising modestly, while U.K. yields edged lower. - Macro Outlook:

Sentiment remains cautious amid soft industrial data and persistent recession concerns, especially in the euro area.

Crypto

- XRP Holds $3.00 Support:

XRP is holding above $3.00 ahead of a major U.S. crypto policy report from a Trump-appointed task force. Futures Open Interest has declined from $10.94B to $8.57B, and volume is down sharply, signaling weaker conviction. A break below $3.00 remains possible if pressure continues. - ETH Turns 10, Holds Above Support:

Ethereum marks its 10-year anniversary while holding above $3,730. With corporate ETH purchases increasing and ETFs gaining traction, bulls are eyeing a breakout toward $4,000. However, traders remain cautious ahead of macro volatility tied to Fed policy. - AI Token Selloff:

Bittensor (TAO) leads a sharp 13% weekly drop in AI token market cap. TAO fell below its major EMAs, while Virtuals Protocol and AIOZ Network also declined. Futures positioning remains leveraged, but sentiment is shaky ahead of tariff deadlines and Fed fallout. - SEC Accelerates Ethereum ETF Review:

Regulatory developments have sparked fresh speculation around spot ETH ETF approvals. Coinbase saw increased interest on the news.