North America News

Dow Inches Up, Nasdaq Slips as Major U.S. Indices End Month Strong

U.S. stock markets closed Friday with a split performance. The Dow Jones Industrial Average rose by 54.34 points to end at 42,270.07 (+0.13%), while the S&P 500 was essentially flat, down 0.48 points to 5911.69 (-0.01%). The Nasdaq Composite fell 62.11 points to 19,113.77 (-0.22%), and the Russell 2000 lost 0.41% to settle at 2066.26.

Weekly Gains:

- Dow: +1.60%

- S&P 500: +1.88%

- Nasdaq: +2.01%

- Russell 2000: +2.01%

Monthly Performance (May 2025):

- Dow: +3.94%

- S&P 500: +6.15%

- Nasdaq: +9.56%

- Russell 2000: +5.20%

Despite early-year setbacks, all four indices have recovered significantly from their April lows. However, for the year so far:

- Dow is down 0.64%

- S&P 500 is down 0.51%

- Nasdaq is down 1.02%

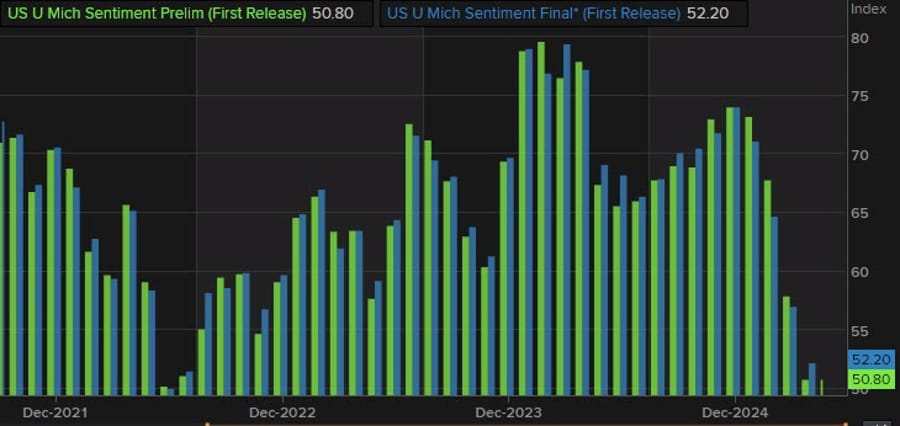

U.S. Consumer Sentiment Holds at 52.2 in Final May Reading

The University of Michigan’s final sentiment index for May came in at 52.2, beating the 51.0 forecast and matching April’s level. Current conditions rose to 58.6, up from the preliminary 57.6 but below April’s 59.6. Expectations improved to 47.9, better than the 46.5 preliminary figure. On inflation, one-year expectations dropped to 6.6% from the 7.3% early reading, while the five-year outlook eased to 4.2% from 4.6%.

Joanne Hsu from the Univ. of Michigan says:

Consumer sentiment was unchanged from April, ending four consecutive months of plunging declines. Sentiment had ebbed at the preliminary reading for May but turned a corner in the latter half of the month following the temporary pause on some tariffs on China goods. Expected business conditions improved after mid-month, likely a consequence of the trade policy announcement. However, these positive changes were offset by declines in current personal finances stemming from stagnating incomes throughout May. Overall, consumers see the outlook for the economy as no worse than last month, but they remained quite worried about the future.

Year-ahead inflation expectations were little changed at 6.6%, inching up from 6.5% last month. This is the smallest increase since the election and marks the end of a four-month streak of extremely large jumps in short-run expectations. Notably, long-run inflation expectations fell back from 4.4% in April to 4.2% in May. This is the first decline seen since December 2024 and ends an unprecedented four-month sequence of increases. Given that consumers generally expect tariffs to pass through to consumer prices, it is no surprise that trade policy has influenced consumers’ views of the economy. In contrast, despite the many headlines about the tax and spending bill that is moving through Congress, the bill does not appear to be salient to consumers at this time.

U.S. Core PCE Inflation Holds Steady at 2.5% in April

Core PCE, the Fed’s preferred inflation gauge, rose 0.1% in April, in line with expectations. The year-over-year rate held at 2.5%. March’s data was revised up slightly, with monthly core inflation now at 0.1% (from 0.0%) and the annual rate adjusted to 2.7% from 2.6%. Overall PCE also rose 0.1% month-on-month and 2.1% annually—just under the 2.2% forecast. Personal income climbed 0.8%, far ahead of the 0.3% estimate, while spending grew just 0.1%, a sharp slowdown from March’s 0.7%.

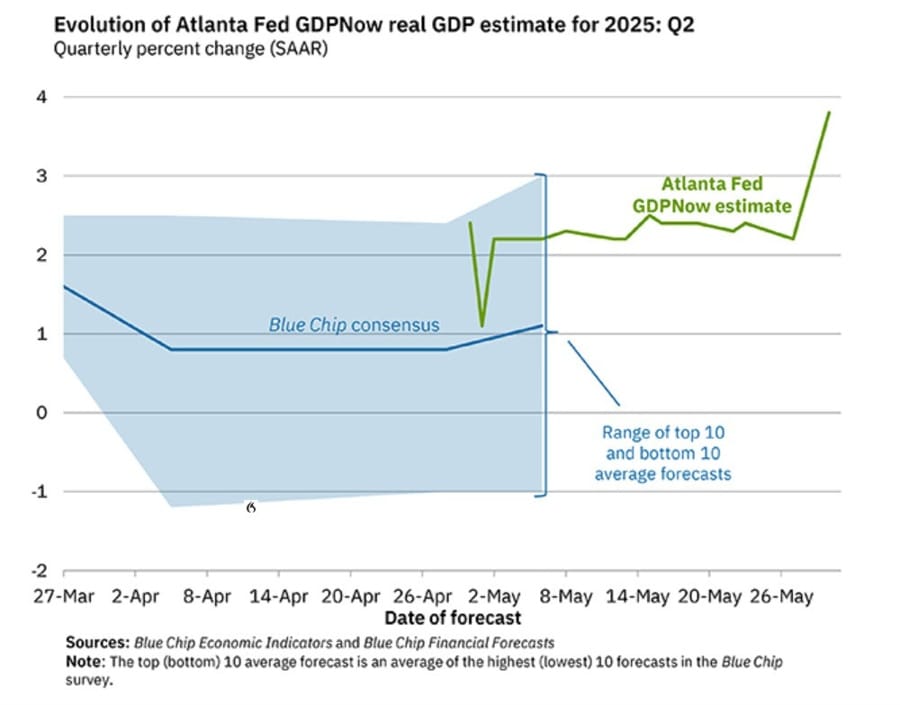

Atlanta Fed GDPNow Model Lifts Q2 Growth Forecast to 3.8%

The Atlanta Fed’s GDPNow model now sees Q2 2025 U.S. GDP expanding at a 3.8% annualized rate, up sharply from its prior 2.2% estimate. The revision was driven primarily by stronger-than-expected contributions from net exports.

In their own words:

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2025 is 3.8 percent on May 30, up from 2.2 percent on May 27. After recent releases from the US Census Bureau and the US Bureau of Economic Analysis, the nowcast of the contribution of net exports to second-quarter real GDP growth increased from -0.64 percentage points to 1.45 percentage points, while the nowcasts of second-quarter real personal consumption expenditures growth and second-quarter real gross private domestic investment growth declined from 3.7 percent and -0.2 percent, respectively, to 3.3 percent and -1.4 percent.

JPMorgan’s Dimon: Kill Carried Interest, Brace for Bond Trouble

JPMorgan CEO Jamie Dimon voiced strong criticism of U.S. fiscal policy, calling for the elimination of the carried interest loophole while opposing any increase in the SALT deduction cap. He warned of a potential bond market disruption, though the timing is unclear. Dimon said the U.S. must aim for 3% growth and emphasized that AI-driven deflation is a longer-term story. He backed the Fed’s cautious approach and hinted at a possible run for office if he saw a real chance to win.

Trump Praises Tariff Ruling, Signals Long-Term Cuts

Former President Trump celebrated a favorable appeals court decision on tariffs, calling them “important” and signaling that tax and trade policy changes would continue in a measured, long-term fashion. He mentioned progress toward deals on Gaza and Iran, teased future tax cuts in House legislation, and criticized elite funding of universities—advocating instead for trade school support. Trump said Elon Musk “will be back and forth” and confirmed his intent to speak with China’s Xi Jinping at some point, though no date is set.

U.S. Trade Rep Slams China, Signals More Tariff Tools Available

U.S. Trade Representative Greer sharply criticized China’s trade practices, calling them “completely unacceptable” in an interview with CNBC. She emphasized that the U.S. has more tools at its disposal if the current tariff ruling doesn’t go its way. Despite tensions, Greer said trade talks are ongoing and not derailed, with foreign counterparts continuing negotiations. She also noted a lack of Chinese compliance in critical minerals supply and hinted at possible expansion of Section 301 tariffs.

Fed’s Logan says monetary policy is in a good place for now

- Federal Reserve Bank of Dallas President Lorie Logan

- Risks to employment, inflation goals ‘roughly balanced’

- For now, monetary policy is in a good place

- Could take ‘quite some time’ to see shift in balance of risks

- If balance shifts, Fed is well prepared to respond

- Labor market strong, inflation trending gradually to 2%

Fed’s Daly says workers are worried about inflation

- Mary Daly, President of the Federal Reserve Bank of San Francisco

- Labor market in solid shape

- Workers are worried about inflation

- Won’t get to 2% inflation this year

- Really making progress on inflation

- Fed is resolute to get job on inflation done

- Bond yields show markets trying to process uncertainty about policy and economy

- Fed policy in a good place

- US economy in a good place

- Deregulation and tax relief usually a net positive for growth

- Don’t know impact of immigration policy

- On tariffs don’t know scope, size or timing; premature to speculate how it will work out

- Businesses say they are continuing to do what they do, but taking fewer risks

- Businesses have not put their pencils down

- Fed is ‘wait to see’

- Expect to continue to bring inflation down, labour market slowing but solid

- Two rate cuts this year would make sense if labor market stays solid and inflation falls, but range of possible risks is large

- Currently tilt toward a focus on inflation

- Need modestly or moderately restrictive policy to keep bringing down inflation

- Looking for signs inflation is continuing to fall, or if it’s rising or stays sticky

- Also looking for any weakening in job market, not seeing any

- Not facing policy tradeoffs now

- Fed is agile, policy well-positioned

- Businesses are not stalled in the face of uncertainty, though taking fewer risks

- Keeping Fed policy rate steady is an active decision

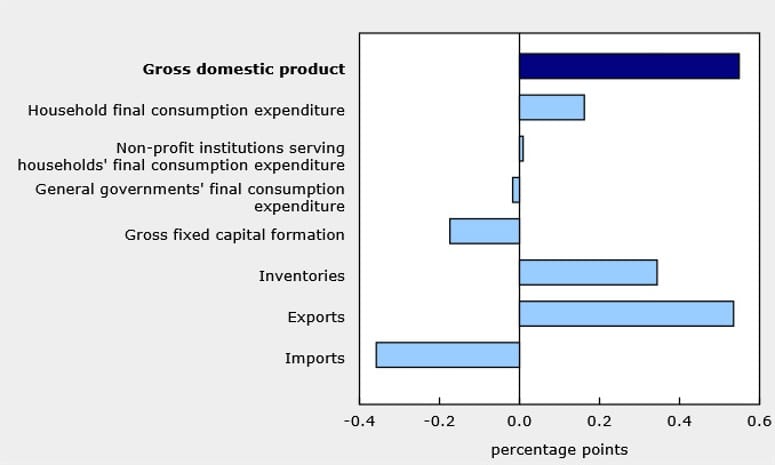

Canada’s Economy Grew 0.1% in March, Q1 Led by Export Gains

Canada’s GDP rose 0.1% in March, in line with expectations and rebounding from February’s 0.2% contraction. The economy expanded 0.5% in Q1, matching the previous quarter’s pace. The uptick was powered by strong goods exports and stockpiling of non-farm business inventories. However, rising imports and sluggish resale activity in housing weighed on overall growth. An early estimate for April points to another 0.1% monthly increase.

Canadian Economy Grew at 2.2% Annualized Rate in Q1

Canada’s economy expanded at a 2.2% annualized pace in Q1 2025, topping the 1.7% estimate. On a quarterly basis, real GDP grew 0.5%, unchanged from Q4. Per capita growth improved to 0.4%, up from 0.1% in the prior quarter. Domestic demand was flat—the first stall since late 2023—while goods exports and business inventory buildup were the main growth drivers. Imports and housing resale activity offset some of the gains.

Commodities News

Gold Drops Below $3,300 as Dollar Strengthens and Trade Tensions Rise

Gold prices slipped on Friday, with gold falling 0.83% to trade at $3,289, pressured by a firmer U.S. Dollar and renewed geopolitical stress following Trump’s comments and a legal reinstatement of tariffs on China.

President Trump publicly accused Beijing of breaching its trade commitments: “China… HAS TOTALLY VIOLATED ITS AGREEMENT WITH US,” he posted. This added to market jitters after a federal appeals court allowed Trump’s April 2 tariffs—branded “Liberation Day” duties—to remain in effect while under appeal.

Despite softer inflation data, gold couldn’t catch a bid. The core PCE Price Index—the Fed’s preferred inflation measure—eased to 2.5% year-over-year in April from 2.6%, with headline inflation dipping to 2.1% from 2.3%.

Other key developments:

- DXY (Dollar Index) edged up 0.11% to 99.44

- Treasury yields fell modestly

- COT data showed short positions in the dollar are being reduced

- University of Michigan sentiment rose to 52.2 from 50.8, with inflation expectations easing

The Atlanta Fed’s GDPNow model revised Q2 GDP growth up to 3.8% from 2.2% following the inflation data. San Francisco Fed President Mary Daly reiterated that while the labor market remains strong, the 2% inflation target likely won’t be met this year—yet the Fed could still cut rates twice if disinflation stays on course.

Crude Oil Ends the Week Lower, Settles at $60.79

Crude oil futures wrapped up Friday’s session slightly lower, settling at $60.79 per barrel, a drop of $0.15 or -0.25% on the day.

This marks a weekly decline of 1.59%, adding to the longer-term slide, with prices now down 15.43% year-to-date. While daily losses were limited, ongoing concerns over demand softness and geopolitical uncertainty continue to weigh on the energy complex.

Silver Sinks Below $33 as Dollar Gains, Weekly Loss Nears 2%

Silver fell sharply during Friday’s U.S. session, trading at $32.87, down 1.29% on the day. It’s set to close the week with a 1.8% loss as a rebounding U.S. dollar weighs on precious metals.

The technical setup shows a bearish harami candlestick pattern and soft RSI momentum, hinting at more downside. A break below $32.70 could bring tests of the 50-day SMA at $32.68 and potentially the 100- and 200-day SMAs at $32.11 and $31.40.

On the upside, clearing $33.00 could spark a run to resistance at $33.69 and $34.00, with further targets at $34.58 and $35.00 if momentum shifts.

U.S. and Canadian Rig Counts Fall Again, Offshore Rigs Rise

Baker Hughes reported that the U.S. rig count dropped by 3 to 563 this week. Oil rigs fell by 4 to 461, while gas rigs added 1 to reach 99. The total is now 37 rigs below the same time last year. Offshore rigs increased by 2 to 13 but remain 9 below year-ago levels.

Canada’s rig count slipped by 2 to 112. Oil rigs fell to 69, while gas rigs held steady at 43. Canada is now 16 rigs below last year’s total, with oil rigs down 5 and gas rigs down 11.

TDS: Gold Is Underowned Despite Macro Tailwinds

According to TD Securities strategist Daniel Ghali, gold is “overbought but underowned.” Open interest in CME gold futures has dropped to extreme lows—around 425,000 contracts—which in past cycles has marked major buying opportunities.

Despite a strong macro backdrop, gold is not yet a crowded trade, Ghali argues. Algorithmic traders (CTAs) are expected to ramp up buying into next week’s U.S. jobs report, potentially scaling up to 30% of their maximum exposure. ETF selling appears exhausted, and with macro funds mostly flat, fresh positioning could drive the next leg of the rally—especially if more trade turbulence arises.

OPEC+ May Discuss Bigger Output Boost for July

According to a Reuters report, OPEC+ could be weighing a production increase for July that exceeds the previously expected 411,000 barrels per day. The group is set to meet tomorrow. The news has already weighed on oil prices, as traders anticipate a larger-than-planned supply boost.

Kazakhstan Sees Oil Above $70–$75 as Fair for All

Kazakhstan’s Energy Minister stated that oil prices above $70–$75 per barrel are reasonable and benefit most producing nations. Addressing OPEC+ quota concerns, he said Kazakhstan’s small share of global production—under 2%—shouldn’t distort group output. He also blamed U.S. tariffs for adding instability to energy markets.

OPEC+ Expected to Increase Exports, CTAs May Keep Selling Crude

OPEC+ is expected to boost crude exports further heading into the summer, even as speculative traders continue to sell. TD Securities notes that CTA selling is likely to persist into next week’s OPEC meeting.

While global markets may struggle to absorb the added supply, factors like peaking U.S. shale output, the expiration of Venezuela’s export waivers, and ongoing risks tied to Iran could help cushion prices in the short term.

Still, Ghali warns that the path to higher crude prices remains narrow. Despite resilient demand, supply pressures and bearish positioning keep the market under strain.

Russia Paid Iran $104M in Gold for Drones: Report

Russia delivered 1.8 tons of gold—valued at around $104 million—as payment to Iran for Shahed-136 drones, according to a report citing U.S. analysts from C4ADS and The Washington Post. The March 2023 contract valued gold at $58.32 per gram. A follow-up deal for over two tons of gold was signed weeks later, but its completion is unclear. Analysts believe using gold allowed Moscow to avoid U.S. dollar sanctions.

Europe News

European Markets Close Mostly Higher; Germany Hits New Record

European stock markets ended mostly in the green on Friday, with Germany’s DAX leading the way. Here’s how the day and week ended:

- DAX rose 0.31% to 24,007.28 and hit a record 24,225.97 this week, up 1.6% for the week and +6.71% for May.

- CAC 40 dropped 0.36% to 7,751.90 but still gained 0.23% this week and 2.08% this month.

- FTSE 100 climbed 0.64% to 8,772.37, rising 0.62% weekly and 3.27% for May.

- Ibex 35 added 0.25% to 14,152.19, up 0.34% for the week and 6.51% on the month—its best showing since 2007.

- FTSE MIB rose 0.26% to 40,087.39, finishing May up 6.60%, also at levels not seen since 2007.

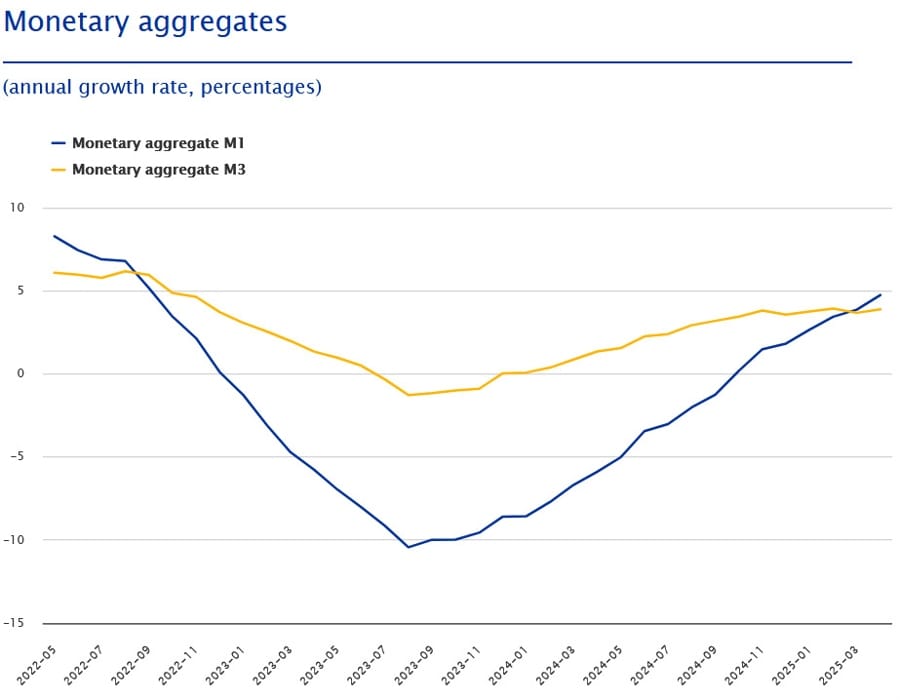

Eurozone M3 Money Supply Grows 3.9% in April, Beats Forecast

The European Central Bank reported a 3.9% annual increase in the Eurozone’s M3 money supply for April, outpacing the expected 3.7%. Lending to households rose 1.9% from a year earlier, while loans to businesses climbed 2.6%, both showing moderate improvement compared to March.

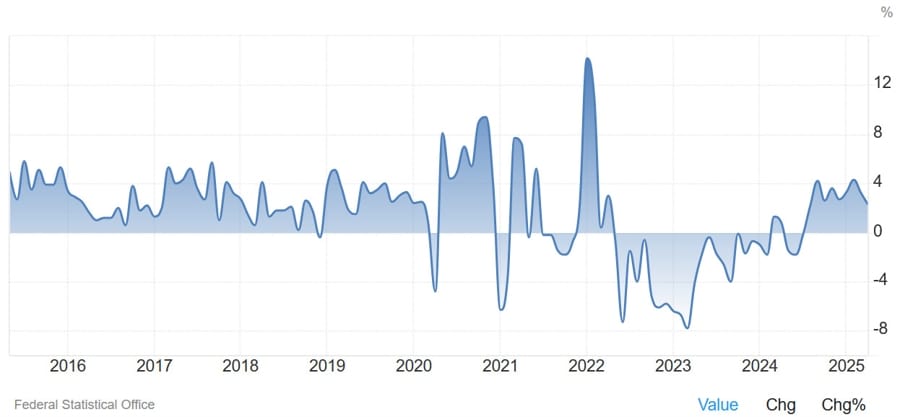

German Retail Sales Slide in April, but Previous Data Revised Sharply Higher

Retail sales in Germany dropped 1.1% month-on-month in April, missing the 0.2% increase that economists expected. However, March’s figures were revised up to a 0.9% gain from an initial -0.2%. Year-over-year, retail sales grew 2.3%, beating the 1.8% estimate. Despite the negative April print, the upward revisions soften the blow. ECB policy trajectory remains unaffected.

Germany May CPI Rises 2.1% Y/Y, Tops Expectations Slightly

Germany’s preliminary harmonized CPI for May came in at 2.1% year-over-year, just above the 2.0% forecast. Month-over-month, inflation rose 0.2%, ahead of the 0.1% estimate. Core CPI held steady at 2.9%. April’s HICP was 2.2% y/y and 0.5% m/m.

German Regional CPI Prints Flat Across the Board in April

Bavaria’s annual CPI held steady at 2.1% in April, unchanged from the previous month. Across other major German states:

- Hesse: 2.3% (same as prior)

- Brandenburg: 2.2% (unchanged)

- Saxony: 2.3% (slightly down from 2.4%)

- North Rhine-Westphalia: 2.0% (up from 1.8%)

- Baden-Württemberg: 2.2% (down from 2.4%)

Inflationary trends across regions remain stable and broadly aligned.

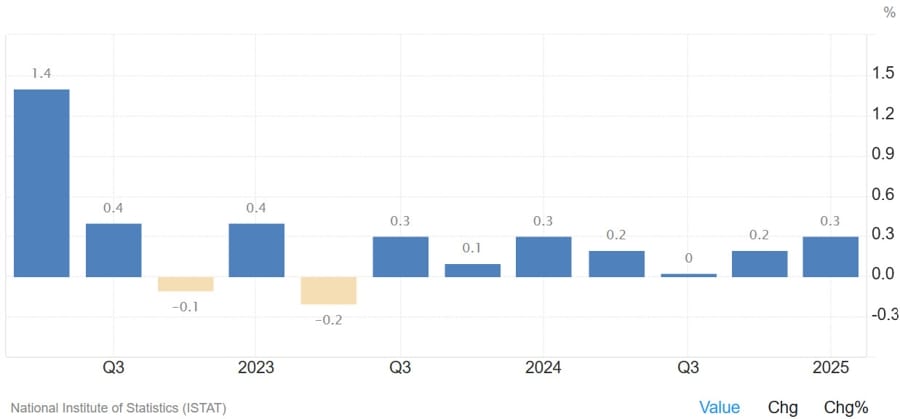

Italy’s Q1 GDP Holds at 0.3%, Full-Year Outlook Remains Uncertain

Italy’s final GDP numbers for Q1 2025 confirmed 0.3% quarter-over-quarter growth, matching preliminary estimates and up from 0.2% in Q4. The increase was supported by investment and modest trade contributions. Year-on-year growth was revised to 0.7%. Lingering concerns over global tariffs continue to cloud forecasts for the rest of the year.

Italian May CPI Stays on Target at 1.9% Y/Y, Slight Monthly Bump

Italy’s preliminary harmonized CPI for May showed a 1.9% year-over-year rise, in line with expectations and down from April’s 2.0%. Monthly inflation was 0.1%, just above the 0.0% forecast. April’s monthly rate was 0.4%.

Italy April PPI Softens to 2.6% Y/Y, Sees Monthly Deflation

Producer prices in Italy rose 2.6% year-over-year in April, cooling from the 3.9% annual pace recorded in March. On a monthly basis, PPI dropped 2.2%, slightly less than March’s 2.4% fall, signaling ongoing disinflation in the production sector.

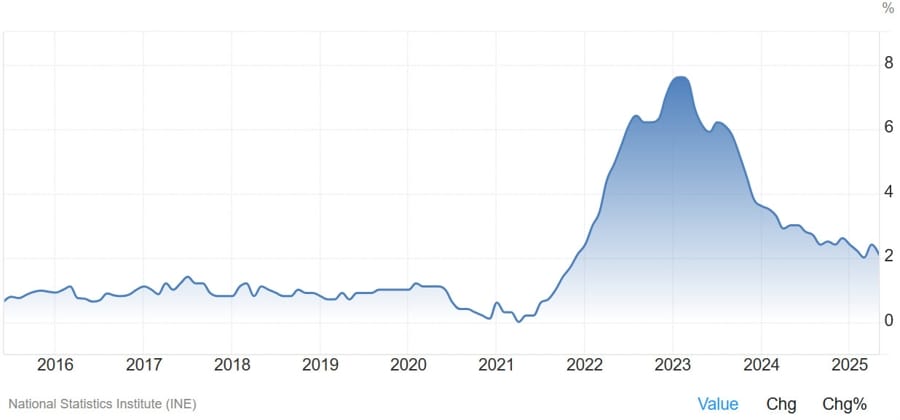

Spain’s May Flash CPI Falls Below Forecast at 1.9% Y/Y

Spain’s harmonized CPI (HICP) for May rose 1.9% year-over-year, a touch below the 2.0% estimate and down from April’s 2.2%. Month-over-month, prices dipped 0.1%, also weaker than the flat reading expected. Core inflation eased to 2.1% from 2.4%. The decline was driven largely by cheaper leisure, culture, and transport costs, as well as more modest electricity price increases than a year ago.

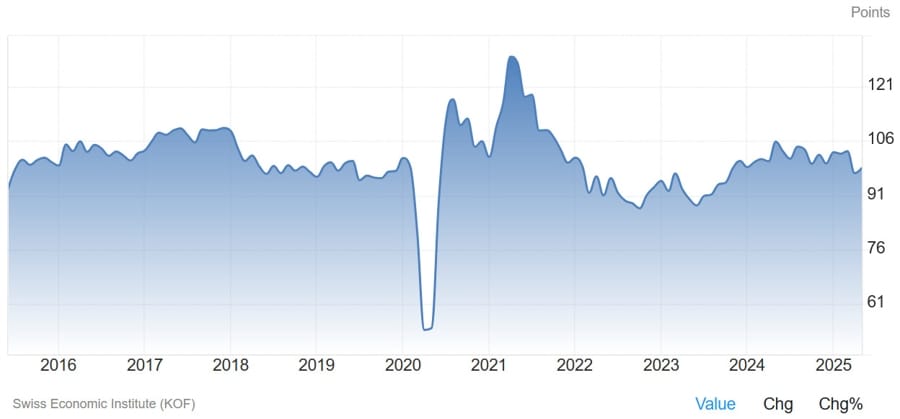

Swiss Business Confidence Edges Higher in May, Hits 98.5

Switzerland’s KOF leading indicator rose to 98.5 in May, just above the forecast of 98.4. This follows April’s dip to 97.1, attributed to market jitters over tariffs announced by Trump on April 2. The rebound suggests some easing in business concerns as trade tensions begin to de-escalate.

ECB’s Panetta: Reduced room to cut rates further, but macro outlook remains weak

- Remarks by ECB executive board member, Fabio Panetta

- Reduced room to cut rates further, but macro outlook remains weak and trade tensions could worsen it.

- Future rate decisions need to be assessed on case by case basis, weighing data, inflation and growth outlook.

- Essential to maintain pragmatic and flexible approach, closely monitor liquidity conditions.

- Disinflation has not taken too high a toll on the Eurozone economy and is now close to completion.

- Outcome of trade negotiations uncertain but impact on European economy bound to be significant.

- Sectors most exposed to tariffs already showing signs of falling confidence, weaker expectations on orders and employment.

BoE Gov Bailey says taking gradual, careful approach as the economy is hard to read

- Bank of England Governor Bailey:

- Challenge we have at the moment is that we don’t know what outcome of trade situation will be

- We take gradual and careful approach as economy is hard to read

- Spend a lot of time looking at risks from market fragilities, including bonds

- Not useful to ask if dollar will remain reserve currency, may see some rebalancing but not anywhere near Dollar losing its status

- Asked about rate cuts, says there is a lot of uncertainty around at the moment

- Says UK labour market data pretty much in line with what we thought

- We’re seeing strengthening in food inflation, but not alone in that

- Less volatile components of UK inflation are gradually grinding down

BoE’s Taylor: Higher inflation not coming from demand and supply pressures

- BoE’s Taylor in the Financial Times, info via Reuters headlines:

- I’m seeing more risk piling up on the downside scenario because of global developments

- A trade war is going to be negative for growth

- Thought we needed to be on a lower monetary policy path

- Higher inflation not coming from demand and supply pressures, for the most part its coming out of one-time tax and administered price changes

Asia-Pacific & World News

China: U.S. Must Cease Unfair Trade Practices, Says Embassy

A spokesperson for China’s U.S. Embassy confirmed ongoing communication with Washington on trade matters. China has voiced repeated concerns over U.S. export controls and restrictions in sectors like semiconductors. Beijing called on the U.S. to stop discriminatory actions and to uphold previously agreed terms from high-level discussions in Geneva.

White House: China Must Uphold Global Trade Rules

White House Chief of Staff Miller stated that China must demonstrate a real commitment to a rules-based international order. He said President Trump hopes Beijing will opt for cooperation and mutual progress rather than confrontation.

China Moves to Resume Japanese Seafood Imports

China and Japan have taken steps toward restoring seafood trade. Japan will certify seafood processing facilities and provide safety documentation confirming no radioactive contamination. This agreement could lift China’s ban, originally imposed in response to Japan’s release of treated wastewater from Fukushima. Restrictions are expected to be eased for regions outside Fukushima.

PBOC May Expand PSL Facility to Support Private Sector

Analysts cited by China’s Securities Times suggest the People’s Bank of China could increase its use of the Pledged Supplementary Lending (PSL) facility. Traditionally used to support public infrastructure and housing, this round may target private sector support. The PSL, introduced in 2014, is a long-term funding tool that acts as a form of targeted economic stimulus.

U.S.-China Treasury Talks Reportedly Stalled

U.S. Treasury Secretary Bessent says negotiations with China are currently at a standstill but expressed confidence that discussions would resume in the coming weeks.

China to Reveal Major Financial Policies During June Forum

China is set to roll out significant financial policies during the Lujiazui Forum on June 18–19, 2025, in Shanghai. People’s Bank of China Governor Pan Gongsheng will deliver a keynote speech. The forum is a major event, co-hosted by the Shanghai city government, the PBOC, the National Administration of Financial Regulation, and the China Securities Regulatory Commission.

PBOC sets USD/ CNY reference rate for today at 7.1848 (vs. estimate at 7.1859)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 291.1bn yuan via 7-day reverse repos at 1.40%

- 142.5bn yuan matured today

- net injection 148.6bn yuan

U.S. to Expand Arms Sales to Taiwan Beyond Trump-Era Levels

The U.S. government is preparing to ramp up weapons deals with Taiwan, potentially surpassing the $18.3 billion sold during Trump’s first term. Officials aim to strengthen Taiwan’s defenses amid rising Chinese military pressure. Washington is also nudging Taiwan’s opposition to back a proposed increase in defense spending to 3% of the national budget. While this may reassure observers wary of Trump’s Taiwan policy, it could also intensify tensions with Beijing.

Australia April Building Permits Dive 5.7% Against Forecast Rise

Australian building permits fell 5.7% month-over-month in April, far off the expected 3.1% gain. This follows an even sharper 8.8% decline in March. Detached housing approvals rose 3.1%, but multi-unit approvals—covering apartments and similar—plunged 19.0%. The numbers reinforce the volatility in this data set.

Australia April Retail Sales Slide by 0.1%, Miss Forecast

Retail turnover in Australia dropped 0.1% in April, undercutting the expected 0.3% gain. This follows a 0.3% rise in March. The downturn highlights soft consumer momentum heading into Q2 2025.

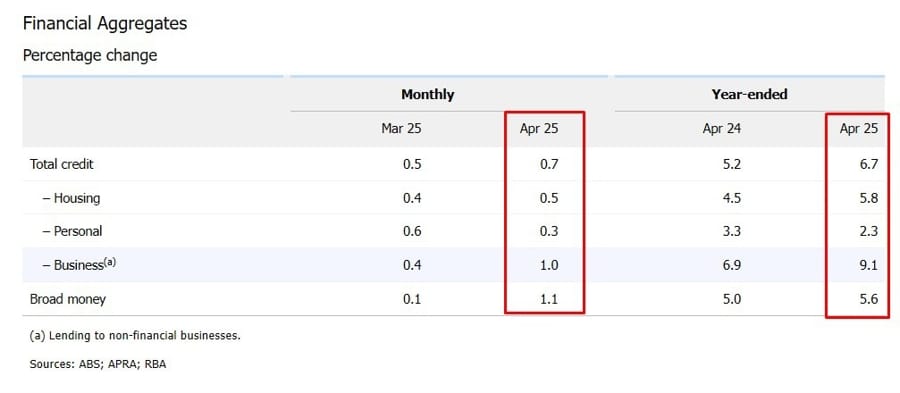

Australian Private Sector Credit Growth Beats Forecast in April

Private sector credit in Australia rose 0.7% month-over-month in April 2025, outpacing both the 0.5% forecast and the previous month’s 0.5% gain, according to Reserve Bank of Australia figures.

New Zealand April Building Consents Plunge 15.6%

New Zealand’s building permits dropped 15.6% month-over-month in April after a 10.7% rise the month before. On an annual basis, consents were down 17.4%, compared to a 15.9% gain previously.

New Zealand Consumer Confidence Tumbles in May

Consumer confidence in New Zealand dropped sharply to 92.9 in May from 98.3 in April, according to ANZ. The 5.5% monthly drop reflects sustained cost-of-living worries and persistent inflation expectations, which remain elevated at 4.6%.

RBNZ: Interest Rates Sitting in Neutral Zone, Cuts Still in Pipeline

Reserve Bank of New Zealand Assistant Governor Silk says current interest rates fall within the neutral range of 2.5% to 3.5%. The full effects of prior rate reductions haven’t hit the economy yet, and robust export performance adds weight to arguments against cutting below neutral. Future rate decisions will be strictly data-driven. Silk also pointed to the high level of uncertainty in U.S. trade policy, noting it’s not feasible to react to every shift.

Japanese Life Insurers Cut Yen Hedges to 14-Year Low

Nine of Japan’s largest life insurers collectively lowered their currency hedges against a rising yen to 44.4% of their foreign investments as of March, down from 45.2% six months earlier, Bloomberg reports. This marks the lowest level of yen protection in 14 years, reflecting reduced expectations of a yen rebound.

Japan April Industrial Production Falls, May Forecast Soars

Japan’s industrial production in April dipped 0.9% from the prior month, less than the projected 1.4% drop. Year-over-year, output rose 0.7%, ahead of the 0.1% estimate. The forecast for May points to a sharp 9% monthly rise, followed by a projected 3.4% decline in June.

Japan Retail Sales Climb 3.3% in April, Meeting Expectations

Retail sales in Japan rose 0.5% month-over-month in April, matching forecasts and recovering from a 1.2% drop in March. Year-over-year growth came in at 3.3%, slightly above the 3.1% recorded in March and ahead of the expected 3.0%.

Tokyo Inflation Holds at 3.4% in May, Core Readings Rise

Tokyo’s consumer price index rose 3.4% year-over-year in May 2025, matching forecasts and easing slightly from April’s 3.5%. Core CPI excluding fresh food hit 3.6%, the highest since January 2023, topping the 3.5% forecast. Core-core CPI, which excludes food and energy, rose 3.3%, marking a new high since January 2024.

Japan April Unemployment Steady at 2.5%

Japan’s jobless rate held at 2.5% in April, in line with expectations. The jobs-to-applicant ratio also remained unchanged at 1.26.

BoJ Governor Ueda aware of of firm’s aggressive price, wage setting behaviour continuing

- Bank of Japan Governor Ueda

- We are aware firms’ aggressive price-, wage-setting behaviour continuing

- Board’s downgrade in inflation forecasts reflect pressure on global growth from trade policy uncertainty, slowing pace of cost-push inflation and recent sharp falls in crude oil prices

- BOJ’s financial position won’t affect its short-term rate decision, which will focus on achieving price target

Japan economy minister Akazawa: Will take appropriate actions re tariffs

- Commenting on the court case

- Will take appropriate actions while gathering necessary information when asked about US court blocking Tromp tariffs

- Mutual trust deepening between PM Ishiba and President Trump through phone talks two weeks in row

- No change in stance that tariffs, including those on auto parts, regretable.

- Aim to complement US, Japan strength in chips

- difficult to agree to a deal if US does not pay greed to drop all tariffs, including reciprocal and auto tariffs

Crypto Market Pulse

Crypto ETF Inflows End as BTC Slides Below $106K

Bitcoin broke below $106,000 on Friday, and the ten-day streak of net inflows into spot Bitcoin ETFs ended with $359 million in outflows. The pullback follows fresh trade policy jitters after a court reinstated Trump’s tariffs.

Altcoins like ETH and XRP also slid toward support, with Ethereum holding just above $2,600.

Despite the correction, BTC volatility remains relatively low. Glassnode reports that the three-month realized volatility is under 50%, much lower than previous bull markets, which saw readings between 80% and 100%. Institutional demand from ETFs and treasury strategies like Metaplanet has provided stability.

However, geopolitical concerns and macro risks may fuel continued weekend volatility, especially as markets absorb fresh inflation data.

XRP Drops to $2.17 as Inflation Eases and Tariff Fears Mount

Ripple’s XRP extended its losses to $2.17 as macro uncertainty spiked. The PCE inflation data for April showed a drop in core inflation to 2.5% from 2.7%, the lowest since early 2021, but the crypto market remained risk-off following renewed tariff concerns.

Despite a milder inflation outlook, XRP liquidations hit $30 million in the past 24 hours, with longs accounting for the bulk. Open Interest rose 11% to $4.2 billion, while trading volume surged 42% to $6.3 million, signaling increased volatility.

If bears keep control, XRP may fall below the $2.00 psychological support. Resistance remains near recent highs around $2.65.

Solana Slumps Toward $140 Support Amid Rising Bearish Pressure

Solana (SOL) dropped 7% this week, now nearing two-week lows as broader crypto weakness sets in following the reinstatement of Trump’s tariffs. At $162.72, SOL has posted three straight daily losses and is threatening a breakdown from its recent consolidation between $185 and $165.

Technical indicators are flashing warnings: the RSI has slipped to 46, showing weakening bullish momentum, while the MACD is turning down with increasing red histogram bars.

Failing to hold above $165.94—the May 17 close—could open the door to a retest of $140.32, the April 30 low. A daily close above $165 would be needed to challenge the $185 resistance zone again.

Dogecoin Tanks 9% as Tariff Tensions Rattle Crypto Market

Dogecoin plunged 9% over the past 24 hours, while Cardano (ADA) and Solana (SOL) each fell 6% amid renewed trade war fears sparked by the reactivation of Trump-era tariffs. The U.S. Court of Appeals issued a temporary stay, reversing a lower court ruling and keeping tariffs in place during the appeal process. These duties—framed by Trump as “Liberation Day” tariffs—were imposed under the 1977 International Emergency Economic Powers Act.

Bitcoin dropped below $106,000, and Ether lost its footing under $2,700. The CoinDesk 20 index slipped 4%, mirroring the widespread sell-off.

Nick Ruck of LVRG Research said Bitcoin’s decline followed both the tariff ruling and soft U.S. GDP data. “Gold surged as jobless claims rose and corporate earnings weakened,” he added, expressing optimism that BTC would bounce as investors seek stability amid turmoil.

Despite the chaos, total crypto market cap held steady around $3.42 trillion.

AI Tokens Slide as Market Digests Tariff Uncertainty

Top AI-focused cryptocurrencies—Bittensor (TAO), Near Protocol (NEAR), and Internet Computer (ICP)—are under pressure as market sentiment turns cautious in the wake of a federal appeals court decision allowing Trump’s tariffs to stay in effect.

TAO is trading near $408, just above critical $400 support. If that level fails, further downside is likely. However, TAO still sits above its 50-, 100-, and 200-day EMAs, which may offer support.

NEAR has fallen nearly 22% since peaking at $3.38, now below all major EMAs. Its bullish higher-lows trendline is at risk of breaking, with potential support at $2.00 and $1.81.

ICP also shows bearish momentum as MACD signals weakness. With AI tokens making up roughly one-third of the $29 billion AI crypto sector, a continued decline could weigh on overall sentiment.

ADA and AVAX Under Pressure After SEC Delays ETF Decisions

The SEC postponed decisions on exchange-traded funds for Cardano and Avalanche, dragging ADA and AVAX prices down by 5–8%. Both tokens are showing signs of technical weakness, with Cardano testing a key support trendline and AVAX threatening to fall below crucial levels.

The Grayscale Cardano Trust ETF decision has been pushed to July 15, while Bitwise’s 10 Crypto Index Fund is now due by July 31.

On the charts, ADA hovers around the $0.64 support zone after forming three straight red candles. A break below this trendline could lead to deeper losses, while resistance awaits at $0.84.

AVAX trades at $21.80 and risks slipping toward $19.09 if current support fails. The token mirrors ADA’s bearish structure, signaling further pain if market sentiment doesn’t shift.

The Day’s Takeaway

United States

Markets Close Mixed, But End Month Strong:

- Dow Jones gained 0.13%, while S&P 500 was flat and Nasdaq dropped 0.22%.

- All major indices posted weekly gains: Nasdaq and Russell 2000 both rose over 2%.

- Monthly performance was robust, with the Nasdaq surging 9.56% in May.

- Despite the bounce, year-to-date performance remains slightly negative across indices.

Inflation Cools, But Tariff Tensions Heat Up:

- Core PCE Price Index for April fell to 2.5% (from 2.6%), and headline inflation dropped to 2.1%.

- Fed commentary stayed cautious: officials signaled patience, with possible rate cuts if disinflation continues.

- Consumer sentiment improved to 52.2 in May (from 50.8), and inflation expectations eased.

Trade Uncertainty Back in Focus:

- A U.S. appeals court reinstated Trump’s April 2 tariffs during the appeal process.

- Trump accused China of violating trade agreements, escalating tensions.

- The market is on edge as reciprocal tariffs could be triggered after a 90-day delay expires.

Canada

GDP Grows as Exports Offset Weak Housing:

- March GDP rose 0.1%, matching estimates; April’s early estimate shows similar growth.

- Q1 GDP grew 0.5% quarter-over-quarter, or 2.2% annualized, topping forecasts.

- Strong exports and inventory accumulation led growth, while imports and weak resale activity weighed.

Commodities

Oil Slips to $60.79, Down for Week and Year:

- Crude futures settled at $60.79, down 0.25% on the day, and 1.59% for the week.

- Oil is down 15.43% year-to-date, reflecting persistent oversupply concerns.

Gold Retreats Below $3,300 Despite Soft Inflation Data:

- Gold fell to $3,289, pressured by a stronger U.S. dollar and Trump’s tariff rhetoric.

- Core PCE softening failed to lift bullion, as ETF outflows and strong GDP expectations kept bulls cautious.

- Gold open interest is near historic lows—TDS sees this as a contrarian bullish signal heading into June.

Silver Drops Below $33.00 as Dollar Rallies:

- Silver lost 1.29% on the day, trading at $32.87, poised for a 1.8% weekly loss.

- Technicals flash bearish: RSI weakening and a bearish harami pattern forming.

TDS Warns of Further Pressure on Oil and Metals:

- OPEC+ is expected to raise exports into summer; CTAs are selling crude and metals (except copper).

- Resilient demand may absorb near-term supply shocks, but the path to higher prices remains narrow.

Europe

Major Indices End May in Strong Form:

- Germany’s DAX hit a new record high this week, rising 6.71% in May.

- France’s CAC 40 dipped on Friday but gained 2.08% for the month.

- UK FTSE 100 added 3.27%, while Spain’s Ibex and Italy’s FTSE MIB rose over 6.5%, both reaching highs not seen since 2007.

Crypto

Tariff Shock Triggers Broad Sell-Off Across Cryptocurrencies:

- Dogecoin plunged 9%, while Cardano (ADA) and Solana (SOL) each fell around 6%.

- Bitcoin dropped below $106,000, and Ethereum dipped under $2,700.

- CoinDesk 20 index slid 4% as legal action revived tariff fears.

SEC ETF Delays Hit Cardano and Avalanche Hard:

- SEC postponed ETF decisions for ADA and AVAX, triggering 5–8% declines.

- Technicals show both assets clinging to support trendlines with downside risks.

Solana Struggles Below $165, Eyes $140 Support:

- SOL posted a third consecutive daily loss, with RSI and MACD indicating bearish momentum.

AI Tokens Show Weakness Amid Geopolitical Headwinds:

- Bittensor (TAO), Near Protocol (NEAR), and Internet Computer (ICP) fell sharply.

- TAO defends $400 support, while NEAR risks breaking below long-term trendline.

XRP Tumbles Despite Softer Inflation:

- XRP dropped to $2.17, with $30M in liquidations and bearish sentiment intensifying.

Bitcoin ETF Flows Turn Negative After 10 Days of Gains:

- Spot ETF outflows hit $359M on Thursday, breaking a 10-day inflow streak.

- BTC remains less volatile than in past cycles, but macro pressure is mounting.