North America News

NASDAQ Closes at Record High as Fed Cuts Rates; Powell Strikes Cautious Tone

US equities ended mixed on Tuesday after the Federal Reserve delivered a widely expected 25-basis-point rate cut but signaled no clear commitment to another move in December.

The NASDAQ Composite surged 0.55% to a record 23,958.47, lifted by gains in major technology stocks ahead of earnings from Microsoft, Alphabet, and Meta. The S&P 500 finished virtually unchanged at 6,890.66, while the Dow Jones Industrial Average slipped 74.02 points (-0.16%) to 47,632.35.

Tech outperformed as AI enthusiasm continued to drive flows into megacaps. Nvidia climbed 3.05%, AMD added 2.45%, and Broadcom rose 3.49%.

Fed Chair Jerome Powell said policymakers remain divided over whether to ease further, remarking that “a further cut in December is not a foregone conclusion — far from it.”

Microsoft Tops Q1 Estimates but Shares Fall on Guidance

Microsoft Corp (MSFT) reported stronger-than-expected fiscal Q1 2026 results, but shares fell more than 4% in after-hours trading as investors took profits following a strong run.

- EPS: $3.72 vs est. $3.67

- Revenue: $77.67B vs est. $75.55B

- Intelligent Cloud: $30.9B vs est. $30.18B

- Total Cloud Revenue: $49.1B

- Azure growth: +39% y/y (ex-FX)

Microsoft Cloud revenue rose 25%, with Azure leading the way. Productivity and business applications also posted solid gains — Microsoft 365 Commercial +15%, Dynamics 365 +16%, and LinkedIn +9%.

Operating metrics were broadly positive, with Commercial RPOs up 51% and advertising revenue up 15%. Windows and devices revenue grew 6%, while Xbox content was flat.

Despite the beat, the stock pulled back as investors focused on decelerating sequential growth and heavy capex linked to AI infrastructure buildout.

Alphabet Smashes Q3 Forecasts on Strength in Ads and Cloud

Alphabet Inc (GOOGL) delivered a strong third quarter, beating estimates across most major metrics and reporting a broad-based rebound in advertising. Shares rose 4.7% in late trading.

- EPS: $2.87 vs est. $2.26

- Revenue: $102.35B vs est. $99.85B

- Google Services: $87.05B vs est. $84.67B

- YouTube Ads: $10.26B vs est. $10.03B

- Google Cloud: $15.16B vs est. $14.75B

Operating income came in slightly below forecasts at $31.23B, while capex jumped to $23.95B amid continued AI and data-center investment.

CEO Sundar Pichai highlighted ongoing strength in subscriptions and cloud bookings, saying Google Cloud ended the quarter with a $155B backlog and over 300M paid subscriptions across Google One and YouTube Premium.

Meta Beats on Revenue, Guides Strong Q4 but Stock Slides on Tax Charge

Meta Platforms (META) reported solid Q3 2025 results, surpassing expectations on revenue and user growth, but shares dropped 7.4% after disclosing a large one-time tax charge.

- EPS: $1.05 (vs. $6.03 y/y, impacted by one-time item)

- Revenue: $51.24B vs est. $49.59B

- Operating Income: $20.54B (+18% y/y)

- Operating Margin: 40%

- Q4 Guidance: $56B–$59B (vs est. $57.4B)

Advertising revenue reached $50.08B, beating estimates, while Reality Labs losses narrowed to $4.43B.

The company recorded a non-cash income tax charge of $15.93B tied to the new “One Big Beautiful Bill Act,” which led to a valuation allowance against deferred tax assets. Excluding that item, Meta’s adjusted EPS was $7.25, above expectations.

CEO Mark Zuckerberg said AI-driven ad tools and Reels monetization continue to drive engagement across the Family of Apps, with daily active users up 8% to 3.54B.

US September Pending Home Sales Flat Despite Lower Mortgage Rates

Pending home sales: 0.0% vs +1.0% expected

Prior: 4.0% (revised to 4.2%)

US pending home sales were unchanged in September, defying expectations for a modest rise despite easing mortgage rates, according to the National Association of Realtors (NAR). The previous month’s reading was revised slightly higher to 4.2%.

The report cited growing anxiety over labor market conditions and noted that housing inventory is now at a five-year high.

Regional breakdown:

- Northeast: +3.1% MoM | +0.5% YoY

- Midwest: -3.4% MoM | -1.5% YoY

- South: +1.1% MoM | +0.9% YoY

- West: -0.2% MoM | -5.3% YoY

The stagnant reading highlights persistent challenges in housing demand even as borrowing costs begin to moderate.

U.S. Mortgage Applications Jump 7.1% on Lower Rates

U.S. mortgage applications rose 7.1% in the week ending October 24, reversing the previous week’s 0.3% decline, according to the Mortgage Bankers Association.

- Market index: 338.7 (prior 316.2)

- Purchase index: 164.3 (prior 157.3)

- Refinance index: 1327.8 (prior 1214.7)

- 30-year mortgage rate: 6.30% (down from 6.37%)

While not typically market-moving, the data suggest housing demand responded modestly to a dip in borrowing costs.

Fed Cuts 25bps; Powell Cautions Against Assuming December Move

The Federal Reserve cut its benchmark rate by 25 basis points to a range of 3.75%–4.00%, marking its sixth cut this year, but signaled growing division among policymakers about further easing.

Key decision details:

- Vote: Miran dissented for a 50 bps cut; Schmid for no change

- Balance sheet: QT to conclude Dec. 1; MBS proceeds to be reinvested into T-bills

- Inflation: “somewhat elevated” but disinflation in services continues

- Labor: job gains have slowed, but unemployment remains low

Powell stressed that another rate cut in December is “not a foregone conclusion,” emphasizing the committee’s split views:

“Some think we should pause, others believe we should go ahead. There are strongly differing views.”

He described policy as now “modestly restrictive” and “at the lower end of neutral,” adding that if the economy evolves as expected, “slower cuts may be appropriate.”

Powell also drew parallels to driving “in the fog,” suggesting the Fed will move cautiously amid limited data due to government reporting delays.

Market pricing: Fed funds futures now imply roughly 70% odds of another cut by year-end, down from nearly 90% before Powell’s remarks.

GOP Senators Break with Trump on Brazil Tariffs

Several Republican senators joined Democrats to vote against President Trump’s national emergency declaration that underpins new tariffs on Brazilian imports.

Senators Thom Tillis, Rand Paul, Susan Collins, and Lisa Murkowski supported a resolution to terminate the emergency, a rare bipartisan challenge to Trump’s trade authority.

Mitch McConnell also signaled support, marking a notable internal rebuke.

The move casts doubt on the durability of Trump’s “reciprocal tariff” framework. Although the White House has vowed a veto, the defection raises uncertainty over future trade measures and could weaken confidence in the administration’s tariff strategy.

Fed Preview: Standard Chartered Expects 25bp Cut, Powell to Stay Guarded

Standard Chartered anticipates a 25bp rate cut from the Federal Reserve at today’s meeting but expects Chair Jerome Powell to keep guidance cautious amid the government data blackout.

The bank noted that fed funds expectations remain stable around 3.85%, suggesting limited repricing ahead of the decision.

Powell is likely to stress the Fed’s commitment to assessing the economy with incomplete data.

A second 25bp cut in December remains possible, though dissent is expected from Governor Miran, who favors a 50bp move. Powell’s press conference is seen as the key driver for market reaction.

Bessent: Japan Government Giving BoJ Space to Manage Inflation, FX Volatility

U.S. Treasury Secretary Bessent said in an X post that Japan’s government is allowing the Bank of Japan sufficient policy space to anchor inflation expectations and limit excess foreign-exchange volatility.

Bessent noted she was encouraged by Finance Minister cooperation and “a deep understanding” of how Abenomics evolved from a purely reflationary strategy into one balancing growth and price stability.

BOC’s Macklem: Policy Now “Providing Some Stimulus”

Bank of Canada Governor Tiff Macklem – post-decision remarks

BOC Governor Tiff Macklem said monetary policy is now “at the lower end of neutral,” providing some support to the economy after this week’s 25 bps rate cut.

Key comments:

- “This isn’t just a cyclical downturn; part of it is structural.”

- “US protectionism is adding costs and limiting demand.”

- “There’s a wider-than-usual range of outcomes.”

- “If the outlook changes materially, we’re prepared to respond.”

Macklem emphasized that uncertainty around US tariffs continues to weigh on Canada’s growth outlook.

Canada’s Upcoming Budget to Include Accelerated Expensing

Report: National Post, ahead of Nov 4 budget

Canada’s November 4 budget—Finance Minister Mark Carney’s first—will include measures allowing companies to write off new machinery and capital investments more quickly, according to the National Post.

The move mirrors the US policy of accelerated expensing designed to spur business investment. While the approach has been credited with boosting US corporate spending, critics warn much of it has flowed into non-productive assets such as private jets.

The Canadian plan aims to strengthen investment competitiveness and stimulate business reinvestment amid slowing domestic growth.

Bank of Canada Cuts Rate 25bp, Signals “Right Level” for Policy

The Bank of Canada cut its policy rate by 25 basis points to 2.25%, as expected, citing economic weakness and subdued inflation pressures.

Governor Tiff Macklem said the decision aims to support the economy amid uncertainty over U.S. trade policy, adding that the central bank stands ready to adjust if the outlook shifts.

The statement described current policy as “about the right level.” The Canadian labour market remains soft, with excess capacity expected to narrow only gradually.

Inflation forecasts:

- 2025: 2.0% (prior 2.4%)

- 2026: 2.2% (prior 2.1%)

- 2027: 1.6%

GDP projections:

- Q3: 0.5% annualized

- Q4: 1.0%

- 2025: 1.2% (prior 1.8%)

- 2026: 1.1% (prior 1.8%)

- 2027: 1.6%

By end-2026, the BoC expects output to be roughly 1.5% lower than projected in January.

International growth outlooks:

- U.S.: 2025 2.1% (prior 2.6%), 2026 2.2%, 2027 2.1%

- Euro area: 2025 1.2% (prior 0.8%), 2026 1.0%, 2027 1.5%

- China: 2025 4.9%, 2026 4.4%, 2027 4.1%

- Global: 2025 3.2%, 2026 2.9%, 2027 3.0%

Markets had priced a 92% chance of a cut ahead of the decision and see a 72% probability of another reduction by March.

Commodities News

Crude Oil Settles Higher After Large Inventory Draw

Crude oil futures rose modestly Wednesday, supported by a larger-than-expected drop in US inventories.

WTI December futures settled $0.33 higher (+0.55%) at $60.48 per barrel after trading between $59.70 and $61.02.

EIA data showed significant drawdowns across crude, gasoline, and distillates. Still, technical resistance remains near the 100-hour moving average at $61.13, with a key upside breakout zone between $61.45–$61.94 needed to shift near-term bias to bullish.

Central Bank Gold Buying Slows Despite Higher Prices – TDS

Central bank purchases of gold have slowed sharply even as prices climb, according to TD Securities’ Daniel Ghali.

The strategist said that the “dedollarization” narrative has largely faded, with BRICS+ countries halting gold accumulation. Recent demand has instead come from smaller European central banks.

While volatility-linked CTA selling may have peaked, Ghali cautioned that new large-scale buying is unlikely at current prices.

“Everyone wants to buy the dip,” he said, “but this may not yet be a dip worth buying.”

Silver Slide Mirrors Gold as Liquidity, Not Demand, Drives Moves – TDS

The recent decline in silver prices closely mirrors gold’s weakness, suggesting liquidity dynamics—not fundamentals—are driving the move, said Daniel Ghali, Senior Commodity Strategist at TD Securities.

“Silversqueeze and Silverflood were liquidity events, not demand-driven,” Ghali noted. “We’re seeing record repletion of London inventories, with free float rising nearly 50% from October lows.”

Industrial demand remains soft, leaving speculative positioning as the main driver. While export controls could disrupt some metals, TDS sees less tariff risk for silver compared to PGMs, nickel, or cobalt.

US Crude Oil Inventories Show Sharp Drawdown

Crude: -6.858M vs -0.211M expected

Distillates: -3.362M vs -1.735M expected

Gasoline: -5.941M vs -1.903M expected

Crude oil inventories fell sharply last week, with the Energy Information Administration reporting a 6.858 million-barrel drawdown—far exceeding market forecasts.

Oil prices rose on the data, with WTI crude climbing to $60.71 before easing slightly to $60.61, up $0.45 on the day.

Technically, crude trades between its 200-hour MA ($59.34) and 100-hour MA ($61.15), finding support around $59.78–$60.10. A break below that zone would turn momentum bearish, while resistance lies between $61.45 and $61.94.

HSBC Expects Gold Rally to Peak in First Half of 2026

HSBC expects gold’s recent softness to be short-lived, forecasting that prices will extend higher into 2026, peaking in the first half of the year.

The bank cites continued safe-haven demand, widening fiscal deficits, and growing concerns about Federal Reserve independence and U.S. fiscal stability as core drivers. It also highlights sustained inflows from ETFs and institutional accounts as key supports for bullion.

HSBC expects gold to trade between $3,700 and $4,050 through the rest of 2025, with a year-end target of $3,950. For 2026, the forecast range widens to $3,600–$4,400, with prices likely surpassing $4,400 at their peak before easing to $3,800 by year-end.

While fewer Fed rate cuts could temporarily slow momentum, the bank expects broad dollar weakness to underpin gold through early 2026.

Malaysia Maintains Ban on Raw Rare Earth Exports Despite U.S. Deal

Malaysia clarified it continues to ban exports of raw rare earths, even after signing a memorandum of understanding with the U.S. during Trump’s visit.

Officials said the agreement guarantees unrestricted trade in processed rare earth compounds but does not lift restrictions on unprocessed materials.

Malaysia’s advantage lies in its processing capacity, hosting the largest facility outside China — a key leverage point in global critical-minerals negotiations.

Copper Surges to Record High on Trade Truce Hopes

London copper: $11,178/ton (all-time high)

Copper prices hit a record high in London as optimism grew over a potential US-China trade truce.

Often viewed as a bellwether for global growth, copper is also drawing support from rising demand tied to electrification, data centers, and green infrastructure.

Analysts warn that the market faces a structural supply deficit, as mine development timelines stretch beyond a decade. Governments are pushing new projects, but capacity expansion remains limited—setting the stage for persistently tight markets.

Ray Dalio Flags Bubble Risks, Calls Gold “Most Fundamental Money”

Bridgewater Associates founder Ray Dalio warned that global markets are showing clear signs of speculative excess, calling his proprietary “bubble indicator” elevated amid loose monetary policy.

Speaking at the Future Investment Initiative 2025 in Riyadh, Dalio said bubbles usually burst when central banks tighten aggressively — a risk that looks distant for now:

“Bubbles don’t pop until they’re popped by monetary tightening,” he said, noting that the economic backdrop still argues for easing.

He compared current conditions to 1998–99 and 1927–28, citing frothy valuations in tech and AI-related sectors. Dalio also warned the U.S. fiscal deficit is a “ticking time bomb” and urged investors to allocate 5–15% of portfolios to gold, which he called “the most fundamental money.”

Private Data Show Larger-Than-Expected U.S. Crude Draw

Private inventory data from the American Petroleum Institute (API) showed a larger crude draw than anticipated last week:

- Crude oil: -4.0 million barrels (expected -2.9 million)

- Gasoline: -6.3 million

- Distillates: -4.4 million

- Cushing: +1.7 million

Europe News

Spain’s Q3 GDP Growth Slows but Meets Forecasts

Spain’s economy grew 0.6% quarter-on-quarter in the third quarter, matching expectations but slowing from the 0.8% pace in Q2, according to preliminary data from INE.

On an annual basis, GDP rose 2.8%, slightly below forecasts of 3.0% and down from 3.1% previously. The figures suggest moderating momentum as domestic demand cools, though growth remains resilient compared with most euro-area peers.

UK Mortgage Approvals Rise to 65,940 in September

Bank of England data showed UK mortgage approvals climbing to 65.94k in September, above expectations for 64.00k and up from a revised 64.96k in August.

Net mortgage borrowing increased by £1.2 billion to £5.5 billion, the highest since March.

Meanwhile, net consumer credit came in at £1.49 billion (expected £1.50 billion), down slightly from £1.69 billion in August.

The annual growth rate in consumer credit edged up to 7.3%, from 7.2% previously, suggesting household borrowing remains firm despite higher rates.

Swiss Investor Sentiment Jumps to -7.7, Sharp Recovery from -46.4

Swiss investor sentiment rebounded sharply in October, with the UBS/CFA Society Switzerland index rising to -7.7 from -46.4 the previous month — one of the steepest month-to-month increases on record.

UBS said the surge ranks among the largest in the indicator’s history, trailing only the recoveries seen after the global financial crisis and during the Covid-19 pandemic.

Despite the rebound, sentiment remains weaker than levels seen before Washington’s 39% tariff announcement on Swiss exports in August.

UK Food Price Drop Fuels Talk of BoE Rate Cut

Markets are repricing the odds of a Bank of England rate cut in December after the steepest drop in UK food prices in five years.

The BRC report, rarely market-moving, gained attention after official inflation data showed headline CPI steady at 3.8%. Traders now assign about a 65% chance of a December cut, with the softer price backdrop continuing to pressure GBP.

Goldman Sachs Now Expects November BoE Rate Cut

Goldman Sachs revised its UK forecast, now predicting a 25bp Bank of England rate cut in November, reversing its earlier call for no change.

The BoE meets on Thursday, November 6.

Asia-Pacific & World News

Beijing: Trump–Xi Talks to Add “New Momentum” to Bilateral Ties

China’s Foreign Ministry said the upcoming Trump–Xi meeting will focus on issues of “strategic and long-term interest,” emphasizing Beijing’s readiness to work with Washington toward “positive outcomes.”

The ministry reiterated that China’s stance on soybean imports remains consistent, echoing its position during previous trade disputes. It also addressed the U.S. fentanyl crisis, expressing sympathy while urging the U.S. to take “concrete actions” to create conditions for deeper cooperation.

“China’s position on fentanyl is consistent and clear,” the statement said, adding that the government remains open to continuing joint efforts to address the issue.

China Buys U.S. Soybeans in Modest Gesture Ahead of Trump–Xi Meeting

China’s COFCO Group has purchased three cargoes of U.S. soybeans totaling 180,000 tons, a move seen as a limited goodwill gesture before tomorrow’s meeting between Donald Trump and President Xi Jinping.

The purchase comes after a sharp drop in Chinese imports of U.S. soybeans, which fell to zero in September, as Beijing cited high U.S. tariffs. The move mirrors tactics used in past negotiations — notably during the 2018–19 “Phase One” trade deal — when China used agricultural imports as a political signal.

Although year-to-date U.S. shipments to China are up about 15%, September data underscore Beijing’s ability to pivot quickly depending on the tone of trade talks.

China imported 12.87 million metric tons of soybeans in September, its second-highest monthly total on record. Shipments from Brazil surged 30%, accounting for 85% of imports, while Argentina’s share rose 91% to about 9%.

Beyond the reported COFCO purchases, China has not booked any additional cargoes from this autumn’s U.S. harvest, suggesting it is keeping leverage ahead of the summit.

PBOC sets USD/ CNY central rate at 7.0843 (vs. estimate at 7.0962)

- PBOC CNY reference rate setting for the trading session ahead.

- PBOC injects 557.7bn yuan at 1.40% via 7-day reverse repos

- Injects net 419.5B yuan in Open Market Operations

Australia’s CBA: RBA Likely to Keep Rates Steady at 3.6%

The Commonwealth Bank of Australia expects no further rate cuts from the Reserve Bank of Australia, projecting the cash rate will remain at 3.6% for an extended period.

Australia’s Core Inflation Surges, Undermining Case for RBA Rate Cuts

Australia’s third-quarter inflation came in stronger than expected, quashing hopes of an imminent rate cut from the Reserve Bank of Australia.

Trimmed mean CPI rose 1.0% quarter-on-quarter, above forecasts for 0.8% and the RBA’s own projection of 0.6%.

Headline CPI gained 1.3% q/q versus expectations for 1.1%, while the weighted median climbed 1.0%, matching the trimmed mean.

On an annual basis, trimmed mean inflation stood at 3.0% (expected 2.7%), headline CPI reached 3.2% (forecast 3.0%), and the weighted median registered 2.8% (expected 2.7%).

The RBA’s next meeting on November 3–4 is unlikely to deliver the 25bp cut that markets had previously priced in following softer jobs data. With inflation accelerating, analysts now expect the central bank to remain on hold through December.

RBNZ Says Financial Conditions Loosening as Rate Cuts Take Effect

The Reserve Bank of New Zealand said recent cuts to the Official Cash Rate are flowing through to the economy as intended.

Financial Markets Director Richardson said interest rates have fallen and credit conditions are “becoming more favourable,” adding that the RBNZ retains “the tools to ensure price stability” as policy transmission continues.

RBNZ Governor Stresses Importance of Central Bank Independence

Reserve Bank of New Zealand Governor Christian Hawkesby said maintaining full operational independence is “crucial” for effective monetary policy.

Speaking at the Directors and Senior Officers Workshop, Hawkesby warned that central bank autonomy is “under attack globally.”

His remarks were not policy-specific, though markets currently price roughly 92% odds of a 25bp cut at the RBNZ’s November meeting.

BofA Sees BoJ Hiking in January After Hawkish October Hold

Bank of America expects the Bank of Japan to hold policy steady at its October meeting but signal a path toward a January rate hike, citing solid wage growth and persistent inflation.

The bank projects a 25bp increase in early 2026, characterizing the upcoming meeting as a “hawkish hold.”

It expects USD/JPY to remain resilient in the near term, supported by U.S.–Japan yield differentials and political optics around the leaders’ summit.

Japan’s Top Spokesman Declines Comment on Bessent Remarks

Japan’s Chief Cabinet Secretary Kihara declined to comment on U.S. Treasury Secretary Bessent’s recent social media post about Bank of Japan policy.

Kihara said monetary policy remains under the BoJ’s jurisdiction, adding that the government will continue close coordination with the central bank to ensure inflation targets are met.

Toyota Considers Reverse Imports from U.S., Government Supportive

Toyota executive Ueda said the company is still evaluating the possibility of reverse imports from its U.S. operations, with the Japanese government taking “a positive view” of the idea.

The Camry is one potential model for such imports. Ueda added that Toyota did not commit to a new $10 billion U.S. investment, though it reaffirmed its intention to maintain job creation and capital spending in America consistent with previous efforts under Trump’s first term.

Japan’s Corporate Titans Line Up for $550 Billion U.S. Investment Push

Japanese conglomerates including SoftBank, Hitachi, Mitsubishi Electric, and Mitsubishi Heavy Industries are among firms preparing to participate in a $550 billion U.S. investment program targeting energy, AI, and critical minerals.

The initiative stems from a trade accord signed earlier this year between Washington and Tokyo. A post-summit factsheet following President Donald Trump’s meeting with Prime Minister Sanae Takaichi confirmed interest from roughly 20 Japanese and U.S. companies.

Tokyo’s commitment includes a mix of equity, loans, and guarantees from state agencies, with as much as $400 billion of that total potentially coming from Japanese projects.

South Korea’s President Warns of Rising Protectionism

South Korean President Lee said global protectionism and nationalism are intensifying, complicating trade negotiations — including ongoing tariff talks with the U.S.

Speaking ahead of the APEC CEO Summit, Lee emphasized supply-chain cooperation and said trust and collaboration among Asia-Pacific businesses have been crucial to regional prosperity.

He plans to propose an AI Initiative at the summit to strengthen economic coordination.

Crypto Market Pulse

XRP Eyes $3 Breakout as Institutional Adoption Accelerates

XRP extended its climb above $2.65, maintaining momentum ahead of the Fed’s expected rate cut.

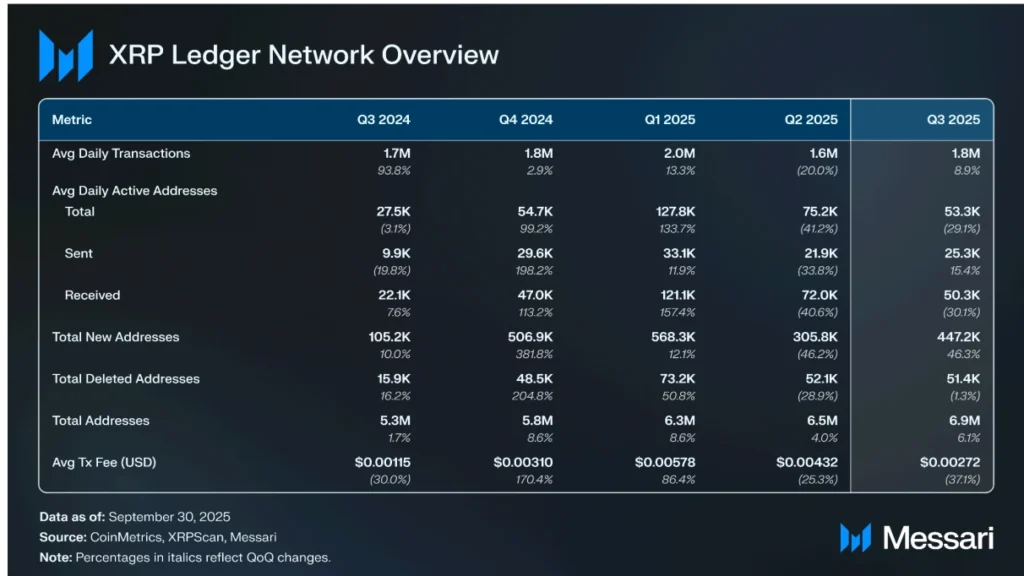

Messari’s State of XRP Ledger Q3 2025 report highlighted:

- Seven US spot ETF applications awaiting SEC approval (decision expected by Nov 18)

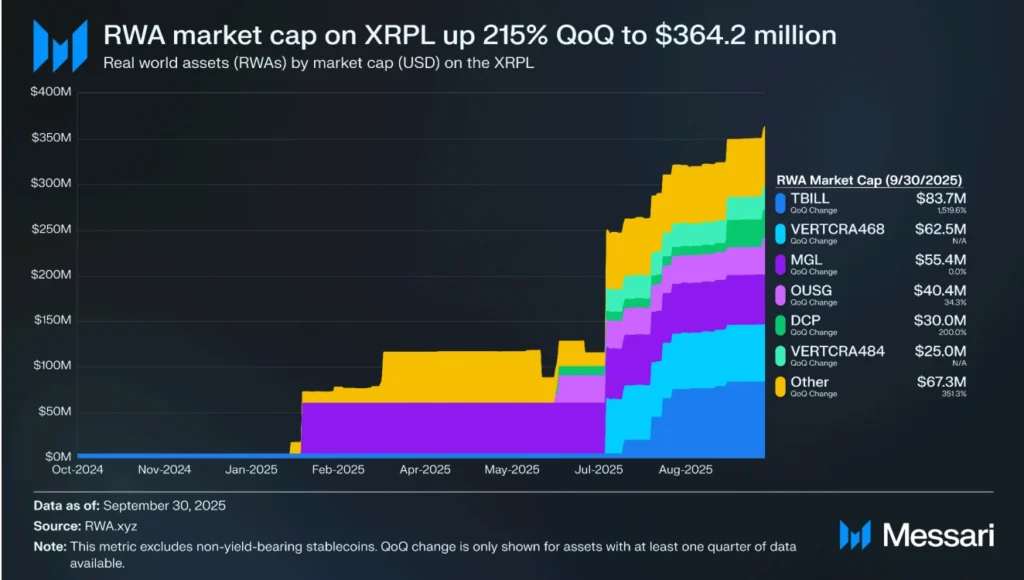

- 215% QoQ surge in XRP Ledger’s real-world asset (RWA) market cap to $364M

- 8.9% increase in daily transactions and 15.4% rise in active addresses

Following Ripple’s legal settlement with the SEC, institutional investment via Digital Asset Treasuries has increased sharply. Analysts say approval of XRP ETFs in Q4 could propel the token toward a $3 breakout.

Tether’s Tokenized Gold Surpasses $2 Billion Market Cap

Tether Gold (XAU₮) has crossed the $2 billion market value threshold, reflecting surging investor demand for tokenized real-world assets.

As of September 30, Tether held 375,572 fine troy ounces of physical gold backing 522,089 XAU₮ tokens—each representing one troy ounce.

CEO Paolo Ardoino said XAU₮’s growth “proves real-world assets can thrive on-chain.”

With gold trading above $4,000 and inflation concerns persisting, digital gold tokens are gaining favor among both institutional and retail investors as blockchain-based stores of value.

France Debates Strategic Bitcoin Reserve Bill

France’s National Assembly debated a proposal on October 28 to create a strategic Bitcoin reserve amounting to 2% of BTC supply—roughly 420,000 BTC—over 7–8 years.

The bill, sponsored by Julien Ranc of the LIOT group, includes tax incentives for energy-efficient domestic mining and frameworks for regulated stablecoin issuance.

While France aims to strengthen its position as Europe’s crypto hub, environmental opposition and political skepticism make passage unlikely. The debate, however, signals growing recognition of Bitcoin as a strategic asset.

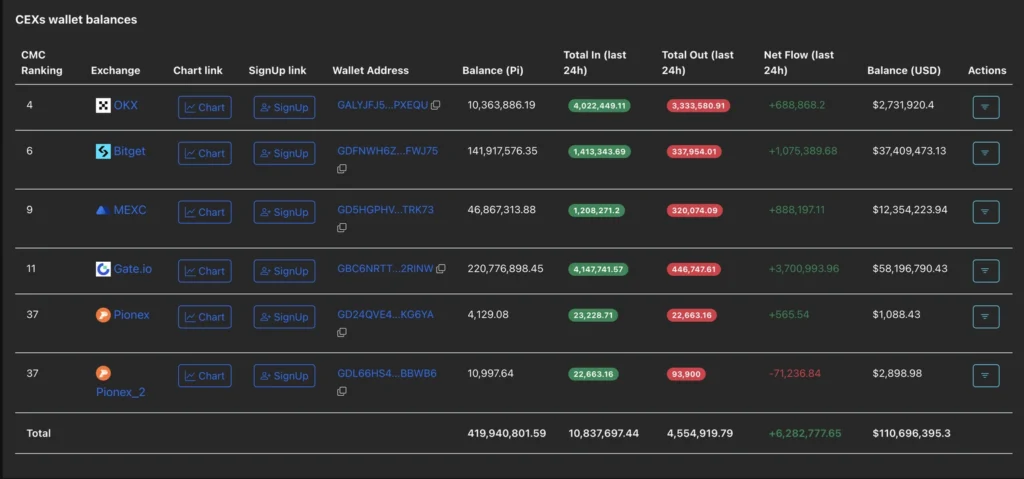

PI Token Rally Holds Despite Rising Exchange Inflows

Pi Network’s native token (PI) climbed above $0.26, reclaiming the 50-day EMA and signaling a potential breakout.

However, inflows of 6.28 million PI into centralized exchange (CEX) wallets raise concerns about possible selling pressure. Around 120 million PI tokens are set to unlock in November, potentially adding to supply risk.

Despite the bullish technical setup, rising token availability could test the sustainability of the rally.

Crypto Today: Bitcoin, Ethereum, XRP Rebound Ahead of Fed Decision

Bitcoin (BTC) rebounded above $113,000 Wednesday, while Ethereum (ETH) climbed past $4,000 and XRP traded above $2.64 as risk appetite improved ahead of the Federal Reserve’s policy decision.

Markets expect a 25 bps rate cut to a range of 3.75%–4.00%, according to the CME FedWatch tool. Lower borrowing costs could benefit risk assets, including cryptocurrencies, by making traditional safe havens less attractive.

Trump Media Launches Crypto Prediction Platform “Truth Predict”

Trump Media & Technology Group (TMTG) is expanding into crypto prediction markets with Truth Predict, a blockchain-based platform for wagering on political, economic, and sports outcomes.

Developed with an affiliate of Crypto.com Derivatives North America, the platform will rival Polymarket and Kalshi. Users can trade binary contracts such as “Will the Fed cut rates before year-end?” or “Will Barcelona win the Champions League?”

CEO Devin Nunes said the service will “democratize information” and launch in beta on Truth Social before expanding globally.

The Day’s Takeaway

North America

Fed Cuts 25bps; Powell Warns Against Assuming December Move

The Federal Reserve delivered a sixth 25bps rate cut this year, lowering the benchmark to 3.75%–4.00%, while signaling growing division within the FOMC. Chair Jerome Powell emphasized caution amid incomplete data, saying another cut in December is “not a foregone conclusion.” Futures now price a 70% chance of another move by year-end, down from nearly 90%. Balance sheet runoff will end December 1, with MBS proceeds redirected into T-bills.

NASDAQ Closes at Record High as Fed Eases

The NASDAQ Composite hit 23,958.47 (+0.55%), led by AI megacaps. The S&P 500 ended flat and the Dow slipped 0.16%. Gains in Nvidia (+3.05%), AMD (+2.45%), and Broadcom (+3.49%) offset profit-taking in other sectors.

Microsoft Beats but Guides Cautiously

Microsoft (MSFT) topped fiscal Q1 estimates (EPS $3.72, rev. $77.7B) but shares fell over 4% in after-hours trade on slower growth guidance and heavy AI-related capex. Azure grew +39% YoY, keeping cloud momentum solid.

Alphabet Smashes Q3 Forecasts

Alphabet (GOOGL) posted EPS $2.87 vs est. $2.26, revenue $102.4B, with strong ad and cloud performance. YouTube ads hit $10.26B, Google Cloud $15.16B. Shares rose 4.7% post-market.

Meta Tops Forecasts but Hit by Tax Charge

Meta (META) reported revenue $51.2B vs est. $49.6B, but a one-time $15.9B tax hit sent shares down 7.4%. Adjusted EPS was $7.25, beating forecasts. Q4 guidance: $56–59B. CEO Zuckerberg noted robust AI-driven ad growth and user engagement.

US Pending Home Sales Flat Despite Rate Relief

September pending home sales were unchanged (0.0% vs +1.0% expected), highlighting demand headwinds despite lower mortgage rates. Inventory hit a five-year high, with mixed regional trends—Northeast strong, Midwest weak.

US MBA Mortgage Applications +7.1%

Mortgage demand rebounded as 30-year rates fell to 6.30%. Purchase and refinance indices rose sharply, showing modest housing response to lower costs.

Bank of Canada Cuts 25bps, Signals Neutral Stance

The BoC lowered its rate to 2.25%, saying policy is now “about the right level.” GDP and inflation projections were trimmed, citing US trade risks. Governor Tiff Macklem later said policy is now “providing some stimulus” and warned that “US protectionism is adding costs.”

Canada’s Budget to Feature Accelerated Expensing

Ahead of the Nov. 4 budget, reports suggest new measures will let firms write off capital investments faster—mirroring US expensing rules to spur investment amid slowing growth.

Commodities

Crude Oil Rises on Major Drawdown

EIA data showed a 6.858M-barrel crude draw, far exceeding expectations, with gasoline (-5.9M) and distillates (-3.3M) also sharply lower. WTI December settled +0.55% at $60.48, supported by tight inventories but capped below technical resistance near $61.13.

Copper Hits Record High on Trade Truce Hopes

LME copper surged to $11,178/ton, an all-time high, amid optimism over a potential US–China trade truce. Structural supply deficits and electrification demand continue to drive the market.

Gold Tests Resistance at $4,037

Spot gold rose $40 to $3,994, testing the 100-hour MA near $4,037. HSBC projects a rally into H1 2026, with prices potentially peaking above $4,400 before easing to $3,800 by year-end 2026.

Silver Tracks Gold, Liquidity Drives Moves

TD Securities said silver’s weakness mirrors gold’s, driven by liquidity rather than fundamentals. Inventories in London have surged, and speculative flows dominate the trade.

Central Bank Gold Buying Slows

TDS also noted that BRICS+ gold accumulation has stalled despite high prices, with demand shifting to smaller European central banks.

Europe

Spain Q3 GDP Growth Slows

Spain’s economy expanded 0.6% QoQ, matching forecasts but down from 0.8% in Q2. Annual growth eased to 2.8%, signaling cooling momentum though resilience remains compared to peers.

Swiss Investor Confidence Rebounds

The UBS/CFA index jumped to -7.7 from -46.4, one of the sharpest recoveries on record, though sentiment remains below pre-tariff levels after the US imposed a 39% levy on Swiss exports.

UK Mortgage Approvals Rise, Rate Cut Odds Grow

UK mortgage approvals climbed to 65.94k, above expectations. Consumer credit growth held firm at 7.3%, while falling food prices stoked bets for a December BoE rate cut, with Goldman Sachs now expecting a move in November.

France Debates Strategic Bitcoin Reserve Bill

France’s National Assembly discussed creating a strategic Bitcoin reserve equal to 2% of total BTC supply (~420,000 BTC). Passage is unlikely, but the debate marks growing institutional recognition of crypto’s strategic role.

Asia

China Buys U.S. Soybeans in Modest Gesture Before Trump–Xi Summit

China’s COFCO Group purchased 180,000 tons of US soybeans—seen as a limited goodwill signal before the leaders’ meeting. September imports from the US had fallen to zero, while Brazil and Argentina dominated supply. Beijing appears to be maintaining leverage ahead of trade talks.

Beijing: Trump–Xi Talks to Add “New Momentum”

China’s Foreign Ministry said the summit will focus on “strategic and long-term interests,” reaffirming cooperation on fentanyl and soybean imports while urging Washington to create “necessary conditions for cooperation.”

BofA: BoJ to Hold, Signal January Hike

Bank of America expects the BoJ to hold policy in October but flag a January rate hike, citing strong wage gains. USD/JPY remains supported by wide yield spreads.

Japan’s Corporate Giants Plan $550B U.S. Investment Push

Major firms including SoftBank, Hitachi, and Mitsubishi are preparing a $550B US investment drive in AI, energy, and critical minerals—part of a bilateral initiative to deepen economic ties.

Australia’s Core Inflation Surges

Q3 trimmed mean CPI rose 1.0% QoQ (vs 0.8% expected), pushing annual core inflation to 3.0%. The strong reading quashes hopes for near-term RBA cuts, with markets now expecting a prolonged hold.

Australia’s CBA: RBA Likely to Stay on Hold

CBA projects the cash rate will remain at 3.6% through early 2026, citing sticky inflation despite softer employment data.

South Korea Warns of Rising Protectionism

President Lee cautioned that global protectionism threatens trade stability ahead of the APEC CEO Summit, urging renewed regional cooperation on AI and supply chains.

RBNZ: Rate Cuts Working, Independence Crucial

The Reserve Bank of New Zealand said policy easing is filtering through, loosening credit conditions. Governor Hawkesby emphasized central bank independence amid global political pressure.

Rest of World

Malaysia Maintains Ban on Raw Rare Earth Exports

Despite signing a new MoU with the US, Malaysia confirmed its ban on raw rare earth exports remains in place. Processed exports continue, maintaining Malaysia’s role as a key non-China supplier.

Crypto

Bitcoin, Ethereum, XRP Rebound Ahead of Fed Decision

Crypto markets rallied as the Fed rate cut boosted risk appetite. BTC traded above $113K, ETH above $4K, and XRP at $2.64. Lower yields are supporting digital assets.

Trump Media Launches “Truth Predict” Crypto Platform

TMTG unveiled Truth Predict, a blockchain-based prediction market for political and economic events, competing with Polymarket and Kalshi. Launches in beta on Truth Social.

Tether Gold Surpasses $2B Market Cap

XAU₮, Tether’s gold-backed token, topped $2B in value, backed by 375,572 troy ounces. CEO Paolo Ardoino said it shows how “real-world assets can thrive on-chain.”

XRP Eyes $3 as Institutional Demand Surges

Following Ripple’s SEC settlement, institutional investment and on-chain activity have soared. With seven US spot ETF filings pending, analysts see potential for a $3 breakout.

PI Token Rally Faces Supply Risks

Pi Network’s PI token rose above $0.26, reclaiming its 50-day EMA, but 6.28M tokens moved to exchanges, raising caution ahead of November unlocks.