North America News

Tech Powers Market Gains as Nvidia, Dell, and Costco Post Strong Numbers

U.S. stocks finished Thursday on a strong note, lifted by big moves in the tech sector and upbeat earnings results. The Dow Jones rose 117 points to 42,215.73 (+0.28%), while the S&P 500 gained 0.40% to finish at 5,912.17. The Nasdaq Composite added 0.39%, ending the day at 19,175.87.

Nvidia Extends Rally on AI Growth

Nvidia (NVDA) climbed 3.24% to $139.18, building on its strong earnings report from the previous session. The company posted a 69% year-over-year sales jump, powered by explosive demand in AI hardware, particularly its data center segment.

Salesforce Drops on Tepid Outlook

While Salesforce (CRM) beat expectations on Q1 results, its forward guidance disappointed. The stock slid 3.30% to $266.92, as cautious commentary from executives sparked concern about growth in the second half of the year.

Other key movers:

- Meta (META) up 0.23%

- Microsoft (MSFT) added 0.29%

- Amazon (AMZN) rose 0.48%

Marvell Beats, Dell Surges, Costco Delivers

$MRVL | Marvell Technology Q1 2025

- Revenue: $1.90B (est. $1.88B)

- EPS (Adj.): $0.62 (est. $0.61)

- Q2 Guidance: Revenue ~$2B ±5%; EPS $0.62–$0.72

$DELL | Dell Technologies Q1 2025

- Revenue: $23.38B (beat est. $23.15B)

- EPS (Adj.): $1.55 (missed est. $1.69)

- AI Server Orders: $12.1B (vs. est. $7.88B)

- Q2 Guidance: Revenue $28.5B–$29.5B (vs. est. $25.35B)

- FY EPS Outlook: $9.40 (up from $9.30)

Dell missed on earnings but crushed expectations on revenue, driven by record-breaking AI server demand. The company now has a $14.4 billion AI server backlog and raised its full-year guidance. Shares rallied 5% in after-hours trading.

$COST | Costco Q3 2025

- EPS: $4.28 (est. $4.24)

- Revenue: $63.21B (slightly below est. $63.31B)

- Same-Store Sales (ex-gas, FX): +8% (beat est. +6.99%)

Costco continues to post strong performance, buoyed by steady consumer demand. Same-store sales came in ahead of expectations, despite broader concerns about consumer spending.

US Treasury Sees Strong Demand in 7-Year Note Auction

The U.S. Treasury auctioned off $44 billion in 7-year notes on Wednesday, drawing notable interest. The high yield came in at 4.194%, pricing 2.2 basis points below the when-issued (WI) level of 4.216%, signaling robust demand.

Auction stats:

- Bid-to-cover ratio: 2.69x vs. 6-month average of 2.64x

- Direct bidders: 23.64% (above 21.4% avg)

- Indirect bidders: 71.52% (vs. 67.6% avg)

- Dealers: 4.85%, far below the 11.0% norm

The low dealer take and a sizable tail through WI confirm widespread appetite from both domestic and foreign investors.

U.S. Pending Home Sales Collapse in April

Pending home sales plunged 6.3% in April, far below the -1.0% estimate, as higher mortgage rates bit into buyer demand.

- Pending Sales Index: 71.3 (down from 76.1 revised)

- Year-over-Year: -2.5%

- Regional breakdown:

- Northeast: -0.6%

- Midwest: -5.0%

- South: -7.7%

- West: -8.9%

With the 30-year fixed mortgage rate hovering around 6.98%, affordability remains a major hurdle.

NAR Chief Economist Lawrence Yun:

“At this critical stage of the housing market, it is all about mortgage rates. Despite an increase in housing inventory, we are not seeing higher home sales. Lower mortgage rates are essential to bring home buyers back into the housing market.”

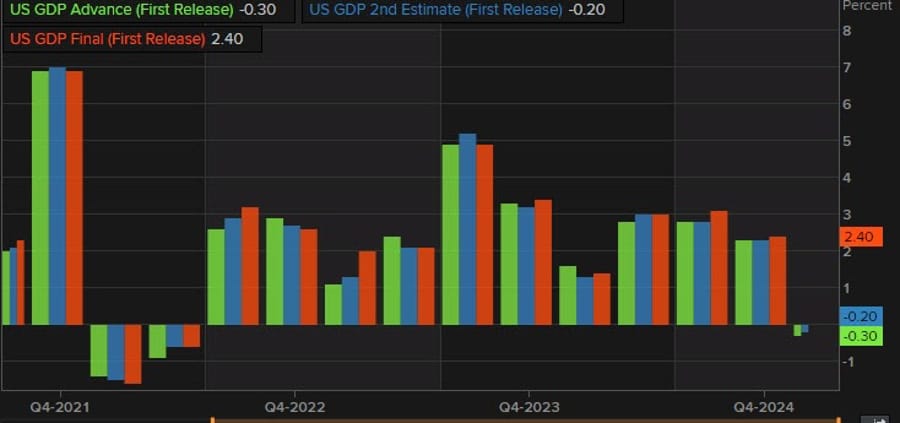

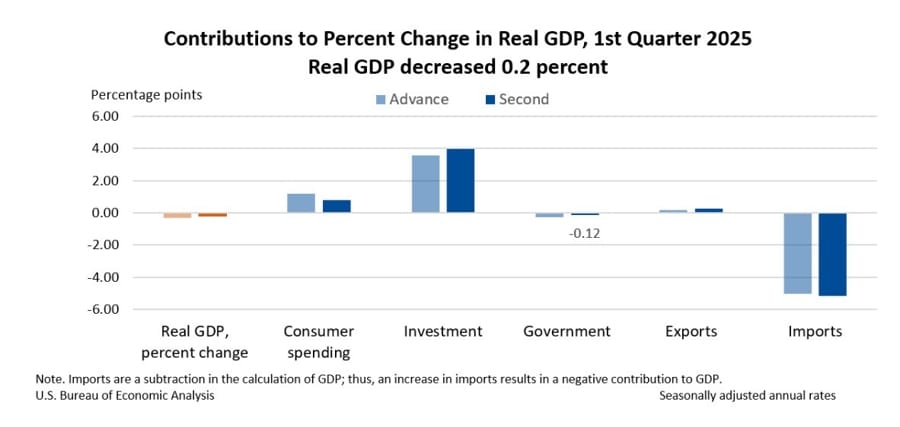

U.S. Q1 GDP Revised to -0.2%, Consumer Spending Weaker Than Thought

The second estimate for Q1 U.S. GDP came in at -0.2%, a modest upward revision from the initial -0.3% figure. The GDP deflator held at 3.7%, while core PCE inflation was revised to 3.4%.

Breakdown:

- Consumer Spending: +1.2% (vs. 1.8% prior est.)

- Business Investment: +9.8%, led by a 69.3% spike in IT equipment

- Net Trade: Subtracted 4.8 points due to import surge

- Inventories: Added 2.3 points to GDP

- Exports: +1.8%

Despite strong business investment, overall growth was dragged down by weak government spending and a flood of imports.

U.S. Jobless Claims Rise Slightly, Still Reflect Stable Market

U.S. initial jobless claims came in at 240,000 last week, slightly above the 230,000 expected. Continuing claims hit 1.919 million, also higher than forecast.

The prior week’s numbers were revised slightly:

- Initial: Down to 226K from 227K

- Continuing: Down to 1.893M from 1.903M

Although the continuing claims number aligns with the Non-Farm Payrolls (NFP) survey week, analysts say it’s not enough to signal a breakdown in the labor market. However, it could lead to a mild uptick in the unemployment rate for May.

Appeals Court Reinstates Trump Tariffs—For Now

A federal appeals court has temporarily reinstated the bulk of President Donald Trump’s “Liberation Day” tariffs, putting a lower court’s ruling on hold. The U.S. Court of Appeals for the Federal Circuit granted the Trump administration’s emergency motion late Thursday, issuing a stay that halts the previous decision from the Court of International Trade.

The move comes just one day after the lower court ruled that the tariffs overstepped presidential authority under the International Emergency Economic Powers Act. Trump’s legal team warned they would seek fast-track emergency relief from the Supreme Court if the stay wasn’t granted.

The appeals court stated the prior ruling is “temporarily stayed until further notice,” as it reviews the administration’s filings. This pause gives the White House a temporary win as it continues to fight to keep the trade measures alive.

For the full details, you can read the article here.

Goolsbee: Tariff Clarity Could Open Door to Lower Rates

Chicago Fed President Austan Goolsbee said that avoiding tariffs—whether via legal action or negotiation—could allow the Fed to lower rates sooner. He warned that central banks often must make tough calls when politics drive economic policy.

While not labeling current conditions as stagflation, Goolsbee said the court ruling on Trump’s tariffs introduces further uncertainty that could weigh on growth.

Powell Meets with Trump, Stresses Policy Independence

Fed Chair Jerome Powell met with President Trump at the White House to discuss the economy but did not offer any signals on future interest rate moves. According to the Fed’s statement, Powell reiterated that policy decisions would be guided solely by economic data and objective analysis, not politics.

He emphasized the Fed’s legal mandate to ensure stable prices and full employment, reiterating the central bank’s independence.

Hassett: White House Confident Tariff Ruling Will Be Overturned

Top Trump economic adviser Kevin Hassett said the administration fully expects to win its appeal after a federal court blocked the so-called “Liberation Day” tariffs.

According to Hassett, the administration has “multiple tools” to implement trade measures and doesn’t see the court’s decision impacting current or future negotiations. He also claimed that three major trade deals are effectively finalized and just await Trump’s sign-off.

The White House appears poised to fast-track the appeal—and if that fails, is expected to escalate the matter to the Supreme Court.

Trump’s “Liberation Day” Tariffs Blocked by Federal Court

A U.S. federal court has put the brakes on former President Trump’s planned “Liberation Day” tariffs. The ruling blocks both the proposed 10% base tariffs and the additional retaliatory duties.

The court challenged the administration’s justification under the International Emergency Economic Powers Act of 1977, asserting that trade deficits do not meet the legal threshold of a “unusual and extraordinary threat.”

Despite the setback, the Trump administration has already filed an appeal, signaling that the tariff battle is far from over.

Musk Quietly Exits Trump Admin Role Amid Policy Rift

The White House confirmed Elon Musk’s departure from his advisory role in the Trump administration. Officials said the “off-boarding” process began Tuesday night.

Sources say Musk left abruptly, without a formal conversation with Trump. His exit comes just one day after criticizing Trump’s tax plan, calling it overly expensive and a threat to his crypto advocacy—particularly related to DOGE.

The move follows shareholder calls for Musk to refocus on Tesla, where his absence has been increasingly felt.

Canada PM Carney: U.S. Tariffs Still Hurting Canadian Industry

Canadian Prime Minister Mark Carney criticized ongoing U.S. tariffs on Canadian steel and autos, calling them unjustified. Though not elaborating on retaliatory steps, Carney’s remarks show rising cross-border trade tension, especially as Trump intensifies his protectionist push.

Commodities News

Gold Breaks Above $3,300 After Weak U.S. Jobs Report and Tariff Ruling

Gold prices surged Thursday, pushing past $3,300 as disappointing U.S. jobless claims and a confirmed GDP contraction reinforced expectations of policy easing from the Federal Reserve. The precious metal gained 0.94%, rising from session lows near $3,245 to trade at $3,318 by the close.

Weak Labor Data Boosts Rate Cut Bets

The latest figures from the U.S. Department of Labor showed jobless claims climbed above estimates, signaling rising pressure on the labor market. Combined with Q1 GDP data confirming an economic contraction, traders ramped up bets that the Fed may have to cut rates sooner to contain economic headwinds.

The U.S. Dollar weakened sharply in response, with the DXY (U.S. Dollar Index) plunging 0.50% to 99.32, down from its earlier high of 100.54. The weaker Greenback helped fuel a safe-haven bid into gold.

Trump Tariff Ruling Adds Fuel to Market Momentum

Gold also found support from a late-Wednesday court decision that overturned most of President Trump’s “Liberation Day” tariffs. A federal panel ruled that the administration had improperly applied the 1977 International Emergency Economic Powers Act, voiding tariffs on countries including Mexico, Canada, and China.

The news sent equities higher and weakened the U.S. Dollar further, as traders anticipated a broader loosening of trade tensions. However, tariffs on steel, aluminum, and autos were not affected by the ruling. The Trump administration has already appealed.

What’s Next: Inflation Watch

Investors now turn their attention to Friday’s release of the Fed’s preferred inflation metric — the Core PCE Price Index. If it shows further signs of easing, it could solidify expectations for a Fed rate cut in the coming months, providing additional tailwinds for bullion.

U.S. Crude Settles Lower Despite Bullish Stockpile Data

U.S. crude futures ended the session down $0.90 at $60.94, a 1.46% drop on the day. The session high hit $63.04, while the low reached $60.57.

Despite the drawdown in inventories, traders pushed prices below key technical levels, including the 100- and 200-hour moving averages, adding pressure to the market.

EIA Reports Unexpected Draws in Crude, Gasoline, and Distillates

The latest U.S. Energy Information Administration (EIA) data revealed a surprise drop in energy stockpiles:

- Crude: -2.795M barrels (vs. +0.118M expected)

- Gasoline: -2.441M (vs. -0.527M est.)

- Distillates: -0.724M (vs. +0.481M est.)

- Cushing: +0.075M (vs. -0.457M est.)

Despite the bullish inventory data, crude prices slid, falling $0.69 to $61.16. The decline saw prices dip below both the 100- and 200-hour moving averages on the hourly chart.

LME Copper Inventories Plunge to Lowest Level Since 2023

Copper inventories at the London Metal Exchange dropped to 83,000 tonnes, their lowest since August 2023. Bloomberg reports Glencore has been behind recent withdrawals from Rotterdam warehouses, reportedly preparing shipments of Russian-origin copper to China.

ING notes that Shanghai Futures Exchange copper stocks are also at a multi-year low.

Market context:

- Trump’s tariff probe on copper is tightening U.S. supply, pulling global metal flows elsewhere

- Prices have been volatile due to both tariffs and China demand uncertainty

- COTR data:

- Net longs in copper fell 765 lots last week

- Aluminium net longs dropped by 2,957 lots

- Zinc net longs rose by 1,112 lots to the highest since mid-April

Oil Prices Climb on Russian Sanction Risk, Weak Iran Outlook

Crude oil futures rallied as geopolitical concerns returned to the forefront. Traders reacted to increasing sanction threats against Russia and fading hopes of a nuclear deal with Iran that might ease oil sanctions.

Trump’s blocked tariffs also lifted sentiment, while traders eye this weekend’s OPEC+ meeting, where a 411K b/d increase in July production is widely anticipated. OPEC+ has already extended group quotas through 2026.

Meanwhile, speculators increased net long exposure to the TTF gas benchmark by 16.5TWh last week, driven by Norwegian supply issues.

Gold Set for a Push Higher as CTAs Load Up – TDS

Quant funds and CTA traders are gearing up for heavy gold buying regardless of macro scenarios, according to TDS strategist Daniel Ghali. Algos could drive up to 30% of their maximum allocation in the coming week, particularly leading into the NFP report.

TDS also sees silver gaining steam on improving technicals and trend signals. Central banks and ETFs remain net buyers, offsetting any potential outflows from retail holders.

Private Oil Inventory Survey Shows Surprise Crude Draw

The American Petroleum Institute’s latest inventory report showed a crude oil draw of 4.236 million barrels, defying expectations for a 1 million barrel build.

Other highlights:

- Gasoline: -528,000 barrels

- Distillates: +1.295 million barrels

- Cushing Hub: -342,000 barrels

The data comes ahead of the official EIA report and could impact near-term price direction for oil futures.

Europe News

ECB Rate Cut Expected on June 5: Reuters Poll

A Reuters survey of 81 economists forecasts a rate cut from the European Central Bank next week, with all respondents expecting the deposit rate to be lowered to 2.00%.

Key findings:

- June 5: Unanimous expectation for a 25bp cut

- July: 71% see a pause

- Next Cut: At least one more expected before year-end

- Eurozone Growth Outlook:

- 2025: 0.9% (prev. 0.8%)

- 2026: 1.1% (prev. 1.2%)

Germany Eyes 10% Digital Tax on Global Tech Firms

Germany may be preparing to impose a 10% digital levy on international tech giants, including Google and Meta, according to a report by the Financial Times. Chancellor Merz’s coalition has already signed off on evaluating the policy in a treaty inked in early May.

Revenue from the potential tax is expected to fund the development of Germany’s media sector.

European Markets Quiet as Ascension Day Holiday Shuts Major Exchanges

Trading volume across Europe was thin on Thursday as several markets remained closed in observance of Ascension Day. France, Germany, and Switzerland were among those on holiday, though Germany’s Xetra and Frankfurt Stock Exchange remained open.

Euronext, one of the largest exchange operators in the region, was fully closed for the day. With fewer participants, market activity was subdued and largely directionless.

BOE Bailey: Merit in seeking to increase the openness of our financial markets

- BOE Bailey speaking

- There is merit in seeking to increase the openness of our financial markets by reducing non-tariff barriers.

- Our jobs as central bankers are much harder if we place more inflexible and uncertain supply-side conditions in our economies

- Hope to see cooperation between Britain and EU central banks can continue as seek to build more resume leads into money market funds

- Evidence on Brexit suggest it has rained on the level of potential UK supply

ECB’s Kazimir Found Guilty of Corruption—Again

Peter Kazimir, the head of Slovakia’s central bank and a policymaker at the European Central Bank, has been found guilty in a corruption case tied to his time as finance minister (2012–2019).

According to the ruling, Kazimir delivered a €48,000 bribe to the tax authority to sway an investigation. Initially fined €100,000 in 2023, the penalty has now been doubled to €200,000 after his appeal was rejected.

Kazimir remains in his role for now. His term ends on June 1, and if a replacement isn’t confirmed in time, he will continue in the post until a successor is selected.

German government to spend 110 bn EUR to boost the nation’s economy

- Germany’s Vice Chancellor and Finance Minister Lars Klingbeil announced an almost a 50% increase vs the previous year:

- to invest 110B euros in 2025

- intent is to revive the country’s sluggish economy

- planned measures are proposals to lower energy prices for industrial companies and the introduction of special tax depreciation options for firms that invest in Germany

- Klingbeil : “We have to turn the mood around now”

Asia-Pacific & World News

China Says Communication with U.S. Continues Post-Geneva Talks

China’s Ministry of Commerce confirmed ongoing engagement with the U.S. at multiple levels, despite recent flare-ups in trade tensions. Officials say both sides have remained in contact through multilateral and bilateral meetings.

Beijing continues to object to U.S. export restrictions, especially in the semiconductor sector, and is also pushing back against the EU’s anti-dumping probe into Chinese tire exports.

The ministry emphasized that China would “vigorously defend” its economic interests and welcomed the recent U.S. court ruling that blocked Trump’s reciprocal tariffs—though it noted other non-tariff restrictions remain in play.

U.S. Blocks More Tech Exports to China: Jet Engines and Chip Software

The U.S. government has paused the export of advanced jet engine technologies and chip design software to China, according to a New York Times report.

This adds to a growing list of tech-related restrictions aimed at limiting China’s access to critical components in aerospace and semiconductors. The move underscores intensifying tech decoupling efforts.

U.S. to Begin Revoking Visas of Chinese Students in Sensitive Fields

Secretary of State Marco Rubio announced the U.S. will begin revoking visas held by Chinese nationals tied to the Chinese Communist Party or studying in strategic disciplines.

The government will also update screening processes for new applicants from mainland China and Hong Kong. The effort is part of a broader national security review aimed at curbing technology transfers through academic channels.

Nvidia’s Revenue Soars Despite $2.5B China Roadblock

The Wall Street Journal reports that Nvidia continues to thrive—even as export rules keep it from shipping $2.5 billion worth of chips to China. The chipmaker posted $44.06 billion in revenue for its latest quarter, up 69% year-over-year and ahead of expectations.

The company’s data center division led the charge with $39.1 billion in revenue, just under analysts’ projections. Even locked out of the Chinese AI chip market, Nvidia’s top-line performance remains robust, demonstrating the firm’s dominance in the AI hardware space.

Huang: China AI Players Catching Up, Huawei ‘Formidable’

Nvidia CEO Jensen Huang says U.S. export controls have backfired, giving Chinese competitors a push forward. Speaking this week, Huang warned that firms like Huawei have grown “formidable,” with its latest chip now on par with Nvidia’s H200.

Nvidia faces an estimated $8 billion hit to China-related revenue this quarter. Huang also questioned the effectiveness of the export restrictions, noting Chinese firms are increasingly sourcing advanced chips domestically. “You can’t ignore the scale and talent in China,” he said.

Russia says there are currently no plans for Putin to speak to Trump

- Remarks by the Kremlin

- We have proposed talks with Ukraine in Istanbul on 2 June

- But yet to have an answer from Kyiv

- Not constructive to claim that Russia is delaying the process

- The main thing right now is to continue direct talks with each other

PBOC sets USD/ CNY reference rate for today at 7.1907 (vs. estimate at 7.2033)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 266bn yuan via 7-day reverse repos at 1.40%

- 154.5bn yuan matured today

- net injection 111.5bn yuan

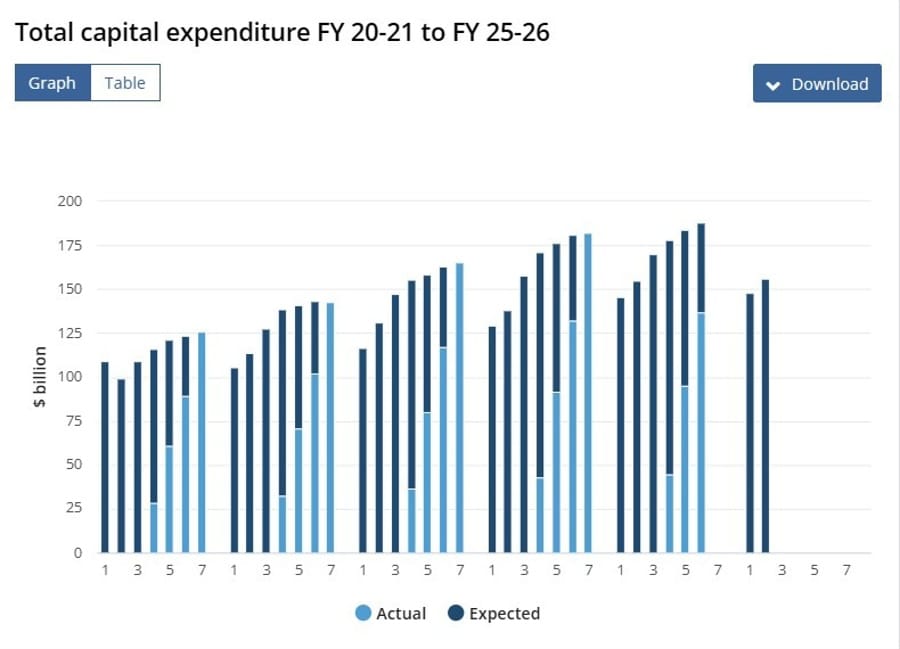

Australia’s Q1 Capex Data Misses Across the Board

Australia’s private capital expenditure report for Q1 2025 came in weaker than forecast, with total capex down 0.1% quarter-on-quarter, missing the expected +0.5%.

Breakdown:

- Building Capex: +0.9% q/q (prior +0.2%)

- Plant/Machinery Capex: -1.3% q/q (prior -0.8%)

Future projections are more optimistic:

- 2025–26 Estimate #2: $155.9B (up from $148B)

- 2024–25 Estimate #6: $187.6B (up from $183.4B)

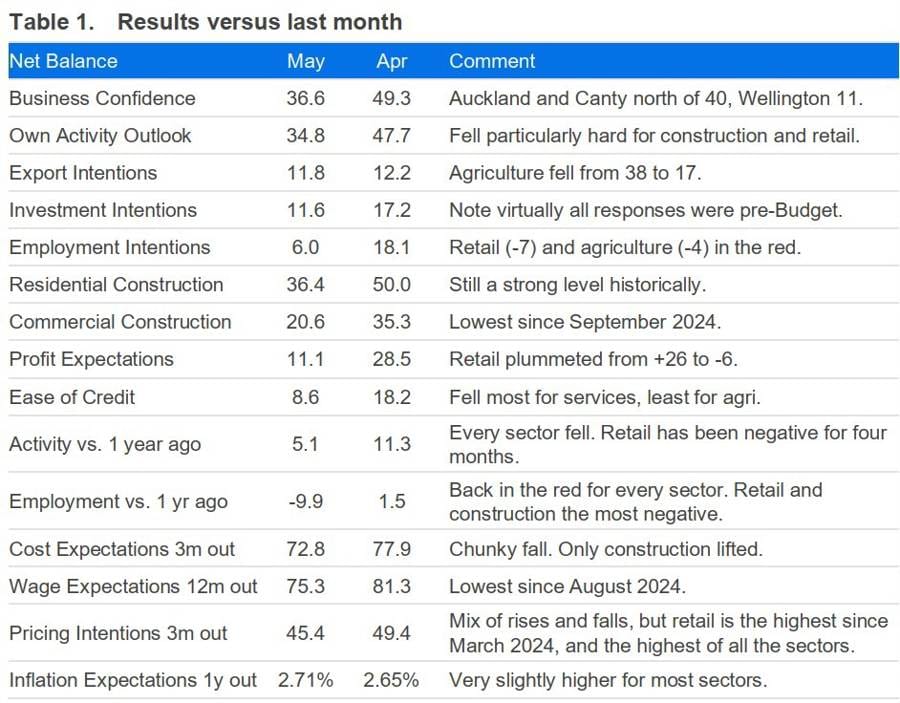

New Zealand Business Confidence Drops Sharply in May

ANZ’s May 2025 business survey shows a clear dip in sentiment. Business confidence fell to 36.6 (from 49.3), while the activity outlook dropped to 34.8 (from 47.7).

The data suggests a cooling outlook:

- Past activity dropped to 5 (from 11)

- Employment expectations turned negative at -10

- Inflation expectations edged up slightly from 2.65% to 2.71%

ANZ noted that later survey responses were more upbeat than early ones, hinting at a possible rebound.

Wells Fargo: RBNZ to Ease at Slower Pace Moving Forward

Wells Fargo analysts now expect the Reserve Bank of New Zealand to take a more gradual approach to further easing. The RBNZ’s latest 25bp rate cut brought the OCR to 3.25%.

Wells Fargo projects future cuts in August and November, which would lower the OCR to 2.75% by year-end. The note cited waning inflation pressure and tentative signs of growth stabilization as reasons for the more measured outlook.

RBNZ’s Hawkesby Flags Weaker Growth, Rising Uncertainty

Appearing before New Zealand’s parliament, RBNZ Governor Christian Hawkesby warned of weakening growth and softer inflation compared to earlier projections. He said there’s still wide uncertainty about the impact of tariffs and global developments.

Chief Economist Paul Conway echoed concerns over medium-term productivity. Assistant Governor Silk predicted a modest house price rise due to easing rates and cited China’s weak domestic demand as a rising external risk.

Japan finance minister says agreed with Bessent that exchange rate should be set by market

- Remarks by Japan finance minister, Katsunobu Kato

- No talk of exchange rate target with Bessent

- G7 finance ministers saw positive signs in tariff talks

Japan Economic Minister Akazawa: Our basic position is to strongly request review of tariff policy

- Japan economy minister Akazawa:

- National security and trade policies are different matters, cannot be negotiated as one

- Our basic position is to strongly request review of tariff policy

- Will continue demanding US to reconsider tariff measures

- Want to meet with Bessent this time

- Will conduct ministerial talks on trade expansion, economic security cooperation

- Aware of US court decision to block Trump tariffs

- Will examine the details and potential impact on Japan

Bank of Korea Delivers Expected 25bp Rate Cut

The Bank of Korea trimmed its base rate by 25 basis points to 2.5%, aligning with forecasts. It marks the central bank’s latest move amid muted inflation and sluggish growth.

Updated forecasts:

- 2025 Inflation: 1.9%

- 2025 GDP Growth: 0.8%

- 2026 Inflation: 1.8%

- 2026 GDP Growth: 1.6%

The central bank signaled it would monitor conditions before committing to further easing.

Crypto Market Pulse

Bitcoin Flatlines While Ethereum Breaks Out to Multi-Month High

Bitcoin (BTC) prices continue to tread water despite high-profile support and major corporate announcements. Trading near $107,100, BTC remains within 5% of its all-time high, but the lack of upward movement has left bulls underwhelmed.

Ethereum Surges to $2,788 Before Retracing

Ethereum (ETH), meanwhile, is stealing the spotlight. It climbed to $2,788—a three-month high—before pulling back to around $2,640. Analysts attribute the ETH rally to capital rotation from Bitcoin into Layer 1 alternatives and AI-linked tokens.

The ETH/BTC pair gained 6%, confirming a market pivot that typically precedes stronger altcoin performance.

Traders Shift Focus to ETH

The long/short ratio for Ethereum derivatives is now over 1.0, meaning more traders are betting long than short. On-chain data shows whales have accumulated 1.4 million ETH since April, reducing available supply on exchanges and reinforcing bullish pressure.

Analysts point to the $3,000–$3,400 range as a near-term upside target, citing strong technical momentum, institutional interest, and reduced exchange liquidity.

BTC Faces Resistance Despite Macro Support

Bitcoin failed to impress at the Bitcoin Conference 2025 in Las Vegas, where it received backing from figures like VP JD Vance and Arthur Hayes. While RSI stands at 62—suggesting room to run—MACD is flashing bearish divergence, with red histogram bars on the daily chart.

The key support to watch remains $102,314, aligning with the upper end of a Fair Value Gap (FVG) on the BTC/USDT chart. Unless BTC breaks out, traders may continue reallocating toward ETH and other promising sectors like DeFi, L2s, and AI tokens.

Solana Holds Firm as Institutions Dive into Liquid Staking and Ecosystem Investment

Solana (SOL) is holding its footing near $172, trading within an upward channel and keeping $170 as a key support level. Institutional confidence is clearly growing, with two major announcements adding to the ecosystem’s credibility and treasury strength.

DeFi Dev Corp Leverages Liquid Staking for Treasury Growth

DeFi Development Corp announced it will begin using liquid staking tokens (LSTs) to enhance its SOL reserves. Through dfdvSOL, a staked asset tied to its validators, the firm aims to generate rewards without locking up liquidity—providing operational flexibility while boosting validator exposure.

CIO Parker White emphasized this move aligns with their long-term Solana strategy, saying it helps “drive stake to our validators and increase SOL holdings.”

SOL Strategies Plans to Raise $1B for Infrastructure

In another bullish signal, Canadian public company SOL Strategies filed a preliminary prospectus to raise $1 billion over two years. The capital will go toward Solana-based infrastructure development and investment across the ecosystem. While specific funding rounds or dates haven’t been confirmed, the filing with Canadian Securities Administrators reflects growing institutional appetite.

Despite the SEC’s delay of the SOL ETF decision to October, these moves reinforce the growing momentum behind Solana in the public markets.

XRP Targets 14% Surge Ahead of SEC Crypto Task Force Roundtable

XRP hovered around $2.28 on Thursday, posting modest gains as traders digested a favorable court ruling on Trump’s tariffs and looked ahead to regulatory updates from the SEC.

SEC Prepares for DeFi Roundtable on June 9

The SEC’s Crypto Task Force will host a roundtable titled “DeFi and the American Spirit” at its Washington headquarters, aimed at charting a regulatory path for decentralized finance.

The event will feature nine panelists, including:

- Rebecca Rettig (Jito Labs)

- Jill Gunter (Espresso Systems)

- Omid Malekan (Columbia Business School)

- Peter Van Valkenburgh (Coin Center)

Commissioner Hester Peirce framed the event as an opportunity to “build a space where DeFi can flourish.”

XRP Derivatives Show Mixed Signals

While spot price action is mildly bullish, XRP futures tell a more cautious story. Open interest dropped to $4.8 billion, driven by a spike in long liquidations—indicating traders may be pulling back from leveraged bullish bets ahead of the roundtable.

Still, with macro sentiment improving and regulatory discussions heating up, XRP bulls are eyeing a possible 14% breakout, targeting resistance levels near $2.60 if momentum returns.

NYC to Launch Bitcoin-Backed Bonds, Reform Crypto Rules

New York City is launching a first-of-its-kind Bitcoin-backed municipal bond dubbed “BitBond,” part of a major push to position itself as a crypto innovation hub. The move was announced by Mayor Eric Adams at the Bitcoin 2025 event in Las Vegas.

Key initiatives:

- Eliminate the restrictive BitLicense

- Launch an advisory Digital Assets Council

- Use blockchain for public services like birth certificates and tax payments

NYC is also engaged in the Transatlantic Regulatory Exchange (TRE) program with the Bank of England to align on global digital asset oversight.

Top AI Tokens Set for Breakout: NEAR, FET, ICP in Focus

AI-related cryptocurrencies are flashing bullish signals, with market capitalization climbing from $32.46B to $38.08B in May.

NEAR:

- Trading at $2.94

- Forming inverse Head and Shoulders pattern

- Next key resistance: $3.50

- TVL surged from $124M to $173M

- MACD near bullish crossover

FET:

- Trading at $0.91

- Up 62% in April and 21% so far in May

- Support trendline in place

- Faces resistance at $1.04–$1.22 zone

- Fib retracement target: $1.25

Bullish momentum in the AI sector could soon rotate capital into these names.

Santander Eyes Stablecoin Launch, Expands Crypto Services via Openbank

Spain’s largest bank, Santander, is planning to expand into digital assets through its digital arm, Openbank, which has applied for crypto service licenses under the EU’s new MiCA rules.

Plans include:

- Issuing stablecoins pegged to USD and EUR

- Providing retail crypto access across Europe

- Launching in markets like Portugal, Germany, and the Netherlands

Stablecoins are booming, now with a market cap over $250 billion. Santander’s move aligns with the U.S. GENIUS Act and comes as other major banks explore similar initiatives.

The Day’s Takeaway

United States

- Tech-Fueled Market Rally

All three major indices closed higher:- Dow Jones: +117 pts to 42,215.73

- S&P 500: +0.40% to 5,912.17

- Nasdaq: +0.39% to 19,175.87

Nvidia led gains with a +3.24% rise on strong AI momentum. Salesforce fell -3.30% on cautious forward guidance. Dell and Marvell posted solid earnings.

- Trump Tariffs Temporarily Reinstated

A federal appeals court granted the Trump administration a temporary stay, pausing a lower-court ruling that struck down most of the “Liberation Day” tariffs. The administration is prepared to seek emergency relief from the Supreme Court if necessary. - Jobless Claims and GDP Disappoint

Initial jobless claims rose to 240K vs. 230K expected. GDP for Q1 was revised slightly higher to -0.2% from -0.3%, but still confirmed a contraction. Consumer spending was weaker than initially reported. - Pending Home Sales Drop Sharply

April pending home sales fell -6.3% vs. -1.0% expected, with declines seen across all regions. Higher mortgage rates near 6.98% are cooling buyer activity.

Canada

- PM Carney Criticizes U.S. Tariffs

Canadian Prime Minister Mark Carney called current U.S. tariffs on Canadian steel and autos “unjustified,” adding a new flashpoint to trade tensions.

Commodities

- Gold Breaks Above $3,300 on Weak U.S. Data

Gold jumped 0.94% to $3,318 after weak jobless claims and a confirmed GDP contraction fueled safe-haven demand. A court decision striking down Trump tariffs also weighed on the U.S. dollar. - Oil Dips Despite Inventory Draws

Crude settled at $60.94, down $0.90 or -1.46%.- EIA data showed:

- Crude: -2.795M

- Gasoline: -2.441M

- Distillates: -0.724M

Cushing saw a surprise build of +0.075M.

- EIA data showed:

- CTAs Set to Fuel Gold and Silver Rallies – TDS

Trend-following funds (CTAs) are expected to ramp up gold buying activity this week. TDS notes ETF outflows are slowing, while central bank demand remains firm. Silver is also flashing improved trend signals.

Europe

- ECB Rate Cut Expected on June 5

A Reuters poll showed all 81 economists expect the ECB to cut the deposit rate to 2.00% next week, with most seeing a pause in July. - Germany Considers 10% Digital Tax

The German government is reportedly evaluating a 10% digital services tax on tech giants like Meta and Google to fund domestic media initiatives. - ECB’s Kazimir Found Guilty of Corruption

Slovak central bank chief and ECB policymaker Peter Kazimir has been fined €200,000 over a bribery case. His term ends June 1, and it’s unclear if he will be reappointed. - Some European Markets Closed for Ascension Day

Germany, France, and Switzerland observed a bank holiday, though the Xetra exchange remained open. Euronext was closed.

Asia

- China Maintains U.S. Communication, Slams EU Tariff Probe

Beijing reaffirmed ongoing diplomatic contact with Washington and expressed frustration with EU anti-dumping investigations into Chinese tires. - White House Adviser Hassett Confident Tariff Appeal Will Succeed

Economic adviser Kevin Hassett said the court decision would not derail Trump’s trade agenda and predicted the ruling would be overturned.

Crypto

- Solana Draws Institutional Capital with Liquid Staking & $1B Fundraise

Solana trades at $172, holding support in an ascending channel. DeFi Development Corp adopted liquid staking, while SOL Strategies filed to raise $1 billion to build Solana’s ecosystem. - XRP Eyes 14% Rally as SEC Roundtable Nears

XRP trades around $2.28 as traders anticipate the June 9 SEC Crypto Task Force roundtable. Derivatives open interest has fallen to $4.8B amid long liquidations. - Bitcoin Flat as ETH Surges Toward $3K

Bitcoin stagnated around $107K despite bullish headlines from the Bitcoin Conference. Ethereum rallied to $2,788 before retreating slightly, with traders targeting $3,000–$3,400. ETH/BTC ratio and long/short ratios both support continued ETH strength.