North America News

U.S. Stock Indices Fall; Salesforce Pops in After-Hours on Strong Guidance

Major U.S. stock indices closed lower on Wednesday, finishing near session lows:

- Dow fell 244.95 points (-0.58%) to 42,098.70

- S&P 500 lost 32.99 points (-0.56%) to 5,888.55

- Nasdaq dropped 98.22 points (-0.51%) to 19,100.94

After-hours earnings movers:

- Salesforce (CRM) beat expectations with EPS of $2.58 and $9.8B in revenue. It guided above estimates for Q2 and full-year, sending shares up 5% after hours to $289.87.

- C3.ai (AI) disappointed with Q4 revenue of $21.39M vs. $107.7M expected. Posted a $0.60 loss per share and a large $89M operating loss. The company guided Q1 revenue between $100M–$109M.

- Synopsys (SNPS) beat with Q2 EPS of $3.67 and matched revenue estimates at $1.6B. Issued strong Q3 and full-year guidance.

- HP Inc (HPQ) missed on EPS ($0.71 vs. $0.81 est.), with soft margins and negative free cash flow of -$100M. It also cut full-year guidance, citing margin pressures and weaker hardware sales.

Nvidia Q1 Earnings Beat Expectations Despite Margin Pressure and China Drag

Nvidia ($NVDA) delivered a strong Q1 2025 earnings report, but not without a brief misfire. An initial error listed adjusted EPS at $0.81, sending a shock through markets—later corrected to the actual figure of $0.96, beating the $0.93 estimate.

Key Q1 results:

- Revenue: $44.1B (up 69% YoY) vs. $43.29B expected

- Adjusted EPS: $0.96 (up 33% YoY) vs. $0.93 expected

- Adjusted Gross Margin: 61% vs. 71% expected

- EBIT: $21.64B vs. $26.97B expected

Segment Performance:

- Data Center Revenue: $39.1B vs. $39.22B expected

- Compute Revenue: $34.16B vs. $35.47B expected

- Networking Revenue: $4.96B vs. $3.45B expected

Outlook:

- Q2 Revenue: $45.0B ±2% vs. $45.5B estimate

- Q2 Gross Margin (adj.): 71.5%–72.5% vs. 71.7% expected

- $8B in lost Q2 sales factored in due to ongoing chip restrictions on China

- $2.5B in H20 chip revenue delayed from Q1 also impacted topline

CEO Jensen Huang described Nvidia as being at the “center of a transformation,” emphasizing “incredibly strong” global demand for AI infrastructure. The Blackwell NVL72 AI supercomputer is now in full production.

Despite margin pressures and geopolitical constraints, Nvidia continues to dominate the AI hardware space with overwhelming demand from hyperscalers and enterprise clients.

Treasury’s $70B Five-Year Note Auction Draws Strong Foreign Demand

The U.S. Treasury auctioned $70 billion in 5-year notes at a high yield of 4.071%, slightly below the when-issued (WI) yield of 4.075%—a sign of decent demand.

Auction breakdown:

- Bid-to-cover ratio: 2.39x (in line with six-month average of 2.4x)

- Direct bidders (domestic): 12.4% (below 20.2% average—weak showing)

- Indirect bidders (foreign): 78.4% (well above 68.2% average—strong demand)

- Dealer share: 9.24% (less than the average 11.6%)

Bottom line: Foreign buyers stepped up, compensating for soft domestic interest. The slight tail and strong indirect bidding signal overall healthy appetite for U.S. debt.

Dallas Fed: Services Revenue Drops in May, Outlook Remains Negative

The Dallas Fed reported a sharp decline in service sector revenue for May:

- Services revenue index fell to -4.7, down from 3.8 in April

- The broader Texas Service Sector Outlook index came in at -10.1, a slight improvement from -19.4 but still deep in negative territory

This drop signals weaker demand and business conditions across Texas’ service industries, even as other regional data shows tentative signs of stabilization.

Richmond Fed: Manufacturing Still Contracting, but Pace Slows

The Richmond Fed’s May survey showed manufacturing activity remains negative, but the pace of contraction eased slightly:

- Composite Index: -9 (up from -13 in April)

- Shipments: -10 (was -17)

- New Orders: -14 (was -15)

- Employment: -2 (was -5)

Other metrics:

- Backlogs improved slightly to -19

- Inventories dropped to 18 from 23

- Capex weakened to -11

- Vendor lead times rose to 15, indicating supply-side friction

- Wages and prices remained mostly stable

Meanwhile, services activity in the region worsened, with the services index dropping to -11 from -7.

U.S. Mortgage Applications Slip Again as Rates Hold High

Mortgage Bankers Association data shows U.S. mortgage applications fell 1.2% for the week ending May 23, following a 5.1% decline the prior week.

Refinancing activity dropped further, while purchase activity ticked higher. The average 30-year fixed mortgage rate rose slightly to 6.98%. Higher rates continue to put pressure on the housing market.

Fed Survey: Americans Still Stressed About Prices Despite Some Stability

According to the Fed’s 2024 survey on household finances:

- 73% of respondents said they were financially “okay” or “comfortable,” roughly unchanged from 2023

- Inflation and price hikes remained the top concerns for most Americans

- While perceptions of both local and national economies improved slightly, only 29% rated the economy as “good” or “excellent”—a steep drop from 50% in 2019

- 60% said rising prices worsened their financial situation (down from 65% in 2023)

- 79% changed their spending behavior in response to inflation

- 63% could cover a $400 emergency expense—consistent with last year

Overall, the data shows a public adapting to persistent inflation but still feeling its sting.

Trump Moves to Block U.S. Chip Sales to China, Says FT

President Trump has reportedly ordered U.S. semiconductor design firms to stop selling to China, according to a Financial Times report. The move signals an aggressive new front in tech-related trade restrictions and could have broad implications for U.S. firms with Chinese clients.

Details remain sparse, but this directive, if confirmed, would mark one of the most direct actions yet in the ongoing U.S.-China chip war.

Fed Minutes: Uncertainty Rising, Inflation Could Stay Sticky

Federal Reserve officials signaled rising concern over the U.S. economic outlook during their May 6–7 policy meeting, according to newly released minutes.

Key takeaways:

- Policymakers agreed on a wait-and-see approach amid mixed signals

- Several noted the economy faces “difficult trade-offs” with both inflation and unemployment rising

- Staff forecasts now show weaker GDP growth for 2025–2026 compared to March projections

- Tariff policies are expected to drag more on economic activity than previously assumed

- Inflation persistence is a top concern; many warned it could last longer than hoped

- The committee also voted to renew dollar and foreign currency swap lines

- Some flagged changing asset-price correlations, potentially impacting U.S. safe-haven status

The overall message: the Fed is preparing for a bumpier road ahead and keeping its options open.

Trump: Still Unclear Where Putin Stands on Ending the War

Speaking to reporters, Donald Trump said he still doesn’t know whether Russian President Vladimir Putin genuinely wants to end the war in Ukraine.

Key points:

- Trump said he’ll “find out in about a week” and warned of a stronger response if Putin is “playing” the U.S.

- Expressed disappointment over the situation in Ukraine

- Mentioned ongoing negotiations related to Iran and Gaza, suggesting progress is possible

- Commented on TikTok, saying he has a “warm spot” for the app, but acknowledged China’s approval would be needed for any deal

- On higher education, suggested foreign student enrollment caps (possibly 15%) at institutions like Harvard

- On Republican policy, said he’s working closely with Sen. John Thune and others to unify GOP support for upcoming legislation

The remarks covered a wide range of geopolitical issues, reflecting Trump’s push to influence foreign and domestic policy narratives.

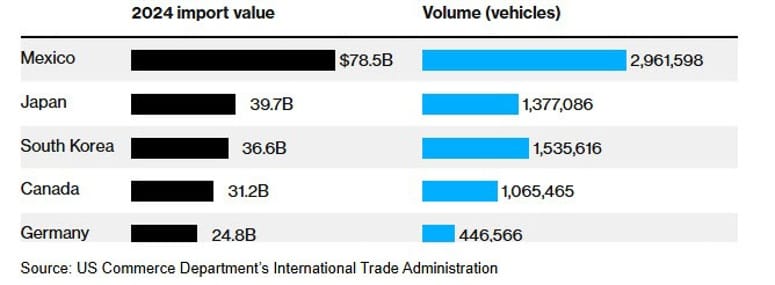

German Carmakers in U.S. Tariff Talks as Shift Toward Company Deals Grows

BMW, Mercedes, and Volkswagen are in negotiations with the U.S. trade minister, aiming to strike a tariff agreement by early July, according to sources cited by Handelsblatt.

Automakers are reportedly working on mechanisms to offset imports and exports, and may boost U.S. investments as part of the deal. This marks a shift from country-level talks to firm-specific negotiations.

Separately, U.S. manufacturing still features some iconic shoe brands:

- New Balance: 4M pairs made annually in U.S. factories

- Red Wing, Wolverine, Danner, Allen Edmonds: Well-known for U.S.-made work boots and dress shoes

- Quoddy, Softstar, Oak Street, Rancourt & Co.: Smaller heritage shoemakers producing locally in Maine, Oregon, and Wisconsin

Citi: Trump’s Deficit Plans Pose Risk and Opportunity for Markets

Citi sees both threats and potential upside for markets from Donald Trump’s proposed sweeping economic bill.

The U.S. is already headed for a $2 trillion deficit this year. Citi estimates the new bill could add another $600 billion, though tariffs might offset about $200 billion.

Higher deficits mean more Treasury issuance and potentially higher interest rates—bad for valuations but possibly supportive of earnings if stimulus kicks in. Citi sees the S&P 500 as fairly valued at about 23x trailing earnings, but expects volatility ahead as economic news filters through the summer.

Fed’s Williams says wants to avoid inflation becoming highly persistent

- Federal Reserve Bank of New York President John Williams

- Important that inflation expectations are well anchored

- You want to avoid inflation becoming highly persistent because that could become permanent

- Way to avoid that is to respond relatively strongly when inflation begins to deviate from Target

- Misperceptions about ‘r star’ can lead to long-lasting deviations

- We have to be very aware that inflation expectations could shift in any ways that could be detrimental

- You want the whole curve of inflation expectations to be well behaved

- It’s not to say inflation expectations shouldn’t move, it means they should move in a way that emerges back to target within several years

- Levels of reserves in US are clearly abundant

- When you get big shocks its really nice to have a buffer via reserves

- For emerging market economies, exchange rate is very important aspect of inflation process, demand process

Commodities News

Gold Holds Steady at $3,300 as Fed Flags Stagflation Risk

Gold prices hovered near $3,300 on Wednesday, as traders reacted to the Federal Reserve’s May meeting minutes, which highlighted growing concerns about inflation and rising unemployment—a stagflation scenario.

The Fed warned that elevated tariffs could prolong inflation while simultaneously weakening labor market conditions. Officials agreed that heightened uncertainty makes it wise to pause before adjusting policy, noting that inflation might persist longer than previously anticipated.

Gold traded in a narrow band between $3,280 and $3,360. Technical indicators like RSI suggest little near-term momentum. Notably, the Fed minutes predated Trump’s recent easing of China tariffs, which may yet alter future forecasts.

U.S. Crude Oil Futures Climb to $61.94 Ahead of Inventory Data

U.S. crude oil futures settled higher on Wednesday, gaining $0.95 or 1.56% to close at $61.94 per barrel. Traders are positioning ahead of the American Petroleum Institute’s private inventory report due later today, followed by the EIA’s official weekly inventory release tomorrow.

Oil Markets on Edge as Sanction Risks Grow Ahead of OPEC+ – ING

Crude oil came under pressure due to a stronger dollar and investor caution ahead of this weekend’s OPEC+ meeting, now moved to Saturday. While no policy change is expected from today’s committee session, markets remain tense.

New sanctions against Russia may be on the table after President Trump’s social media post criticizing Putin’s recent actions in Ukraine. Tighter Russian crude flows could drive volatility.

Elsewhere, the ICE gasoil market shows signs of tightening. Prompt timespreads widened to $8/ton, and U.S. distillate stocks are at their lowest seasonal level since 2003. Speculators have flipped from net short to net long in recent weeks, signaling a shift in sentiment.

Silver Stalls Below $33.70 Amid Stronger Dollar and Risk-On Mood

Silver’s recent rebound lost steam Wednesday as risk appetite improved and the U.S. dollar gained strength. Prices are retreating from a high of $33.70, with support forming around $32.89.

Investor sentiment was boosted by upbeat U.S. consumer confidence data and a temporary easing of trade tensions following Trump’s delay on European tariffs. The technical picture remains mixed—silver faces strong resistance near $33.50–$33.70, while holding support at $32.80.

A break below $32.80 could expose the $32.15 level, while upside moves remain capped for now.

CTAs May Apply Selling Pressure to WTI Despite Tight Supply – TDS

Commodity Trading Advisors (CTAs) are expected to sell WTI crude regardless of price movements this week, according to TD Securities’ Daniel Ghali. While not as aggressive as CTA activity in gold, it could still weigh on crude.

Despite tight supply—driven by peaking U.S. shale, expiring Venezuelan licenses, and geopolitical tensions—Ghali says OPEC+ is shifting strategy. Their new approach may test U.S. shale output, reinforce quota discipline, and build future leverage. But the market may struggle to absorb extra barrels, especially post-summer.

Gold Set for Rally as CTAs Ready to Reenter – TDS

TDS’s Daniel Ghali sees CTA (algorithmic fund) buying as the likely trigger for gold’s next leg up. He expects it to begin imminently and accelerate heading into the next U.S. jobs report.

Gold ETFs are seeing reduced selling, especially in China, and Shanghai gold has broken its previous downtrend. Strong central bank buying is expected to continue, offsetting outflows from retail investors. The combination of CTA positioning and macro fund underweighting could drive gold prices significantly higher in the near term.

European Natural Gas Rally Cools as Norwegian Outages Drag On – ING

European gas prices dipped slightly, with TTF contracts settling 0.66% lower, ING reports. Norwegian supply issues persist following maintenance at the Troll field, limiting flows to the continent.

EU gas storage sits at just under 47% full—down from 69% a year ago and below the five-year average of 58%. Additionally, a narrowing JKM-TTF spread is putting pressure on TTF pricing.

Oil Stuck in Neutral as Market Waits for a Trigger

Crude oil prices remain trapped in a range, as supply and demand factors cancel each other out. Last week’s news that OPEC+ might hike production by 411,000 barrels per day in July pushed prices lower, but strong growth expectations provided a floor.

Key levels to watch:

- Resistance: $63.00–$64.00

- Support: $60.00

- A break above resistance could lead to $72.00; a breakdown could retest $55.00

OPEC+ Holds Production Levels Through 2026, Sets New Baseline Strategy

OPEC+ confirmed it will maintain current crude oil production levels for both OPEC and non-OPEC members under the Declaration of Cooperation (DoC) agreement through the end of 2026.

Key decisions:

- 2025 output levels will serve as the baseline for 2027 production quotas

- The OPEC Secretariat has been tasked with developing a new method for determining each country’s maximum sustainable capacity

- The group pledged to continue monitoring the oil market, supply levels, and policy compliance

- The next OPEC+ meeting is scheduled for November 30

This reaffirmation comes amid ongoing efforts to stabilize global oil prices.

U.S. Grants Chevron License to Maintain Venezuela Oil Assets

The U.S. government will let Chevron preserve its oil assets in Venezuela, but the company won’t be allowed to import Venezuelan crude. The license ensures Chevron can maintain critical infrastructure in the country without resuming commercial shipments.

Wall Street Journal (gated)

Standard Chartered: Gold Rally to Pause at $3,100, Resume Later

Standard Chartered expects gold to consolidate near $3,100 per ounce over the next few months, calling the recent surge a familiar pattern.

While the bank has dialed back its short-term enthusiasm, long-term projections remain bullish. Analysts think prices could reach $3,500 within the next year as central bank demand picks up again.

Europe News

European Markets Slip, DAX Retreats from Record Close

European stock markets ended the session in the red as traders wrapped up for the day. After hitting a record close yesterday, Germany’s DAX lost 188.30 points, falling 0.78% to 24,038.20.

Other indices followed suit:

- France’s CAC 40 dropped 38.69 points (-0.49%) to 7,788.11

- UK’s FTSE 100 fell 52.05 points (-0.59%) to 8,726.01

- Spain’s IBEX shed 139.30 points (-0.98%) to 14,100.61

- Italy’s FTSE MIB was the outlier, posting a slight gain of 2.85 points (flat at +0.01%) to close at 40,127.74

U.S. equities also traded lower, with investor caution spreading across global markets.

ECB Survey: Eurozone Consumers Expect Higher Short-Term Inflation

The ECB’s April survey shows euro area consumers now expect inflation to rise to 3.1% over the next 12 months—up from previous readings.

While short-term expectations have ticked higher throughout 2025, the long-term inflation outlook remains relatively stable and anchored.

German Unemployment Rises by 34,000 in May

Germany’s jobless numbers came in worse than expected, with 34,000 more people out of work in May versus a forecast of 10,000.

The unemployment rate held steady at 6.3%. The Federal Employment Agency said the labor market lacks the momentum needed for a recovery and warned jobless figures could worsen over the summer.

Germany’s Import Prices Drop Sharply in April, Led by Energy

German import prices fell 1.7% month-over-month in April, the sharpest monthly decline since the COVID era, according to Destatis. That exceeded forecasts of a 1.4% drop.

The slump was driven by an 11.2% plunge in energy prices. Excluding energy, the monthly fall was more modest at 0.8%.

France’s Q1 GDP Holds Flat Despite Falling Household Spending

INSEE confirmed France’s economy grew 0.1% in Q1 2025, matching preliminary figures. However, household consumption declined 0.2%, dragging domestic demand into negative territory for the quarter.

Inventory buildup contributed 1.0% to GDP, offset by a 0.8% drag from net exports. The headline growth masks soft underlying trends.

Swiss Investor Sentiment Improves in May, Still Negative

UBS’s May investor sentiment index for Switzerland rose to -22.0 from April’s -51.6, showing a modest rebound. Easing trade tensions—especially between the U.S. and China—were cited as a key driver behind the improvement.

ECBs Knot: Near term growth and inflation risks are to the downside

- ECBs Knot speaks

- Near term growth and inflation risk talk to the downside.

- Medium-term inflation outlook is more ambiguous

EU and UAE Launch Free Trade Agreement Talks

The European Union and the United Arab Emirates have officially kicked off negotiations for a bilateral free trade agreement.

Talks are expected to begin next week. The deal would mark the EU’s first comprehensive trade pact in the Gulf. UAE officials said this bilateral push won’t obstruct broader GCC-EU trade goals.

EU, U.S. in Constant Trade Talks on Key Sectors

The EU Trade Commissioner said discussions with the U.S. are ongoing and wide-ranging, covering sectors like aviation, semiconductors, and steel.

He’s set to meet U.S. Commerce Secretary Lutnick and Trade Rep. Greer on Thursday. The two sides plan to stay in close contact, with meetings “every other day” moving forward.

Lagarde May Leave ECB Early to Take Over World Economic Forum

FT reports that ECB President Christine Lagarde is preparing to leave before her official term ends in October 2027 to lead the World Economic Forum.

WEF founder Klaus Schwab said they’ve discussed this transition for years, with the latest conversation happening in April. Lagarde has served on the WEF board since 2008.

Swiss government says further development on tariffs is still uncertain

- A statement by the Swiss government

- Swiss federal council consults on impact of US tariffs, agrees on existing instruments

- No slump in overall economic development currently expected

Asia-Pacific & World News

China Invites U.S. Financial Firms to Deepen Ties

Chinese Vice Premier He Lifeng extended an open invitation to U.S. financial firms and long-term capital to participate more deeply in China’s capital markets.

He met with Morgan Stanley executives in Beijing and highlighted the recent softening of U.S. tariffs on Chinese goods—reduced on May 12 with a 90-day window for further discussions.

China to Hit Record Fiscal Spending in 2025, Says Premier Li

At a summit in Malaysia, Chinese Premier Li Qiang said Beijing is pushing fiscal spending to record highs this year to support domestic consumption and economic recovery.

Li also criticized growing global protectionism, calling for renewed commitment to open trade and multilateralism under the WTO framework. He said despite external pressure, Chinese exports have remained resilient.

WSJ: Putin’s War Economy Now Russia’s Growth Engine

According to a Wall Street Journal analysis, Russia’s economy has become increasingly war-focused. President Putin’s reliance on defense spending is seen as central to current economic growth—and as a constraint on peace negotiations.

Alexander Kolyandr of the Center for European Policy Analysis warned that a rollback in military spending is unlikely anytime soon, making economic diversification difficult. Russia’s neighbors worry that if the Ukraine war ends, the military-industrial complex might shift its attention elsewhere.

China Courts German SMEs With Market, Tech, and Trade Perks

China’s Vice Commerce Minister Ling Ji told German small and mid-sized businesses that China remains a prime growth venue, citing strong consumer demand, robust supply chains, and fast-moving innovation.

Meeting in Beijing, Ling emphasized mutual benefits and encouraged closer cooperation between China and Germany to promote free trade and protect global supply networks. The message, reported by Chinese state outlet Global Times, aligns with Beijing’s ongoing efforts to draw foreign investment.

PBOC sets USD/ CNY mid-point today at 7.1894 (vs. estimate at 7.1996)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 215.5bn yuan via 7-day reverse repos at 1.40%

- 157bn yuan matured today

- net injection 58.5bn yuan

Australian April Inflation Beats Forecasts at 2.4% y/y

Australia’s monthly CPI held steady at 2.4% in April, just above the forecasted 2.3%. The trimmed mean came in at 2.8%, slightly higher than March’s 2.7%.

Though not all CPI components are included in the monthly update, the data keeps inflation concerns in play ahead of more comprehensive quarterly figures.

Australian Construction Work Stalls in Q1

Construction activity in Australia flatlined in Q1 2025, posting 0.0% quarterly growth—well below the expected 0.4%. That makes it a drag on GDP for the quarter.

The public sector was notably weak, while residential construction fared somewhat better. Still, the stagnation in overall construction leaves inflation as the more pressing economic concern for policymakers.

NAB and SocGen See Australia’s Rate Peak Higher Than Expected

National Australia Bank has raised its forecast for the RBA terminal rate to 3.1%, up from 2.6%. The bank sees fewer global headwinds ahead and thinks the RBA will return to a neutral stance over the coming months.

Societe Generale agrees, noting Australia’s growth outlook for 2025 is now outpacing the U.S., which could continue to lift the AUD. The usual link between FX and yields is weakening, making economic growth a stronger driver for currency movements.

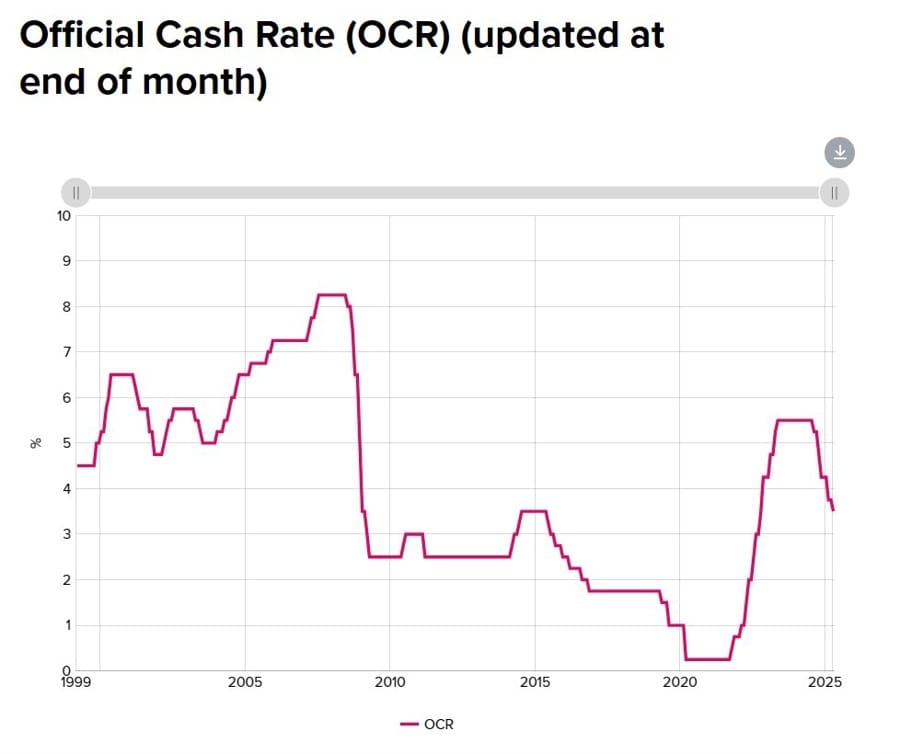

RBNZ Cuts Rates to 3.25% and Lowers Future Projections

The Reserve Bank of New Zealand reduced its official cash rate by 25 basis points in May 2025, bringing it down to 3.25%, as widely expected. More notably, the Bank also lowered its projected rate path.

Forecasts now show:

- 3.12% in September 2025 (down from 3.23%)

- 2.87% in June 2026 (was 3.1%)

- 2.9% in September 2026 (was 3.1%)

- 3.1% in June 2028

Inflation is cooling and sits within the target range. The Bank notes spare capacity in the economy and believes current conditions align with inflation returning to 2% over the medium term.

Minutes showed a 5–1 vote for the cut. The committee debated whether to hold or lower the rate but agreed that recent cuts haven’t fully filtered through yet. External risks like new U.S. tariffs could weigh on New Zealand’s export outlook.

RBNZ’s Hawkesby: Split Vote Shows a Healthy Policy Debate

Reserve Bank of New Zealand Deputy Governor Christian Hawkesby downplayed concerns about a divided vote on the latest rate decision, calling it a normal feature during economic transitions. According to Hawkesby, diverging opinions among committee members signal a healthy and engaged policy process rather than a red flag.

He noted that the central projection for the cash rate remains intact, but uncertainty is high enough that the committee holds no firm bias on what the next move should be. With rates now sitting in a neutral zone, monetary policy decisions rely more on judgment than mechanical forecasts.

The key takeaway: the RBNZ has made significant progress, and future moves won’t follow a preset path. Committee members agreed on the rate outlook but differed on timing, reflecting the current ambiguity.

Japan’s Auto Sector Bracing for Impact From U.S. Tariffs, Akazawa Warns

Japanese Minister Akazawa flagged significant risks to Japan’s auto industry from ongoing U.S. tariffs during a parliamentary address. Ahead of his trip to Washington, Akazawa reaffirmed Japan’s position: full removal of tariffs remains the goal.

He’s scheduled to meet U.S. counterpart Bessent on Friday for high-level talks, but expectations for a breakthrough remain low.

Nikkei 2025 Outlook Cut to 39,600

Analysts now expect Japan’s Nikkei 225 to end 2025 at 39,600, down from a February projection of 42,500, according to a Reuters poll.

Market watchers blame U.S. trade policy uncertainty—particularly Trump’s tariff threats—for the downgrade. Still, some remain optimistic that easing trade tensions and a weak yen could boost earnings and drive the index to record highs by 2026.

Japan to Buy Nearly $7B in U.S. Semiconductors

Japan is reportedly planning to buy up to $6.94 billion worth of U.S. semiconductors as part of ongoing trade discussions with Washington. The Asahi newspaper reports the Japanese government will subsidize domestic firms purchasing U.S.-made chips, with companies like Nvidia expected to benefit.

The aim is to reduce Japan’s large trade surplus with the U.S., which stands at about 10 trillion yen.

BOJ Expected to Keep Pulling Back on Bond Purchases

Bank of America analysts believe the Bank of Japan will continue tapering its Japanese Government Bond (JGB) purchases. The central bank is likely to outline the next steps in its tapering plan during the June 16–17 policy meeting.

BofA forecasts the BOJ will cut back its monthly JGB buying by 400 billion yen each quarter through March 2026. After that, the pace may slow further, reducing by 300 billion yen per quarter from April 2026 onward, with the taper potentially lasting into 2027.

Bank of Japan Governor Ueda says tariff negotiations means outlook remains uncertain

- BoJ Gov Ueda speaking in Tokyo

- Many tariff negotiations include those between U.S.-Japan still ongoing, so the outlook remains uncertain

- Also it remains unclear how tariff policies would affect global, Japan economy

- Will carefully examine data

- Won’t comment on short-term developments of interest rates

- Will closely monitor bond market, want to watch rising super-long yields closely

- Swings in short-term, medium-term interest rates have bigger impacts on economic activities

- Will be mindful that large swings in super-long bond yields could impact other yields

Japan finance minister Kato – Will closely monitor bond market situations

- Kato is concerned about rocketing yields in Japan

- Will closely monitor bond market situations

Crypto Market Pulse

Bitcoin Slips Despite GameStop and K33 Bitcoin Treasury Moves

Bitcoin dropped below $108,000 Wednesday, down 2.3% despite GameStop disclosing a purchase of 4,710 BTC and K33 announcing a $6.2M Bitcoin treasury.

GameStop’s BTC buy—worth around $508M—follows its $1.3B convertible note raise. K33, backed by Nordic investors, also plans to use its new funds to bolster its balance sheet with Bitcoin.

Despite this institutional enthusiasm, profit-taking by long-term BTC holders (1–5 years) hit $4.02B in May. Outflows came mainly from the 3–5 year group ($2.6B) and 2–3 year group ($1.41B). This selling pressure is curbing BTC’s upward momentum for now.

Solana Holds Ground as DeFi and Futures Metrics Remain Strong

Solana (SOL) is consolidating between $164 and $185, trading around $174 midweek. Despite mixed technical signals, its DeFi ecosystem remains robust with Total Value Locked (TVL) up 28% since April 1 to $9.34 billion.

SOL futures open interest stands at $7.35 billion, up from $6.4 billion just last week, showing consistent investor interest. These trends suggest traders are positioning for further upside, though indicators like RSI and MACD are flashing caution.

XRP Weakens Toward $2.27 Support Ahead of SEC Conference

XRP has edged down to $2.28, nearing key support at $2.27, as it trades sideways for a third straight week. A deeper drop could push the price toward $2.07, a demand zone traders are watching.

The SEC will host its third digital asset conference on June 5. Ripple has submitted a formal letter urging the agency to create a clearer legal framework for crypto, arguing that most fungible tokens shouldn’t be considered securities in secondary transactions.

Ripple’s legal team emphasized the need for regulatory clarity rather than enforcement ambiguity.

ADA ETF Decision Looms as Triangle Breakdown Threatens Cardano Price

Cardano (ADA) is trading under pressure at $0.74 ahead of the SEC’s deadline to approve or delay the Grayscale ADA ETF, set for Thursday. The funding rate has dropped sharply, indicating trader caution.

A tightening triangle pattern has formed on the daily chart. The price risks breaking below the 200-day EMA at $0.72, which could open a path to $0.64. Despite some bullish signals like a golden cross between the 50- and 200-day EMAs, weakening MACD and RSI suggest downward momentum could win out.

The SEC already extended the deadline once on March 11, and there’s speculation they may do it again—similar to their recent delay on Fidelity’s Solana ETF.

SPX6900 Meme Coin Jumps 33% in a Week as Big Wallets Accumulate

SPX6900, a trending meme coin, surged over 30% in the past week and continues to gain ground Wednesday. Open interest in SPX futures has soared to $65.2 million, the highest since January, signaling increased speculation.

Santiment data shows whale wallets holding 100K to 100M SPX tokens are buying, while mid-tier whales (1M–10M SPX) appear to be selling. SPX’s market cap now stands around $917 million. If the rally continues, SPX6900 could surpass rival meme coin FLOKI in valuation.

Quant Eyes $143 Target as Momentum Builds Post-Fusion Announcement

Quant (QNT) trades at $119 after an 11% daily gain driven by institutional buzz from EBAday in Paris. The introduction of Quant Flow and Overledger Fusion has reignited investor interest, with the token up 25% this week.

Technicals point to a bullish reversal, including a golden cross and a breakout from an inverted head-and-shoulders pattern. Resistance lies between $121 and $125. If that zone breaks, Fibonacci analysis targets the next level at $143.

Bitcoin Hits Key Support as Market Awaits Inflation Clues

Bitcoin remains in bullish territory, riding a trendline that has held since early April. The recent lift came after Trump paused new tariffs, boosting both crypto and equities.

Traders are watching closely as BTC tests the trendline on the 4-hour chart. Bulls are expected to defend it, while a break could trigger a drop toward 102,127.

The Day’s Takeaway

United States

- Stocks Close in the Red

All major U.S. indices ended the day lower:- Dow: -244.95 (-0.58%)

- S&P 500: -32.99 (-0.56%)

- Nasdaq: -98.22 (-0.51%)

- Fed Minutes Highlight Stagflation Risks

The Fed’s May meeting minutes flagged persistent inflation and a softening job market as dual threats. Officials cited elevated uncertainty, particularly regarding the economic impact of trade policy shifts. - Trump Moves to Block U.S. Chip Sales to China

As reported by the Financial Times, President Trump has ordered U.S. chip designers to cease sales to China, adding new intensity to the ongoing U.S.-China tech standoff. - Earnings: Mixed Bag with Standouts and Misses

- Salesforce (CRM) beat estimates on both EPS and revenue; guidance topped expectations. Stock surged 5% after hours.

- C3.ai (AI) posted a massive revenue miss and a steep operating loss.

- Synopsys (SNPS) beat on EPS and revenue, reaffirmed its strong FY outlook.

- HP Inc (HPQ) missed on EPS and margins, cut full-year guidance amid margin pressure.

- Nvidia (NVDA): Revenue and EPS beat forecasts after correcting an EPS reporting error. Margins missed, with $8B in Q2 sales lost to China restrictions and $2.5B in delayed H20 shipments. CEO reaffirmed AI demand is “incredibly strong.”

Commodities

- Crude Oil Rises Ahead of Inventory Data

WTI crude settled at $61.94, up $0.95 (+1.56%) as traders await EIA inventory reports. OPEC+ strategy shifts and CTA selling pressure remain in focus. - Gold Steadies at $3,300

Gold prices hovered in a tight range as the Fed minutes reignited stagflation concerns. Technical indicators suggest limited momentum in either direction. - Silver Loses Traction Below $33.70

Silver corrected lower on risk-on sentiment and a firmer dollar. Key support at $32.89 is holding, while a break below could target $32.15. - Natural Gas Retreats as Norway Outages Linger

European TTF gas prices slipped 0.66%. Norwegian outages persist and EU storage levels remain low at just 47% full—well below seasonal norms.

Europe

- Markets Lower Across the Region

European indices ended the session weaker:- DAX: -0.78%

- CAC 40: -0.49%

- FTSE 100: -0.59%

- IBEX: -0.98%

- FTSE MIB: flat

- Russian Sanction Risk Returns to Spotlight

Trump’s latest comments on Putin—warning he’s “playing with fire”—raised the prospect of renewed sanctions. Energy traders are closely watching developments ahead of the OPEC+ meeting.

Crypto

- Bitcoin Dips Despite Institutional Buys

BTC fell to $107,700, even as GameStop revealed a $508M Bitcoin purchase and K33 launched a new Bitcoin treasury with $6.2M in funding. Profit-taking by long-term holders weighed on price action. - Cardano Volatility Builds Ahead of SEC ETF Decision

ADA traded at $0.74, near a key support at $0.72, with a triangle pattern breakdown looming. The SEC is expected to issue a decision on Grayscale’s ADA ETF Thursday. - SPX6900 Rallies Over 30% on Whale Accumulation

SPX meme coin surged as open interest hit a multi-month high. Large wallet holders have been accumulating aggressively, with the token nearing FLOKI’s market cap. - Quant Eyes $143 After Breakout Pattern and New Institutional Tools

QNT rose to $119 after launching Quant Flow and Overledger Fusion. Technical indicators support a bullish move, with the next major resistance at $143. - Solana Consolidates with Strong On-Chain Metrics

SOL holds around $174. DeFi TVL has risen 28% to $9.34B since April. Futures OI remains elevated at $7.35B, showing sustained bullish interest. - XRP Faces Downside as Range Tightens

XRP neared its $2.27 support level amid broader market softness. Ripple is urging the SEC to adopt a more transparent regulatory framework ahead of the agency’s June 5 digital asset conference.