North America News

US Stock Market Tumbles as Tariff Fears Dominate

- Major US indexes suffer steep losses amid tariff concerns.

- Tech stocks struggle, with Nvidia down nearly 10% this week.

- Markets show weakness heading into April 2 tariff deadline.

Stock Market Performance

Friday’s close:

- S&P 500: -2.0%

- Nasdaq Composite: -2.7%

- Dow Jones Industrial Average (DJIA): -1.7%

- Russell 2000: -2.2%

Weekly performance:

- S&P 500: -1.5%

- Nasdaq Composite: -2.6%

- DJIA: -1.0%

- Russell 2000: -1.8%

Quarterly losses (with one day left):

- S&P 500: -5.2%

- Nasdaq Composite: -10.3%

- Russell 2000: -1.7%

Tech Stocks Lead the Decline

Tech stocks continue to struggle, with Nvidia down 1.6% on Friday and nearly 10% this week. Analysts suggest the AI boom may be transitioning from the “picks and shovels” phase into a slowdown before the next major productivity boom.

Tariff Worries Weigh on Equities

- Investors remain cautious ahead of Trump’s April 2 trade announcement.

- No White House reassurances have been made to ease concerns.

- Weak consumer sentiment and spending data add to the market’s pessimism.

With key economic data and tariff decisions looming, volatility is expected to remain high in the coming week.

UMich March Consumer Sentiment Revised Lower to 57.0

The final University of Michigan Consumer Sentiment Index for March came in at 57.0, down from the preliminary reading of 57.9. The decline reflects continued concerns about inflation and economic conditions.

Key Components:

- Current Conditions: 63.8 vs 63.5 prelim

- Expectations: 52.6 vs 54.2 prelim

- 1-year inflation expectations: 5.0% (up from 4.9% prelim)

- 5-year inflation expectations: 4.1% (up from 3.9% prelim)

A significant note is that two-thirds of consumers expect unemployment to rise in the coming year, the highest level of pessimism since 2009.

“This month’s decline reflects a clear consensus across all demographic and political affiliations,” UMich survey says.

It’s not just Democrats who are seeing ‘expectations’ decline anymore.

NY Fed GDP Tracker Sees GDP at 2.86% vs 2.72% Prior

- NY Fed tracker revised Q1 GDP estimate higher to 2.86% from 2.72%

- Contrasts with Atlanta Fed GDPNow (-2.8%)

- Report cites:

- Negative impact from personal consumption data

- Positive impact from manufacturers’ new orders

Atlanta Fed GDPNow Forecast Falls to -2.8%

The latest GDPNow estimate from the Atlanta Federal Reserve dropped sharply to -2.8% from the previous -1.8%, pointing to a possible economic contraction in Q1.

One silver lining: The gold-adjusted model estimates a smaller -0.5% decline. However, the sharp downward revision raises concerns about the near-term economic outlook.

In their own words:

“After recent releases from the US Census Bureau and the US Bureau of Economic Analysis, the nowcast of the contribution of net exports to first-quarter real GDP growth declined from -3.95 percentage points to -4.79 percentage points in the standard model and from -1.92 percentage points to -2.53 percentage points in the alternative model”

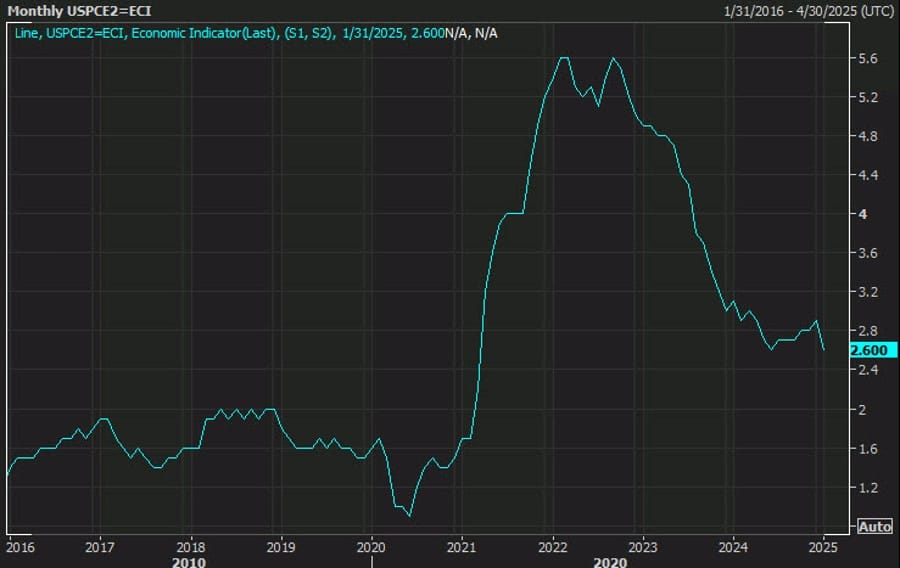

US February PCE Core Inflation at 2.8% YoY, Above Expectations

The latest US Personal Consumption Expenditures (PCE) report for February showed core inflation rising 2.8% year-over-year, slightly above the expected 2.7%. The monthly core inflation rate also came in stronger at +0.4% vs +0.3% expected.

Core PCE (Excluding Food & Energy):

- Prior: +2.6% (revised to +2.7%)

- Monthly: +0.4% vs +0.3% expected

- Unrounded Core PCE: +0.38% vs +0.285% prior

- Supercore (Services ex-Shelter): +0.375% m/m

Headline PCE:

- +2.5% y/y, matching expectations

- +0.3% m/m, in line with forecasts

- Unrounded headline: +0.34% vs +0.325% prior

Consumer Spending & Income for February:

- Personal income: +0.8%, above the +0.4% expected (prior revised to +0.7%)

- Personal spending: +0.4%, slightly below the +0.5% expected (prior revised to -0.3%)

- Real personal spending: +0.1%, compared to -0.6% prior

- Savings rate: 4.6%, unchanged

The hotter-than-expected inflation data adds pressure on the Federal Reserve’s decision-making process as markets weigh the timing of potential rate cuts.

Trump says his preference is to work things out with Iran

- Tough to parse these comments

- Told Iran they need to make a decision

- Iran is on his list of things to watch

- Is looking at reports of Iranian drones used in Ukraine

Trump gave Iran some deadlines about its nuclear program at the start of his term and this was reportedly the response:

1. Iran reaffirms that it will not negotiate directly with the United States, especially under the policy of maximum pressure, and it rejects the American approach categorically.

2. Iran states that it does not negotiate on behalf of any regional power, and that Iran does not dictate the foreign policy of other nations or groups, including Yemen’s Ansarallah, which is an independent ally.

3. Iran states that it will not accept Trump’s ‘unrealistic conditions’, and that the U.S. demands were so extensive that they cannot be entertained even hypothetically.

4. Iran warns unequivocally that any military or hostile action, whether by the United States or any of its ‘stooges’, will be met with an Iranian response that will encompass all U.S. military assets in the Middle East.

Fed’s Daly: Two rate cuts still reasonable for 2025

- Daly holds onto the dovish bias

- Need a wait-and-see posture on monetary policy, give industries time to adjust to tariffs

- Policy is in a good place, have to be patient

- Doesn’t have enough info to change her forecast

- Hearing ‘cautious optimism’ from businesses

JPMorgan sees limited downside for S&P 500 despite modest overvaluation – fair value 5400

- Says valuations are slightly elevated but not alarming

JPMorgan estimates the S&P 500’s fair value at around 5400, implying the index is about 6% overvalued.

However, the bank views this premium as modest and likely to be offset by earnings growth and strong U.S. liquidity trends.

Using a 4.8% discount rate—just below the 10-year average—JPMorgan says valuations are slightly elevated but not alarming. The bank cautions against relying on headline P/E ratios, urging investors to consider where the market sits in the earnings cycle.

Looking ahead, the April 2 tariff announcement remains a key risk, though JPMorgan notes recent investor flows suggest expectations for a benign outcome. Despite valuation concerns, the bank believes accelerating money supply and corporate earnings could continue to support equities through 2025.

Fed’s Barkin warns not assume just a one-time change in prices from tariffs

- Federal Reserve Bank of Richmond President Barkin:

Federal Reserve Bank of Richmond President Barkin:

- My instinct on auto tariffs is that the top line number will not be the increase that is faced by consumers given competition, exchange rates, other issues

- Auto companies will face challenges in passing tariffs through to consumers, given competition in market-relative prices will matter a lot

- Companies may find themselves with less pricing power than they might have otherwise thought

- Firms will have a difficult choice of raising prices and losing volume or not raising prices and having margins squeezed

- The inflationary risk of tariffs is obvious, but there may also be labor market risk if firms have to cut costs

- Dampened business demand would most likely be seen in capital spending and hiring

- Not as confident that lowered sentiment will change consumer spending, not yet seeing it in credit card data

- Understand the argument that tariffs would involve a one time shift in price level, but will be watching carefully for things like how businesses and consumers react

- Do not start with the assumption that this will Involve a one time change in prices

Earlier:

- Current moderately restrictive stance is a good place to be. If conditions shift, the Fed can adjust.

- Current levels of uncertainty could dampen consumer and business spending.

- Federal government policy currently at center stage. The pace of change has created a sense of instability.

- Direction of federal policy changes may be known, but the extent and how they net out in the economy remains uncertain.

- Regarding tariffs, given recent high inflation there could be more of an impact on prices. But it’s still not known where rates will settle or how affected countries, businesses, and consumers will respond.

- In the current environment, it’s hard to imagine the economy breaks toward more hiring.

Trump warned US automakers not to raise prices due to tariffs

- This is despite US automakers saying they are facing higher costs

The Wall Street Journal (gated) is reporting that Trump has warned US automakers not to raise prices:

- Trump told the executives that the White House would look unfavorably on such a move, leaving some of them rattled and worried they would face punishment if they increased prices, people with knowledge of the call said.

- Instead, Trump said, they should be grateful for his elimination of what he called President Joe Biden’s electric-vehicle mandate, which involved subsidies and emissions requirements to encourage electric-car production.

Automakers in the US say they face a surge in costs due to tariffs on Canada and Mexico – Trump’s tariffs apply not only to imported cars but imported parts.

Fed’s Collins says inflation risks are to the upside

- Collins also leaning towards not cutting rates any time soon

Federal Reserve Bank of Boston President Susan Collins:

- Cautiously, realistically optimistic about the economy.

- Economy started 2025 in a good place.

- Inflation had come down but was still elevated at the start of the year.

- The outlook now is much cloudier for inflation and growth.

- Inevitable tariffs will increase inflation in the near term.

- It remains a question how long tariff-driven inflation will last.

- Inflation risks are on the upside.

- Strongly supported the Fed’s decision to hold rates steady.

- Expects the Fed will likely hold rates steady for longer given the outlook.

- Federal layoffs still small relative to aggregate size of labor market

- Economic uncertainty causes businesses to pull back

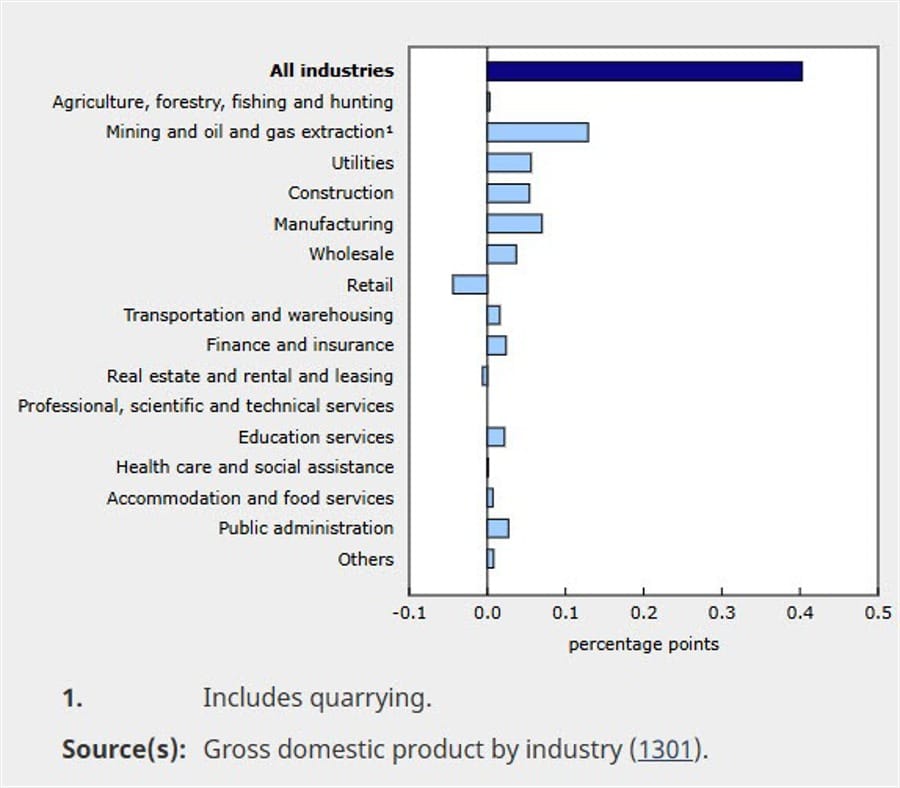

Canada’s January GDP Beats Expectations at 0.4%

Canada’s economy expanded 0.4% in January, surpassing the 0.3% estimate. The strong performance was driven by goods-producing industries, while services saw only modest growth.

Sector Breakdown:

- Manufacturing and finance & insurance contributed to growth

- Retail trade, real estate, and oil & gas extraction dragged down the numbers

Key Data:

- GDP growth: +0.4% (vs +0.3% expected), up from +0.3% in December

- 13 of 20 sectors saw growth

- Goods-producing industries surged +1.1%, marking the biggest gain since October 2021

- Mining, oil & gas, and manufacturing were the top contributors

More Highlights:

- Services sector: Rose +0.1%, contributing only modestly

- Mining, quarrying, and oil & gas extraction: Gained +1.8%, second consecutive month of growth

- Manufacturing: Rebounded +0.8%, led by durable goods (+2.0%)

- Utilities: Jumped +2.7%, following a 5.0% gain in December

- Construction: Grew +0.7%, with broad-based increases

- Retail trade: Dropped -0.9%, reversing gains from December

The early estimate for February GDP indicates 0.0% growth, signaling a potential slowdown.

Canada PM Carney: Canada will implement retaliatory tariffs

Canada PM Carney is commented on call with Trump and said:

- Canada will implement retaliatory tariffs

- Said will talk to Trump on the economy and security after the Canadian election.

- He says call with Pres. Trump was ‘very constructive’.

- He and Trump agreed to begin comprehensive negotiations about a new economic and security relationship immediately following the election.

- In the interim, deputies will “will intensify to address immediate concerns”

- Trump did not give any guarantees he would back down on tariffs

- Carney says Trump respected Canada’s sovereignty today both in private and public comments

- Talk with Trump was very cordial

- It’s not clear whether there will be new trade discussions between Canada, the US and Mexico

- It’s the preference of Canada that Mexico would be included

- Says he will meet Trump

- Canada’s system of agriculture supply management will never be on the table in talks with the US

Wells Fargo warns of downside risks for Mexican peso amid tariff threats

- This is from a note prior to the rate cut in Mexico on Thuirsday

Mexico’s peso has shown resilience in early 2025, gaining about 3.2% against the U.S. dollar, but Wells Fargo expects it could weaken ahead. The currency remains overvalued, according to the bank, and faces growing headwinds—including a likely recession triggered by potential U.S. tariffs and the risk of sovereign credit downgrades.

Wells Fargo projects Mexican GDP growth of just 0.1% this year, with a recession likely by the second quarter. If broad 25% tariffs are imposed in April, the economic downturn could be deeper.

While any peso depreciation is expected to be gradual due to “tariff fatigue” and diplomatic efforts by President Claudia Sheinbaum, Wells Fargo says the risk of a sharp drop remains high.

Wells Fargo does not anticipate the Bank of Mexico it will intervene in currency markets if the peso weakens, allowing it to adjust in line with economic fundamentals.

Commodities News

Gold Hits Record High as Traders Bet on Fed Cuts Amid Trade War Tensions

- Gold surges to $3,090, driven by safe-haven demand and tariff concerns.

- Despite rising PCE inflation, markets expect two Fed rate cuts in 2025.

- DXY weakens, US yields fall, while Canada and the EU prepare retaliatory tariffs.

Gold Prices Surge Amid Tariff Fears

Gold hit a new all-time high of $3,086 on Friday as investors rushed to safe-haven assets ahead of Trump’s April 2 auto tariff deadline. The move comes despite an uptick in the Federal Reserve’s preferred inflation gauge, reinforcing expectations of two rate cuts in 2025.

Markets are bracing for global trade retaliation, with Canada and the EU preparing countermeasures against Trump’s 25% tariffs on car imports. This geopolitical uncertainty has weakened the US dollar, pushing gold prices even higher.

Market Sentiment: Fed Easing Bets Rise

- Core PCE Price Index (YoY): 2.8% (up from 2.7%).

- University of Michigan Consumer Sentiment: Dropped from 57.9 to 57.0.

- One-year inflation expectations: Jumped to 5%.

Despite the inflation uptick, San Francisco Fed President Mary Daly reinforced the expectation of two rate cuts in 2025, focusing on inflation progress. Money markets now price in 73.5 basis points (bps) of Fed easing, up 10 bps from the previous day.

What’s Next for Gold?

With gold approaching $3,100, traders are watching key events next week, including:

- Trump’s April 2 tariff announcement

- ISM Manufacturing PMI for March

- JOLTS Job Openings

- Nonfarm Payrolls

Baker Hughes Rig Count: U.S. -1 to 592, Canada -17 to 163

- U.S. Rig Count:

- -1 to 592 (Oil: -2 to 484, Gas: +1 to 103)

- Down 29 rigs Y/Y

- Offshore rigs: Unchanged at 14 (-6 Y/Y)

- Canada Rig Count:

- -17 to 163 (Oil: -10 to 108, Gas: -7 to 54)

- Up 12 rigs Y/Y

Silver Hits Five-Month High Near $34.60 Amid Trade Concerns

- Key Drivers:

- Trump’s upcoming tariffs expected to slow global growth, raise inflation

- U.S. core PCE inflation rose 2.8% Y/Y (vs 2.7% prior)

- Fed may maintain higher rates longer

- Technical Outlook:

- Silver price testing $34.87 resistance

- 20-day EMA near $33.30 providing support

Market Does Not Expect US Import Tariffs on Canadian & Mexican Crude – Commerzbank

- Potential Tariffs:

- 10% on Canadian crude

- 25% on Mexican crude

- Market expects no tariffs, as Canadian crude discount to WTI shrank to $12/barrel from $18 in January

US Natural Gas Storage Rises – ING

- Inventories: +37 bcf (expected: +32 bcf)

- Total gas stockpiles: 1.74 tcf (down 24.2% Y/Y, 6.5% below five-year average)

- Oil Markets: Flat amid cautious demand outlook

Copper Retreats from Nine-Month High – ING

- Key Factors:

- Tariff threats on copper imports to U.S. weighing on prices

- Slowing U.S. growth and China struggles reducing demand

- Impact:

- Tariffs seen as bearish for industrial metals

- Persistent inflation could delay Fed rate cuts

Europe News

European Markets End Lower for the Day & Week

Major European stock indices closed lower on both the day and the week, reflecting broader risk aversion across global markets.

Market Performance:

- Germany DAX: -0.90% (-222.86 points) at 22,455.89 (weekly: -1.90%)

- France CAC: -0.93% (-74.03 points) at 7,916.09 (weekly: -1.58%)

- UK FTSE 100: -0.08% (-7.27 points) at 8,658.86 (weekly: +0.14%)

- Spain IBEX: -0.84% (-113.30 points) at 13,309.29 (weekly: -0.31%)

- Italy FTSE MIB: -0.92% (-359.56 points) at 38,739.29 (weekly: -0.76%)

Bond Yields:

- German 10-year: 2.73% (-2 bps)

- French 10-year: 3.437% (-1.7 bps)

- UK 10-year: 4.708% (-0.8 bps)

- Spanish 10-year: 3.363% (-5.1 bps)

- Italian 10-year: 3.85% (+1.1 bps)

Market sentiment remained weak, with uncertainty over economic conditions and geopolitical factors weighing on risk assets.

ECB Survey: Inflation Expectations Hold Steady

The ECB’s latest consumer expectations survey for February showed no change in inflation projections:

- One-year ahead expectations remained at 2.6%.

- Three-year ahead expectations held at 2.4%.

- Perceived past 12-month inflation dropped to 3.1%, the lowest since September 2021.

Encouragingly, uncertainty about future inflation eased, marking its lowest level since January 2022. However, geopolitical and trade risks could still impact inflation trajectories in the coming months.

Eurozone Consumer Confidence Dips in March

Eurozone consumer confidence remained at -14.5 in March, unchanged from the preliminary reading but below February’s -13.6.

- Economic confidence declined to 95.2, missing the expected 97.0.

- Industrial confidence improved slightly but remained negative at -10.6.

- Services confidence fell sharply to 2.4 from a revised 5.1 in February.

The deteriorating sentiment reflects ongoing uncertainty, with factors like U.S. tariffs and rising inflation expectations weighing on economic outlooks.

Germany’s Consumer Sentiment Improves Slightly but Remains Weak

Germany’s GfK consumer sentiment index for April rose to -24.5 from a revised -24.6 in March, slightly better than the expected -22.7.

NIM consumer expert Rolf Bürkl notes that optimism linked to political changes has lifted sentiment. However, a rising tendency to save is holding back a stronger recovery in consumer confidence.

German Unemployment Rises More Than Expected in March

Germany’s job market showed signs of weakening as unemployment increased by 26,000 in March, far exceeding the anticipated 10,000 rise.

- Unemployment rate climbed to 6.3%, up from February’s 6.2%.

- The jobless rate is now at its highest level since September 2020.

The trend suggests further labor market softness, which could impact economic growth and policy decisions.

France’s March Inflation Softer Than Expected

French consumer prices rose by 0.8% year-over-year in March, slightly below the 0.9% forecast.

- Harmonized Index of Consumer Prices (HICP) increased by 0.9%, missing the expected 1.1%.

With inflation remaining under 2%, the data supports the European Central Bank’s (ECB) more measured stance on monetary policy.

Spain’s Inflation Declines in March

Spain’s preliminary CPI for March came in at 2.3% annually, slightly below the expected 2.4%.

- HICP was 2.2%, missing the forecast of 2.6%.

- Core inflation fell to 2.0%, down from February’s 2.2%.

The disinflation trend continues, providing some relief to consumers and policymakers amid broader eurozone inflationary concerns.

UK Economy Posts Marginal Growth in Q4

The UK’s final GDP estimate for Q4 2024 confirmed a modest 0.1% quarterly expansion, in line with preliminary data. On an annual basis, GDP grew by 1.5%, slightly above the initial 1.4% estimate.

Despite sluggish growth, the UK economy avoided contraction, but structural challenges remain a concern heading into 2025.

UK Retail Sales Surge in February

Retail sales in the UK unexpectedly rose by 1.0% in February, surpassing the expected 0.4% decline.

- Annual sales grew by 2.2%, well above the projected 0.5% increase.

- Non-food store sales saw a 3.1% monthly gain, while household goods sales surged 6.8%, the highest since April 2021.

- Food store sales fell 2.0%, with retailers attributing the drop to higher prices.

The strong performance in discretionary spending signals resilience in consumer demand despite cost pressures.

Swiss Economic Outlook Strengthens as Leading Indicator Hits Seven-Month High

Switzerland’s KOF leading indicator rose to 103.9 in March, exceeding the expected 102.2 and reaching its highest level since August 2024.

While the data points to a stronger economic outlook, investor sentiment remains cautious due to concerns over global trade uncertainties and tariffs.

EU floats concessions to White House but expects 10-25% tariff rate

- Bloomberg with the earlier scoop

A report from Bloomberg highlights the state of play between the US and Europe in the tariff war, citing sources:

- EU officials expect 10-25% tariff rate on all or most goods

- European Union is identifying concessions it’s willing to make in a term sheet

- They were told there is no way to avoid tariffs next week

- Areas for negotiations on the punitive trade measures, including lowering its own duties, mutual investments with the US as well as easing certain regulations and standards

- Non-tariff issues such as the VAT, digital taxes and several EU regulations and food standards featured prominently during the talks in Washington

- The EU may be eyeing US services imports in retaliation

ECB’s de Guindos: Caution is even more important during times of uncertainty

- Remarks by ECB vice president, Luis de Guindos

- Trade war would mostly impact economic growth

- Disinflation process is continuing, goal to be reached in the coming months

- Trade war impact on inflation would be offset over the medium-term amid lower growth

Asia-Pacific & World News

Russia reserves right to pull out of the moratorium on energy strikes

- Some geopolitics with Russia accusing Ukraine of carrying energy strikes despite the moratorium

- Kremlin says Putin did not raise idea of Ukraine being put under temporary administration with Trump.

- Says Ukrainian army is out of control and not heeding orders from Ukraine’s leadership.

- Says armed nationalist forces in Ukraine are gaining strength which is why Putin mentioned idea of temporary external administration.

- Says Ukraine is continuing to strike Russian energy targets despite moratorium on attacks.

- Says Russia reserves right to pull out of the moratorium on energy strikes if Kiev violates accord.

- Says Russia is respecting the agreement for now and is not striking Ukrainian energy targets.

- Says it would be however illogical to stand by and watch Ukraine strike Russian energy targets ‘every night’.

China president Xi: US-China relations should stay stable, healthy

- Remarks by China president Xi, as he meets with foreign CEOs in Beijing

- Reaffirms that maintaining stable, healthy development of US-China relations is fundamental

- Will handle US-China relations based on the principles of mutual respect and win-win cooperation

- China will remain an ideal, safe and promising investment destination

- Will ensure foreign firms have fair access to factors of production

- “Blocking someone else’s path will only block your own path in the end”

- I often say “blowing out other people’s lights will not make your own light brighter”

Barclays are expecting the People’s Bank of China to cut the value of the yuan

- Yuan to fall on fundamentals

Barclays says there is a fall ahead =for the yuan, that markets have not yet ‘priced in’ higher tariffs.

- see fundamental reasons for the yuan to fall

- says the yuan has resilience since the US election, but “Despite this, we expect continued pressure on China’s balance of payments dynamics owing to tariffs”

- scope for large-scale trade diversion is much more limited compared with Trump’s first term

- China is still facing deflation, weak domestic demand and a troubled real estate market

- “We think the PBOC will react to tariffs by depreciating the CNY given the lack of other options, but could wait for further clarity before acting”

PBOC sets USD/ CNY mid-point today at 7.1752 (vs. estimate at 7.2591)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 78.5bln yuan via 7-day reverse repos at 1.50%

- 93bn yuan mature today

- net drain is 14.5bn yuan

China unveiled a plan to enhance the sustainability of its aluminum industry by 2027

- China bauxite news

China has unveiled a comprehensive plan to enhance the quality and sustainability of its aluminum industry by 2027. Spearheaded by ten government departments, including the Ministry of Industry and Information Technology, the initiative sets ambitious targets:

- Increase Domestic Bauxite Resources: Aiming for a 3%–5% boost to reduce reliance on imports.

- Expand Recycled Aluminum Output: Targeting an increase exceeding 15 million tons to promote environmental sustainability.

This strategy aligns with China’s broader environmental goals, including the expansion of its carbon trading market to encompass the aluminum sector by 2025. This move will require aluminum producers to purchase credits to cover their emissions, encouraging the adoption of low-carbon technologies and the phasing out of outdated, polluting facilities.

The plan also underscores the importance of energy efficiency and carbon reduction in aluminum electrolysis, aiming for significant energy savings and emission reductions through technological upgrades.

By focusing on resource efficiency, recycling, and emission controls, China aims to position its aluminum industry for sustainable growth amid global environmental challenges.

Chinese President Xi Jinping met with global CEOs in Beijing on Friday

- Xi doing his bit to boost confidence ion China business

Chinese President Xi Jinpingmet with CEOs of such firms as BMW, Mercedes, Qualcomm.

As the US appears to be pulling back on global ties China is stepping up.

Poll shows expectations are for the Reserve Bank of Australia to stay on hold next week

- The Reserve Bank of Australia meet on March 31/April 1, no change in the cash rate expected

The latest poll on the Reserve Bank of Australia from Reuters, in brief:

- RBA to hold steady in April: All 39 economists surveyed by Reuters expect the Reserve Bank of Australia to keep the cash rate at 4.10% on April 1.

- Two cuts expected in 2025: Median forecast sees 25 bps cuts in May and September, bringing the rate to 3.60% by Q3.

- Cautious easing approach: RBA is likely to cut gradually due to still-elevated core inflation (3.2%), low unemployment, and recovering growth.

- May cut hinges on inflation data: Around 75% of economists expect a cut in May, pending Q1 inflation results.

- Major banks aligned on April: ANZ, CBA, NAB, and Westpac all expect rates to remain unchanged next week but differ on the pace and depth of easing.

- Market pricing in line: Interest rate futures broadly reflect the poll’s expectations.

- RBA wary of over-easing: Analysts say the RBA is aware that deep rate cuts could reignite inflation due to ongoing supply constraints.

Confirmed – Australian national election will be on May 3

- Australia’s Prime Minister Anthony Albanese has called an election for May 3

Australian financial markets are rarely troubled too much by a change in government. The differences between the two sides are rarely vast.

We await official election policies but top-of-mind right now is that:

- the government has promised new income tax cuts

- the opposition, on the other hand, have promised petrol (gasoline) tax cuts

Goldman Sachs moves its RBA rate cut forecast from April to May

- Goldman Sachs were projecting a Reserve Bank of Australia 25 rate cut on April 1

- All 39 economists surveyed by Reuters expect the Reserve Bank of Australia to keep the cash rate at 4.10% on April 1.

New Zealand Consumer Confidence Declines in March

Consumer sentiment in New Zealand fell to 93.2 in March, according to the ANZ-Roy Morgan survey, down from February’s 96.6.

The decline reflects ongoing economic uncertainty, with households remaining cautious about future spending. While inflation and interest rates remain key concerns, employment conditions will be crucial in shaping consumer confidence in the coming months.

BOJ Summary of Opinions – March meeting

- Bank of Japan Summary of Opinions of the March 18 and 19 meeting

- One member said inflation is somewhat overshooting expectations.

- One member said wage hikes in spring wage talks are somewhat exceeding last year’s figures, with nominal wages rising at a pace in line with the achievement of the BOJ’s price goal.

- One member said rising wages are likely to underpin consumption.

- One member said there are questions about whether wage gains would be sustainable.

- One member said global economic uncertainty is heightening.

- One member said heightened uncertainty over the global economy could be one new risk factor since our previous meeting in January.

- One member said U.S. inflationary risk and economic worsening risk are both heightening.

- One member said underlying inflation is highly likely to steadily accelerate toward 2%, given steady price rises and the outcome of wage talks.

- One member said the new U.S. administration’s policies could affect Japan’s price moves via fluctuations in markets and FX rates.

- One member said food price rises can be categorised as supply shock but could become sustainable, so must be vigilant to impact on inflation expectations

- One member said soaring agriculture goods prices may not be temporary, could affect households inflation expectations and underlying inflation

- One member said upward price pressure may continue for some time

- One member said we are close to achieving our price goal due to domestic inflationary pressure, must communicate based on such assumption

- One member said BOJ will continue to hike rates if economy, prices move in line with forecast but should not have preset idea on specific policy management

- One member said for the time being, BOJ must scrutinise U.S. policy impact on global economy and markets as well as effect of BOJ’s past rate hike on Japan’s economy, then move to next rate hike

- One member said we don’t have enough data to gauge impact of January policy change, recent long-term rate moves, on economy

- One member said downside risks from U.S. heightening sharply and could have negative impact on Japan’s economy, so we must be even more cautious on deciding next rate-hike timing

- One member said downside risks to Japan’s economy heightening due to U.S. tariff policy, supply chain disruptions, so must keep policy steady for time being

- One member said at next meeting, we must scrutinise inflation expectations, chance of upside price risk materialising, progress in wage hikes, in setting monetary policy

Stronger Tokyo inflation data bolsters case for May BoJ rate hike, says ING

- Point to signs of broadening price pressures across both goods and services

A hotter-than-expected reading on Tokyo inflation has strengthened the case for a Bank of Japan rate hike as soon as May, according to ING, which points to signs of broadening price pressures across both goods and services.

Consumer price inflation in the Japanese capital rose to 2.9% year-on-year in March, up from a revised 2.8% in February and ahead of market expectations for a 2.7% gain. Core inflation, which excludes fresh food, also picked up to 2.4%, beating consensus forecasts of 2.2%.

ING analysts note that while prices for fresh food and utilities eased slightly over the month, broader inflation pressures remain persistent. Notable gains were seen across key categories: household goods rose 5.2%, clothing climbed 3.1%, and medical care increased by 2.4%.

“Price pressures are becoming more broadly based, and this trend reinforces our long-held view that the Bank of Japan will raise rates in May,” ING said in a note following the data release.

The firm also highlighted rising processed food prices, noting that earlier spikes in fresh food costs are beginning to flow through to broader categories — including eating-out prices — with a time lag. These second-round effects are already being monitored closely by the BoJ.

With inflation momentum building across both goods and services, ING believes the risks are skewed toward a policy response sooner rather than later. “Upside risks to inflation are growing, and the odds of a rate hike in May are clearly increasing,” the note added.

Tokyo Inflation Surpasses Expectations in February

Tokyo’s consumer price index (CPI) for February rose by 2.9% year-over-year, aligning with January’s reading but surpassing the expected 2.7%.

- Core CPI (excluding fresh food) increased by 2.4%, ahead of the 2.2% forecast.

- Core-core CPI (excluding fresh food and energy) climbed to 2.2%, exceeding both the expected 2.0% and the prior 1.9%.

With all inflation measures exceeding the Bank of Japan’s 2% target, speculation grows over potential policy shifts, which could strengthen the yen and impact interest rates.

A look at the ex-fresh food chart:

Crypto Market Pulse

Bitcoin Weekly Forecast: BTC Stays Calm Before Potential Volatility

- Bitcoin consolidates between $85,000 and $88,000 amid market caution.

- K33 Research predicts volatility as investors react to tariff developments.

- PlanB’s S2F model suggests Bitcoin is significantly undervalued compared to Gold and housing.

Bitcoin Holds Steady Ahead of Trump’s Tariff Moves

Bitcoin started the week strong, reaching a high of $88,765 on Monday, following a 4.25% recovery the previous week. The move was fueled by a Wall Street Journal report indicating that the White House may take a more selective approach to tariffs set for April 2, focusing on targeted nations rather than broad industry-wide tariffs.

Tuesday’s K33 Research report highlighted that the market remains relatively calm but is likely to experience a volatility surge as the tariff situation unfolds. With President Donald Trump’s announcement looming, traders are bracing for three possible outcomes:

- A softened stance could spark a market rally.

- A vague approach may lead to unpredictable swings in both long and short positions.

- A hardline stance could trigger a sharp downturn, echoing previous tariff-driven sell-offs.

On Wednesday, Trump announced a 25% tariff on automobile imports effective April 3, along with broader reciprocal tariffs against major US trade partners. QCP Capital analysts warn that any retaliatory actions from these nations could inject fresh uncertainty into global markets.

GameStop Joins the Bitcoin Holders Club

Institutional interest in Bitcoin continues to grow, with GameStop (GME) becoming the latest corporation to add BTC to its treasury. The company updated its investment policy to include Bitcoin and announced a $1.3 billion private offering of senior convertible notes at 0% interest to strengthen its reserves.

GameStop follows MicroStrategy, which added 6,911 BTC for $584.1 million this week. The company now holds 506,137 BTC, acquired at an average price of $66,608 per Bitcoin, making it the largest corporate Bitcoin holder. This aligns with a broader trend of institutional adoption, especially after Trump’s recent executive order establishing a strategic cryptocurrency reserve.

Bitcoin’s Valuation Compared to Gold and Housing

PlanB’s Stock-to-Flow model suggests Bitcoin is highly undervalued compared to gold and real estate:

- Bitcoin market cap: $2 trillion vs. Gold: $20 trillion.

- Bitcoin scarcity ratio (S2F): 120 vs. Gold: 60 years.

Glassnode’s Forging Long-Term Holders report reveals Bitcoin is trading within a new range of $78,000 – $88,000, with weakening sell pressure. While short-term holders are facing financial stress, long-term holders are accumulating, signaling a potential supply squeeze in the coming months.

Technical Outlook: Consolidation Persists

Bitcoin is holding within the $85,000 – $88,000 range after breaking above the 200-day EMA. However, the Relative Strength Index (RSI) sits at 50, indicating a lack of momentum.

If Bitcoin breaks below $85,500, it could fall toward the next major support level at $78,258.

Dogecoin, XRP Drop 7% as Tariff Concerns Hit Markets

- Crypto Market Reaction:

- DOGE, XRP down 5-7%

- Bitcoin options worth $12.2B expiring (max pain: $85,000)

- Investors cautious ahead of PCE inflation data

- Gold Rallies: Hits $3,109, continuing March surge

- Market Volatility Tied to U.S. Tariffs & Inflation Risks

The Day’s Takeaway

Day’s Takeaway: Key Market Trends & Developments

United States: Markets on Edge as Tariff Fears and Inflation Shape Sentiment

- Stocks Slump:

- Major indexes closed lower, with the S&P 500 down 2.0%, Nasdaq 2.7%, and Dow 1.7% as investors braced for Trump’s April 2 tariff announcement.

- Tech stocks struggled, with Nvidia down nearly 10% this week, signaling potential exhaustion in the AI-driven rally.

- Tariff Uncertainty:

- Trump confirmed a 25% tariff on auto imports starting April 3, alongside broader reciprocal tariffs against key trading partners.

- Markets fear retaliation from Canada, the EU, and Asia, adding fresh layers of uncertainty.

- Fed Rate Cut Expectations:

- Core PCE inflation ticked up to 2.8%, but markets still expect two Fed rate cuts in 2025.

- Money markets now price in 73.5 basis points (bps) of easing, reflecting traders’ confidence in eventual rate relief.

- Consumer Sentiment Dips:

- The University of Michigan’s index fell from 57.9 to 57.0, showing growing consumer pessimism about inflation and tariffs.

Canada: Preparing for Trade Retaliation

- Tariff Response in the Works:

- Canada is finalizing countermeasures against Trump’s auto tariffs, expected to include import levies on US goods.

- Ottawa warns that US tariffs could disrupt the North American auto industry, increasing car prices on both sides of the border.

- Stock Market Hit:

- TSX declined alongside US equities, weighed down by resource and industrial stocks.

- Canadian Dollar Weakens:

- The loonie dropped as investors priced in economic risks from trade tensions.

Commodities: Gold Surges as Safe-Haven Demand Rises

- Gold Hits All-Time High:

- Prices spiked to $3,090, driven by:

- Safe-haven demand ahead of Trump’s tariff deadline.

- Weaker US dollar and falling Treasury yields.

- Persistent inflation fears despite Fed cut bets.

- Prices spiked to $3,090, driven by:

Europe: Economic Uncertainty as Trade War Looms

- EU Plans Retaliation Against US Tariffs:

- Brussels is preparing its own set of counter-tariffs in response to Trump’s 25% levy on auto imports.

- European automakers, including Volkswagen and BMW, saw stock declines, fearing supply chain disruptions.

- Stock Markets Decline:

- DAX (-1.8%) and CAC 40 (-1.6%) dropped, reflecting concerns over global trade instability.

- Euro Strengthens Slightly:

- The EUR/USD pair climbed as traders speculated on a possible ECB policy shift to counteract economic slowdown risks.

Rest of the World: Global Markets React to US Trade Moves

- China:

- Beijing warned of possible retaliatory tariffs and currency interventions if Trump escalates trade measures.

- The Shanghai Composite dipped 1.3% on fears of slowing exports.

- Japan:

- Nikkei fell 2.2%, tracking losses in global equities.

- The yen strengthened, reflecting risk-off sentiment and safe-haven demand.

- Emerging Markets:

- MSCI Emerging Markets Index fell, with investors worried about capital outflows due to US trade policy.

Crypto: Bitcoin Holds Steady, Institutional Adoption Grows

- Bitcoin Consolidates Between $85,000 – $88,000:

- Despite market volatility, BTC held its range, with traders awaiting key macroeconomic developments.

- Corporate Adoption Rises:

- GameStop (GME) added Bitcoin to its treasury, following MicroStrategy’s recent $584M BTC purchase.

- PlanB’s S2F Model: Bitcoin Still Undervalued

- Bitcoin’s scarcity ratio (S2F) at 120 is double that of gold, signaling potential upside.

- Technical Outlook:

- BTC needs to hold $85,500 support to avoid a drop to $78,258.

The Bottom Line:

Markets are entering a high-stakes period with the April 2 tariff deadline at the center of global risk. Equities remain under pressure, gold is surging, and Bitcoin is holding steady. The next moves by Trump, the Fed, and major economies will shape market direction in the weeks ahead.

📊 Key Watchlist for Next Week:

✔ Trump’s Tariff Speech (April 2)

✔ US ISM Manufacturing PMI & JOLTS Report

✔ EU & Canada’s Response to Trade Measures