North America News

US Stocks Close at Record High Despite Trump Blowing Up Canada Talks

U.S. equity markets wrapped up Friday at new record highs, brushing off a late-session jolt from Trump’s surprise move to end trade negotiations with Canada.

The session started on a strong note, with buyers piling in early and pushing major indexes toward all-time highs. Optimism was fueled initially by the day’s economic data: the latest PCE report showed core inflation running hotter than expected, but spending was weak—hinting at a tricky “stagflation-lite” scenario for the Fed to navigate. This led to some early selling in the dollar and pushed the euro to a fresh three-year peak.

The rally stumbled late in the afternoon when Trump announced he was halting trade talks with Canada over their new digital services tax on U.S. tech firms. The headline sent a shiver through markets, erasing over 40 points from the S&P 500 and flipping it briefly into the red. The move also sparked a sharp 70-pip jump in USD/CAD and a broader rise in the U.S. dollar as investors scrambled for safety.

Yet, in classic fashion, dip buyers swooped in almost immediately, betting that Trump’s outburst was more of a bargaining ploy than a genuine policy shift. The “TACO” trade took hold, and the S&P 500 reversed course to close up 0.5%, gaining 32 points on the day.

Here’s where the major indexes settled:

- S&P 500: +0.5%

- Nasdaq: +0.5%

- Dow Jones Industrial Average: +1.0%

- Russell 2000: Flat on the day

Weekly performance:

- S&P 500: +3.4%

- Nasdaq: +4.2%

- Russell 2000: +2.9%

On the stock-specific front, Palantir tumbled 9.04%, giving back ground after a massive rally. Investors appear to be locking in profits, and some concerns emerged around a slightly lower U.S. defense budget this year.

Looking ahead, traders will be watching the fallout from Trump’s announcement closely, especially with Canada’s digital services tax set to kick in on Monday. The weekend could bring further volatility if negotiations twist again.

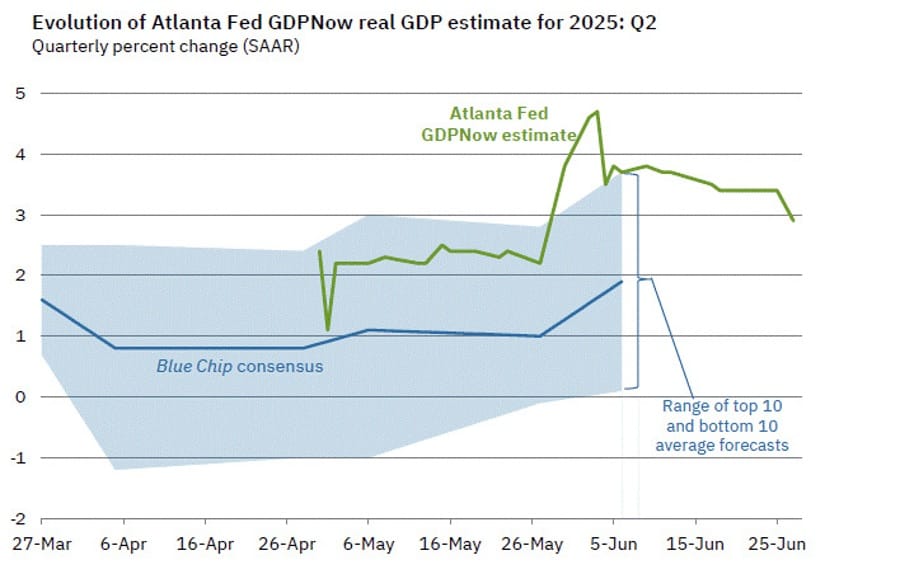

Atlanta Fed Lowers Q2 Growth Outlook to 2.9%

The Atlanta Fed’s GDPNow model has reduced its second-quarter growth estimate to 2.9%, down from 3.4%. The revision follows weaker-than-expected trade data and softer consumer spending figures from the May PCE report.

While the GDPNow forecast has been gradually trending lower throughout June, the model still points to moderate economic expansion. The initial Q2 GDP report is due in late July.

In their own words:

“After recent releases from the US Census Bureau and the US Bureau of Economic Analysis, an increase in the nowcast of the contribution of net exports to second-quarter real GDP growth from 2.07 percentage points to 3.49 percentage points was more than offset by a decrease in the nowcasted GDP growth contribution of inventory investment from -0.42 percentage points to -2.22 percentage points.”

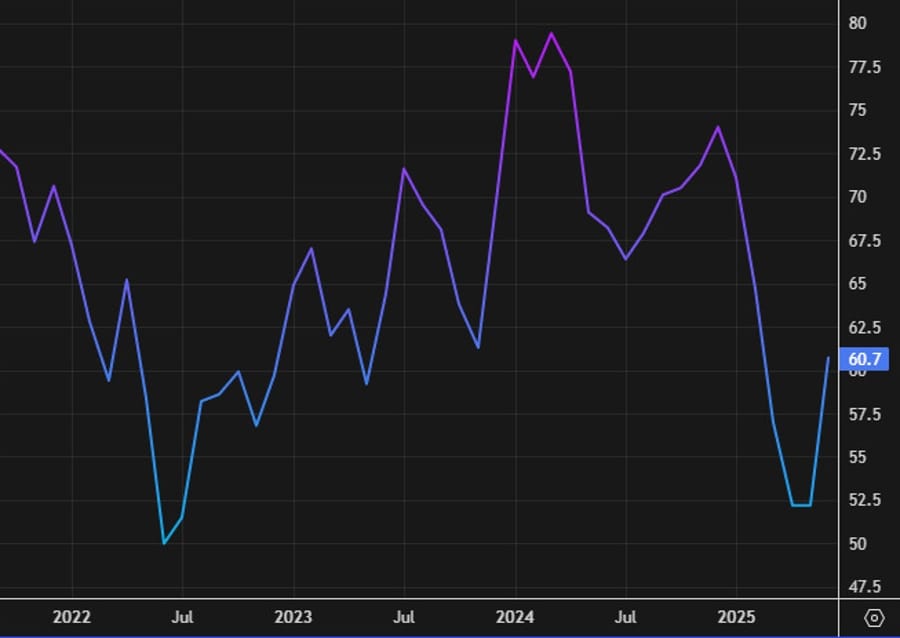

U.S. Consumer Sentiment Inches Higher, But Still Depressed

Final data for June from the University of Michigan showed consumer sentiment at 60.7, slightly above the preliminary reading of 60.5 and well ahead of April’s 52.2.

Current conditions improved to 64.8, up from 63.7, while expectations dipped slightly to 58.1 from 58.4. Inflation expectations for the next year came in at 5.0%, and at 4.0% for the five-year outlook—both just below earlier estimates.

While sentiment has bounced off recent lows, it remains far below late-2024 levels. The market reaction was muted.

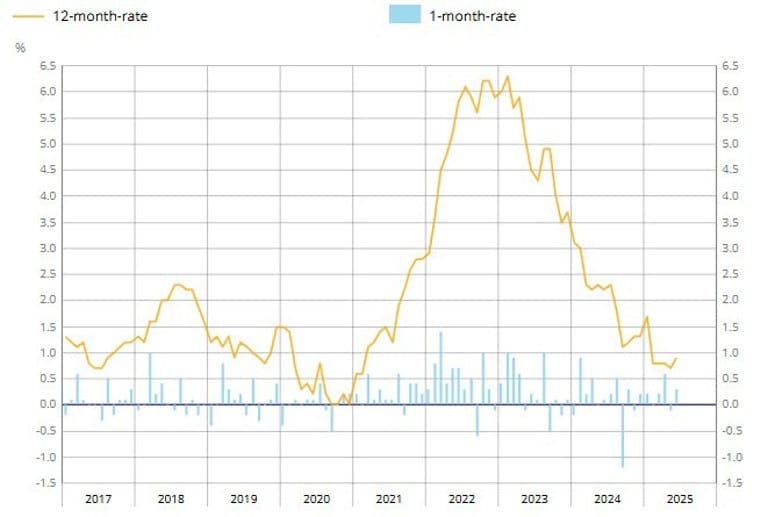

U.S. May Core PCE Inflation Runs Hotter Than Expected

Core personal consumption expenditures (PCE) rose 2.7% year-over-year in May, above the expected 2.6%, with the monthly reading up 0.2%. The unrounded core figure came in at +0.1788%.

Headline PCE inflation matched estimates at 2.3% y/y, while the deflator rose 0.1% m/m. But signs of economic strain emerged in the income and spending data: personal income dropped 0.4% (vs. +0.3% expected) and spending declined 0.1%, both below forecasts.

Real personal consumption fell 0.3%. The report suggests that while inflation remains sticky, consumer momentum may be losing steam.

Dallas Fed: May Trimmed Mean PCE Falls to 2.0%

The Dallas Federal Reserve’s trimmed mean PCE—a key alternative inflation gauge—slowed to an annualized rate of 2.0% in May. That’s down from April’s 2.7%, signaling easing price pressures beneath the surface.

Trump Halts Trade Talks with Canada Over Digital Services Tax

Former President Donald Trump abruptly announced the termination of trade discussions with Canada in response to its proposed digital services tax on American tech firms.

Trump described Canada as a “very difficult country to trade with” and criticized its historical tariffs on U.S. dairy products, some as high as 400%. In a strongly worded statement, Trump declared all talks suspended effective immediately and promised to reveal new tariffs on Canadian goods within the next week.

The move echoes tensions similar to those with the European Union, as Canada’s tax mirrors the EU’s digital levy that is also under discussion with Washington.

Fed’s Kashkari: I continue to expect two rate cuts in 2025

- Adds that the first could possibly come in September

- Official data so far reveals only modest impact of tariffs on prices, activity, labor market.

- If the Fed cuts in September and tariff effect shows up later, could pause rate cuts.

- Inflation boost is likely coming, but actual inflation indicates renewed progress towards 2% target.

- More time is needed to determine if effects of trade war are delayed, or if it will be smaller than thought.

- Emphasis must be on actual inflation, real economic data without committing to an easing policy path in case tariff effects delayed.

US Bessent: Confident that magnets will flow in China-US deal

- Remarks from the US Treasury Secretary to Fox Business

- This is a de-escalation.

- Agreement with China will allow magnets to flow to everyone who received them before on a regular basis.

- 20% fentanyl tariffs on China remain in place.

- Now our tariffs are 30% on China, theirs are 10%.

- On August 12 tariffs date says going to be up to Chinese, think we can keep this de-escalation under control.

- We don’t want to decouple from China.

- After 10 or 12 deals, there are 20 more important ones.

Kashkari: Inflation Must Return to 2% Even as Labor Market Holds Firm

Minneapolis Fed President Neel Kashkari reiterated the central bank’s goal to bring inflation back down to 2%. While he acknowledged that the labor market remains robust, he emphasized the importance of moving cautiously given the delayed effects of tariff-related inflation.

Kashkari also noted that historically, independent monetary policy has helped reduce inflation and support strong employment. He was surprised geopolitical tensions between Israel and Iran hadn’t caused oil prices to spike.

Trusted Musk Associate Omead Afshar Exits Tesla

A key executive close to Elon Musk has parted ways with Tesla. Omead Afshar, who served in the CEO’s office and was responsible for North American and European sales and manufacturing, has left the company, sources told Reuters.

Afshar joined Tesla in 2017 and became one of Musk’s most trusted lieutenants, playing a leading role in major initiatives like the Texas Gigafactory. His departure comes as the automaker struggles with sluggish demand in global markets.

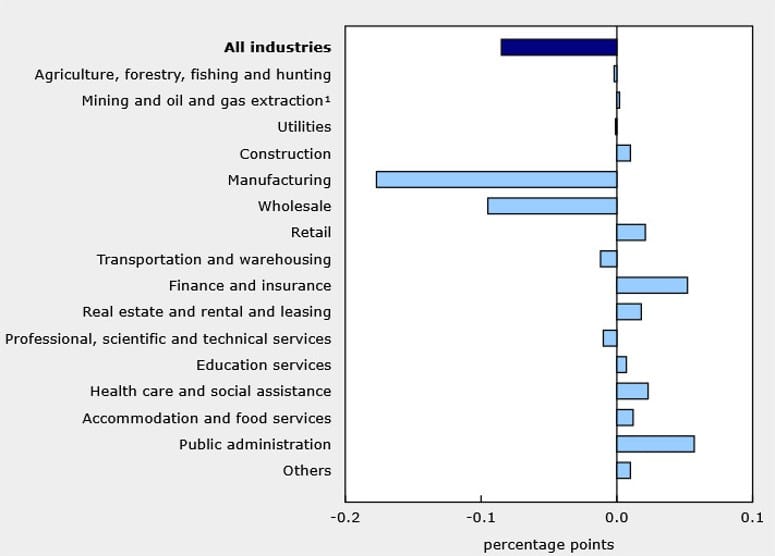

Canada’s GDP Contracts in April; Manufacturing Slumps

Canada’s economy slipped by 0.1% in April, underperforming forecasts that called for flat growth. Statistics Canada revised March’s figure up to a 0.2% gain from the earlier 0.1%.

The April decline was mainly due to a 0.6% drop in goods-producing sectors, led by a downturn in manufacturing. Meanwhile, services edged up 0.1%, with public administration, finance and insurance, and arts and recreation showing strength. Overall, 10 out of 20 industries recorded gains.

An early estimate for May suggests another 0.1% monthly decline.

Commodities News

Gold Drops Below $3,300 as Risk Appetite Returns

Gold prices sank over 1.5% on Friday, falling to $3,274 after touching a high of $3,328. The decline reflects renewed investor optimism amid easing geopolitical tensions and the signing of a trade deal between the U.S. and China.

The U.S. Commerce Secretary confirmed the agreement, noting further deals are expected before July 9. Iran’s willingness to negotiate and hints at a resolution to the Israel-Gaza conflict added to risk-on sentiment, further reducing gold’s safe-haven appeal.

In economic data, U.S. core PCE inflation rose 2.7% in May, slightly above forecasts. Fed officials, including Neel Kashkari, still anticipate two rate cuts in 2025 despite recent inflation trends.

U.S. consumer sentiment ticked higher to 60.7, and inflation expectations eased slightly. Meanwhile, the U.S. Dollar Index held steady at 97.28, and the 10-year Treasury yield was flat at 4.24%. Traders are currently pricing in about 63 basis points of rate cuts by year-end, reflecting a cautious but improving economic outlook.

U.S. Rig Count Drops as Canadian Activity Inches Higher

Baker Hughes reported a decline in the U.S. rig count this week, down by 7 rigs to 547. The breakdown shows oil rigs dropping by 6 to 432, gas rigs falling by 2 to 109, while miscellaneous rigs increased by 1 to 6.

Compared to last year, the total U.S. rig count is down by 34, with oil rigs accounting for most of that drop (down 47), while gas rigs rose by 12 and miscellaneous rigs added 1.

Offshore activity also dipped, with the U.S. offshore rig count dropping by 2 to 12, marking a year-over-year decrease of 9 rigs.

In Canada, the rig count edged up by 1 to 140 this week. Oil rigs increased by 1 to 94, while gas rigs stayed unchanged at 46. Compared to the same time last year, Canada’s total rig count is lower by 36, with oil rigs down by 22 and gas rigs down by 13.

OPEC+ May Deliver Another Large Output Boost in July

OPEC+ is preparing for its July 6 meeting, and Bloomberg reports that another substantial supply increase is on the table. Oil prices edged lower following news that the group may approve a so-called “super-sized” output hike.

Market expectations are already leaning toward another 411,000 barrel-per-day increase. The key question is whether this pace continues in future meetings, depending on global prices and inventory levels.

Platinum Rockets Past $1,400 on Surging Demand from China

Platinum prices have soared past $1,400 per troy ounce—the highest level since September 2014—driven largely by demand from Chinese jewelry buyers, according to Commerzbank analysts.

The metal has gained roughly $400, or 40%, over the past six weeks. Imports into China reached their highest level since April 2024. Analysts caution that the price surge may be overheated, especially given that previous supply deficits failed to trigger similar moves. The rally seems to reflect Platinum’s discount to Gold, which remains relatively expensive.

Central Banks Plan to Boost Gold Reserves, Dollar Loses Appeal

A growing number of central banks are looking to add more gold to their reserves, per a recent OMFIF survey cited by Commerzbank.

Roughly one-third of 75 central banks plan to increase gold holdings in the next 1–2 years, with that figure rising to 40% over a ten-year horizon. At the same time, the U.S. dollar’s popularity is fading—dropping from the most favored currency to seventh place, largely due to political uncertainty in the U.S.

Despite that, the dollar is still expected to retain a 52% share of global reserves in a decade. The euro is projected to hold 22%, though it now trails gold as the third most important reserve asset, according to a recent ECB study.

EU Relaxes Gas Storage Rules to Ease Market Strain

The EU has agreed to loosen its natural gas storage mandates, giving member states more leeway in hitting their targets, according to Commerzbank.

Previously, countries were required to reach 90% capacity before withdrawals began. Now, deviations of up to 10 percentage points are permitted under normal conditions, and an additional 5 points in adverse market scenarios. The deadline has also been pushed out by two months.

The policy change is aimed at reducing market stress, especially after a tough winter depleted inventories. Meanwhile, subdued LNG demand from China—driven by ample pipeline supplies—may help keep European prices in check.

Copper Spreads Surge Again Amid Inventory Crunch

Copper spreads have tightened sharply again on the London Metal Exchange (LME), driven by dwindling inventories and strong U.S. demand, ING reports.

Cash contracts now trade at a $319/t premium over three-month futures—though down from Monday’s record $379/t. The tom/next spread surged to $98/t, the highest on record.

LME stockpiles are at their lowest since August 2023. Meanwhile, U.S. buyers are racing to import copper before potential Trump-era tariffs take effect. While current dynamics support higher prices, any implemented U.S. tariffs could reverse this trend and send prices lower as inventories rebuild.

Natural Gas Prices Continue Downward Slide in Europe

European natural gas prices are on the decline, with Dutch TTF futures falling 3.89% to a seven-week low, according to ING analysts.

A key factor is reduced geopolitical risk after a de-escalation in the Middle East. In addition, EU gas storage is currently at 57% capacity—well below last year’s 76% but comparable to 2022 levels.

The market remains tightly balanced, but short-term downside may be limited as storage builds and global LNG trade dynamics remain in flux.

Crude Oil Holds Ground at Key Support as Traders Await Next Move

Oil prices have stabilized at a crucial technical support level around $64–$65 after giving back gains from the Israel-Iran conflict. The market is now looking for its next catalyst.

With geopolitical tensions easing, attention has returned to macro drivers like Fed rate cuts, economic stimulus under Trump’s administration, and progress on trade talks. Short term, oil appears range-bound between $60 and $90. Buyers are stepping in at support levels, while sellers await a decisive breakdown before targeting prices as low as $55.

Goldman Sachs: Brent Could Hit $90 if Strait of Hormuz Trade Disrupted

Goldman Sachs warns that oil prices could jump to $90 a barrel if trade through the Strait of Hormuz were to be interrupted. While the firm sees that scenario as unlikely, it’s part of their risk modeling.

Current market expectations show a 60% chance that Brent stays in the $60s over the next three months, with a 28% probability it climbs above $70, based on option pricing.

U.S. Postpones SPR Oil Deliveries Until December Amid Maintenance Work

The U.S. Department of Energy has pushed back the remainder of its planned crude oil deliveries to the Strategic Petroleum Reserve (SPR) until the end of the year due to ongoing site maintenance.

Of the 15.8 million barrels scheduled for delivery between January and May, only 8.8 million have arrived. The remaining 7 million barrels are now expected in December, amounting to a delay of approximately six months, according to Reuters.

Reports that Iran’s enriched uranium is stored in protected underground tunnels

- Israel monitoring attempts to retrieve it, if any

An Axios reporter:

- Three senior Israeli officials with direct knowledge of the intelligence about Iran’s nuclear program told me the HEU stockpile is in underground tunnels in Fordow and Isfahan “sealed off” from the outside world due to the bombing of the nuclear facilities.

- Israeli officials believe they will detect any Iranian attempt to recover the HEU.

Europe News

Eurozone Confidence Slides on Weak Manufacturing Sentiment

The European Commission’s final reading on consumer confidence for June stood at -15.3, in line with the earlier estimate. However, broader economic sentiment fell short of expectations, dropping to 94.0 from a prior 94.8 (forecast: 95.1).

Industrial confidence dropped more than expected to -12.0 (versus -9.9 forecast), while services sentiment surprised to the upside, rising to 2.9 from 1.8 previously. Despite weaker factory data, the services sector remains a relative bright spot.

French Inflation Edges Up in June, Led by Services

France’s preliminary inflation reading for June came in hotter than expected, rising 0.9% year-over-year, above the anticipated 0.7%, according to INSEE.

The Harmonised Index of Consumer Prices (HICP) climbed 0.8% from a year earlier, compared to a 0.6% increase in May. A notable factor behind the uptick was a rise in services inflation, which accelerated to 2.4% for the month—up from 2.1% in May.

Spain’s June CPI Overshoots Expectations at 2.2%

Spain’s headline inflation came in slightly above expectations in June, with the preliminary CPI rising 2.2% year-over-year—just above the 2.0% forecast. The same 2.2% increase was reported in the EU-harmonised index (HICP).

Core inflation is estimated to hold steady at 2.2%. With inflation broadly stable, there’s little urgency for the ECB to adjust policy ahead of its summer break.

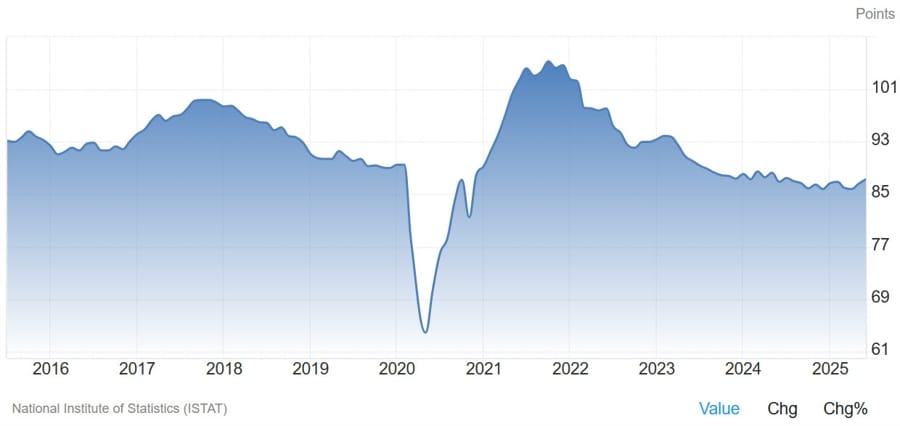

Italy’s Consumer Confidence Falls Slightly in June

Consumer sentiment in Italy softened a bit in June, with the confidence index slipping to 96.1, below the expected 97.0 and down from 96.5 in May.

Meanwhile, business sentiment showed improvement, rising to 87.3 from 86.6 and beating forecasts of 87.0. The rebound in business confidence aligns with a broader trend seen across the Eurozone since the lows of April.

ECB’s de Guindos says on track to meet 2% inflation target

- Remarks by ECB vice president, Luis de Guindos

Nothing notable here by de Guindos. As a reminder, markets are anticipating the ECB to pause all through the summer with just ~24 bps of rate cuts priced in by year-end currently.

ECB’s Knot: The ECB may well need to keep rates on hold for some time

- Comments from the ECB policymaker

- We can’t exclude another ECB rate cut.

- The ECB rate currently at neutral is a good place to be.

- Inflation risks are currently two sided.

Macron Warns U.S.: EU Will Match Any Tariff Hikes

French President Emmanuel Macron has stated that if the U.S. keeps its 10% import tariff in place, the European Union will impose equivalent countermeasures on American companies.

Macron reiterated his support for a balanced and expedited EU-U.S. trade agreement, but made clear that Europe would not let new U.S. trade barriers go unanswered.

Asia-Pacific & World News

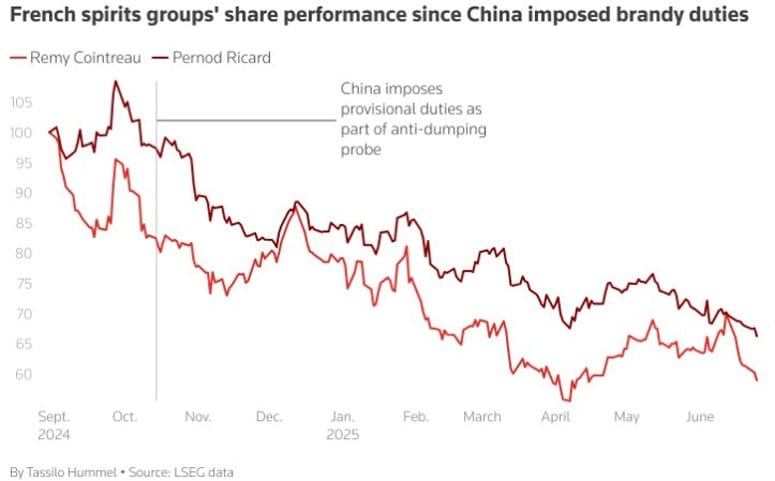

China Pressures France to Link Cognac Deal to EV Tariff Dispute

According to Reuters, China is tying its provisional deal on French cognac to the European Union’s stance on tariffs for Chinese-made electric vehicles.

The agreement, which would replace current temporary tariffs of up to 39%, is reportedly ready but pending Chinese approval. Sources say Beijing wants the EU to move first on the EV tariff issue before finalizing the spirits deal. China had imposed the duties on European brandy in retaliation for the EU’s anti-dumping probe into Chinese EVs. Here’s an indication of the struggle since last year:

China Says London Talks Cemented Framework Details

According to China’s commerce ministry, the recent meeting in London helped both sides solidify key elements of a working framework. China signaled it will begin approving export applications for regulated goods.

In exchange, the U.S. is expected to roll back a number of restrictive trade measures. Both governments are maintaining close dialogue following the meeting.

PBoC: Will enhance monetary policy adjustment strength

- Remarks from the Chinese Central Bank

- Will keep liquidity ample.

- To guide financial institutions to step up credit supply.

- Will enhance central bank policy interest rate guidance.

- To give full play to the role of the self-discipline mechanism for market interest rate pricing.

- To enhance interest rate policy implementation.

- To guide social financing cost to lower.

- To pay attention to the changes in long-term yields in bond market.

- To prevent forex rate overshooting risk.

- To keep yuan exchange rate basically stable at reasonable, balanced level.

- To intensify efforts to revitalise existing commercial housing and land.

- To consolidate stabilising trend in property market.

- To expand domestic demand, stabilise expectations.

- To step up implementation of incremental policies.

- To support banks replenishing capital.

- To use financial services to support private economy.

- To improve efficiency in fund use, prevent fund from going idle.

U.S.-China Rare Earths ‘Understanding’ Falls Short of Deal

A White House official clarified that a recent agreement with China on rare earth shipments is not a formal deal, but merely an “understanding” on how to resume and expedite exports of these critical materials to the U.S.

The official emphasized that this development does not yet constitute a binding agreement and remains far from a finalized trade deal.

JP Morgan: Weaker Dollar May Spark EM Asset Rally

J.P. Morgan now sees broader potential in emerging markets, raising its year-end target for the MSCI Emerging Markets Index from 1,150 to 1,250.

The bank points to attractive valuations, easing trade tensions, and a weaker dollar—which has fallen 10% in 2025—as reasons for increased optimism. With the U.S. economic outlook uncertain, investors may seek better returns in EM assets. J.P. Morgan also expects 19 out of 21 EM central banks to cut rates in the second half of the year, except India and Czechia. The firm highlights the Brazilian real and Mexican peso as top-yielding EM currencies.

China’s Industrial Profits Slide 1.1% in First Five Months of 2025

After positive momentum early in the year, China’s industrial sector is showing signs of strain. Profits dropped 1.1% year-over-year from January through May, reversing a 1.4% gain reported in the previous four-month stretch.

The situation worsened in May, with profits plunging 9.1% compared to the same month last year. Analysts had expected only a slight decline of 0.3%. The downturn reflects persistent deflationary pressures and continued fallout from heightened U.S. tariffs. The data applies to firms with annual operating revenue above 20 million yuan ($2.78 million).

PBOC sets USD/ CNY reference rate for today at 7.1627 (vs. estimate at 7.1771)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 525.9bn yuan via 7-day reverse repos at 1.40%

- 161.2bn yuan mature today

- net injection is 364.7bn yuan

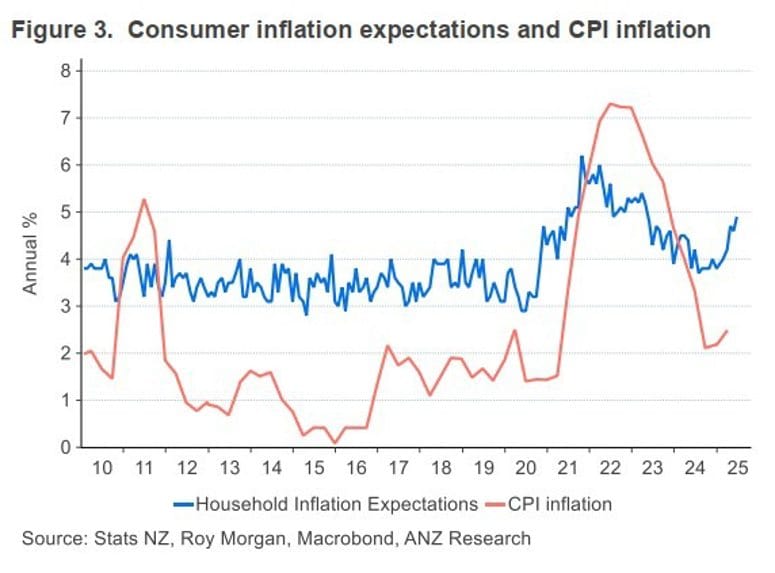

New Zealand Inflation Expectations Climb to 14-Month High

Consumer sentiment in New Zealand saw a noticeable lift in June, but inflation concerns are rising again. The ANZ-Roy Morgan Consumer Confidence Index rose by six points to 98.8, up from 92.9 in May.

At the same time, inflation expectations ticked up by 0.3 points to 4.9%—the highest since April 2023. Food inflation, currently at 4.4%, appears to be a key factor driving the surge, posing a new challenge for the Reserve Bank of New Zealand.

Japan’s Job Market Holds Steady in May

Japan’s unemployment rate remained at 2.5% in May, matching both expectations and the prior month’s figure.

However, the job-to-applicant ratio dipped slightly to 1.24, down from 1.26 in April and missing forecasts. The softening in this metric may point to a marginal cooling in Japan’s labor market conditions.

Tokyo Inflation Slows Slightly in June, Core Figures Hold at 3.1%

Inflation in Tokyo decelerated in June, with headline CPI rising 3.1% year-over-year, below the expected 3.3% and down from 3.4% in May.

Core CPI excluding fresh food also came in at 3.1%, matching the figure excluding both food and energy. This marks the highest core-core CPI rate since January 2024 but falls short of market forecasts, suggesting easing price pressures in the capital.

Japan’s May Retail Sales Disappoint With Just 2.2% Annual Growth

Retail sales in Japan grew 2.2% in May compared to a year earlier, missing expectations of a 2.7% increase. That’s a steep drop from the 3.5% growth recorded in April.

Month-over-month data also came in weak, falling by 0.2% versus forecasts of a 0.3% rise. April’s monthly gain was 0.7%. The numbers suggest sluggish domestic demand in the second quarter.

South Korea Convenes Emergency Meeting to Tackle Soaring Household Debt

The South Korean government has held an emergency session to address rising household debt levels, among the highest in the OECD.

Officials are tightening lending standards again as mortgage growth, driven by looser credit policies and surging home prices in cities like Seoul, continues to climb. Policymakers are pushing fixed-rate and amortizing loans to curb risky borrowing. High debt levels have made households vulnerable to rate changes and economic downturns, constraining the Bank of Korea’s ability to adjust interest rates effectively.

Crypto Market Pulse

Crypto Market: Bitcoin Consolidates, Ethereum and XRP Hold Ground

Bitcoin traded near all-time highs on Friday but saw a cooling in trading volume, suggesting consolidation. The cryptocurrency briefly touched above $108,000 on Thursday before slipping to around $107,147.

Ethereum was last seen at approximately $2,451, with immediate support from its 50-period EMA on the 4-hour chart. Resistance is marked by the confluence of the 100- and 200-period EMAs near $2,467. The RSI at 55 indicates a neutral stance, with a potential upside target of $2,570 if bulls gain traction.

XRP traded at $2.08, consolidating after recent losses. While Open Interest in XRP futures rose to $4 billion from $3.54 billion on Monday, suggesting heightened market interest, technical indicators like the RSI (41) and a bearish MACD signal imply caution. Short-term support holds at $2.08, with possible rebounds toward $2.19 or even $2.33 if sentiment shifts.

Meanwhile, Bitcoin spot ETFs continued to see net inflows, adding $228 million on Thursday, though this was down from $548 million the previous day. Total net inflows now stand at around $48.4 million, supporting Bitcoin’s steady tone despite global uncertainties.

XRP Faces Bearish Pressures, Risks Slide Below $2

Ripple’s XRP continued its downward slide on Friday, trading around $2.08 after failing to break above $2.23 resistance. The bearish momentum leaves the token at risk of slipping below the $2 mark as traders pull back.

Despite price struggles, Ripple is pushing forward on the tech front. The company announced a partnership with Wormhole to enhance multi-chain capabilities for the XRP Ledger. This integration aims to improve cross-chain transfers and messaging, supporting the adoption of stablecoins and tokenized assets.

Wormhole’s infrastructure will connect XRPL and its Ethereum Virtual Machine sidechain, allowing seamless movement of assets like XRP, IOUs, and multi-purpose tokens across different blockchain ecosystems. Ripple’s CTO David Schwartz emphasized the importance of interoperability for mass adoption, saying the move sets up XRP Ledger assets to interact smoothly with other networks while maintaining control and native issuance.

Tron Prepares for Breakout as On-Chain Activity Surges

Tron (TRX) traded between $0.2704 support and $0.2751 resistance on Friday, showing signs of a potential breakout. On-chain data indicates transactions on the network are nearing nine million—almost double the levels seen in late 2023.

Average gas fees have fallen from 2.72 TRX in September 2023 to around 0.79 TRX in June, supporting increased user activity. Analysts highlight that TRX’s price action is being driven by functional demand as more transactions require TRX for fees.

Tron has become the dominant network for USDT transfers, with the supply of Tether on Tron hitting a record $80 billion as of June 23. This surge—adding over $20 billion since January—underscores the protocol’s role in stablecoin usage.

With strong fundamentals and increasing adoption, TRX could be poised for further gains if it can clear immediate technical hurdles.

Aptos (APT) Maintains Bull Run as Derivatives Activity Surges

Aptos (APT) continued its bullish streak, gaining another 5% on Friday and trading back above $5.00. The Layer-1 token has risen nearly 30% over the past week, bolstered by increased activity in the derivatives market.

Open Interest (OI) for APT surged 20% in the past 24 hours to $232 million, according to CoinGlass. Bullish sentiment dominates with long trades making up 53.89% of recent volume, pushing the long/short ratio to 1.16.

APT is still trading within a broader descending channel, but momentum appears strong enough for a test of the upper boundary.

Hyperliquid (HYPE) Rebounds as DeFi Activity Surges

After three straight days of losses, Hyperliquid (HYPE) bounced nearly 3% on Friday, trading around $36.82. The Layer-1 token found support near $35.00 and is now eyeing a return to its all-time high of $45.71.

Hyperliquid’s decentralized finance (DeFi) total value locked (TVL) reached $1.77 billion, an 80% increase since April 1. The rise in TVL suggests growing user trust and deeper liquidity across the platform’s lending, trading, and staking services.

However, caution may be warranted. Open Interest in HYPE futures has declined since peaking near $1.98 billion on June 17. The drop to an average of $1.66 billion indicates reduced speculative appetite, possibly capping near-term gains.

The Day’s Takeaway

United States

U.S. stocks closed at record highs despite a late-day shock from former President Trump, who abruptly ended trade talks with Canada over a new digital services tax. The S&P 500 finished up 0.5% after rebounding from a steep midday drop. The Dow led gains, closing 1.0% higher, while the Nasdaq also added 0.5%.

On the economic front, the May core PCE inflation rose 2.7% y/y, topping expectations, while personal spending slipped 0.1% and income fell 0.4%, fueling talk of a stagflation risk. Consumer sentiment improved slightly to 60.7 in June, but remains historically low.

The Atlanta Fed downgraded its Q2 GDP growth forecast to 2.9% from 3.4%, reflecting softer trade and spending data. Meanwhile, the Dallas Fed’s trimmed mean PCE cooled to 2.0%, suggesting mixed signals on inflation trends.

Canada

Canada’s GDP for April contracted by 0.1%, missing forecasts for flat growth. The decline was driven by a 0.6% pullback in goods-producing sectors, especially manufacturing. Services advanced slightly by 0.1%. Early estimates suggest a further 0.1% drop in May.

The rig count in Canada rose slightly by 1 to 140, with oil rigs ticking up to 94. However, the count remains 36 rigs below last year’s level.

Commodities

Oil markets were in focus ahead of the OPEC+ meeting on July 6, with reports suggesting the group may approve another large supply increase. Crude consolidated around a key technical support zone, awaiting clear direction.

Gold plunged more than 1.5%, slipping below $3,300 as investors embraced risk amid U.S.-China trade breakthroughs and easing Middle East tensions. The yellow metal last traded near $3,274.

Copper spreads on the LME surged again, driven by tight inventories and pre-tariff rushes into the U.S., while platinum soared past $1,400 for the first time since 2014 on Chinese jewelry demand.

Natural gas prices in Europe continued to slide, supported by improved storage levels and less pressure from global LNG markets. The EU also relaxed gas storage mandates to ease price volatility.

Europe

In France, June’s preliminary CPI rose 0.9% y/y, beating forecasts, with services inflation notably higher. Spain’s CPI also overshot expectations at 2.2% y/y, while Italy’s consumer confidence softened slightly to 96.1.

Eurozone economic confidence slipped to 94.0, weighed by weakening industrial sentiment, though services showed resilience.

French President Macron warned of retaliatory tariffs if the U.S. keeps its 10% import levy, while the White House clarified that a rare earths understanding with China is not a formal deal.

Asia

China’s industrial profits fell 1.1% y/y for the first five months of 2025, reversing earlier gains. In May alone, profits plunged 9.1%, reflecting the impact of weak domestic demand and U.S. tariffs.

China signaled that recent London talks further confirmed export framework details and hinted at easing restrictions on certain goods in exchange for U.S. policy shifts.

In Japan, retail sales for May missed expectations, rising just 2.2% y/y, while Tokyo’s June CPI softened to 3.1% y/y. The unemployment rate held steady at 2.5%, but the job-to-applicant ratio dipped to 1.24.

South Korea held an emergency meeting on household debt, tightening lending rules further to curb mortgage risks.

Rest of the World

New Zealand’s consumer confidence rose in June, but inflation expectations surged to 4.9%, the highest since April 2023, stoking worries for the RBNZ.

Crypto

Bitcoin hovered near record highs, consolidating around $107,147 after peaking above $108,000. ETF inflows continued, although volumes cooled.

Ethereum traded around $2,451, stuck between key moving average levels, while XRP consolidated near $2.08 after three days of losses, despite rising Open Interest suggesting continued trader interest.

Aptos (APT) extended its rally, gaining nearly 30% this week, driven by bullish derivatives activity. Hyperliquid (HYPE) rebounded off support, helped by an 80% rise in DeFi TVL over three months.

Tron (TRX) traded in a tight range but looks poised for a breakout, as on-chain activity surged to nearly nine million daily transactions. USDT supply on Tron reached a new record above $80 billion, underscoring strong stablecoin adoption.