North America News

Wall Street Soars After Tariff Reprieve; Nasdaq Leads with 2.47% Surge

U.S. equities roared back on Tuesday as traders returned from the long Memorial Day weekend with renewed optimism. President Trump’s decision to postpone sweeping tariffs on EU goods until July 9 sparked a sharp rebound, reversing Friday’s losses and sending major indices sharply higher.

All three benchmarks opened with bullish gaps and maintained gains throughout the session, led by tech-heavy Nasdaq:

- Dow Jones Industrial Average climbed 740.58 points (+1.78%) to close at 42,343.65, having opened up 245 points at session low.

- S&P 500 added 118.72 points (+2.05%) to 5,921.54.

- Nasdaq Composite surged 461.96 points (+2.47%) to finish at 19,199.16, recovering from a low of 224 points.

YTD Performance (2025):

- S&P 500: +0.68%

- Nasdaq: -0.58%

- Dow: -0.47%

Top Gainers:

- Tesla (TSLA): +6.90% to $362.75

- GameStop (GME): +6.02% to $35.02

- Stellantis (STLA): +5.92% to $10.48

- Block (SQ): +5.81% to $62.15

- Southwest Airlines (LUV): +5.53% to $32.66

- United Airlines (UAL): +4.73% to $78.18

- American Airlines (AAL): +4.02% to $11.64

- Ethereum (ETH): +4.65% to $2,686.91

Big Tech Highlights:

- Nvidia +3.21% (ahead of earnings)

- Microsoft +2.33%, Meta +2.43%, Apple +2.53%, Alphabet +2.63%, Amazon +2.50%

Two-Year Treasury Auction Clears at 3.955%, Strong Direct Bid

The U.S. Treasury auctioned $69 billion in 2-year notes on Tuesday with a high yield of 3.955%, slightly outperforming the WI level of 3.965%.

- Tail: -1.0 basis point (vs. -0.4 bps average)

- Bid-to-Cover: 2.57x (below 6-month average of 2.65x)

- Directs: 26.2% (well above avg. 16.4%)

- Indirects: 63.3% (below avg. 72.7%)

- Dealers: 10.5% (in line with avg. 10.9%)

Grade: B-, with strength from direct bidders but weaker foreign demand.

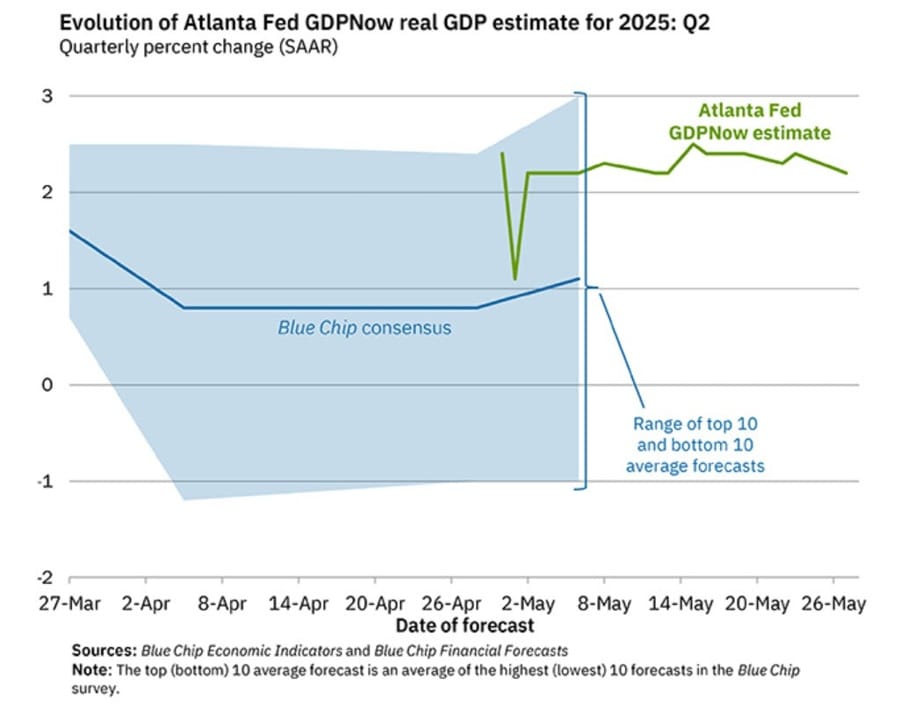

Atlanta Fed Lowers Q2 GDPNow Estimate to 2.2%

The Atlanta Federal Reserve’s latest GDPNow model update shows estimated Q2 2025 U.S. GDP growth has been revised slightly downward to 2.2%, down from 2.4% in the previous reading.

The modest adjustment reflects mixed incoming data, including the latest soft patch in durable goods and uncertainty around consumer spending trends. While the estimate remains in healthy territory, it reinforces the narrative of a slowing but still growing economy.

In their own words:

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the second quarter of 2025 is 2.2 percent on May 27, down from 2.4 percent on May 16. After recent releases from the US Census Bureau and the National Association of Realtors, the nowcast of second-quarter real gross private domestic investment growth decreased from 0.7 percent to -0.2 percent.

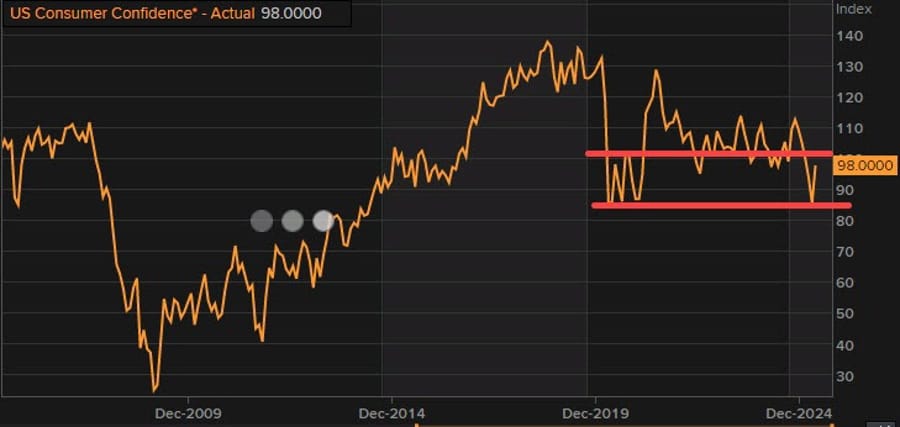

U.S. Consumer Confidence Jumps to 98.0 in May, Beating Forecasts

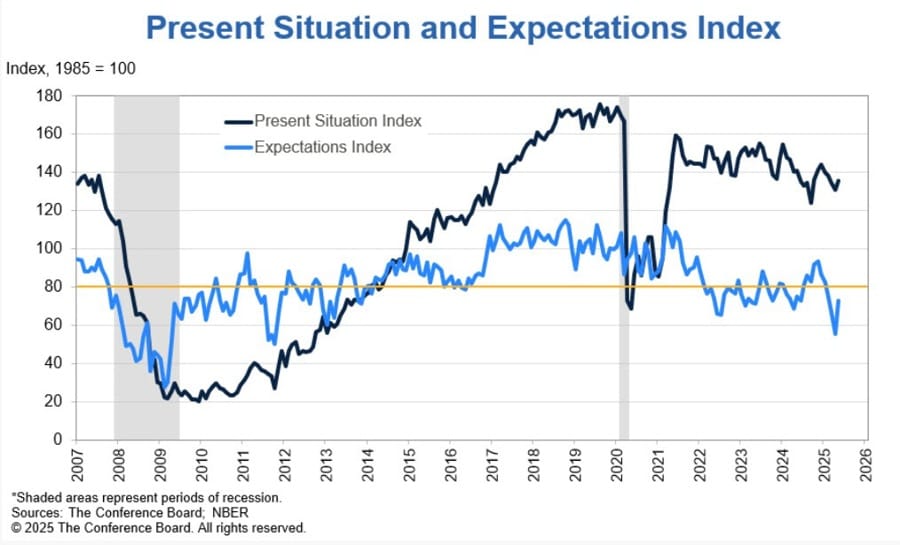

The Conference Board’s Consumer Confidence Index climbed to 98.0 in May, up from 86.0 in April and well above the 87.0 estimate. This marks a significant rebound after five straight months of declines and follows April’s nearly five-year low.

While the Present Situation Index edged slightly higher to 135.9 from 133.5, indicating stable views of current conditions, the Expectations Index surged to 72.8 from 54.4. Although still under the 80 threshold often linked to recession risk, this was the strongest forward-looking sentiment since February.

Key Takeaways:

- One-Year Inflation Expectations: Fell to 6.5% from 7.0%

- Business Conditions (Current):

- “Good”: 21.9% (up from 19.2%)

- “Bad”: 14.0% (down from 16.3%)

- Labor Market (Current):

- “Jobs plentiful”: 31.8% (slightly up)

- “Jobs hard to get”: 18.6% (up from 17.5%)

Six-Month Outlook:

- Business improvement expected: 19.7% (from 15.9%)

- Business worsening expected: 26.7% (from 34.9%)

- More jobs expected: 19.2% (from 13.9%)

- Higher income expected: 18.0% (up from 15.9%)

The rise in confidence may reflect easing concerns about tariffs or fiscal uncertainty, potentially signaling stronger consumer spending in the near term. Still, the Expectations Index remains cautious, highlighting lingering worries about economic headwinds.

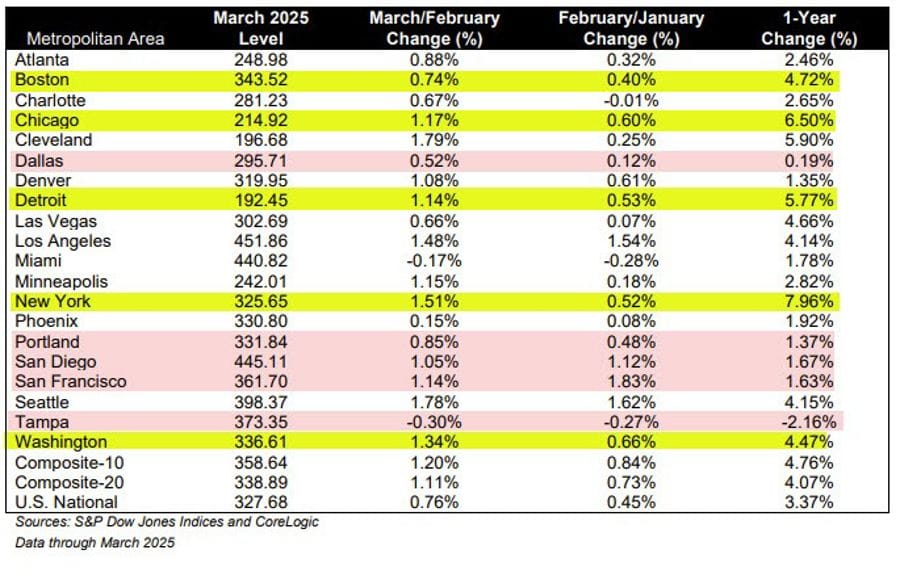

U.S. Home Price Growth Slips in March, Year-on-Year Gains Uneven Across Regions

S&P/Case-Shiller’s 20-City Home Price Index for March recorded a surprise decline of 0.1% month-over-month, missing the expected 0.3% gain. This followed a 0.4% increase in February. On a year-over-year basis, home prices rose 4.1%, also below the forecast of 4.5% and matching February’s pace.

According to Nicholas Godec at S&P Dow Jones Indices, the market showed strong spring performance, but the annual growth rate continued to decelerate. Tight supply and steady buyer interest kept pricing resilient in most areas, although affordability issues remain widespread.

Regional Highlights:

- New York: +8.0% YoY (highest among 20 cities)

- Chicago: +6.5%

- Cleveland: +5.9%

- Dallas: +0.2%

- Tampa: -2.2% (only YoY decline)

Markets like Dallas and Tampa, which experienced sharp price booms earlier in the cycle, continue to recalibrate under the weight of elevated mortgage rates and affordability stress. Overall, the March data shows a housing market stuck between strong seasonal momentum and structural affordability challenges.

Below is the % change for the most recent months and YoY values.

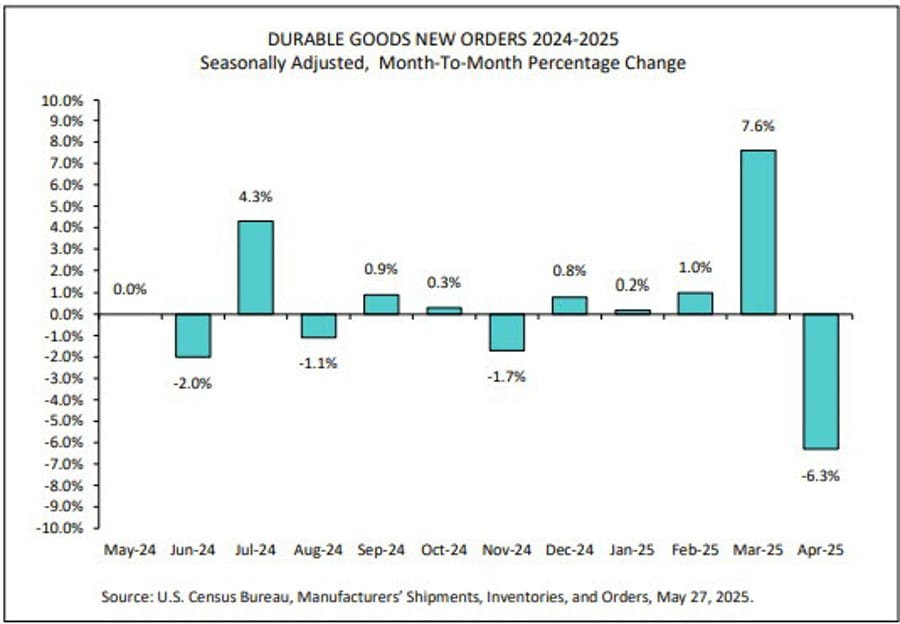

U.S. Durable Goods Orders Drop Sharply in April, But Core Orders Show Some Stability

New data from the Census Bureau shows U.S. durable goods orders declined by 6.3% in April, coming in slightly better than the -7.8% forecast, but still reversing a strong 7.6% increase in March. The drop was driven heavily by transportation, especially aircraft orders, which caused overall volatility.

Stripping out transportation, orders actually rose 0.2%, rebounding from March’s 0.2% drop. However, the key barometer of business investment—nondefense capital goods excluding aircraft—slipped by 1.3%, pointing to mounting uncertainty among firms amid tariff and policy volatility. This figure was down from a 0.3% gain the prior month.

The markets are keeping close tabs on this investment segment, which may influence future Fed rate decisions. Currently, traders are assigning a 56% probability to a September rate cut, with another expected by year-end. However, shifting expectations and unclear economic signals may delay further action.

Durable Goods Breakdown (April 2025):

- New Orders: -6.3% to $296.3B (first decline in 5 months)

- Ex-Transportation: +0.2%

- Ex-Defense: -7.5%

- Transportation Equipment: -17.1% to $98.8B

Shipments:

- Overall: +0.4% to $300.6B (5th straight monthly increase)

- Transportation: +1.4% to $97.8B

Unfilled Orders:

- Up $0.6B to $1,408.5B (up in 11 of last 12 months)

- Transportation: +$1.0B to $850.9B

Inventories:

- Total: +$0.9B to $586.7B (7th monthly gain)

- Transportation: +$0.3B to $188.5B

Nondefense Capital Goods:

- New Orders: -19.1% to $87.3B

- Shipments: +3.5% to $87.4B

- Inventories: -0.1% to $249.2B

Defense Capital Goods:

Inventories: +1.0% to $26.6B

New Orders: +30.5% to $14.1B

Shipments: +1.0% to $13.9B

Fed’s Barkin: U.S. Economy Stable But Signs of Business Hesitation Growing

Speaking with Bloomberg, Richmond Fed President Tom Barkin said that while the U.S. economy appears to be on a familiar path—with low unemployment and gradually cooling inflation—underlying business and consumer behavior points to caution.

Barkin cited widespread hiring freezes and deferred investments as businesses “pull to the sidelines.” Despite this, he doesn’t see companies canceling plans outright. On the consumer side, sentiment is fragile, but actual spending hasn’t yet fallen off in real-time data.

He also addressed the dual effects of Trump’s tariffs, saying some firms are front-loading imports while others are scaling back. Government budget tightening, especially in the D.C. area, is already showing up in hiring data.

Barkin’s stance leans neutral but alert: no immediate policy action is expected, though risks from policy shifts, inflation psychology, and global volatility are rising. Like many Fed officials, he’s keeping the focus on incoming data before making any forward moves.

Trump Considers Fresh Sanctions on Russia as Trade Remains Minimal

U.S. President Donald Trump is reportedly considering a new round of sanctions against Russia, citing mounting frustration with President Vladimir Putin following recent drone attacks.

While any move would be largely symbolic—Russia now accounts for less than 0.3% of total U.S. trade—the gesture could further chill relations. U.S. exports to Russia have already plunged from over $5 billion annually before 2022 to just $1.9 billion by the end of 2023. Imports, primarily energy and industrial commodities, have also fallen steeply due to previous sanctions and bans.

With trade between the two nations at its lowest level in more than two decades, any new measures are unlikely to carry economic weight but would underscore geopolitical tensions.

Fed’s Kashkari: There is a healthy debate on whether to look through tariffs impact

- Remarks by Minneapolis Fed president, Neel Kashkari

- There is a healthy debate among Fed policymakers on whether to look through inflationary effects of tariffs

- It may take months or years for trade negotiations to fully conclude

- And there could also be tit-for-tat tariff increases throughout the whole ordeal

- It will take time for the full effect of tariffs to pass through to final prices

- These arguments support a stance of maintaining the policy rate, which is likely only modestly restrictive now, until there is more clarity on the path for tariffs and their impact on prices and the economy

Commodities News

Gold Drops Nearly 2% as Dollar and Risk Appetite Rebound

Gold prices plummeted 1.93%, falling below $3,300 on Tuesday as investors shifted away from haven assets in response to Trump’s EU tariff pause. The improved risk tone and a firmer U.S. Dollar (DXY) dragged bullion sharply lower.

Market Drivers:

- Trump delays 50% tariffs on EU goods until July 9, reducing trade war fears.

- DXY gains 0.62% to 99.54, boosted by U.S. consumer confidence hitting a 4-year high (98.0 from 86.0).

- Outlook brightened by hints of upcoming trade agreements, including a potential U.S.-India deal.

Key Watchpoints This Week:

- Fed meeting minutes

- Q1 GDP second estimate

- Core PCE inflation data

A soft economic print could revive demand for safe havens later in the week.

Oil Slips as Resistance Holds; Futures Close at $60.89

Crude prices struggled to sustain upward momentum Tuesday, with WTI futures settling at $60.89, down $0.64 (-1.04%).

Repeated attempts to break above both the 100- and 200-hour moving averages failed, with the price retreating toward $60.29 intraday. The market eyes $60.12 and $60.00 as the next key supports—levels that, if breached, could spark deeper losses.

Silver Holds $33.29 Despite Drop, Eyes $34.58 if Resistance Breaks

Silver pulled back 0.70% to $33.29 after tagging a two-day low at $32.77, but it’s still clinging to its bullish structure. The white metal remains supported by its 50-day SMA at $32.73, while bulls aim for a breakout above key resistance at $33.69.

Upside Targets:

- Immediate: $33.69 (May 22 high)

- Follow-through: $34.58 (March 26 high), then $35.00

Downside Risk:

- A daily close below $32.90 would expose $32.11 (100-day SMA), followed by $31.40 (200-day SMA).

Momentum Check:

- RSI remains in bullish territory, suggesting upside potential isn’t exhausted yet.

- Trend structure remains intact, but traders should watch for momentum loss near resistance.

ECB Eyeing Gold as Safe Haven as Dollar Loses Luster

Commerzbank reports that the European Central Bank is increasingly focused on gold, driven by diminished confidence in the U.S. dollar and U.S. Treasuries due to erratic Trump-era policy shifts.

- COMEX gold futures with physical delivery surged by 150% to 45 million ounces between December and April.

- Eurozone investors’ exposure to gold derivatives jumped 58% to €1 trillion, including many OTC contracts—raising systemic risk concerns.

Gold’s appeal: no counterparty risk, limited supply, and store-of-value properties unmatched in times of volatility.

China’s April Gold Imports from Hong Kong Triple to 59 Tons

China’s gold imports via Hong Kong jumped sharply in April, hitting 59 tons, nearly triple March’s volume.

- The rise came despite high prices, which are normally a headwind for jewelry demand.

- Banks reportedly received higher import quotas, which they used aggressively despite lukewarm retail demand.

- Net imports stood at 43 tons, swinging back from March’s net export.

Oil Market Balanced Between Production Talks and Geopolitics

Brent crude is hovering around $65 as investors weigh OPEC+ output adjustments ahead of this weekend’s meeting, Commerzbank notes.

- Talks of lifting voluntary production cuts by eight member nations are ongoing.

- On the geopolitical front, U.S.-Iran nuclear talks show signs of progress.

- However, rising tensions between the U.S. and Russia—following recent airstrikes in Ukraine—could reignite sanctions, creating fresh uncertainty.

South Africa Eyes $1B LNG Deal With U.S. in Bilateral Trade Push

South Africa is reportedly negotiating a trade deal with the United States that would see the African nation import approximately $1 billion in liquefied natural gas (LNG) annually. In exchange, South Africa is seeking exemption from U.S. tariffs on roughly 40,000 vehicle exports per year.

The LNG-for-auto deal would mark a significant step in expanding energy trade between the two nations while offering South Africa relief from automotive trade barriers. Talks are ongoing, but sources say the deal is nearing agreement.

Goldman Sachs Warns of Lower Oil Prices and Shale Slowdown

Goldman Sachs has revised its outlook for oil prices downward for 2025–2026, citing a projected supply glut from new non-OPEC production. The bank expects top non-OPEC, non-Russian oil fields to bring an additional 1 million barrels per day to market over the next two years.

In parallel, Goldman notes that natural gas megaprojects in Qatar and Saudi Arabia will likely boost OPEC’s natural gas liquids (NGL) output by 200,000 barrels per day annually. As a result, U.S. shale production could peak sooner and at a lower level than previously anticipated, raising strategic questions for American producers.

Europe News

German DAX Hits Record as European Markets Mostly Gain

European stock markets wrapped up mostly in the green on Tuesday, with Germany’s DAX setting a fresh record high. While France’s CAC saw a minor dip, the broader tone across the continent was positive.

- DAX surged 198.84 points (+0.83%) to end at 24,226.50, a new all-time high.

- CAC 40 dipped just -1.34 points (-0.02%) to 7,826.80.

- FTSE 100 added 60.10 points (+0.69%) to close at 8,778.06.

- Ibex 35 ticked up 18.32 points (+0.13%) to 14,239.91.

- FTSE MIB rose 136.42 points (+0.34%) to settle at 40,124.89.

Eurozone Confidence Inches Up in May, but Risks from Tariffs Linger

Final consumer confidence data for the eurozone in May held steady at -15.2, matching the preliminary estimate. Other sentiment indicators from the European Commission also showed slight improvements:

- Economic sentiment index: 94.8 (up from revised 93.8)

- Services confidence: 1.5 (from 1.4)

- Industrial sentiment: -10.3 (improved from -11.0)

Despite the uptick, the overall tone remains subdued. With threats of new U.S. tariffs hanging over the region, businesses and consumers remain cautious. The data reflects a eurozone economy still grappling with uncertainty, especially as geopolitical tensions and sluggish growth persist into the second half of 2025.

Germany’s Consumer Sentiment Inches Up, but Caution Remains

Germany’s GfK Consumer Climate Index for June improved slightly to -19.9 from a revised -20.8 in May, beating expectations of -19.8. However, beneath the surface, the data reveals a cautious household mindset.

Willingness to spend continues to fall, while saving intentions have risen. The modest improvement in the headline number was largely driven by a better outlook on economic prospects, rather than any rebound in consumer behavior. The reading shows that German households remain hesitant, even as inflation stabilizes.

DIHK Trims 2025 GDP Forecast for Germany to -0.3%, Exports Seen Falling 2.5%

Germany’s economy is now expected to contract by 0.3% in 2025, according to the latest forecast from the German Chamber of Commerce and Industry (DIHK). That’s a slight improvement from their earlier projection of a 0.5% decline.

The outlook for exports remains weak, with a 2.5% drop now forecast across the year. Meanwhile, inflation is seen holding steady at 2.1%, down just slightly from 2024’s 2.2%. The revised forecast reflects ongoing challenges in global trade and weak industrial momentum, despite some stabilization in domestic demand.

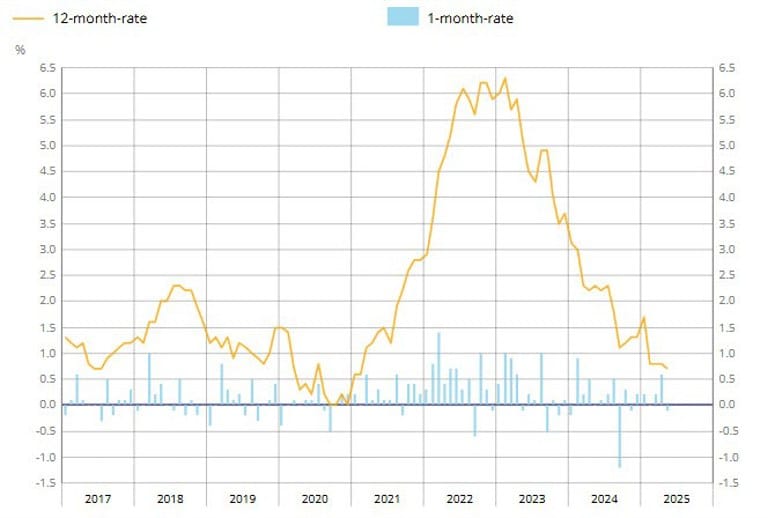

French Inflation Eases in May, Services Drive Soft Print

France’s preliminary inflation data for May came in below expectations, with headline CPI rising just 0.7% year-on-year compared to a forecast of 0.9%. That’s also down from April’s 0.8%.

The Harmonised Index of Consumer Prices (HICP) followed suit, up only 0.6% y/y, short of the 0.9% forecast. The biggest contributor to the deceleration was services inflation, which dropped from 2.4% to 2.1%. With France’s core inflation already running cooler than most of the eurozone—at 1.3% last month—this softer print could further ease pressure on the ECB from a French perspective.

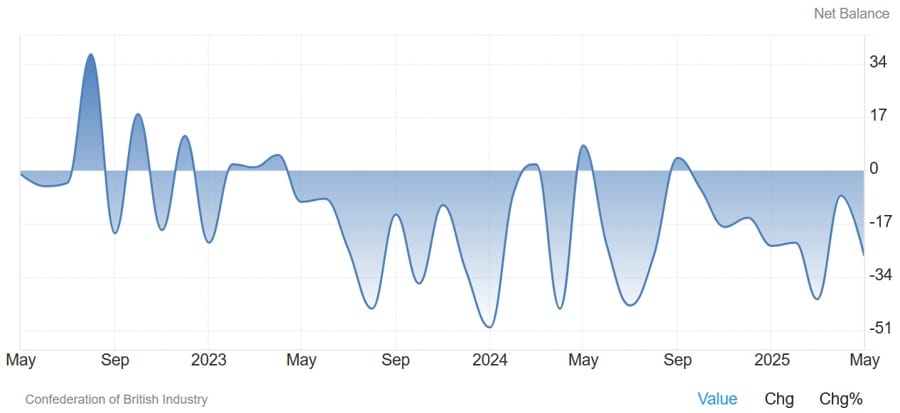

UK Retail Outlook Darkens Sharply as CBI Sales Index Crashes in May

The UK’s CBI Distributive Trades Survey revealed a steep drop in reported retail sales for May, falling to -27 from -8 in April. This marks the weakest reading since March and highlights growing strain in consumer-facing sectors.

Looking ahead, expectations for June deteriorated even further, with the forecast balance dropping to -37 from -33. If realized, that would be the lowest forward-looking figure since February 2024. While the data series is known for its volatility and limited market impact, the sharp decline reinforces concerns about waning retail momentum.

UK Retail Price Index Unchanged in May, Deflationary Trend Persists

Data from the British Retail Consortium (BRC) showed that UK shop prices fell by 0.1% year-on-year in May, unchanged from both the April reading and market expectations. The flat reading signals continued pricing pressure in the retail sector as demand remains subdued.

This marks another month of soft price trends, raising questions about the durability of the UK’s inflation recovery and consumer confidence heading into the second half of 2025.

Switzerland’s Trade Surplus Holds Steady in April Despite Drop in Both Exports and Imports

Switzerland posted a trade surplus of CHF 6.36 billion in April, nearly unchanged from the revised March figure of CHF 6.29 billion, according to data released by the Federal Statistical Office on May 27.

Exports fell sharply from CHF 30.3 billion in March to CHF 25.4 billion in April, while imports also declined from CHF 24.0 billion to CHF 19.1 billion. The large contraction in trade flows didn’t disrupt the balance much, reflecting a synchronized pullback in both inbound and outbound activity.

ECB Lane: No one is talking about dramatic rate cuts

- ECB Lane speaking

- No one is talking about dramatic rate cuts

- We are in a zone of normal central banking

- ECB task is to bring inflation back to 2%

- That task is mostly completed and inflation to remain close to 2% in the coming months

- Service inflation still too high

- The main focus of ECB monetary policy is on the medium-term horizon.

- The neutral interest rate can only be estimated and it is a long-term concept.

- In the long term the neutral interest rate could be around where we are now.

ECB’s Holzmann: The ECB should pause further interest rate cuts until at least September

- Remarks by the most hawkish ECB policymaker to the Financial Times

- The ECB should pause further interest rate cuts until at least September.

- We should keep out powder dry given the US-EU trade war.

- No reason to lower rates in June and July.

- Cutting further would be more risky than staying where we are now.

- Further rate cut would likely have no effect on economic activity.

- Economic activity held back by uncertainty rather than restrictive monetary policy.

- Borrowing costs have come down so much over the past year that they are no longer slowing down economic activity and are potentially even stimulating growth.

- A ‘number of people’ in the ECB Governing Council are also ‘skeptical’ about additional rate cuts.

ECB’s Patsalides: A bigger rate cut is unwarranted now

- Comments from the ECB policymaker, Christodoulos Patsalides

- Optionality remains essential.

- Inflation undershoot would only be temporary.

ECB’s Simkus: The risks that inflation will be below the goal in the future have increased

- In case you missed what he said yesterday

- I see scope for an interest rate reduction in June.

- Balance of risks for inflation is to the downside due to trade friction with the US and stronger euro.

- Borrowing costs are currently at the upper end of the neutral range.

- The risks that inflation will be below the goal in the future have increased.

ECB’s Villeroy: Policy normalisation in the euro area is probably not complete

- Remarks by ECB policymaker, Francois Villeroy de Galhau

- We are likely to see that to be the case at our meeting next week

- French inflation is a positive indicator

UK Launches £3 Billion Training Initiative to Curb Reliance on Migrant Workers

The UK government has unveiled a £3 billion workforce training package designed to reduce dependency on foreign labor by creating 120,000 new training placements across sectors such as construction, healthcare, engineering, and tech.

This initiative comes in the wake of rising public support for immigration curbs, especially after local election gains by the Reform UK party. Prime Minister Keir Starmer has declared the era of open borders “over,” with additional measures including tougher visa rules and a 32% hike in the immigration skills charge, which will help fund the program.

Despite concerns from business groups that stricter immigration controls could disrupt the labor market, ministers argue the investment will help build domestic skills and improve long-term economic resilience.

SNB’s Schlegel: In the coming months we cannot rule out negative inflation in Switzerland

- SNBs Schlegel speaking

- In the coming months we cannot rule out negative inflation in Switzerland

- Price stability is essential contribution a central bank can make.

- Trade uncertainties are currently enormous, related to the tariffs from the United States.

- Yeah or so was yada yada sed you see him go check it maybe is with her daddy in the kitchen areas I hear Our focus is not on current rate or inflation, but price stability over the midterm.

Switzerland says hopes for trade talks with the US to yield a result by July

- Remarks by Swiss economy minister, Guy Parmelin

- Hope that by the beginning of July, we will have a result from discussions with the US

- Need to diversify; important not to depend on single trading partner

As a reminder, Switzerland was slapped with 31% tariffs from the initial announcement in April as they are being treated separately from the EU. However, now the tables have turned a little with Trump threatening the latter with 50% tariffs upon the same deadline in July.

Asia-Pacific & World News

BIS Chief Carstens Urges Governments to Rein in Soaring Debt

Agustín Carstens, head of the Bank for International Settlements, issued a stark warning to governments around the world, urging fiscal policymakers to get serious about ballooning debt levels before public trust erodes.

Carstens emphasized that with the era of ultra-low interest rates behind us, fiscal authorities have a shrinking window to stabilize their balance sheets. He also reminded markets that it’s unrealistic to expect central banks to control inflation within tight bands over short timeframes, especially in such an uncertain macroeconomic environment.

China Highlights Robust April Industrial Profits as High-Tech Sectors Lead Growth

Chinese state media are spotlighting strong April data showing a 3.0% year-over-year increase in industrial profits—a pace faster than the 2.6% recorded in March and the best monthly reading since December. The Global Times attributes the growth to strong performance in emerging sectors such as high-tech manufacturing and equipment production.

Between January and April, high-tech industries saw profits surge 9.0% year-on-year. That figure not only outpaced the January–March growth rate by 5.5 percentage points but also outstripped the broader industrial average by 7.6 points. Officials describe the gains as evidence of “new momentum” bolstering China’s industrial recovery amid continued global uncertainties.

China’s Manufacturing Sector Regains Its Footing with April Profit Rebound

China’s industrial sector showed signs of renewed strength in April, with profits climbing 3.0% from a year earlier, improving from March’s 2.6% rise. Year-to-date, profits are now up 1.4%, doubling the 0.8% seen in the first three months of the year.

The April performance marks the sharpest gain since December, offering some relief to policymakers seeking signs of stabilization in the manufacturing economy. Still, while encouraging, analysts caution that structural headwinds remain—including weak global demand and ongoing trade friction.

PBOC sets USD/ CNY central rate at 7.1876 (vs. estimate at 7.1842)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 448bn yuan via 7-day reverse repos at 1.40%

- 357bn yuan matured today

- net injection 91bn yuan

RBNZ Poised for 25bp Rate Cut, More Easing Likely Ahead

New Zealand’s major banks widely expect the Reserve Bank of New Zealand (RBNZ) to cut its Official Cash Rate (OCR) by 25 basis points this Wednesday, bringing the benchmark rate down to 3.25% from 3.5%. ANZ, ASB, BNZ, Kiwibank, and Westpac are all aligned in their projections.

Analysts note that recent data volatility has done little to alter the policy outlook, and markets have already priced in a cut. Beyond this meeting, forecasts from ASB and Westpac anticipate the OCR could fall further to around 2.75% or lower by late 2025, depending on how inflation and trade tariffs evolve.

Banks caution that while rate cuts are likely, the RBNZ will tread carefully in its messaging, retaining a data-driven, flexible stance due to geopolitical risks and lingering uncertainty over how tariff dynamics will affect the domestic economy.

Japan Considers Reducing Super-Long Bond Issuance Amid Yield Spike

Japan may soon scale back its issuance of super-long government bonds, according to an exclusive Reuters report citing unnamed officials. The move comes in response to a sharp uptick in yields, which has raised concerns among policymakers.

While total bond issuance is expected to remain unchanged, the Ministry of Finance is considering adjusting the duration mix to alleviate pressure on the super-long end of the yield curve. A formal decision is expected in June. News of the plan temporarily calmed market concerns and helped ease pressure on the Japanese yen.

Here you can find the full report

Tokyo Hosts Central Bank Gathering as Inflation, Tariffs Dominate Agenda

A major central banking summit kicked off in Tokyo on Tuesday, drawing comparisons to the U.S. Federal Reserve’s annual Jackson Hole gathering. The event, hosted by the Bank of Japan, brings together top monetary policymakers and economists from around the globe.

This year’s themes include dealing with long-tail inflation caused by supply chain disruptions, navigating quantitative tightening, and managing interest rate normalization in a world still rattled by U.S. trade policy shifts.

Japan’s recent 3.5% core inflation reading adds pressure on the Bank of Japan, with Governor Ueda indicating hikes could return if inflation stays hot. However, the uncertainty created by global tariffs and fragile growth prospects are forcing central banks—including the Fed and ECB—to weigh their next moves with extreme caution.

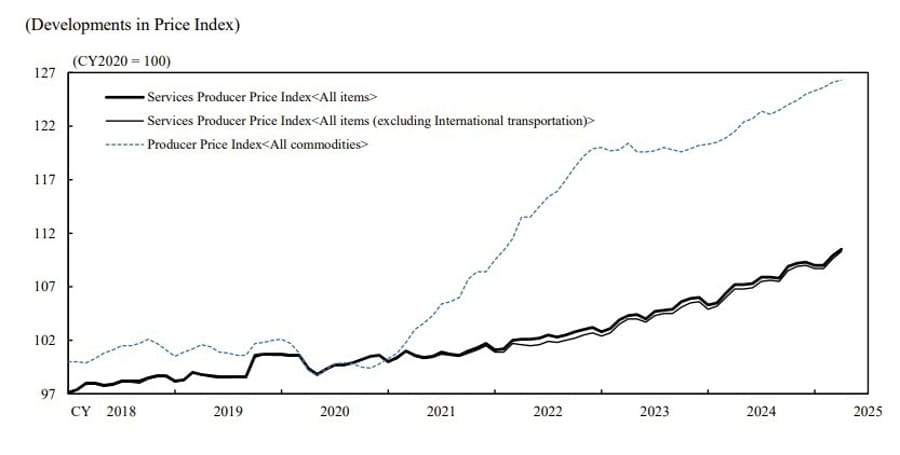

Japan’s Services Prices Hold Steady in April, Matching Forecasts

The Bank of Japan reported Monday that its Services Producer Price Index (PPI) for April came in at 3.1% year-over-year, exactly matching the prior month’s reading and narrowly beating expectations of 3.0%.

The stable result underscores steady upward pressure in Japan’s service economy, a key area of focus as the Bank evaluates how sustained inflation pressures could justify future policy normalization. April’s data shows that price momentum in the services sector remains resilient.

Japan finance minister Kato: Market sees rising rates as reflecting concerns about state finances

- Japan finance minister Kato:

- interest rates reflect various factors, but market sees rising rates as reflecting concerns about state finances

- Will closely monitor bond market situation including super long sector

- Will continue close dialogue with bond investors, market participants

- Not aware of any details about Softbank CEO’s idea of creating joint Japan-US sovereign wealth fund

- Important for currencies to move in a stable manner reflecting fundamentals

- Generally speaking, higher yen could push down import costs and prices

Bank of Japan Governor Ueda – close to inflation target but not quite there

- Bank of Japan Governor Ueda is sending the yen shooting higher with his remarks

- While many of my G7 colleagues looked relieved by progress made in fight against inflation, they also acknowledged new challenges such as heightened trade policy uncertainty and dealing with more frequent supply side shocks

- In Japan we are still grappling with longstanding challenge of achieving our 2% inflation target in sustainable manner

- While we are now closer to our inflation target than any time during the last few decades, we are not quite there

- Inflation in Japan has picked up again, driven primarily by increases in food prices, most notably rice prices

- Japan’s real policy rate remains deeply negative

- In light of growing uncertainties, particularly those related to trade policy, we have recently revised down our economic and inflation outlook

- But we continue to expect underlying inflation to gradually move toward 2% over the second half of our forecast horizon

- There are both upside, downside risks around our baseline scenario

- Risks to economic activity, prices are skewed to downside for fiscal 2025 and 2026

- To extent incoming data allows us to gain more confidence in our baseline scenario, as economic activity and prices improve, we will adjust degree of monetary easing as needed to ensure achievement of sustainable 2% inflation target

- Considering extremely high uncertainties, it is important for us to judge whether the outlook will be realised, without any preconceptions

- Increases in underlying inflation in Japan were driven not only by economic recovery from pandemic and tight labour market, but also by supply shocks, as they fed into domestic prices and wages

- Now we are facing another round of supply shocks in form of food price increases

- Our baseline view is that effects of food price inflation in Japan are expected to wane

- But given underlying inflation is closer to 2% than a few years ago, we need to be careful about how food price inflation will impact underlying inflation

- As supply shocks become more frequent globally, relationship between headline and underlying inflation will likely remain major focal point for many central banks

Crypto Market Pulse

XRP Holds the Line at 50-Day EMA as Activity Declines

Ripple’s XRP continues to trade sideways, clinging to its 50-day EMA support at $2.33 after last week’s stall below the $3.00 threshold. A notable 44% drop in active wallet addresses since January suggests waning investor confidence.

Price Levels:

- Current: $2.33

- Recent high: $2.65 (May 12)

Network Metrics:

- Active Addresses: Fell from 39,515 to 22,253, down 44%

- Long liquidations rising alongside volume implies increasing bearish pressure.

The chart shows XRP remains stuck in consolidation. Bulls must reclaim $2.65 to revive momentum toward the $3.00 psychological zone, but declining on-chain activity signals a weakening narrative.

Ethereum Jumps 4% as Sharplink Unveils $425M ETH Treasury Plan

Ethereum surged 4% on Tuesday to $2,670, after Sharplink Gaming disclosed plans to buy $425 million worth of ETH as part of a strategic treasury shift.

Treasury Move Highlights:

- Sharplink raised $425M via a PIPE offering.

- Funds will be allocated to purchasing Ether as a long-term reserve.

- Joseph Lubin (Consensys CEO, Ethereum co-founder) to join Sharplink’s board as Chairman after the deal closes on Thursday.

Key Resistance Levels:

- Immediate: $2,750–$2,850

- Strong volume will be needed to push past this zone.

Other firms, including BTCS and BioNexus, have made similar ETH treasury moves in recent months. This growing trend may signal rising institutional confidence in Ethereum as a reserve asset, even after being outpaced by BTC and SOL in 2024.

Senate to Debate $1M Bitcoin Reserve Proposal

Senator Cynthia Lummis confirmed that a new bill aiming to create a $1 million federal Bitcoin reserve will hit the Senate floor next week.

She added: “President Trump supports the bill.”

This follows recent legislative movement around stablecoin frameworks. The proposal marks a potential shift toward crypto as a strategic asset.

AI Tokens Pop Ahead of Nvidia Q1 Earnings

With Nvidia set to report Q1 earnings Wednesday, AI-linked tokens saw solid gains:

- NEAR +2.5%

- VIRTUAL +10.3%

- KAITO +10.4%

The broader AI token index rose 3%, riding on expectations of an 8% post-earnings move in Nvidia’s market cap—equivalent to $250 billion in value.

This marks another example of the “sell-the-news” effect, where tokens often rally ahead of Nvidia reports, then retrace immediately after.

Helium Approaches Breakout Point Amid Rising Open Interest

Helium (HNT) is coiling within a tightening triangle pattern, trading at $4.121 on Tuesday as open interest surges to $6.69 million, up from $5.35 million last week.

- Triangle pattern formed between converging 50-day and 200-day EMAs.

- A breakout above $4.35 (200-day EMA) could push HNT to $5.81.

- MACD is close to a bullish crossover; RSI remains neutral.

Support lies at $3.83, with a deeper floor at $3.22.

Standard Chartered Sees Solana at $275 by Year-End, $500 by 2029

Solana (SOL) could reach $275 by the end of 2025, with a longer-term projection of $500 by 2029, according to a forecast from Standard Chartered.

- The bank expects the ETH/SOL ratio to climb from 14 to 17 by 2027.

- SOL is viewed as undervalued relative to its utility but weighed down by high volatility in memecoin trading.

- Standard Chartered cautions that while Solana may eventually lead in high-speed, low-fee application spaces, that dominance will take time to materialize.

The Day’s Takeaway

United States

- Stocks rallied hard on Tuesday after President Trump delayed the 50% EU tariff threat to July 9. The NASDAQ led with a 2.47% gain, followed by the S&P 500 at +2.05%, and the Dow Jones at +1.78%.

- Tesla soared 6.9%, and big tech was solid: Nvidia +3.21%, Microsoft +2.33%, Meta +2.43%, Apple +2.53%, Alphabet +2.63%, Amazon +2.50%.

- Consumer Confidence (May) jumped to 98.0, up from 86.0, beating expectations and marking the largest increase in four years. The Expectations Index rose sharply to 72.8, but still signals mild recession risk.

- Durable Goods Orders (April) fell 6.3%, worse than forecast (-7.8%), due to a 17.1% drop in transportation. But core orders excluding transportation rose 0.2%. Business investment proxy (nondefense capex ex-aircraft) was down 1.3%, reflecting tariff-related uncertainty.

- Case-Shiller Home Price Index (March) dropped 0.1%, surprising to the downside vs. +0.3% estimate. YoY home price growth decelerated to +4.1%, from 4.5% in February.

- Atlanta Fed GDPNow lowered its Q2 growth estimate to 2.2% from 2.4%.

- Two-Year Treasury Auction: Yield came in at 3.955%, stronger than WI levels. Direct bidders showed strong demand (26.2%), while foreign demand lagged.

Commodities

- Crude Oil (WTI) settled at $60.89, down $0.64 (-1.04%). Prices briefly tested highs but faded as traders failed to push through key moving averages. Support levels remain at $60.12 and $60.00.

- Brent Crude held near $65, aided by Trump’s tariff delay and OPEC+ production meeting anticipation. Eight cartel members are weighing a reversal of voluntary cuts in July. Tensions over new Russian sanctions and Iran nuclear talks are in focus.

- Gold plunged nearly 2% to below $3,300, pressured by rising risk appetite and a stronger U.S. dollar. The DXY gained 0.62% to 99.54, as investor sentiment improved.

- Silver dipped 0.70% to $33.29, but held above critical support at $32.77. The metal remains in a bullish consolidation. A push above $33.69 could aim for $34.58.

- China’s Gold Imports via Hong Kong nearly tripled to 59 tons in April, despite high prices, likely due to expanded import quotas.

- ECB Comments on Gold: The central bank flagged surging investor interest in gold futures with physical delivery, highlighting the metal’s perceived safety over U.S. assets amid policy volatility.

Europe

- German DAX closed at a record high, up 0.83%, leading a mostly higher European session. France’s CAC 40 slipped -0.02%, while FTSE 100 rose 0.69%.

- Germany’s GfK Consumer Sentiment improved slightly to -19.9, driven by better economic expectations. Still, household spending sentiment remains weak.

- France CPI (May, prelim) slowed to +0.7% y/y, below expectations. Services inflation eased notably, signaling softer core inflation pressures.

- Eurozone Consumer Confidence (Final) remained at -15.2, in line with the flash estimate. Economic sentiment ticked up, but the outlook remains clouded by tariff uncertainty.

- Germany DIHK Forecast: German GDP expected to shrink 0.3% in 2025. Exports seen down 2.5%, while inflation stabilizes around 2.1%.

- UK’s CBI Retail Sales (May) plummeted to -27, the weakest since March 2024, with expectations worsening for June.

- UK Shop Price Index (BRC) remained deflationary at -0.1% y/y in May, unchanged from April.

- UK Unveils £3 Billion Training Plan, aimed at reducing dependency on foreign workers and creating 120,000 new positions in construction, healthcare, and tech.

Asia

- China April Industrial Profits rose 3.0% y/y, the strongest since December. Profits in high-tech manufacturing jumped 9.0%, underscoring structural resilience.

- Japan April Services PPI held steady at +3.1% y/y, slightly above forecast.

- Japan Considers Reducing Super-Long Bond Issuance to calm rising yields. A shift in bond composition is expected in June.

- RBNZ Expected to Cut Rates by 25bps to 3.25% this week. Markets and economists see further easing due to tariff uncertainty and inflation outlook.

- BOJ Hosts Global Central Bank Conference in Tokyo, addressing inflation risks, QT, and rate management amid rising global uncertainty tied to U.S. trade policies.

Rest of the World

- South Africa Nears LNG Deal with U.S., set to import $1 billion/year worth of natural gas. In return, it may secure continued duty-free car exports to the U.S.

Crypto

- XRP holds at $2.33, supported by the 50-day EMA, but sentiment weakens as active addresses fall 44% since January. Long liquidations rising.

- Ethereum (ETH) gains 4% to $2,670, after Sharplink Gaming announced a $425 million ETH treasury strategy. Consensys leads the investment; ETH is now the company’s official reserve asset.

- Bitcoin (BTC) and ETH face bullish pressure from increased corporate treasury adoption.

- Helium (HNT) trades at $4.12, coiling within a triangle formation. A breakout above $4.35 targets $5.81.

- Solana (SOL) could hit $275 by end-2025 and $500 by 2029, per Standard Chartered. Memecoin activity fading, but broader ecosystem potential remains.

- AI Tokens Surge Ahead of Nvidia Earnings:

- NEAR: +2.5%

- VIRTUAL: +10.3%

- KAITO: +10.4%

Traders anticipate strong volatility tied to Nvidia’s Q1 report.

- Senator Lummis to introduce bill next week for the U.S. to purchase $1M in Bitcoin for a Strategic Reserve. Trump reportedly supports the plan.