North America News

US equities finish higher as PCE data eases inflation fears

US stocks ended Friday with solid gains after the PCE inflation report matched expectations, calming fears of an inflation rebound. The rally wavered midday but regained momentum into the close, snapping a three-day slide. Tesla, Intel, and Boeing led winners.

- Day performance: S&P 500 +0.6%, Nasdaq +0.4%, DJIA +0.7%, Russell 2000 +0.8%

- Week performance: S&P 500 -0.3%, Nasdaq -0.7%, Russell 2000 -0.7%

The report reassured investors that steady inflation is tolerable for markets, even if disinflation has slowed. Bonds traded choppy, with 10-year yields holding in a 4.15–4.20% range. Commodities showed surprising strength, hinting at underlying inflationary concerns.

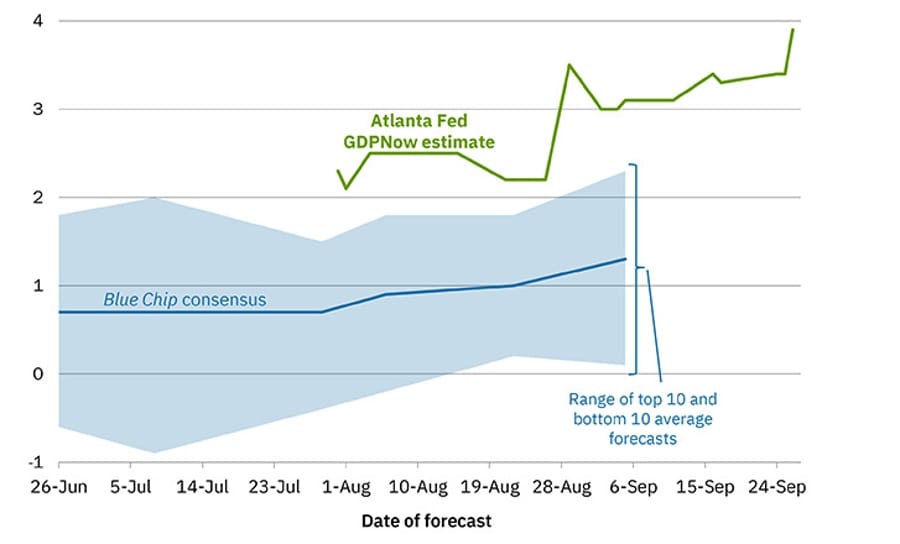

Atlanta Fed GDPNow Jumps to 3.9% for Q3

The Atlanta Fed revised its GDPNow estimate for Q3 growth sharply higher to 3.9% from 3.3%. The upgrade follows stronger-than-expected U.S. data across several releases this week, improving sentiment around the economy’s near-term momentum.

In their own words:

After recent releases from the US Census Bureau, the US Bureau of Economic Analysis, and the National Association of Realtors, a decrease in the nowcast of third-quarter real gross private domestic investment growth from 6.4 percent to 4.1 percent was more than offset by increases in the nowcast of third-quarter real personal consumption expenditures growth from 2.7 percent to 3.4 percent and the nowcast of the contribution of net exports to third-quarter real GDP growth from 0.08 percentage points to 0.58 percentage points.

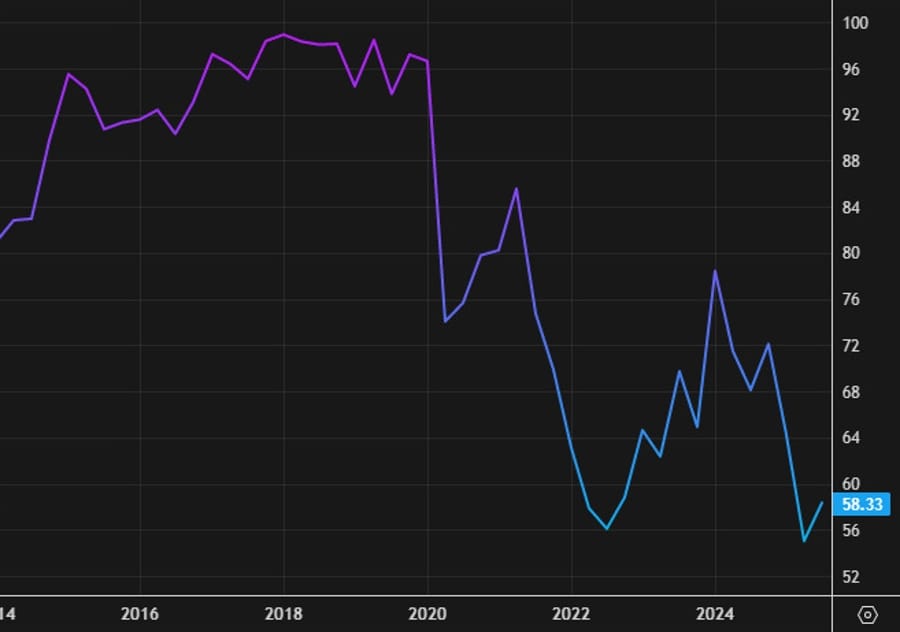

U.S. Consumer Sentiment Softens in September — UMich Final

The University of Michigan’s final September consumer sentiment index came in at 55.1, below expectations of 55.4 and down from August’s 58.2.

Breakdown:

- Current conditions: 60.4 (vs prelim 61.2).

- Expectations: 51.7 (vs prelim 51.8).

- 1-year inflation outlook: 4.7% (down from prelim 4.8%).

- 5-year inflation outlook: 3.7% (down from prelim 3.9%).

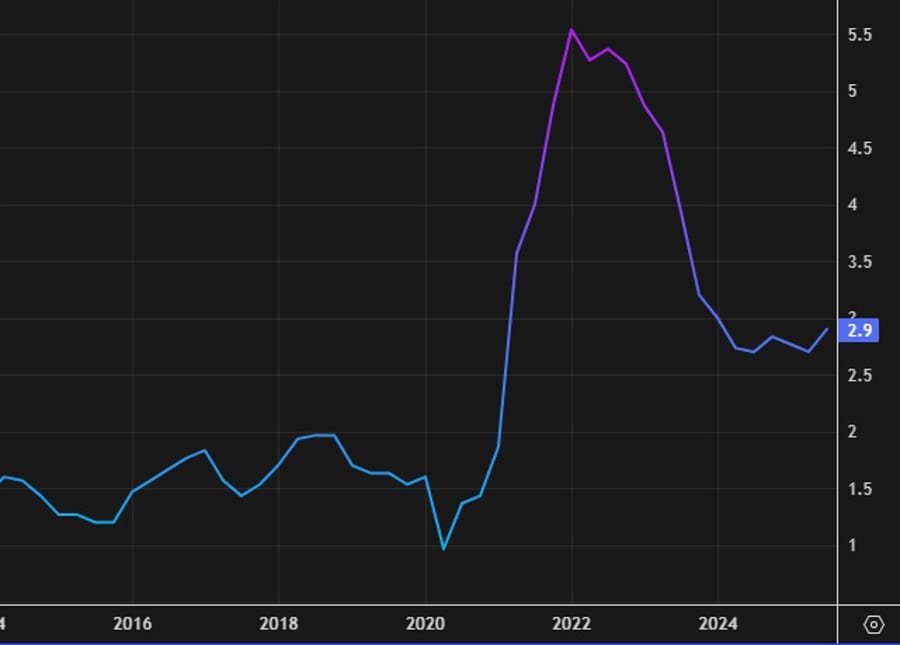

U.S. PCE Data Matches Expectations in August

The August 2025 PCE report showed inflation largely on target:

- Core PCE: +2.9% y/y (unchanged, as expected). Monthly +0.2%. Unrounded +0.227%.

- Supercore (services ex-shelter): +3.4%.

- Services inflation: +3.6% y/y, +0.325% m/m.

- Headline PCE: +2.7% y/y (in line). Monthly +0.3% (+0.265% unrounded).

Spending & Income:

- Personal income +0.4% m/m (vs +0.3% expected).

- Personal spending +0.6% (vs +0.5% expected).

- Real personal spending +0.4%.

- Savings rate fell to 4.6% from 4.8%.

Fed’s Bowman: Fed to shift toward proactive forward looking approach

- Fed’s Bowman speaking

Fed’s Bowman – who voted for a 25 basis point cut at the most recent meeting – is out saying it is now time for the Fed to act decisively (and more):

- Recent data show a materially more fragile labor market, inflation ex-tariffs hovering not far above target

- Time for FOMC to act decisively and proactively to address decreasing labor market dynamism, emerging signs of fragility

- Recent data, including benchmark payroll revisions, show we are at serious risk of already being behind the curve

- Should these conditions continue, concerned we will need to adjust policy at faster pace and to a larger degree going forward

- Shift is appropriate as forecasters widely expect inflation to significantly decline next year

- Expect inflation to return to target after one-time adjustment from tariffs

- Appropriate to look through one-time effects of tariffs

- Economy may be experiencing extended productivity surge from recent tech advances

- Inflexible, dogmatic view of data dependence gives backward-looking view of economy, guarantees we remain behind the curve

- Fed should consider shifting focus from overweighting latest data points to a proactive forward-looking approach

- Prefer smallest balance sheet possible with reserves closer to scarce than ample

- Active balance sheet management would give more timely indication of market stress, market-function issues

- Lower level of reserves might encourage banks to be more active in reserve positions and liquidity-risk management

- Smaller balance sheet as percent of GDP gives Fed more optionality to respond to future shocks

- Strongly support holding only Treasuries

- Look forward to discussion of sales of MBS; passive runoff won’t allow return to Treasury-only holdings in credible time frame

- Balance sheet tilted toward more shorter-dated securities would offer more flexibility

- Emergency lending facilities should be limited to single-purpose use in emergencies and not made permanent

- Reforming enhanced supplementary leverage ratio would address some of the problems permanent facilities like standing repo were designed to alleviate

- See slower population growth, aging population as more prominent factors in pulling down neutral rate

Fed’s Barkin: High Uncertainty Around Inflation Forecasts

FOMC member Thomas Barkin said policymakers lack strong confidence in inflation projections, highlighting both upside and downside uncertainties.

Key remarks:

- Consumers are fatigued by higher prices; companies want to pass costs along but face pushback.

- Productivity gains and shifting spending habits are helping contain inflation.

- Unemployment remains low but could move in the wrong direction.

- Spending is stable across income brackets.

- Fed won’t consider tolerating a range around its 2% target until the goal is actually reached.

- Barkin emphasized real-time data reactions matter more than theoretical “neutral rate” levels.

JPMorgan Flags Rare U.S. Economic Split

J.P. Morgan economists highlighted an unusual “decouple” in the U.S. economy, with business investment climbing even as hiring slows — something not seen in over 60 years.

The divergence reflects AI-driven productivity offsetting weak labor markets, while tariff-related headwinds dampen real incomes. JPMorgan said the opposing forces complicate Fed policy decisions and could increase volatility across equities, fixed income, and FX markets.

Citadel’s Griffin Sees Limited Fed Cuts Ahead

Ken Griffin, founder of Citadel, expects one more Federal Reserve rate cut in 2025, with two possible at most. He cited rising unemployment, now 4.3% — the highest since 2021 — and slowing job creation as key risks.

Griffin stressed the importance of Fed independence, arguing President Trump should preserve the central bank’s autonomy even while advocating for lower rates.

Goldman Sachs Boosts MSCI EM Target, Backs EMFX Strength

Goldman Sachs raised its 12-month target for the MSCI Emerging Markets Index to 1,480, citing stronger earnings and resilient inflows. The bank expects emerging-market currencies to outperform G10 peers as carry trades and cyclical conditions favor high-yield markets.

Goldman highlights structural growth, robust balance sheets, and advanced easing cycles as supports for equities and FX, advising investors to build exposure on dips.

Barclays: Dollar Strength Likely to Hold

Barclays strategists said the U.S. dollar has stabilized after earlier weakness despite several “extraordinarily bearish shocks.”

They expect the U.S. economy’s resilience to keep the dollar supported but flagged concerns about Federal Reserve independence as a potential risk.

Trump to Impose New Tariffs on Trucks, Furniture, Cabinets, and Pharma

Donald Trump announced a fresh set of tariffs effective October 1, 2025:

- 25% on all heavy trucks manufactured abroad.

- 50% on kitchen cabinets, bathroom vanities, and related goods.

- 30% on upholstered furniture.

- 100% on branded or patented pharmaceuticals unless companies are actively constructing U.S. manufacturing plants.

Trump cited national security and unfair import practices as reasons for the measures.

Intel Turns to TSMC and Others for Turnaround Push

Intel is seeking strategic partnerships and investment from Apple and Taiwan Semiconductor Manufacturing Co. (TSMC) to advance its recovery. The U.S. government recently took a 10% stake in the company and is encouraging other major tech firms to align with Intel.

Commitments already include $2 billion from SoftBank and $5 billion from Nvidia. CEO Lip-Bu Tan has been lobbying heavily for additional backing and customer commitments. Intel’s outreach began prior to President Trump’s engagement last month but has accelerated since Washington revealed its stake, according to the Wall Street Journal.

UBS Sees S&P 500 Rising to 6,800 — With Bull Case at 7,500

UBS forecasts the S&P 500 could climb to 6,800 by June 2026, with a bullish case as high as 7,500. The bank expects the Federal Reserve to cut rates by 75 basis points by early 2026, prioritizing employment support over temporary tariff-driven inflation.

Key drivers cited:

- 80% of S&P 500 firms surpassing sales estimates.

- Robust household and corporate balance sheets.

- Earnings growth projections of 8% for 2025 and 7.5% for 2026.

UBS also highlights AI as a long-term catalyst, estimating a $1.5 trillion annual global revenue opportunity. The firm advises phased exposure, using pullbacks to add positions in AI, energy, resources, and longevity themes.

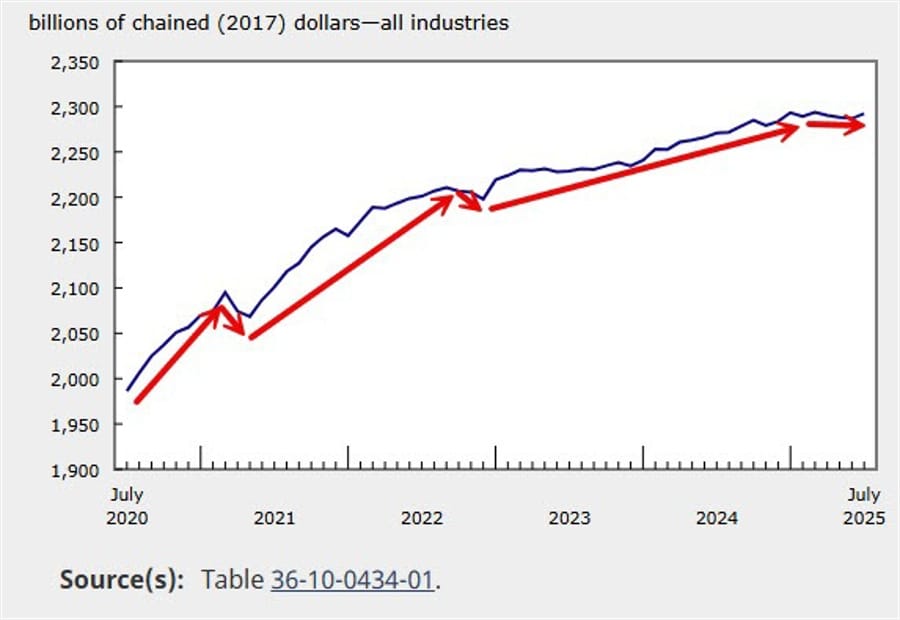

Canada GDP Rises 0.2% in July, First Gain in Four Months

Statistics Canada reported GDP growth of 0.2% in July, beating the 0.1% forecast and ending a four-month losing streak.

Details:

- Goods-producing industries +0.6%, led by mining, quarrying, and oil & gas (+1.4%).

- Manufacturing rebounded +0.7% after June’s -1.5%.

- Services +0.1%, supported by wholesale trade and real estate but weighed by retail.

- Wholesale trade +0.6%, third straight monthly gain.

- Real estate and leasing +0.3%, fourth consecutive rise.

- Transport and warehousing +0.6% after June’s -0.7%.

- 11 of 20 sectors expanded.

Advance Estimate for August: Real GDP flat, with gains in wholesale and retail offset by losses in mining, manufacturing, and transport. Official data due October 31.

Commodities News

Gold climbs as Fed’s preferred gauge supports dovish bets

Gold advanced 0.6% to $3,774 on Friday after core PCE inflation remained below 3%, reinforcing expectations of more Fed easing.

- Traders see rate cuts staying on the table for year-end meetings.

- Consumer sentiment fell in September as households worried about high prices and jobs, but long-term inflation expectations eased.

- Fed officials highlighted a fragile labor market and steady inflation trends.

Bullion traders are also monitoring new US tariffs on pharmaceuticals and furniture. Next week’s calendar brings Fed speakers, ISM manufacturing data, jobless claims, and the September NFP report.

Trump signals openness to lifting Ukraine strike limits

WTI crude gained 0.7% Friday, extending weekly gains amid reports of Russian export capacity losses from drone strikes.

Separately, the Wall Street Journal reported President Trump told Ukrainian President Zelensky he was open to ending restrictions on Kyiv’s use of US long-range weapons to strike inside Russia. Trump stopped short of committing to a policy change, according to US and Ukrainian officials. Zelensky pressed for more missiles and broader targeting authority during their UN meeting.

Baker Hughes rig count rises in US and Canada

US rig count rose 7 w/w to 549, with oil rigs +6, gas rigs -1, misc +2.

- Down 38 rigs y/y (oil -60, gas +18, misc +4).

- US offshore rigs +1 w/w to 14, still -5 y/y.

- Canada rigs +1 w/w to 190 (oil +1, gas flat).

- Down 28 rigs y/y (oil -23, gas -5).

China to tighten copper smelting expansion – ING

China’s metals association urged stricter limits on smelting projects as treatment fees hit record lows.

2025 production forecast at 380kt.

Authorities drafting new regulations to curb capacity growth.

Peru’s Antamina mine to expand output: targeting 450kt in 2026, ~400kt annually thereafter.

US natural gas storage rises above forecasts – ING

EIA data showed inventories rose 75 Bcf last week, slightly above expectations (74 Bcf).

- Total storage: 3.51 Tcf, 6.1% above 5-yr average.

- Henry Hub front-month prices were steady as weather outlooks stayed mixed.

Gold Resilient Despite Dollar Surge and Rising Yields

Gold prices managed to climb yesterday even as strong U.S. data, higher yields, and a firmer dollar stacked against it.

Fundamentals:

The resilience stands out, though the near-term upside looks constrained by markets repricing rate expectations. Traders are now factoring in 39 bps of easing by year-end and 100 bps by the close of 2026 — more aggressive than the Fed’s 75 bps projection. Longer term, gold’s uptrend remains supported by expectations of falling real yields.

Key Data Ahead:

Next week brings U.S. ISM PMIs along with ADP and NFP labor releases, which will drive Fed expectations.

Technical Levels:

- Daily chart: Consolidation dominates. Buyers may re-enter near the major trendline, while a break lower could target 3,120 — likely needing strong data to spark hawkish repricing.

- 4-hour chart: Minor trendline supports bullish bias. Pullbacks may offer long setups into record highs; breakdown risks extend toward 3,627.

- 1-hour chart: Market is consolidating near highs. Sellers lean on a descending trendline, while buyers need a break above 3,761 to chase fresh highs.

China’s gold imports decline in August – Commerzbank

High prices are cooling physical demand despite ETF inflows.

- Imports: -3.4% m/m in August.

- Net imports from Hong Kong: -39% to 27 tons.

- Dealers offering $21–$36/oz discounts, the steepest since 2020.

Copper rally highlights fragile sentiment – Commerzbank

Copper spiked nearly 5% after Grasberg mine in Indonesia declared force majeure, exposing fragile supply sentiment. Still, Commerzbank points out production remains robust:

- Global mine output (Jan–Jul): +3.4% y/y, led by Chile, Peru, DRC; Indonesia -32%.

- Metal production: +3.9% y/y.

- Market currently in a 100kt surplus, down from 400kt a year ago.

Gold nears record as safe-haven demand grows – ING

Gold and silver extended gains on risk aversion. Silver broke $45/oz (highest since 2011).

- Gold YTD: +43%, supported by ETF inflows (+12.8moz YTD to 96.2moz).

- Drivers: weaker dollar, central bank buying, geopolitical risks.

- Traders await Friday’s US PCE inflation data.

Black Sea oil exports resume after drone attacks – ING

Russian Black Sea oil ports, including CPC and Sheskharis, resumed operations after Ukrainian drone strikes earlier this week.

- ARA inventories: +68kt to 5.98mt (gasoline +35kt, gasoil +27kt; fuel oil -22kt, naphtha -15kt).

- Singapore stocks: -2.6m bbl to 46.9m, with residual fuel down 2.6m bbl.

Russia moves to restrict diesel exports – Commerzbank

Diesel crack spreads surged to $27/bbl, a 19-month high, on news Russia may restrict some exports. Deputy PM Novak later clarified the ban targets traders/resellers, limiting the scope.

- Russian refining down 7% since August after repeated attacks.

- Diesel markets already tight; US EIA sees inventories at multi-year lows into 2026.

- EU’s Russian oil products ban kicks in early 2026, likely boosting demand.

Iraqi Kurdistan oil exports set to resume – Commerzbank

Oil prices tested a two-month high on geopolitics and supply headlines. Iraq confirmed exports from Kurdistan will resume after a deal with Baghdad.

- Pipeline restart: 230k bpd via Iraq-Turkey route, idle since March 2023.

- Exports expected to restart Saturday, though prior attempts failed.

- Iraq may need to cut elsewhere to stay within OPEC+ quota.

Europe News

European equities close higher, led by Spain’s Ibex

European shares posted broad gains, with Spain’s Ibex outperforming at +1.3%. Other benchmarks followed:

- DAX (Germany): +0.87%

- CAC 40 (France): +0.97%

- FTSE 100 (UK): +0.77%

- FTSE MIB (Italy): +0.96%

ECB Survey: Eurozone Consumers See Higher Inflation

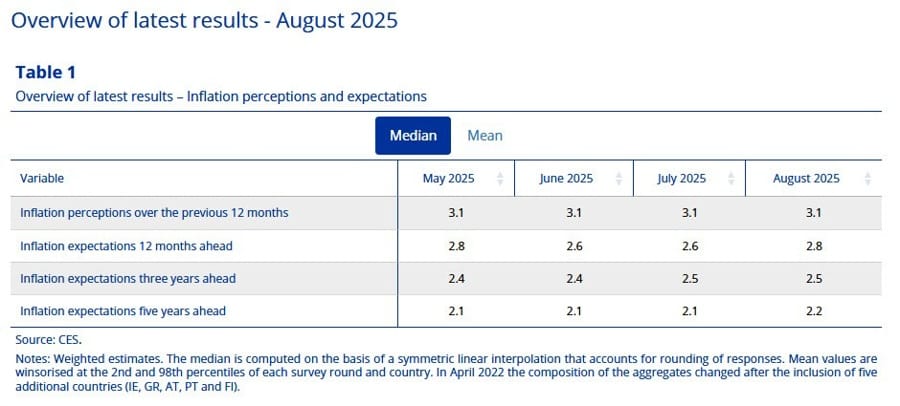

The ECB’s August 2025 consumer expectations survey showed inflation forecasts for the next 12 months edging up to 2.8% from 2.6% in July — the highest since May. Longer-term, five-year inflation expectations also ticked up to 2.2%. The full set of readings can be found in the table below:

Italy September Business Confidence Misses, Consumer Sentiment Beats

Italy’s Istat reported September business confidence at 87.3, slightly below expectations of 87.5 and revised August’s reading to 87.3. Consumer confidence, however, came in stronger at 96.8 versus 96.5 expected, up from 96.2 previously.

BOE Dhingra: Restrictive monetary policy risks damaging the economy

- Speaking to The Times of London

- Inflation outlook

- Drivers of UK inflation (indexed/administered prices, global commodity shocks) will soon fade.

- UK is not facing a “uniquely British” inflation problem compared with Europe.

- Food price inflation is not worse than in continental economies; some UK-specific items (like chocolate) skew the measure.

- Wage growth plays a smaller role in services inflation than headlines suggest (61% in market-based services vs. 27% in administered services).

- Policy stance

- Restrictive monetary policy risks damaging the economy.

- “We should not be overly cautious about cutting interest rates.”

- Supports further cuts without endangering the inflation target.

- Dissented at the last meeting, calling for a cut to 3.75% (vs. 4.0% current).

- Stresses that administered price shocks (e.g., water bills, bus fares) are not responsive to tight policy.

- Economic risks

- UK projected to have the highest inflation in the G20 this year (OECD sees 3.5%).

- Warns prolonged tight policy will strain businesses and growth.

- Divides within the BoE sharpen, as others (e.g., Megan Greene) advocate caution on rate cuts.

EU Expects U.S. to Honor Pharma Tariff Cap

European Union officials said they expect Washington to stick to a 15% tariff ceiling on pharmaceuticals outlined in the preliminary trade deal.

However, the framework is non-binding, and President Trump has yet to sign an executive order to formalize the agreement. Trump’s new tariff plans would impose 100% duties on branded drugs unless producers have already begun construction on U.S. manufacturing facilities.

Credit Agricole: Month-End Signals Euro Buying, Pound Selling

Credit Agricole’s corporate flow model points to euro inflows and pound outflows into month-end, alongside moderate dollar selling. The bank highlights the strongest greenback sell signal against the Australian dollar.

As a result, Credit Agricole recommends staying long in the euro against a basket of dollar and sterling through September 30.

BofA: Month-End Flows to Favor Euro, Yen, and Sterling

Bank of America’s preliminary month-end rebalancing model suggests currency demand will lean toward the euro, pound, and yen, while overall dollar flows appear neutral.

The framework, based on a traditional 60/40 equity-bond portfolio, estimates relative flows by tracking cross-country asset performance:

- Euro inflows of about +1.0δ, reflecting weaker European equity performance this month.

- Pound inflows of around +0.9δ, tied to lagging UK assets.

- Yen inflows of roughly +0.6δ, supported by Japan’s softer asset showing.

Emerging-market currencies are expected to face the heaviest selling, with projected outflows of -1.5δ following stronger EM performance earlier in the month. Dollar flows look neutral, with marginal outflows of about -0.2δ.

Asia-Pacific & World News

Trump Approves TikTok Deal Through Executive Order

Donald Trump confirmed he has signed an executive order supporting a $14 billion arrangement to keep TikTok operating in the United States, pending Chinese approval. Under the deal:

- ByteDance will hold less than 20% of the new venture.

- Oracle, Silver Lake, and MGX Fund will control about 45%.

- Existing ByteDance investors retain 35%.

Oracle will manage security and cloud operations, with Larry Ellison personally engaged. JD Vance, the U.S. Vice President, confirmed the $14 billion valuation. Trump emphasized the platform will be “fully American-run.”

Equity contributions come from investors such as Sequoia, General Atlantic, and Susquehanna, while U.S. regulators gain control of the algorithm. No federal equity stake is included. Trump also noted possible involvement by Rupert and Lachlan Murdoch, alongside Dell CEO Michael Dell.

EU Preparing 25–50% Tariffs on Chinese Steel

According to senior officials cited by Germany’s Handelsblatt, the European Commission is moving toward tariffs of 25% to 50% on Chinese steel and related imports. The measures are expected within weeks. Reuters confirmed the plan but did not provide additional details at this stage.

PBOC sets USD/ CNY reference rate for today at 7.1152 (vs. estimate at 7.1439)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 165.8bn yuan via 7-day reverse repos at 1.40%

- also injected 600bn yuan via 14-dayers

NAB Pushes RBA Rate-Cut Forecasts to May 2026

National Australia Bank now expects the Reserve Bank of Australia to maintain its cash rate at 3.6% until May 2026, revising prior forecasts of cuts in November 2025 and February 2026.

The adjustment follows hotter-than-expected Q3 CPI data, showing a trimmed mean increase of 0.9–1.0% — about 0.3 points above the RBA’s projections. NAB pointed to unexpectedly strong services inflation, arguing it reduces confidence that inflation is near the 2.5% target.

Reuters Poll: RBA to Hold Rates, November Decision Hinges on CPI

All 39 economists surveyed in a Reuters poll expect the Reserve Bank of Australia to keep rates at 3.60% in its September 30 meeting.

The key variable is Q3 CPI, which will shape the outlook for a potential November cut. August CPI accelerated to 3.0% y/y, prompting some analysts to delay expectations. While most respondents see at least one more 25bp cut by end-2025, NAB has pushed forecasts back to May 2026.

New Zealand Consumer Confidence Edges Up in September

The ANZ-Roy Morgan New Zealand Consumer Confidence Index rose to 94.6 in September, up from 92.0 in August.

Japan’s Tariff Negotiator Responds Cautiously to Trump’s Measures

Japan’s tariff negotiator, Akazawa, declined to directly comment on Trump’s latest tariff announcements. He said Japan has secured assurances that U.S. tariff rates on chips and pharmaceuticals will not exceed those applied to other nations.

Akazawa added Tokyo will continue assessing the U.S. actions for consistency with existing bilateral agreements.

Japan Revises July Real Wages to Negative

Japan’s government revised July real wages from a preliminary +0.5% to -0.2%. Nominal cash earnings were adjusted down to +3.4% y/y from +4.1%.

This marks the seventh consecutive month of real wage contraction, challenging the Bank of Japan’s narrative of income-led growth as a reason for tightening policy.

Japan to Channel $550 Billion Into U.S. via JBIC

Finance Minister Shunichi Kato announced that Japan will direct $550 billion of planned investment into the United States through a new facility at the Japan Bank for International Cooperation (JBIC).

The move expands JBIC’s scope and underscores Tokyo’s commitment to deepening economic ties with Washington amid global capital competition.

Tokyo CPI Softens to 2.5% in September

Tokyo’s September CPI, a leading indicator for Japan’s national figures, showed softer readings:

- Headline CPI: +2.5% y/y (vs. 2.6% prior, 2.8% expected).

- CPI ex-fresh food: +2.0% y/y (vs. 2.5% prior).

- CPI ex-fresh food and energy: +2.5% y/y (vs. 3.0% prior).

The weaker figures ease pressure on the Bank of Japan.

Crypto Market Pulse

Crypto market wobbles as ETF outflows pressure sentiment

Bitcoin stabilized above $109,500 on Friday after plunging below $110,000 on Thursday, triggering mass liquidations. Altcoins showed tentative recovery:

- Ethereum held the 100-day EMA near $3,900.

- XRP stayed pinned near $2.70 support.

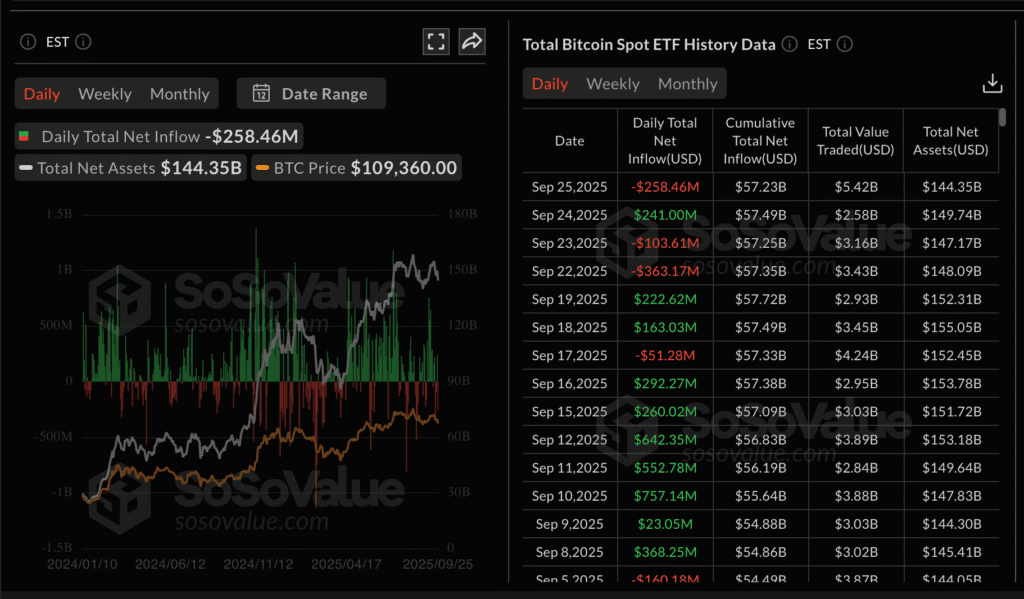

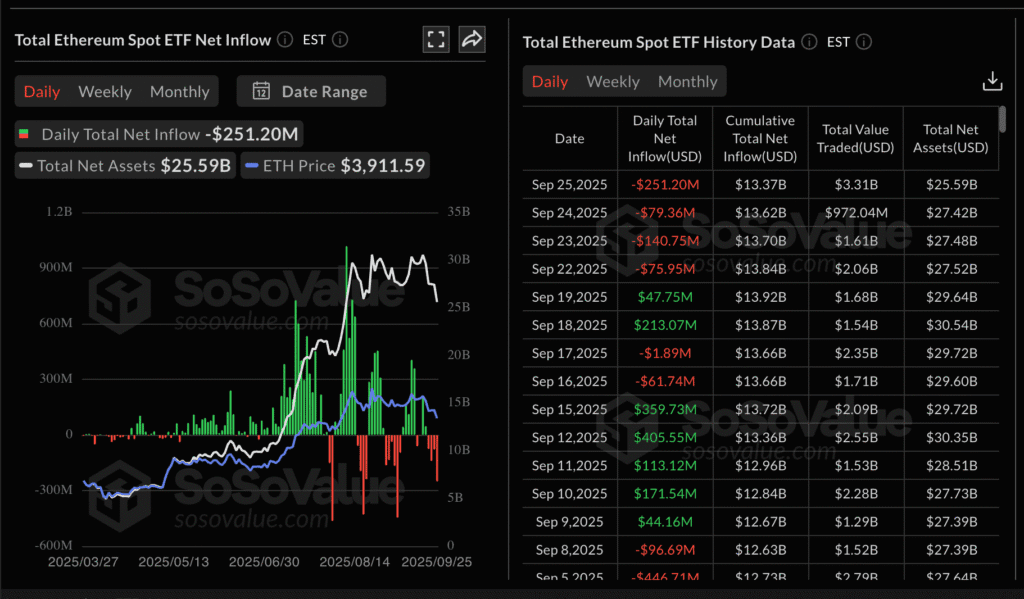

ETF flows highlighted weak sentiment:

- BTC spot ETFs: $258m outflows Thursday.

- ETH ETFs: $251m outflows, fourth straight day.

If outflows persist, analysts warn BTC could test the $100,000 level. Ethereum and XRP will need stronger demand to close September in positive territory.

Quant leads UK’s tokenized sterling initiative

Quant Network secured UK Finance’s Tokenized Sterling Deposits project, partnering with major banks including HSBC, Barclays, Lloyds, and NatWest.

- Initiative aligns with BoE Governor Bailey’s call for digital payments adoption.

- On-chain activity: whale transactions ($100k+) rose to 26 on Thursday.

- Exchange reserves: 1.44m QNT, down from 1.56m.

- Open interest: +17% in 24h to $29.8m, signaling bullish sentiment.

Vanguard considers crypto ETF access for brokerage clients

Vanguard, with $10T AUM, is weighing access to spot crypto ETFs for brokerage accounts, marking a sharp policy shift.

- Won’t launch its own products, but may allow access to approved ETFs.

- Comes as SEC finalizes a crypto ETF framework.

- Bitcoin spot ETFs: $57B inflows, $144B AUM.

- Ethereum spot ETFs: $13.3B inflows, $25.6B AUM.

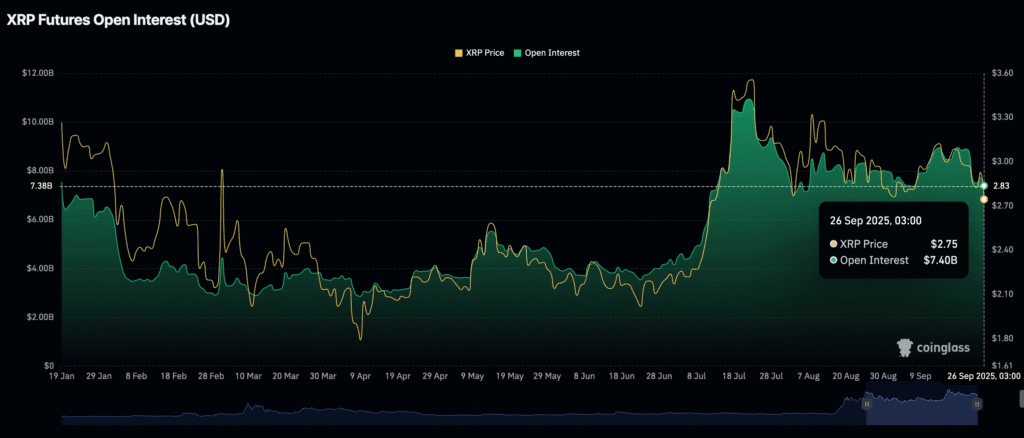

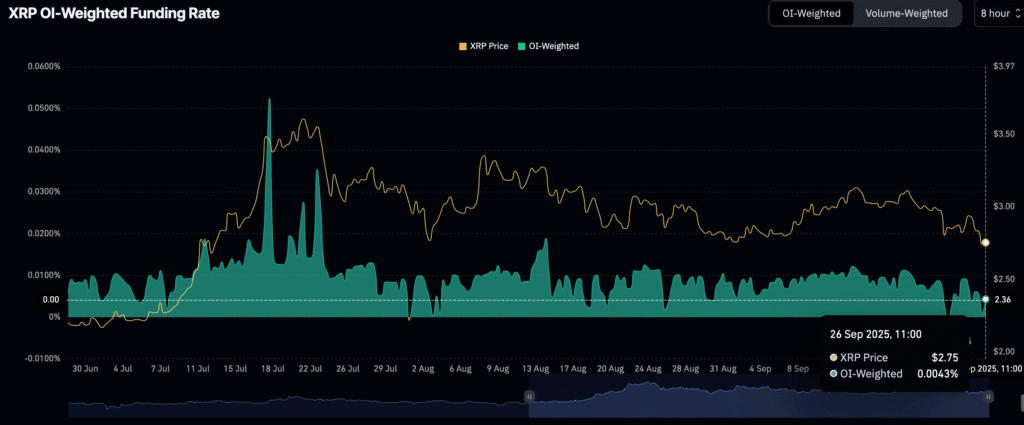

XRP derivatives market weakens as price correction extends

XRP slipped to $2.70, testing its 200-day EMA, after two days of declines.

- Open interest: $7.4B, down from $8.95B peak in September.

- Indicates fading trader confidence, risk of deeper correction.

- Funding rate stays positive at +0.0043%, suggesting traders still lean long.

- Bulls eye $3.00 breakout if sentiment stabilizes.

Elliptic warns of industrial-scale pig-butchering scams

Elliptic’s 2025 report shows pig-butchering fraud has grown into a multibillion-dollar global industry.

- Scammers use self-hosted wallets, mule accounts, cross-chain bridges.

- Mule accounts show repeated IPs, addresses, and clustered transfers.

- Photos suggest call center operations in SE Asia.

- Blockchain transparency enables tracing despite laundering tactics.

Citi Projects Stablecoins at $4 Trillion by 2030

Citigroup now estimates stablecoin issuance could reach $1.9–4 trillion by 2030, supporting $100–200 trillion in annual transactions if turnover matches fiat currency velocity.

The bank notes that while stablecoins are expanding rapidly, bank-issued tokens may ultimately surpass them due to regulatory appeal and real-time settlement. Despite this, Citi expects the U.S. dollar to maintain dominance in digital finance.

The Day’s Takeaway

North America

- US Equities Bounce: Stocks snapped a 3-day slide, with S&P 500 +0.6%, Nasdaq +0.4%, DJIA +0.7%. PCE inflation matched expectations, easing rate fears.

- Trump’s Tariffs: New duties hit trucks (25%), furniture (30%), cabinets (50%), and branded pharma (100%) unless firms build US plants.

- TikTok Deal Approved: Trump signed off on a $14B restructuring, making the platform “American-run” under Oracle’s oversight.

- Intel’s Rescue Plan: US takes 10% stake in Intel; SoftBank and Nvidia commit billions as Apple and TSMC circle partnerships.

- UBS S&P 500 Call: UBS sees the index reaching 6,800 by mid-2026, with AI and strong balance sheets driving upside.

- JPMorgan Warning: US economy shows a rare split—business investment rising as hiring slows. Fed policy risks rise.

- Citadel’s Griffin: Expects at most two more Fed cuts in 2025, stressing central bank independence.

- Macro Data:

- PCE inflation steady at 2.9% core y/y.

- UMich sentiment fell to 55.1.

- Atlanta Fed GDPNow raised to 3.9% for Q3.

- Canada GDP: July GDP +0.2%, first gain in four months, led by mining and manufacturing.

Europe

- Tariffs on Chinese Steel: EU preparing 25–50% duties on imports within weeks.

- Equities Advance: Spain’s Ibex led with +1.3%, followed by France’s CAC +0.97%, Germany’s DAX +0.87%.

- Italy Confidence Split: Business sentiment softened, consumer confidence rose.

- ECB Survey: Inflation expectations rose to 2.8% for next year, five-year view up to 2.2%.

- FX Flows: BofA and Crédit Agricole models point to euro inflows into month-end, with pound selling pressure.

- EU Pharma Tariff Watch: Officials expect US to cap duties at 15%, but Trump’s new plan risks a clash.

Asia

- Tokyo CPI Softens: Inflation cooled to 2.5% y/y, easing pressure on the BoJ.

- Japan Real Wages Revised Down: July flipped from +0.5% to -0.2%, seventh straight month negative.

- Japan’s $550B US Push: Tokyo to channel investments into the US via JBIC.

- China Metals Policy: Authorities drafting stricter limits on copper smelting expansion.

- Australia: NAB pushed RBA rate-cut forecasts to May 2026 after hotter CPI; Reuters poll sees no cuts near-term.

- New Zealand: Consumer confidence rose to 94.6 in September.

Rest of World

- Goldman Sachs EM Upgrade: Boosted MSCI EM target to 1,480, citing strong earnings and inflows. EMFX seen outperforming G10.

Commodities

- Gold: Near record highs at $3,774 on safe-haven demand, +43% YTD. ETF inflows +12.8moz this year.

- Oil: WTI up on supply headlines—Kurdistan exports resuming (230k bpd), Black Sea ports back online, and Russia’s diesel exports restricted.

- Copper: Spiked 5% after Grasberg mine force majeure, though global supply still in surplus.

- China Gold Imports: Fell 3.4% m/m; dealers offering steepest discounts since 2020.

- Gas: US storage +75 Bcf, slightly above forecast, inventories 6% above 5-yr avg.

- Rigs: Baker Hughes count rose in both US (+7 to 549) and Canada (+1 to 190).

Crypto

- Vanguard Shift: Considering access to crypto ETFs for brokerage clients, marking a major policy turn.

- Citi Stablecoin Forecast: Stablecoins could reach $4T by 2030, supporting $100–200T in transactions.

- Quant Network: Leading UK’s tokenized sterling initiative with major banks.

- Elliptic Report: Pig-butchering scams now industrial-scale, traced via blockchain transparency.

- XRP: Dropped to $2.70, testing key support; open interest down sharply.

- ETF Outflows: Bitcoin ETFs lost $258M, Ethereum $251M in a day, dragging sentiment; BTC risks retesting $100K.