North America News

Nvidia Headlines a Packed Week of Earnings Amid Tariff Watch

Nvidia is set to report quarterly earnings on Wednesday after the market closes, marking one of the most highly anticipated releases of the week. The chipmaker’s results come as investors closely monitor corporate performance for signs of how tariff policy is affecting supply chains and costs.

Retailers will also be in focus, with several major names reporting:

Wednesday (Before Market Open):

- Dick’s Sporting Goods (DKS)

- Abercrombie & Fitch (ANF)

- Macy’s (M)

Wednesday (After Market Close):

- Nvidia (NVDA)

- Salesforce (CRM)

Thursday (Before Market Open):

- Foot Locker (FL)

- Best Buy (BBY)

- Kohl’s (KSS)

Thursday (After Market Close):

- Marvell Technology (MRVL)

- Costco (COST)

- Dell Technologies (DELL)

Tariffs and shifting trade dynamics are expected to play a larger role in management commentary this week, especially for companies with global supply chains.

US and UK Market Holidays Limit Monday Activity

Markets in the United States and the United Kingdom are closed today—Memorial Day in the U.S. and Spring Bank Holiday in the UK—leading to a quieter start to the global trading week. U.S. stock, bond, and bank markets are shut, though Canadian markets remain open. Earlier weakness in the U.S. dollar was reversed as North American hours began, but overall, market movement is expected to be subdued due to the limited participation.

Market Holiday Alert: UK and US Closed on Monday, May 26

Markets in both the United Kingdom and the United States are closed on Monday, May 26, due to the Spring Bank Holiday and Memorial Day, respectively. Trading will resume on Tuesday.

Allianz: U.S. Now a Risky Bet for Global Investors

Allianz Global Investors, which oversees $650 billion in assets, has warned that the U.S. may no longer be a dependable destination for investment capital. In light of volatile policy shifts, Allianz suggests investors may begin redirecting funds toward more stable environments such as Canada and the EU. The firm called for “clarity and consistency” from U.S. policymakers to avoid capital flight.

Analysts Dismiss Trump’s Tariff Threats as Negotiating Theater

Analysts from Vanguard and Barclays are pushing back against fears of a 50% tariff on EU goods, saying the market sees it as more bluff than reality. Vanguard likened it to a “boy who cried wolf” situation, noting that similar threats against China were eventually dialed back. Barclays echoed this view, describing Trump’s rhetoric as a tactical maneuver amid broader trade volatility.

Fed’s Kashkari – Uncertainty top of mind for Fed, US businesses

- Minneapolis Federal Reserve President Neel Kashkari is in Tokyo

- Uncertainty top of mind for Fed, US businesses

- Not sure if the picture will be “clear enough by September”

- Have to see what the data says, and also how trade negotiations progress

- If US can strike trade deals in the coming months, that should “provide a lot of clarity”

- Immigration policy is also causing businesses to rethink investment plans

- In waiting to observe mode

- Tariffs shock is stagflationary

- Extended tariffs raise risk of stagflation

- Question now is scale of stagflation

US Senator says there are enough NO votes to block Trump’s “One Big, Beautiful Bill”

- The bill passed the lower house last week and will be voted on in the Senate

Sen. Ron Johnson, R-Wis spoke with CNN on Sunday:

- “My primary focus now is spending. This is completely unacceptable. Current projections are $2.2 trillion per year deficit,” he said. “There should be a goal of this Republican Senate to reduce the deficit, not increase it. We’re increasing it.”

- “I think we have enough to stop the process until the president gets serious about spending reduction and reducing the deficit,” Johnson said.

We heard similar from Republicans objecting in the House and they all caved in. More here

Bank of Canada Governor: Trump Tariffs Are Canada’s Top Economic Threat

In an interview with the New York Times, Bank of Canada Governor Tiff Macklem identified Trump’s tariff policy as the most serious risk facing Canada’s economy. Though the impact hasn’t yet appeared in economic indicators, Macklem said officials are watching closely. Canada has already imposed retaliatory duties on U.S. goods after Trump slapped a 25% tariff on Canadian imports.

Commodities News

Gold Retreats as Risk Appetite Improves and Tariff Threats Cool

Gold prices dipped over 0.5% on Monday, slipping to around $3,336 as traders responded to a calmer market tone following Trump’s announcement that planned 50% tariffs on EU goods would be delayed until July 9. Thin trading volume due to U.S. and U.K. holidays also muted movement in the precious metals market.

Last week, gold spiked 4.86%—its strongest weekly gain since early April—on rising geopolitical tensions and aggressive trade rhetoric. Friday’s session saw a jump from $3,287 to $3,365 as Trump threatened both the EU and Apple with tariffs.

Despite the pullback, fundamentals still support gold’s longer-term bullish trend. China’s net gold imports via Hong Kong in April more than doubled compared to March, reaching their highest levels in over a year. Meanwhile, Russia’s sustained military strikes on Ukraine over the weekend have kept geopolitical risk on investors’ radar.

The U.S. Dollar Index (DXY) fell slightly to 99.00, while traders are pricing in nearly 50 basis points of rate cuts by year-end. The fiscal outlook remains shaky, with a $4 trillion spending package advancing in Congress and Moody’s recently downgrading U.S. debt from AAA to AA1. These factors continue to provide a supportive backdrop for gold, even as short-term momentum pauses.

Silver Holds Above $33.00, Targets $34.50 After Bullish Triangle Breakout

Silver is holding steady above $33.00 in Monday trading, pausing after a strong 4% gain last week driven by a bullish breakout from a symmetrical triangle pattern. Spot prices are currently near $33.40, consolidating just below Friday’s local high of $33.54.

Last week’s breakout pushed silver above the triangle’s descending resistance, followed by a successful retest of the former resistance zone around $32.60–$32.80. This region now acts as solid technical support, bolstered by the 21-day EMA.

Momentum indicators remain constructive. The RSI is at 56.24—above neutral levels, but still short of overbought territory—indicating the metal has room to climb. MACD remains in bullish territory with positive divergence, suggesting that current consolidation is part of a broader uptrend rather than the start of a reversal.

Resistance is layered at $33.70 to $34.00. A breakout above this range could bring March’s high near $34.60 into view, with the $35.00 psychological level not far behind. Should the market weaken, support below $32.60 opens downside risks toward $32.00 and $31.00.

Despite a quiet start to the week, silver’s price structure and momentum remain in favor of another leg higher—especially if geopolitical tensions or macroeconomic uncertainties resurface.

OPEC+ Advances Meeting Date to May 31

OPEC+ has officially moved its next policy meeting up to May 31 from the originally scheduled June 1 date, according to a Reuters report citing three sources. The adjustment adds urgency as markets prepare for potential decisions on July production targets amid supply concerns and volatile demand projections.

Oil Prices Stabilize as Trump Delays Tariff Deadline, Geopolitical Risks Build

Oil prices firmed on Monday as President Trump postponed the 50% tariff threat on EU goods from June 1 to July 9. The move followed a phone conversation with European Commission President Ursula von der Leyen and eased immediate concerns about a transatlantic trade blow-up. However, ING analysts Ewa Manthey and Warren Patterson say geopolitical tensions and OPEC+ decisions remain key drivers this week.

Key Developments:

- Russia intensified its military campaign in Ukraine. Trump hinted at potential sanctions on Moscow, raising concerns over Russian energy supply risks.

- The U.S. drilling sector continues to shrink. Baker Hughes reported an 8-rig drop last week, bringing the count to 465—the lowest since November 2021.

- Frac spread activity is also slowing, aligning with sub-$65 WTI prices, which are near break-even levels for new drilling according to Dallas Fed data.

OPEC+ Outlook:

Markets await the June 1 OPEC+ meeting. Expectations are growing that the group may agree to raise output by 411,000 barrels per day in July. ING has already factored this into its balance sheet forecast, suggesting the market may remain oversupplied through H2 2025.

Speculators increased long positions in ICE Brent by 12,185 contracts last week, while also raising short bets—highlighting mixed views ahead of the policy decision.

WTI Oil Holds Above $61.30 as Trade Tensions Ease but Supply Risks Linger

WTI crude continues to consolidate above $61.30, buoyed by the U.S. decision to delay EU import tariffs and worsening violence in Gaza. Prices are currently hovering near $61.50 but face upside resistance due to looming supply increases from OPEC+.

Fundamental Drivers:

- President Trump’s Friday announcement delaying EU tariffs until July 9 helped calm fears of a near-term trade shock.

- Escalating conflict in Gaza added geopolitical risk, especially after reports of a deadly airstrike on a school.

- Iranian nuclear deal talks remain stalled, further tightening market expectations for supply in the near term.

OPEC+ Decision Looms:

Markets are anxious over whether OPEC+ will approve a 411,000 bpd increase for July. Traders worry that such a move—combined with weak demand growth—could tip the market into surplus.

Technical Outlook:

- A bullish engulfing candle on Friday suggests short-term support

- RSI is flat near the neutral 50 level, showing no clear trend

- Resistance levels: $62.00 and $63.45

- Key support: $61.30, followed by $60.00

WTI remains about 25% below its highs from January, reflecting the lingering uncertainty over trade, supply, and demand fundamentals.

Citi Targets Gold at $3,500 Over Next 3 Months Amid Trade Turmoil

Citi has raised its short-term gold price forecast to $3,500 per ounce, citing rising global uncertainty and intensifying trade friction. Strategists at the bank expect the yellow metal to trade within a $3,100 to $3,500 range in the near term, pointing to heightened investor demand for safe-haven assets as trade tensions re-escalate.

Europe News

European Stocks Mostly End Higher; UK Index Lags on Holiday

Most major European equity markets closed in positive territory on Monday, led by strong gains in Germany and France. Although the London Stock Exchange was shut for the Spring Bank Holiday, derivatives markets suggest the FTSE 100 would have ended in the red.

Here’s where things stood at the close:

- Germany DAX: +1.68%

- France CAC 40: +1.21%

- Spain IBEX 35: +0.83%

- Italy FTSE MIB: +1.20%

- UK FTSE 100 (Futures): -0.24%

Overall sentiment across the continent was supported by easing trade war fears and positive momentum in global markets.

Swiss National Bank Sight Deposits Hold Steady Amid Strong Franc

Total sight deposits at the Swiss National Bank stood at CHF 443.4 billion for the week ending May 23, only slightly up from CHF 443.2 billion the previous week. Domestic deposits rose to CHF 435.7 billion. As the Swiss franc remains strong, the SNB continues to face mounting pressure in its efforts to combat deflation.

Bloomberg: EU plans to fast track trade talks with the US

- There is a new impetus for the negotiations

According to Bloomberg,

- EU plans to fast track trade talks with the US

- There is a new impetus for the negotiations

- Both Trump and Ursula von der Leyen agree to fast track and keep in close contact.

ECB’s Lagarde Sees Potential for Euro to Expand Global Influence

In a speech delivered in Germany, European Central Bank President Christine Lagarde outlined a strategic vision for the euro’s global role but stopped short of discussing monetary policy or inflation.

Lagarde warned that the rise of protectionism and fragmentation in global trade pose long-term threats to Europe’s export-oriented economy. While the euro currently holds about 20% of global reserves—far behind the U.S. dollar’s 58%—she argued the bloc now has an opportunity to strengthen the euro’s global presence.

To seize this “euro moment,” Lagarde stressed that Europe must:

- Reduce its dependence on foreign exchange exposure

- Lower sovereign and corporate borrowing costs

- Strengthen resilience to external sanctions and political coercion

She outlined three pillars necessary to elevate the euro’s standing:

- Geopolitical credibility via robust alliances and trade networks

- Economic depth, including strong growth and a large, liquid bond market

- Institutional integrity, including independent monetary policy and legal reliability

Lagarde urged the EU to accelerate capital market integration and pursue joint fiscal initiatives to back the euro with safe assets. The ECB’s role, she emphasized, is supportive but ultimately secondary to the EU’s political unity and economic reforms.

Germany’s Economy Minister Urges Patience Amid Tariff Tensions

German Economy Minister Katherina Reiche urged calm over Trump’s latest tariff threats, advising that negotiations should continue despite the looming July 9 deadline. While the initial 50% tariff threat targeted June 1, the delay buys negotiators a few more weeks—but not much breathing room, she noted.

EU Spokesperson Says Von der Leyen Initiated Call with Trump

An EU spokesperson confirmed that European Commission President Ursula von der Leyen initiated a recent call with Donald Trump. The conversation reportedly injected fresh momentum into stalled trade talks, though no further details were provided. EU Trade Commissioner Maroš Šefčovič is scheduled to speak with U.S. Trade Representative Howard Lutnick later today.

Macron: EU-US Trade Talks Made Progress, But Clock Is Ticking

French President Emmanuel Macron said the recent discussion between Trump and von der Leyen was productive and showed promise. Macron reiterated his goal of achieving minimal tariffs, but acknowledged that meaningful progress has been elusive. With just over six weeks left before the new July 9 deadline, Macron cautioned that the window to strike a deal is closing fast.

Asia-Pacific & World News

China Rebukes Australia’s Plan to Reclaim Control of Darwin Port

Beijing is criticizing Australia’s intention to force Chinese firm Landbridge to relinquish control of Darwin Port, which it secured under a 99-year lease back in 2015. Prime Minister Anthony Albanese’s government says it plans to revoke the lease on national security grounds. China’s embassy in Canberra called the move unjust and accused Australia of breaching fair business practices. Landbridge maintains that the port is not for sale and continues to operate it profitably.

Country Garden Seeks Court Approval to Delay Offshore Debt Overhaul

Country Garden Holdings is heading to court in Hong Kong on Monday, seeking an extension to finalize a $14.1 billion debt restructuring plan. The developer, once China’s top homebuilder by contracted sales, has already secured support from creditors representing over 70% of the debt involved. However, several key banks have yet to agree, based on reporting as of May 22.

China Considering New Economic Policy Measures as Global Trade Strains Deepen

Chinese Premier Li Qiang, speaking at a symposium with business leaders in Jakarta over the weekend, acknowledged rising challenges to global economic systems. According to China’s state media, Li highlighted the increasing fragmentation of supply chains and a rise in trade restrictions as significant threats to global growth. In response, Beijing is evaluating fresh policy tools—including what were described as “unconventional” options—to navigate this shifting landscape. Li emphasized China’s intent to expand international economic partnerships. He’s currently visiting Indonesia, with Malaysia next on his agenda for the ASEAN-GCC-China Summit.

Goldman Sachs: Stronger Yuan May Lift Chinese Stocks Further

Goldman Sachs analysts say a firmer yuan could be a tailwind for Chinese equity markets. Their research indicates that a 1% appreciation in the yuan could translate into a 3% gain in Chinese stocks, citing enhanced earnings and increased capital inflows. The bank recently upgraded its yuan forecast to 7.00 per dollar (from 7.35). They retain an overweight view on China’s market, especially favoring sectors like consumer discretionary, real estate, and financials.

PBOC sets USD/ CNY reference rate for today at 7.1833 (vs. estimate at 7.1737)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 382bn yuan via 7-day reverse repos at 1.40%

- 135bn yuan matured today

- net injection 247bn yuan

NZIER Shadow Board Recommends RBNZ Cut Rates by 25bp

Ahead of the May 28 policy meeting, the New Zealand Institute of Economic Research’s independent Shadow Board is advocating for a 25-basis-point cut to the Official Cash Rate. While nearly half of the members backed this move, one pushed for a 50-bp cut. Others argued to keep rates steady, citing persistent inflation and global economic headwinds.

Japan’s PM Eyes U.S. Trade Deal Before Mid-June G7 Summit

Japanese Prime Minister Ishiba said on Sunday that he’s pushing to wrap up a trade deal with the United States in time for the G7 summit scheduled for June 15. Talks have shown recent progress, with Ishiba expressing optimism and reiterating Japan’s willingness to cooperate in strategic sectors such as shipbuilding.

U.S. Pressured South Korea Over Trade Imbalance, Per YTN Report

South Korean media outlet YTN reported that the U.S. recently pushed Seoul to address its trade imbalance in bilateral talks. The details of the exchange remain limited, but further discussions are expected to resume after South Korea’s June 3 presidential election. The South Korean government hopes to finalize a trade agreement by early July.

Crypto Market Pulse

XRP Aims for 14% Breakout as Traders Watch Pennant Pattern

XRP continues to consolidate around $2.32 on Monday, trading sideways after last weekend’s market dip. Although spot volumes are still low, derivatives activity shows signs of life, with Open Interest climbing to $4.74 billion and trading volume rising 10% to $2.97 billion.

Despite the sideways movement, XRP is approaching the apex of a pennant formation. A bullish breakout could unlock a 14% rally, putting the $2.60 zone in focus and potentially reopening the path back to $3.00. However, a major resistance level looms at $2.25, where multiple indicators converge.

CoinShares data shows digital asset inflows hit $3.3 billion last week—pushing 2024’s total to $10.8 billion. Bitcoin and Ethereum led the gains, while XRP saw an outflow of $37.2 million, the largest in its history and a sudden break from 80 consecutive weeks of net inflows.

This divergence between inflows and sentiment may explain why XRP’s bullish momentum is stalling despite broader market optimism. Binance’s long-to-short ratio on XRP/USDT stands at 3.0371, indicating a strong bullish lean. However, long position liquidations totaled $2.6 million over the past 24 hours—nearly double the amount liquidated from shorts. Traders may need to tread cautiously as conflicting signals emerge.

Meme Coin Momentum Fades: Dogecoin and Shiba Inu Struggle for Attention

Dogecoin (DOGE) and Shiba Inu (SHIB) opened the week with mild gains, but the uptrend is being stifled by a sharp decline in social engagement. Market buzz—a key driver of meme coin price action—is showing signs of fatigue, with mentions of both tokens plummeting from their earlier-year peaks.

According to Santiment, DOGE’s social volume has fallen from roughly 1,480 to just 170 mentions across platforms like X (formerly Twitter), Reddit, and Telegram. SHIB’s drop is even steeper, plunging from 330 in December to 25—a nearly 92% decline. This lack of chatter reflects weakening interest from the retail crowd.

Price-wise, DOGE remains capped by a descending trendline stretching back to December. Meanwhile, SHIB is testing resistance along a 12-hour descending channel. However, the 50-period EMA is currently supporting SHIB’s short-term structure, and if that holds, the token may aim to recover above its 200-period EMA.

Kaiko noted that despite Bitcoin hitting all-time highs last week, the broader crypto market has not shown signs of “retail euphoria.” Meme coin rallies historically rely on social momentum and community engagement, and the current data suggests those engines are sputtering.

Trump Media Seeks $3 Billion War Chest for Crypto Investments

Trump Media & Technology Group (TMTG), the parent firm behind Truth Social, is reportedly planning to raise $3 billion with the intent to invest heavily in cryptocurrency markets.

CEO Devin Nunes—former House Intelligence Committee Chair and a close Trump ally—has led the company since resigning from Congress in early 2022. In January 2025, he also took on a role as Chair of the President’s Intelligence Advisory Board.

Now publicly traded under the symbol DJT on Nasdaq, TMTG is positioning itself to expand into crypto and fintech services. The firm’s push into digital assets is part of a broader strategy to diversify beyond social media and align with Trump-era economic and political priorities.

With this funding move, TMTG is signaling its ambition to become a serious player in digital finance, not just political tech.

JUP Surges Toward Breakout as Open Interest Hits Highest Since February

Jupiter (JUP) rallied 10% on Monday, pressing up against a key descending trendline that could trigger a bullish technical breakout. CoinGlass data shows JUP’s Open Interest climbed to $160.43 million—the highest it’s been since February 21. This jump in OI suggests fresh capital is flowing into the market, backing a wave of long positions from traders anticipating further upside.

JUP’s long-to-short ratio has also spiked to 1.24, a one-month high, signaling broad bullish sentiment. If the token can pierce through its current resistance, analysts see room for a run toward the $0.87 mark. The rising OI and strong directional bias from traders set the stage for a potential breakout in the days ahead.

Bittensor Aims for 60% Gain as Subnet Growth and Technicals Align

Bittensor (TAO) continued its recovery on Monday, trading above $450 as the broader crypto market responded positively to news that President Trump postponed EU tariffs until July 9. TAO is now approaching a major technical inflection point—a rounding bottom formation that may signal the start of a breakout toward $778.

The move has already brought TAO up nearly 170% from its April 7 low at $167. Momentum is building: the 50-day EMA has crossed above the 200-day EMA, forming a golden crossover and confirming the strength of the trend reversal. Meanwhile, the RSI hovers at 60 but shows signs of divergence as price consolidates between $410 and $480.

MACD indicators are nearing a bullish crossover, while weakening red histograms point to declining sell pressure. If TAO breaks through the $480 neckline, the 60% target from the rounding bottom pattern remains in play. Otherwise, a fall below $410 risks invalidating the setup and retesting the 200-day EMA at $374.

Adding to the bullish narrative is the explosive growth of Bittensor’s subnet market, which has now reached a market cap of $3.57 billion. These specialized mini-networks, optimized for AI services, are fueling optimism and investor interest.

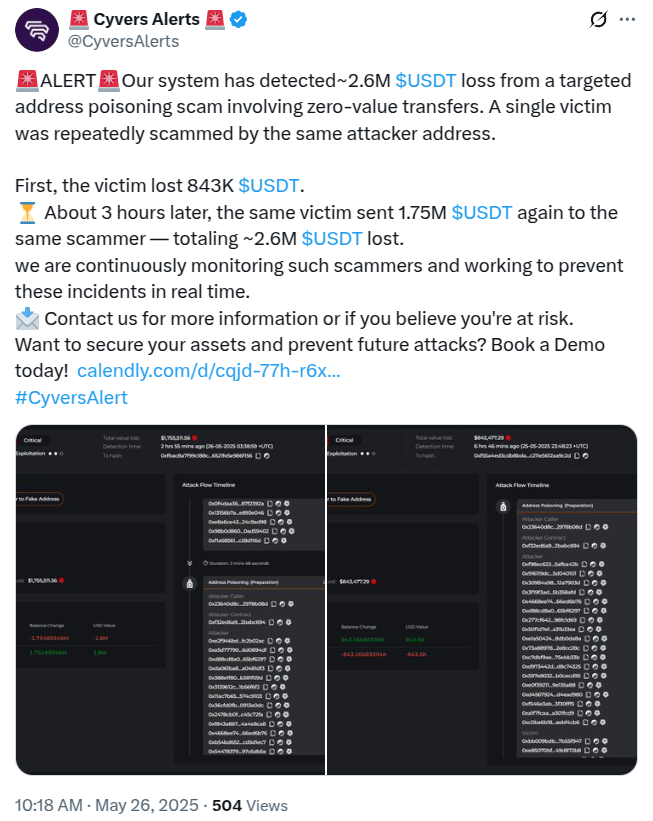

Investor Duped in Back-to-Back Phishing Scams, Loses $2.6 Million in Stablecoins

In an alarming example of onchain fraud, one investor was scammed twice in the span of three hours, losing a total of $2.6 million in USDt, according to Cyvers on May 26. The attacker used a sophisticated phishing method involving zero-value token transfers—a technique that manipulates wallet histories to create the illusion of a safe address.

The scam worked by executing zero-token transfers from the victim’s address to a fake one, which then appeared in the wallet history. Mistaking the spoofed address as familiar, the user later sent $843,000 and then another $1.75 million to the attacker.

This type of exploit is a more advanced form of address poisoning. It leverages how users often copy addresses from recent transaction logs or trust partial matches in UI displays. Similar attacks have previously resulted in multi-million dollar losses, including a $20 million theft in 2023.

A report earlier this year revealed more than 270 million address poisoning attempts occurred between July 2022 and June 2024 across Ethereum and BNB Chain, with confirmed losses surpassing $83 million. Firms like Trugard and Webacy are now deploying AI tools to counter such threats, claiming a 97% detection success rate.

SUI Holds $3.50 Support After Hack Fallout, Rebound Signals Build

Sui (SUI) is stabilizing above $3.50 following last week’s major breach at Cetus, a decentralized exchange in its ecosystem. At press time Monday, SUI is up modestly at $3.61, supported by improving technical conditions and signs of recovery in on-chain metrics.

Friday’s nearly 8% drop left a bearish engulfing candle, but SUI printed a long-tailed Doji on Sunday—a sign that buyers are defending the $3.50 zone. The 50-day EMA is climbing and now hovers just above $3.50, having crossed the 200-day EMA earlier this month in a bullish golden crossover.

Despite this, momentum indicators show mixed signals. RSI has leveled at 50 after dropping from overbought territory, and MACD continues to decline toward the center line, reflecting weakening bullish momentum.

If bears regain control, a breakdown below $3.50 could drag SUI back toward its 200-day EMA at $3.01. On the upside, a recovery above $4.07 would shift sentiment decisively in favor of the bulls.

The Day’s Takeaway

United States

- Memorial Day Closes U.S. Markets

U.S. banks, stock exchanges, and bond markets were closed for Memorial Day. Despite low trading volume, the dollar initially weakened before stabilizing as the North American session began. - Trump Delays EU Tariffs to July 9

President Donald Trump postponed a proposed 50% tariff on EU imports, calming immediate trade tensions. The move came after a call with European Commission President Ursula von der Leyen. - Trump Media Eyes $3 Billion Raise

Trump Media & Technology Group, under CEO Devin Nunes, is preparing to raise $3 billion to fund cryptocurrency investments. The firm trades under the ticker DJT and is expanding beyond social media into fintech and digital assets.

Canada

- Canadian Markets Open Despite U.S. Holiday

While U.S. markets were closed, Canada remained active, providing some liquidity to North American trade. No major Canadian economic releases occurred today.

Commodities

- Gold Pulls Back as Trade Tensions Ease

Gold fell over 0.5% to $3,336 after Trump delayed the EU tariff hike. Thin holiday trading and reduced safe-haven demand contributed to the dip. Still, China’s strong April gold imports and rising geopolitical risks keep the long-term outlook bullish. - Silver Holds Near $33.50, Targets $34.50

Silver consolidated above $33.00 following a 4% weekly gain. A symmetrical triangle breakout confirmed last week continues to support bullish sentiment, with resistance at $34.00 and $34.60 in sight. - WTI Crude Steady Above $61.30

Oil prices remained supported by Trump’s tariff delay and escalating Middle East tensions, but upside is capped by concerns of increased OPEC+ output. Speculation swirls ahead of the May 31 OPEC+ meeting.

Europe

- European Stocks Mostly Higher

- Germany DAX: +1.68%

- France CAC 40: +1.21%

- Spain IBEX 35: +0.83%

- Italy FTSE MIB: +1.20%

- UK FTSE 100 (Futures): -0.24% (UK market closed)

Asia

- No Major New Developments Reported

Asian markets were relatively quiet due to the U.S. holiday and lack of region-specific macroeconomic releases today. Focus shifts to upcoming China PMI data and regional inflation prints later in the week.

Crypto

- XRP Targets 14% Breakout Amid Mixed Signals

XRP traded at $2.32 as it tested a pennant pattern. Open Interest rose to $4.74B while traders remain net long. However, the $37.2M weekly outflow broke a historic inflow streak, signaling caution. - Dogecoin and Shiba Inu Lose Momentum as Social Buzz Fades

Social media mentions for DOGE and SHIB are down over 90% since their peaks, signaling weak retail interest. Both coins trade below key trendline resistance levels despite a stable broader market. - Bittensor (TAO) Eyes 60% Rally on Rounding Bottom Breakout

TAO traded above $450, forming a rounding bottom pattern. Subnet market cap hit $3.57B, driving bullish interest. A confirmed breakout above $480 could target $778. - SUI Holds $3.50 Post-Hack, Outlook Stabilizes

Following a major DEX hack, SUI is steady at $3.61. Price action shows resilience, supported by EMAs and rising derivatives activity. A move above $4.07 could confirm recovery. - Investor Loses $2.6M in Double Phishing Scam

A victim fell prey to two zero-transfer phishing attacks within hours, sending $2.6M in USDT to scammers. The exploit, which manipulates onchain history, reflects rising risks across Ethereum and BNB chains.