North America News

US Stocks End Mixed as Market Catches Its Breath, Eyes PCE Report

Wall Street closed mostly unchanged on Wednesday as investors paused to reassess after a hectic stretch of geopolitical headlines and central bank commentary. The S&P 500 finished flat, the Nasdaq gained 0.3%, and the Russell 2000 added 0.2%. The Dow Jones Industrial Average slipped 0.2%.

Tech led modest gains, with Nvidia climbing 4.3% to a new all-time high. After the bell, Micron jumped 5% following stronger-than-expected earnings on both revenue and profit.

Bond and equity markets were relatively quiet, but currency markets saw more movement. The U.S. dollar extended its recent slide, partly in response to weak housing data and shifting expectations around Fed policy. May’s new home sales fell sharply, which added fuel to growing bets on interest rate cuts.

Traders are now pricing in 63 basis points of cuts by year-end, up from 49 bps a week ago. A key factor behind the adjustment is the continued drop in oil prices, which should ease inflation pressures. While Fed Chair Jerome Powell and other officials have stuck to a cautious tone, markets are reading the data as pointing to a cooling economy.

All eyes now turn to the May PCE inflation report, a key test for the Fed’s narrative.

US Sells $70B in 5-Year Notes at 3.879%, Demand Mixed

The U.S. Treasury auctioned $70 billion in five-year notes at a high yield of 3.879%, slightly above the when-issued level of 3.874%, creating a 0.5 basis point tail—indicative of slightly weak demand.

Domestic buyers (directs) took a solid 24.44% of the issue, above the six-month average of 18.2%, while international buyers (indirects) accounted for 64.68%, below their 70.5% average. The bid-to-cover ratio landed at 2.36x, just shy of the 2.39x average. Overall, the auction was below average as overseas demand came in soft.

US New Home Sales Plunge 13.7% in May, Hit 3-Year Low

Sales of new homes in the U.S. dropped to 623,000 in May, well below the 693,000 expected and down from a downward-revised 722,000 in April. The sharp -13.7% monthly decline reverses the previous month’s spike and takes new home sales to their lowest level in nearly three years. The housing market continues to struggle under the weight of high mortgage rates and affordability challenges.

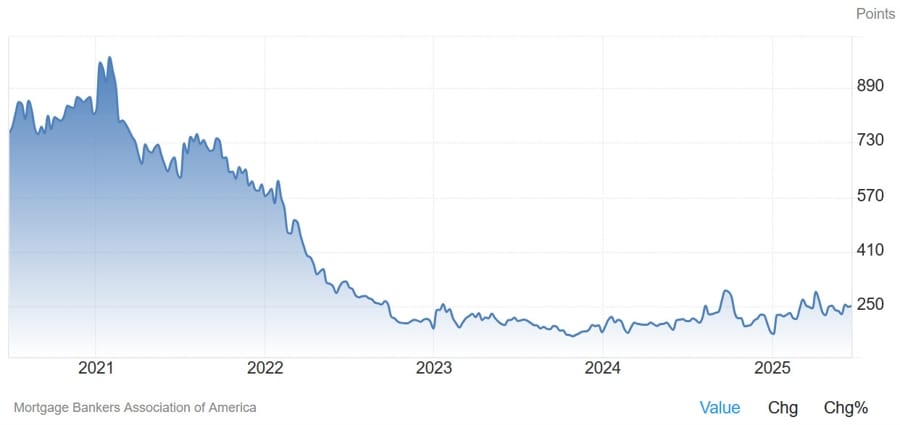

US Mortgage Applications Rise 1.1% Despite Higher Rates

Mortgage applications in the U.S. rose 1.1% for the week ending June 20, according to the Mortgage Bankers Association. This rebound follows a 2.6% drop the previous week.

The 30-year mortgage rate edged up to 6.88% from 6.84%. Refinancing activity increased, with the refinance index rising to 713.4 from 692.4. The purchase index was flat at 165.2, signaling buyers are still cautious amid elevated borrowing costs.

Powell Says Fed Watching Inflation Carefully, Tariff Impact Still Unclear

Federal Reserve Chair Jerome Powell told lawmakers that the Fed is still gauging how tariffs may affect inflation and said monetary policy should move slowly in such an uncertain environment.

He emphasized that the bond market remains functional, inflation is “in a good place,” and there’s no sign of stagflation. Powell also said tariffs could cause a one-off inflation spike, warning that misjudging their impact would have long-term costs. On recent dollar weakness, Powell said markets are adjusting to complex global conditions.

Trump Praises NATO Summit, Signals Iran Talks and Hits Out at Spain

Following the NATO summit, Donald Trump said alliance members had stepped up with $700 billion in added defense spending. He declared the Israel-Iran war “likely over” and said the U.S. won’t block Iran’s oil exports to China.

Trump also revealed plans to speak with Iranian leaders next week about a potential non-nuclear agreement. On Ukraine, he confirmed a positive meeting with President Zelensky but said no ceasefire was discussed. Meanwhile, he took a swipe at Spain over trade, warning Madrid would “pay twice as much” under new negotiations. He also mentioned narrowing down his shortlist for Fed chair to three or four candidates.

Fed’s Collins Says Policy Is on Track, Calls for Patience on Rate Cuts

Boston Fed President Susan Collins said U.S. monetary policy is “well-positioned” and that there’s room for patience before making any rate adjustments. She backed the Fed’s decision to hold rates steady last week and reiterated that cuts may be appropriate later in 2025—but only if trade-related impacts become clearer. Collins expects tariff fallout to become more visible in the months ahead but sees the broader economy as solid.

US Secretary of State Rubio: We’re going to continue to engage with Russia

- Remarks from the US Secretary of State to Politico

- If there’s an opportunity for us to make a difference and get Russia to table, we’re going to take it.

- President Trump will buck Europe’s pleas to ratchet up sactions on Russia, US still wants room to negotiate a peace deal.

Fed’s Schmid says the FOMC has time to ‘wait and see’

- Jeff Schmid is president and chief executive officer of the Federal Reserve Bank of Kansas City

- Both jobs and inflation are near the Fed’s goals

- Central bank has time to study tariff effects on inflation before any rate decision

- Resilience of the economy means the Fed has time to wait and see what happens before rate cuts

- Contacts say that tariffs will raise prices and weigh on activity

Commodities News

Gold Holds Steady at $3,334 as Powell Defends Hawkish Tone, Housing Data Sinks

Gold prices edged higher to $3,334/oz, up 0.34%, as weaker-than-expected U.S. housing data added to concerns over the strength of the economy. A temporary risk reset following the Israel–Iran ceasefire also lifted market sentiment.

But Fed Chair Jerome Powell struck a cautious tone in testimony to Congress, warning that tariffs could pose inflation risks even if their impact is brief. Powell said, “If it comes in quickly and it is over and done, then yes, very likely it is a one-time thing,” referring to the inflationary effects of tariffs. However, he emphasized the Fed’s responsibility to manage that risk.

Powell’s comments were echoed by Boston Fed President Susan Collins, who said policy is “well-positioned,” though rate cuts later in the year remain a possibility if conditions shift.

The latest housing data provided fresh evidence of economic strain. New home sales dropped 13.7% in May, falling from a revised 722,000 in April to 623,000, well below the 693,000 forecast. High mortgage rates near 7% continue to weigh on buyers.

The U.S. Dollar Index slipped 0.13% to 97.84, while Treasury yields nudged higher. Traders are now pricing in 59 basis points of rate cuts by year-end.

Looking ahead, markets will focus on Durable Goods Orders, GDP revisions, and Initial Jobless Claims before closing out the week. Next week’s ISM manufacturing data will provide another key test for gold and rates.

Goldman Sachs Hikes Copper Outlook for H2 on China Demand, Tariff Effects

Goldman Sachs has raised its second-half 2025 copper price forecast by $750 to an average of $9,890 per tonne. The firm sees prices peaking at $10,050 this year, driven by Chinese demand and tariff-related stock drawdowns outside the U.S.

The bank projects a mild retreat to $9,700 by year-end due to easing restocking cycles but maintains a long-term bullish stance, still targeting $15,000 in the years ahead. Goldman now expects copper to average $10,000 in 2026, slightly below the previous $10,170 projection. Supply disruptions at major sites like Cobre Panama and Kamoa-Kakula are still on the radar.

Crude Stockpiles Drop Sharply as Fuel Inventories Slide

U.S. crude oil inventories dropped by 5.836 million barrels for the week ending June 13, far exceeding expectations of a 1.96 million barrel draw, according to the EIA.

- Gasoline stocks: -2.075M vs. +381K expected

- Distillates: -2.075M vs. +410K expected

The large inventory draws across the board reflect strong demand and may support oil prices heading into the next OPEC+ meeting.

Shell Reportedly in Early Talks to Acquire BP

Shell is reportedly exploring a takeover of BP in what could be one of the energy sector’s largest-ever mergers, according to the Wall Street Journal. Shares of BP surged 7.8% on the news. BP was valued at around $80 billion before the report broke. Talks are still in early stages, with no formal agreement announced yet.

Russia Reportedly Open to Backing More OPEC+ Output Hikes

Russia is said to be open to another OPEC+ production hike at the group’s July 6 meeting, according to Bloomberg. While prior expectations leaned toward continued supply restraint, recent stabilization in oil prices has shifted attention toward potential increases in output from October onward. The next meeting will be closely watched for updated guidance.

Silver Dips, Tests Key Support as Bullish Momentum Slows

Silver is treading water around $35.75, down about 0.46%, as safe-haven demand fades post-ceasefire. The metal is now testing a key ascending channel support, as well as the 20-day moving average around $35.71.

RSI divergence and narrowing Bollinger Bands suggest that momentum is weakening. A decisive break below $35.60–$35.70 could expose the $34.00 area. However, the longer-term trend remains bullish unless this key zone is breached.

Gold Falls as Safe-Haven Demand Cools After Ceasefire

Gold prices slipped over 1% to $3,324 per ounce after Iran and Israel agreed to maintain a ceasefire, according to ING analysts. With geopolitical tensions easing and Fed officials signaling no urgency to cut rates, demand for safe-haven assets has cooled.

Silver also underperformed, reflecting a broader shift toward risk assets. Expectations that the Fed will hold off on rate cuts due to lingering inflation are putting additional pressure on metals.

Copper Tightens on LME as Inventory Drop Sparks Squeeze

Copper prices on the London Metal Exchange have climbed for four straight days, driven by shrinking inventories and supply constraints, ING analysts report.

At one point this week, spot copper traded at a $379/ton premium to three-month contracts—down slightly to $150/ton now but still far above early-year levels. Since January, LME inventories have plunged by around 176,000 tons to just 95,000 tons, tightening the market significantly.

Oil Rebounds After Ceasefire, Trump Comments on Iranian Supply

Oil prices ticked higher on Wednesday after a two-day selloff, helped by a de-escalation between Iran and Israel and fresh remarks from Donald Trump supporting continued Iranian oil exports. Brent climbed back toward $68, while WTI pushed above $65.

Despite Trump’s tone, White House officials later clarified that sanctions would stay in place. OPEC+ is set to meet on July 6 via video to discuss a possible production increase for August. Meanwhile, API data showed a sharp 4.28 million barrel draw in U.S. crude stockpiles, helping lift prices.

Europe News

Spain Drags Down European Stocks as Trump Threatens Trade Action

European stock markets closed broadly lower, with Spain underperforming after drawing criticism from Donald Trump. Here’s how the main indices fared:

- Spain’s IBEX: -1.5%

- Germany’s DAX: -0.6%

- France’s CAC 40: -0.7%

- UK’s FTSE 100: -0.4%

- Italy’s FTSE MIB: -0.4%

Investors appeared wary of renewed U.S.-Spain trade friction following Trump’s comments.

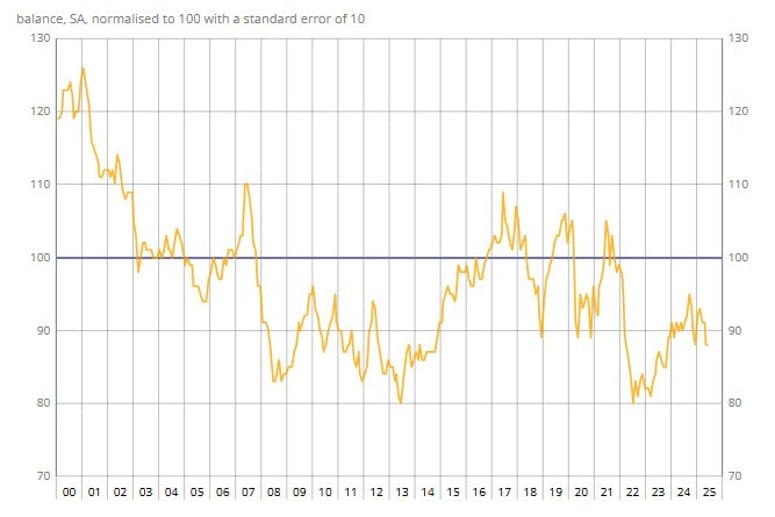

French Consumer Confidence Stalls in June at 88

France’s consumer sentiment remained unchanged at 88 in June, falling short of the expected 89, according to INSEE. The latest survey data shows little change from May, with households still uneasy about future job prospects and financial conditions. The persistent caution signals no real momentum in consumer outlook.

Spain Confirms 0.6% GDP Growth in Q1, Yearly Pace at 2.8%

Spain’s economy expanded 0.6% in Q1, according to final figures from the national statistics office INE. The result matches preliminary readings and reinforces the view that Spain continues to outperform most of its European peers. Year-on-year GDP growth was confirmed at 2.8%, though slower than the 3.4% pace seen in the previous quarter.

Swiss Investor Confidence Jumps to -2.1, Best Since February

UBS’s latest investor sentiment index for Switzerland climbed to -2.1 in June from -22.0 in May, its highest since February. Despite global trade tensions and lingering fears tied to the Middle East, investors remain optimistic about long-term growth and stable inflation expectations.

UK Job Market Softens as Pay Rises Lag Behind Inflation

The UK’s labor market is showing signs of cooling, with job vacancies slipping and wage growth falling short of inflation.

Private sector pay increases averaged 3% from March to May—below the 3.4% inflation rate. Nearly 15% of employers handed out smaller 2.5% raises.

Job postings dropped 5% from late March through mid-June and are now 21% below pre-pandemic levels. The UK stands out as the only major economy where vacancies are still below 2019 levels.

Graduate job ads have collapsed, especially in HR, accounting, and marketing. AI adoption may be playing a role in dampening demand for some white-collar roles.

Asia-Pacific & World News

Market Expects US Tariffs on China to Hold at 10% Post-July Talks

Markets are bracing for U.S. tariffs on Chinese goods to stay at 10% beyond the July 9 deadline, even as talks continue. Vietnam’s trade ministry expects a deal soon, possibly within two weeks. While tariffs could pressure global growth, investors seem unfazed, betting that monetary easing and fiscal stimulus will offset the drag.

Xi Jinping to Miss BRICS Summit for First Time

Chinese President Xi Jinping will skip the upcoming BRICS summit in Rio de Janeiro (July 6–7), marking his first absence from the gathering since China joined the group. Premier Li Qiang will lead the delegation instead.

China cited scheduling conflicts and Xi’s recent meetings with Brazilian President Lula as the reasons. Still, Brazil reportedly expressed disappointment, especially given the diplomatic overture of hosting Indian PM Modi for a state dinner.

Li Qiang is expected to arrive in Brazil later next week.

China Accelerates Yuan Globalization as Dollar Loses Ground

China is stepping up its push to elevate the yuan’s global profile, leveraging declining faith in the U.S. dollar, which has fallen over 9% this year. Meanwhile, the offshore yuan has appreciated more than 2%.

Three major Chinese exchanges opened 16 new derivatives contracts to international investors, aiming to entrench the yuan in global commodities pricing. Central bank chief Pan Gongsheng also unveiled plans for a yuan-focused digital finance hub in Shanghai and expanded currency futures trading.

Beijing is loosening foreign access by accepting foreign currencies as trade collateral, introducing ETF options for global investors, and slashing fees for overseas institutions in the bond market.

Though the dollar remains dominant in global settlements, yuan-based cross-border trade is expanding, particularly in energy. Yet capital controls and legal murkiness still deter many investors. Analysts say there’s room for more institutional inflows into yuan assets.

Chinese Equities to Stay Flat in H2 2025, Says RBC

RBC Wealth Management anticipates that Chinese stocks will remain largely range-bound through the second half of 2025. The firm sees two main catalysts determining performance: the ongoing tug-of-war in U.S.-China trade negotiations and the strength of corporate earnings.

Although the worst outcomes on the trade front appear to have been sidestepped, RBC expects volatility to resurface as headlines emerge. They’re also watching for signs of fundamental economic improvement and how U.S. tariffs are beginning to influence corporate results.

Investors will zero in on whether earnings per share (EPS) growth has enough muscle to drive valuations higher. Meanwhile, policy moves—such as increased market openness and targeted industrial reforms—could inject upside surprises into the market.

Premier Li Criticizes Global Trade Disruptions Without Naming Trump

At the World Economic Forum in Tianjin, Chinese Premier Li Qiang delivered a veiled critique of former U.S. President Donald Trump’s trade policies, without explicitly naming him.

Li warned that global supply chains are fragmenting, blaming some nations for meddling in the international division of labor under the pretext of risk mitigation. Despite growing uncertainty, he said global trade continues to evolve in a “spiraling upward” motion.

He urged countries to commit to multilateralism, maintain open trade, and avoid the over-politicization of economic issues. Li reaffirmed China’s readiness to work with other countries, expand market access, and support entrepreneurs. He also emphasized China’s ambitions to transition from a manufacturing base to a powerhouse consumer market.

PBOC sets USD/ CNY mid-point today at 7.1668 (vs. estimate at 7.1709)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 365.3bn yuan via 7-day reverse repos at 1.40%

- 156.3bn yuan mature today

- net injection is 209bn yuan

Iran’s Nuclear Capability Mostly Intact Despite Strikes

A classified intelligence assessment shared with U.S. officials reveals that recent airstrikes did little to cripple Iran’s nuclear program.

According to the report, Iran’s underground facilities largely withstood the attacks, with only surface-level damage. Crucial equipment remained functional.

Iran reportedly moved uranium stockpiles before the strikes, minimizing disruption. There’s also growing concern that Tehran may be operating undeclared enrichment sites.

The assessment suggests the strikes delayed progress by just a few months, rather than the years initially projected—adding urgency to ongoing diplomatic talks.

Australia’s May CPI Slows Sharply, Supports Rate Cut Case

Australia’s monthly inflation figures for May showed weaker-than-expected results, bolstering the case for a rate cut at the Reserve Bank’s July 7–8 meeting.

Headline inflation came in at 2.1% year-on-year, below the forecast of 2.3% and a marked drop from April’s 2.4%. On a monthly basis, prices fell 0.4%.

The trimmed mean CPI—a key core inflation metric—dropped to 2.4% from 2.8% in April. Analysts view this as a decisive signal that inflation is cooling more quickly than anticipated.

New Zealand Trade Steady in May, Narrow Surplus Reported

New Zealand’s trade numbers for May were largely flat compared to April. Exports totaled NZ$7.68 billion, slightly down from NZ$7.84 billion. Imports ticked up to NZ$6.44 billion from NZ$6.42 billion.

The monthly trade surplus came in at NZ$1.24 billion, better than the expected NZ$1.06 billion but lower than April’s NZ$1.43 billion. The annual trade deficit sits at NZ$3.79 billion.

BOJ’s Tamura: For now, I don’t think we need an imminent rate hike

- Tamura tries to temper down his hawkish rhetoric put out today

- Won’t rule out possibility of hiking rates to address upside risks amid ongoing trade talks

- But that would require price risks to be so large that BOJ might fall behind the curve

- For now though, I don’t think upside price risks warrant an imminent rate hike

- No preset idea on next rate hike timing

- It could come sooner or later depending on tariffs and their impact to the economy

- Inflation accelerating more than I expected back in May

- The fog surrounding US tariffs is clearing somewhat

- But it is still hard to predict the outlook

- BOJ may need to act decisively if upside price risks heighten further

RBC Sees Upside in Japan Equities, but Tariff Optimism Overdone

RBC Wealth Management maintains a constructive stance on Japanese equities, expecting a U.S.-Japan trade deal—but not before Japan’s upper house elections on July 20.

However, RBC warns the market may be too bullish on tariff cuts, especially in the auto sector. They argue much of the benefit has already been priced in.

Tailwinds include a likely achievement of the BOJ’s 2% inflation target, strong consumer demand, solid wage growth, inbound tourism, and a surge in retail investing under the expanded Nippon Individual Savings Account program.

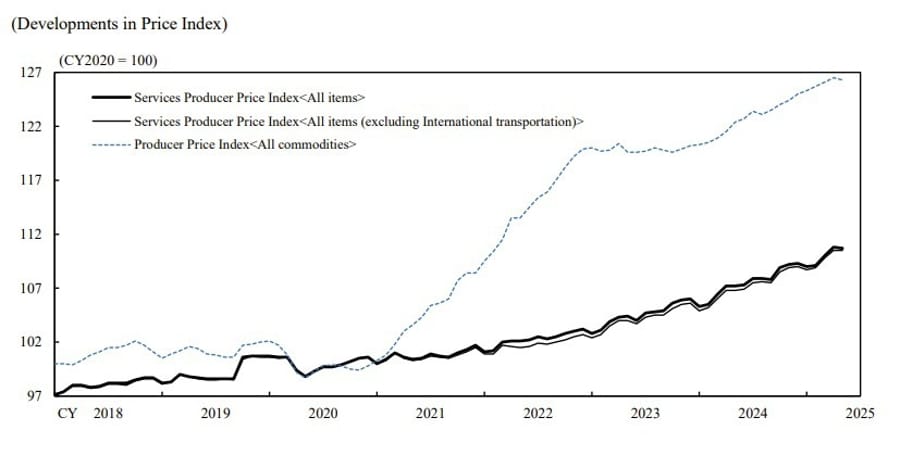

Japan’s May Services PPI Beats Forecasts at 3.3% Y/Y

The latest data from the BOJ showed Japan’s corporate services prices climbed 3.3% year-over-year in May, topping expectations of 3.1%. The prior month also registered at 3.1%.

This reinforces the view that service-sector inflation remains sticky and could justify further policy tightening down the line.

Japan’s Service Inflation Stays Elevated, Hike Outlook Intact

Japan’s services producer price index rose 3.3% in May from a year earlier, exceeding expectations and underscoring persistent inflationary pressure in the services sector.

This index tracks prices businesses charge each other for services and is a key barometer for domestic inflation trends.

Although economic risks from tariffs led the BOJ to downgrade growth projections, service-sector inflation is keeping rate hike expectations alive. A slim majority of economists now expect the next 25 basis point increase to come in early 2026.

BOJ’s Tamura Sees Inflation Rising Faster Than Forecast

In a detailed speech, BOJ policymaker Naoki Tamura said inflation is running slightly hotter than the central bank expected, driven by wage gains and rising service costs.

April and May inflation data beat expectations, with fresh food prices no longer seen as a temporary spike. Tamura believes inflation expectations across firms and households are already close to 2%, and could overshoot.

He argued that the BOJ must raise rates at the right moment—neither prematurely nor too late—and that the 0.5% level isn’t a ceiling. He also called for faster unwinding of the BOJ’s bond holdings.

BOJ Split on Policy Path Amid Inflation Surge and Tariff Fears

The Bank of Japan appears divided over the pace of rate hikes, with some members warning that inflation could demand stronger action—even as U.S. tariffs pose downside risks.

At the June meeting, the BOJ left its policy rate at 0.5% and slowed its bond taper plans. But internal documents show some members were concerned inflation had already exceeded expectations.

One policymaker labeled Japan’s economy “somewhat stagnant,” even before the full tariff impact hits. Higher food costs, especially rice, are feeding inflation worries. Still, most analysts see the next rate hike pushed to 2026.

Japan’s BOJ May Raise Rates ‘Decisively’ Despite Tariff Shock

Bank of Japan board member Naoki Tamura hinted that rate hikes might come faster and stronger than many expect, citing steady inflation progress toward the 2% goal—even with U.S. tariffs clouding the economic picture.

Speaking in Fukushima, Tamura noted that inflation was already exceeding forecasts before the tariffs were announced in April. He believes consumer prices will hover near the 2% mark through fiscal 2027, supported by persistent wage and price hikes.

Tamura signaled the BOJ might be forced to act decisively if upside inflation risks continue to grow, even if economic uncertainty persists. Despite a more cautious outlook following the tariff shock, inflation expectations across businesses and households seem anchored near 2%.

BoJ Summary of Opinions June meeting

- Bank of Japan

BOJ summary of opinions at June meeting:

- One member said: While much of the hard data for April and May has been relatively solid, it is likely that the effects of tariff policies are yet to materialize

- One member said while the impact of U.S. tariff policy will certainly exert downward pressure on firms’ sentiment, the bank needs to take some time to examine the magnitude of the impact on the real economy

- One member said despite the impact of U.S. tariff policy, many firms will likely continue to raise wages to address labor shortages, make high levels of business fixed investment

- One member said although the direct impact of U.S. tariff policy has not been observed so far, Japan’s economy has been somewhat stagnant

- One member said Japan’s economy at crossroads between making a transition to a “growth-oriented economy driven by wage increases and investment” and falling into stagflation

- One member said although uncertainty regarding trade policies remains extremely high, on the domestic front, wage developments have been solid, and the CPI has been slightly higher than expected

- One member said as the price of rice could affect perceived inflation and inflation expectations, it is necessary to closely monitor developments in rice prices

- One member said as US, Europe and emerging economies leaning toward accommodative policies, Japan’s economy could unexpectedly be pushed up or experience inflationary pressure

- One member said if its outlook for economic activity and prices will be realized, the bank, in accordance with improvement in economic activity and prices, will continue to raise the policy interest rate

- One member said given high uncertainty, the bank should, at this point, maintain accommodative financial conditions with the current interest rate level and thereby firmly support the economy

- One member said even though prices have been somewhat higher than expected, it is appropriate for the Bank to maintain current policy, given downside risks stemming from U.S. tariff policy and situation in the Middle East

- One member said with extremely high uncertainty in the outlook, it is appropriate for the Bank to maintain the current policy interest rate for the time being

- One member said increased volatility in the super-long-term zone may spill over to the entire yield curve, thereby spreading unintended tightening effects to the market as a whole

- One member said situation of government bond markets around the world has been a major topic of discussion, such as at international meetings, attention is warranted on the possibility that developments overseas will spread to Japan

- One member said although the CPI has been higher than expected, the pass-through of higher wages to services prices seems to have plateaued

- One member said with inflation being at levels higher than expected, the bank may face a situation where it should adjust the degree of monetary accommodation decisively, even when there is high uncertainty

Crypto Market Pulse

Bitcoin Treasury Buyers Keep Accumulating, But Prices Stay Stuck

Corporate appetite for Bitcoin is surging, but so far it hasn’t pushed prices higher. According to K33 Research, even as more firms adopt BTC treasury strategies, the price response has been muted.

On Wednesday, ProCap revealed it had purchased an additional 1,208 BTC for around $128 million, bringing its total holdings to 4,932 BTC. The move is part of the company’s broader $1 billion Bitcoin treasury strategy, which has accelerated since its announcement to go public.

GameStop also recently secured $450 million through a convertible note extension, increasing its total to $2.7 billion. Part of those funds are expected to support Bitcoin purchases, including its already confirmed 4,710 BTC holding.

In Japan, Metaplanet raised $515 million as part of an ongoing effort to reach 1% of Bitcoin’s total supply by 2027. The company already holds 11,111 BTC, and its recent funding round included a conversion of 54 million shares from major investor EVO Fund.

Despite these large-scale purchases, Bitcoin’s price has shown limited reaction. Analysts at K33 suggest that because many of these acquisitions are made in-kind—where BTC holders trade coins for shares—they have little impact on net demand.

Additionally, some investors may be selling spot BTC to buy into these treasury firms’ share offerings, offsetting buying pressure. K33 noted the weak correlation (R² = 0.18) between corporate buying and BTC price performance, reinforcing the idea that this new wave of buying isn’t moving the needle—yet.

At the time of writing, Bitcoin is trading at $107,600, up 2% on the day.

Pi Network Surges on AI Integration Buzz

Pi Network (PI) soared double digits to $0.63, rallying from weekend lows of $0.46 on growing hype about a potential generative AI integration. This comes as the network marks 100 days since launching its Open Network.

Social sentiment spiked after co-founder Nicolas Kokkalis appeared on a panel discussing the role of AI in blockchain. A MACD buy signal and support at the 50-day EMA ($0.59) could help push PI toward the $1.00 level if the uptrend continues.

Cardano Whales Accumulate as Retail Traders Exit

Cardano (ADA) slipped slightly on Wednesday, giving up part of its weekly gains. Despite the dip, on-chain data reveals that large holders are scooping up ADA while retail investors are reducing exposure.

Whales holding over 10 million ADA added 270 million tokens in June, boosting their stake to 18.23 billion ADA. In contrast, smaller holders (10–10K ADA) offloaded 10 million tokens since the start of the month. While this shows strong institutional interest, fading retail confidence could dampen short-term momentum.

Story Crypto Slips Despite $10M AI-IP Fund Launch with OKX Ventures

Story (IP) is slightly lower at $2.99 despite announcing a new $10 million fund with OKX Ventures to back startups at the intersection of intellectual property and AI.

The fund, managed with input from PIP Labs, will focus on building decentralized AI infrastructure and on-chain IP asset classes. Story aims to provide real-world utility for IP in AI training, especially around data consent and credit attribution.

Technically, Story shows potential to recover above $3.00. The MACD is approaching a bullish crossover, and traders are watching for upward momentum toward the $3.76 and $4.09 resistance levels.

Dogecoin, Dogwifhat, SPX Rebound as Risk Sentiment Improves

Crypto markets are bouncing as risk-on sentiment returns. Dogecoin (DOGE), Dogwifhat (WIF), and SPX6900 (SPX) are all aiming to extend their recovery following the ceasefire between Iran and Israel.

Dogecoin is eyeing a push toward $0.20, supported by a bullish morning star pattern and rising MACD. Immediate resistance sits at $0.1710. RSI has turned higher from oversold territory, suggesting waning bearish pressure.

Dogwifhat is pulling back slightly after a strong start to the week, while SPX6900 is staging a sharp V-shaped rebound off key support, with eyes on fresh all-time highs.

Bitcoin Eyes $125,000 as Bullish Momentum Builds

Bitcoin is flashing strong bullish signals after rallying more than 8% this week, lifted by easing geopolitical tensions and expectations of Fed rate cuts. The end of the Iran-Israel conflict, confirmed by former President Trump, fueled the breakout.

On the daily chart, BTC is forming a bullish flag, projecting a target as high as $125,000. Short-term resistance sits near $107,000, while bulls eye a breakout toward $109,000. A failure to clear this zone could pull prices back to $104,750 or even the lower end of the flag around $100,000. However, as long as the Fed stays dovish, the broader uptrend remains intact.

The Day’s Takeaway

US

- Stock Markets Flat to Mixed:

Major U.S. indices closed mostly unchanged as investors paused to digest a wave of geopolitical headlines and economic data. The S&P 500 finished flat, while the Nasdaq rose 0.3%—led by a 4.3% surge in Nvidia to a new record. The Dow slipped 0.2%. Micron shares jumped 5% post-market on strong earnings. - Soft Housing Data:

New home sales dropped 13.7% in May, the weakest level in three years. Higher mortgage rates and affordability concerns are stifling demand. - Fed Tone Remains Cautious:

Fed Chair Powell reiterated that tariffs may result in only a one-time price bump, but warned of potential inflation persistence. He stressed the need for caution and gave no indication of near-term rate cuts. Boston Fed’s Collins supported the hold but remained open to cuts later this year if warranted. - Rate Cut Expectations Rising:

Markets are now pricing in 63 bps of rate cuts by year-end, up from 49 bps last week, largely due to weaker data and falling oil prices.

Commodities

- Gold Holds Ground:

Gold steadied at $3,334/oz, supported by weak U.S. housing data and reduced geopolitical risk following the Israel–Iran ceasefire. Despite a strong dollar and higher yields, bullion found footing. - Copper Forecast Upgraded:

Goldman Sachs raised its H2 2025 copper forecast by $750 to $9,890/tonne, citing stock drawdowns outside the U.S. and strong Chinese demand. Peak 2025 price seen at $10,050. - Crude Inventories Fall Sharply:

EIA data showed U.S. crude stocks fell by 5.836 million barrels, far outpacing forecasts. Gasoline and distillates also posted large draws, reflecting strong demand. - OPEC+ Update:

Russia is reportedly open to another OPEC+ production hike at the upcoming July 6 meeting, as attention shifts to balancing output later in the year. - Shell Eyes BP in Potential Mega Merger:

Shell is reportedly in early talks to acquire BP, according to the WSJ. BP shares jumped 7.8% on the report. The potential merger would be one of the largest ever in the energy sector.

Europe

- Markets Close Lower:

Most European indices ended in the red. The Spanish IBEX fell 1.5%—the day’s worst performer—after Trump criticized Spain over trade.- DAX: -0.6%

- CAC 40: -0.7%

- FTSE 100: -0.4%

- FTSE MIB: -0.4%

Crypto

- Bitcoin Treasury Momentum Builds, Price Unfazed:

ProCap, GameStop, and Metaplanet have all boosted their Bitcoin holdings significantly in recent weeks. ProCap alone added 1,208 BTC, while GameStop secured $450M in additional funding. Despite these moves, BTC price remains largely unaffected, trading near $107,600. K33 Research noted a weak correlation between treasury buying and BTC returns, citing in-kind share swaps as a neutralizing factor. - Pi Network Surges on AI Buzz:

PI token rallied to $0.63, driven by community optimism over potential generative AI integration. Technicals support continued upside toward the $1.00 mark. - Cardano Sees Whale Accumulation:

ADA dipped slightly, but on-chain data shows large holders are accumulating. Retail investors, meanwhile, have reduced exposure, suggesting mixed short-term sentiment despite longer-term confidence.