North America News

U.S. Stocks Close Lower, Nasdaq Breaks Key Support Level

U.S. equities faced a mixed session, with the Nasdaq closing below its 100-day moving average for the first time since September 2024.

Closing levels:

- Dow Jones: +159.95 points (+0.37%), closing at 43,621.17.

- S&P 500: -28.0 points (-0.47%), closing at 5,955.25.

- Nasdaq: -260.54 points (-1.35%), closing at 19,026.39.

- Russell 2000: -8.18 points (-0.38%), closing at 2,170.08.

Key technical levels:

- Nasdaq 100-day MA: 19,211.55 (now acting as resistance).

- S&P 500 tested 100-day MA: 5,946.04 but closed slightly above.

- Russell 2000 closed below its 200-day MA (2,203.04) for the third straight day.

Stock highlights:

- Nvidia (-2.80%) closed at $126.63, marking its third consecutive decline ahead of earnings.

- Broadcom (-2.59%) tested its 100-day MA ($200.01) before a slight recovery.

- Meta fell for the sixth straight session after previously rallying for 20 consecutive days.

Earnings reports:

- ZoomInfo (ZI): Q4 EPS $0.26 (vs. $0.22 est.), revenue $309.1M (vs. $297.6M est.).

- AMC Entertainment (AMC): Q4 revenue $1.31B, adjusted loss per share of $0.18.

- CAVA Group (CAVA): Q4 net income $78.6M, revenue $227.4M (vs. $223.9M est.).

- Lucid Group (LCID): Q4 revenue $234.5M (vs. $214.2M est.), net loss of $397.2M.

With tech stocks under pressure, market sentiment remains fragile.

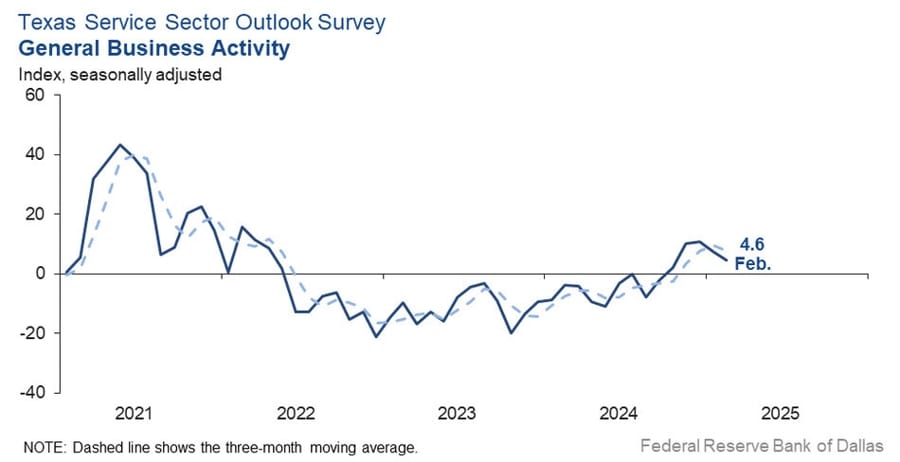

Dallas Fed Services Index Falls to 4.6, Tariffs & Labor Concerns Weigh

The Dallas Fed Services Index fell to 4.6 from 7.4, with businesses citing:

- Tariff uncertainty impacting costs.

- Concerns over labor shortages due to deportation policies.

U.S. Treasury Sells $70B in 5-Year Notes at 4.123% Yield

The U.S. Treasury auctioned $70B in 5-year notes, with a high yield of 4.123%, slightly below the WI level of 4.133%.

Auction details:

- Bid-to-cover ratio: 2.42x (vs. 6-month avg: 2.40x)

- Direct buyers: 14.5% (vs. 6-month avg: 19.2%)

- Indirect buyers: 74.9% (vs. 6-month avg: 68.6%)

- Dealer participation: 10.6% (vs. 6-month avg: 12.3%)

Strong demand from international buyers suggests continued appetite for U.S. debt.

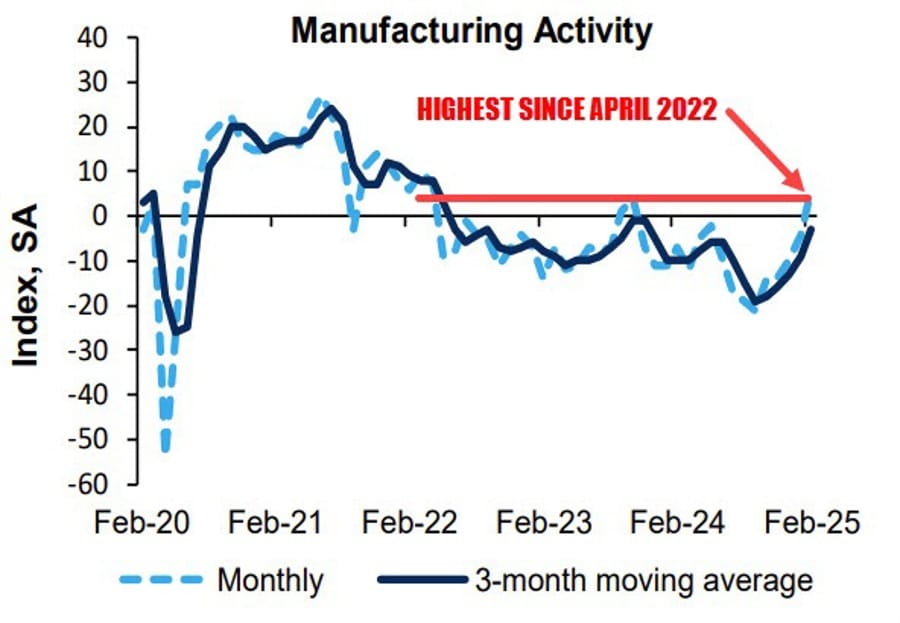

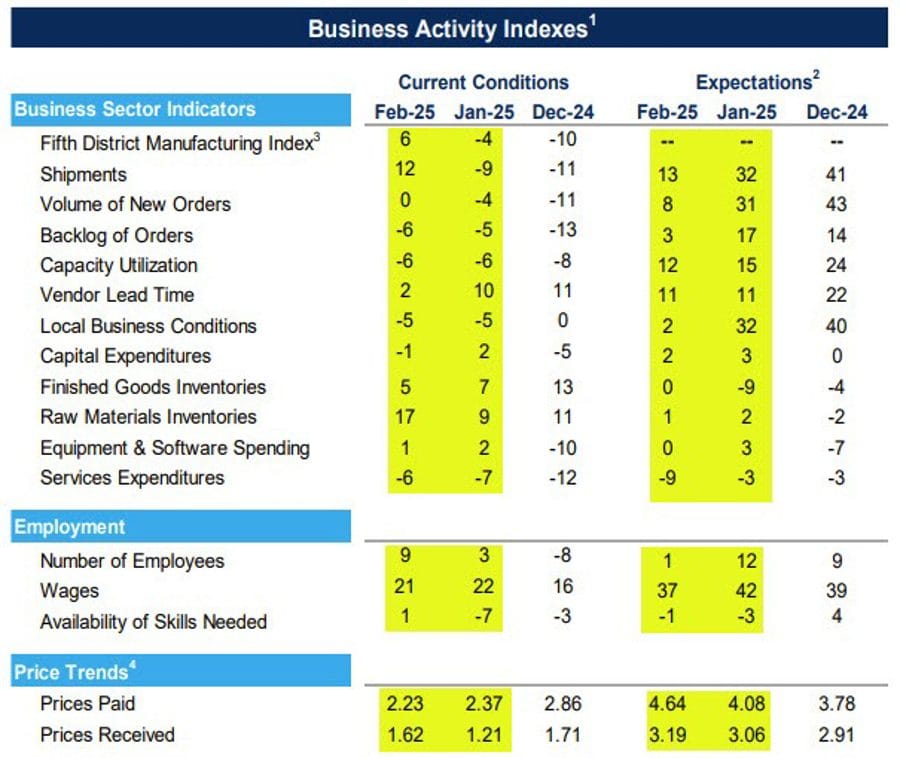

Richmond Fed Index Jumps to 6, Best Level Since April 2022

The Richmond Fed Composite Index rebounded to 6 in February, a sharp improvement from -4 last month.

- Service index: +11 (vs. +4 prior)

- Manufacturing shipments: +12 (vs. -9 prior)

- Prices paid: 2.23 (vs. 2.37 prior)

- Prices received: 1.62 (vs. 1.21 prior)

- Employment index: +9 (vs. +3 prior)

While business activity improved, future expectations weakened, signaling uncertainty ahead.

U.S. December Case-Shiller Home Prices Rise 4.5% Y/Y, Beating Forecasts

The 20-city Case-Shiller Home Price Index climbed 4.5% year-over-year (y/y) in December, exceeding expectations of 4.4%.

- Prior reading: +4.3% y/y

- Monthly increase: +0.5% (vs. +0.3% expected, +0.4% prior)

FHFA House Price Index:

- Y/Y: +4.7% (vs. +4.2% prior, revised to +4.5%)

- Monthly: +0.4% (vs. +0.3% prior)

Despite higher mortgage rates, tight supply is keeping home prices elevated.

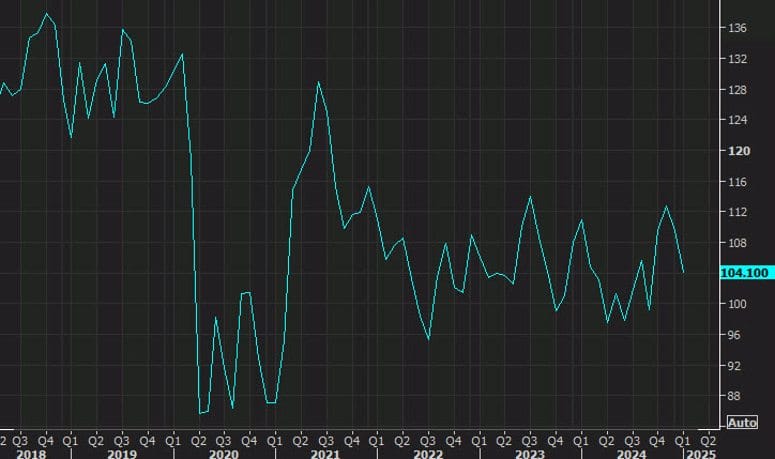

U.S. Consumer Confidence Falls to 98.3, Largest Monthly Drop Since 2021

The Conference Board Consumer Confidence Index fell to 98.3, well below expectations of 102.5.

- Prior reading: 104.1

- Present Situation Index: 136.5 (vs. 133.1 prior)

- Expectations Index: 72.9 (vs. 82.2 prior)

- 12-month inflation expectations: 6.0% (vs. 5.2% prior)

This is the third straight monthly decline, approaching levels last seen in 2022.

Fed’s Barkin: Uncertainty Warrants Caution on Rate Cuts

Richmond Fed President Thomas Barkin signaled that the Fed should remain patient, noting:

- Uncertainty in the inflation fight calls for modest policy restrictiveness.

- Upcoming PCE inflation data expected to show further declines.

- Small business confidence remains strong, which could support hiring trends.

Fed’s Barr: Clear Communication Key for Financial Stability

Fed Vice Chair Michael Barr emphasized that transparent communication is critical to prevent financial crises:

- Confidence loss among market participants can trigger instability.

- Stronger regulations and crisis management structures are essential.

His comments underscore the Fed’s focus on stability amid ongoing economic risks.

Ukraine Agrees to U.S. Minerals Deal, Lifting Euro Sentiment

Ukraine has agreed to a minerals deal with the U.S. after Washington dropped its demand for a $500 billion revenue claim, according to the Financial Times.

- Ukraine will allocate 50% of mineral revenues to a development fund.

- The deal does not include U.S. security guarantees.

- Needs parliamentary approval before finalization.

News of the agreement boosted the euro and improved market sentiment.

Bank of America CEO: No Fed Rate Cuts Expected in 2024 or 2025

Bank of America CEO Brian Moynihan pushed back against market expectations for Fed rate cuts, stating that no easing is expected this year or next.

- This contrasts with market pricing, which has shifted to 55bps of rate cuts in 2024, up from 41bps two weeks ago.

- The change in market sentiment follows weaker economic data and rising recession concerns.

If Moynihan’s view holds, interest rates could remain higher for longer, impacting growth-sensitive assets.

U.S. Treasury Secretary Bessent: U.S. Economy “Brittle” Beneath the Surface

Treasury Secretary Bessent warned that the U.S. economy is weaker than it appears, citing:

- Excessive government spending under Biden’s administration.

- Job growth concentrated in government-related sectors.

- Wealth distribution skewed, with financial strength mostly at the top.

She emphasized the need to shift growth from government spending to the private sector.

Deutsche Bank: Month-End Flows to Boost U.S. Dollar

Deutsche Bank’s month-end rebalancing model signals a bullish bias for the U.S. dollar (USD), driven by equity performance trends.

- The most significant factor is the underperformance of U.S. equities relative to European stocks, leading to EUR/USD selling pressure.

- Deutsche also notes seasonal selling patterns in NZD/USD and AUD/USD around February 27-28.

With limited news catalysts this week, Deutsche sees stronger USD flows dominating near month-end.

Trump Confirms Tariffs on Canada & Mexico Will Proceed

Trump reaffirmed that tariffs on Canada and Mexico will take effect as scheduled on March 4, 2025.

- Hinted at potential reciprocal tariffs.

- Justified the move by claiming the U.S. has been “taken advantage of” in trade.

UBS: S&P 500 to Reach 6,600 by Year-End, Despite Tariff Concerns

UBS remains bullish on U.S. equities, maintaining a year-end target of 6,600 for the S&P 500.

- Reasons for optimism:

- Solid U.S. economic fundamentals

- Strong corporate earnings growth

- Advancements in AI driving market momentum

Bank of America Sees Growing U.S. Stagflation Risks

Bank of America economists flagged rising stagflation risks due to Trump’s economic policies:

- Key stagflation drivers:

- Higher tariffs & trade restrictions

- Job losses from deportations & government cuts

- Potential fiscal stimulus delays

However, they expect a mild version of stagflation, with:

- GDP growth remaining around 2%.

- Inflation rising but staying below 3%.

Fed’s Goolsbee: Trump Tariffs Could Force Fed to Act on Inflation

Federal Reserve official Austan Goolsbee stated that if Trump’s tariff policies drive up prices, the Fed must intervene under its mandate.

- Concerns from auto parts suppliers about cost increases.

- Fed needs more clarity before resuming rate cuts.

- “Wait-and-see” approach before adjusting monetary policy.

JPMorgan: Tariff Risks Will Dominate Headlines Through 2025

JPMorgan warned that tariff-related uncertainty will be a persistent theme throughout 2025.

- Key concerns:

- Escalation of trade wars could impact business confidence.

- U.S. likely to be less affected than other economies.

This aligns with growing concerns about protectionist policies and economic slowdowns.

Mexico’s Sheinbaum Confident on U.S. Tariff Deal Before March 4 Deadline

Mexican presidential frontrunner Claudia Sheinbaum downplayed concerns over ongoing U.S. tariff negotiations, saying:

- Talks with the U.S. are progressing, with a deal expected before March 4.

- Security and trade remain the main focus areas of discussions.

- “You have to keep a cool head and not take Trump’s statements out of context.”

With Trump’s latest deadline approaching, markets are watching closely for any last-minute surprises.

Trump Calls for Keystone XL Pipeline Revival

Donald Trump reiterated his support for reviving the Keystone XL pipeline, urging the original developer to return to the U.S. and restart construction.

- Promises of quick approvals, hinting at an immediate start.

- If the original company doesn’t proceed, another firm may take over.

This move could reshuffle U.S. energy policy, with potential geopolitical implications.

Commodities News

Gold Prices Tumble as Traders Take Profits Amid Falling Yields

Gold prices dropped sharply on Tuesday as investors locked in profits, while U.S. Treasury yields fell further, adding to market uncertainty.

- Current price: $2,905, after hitting a daily low of $2,888.

- Key drivers:

- Trump’s tariff threats on Mexico and Canada, creating uncertainty.

- Weak U.S. consumer confidence data, raising stagflation fears.

- Rising layoffs of federal workers, impacting economic sentiment.

The CB Consumer Confidence Index fell to 98.3, an eight-month low, marking the sharpest decline in 3.5 years.

Market expectations:

- The Fed is now priced for 50bps of rate cuts in 2025.

- Goldman Sachs raised its year-end 2025 gold price forecast to $3,100.

Despite the dip, gold remains supported by market uncertainty.

Crude Oil Drops 2.5% to $68.93, New 2025 Lows

WTI crude oil fell $1.77 (-2.5%), settling at $68.93, driven by:

- Weak U.S. consumer confidence data, raising economic slowdown fears.

- Potential Ukraine-Russia peace talks, which could ease sanctions on Russian oil.

- Technical selling, with WTI staying below key moving averages:

- 100-day MA: $71.47

- 200-day MA: $73.87

Next downside target: $66.53 – $68.45.

WTI Crude Rises to Near $71 as U.S. Imposes Fresh Sanctions on Iran

WTI crude oil prices climbed to $70.90 per barrel, extending gains for a second straight session, driven by:

- New U.S. sanctions targeting brokers, tanker operators, and shipping firms involved in Iranian oil exports.

- Uncertainty over U.S. trade policy, as Trump confirmed tariffs on Canada and Mexico will proceed.

- Speculation of a Ukraine-Russia truce, which could ease Russian oil sanctions.

Despite these gains, potential supply increases from Iraq’s Kurdistan region could cap oil’s upside.

Goldman Sachs Forecasts Copper Price Surge to $10,500-$11,500/t

Goldman Sachs predicts that copper prices will enter a higher trading range, citing supply deficits and strong demand.

- Forecasted range: $10,500-$11,500 per ton.

- Projected supply deficits:

- 180,000 tons in 2025

- 250,000 tons in 2026

- Expected price peak: Above $10,500/t in Q1 2026, but capped at $11,500/t.

Europe News

European Markets Hold Steady Despite U.S. Equity Weakness

European stocks remained stable even as U.S. markets declined, reflecting relative resilience across the region.

Closing changes in European indices:

- Stoxx 600: +0.1%

- DAX (Germany): -0.1%

- CAC 40 (France): -0.5%

- FTSE 100 (UK): +0.1%

- IBEX 35 (Spain): +0.9%

- FTSE MIB (Italy): +0.6%

European equities are weathering market volatility, despite concerns over U.S. tariffs and slowing global growth.

Germany Confirms Q4 GDP Contraction of -0.2%

Germany’s economy contracted by -0.2% in Q4 2024, in line with preliminary estimates, according to Destatis.

- Prior quarter growth: +0.1%

- If 2025 results in another contraction, it would mark three consecutive years of GDP declines—the first time since German reunification in 1990.

This reinforces recession fears and raises questions about ECB policy direction.

ECB’s Stournaras: “Too Early to Pause Rate Cuts”

European Central Bank (ECB) policymaker Yannis Stournaras pushed for continued rate cuts, arguing:

- ECB should keep easing until rates reach 2%.

- Eurozone rates remain too restrictive for economic recovery.

- Not yet time to discuss pausing cuts.

His comments contrast with more cautious ECB officials, highlighting internal divisions over the pace of monetary easing.

Germany’s Merz Rules Out Debt Brake Reform in the Near Term

Germany’s Chancellor-in-waiting Friedrich Merz dismissed speculation about loosening the country’s strict debt brake, calling it a “complex task” that is not on the near-term agenda.

- Markets had hoped for more fiscal flexibility, given Germany’s weak growth outlook.

- His comments dampen expectations for higher government spending.

This stance could keep pressure on the ECB to support growth through monetary policy.

ECB’s Schnabel: Higher Natural Interest Rate May Reshape Policy

ECB’s Isabel Schnabel suggested the Eurozone’s natural rate of interest (R) has risen significantly*, raising key policy implications:

- Current financing conditions may not be holding back spending as much as previously thought.

- Subdued growth isn’t necessarily proof that ECB policy is overly restrictive.

- Shift from a “savings glut” to a “bond glut” could impact market liquidity.

Schnabel’s comments indicate that ECB rate cuts may be slower and shallower than markets expect.

ECB’s Nagel: “No Need to Rush Rate Cuts”

ECB policymaker Joachim Nagel struck a cautious tone on interest rate policy, stating:

- Inflation outlook is improving, but core and services inflation remain persistent.

- No need to speculate on future rate paths—ECB should take things step by step.

His remarks align with the hawkish camp, signaling a slower rate-cut cycle.

Macron: EU Set to Announce Short-Term Defense Funding

French President Emmanuel Macron signaled that the EU will soon announce a short-term defense financing package, citing geopolitical tensions.

- Key concerns:

- Trump’s tariffs could complicate EU defense spending plans.

- Calls for a trade war de-escalation, warning it could harm Europe’s economy.

Macron’s comments follow his meeting with Trump on Monday, where trade and security were key topics.

Asia-Pacific & World News

China’s February CPI Expected to Decline Moderately, PBOC Advisor Says

People’s Bank of China (PBOC) advisor Huang Yiping predicts moderate consumer price index (CPI) declines in February, citing:

- External pressures slowing domestic demand.

- Deep property market adjustments weakening consumer activity.

- Trump’s tariff hikes directly impacting U.S.-China trade, which could cause a sharp drop in Chinese exports to the U.S.

This outlook suggests continued deflationary risks for China’s economy.

Tesla Expands Autopilot Capabilities in China with Urban Road Navigation

Tesla has rolled out a major software update for its Chinese customers, introducing Autopilot functionality for urban roads.

- The upgraded Navigate on Autopilot system can now handle:

- Exit ramps and intersections

- Traffic light detection

- Lane changes based on speed and route conditions

- If no specific route is set, the vehicle will select the best path using real-time traffic data.

This marks a significant step forward for Tesla in China, where urban driving conditions are more complex.

Trump Administration Plans Stricter Chip Controls on China

The Trump administration is considering tighter restrictions on Nvidia (NVDA) chip exports to China, as well as broader semiconductor-related controls.

- Key measures under review:

- Stricter regulations on Nvidia’s H100 and H20 AI chips.

- Increased export controls on SMIC and SCMT, two major Chinese semiconductor firms.

- Pressure on Japan and the Netherlands to align with U.S. export restrictions.

- Potential bans on Tokyo Electron and ASML engineers servicing Chinese semiconductor plants.

This move signals a continued escalation in the U.S.-China tech war, with semiconductors at the center of geopolitical tensions.

Chinese Tech Giants Accelerate Orders for Nvidia’s H20 AI Chip

Chinese tech giants Tencent, Alibaba, and ByteDance are ramping up orders for Nvidia’s H20 AI chip, designed specifically for China due to U.S. export controls.

- Why the rush?

- H20 chips power DeepSeek’s AI models, which are gaining traction in cost-sensitive AI applications.

- Adoption is expanding into healthcare and education.

- Potential new U.S. restrictions have prompted firms to secure supplies quickly.

Despite Huawei’s growing AI chip presence, Nvidia’s H20 remains the dominant choice in China, with projected shipments of 1 million units in 2024.

PBOC sets USD/ CNY mid-point today at 7.1726, lowest since January 20

- PBOC CNY reference rate setting for the trading session ahead.

People’s Bank of China injects 318.5 billion yuan via 7-day reverse repos at 1.50%

- 489.2 bln yuan mature today

- net drain is 170.7bn yuan

People’s Bank of China 300bn yuan Medium-term Lending Facility (MLF) at unchanged rate 2%

- 500bn yuan mature thus a net drain

- one-year

- unchanged rate 2%

- 500bn yuan matures, thus net 200bn drain

Australian Consumer Confidence Hits Highest Level Since May 2022

The ANZ-Roy Morgan Consumer Confidence Index jumped to 89.8, up from 85.1, marking its highest level since May 2022.

- Despite still being below 100 (indicating net pessimism), sentiment is improving.

- Drivers of the increase:

- The Reserve Bank of Australia’s rate cut.

- Strong labor market data supporting household spending.

This trend could bolster economic activity in the coming months.

Japan’s January PPI Services Rises 3.1% Y/Y, Meeting Expectations

Japan’s Corporate Services Price Index (PPI Services) increased 3.1% year-over-year in January, in line with forecasts.

- Prior reading: +2.9%

- Sectors seeing price increases: transportation, finance, and leasing services

This reinforces the Bank of Japan’s cautious approach toward rate hikes.

Bank of Korea Cuts Interest Rate by 25bps to 2.75%

The Bank of Korea (BOK) lowered its benchmark interest rate from 3.00% to 2.75%, in line with expectations.

Economic projections:

- 2025 GDP growth: 1.5%

- 2026 GDP growth: 1.8%

- 2025 inflation: 1.9%

- 2026 inflation: 1.9%

With growth expected to remain subdued, further rate cuts may be on the table.

Bank of Korea: U.S. Tariffs & Fed Policy Create Economic Uncertainty

The BOK flagged several risks to South Korea’s economic outlook:

- High uncertainty around future rate cuts.

- Concerns over rising household debt despite looser monetary policy.

- Slow export growth could weigh on GDP.

- Potential volatility from U.S. tariffs and Federal Reserve policy changes.

Despite these challenges, inflation is expected to stabilize around 2%, supported by weak demand pressures.

Crypto Market Pulse

Bitcoin Falls Below Key $90K Support, Hits 2025 Lows

Bitcoin (BTC) broke below a major support zone ($90,742 – $92,092), plunging to new 2025 lows under $90,000.

- Next key support: $86,520 (38.2% retracement of the August 2024 rally).

- Prior breakdown (January 13) led to a sharp rebound and an all-time high of $109,356 a week later.

If Bitcoin fails to reclaim its former support zone, sellers remain in control.

Bitcoin Traders “Buying the Dip” as Price Slips Below $88K

Bitcoin fell below $88,000 but saw increased buying activity on Kraken, one of the top 10 global crypto exchanges.

- Kraken’s long-short ratio jumped to a record 0.8, indicating more long positions relative to shorts.

- BTC open interest surged by $1 billion on Binance, suggesting traders are positioning for volatility.

While this shows bullish sentiment, the market remains vulnerable to further downside if liquidations rise.

Bitcoin Holds Near $89K as Crypto Selloff Continues

Bitcoin (BTC) has dropped 7% over the last two days, now testing support near $89,000—its lowest level since January.

- Key technical level: BTC is hovering around $89,028, and a firm breakdown could accelerate selling pressure.

- Ethereum (ETH) under pressure: Down 15% this week, now near $2,400, threatening a break of long-term support levels.

- The recent selloff is partly linked to the Bybit hack, with ongoing speculation about the incident’s scale and impact.

If Bitcoin fails to hold support, it could lead to a wider crypto market downturn.

Ethereum Falls Below $2,600 Amid Trump Tariff Concerns

Ethereum (ETH) dipped under $2,600, caught in a broader sell-off in risk assets triggered by concerns over Trump’s tariff policies.

- Other risk assets, including stocks and commodities, also faced pressure.

- Market sentiment remains fragile, with investors awaiting clarity on trade policies.

The Day’s Takeaway

Day’s Takeaway: Key Market Trends & Developments

U.S. Stocks Under Pressure, Nasdaq Breaks Key Support

- Nasdaq closes below its 100-day moving average for the first time since Sept. 2024.

- Tech stocks continue to slide, with Nvidia down ahead of earnings.

- Russell 2000 remains weak, trading below its 200-day moving average.

U.S. Dollar Strengthens as Markets Brace for Month-End Flows

- Deutsche Bank sees a bullish bias for the USD, driven by equity rebalancing.

- Seasonal selling in NZD/USD and AUD/USD expected on Feb. 27-28.

Gold Price Tumbles on Profit-Taking, But Long-Term Outlook Remains Strong

- Gold fell to $2,905 amid profit-taking and falling U.S. Treasury yields.

- Trump’s tariff threats on Mexico & Canada fuel uncertainty.

- Goldman Sachs raised its 2025 gold target to $3,100.

Bitcoin Struggles as Sellers Dominate, But Dip Buyers Emerge

- BTC fell below $90,000, testing a key support area at $86,520.

- Kraken reports an increase in long positions, suggesting dip buying.

- ETH remains under pressure, down 15% this week.

Fed Officials Signal Caution on Rate Cuts

- Richmond Fed’s Barkin: “Policy should remain modestly restrictive.”

- Fed’s Barr: “Clear communication is key for financial stability.”

- Markets now pricing in 50bps of rate cuts in 2025.

U.S. Consumer Confidence Drops to an 8-Month Low

- Conference Board index falls from 104.1 to 98.3, the largest drop since August 2021.

- Consumers expect inflation to rise from 5.2% to 6% over the next 12 months.

Crude Oil Falls 2.5% to $68.93 as Market Eyes Russia-Ukraine Talks

- WTI hits new 2025 lows amid recession fears and technical selling.

- Talks of a Ukraine-Russia truce weigh on oil prices.

- Next key downside target: $66.53 – $68.45.

Germany’s Merz Rules Out Debt Brake Reform, Keeping Fiscal Policy Tight

- Markets had hoped for more fiscal flexibility, but Merz calls it a “complex task.”

- This could keep pressure on the ECB to support growth via monetary policy.

Ukraine Finalizes U.S. Minerals Deal, Boosting Euro Sentiment

- Ukraine agrees to allocate 50% of mineral revenues to a development fund.

- No mention of U.S. security guarantees in the agreement.

ECB’s Stournaras Pushes for More Rate Cuts

- Says ECB should keep cutting rates until they reach 2%.

- Contrasts with more cautious ECB policymakers.

Final Thoughts:

Today’s market action was dominated by profit-taking in gold, U.S. stock weakness, and rate cut uncertainty:

- Gold fell despite long-term bullish sentiment remaining intact.

- The Nasdaq breaking key support raises concerns for tech stocks.

- Bitcoin remains volatile, with traders split between selling pressure and dip buying.

- Rate cut expectations are shifting, but the Fed remains cautious.

As we head into the next trading session, all eyes will be on the Fed’s preferred inflation gauge, Core PCE, set for release later this week.