North America News

Intel Eyes Apple Investment in Comeback Push; Stocks End Lower

Intel is exploring the possibility of bringing Apple on board as an investor, part of its broader effort to stage a comeback in the semiconductor space. Sources say the two companies have also discussed working more closely together, though the talks are still at an early stage and may not yield a deal.

This marks another chapter in Intel’s remarkable rebound since the political turmoil earlier this summer.

Trump Calls for CEO’s Resignation

On August 7, 2025, former President Donald Trump demanded Intel CEO Lip-Bu Tan resign over “conflicted interests,” citing alleged ties to Chinese firms with defense links.

CEO Pushes Back

Tan denied the accusations, calling them “misinformation” and defending his career and ethics.

Tone Shifts After Meeting

Just days later, around August 11, Trump met with Tan, later calling the discussion “very interesting” and describing Tan’s career as an “amazing story.”

Government & Industry Moves

- The U.S. government took steps to acquire a ~10% stake in Intel, signaling support for the firm.

- Nvidia announced a $5 billion investment, making it one of Intel’s biggest shareholders. The companies plan to co-design chips leveraging Intel’s CPU expertise with Nvidia’s AI/GPU dominance.

Now, reports of a potential Apple tie-up mark the latest twist in Intel’s turnaround.

Intel shares closed 5.61% higher at $31, bucking the broader market downtrend.

Market Wrap

Major U.S. indices fell for a second straight day:

- Dow Jones: -171.50 pts (-0.37%)

- S&P 500: -18.95 pts (-0.28%) at 6,637.97

- Nasdaq: -75.62 pts (-0.33%) at 22,497.86 (after being down as much as -176.48 pts intraday)

U.S. Treasury Auctions $70B in 7-Year Notes

The U.S. Treasury sold $70 billion in 7-year notes at a high yield of 3.710%, almost identical to the when-issued (WI) level of 3.709% at the time of the auction.

- High-yield: 3.71%

- WI level: 3.709%

- Tail: 0.1 bps (vs. 6-month avg. 0.2 bps)

- Bid-to-cover: 2.34x (vs. 6-month avg. 2.36x)

- Direct bidders: 28.6% (vs. 22.1% avg.)

- Indirect bidders: 59.4% (vs. 66.19% avg.)

- Dealers: 11.9% (vs. 10.9% avg.)

The auction was steady overall, showing balanced demand but slightly softer indirect participation.

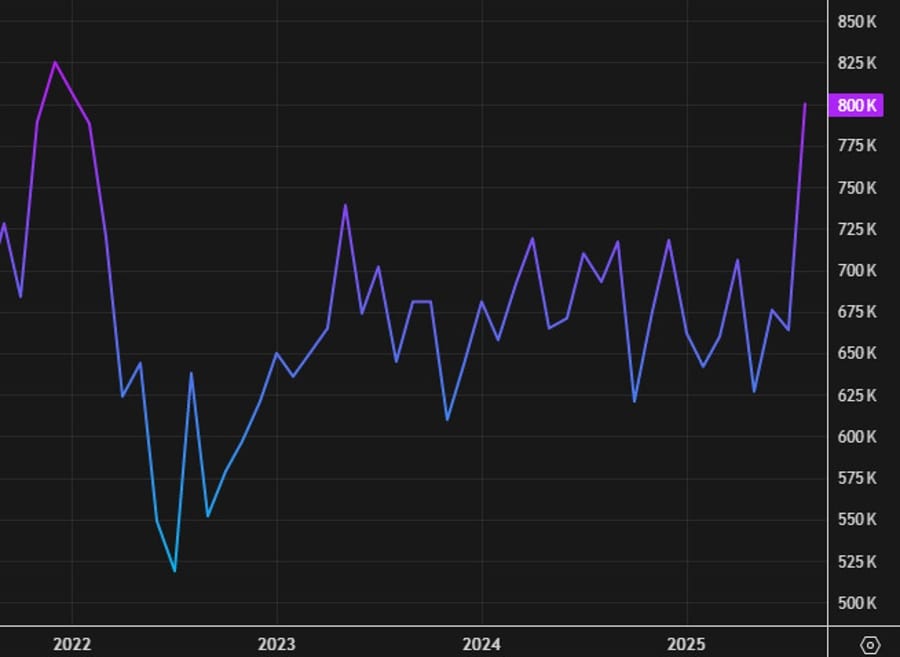

U.S. New Home Sales Jump to 800K in August

New home sales surged to 800K in August, far exceeding expectations of 650K and marking the strongest reading since 2022.

- Prior: 652K (revised to 664K)

- Change: +20.5% vs. expected -0.3% decline

- Median sale price: $413.5K (+1.9% YoY; prior $403.8K, -5.9% YoY)

- Inventories: 7.4 months (vs. 9.0 prior)

The sharp rise comes even before mortgage rates dipped below 6.5%. Some analysts question whether the surge reflects genuine demand strength or a statistical anomaly, as builder sentiment surveys show weaker momentum.

U.S. MBA Mortgage Applications – Week Ending Sept 19

Data from the Mortgage Bankers Association showed a modest gain in mortgage applications for the week ending September 19, 2025:

- Market index: 388.3 (prior 386.1)

- Purchase index: 174.5 (prior 174.0)

- Refinance index: 1609.8 (prior 1596.7)

- 30-year mortgage rate: 6.34% (prior 6.39%)

Overall applications rose +0.6%, down sharply from the +29.7% surge the prior week. This release is not typically a market mover.

US Bessent: Fed has been too high for too long

- Comments from the US Treasury Secretary, Scott Bessent to Fox News

- We’re going into an easing cycle

- Not sure why Powell has backed up a bit

- Surprised Fed Chair Powell hasn’t signalled destination for interest rates

- Revisions on jobs show something was wrong

- Rates are too restrictive and need to come down

- Will hold lots of Fed interviews next week

- Couple of Fed candidates surprised me

- Less concerned about recession

- We need rate relief; get back at least to neutral rate

- Powell should have signalled 100-150 bps cut

- Looking for someone with an open mind for Fed Chair

- I believe we will see a substantial drop in inflation

- We’ll see what happens with this AI boom

USTR Greer: Will look to finalise more trade deals with ASEAN countries in coming months

- Remark by US trade representative, Jamieson Greer

- Hopes US-ASEAN trade is balanced and reciprocal

Canada Manufacturing Sales Likely Fell in August

Statistics Canada’s advance estimate shows manufacturing sales in August dropped by 1.5% month-on-month. Final data will confirm the decline.

Canada–U.S. Trade Talks Continue, Carney Confirms

Canadian Prime Minister Mark Carney said negotiations with the U.S. over trade issues are ongoing and will eventually feed into the broader USMCA review process. Carney emphasized that Ottawa will only finalize an agreement once it is confident it serves Canada’s interests.

Commodities News

Gold Rally Extends: Momentum, Catalysts, and Risks

The bullish trend in gold shows little sign of slowing, with traders still waiting on key U.S. data for the next potential turning point. The absence of strong bearish drivers has allowed the metal to continue climbing to new records.

Fundamental Picture

Gold set another all-time high yesterday, with market action largely driven by momentum in the absence of new catalysts. Since the FOMC meeting, little has changed, leaving traders focused on this week’s jobless claims and next week’s nonfarm payrolls report.

- Stronger data could pressure gold by reviving hawkish rate expectations.

- Weaker numbers would likely add fuel to the upside.

Looking further ahead, falling real yields tied to the Fed’s dovish stance should continue to underpin the uptrend. Still, in the short term, gold remains vulnerable to pullbacks whenever strong U.S. data sparks a repricing in rate outlooks.

Technical Outlook – Daily Chart

On the daily timeframe, gold hit another record before easing slightly. Buyers have the more favorable setup when entering near the major trendline, with defined risk management levels. Sellers, however, will look for confirmation of a breakdown to target the 3,120 zone, though such a deep move may require robust U.S. data to trigger.

Technical Outlook – 4-Hour Chart

A smaller upward trendline currently defines momentum on the 4-hour view. If price retraces to this level, buyers may step in with stops below, aiming for another run at fresh highs. For sellers, the opportunity lies in a clean break below this support, which could open the path toward the broader trendline.

Technical Outlook – 1-Hour Chart

On the 1-hour chart, gold has formed a consolidation near the highs, resembling a descending triangle. A decisive break in either direction could set up the next sustained move.

WTI Hits Three-Week High on U.S. Inventory Draw and Geopolitical Tensions

West Texas Intermediate (WTI) crude climbed for the second consecutive session Wednesday, rising more than 1.5% to about $64.55 per barrel, its strongest level since September 3.

The rebound followed a mix of supply data and fresh geopolitical risks that boosted risk premiums in oil markets.

EIA Report: Crude Draw Surprises

U.S. Energy Information Administration data showed:

- Crude inventories: -0.607M barrels (vs. +0.5M expected)

- Prior week: -9.3M barrels

- Commercial stocks: Down 0.6M barrels

- Strategic Petroleum Reserve: Slightly higher

- Total crude holdings: 820.7M barrels

- Refinery runs: Flat at 16.48M bpd

The modest draw, though far smaller than the previous week’s sharp drop, still pointed to steady refining activity and firm demand.

Political Heat Adds to Rally

Beyond supply figures, geopolitical tensions gave oil prices another lift:

- Iran vowed to continue crude sales to China even if U.N. sanctions are reinstated. Analysts estimate China bought 80% of Iran’s exports last year.

- Trump at the UNGA: The U.S. president warned European nations to halt Russian oil and gas imports or face new American tariffs. He called ongoing purchases from Moscow “inexcusable,” signaling Washington’s intent to further squeeze Russia’s energy revenues.

Together, the data and politics pushed WTI back toward recent highs after touching near two-week lows earlier this week.

EIA Weekly Crude Report

U.S. Energy Information Administration (EIA) data for the week showed mixed results:

- Crude oil inventories: -607K (vs. +235K expected; prior -9,285K)

- Gasoline: -1,081K (vs. +150K expected)

- Distillates: -1,685K (vs. -494K expected)

- Refinery utilization: -0.3%

The report indicated a surprise drawdown in crude, gasoline, and distillates, contrasting with expectations of a build.

Copper Surges After Fatal Grasberg Mine Incident

Copper prices jumped 2.6% after Freeport-McMoRan reported a mudrush incident at its Grasberg mine in Indonesia, the world’s second-largest copper operation.

- Casualties: 2 miners confirmed dead, 5 still missing.

- Volume of mud: 800,000 tonnes.

- Production halt: Entire Grasberg district suspended.

Impact on output:

- Q3 2025: Copper sales down 4%, gold sales down 6%.

- Q4 2025: Copper and gold sales expected to be “insignificant” vs. 445M lbs Cu and 345K oz Au previously forecast.

- 2026: Production could fall 35%, equating to ~270,000 tonnes of copper (1.2% of global supply).

- 2027: Earliest timeline for a full return to pre-incident production.

This disruption could swing the global copper market into deficit, as the International Copper Study Group had projected a surplus for 2026.

Dallas Fed Oil Survey: Growing Pessimism

The Dallas Fed’s quarterly oil survey highlights rising concerns among U.S. energy executives as oil prices hover near $65 per barrel.

Survey results:

- Business activity index: -6.5 (vs. -8.1 prior)

- Company outlook index: -17.6 (vs. -6.4 prior)

- Production index: -8.6 (vs. -8.9 prior)

- Capex index: -11.9 (vs. -3.0 prior)

- Input costs: +34.8 (vs. +40.0 prior)

- Finding/development costs: +22.0 (vs. +11.4 prior)

- Oilfield services utilization: -13.0 (vs. -4.6 prior)

Executives emphasized the fragility of shale, where production declines quickly without fresh drilling. A special survey question asked how much regulatory changes since January 2025 have reduced break-even costs per barrel for new wells.

Silver Holds Near 14-Year Highs Above $44

Silver prices remain firm near $44.10 per ounce in Wednesday’s European session, not far from Tuesday’s 14-year peak of $44.47.

Drivers Supporting Silver

- Fed policy expectations: CME FedWatch shows a 93% chance of a 25bp cut in October, up from 90% yesterday.

- Geopolitical tensions: NATO pledged a “robust” response to Russian airspace violations, while U.S. President Trump warned of a “very strong round” of tariffs if Russia does not withdraw from Ukraine.

- Demand and supply:

- Tight supply and rising industrial demand from solar, EVs, and electronics continue to underpin prices.

- India’s silver imports are projected to rise in coming months, absorbing last year’s surplus.

The safe-haven appeal, coupled with strong fundamentals and expectations of monetary easing, is keeping silver close to multi-year highs.

Deutsche Bank: Stay Long Gold Into 2026

Deutsche Bank reaffirmed its bullish gold view, projecting prices to reach $4,000 next year, while taking a bearish stance on oil.

Gold Outlook

The bank expects gold to gain another 24% in 2026, supported by:

- The Fed resuming its easing cycle.

- The ECB pausing rate cuts.

- The BOJ leaning hawkish, which together undermines the dollar’s yield appeal.

- Strong, ongoing central bank demand, particularly from China, including unreported flows.

These dynamics are expected to erode dollar demand and continue boosting gold.

Oil Outlook

By contrast, Deutsche advises staying short on oil. The bank sees a growing supply glut coupled with slowing demand growth, clouding the medium-term picture for crude.

API Report Shows Larger-than-Expected Crude Draw

The American Petroleum Institute’s latest private survey revealed oil stock data that diverged from forecasts.

- Crude oil: –3.821 million barrels

- Gasoline: –1.046 million barrels

- Distillates: +518,000 barrels

- Cushing hub: +72,000 barrels

Markets had expected a crude build, making the reported draw a notable headline surprise.

Europe News

European Indices End Mixed; DAX Higher, CAC Lower

European equity markets closed with a mixed performance:

- Germany DAX: +0.30%

- France CAC 40: -0.57%

- UK FTSE 100: +0.29%

- Spain Ibex: +0.24%

- Italy FTSE MIB: -0.13%

France and Italy lagged, while Germany and the UK posted modest gains.

Germany Ifo Index Falls Short of Expectations

The September Ifo business climate index disappointed at 87.7, well below the expected 89.3.

- Prior: 89.0 (revised to 88.9)

- Current conditions: 85.7 (forecast 86.5; prior 86.4)

- Expectations: 89.7 (forecast 92.0; prior 91.6 revised to 91.4)

The weaker numbers dampen optimism about the German economy. While PMI data has suggested services are helping to counter manufacturing weakness, the decline in forward-looking expectations signals continued headwinds.

BOE’s Greene: Time to Rethink Policy Response to Supply Shocks

Bank of England policymaker Megan Greene argued at the University of Glasgow that central banks should reconsider their long-held stance of “looking through” supply shocks.

Key points from Greene’s remarks:

- Climate change and geopolitical risks make supply shocks more frequent and severe.

- Policy reversals are not advisable, but rate cuts should be approached cautiously.

- Inflation persistence remains uncertain, requiring vigilance.

- Inflation may respond faster to policy tightening than output, particularly when inflation has been above target for an extended period.

- Risks to inflation are tilted to the upside, while risks from weaker demand have eased.

- Greene is less concerned about a sudden labor market decline.

She concluded that monetary policy should offset supply shocks rather than ignore them.

ECB’s Cipollone: The European economy has been surprisingly resilient

- Comments from the ECB policymaker, Piero Cipollone to Bloomberg

- We are doing pretty well

- We expect growth to be in a good place in the coming years on good fundamentals and resilient labour market

- Uncertainty is still there

- Risks to inflation very balanced

- We are in a good place

- We will be close to target for the next two years

- Inflation expectations are well anchored

Asia-Pacific & World News

G7 Explores Price Floors for Rare Earths to Counter China

G7 nations are evaluating strategies to curb China’s dominance in rare earth elements (REEs), including introducing price floors and imposing taxes on Chinese exports, according to sources.

China currently controls 60–70% of global mining and over 80% of refining capacity for REEs, which are critical for EV batteries, wind turbines, defense systems, and advanced electronics. Beijing has previously leveraged this dominance, notably restricting exports to Japan in 2010.

With demand surging for green energy and defense technologies, the G7 is considering measures that could raise costs but reduce dependency on China’s supply chains, limiting Beijing’s geopolitical leverage.

Li Qiang Calls for Reset in Canada–China Relations

Chinese Premier Li Qiang urged Canada to adopt a more balanced approach to bilateral ties, according to Xinhua.

Key points:

- Respect each other’s core interests to stabilize cooperation.

- Work together to foster healthier, more sustainable relations.

- Address economic and trade issues through dialogue.

- Ensure a fair business environment for Chinese companies operating in Canada.

Li also expressed China’s readiness to coordinate with Canada to promote globalization and free trade.

China Drops Developing-Nation Status at WTO

China will no longer seek “special and differential” treatment reserved for developing nations in WTO talks, Premier Li Qiang announced in New York.

This reversal removes a longstanding friction point with the U.S. and could open the door to global trade reform progress.

- Old stance: Claimed developing-nation status for favorable terms.

- Criticism: U.S. argued it was unfair given China’s economic scale.

- New stance: China will refrain from seeking such privileges in current and future negotiations, signaling readiness to accept stricter obligations.

OECD Lifts 2025 Global Growth Outlook to 3.2%

The OECD upgraded its 2025 global growth projection to 3.2%, up from 2.9% in June, citing resilience in emerging markets, AI-driven investment in the U.S., and China’s fiscal stimulus.

- U.S. economy: forecast at 1.8% growth this year, higher than June’s 1.6% but down from 2.8% in 2024.

- 2026 outlook: global growth at 2.9%, U.S. growth at 1.5%.

The OECD warned that the full effects of sweeping U.S. tariffs—now averaging nearly 20%, the steepest since 1933—are yet to play out. While trade front-loading boosted early 2025, tariffs are already straining consumer prices, jobs, and investment.

Key inflation forecasts:

- G20 headline inflation at 3.4% (slightly below June’s 3.6%).

- U.S. inflation lowered to 2.7% from 3.2%.

Risks remain elevated, but AI adoption and easing trade barriers could provide upside.

Xi–Trump Meeting Delayed Until 2026

Despite U.S. President Donald Trump suggesting an imminent meeting with Chinese President Xi Jinping in South Korea, U.S. Ambassador to China David Perdue confirmed any formal meeting is more likely in 2026.

Perdue described the leaders’ relationship as “encouraging” but said scheduling issues make a 2025 summit unlikely. China’s official summary of the recent Trump–Xi call did not mention Trump’s claims about upcoming state visits.

A U.S. congressional delegation led by Representative Adam Smith also met with senior Chinese officials in Beijing, including Premier Li Qiang and Vice Premier He Lifeng. Talks covered military communications and TikTok ownership disputes. Smith noted progress in dialogue but said the two sides still “need to get in the same book.”

PBOC sets USD/ CNY mid-point today at 7.1077 (vs. estimate at 7.1080)

- PBOC CNY reference rate setting for the trading session ahead.

- PBOC injected 401.5bn yuan via 7-day reverse repos at 1.40%

Australian CPI Spike Limits RBA Flexibility

Consumer prices in Australia rose at their fastest pace in a year in August, complicating expectations of near-term rate cuts by the Reserve Bank of Australia.

- CPI: +3% y/y (prior 2.8%, forecast 2.9%)

- Monthly change: flat

- Electricity: –6.3% due to government rebates

- Holiday travel/accommodation: fell

- Trimmed mean inflation: 2.6% (prior 2.7%)

- Ex-volatile measure: 3.4% (up from 3.2%)

With headline inflation hot, the RBA is widely expected to hold rates steady at its September 29–30 meeting.

Australia’s August CPI Hits 3%

Australia’s monthly CPI for August 2025 came in at 3%, higher than July’s 2.8% and slightly above expectations of 2.9%. That puts inflation at the upper end of the Reserve Bank of Australia’s 2–3% target range.

The trimmed mean CPI—a key measure of core inflation—registered 2.6% year-on-year, easing slightly from 2.7%. Full quarterly data will be released in late October.

Anna Breman Appointed Governor of RBNZ

New Zealand Finance Minister Nicola Willis confirmed the appointment of Anna Breman as the new Governor of the Reserve Bank of New Zealand.

Breman was selected after a global search involving 300 candidates. Her five-year term begins on December 1, 2025. She replaces Christian Hawkesby, who has been acting governor since April and will step down upon her arrival.

Ex-BoJ member Adachi: October rate hike cannot be ruled out

- Comments from the former BoJ board member Adachi

- BoJ likely to revise up economic, price forecasts in October quarterly outlook report

- Rate hike cannot be ruled out if solid Q2 GDP growth leads to upgrade in board’s growth, price forecasts

- If BoJ focuses on risks, it will likely hold off raising interest rates until March 2026

- A BoJ rate hike to 0.75% will likely do little harm to Japan’s economic growth

Japan PM contender Takaichi: Government responsible to set direction of fiscal, monetary policy

- Remarks by Sanae Takaichi, the frontrunner in the leadership contest to become Japan’s next prime minister

- BOJ decides on means for monetary policy

- Higher interest rates could affect corporate investment, mortgage rates

- Current inflation mostly driven by import costs or cost-push inflation

- Wants to shift Japan’s inflation into moderate price rises driven by wages

Verdad Plans Japan Small-Cap Fund Amid Investor Demand

Hedge fund Verdad Advisers LP is preparing to launch a new fund focused on Japanese small-cap equities, building on its experience with micro-cap strategies.

Founder Daniel Rasmussen said the new vehicle could debut this year and will target companies with market caps above $400 million. The strategy will center on balance sheet inefficiencies such as over-leveraged or cash-rich firms.

Challenges include limited liquidity and sparse English-language disclosures. Still, Japan’s push for corporate reform and shareholder-friendly policies creates fertile ground. The MSCI Japan Small Value index has already gained more than 30% this year, underlining the sector’s momentum.

Japan Manufacturing PMI Falls, Services Expand

Japan’s September flash PMI showed manufacturing activity contracting at the sharpest pace in six months.

- Manufacturing PMI: 47.4 (prior 49.7)

- New orders hit a five-month low.

- Export orders fell but less sharply than August’s 17-month low.

- Input cost inflation dropped to early-2021 levels.

- Output price inflation accelerated.

- Employment shrank for the first time since November 2024.

- Services PMI: 53.0 (prior 52.0)

- Expansion continued for a sixth straight month.

- Employment rose modestly.

- Composite PMI: 53.0 (prior 52.0)

- Business activity growth slowed to its weakest since May.

Crypto Market Pulse

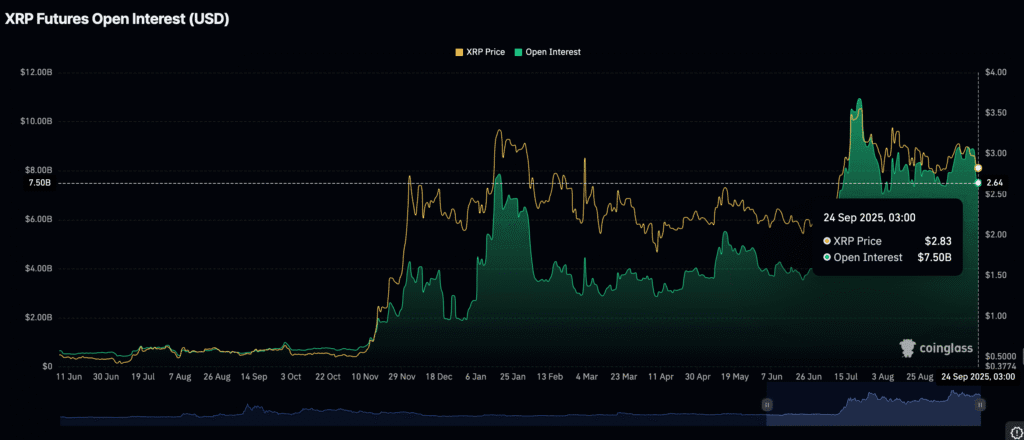

XRP Holds Bullish Setup, Eyes $3.00 Breakout

XRP traded above $2.88 on Wednesday, supported by a rebound from its 100-day EMA and holding above $2.83 support, raising prospects for a move beyond the $3.00 level.

Ripple-Securitize Partnership

Ripple announced a collaboration with tokenization firm Securitize to enable holders of BlackRock’s BUIDL and VanEck’s VBILL tokenized funds to swap shares into the RLUSD stablecoin.

- BUIDL: BlackRock’s USD Institutional Digital Liquidity Fund.

- VBILL: VanEck’s tokenized treasury fund.

- Both are issued on public blockchains.

The partnership:

- Expands RLUSD utility as an off-ramp for tokenized assets.

- Integrates Securitize’s tokenization infrastructure into the XRP Ledger (XRPL).

- Boosts liquidity and interoperability for on-chain finance.

Market Sentiment

Despite the news, retail interest has waned, with XRP futures open interest falling to $7.50B from $8.79B on Friday. The drop suggests weaker conviction in sustaining an uptrend, potentially limiting momentum toward the $3.00 breakout.

CFTC to Pilot Tokenized Collateral Program

The U.S. Commodity Futures Trading Commission (CFTC) announced a three-year pilot program to test the use of tokenized assets, including stablecoins, as collateral in regulated derivatives markets.

The initiative will involve clearinghouses and futures commission merchants under CFTC oversight. Participants must meet strict compliance and risk standards.

Chairman Rostin Behnam said the project aims to modernize collateral management while maintaining market stability and customer protections. The pilot does not endorse any specific stablecoin but represents the first official U.S. regulatory effort to test their role in derivatives collateral.

Deutsche Bank: Bitcoin Won’t Replace the Dollar

Bitcoin surged past $123,500 in mid-August, marking a new record alongside historically low volatility. According to Deutsche Bank, the 30-day volatility dropped to 23%, the calmest trading stretch in the token’s history.

The bank suggested this may signal a gradual decoupling of bitcoin’s price from volatility, reflecting deeper portfolio integration. Still, analysts cautioned that neither bitcoin nor gold is on a path to displace the U.S. dollar as the world’s reserve currency.

Deutsche Bank expects crypto adoption to grow as regulations mature and legitimacy builds. The note highlighted that human nature drives investors to seek alternatives to traditional assets, potentially accelerating U.S.-led mainstream adoption.

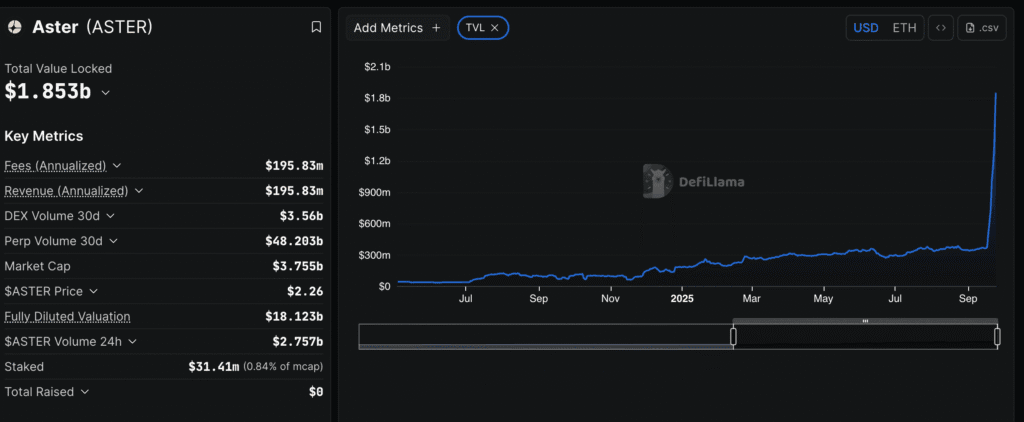

ASTER Surges as Whale Activity Boosts Rally

ASTER, the new perpetual DEX token backed by YZi Labs, jumped over 18% Wednesday to trade above $2.34. The rally follows record demand from whale investors and a surge in DeFi Total Value Locked (TVL).

SpotOnChain reported multiple large-scale whale moves:

- Wallet “0xFB3” moved $73.95M USDT into Gate.io and withdrew 24M ASTER ($46.6M).

- Wallet “0x5bd” withdrew 6.72M ASTER (~$13M) from Bybit.

- Wallet “0x8bc” swapped $1.19M USDT for 595,580 ASTER at $2.00.

- Wallet “0x5e3” swapped 1,090 BNB (~$1.11M) for 549,194 ASTER.

DeFiLlama data shows ASTER’s TVL soared to $1.85B, up from $347M on September 1, underscoring investor confidence. The token now rivals established BNB Chain DEX players such as PancakeSwap and Venus.

Morgan Stanley to Roll Out Retail Crypto Trading in 2026

Morgan Stanley is preparing to bring cryptocurrency trading to its E-Trade platform in the first half of 2026, according to an internal memo. The initiative will initially support bitcoin, ether, and solana trades, moving beyond the bank’s earlier strategy of offering crypto exposure through funds for wealthy clients.

The Wall Street giant has partnered with Zerohash to handle liquidity, custody, and settlement, while also investing in the startup. Wealth management chief Jed Finn described the move as “just the beginning,” emphasizing future plans to integrate tokenized cash, stocks, bonds, and real estate with traditional wealth products.

A new wallet for client-held digital assets is in development as part of this push. Analysts see the step as one of the most aggressive crypto expansions by a U.S. bank, especially since Washington shifted its policy stance under President Trump. Tokenization is expected to disrupt the wealth management sector significantly.

Tether Eyes $500B Valuation in $20B Equity Raise

Tether Holdings, the company behind USDT, is pursuing an ambitious fundraising plan that could push its valuation to around $500 billion. Early discussions are underway to raise between $15 billion and $20 billion through the sale of about 3% of new equity.

Currently headquartered in El Salvador, Tether dominates the stablecoin market with a capitalization of $172 billion—more than double Circle’s USDC, which sits at $74 billion. If the funding goes through, it would mark one of the largest private capital raises in crypto’s history.

The negotiations remain in preliminary stages, and the final structure may shift. A valuation this high would further solidify Tether’s leadership, though it could also invite heavier scrutiny of its reserves.

The Day’s Takeaway

North America

U.S. Stocks Close Lower for Second Day

Major indices slipped again on Wednesday, though the Nasdaq pared heavier intraday losses:

- Dow Jones: –171.50 pts (–0.37%)

- S&P 500: –18.95 pts (–0.28%) at 6,637.97

- Nasdaq: –75.62 pts (–0.33%) at 22,497.86 (after falling as much as –176.48 pts)

Intel’s Comeback Push Gains Steam

Intel shares jumped 5.61% to $31 after reports the company may seek Apple as an investor. This follows:

- A U.S. government plan to take a ~10% stake.

- Nvidia’s $5B investment to co-develop AI–CPU chips.

- CEO Lip-Bu Tan surviving political pressure after Trump demanded his resignation in August.

U.S. Treasury Auctions $70B in 7-Year Notes

The auction cleared at a 3.71% high yield, in line with expectations. Demand was steady, with a bid-to-cover ratio of 2.34x. Indirect bidder participation was softer than average at 59.4%.

U.S. Housing Market Surges

New home sales spiked 20.5% to 800K in August, the strongest since 2022 and well above expectations of 650K. Median price rose 1.9% YoY to $413.5K, while inventories tightened to 7.4 months. Analysts questioned if this reflects true demand or statistical noise, given builder sentiment remains weak.

U.S. MBA Mortgage Applications

Applications rose 0.6% in the week ending Sept 19, sharply slower than +29.7% prior.

- Market index: 388.3

- Purchase index: 174.5

- Refinance index: 1,609.8

- 30-year rate: 6.34%

Canada Manufacturing Sales Likely Fell

Statistics Canada estimated August sales fell 1.5% m/m, pointing to weaker factory activity.

Canada–U.S. Trade Talks Ongoing

Prime Minister Mark Carney said negotiations continue with the U.S. as part of the USMCA review, but Ottawa will only finalize terms once convinced they serve national interests.

Commodities

Gold Rally Extends

Gold hit another record before easing slightly, supported by momentum and a dovish Fed backdrop. Traders await jobless claims and next week’s NFPs. Technicals show consolidation, with buyers watching trendline support and sellers eyeing 3,120 if strong data hits.

Deutsche Bank Reaffirms Gold Bull Case

The bank sees gold at $4,000 in 2026, citing Chinese central bank demand, dollar weakness, and Fed easing. It recommends staying long gold while turning bearish on oil.

Silver Holds Near 14-Year Highs

Silver trades around $44.10/oz, just off Tuesday’s 14-year peak. Support comes from Fed cut bets, geopolitical risks, rising industrial demand (solar, EVs), and stronger Indian imports.

Oil Prices Rebound

WTI crude climbed to $64.55/bbl, a three-week high, boosted by:

- EIA data: crude –0.607M, gasoline –1.081M, distillates –1.685M (all draws vs. expected builds).

- Geopolitics: Trump threatened tariffs on Europe if it continues buying Russian energy; Iran vowed to keep selling to China despite possible sanctions.

Dallas Fed Oil Survey Signals Weakness

- Business activity: –6.5

- Outlook: –17.6

- Production: –8.6

Executives warned shale production declines quickly without drilling and flagged lower capex.

Copper Surges on Grasberg Mine Halt

Copper jumped 2.6% after Freeport’s Indonesian Grasberg mine suspended output following a mudrush. Casualties: 2 dead, 5 missing. Q3 sales –4% Cu, –6% Au; Q4 output “insignificant.” 2026 production could fall 35% (~270,000 tonnes, 1.2% of global supply), potentially swinging the market from surplus to deficit.

API Report: Larger Crude Draw

Private data showed a –3.821M barrel crude draw, vs. expected build, alongside gasoline –1.046M and distillates +0.518M.

Europe

Germany Ifo Index Disappoints

Business climate fell to 87.7 (exp. 89.3), with weaker current conditions (85.7) and expectations (89.7).

BOE’s Greene: Rethink on Supply Shocks

Megan Greene argued central banks can’t simply “look through” supply shocks. She warned inflation risks are tilted up and rate cuts should be cautious.

European Equities End Mixed

- DAX: +0.30%

- CAC 40: –0.57%

- FTSE 100: +0.29%

- Ibex: +0.24%

- FTSE MIB: –0.13%

G7 Eyes Rare Earths Strategy

Leaders are weighing price floors and export taxes to reduce dependence on China, which controls 60–70% of mining and over 80% of refining capacity for REEs.

Asia & Rest of World

Japan PMI: Manufacturing Weak, Services Strong

- Manufacturing: 47.4 (6-month low).

- Services: 53.0, up for a sixth month.

- Composite: 53.0, signaling ongoing but slower expansion.

China–U.S. Diplomacy Update

Ambassador Perdue said a Trump–Xi summit is unlikely before 2026, despite Trump’s hints. Talks with congressional delegates covered defense channels and TikTok disputes.

China Drops Developing-Nation Status at WTO

Beijing will no longer seek “special treatment” in trade talks, signaling readiness to accept stricter obligations.

China’s Li Qiang Calls for Reset with Canada

Premier Li urged Ottawa to ensure fair treatment of Chinese firms, framing bilateral ties as vital for global trade cooperation.

Australia August CPI Rises to 3%

Headline inflation accelerated from 2.8% (exp. 2.9%). Core trimmed mean slipped to 2.6%. The hotter print likely keeps the RBA on hold at its Sept 29–30 meeting.

New Zealand: Breman Named RBNZ Governor

Anna Breman will take office Dec 1 for a five-year term, succeeding acting governor Christian Hawkesby.

OECD Upgrades Global Growth

2025 forecast lifted to 3.2% (from 2.9%), citing U.S. AI investment, Chinese stimulus, and EM resilience. Risks include tariffs, though inflation is expected to ease.

Crypto

Tether Pursues $20B Raise at $500B Valuation

The stablecoin issuer seeks one of the largest private raises ever, offering 3% equity. With USDT already at $172B market cap, the raise would solidify dominance but heighten scrutiny.

Morgan Stanley to Launch Retail Crypto Trading in 2026

The bank will integrate bitcoin, ether, and solana trading on E-Trade, partnering with Zerohash. Plans include tokenizing stocks, bonds, and real estate.

Deutsche Bank: Bitcoin Won’t Replace Dollar

Bitcoin hit a record $123,500 with record-low volatility, but DB argued neither BTC nor gold will supplant the USD. Adoption will keep rising as regulation matures.

XRP Eyes $3.00 Breakout

Trading above $2.88, XRP shows bullish setup, helped by Ripple’s new partnership with Securitize to link tokenized funds (BlackRock’s BUIDL, VanEck’s VBILL) with RLUSD stablecoin. Futures OI has eased, hinting limited short-term momentum.

ASTER Surges on Whale Activity

The DeFi token jumped 18% to $2.34, with whale inflows and TVL surging to $1.85B from $347M earlier this month.

CFTC Tokenized Collateral Pilot

The regulator launched a three-year pilot to test stablecoins and tokenized assets as derivatives collateral, aiming to modernize settlement while enforcing compliance.