North America News

U.S. Stock Market Ends Mixed: Dow Drops, S&P Flat, Nasdaq Inches Higher

U.S. equities closed Thursday on uneven footing, with the Dow Jones Industrial Average leading the decline. After flirting with a new record in the prior session, the Dow fell sharply by 316.38 points, or 0.70%, to finish at 44,693.91.

The S&P 500 barely budged, adding just 4.44 points to close at 6,363.35, a modest gain of 0.07%. Meanwhile, the Nasdaq Composite ticked up by 0.18%, or 37.94 points, to settle at 21,057.96.

Semiconductors outperformed on the day:

- Nvidia rose 1.72%

- Broadcom added 1.77%

- AMD jumped 2.19%

Intel, which reported earnings after the bell, saw shares dip 3.66% during the regular session, though the stock recovered in after-hours trading with a modest 1% gain.

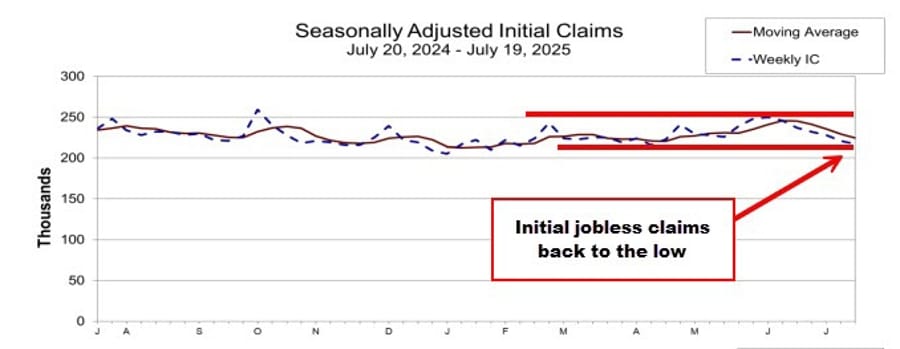

U.S. Weekly Jobless Claims Drop to 217,000, Below Expectations

Initial jobless claims for the week came in at 217,000, down from the prior 221,000 and lower than the 226,000 forecast. The 4-week moving average also eased to 224,500, down from 229,500.

Continuing claims were reported at 1.955 million, just under the 1.960 million estimate. The previous week was revised slightly to 1.951 million. The 4-week average held relatively steady at 1.954 million.

These figures suggest labor market conditions remain relatively stable, despite broader economic uncertainty.

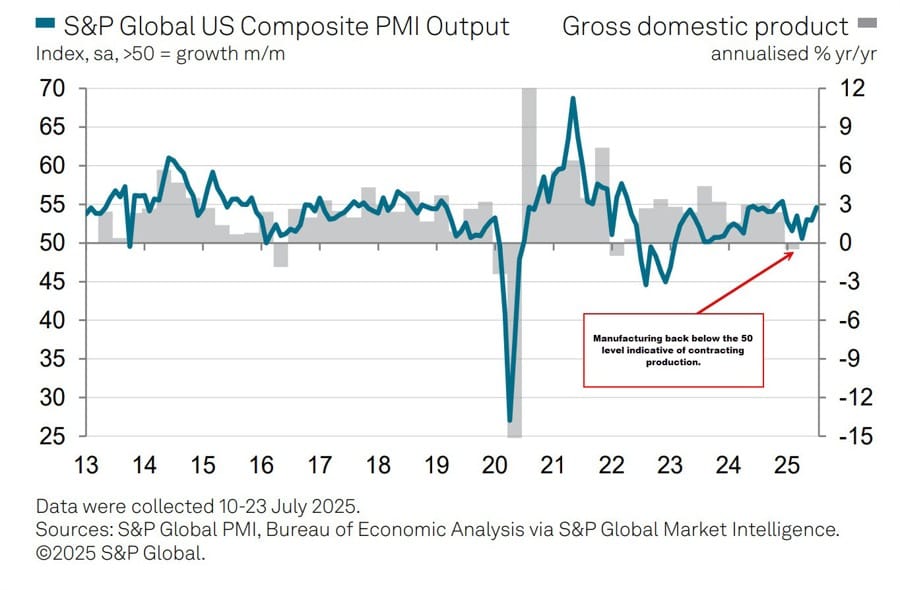

U.S. Flash Manufacturing PMI Misses at 49.5, Services Surges to 55.2

S&P Global’s early July reading for the U.S. Manufacturing PMI dropped sharply to 49.5, well below the 52.7 estimate and signaling renewed contraction in the factory sector. That’s also a reversal from the 52.9 print last month.

In contrast, the Services PMI jumped to 55.2, handily beating the 53.0 estimate and accelerating from last month’s 52.9. This strength in services lifted the Composite PMI to 54.6, up from 52.9 in June.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence commented:

“The flash PMI data indicated that the US economy grew at a sharply increased rate at the start of the third quarter, consistent with the economy expanding at a 2.3% annualized rate. That represents a marked improvement on the 1.3% rate signalled by the survey for the second quarter. “Whether this growth can be sustained is by no means assured. Growth was worryingly uneven and overly reliant on the services economy as manufacturing business conditions deteriorated for the first time this year, the latter linked to a fading boost from tariff front-running.

“Business confidence about the year ahead has also deteriorated in both manufacturing and services to one of the lowest levels seen over the past two-and-a-half years. Companies cite ongoing concerns over the impact of government policies, notably in terms of both tariffs and cuts to federal spending. “Inflation pressures have meanwhile intensified. Companies most commonly attributed higher costs and selling prices to tariffs, though increased labour costs are also prevalent, in part reflecting labor shortages.

“The rise in selling prices for goods and services in July, which was one of the largest seen over the past three years, suggests that consumer price inflation will rise further above the Federal Reserve’s 2% target in the coming months as these price hikes feed through to households.”

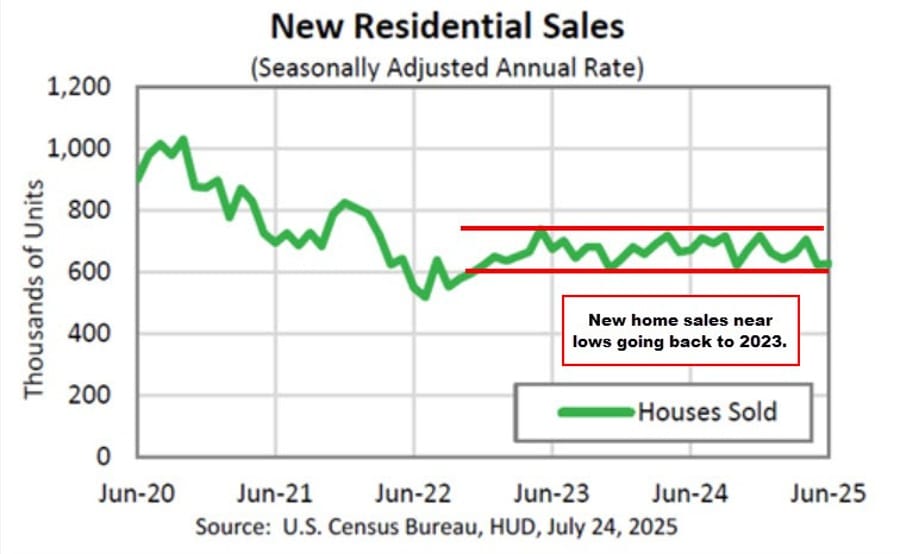

U.S. New-Home Sales Miss at 627K in June

June’s U.S. new-home sales came in at 0.627 million (SAAR), below the 0.650M forecast but up from May’s 0.623M. Inventory equals 9.8 months (prev. 9.7). The median price dropped to $401,800 (–4.9% MoM, –2.9% YoY), while the average price was $501,000 (–2% MoM, +1.1% YoY). Homes for sale rose to 511,000 (+1.2%).

U.S. Treasury To Auction $183 Billion in Notes Next Week

The U.S. Treasury plans to front-load next week’s auctions ahead of Wednesday’s FOMC meeting:

- 2-year notes: $69B (Monday)

- 5-year notes: $70B (Monday)

- 7-year notes: $44B (Tuesday)

By scheduling before the Fed’s rate decision, they aim to reduce auction timing risk.

Freddie Mac: 30-Year Mortgage Rate Slightly Drops to 6.74%

Freddie Mac reports the 30-year U.S. mortgage rate now averages 6.74%, scarcely lower than last week. With both new- and existing-home sales underperforming, the persistently elevated rate, influenced by the 10-year Treasury, remains a point of concern. Since November, rates have ranged between 6.68%–7.04%.

Trump Proposes 15–50% Tariffs on Countries Unless US Gains Market Access

President Trump expressed support for a 15%–50% flat tariff on imports from countries that restrict U.S. companies’ access to their markets. This includes serious discussions with the EU. He rejected lowering tariffs on autos (held at 25%) and is considering a “straight tariff” regime for most countries, aiming to lower energy costs and secure trade accords with China and various Asian nations.

Tesla CEO Musk Expects European Sales Surge; Affordable EV in Production

Elon Musk said he anticipates accelerating Tesla sales in Europe now that the Full Self-Driving (FSD) system is approved. In China, regulatory progress is ongoing. Tesla also confirmed it has begun producing a long-awaited more affordable EV to be priced below the current Model 3, aiming for mass production in late 2025. In Q2:

- Revenue: $22.5B (–12% YoY)

- Net Income: $1.2B (–16%)

- Deliveries: dropped 13.5%

Robotaxi and Semi production are also set to ramp up throughout 2026.

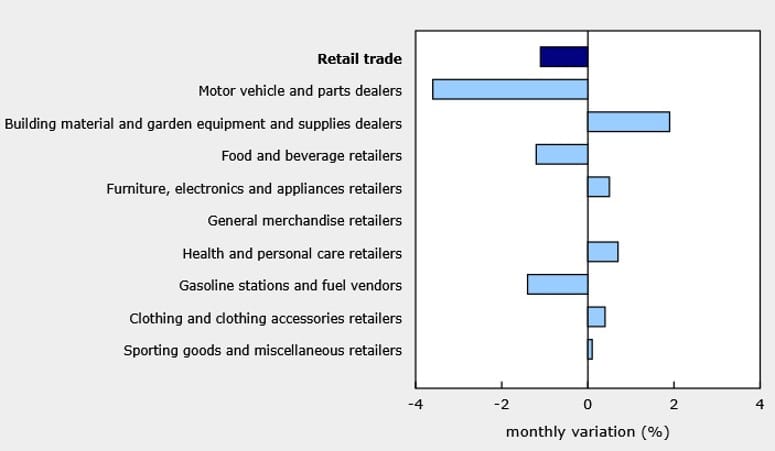

Canada Retail Sales Drop 1.1% in May, But Advance Estimate for June Rebounds

Canadian retail sales fell 1.1% in May, exactly matching expectations. Excluding autos, sales slipped 0.2%, slightly better than the forecasted –0.3%.

April’s figure was revised upward from +0.3% to +0.4%. On a year-over-year basis, sales increased 4.9%, just below the 5.0% pace seen previously.

StatsCan’s feedback shows 32% of retailers reported impacts from U.S.-Canada trade tensions, a slight improvement from 36% in April. Businesses most frequently cited rising input costs, pricing volatility, and shifts in demand as top challenges.

The early read for June retail sales offers some relief, with a robust +1.6% advance print.

Commodities News

Gold Dips Again as Risk Appetite Grows and Dollar Strengthens

Gold extended its decline for a second straight day on Thursday, slipping below recent highs as investors moved into risk assets and the U.S. dollar gained traction.

Spot gold is trading just above $3,370, pulling back from earlier highs near $3,440. The move reflects fading safe-haven demand as markets gain confidence in the possibility of a U.S.–EU trade breakthrough ahead of the August 1 tariff deadline.

Improving job market data added to the pressure on gold:

- Initial jobless claims dropped to 217,000, better than the 227,000 forecast.

- Continuing claims came in slightly lower at 1.955 million.

On the economic front, the July flash S&P Global PMIs showed mixed signals:

- Manufacturing PMI fell sharply to 49.5, missing the 52.5 estimate and signaling contraction.

- Services PMI beat expectations at 55.2, up from 52.9 last month.

- The Composite PMI climbed to 54.6, showing overall private sector strength.

With services holding up and labor data still firm, markets are now split on what the Fed may do next. According to the CME FedWatch Tool, there’s currently a 60% probability of a rate cut in September, with a 38% chance that rates remain unchanged.

Trade optimism remains the key narrative:

At an AI event Wednesday, President Donald Trump doubled down on his “simple tariff” plan of 15% to 50%, but opened the door to reduced tariffs for EU nations willing to ease access for U.S. firms. German Chancellor Friedrich Merz added to the optimism, saying that potential breakthroughs could be near after talks with French President Emmanuel Macron.

Still, Brussels is holding firm on demands. EU negotiators are reportedly pushing for a 15% baseline tariff, and are seeking sector-specific clarity, particularly for pharmaceuticals, automobiles, and semiconductors — all considered economic priorities.

As a result, gold remains stuck below the key Fibonacci resistance near $3,400, and unless safe-haven demand returns or the dollar weakens further, momentum looks stalled in the near term.

Crude Oil Climbs 1.2%, Settles at $66.03

Crude futures closed up $0.78 (1.20%), settling at $66.03. After struggling below the 100‑day moving average for two days, bearish momentum faded and buyers pushed prices higher. A decisive drop under that MA could target the $64.03–64.70 zone, while the next upside levels are $66.96 and the 200‑day MA at $68.01.

Silver Slides from 14-Year Peak as Risk Appetite Returns

Silver eased about 0.50% Thursday, trading near $39.00, though it remains +2.3% for the week. After spiking to a 14-year high of $39.53, the metal pulled back amid improved trade sentiment and USD strength. Silver remains well above multiple EMAs, with strong RSI and ADX indicators pointing to a bullish structure.

Gold Pulls Back After Failing to Breach Key Resistance

Gold prices dropped 0.6% on Friday to $3,368 after twice more failing to pierce resistance at $3,430–35. Despite a weaker dollar earlier in the week pushing gold above $3,400, sellers reclaimed control. Prices are now trading between major moving averages. Support holds near the 200-hour MA at $3,365, but a break lower could open paths toward $3,300; a rebound above $3,430 may reignite bullish momentum.

Goldman Maintains Bullish 2026 Outlook on US Natural Gas at $4.50

Goldman Sachs held its forecast for Henry Hub natural gas at $4.50/mmBtu by summer 2026, citing upside risks if producers delay investment. The bank recommends taking a long position in April 2026 futures, warning current capital expenditure may fall short of meeting future consumption needs.

Europe News

European Markets Finish Mixed

European benchmarks ended the session with divergent performances:

- Germany DAX: +0.23%

- France CAC: –0.41%

- UK FTSE 100: +0.50%

- Spain Ibex: +1.34%

- Italy FTSE MIB: –0.24%

Spain and the UK led gains, while France and Italy lagged.

ECB Holds Interest Rates Steady in July Meeting

The European Central Bank delivered a July policy match, maintaining:

- Deposit rate: 2.00%

- Refinancing rate: 2.15%

- Lending facility: 2.50%

This move reflects ongoing inflation easing and economic resilience. The ECB will remain data-driven, making decisions on a meeting-by-meeting basis.

Eurozone Services PMI Hits 51.2; Composite Rises to 51.0

HCOB’s July preliminary PMI for the euro area reports:

- Services: 51.2 (vs 50.7 expected; prior 50.5)

- Manufacturing: 49.8 (vs 49.7 expected; prior 49.5)

- Composite: 51.0 (vs 50.8 expected; prior 50.6)

Services led the way, lifting overall activity to an 11-month high, while manufacturing softened. Cost pressures eased, and new orders stabilized although firms continued passing through price increases.

HCOB notes that:

“The eurozone economy appears to be gradually regaining momentum. The recession in the manufacturing sector is coming to an end, and growth in the services sector accelerated slightly in July. Our GDP Nowcast, which also takes into account the HCOB Flash PMI, points to robust economic growth for the third quarter. However, further data should be awaited before too much weight is given to this assessment.

“Manufacturing output has expanded cautiously for five months in a row. Germany is playing a key role here and, together with other countries, has been able to more than offset the weakness in France. However, for the manufacturing sector in the eurozone to return to solid growth in the long term, French industry must also regain its footing. The current political uncertainty in Paris is certainly an obstacle to this.

“In Germany, slight economic growth is on the cards for July, while France is set to see a slight contraction. This contrast is likely to be accounted for in part to the political environment. In France, this is characterized by the plan of massive budget cuts and a looming vote of no confidence against Prime Minister François Bayrou. In Germany, on the other hand, the economy can hope for higher government spending, which will ideally be accompanied by higher private and public investment. The corresponding mood is reflected in the outlook for the future in France, which has fallen by around eight points in the manufacturing sector, an unusually sharp decline. In Germany, the corresponding index has only fallen by a good two points.

“There is good news for the ECB, as the disinflation trend has continued in the closely watched service sector. Prices for goods did not fall further in July, but the stronger euro and US tariffs are likely to exert downward rather than upward pressure on inflation in the coming months.”

Germany’s July Manufacturing Index Falls to 49.2; Services Firm at 50.1

Germany’s preliminary PMIs for July show slight gains in services but weakness in industry:

- Manufacturing: 49.2 (vs 49.5 expected; prior 49.0)

- Services: 50.1 (vs 50.0 expected; prior 49.7)

- Composite: 50.3 (vs 50.7 expected; prior 50.4)

Manufacturing output fell to a five-month low, though services noted the first rise in new business in nearly a year. The data overall suggest modest expansion in Germany.

HCOB notes that:

“The economic situation in the manufacturing sector remains fragile, as underscored by the headline PMI remaining below the 50 mark. However, the fact that production in this sector has now expanded for five months in a row is encouraging. Given the sustained rise in export orders over the past four months, it is reasonable to anticipate a continued expansion in output. Against this backdrop, manufacturing companies have also slowed the pace of job cuts. Overall, we see increasing signs of a recovery in the manufacturing sector, a picture that is confirmed by the latest investment initiative by key business leaders and supported by the measures taken by the federal government, including more favourable depreciation conditions for investments since July 1. Even higher US tariffs should not fundamentally change this outlook.

“The service sector is no longer acting as a drag on the economy but has returned to growth, albeit at a rate that can be described as marginal at best. After ten months of decline, new business is showing slight growth, and sentiment has improved as companies are significantly more confident that they will have expanded their activities in twelve months’ time. The brightening outlook is in line with our expectation that rising real wages and expansionary fiscal policy should help the sector as a whole to regain its footing.

“Inflation has eased again in sales prices. Prices are falling in industry, as the stronger euro is leading to lower import prices and tariff barriers in the US are also likely to support the downward trend in prices here. The disinflationary trend is continuing in the service sector, with lower goods prices and less rapid wage growth providing tailwinds, at least temporarily.

“With the relatively favourable start to the third quarter, our GDP nowcast, which also takes the HCOB PMI indicators into account, points to relatively solid growth, driven by both the industrial and service sectors. However, given the many unknowns and the lack of data at this stage, this is only a very preliminary statement.”

Germany’s August Consumer Confidence Drops to –21.5

According to the GfK index released July 24, German consumer sentiment for August fell sharply to –21.5 (down from –20.3 in July and below the –19.2 consensus). The willingness to save rose to 16.4, the highest in 18 months, as households cite price volatility—especially for food—and economic uncertainty as reasons to increase savings buffers.

France Business Sentiment Stable at 96 but Employment Gauge Slips

France’s INSEE data for July shows the overall business confidence reading remaining unchanged at 96. The manufacturing and services sub-indices also held steady at 96, though manufacturing was revised slightly to 97. The employment outlook weakened, falling to 96.7 from 98.3 in June, signaling growing caution in labor demand.

French Services Sector Nears 50.0, But Momentum Still Subdued

Preliminary July PMI data from HCOB shows:

- Services PMI at 49.7 (vs 49.6 expected; prior 49.6)—marking an 11-month high

- Manufacturing PMI at 48.4 (vs 48.5 expected; prior 48.1)

- Composite index at 49.6 (vs 49.3 expected; prior 49.2)

While services are improving, the manufacturing sector continues to contract, with new orders falling sharply and business sentiment worsening to its weakest level since last November.

HCOB notes that:

“The latest HCOB Flash PMIs from France are neither fish nor fowl. While momentum has been trending upward since the beginning of the year, the index remains below the critical 50-point threshold. This continues to signal a deterioration in economic conditions, albeit one that is only marginal. France remains under considerable pressure, both economically and politically. GDP growth is unlikely to exceed the 1% mark this year. At the same time, questions are mounting over whether Prime Minister Bayrou can sustain his austerity course politically. Global trade upheaval is compounding the strain on France as a business location, though the recent deal between Washington and Tokyo may bring a potential EU–US agreement closer within reach.

“Conditions in the service sector remain subdued. Business activity is stagnating at a low level, showing little movement compared to June. Particularly concerning is the sharp decline in the sub-index for future business expectations. This drop is likely a direct response to Bayrou’s draft budget proposal, presented in parliament last week. Should an agreement on the austerity package be reached, it would reduce disposable income for many households—posing clear downside risks for domestic demand and especially for the services sector. Conversely, failure to reach a budget deal could further escalate political uncertainty.

“The situation in the manufacturing sector also remains tense. The slight uptick in the headline index should not be overinterpreted. Of greater concern is the sharp decline in forward-looking sub-indices: both order intakes and business expectations fell significantly in July. This likely represents increased domestic uncertainty due to the fresh austerity proposal, and international unease stemming from protectionism in global trade policy. There is, however, a faint glimmer of hope on the pricing front as after a period of price reductions, output prices edged up again in July, helping firms to recoup margin losses in recent months.”

UK July Service Sector Loses Momentum, PMI Slides to 51.2

The UK’s S&P preliminary service PMI for July fell to 51.2 (below 53.0 prior), while manufacturing remained subdued at 48.2 (from 47.7). The composite index dropped to 51.0 from 52.0. New orders and output growth slowed, and input prices ticked higher—suggesting inflationary pressures. Employment data looked weaker, fueling expectations for a BOE rate cut in August.

S&P Global notes that:

“The flash UK PMI survey for July shows the economy struggling to expand as we move into the second half of the year. Output growth weakened to a pace indicative of the economy growing at a mere 0.1% quarterly rate, with risks tilted to the downside in the coming months.

“The sluggish output growth reported in July reflected headwinds of deteriorating order books, subdued business confidence and rising costs, all of which were widely linked to the ongoing impact of the policy changes announced in last autumn’s Budget and the broader destabilising effect of geopolitical uncertainty.

“Particularly worrying is the sustained impact of the Budget measures on employment. Higher staffing costs have exacerbated firms’ existing concerns over payroll numbers in the current environment of weak demand, resulting in another month of sharply reduced headcounts in July.

“The weak growth trajectory and sustained culling of jobs will add to pressure on the Bank of England to cut rates again at its next policy meeting in August. It seems likely that the disappointing growth and labour market trends will increasingly dominate the inflation forecasting narrative, encouraging policymakers to ‘look through’ the recent rise in price pressures and instead focus on helping to revive growth.”

UK CBI Reports Manufacturing Order Declines to –30 in July

The CBI’s July data show total manufacturing orders at –30 (vs –28 expected), a slight improvement from –33 in June. The sector remains fragile, with firms holding off investment amid uncertain demand. CBI highlights challenges related to high input costs, labour shortages, and supply chain disruptions.

Lagarde: Eurozone Economy Stabilizing, Inflation Controlled

At the ECB press conference, President Lagarde described the euro area as being in a “good place,” noting Q1 growth of 0.6%, aided by resilient consumption and investment. Inflation is near target, well-anchored by wage moderation and productivity. Risks include trade tariffs and geopolitical volatility, but if resolved, could further spur growth. ECB remains patient and cautious, with any adjustments guided by incoming data.

ECB Signals Rate Hold Likely in September Too

Speaking after the rate hold, ECB sources indicate a strong bias toward pausing policy in September as well. Any rate cut would require definitively weaker data and lowered economic projections. Those favoring cuts face stiff resistance.

EU’s Costa on talks with China: committed to deepening bilateral relationship

EU Costa on talks with China

- Remains committed to deepening our bilateral relationship, addressing our concerns with honesty

- Tackling global challenge of climate change is shared priority for EU and China

- Discussed ways to deepen climate change engagement with China’s Xi and Li

- We discussed trade distortions, imbalances and market access issues; fair and mutually beneficial trade relations are possible and should be our joint aim

EU Gears Up for Swift Retaliation if US Talks Fail

According to the FT, the EU has pre-approved retaliatory tariffs of up to 30% on €93 billion of US goods, ready to launch by August 7. These countermeasures would be suspended if a deal is reached with the US by the August 1 deadline, allowing rapid response without intra-EU debates.

EU’s von der Leyen says had an excellent meeting with China president Xi today

- Remarks by European Commission president, Ursula von der Leyen

- We want this relationship to be beneficial for both sides

- Had ‘intense’ dialogue on how to make better use of emissions trading systems

- Trade relationship today is not balanced, competition has to be fair

- It is vital we understand each other’s interest and concerns, and to act on them

EU member states back potential counter-tariffs of €93 billion of US goods

- As confirmed by EU diplomats

This is their supposed safety net in case negotiations go awry in the coming days before the 1 August deadline. They’ve consolidated the counter-tariffs into a single list now, and that totals up to be €93 billion. And these will be part of their retaliation if the US steps up tariffs against the EU in the event both sides fail to find a deal before the deadline.

EU’s von der Leyen: Balancing the Relationship With China Crucial

In Beijing today, EU Commission President Ursula von der Leyen emphasized that Europe and China have reached a turning point in their relationship. With increasing economic ties, she stressed the need to address growing imbalances and urged both sides to present practical solutions to rebalance cooperation.

Asia-Pacific & World News

China Reaffirms Rare-Earth Export Policies Are International Norm

China’s foreign ministry stated that its rare-earth export policy aligns with global standards, and it is open to collaboration with partner nations to maintain supply chain resilience. While publicly cooperative, Beijing’s dominance in the rare-earths market gives it strategic leverage—raising concerns among global stakeholders who still depend heavily on Chinese sources.

President Xi Clarifies EU’s Challenges Don’t Originate in China

Chinese President Xi Jinping, in remarks carried by state media, stated that the current issues facing the EU do not stem from China. He urged proper management of disagreements and called for open trade and investment environments. Xi insisted there are no fundamental conflicts of interest between the EU and China, requesting European support for Chinese businesses and respect for his country’s core concerns.

AMD CEO: US-China Chips Made in Arizona May Cost 5–20% More

AMD CEO Lisa Su told Bloomberg that chips produced at TSMC’s new Arizona plant could cost 5–20% more than those manufactured in Taiwan. The price differential reflects higher labor and supply chain costs in the U.S. She emphasized the strategic advantage of diversifying supply sources, while noting it’s undecided whether additional costs will be passed to customers.

Xi and von der Leyen Meet Today in Beijing to Tackle Trade, Ukraine

China’s state media confirmed that President Xi Jinping and EU Commission President Ursula von der Leyen are scheduled to meet in Beijing today. Their agenda includes discussions on trade conflicts, bilateral relations, and the war in Ukraine. von der Leyen has already arrived in Beijing ahead of today’s summit.

PBOC sets USD/ CNY reference rate for today at 7.1385 (vs. estimate at 7.1503)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 331bn yuan via 7-day reverse repos at 1.40%

- 211.5bn yuan mature today

- net 119.5bn drain yuan

Australia Flash PMIs Show Broader Expansion in July

Australia’s S&P flash PMIs for July reveal continued expansion:

- Manufacturing: 51.6 (from 50.6 in June)

- Services: 53.8 (from 51.8)

- Composite: 53.6 (from 51.6)

All three indicators remain in growth territory, with services leading the charge, reflecting a solid momentum in Australia’s economy.

RBA Bullock: Q2 core inflation may not have slowed as much as first expected

- Reserve Bank of Australia Governor Bullock

- RBA Governor Bullock says a measured, gradual approach to monetary policy easing is appropriate.

- She notes the labour market has eased only gradually, with the unemployment rate still relatively low.

- The rise in unemployment in June was in line with forecasts and not considered a shock.

- June data suggests the labour market has moved a little further toward balance.

- Leading indicators are not pointing to a significant near-term increase in unemployment.

- Other labour market measures, such as the vacancy rate, have remained stable.

- Labour market rebalancing is occurring through vacancies, hours worked, and voluntary job switching.

- The RBA is not targeting a specific unemployment rate or job losses.

- Bullock says Q2 core inflation may not have slowed as much as initially expected.

- The RBA needs further data to support its forecast that core inflation will ease toward 2.5%.

- Maintaining low and stable inflation remains a key objective.

- There is still uncertainty and unpredictability in the global economy.

- However, the likelihood of a severe downside trade war scenario now appears to have diminished.

- Monthly job numbers pop up and down, board would have made same rate decision

- Don’t think digital money is inherently inflationary

- New complete monthly CPI will still be transitional for a while

- New CPI will be much more helpful in judging inflation momentum

RBNZ Economist Warns Tariffs Will Weigh on Investment and Inflation

RBNZ Chief Economist Yuong Ha Conway warned that U.S. tariffs could weaken the global economy, reducing demand and dampening business investment. She noted New Zealand’s Q2 CPI aligned with projections and suggested continued inflation easing could open the door to further rate cuts. Preliminary data also indicate China’s tariffs have slowed global growth.

Japan’s Akazawa says there is no difference in understanding on trade deal with US

- Remarks by Japan trade negotiator, Ryosei Akazawa

- The trade deal is in line with Japan’s interests

- Had no discussion with US officials about how to implement the deal yet

- No comment (when asked about a quarterly review on the deal, as suggested by Bessent)

Cboe to Exit Japanese Equities Markets in August 2025

Cboe Global Markets announced it will discontinue its Japanese equities operations, including the proprietary trading system and its BIDS block trading platform, effective August 29, 2025. The decision reflects revised business strategy and challenges in maintaining profitability in Japan.

Japan’s Manufacturing Contracts in July; Services Offset Decline

Japan’s preliminary July PMI dropped to 48.8, down from 50.1 in June and below expectations of 50.2—signaling a contraction in manufacturing. This was driven by trade policy uncertainty impacting new orders and production. In contrast, the services PMI jumped to 53.5, the strongest pace in five months, supported by robust domestic demand. The mixed picture leaves the composite PMI at 51.5.

Barclays Sees Yen Support From US–Japan Trade Pact and BOJ Pivot

Barclays analysts say the Japanese yen may strengthen soon, citing remarks from BOJ Deputy Governor Uchida. They argue reduced tariff ambiguity between the U.S. and Japan, combined with a faster-than-expected Bank of Japan rate-hike trajectory, should buoy the yen in the near future.

South Korea–US Trade Talks Postponed Over Scheduling Conflict

South Korea announced that planned 2+2 trade discussions with the U.S. have been cancelled due to the U.S. Treasury Secretary’s scheduling constraints. However, Washington indicated it will reschedule the talks soon, and both sides are working towards a new mutually convenient date.

Crypto Market Pulse

Bitcoin Regains $118K, While Ethereum and XRP Struggle Amid Bearish Signals

Bitcoin (BTC) rebounded off the $117,116 support zone on Thursday and is aiming once again for $120,000. The recovery follows recent selling pressure that brought the coin down from Wednesday’s high of $120,090.

Ethereum (ETH) dipped to $3,500 overnight but has since inched back to around $3,630, though still down 6% from recent peaks. XRP, meanwhile, extended its correction to a low of $2.95 before bouncing modestly to $3.10.

Derivatives data shows cooling Open Interest (OI) across major coins:

- BTC OI dropped to $83.55B (from $87.89B on July 15)

- ETH OI declined to $53.50B (down from $57.69B)

- XRP OI fell to $9.27B, a 15% drop from Tuesday

Ethereum still holds above key EMAs but faces resistance near $3,858. If momentum fades, downside support levels to watch include the 50-EMA at $3,318, 100-EMA at $3,035, and 200-EMA at $2,769.

XRP is under heavier selling pressure, with RSI dropping from 88 to 59. A bearish MACD crossover is forming, and if the $2.95 support breaks, expect further tests at the 50-day EMA ($2.65), 100-day EMA ($2.47), and 200-day EMA ($2.25).

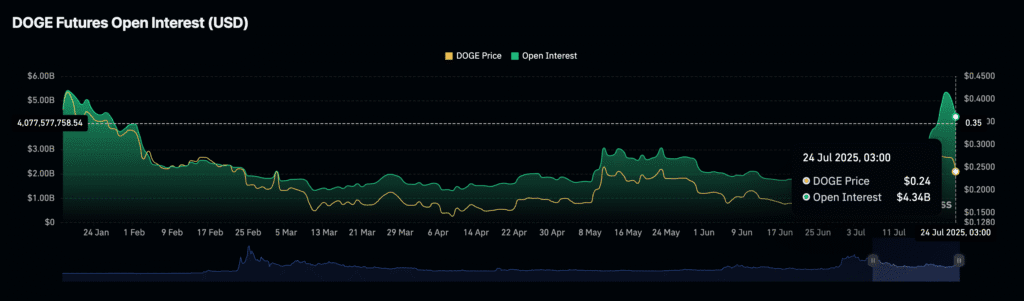

DOGE Drops Over 23% as Network Activity Slumps

Dogecoin (DOGE) slid from recent highs, testing support at $0.2219 after topping $0.2873—a near 23% drop. Price stands around $0.2372. Daily active addresses have diminished sharply—from 517K–675K in June/May to just 70K, indicating weak demand. Futures Open Interest fell from $5.35B to $4.34B, reflecting lower market interest and bearish sentiment.

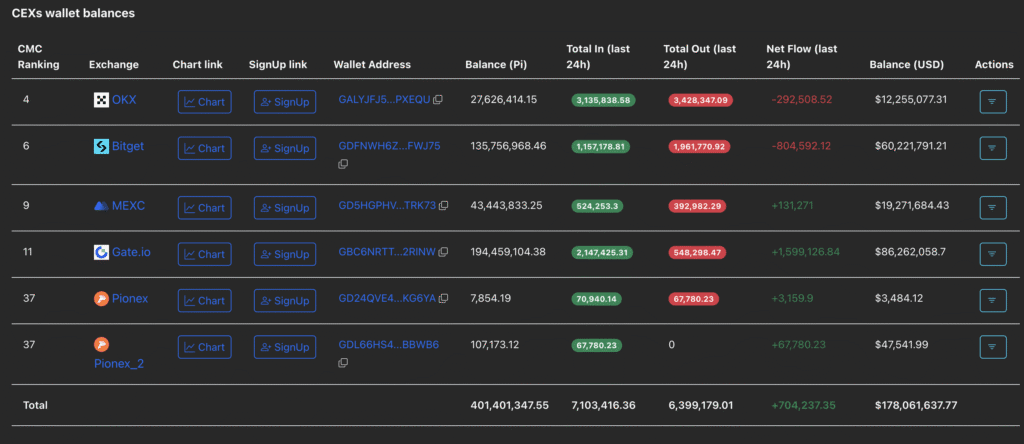

Pi Network Declines Ahead of 10.8M Token Unlock

Pi Network (PI) dropped 2%, retesting key support levels before a 10.8 million token unlock next Monday. Centralized exchange wallet balances rose by 704,237 PI, signaling pre-unlock accumulation and possible profit-taking. On-chain trends suggest increasing bearish pressure, pointing toward further declines—potentially down to $0.40.

Ethena’s Stablecoin ENA Rallies 5% on Anchorage Partnership

Ethena (ENA) jumped 5% Thursday after partnering with Anchorage Digital to introduce USDtb, the first stablecoin launched under the GENIUS Act framework. Anchorage Bank will host USDtb, making it the first FCC-regulated stablecoin product. The announcement follows increasing interest in institutional stablecoin projects. The market cap for stablecoins sits at $270.4B, with projections of doubling by 2028.

VeChain Gears for 33% Upside After Institutional Tie-ups

VeChain (VET) is gaining bullish momentum, trading at $0.0253 after falling from July highs. The DeFi token announced institutional partnerships with Franklin Templeton, BitGo, and Keyrock to support tokenized asset use cases. The collaboration involves the BENJI platform and the $800M FOBXX fund. Collective infrastructure support hints at a solid institutional foundation for VET.

White House to Release Crypto Strategy Report, Including Bitcoin Reserve

On July 30, the White House will publish its crypto policy report, following a 180-day review ordered by an executive action issued by former President Trump in January. The report is expected to introduce the concept of a Strategic Bitcoin Reserve, detailing the amount of BTC seized by enforcement and proposing it for formal inclusion in federal reserves. It will also outline a proposed regulatory framework for digital asset issuance, management, and usage.

The Day’s Takeaway

United States

- Markets Mixed:

- Dow Jones fell 316.38 points (-0.70%) to 44,693.91 after nearly touching a record high the previous day.

- S&P 500 was nearly flat, closing up 0.07% at 6,363.35.

- Nasdaq edged up 0.18% to 21,057.96, marking modest tech gains.

- Chip stocks led: Nvidia +1.72%, Broadcom +1.77%, AMD +2.19%. Intel fell -3.66% pre-earnings but recovered post-market.

- Economic Data:

- Initial jobless claims: 217K (vs. 226K expected)

- Continuing claims: 1.955M (slightly better than expected)

- S&P Global Flash PMIs:

- Manufacturing: 49.5 (vs. 52.7 est.) — contraction

- Services: 55.2 (vs. 53.0 est.) — strong growth

- Composite: 54.6 (up from 52.9)

- New-Home Sales (June):

- 627K units, below the 650K estimate

- Median sale price: $401,800 (-4.9% MoM, -2.9% YoY)

- Inventory: 511K homes, up 1.2%

- Month’s supply: 9.8 months — historically elevated

- Mortgage Rates:

- Freddie Mac’s 30-year fixed at 6.74%, near the top of its 2024–25 range

- Treasury Auctions (Next Week):

- $69B in 2-year, $70B in 5-year, $44B in 7-year notes

- Frontloaded due to FOMC decision mid-week

Canada

- Retail Sales (May):

- -1.1% MoM, matching expectations

- Ex-Auto Sales: -0.2% (better than expected)

- Advance June Estimate: +1.6%

- Businesses cited U.S. trade tensions as a continued drag — 32% reported impact in May

Commodities

- Gold:

- Dropped to $3,370, second day of losses

- Risk-on mood and firm U.S. Dollar reduced safe-haven demand

- Key resistance near $3,440 rejected again; Fibonacci levels in focus

- Market expects a 60% chance of Fed rate cut in September, per CME data

- Silver:

- Pulled back to $39.00 from 14-year high of $39.53

- Down 0.50% on the day but up 2.36% for the week

- Still technically bullish above rising EMAs, but momentum indicators show cooling

- Crude Oil:

- WTI settled at $66.03/barrel, up $0.78 (1.20%)

- Sellers backed off after multiple failed attempts to break below the 100-day MA

- Key resistance now at $66.96 and 200-day MA at $68.01

Europe

- ECB Holds Rates Steady:

- Deposit Rate: 2.00%

- Main Refinancing Rate: 2.15%

- ECB reiterated no pre-commitment to rate path

- Lagarde: “We’re in a good place” as inflation nears target, but trade risks loom

- ECB sources signal no September cut unless data worsens

- PMIs & Data:

- Eurozone Composite PMI: 51.0 (11-month high)

- Germany Composite PMI: 50.3

- France Composite PMI: 49.6 (still under 50)

- UK Composite PMI: 51.0 — services growth losing steam

- Germany GfK Consumer Sentiment (Aug): -21.5 (missed expectations)

- France Business Confidence (July): Steady at 96

- UK CBI Orders: -30 (still subdued)

- EU–China Relations:

- von der Leyen: Imbalances must be addressed

- Xi Jinping: EU’s economic issues aren’t China’s fault

- China urges EU to maintain openness and respect “core interests”

- Trade Retaliation Watch:

- EU prepared to activate 30% tariffs on $93B of U.S. goods if no deal by August 1

- Talks reportedly making progress; Brussels wants clarity on sector-specific tariffs

- Markets Mixed:

- DAX: +0.23%

- CAC 40: -0.41%

- FTSE 100: +0.5%

- Spain’s Ibex: +1.34%

- Italy’s FTSE MIB: -0.24%

Asia-Pacific

- China–EU Diplomacy:

- High-level meetings in Beijing address trade, rare earths, Ukraine

- China reaffirmed rare earth policy aligns with “global norms”

- Japan:

- July Manufacturing PMI: 48.8 — back in contraction

- Services PMI: 53.5 — fastest growth in 5 months

- BOJ comments (Uchida) seen as bringing rate hikes closer

- Australia:

- Flash PMIs (July):

- Manufacturing: 51.6

- Services: 53.8

- Composite: 53.6 — all sectors in expansion

- Flash PMIs (July):

- South Korea:

- US–Korea trade talks cancelled due to scheduling; new date pending

- Cboe Global Markets:

- Exiting Japanese equities business by August 29, citing market viability

- New Zealand:

- RBNZ Chief Economist Conway warned U.S. tariffs will hit global demand

- CPI in line with expectations; scope exists for rate cuts if inflation keeps easing

- Q2 growth appears to have slowed

Crypto

- Bitcoin (BTC):

- Back above $118,000, aiming for $120,000

- Recovery from $117,116 support; OI down to $83.55B

- Ethereum (ETH):

- Holding $3,500–3,630 range, down 6% from highs

- Open Interest cooling signals near-term caution

- XRP:

- Trading near $3.10, off from record $3.66

- RSI and MACD showing bearish divergence

- Ethena (ENA):

- Jumped 5% after Anchorage partnership to launch USDtb stablecoin

- First stablecoin under new GENIUS Act framework

- VeChain (VET):

- Rebounded on Franklin Templeton, BitGo, Keyrock deal

- Targeting tokenized asset infrastructure and B2B settlement

- Pi Network (PI):

- Slipping 2%, retesting critical support

- 10.8M token unlock on Monday may increase selling pressure

- Dogecoin (DOGE):

- Down 23% from highs, now near $0.2372

- Daily active users, OI, and network activity declining sharply