North America News

Wall Street Powers Higher on Powell’s Calm Tone, But FedEx Sounds Alarm After Hours

U.S. equity markets surged Tuesday, with the Dow, S&P 500, and Nasdaq all closing more than 1.1% higher as investor sentiment improved on two fronts: a Middle East ceasefire and reassuring comments from Federal Reserve Chair Jerome Powell.

Powell Strikes a Balanced Tone on Capitol Hill

In his testimony before the House Financial Services Committee, Powell told lawmakers the U.S. economy is not in recession, highlighting continued labor market strength. He acknowledged no “imminent” risks to either side of the Fed’s dual mandate and said current interest rate levels give the central bank room to remain patient.

While Powell did not commit to a specific path, he left the door open for a possible rate cut as soon as July—emphasizing that any move would depend on incoming data. He noted that inflation could surprise to the downside, especially as some price pressures wane. However, new tariffs could temporarily boost inflation in the coming summer months.

“If inflation had remained under control, we likely would have resumed rate cuts already,” Powell said, clarifying that the Fed isn’t locked into a preset timeline.

He also touched on housing, pointing to structural imbalances in supply that fall outside the Fed’s toolkit, and said it was still too early to judge the broader implications of the situation in the Middle East.

Other Fed Voices Reinforce ‘Wait and See’ Strategy

- New York Fed President John Williams (voting member) projected slowing GDP growth to around 1% in 2025, with unemployment rising modestly to 4.5%. He estimated that tariffs would lift inflation by 0.25%, peaking near 3% before slowly trending back to 2% over the next two years.

- Minneapolis Fed President Neel Kashkari said businesses remain optimistic about fundamentals but increasingly anxious over tariff policy. He reiterated progress on inflation, though it still sits above the 2% target.

- Fed Vice Chair for Supervision Michael Barr echoed Powell’s cautious stance. He warned that tariffs could drive inflation higher and drag on economic momentum. He emphasized that the current policy stance is appropriate while the Fed evaluates risks.

Markets Rally Into the Close

Following Powell’s appearance, all three major indexes extended their early-session gains sparked by news of the Israel-Iran ceasefire. The Nasdaq led with a 1.43% surge, followed by the Dow and S&P 500:

- Dow Jones: +507.24 points (+1.19%) at 43,089.02

- S&P 500: +67.01 points (+1.11%) at 6,092.18

- Nasdaq Composite: +281.56 points (+1.43%) at 19,912.53

U.S. Treasury yields also drifted lower, adding to the bullish tailwind:

- 2-Year: 3.818% (-1.0 bps)

- 5-Year: 3.857% (-2.8 bps)

- 10-Year: 4.292% (-3.0 bps)

- 30-Year: 4.831% (-2.8 bps)

But FedEx Clouds the Afterglow

After the bell, FedEx shares slid 2.3% as the logistics giant pulled guidance and revised down its Q1 EPS forecast to a range of $3.40–$4.00, missing consensus of $4.03. The company also trimmed capital expenditure plans.

Chief Financial Officer John Dietrich cited broad weakness in the U.S. industrial sector, noting “continued uncertainty” and softening demand in the company’s business-to-business segment.

Treasury Sells $69B in 2-Year Notes at 3.786%, Modest Foreign Demand

The U.S. Treasury auctioned $69 billion in two-year notes on Tuesday with the following results:

- High Yield: 3.786%

- WI Level at Auction: 3.787%

- Tail: -0.1 basis points (vs six-month average of -0.3 bps)

- Bid-to-Cover Ratio: 2.58x (vs 2.62x average)

- Directs: 26.3% (vs 17.6% average)

- Indirects: 60.5% (vs 71.3% average)

- Dealers: 13.2% (vs 11.1% average)

The auction cleared smoothly, though foreign interest came in lighter than usual. Direct bidders were stronger than average, helping absorb excess supply as primary dealers took on a larger share.

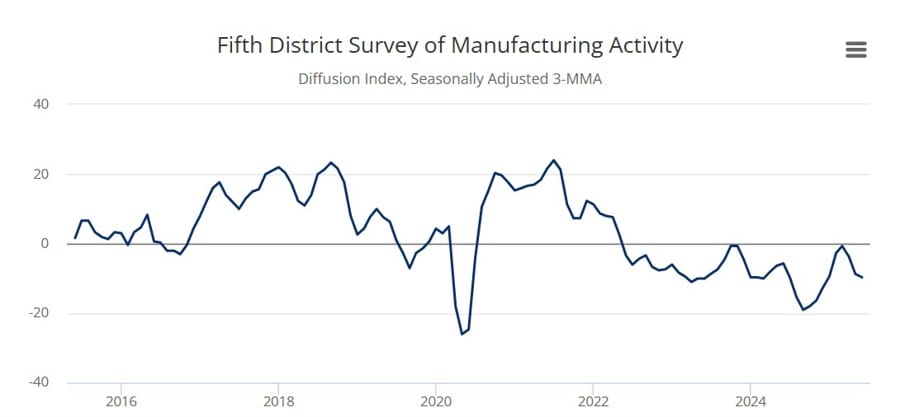

Richmond Fed Manufacturing Index Posts Smaller Decline in June

The Richmond Fed’s regional manufacturing report for June showed improvement across the board, though activity remains subdued overall.

- Composite Index: -7 (vs expected -10, prior -9)

- Services Index: -4 (prior -11)

- Shipments Index: -3 (prior -10)

While still in contraction territory, the narrower declines indicate stabilizing business activity. Manufacturing firms reported slightly better conditions amid ongoing concerns about orders and labor availability.

Details from the Richmond Fed report:

- Composite manufacturing index rose slightly to -7 in June from -9 in May, still in negative territory.

- Shipments index improved to -3 and new orders rose to -12.

- Employment index declined to -5 from -2.

- Local business conditions index remained negative but improved from -25 to -20.

- Future local business conditions deteriorated to -11 from -6.

- Future shipments index increased from 2 to 4.

- Future new orders index rose from -3 to 5.

- Vendor lead time index increased to 16.

- Backlog of orders index declined slightly from -19 to -20.

- Prices paid and received growth rates rose in June.

- Firms expect prices paid growth to moderate and prices received growth to increase over the next 12 months.

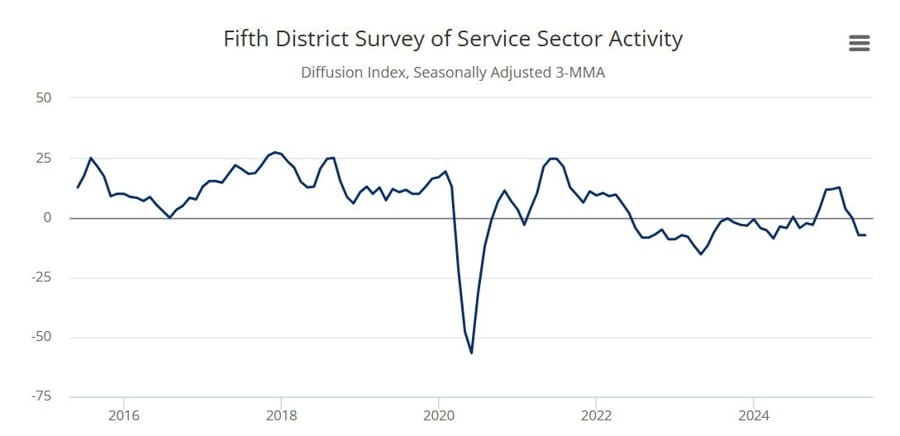

Details showed:

- Service sector activity remained soft in June.

- Revenues index improved from -11 to -4.

- Demand index edged up from -8 to -7.

- Future revenues and demand indexes rose to 20 and 13, respectively.

- Local business conditions index increased from -18 to -16.

- Future local business conditions improved from -18 to -11, but stayed negative.

- Current employment index rose from 0 to 3.

- Future employment index increased from 11 to 14.

- Wages index declined slightly to 19, but firms still expect to raise wages over the next six months.

- Prices paid and received growth edged higher in June.

- Firms expect little change in price growth over the next 12 months.

Overall, both manufacturing and services improved but remained in negative territory.

U.S. Consumer Confidence Falls Sharply in June

Consumer sentiment in the U.S. deteriorated in June, according to the Conference Board’s latest survey.

- Headline Index: 93.0 (vs expected 100.0, prior 98.0)

- Present Situation Index: 129.1 (vs prior 135.5)

- Expectations Index: 69.0 (vs prior 73.6)

- 12-Month Inflation Expectations: 6.0% (vs prior 6.4%)

- Jobs Hard-to-Get: 18.1% (vs prior 18.4%)

The drop was broad-based, with consumers expressing more pessimism about current conditions and future expectations. Despite easing inflation expectations, overall sentiment took a hit.

“Consumer confidence weakened in June, erasing almost half of May’s sharp gains,” said Stephanie Guichard, Senior Economist, Global Indicators at The Conference Board. “The decline was broad-based across components, with consumers’ assessments of the present situation and their expectations for the future both contributing to the deterioration. Consumers were less positive about current business conditions than May. Their appraisal of current job availability weakened for the sixth consecutive month but remained in positive territory, in line with the still-solid labor market. The three components of the Expectations Index—business conditions, employment prospects, and future income—all weakened. Consumers were more pessimistic about business conditions and job availability over the next six months, and optimism about future income prospects eroded slightly.”

U.S. Home Price Data Disappoints as Case-Shiller, FHFA Show Declines

April housing market data painted a downbeat picture for U.S. home prices, with both the Case-Shiller 20-city index and the FHFA national gauge showing month-over-month declines.

- Case-Shiller 20-city m/m: -0.3% (vs expected -0.1%, prior -0.1%)

- Case-Shiller y/y: +3.4% (vs expected +4.0%, prior +4.1%)

- FHFA m/m: -0.4% (vs prior 0.0%)

- FHFA y/y: +3.0% (vs prior +3.9%)

The data points to cooling momentum in housing as high mortgage rates and affordability constraints weigh on demand. Price appreciation has decelerated across most major cities.

Philadelphia Fed Non-Manufacturing Index Improves to -25.0

The Philadelphia Fed’s latest read on non-manufacturing activity improved in June, with the index rising to -25.0 from -41.9 in the previous report.

Though still in negative territory, the smaller contraction suggests modest improvement in services and non-industrial sectors in the region. The rebound may reflect a soft reset after a period of sharp weakness.

Kashkari: Economy’s Foundation Is Solid, But Tariffs Complicate the Picture

Minneapolis Fed President Neel Kashkari offered a measured take on the U.S. economy Tuesday, saying that while inflation remains above target, substantial progress has been made. Businesses continue to report strong internal performance but are increasingly wary of trade policy shifts.

“Fundamentals are good,” Kashkari said, “but tariffs are adding layers of complexity.”

He did not signal any urgency for interest rate cuts but noted that the Fed is watching inflation trends and business sentiment closely. His comments align with broader Fed messaging that monetary policy should remain flexible and responsive to evolving risks.

Fed’s Barr: Policy Position Gives Flexibility as Tariff Effects Loom

Federal Reserve Vice Chair for Supervision Michael Barr reiterated that the current stance of monetary policy is well-positioned to absorb shocks and respond as needed. He emphasized that the U.S. economy remains on solid ground, with stable unemployment and steady progress on disinflation.

However, Barr cautioned that new tariffs could increase inflation in the near term and potentially slow growth, which might nudge unemployment higher. His remarks reinforced Chair Powell’s testimony and added to the chorus of officials urging patience.

“Our job now is to monitor how these factors unfold,” Barr said, “and be ready to act if necessary.”

Powell: Well-positioned for the time being to wait to learn about the course of the economy

- Fed Powell prepared text for his testimony on Capitol Hill

- Fed is well-positioned for the time being to way to learn more about likely course of economy before adjusting policy.

- Economy solid despite elevated uncertainty.

- Near full employment, inflation somewhat above 2% target.

- Attentive to risks on both sides of the Fed’s mandate.

- Strong labor market has helped narrow demographic disparities in earnings, employment.

- Increase tariffs likely to push up on inflation, weigh on economic activity.

- Fed’s obligation is to prevent the one-time increase in price level from becoming ongoing inflation problem by keeping inflation expectations while anchored.

- To meet that obligation will balance employment and price stability mandates.

- Without price stability, cannot achieve long periods of strong labor market conditions.

Fed’s Hammack: Rate policy could be on hold for quite some time

- Comments from the Cleveland Fed President

- Doesn’t see any imminent case to cut rates

- Would rather be slow and right than fast and wrong with mon pol

- Possible tariffs may have one-time hit on inflation but that’s hard to say right now

- US economy has solid momentum, job market solid so far

- Still some ways to get inflation to 2% target

- Tariffs have added uncertainty to outlook

Powell: Many paths on the economy are possible

- Comments in the Q&A from Powell

- Could see inflation come in not as strong as expected, if that’s the case it would suggest cutting sooner

- We could see the labor market weakening and that would also suggest cutting sooner

- If we see labor market stronger, it would suggest cutting later

- A significant majority of policymakers think it will be appropriate to reduce rates later this year

- Projections are subject to great uncertainty

- Too early to know economic implications of the Middle East

- Reason we are not cutting rates is that forecast in and out of Fed expect a meaningful increase in inflation this year

- We don’t see weakness in the labor market, that would matter but we don’t see it

- As long as economy is strong we can take a little bit of a pause here

- It’s too soon to say anything on supply chains, we’re watching that

- We don’t see weakness in the labor market

- If not for our forecast on inflation, we could have continued cutting

- Supply chains really matter, it’s too soon to say on that

- It’s difficult to decide when to move

- Says uncertainty about size and potential potential persistence of inflation from tariffs is reason not to cut rates

- We are getting closer to price stability, not quite there yet.

- Once get there, can react more strongly to downturns in the economy.

- Talk to a lot of lawmakers privately that says the Fed is doing the right thing rates.

- Asset prices high, but leverage in a particularly high.

- Overall financial stability conditions not in a place where we worry a lot.

- We would expect to see meaningful tariff inflation effects in June, July, and August.

- If we don’t see that, that would lead to cutting earlier.

- Fed is in a watch and wait mode.

- Tariffs may prove to be one time hit to inflation, but want to approach that with some care.

- Overall inflation picture is positive.

- Think it is time for us to be seen inflation in the data, if we don’t or do that will matter.

- I would not say dollar is in decline; statements to that effect are premature, overdone

Feds Williams: Modestly restrictive monetary policy gives space to examine new data

- New York Fed president Williams speaking

- Modestly restrictive monetary policy gives space to examine new data.

- US economy in good place, job market is still solid.

- Uncertainty, tariffs and reduced immigration will slow economy.

- US economy likely to grow around 1% this year.

- Expects unemployment rate to rise to around 4.5% by years end.

- Tariffs will boost inflation to 3% this year.

- Expects inflation to gradually put the client to 2% over the next two years.

- Overall inflation close to 2%, but underlying inflation still elevated.

- See signs tariffs impacting inflation in some sectors.

- Flax week soft data versus more resilient hard data.

- Fed balance sheet drawdown continues to be smooth.

- Economy will grow at a slower pace this year.

- Job market to stay solid

- Uncertainty is as important as tariffs impact for economy’s performance.

- If uncertainty resolved, it would give economy a pump.

- Already seen tariff impact in the economy.

- Tariffs may be adding 1/4 of a percentage point to inflation right now.

- Markets have been volatile, but not surprising given policy changes.

- Over last month market volatility has been more normal.

- Has not seen any cracks in the market despite volatility. Monetary policy is very well-positioned.

- Outside of tariffs, inflation is very much on track.

- Hopefully tariff impact won’t last for too long.

- Eventually interest rates need to move lower

Fed’s Bostic: No need to cut rates now

- Comments from the FOMC policymaker

- Sees single quarter point (25 bps) reduction late this year.

- Business officials have become less pessimistic, feel they can manage through tariffs, but say price increases are just a matter of time.

- Labour market remains solid, consumption still resilient.

- Inflation risks remain as businesses run out of ways to postpone tariff driven price hikes.

- Economic growth slowing to 1.1% this year, inflation rising to 2.9%.

Canada Inflation Holds at 1.7% in May, But Monthly CPI Surges

Canada’s consumer price index (CPI) came in flat at 1.7% year-over-year in May, matching both expectations and the prior month’s reading. However, monthly inflation showed unexpected momentum.

- CPI m/m: +0.6% (vs expected +0.5%, prior -0.1%)

- Core CPI m/m: +0.6% (prior +0.5%)

- Core CPI y/y: 2.5% (unchanged)

- CPI Median y/y: 3.0% (prior 3.2%)

- CPI Trim y/y: 3.0% (prior 3.1%)

- CPI Common y/y: 2.6% (vs prior 2.5%)

The data shows sticky underlying inflation, even as headline figures remain anchored. The stronger monthly readings could raise caution flags for the Bank of Canada heading into the next rate-setting cycle.

Commodities News

Gold Falls Below $3,350 as Powell Downplays Urgency for Rate Cuts

Gold prices fell more than 1.5% on Tuesday to around $3,315 as Fed Chair Jerome Powell struck a cautious tone on monetary easing, stating that it’s too early to respond to tariff-driven uncertainty with lower rates.

Middle East tensions also cooled after a ceasefire between Israel and Iran was confirmed, further reducing demand for safe-haven assets. Despite declining Treasury yields and a weaker U.S. dollar, gold failed to find traction.

- 10-Year Yield: 4.30% (-4 bps)

- DXY: 97.79 (-0.56%)

Markets are now focused on Powell’s Senate testimony, upcoming GDP data, and durable goods orders. Other Fed speakers, including Cleveland’s Beth Hammack and New York’s John Williams, also emphasized caution, with inflation expected to settle closer to 2% by 2026.

Oil Sinks for Second Straight Day as Ceasefire Unwinds Geopolitical Premium

Crude oil prices slumped for a second session, shedding another $4.14 to close at $64.37 on Tuesday. That puts the two-day slide at more than $10.50.

Over the weekend, U.S. forces targeted Iran’s nuclear infrastructure. Iran’s measured response — a strike on a U.S. base in Qatar with no reported casualties — was seen as a de-escalatory move. The announcement of a ceasefire between Israel and Iran further eased concerns about a broader regional war.

With the geopolitical risk premium fading, traders have shifted focus back to oversupply concerns. The third round of OPEC+ production increases, set to go live July 1, will restore another 411,000 barrels per day to global output.

From a technical standpoint, oil broke below major support levels:

- 200-day MA: $68.56 (breached Monday)

- 100-day MA: $65.83 (breached Tuesday)

- Key support now: $64.41 (swing low), $60.00 psychological level, and $55.15 (YTD low)

If selling persists, further downside toward $60 or lower remains on the table.

Private Inventory Report Shows Larger-Than-Expected Crude Draw

Private oil stockpile data from the American Petroleum Institute (API) showed a substantial crude draw in the latest weekly reading, ahead of the official Energy Information Administration (EIA) release.

- Crude oil: -4.277 million barrels

- Gasoline: +764,000 barrels

- Distillates: -1.026 million barrels

- Cushing: -75,000 barrels

- Strategic Petroleum Reserve (SPR): +200,000 barrels

The headline crude draw far exceeded expectations and could offer temporary price support heading into the EIA data. However, rising SPR builds and product stockpiles are likely to keep the market cautious until a clearer trend emerges.

Silver Retreats to $35.80, Tests Trendline After Profit-Taking

Silver gave up early gains and traded near $35.80 Tuesday afternoon, bouncing modestly from an intraday low of $35.28 as the metal tested its rising trendline and 21-day EMA support near $35.50–$35.60.

The metal had surged to 13-year highs last week, driven by safe-haven flows and tight supply. But recent selling reflects a wave of profit-taking and waning momentum.

- RSI: 56.50 (neutral zone)

- MACD Histogram: Slightly negative

- Support Levels: $35.50 (trendline), $34.50 (previous resistance)

- Resistance Levels: $36.50 and $37.00

As long as silver holds above key moving averages, the bullish structure remains intact. Market positioning shows traders continue to price in nearly 58 bps of Fed easing by year-end.

Copper Market Faces Tightness as LME Backwardation Hits Multi-Year High

The copper market remains under stress, with near-term supply constraints pushing prices higher and triggering sharp backwardation.

Spot copper on the LME climbed above $10,000 per ton Monday, with the premium over the 3-month contract reaching nearly $380—the highest spread since 2021. Commerzbank’s Barbara Lambrecht attributes the move to a surge in U.S. buying ahead of potential tariffs.

She also noted concerns over long-term supply after reports of negative processing fees for smelters. However, Chinese firms are now reportedly negotiating longer-term contracts with slightly positive terms, easing fears that the country’s copper boom could collapse.

Gold Price Holds Ground Amid Fed Cut Bets, Despite Ceasefire

Gold prices held firm Monday, even as crude fell sharply in response to news of a ceasefire between Iran and Israel. Commerzbank’s Thu Lan Nguyen said the metal’s resilience reflects expectations for a potential U.S. rate cut as early as July.

Fed Governor Michelle Bowman signaled support for a cut if inflation stays in check. With inflation prints under expectations in both April and May, markets are beginning to price in a higher probability of near-term easing.

Gold dipped slightly after the ceasefire was announced but remains within striking distance of the $3,400 level. A confirmed July rate cut could put it back above that mark on a more sustained basis.

Kazakhstan Overproducing Oil Again in June, Weighing on OPEC+ Strategy

Kazakhstan’s crude and condensate production is expected to rise by 6% in June to 2.14 million barrels per day, according to Reuters—well above its OPEC+ quota.

Commerzbank’s Barbara Lambrecht says this consistent overproduction is undermining the cartel’s voluntary cut strategy. If other members follow suit or if Kazakhstan’s overage continues, OPEC+ could be forced to rethink its plan entirely.

Lambrecht warns that if daily production rises by over 400,000 barrels from August onward, a major supply glut could form by autumn—especially once seasonal demand cools. Oil prices could face heavy downside pressure unless new geopolitical risks emerge.

Trump Says China Can Keep Buying Oil From Iran, No Sanctions Planned

In a Monday post, former President Donald Trump announced that China is free to continue buying oil from Iran and suggested U.S. crude exports may also benefit.

“There are no sanctions coming,” Trump said. “Hopefully, they will be purchasing plenty from the U.S., also. It was my Great Honor to make this happen!”

The statement comes amid a rocky week for oil markets and adds a new wrinkle to the global energy supply narrative.

Europe News

HSBC Sees Euro Strengthening to $1.20 on De-Dollarization Trend

HSBC has lifted its euro forecast, targeting $1.20 by the end of 2025. The bank is now explicitly factoring in de-dollarization as a key structural trend that could reshape currency dynamics globally.

Analysts at HSBC see a mix of drivers working against the U.S. dollar—narrowing rate differentials, slower U.S. growth relative to global peers, and reserve diversification by central banks and trade partners. The result, they argue, will be broad-based dollar weakness supporting EUR/USD gains through 2025.

Germany’s Ifo Business Climate Index Improves in June

Germany’s Ifo Institute reported a stronger-than-expected improvement in business sentiment for June:

- Business Climate: 88.4 (vs expected 88.2; prior 87.5)

- Current Conditions: 86.2 (vs expected 86.5; prior 86.1)

- Expectations: 90.7 (vs expected 90.0; prior 89.0, revised)

The gain in expectations helped offset a slight miss in current conditions, suggesting firms remain optimistic about the second half of the year.

UK Manufacturing Orders Slide to Fresh Low in June – CBI

UK manufacturing order books continued to weaken in June, with the CBI’s industrial trends survey showing total orders at -33, the lowest since January and below expectations of -27.

This marks a deterioration from May’s reading of -30 and underscores the ongoing slump in factory activity. However, the average price expectations index for the next three months fell to 19, the lowest since February—suggesting softer inflation ahead.

Amazon Commits $54 Billion to UK Expansion Through 2027

Amazon will inject £40 billion ($54 billion) into its UK operations over the next three years, bolstering its footprint in the company’s third-largest market after the U.S. and Germany. The investment includes a significant logistics build-out and job creation plan.

Two large-scale fulfillment centers are planned for central England by 2027, while new sites in Hull and Northampton—each adding 2,000 jobs—are due to open between 2024 and 2025. Amazon is also enhancing its delivery network, upgrading over 100 facilities, expanding its London HQ, and redeveloping Bray Film Studios in Berkshire.

The UK government has welcomed the investment, calling it a major boost to economic sentiment and employment.

ECB’s Kazimir: I think we are at target when it comes to neutral rate

- Comments from the ECB policymaker

- I am amond the governors who thinks we are at target when it comes to neutral rate.

- Caution will be in first place in policy making.

- I would not touch rates until trade wars situation is clearer.

- Recent days show fragility of inflation outlook.

- The ECB must be vigilant and evaluate incoming data.

ECB’s Villeroy says further rate cuts still possible despite present conditions

- Remarks by ECB policymaker, Francois Villeroy de Galhau, to the FT

- Inflation expectations remain moderate

- Recent uptick in oil prices has partly offset the “significant” appreciation in the euro

- If Iran-Israel ceasefire is confirmed, possible for further policy accommodation in the next six months

- Oil price alone is not a sufficient enough guide for our reaction function

- A neutral rate and a terminal rate are not exactly the same thing

- We will see how things evolve

- The conflict in the Middle East has not altered the underlying inflation outlook for now.

- Inflation expectations remain moderate.

- Significant appreciation of the Euro partly offset the rise in oil prices.

- Now we are back to normal but this does not mean the ECB would keep rates at this level.

- The conflict in the Middle East is a new source of uncertainty.

- The oil price per se is not a sufficient guide for out reaction function.

- If we were to see spillovers to underlying inflation and de-anchoring of inflation expectations, then we could possibly adapt monetary policy.

- We will stick to data driven and meeting by meeting decisions.

- We will see how things evolve.

The full interview can be found here (may be gated).

BOE’s Ramsden notes loosening in labor market, attaches more weight to downside risks

- Comments from the Bank of England’s David Ramsden:

- Says cumulative evidence of ‘material loosening’ in labor market has influenced him

- Says he attaches more weight to downside risks to inflation in medium term

- June decision was a finely balanced judgement for him

- Vacancies to employment has come down ‘significantly’ due to lower vacancies

- Even at 4% monetary policy would remain clearly in restrictive territory

BOE’s Greene: A careful, gradual approach on rate cuts continues to be warranted

- Remarks by BOE policymaker, Megan Greene

- The risks remain two-sided but skewed to the downside on growth but upside on inflation

- Noisy data means that it will take longer for me to take comfort from disinflationary trends

- Given the recent period of elevated inflation, I think price stability is the key priority

- Worried about near-term profile for inflation this year

- It now resembles more of a “plateau” than a “hump” in my view

- The risk is that it feeds through into second round effects, skewing risks to the upside

Asia-Pacific & World News

PBOC Outlines Plans to Boost Consumer Spending and Economic Support

China’s central bank pledged more financial support to the real economy, promising to enhance credit access and reinforce consumption.

The People’s Bank of China said it would increase countercyclical and cross-cyclical adjustments, maintain adequate liquidity, and work to expand financial supply in consumer-related sectors. It also plans to improve financial services tied to employment and income growth.

However, the statement lacked specifics. With China’s domestic demand still under pressure, economic confidence heading into H2 remains fragile.

China Pushes Back on EU Procurement Limits for Medical Devices

Beijing criticized the European Union on Monday over new restrictions impacting Chinese medical device makers. China’s Ministry of Commerce said the actions “hurt Chinese business interests” and demanded an immediate reversal of the measures.

China expressed readiness to engage in dialogue with EU officials but urged Brussels to “correct its mistakes” and stop discriminatory treatment. The dispute adds to ongoing trade friction between the EU and China.

Ford Still Struggling With Magnet Supply Despite China Deal

Ford is still grappling with rare-earth magnet shortages, according to a Wall Street Journal report, despite recent efforts to loosen Chinese export controls. Lisa Drake, a VP at Ford overseeing industrial planning, said the company continues to “move things around” to avoid production stoppages.

Although supply conditions have improved slightly, Ford’s operations remain vulnerable. In May, the automaker was forced to shut down a Chicago-area plant due to magnet shortages.

Since April, China has required permits for rare-earth magnet exports—a critical component in electric vehicle motors. China controls around 90% of global rare-earth supply, making it a dominant force in tech-related manufacturing inputs worldwide.

PBOC sets USD/ CNY central rate at 7.1656 (vs. estimate at 7.1605)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 406.5bn yuan via 7-day reverse repos at 1.40%

- 197.3bn yuan mature today

- net injection is 209.2bn yuan

Japanese Economy Minister Akazawa to visit the US as early as June 26th for tariff talks

- Japanese media, Yomiuri, reporting on the dates – conveyed via Reuters

- Akazawa is arranging his seventh visit to the United States for as early as June 26

- the first ministerial-level tariff negotiation since the Japan-U.S. summit held in Canada on June 16

Japan’s chief cabinet secretary Hayashi says Japan to hold upper house election on July 20

- Hayashi confirming what we already know.

It’s a half-election for the upper house, with 124 of the 248 seats up for grabs

- the ruling LDP-Komeito coalition must retain at least 125 seats to maintain its majority in the upper house.

PM Ishiba, who assumed the premiership in November 2024 following the LDP’s loss of its lower house majority, now leads a minority government.

South Korea Consumer Sentiment Hits 3-Year High, Inflation Expectations Slide

South Korea’s consumer confidence index surged to 108.7 in June, up sharply from 101.8 in May, marking the highest reading since June 2021.

Data from the Bank of Korea also showed consumer 12-month inflation expectations fell to 2.4%, down from 2.6% in May—the lowest since October 2021.

The twin signals of rising optimism and easing inflation expectations come as policymakers seek to balance growth momentum with price stability entering the second half of 2025.

Crypto Market Pulse

Crypto Markets Hold Gains as BTC, ETH, and XRP Ride Ceasefire Optimism

Bitcoin continues to trade firmly above $105,000, while Ethereum and XRP also maintain upward momentum following Monday’s risk-on bounce sparked by the Iran-Israel ceasefire.

President Trump’s announcement of a U.S.-brokered ceasefire came after Iran retaliated with a missile strike on a U.S. base in Qatar, which resulted in no injuries. That limited response paved the way for a diplomatic pause in hostilities and helped reinforce investor appetite for digital assets.

Bitcoin and Ethereum spot ETFs saw renewed inflows:

- BTC ETFs: $350M net inflow on Monday (vs $6.4M on Friday)

- ETH ETFs: $100M net inflow (rebounding from $11M outflow Friday)

Cumulative BTC ETF inflows have now reached $47B, with $127B in net assets. Ethereum’s equivalent funds have pulled in $4B total to date, with $9.3B in AUM.

Ethereum Technicals: ETH is trading near $2,416, anchored by support at the 4-hour 50 EMA. Key resistance levels lie around $2,475 and $2,570. MACD shows a buy signal, and RSI remains bullish above the 50 midline.

XRP Technicals: XRP is up 1.2% at $2.18, extending gains off the $1.90 floor. A move above the 200-period EMA at $2.19 could unlock upside toward $2.33, with MACD and RSI supporting the rally. Key support rests at $2.00 and $2.15.

Market participants remain cautious as crypto continues to track broader geopolitical headlines, but near-term indicators show bullish momentum.

BNB Holds Steady as Nano Labs Launches $500 Million Treasury Bid

BNB climbed 3% on Tuesday as Nano Labs unveiled plans to raise $500 million via zero-coupon convertible notes to build a dedicated BNB treasury.

According to a company statement, the Nasdaq-listed Web3 infrastructure firm intends to use proceeds to purchase up to $1 billion worth of BNB over time, potentially holding up to 10% of the token’s total supply. The notes, issued under a 360-day maturity period, are designed to fund long-term accumulation depending on market conditions.

Binance founder Changpeng Zhao (CZ) acknowledged the move on X, clarifying he and his entities are not involved in the raise.

This comes on the heels of a separate report that former Coral Capital Holdings executives are planning to create a $100 million BNB treasury through a rebranded public company called Build & Build Corporation.

BNB’s price action reflects the growing interest in blockchain-native treasury strategies. The token is now pressing against resistance at $645—strengthened by the 200-day SMA. If it can break above the current descending trendline, BNB could make a run toward $700. A rejection, however, could drag the price back to the $600–$615 support zone.

Bitcoin Rebounds as Geopolitical Risk Fades and Fed Signals Easing on Crypto Oversight

Bitcoin is hovering near $105,000 after a strong 4.3% rally on Monday, sparked by improved sentiment in response to a ceasefire agreement between Israel and Iran and regulatory tailwinds in the U.S.

Donald Trump’s official post on Truth Social confirmed the ceasefire is now active, which helped calm global markets. Crypto assets responded immediately, as investors rotated back into risk assets with expectations of a more accommodative policy backdrop.

The Federal Reserve added fuel to the rebound, announcing that so-called “reputational risk” would no longer be used in assessing banks’ exposure to crypto. This marks a reversal of Operation Choke Point 2.0 — a practice that had discouraged banks from engaging with the digital asset sector.

Senator Cynthia Lummis welcomed the policy shift, calling it a step in the right direction. Traders now await Fed Chair Jerome Powell’s testimony before Congress, along with U.S. data releases including Consumer Confidence and Durable Goods Orders.

Institutional accumulation remains strong, with Strategy and Metaplanet both adding to their BTC holdings, while spot Bitcoin ETFs recorded $350.43 million in inflows Monday alone.

Japan Eyes Bitcoin ETF Legalization, Crypto Tax Cut to 20%

Japan’s Financial Services Agency (FSA) proposed a major overhaul of crypto asset regulation on Tuesday, signaling the potential legalization of Bitcoin ETFs and a dramatic shift in taxation policy.

Under the draft, crypto assets would fall under the Financial Instruments and Exchange Act (FIEA), aligning them with traditional securities. The FSA also supports lowering capital gains tax from up to 55% to a self-reported flat rate of 20%.

The rulebook rewrite will be reviewed June 25 and could open the door to institutional-grade crypto products. It also underscores Japan’s ambitions to be a Web3 and DeFi hub, aiming to boost domestic crypto adoption and capital market inclusivity.

The country’s crypto market is forecast to reach $2 billion in revenue by year-end, with a CAGR of 3.44% through 2026.

XRP Pushes Higher After Ceasefire, Derivatives Market Signals Rally

XRP is extending its recovery after a weekend sell-off brought the token down to $1.90. As of Tuesday, XRP is holding near $2.17 with signs of a breakout forming on technical charts and derivatives metrics.

The ceasefire between Israel and Iran has helped reintroduce risk appetite. At the same time, Fed Chair Jerome Powell stressed that rate cuts aren’t imminent due to ongoing tariff concerns and inflation uncertainty.

Open interest in XRP derivatives rose 5% to $3.74 billion, while trading volume jumped over 10% to $9.5 billion. Liquidations skewed heavily toward shorts ($9.3M vs $3.5M in longs), indicating a short squeeze.

- Long-to-Short Ratio (Binance): 2.38

- Key Levels:

- Support: $1.82 (50-week EMA), $1.38 (100-week), $1.01 (200-week)

- Resistance: $2.50 (May peak), $3.00 psychological zone

The Relative Strength Index (RSI) has flipped bullish again, reinforcing the technical setup for a move beyond $2.50 if momentum holds.

The Day’s Takeaway

United States

Wall Street Rallies on Powell’s Testimony, Stocks Close Near Records

U.S. markets finished sharply higher after Federal Reserve Chair Jerome Powell told lawmakers the economy remains strong, with no current signs of recession. Powell reiterated that the Fed has flexibility due to elevated rate levels but is not rushing into rate cuts. He left the door open for a potential cut as early as July, depending on inflation data and labor market conditions. He warned that summer tariffs could add near-term inflation, but downplayed risks to dual mandate goals. The Dow rose 507 points (+1.19%) to 43,089.02, the S&P 500 gained 67 points (+1.11%) to 6,092.18, and the Nasdaq climbed 281 points (+1.43%) to 19,912.53.

Yields Decline Across Curve, Supporting Equities

- 2-Year: 3.818% (-1.0 bps)

- 5-Year: 3.857% (-2.8 bps)

- 10-Year: 4.292% (-3.0 bps)

- 30-Year: 4.831% (-2.8 bps)

Fed Commentary Highlights:

- Powell: Inflation easing may allow cuts, but tariff risks loom. Majority of Fed sees cuts later in 2025.

- John Williams: Economy solid, but tariffs may add 0.25% to inflation, pushing it to 3% in 2025.

- Neel Kashkari: Businesses remain healthy, but tariffs cloud outlook. Inflation still above target.

- Michael Barr: Policy well positioned; tariffs could raise inflation and slow growth.

Consumer Confidence Weakens

Conference Board’s June confidence index fell to 93.0 vs 100.0 expected. Both present and future expectations declined, while inflation expectations dropped to 6.0% from 6.4%.

Richmond Fed Index Improves Slightly

Manufacturing composite index rose to -7 (vs -10 prior), with gains across shipments and services.

Case-Shiller, FHFA Housing Data Disappoints

Home prices softened:

- Case-Shiller 20-City m/m: -0.3% (vs -0.1% expected)

- FHFA m/m: -0.4% (prior 0.0%)

- y/y readings also missed expectations

Treasury Sells $69B in 2-Year Notes

Auction cleared at 3.786%, with strong direct bidder demand but weaker international interest. Bid-to-cover at 2.58x (vs 2.62x average).

FedEx Warns After Hours

Shares dropped 2.3% post-close. Company cut Q1 EPS guidance to $3.40–$4.00 (vs est. $4.03) and reduced capital spending, citing weak U.S. industrial demand.

Canada

Inflation Steady at 1.7%, But Monthly Pressures Build

Canada’s May CPI:

- y/y: 1.7% (unchanged, expected)

- m/m: +0.6% (vs +0.5% expected, prior -0.1%)

- Core CPI m/m: +0.6%

- Core y/y: 2.5%

- CPI Median/Trim/Common all hovered around 3.0%

The monthly jump raises concerns ahead of the Bank of Canada’s next move, despite the stable annual rate.

Commodities

Crude Oil Drops Again as Ceasefire Unwinds Risk Premium

WTI settled down $4.14 to $64.37, extending its two-day loss to over $10.50. The ceasefire between Israel and Iran defused geopolitical fears, and attention shifted back to oversupply concerns, including a new 411,000 bpd OPEC+ production boost scheduled for July.

- Broke below 200-day MA ($68.56) and 100-day MA ($65.83)

- Testing swing support at $64.41, next support zones at $60.00 and $55.15

API Inventory Snapshot (Private Data)

- Crude: -4.277M barrels

- Gasoline: +764K

- Distillates: -1.026M

- Cushing: -75K

- SPR: +200K

Gold Slides Below $3,350 as Powell Pushes Back on Cuts

Gold fell 1.5% to $3,315 despite a weaker dollar and lower yields. The decline followed Powell’s cautious remarks and easing geopolitical tensions. Markets now await further data and Fed signals before returning to bullish positions.

Silver Tests Trendline Support After Pullback

Silver dropped to $35.80 after touching an intraday low of $35.28. Technicals show RSI easing from overbought and MACD turning slightly negative, but uptrend remains intact above the 21-day EMA and $35.50 support. A rebound could target $36.50–$37.00 if buyers return.

Crypto

Bitcoin Rallies as Ceasefire, Fed Shift Boost Risk Appetite

BTC is holding above $105,000 after a 4.3% gain Monday. Markets responded to the Iran-Israel ceasefire and a surprise Fed policy shift: “reputational risk” will no longer factor into bank examinations for crypto clients, easing regulatory pressure.

BNB Climbs on $500M Treasury Plan from Nano Labs

BNB gained 3% after Nano Labs announced plans to raise $500 million via convertible notes to fund a long-term BNB treasury, potentially acquiring up to 10% of BNB’s supply. Binance founder CZ clarified he has no direct involvement. A separate $100M BNB treasury from ex-Coral Capital execs was also confirmed.

Crypto Majors Hold Gains After Geopolitical Calm

- BTC ETFs: +$350M in inflows Monday (cumulative $47B, $127B AUM)

- ETH ETFs: +$100M inflows (cumulative $4B, $9.3B AUM)

- ETH: Trading at $2,416; technical support at 50 EMA ($2,415), resistance at $2,570

- XRP: Up 1.2% at $2.18, supported at $2.00 and $2.15. A break above $2.19 (200 EMA) could spark further upside.

Market still riding risk-on momentum but remains sensitive to further Fed or macro shocks.