North America News

US Stocks Close Lower as Tech Drags

Wall Street ended Tuesday in the red, snapping its streak of record highs. The NASDAQ led losses, falling 0.95%, its worst day since September 2.

Closing levels:

- Dow Jones Industrial Average: -88.76 points (-0.19%) at 46,292.78

- S&P 500: -36.83 points (-0.55%) at 6,656.92

- NASDAQ Composite: -215.50 points (-0.95%) at 22,573.47

- Russell 2000: -5.82 points (-0.24%) at 2,457.51

Mega-cap tech names led declines:

- Nvidia -2.82%

- Amazon -3.04%

- Oracle -4.36%

- Microsoft -1.01%

- Meta -1.28%

- Tesla -1.93%

US Treasury Sells $69B in 2-Year Notes at 3.571%

The U.S. Treasury auctioned $69 billion in 2-year notes at a high yield of 3.571%, nearly matching the WI level of 3.572%.

Auction results:

- Tail: -0.1 bps (vs -0.5 bps 6-month avg)

- Directs: 30.77% (vs 27.3% avg)

- Indirects: 57.75% (vs 61.4% avg)

- Bid-to-cover: 2.51x (vs 2.61x prior)

The outcome was broadly average, with no major surprises.

US Richmond Fed Index Signals Manufacturing Struggles

The Richmond Fed’s composite index fell to -17 in September, worse than August’s -7.

- Services index: +1 (prior +4)

- Manufacturing shipments: -20 (prior -5)

The results highlight sharp weakness in manufacturing activity. Regional readings have been mixed recently, with Empire State showing weakness and Philadelphia Fed reporting strength.

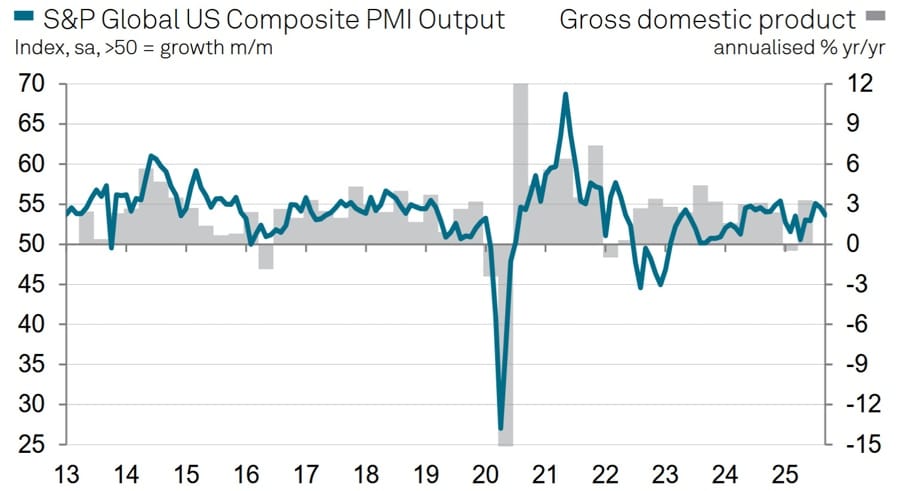

US September Flash PMIs Show Cooling Momentum

S&P Global’s flash PMIs for September indicated softer expansion across services and manufacturing:

- Services PMI: 53.9 (expected 54.0, prior 54.5)

- Manufacturing PMI: 52.0 (expected 52.0, prior 53.0)

- Composite PMI: 53.6 (prior 54.6)

The readings point to continued growth but at a slower pace than earlier in the summer.

Chris Williamson at S&P Global Market Intelligence:

“Further robust growth of output in September rounds off the best quarter so far this year for US businesses. PMI survey data are consistent with the economy expanding at a 2.2% annualized rate in the third quarter.

“However, the monthly profile is one of growth having slowed from its recent peak back in July, and September saw companies also pull back on their hiring. Softening demand conditions are also becoming more widely reported, curbing pricing power. Although tariffs were again cited as a driver of higher input costs across both manufacturing and services, the number of companies able to hike selling prices to pass these costs on to customers has fallen, hinting at squeezed margins but boding well for inflation to moderate.

“The survey data are nevertheless still indicative of consumer inflation remaining above the central bank’s 2% target in the coming months. However, in manufacturing, there are also signs that disappointing sales growth has caused inventories to accumulate at an unprecedented rate, which could also further help soften inflation in the coming months.

“The inventory build-up of course also hints at some downside risks to future production. While growth expectations across both manufacturing and services also continue to be dogged by concerns over the political environment, and especially tariffs, September encouragingly saw business sentiment improve in part due to the anticipated beneficial impact of lower interest rates.”

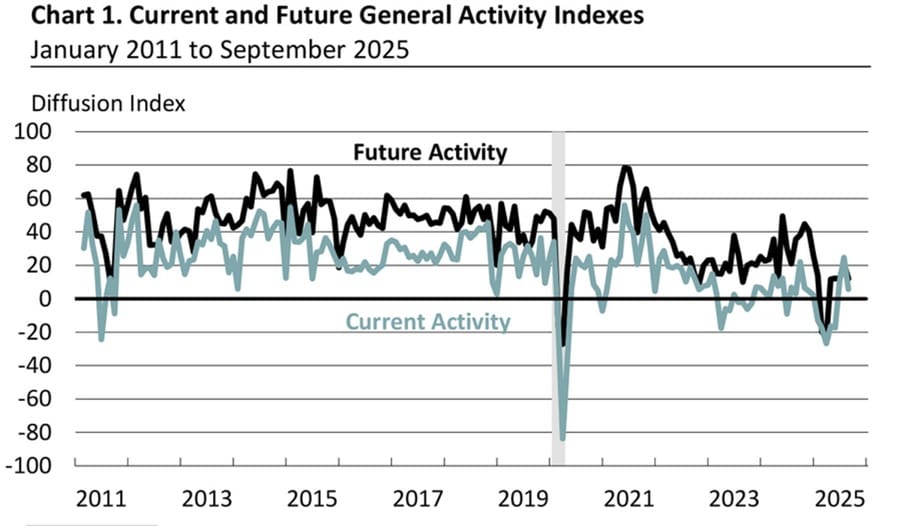

Philly Fed Non-Manufacturing Survey Remains Negative in September

The Philadelphia Fed’s non-manufacturing index improved slightly in September to -12.3, up from -17.5 prior.

Key details:

- General business activity: +5.8 (prior +24.6)

- New orders: +0.5 (prior +21.5)

- Employment, full-time: +9.4 (prior -3.8)

- Prices paid: +38.8 (prior +43.2)

- Capex: +0.2 (prior +10.2)

- Six-month index: -8.4 (prior +1.3)

The report’s signals were mixed, with business activity slowing sharply while hiring picked up. A special survey question revealed that 60% of firms saw higher sales in Q3 than Q2, while 25% reported declines.

US Current Account Deficit Narrows Sharply in Q2

The U.S. current account deficit came in at -$251.3 billion for Q2, narrower than expectations of -$256.8 billion.

The previous quarter’s figure was revised to -$439.8 billion from -$450.2B. Analysts attribute the improvement largely to weaker imports, a consequence of tariff front-loading earlier in the year.

Powell: Labor Market Risks Justified Rate Cut

Fed Chair Jerome Powell, speaking in Rhode Island, explained last week’s rate cut as a response to shifting risks:

- Downside risks to employment outweighed upside risks to inflation.

- The cut was part of moving policy toward a more neutral stance, while keeping it modestly restrictive.

- Growth has moderated, the labor market has softened, and consumer spending has slowed.

- Inflation is still somewhat elevated, with tariffs boosting goods prices but expected to fade by year-end.

Powell noted that PCE inflation likely stood at 2.7% in August, with core PCE at 2.3%. Both remain above target but are largely tariff-driven.

In Q&A, Powell added:

- Beige Book showed only modest growth.

- Hiring has slowed, possibly linked to tariff costs and AI-driven changes.

- Equity prices are “fairly highly valued” but financial stability risks remain contained.

- The Fed is prepared to adjust policy again if data show it’s not in the right place.

Fed Officials Signal Different Shades of Caution

Austan Goolsbee (Chicago Fed)

- Inflation must return to 2% target.

- Neutral rate is likely 100–150 bps lower than current levels.

- Immigration is shifting labor supply.

- Rates can move down eventually, but with inflation over target for 4.5 years, policymakers need to be cautious.

Michelle Bowman (Kansas City Fed)

- Supported last week’s quarter-point rate cut.

- Warned that tariffs are temporary, but risks of housing weakness and fast job deterioration loom.

- Concerned the Fed may be behind the curve on labor market risks.

Raphael Bostic (Atlanta Fed)

- Could support raising the inflation target to 1.75–2.25% in the future.

- Businesses still face cost pressures.

- Said he remains concerned about persistent inflation.

Jamie Dimon: Tariffs Add Inflation, Mild Recession Risk

JPMorgan Chase CEO Jamie Dimon said tariffs will be “modestly inflationary” and “a little recessionary” — though unlikely to trigger a sharp shock.

Dimon explained that the effects won’t hit all at once, but rather in waves. “If they came in immediately, you’d see a spike and then a drop. Instead, they’ll spread out over time,” he said in an interview with The Times of India.

He stressed tariffs alone won’t sink the U.S. economy but warned they are “one more straw on the camel’s back” as businesses brace for higher costs and supply chain disruptions.

Citadel Warns of Seasonal Weakness Despite S&P Rally

Citadel Securities strategist Scott Rubner cautions that the 39th trading week of the year — now underway — has historically been the weakest for the S&P 500, often marked by daily declines of around 1%.

Although the index is up 3% in September so far, history suggests caution. Over the last five years, September has averaged a 4.2% loss. Rubner added that the week following September’s options expiry also tends to bring volatility.

One in Five Global Manufacturers Pulls Back from U.S. Market

A survey by Revalize revealed that 20% of international manufacturers exited or scaled back their U.S. presence over the past year.

The U.S. now ranks among the top three countries seeing retreats, alongside China (22%) and Russia (30%), due to tariffs, compliance costs, and economic uncertainty.

U.S. firms have felt the pain too: 54% reported major revenue declines over the past 12 months. Many companies are diversifying supply chains away from high-tariff regions to protect margins.

Piper Sandler Boosts Tesla Price Target to $500, Cites AI Advantage

Tesla shares advanced after Piper Sandler’s Alexander Potter raised his target to $500 from $400, projecting a record-breaking Q3 in sales.

Potter’s confidence comes after a research trip to China, where leading EV competitors — Xiaomi, Li Auto, and Leapmotor — acknowledged Tesla’s dominance in AI and autonomous driving technology.

While Chinese automakers may hold an edge in manufacturing, Potter noted Tesla’s strength in AI infrastructure and software design. He also pointed to strong reception of the latest Full Self-Driving (FSD) rollout as a further boost to sales momentum.

Goldman Sachs Sees S&P 500 Climbing Toward 7,200 by 2026

Goldman Sachs has revised its S&P 500 forecast upward, now targeting 6,800 by year-end (up from 6,600), implying a 2% rise from the current level.

The bank projects the index to reach 7,000 within six months and 7,200 in 12 months, citing resilient earnings and a dovish Federal Reserve.

The Fed cut rates for the first time since December last week and signaled further quarter-point cuts in October and December. Goldman expects those reductions to proceed, a view echoed by most Wall Street peers.

BOC’s Macklem: USD Hedge Value Under Strain

Bank of Canada Governor Tiff Macklem warned that the US dollar’s traditional role as a hedge may be weakening:

- Trump’s efforts to influence the Fed raise questions about U.S. monetary policy independence.

- New tariffs have cast doubt on the USD’s safe-haven role.

- Canada should chart a more independent course, diversifying markets and reducing reliance on U.S. policy.

Macklem also stressed that independent central banks deliver better price stability, and voiced support for Fed Chair Powell’s leadership under political pressure.

Canadian Housing Prices Fall in August

Canada’s new housing price index dropped 0.3% in August, steeper than July’s -0.1% reading.

The decline underscores ongoing weakness in the housing sector amid elevated borrowing costs.

Commodities News

Gold Hits $3,791 Record Before Pullback on Powell Comments

Gold spiked to a record $3,791 on Tuesday before easing as Fed Chair Jerome Powell’s speech fueled volatility. The metal settled at $3,772, up 0.73% on the day, after bouncing off lows of $3,736.

Drivers of the move:

- Softer US PMI data signaled cooling momentum.

- Powell said downside employment risks justified last week’s rate cut, though inflation remains somewhat elevated.

- He emphasized policy is still modestly restrictive and data-dependent.

Other Fed commentary highlighted the policy divide:

- Raphael Bostic (Atlanta Fed): Open to inflation target range; warned inflationary pressures may persist.

- Michelle Bowman (Fed Governor): Expects three cuts in 2025 to support jobs.

- Austan Goolsbee (Chicago Fed): Stressed need to return inflation to 2%.

Looking ahead, markets await key US data: Durable Goods Orders, the final Q2 GDP print, and the core PCE Price Index, the Fed’s preferred inflation measure.

Crude Oil Rises, Settles at $63.41

WTI crude futures settled at $63.41 per barrel, up $1.13 (+1.81%) on the day.

- Price remains above the 100-day average at $62.71.

- The next resistance is the 100-day moving average at $64.38.

- On the downside, a support zone at $61.45–$61.94 has held for two sessions.

A sustained break above $64.38 would give buyers more control and strengthen upside momentum.

Commodities Outlook: Oil Faces Bearish Pressure, Platinum Supported by Deficits

Oil Forecast

Brent crude prices are forecast to slide from $68 per barrel in August to around $59/b in Q4 2025, with risks of touching $50/b in early 2026.

The bearish outlook stems from a rapid inventory build, as OPEC+ and other producers lift output by more than 2 million barrels per day. With OPEC+ also pledging fresh increases in October, near-term downside looks likely.

If Brent stays close to $50/b, analysts expect eventual supply cuts in 2026 to prevent unsustainable losses.

Platinum Outlook

Platinum has climbed toward $1,410/oz, its monthly high, as supply constraints support prices. The World Platinum Investment Council projects a 2025 deficit of 850,000 oz, with supply at a five-year low.

Despite a slowdown in industrial demand, investment flows and Chinese jewelry purchases remain strong. Platinum is also gaining relative appeal versus gold, aided by Fed easing expectations, a weaker dollar, and geopolitical uncertainty.

Trump Calls on Europe to Halt Russian Energy Imports

Former President Donald Trump reiterated his call for European nations to immediately stop buying Russian energy.

He said he would raise the issue in discussions with European leaders today.

Crude prices reacted, with WTI up $1.13 to $63.40.

Trump: Hungary May Stop Buying Russian Oil

Donald Trump commented that Hungary could soon end its Russian oil purchases, calling it a significant development as the country has been a major holdout within Europe.

He also said NATO allies should shoot down Russian aircraft if they enter allied airspace.

On Denmark, Trump noted he was not sure “what exactly happened.”

Europe News

European Equity Markets Close Mostly Higher

At Tuesday’s close, most major European indices were in positive territory:

- Germany DAX: +0.36%

- France CAC: +0.54%

- Spain Ibex: +0.50%

- Italy FTSE MIB: +0.13%

- UK FTSE 100: -0.04%

The FTSE was the only laggard, finishing marginally lower.

Eurozone PMI Mixed as Services Offset Manufacturing Slump

Eurozone flash PMI figures from HCOB showed uneven performance in September:

- Services PMI: 51.4 (expected 50.5, prior 50.5)

- Manufacturing PMI: 49.5 (expected 50.7, prior 50.7)

- Composite PMI: 51.2 (expected 51.1, prior 51.0)

The services sector provided modest support, while manufacturing returned to contraction territory. Overall growth in private-sector activity remains marginal.

The ECB is seen holding steady for now, though softer inflation signals from the PMI report could encourage a more dovish tone later this year.

HCOB mentions that:

“The eurozone is still on a growth path. Manufacturing output has increased for the seventh month in a row, and business activity in the services sector has been expanding almost continuously since February 2024. That said, we’re still a long way from seeing any real momentum. Just consider that the Composite PMI, which combines activity in both manufacturing and services, hit a modest 51.2 points and reached with this a 16-month high.

The outlook for manufacturing is looking a bit cloudy. Production is still growing, but the pace is being dragged down by France, where the government shake-up in early September likely threw a wrench into companies’ production plans. Apart from this, hopes for an acceleration in growth are not justified as new orders have dropped significantly in both Germany and France. In the medium term, higher defence spending could drive up demand for industrial goods. A more immediate impact might come from Germany’s so-called investment booster and the infrastructure package. Still, according to the survey, confidence in rising output has actually dipped in both Germany and the eurozone overall.

Hiring, which was already pretty sluggish this year, has now come to a halt. That’s due to slower hiring in services and faster job cuts in manufacturing. Germany, in particular, has been a drag here. It is possible that the eurozone’s official unemployment rate, which fell to a seasonally adjusted 6.2% in July, has now bottomed out.

Cost inflation in the services sector, which the European Central Bank watches closely, has eased slightly but remains unusually high given the fragile economic backdrop. Selling prices have cooled more noticeably, which might just prompt the ECB to consider whether a rate cut before year’s end could be back on the table.”

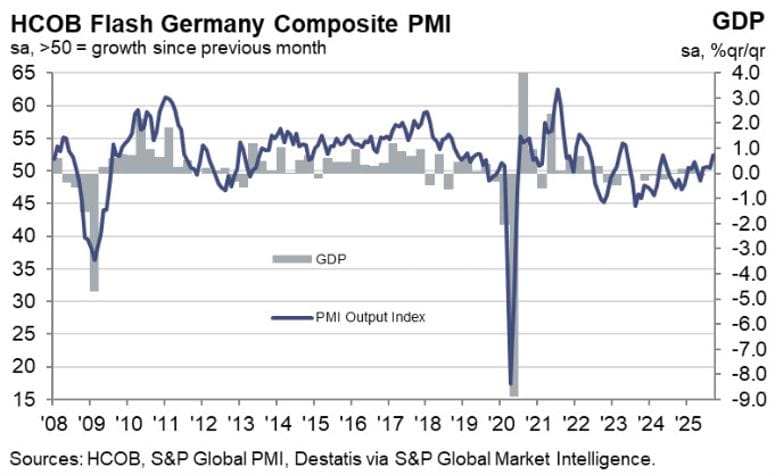

Germany September PMI Shows Divergence Between Services and Manufacturing

Germany’s HCOB flash PMIs revealed mixed results for September:

- Manufacturing PMI: 48.5 (expected 50.0, prior 49.8)

- Services PMI: 52.5 (expected 49.5, prior 49.3)

- Composite PMI: 52.4 (expected 50.6, prior 50.5)

While manufacturing disappointed with another contraction reading, the services sector surged ahead, pushing overall growth to its fastest pace in 16 months.

Analysts say the outlook could improve further if Fed rate cuts continue to ease global financial conditions.

Commenting on the flash PMI data, Dr. Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, said:

“Trouble seems to be brewing in manufacturing. Sure, companies have been ramping up production for seven straight months, but new orders took a nosedive in September. If demand, both at home and abroad, keeps dropping, it won’t be long before firms hit the brakes on production, too.

“The services sector picked up a bit of steam in September. It is back in growth territory, expanding at the joint-fastest pace we have seen all year. That is a turnaround after five months of mostly declining activity. Still, companies are not exactly bursting with confidence. They have actually dialled back their optimism a notch. Given that orders, including those from abroad, are falling again, it is not hard to see why.

“Costs remain a headache for service providers. In September, input costs, which include wages and energy, rose at the fastest rate since April, pushing services input price inflation further above the long-term average. At least services firms managed to pass some of those higher costs on to their customers. Even so, profits are likely under pressure, which probably explains why jobs in this sector have been cut for two months running.

“The overall economy is growing at its fastest clip in 16 months. But do not get too comfortable. Orders are under pressure, especially in manufacturing but also in services, signalling another slowdown could be on the horizon. Despite the promise of billions in capex and investment incentives, business expectations for the year ahead are pretty muted. That is unlikely to change until these investment projects really get off the ground and become visible, not just here and there, but across the board.”

German Tax Revenues Grow, But Recovery Still Elusive

Germany’s federal and state tax revenues rose 2% year-on-year in August to €63.2 billion ($74.4B). From January to August, revenues totaled €576.5B, up 6.8% from last year.

For 2025, analysts expect collections to grow 3.7% to €893.3B.

Despite the stronger receipts, the finance ministry warned there’s no sign of a quick rebound. Germany’s economy shrank for a second straight year in 2024, weighed down by weak domestic demand and U.S. tariffs.

Trade with the U.S., its largest partner, reached €253B in 2024, but external risks remain a major drag.

France September PMI Points to Weakest Activity in Five Months

France’s September flash data from HCOB showed the economy slipping deeper into contraction:

- Services PMI: 48.9 (expected 49.6, prior 49.8)

- Manufacturing PMI: 48.1 (expected 50.1, prior 50.4)

- Composite PMI: 48.4 (expected 49.7, prior 49.8)

Business activity is falling at the sharpest pace in five months as domestic demand remains sluggish. New orders declined for the 16th straight month, underscoring structural weakness.

On the brighter side, employment held steady and price pressures cooled slightly. Still, France stands out as the weakest performer in the eurozone economy this month.

HCOB notes that:

“After signs of stabilization in the French private sector over the summer months, the September data has brought a sobering reality check. Economic activity in France has weakened more sharply than at any point since April. Output has declined in both manufacturing and services, with the respective index for manufacturing falling to its lowest level in seven months. Overall, the composite index has been below the growth threshold for over a year, underscoring the country’s subdued economic prospects. We expect GDP growth rates to be between 0.5 and 1 percent in both 2025 and 2026, with the increasingly tense domestic political situation likely to have a negative impact on household consumption and investment decisions.

“The positive momentum in manufacturing that we observed in August has dissipated in September. The Manufacturing PMI has slipped back below the growth threshold and it is particularly notable that demand-side sub-indices have deteriorated. Production volumes have declined significantly and new orders have also taken a hit. Whether this means the medium-term trend toward stabilization has ended remains to be seen. Forward-looking indicators, such as quantity of purchases, new orders and future business expectations do not suggest any major improvements in the coming months.

“The service sector has also suffered a setback. Although cost pressures in the service sector have eased, providers have also lowered their final prices, likely due to persistently weak demand. This is reflected in reduced workloads and a drop in hiring. So far, real wage gains – which should in theory lead to increased household consumption – have not yet translated into a revival of demand. This situation is likely to persist as long as the political deadlock continues.”

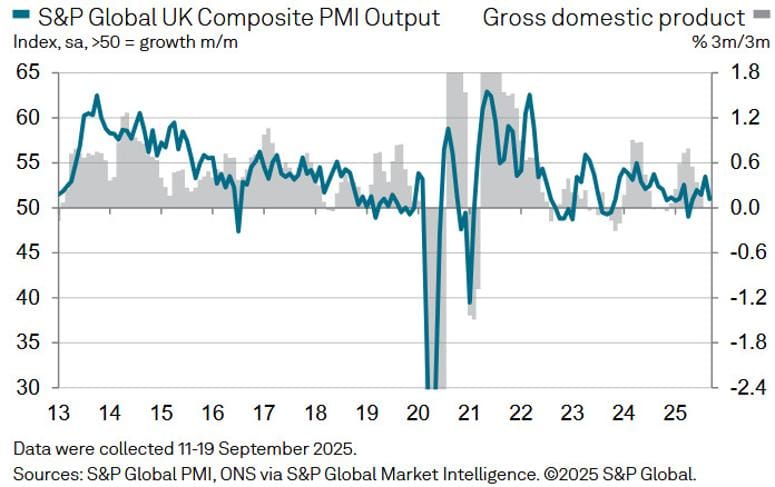

UK PMI Weakens Across the Board in September

The latest S&P Global flash survey showed slower UK growth momentum:

- Services PMI: 51.9 (expected 53.5, prior 54.2)

- Manufacturing PMI: 46.2 (expected 47.1, prior 47.0)

- Composite PMI: 51.0 (expected 53.0, prior 53.5)

The data reveals the slowest private sector expansion since May, with services losing steam and manufacturing sinking deeper into contraction.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence:

“September’s flash UK PMI survey brought a litany of worrying news including weakening growth, slumping overseas trade, worsening business confidence and further steep job losses.

“The only good news is perhaps that, just as the Bank of England grows increasingly worried about persistently elevated inflation, the PMI indicated that price pressures have moderated in September. Companies reported one of the smallest increases in prices charged for goods and services seen since the pandemic.

“With the weakening of business activity growth to a rate consistent with the economy almost stalling, and around 50,000 job losses being signalled by the PMI again in the three months to September, alarm bells should be ringing that the economy is faltering, which could help shift the policy debate at the Bank of England back towards a more dovish stance.

“However, amid talk of further tax rises being needed in the Budget later this year, it’s not surprising to see that business expectations have worsened again in September, and in the absence of an improvement in confidence, it’s unlikely that the economy will make any strong gains in the months ahead irrespective of the outlook for interest rates.”

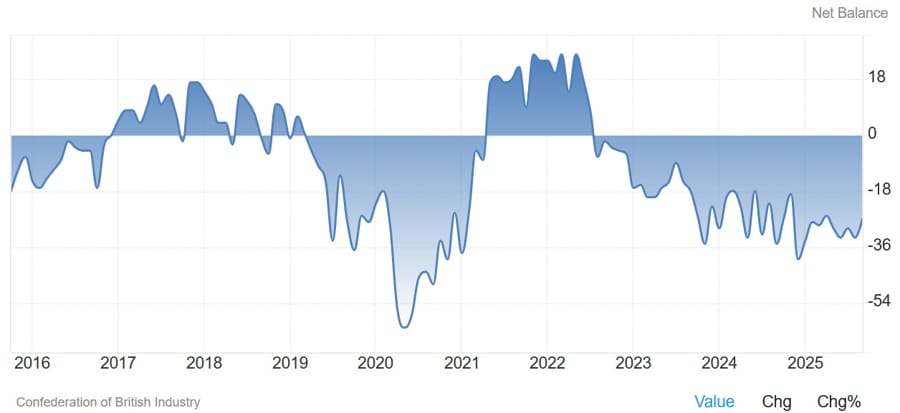

UK CBI Trends Survey: Modest Improvement in September

The CBI September trends survey showed total orders at -27, slightly better than the expected -30 and the prior -33.

Selling price expectations eased, dropping to +4 in September from +9 in August, signaling softer inflationary pressures in the pipeline.

BoE’s Pill: I wanted to keep QT at £100 billion in BoE vote last week

- Comments from the BoE’s policymaker, Huw Pill

- The UK approach to QE is more transparent than elsewhere.

- QE has worked, consequences are challenging to manage.

- We have been clear we will not sell gilts into a dysfunctional market.

- Last week’s MPC vote on QT pace was a pragmatic approach to reducing footprint in markets.

- I put higher weight on the need to get out of QE.

- I have more faith that the market is functioning better.

- UK inflation has proved more stubborn than expected

- Domestic inflation falling at quite a slow pace

- Underlying inflation not back in line yet

- Budget tax changes had direct impact on inflation

- Not seeing a revival in labour force participation

- Less competitive labour market than in the past

- Inactivity, Brexit and immigration changes could allow for larger markups on wage which might support inflation

- I am more comfortable now on balance of inflation risks than 6-12 months ago

- We don’t want to constrain banks’ ability to use liquidity

- We are moving toward a more repo-led system

Asia-Pacific & World News

China Orders Pause on Asset Tokenization in Hong Kong

China’s securities regulator (CSRC) has asked some brokerages to halt real-world asset (RWA) tokenization in Hong Kong, sources told Reuters.

The move comes amid a surge in tokenized products — ranging from stocks to real estate — launched by firms like GF Securities and CMBI.

While Hong Kong is positioning itself as a hub for digital assets, Beijing remains cautious. The CSRC urged tighter risk controls to ensure projects are backed by solid fundamentals.

Despite China’s 2021 ban on crypto trading and mining, shares of firms tied to Hong Kong’s crypto market have surged. Guotai Junan International jumped over 400% after securing approval for crypto trading, while Fosun International climbed 28% following reports of stablecoin discussions.

PBOC sets USD/ CNY central rate at 7.1057 (vs. estimate at 7.1066)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 267.1bn yuan via 7-day reverse repos at 1.40%

- net 10.9bn yuan drain

Australian PMIs Slip Across the Board in September

Australia’s flash PMIs for September 2025 showed a slowdown across all sectors:

- Composite PMI: 52.1 (down from 55.5)

- Manufacturing PMI: 51.6 (down from 53.0)

- Services PMI: 52.0 (down from 55.8)

The data points to weaker business activity, with new orders slowing, manufacturing sliding back toward contraction under U.S. tariff pressure, and export demand softening.

Business confidence fell to a one-year low, though job growth remained stable. Rising input costs continued to squeeze manufacturer margins.

New Zealand Poised to Appoint First Female Central Bank Governor

New Zealand is preparing to name a female Governor for the Reserve Bank (RBNZ) for the first time in history, Bloomberg reports.

The appointment, expected to be announced by Finance Minister Nicola Willis on Wednesday, September 24, 2025, at 1 PM NZT (0100 GMT / 2100 US ET), will replace interim Governor Christian Hawkesby, who stepped in after Adrian Orr’s abrupt departure.

The incoming governor will reportedly be an outsider, not currently on the RBNZ board, and could potentially be a foreign candidate.

Nomura Stays Bullish on Japan Stocks Into 2026, Prefers IT Over Autos

Nomura Asset Management is maintaining a positive stance on Japanese equities, citing attractive valuations and corporate governance reforms as key supports through 2026.

Executives also welcomed the recent U.S.–Japan trade framework, which capped tariffs at 15% and boosted sentiment.

Nomura said it remains overweight in IT while underweighting the auto sector, betting that technology will deliver stronger growth.

Japanese PM Contenders Clash on Fiscal Discipline and Growth

Candidates vying to replace outgoing Prime Minister Shigeru Ishiba are making their economic pitches ahead of the October 4 vote.

- Sanae Takaichi: Plans to use tax revenues for cuts and inflation relief but left the door open to bond issuance if necessary.

- Shinjiro Koizumi: Stressed the need for fiscal discipline but argued that robust growth is the foundation for sound policy.

- Hayashi: Opposed deficit bonds, emphasizing clear signals of fiscal restraint.

The balancing act between growth and discipline has become a central theme of the leadership race.

South Korea’s Producer Prices Dip for First Time Since May

South Korea’s producer price index (PPI) fell 0.1% in August compared with July’s 0.4% increase — the first drop in three months.

The decline was largely attributed to SK Telecom’s one-off 50% bill discount following a major data breach. Without that factor, PPI would have posted a modest gain.

On a year-over-year basis, PPI rose 0.5%, extending its growth streak to 25 consecutive months.

Meanwhile, the domestic supply price index (including imports) edged up 0.2% on higher raw material costs. Consumer inflation cooled to 1.7%, the weakest pace in nine months.

Crypto Market Pulse

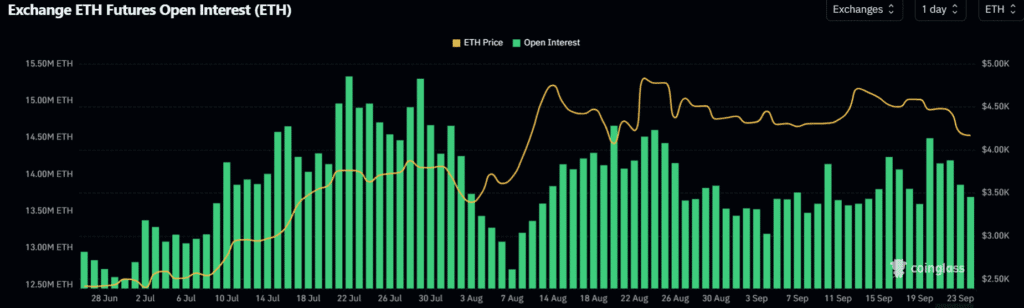

Ethereum Recovers After $490M in Long Liquidations

Ethereum (ETH) traded at $4,160 on Tuesday, bouncing after a sharp $490 million long liquidation event — one of the largest in 2025.

Key points:

- ETH tested the $4,100 support zone, with technical indicators showing oversold conditions.

- Despite heavy liquidations, exchange net outflows exceeded 288,000 ETH, signaling strong accumulation.

- Leverage-driven selling wiped out nearly all of the 890K ETH increase in open interest from the prior weekend.

Analysts note that liquidation resets often clear excess leverage, creating a healthier base for new upside moves.

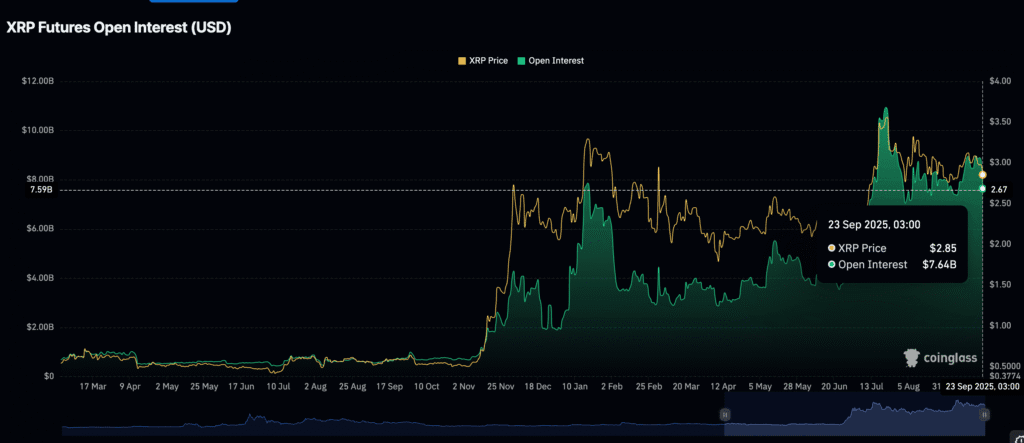

XRP Holds Support as Ripple Expands Institutional DeFi

XRP stabilized above $2.83 support on Tuesday, after falling to $2.69 earlier this week. Futures open interest dropped to $7.64B, down from $8.79B, reflecting weaker retail participation.

Near-term outlook:

- Sideways trading near $2.83

- Rebound toward $3.00

- Risk of a slide toward $2.50 if momentum weakens

Ripple announced progress on institutional DeFi initiatives, including:

- Tokenization of real-world assets (RWAs), with the XRPL surpassing $1B in monthly stablecoin volume.

- New features such as decentralized identifiers (DID), permissioned domains, and a permissioned DEX.

- Plans to launch Credit On-Chain, a native lending protocol offering institutional-scale, underwritten credit with preset amortization schedules.

MEXC Names Cecilia Hsueh as Chief Strategy Officer

Crypto exchange MEXC appointed Cecilia Hsueh as Chief Strategy Officer, signaling its push to evolve into a broader Web3 ecosystem player.

Hsueh co-founded Morph, a Layer-2 scaling project, and previously helped grow Phemex. Her background spans finance, technology, and consulting, reflecting the diverse skills now required in the blockchain industry.

The move comes as exchanges expand beyond trading into payments, NFTs, staking, and DeFi infrastructure. MEXC says the appointment will help it develop strategies for global regulatory compliance and regional market growth.

Other exchanges are making similar moves. In June, Coinbase added David Plouffe, former Obama campaign strategist, to its global advisory council to bolster its regulatory and public policy expertise.

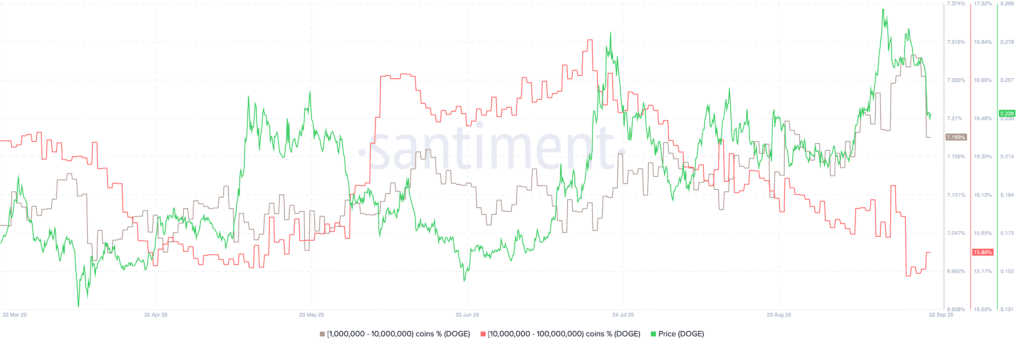

Dogecoin Under Pressure as Whales Cut Holdings

Dogecoin is struggling to hold support near $0.2400, down 21% from last week’s peak of $0.3072. On-chain data shows declining network activity, with daily active addresses at just 55,000 — a steep fall from 517,000 in June.

Large holders have been steadily reducing exposure. Wallets with 10M–100M DOGE now control 15.86% of supply, down from 16.85% in July.

Mid-sized wallets (1M–10M DOGE) had increased holdings through August, peaking at 7.3% on September 8 before slipping back to 7.18%.

If whales keep selling and adoption remains muted, DOGE could struggle to recover toward last week’s highs.

Hyperliquid’s Market Share Crumbles as Rivals Rise

Hyperliquid, once commanding 71% of the on-chain perpetuals market in May, has seen its share collapse to 38%, according to Dune Analytics.

Competitors Lighter (16.8%) and Aster (14.9%) have gained ground, backed by a16z and Binance Labs respectively.

The decentralized perpetuals market has ballooned, with nearly $700B in trading volume over four weeks, and over 80 active protocols compared with just two in 2022.

The rivalry between Hyperliquid and Aster has turned personal: Hyperliquid listed Aster’s token with 3x leverage, only for Aster to retaliate by listing Hyperliquid’s HYPE with a staggering 300x leverage.

Agriculture Firm Turns Bitcoin Miner, Launches AVAX One with Scaramucci’s Backing

AgriFORCE Growing Systems, once known for its agri-tech solutions, has reinvented itself as a bitcoin mining player. Now, the company is taking another leap by forming AVAX One, a venture focused on acquiring AVAX tokens issued on the Avalanche blockchain.

The initiative is backed by Anthony Scaramucci, founder of SkyBridge Capital and ex-Trump adviser, who will serve as head of the advisory board. Scaramucci will guide fundraising and marketing efforts as the firm raises about $550 million from external investors.

Joining him is Matt Zhang of Hivemind Capital, a former Citigroup executive, who has made what the firm calls a “substantial” investment. Zhang is set to chair the new board, while Scaramucci and other partners will collectively hold a controlling stake.

AgriFORCE shares spiked 134% on Monday, even as bitcoin prices slid slightly.

The Day’s Takeaway

North America

US Stocks Close Lower as Tech Drags

Wall Street ended Tuesday in the red, breaking its run of record highs. The NASDAQ fell 0.95%, its worst session since September 2.

- Dow Jones: -88.76 (-0.19%) at 46,292.78

- S&P 500: -36.83 (-0.55%) at 6,656.92

- NASDAQ: -215.50 (-0.95%) at 22,573.47

- Russell 2000: -5.82 (-0.24%) at 2,457.51

Big tech led declines: Nvidia -2.82%, Amazon -3.04%, Oracle -4.36%, Microsoft -1.01%, Meta -1.28%, Tesla -1.93%.

US September Flash PMIs Show Cooling Momentum

- Services: 53.9 (prior 54.5)

- Manufacturing: 52.0 (prior 53.0)

- Composite: 53.6 (prior 54.6)

Growth continues but at a slower pace than summer highs.

Fed Chair Powell: Labor Market Risks Justified Rate Cut

Powell said downside employment risks outweighed inflation risks in deciding on last week’s cut.

- Policy now “more neutral” but still modestly restrictive.

- Inflation remains elevated (PCE 2.7% in Aug; core PCE 2.3%).

- Tariff-driven price pressures expected to fade by year-end.

- Powell noted equities are “fairly highly valued” but no major stability risks.

Fed Officials Send Mixed Signals

- Goolsbee: Neutral rate likely 100–150 bps lower; warned against aggressive easing.

- Bowman: Backed last week’s cut but warned housing and jobs could deteriorate quickly.

- Bostic: Open to higher inflation target; still concerned about cost pressures.

Philly Fed Non-Manufacturing Index Still Weak

Improved to -12.3 in September from -17.5 prior. Hiring improved, but new orders and business activity slowed sharply.

US Current Account Deficit Narrows Sharply

Q2 deficit came in at -$251.3B, smaller than expected (-$256.8B) and sharply narrower than Q1’s revised -$439.8B, largely due to weaker imports.

US Treasury Auction

$69B in 2-year notes sold at 3.571%, broadly average.

US Richmond Fed Survey Weak

Composite index dropped to -17 from -7 prior. Manufacturing shipments fell -20, while services improved slightly to +1.

Citadel Warns of Seasonal Weakness

Strategist Scott Rubner flagged that the 39th trading week is historically the weakest, averaging ~1% daily declines, even as September is up 3% so far.

One in Five Global Manufacturers Pulls Back from US

Revalize survey shows 20% of global manufacturers scaled back US operations over the past year due to tariffs and compliance costs.

Canada: Housing Prices Decline Again

New housing price index fell -0.3% in August, deeper than July’s -0.1%, highlighting sector strain.

BoC’s Macklem: USD Hedge Value Under Strain

Said tariffs and political pressure on the Fed are eroding the dollar’s safe-haven role. Urged Canada to diversify markets and stressed central bank independence.

Commodities

Gold Hits Record Before Pullback

Gold surged to $3,791, then eased to $3,772 (+0.73%). Gains driven by softer US PMIs and Powell’s cautious tone.

Oil Forecast Turns Bearish

Brent seen sliding from $68/b in August to ~$59/b in Q4 2025, with risks of $50/b in early 2026. Rising inventories and fresh OPEC+ supply weigh heavily.

Crude Oil Settles Higher

WTI futures closed at $63.41 (+1.81%), above key $62.71 support. Resistance seen at $64.38.

Platinum Supported by Supply Deficits

Prices neared $1,410/oz on tight supply. WPIC projects an 850k oz deficit in 2025, with Chinese jewelry demand and investment flows providing resilience.

Europe

France PMI Weakest in Five Months

- Services: 48.9

- Manufacturing: 48.1

- Composite: 48.4

New orders fell for the 16th straight month, confirming sluggish domestic demand.

Germany PMI Shows Split Economy

- Manufacturing: 48.5 (contracting)

- Services: 52.5 (fastest in 16 months)

- Composite: 52.4

Services growth offset industrial weakness.

Eurozone PMI Mixed

- Services: 51.4

- Manufacturing: 49.5

- Composite: 51.2

Private-sector growth remains modest.

UK PMI Slows

- Services: 51.9

- Manufacturing: 46.2

- Composite: 51.0

Private-sector expansion is the weakest since May.

UK CBI Trends Survey

Orders improved slightly to -27 (from -33). Selling price expectations eased to +4.

Germany: Tax Revenues Rise

Up 2% YoY in August; Jan–Aug total €576.5B (+6.8%). But recovery remains elusive after two years of contraction.

European Equities Close Mostly Higher

- DAX: +0.36%

- CAC: +0.54%

- Ibex: +0.50%

- FTSE MIB: +0.13%

- FTSE 100: -0.04%

Trump Calls on Europe to Halt Russian Energy Imports

Reiterated push to end purchases. WTI jumped $1.13 to $63.40 on the remarks.

Trump: Hungary May Stop Buying Russian Oil

Added that NATO allies should be prepared to shoot down Russian aircraft entering their airspace.

Asia

Australia PMIs Slip

Composite fell to 52.1 (prior 55.5). Manufacturing (51.6) and Services (52.0) weakened. Confidence dropped to a one-year low.

South Korea PPI Falls for First Time Since May

August PPI -0.1% MoM, mainly due to SK Telecom’s one-off bill discount. YoY PPI +0.5%. Inflation cooled to 1.7%, a nine-month low.

Japan: Nomura Bullish on Stocks

Expects equities to outperform through 2026, overweight IT, underweight autos.

Japan PM Race Highlights Fiscal Divide

Takaichi open to bond issuance if needed, Koizumi stressed discipline, Hayashi opposed deficit bonds. Growth vs discipline is the core debate.

Rest of World

New Zealand to Name First Female Central Bank Governor

Announcement expected September 24, replacing interim Governor Hawkesby. Reportedly an outsider and possibly foreign candidate.

Jamie Dimon: Tariffs Mildly Inflationary and Recessionary

JPMorgan CEO said tariffs will weigh on growth gradually but won’t alone cause a downturn.

Crypto

Ethereum Rebounds After $490M Long Liquidations

ETH at $4,160, recovering from a sharp selloff. Exchange outflows suggest accumulation. Analysts see liquidation reset as a healthier base for upside.

XRP Holds Support, Ripple Expands DeFi Push

Stable above $2.83. Ripple advancing RWAs, permissioned DEX, and new Credit On-Chain lending protocol.

Dogecoin Under Pressure as Whales Exit

Down 21% from last week’s peak. Large wallets trimming holdings; daily active addresses collapsed from June highs.

Hyperliquid Loses Market Share

Once 71% of on-chain perps, now 38%. Rivals Lighter (16.8%) and Aster (14.9%) gain ground.

AgriFORCE Turns Bitcoin Miner, Launches AVAX One

Backed by Anthony Scaramucci and Matt Zhang, the venture aims to raise $550M for Avalanche-based token acquisitions. Shares surged 134%.

China Orders Pause on Asset Tokenization in Hong Kong

CSRC told brokerages to halt some projects amid a surge in tokenized products. Despite the caution, Hong Kong crypto-related stocks have soared.

MEXC Appoints Cecilia Hsueh as Chief Strategy Officer

Part of a pivot toward becoming a broader Web3 ecosystem player, expanding into NFTs, staking, and payments.