North America News

Wall Street Climbs as Iran Strike Fallout Eases, Powell Testimony in Focus

Dow Jones: +374.96 → 42,581.78

Nasdaq: +183.57 → 19,630.99

S&P 500: +57.33 → 6,025.17

U.S. stocks rallied Monday after weathering early jitters over Iran’s missile retaliation against U.S. bases. Initial reports of the attack created uncertainty across global markets, but as more details emerged—namely that the missiles were intercepted and no casualties were reported—a relief rally took hold.

The S&P 500 briefly dipped after hitting resistance at the 6,000 level, only to bounce sharply higher as risk sentiment normalized. News that Iran had notified Qatari officials ahead of the strike helped ease fears of an uncontrollable escalation. By the close, all major indices had posted solid gains, with the Nasdaq and Dow both adding more than 1%.

Sector Highlights

- Energy (-2.5%): The only major sector to close in the red, dragged lower by a 7% plunge in WTI crude prices.

- Consumer Discretionary (+1.8%): Led the market, driven by an 8.2% surge in Tesla (TSLA +26.55 to $348.71) following the launch of its robotaxi service in Austin, TX.

- Real Estate (+1.5%), Utilities (+1.3%), and Financials (+1.2%): Benefited from falling bond yields.

Yield Drop Boosts Rate-Sensitive Sectors

The bond market saw strong demand, pushing yields lower as investors priced in a greater chance of monetary easing:

- 2-Year Treasury Yield: -8 bps to 3.83%

- 10-Year Treasury Yield: -6 bps to 4.32%

Money markets now assign a 22.7% chance of a July rate cut, up from 14.5% on Friday, based on CME FedWatch data.

Fed Governor Michelle Bowman bolstered this dovish outlook, echoing Friday’s remarks from Governor Waller by saying she would consider a rate cut next month if inflation remains under control.

Data Recap: Mixed Macro Picture

- S&P Global Manufacturing PMI (June): 52.0 (unchanged)

- S&P Global Services PMI (June): 53.1 (down from 53.7)

- Existing Home Sales (May): +0.8% m/m to 4.03M SAAR

- Down 0.7% y/y

- Inventory levels rose, but demand remains soft due to affordability pressures tied to high prices and mortgage rates.

What’s Next: Powell’s Testimony, Inflation Watch

Investors now turn to Fed Chair Jerome Powell’s semiannual testimony before Congress on Tuesday. While recent Fed speakers have hinted at easing, Powell’s last press conference suggested a more cautious stance.

Traders will also monitor:

- Consumer Confidence

- Durable Goods Orders

- Jobs and Housing Data

- Core PCE Price Index (the Fed’s preferred inflation measure)

YTD Performance Snapshot

- S&P 500: +2.4%

- Nasdaq: +1.7%

- Dow Jones: +0.1%

- S&P 400 MidCap: -2.3%

- Russell 2000: -4.4%

The day’s trading action reflected cautious optimism: geopolitical risk remains elevated, but the absence of direct military escalation and a possible pivot by the Fed kept bulls in control—for now.

U.S. Flash PMIs Show Modest Cooling in June, Price Pressures Climb

S&P Global’s June flash PMIs for the U.S. revealed a slight softening in economic activity despite outperforming expectations on the manufacturing side.

- Services PMI: 53.1 (expected 53.0; prior 53.7)

- Manufacturing PMI: 52.0 (expected 51.0; prior 52.0)

- Composite PMI: 52.8 (prior 53.0)

Price inflation intensified across both sectors. Manufacturers added staff at the fastest pace in over a year, even as inventories piled up. Meanwhile, services exports contracted sharply in Q2—marking the worst drop since late 2022. While the numbers are above forecast, overall momentum cooled slightly.

Commenting on the flash PMI data, Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said:

“The June flash PMI data indicated that the US economy continued to grow at the end of the second quarter, but that the outlook remains uncertain while inflationary pressures have risen sharply in the past two months. Although business activity and new orders have continued to grow in June, growth has weakened amid falling exports of both goods and services. Furthermore, while domestic demand has strengthened, notably in manufacturing, to encourage higher employment, this in part reflects a boost from stock building, in turn often linked to concerns over higher prices and supply issues resulting from tariffs. Such a boost is likely to unwind in the coming months. Prices for goods have meanwhile jumped sharply again, the rate of increase accelerating to a three year high as firms pass higher tariff-related costs on to customers. Service providers are by no means immune to this tariff impact and likewise reported another jump in prices, often linked to tariffs on inputs such as food. The data therefore corroborate speculation that the Fed will remain on hold for some time to both gauge the economy’s resilience and how long this current bout of inflation lasts for.”

U.S. Existing Home Sales Beat Forecasts in May, Edge Up Slightly

May’s existing home sales data came in stronger than anticipated, signaling some resilience in the U.S. housing market despite broader economic uncertainty.

- May Sales: 4.03 million (expected 3.95 million; prior 4.00 million)

Though the increase was modest, the uptick reflects marginally improved buyer activity, likely aided by easing mortgage rates and pent-up demand.

Fed’s Bowman Signals Shift: Open to Rate Cuts by Summer

Federal Reserve Governor Michelle Bowman indicated a more dovish stance, opening the door to rate cuts as early as July if inflation remains subdued.

Bowman emphasized the need to weigh downside risks to the labor market more seriously and downplayed the inflationary impact of recent trade policy shifts. She added that recent government actions have reduced inflation uncertainty.

She also flagged the Middle East conflict as a potential trigger for higher commodity prices, though she maintained that trade-related inflation remains limited for now.

Fed’s Goolsbee: Thus far impact of tariffs not as bad as feared

- Comments from the Chicago Fed President

- Thus far impact of tariffs not as bad as feared

- Tariffs are not unlike oil shocks with stagflationary implications

- Tariff impact blunted by lower levels and exemptions

- Current form of uncertainty is disconcerting

- Critical to look at soft economic data at current moment of transition

Tesla Debuts Robotaxi Trial in Austin with Safety Monitors, Flat Fares

Tesla has launched a pilot robotaxi service in Austin, Texas, using self-driving cars accompanied by safety monitors but no backup drivers. The test covers a small area and involves about 10 vehicles transporting paying customers.

CEO Elon Musk called it “a decade of work in the making,” touting Tesla’s proprietary AI hardware and software. Participants, mainly social media influencers, were charged a flat $4.20 per ride.

Texas has passed legislation requiring autonomous vehicles to operate at Level 4 autonomy starting September. Tesla’s current system is rated at Level 2.

Experts caution that scaling such services city-wide—or nationally—remains a long-term challenge, with competitors like Waymo further along in development.

Global Security Alert Issued by U.S. State Department Amid Escalating Middle East Conflict

The U.S. State Department has issued a global travel warning, urging American citizens abroad to be on high alert. The advisory points to mounting instability linked to the escalating confrontation between Israel and Iran.

“The ongoing conflict has led to flight disruptions and temporary airspace closures across the Middle East,” the statement read. “There’s a growing possibility of anti-American demonstrations or actions targeting U.S. interests.”

Citizens are urged to remain vigilant as tensions ripple beyond the region.

Commodities News

Gold Surges to $3,385 as Iran Strikes U.S. Bases and Israel Intensifies Assault on Tehran

Gold extended its rally Monday as geopolitical tensions in the Middle East escalated sharply. The yellow metal jumped to $3,385 per ounce, up 0.39% on the day, as reports confirmed Iran had launched missile attacks on U.S. military installations in Qatar, Kuwait, and Iraq. The move came in retaliation for Saturday’s U.S.-led airstrikes on Iran’s nuclear infrastructure.

The situation deteriorated further as Israel intensified its assault on Iranian targets, including a direct strike on Evin prison in northern Tehran—described by Israeli officials as the most forceful bombardment of Iran’s capital to date.

Amid the intensifying conflict, safe-haven demand for gold strengthened. Fed Governor Michelle Bowman added fuel to the rally, signaling she would support a July rate cut if inflation continues to ease. Her dovish tone weighed on both the U.S. dollar and Treasury yields.

- Dollar Index (DXY): -0.25% to 98.52

- 10-Year Treasury Yield: -7 basis points to 4.306%

- Real Yields: down to 1.978%

Risk appetite remained fragile despite economic data showing U.S. manufacturing holding steady at 52.0 and services softening slightly to 53.1 in June.

With Fed Chair Jerome Powell set to testify before Congress Tuesday and the Core PCE inflation report due later this week, traders are watching for more signals on the policy path. However, geopolitics—not macro—dominated the narrative Monday.

Money markets are currently pricing in about 57.5 basis points of rate cuts before year-end, according to Fed fund futures.

WTI Crude Slides Sharply After Iran Missile Strike Fails to Trigger Supply Disruption

WTI crude oil experienced a dramatic reversal on Monday, climbing to an intraday high of $76.74 before plunging nearly 5% to settle near $70.80 per barrel. The early surge followed reports that Iran had fired six missiles at U.S. military bases in Qatar, raising fears of a broader Gulf conflict and potential disruption at the Strait of Hormuz—a corridor vital to roughly 20% of global oil flows.

But the initial panic faded fast. No confirmed damage or casualties were reported, and follow-up coverage indicated that Qatar’s missile defense systems successfully intercepted the threats. Traders quickly pivoted from panic to profit-taking, triggering a steep intraday decline.

The reversal underscored the market’s sensitivity to headlines without any direct impact on supply. Despite high geopolitical tension, the actual fundamentals—inventory levels, demand forecasts, and shipping logistics—remained intact.

Key technical support now sits near $70.00, with downward momentum increasing. Traders remain cautious: a confirmed strike on U.S. assets or a maritime incident in the Strait of Hormuz could reverse the current downtrend instantly.

For now, WTI’s slide reflects skepticism that the geopolitical standoff will trigger real-world supply shocks—at least not yet.

TDS Flags Copper Inventory Crunch as Physical Supply Tightens

Copper inventories are under renewed pressure, according to TD Securities, as visible stockpiles on the London Metal Exchange dwindle and competition for supply grows between China and the U.S.

Senior strategist Daniel Ghali highlighted that copper has been draining from global systems for months, increasing fears of a potential stock-out. Shanghai traders have been aggressively selling positions, totaling 84.5kt in notional copper sales month-to-date, yet replenishment remains scarce.

Despite this, Ghali noted CTA-driven buying could keep upward pressure on LME prices and maintain the squeeze on the forward curve.

TDS: Gold’s Case Strengthens as Geopolitical and Fiscal Risks Loom

Gold is regaining attention as a shield against growing uncertainty, with TD Securities warning that a prolonged U.S. engagement in the Middle East could worsen the fiscal outlook and amplify safe-haven demand.

Daniel Ghali noted that gold remains one of the most effective hedges against geopolitical escalation. He outlined multiple triggers for further price gains, including renewed Fed easing, stagflation, or credibility concerns surrounding the Fed’s leadership transition.

He likened the current setup to early 2024, with gold prices hovering just below record highs and optionality looking underpriced.

TDS: Oil Prices Running Hot Despite No Real Supply Hit

TD Securities sees current oil prices as inflated, driven more by speculation and geopolitical anxiety than actual supply disruption.

Daniel Ghali pointed out that no barrels have been removed from global markets, and Iran continues to export oil despite regional tensions. He argued that economic self-interest will likely keep the Strait of Hormuz open.

Ghali also noted that domestic disruptions in Iran have ironically increased the country’s oil exports, while U.S. shale firms are hedging aggressively—further anchoring a price floor. He warned, however, that CTAs could reverse long positions if crude falls below $76.85/bbl.

Commerzbank: Oil Shock Could Boost Dollar—But Only If Fed Holds the Line

Commerzbank’s Thu Lan Nguyen warned that while rising oil prices typically lift the dollar, this may not hold if U.S. policy loses credibility amid the widening conflict with Iran.

She explained that a higher oil price improves the U.S. terms of trade—making exports more valuable and increasing dollar demand. However, the dollar’s trajectory ultimately hinges on the Fed’s ability to contain inflation.

If monetary policy slips or political instability escalates, Nguyen cautioned that any dollar strength may be short-lived.

Congo Extends Cobalt Export Ban, Prices Surge 35%

The Democratic Republic of Congo has extended its ban on cobalt exports by three months, pushing the suspension through September 2025. The country is the world’s top cobalt producer and its decision has sent shockwaves through global supply chains.

Originally triggered in February when prices fell to a nine-year low of $10 per pound, the halt has since driven prices up 35%. Mining giant Glencore was forced to pause shipments under the initial ban.

Countries like Indonesia are moving to capture a larger slice of the cobalt market in response to Congo’s continued restrictions.

Tankers Divert as Tensions Mount Near Strait of Hormuz

Shipping activity near the Strait of Hormuz is seeing some disruptions, according to data from MarineTraffic and Kpler.

- Three oil and chemical tankers have altered course away from the strait.

- Two supertankers carrying crude oil are also reportedly reversing direction near the area.

These movements come amid growing fears of Iranian retaliation and a possible blockade. While such threats are not new—and Iran has never successfully shut down the strait—markets remain on edge, with oil prices spiking earlier in the week in response.

Oil Markets Brace for Disruption as Analysts Warn of $95/Barrel Risk

Energy analysts are sounding the alarm over potential oil supply shocks stemming from heightened U.S.–Iran tensions. ANZ Bank flagged the strategic Strait of Hormuz as a pressure point, noting that Iranian retaliation could hit global oil flows hard.

“With direct U.S. involvement, the odds of Iran choking off exports have spiked,” ANZ said, forecasting crude prices could climb to the $90–$95 per barrel range.

JP Morgan took a broader view, reminding investors that historical regime changes in the region have led to price surges—up to 76% in some cases—with an average increase of around 30%.

Strait of Hormuz Still Under Threat, RBC Warns Against False Calm

Analysts at RBC Capital Markets are urging markets not to assume the worst is over. They emphasized that Iran has a variety of ways to retaliate beyond full closure of the Strait of Hormuz.

“It’s not just all-or-nothing. Individual tankers and ports remain viable targets,” RBC said. They noted the Iranian response could unfold over days or even weeks, warning against premature optimism.

“We advise investors to be wary of the ‘it’s behind us’ narrative. Risk remains elevated,” they added.

Goldman Sachs Maps $110 Oil Price Scenario if Hormuz Flows Halve

Goldman Sachs has outlined a possible spike in oil prices to $110 per barrel if Iranian actions disrupt shipments through the Strait of Hormuz. While their base case still assumes no major outages, they noted that supply-side risks have increased significantly.

According to their model, even a 1.75 million barrel/day drop in Iranian output would send Brent to $90. But a partial shutdown of Hormuz—cutting flows by 50% for a month and then 10% for the next 11 months—could briefly spike Brent to $110.

They also flagged upside risks to European gas markets, estimating TTF could approach €74/MWh or roughly $25/MMBtu.

Europe News

Eurozone Business Activity Holds Flat in June as Services Stabilize

The Eurozone economy remains stuck in low gear based on flash PMI readings for June. While services activity improved slightly, manufacturing came in weaker than forecast.

- Services PMI: 50.0 (in line with expectations; prior 49.7)

- Manufacturing PMI: 49.4 (vs expected 49.8; prior 49.4)

- Composite PMI: 50.2 (vs expected 50.5; prior 50.2)

The data shows a sluggish recovery, with little sign of a meaningful turnaround. New orders are still falling—though at their slowest pace in a year—while business confidence is improving as trade-related concerns ease. HCOB notes that:

“The eurozone economy is struggling to gain momentum. For six months now, growth has been minimal, with activity in the service sector stagnating and manufacturing output rising only moderately. In Germany, there are signs of a cautious improvement in the situation, but France continues to drag its feet. The momentum evident in the official growth figure of 0.6 percent for the first quarter is unlikely to have carried over into the second quarter, especially since special factors such as Ireland’s unusual jump in growth inflated this figure. However, there is no reason to be resigned, as the outlook has brightened according to the survey and companies are keeping employment roughly constant.

Delivery times increased in June. Given the weak order situation and only moderate growth in production, this may be related, among other things, to the new geopolitical crises and the variable tariff policy of the US. Both factors are making supply chain management more difficult. Overall, however, the delivery time indicator shows that most companies are relatively good at adapting to uncertainty and that there have been no major disruptions so far.

For the ECB, the price environment for services remains slightly tense. Companies are still facing quite significant cost increases and raised their selling prices slightly more in June than in the previous month. This higher inflation in the service sector is partly offset by a deflationary environment in the goods sector. However, energy prices play an important role here. Until recently, they were still falling, but have risen sharply since the conflict between Israel and Iran. This information has only been partially reflected in the surveys. Overall, however, the ECB can remain relatively calm, as the strong euro and the deflationary effect of US tariffs argue against a short-term rise in inflation.”

Germany’s Economy Picks Up Pace in June, Services Surprise to the Upside

German flash PMI data for June shows the economy gaining traction, particularly in the services sector, which outperformed expectations by a wide margin.

- Manufacturing PMI: 49.0 (expected 49.0; prior 48.3)

- Services PMI: 49.4 (expected 47.5; prior 47.1)

- Composite PMI: 50.4 (expected 49.0; prior 48.5)

Key highlights:

- Services activity hit a three-month high.

- Manufacturing output surged to its strongest level in over three years.

- Overall business activity moved back into expansion territory.

The bounce in both services and factory output hints at renewed momentum in Europe’s largest economy.

Commenting on the flash PMI data, Dr. Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, said:

“It looks like Germany’s manufacturing sector might finally be turning a corner. For four months in a row now, production has been ticking up. As a result, economic output in this sector grew in the first half of this year. At 49 points, the headline index is still slightly in recessionary territory, due to factors such as further job cuts, but the trend has been upward since the beginning of the year. It is also encouraging that order intakes have returned to growth, meaning that the momentum of recent months cannot be attributed solely to advance orders from the US, where many companies had stocked up on goods in anticipation of higher tariffs.

“Following the sharp slump in activity in May, the situation in the service sector is stabilizing somewhat. Business activity has declined only slightly, and companies in this sector have increased their staffing levels somewhat more than in the previous month. The fact that companies were able to implement greater price increases than in May also suggests that the sector is not doing as badly as might have been expected after the previous results.

“Changes in inventories are often seen as an indicator of economic turning points. However, the accelerated reduction in inventories should not be misinterpreted in the current context. This may be explained by the fact that some companies were surprised by the higher demand for their goods and therefore drew more heavily on their inventories. The coming months will show whether companies are becoming more confident about the emerging upturn – which is our expectation – or whether they remain cautious and continue to reduce their inventories.

“There is a decent chance Germany could finally break out of the frustrating stop-start growth pattern it’s been stuck in for the past two years – one quarter of growth followed by another of contraction. This is indicated by our nowcast, which takes into account the rise of the Composite PMI. We are confident about the second half of the year anyway, as the new federal government’s initial expansionary measures could then take effect.”

French Private Sector Weakens Further in June as Demand Slips and Jobs Cut

France’s June flash PMI numbers confirm deepening economic strain, with both services and manufacturing readings falling short of expectations.

- Services PMI: 48.7 (vs expected 49.2; prior 48.9)

- Manufacturing PMI: 47.8 (vs expected 50.0; prior 49.8)

- Composite PMI: 48.5 (vs expected 49.3; prior 49.3)

The latest figures from HCOB show demand continues to deteriorate. Employment trends worsened as well, with more firms cutting jobs. These numbers highlight the uphill battle France faces in shaking off its current economic stagnation. HCOB notes that:

“This is a little setback. Since the middle of the first quarter, the headline French HCOB PMI has risen significantly, which had sparked hopes for a recovery in the French private sector. This upward movement was particularly supported by the positive trend in the manufacturing sector. That momentum has now come to a halt, as manufacturing suffered a setback in June, which is weighing on the overall development and dragging down the Composite PMI. The performance of the services sector is underwhelming, though it was broadly similar to the previous month, unlike the manufacturing sector.

“Overall, the question arises whether the decline in manufacturing output this month represents a mere temporary dip or already marks the end of the upward trend. The outlook is certainly clouded, as domestic demand for goods has weakened, as indicated by the decline in new orders. While the ECB’s interest rate cuts, deregulation efforts at the EU level, and planned defence investments are likely to continue providing support to the manufacturing sector, uncertainties surrounding global trade and geopolitics – now further exacerbated by escalations in the Middle East – as well as global competition, are dampening the outlook.

“Since the beginning of the year, price developments have contributed little momentum. That remains unchanged this month. After declining in May, output prices rose marginally in June, but remained at a low level. However, input prices continue to hover at a relatively elevated level, both in services and manufacturing, which is likely to put pressure on corporate margins. A potentially structurally higher oil price as an economic consequence of the Middle East conflict could further exacerbate this issue.”

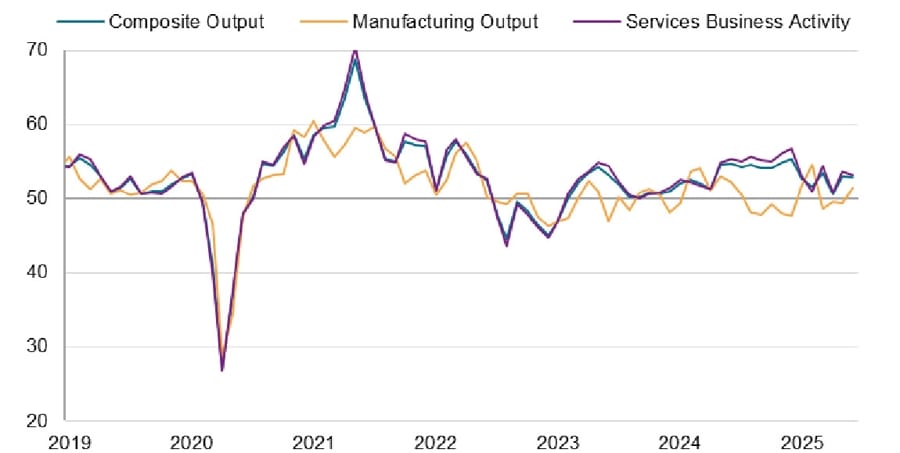

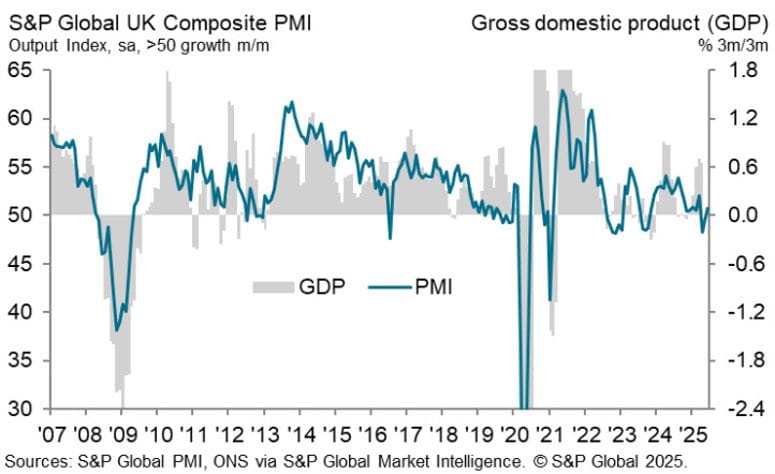

UK Flash PMI: Services Hold Steady, Manufacturing Rebounds Slightly

UK business activity in June showed mixed but slightly encouraging signs, according to flash PMI data:

- Services PMI: 51.3 (in line with forecast; prior 50.9)

- Manufacturing PMI: 47.7 (vs expected 46.6; prior 46.4)

- Composite PMI: 50.7 (vs expected 50.5; prior 50.3)

While overall output increased, job cuts persisted. The bright spot came from a significant easing in prices charged, hitting their lowest level in over four years.

S&P Global noted the soft inflation readings strengthen the case for a Bank of England rate cut in August.

Swiss Sight Deposits Edge Higher After SNB’s Policy Shift

The Swiss National Bank reported a modest uptick in sight deposits in the week ending 20 June:

- Total Sight Deposits: CHF 442.5 billion (prior CHF 434.8 billion)

- Domestic Deposits: CHF 430.0 billion (prior CHF 426.7 billion)

After two weeks of decline, deposits rebounded slightly. The SNB recently reintroduced a tiered remuneration system, effectively discouraging banks from holding excess cash at the central bank. The move aims to stimulate liquidity in local money markets.

ECB’s Lagarde: Survey data point overall to some weaker prospects for economic activity

- ECB Pres. Lagarde speaking

- Survey data point overall to some weaker prospects for economic activity in the near.

- Prior tariffs and a stronger euro are expected to dampen exports.

- Uncertainty is delaying investment decisions.

- Risk to growth outlook remain tilted to the downside.

- Interest rate decisions will be based on inflation outlook, the dynamics of underlying inflation strength of monetary policy transmission.

- Progress toward a digital euro strategic priority

BOE’s Bailey: UK Has Extended Advantage from Low Debt Servicing Costs

Bank of England Governor Andrew Bailey pushed back on criticism of the central bank’s quantitative tightening strategy, insisting the UK stands to benefit from lower debt servicing costs for longer than most advanced economies.

Bailey defended the expense of the UK’s QT program, noting that critics ignore broader structural factors—particularly the UK’s banking ringfence rules, which channel domestic deposits directly into the UK economy. That, he argued, reinforces local lending capacity and cushions economic pressure.

Asia-Pacific & World News

Russia Blames U.S. Strikes for Expanding Iran Conflict, Awaits Talks with Tehran

The Kremlin says U.S. military action against Iran has widened the regional conflict and drawn in more parties.

- President Putin is set to meet Iran’s Foreign Minister today.

- Moscow claims it was not properly briefed ahead of the U.S. strikes.

- Russian officials warn of uncertain conditions around Iran’s nuclear infrastructure and radiation risk.

- The Kremlin says it regrets and condemns the attacks, but adds communication lines with the U.S. remain open.

- A Trump–Putin call can be arranged quickly if needed, but there are no plans for one yet.

Russia describes the situation on the ground in Iran as deeply concerning, and a clear escalation.

Iran Military Issues New Threats, Promises “Heavy Consequences” for U.S.

Iran’s military leadership has escalated its rhetoric, vowing “powerful operations” against the United States in response to recent developments in the Middle East conflict.

Commanders stated that U.S. involvement has expanded what they consider “legitimate targets,” warning of severe retaliation.

A statement from Iran’s central command delivered a pointed message to former President Trump: “You may start this war, but we will be the ones to end it.”

People’s Bank of China sets yuan reference rate at 7.1710 (vs. estimate at 7.1914)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 220.5bn yuan via 7-day reverse repos at 1.40%

- 242bn yuan mature today

- net drain is 21.5bn yuan

Australia’s Flash PMIs Show Strong Services Growth in June

Australia’s early PMI data for June 2025 shows steady factory activity and a notable rise in the services sector. The S&P Global flash services PMI climbed to 51.3 from 50.6, while manufacturing held steady at 51.0.

The composite PMI, reflecting both sectors, came in at 51.2—up from 50.5 in May.

These figures point to modest but encouraging economic momentum, especially in services.

Australian Mortgage Arrears Climb Sharply in Early 2025, Says Fitch

Australian households are feeling the sting of prolonged high interest rates and rising living costs, with Fitch Ratings reporting an unusually large increase in mortgage arrears during Q1 2025.

Conforming loan arrears (30+ days overdue) hit 1.36%, up 23 basis points. Non-conforming loans saw a steeper rise, climbing 39 basis points to 5.32%. That’s nearly triple the typical seasonal increase, which averages about 8 basis points in Q1.

Fitch noted that recent RBA rate cuts in February and May are expected to offer some relief, though their impact won’t be felt until future quarters. Housing prices rebounded 0.9% in Q1, and further gains are expected amid falling rates, tight supply, and immigration-driven demand.

Japan’s June Flash PMI Points to Manufacturing Recovery

Japan’s factory activity posted a meaningful gain in June 2025, with the Jibun Bank manufacturing PMI rising to 50.4 from May’s 49.4, signaling a return to growth.

Services also saw a lift, climbing to 51.5 from 51.0. The composite PMI, which combines manufacturing and services, rose to 51.4 from 50.2.

This marks a solid improvement across sectors and could indicate momentum heading into the second half of the year.

Trump wants a Japan, South Korea, Australia leaders meeting at the NATO summit

- Trump wants to expand security cooperation

Nikkei carries the report:

- Trump seeks Japan, South Korea, Australia leaders meeting at NATO summit

- Summit to include Japanese Prime Minister Shigeru Ishiba, South Korean President Lee Jae myung, NATO Secretary-General Mark Rutte

- Trump regards the meeting as an opportunity for the U.S. and European members of NATO to expand security cooperation

The NATO meeting is Tuesday, 24 June 2025 and Wednesday, 25 June 2025.

Crypto Market Pulse

Crypto Markets Show Resilience After Geopolitical Shock

Crypto assets staged a partial recovery on Monday, bouncing back after weekend losses driven by U.S. military action against Iran. Bitcoin (BTC) reclaimed the $101,000 level after dipping as low as $98,200, and Ethereum (ETH) and XRP also pared declines.

The broader market correction came after U.S. President Trump ordered strikes on Iranian nuclear sites, igniting fears of a regional escalation. Liquidations topped $1 billion, underscoring the event’s market impact.

Bitcoin is now targeting $105,000, supported by the realized price of short-term holders. ETH found footing at $2,111, while XRP clings to $2.00 amid declining exchange reserves and steady product inflows.

Investor Activity Remains Bullish Despite Tensions

According to CoinShares, digital asset products brought in $1.24 billion last week, pushing year-to-date inflows to $15.1 billion. Bitcoin alone accounted for $1.1 billion, while Ethereum added $124 million—its ninth consecutive week of inflows.

Ethereum’s recovery effort hinges on surpassing resistance at $2,366 (100-day EMA), $2,417 (50-day EMA), and $2,469 (200-day EMA). However, its Money Flow Index is nearing oversold territory, suggesting a lack of buying strength.

XRP, meanwhile, remains fragile. If it fails to hold above $2.00, traders should watch for potential retests of $1.80 and $1.61. Upside may be capped at the 200-day EMA of $2.09 in the near term.

Dogecoin Rebounds Sharply After Weekend Shakeout

Dogecoin (DOGE) saw a dramatic reversal after dipping to $0.143 during a weekend selloff. Surging volume—more than five times its average—drove a swift recovery above $0.153, hinting at renewed bullish interest.

DOGE traded in a wide 24-hour range, from a high of $0.157 to a low of $0.143. A strong buying burst around $0.145 helped stabilize price action. Another volume surge around 05:11 pushed the coin to a local high, signaling buyer conviction.

This price action suggests DOGE’s support zone between $0.145–$0.153 is firm, even as broader crypto markets remain sensitive to macro risk. Technical watchers are now eyeing a clean break above $0.1534 as a potential trigger for further upside.

Ethereum Finds Support After U.S.–Iran Escalation, Volatility Soars

Ethereum (ETH) bounced to $2,300 after briefly testing the $2,110 support level over the weekend. The U.S. military’s strike on Iranian nuclear sites, followed by Iran’s reported retaliation at a U.S. base in Qatar, sent ETH into a volatile spiral.

Since Friday, ETH traders have realized over $750 million in gains and losses, while $600 million in long positions were liquidated. Short-term holders drove most of the selling, as shown by the drop in 90-day and 180-day Mean Coin Age.

Derive’s Sean Dawson noted a spike in 7-day implied volatility to 83%, a signal of heightened downside hedging. Despite this, CryptoQuant data shows consistent exchange outflows—totaling nearly 110,000 ETH over three days—hinting at modest accumulation.

U.S. spot Ethereum ETFs also logged $124 million in inflows for the ninth consecutive week, reinforcing investor confidence amid uncertainty.

XRP Struggles Near $2.00 as Macro Risks Cloud Outlook

Ripple’s XRP is holding precariously above the $2.00 mark after a weekend flash crash triggered by U.S. military strikes on Iran. Although XRP-related products attracted $2.69 million in inflows last week, price action remains constrained by geopolitical fears and investor caution.

Exchange-held XRP reserves dropped sharply to $2.3 billion from a peak of $2.9 billion earlier in May, suggesting that some long-term holders may be pulling their tokens off exchanges.

“If Middle East tensions intensify, expect more capital to flee crypto for safer assets,” said Andrejs Balans, risk manager at YouHodler. He noted that XRP could slide further if Iran retaliates.

Still, some analysts see room for recovery. If buyers defend the $2.00 zone, XRP could retest resistance levels at $2.25 and $2.65 in the short term. QCP Capital noted that the market remains “stuck between a risk-on bounce and risk-off retreat,” adding to uncertainty.

ProCap Eyes Public Debut With $1B Bitcoin Treasury, Strategy Adds 245 BTC

Anthony Pompliano’s ProCap BTC is going public via a merger with Nasdaq-listed Columbus Circle Capital (CCCM), creating ProCap Financial—an entity aiming to anchor $1 billion worth of Bitcoin on its balance sheet.

ProCap has already secured $750 million in funding: $516.5 million through equity and $235 million via convertible notes. According to Pompliano, the new company won’t just accumulate Bitcoin—it plans to monetize its BTC holdings through risk-managed strategies.

“ProCap Financial is our answer to the growing demand for Bitcoin-native financial solutions from institutional investors,” Pompliano said.

Meanwhile, Strategy continues its BTC buying spree, adding 245 BTC for $26 million at an average price of $105,856 per coin. Its total holdings now stand at 592,345 BTC, over 2.8% of Bitcoin’s circulating supply.

Japanese firm Metaplanet also entered the headlines Monday, revealing a purchase of 1,111 BTC worth roughly $117 million. This supports its broader ambition to control 1% of Bitcoin’s total supply—targeting 210,000 BTC by 2027.

Bitcoin traded around $103,100 at the time of writing, up 4% following the ProCap announcement.

HYPE Technicals Flash Mixed Signals as Open Interest Stays Firm

Hyperliquid (HYPE) has slipped from its all-time high near $45.71, retreating over 32% before stabilizing around $34.15. Resistance near $37.00 capped the latest recovery attempt following a Middle East-triggered weekend selloff.

Technical indicators remain split: the MACD has issued a fresh buy signal, but the RSI continues to trend lower, suggesting that momentum remains weak and downside risks linger.

Futures open interest in HYPE remains steady at $1.74 billion, indicating investor positioning hasn’t changed significantly despite the volatility. Still, long liquidations surged last week, exposing vulnerability if support at $30.00 fails to hold in the coming sessions.

The Day’s Takeaway

U.S.

- Stocks Rally on Middle East De-escalation, Rate Cut Hopes Grow

U.S. equities surged as fears of a broader Iran–U.S. conflict eased. The S&P 500 closed above 6,000, up 57 points, with the Nasdaq and Dow gaining 183 and 374 points respectively. The relief rally was fueled by confirmation that Iranian missiles launched at U.S. bases in Qatar caused no casualties. - Fed Turns Dovish as Powell Testimony Looms

Fed Governor Michelle Bowman joined the chorus of officials signaling openness to rate cuts, saying a July move is on the table if inflation remains tame. Fed fund futures now price in a 22.7% chance of a July cut, up sharply from 14.5% last week. Attention now turns to Jerome Powell’s testimony before Congress on Tuesday. - Bond Yields Slide

Treasury yields fell across the curve. The 2-year dropped to 3.83%, while the 10-year settled at 4.32%. Lower yields boosted real estate, financials, and utilities. - Data Watch

- Manufacturing PMI (June, flash): 52.0 (unchanged)

- Services PMI (June, flash): 53.1 (down from 53.7)

- Existing Home Sales (May): 4.03 million (+0.8% m/m, -0.7% y/y)

Home inventories rose, but affordability remains tight due to high rates and prices.

Commodities

- Gold Soars to $3,385 as Iran Retaliates, Safe-Haven Demand Explodes

Gold prices pushed higher as Iran fired missiles at U.S. military installations in Qatar, Kuwait, and Iraq. The metal rallied 0.39% to $3,385, supported by falling yields and geopolitical uncertainty. Israel’s strikes on Evin prison in Tehran added to the safe-haven rush. - WTI Crude Reverses Sharply After False Breakout

Oil briefly spiked to $76.74 before tumbling nearly 7% to $68.63. Early buying on fears of Gulf supply disruption reversed after no major damage or escalation was confirmed. Traders locked in profits, and oil closed near session lows. Momentum now favors a retest of support near $70.

Europe

- France’s Private Sector Contracts Again in June

France’s flash PMI data showed economic deterioration continued:- Services PMI: 48.7 (expected 49.2)

- Manufacturing PMI: 47.8 (expected 50.0)

- Composite PMI: 48.5

Demand conditions worsened, and job losses accelerated, keeping France stuck in contraction.

- Germany Shows Signs of Acceleration

Germany’s PMI numbers exceeded expectations, particularly in services:- Manufacturing PMI: 49.0 (expected 49.0)

- Services PMI: 49.4 (expected 47.5)

- Composite PMI: 50.4

Output reached a 3-month high, and manufacturing showed its strongest activity in nearly three years, signaling a potential turning point.

- Eurozone Growth Stabilizing, But Barely

The Eurozone-wide PMIs showed little momentum but some signs of resilience:- Services PMI: 50.0

- Manufacturing PMI: 49.4

- Composite PMI: 50.2

New orders continue to decline, but at a slower pace. Sentiment improved slightly as tariff-related worries faded.

- UK Business Activity Holds Steady, Inflation Eases

Flash PMI readings in the UK suggest a modest recovery:- Services PMI: 51.3

- Manufacturing PMI: 47.7

- Composite PMI: 50.7

Prices charged dropped to a 4.5-year low. The data supports expectations for a Bank of England rate cut in August.

- Switzerland: SNB Deposits Edge Higher

Sight deposits rose to CHF 442.5 billion after the Swiss National Bank reintroduced tiered interest penalties. The shift is intended to push liquidity back into money markets and discourage hoarding at the central bank.

Asia

- Markets Volatile but Resilient After Iran Missile Launch

Asian markets were rattled early by Iran’s strikes on U.S. bases, but sentiment stabilized after reports showed the missiles were intercepted and caused no casualties. Gold and oil saw heavy volume in Tokyo and Shanghai trading hours. - Japan, China Monitor Commodities as Safe-Haven Demand Builds

Gold ETFs saw increased demand in Asia. Crude oil’s sharp reversal also prompted caution among Asian energy traders.

Rest of the World

- Middle East Conflict Escalates But Contained So Far

Iran launched missiles at U.S. bases in Qatar, Kuwait, and Iraq in retaliation for American airstrikes on Iranian nuclear facilities. The attack also included reported closures of the Strait of Hormuz and retaliatory fire toward Israel. - Israel Targets Tehran, Bombs Evin Prison

In its most intense strike on the Iranian capital yet, Israel targeted the notorious Evin prison. U.S. President Trump called the previous weekend’s bombing of Fordow, Natanz, and Isfahan “a very successful operation” and warned of additional action if Iran resists diplomacy.

Crypto

- Bitcoin Rebounds After Dip Below $100K

BTC fell to $98,200 on news of the Iran–U.S. escalation but rebounded to above $103,000 by session’s end. ProCap’s plan to go public with a $1B BTC treasury also buoyed sentiment. - Ethereum Holds $2,300 Amid Volatility Spike

ETH climbed 5% after bouncing from $2,110 support. Short-term holders took on $750 million in realized profits and losses. Spot ETF inflows continued for a ninth week, with $124 million added. - XRP Clings to $2.00 as Macro Uncertainty Weighs

XRP exchange reserves fell to $2.3 billion. Despite $2.69M in institutional inflows, the token remains under pressure from geopolitical volatility and resistance at $2.25. - Hyperliquid (HYPE) Slides 32% from Highs

HYPE continues to correct after hitting $45.71. Futures open interest remains stable at $1.74B, but mixed technicals keep the outlook uncertain. - Dogecoin Bounces Sharply from Weekend Lows

DOGE surged from $0.143 to $0.153, with a massive spike in trading volume signaling strong buyer interest at key support. A clean break above $0.1534 could confirm bullish momentum.