North America News

Markets Sink as Trump Targets Apple and EU With Aggressive Tariffs

U.S. stock markets fell to close out the week after Donald Trump threatened sweeping new tariffs, including a 25% levy on Apple products made outside the U.S. and a 50% flat tariff on all EU imports starting June 1.

Apple’s stock dropped for a seventh straight session, shedding nearly 9% from its mid-May peak. Broader equity markets followed suit:

📉 May 23 Closing Figures:

- Dow Jones: -256.02 pts (-0.61%) to 41,603.07

- S&P 500: -39.29 pts (-0.67%) to 5,802.82

- Nasdaq: -188.53 pts (-1.00%) to 18,737.21

📉 Weekly Losses:

- Dow: -2.47%

- S&P 500: -2.61%

- Nasdaq: -2.47%

Bond yields rose as uncertainty deepened:

- 2-year: 3.993%

- 10-year: 4.509%

- 30-year: 5.031%

Fed officials struck a cautious tone. Chicago Fed President Austan Goolsbee warned of inflation risks tied to tariffs and urged patience. St. Louis Fed’s Musalem flagged concerns that short-term inflation expectations might bleed into longer-term outlooks. Kansas City Fed’s Schmid emphasized the need to focus on hard data over projections amid rising unpredictability.

Markets are now pricing in roughly 83 basis points of rate cuts over the next 12 months, though those expectations may shift again if tariff tensions continue to escalate.

U.S. New Home Sales Jump in April

April saw a strong rebound in new home sales in the U.S., with a seasonally adjusted annual rate of 743,000 units—well above the 693,000 consensus. The prior month was revised down to 670,000 from 724,000. Monthly sales growth came in at 10.9%, more than doubling the previous 2.6% gain. The housing market appears to be regaining momentum after a sluggish start to the year.

Bessent Defends Tariff Plan, Says More Trade Deals Coming

U.S. Treasury Secretary Bessent defended Trump’s proposed EU tariffs, arguing the bloc’s negotiation stance has been too rigid. He hinted at big trade deals ahead, including progress with India and several Asian nations. Bessent also floated the idea of Apple helping rebuild America’s semiconductor manufacturing base.

He predicted “several hundred billion dollars” in tariff revenue annually and said multiple agreements are likely to be unveiled in the next 90 days. Bessent criticized the EU’s collective-action problem but praised Germany’s responsiveness, suggesting a potential reset under Friedrich Merz.

Trump Proposes 50% EU Tariff Starting June 1

Donald Trump has proposed a sweeping 50% tariff on goods from the European Union, set to take effect June 1. The move, he said, stems from frustration over stalled trade negotiations. Trump made clear the tariffs won’t apply to items manufactured within the United States, framing the policy as a push to incentivize domestic production amid a breakdown in talks with the EU.

Fed’s Cook: Seeing some signs of stress among low-moderate income households

Fed’s Cook is out saying:

- Seeing some signs of stress among low – moderate income households

- Sufficiently large income shock could push up defaults, lead to losses for lenders.

- Treasury market function orderly during April volatility.

- Watching commercial real estate market closely.

Fed’s Musalem: Do not want short-term inflation expectations to bleed into longer term

- Comments from Musalem and Schmid

Musalem:

- Businesses expect higher prices for inputs and outputs, Fed is watching that carefully

- Business executives are trying to figure out how to manager uncertainty

- Inflation is stills above target

- Today’s world is very different from the pandemic, one in five chance at most that Fed

Schmid:

- Uncertainty is being driven by the tariff conversation

- Will lean very much on hard data in making interest rates decisions, allows for less focus on forecasts

- Fed needs to be careful how much emphasis it puts on soft data

- The Fed needs to think hard in future years about when and how it wants to use the balance sheet

Fed’s Goosbee: Businesses want some consistency in policy

- Fed’s Goolsbee on CNBC

- Companies want some consistency

- Leaders have to put pencils down because of so much change

- A 50% EU tariff is an order of magnitude different from current situation

- Tariff rates that high would be scary for the suppl;y chain

- There is anxiety among firms that continued tariff announcements would disrupt the supply chain and lead to rising price environment.

- In the short run the Fed needs to wait for the dust to clear, the bar for action is higher until that happens.

- If tariffs have a stagflationary impact then that is the central banks worse situation

- My fear is the data comes out with a lag, so something may have already happened. Upcoming reports may show a more serious impact from actions already taken.

- The market determines the long end of yields. We should take into consideration the impact from that impact on the economy.

- Our job is to look at anything that affects prices and employment

- Interest rates are still within historical ranges, if there is a crisis over US fiscal stability they would be moving higher.

- ON April 2, I thought rates could come down by the end of the year.

- That might be extended out 10-16 months from now.

- Still feel that underneath the volatility, the economy remains strong, if tariffs and uncertainty were not a threat to inflation, rates would eventually fall.

Morgan Stanley Expects S&P 500 to Hit 6,500 by Mid-2026

Morgan Stanley has increased its S&P 500 forecast to 6,500 by mid-2026, citing potential tailwinds from Federal Reserve rate cuts, a softer U.S. dollar, and looser regulations. While cautioning that short-term progress may be slow due to high Treasury yields and persistent inflation, the firm expects gains to pick up later this year, bolstered by upgraded U.S. equity ratings and a strong start to the year.

UBS Raises S&P 500 Forecast on Strong Earnings

UBS has revised its year-end S&P 500 target to 6,000 and now expects the index to reach 6,400 by mid-2026. The bullish outlook is based on better-than-anticipated Q1 earnings and improved U.S. economic indicators. UBS also increased its EPS estimates to $260 for 2025 and $280 for 2026, signaling optimism despite inflation and policy concerns.

Citi Forecasts Economic Slowdown in H2 2025

A new research note from Citi, as cited by CNBC, anticipates a downturn for the U.S. economy in the second half of 2025. The report warns of a “double hit” to demand: first from the direct impact of tariffs reducing consumer purchasing power, and second from a slowdown in spending after prior buying was pulled forward. Citi sees this period as the “calm before the storm.”

Canada Retail Sales Show Mixed Results in March

Canadian retail sales in March rose 0.8%, slightly ahead of the 0.7% forecast, according to new data. However, the gain came with caveats: the prior month was revised lower to -0.5%, and core sales excluding autos dropped 0.7%—sharply missing the flat forecast and reversing from a revised +0.6%.

On a brighter note, the preliminary April figures point to a 0.5% rise, aligning with the recent RBC survey suggesting consumers remained resilient last month.

Commodities News

Gold Soars Past $3,350 as Tariff Tensions Spark Safe-Haven Demand

Gold prices surged nearly 2% Friday, closing at $3,359 and notching a 5% weekly gain. The rally was sparked by President Trump’s tariff threats and concerns about ballooning U.S. debt levels.

Trump’s vow to slap 50% tariffs on EU imports by June 1 rattled investors. Simultaneously, the House passed a $4 trillion debt-heavy budget, raising fiscal alarm bells. The combination of a weaker dollar—DXY dropped below 99.25—and political risk pushed gold sharply higher.

Despite progress in diplomatic talks with Russia and Iran, markets remained firmly risk-off. Traders were also digesting mixed U.S. housing data: New home sales rose 10.9%, while building permits dropped 4%.

Technical indicators favor more upside for gold, with traders now watching upcoming data on durable goods, GDP revisions, and the Fed’s preferred inflation gauge, the PCE Price Index.

Silver Holds Ground Near $33 Amid Fiscal Worries and Trade Tensions

Silver stayed nearly flat at around $33 during Friday’s North American session, trading within Thursday’s price range. The metal showed resilience even as the U.S. Dollar weakened significantly, driven by mounting concerns over U.S. fiscal stability.

The U.S. Dollar Index (DXY) dipped to 99.10—its lowest point in over three weeks—after the Congressional Budget Office warned that President Trump’s new tax-and-spending bill would balloon the national debt by $3.8 trillion over ten years, pushing the total to $36.2 trillion. Moody’s recently downgraded U.S. sovereign credit from Aaa to Aa1, adding pressure on the greenback.

Geopolitical risk is also feeding into silver’s appeal. President Trump threatened a blanket 50% tariff on EU imports starting June 1 unless the goods are produced in the U.S., escalating trade tensions and fueling safe-haven demand.

Technically, silver is range-bound between $31.65 and $33.70, hugging its 20-period EMA near $32.75. RSI between 40–60 signals indecision. Resistance lies at $34.60, with support near $30.90.

Crude Oil Ends Week Higher, but Down From Weekly Highs

Crude oil settled up $0.33 on Friday at $61.53, but finished the week down 0.54%—its first weekly loss in three weeks. The price hit a high of $64.14 during the week before retreating amid renewed concerns over global growth and OPEC+ supply strategy.

The trading range remained tight, with a low of $60.06 and a weekly close below key 100- and 200-hour moving averages (both near $61.66). The technical picture leans bearish heading into next week unless prices push convincingly back above those levels.

Traders are weighing the potential impact of more OPEC+ output increases alongside weaker demand expectations driven by rising tariffs and global economic friction.

Platinum and Palladium Prices Rally on Relative Bargain Status

Platinum jumped 5.6% Tuesday, hitting a 12-month high of $1,090/oz, while palladium climbed 8% to $1,055/oz. The rally comes despite mixed demand forecasts and follows a fresh batch of market outlooks.

At a 3:1 price ratio to gold and a $2,200 discount, these metals appear undervalued. Still, past spikes have quickly reversed. Sustained gains likely depend on clarity around global trade and tariff policy.

U.S. Fiscal Uncertainty Fuels Gold Price Surge

Rising concerns about the U.S. budget deficit have sent gold above $3,300/oz again, according to Commerzbank’s Thu Lan Nguyen. Long-term U.S. bond yields are up, reflecting a rising risk premium.

A pending fiscal package and a U.S. credit downgrade have fueled doubt about Treasuries as safe-haven assets, boosting gold’s appeal. This feedback loop may drive further volatility and price swings in the weeks ahead.

Kazakhstan Overshoots Oil Output Quota Again

Kazakhstan produced around 1.86 million barrels per day in May—well above its OPEC+ quota of 1.49 million. The Tengiz field, responsible for about half the country’s output, has hit peak capacity.

This repeated overproduction may prompt other OPEC+ members, including Saudi Arabia, to boost their own output. A significant production hike in July now appears likely.

North American Rig Counts Drop Sharply

Baker Hughes data shows U.S. rig counts fell by 10 in the past week to 566. The breakdown: oil rigs dropped by 8 to 465, gas rigs fell by 2 to 98, and miscellaneous rigs held steady at 3. Compared to last year, the U.S. count is down by 34 rigs overall.

In Canada, the rig count declined by 7 to 114, with oil rigs down 3 and gas rigs down 4. Year-over-year, the total is 6 rigs lower. Despite the dip, oil rigs are up 7 from the same time last year, while gas rigs are down 13.

Gold Climbs Past $3,300 on Geopolitical Tensions

Gold surged past $3,300 per ounce as global instability and a declining U.S. dollar reignited demand. Commerzbank’s Barbara Lambrecht said gold’s safe-haven appeal is back in focus, though high prices may cool physical demand in Asia.

China’s April imports were likely strong following a quota increase. However, further upside may be limited unless political tensions escalate even more.

Natural Gas Drops on Oversized U.S. Storage Build

U.S. natural gas prices slid after EIA data showed a 120 bcf storage build—much higher than the 87 bcf five-year average. NYMEX Henry Hub futures dropped 3.4% on the day, as noted by ING analysts.

Total storage now stands at 2.375 trillion cubic feet, or 3.9% above the five-year norm. The oversupply could pressure prices further in the short term.

OPEC+ Faces Market Share vs. Price Tug-of-War

Oil markets are bracing for a possible OPEC+ output increase in July. ING analysts expect a 411,000 b/d bump in production, matching May–June expansions. This shift appears to prioritize market share over price stabilization.

EU leaders, meanwhile, are considering lowering the G7’s Russian oil price cap from $60 to $50. Russian Urals currently trade near $55, so changes could impact global shipping and trade flows significantly.

Europe News

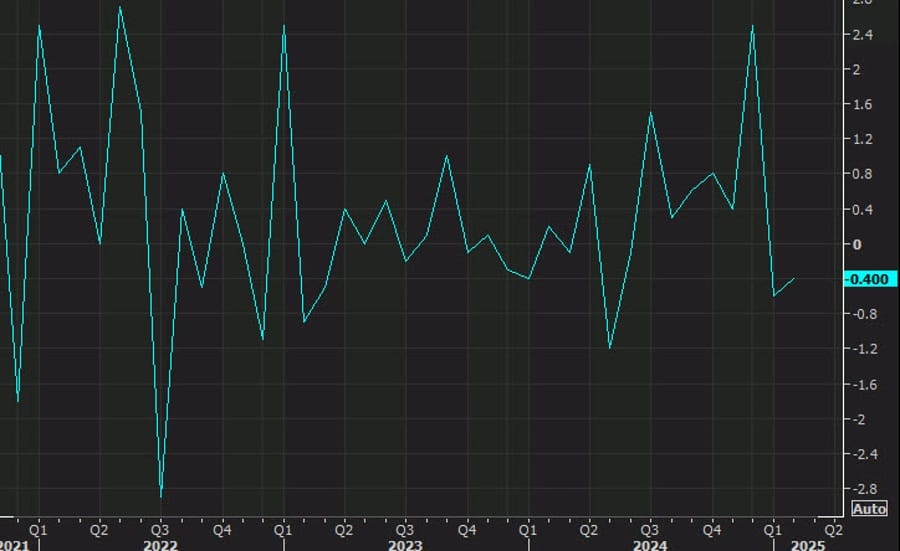

Eurozone Wage Growth Slows Sharply in Q1 2025

The European Central Bank’s negotiated wage indicator showed a sharp slowdown in wage increases for Q1 2025, rising 2.38% versus 4.12% in Q4 2024. While wage growth tends to lag broader trends, the data supports policymakers’ expectations that inflation is on a path back to target.

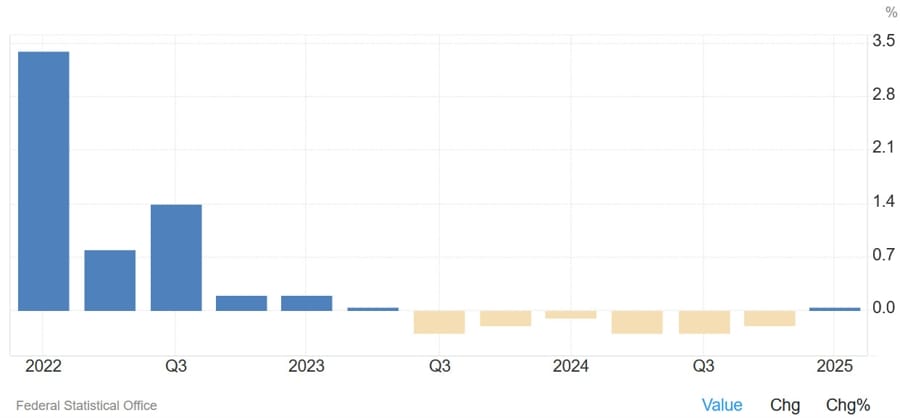

Germany Beats Q1 GDP Estimates With 0.4% Growth

Germany’s economy grew faster than initially thought in the first quarter of 2025. Destatis reported a 0.4% increase in GDP, doubling the 0.2% consensus estimate. The growth revision reflects stronger-than-expected impact from ECB rate cuts and fiscal stimulus, reinforcing optimism for a solid economic trajectory in the coming quarters.

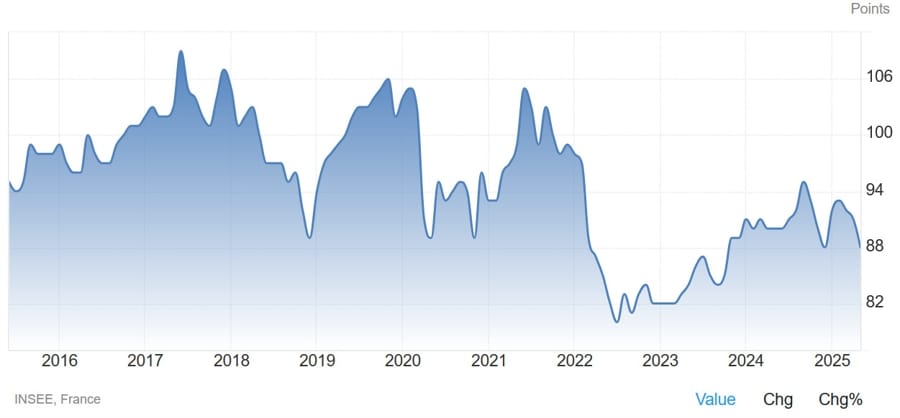

France Consumer Sentiment Falls Further in May

French consumer confidence fell to 88 in May, well below the anticipated 93, according to INSEE data. The prior reading was also adjusted downward to 91 from 92. Confidence has steadily eroded throughout 2025, weighed down by ongoing trade tensions. While sentiment hasn’t bottomed out yet, analysts suggest a potential turnaround could come in the next few months if conditions stabilize.

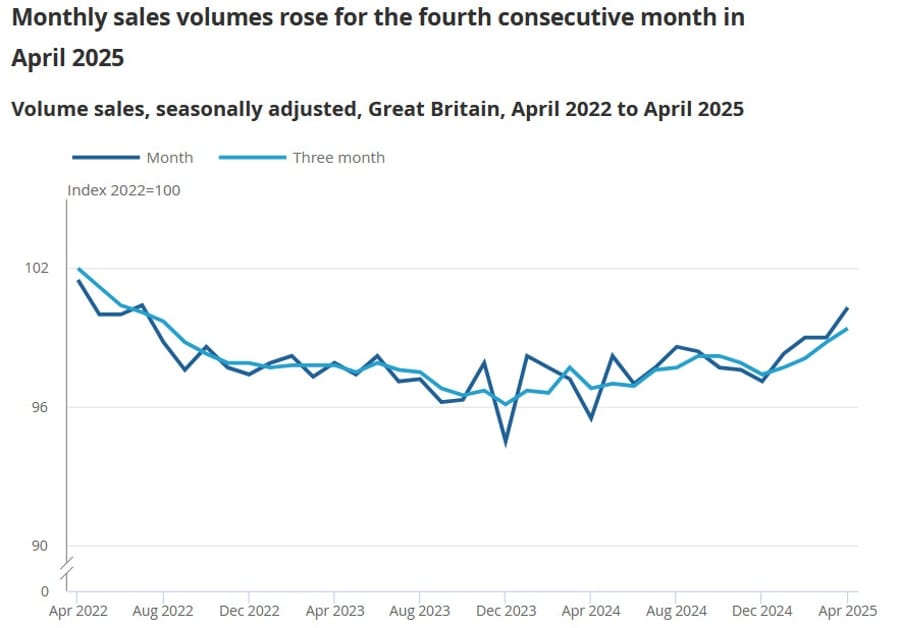

UK Retail Sales Surge Beyond Expectations in April

According to the ONS report released on May 23, UK retail sales jumped 1.2% month-over-month in April—well above the 0.2% forecast. Year-over-year, sales rose 5.0%, beating the expected 4.5%. The prior month’s numbers were revised lower to 0.1% m/m and 1.9% y/y.

Stripping out automotive and fuel sales, the monthly increase was even stronger at 1.3% (vs. 0.3% expected), while the annual figure climbed 5.3% (vs. 4.4%). This represents a significant rebound from the previous revised figures of 0.2% m/m and 2.6% y/y.

UK Consumer Sentiment Improves, But Remains Deeply Negative

The UK’s GfK consumer confidence index improved slightly to -20 in May, up from -23 in April. While this beat the expected reading of -22, sentiment remains well below the long-run average of -11, indicating persistent pessimism among British consumers.

Trump Pressures EU for Tariff Concessions

Former President Donald Trump is urging the European Union to lower tariffs or face retaliatory duties, according to the Financial Times. U.S. Trade Representative Greer is preparing to tell EU officials that a recent explanatory note on tariffs is insufficient. The U.S. is seeking unilateral concessions amid broader trade friction with both the EU and Japan.

ECB’s Lane: Confident services inflation will come down

- Remarks from the ECB policymaker, Philip Lane

- Confident services inflation will come down.

ECB’s Rehn: June cut ‘appropriate’ if data confirm stabilisation of inflation

- Remarks by ECB policymaker, Olli Rehn

- June cut ‘appropriate’ if data confirm stabilisation of inflation, weak growth.

- Given the uncertain environment, the ECB should stick to its data-dependent approach.

ECB’s Lagarde says must question links of dependency that we have with the United States

- Lagarde is in Canada for the G7.

European Central Bank Lagarde is attending the meeting in Banff with finance ministers and central bank governors from the G7 countries. The full official summit is in June.

Lagarde calling for the full implementation of the free trade agreement between Canada and the European Union (EU), Comprehensive Economic and Trade Agreement (CETA)

- warned that international trade will be changed forever by the tensions over tariffs

- “While it is fairly obvious that international trade will never be the same again, it’s also pretty clear that there will be further negotiations,”

- said that with Trump’s extension of his trade war to nearly every country, we must question the links of dependency that we have with each other and, in certain matters, with the United States

ECB’s Stournaras: I see a June rate cut and then pause

- Remark by ECB policymaker, Yannis Stournaras

- I see a June rate cut and then pause.

Asia-Pacific & World News

JPMorgan Cites Signs of Recovery and Foreign Interest in China

JPMorgan is seeing a resurgence in China’s financial markets, according to co-senior China officer Rita Chan. At the Global China Summit, Chan noted rising market liquidity, stronger trading volume, and renewed foreign direct investment. She credited recent government stimulus and Beijing’s reaffirmed commitment to financial reforms for restoring investor confidence.

U.S. and China Diplomatic Officials Emphasize Communication

U.S. Deputy Secretary of State Christopher Landau held a call with China’s Executive Vice Foreign Minister Ma Zhaoxu. Both sides recognized the significance of U.S.-China relations and agreed that maintaining open lines of communication remains vital. The discussion covered several areas of shared interest.

China Trade Council and JPMorgan CEO Discuss Cross-Border Business Ties

On May 22, the head of the China Council for the Promotion of International Trade met with JPMorgan CEO Jamie Dimon. Their discussion focused on strengthening links between American and Chinese businesses and deepening collaboration in financial investments.

TSMC Warns U.S. Chip Tariffs Could Derail Arizona Expansion

Taiwan Semiconductor Manufacturing Co. (TSMC) has cautioned that proposed U.S. tariffs on foreign-made semiconductors could threaten its $165 billion investment in Arizona. In a filing to the U.S. Commerce Department, TSMC expressed concern that weakened demand from the tariffs could hurt the long-term sustainability of its U.S. chip plants. The company noted its Arizona facilities will eventually handle around 30% of its advanced 2nm and future-generation chip production and confirmed construction has started on a third site set to introduce A16 process chips after launching with 2nm.

US Deputy Secretary of State spoke with Chinese counterpart on Thursday

- Nothing much to this report.

US Deputy Secretary of State spoke with Chinese counterpart on Thursday

- Acknowledged the importance of the bilateral relationship to the people of both countries

- Discussed a wide range of issues of mutual interest, and agreed on the importance of keeping open lines of communication

PBOC sets USD/ CNY reference rate for today at 7.1919 (vs. estimate at 7.2151)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 142.5bn yuan via 7-day reverse repos at 1.40%

- 106.5bn yuan matured today

- net injection 36bn yuan

New Zealand Retail Sales Outperform Expectations in Q1 2025

New Zealand’s retail sector posted stronger-than-expected growth in the first quarter of 2025. Overall sales were up 0.8% quarter-over-quarter (vs. 0.1% expected) and 0.7% year-over-year (vs. 0.1%). Core retail sales rose 0.4% for the quarter, below the expected 0.7% and down from 1.4% in Q4 2024.

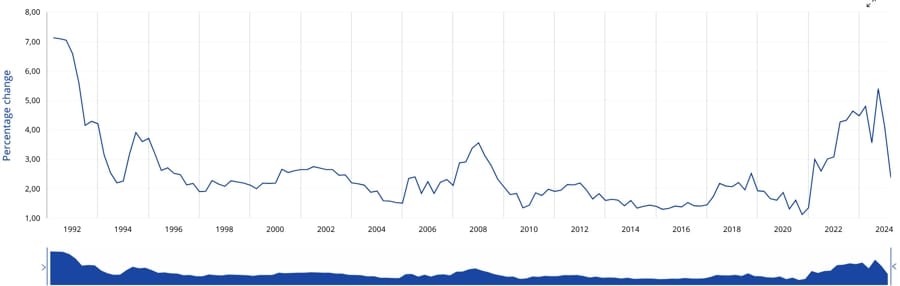

Japan Inflation Stays High in April

Japan’s consumer inflation remained elevated in April. Headline CPI rose 3.6% year-over-year, slightly above expectations. Excluding fresh food, inflation hit 3.5%—the fastest pace in two years. Core inflation, excluding food and energy, reached 3.0%, aligning with forecasts but up from 2.9% in March.

Japan’s Farm Minister Targets Sub-¥3,000 Rice Price

Japan’s new Agriculture Minister, Shinjiro Koizumi, is setting his sights on lowering rice prices. He aims to push the cost of a 5kg bag below ¥3,000. Koizumi plans to bypass traditional auctions by directly releasing government rice stockpiles to retailers—a move aimed at combating rising food inflation.

BoJ Governor Ueda says shared with G7 that should be highly committed to price stability

- Won’t comment on interest rate situation, will closely monitor market

Bank of Japan Governor Ueda:

- Shared with G7 that we should be highly committed with price stability

Japan PM Ishiba: No change to our stance on U.S. tariffs

- Japan wants US tariffs eliminated

Japan PM Ishiba on his call with Trump

- No change to our stance on U.S. tariffs

- Discussed U.S. tariffs with President Trump

- Discussed diplomacy, security with Trump as well

- There might be occasion where I’ll visit U.S. for in-person talks with President Trump

- No change to our stance of demanding elimination of tariffs

- No change to our policy of talking with U.S. on creating U.S. jobs

Crypto Market Pulse

Bitcoin Falls Below $110K After Trump’s Fresh Tariff Threats on EU and Apple

Bitcoin dropped under $110,000 on Friday, reversing part of its recent rally as President Trump reignited trade tensions. The president announced a potential 50% tariff on European Union imports and a separate 25% tariff targeting Apple unless it brings iPhone manufacturing back to U.S. soil.

“Tim Cook has known for years—I expect those iPhones sold in America to be made here,” Trump posted on Truth Social.

The timing rattled financial markets, with Bitcoin falling roughly 2% on the day after climbing nearly 50% since early April. The crypto had just touched a new high of $111,970 the day before. Altcoins also took a hit, with Ethereum, XRP, and Dogecoin all sliding by around 3%.

Analysts suggest Trump’s hardline approach may be more of a negotiation tactic than a finalized policy—but the damage to sentiment is already visible. Stocks opened in the red and pared losses slightly, though volatility remains elevated.

Rising XRP Exchange Reserves Signal Possible Selling Pressure

XRP’s rally to $2.44 may face headwinds as exchange reserves jump from 2.7 billion to 2.9 billion XRP, typically a bearish signal. Whale accumulation continues, with wallets holding 10M–100M coins increasing their share from 11.58% in April to 12.1% this week, per Santiment.

Open interest in XRP futures is also up, now sitting at $4.94B. While this signals more market participation, traders may be cautious due to heightened volatility risks, especially if increased reserves lead to profit-taking.

Big U.S. Banks Move Toward Stablecoin as Senate Pushes GENIUS Act Forward

JPMorgan, Bank of America, Citigroup, and Wells Fargo are laying the groundwork for a joint stablecoin, signaling a major shift in U.S. banking’s relationship with crypto. The dollar-pegged coin would compete with industry staples like USDT and USDC, potentially transforming payment infrastructure across the financial sector.

This move comes as the GENIUS Act—landmark legislation regulating stablecoins—makes headway in the U.S. Senate, passing a critical cloture vote 66–32. Under the bill, the Federal Reserve and OCC would supervise large-scale issuers, while smaller players fall under state oversight.

Supporters argue the stablecoin and bill together could future-proof U.S. payment systems. Paul Atkins, SEC Chair under the Trump administration, has also pledged a cooperative approach to crypto, steering clear of the regulation-by-enforcement stance of past leadership.

JUP Targets $0.82 as Jupiter Lend Prepares to Launch

Jupiter (JUP) surged 16% after announcing Jupiter Lend, a new DeFi lending platform built on Solana in partnership with Fluid. The lending app features a dual-layer architecture and promises fast liquidity against crypto collateral.

JUP is riding the momentum of a bullish technical setup—a confirmed inverted head-and-shoulders pattern points to a potential 41% rally toward $0.82. RSI is nearing overbought at 68, while MACD confirms a bullish crossover. The project’s Total Value Locked (TVL) on DeFiLlama is $2.677 billion, making it Solana’s largest DEX.

Meme Coin Bonk Climbs as TRUMP Slides on Tariff Fallout

Bonk (BONK) and Fartcoin (FARTCOIN) continue to gain ground as TRUMP, a meme coin tied to Donald Trump, faces backlash following his proposed EU tariffs. BONK, up over 50% in the past month, is aiming to retest $0.00003. MACD indicators suggest continued bullish momentum.

TRUMP, on the other hand, slipped below $13 after peaking near $16, struggling to recover as negative sentiment around Trump’s dinner events and trade war rhetoric weighs on demand.

Texas Poised to Establish Bitcoin Reserve With Senate Bill 21

Texas is on track to become the second U.S. state to hold Bitcoin reserves. A decisive 101–42 House vote on Senate Bill 21 sends it to Governor Greg Abbott, a known crypto supporter. The legislation allows the state comptroller to manage digital assets, including Bitcoin—currently the only crypto meeting the bill’s market cap criteria.

With a $2.7 trillion economy and rising influence in crypto mining, Texas could shape national digital asset strategies. This bill joins a wave of state-level crypto efforts, even as others like Florida and Montana have hit roadblocks over volatility concerns.

Whale Moves Signal Pi Network May Slide to $0.66

Pi Network (PI) fell 4% on Friday, trading at $0.79 amid signs that the latest rebound is faltering. Whale transfers tracked by PiScan and a technical breakdown in short-term charts suggest PI may revisit its recent low at $0.66.

Despite a brief boost after Consensus 2025 and a $100M startup initiative announcement, investor sentiment weakened again. Technical indicators such as the RSI (at 48) and MACD show bearish momentum. If the trendline breaks, downside targets lie at $0.66 and $0.57. A rebound off the 200 EMA near $0.78 could keep the uptrend alive with a possible bounce back to $0.84.

Major U.S. Banks Explore Joint Stablecoin Project

Leading American banks—including JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo—are in early talks about launching a joint stablecoin. The goal is to enhance transaction efficiency, especially for cross-border payments, and challenge the dominance of existing crypto alternatives. Although the initiative is still conceptual, banks are discussing a model that would allow others to use the digital currency. Security and regulatory issues remain key hurdles.

Wall Street Journal (gated) report

The Day’s Takeaway

United States

- Trump Rekindles Trade War with EU and Apple

Former President Donald Trump declared a 50% tariff on all EU imports starting June 1, and warned Apple of a 25% tariff if it doesn’t relocate iPhone manufacturing to the U.S. Apple shares have fallen nearly 9% over the past seven sessions. - Markets Close Lower Amid Policy Uncertainty

- Dow Jones: -0.61%

- S&P 500: -0.67%

- Nasdaq: -1.00%

Equities ended the week on a sour note as trade policy instability weighed on sentiment. Weekly losses for all three indexes exceeded 2.4%.

- Bond Market Volatile as Fed Officials Sound Caution

Long-end yields rose sharply:- 10-year yield: 4.509% (+6.4 bps for the week)

- 30-year yield: 5.031% (+12.7 bps for the week)

Fed speakers including Goolsbee, Musalem, and Schmid warned that tariff uncertainty is complicating inflation and interest rate outlooks.

Canada

- Retail Sales Surprise on Headline Beat, But Core Misses

- Headline (March): +0.8% m/m vs +0.7% expected

- Ex-Autos: -0.7% m/m vs 0.0% expected

Early April data suggests a 0.5% rise, consistent with stronger consumer sentiment, but underlying weakness is evident in core figures.

Commodities

- Gold Rockets to $3,359 on Safe-Haven Demand

Fueled by Trump’s tariff announcement, a weaker U.S. Dollar, and a $4 trillion fiscal package, gold gained 2% Friday and 5% for the week. The DXY fell to 99.24. - Silver Holds Flat at $33 Despite Bullish Tailwinds

The white metal remains in a tight range as traders weigh fiscal risks and global trade escalation. Key resistance at $34.60, support at $30.90. - Crude Oil Ends Higher but Logs Weekly Decline

- Friday Close: $61.53 (+$0.33)

- Weekly Change: -0.54%

Market remains cautious ahead of potential July output hikes by OPEC+. Growth concerns linked to tariffs are also dragging on sentiment.

- Natural Gas Drops on Oversized Inventory Build

EIA data showed a 120 bcf increase in storage—well above the five-year average. Prices fell 3.4% on the day, with inventories now 3.9% above trend. - Platinum & Palladium Bounce Off Lows

Platinum surged 5.6% to $1,090, its highest in nearly a year. Palladium gained 8%, crossing $1,055. Still seen as undervalued vs. gold, but gains may not hold unless trade volatility eases.

Europe

- France Consumer Confidence Drops to 88

Confidence fell further from 91 in April (revised), undershooting the expected 93. Ongoing trade tensions with the U.S. are worsening sentiment. - Germany GDP Outperforms at 0.4% in Q1

Revised data shows stronger-than-expected growth, likely boosted by ECB easing and government stimulus. This supports a more optimistic outlook moving forward. - UK Retail Sales Blow Past Forecasts

- April m/m: +1.2% (vs +0.2%)

- April y/y: +5.0% (vs +4.5%)

Ex-autos and fuel: +1.3% m/m, +5.3% y/y

Strong momentum signals resilient consumer demand in the face of global economic pressure.

Asia

- Japan Inflation Remains Sticky

- Headline CPI (April): 3.6%

- Core CPI: 3.5%

- Core-core (ex-food, energy): 3.0%

Prices are still running hot, putting the Bank of Japan under pressure to assess normalization paths.

- Japan Targets Cheaper Rice Amid Inflation Pressures

Farm Minister Koizumi aims to push rice prices below ¥3,000 for 5kg by bypassing auctions and using government stockpiles.

Rest of the World

- New Zealand Retail Sales Beat Forecasts in Q1

- Q1 Sales: +0.8% q/q (vs +0.1%)

- Y/Y: +0.7%

Core retail up 0.4%, but below expectations. Strong headline growth hints at resilient spending patterns despite inflation.

- Kazakhstan Oil Output Overshoots OPEC+ Cap

Production reached 1.86 million b/d in May—well above its 1.49 million b/d quota. This raises risks of wider OPEC+ non-compliance and potential supply gluts in Q3.

Crypto

XRP Exchange Reserves Rise — A Caution Flag

XRP rose to $2.44, but a spike in Binance reserves (2.7B → 2.9B) may indicate incoming selling pressure. Whale accumulation continues, but upside could stall short-term.

Bitcoin Drops Below $110K on Tariff Jitters

BTC fell 2% after Trump’s EU and Apple tariff threats. The selloff halted a multi-week rally that saw Bitcoin reach a record $111,970. Altcoins dropped 3–4%.

GENIUS Act Advances, Big Banks Explore Stablecoin

JPMorgan, Citi, BofA, and Wells Fargo are discussing a dollar-backed stablecoin. The GENIUS Act passed a key Senate vote, paving the way for formal stablecoin regulation.

JUP Jumps 16% as Jupiter Lend Announced on Solana

With the upcoming launch of Jupiter Lend, JUP completed a bullish pattern breakout, aiming for $0.82. The project partners with Fluid to disrupt DeFi lending.

Pi Network Under Pressure Amid Whale Moves

PI fell 4% Friday as price risks a return to $0.66. Heavy transfers and technical weakness indicate fading short-term momentum after a brief bounce.

Bonk and Fartcoin Hold Gains, TRUMP Coin Tanks

Meme coins remain volatile. BONK targets $0.00003 while TRUMP coin dropped below $13, hit by negative sentiment tied to the real Trump’s trade threats.