North America News

US Stock Indices Rally on Powell Speech, Russell 2000 Leads

US equities finished the week on a strong note as investors reacted positively to Federal Reserve Chair Jerome Powell’s remarks. The small-cap Russell 2000 led the surge, jumping 3.86%, its biggest one-day gain since April 9.

Major indices notch largest gains in months

- Dow Jones Industrial Average: +846.24 points (+1.89%), the strongest rise since May 12. The index also closed at a record high.

- S&P 500: +96.74 points (+1.52%) to 6,466.91, marking its best day since May 27.

- NASDAQ Composite: +1.88%, the sharpest one-day gain since August 4.

Sector performance: Consumer discretionary shines

Among S&P 500 components, consumer discretionary stocks led with a 3.19% jump. Consumer staples was the only laggard, slipping 0.35%.

- Consumer Discretionary (S5COND): +3.19%

- Energy: +1.99%

- Communication Services (S5TELS): +1.87%

- Materials (S5MATR): +1.70%

- Financials (SPF): +1.65%

- Industrials (S5INDU): +1.62%

- Real Estate (S5REAS): +1.62%

- Information Technology (S5INFT): +1.32%

- Health Care (S5HLTH): +0.82%

- Utilities (S5UTIL): +0.53%

- Consumer Staples (S5CONS): -0.35%

Weekly recap: Russell 2000 outperforms

Despite Friday’s strong finish, the NASDAQ still ended the week lower, while the Dow and S&P managed modest gains. The Russell 2000 was the standout performer, up more than 3% for the week.

- Dow: +1.53%

- S&P 500: +0.27%

- NASDAQ: -0.58%

- Russell 2000: +3.29%

Fitch Holds U.S. Credit Rating at AA+, Outlook Stable

Fitch affirmed the U.S. rating at AA+ (Stable), citing resilience in fiscal capacity.

Current agency ratings:

- Fitch: AA+ (Stable)

- S&P Global: AA+ (Stable)

- Moody’s: downgraded from Aaa to Aa1 in May 2025, outlook Stable

Comparisons:

- Canada: Fitch AA+, S&P AAA, Moody’s Aaa (all Stable)

- UK: Fitch AA-, S&P AA, Moody’s Aa3 (all Stable)

- Germany: AAA across all agencies

- France: Fitch AA-, S&P AA, Moody’s Aa2

- Italy: Fitch BBB, S&P BBB, Moody’s Baa3

- Spain: Fitch A-, S&P A, Moody’s Baa1

- Japan: Fitch A, S&P A+, Moody’s A1

- China: Fitch A+, S&P A+, Moody’s A1

- Australia: AAA across all three agencies

Fed’s Hammack: Inflation Still Too High, Open Mind on Policy

Speaking on CNBC, Fed President Hammack underscored that inflation remains elevated and continues to pressure U.S. households.

Key takeaways:

- Inflation is too high, requiring a restrictive policy stance for now.

- Unemployment could keep rising.

- Policy decisions will hinge on upcoming data ahead of the September Fed meeting.

- Current policy is only “modestly restrictive.”

- A higher unemployment rate could sway policy toward easing.

- The Fed must balance inflation persistence with labor market developments.

- A substantial softening in jobs could trigger a policy shift.

Powell: Fed Framework Shifts Toward Balance, Policy May Adjust

In his Jackson Hole speech, Fed Chair Jerome Powell unveiled the central bank’s new policy framework, dropping the 2020 “makeup” strategy that allowed inflation overshoots and returning to a flexible inflation-targeting approach.

Key changes include:

- Removal of language framing the zero-lower-bound as a defining constraint.

- Elimination of the explicit commitment to let inflation run above 2%.

- Replacement of “shortfalls” in employment language with a more balanced stance.

Powell emphasized that when inflation and employment goals are in tension, the Fed must weigh both sides carefully. He highlighted risks from tariffs now pushing up consumer prices and warned that while these effects may prove temporary, the Fed cannot allow one-time shocks to trigger lasting inflation.

Latest data show headline PCE inflation at 2.6% in July, with core at 2.9%. Payroll growth has slowed sharply to 35,000 per month over the last three months, and the unemployment rate has edged up to 4.2%.

Powell’s Speech: Key Themes on Inflation, Labor, and Growth

Inflation: Headline PCE up 2.6% y/y in July, core at 2.9%. Tariffs are visibly lifting prices, but Powell expects the effects to be short-lived. Longer-term inflation expectations remain anchored near 2%.

Labor Market: Hiring has slowed sharply; payroll growth averaged 35,000 monthly in recent months versus 168,000 in 2024. The unemployment rate is 4.2%, with tighter immigration policies contributing to weaker labor force growth. Powell described the market as “in balance,” but flagged downside risks.

Growth: GDP slowed to 1.2% in H1 2025, down from 2.5% in 2024, with consumer spending cooling. Structural pressures — including tariffs and tighter labor supply — weigh on the outlook.

Policy Outlook: The Fed’s stance remains restrictive but is now closer to neutral. Powell stressed the Fed will proceed carefully, guided by incoming data, while maintaining its dual mandate of maximum employment and price stability.

UBS Lifts S&P 500 Year-End Target to 6,600

UBS Global Wealth Management raised its year-end target for the S&P 500 to 6,600, up from a previous forecast of 6,200. The revision reflects the index’s rally — up around 30% since April’s lows.

A drop back to the old target would imply only a modest pullback of less than 3%. UBS sees ongoing strength in equities, underpinned by momentum from the AI boom and continued “buy-the-dip” flows.

Fed’s Collins: Growth has been slowing but economic fundamentals are relatively solid

- Fed’s Collins is speaking from Jackson Hole

- Growth is slowing but economic fundamentals are relatively solid.

- We cannot wait for all on the uncertainty to be behind us.

- Have to look at the whole picture and not focus too much on 1 or 2 specific indicators.

- the number 1 concern is the inflation picture but she is of course looking out on the employment side as well

- Upside risk to inflation, downside risk to employment.

- They are anticipating into the next quarter and into next year that inflation will remain elevated.

- Does not rule out a larger impact from tariffs on inflation

- Not a done deal terms of what we do at next meeting.

- The risks on both sides of the mandate have into rough balance.

- She is not that worried about inflation expectations moving up.

- Policy is moderately restrictive which is appropriate.

- She is laser focused on the data.

- Repeats that the underlined fundamentals are still quite healthy

Ex Fed Pres. Parker Harker: The data is fuzzy. It is not crystal clear

- Speaking on CNBC

Former Fed Gov. Ferguson

- We are in a period of “stagflation light”.

- Think the Fed chair will try to create as much flexibility.

- Administration is often pressuring the Fed chair privately. The public pressure is highly unlikely.

Former Fed Pres. Harker:

- The data is fuzzy.

- It is not crystal clear.

- Although there are some businesses that are planning ahead like data, but most businesses are sitting and waiting.

- There is a lot of diversity of opinion

- We are all looking at the data, it is how you interpret it.

Fed’s Powell to Reverse 2020 Policy Framework, WSJ Reports

According to The Wall Street Journal, Fed Chair Jerome Powell plans to roll back two major components of the Fed’s 2020 framework:

- Allowing inflation to run above 2% to offset past undershoots

- Placing less weight on unemployment risks

He is expected to outline these changes during his final Jackson Hole address. While the revisions won’t impact immediate rate decisions, they reflect a strategic shift after critics blamed the 2020 policy for delaying rate hikes during the 2021–22 inflation surge.

The goal now is to craft a policy framework resilient to future shocks that affect both inflation and jobs simultaneously.

Goldman: Powell Likely to Support Cuts Without Explicit Signal

Goldman Sachs expects Fed Chair Jerome Powell to lean dovish in his Jackson Hole remarks, hinting at support for a September rate cut without committing outright. Markets currently anticipate three consecutive 25bp cuts in September, November, and December, followed by two more next year.

Powell is expected to highlight softening labor data and argue that tariffs are a one-off price shock rather than a lasting inflation driver. Analysts also expect him to back away from elements of the 2020 Fed framework.

Fed’s Goolsbee: September Meeting Still in Play, Economy Giving Mixed Signals

Austan Goolsbee of the Federal Reserve said the September FOMC meeting remains “live,” with policymakers keeping options open. He acknowledged recent inflation numbers were disappointing but noted that the Fed still has time to evaluate additional data.

Goolsbee described conflicting economic signals, adding that stagflation shocks are especially difficult to address. He emphasized the importance of central bank independence and suggested tariffs could fuel inflation that may prove stubborn.

Boston Fed’s Collins Signals Openness to Rate Cut

Boston Fed President Susan Collins said she is open to a rate cut as early as next month, citing risks from higher tariffs and a potentially weaker labor market. She cautioned that rising tariffs may erode consumer purchasing power and spending.

Collins expects inflation to rise through the rest of 2025 before easing in 2026, but still sees room to cut rates if employment weakens further or tariffs bite harder.

OpenAI’s Chief People Officer Resigns

OpenAI confirmed that its Chief People Officer will be stepping down from the company this Friday. The announcement follows her earlier promotion to the role, as reported by Reuters.

California Senate Approves Redistricting Plan to Boost Democrats

California’s Senate has passed a new congressional redistricting plan designed to give Democrats an edge, potentially adding five seats to their representation in the US House. This move comes as a direct counter to the GOP-led map passed in Texas.

The proposal now moves to the Assembly for review and would ultimately require voter approval. In parallel, the California Assembly already signed off on a constitutional amendment that temporarily bypasses the state’s independent bipartisan redistricting commission, sending that measure on to the Senate.

Supreme Court Clears Trump-Era Cuts to NIH Diversity Grants

The US Supreme Court has removed a lower-court block that had frozen Trump administration cuts to National Institutes of Health programs tied to diversity. With the block lifted, the funding reductions targeting diversity-related grants can now move forward.

Rubio Halts Truck Driver Visa Program

Senator Marco Rubio has announced an immediate suspension on the issuance of worker visas for commercial truck drivers. The decision takes effect without delay and halts all new approvals for such visas.

Canada to Scrap Retaliatory Tariffs on US Goods

Canada is preparing to remove retaliatory tariffs on a range of US products, aligning with trade terms under the US-Mexico-Canada Agreement (USMCA).

Key details:

- Standard Tariff: On August 1, 2025, the US raised tariffs on Canadian goods not covered by USMCA to 35% from 25%.

- USMCA-Compliant Goods: Over 85% of bilateral trade — including nearly all energy exports — remains duty-free.

- Sector-Specific Tariffs:

- Steel & aluminum: Subject to 50% tariffs.

- Autos & parts: Non-USMCA compliant vehicles face a 25% tariff.

The move eases pressure on several Canadian industries hit by US measures while leaving the broader USMCA framework intact.

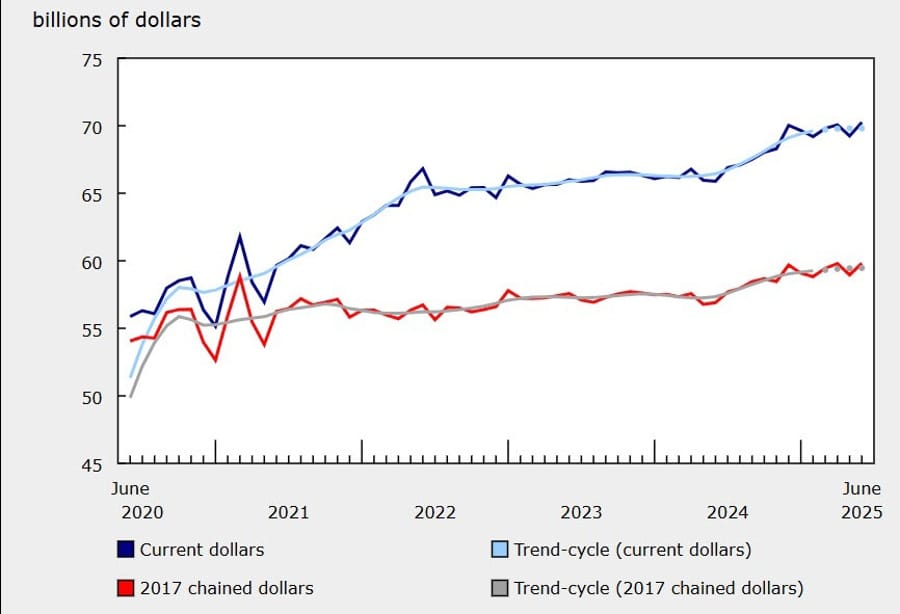

Canada Retail Sales Rise 1.5% in June, Matching Forecasts

Canadian retail sales increased 1.5% in June, in line with expectations, reaching $70.2 billion. The prior month was revised lower to -1.2% from -1.1%. An advance estimate suggested July sales rose 0.8%.

Details from Statistics Canada show:

- Core sales (excluding autos, fuel, and gas stations): +1.9% in June.

- Food & beverage retailers: +2.3% overall; supermarkets +1.8%, liquor stores +4.3%, convenience stores +5.3%.

- Clothing & accessories: +5.1%.

- General merchandise: +1.6%.

- Gasoline stations & fuel vendors: +1.8% (volumes +2.7%), snapping a three-month decline.

- Motor vehicles & parts dealers: +0.2%; new car dealers +0.1%.

In volume terms, June sales climbed 1.5%, while Q2 sales rose 0.4% and quarterly volume sales advanced 0.7%.

By province:

- Ontario: +3.2% (Toronto +3.9%), led by autos.

- British Columbia: +1.5% (Vancouver +2.0%), with gains in building materials and garden supplies.

- Saskatchewan: –1.4%, hit by wildfire evacuations and weaker auto sales.

Trade tensions continued to affect operations, though fewer firms reported being impacted (27% in June vs 32% in May).

Commodities News

Gold Rallies as Powell Signals Labor Market Risks, Fed Tilt

Gold prices climbed on Friday as Jerome Powell flagged rising risks to employment and suggested the Fed may lean dovish despite inflation concerns. The remarks fueled bets on a rate cut ahead of September.

Gold price action and Powell’s remarks

Spot gold traded at $3,371, after bouncing from a daily low of $3,321 and briefly touching a high of $3,378. Powell noted that inflation risks remain tilted upward but emphasized that the labor market is softening — a mix he described as a “challenging situation.”

He also commented that tariffs could create a “one-time” spike in prices but would not change the broader inflation trajectory.

Market pricing: Rate cut expectations rise

Traders now assign a 90% probability of a 25 bps cut at the Fed’s next meeting, according to Prime Market Terminal. Still, key data points remain ahead: two inflation prints and the September 5 Nonfarm Payrolls report.

After Powell’s speech, Cleveland Fed President Beth Hammack stressed that Powell remains open-minded on policy and reiterated the Fed’s focus on returning inflation to target.

Next week’s economic calendar

Markets will watch a busy US data slate, including:

- Durable Goods Orders

- CB Consumer Confidence

- Q2 GDP figures

- Initial Jobless Claims

- Core PCE Price Index (the Fed’s preferred inflation gauge)

WTI Crude Futures End at $63.66

WTI crude oil settled at $63.66 per barrel, up $0.14 (+0.22%). Trading ranged from a low of $63.31 to a high of $63.93.

Weekly recap:

- Monday’s low at $61.45 marked the week’s floor.

- Tuesday tested the 100-hour moving average and dropped to $61.67.

- Momentum turned upward midweek, breaking above both the 100- and 200-hour MAs.

- Thursday retested the 100-hour average, where buyers defended support.

- Friday’s rally extended to $63.93, the week’s high.

Overall, crude gained 1.05% for the week. Buyers now control the short-term above the 100/200-hour MAs, but price remains below the 100-day MA ($64.36) and the 38.2% retracement ($64.91). Bulls need to break both to strengthen their position.

Baker Hughes Rig Count: U.S. Dips, Canada Declines Further

The U.S. rig count dropped by one this week, leaving the total at 538 rigs. Oil rigs slipped by 1 to 411, while gas rigs stayed at 122 and miscellaneous rigs held at 5.

Compared with the same week last year, the U.S. count is down by 47 rigs. Oil rigs have fallen by 72, gas rigs have gained 25, and miscellaneous rigs remain flat.

Offshore activity in the U.S. stood still at 13 rigs, which is 6 fewer than a year ago.

In Canada, the rig count decreased by 3 to 180. Oil rigs fell by 3 to 123, gas rigs dipped by 1 to 56, and miscellaneous rigs rose by 1 to 1.

Year-over-year, Canada’s tally is down by 39 rigs: oil rigs lower by 30, gas rigs down 10, and miscellaneous rigs up by 1.

Copper Mining Lags Behind Refined Output

According to the International Copper Study Group, global mine production grew 2.7% YoY in H1.

Country highlights:

- DRC: +9.5%

- Mongolia: +31%

- Peru: +3.6%

- Chile: +2.6%

- Indonesia: significant decline due to mine maintenance

Refined copper output rose faster, at +3.6%, with gains from:

- DRC: +6.5%

- China: +6%

- Rest of world: +0.6%

- Chile: -8.4%

Consumption surged +4.8%, driven by China (+7.5%). Japan, the EU, and U.S. saw declines.

Market posted a surplus of 251k tons in H1, down from 395k last year. Recent Chinese data show refined output still rising while mine supply issues persist, worsening raw copper shortages.

Swiss Gold Exports to U.S. Surge in July

Switzerland exported 51 tons of gold to the U.S. in July, the largest since March, aligning with an increase in COMEX inventories.

Context:

- Surge linked to tariff uncertainty in July, including a 39% tariff on Switzerland.

- Exports to UK: 30.5 tons (lower than June)

- Exports to India: 13 tons, highest in 2025 but still modest

- Combined shipments to China & Hong Kong: same as India (13 tons)

- Turkey received only 2.2 tons, the weakest in more than 2 years, reflecting lower inflation (33.5%, lowest in 4 years).

Saudi Arabia Produces More Oil but Exports Less

In June, Saudi oil production rose by 570k bpd to 9.75M, but exports dropped by 50k bpd to 6.14M.

Additional barrels stayed domestic, likely stored, as:

- Refining slipped to 2.7M bpd

- Power demand climbed 185k bpd to 674k bpd

The stored crude could re-enter markets later.

U.S. Crude Inventories Drop Sharply

The DOE reported a 6M-barrel decline in U.S. crude stocks last week, well above forecasts of under 1M.

Drivers:

- Higher exports, lower imports

- Refining close to annual highs

Other balances:

- Gasoline stocks: -2.7M

- Distillates: +2.3M (up 13M since July, easing tightness)

Despite stock builds, diesel and gasoil cracks widened, reflecting strong demand. Jet fuel demand reached its highest since 2019.

TTF Gas Rises on Norwegian Maintenance Fears

European gas benchmark TTF gained nearly 4% as maintenance in Norway is set to cut supply.

Storage update:

- EU storage: ~75% full, below 5-year average (82%) and last year (91%).

- To secure LNG ahead of winter, Europe must stay competitive against Asia. LNG inflows have been easing since June.

Oil Prices End Week Higher

Oil prices strengthened as ceasefire hopes between Russia and Ukraine dimmed.

Factors:

- Putin-Zelensky summit stalled; Russia demanded role in Ukraine security guarantees.

- Russia launched its largest strike in over a month.

- U.S. set to impose 25% tariffs on Indian purchases of Russian oil starting Aug 27.

Meanwhile, distillate stocks showed mixed signals:

- ARA inventories: +170k to 2.03M tons

- Singapore stocks: +371k barrels

- U.S. distillates: +2.34M barrels earlier in the week

Refinery outages helped strengthen gasoil cracks despite stock builds.

Europe News

European Equity Markets Close the Week in Green

Major European benchmarks ended both the session and the week with gains. Spain’s Ibex and Italy’s FTSE MIB each reached highs not seen in 17–18 years, while the UK’s FTSE 100 set a new record close.

Daily performance:

- DAX (Germany): +0.29%

- CAC (France): +0.40%

- FTSE 100 (UK): +0.13%

- Ibex (Spain): +0.61%

- FTSE MIB (Italy): +0.69%

For the week:

- DAX: +0.02%

- CAC: +0.58%

- FTSE 100: +2.0%

- Ibex: +0.78%

- FTSE MIB: +1.54%

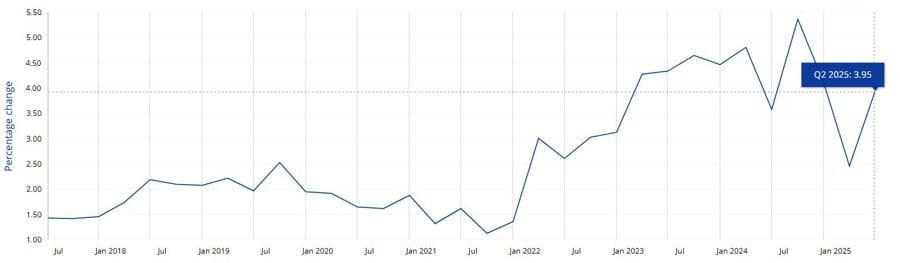

Eurozone Wages Accelerate in Q2, Keeping ECB on Edge

Negotiated wages across the eurozone rose 3.95% year-on-year in Q2, sharply higher than the 2.46% pace in Q1 and above the ECB’s own tracker forecast of 3.4%.

After easing in the first quarter, the pickup complicates the ECB’s hopes for moderating wage pressures. The central bank has been monitoring closely after elevated wage growth through 2023 and 2024 fueled inflation risks.

For full-year 2025, the ECB’s tracker projects wage growth of 3.2%, leaving the Q3 and Q4 results critical for policy direction.

Germany Q2 GDP Revised Lower to -0.3%

Germany’s Q2 GDP has been revised down to -0.3% quarter-on-quarter, worse than the initial -0.1% estimate. The previous quarter had shown growth of +0.4%.

On an annual basis, GDP fell -0.2% (non-seasonally adjusted), compared with a flat preliminary reading. Seasonally adjusted GDP rose +0.2% year-on-year, weaker than the earlier +0.4% estimate.

The downgrade reflects weaker performance in both manufacturing and construction in June. Consumer spending rose 0.3% for the quarter, though private consumption increased only 0.1%, below flash estimates.

While this marks another setback for Germany’s economy, more recent Q3 data points to some improvement. Still, looming US tariffs, especially targeting autos, could weigh on the outlook.

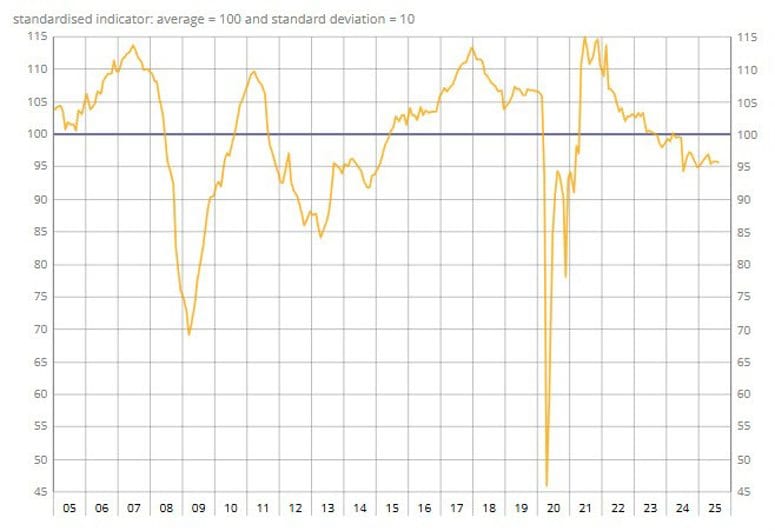

France August Business Confidence Holds Steady at 96

France’s business confidence index remained unchanged at 96 in August, according to INSEE. Services confidence dipped slightly to 95 from 96, while manufacturing confidence stayed at 96.

The overall climate index registered 95.8, little changed from July’s 95.9. Sentiment in retail trade fell during the month, though brighter conditions in building construction helped offset that weakness.

Employment indicators showed fresh strain, falling back to 95 from 96 in July — the lowest level since May, and reversing the bounce recorded in June.

UK Consumer Confidence Beats Expectations at -17

The latest GfK consumer confidence survey for August showed a reading of -17, stronger than the -20 expected and an improvement from July’s -19.

ECB’s Nagel: Expects a micro recession in Germany

- Nagel is more of a hawk

- Expects more recession in Germany

- Believes inflation is not the point anymore.

- Reiterates the importance of central bank independency

- I don’t see many arguments that we should do more here on rates

- The bar for rate cuts aside.

Morgan Stanley Pushes ECB Rate Cut Outlook to December

Morgan Stanley has shifted its forecast for European Central Bank rate cuts, now expecting the first move in December rather than September. The next cut is projected for March 2026.

The adjustment comes after stronger-than-expected eurozone PMI results, particularly in manufacturing, suggested resilience in the economy despite persistent price pressures. Markets currently see less than 10 basis points of easing priced in by year-end.

Asia-Pacific & World News

Xi Jinping Expected to Skip ASEAN Summit, Sources Say

Reuters reports that Chinese President Xi Jinping is likely to miss the ASEAN Summit in Malaysia this October, with Premier Li Qiang expected to attend instead.

The absence would undercut expectations of a possible Trump–Xi meeting on the sidelines. Observers suggest that if Xi skips, Trump may also cancel his appearance despite Malaysian Prime Minister Anwar Ibrahim confirming Trump’s attendance.

The move is being read as a sign of China’s unwillingness to give diplomatic face to Washington, even as both sides try to maintain a public show of restraint in their trade disputes.

Nvidia CEO on China Shipments, US Talks, and TSMC

Nvidia’s CEO said he appreciates that the company can continue shipping its H20 chips to China, stressing that the issue does not involve national security. He added that launching a successor AI data center product in China is not Nvidia’s decision to make.

The CEO confirmed discussions with the US government are ongoing but premature to judge. He noted Nvidia’s upcoming GTC conference will be hosted in Washington, DC, for the first time.

On a brief visit to Taiwan, he had dinner with TSMC leaders, highlighting the company’s new Rubin architecture featuring six chips.

Xi, Putin, and Global Leaders to Attend SCO Summit in Tianjin

China’s assistant foreign minister confirmed that President Xi Jinping, President Vladimir Putin, UN Secretary General António Guterres, and more than 20 other heads of government will attend the upcoming Shanghai Cooperation Organization (SCO) summit in Tianjin.

Xi will announce new initiatives for strengthening SCO cooperation and unveil the “Tianjin Declaration.” Several bilateral meetings and additional cooperation agreements are also expected.

China and Pakistan Commit to Stronger Ties, Upgrade of CPEC

China’s foreign minister met with Pakistan’s president in Islamabad, pledging to deepen strategic cooperation and strengthen traditional ties. He also said China is prepared to move forward with upgrading the China-Pakistan Economic Corridor (CPEC).

Nvidia Stops H20 Production After China Blocks Purchases

Nvidia has halted production of its H20 chips after Beijing issued directives preventing purchases, according to reporting from The Information.

PBOC sets USD/ CNY mid-point today at 7.1321 (vs. estimate at 7.1871)

- PBOC CNY reference rate setting for the trading session ahead.

Japan Inflation Slightly Higher Than Forecast

Japan’s nationwide core CPI for July rose 3.1% year-on-year, above expectations of 3.0% but down from June’s 3.3%. Overall CPI growth also came in at 3.1%, slipping from the prior 3.3%.

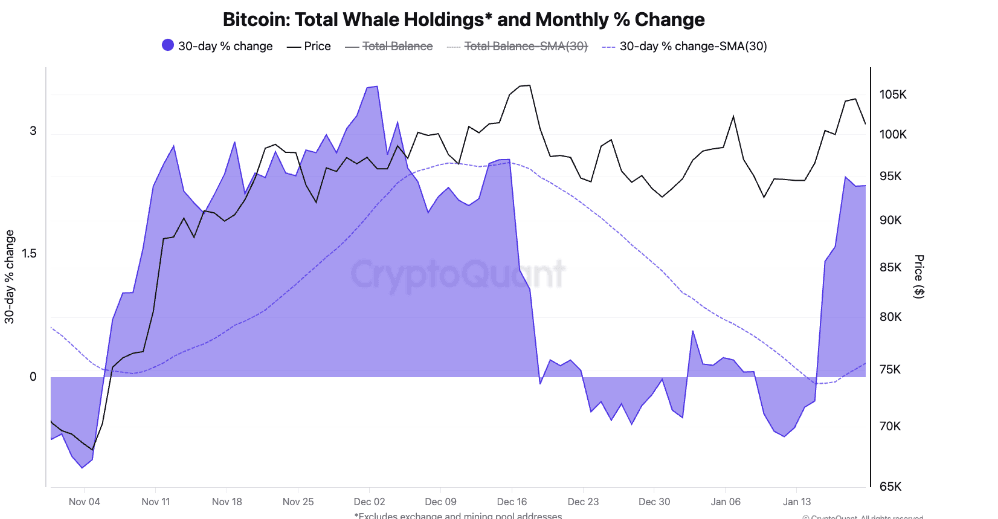

Crypto Market Pulse

Crypto Market Jumps on Powell’s Dovish Remarks

Cryptocurrencies surged Friday after Fed Chair Powell signaled a potential rate cut at Jackson Hole.

- Bitcoin: +3%, rising above $116,000

- Ethereum: +12%

- XRP: +5%

- Solana: +8%

Powell suggested the Fed could pivot if labor market weakness threatens stability, moving away from a purely restrictive stance. Odds of a 25 bps September rate cut climbed to nearly 90%, up from 73%.

Market cap for all crypto added more than 5% in 24 hours, pushing the total above $4 trillion.

U.S. Pushes Toward Becoming Crypto Hub Under Trump

The U.S. is tilting toward a more pro-crypto regulatory climate since Donald Trump took office.

Key steps:

- GENIUS Act, Strategic Bitcoin Reserve, and Trump-backed World Liberty Financial (WLFI)

- Pro-crypto regulatory appointments

- SEC Chair Gary Gensler’s resignation, effective January 2025

Impact on markets:

- Bitcoin hit $76,400 after Trump’s election win in November 2024.

- On inauguration day, BTC surged to $109,588.

- Trump’s WLFI project holds $460.42M in crypto assets and launched stablecoin USD1.

- Trump Media filed for a Bitcoin ETF and launched meme token TRUMP, with a peak market cap of $8.79B.

Regulatory shifts:

- Acting SEC Chair Mark Uyeda created a crypto task force under Commissioner Hester Peirce.

- Trump signed an Executive Order promoting blockchain innovation, banning a U.S. CBDC, and reversing Biden’s EO 14067.

Crypto Update: Bitcoin and XRP Under Pressure, Ethereum Steady

Bitcoin and XRP slipped as profit-taking eroded momentum ahead of Powell’s Jackson Hole speech. Ethereum stayed resilient within a rising channel.

- BTC: $112,736, down from $113,525; key support at $111,920. A breakdown could target $107,245.

- ETH: +1.5% on Friday, market cap at $518B; channel support near $4,100, with risk of drop to $3,860.

- XRP: -0.50%, at risk of testing $2.75 support.

Profitability data:

- BTC supply in profit: 92.138% (down from 100%)

- XRP supply in profit: 91.74% (down from 98.2%)

- ETH supply in profit: 96.75%, supported by institutional demand

Indicators show bearish bias: MACD negative for BTC and XRP; RSI levels at 41 for BTC/XRP, 56 for ETH.

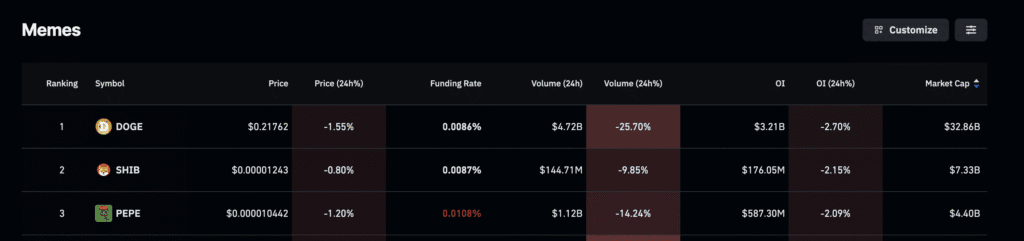

Meme Coins Face Pressure as Whales Exit Positions

Dogecoin (DOGE), Shiba Inu (SHIB), and Pepe (PEPE) are under increased downside risk as whale activity weakens and derivatives market interest declines. On-chain signals and technical indicators are flashing bearish for all three meme coins.

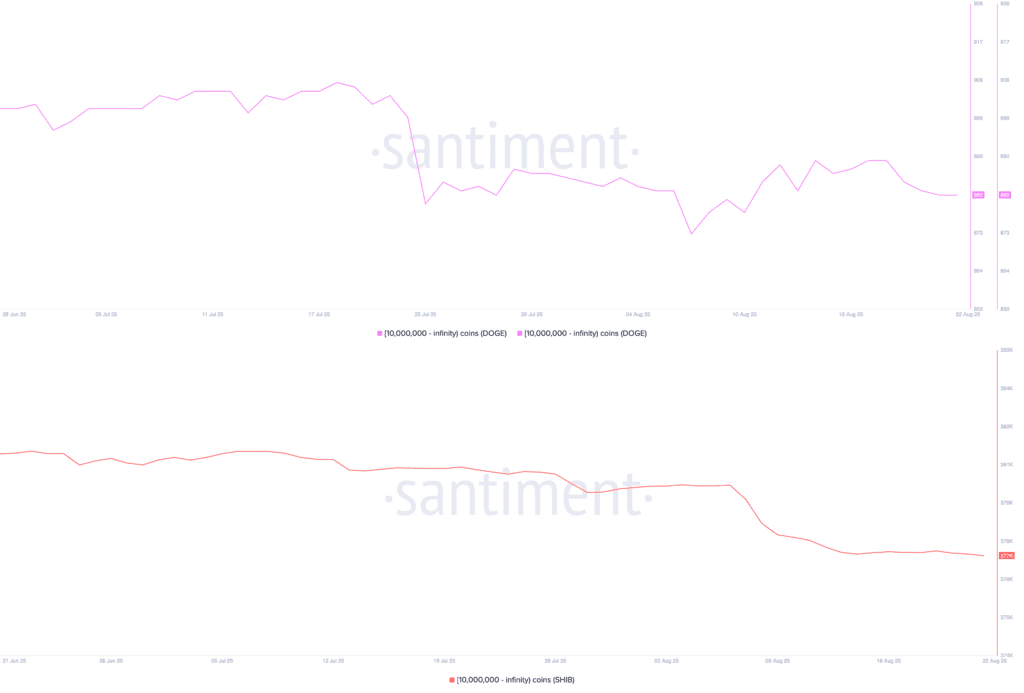

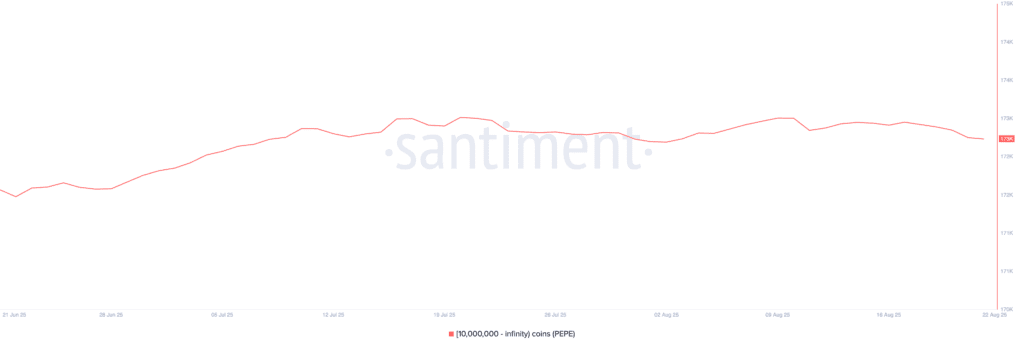

Whale numbers and Open Interest decline

Large-wallet investors, often seen as a measure of project conviction, are pulling back. Santiment data shows DOGE wallets holding over 10 million tokens fell to 882, down from 887 on Monday. SHIB whales also declined to 377K, compared to the monthly peak of 380.48K. PEPE whale count slipped to 173K, from the 30-day high of 173.57K.

At the same time, CoinGlass data shows meme coin Open Interest dropped by over 2% in 24 hours for DOGE, SHIB, and PEPE — a clear signal of capital outflows and rising risk-off sentiment.

Technical picture grows fragile

- Dogecoin is still holding above a key moving average, but the MACD has issued a sell trigger.

- Shiba Inu risks breaking down from its triangle pattern, exposing it to further losses.

- Pepe wavers near the $0.00001000 psychological level, while a looming Death Cross adds bearish weight.

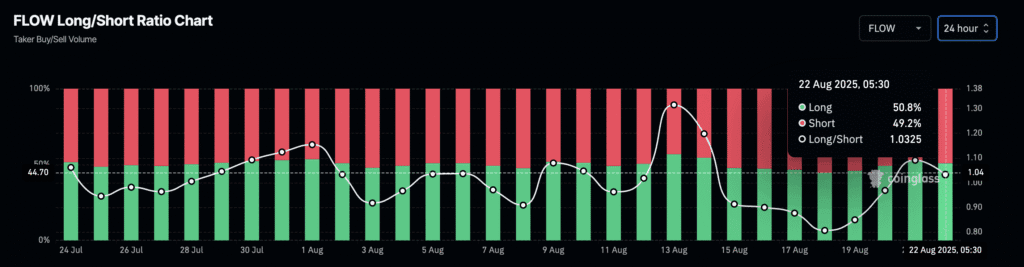

Flow’s DeFi Ecosystem Sees Record Growth Amid Disney Deal

Flow (FLOW), the Proof-of-Stake blockchain, posted significant growth in Q2 2025 across DeFi metrics, but its price has yet to follow suit. Despite higher Total Value Locked (TVL), surging smart contracts, and a Disney+ partnership, FLOW’s spot market continues to lag.

DeFi expansion and Disney partnership boost adoption

Messari’s quarterly report shows TVL on Flow rose 46.3% QoQ, reaching $68M by the end of June, with the latest figure now at $79.98M. Smart contracts hit a record 45,239 deployments since October 2024.

Stablecoin liquidity also grew. PayPal’s PYUSD reached $26.2M on June 30, making up 65.8% of Flow’s stablecoin share. Circle’s USDC accounted for $13.6M. As of Friday, stablecoin market cap on Flow stood at $36.89M, with PYUSD at 64.7% dominance.

Disney’s Pinnacle partnership added more than 50 million subscribers into Flow’s network through digital collectibles, highlighting mainstream adoption potential.

Technical outlook: price struggles despite bullish activity

At the time of writing, FLOW trades at $0.373, caught between the July 21 pivot ($0.458) and August 2 pivot ($0.345). The token continues to face resistance at the 50-day EMA ($0.381), while the 100- and 200-day EMAs remain in decline, pointing to a longer-term bearish setup.

Momentum indicators show mixed signals:

- Stoch RSI is nearing oversold, with a crossover likely to trigger a bullish reversal.

- RSI at 46 remains flat under the midpoint, suggesting neutrality.

On derivatives, CoinGlass shows taker buy volume (longs) at 50.8%, down from 52.17% a day earlier. That suggests a slow return of risk-on sentiment.

OKB Surges to Record High, ZEC and MORPHO Hint at Breakouts

OKB (OKB) continues its powerful run, crossing the $250 mark and becoming the top gainer in the crypto market. ZCash (ZEC) and Morpho (MORPHO) also show strong breakout potential as bullish momentum builds.

OKB extends rally past $250

At press time Friday, OKB is up 7%, building on Thursday’s 33% surge. The move, fueled by a 65M token burn, has pushed the token to the R3 pivot resistance at $255.

A firm close above this level could pave the way for a run to R4 pivot resistance at $311. Momentum indicators remain strongly bullish, with RSI at 89, deep in overbought territory — showing buyers are still firmly in control.

Still, a pullback from the current peak could retest the $200 psychological level as support.

ZEC and MORPHO set for rallies

- ZCash (ZEC): Breaking out of a falling wedge pattern, setting up for a potential extension higher.

- Morpho (MORPHO): Edges closer to resistance as a Golden Cross forms, typically a bullish signal of longer-term upside.

The Day’s Takeaway

North America

Markets Surge on Powell’s Speech

US equities rallied strongly, led by the Russell 2000, which jumped 3.86%, its biggest gain since April. The Dow Jones rose 1.89% (846 points) to a record close, the S&P 500 added 1.52%, and the Nasdaq gained 1.88%.

- Weekly performance: Dow +1.53%, S&P +0.27%, Nasdaq -0.58%, Russell 2000 +3.30%.

Sector Moves: Consumer Discretionary led with +3.19%, while Consumer Staples was the only laggard at -0.35%.

Powell’s Policy Shift: At Jackson Hole, Powell confirmed the Fed is abandoning its 2020 “makeup” strategy, returning to flexible inflation targeting. He stressed balancing inflation and labor risks, warning tariffs are pressuring prices but framing them as short-lived shocks.

Fed Watch:

- Austan Goolsbee called the September FOMC meeting “live,” citing mixed economic signals.

- Susan Collins signaled openness to a rate cut, pointing to tariff risks and a weakening labor market.

Supreme Court Ruling: Cleared the way for Trump-era cuts to NIH diversity-related grants.

Political Developments: California Senate passed a redistricting plan that could add up to five Democratic House seats, bypassing the independent redistricting commission.

Immigration Policy: Senator Marco Rubio announced an immediate halt to worker visas for commercial truck drivers.

Wall Street Outlooks:

- Goldman Sachs: expects Powell to back cuts without explicitly signaling; markets price in three consecutive 25bp cuts starting in September.

- UBS: raised its year-end S&P 500 target to 6,600 (from 6,200), citing AI momentum and buy-the-dip flows.

Canada

- Retail Sales: June retail sales rose 1.5%, in line with forecasts. Gains came from food & beverages (+2.3%), clothing (+5.1%), and gasoline (+1.8%). Ontario led regionally (+3.2%). July advance estimate: +0.8%.

- Tariffs: Canada will scrap retaliatory tariffs on US goods to align with USMCA, easing pressure on autos, steel, and aluminum.

Commodities

Gold Rally: Gold surged after Powell’s dovish tone, rising to $3,371 after a high of $3,378. Traders now price in a 90% probability of a 25bp Fed cut in September.

WTI Crude: Futures settled at $63.66, up 0.22% on the day and +1.05% for the week. Momentum turned bullish above the 100/200-hour moving averages, though price remains below the 100-day MA ($64.36).

Baker Hughes Rig Count: US rigs fell by 1 to 538; Canada fell by 3 to 180. Year-over-year, US rigs are down 47, Canada down 39.

Saudi Arabia: June output rose +570k bpd to 9.75M, but exports slipped 50k bpd to 6.14M as more crude was held domestically.

US Inventories: DOE reported a 6M barrel draw, gasoline fell 2.7M, distillates rose 2.3M.

European Gas (TTF): Prices climbed nearly 4% on Norwegian maintenance risks. EU storage sits at ~75%, below both last year (91%) and the 5-year average (82%).

Copper: Global mine supply grew +2.7% YoY in H1, while refined output rose faster (+3.6%) on Chinese demand (+7.5%). Market surplus narrowed to 251k tons.

Swiss Gold Exports: Shipments to the US hit 51 tons in July, the largest since March, coinciding with higher COMEX inventories.

Europe

Equity Markets: All major benchmarks closed higher for the day and the week.

- Daily: DAX +0.29%, CAC +0.40%, FTSE 100 +0.13%, Ibex +0.61%, FTSE MIB +0.69%.

- Weekly: DAX +0.02%, CAC +0.58%, FTSE 100 +2.0%, Ibex +0.78%, FTSE MIB +1.54%.

Economy:

- Germany: Q2 GDP revised down to -0.3% QoQ.

- France: business confidence steady at 96; retail trade weaker.

- Eurozone wages: +3.95% y/y in Q2, complicating ECB’s path.

- UK: August consumer confidence improved to -17 (vs. -20 expected).

Fitch Ratings: Reaffirmed US at AA+ (Stable). Germany and Australia hold triple-A across agencies; France, Italy, and Spain remain lower.

Asia

Japan: July core CPI at 3.1% y/y, slightly above expectations.

China:

- Foreign Minister pledged deeper cooperation with Pakistan, upgrading CPEC.

- Reports suggest Xi may skip ASEAN summit, Li Qiang to attend instead.

- Nvidia paused H20 chip production under Chinese restrictions; CEO Jensen Huang confirmed ongoing discussions with Washington and unveiled Rubin AI architecture.

SCO Summit (Tianjin): Confirmed attendance from Xi, Putin, and UN Secretary-General Guterres. Xi to present the Tianjin Declaration with new SCO initiatives.

Crypto

Powell Boosts Market: Bitcoin surged +3% above $116,000, Ethereum jumped +12%, Solana +8%, and XRP +5% after Powell’s dovish Jackson Hole remarks. Market cap rose 5%+ in 24 hours to surpass $4T. Odds of a September rate cut are now ~90%.

Trump’s Crypto Push: Since Trump took office, pro-crypto policy momentum has accelerated:

- GENIUS Act, creation of a Strategic Bitcoin Reserve, and Trump-backed World Liberty Financial ($460M AUM, USD1 stablecoin).

- Acting SEC Chair Mark Uyeda launched a new crypto task force; Biden-era CBDC plans repealed.

- Trump Media filed for a Bitcoin ETF and launched the meme token TRUMP (peak cap $8.8B).

Market Update:

- Bitcoin: $112,736, testing support at $111,920; a break risks $107,245.

- Ethereum: +1.5% Friday, mcap $518B, support near $4,100.

- XRP: -0.50%, at risk of breaking $2.75 support.

On-chain & Technicals:

- BTC supply in profit: 92%; ETH: 96.7%; XRP: 91.7%.

- MACD bearish for BTC/XRP, RSI: BTC/XRP at 41, ETH at 56.

Altcoins:

- OKB extended rally above $250, up 7% Friday after a 33% surge Thursday, fueled by a 65M token burn.

- ZCash (ZEC): Breaking out of falling wedge, eyeing upside extension.

- Morpho (MORPHO): Golden Cross forming, signaling bullish momentum.

- Flow (FLOW): Disney+ deal and record DeFi growth pushed TVL to $80M, but token lags at $0.373, capped below the 50-day EMA.

- Meme Coins: DOGE, SHIB, and PEPE face downside pressure as whale activity and open interest decline. Technical setups show breakdown risks, with DOGE flashing a MACD sell signal and PEPE nearing a “death cross.”