North America News

Nasdaq Leads as Dow, S&P End Flat in Mixed Session

U.S. stock indexes finished Thursday in mixed territory, with the Dow Jones Industrial Average and S&P 500 posting negligible declines while the Nasdaq Composite closed in the green.

Final numbers at the bell:

- Dow Jones slipped by just 1.35 points, essentially flat, ending the session at 41,859.09

- S&P 500 dipped 2.6 points, or 0.04%, to finish at 5,842.01

- Nasdaq Composite gained 53.09 points, a 0.28% rise, to settle at 18,925.73

The Nasdaq got a boost from strength in several heavyweight tech and growth names. Notable gainers included:

- Pinduoduo (PDD): +3.10%

- Tesla (TSLA): +1.89%

- Palantir Technologies (PLTR): +1.42%

- Alphabet (GOOGL): +1.37%

- Arm Holdings (ARM): +1.30%

- Booking Holdings (BKNG): +0.92%

- Intuit (INTU): +0.92%

- NVIDIA (NVDA): +0.78%

- Honeywell (HON): +0.79%

- Amazon (AMZN): +0.96%

The broader market wavered as traders weighed softer bond yields against firm economic data and renewed macro concerns.

Mortgage Rates Hit 6.86%, Highest Since February

Freddie Mac reported that the 30-year fixed mortgage rate rose to 6.86% for the week ending May 22, 2025, up from 6.81% the previous week. This is the highest reading since mid-February.

- 2025 peak so far: 7.04%

- 2024 peak: 7.22%

- 2023 peak: 7.79%

- Recent low: 6.09% (September 2024)

- 2025 low: 6.62% (April)

The 15-year fixed mortgage rate also increased to 6.01%, compared to 5.92% last week.

Housing affordability remains under strain. Despite a growing number of listings, elevated rates and high prices are keeping many buyers on the sidelines.

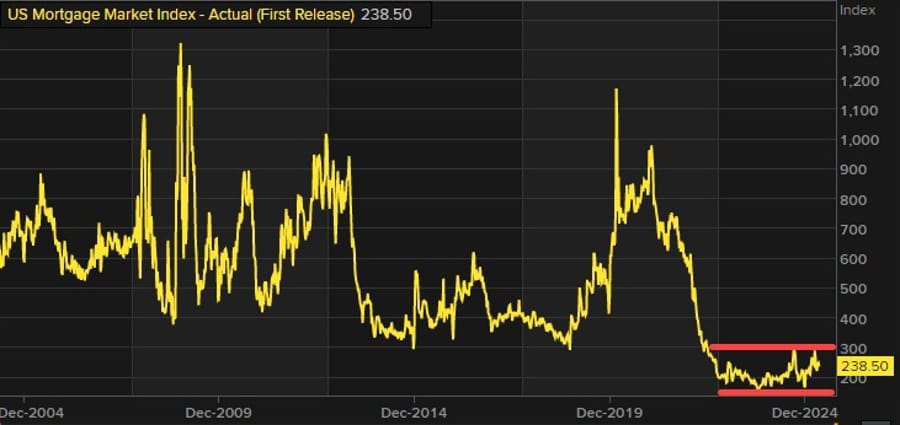

According to MBA data for the week ending May 16:

- Mortgage applications fell 5.1%

- Purchase index dropped from 166.5 to 157.8

- Refinance index fell from 718.1 to 682.5

- Market index: down to 238.5 from 251.2, hovering near 2004-era lows

U.S. Sells $18B in 10-Year TIPS at 2.22% Yield

The U.S. Treasury auctioned $18 billion in 10-year Treasury Inflation-Protected Securities (TIPS) at a high yield of 2.22%, matching the pre-auction when-issued (WI) level.

- Tail: 0.0 basis points

- Bid-to-cover ratio: 2.36x (slightly below 6-month avg. of 2.39x)

- Direct bidder share: 16.7% (vs. 20.7% avg)

- Indirects: 71.4% (up from 68.9%)

- Dealers: 11.9% (vs. 10.4%)

While the auction cleared smoothly, softer domestic demand hints at cautious sentiment among U.S. buyers.

KC Fed Manufacturing Index Drops to -10, Export Orders Sink Further

The Kansas City Fed’s latest manufacturing survey showed regional activity worsening, with the index falling to -10 in May, compared to -5 in April. Export orders deteriorated significantly, with the reading plunging to -21 from -10.

- Composite index: -3, slightly better than last month’s -4

- Prices paid: 34 (down from 42)

- Prices received: 17 (down from 29)

On workforce plans for the rest of 2025, 52% of firms reported no change since the start of the year, 34% expect to reduce hiring, and 14% plan to add jobs.

Survey comments reflected a mix of stress and adaptation:

- “Current business volume not sustainable long-term.”

- “Some inventory levels are down due to slower sales; others are high from bulk purchasing.”

- “We’re facing historic supply shortages.”

- “Demand was strong earlier this year but appears to be cooling off.”

- “Policy uncertainty is damaging consumer confidence and our operations.”

- “We’re shifting sourcing and pricing strategies in real time.”

- “We’re bringing equipment builds in-house, which should lead to growth and three new hires.”

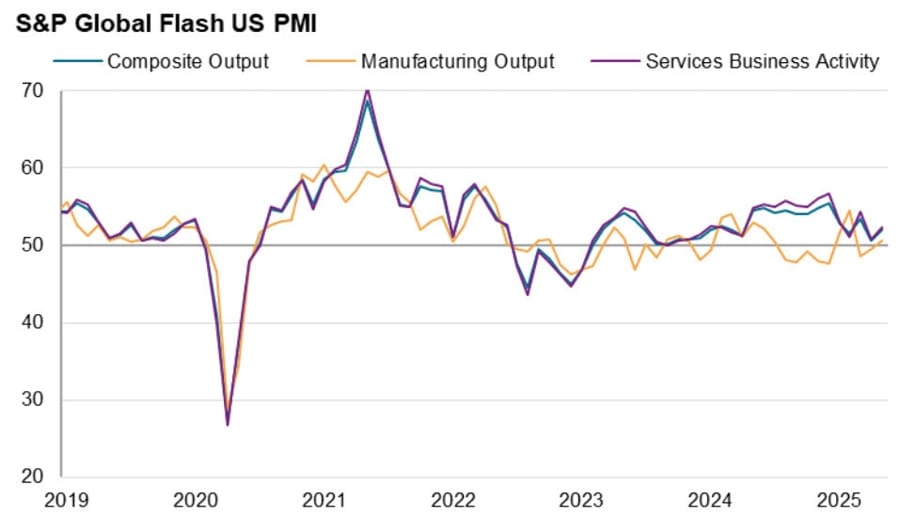

U.S. Services and Manufacturing PMI Surprise on the Upside

The latest flash PMI data from S&P Global shows stronger-than-expected activity in both U.S. services and manufacturing sectors:

- Services PMI: 52.3 (vs. 50.8 expected, prior 51.4)

- Manufacturing PMI: 52.3 (vs. 50.1 expected, prior 50.7)

- Composite PMI: 52.1 (up from 51.2)

May’s manufacturing reading marked the biggest monthly gain since June 2022.

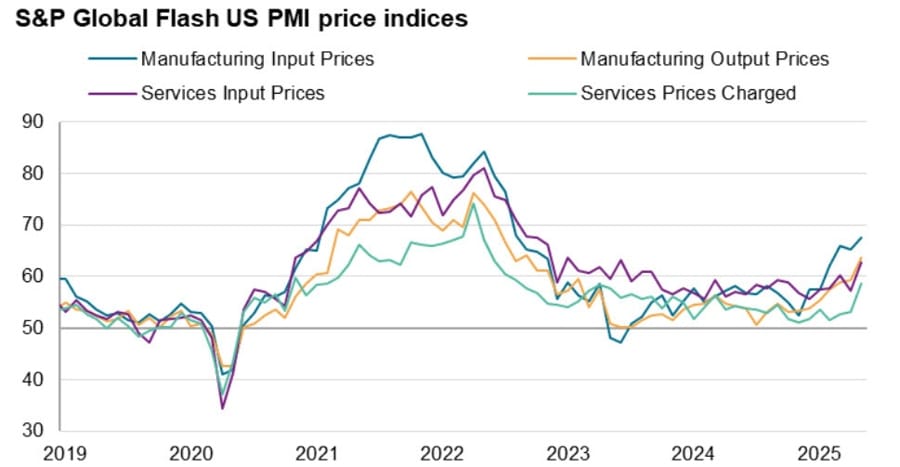

However, inflation flags are waving again. Input and output prices rose sharply:

- Goods and services prices surged at the fastest pace since August 2022

- Tariff-driven cost increases were cited as the main factor

- Manufacturing input costs rose most since August 2022

- Service sector costs climbed at their fastest pace since June 2023

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence

“Business confidence has improved in May from the worrying slump seen in April, with gloom about prospects for the year ahead lifting somewhat thanks largely to the pause on higher rate tariffs. Current output growth has also picked up from April’s recent low, which had seen the weakest rise for over one-and-a-half years, in response to an upturn in demand.

“However, both sentiment and output growth remain relatively subdued, and at least some of the upturn in May can be linked to companies and their customers seeking to front-run further possible tariff-related issues, most notably the potential for future tariff hikes after the 90-day pause lapses in July. In particular, concerns over tariff-related supply shortages and price rises led to the largest accumulation of input inventories recorded since survey data were first available 18 years ago.

“Supply chain delays are now more prevalent than at any time since the pandemic led to widespread shortages in 2022, and prices charged for both goods and services have spiked higher as firms and their suppliers seek to pass on tariff levies to customers. The overall rise in prices charged for goods and services in May was the steepest since August 2022, which is indicative of consumer price inflation moving sharply higher.”

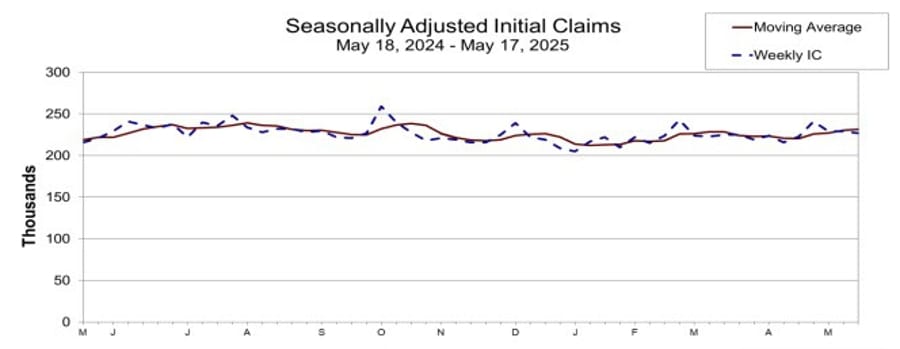

U.S. Jobless Claims Edge Lower; Continuing Claims Tick Up

Initial claims for unemployment benefits in the U.S. came in at 227,000, just under the 230,000 estimate, and down slightly from the prior week’s revised 229,000.

- 4-week moving average: 231,500 (vs. prior 230,500)

- Continuing claims: 1.903 million (vs. 1.885 million expected)

- Revised prior continuing claims: 1.867 million

- 4-week average continuing claims: 1.8875 million (up from 1.870 million)

Weekly fluctuations showed:

- Largest increases: Massachusetts (+3,410), Virginia, Pennsylvania, Illinois, and Nebraska

- Largest declines: Michigan (-5,827), California, Ohio, New York, and New Hampshire

This report aligns with expectations for a steady labor market in May’s jobs survey week.

U.S. April Existing Home Sales Miss Forecasts

Sales of previously owned U.S. homes declined to 4.00 million units in April, falling short of the 4.10 million forecast and slightly below March’s 4.02 million reading.

- Sales change: -0.5% (vs. -5.9% in March)

- Inventory: 4.4 months (up from 4.0)

- Median sale price: $414,000 (up 1.8% year-over-year)

Despite some resilience, with mortgage rates hovering above 7%, the market appears to be slipping back toward lows seen in late 2023 and early 2024.

Fed’s Waller: If tariffs are closer to 10%, then economy is good shape for 2H

- Speaking to FOX Business

- Markets are watching fiscal policy and have concerns.

- Markets are looking for more fiscal discipline.

- Fed won’t buy bonds in primary auctions.

- Hard data shows economy doing quite well, scant sign of tariff impact so far.

- If tariffs are closer to 10%, then economy is good shape for 2H.

- If tariffs settle down, Fed could be in position to cut in later part of the year.

- Much more optimistic now relative to last month on tariffs.

- Very hopeful the current path of administration is a good one.

- Firms are pausing but not cancelling plans.

- Continue to believe tariffs will be a one time price increase.

- Standard Fed playbook is to look through one time price impact.

- Doesn’t see much from tariffs to drive inflation persistently.

- Everyone in markets expected more fiscal restraint from tax bill.

- As long as economy gets back on good path, could reinvigorate demand for US assets.

Nike to Raise Prices Across Multiple Product Lines

Nike is preparing to raise prices on a wide range of products starting this week, according to a CNBC report citing an internal source.

- Apparel and equipment will increase by $2 to $10

- Footwear priced between $100–$150 will rise by $5

- Shoes above $150 will jump by $10

- Kids’ items and products under $100 will remain unchanged

- The Air Force 1 will stay at $115

The price hikes are expected to take effect by June 1 but may be visible in stores before then.

Morgan Stanley: First Fed Rate Cut May Be Delayed to September

Morgan Stanley now sees the Federal Reserve holding off on rate cuts until September 2025, with additional easing likely rolling into 2026.

The bank also forecasts a significant drop in long-term yields, projecting the 10-year Treasury rate to fall to 3.45% by mid-2026—reflecting slower growth and lower inflation expectations down the road.

Walmart to Slash 1,500 Jobs in Cost-Cutting Move

Walmart plans to eliminate roughly 1,500 positions as it looks to streamline operations and reduce costs. The move follows pressure from tariffs and public criticism from President Trump, who urged the retailer to absorb import costs instead of passing them on to consumers.

Walmart recently announced that some price increases were necessary, citing supply chain pressures and shifting sourcing strategies.

The Journal is gated, link here for more on this story.

WSJ: Trump Told EU Leaders Putin “Still Thinks He’s Winning”

According to the Wall Street Journal, President Trump told European leaders during a private call that Vladimir Putin believes he’s winning the war in Ukraine and isn’t ready to stop.

Three sources familiar with the conversation said Trump proposed shifting from sanctions to low-level diplomatic efforts—potentially hosted at the Vatican. The message aligned with European concerns but suggested Trump is recalibrating U.S. involvement as he balances pressure from allies with his own diplomatic aims.

BOC’s Macklem: G7 Focused on Better Tariff Coordination

Bank of Canada Governor Tiff Macklem said G7 finance talks centered on improving communication around tariff policies and addressing broader global trade tensions.

He noted the IMF, backed by the G7, will take on more work analyzing global imbalances.

Canadian Finance Minister Chrystia Freeland added:

- G7 ministers are making progress on supply chain resilience, financial crimes, and growth strategies

- There was some U.S. tariff friction in discussions, but talks were largely constructive

Canada’s Producer Prices Fall More Than Expected in April

Canada’s industrial price data showed a sharper-than-expected pullback in April. The Producer Price Index (PPI) fell 0.8% month-on-month, steeper than the forecast of -0.5%, and down from a +0.5% rise the previous month.

Year-on-year PPI figures were not confirmed in the release but follow a previous +4.7% reading. Meanwhile, the Raw Materials Price Index (RMPI) plunged 3.0% month-on-month, a sharper drop than the expected -1.0%. On an annual basis, raw input costs declined 3.6%, reversing a previous 3.9% increase.

Commodities News

Gold Slips Below $3,300 as Dollar Firms Post-Budget Vote

Gold lost altitude on Thursday, sliding back below $3,300 per ounce after the U.S. House passed President Trump’s controversial budget proposal. The bullion selloff coincided with gains in the U.S. Dollar Index (DXY) and stronger-than-expected economic readings.

- Spot gold dropped 0.83% to trade at $3,289, retreating from an earlier peak of $3,345, its highest in two weeks.

The approval of a fiscal plan that would add roughly $4 trillion to the national debt ceiling pressured safe-haven assets, even as Moody’s recent downgrade of U.S. credit continues to hang over investor sentiment.

The U.S. Dollar Index rebounded by 0.18%, reaching 99.86, trimming earlier weekly losses and putting added pressure on gold, which is priced in dollars.

Despite Thursday’s pullback, the broader case for gold remains bullish amid persistent geopolitical instability. Israeli plans to strike Iranian nuclear facilities — if diplomacy with Washington fails — were reported by Walla, citing unnamed officials.

On the macro front:

- U.S. S&P Global Manufacturing PMI Flash rose from 50.2 to 52.3

- S&P Services Flash PMI also jumped to 52.3, topping expectations

- Initial jobless claims came in at 227K, beating the 230K forecast and prior 229K

Treasury yields eased despite the strong data:

- 10-year Treasury yield slipped 3 bps to 4.55%

- Real 10-year yield edged lower by 4 bps to 2.207%

Comments from Fed Governor Christopher Waller added more color to the rate outlook. He noted that tariffs near 10% would not derail the economy in the second half of the year and that easing may still be on the table.

Chicago Board of Trade (CBOT) futures reflect 50.5 basis points of rate cuts priced in by year-end.

Crude Oil Settles at $61.20, OPEC+ Talks Pressure Prices

Crude oil futures settled at $61.20, down $0.37 on the session, after reports that OPEC+ is discussing a possible output increase of 411,000 barrels per day in July.

No formal agreement has been reached, but the market responded quickly to headlines suggesting supply growth may be on the table.

From a chart perspective:

- Price remains below key swing area between $61.92 and $64.71

- Also under the 50% retracement of the rally from 2021 lows at $64.71

As long as prices stay under this resistance, the bias remains tilted lower.

Silver Pulls Back From 7-Week Highs

Silver saw a sharp intraday reversal on Thursday, falling from $33.70 to around $32.95, down more than 2%, following early strength.

The metal stalled just below the April high and a key psychological barrier at $34.00 before retreating. A modest rebound in the U.S. dollar also weighed on sentiment.

From a technical view:

- Support zone: $32.50–$32.70

- 21-day EMA and triangle breakout base converge here

Indicators:

- RSI: 52 (neutral, showing cooling momentum)

- MACD: Still in bullish crossover, but flattening

The move appears to be a retest of the breakout area. A close below $32.50 could set up further declines. Resistance remains near $33.50 and $34.25.

U.S. Unmoved on Lowering G7 Oil Price Cap, Talks Continue

At this week’s G7 finance meeting, the U.S. reportedly resisted calls to lower the oil price cap on Russian crude exports. American delegates argued that declining oil prices are already biting into Russian revenues.

A European official noted that while the U.S. didn’t reject the idea entirely, it remained unconvinced for now. Discussions will continue.

Meanwhile, crude oil prices dipped $0.42 to $61.16, as supply and geopolitical sentiment continue to shape energy markets.

OPEC+ Weighs July Output Increase, Markets React Bearishly

According to Bloomberg, OPEC+ is in active discussions about raising oil production by another 411,000 barrels per day in July. The proposal, cited by multiple delegates, has already nudged crude prices lower as traders brace for the impact of increased global supply.

The prospect of a supply bump is capping any upward momentum in oil markets, with sentiment turning cautious in anticipation of a formal announcement.

CBA Sees Gold Surging to $3,750 by Year-End

The Commonwealth Bank of Australia is calling for gold to climb to $3,750 per ounce by Q4 2025, citing rising geopolitical tension and a weakening U.S. dollar.

Analyst Vivek Dhar points to the heightened risk of U.S.–Iran conflict and the fading credibility of the greenback as key factors pushing investors toward safe havens. With tariffs rising and Treasury yields under pressure, gold has outpaced both the dollar and government bonds in recent months.

CBA expects the U.S. dollar to gradually lose ground through late 2025 and into 2026, supporting a strong bullish case for bullion.

U.S. National Security Panel Completes Review of Nippon Steel–U.S. Steel Deal

The U.S. Committee on Foreign Investment (CFIUS) has finalized its review of Nippon Steel’s proposed $14.9 billion acquisition of U.S. Steel and handed its findings to President Trump. The contents remain sealed.

Trump now has 15 days to decide whether to greenlight or block the deal—unless he grants an extension.

Nippon Steel has tried to allay national security concerns by pledging a $14 billion U.S. investment, including a $4 billion steel plant. Biden had previously halted the deal in January, citing national security issues. The companies then sued, claiming the process was biased. The executive order behind this review also requires each CFIUS agency to file a written position.

Europe News

European Stocks Recover Some Ground After Morning Slide

Major European indices finished lower on the day, but off their session lows after stabilizing in the afternoon:

- German DAX: -0.5%

- France CAC 40: -0.7%

- UK FTSE 100: -0.6%

- Spain IBEX: -0.3%

- Italy FTSE MIB: -0.8%

The early session saw more aggressive selling, but yields pulling back helped limit losses by the close.

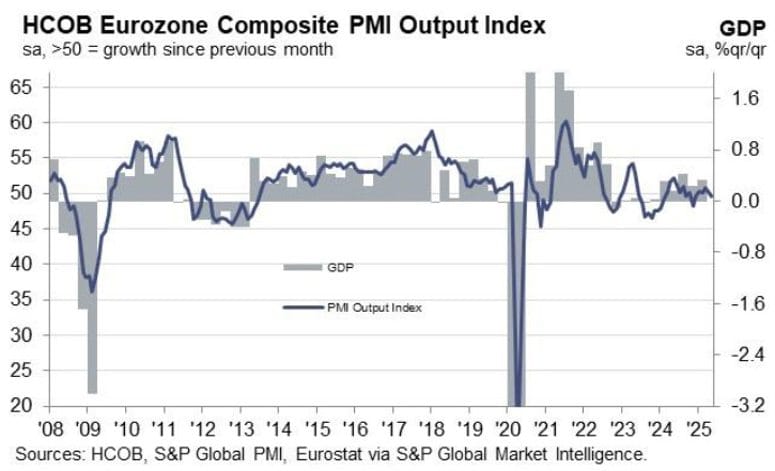

Eurozone Services Stumble in May as Composite PMI Falls to 6-Month Low

The Eurozone’s preliminary May PMIs reveal that services activity has sharply declined, dragging down the broader economic picture:

- Services PMI: 48.9 (vs. 50.3 expected, prior 50.1)

- Manufacturing PMI: 49.4 (slightly ahead of 49.3 expected, prior 49.0)

- Composite PMI: 49.5 (vs. 50.7 expected, prior 50.4)

Key details from HCOB:

- Composite output at lowest level in half a year

- Services activity at a 16-month low

- Manufacturing growth continues at an unchanged pace

- Manufacturing PMI at a 33-month high, highlighting a shifting sector dynamic

Commenting on the flash PMI data, Dr. Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, said:

“The eurozone economy just cannot seem to find its footing. Since January, the overall PMI has shown only the slightest hint of growth and in May, the private sector actually slipped into contraction. Do not blame US tariffs for this one. In fact, efforts to get ahead of those tariffs might partly explain why manufacturing has held up a bit better lately. Manufacturers have now increased production for the third straight month, and for the first time since April 2022, new orders did not decline. On the flip side, service providers, who are generally less exposed to US trade policy, except in areas like international logistics, are seeing business activity shrink for the first time since November 2024. While foreign demand for services is softening, it is the sluggish domestic demand that seems to be dragging the sector down.

“May’s snapshot is not pretty. Looking ahead, companies are only cautiously optimistic. The expectations index is still well below its long-term average. However, there are reasons for confidence in the longer term. The recovery in manufacturing is broad-based, with encouraging signs coming out of both Germany and France. Further interest rate cuts could provide a boost, and lower oil prices compared to last year are also helping. Germany, in particular, might be gearing up to reclaim its role as the eurozone’s economic engine, thanks to a potentially very expansionary fiscal policy. That is backed up by a notable jump in Germany’s future production index, which has climbed to an above-average level.

“For the European Central Bank, these numbers are likely to leave it with mixed feelings. Inflation in service sector sales prices has ticked down slightly from an already low level, but input costs are still rising and even picking up speed. With energy prices falling, higher wages are probably the main driver here. Still, the ECB seems inclined to continue with cautious rate cuts, especially with purchase prices in manufacturing on the decline.”

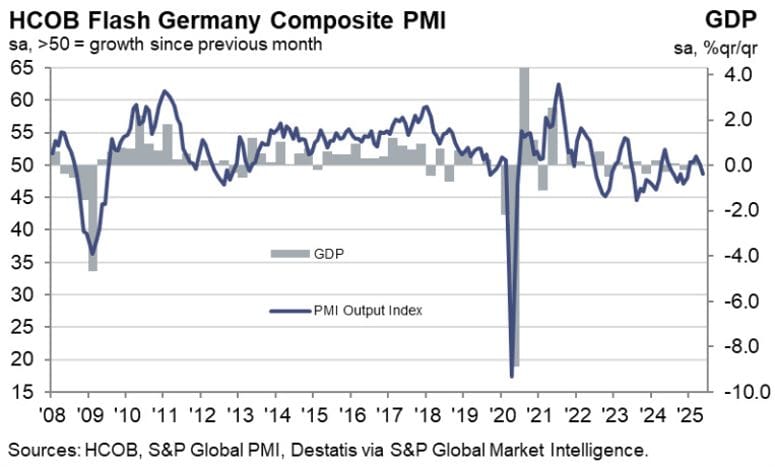

German PMI Shows Weakness in Services, Slight Uptick in Manufacturing

Germany’s flash May PMIs from HCOB show divergent trends:

- Manufacturing PMI: 48.8 (just under 48.9 expected, prior 48.4)

- Services PMI: 47.2 (well below 49.5 expected, prior 49.0)

- Composite PMI: 48.6 (vs. 50.4 expected, prior 50.1)

Key notes:

- Composite output at a five-month low

- Services at their weakest in 30 months

- Manufacturing output at a three-month low

- Headline manufacturing PMI is at a 33-month high, suggesting a nuanced recovery beneath weak headline numbers

Commenting on the flash PMI data, Dr. Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, said:

“These numbers paint a mixed picture – there are both positives and negatives here. On the bright side, manufacturing is doing better, as output has been climbing for three months in a row, and new orders are following suit. In the service sector, by contrast, activity has taken a sharper tumble. And since services make up a big chunk of the economy, that drop has pulled overall activity into contraction. Considering the modest growth we saw in Q1, this latest data lines up with what the German Council of Economic Experts are forecasting, namely that the economy might just be treading water this year.

“In manufacturing things are looking up. While the headline PMI is still in recessionary territory, it’s been inching higher for five straight months. That upward trend likely reflects a mix of short-term factors – like companies rushing orders ahead of US tariffs – and broader cyclical improvements supported by ECB rate cuts. Looking ahead, increased defence spending and a more defined infrastructure package could give the sector an extra push. Plus, falling input costs, which are driven by cheaper energy, should offer manufacturers some breathing room.

“Service providers are struggling a bit. Activity has been sliding for two months now, with new business drying up and pricing power fading. Meanwhile, costs are still climbing fast, which could squeeze profit margins. On a more positive note, service providers are still hiring, bucking the broader trend. And future expectations have ticked up a bit, though the level of optimism is still well below the long-term average. Overall, our nowcast model, which considers the PMI among other factors, calculates that activity of service providers will barely expand in the second quarter.”

German Business Sentiment Inches Higher, But Current View Slips

Germany’s Ifo business climate index edged up to 87.5 in May, narrowly beating the 87.4 forecast. However, the details were mixed:

- Current conditions: 86.1 (below 86.8 expected, prior 86.4)

- Expectations: 88.9 (above 88.0 expected, prior 87.4)

While overall sentiment improved, the softer current assessment suggests the recovery remains patchy.

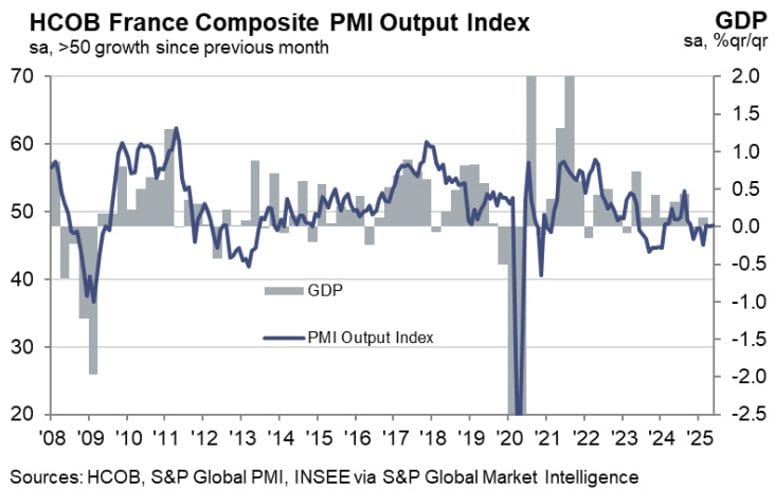

France Flash PMIs Improve Slightly, But Services Still Contracting

HCOB’s flash May PMIs for France showed a modest improvement, with both services and manufacturing indexes rising slightly:

- Services PMI: 47.4 (vs. 47.5 expected, prior 47.3)

- Manufacturing PMI: 49.5 (vs. 48.9 expected, prior 48.7)

- Composite PMI: 48.0 (in line with expectations, prior 47.8)

Despite remaining below the growth threshold, the manufacturing output index hit a 37-month high, and the services business activity index reached a two-month high—offering some signs of stabilization.

Commenting on the flash PMI data, Jonas Feldhusen, Junior Economist at Hamburg Commercial Bank, said:

“France’s private sector remained subdued in May. The Flash Composite PMI continues to signal contraction, reflecting the economic challenges France is facing amid domestic political instability and a fragile macroeconomic environment.

“Diverging trends emerged across sectors. The services sector deteriorated, with business activity still weak. Looking ahead, prospects are equally dim. The index measuring the order situation—an indicator of future business—remains well below the long-term average and inside contraction territory. In contrast, the manufacturing sector showed signs of recovery.

“The Manufacturing PMI improved for the fifth straight month, supported by increased factory output. Despite ongoing uncertainty and trade-related headwinds, several factors may explain this upward trend, such as the ECB’s easing of credit conditions, EU efforts to reduce regulatory burdens, and the push to increase defense spending. These developments could, despite prevailing risks, pave the way for a cyclical rebound following the prolonged downturn in the sector.

“Price dynamics raise new concerns for French businesses. While output prices slipped into deflationary territory in May, input cost inflation accelerated, signalling a squeeze on profit margins, particularly in the services sector. This raises the question of how trade frictions will influence European price levels in the coming months.

“On one hand, supply chain disruptions and frontloading could drive prices up. On the other hand, goods facing increased competition as a result of supply being redirected to the European market away from the US might exert downward pressure on prices. Nevertheless, HCOB Economics still expects three additional ECB rate cuts this year, as the subdued growth and inflation environment leaves scope for further easing.

“Despite improvements in manufacturing and President Macron’s recent efforts to position France as an attractive destination for investment, research and development, the overall outlook for the private sector remains bleak, as seen by the business outlook falling sharply in May, especially in the service sector.”

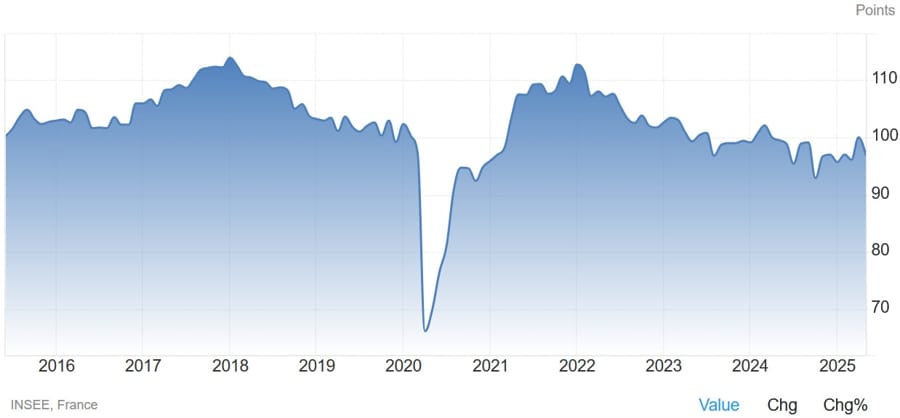

French Business Confidence Slides in May

France’s May business sentiment index fell to 97, missing expectations of 99. The previous month’s figure was revised up slightly to 100.

While not a market-moving release, the drop underscores a cautious business outlook in Europe’s second-largest economy.

Belgian Business Confidence Improves Slightly in May

Belgium’s business confidence index for May rose to -13.5, slightly better than the -14.0 forecast and up from April’s -14.7.

Though still negative, the small improvement supports cautious optimism. As a leading indicator, it points to tentative stabilization in sentiment across the Belgian economy.

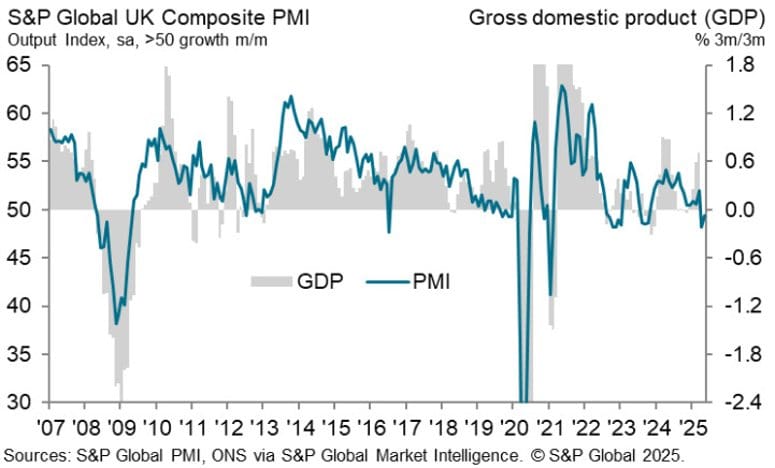

UK Flash PMI for May Shows Slight Services Rebound, Manufacturing Still Weak

S&P Global’s flash data for May shows the UK’s services PMI at 50.2, just above the neutral mark and slightly ahead of expectations (50.0). That’s up from April’s 49.0, signaling marginal improvement.

- Manufacturing PMI: 45.1 (vs. 46.0 expected, prior 45.4)

- Composite PMI: 49.4 (vs. 49.3 expected, prior 48.5)

While inflation pressures are said to be easing, S&P Global noted ongoing pessimism about future business conditions. Job shedding remains aggressive, particularly in manufacturing. The firm maintains its view that the Bank of England is still on track to cut rates further.

EU’s Dombrovskis: Ministers put forth proposals on further Russian sanctions

- EU’s Dombrovskis:

- G7 ministers put forth proposals on next package of EU sanctions on Russia oil price cap adjustments

- There was a suggestion to lower oil price cap to $50/barrel

- G7 did not go into in-depth discussion on Russian sanctions

ECB Accounts: Growing Confidence in Medium-Term Inflation Path

Minutes from the ECB’s April meeting show that policymakers are increasingly confident that inflation will return to target over the medium term.

Key highlights:

- Greater probability that recent trade shocks could fuel inflation longer than expected

- Most members aligned with the March baseline, seeing inflation settling near 2%

- Some officials considered a 50bps rate cut but opted for a more cautious approach

- The euro’s strength and lower energy prices are tempering short-term price pressures

- A majority agreed that the euro area has become more resilient to shocks

- Discussions emphasized not setting a fixed endpoint for the rate cycle

ECB’s Holzmann: The Euro’s importance as a global currency is set to increase

- Remarks by the ECB policymaker

- The Euro’s importance as a global currency is set to increase.

- Frequent shifts in trade policy have fuelled economic uncertainty, undermining stability and resulting in tangible losses for all parties involved.

- It makes economic forecasts more complex and policy decision more challenging in an already uncertain environment.

ECB’s Vujcic: Eurozone growth positive but low

- Comments from the ECB policymaker

- Eurozone growth positive but low.

- I expect to get close to 2% target at the end of 2025.

- I expect to reach the target in early 2026.

ECB’s Nagel sees progress on tariffs, but says still more work to be done

- European Central Bank Governing Council member and head of Germany’s Bundesbank

- said there has been progress in resolving the U.S.-EU tariff dispute, but more hurdles remain.

- Speaking from the G7 meeting in Banff, Canada, Nagel noted a better mutual understanding is developing between the U.S. and Europe.

- He stressed that both sides now recognize trade conflicts have no winners.

- Nagel is “a little more confident” than he was days earlier, suggesting improved dialogue with the U.S.

- The German Council of Economic Experts cut its growth forecast for Germany, citing the negative impact of tariff uncertainty.

- Nagel expects German Q1 growth might surprise on the upside, but warns of deterioration in Q2 as tariff effects bite.

- He sees potential for German growth to return to 1% or more by 2026, depending on the speed of fiscal policy rollout.

- In a separate interview, Nagel described U.S. Treasury Secretary Scott Bessent as “constructive.”

- He rejected any notion of a G7 split over U.S. policy, affirming: “It’s a G7.”

Asia-Pacific & World News

China and ASEAN Finalize Major Upgrade to Free Trade Pact

China and 10 ASEAN nations have wrapped up negotiations on the upgraded China–ASEAN Free Trade Agreement (CAFTA 3.0), which is now slated for formal signing by year-end.

The revamped deal introduces nine new chapters covering digital trade, green development, and tighter supply chain integration. Officials say it will fortify economic ties and give institutional support to high-efficiency regional trade networks.

With China–ASEAN trade closing in on $1 trillion for 2024, the agreement marks a major milestone in Asia’s economic alignment and a direct challenge to fragmented global trade systems.

Morgan Stanley: China’s Already Won the EV Hardware Race—Tesla’s Betting on Software

Morgan Stanley is warning that the electric vehicle race is shifting dramatically—and China’s already crossed the finish line when it comes to hardware. According to a new research note, Tesla’s recent pivot toward full autonomy is no accident; it’s a direct reaction to a collapsing moat in EV manufacturing.

The game-changer? Xiaomi’s SU7, dubbed an “electric Ferrari at Volkswagen prices,” and the newer YU7, blend high-end styling with aggressive affordability. Their pricing undercuts the competition while delivering performance Western automakers can’t yet match.

Xiaomi’s EV division could hit revenue of RMB 233 billion (about $32 billion) by 2027—matching Tesla’s total auto revenue from 2020 in just three generations. Legacy U.S. and European players? They’re years behind.

Tesla’s strategy now hinges on its self-driving stack. As Chinese automakers close the quality gap, the future profit engine lies in data, AI, and software—not in wheels and batteries. That’s why Morgan Stanley believes the market is misjudging Tesla’s margin play while underestimating how fast Chinese competition is scaling.

PBOC sets USD/ CNY reference rate for today at 7.1903 (vs. estimate at 7.2009)

- PBOC CNY reference rate setting for the trading session ahead.

PBOC injected 154.5bn yuan via 7-day reverse repos at 1.40%

- 64.5bn yuan matured today

- net injection 90bn yuan

RBA’s Hauser: Aussie Exporters See China Holding Strong in Trade Battle

RBA official Jonathan Hauser offered a positive readout from a recent trip to China, reporting that Australian exporters are optimistic about Chinese demand holding steady despite global trade tensions.

Takeaways:

- Confidence in Beijing’s ability to maintain growth is high

- Chinese firms believe tariffs will mostly hit U.S. consumers

- No significant expectation for yuan devaluation

- Potential rise in domestic competition from Chinese firms offering discounted goods

- Overall impact on Australian sectors seen as limited due to minimal direct overlap

Australia’s Manufacturing PMI Holds Steady in May

Australia’s flash PMI data for May showed stability in the manufacturing sector, with the index holding at 51.7 for the second month in a row.

- Services PMI: 50.5 (down from 51.0)

- Composite PMI: 50.6 (down from 51.0)

While services growth softened, overall economic activity remains in expansion mode, albeit at a slower pace.

New Zealand Shrinks Budget Deficit Forecast, Cuts Near-Term Bond Issuance

Wellington is dialing back its deficit and adjusting bond sales. New Zealand now expects a fiscal shortfall of NZ$14.74 billion for FY 2024–25, down from the NZ$17.32 billion forecast in December. The improved number reflects stronger revenue and better-than-expected economic momentum.

Net debt is projected to peak at 46% of GDP in 2027/28—slightly later than before but at a lower level than the previous 46.5% forecast.

The Debt Management Office has trimmed gross bond issuance to NZ$38 billion for 2025/26, down from NZ$40 billion. However, over the longer horizon to 2029, the total bond issuance outlook has been raised to NZ$132 billion, up from NZ$128 billion, reflecting bigger funding needs for infrastructure and economic transformation.

Japan Machinery Orders Blow Past Expectations

Japan’s core machinery orders soared 13.4% month-over-month in March, crushing forecasts for a 1.6% decline. Year-over-year, orders jumped 8.4%.

The blowout data points to rising business investment and a possible lift to the country’s economic recovery narrative. After months of recession worries, the latest capex signal may prompt forecasters to upgrade their growth outlook.

Japan’s Manufacturing PMI Shows Sector Still Shrinking

Japan’s preliminary manufacturing PMI for May came in at 49.0, slightly up from April’s 48.7 but still signaling contraction. If confirmed in the final reading, May would mark the 11th straight month below the 50 threshold.

- Output fell at a faster pace

- New orders and export demand declined, though at a slower rate

- Input costs rose at the slowest clip in 14 months

- Output price inflation hit a near four-year low

The services PMI slipped to 50.8 from 52.4, while the composite index fell to 49.8 from 51.2, suggesting economic headwinds are broadening.

Reuters survey: Two-thirds of Japanese firms want BOJ to pause rate hikes

- Due to Trump’s tariffs

Reuters Japan Corporate Survey:

- Two-thirds of Japanese firms want BOJ to pause rate hikes due to Trump’s tariffs

- More than 80% of Japan firms intend to proceed with wage hikes despite tariff impact

- More than 60% of Japanese firms expect negative earnings impact from new US tariffs

Japan finance minister Kato says Unsustainable imbalance in some countries behind trade imbalance

- Japan finance minister Kato:

- Told G7 meeting that US tariffs are creating uncertainties

- Discussed overcapacity with G7

- Told G7 unsustainable macro-economic imbalance of some countries behind trade imbalance

- Told G7 each country must take steps to boost domestic demand, cut fiscal deficit

- Talk with Bessent lasted 30 minutes

- Met with U.S. Treasury Secretary Bessent today

- Told Bessent that US tariffs are regrettable

- Agreed with Bessent that FX rates should be set by markets

- Reaffirmed excessive volatility in currency moves has adverse impacts on economic and financial stability

- No talk on FX levels

- Tariffs are not appropriate means to correct macroeconomic imbalances that are behind trade imbalances

- Did not directly discuss Japan’s US Treasury holdings in meeting with Bessent

- Leave monetary policy to BOJ

- Monetary policy falls under jurisdiction of BOJ, when asked whether he discussed BoJ policy with Bessent

Bank of Japan board member Noguchi: Japan’s economy is growing steadily

- Bank of Japan board member Noguchi – BOJ likely to keep adjusting policy rate

- Japan’s economy is growing steadily

- Japan’s economy is currently shifting to a new phase where sustainable inflation is realized accompanied by wage increases

- Downside risks to Japan economy stemming from overseas economies have rapidly heightened due to U.S. tariff policies

- BOJ likely to keep adjusting policy rate while carefully examining whether underlying inflation would be stabilising around 2%

- BOJ shouldn’t pre-set terminal rate in raising rates

- BOJ should spend time gauging impact of each rate hike on economy, scrutinise risks, before moving to next hike

- 10-year JGB yield rose near 1.6% in March but I didn’t see it as disruptive as it reflected change in market’s view on terminal rate

- Personally don’t see need to make big changes to existing BOJ taper plan

- As for taper plan for April 2026 onward, we need to examine with a longer-term perspective

- BOJ can spend sufficient time reducing its balance sheet, doing so is desirable for market stability

- BOJ is maintaining loose monetary policy as rise in inflation is mainly driven by import costs, not necessarily sustainable

- Monetary policy must focus on underlying price moves that are strongly linked to nominal wage developments

- Wage, domestic demand-driven price pressure not strong enough but steadily increasing

- Our basic monetary policy stance should be to cautiously move on policy adjustment while scrutinising economy and its risks

BOJ Noguchi says Bank should only ramp up bond purchases during “severe market disruption”

- No need right now to step in despite rising yields

Bank of Japan (BOJ) board member Asahi Noguchi says the central bank should only ramp up bond purchases during “severe market disruption”, signaling no immediate need to counter the recent spike in super-long bond yields.

- Noguchi believes no major changes are needed to the BOJ’s current bond tapering plan, which runs through March 2026, though he says the strategy beyond that should be reviewed from a long-term perspective.

- The BOJ plans to conduct an interim review of its tapering program at its policy meeting next month and outline a new approach for the period beyond March 2026.

- A known dove on the BOJ board, Noguchi also urged caution on future interest rate hikes, saying they should proceed gradually and only with clear evidence that inflation is sustainably anchored around the 2% target, supported by wage growth.

- While the BOJ allows markets to determine long-term interest rates, Noguchi noted it retains the option to adjust bond buying in response to volatility—but such emergency operations should be used only in exceptional circumstances.

Japan’s Mimura says Japan, US did not discuss FX levels at finance ministers’ meeting

- Reaffirmed that forex should be determined by the market

Japan’s Mimura says Japan, US did not discuss FX levels at finance ministers’ meeting

- reaffirmed that forex should be determined by the market

- Do not believe that there is any gap in understanding with the U.S.

- Finance Minister Kato agreed with Bessent that FX rates should be set by markets

- Did not discuss current rates

- Did not discuss future rates

Singapore GDP Beats Forecasts in Q1, But Growth Outlook Remains Cautious

Singapore’s economy expanded 3.9% year-over-year in Q1 2025, beating expectations of 3.6%. On a quarter-over-quarter basis, GDP shrank 0.6%, a slightly better result than the projected -1.0%.

Despite the beat, the Ministry of Trade and Industry kept its full-year growth forecast at 0.0% to 2.0%, citing uncertainty around global trade and manufacturing. Export-heavy sectors and financial services are expected to stay soft through the year, even as global sentiment shows tentative signs of improvement.

Singapore central bank official says current monetary policy settings remain appropriate

- Monetary Authority of Singapore is the country’s central bank

An official of the Monetary Authority of Singapore says current policy stance remains appropriate

Crypto Market Pulse

Strategy to Raise $2.1B in Stock Sale to Add More Bitcoin

Strategy (formerly MicroStrategy) announced plans to sell $2.1 billion worth of STRF preferred stock to fund additional Bitcoin purchases.

- Stock offering: up to 10% of Series A STRF at $0.001/share

- Proceeds to expand BTC holdings and support operations

Earlier this week, Strategy revealed it had bought 7,390 BTC for $764.9 million, averaging $103,498 per coin. Its total BTC stash now stands at 576,230 BTC, about 2.74% of the total supply — valued near $64 billion, with unrealized gains of around $24 billion.

Bitcoin is trading at $111,400, just off its record high of $111,800, driven in part by sustained buying from institutions following Strategy’s playbook.

XRP Targets $3 as ETF Launch, Open Interest Fuel Bullish Structure

XRP is pushing higher, trading around $2.43, supported by a major uptick in market engagement. Open interest surged 25% to $4.96 billion, while trading volume hit $6.59 billion, up 59% in 24 hours.

Key support sits just below at:

- $2.40 short-term floor

- 50-day EMA: $2.29

- 100-day EMA: $2.26

Volatility Shares is preparing to launch the first XRP futures ETF on NASDAQ, with 80% of net assets allocated to XRP-linked contracts via a Cayman Islands-based entity. It will trade under ticker XRPI.

The firm also confirmed plans for a 2x leveraged ETF tied to XRP futures, following April’s leveraged XRP product from Teucrium.

In parallel, Ripple and the SEC have moved toward resolving their longstanding legal battle with a proposed $50 million settlement, though the court denied the joint motion to dismiss appeals.

Technicals show further room to run:

- RSI: 56 — positive momentum without being overbought

- Pattern: Higher lows intact

Cetus Hack Puts Sui’s Bullish Run at Risk

The Sui blockchain’s strong performance is under threat following a $220 million exploit of its top liquidity provider, Cetus.

Cetus halted all trading and paused smart contracts after discovering the breach. The attacker reportedly used fake tokens like BULLA and MOJO to manipulate pricing mechanisms and drain liquidity from vulnerable pools.

SUI has reversed gains, down to $3.81 on the day after a 60% rise over the past month. CETUS, the platform’s native token, dropped 40%.

Sui’s team confirmed that they are actively supporting the Cetus investigation and promised further updates.

BNB Jumps 5% as Binance Ecosystem Expands

BNB rallied over 5% in the past 24 hours, riding the wave of renewed optimism across crypto markets and strength in the Binance ecosystem.

Key on-chain metrics:

- Over 8 million daily transactions on BNB Chain

- 2 million+ active wallets

- Strong support at $682 with resistance around $684

CoinDesk Research notes the asset’s uptrend is supported by volume spikes and repeated defense of key technical levels. Late-session volatility saw BNB jump from $680.85 to $683.78 in just two minutes, before consolidating near $682.28.

Chainlink Eyes $25 as Whale Activity Heats Up

Chainlink (LINK) gained nearly 2%, reaching $16.45 as Thursday trading continued, buoyed by surging whale interest and broader bullish sentiment.

- Whale addresses have accumulated over 25 million LINK since February

- LINK now trades above the 200-day EMA ($16.01)

- Resistance sits around $18

- A potential inverted head and shoulders breakout could send the price toward $25.34, aligning with the 78.6% Fibonacci retracement of the $29.26 → $10.93 move

The RSI at 58 suggests increasing strength without being overbought, though a reversal below $15.00 could invalidate the bullish setup.

Meme Coins Explode Higher as Bitcoin Crosses $111K

Bitcoin surged to $111,880, sparking a rally across meme coins and altcoins, as investor concerns over U.S. debt levels intensified. The Bitcoin dominance index dipped to 63.84% as traders piled into high-beta plays.

Standout moves:

- Fartcoin (FARTCOIN) flipped $1.20 resistance to support, targeting $2.73

- Dogwifhat (WIF) broke out of a bull flag, aiming for $1.74

- Popcat (POPCAT) surged following a descending triangle breakout with a 29% upside target

The backdrop: Moody’s downgraded the U.S. from Aaa to Aa1 on May 16, citing spiraling debt. The move follows prior downgrades by S&P (2011) and Fitch (2023). With confidence in Treasuries waning, investors are turning to Bitcoin and even meme coins as hedges.

Bitcoin trades at $110,666, with MACD signaling strong momentum. However, the RSI at 76 warns of overbought territory, raising the risk of a near-term pullback.

The Day’s Takeaway

United States

- Equities:

U.S. stock markets closed mixed. The Dow dipped 1.35 points to 41,859.09, virtually unchanged. The S&P 500 slipped 0.04% to 5,842.01, while the Nasdaq outperformed, rising 0.28% to 18,925.73 on strength in tech. Top Nasdaq gainers included PDD (+3.10%), TSLA (+1.89%), GOOGL (+1.37%), and AMZN (+0.96%). - Economic Data:

The Kansas City Fed Manufacturing Index fell deeper into contraction territory at -10, down from -5. Export orders dropped sharply to -21. Inflationary pressures eased as prices paid fell to 34 and prices received to 17.

Jobless claims came in at 227K, below the 230K estimate, while continuing claims ticked up.

S&P Global PMIs surprised to the upside:- Manufacturing Flash PMI: 52.3 (prior 50.2)

- Services Flash PMI: 52.3 (prior 50.8)

- Gold & Rates:

Gold dropped to $3,289, down from a $3,345 high, pressured by a firmer USD (DXY at 99.86) and solid economic data.

The 10-year Treasury yield eased 3 bps to 4.55%, while real yields fell to 2.207%.

Fed’s Waller said tariffs near 10% wouldn’t derail the economy and hinted at potential rate cuts in H2.

CBOT futures are pricing in 50.5 bps of rate cuts by year-end.

Canada

- Producer Prices:

Canada’s PPI fell 0.8% m/m in April (vs. -0.5% expected), down from +0.5% prior.

The Raw Materials Price Index sank 3.0% m/m and 3.6% y/y, marking a sharp reversal from March’s 3.9% y/y gain. - BOC Commentary (G7):

Governor Tiff Macklem noted G7 finance ministers focused on improving global tariff coordination and addressing systemic trade issues. Canada emphasized the need for better dialogue on supply chains, financial crimes, and imbalances.

Commodities

- Crude Oil:

Oil futures settled at $61.20, down $0.37 on reports that OPEC+ may raise output by 411,000 barrels/day in July.

The market remains below key resistance between $61.92–$64.71, reinforcing a bearish technical bias. - Silver:

After surging to a 7-week high of $33.70, Silver fell back to $32.95, down over 2%.

The pullback was technical in nature, triggered by profit-taking and a USD rebound.

Support now sits around $32.50–$32.70, with bullish structure still intact above that zone.

Europe

- Stock Markets:

European equities closed off their lows but still in the red:- DAX: -0.5%

- CAC 40: -0.7%

- FTSE 100: -0.6%

- IBEX: -0.3%

- FTSE MIB: -0.8%

Rest of World

- G7 Finance Meeting Takeaways:

Tariffs and trade tensions remained a dominant topic, but officials reportedly worked constructively on broader global financial and supply chain issues.

The IMF, with G7 backing, agreed to ramp up analysis on global imbalances.

Crypto

Bitcoin & Strategy:

BTC trades near $111,400, just below its new ATH of $111,800.

Strategy (ex-MicroStrategy) will sell $2.1B in STRF preferred stock to expand its BTC stash beyond 576,230 BTC (~2.74% of supply).

Recent BTC gains are being driven in part by sustained institutional accumulation and fiscal uncertainty post-Moody’s downgrade of U.S. debt.

XRP:

XRP trades at $2.43, supported by a 25% jump in open interest to $4.96B and rising volume.

ETF news lifted sentiment: Volatility Shares will launch the first XRP futures ETF on NASDAQ, allocating 80% of net assets to XRP-linked contracts.

Ripple’s legal battle nears resolution with a proposed $50M settlement, though the court denied a motion to dismiss appeals.

SUI (Sui):

Bullish momentum halted after a $220 million hack hit its top liquidity provider Cetus.

The platform paused trading and smart contracts. CETUS token plunged 40%.

Sui is assisting in the investigation and promised updates.