North America News

U.S. Stocks Bounce Back to Even for the Week

Tuesday marked a strong rebound session on Wall Street, clawing back ground lost on Monday and pushing all major indexes back to near even for the week.

- S&P 500: +2.5%

- Nasdaq Composite: +2.7%

- Dow Jones Industrial Average (DJIA): +2.7%

- Russell 2000: +2.8%

The reversal moves helped restore sentiment and left markets in better shape as the week progresses.

U.S. Treasury’s $69 Billion 2-Year Note Auction Draws Mixed Demand

The Treasury’s latest two-year note auction saw a high yield of 3.795%, slightly above the 3.789% “when-issued” (WI) level at the time of sale—producing a 0.6 basis point tail. That’s in contrast to the average -0.4 basis points over the last six auctions.

- Bid-to-cover ratio came in at 2.52x, below the six-month average of 2.65x.

- Direct bidders took 30.1%, doubling the 15.4% average.

- Indirect bidders accounted for just 56.2%, down from the usual 73.0%.

- Dealers ended up with 13.7%, above the 11.6% norm.

This shift suggests stronger domestic demand while international appetite cooled, forcing the yield higher to draw in buyers.

Tesla Misses Q1 Expectations, Guidance Removed

Tesla’s first-quarter numbers disappointed across key metrics:

- Revenue came in at $19.34B, well short of the $21.37B estimate.

- Adjusted EPS landed at $0.27, missing the expected $0.43.

- GAAP EPS was $0.12.

- Gross margin was 16.3% (above est. 16.1%), but

- Operating income fell to $399M (vs. $1.13B expected).

- Free cash flow totaled $664M, below the $1.08B forecast.

- Adj. net income: $934M vs $1.431B expected.

Year-over-year, automotive revenue dropped 20%, while Tesla noted that tariffs will likely impact its energy division more than autos.

Production plans for new, more affordable EV models are still on track for H1 2025. However, the company removed its guidance for a return to growth this year, stating that it will revisit 2025 expectations in Q2. Liquidity remains solid to support ongoing development, though future growth depends on several market variables.

The company said:

Uncertainty in the automotive and energy markets continues to increase as rapidly evolving trade policy adversely impacts the global supply chain and cost structure of Tesla and our peers. This dynamic, along with changing political sentiment, could have a meaningful impact on demand for our products in the near-term. We remain committed to expanding our business model to include delivering autonomous robots across multiple form factors and use cases – powered by our real-world AI expertise – to our customers and for use in our factories, as we navigate these headwinds.

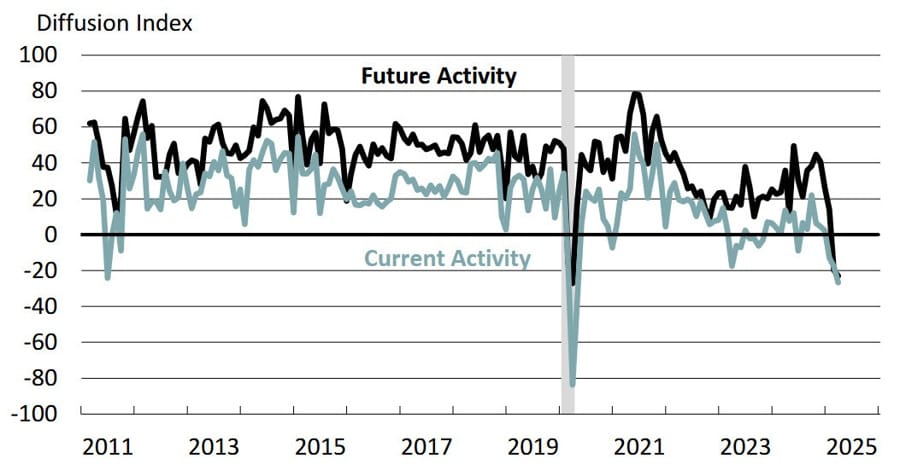

Philly Fed Non‑Manufacturing Survey at Deepest Low Since 2020

April’s Philadelphia Fed services survey collapsed to –42.7 (versus –32.5 prior), marking the worst reading since May 2020.

- Firm‑level activity: –26.7 (from –17.5)

- New orders: –6.9 (improved from –19.5)

- Revenues: –7.8 (from –4.7)

- Full‑time employment: –7.2 (from –7.5)

- Part‑time: –7.9 (down from +3.5)

- Prices paid surged to 46.5; prices received fell to –0.1.

Future six‑month outlooks also weakened to –31.8 (general) and –23.0 (firm), both multi‑year lows.

GE and Moody’s Q1 Results Snapshot

- General Electric

- Revenue: $9.00 billion (est. $9.05 billion)

- Adjusted EPS: $1.49 (est. $1.27) | Continuing ops: $1.83

- Free cash flow: $1.44 billion (est. $1.46 billion)

- Orders: $12.3 billion, up 12%

- Backlog: >$170 billion (Commercial services >$140 billion)

- FY guidance: Adjusted EPS $5.10–$5.45 (est. $5.42); FCF $6.3–$6.8 billion (est. $6.64 billion)

- Note: Outlook excludes further tariff escalation.

- Moody’s ($MCO)

- Q1 EPS: $3.83 (vs. $3.56 est.)

- Revenue: $1.92 billion (vs. $1.90 billion est.)

- Market cap: $75.35 billion

Richmond Fed Composite Index Tumbles

The Richmond Fed’s April composite business conditions index plunged to –13 (its weakest since November), down from –4 in March. The services component fell to –7 (from –4), and manufacturing shipments dropped to –17 (from –7), signaling broad regional slowdown.

Fed Officials Warn Tariffs Could Risk Anchored Inflation Expectations

Two top Fed voices weighed in Tuesday with inflation concerns tied to tariff pressures:

- Richmond Fed President Tom Barkin said inflation expectations may be loosening.

- Minneapolis Fed’s Neel Kashkari warned that high inflation poses a risk to long-run expectations becoming unanchored.

Kashkari noted that while tariffs typically cause one-off price increases, the broader inflation backdrop may amplify their effect. So far, long-run expectations have remained stable, but both officials cautioned that rising price pressures and slowing growth make monetary policy independence all the more crucial. The Fed cannot risk letting inflation expectations drift too far.

Treasury Secretary Bessent: Trade Talks With China Will Be a Grind

In private remarks, U.S. Treasury Secretary Sarah Bessent described current trade relations with China as effectively an “embargo,” warning that negotiations would be a “slog.”

Key points from the meeting:

- The status quo is unsustainable and some form of de-escalation is likely in the near term.

- The goal is not to decouple the U.S. and Chinese economies.

- A two- to three-year rebalancing—with the U.S. shifting toward manufacturing and China pivoting to consumption—would be a major strategic win.

- The lingering question is whether Beijing is willing to engage on that path.

These remarks offer a rare look at Washington’s longer-term trade vision, even as near-term outcomes remain uncertain.

Kimberly‑Clark Q1: Currency Drags, Outlook Slashed

Kleenex and Huggies maker Kimberly‑Clark saw first‑quarter net sales fall 6% to $4.8 billion, with FX translation accounting for a 2.4% hit. The company cut its constant‑currency operating‑profit guidance from “high single‑digit growth” to “flat to modest gains,” citing higher global supply‑chain costs. Shares slipped 3.5%. On the bright side, price declines were limited to 1.5%, and sales volume was flat year‑on‑year—offering some relief on inflation, even as pricing power wanes in a softer consumer market.

Congressman Warns of Market Stress Over Treasury Sales

Rep. Frank Lucas, chair of a key congressional economic task force, says each Treasury debt auction feels like a “hold your breath” moment. He stressed the need to safeguard Fed independence as Trump ramps up attacks on Powell.

Moody’s Zandi: Trump’s Trade War Could Do Lasting Damage

Moody’s Analytics Chief Economist Mark Zandi warns that Trump’s economic strategy could harm the U.S. for years. His erratic tariff policies weaken the rule-of-law image that underpins U.S. economic strength, threaten Fed autonomy, and could drive borrowing costs up.

Morgan Stanley: Tariff Turmoil Echoes COVID-Era Uncertainty

Analysts at Morgan Stanley are sounding the alarm—saying Trump’s unpredictable trade moves are stirring COVID-level uncertainty. Companies are finding it hard to plan, and the S&P 500 is likely stuck between 5,000 and 5,500 for now. The Fed is holding back on rate cuts while trade war fallout unfolds.

JP Morgan Flags Inflation Risk if Fed Loses Independence

JP Morgan analysts warn that any erosion of the Fed’s independence could stoke inflation fears and push long-term interest rates higher. This would further strain the economy and deepen the fiscal hole.

Citigroup Delays Rate Cut Forecast, Still Expects 125bps in 2025

Citi economists have shifted their call for the next Fed rate cut from May to June. They’re still projecting a total of 125 basis points in cuts for the year, even as the timing becomes more uncertain.

Trump Preps Powell Scapegoat Strategy

Donald Trump is laying the political groundwork to deflect blame for any economic slump tied to his trade policies—targeting Fed Chair Jerome Powell. If interest rates don’t drop soon, Trump seems ready to fault the Federal Reserve, even at the risk of undercutting its independence and credibility.

The Journal is gated, here is the link if you can access it.

Canada’s March PPI Beats Expectations

Canada’s producer price index rose 0.5% month‑over‑month in March (consensus +0.3%), following a 0.6% February gain (revised higher from 0.4%). On an annual basis, the PPI eased to +4.7% from +4.9%. Meanwhile, the raw materials price index tumbled 1.0% m/m (versus +0.3% prior) and +3.9% y/y (down from +6.6%).

Commodities News

Gold Slips From Record High as China Trade Optimism Spurs Profit-Taking

Gold prices pulled back from a fresh record high of $3,500, falling nearly $100 after U.S. Treasury Secretary Scott Bessent signaled a possible thaw in U.S.–China trade tensions.

As of writing, gold is trading near $3,400, down 0.63% on the day. The drop was triggered by a shift to risk-on sentiment, even as U.S. Treasury yields edged lower.

Despite the retreat, gold remains up 29% YTD, supported by:

- Escalating geopolitical tensions

- Concerns over Fed credibility

- Ongoing uncertainty around U.S. trade and monetary policy

The World Gold Council (WGC) reports that Q1 2025 ETF inflows hit $21 billion, the second-highest quarterly amount on record—only behind Q2 2020’s $24 billion.

Markets are now pricing in 91 basis points of Fed rate cuts by year-end 2025, with the first likely in July. This week’s U.S. data docket includes PMIs, durable goods, and consumer sentiment, which may further influence gold’s direction.

Oil Rallies Nearly 2% on Sanctions, Despite OPEC+ Supply Plans

WTI crude futures for May delivery settled at $64.31, a $1.23 gain on the day, or +1.95%.

The rally was fueled in part by fresh U.S. Treasury sanctions targeting Iranian LPG magnate Seyed Asadoollah Emamjomeh and his extensive business network—effectively locking down large volumes of Iranian LPG and crude from reaching global buyers.

Also lifting prices: renewed optimism around trade discussions with China, Japan, and India, although any breakthroughs are still a long way off.

On the downside, OPEC+ is preparing to raise output, adding 411,000 barrels per day next month—but markets had largely priced that in already.

Silver Stalls Below $33 as Trade Deal Hopes Weigh on Safe-Haven Bid

Silver held steady around $32.50 during Tuesday’s European session, as traders awaited fresh cues on U.S.–China trade negotiations and digested recent political developments.

The market is in a holding pattern after a volatile second week of April when President Trump announced a 90-day pause on certain tariffs, even as broader retaliatory duties remain in place.

U.S. officials maintain a cautiously optimistic tone. Commerce Secretary Howard Lutnick said over the weekend that the White House is confident a deal will come through. Meanwhile, Press Secretary Karoline Leavitt reaffirmed Trump’s stance that “China needs to make a deal with us”—adding a layer of political gamesmanship to the economic standoff.

Meanwhile, Trump’s conflict with Fed Chair Powell continues to weigh on the U.S. Dollar. A weaker dollar typically boosts silver’s value proposition for investors.

While the long-term macro picture supports silver’s role as a safe-haven asset, near-term price action will depend heavily on trade headlines and central bank rhetoric.

Oil Slides Despite Tight Spot Market, Traders Reduce Exposure

Oil prices took a hit on Monday as broader risk-off sentiment weighed on commodities. According to ING analysts Ewa Manthey and Warren Patterson, ICE Brent crude ended the day down 2.5%, even though prompt supply conditions remain relatively tight.

Contributing to the downside:

- Ongoing demand concerns tied to tariff uncertainty

- Geopolitical pressure from Trump’s Fed attacks

- Hints of progress in U.S.–Iran nuclear talks, which could bring more oil supply online

Despite the soft flat price, the prompt timespread remains strong, hovering near $1/bbl backwardation, indicating tightness in immediate supply. Refinery margins also remain resilient, which could support demand if macro fears subside.

However, speculators pulled back sharply, selling 56,887 contracts last week. That leaves net long positioning at 98,951 lots—the lowest since October. Most of that pullback came from longs liquidating, signaling a shift in sentiment among professional traders.

Gold’s Ascent Unabated, Targets $3,500

Gold just keeps powering upward amid mounting global uncertainty. Prolonged U.S. tariffs—originally pitched as a quick win against Japan—have instead tangled negotiations and heightened market turmoil. Meanwhile, U.S.–China brinkmanship drags everyone else into economic fallout. A weakening dollar, plus China’s threats to weaponize the yuan, only bolster gold’s safe‑haven appeal. Even long-term Treasuries are losing luster as 30‑year yields climb back toward 4.91%. Central banks continue to buy bullion, and ETF holdings still trail spot prices. Today’s nearly 2% gain takes gold to about $3,485—within striking distance of $3,500 before week’s end.

Shanghai’s Gold ATM Becomes a Hotspot

With gold prices soaring, Shanghai’s new “Gold ATM” is attracting a steady stream of residents looking to sell. The machine weighs and authenticates gold, offers live pricing, and pays out in under 30 minutes—with an 18 yuan per gram fee.

Europe News

European Markets End Mostly in the Green, Except Italy

European equities closed with solid gains across most major indices, though Italy’s market lagged. Here’s how things wrapped up:

- Germany’s DAX climbed 91.04 points, up 0.43%, ending at 21,296.91.

- France’s CAC 40 advanced 40.60 points, or 0.56%, closing at 7,326.47.

- UK’s FTSE 100 rose by 52.96 points, up 0.64%, to finish at 8,328.61.

- Spain’s Ibex 35 gained 92.61 points, up 0.72%, closing at 13,010.60.

- Italy’s FTSE MIB was the lone underperformer, down 32.55 points, or 0.09%, settling at 35,947.89.

The session showed strength across most of the continent, with Italy marking the only slip on the board.

Eurozone Consumer Confidence Hits New Lows

Preliminary data for April show euro‑area consumer confidence sliding to –16.7, below the –15.5 economists expected and deteriorating from –14.5 in March. This is the lowest reading since October 2023, reflecting growing worries over trade skirmishes and inflation.

Forecasters Raise ECB 2025 Inflation Outlook

In the ECB’s latest professional‑forecaster survey, the median inflation projection for 2025 climbed to 2.2% (up from 2.1% three months ago), and for 2026 to 2.0% (versus 1.9%). Growth forecasts dipped to 0.9% for 2025 (from 1.0%). Respondents cited tariff pressures and rising defense budgets as key drivers behind the upward inflation revisions.

Swiss Sight Deposits Flat at CHF 448.3 billion

Data from the Swiss National Bank through April 18 show overall sight deposits ticking slightly higher to CHF 448.3 billion from CHF 446.9 billion a week earlier. Domestic deposits rose similarly from CHF 438.4 billion to CHF 439.7 billion. The minimal shift suggests the SNB has remained largely on the sidelines, even as a softer dollar exerts downward pressure on capital flows.

ECB’s Lagarde: Either we cut or pause but we will be data dependent to the extreme

- Comments from Lagarde on CNBC

- European trade with US is 17%

- Disinflationary path is clearly on its way

- The US has a trade surplus in the EU with services

- Downside risk on growth “is pretty much a given” and not just in Europe

- The net impact of tariffs is to be seen

- We don’t see a recession in the eurozone

ECB’s Rehn: Great uncertainty is restraining economic activity

- Remarks by ECB policymaker, Olli Rehn

- Great uncertainty is restraining economic activity.

- In the short-term, the impact of tariffs on Euro Area inflation is to the downside due to lower demand.

- Most economist assumed the euro would weaken as a result of tariffs. That has not happened.

- If China redirects its exports toward Europe due to excessively high tariffs by the US, if energy prices fall and if the euro strengthens, then tariffs won’t cause inflation to accelerate in the euro area.

- The trade war started by President Trump has created exceptional uncertainty, which reduces euro-area economic growth.

ECB’s Kazimir: Interest rates are now within the neutral range

- Remarks by ECB policymaker, Peter Kažimír

- Interest rates are now within the neutral range.

- June to depend on data, forecasts and risk outlook.

- Inflation to reach 2% in the next few months.

- Time needed to assess risks associated with tariffs.

- US Trade policy is eroding confidence.

- We must remain vigilant and agile.

BoE’s Greene: Pricing partly reflects global factors

- Remarks from BoE’s policymaker Megan Greene

- Pricing partly reflects global factors.

- Not all market pricing focused on UK.

- I am more concerned about supply side.

- Exchange rates haven’t gone as theory suggests.

- A falling dollar would be disinflationary for UK.

- Too early to say where dust will settle on dollar strength.

- There is no sign of shakeout in labour market yet.

- UK wage growth remains pretty high.

- Services points to inflation persistence.

- I am more worried about services inflation than wages.

- Tariffs are more of a disinflationary risk.

- Rise in inflation expectations worrisome.

- Neutral rate is higher than where it was.

- 3.25-3.50% neutral rate is not unreasonable.

Asia-Pacific & World News

IMF Trims Global Growth Forecasts Again

The IMF’s World Economic Outlook now pegs 2025 global GDP growth at 2.8% (down from 3.3% in January) and 2026 at 3.0% (versus 3.3%). It sees U.S. growth slowing to 1.8% in 2025 (from 2.7%) and 1.7% in 2026 (from 2.1%); China at 4.0% both years (vs. 4.6%/4.5% prior); Germany at flat for 2025 (down from +0.3%). The Fund blamed U.S. tariffs, mounting trade tensions, and volatile financial markets for the downgrades, warning that further policy swings could tighten conditions even more.

China’s Auto Exports Jump 16% in Q1 2025

China’s carmakers are riding high, with exports hitting 1.54 million vehicles from January to March—up 16% year-over-year. March alone saw 570,000 cars shipped abroad, matching the same growth rate.

Tesla Pushes Zero-Interest Deals in China

Facing fierce local competition, Tesla is now offering five-year, zero-interest financing on its revamped Model Y in China. It’s a clear move to juice sales.

China Freezes U.S. Private Equity Ties

Beijing is pulling the plug on new investments in American private equity. State-backed funds like CIC have backed away, part of a larger decoupling trend amid worsening trade tensions.

Ford Halts China Exports; Layoffs Hit Volvo/Mack

Ford has stopped exporting several models—including the F-150 Raptor, Mustang, Bronco, and Lincoln Navigator—to China, thanks to a 150% tariff wall. Meanwhile, Volvo/Mack is cutting up to 450 jobs across plants in Pennsylvania and Maryland, citing soft demand and tariff uncertainty.

PBOC sets USD/ CNY reference rate for today at 7.2074 (vs. estimate at 7.2925)

- PBOC CNY reference rate setting for the trading session ahead

- PBoC injects 220.5bn CNY via 7-day reverse repos, rate at 1.50%

New Zealand Posts March Trade Surplus

New Zealand reported a NZD 970 million surplus in March’s trade balance, more than double February’s figure. Still, the yearly balance remains in the red at -NZD 6.13 billion. Exports surged to 7.59 billion, while imports climbed to 6.62 billion.

Japan Keidanren Chief Tokura: Rapid FX fluctuation not desirable for economy

- KEIDANREN (Japan Business Federation) is a comprehensive economic organization with a membership comprised of 1,542 representative companies of Japan

- Rapid FX fluctuation not desirable for economy.

- Want FX to stabilise as much as possible.

Japan economy min Akazawa confirms agriculture will not be compromised in US tariff talks

- Japan is not just going to roll over on tariffs

Japan’s economy minister Akazawa says he shares PM Ishiba’s stance that agriculture will not be compromised to protect auto industry in U.S. tariff talks.

South Korea PPI Softens Slightly in March

South Korea’s Producer Price Index rose 1.3% in March 2025 compared to last year, a modest slowdown from February’s 1.5%. On a monthly basis, prices were flat.

South Korea Scales Back Fuel Tax Cuts

Seoul will keep fuel tax breaks through June but at reduced rates: gasoline taxes will be cut by 10%, down from 15%, while the discount on diesel and LPG butane will drop from 23% to 15%.

Crypto Market Pulse

CZ Meets Malaysian PM to Explore Blockchain Expansion

Binance co-founder Changpeng “CZ” Zhao met with Malaysian Prime Minister Anwar Ibrahim on Tuesday to advance discussions on blockchain adoption and Malaysia’s ambitions to become a regional hub for digital finance.

The meeting emphasized Malaysia’s intent to lead in blockchain innovation by collaborating closely with key regulatory bodies, including the Securities Commission Malaysia (SC), Bank Negara Malaysia (BNM), and the Ministry of Digital. The goal: balance innovation with regulatory oversight and global compliance standards.

Prime Minister Anwar highlighted tokenization and the digitalization of financial instruments as pillars of Malaysia’s strategy for future economic development. He also stressed that responsible blockchain adoption would play a central role in the country’s digital economy agenda.

CZ’s visit to Malaysia follows similar diplomatic outreach in Pakistan, showing Binance’s strategic alignment with fast-developing markets. Anwar publicly shared highlights from the meeting on his official X (formerly Twitter) account, reinforcing government transparency and its willingness to engage the tech sector on digital transformation initiatives.

Bitcoin Surpasses $91K on ETF Demand and Powell Criticism

Bitcoin broke through the $91,000 mark on Tuesday for the first time in 52 days, driven by renewed investor interest and political noise from Washington.

Fueling the move was a surge in Bitcoin ETF inflows, with $381 million entering U.S.-listed spot ETFs on Monday alone—the largest single-day inflow since January 30. Notably, ARKB led with $116 million, followed by Fidelity’s FBTC ($87 million) and BlackRock’s IBIT ($41 million).

The price rally also coincided with President Trump’s criticism of Federal Reserve Chair Jerome Powell, whom he accused of manipulating rate policy. These comments spooked traditional markets, shifting investor focus toward crypto assets. Bitcoin jumped more than 5% over 48 hours, with analysts now targeting a move toward $95,000 if momentum holds.

New SEC Chair Paul Atkins, known for his pro-market stance, added to the bullish sentiment. In his first remarks, he signaled support for a more transparent, innovation-driven regulatory framework, particularly for spot ETFs and DeFi protocols.

Meanwhile, institutional adoption surged:

- MicroStrategy bought 6,556 BTC for $555.8 million, bringing its total holdings to 538,200 BTC (acquired at ~$67,766 average).

- Japan’s Metaplanet added 330 BTC at $28.2 million, now holding 4,855 BTC worth $414.5 million (average: $85,386).

Despite short-term volatility, the influx of institutional capital hints at a more stable long-term price floor for Bitcoin.

Chainlink Faces Resistance at $14 Amid Heavy Exchange Outflows

Chainlink (LINK) rose nearly 3% on Tuesday to trade around $13.47, buoyed by strong technical signals and significant outflows from crypto exchanges.

According to IntoTheBlock, over $120 million worth of LINK tokens have exited exchanges in the past 30 days, suggesting that investors are moving their holdings into self-custody wallets—a typical signal of accumulation and reduced sell pressure.

The price has climbed 31% since bottoming at $10.13 on April 7, breaking out of a falling wedge pattern with an uptrending RSI, both indicating potential bullish continuation. However, the 50-day EMA remains a sticking point.

One headwind: the In/Out of the Money (IOMAP) metric shows resistance between $14.93–$15.37, where 108,000 LINK tokens were previously bought. Investors in that range may sell into strength to break even, which could slow further gains.

On the downside, support levels are thin, so a pullback below $13 could erase recent gains—especially if macro conditions worsen or market sentiment turns risk-off again.

Bitcoin Surges Past Key Trendline Toward 90,625

Bitcoin decoupled from a sluggish equity sell‑off yesterday, breaking above its long‑standing downward trendline. With the S&P 500 and Nasdaq sliding, crypto’s rally underscores its unique drivers. On the daily chart, BTC comfortably cleared 86,125 and now eyes 90,625 as the next resistance zone—where sellers may re‑emerge. Short‑term traders will likely use 86,125 as their stop‑loss floor and 90,625 as the profit target; bears need a drop below 86,125 to retest supports near 83,000. Having just cracked $90,000—its highest since March 7—bitcoin’s resilience will be tested if U.S. equity markets resume their “sell America” theme.

SEC Names Crypto-Friendly Chairman

Paul Atkins, a known supporter of cryptocurrency, has officially taken over as SEC Chairman. His leadership is expected to pave the way for more favorable crypto regulation.

BlackRock Adds $84M in Bitcoin to ETF

BlackRock has acquired another 1,000 BTC—worth roughly $84 million—for its spot Bitcoin ETF, drawing from Coinbase Prime wallets, according to multiple crypto news outlets.

The Day’s Takeaway

Day’s Takeaway: Key Market Trends & Developments

United States – Mixed Signals Across Markets

- Equities Rebound: Major indices snapped back sharply after Monday’s slide.

- S&P 500: +2.5%

- Nasdaq: +2.7%

- Dow Jones: +2.7%

- Russell 2000: +2.8%

- Treasury Auction Falters: The $69B two-year note auction saw weak demand from foreign buyers, with a 3.795% high yield, a 0.6bps tail, and below-average bid-to-cover (2.52x). Domestic buyers picked up the slack.

- Federal Reserve in Political Crossfire: Trump ramped up attacks on Chair Powell, accusing him of sabotaging the economy. Fed officials Barkin and Kashkari warned that tariffs could unanchor inflation expectations, though long-term forecasts remain steady—so far.

- Tesla Recap:

- Q1 Revenue: $19.34B vs. $21.37B expected

- Adj. EPS: $0.27 vs. $0.43 est

- Auto revenue dropped 20% y/y; guidance pulled, citing tariff impact especially on energy division.

Canada – Producer Prices Outpace Forecasts

- PPI (March):

- +0.5% m/m vs. +0.3% expected

- +4.7% y/y (slightly below 4.9% prior)

- Raw Materials Index fell 1.0% m/m, indicating some cost relief.

Commodities – Volatility Reigns

- Gold & Silver Pull Back:

Gold hit a record $3,500 before profit-taking brought it back near $3,400.

Silver hovered around $32.50, as traders await more clarity on U.S.–China trade tensions. - Oil (WTI) closed at $64.31, up 1.95%.

- Rally driven by U.S. sanctions on Iran’s LPG networks and hopes for trade stabilization.

- Gains capped by OPEC+ output increase and speculation around U.S.–Iran nuclear talks.

- ICE Brent slipped 2.5%, weighed by macro risk-off sentiment.

- Speculators sold off over 56,000 contracts, reducing net longs to the lowest since October.

- Gold ETFs added $21B in Q1, the second-highest quarter ever, per the World Gold Council.

Europe – Green Close for Most Majors

- European indices mostly higher, except Italy:

- DAX +0.43% at 21,296.91

- CAC 40 +0.56% at 7,326.47

- FTSE 100 +0.64% at 8,328.61

- Ibex 35 +0.72% at 13,010.60

- FTSE MIB (Italy) –0.09% at 35,947.89

- Eurozone Consumer Confidence dropped to –16.7, lowest since Oct 2023.

- ECB’s Professional Forecasters raised 2025 inflation outlook to 2.2%, citing tariffs and defense spending.

Asia – Strategic Blockchain Moves & Currency Watch

- Malaysia hosted Binance co-founder CZ for talks on blockchain innovation and digital asset regulation. PM Anwar Ibrahim emphasized tokenization and tech leadership as national priorities.

- South Korea and Japan continue to monitor currency volatility as U.S. monetary policy drama and trade policy friction cast long shadows.

- China sent positive signals on trade de-escalation; this drove a pullback in precious metals prices as traders locked in profits.

Rest of World – Global Growth Downgraded

- IMF slashed global GDP forecast to 2.8% in 2025, down from 3.3%.

- U.S. cut to 1.8%

- China to 4.0%

- Germany to 0.0%

- Primary concern: U.S. tariffs and deepening trade fragmentation.

Crypto – Surge in Institutional Flows, Bitcoin Leads

- Bitcoin broke $91,000, first time in 52 days, and is eyeing $95K next.

- $381M in ETF inflows on Monday — highest since January.

- MicroStrategy added 6,556 BTC ($555.8M), now holding 538,200 BTC.

- Metaplanet added 330 BTC ($28.2M), total holdings: 4,855 BTC.

- SEC Chair Paul Atkins took over, promising clarity and crypto-friendly regulation. Markets see it as a major sentiment shift from the Gensler era.

- Chainlink (LINK) is nearing $14 resistance after a 31% rally. Exchange outflows exceeding $120M over the past month suggest accumulation by long-term holders, but overhead resistance may stall further upside.