North America News

Stocks Finish Higher, but Nvidia Ends a Brutal Week in the Red

US stocks swung sharply on Friday before ending the session higher. The early drop pushed the S&P and Nasdaq below their 100 day moving averages for the first time since May 9. Sellers could not hold control and both indices climbed back above those levels and into positive territory.

Trading was volatile throughout the day.

• The Dow had an 800 point range.

• The S&P moved 137 points, a 2.07 percent swing.

• The Nasdaq moved 627 points, a 2.28 percent swing.

All three indices finished higher:

• Dow up 493.30 points or 1.08 percent to 46245.56

• S&P up 64.20 points or 0.98 percent to 6602.96

• Nasdaq up 195.03 points or 0.88 percent to 22273.08

The strong close did not repair the weekly damage.

• Dow down 1.91 percent

• S&P down 1.95 percent

• Nasdaq down 2.74 percent

Nvidia was the standout loser. The stock fell 3.15 percent Thursday and another 0.96 percent Friday. For the week, Nvidia slid 5.92 percent despite reporting strong earnings. Pressure across large cap tech was widespread.

A long list of big names dropped at least 5 percent this week. The steepest declines included AMD at 17.43 percent, Raytheon at 17.17 percent, Micron at 15.99 percent, Strategy at 14.66 percent, and Roblox at 12.79 percent. Bitcoin logged a 10 percent weekly drop after hitting a record high near 126,000 dollars earlier this month.

The tone across the week was clear. Even with Friday’s rebound, risk appetite remained weak and selling came with two hands.

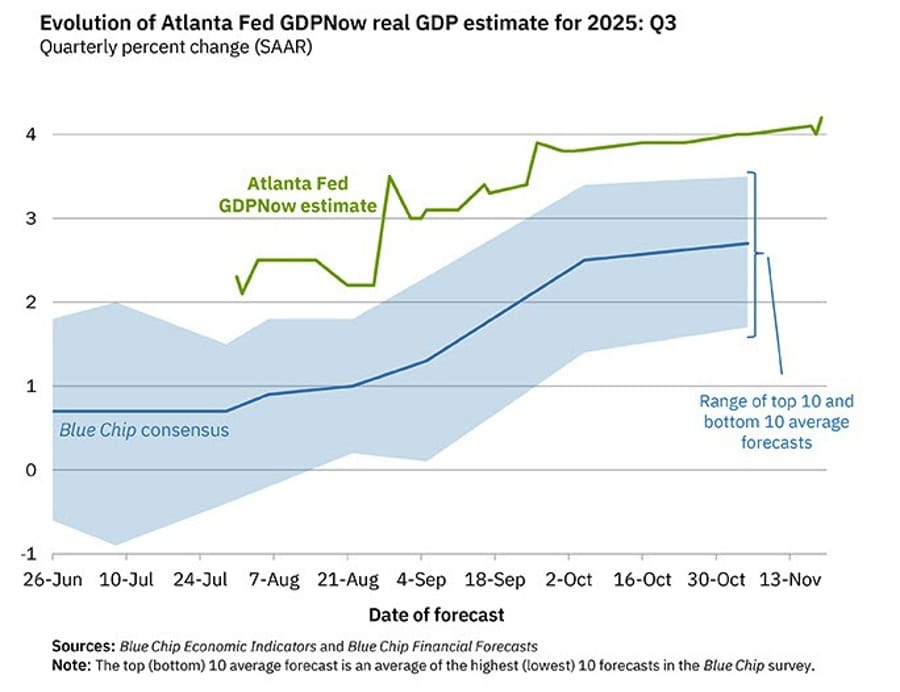

Atlanta Fed GDPNow Holds Q4 Growth Estimate at 4.2 Percent

The Atlanta Fed GDPNow model kept its fourth quarter US growth estimate at 4.2 percent, matching the high for the quarter. The projection has held steady as incoming data signal firm economic momentum.

In their own words

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the third quarter of 2025 is 4.2 percent on November 21, unchanged from November 19 after rounding. After recent releases from the US Census Bureau, the US Bureau of Labor Statistics, and the National Association of Realtors, a slight decrease in the nowcast of third-quarter real personal consumption expenditures growth was offset by an increase in the nowcast of third-quarter real gross private domestic investment growth from 4.8 percent to 4.9 percent.

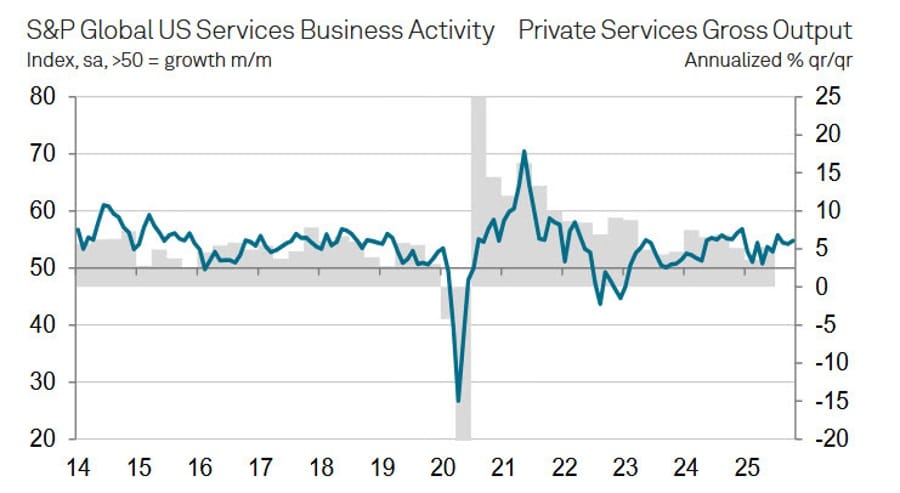

US November Flash PMIs Hold in Expansion

US flash PMIs from S&P Global showed continued growth in November. Services rose to 55.0, ahead of expectations for 54.6 and above the prior 54.8. Manufacturing printed 51.9, just under the 52.0 forecast and below October’s 52.5. The composite index climbed to 54.8 from 54.6 and beat expectations for 54.5.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence:

“The flash PMI data point to a relatively buoyant US economy in November, signalling annualised GDP growth of about 2.5% so far in the fourth quarter. The upturn also looks encouragingly broad-based for now, with output rising across both manufacturing and the vast services economy.

“A marked uplift in business confidence about prospects in the year ahead adds to the good news. Hopes for further interest rate cuts and the ending of the government shutdown have boosted optimism alongside a broader undercurrent of improved economic optimism and reduced concerns over the political environment.

“However, manufacturers reported a worrying combination of slower new orders growth and a record rise in finished goods stock. This accumulation of unsold inventory hints at slower factory production expansion in the coming months unless demand revives, which could in turn feed through to lower growth in many service industries.

“Furthermore, although jobs continued to be created in November, the rate of hiring continues to be constrained by worries over costs, in turn linked to tariffs. Both input costs and selling prices rose at increased rates in November, which will be of concern to the inflation hawks.”

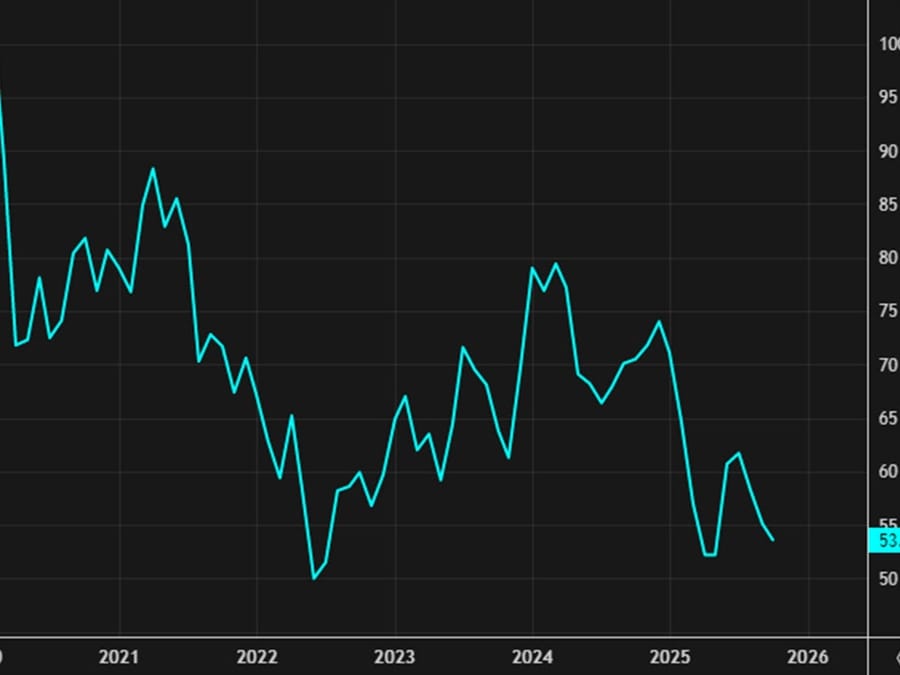

US November Final UMich Sentiment Ticks Higher

The final University of Michigan consumer sentiment index for November rose to 51.0, slightly above expectations for 50.5. The preliminary reading had been 50.5. Current conditions dropped to 51.1 from 58.6, while expectations improved to 51.0 compared with 50.3 last month.

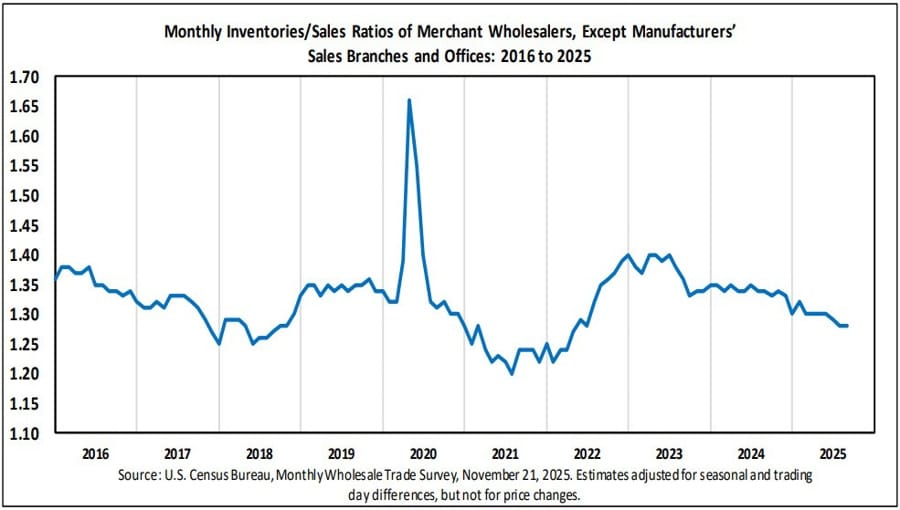

US Wholesale Sales Slow to 0.1 Percent in August

US wholesale sales increased 0.1 percent in August, below the 0.4 percent estimate and down from a revised 1.3 percent in July. Inventories were flat against expectations for a 0.2 percent decline. The inventory to sales ratio held at 1.28 months, matching the prior month and remaining near the lowest levels since mid 2022.

US Real Weekly Earnings Down Slightly in September

US real weekly earnings slipped 0.1 percent in September after a 0.3 percent drop in August. On a year-on-year basis, real weekly earnings increased 0.8 percent compared with 0.7 percent previously.

October CPI Canceled as BLS Shifts Release to November Data

The Bureau of Labor Statistics confirmed that October CPI will not be published. The next release will be the November CPI report on December 18, after the December 10 FOMC interest rate decision. The report will not include a one month change due to the missing October data.

Fed Officials Flag Higher Job Market Risks and Support Holding Rates

New York Fed President John Williams said downside risks to employment have increased even as tariffs lift prices only temporarily. He said inflation progress has stalled but should return to 2 percent by 2027. Williams said policy remains moderately restrictive and still allows for cut options, although he stressed the need to meet the inflation target without jeopardising employment. He projected trend-like growth this year and next and noted markets are highly optimistic about AI.

Boston Fed President Susan Collins said September labour data were mixed and repeated her view that leaving rates steady is appropriate for now. She described policy as mildly restrictive and warned global fragmentation could heighten both inflation and economic volatility.

Dallas Fed President Lorie Logan said rates should be held for a period to assess the data. She reiterated discomfort with supporting a December cut, arguing that inflation remains too high and that the October cut had not been justified.

Fed’s Paulson Calls for Careful Approach to December Meeting

Philadelphia Fed President Anna Paulson said she is approaching December’s meeting with caution as the central bank weighs slower labour momentum against inflation that remains above target. She backed recent cuts but said further moves must be measured because policy is edging closer to providing stimulus.

Paulson said she is slightly more concerned about the job market than inflation. She described the September payrolls report as encouraging but highlighted that hiring remains concentrated in healthcare and social services, a pattern associated with late-cycle conditions. Inflation remains above 2 percent for a fifth consecutive year.

Morgan Stanley Scraps December Fed Cut Call After Payroll Rebound

Morgan Stanley no longer expects a Federal Reserve rate cut in December following a stronger than expected September payroll report. Non-farm payrolls rose by 119,000, reversing the prior month’s small decline and beating consensus for a 50,000 increase.

The unemployment rate edged up to 4.4 percent, a four-year high, but the bank argued that the improvement in hiring breadth signals the summer slowdown may have been overstated. The delayed report, held back by a 43-day government shutdown, has prompted the bank to project the first cut in January, followed by two additional moves in April and June 2026. Morgan Stanley sees rates ending next year in a 3.00 to 3.25 percent range.

US Banks Step Back From Proposed 20 Billion Dollar Argentina Rescue

A group of US lenders has dropped plans for a multi-year 20 billion dollar support package for Argentina, according to reporting from the Wall Street Journal. The funding had been discussed as part of President Javier Milei’s stabilisation drive, but banks concluded the country’s fiscal trajectory and creditor appetite made the structure unworkable.

Banks are now reviewing a smaller, short-term loan aimed at covering roughly 4 billion dollars in debt coming due in January. The alternative would give Buenos Aires brief breathing room but falls far short of the broader backing policymakers hoped to secure. The shift reflects growing caution about Argentina’s financing risks and its capacity to execute reforms.

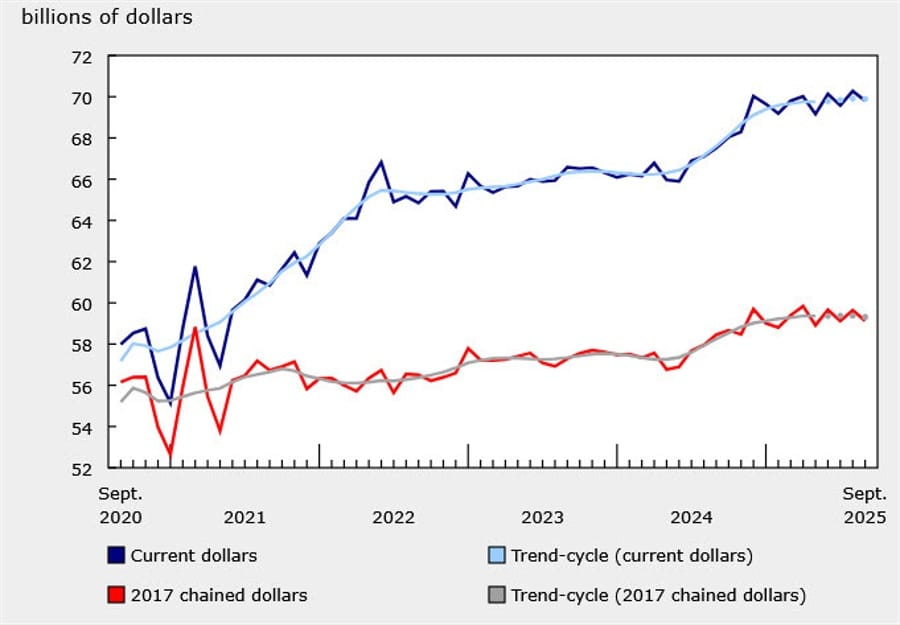

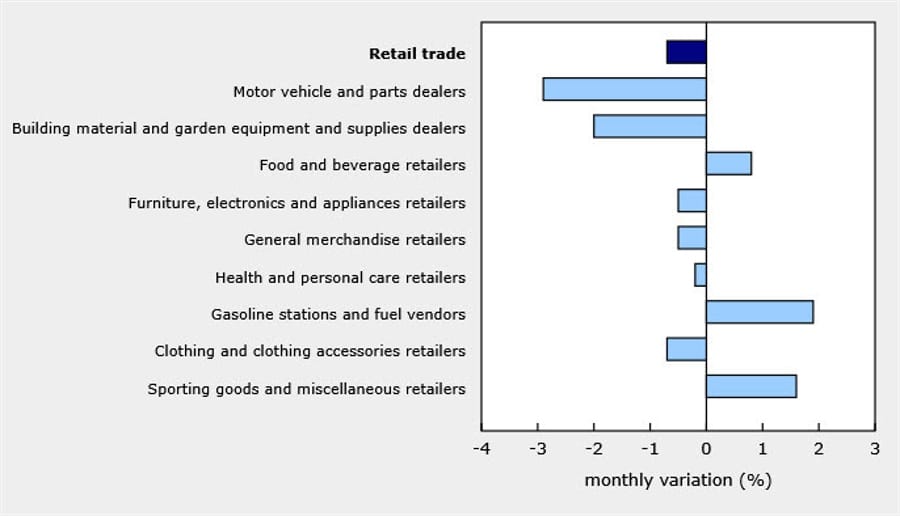

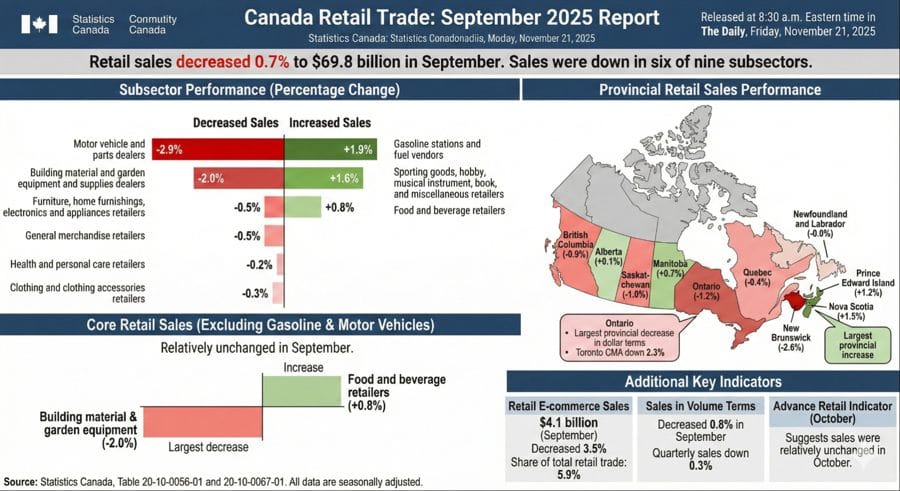

Canada September Retail Sales Fall 0.7 Percent

Canada’s September retail sales declined 0.7 percent, matching expectations after a 1.0 percent gain in August. Six of nine subsectors fell, led by autos. Food and beverage rose 0.8 percent. Sales excluding autos increased 0.2 percent against expectations for a 0.5 percent drop. Ex autos and gas registered no change after a 1.1 percent rise. E-commerce sales fell 3.5 percent. Statistics Canada said preliminary October data show sales were relatively unchanged. Retail sales rose 0.2 percent in the third quarter.

By sector:

Commodities News

Gold Rises as Dovish Fed Remarks Fuel December Cut Expectations

Gold held firm on Friday as comments from Federal Reserve officials strengthened expectations for a rate cut in December. At the time of writing, gold traded near 4096 dollars, up 0.53 percent after touching 4101 dollars.

John Williams and Governor Stephen Miran signaled that easing may be appropriate if economic momentum cools. Their tone encouraged traders to price in a 71 percent chance of a 25 basis point cut in December, up from roughly 31 percent at the start of the day. Boston Fed President Susan Collins and Dallas Fed President Lorie Logan argued for keeping policy restrictive, but their stance did not shift market pricing.

Economic data was mixed. Business activity remained firm, but consumer sentiment for November fell close to its record low. Inflation expectations were revised lower on both the one year and five year horizons.

Gold traded in a tight range for most of the week as investors struggled to read the Fed’s next move. The jump in rate cut odds gave bullion a clear lift heading into the weekend.

WTI Drops to One Month Low as Ukraine Peace Signals Pressure Prices

WTI crude fell to its lowest level in a month on Friday as traders reacted to signs of progress in Ukraine peace efforts. Prices traded near 57.60 dollars, down 1.90 percent on the day and extending a three day slide that pushed crude below the 58 dollar mark.

Reports indicated that President Volodymyr Zelensky is prepared to work on a US backed proposal that includes territorial concessions to Russia and a reduction in Ukraine’s armed forces. These shifts, once considered off limits, raised hopes for a quicker path to a negotiated settlement. A diplomatic breakthrough could lead to softer sanctions on Russia and an increase in global oil supply.

The move comes as new US sanctions on Rosneft and Lukoil take effect, though the market had largely priced them in. Any easing tied to future negotiations could accelerate Russian crude flows.

Demand concerns added to the pressure. Recent US data supported expectations for a December Fed rate cut, while a strong dollar kept a lid on commodity prices by making them more expensive for overseas buyers.

EIA data showed a decline in US crude inventories due to strong exports, but rising gasoline and distillate stocks signaled softer domestic demand.

With geopolitical risk easing and consumption trends fragile, WTI remains vulnerable. Any sudden development in the Russia Ukraine talks could spark sharp price swings.

Baker Hughes Rig Count Rises in US and Canada

US drillers added 5 rigs this week, bringing the US count to 554. Oil rigs increased by 2 to 419, gas rigs increased by 2 to 127 and miscellaneous rigs rose to 8. The count is down 29 rigs from a year ago. Offshore rigs held steady at 19.

Canada added 7 rigs, bringing its total to 195. Oil rigs rose to 128 and gas rigs rose to 67. The count is down 6 rigs from last year.

Swiss Gold Exports Drop Sharply in October as Demand Softens

Swiss gold exports fell across most major destinations in October as record prices curbed demand. Exports to China collapsed more than 90 percent to 2 tons. Shipments to India fell 14 percent to 26 tons. Exports to the US and UK also declined, while Turkey saw an increase.

Exports to China are more than 50 percent lower year to date, while shipments to India are down 44 percent. Deliveries to the US rose earlier this year as traders hedged tariff risks, although flows have shifted back toward Switzerland in recent months.

Silver Market Set for Fifth Straight Deficit, ETF Flows Push Gap Wider

Commerzbank said the silver market is heading for its fifth consecutive deficit, even as physical demand falls. The Silver Institute and Metals Focus now see a 95 million ounce shortfall, smaller than prior estimates. Industrial demand remains close to record highs, down only 2 percent.

Physical investment demand is expected to decline again and reach a six year low. ETF demand, which sits outside physical demand, has been revised sharply higher. Including ETF flows, the market deficit reaches 295 million ounces, the highest level in at least a decade.

Platinum Market Appears Less Tight After Forecast Revision

The World Platinum Investment Council and Metals Focus cut their 2024 deficit estimate to 692,000 ounces from 850,000. Earlier in the year the deficit projection was near 1 million ounces. A small surplus of 20,000 ounces is expected in 2025.

The shift reflects weaker automotive and jewelry demand and weaker investment flows, alongside rising mining and recycling supply. A return to deficit in 2026 depends on easing trade tensions and a decline in exchange registered stocks. Commerzbank said any upside for platinum is likely limited due to the less tight market.

Europe News

European Stocks Close Mostly Lower as Weekly Losses Deepen

Major European indices ended Friday mixed but finished the week firmly lower. The FTSE 100 gained 0.05 percent, while the CAC slipped 0.03 percent. The DAX fell 0.78 percent, Spain’s Ibex dropped 0.99 percent and Italy’s FTSE MIB declined 0.51 percent.

All major indices lost more than 2 percent this week. The DAX fell 3.27 percent, matching its worst week since March. The CAC lost 2.34 percent, the FTSE 100 slid 1.71 percent, the Ibex dropped 3.21 percent and the FTSE MIB declined 3.03 percent.

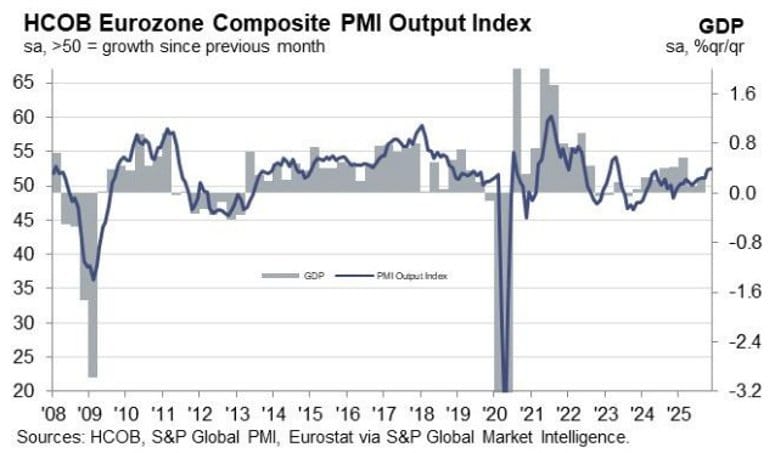

Eurozone November Flash PMIs Signal Continued Expansion

The eurozone posted another month of steady expansion in November. Flash services printed 53.1, slightly above the 52.8 estimate and up from 53.0. Manufacturing slipped to 49.7 compared with 50.2 expected, though still up from 50.0. The composite index came in at 52.4 against 52.5 forecast and unchanged from last month’s 52.5. Readings point to further solid growth across the bloc.

Commenting on the flash PMI data, Dr. Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, said:

“For months the manufacturing sector of the eurozone has been marooned in a no -man’s land of directionlessness. Production has picked up slightly since March of this year, but the overall situation has not improved during this period. Companies continue to face weak demand, which is reflected in a slight decline in new orders.

In this environment, companies have reduced their inventories of both intermediate goods and finished goods even more sharply than in the previous month, meaning that the inventory cycle continues to show no signs of turning upward. We are still several months, and possibly even several quarters, away from sustained expansion in the manufacturing sector. In the manufacturing sector, Germany and France are moving in the same direction – unfortunately, it is the wrong one, with the index falling markedly in both.

In the two largest economies in the eurozone, companies are suffering from declining order intake. In terms of production, Germany remains just within the expansion range, while in France the contraction in output has recently accelerated. If the political situation were to stabilize in the long term, companies would probably feel liberated to invest more, resulting in growing production. However, the political situation remains complicated, meaning that the eurozone is unlikely to receive any positive impetus from this quarter in the short term. The service sector in the eurozone is a ray of hope.

Although business activity growth in Germany has slowed significantly, French service providers have returned to growth. All in all, the eurozone is more or less maintaining its relatively robust expansion rate. Although the manufacturing sector is dampening growth performance, the high weight of the service sector in the overall economy means that the eurozone as a whole should grow faster in the final quarter than in the third quarter.

The acceleration of cost inflation in the service sector is unlikely to go down well with the ECB. However, at the same time, sales price inflation in this sector has slowed, so that, on balance, the headaches for monetary policymakers, who are paying particular attention to the rate of inflation among service providers, should be limited. There is no reason to tighten monetary policy. We expect interest rates to remain unchanged in December.”

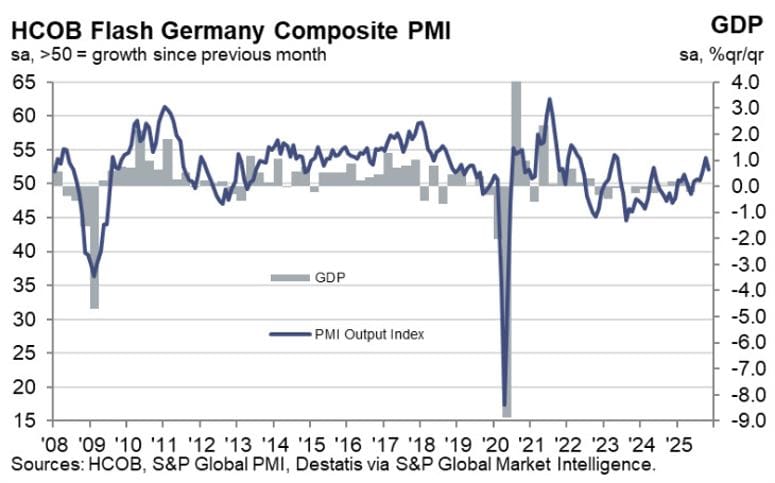

Germany November Flash PMI Slips as Activity Cools

Germany’s November flash PMIs showed a broad loss of momentum. The HCOB manufacturing index fell to 48.4, missing expectations for 49.5 and down from 49.6. Services weakened to 52.7 against a 54.0 forecast and a prior reading of 54.6. The composite index eased to 52.1 compared with expectations for 53.5 and a previous 53.9. Data signalled softer business activity growth heading into year end.

Commenting on the flash PMI data, Dr. Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, said:

“These figures are a major setback for Germany. In the manufacturing sector, the headline PMI has fallen deeper into contraction territory and now signals a slowdown in this part of the economy. Although production is slightly higher than in the previous month, new orders have now declined sharply after broadly stabilising in October. At least there is still growth in the service sector, but hopes that the rate of expansion would pick up speed here have vanished into thin air with the marked decline in the index. Overall, the German economy is limping towards marginal growth at best in the fourth quarter.

“Production in the manufacturing sector rose for the ninth month in a row, but momentum has been slowing for two months now. The slump in new orders, especially from abroad, is also an indication that the final month of the year will more likely see a downward rather than an upward trend.

“Manufacturing companies are looking to the future with significantly more confidence and expect to have increased their production in a year’s time. This is likely to be driven by hopes that relatively high growth can be expected in the coming year in the defence industry and in machinery used for civil engineering infrastructure projects. These are the areas where the government plans to channel debt-financed funds.

“Growth in the service sector has cooled, but new business has ticked up for the second month running, and hiring continues, just more cautiously than before. Overall, moderate growth is expected in the service sector in the current quarter.”

France Business Confidence Slips to 98

France’s November business confidence index fell to 98 from 101, missing expectations for 100, according to INSEE. Services sector confidence improved to 98 from 95. The release had limited market impact.

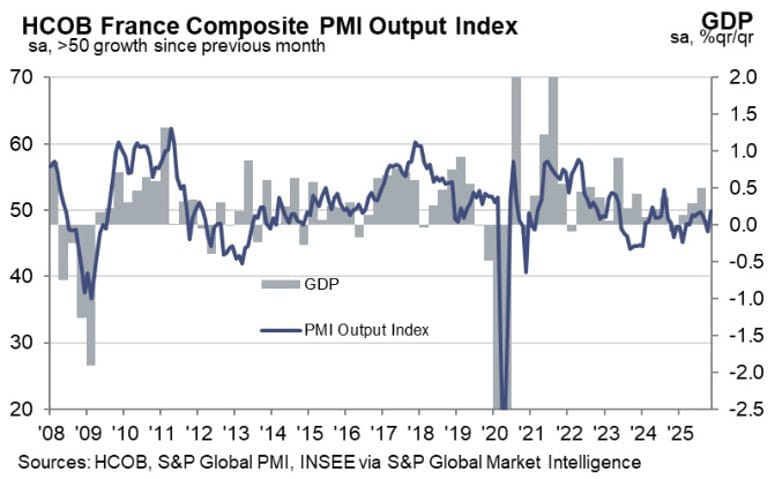

France Flash PMIs Show Services Back in Expansion

France’s November flash services PMI rose to 50.8, beating expectations for 48.4 and marking a return to expansion. Manufacturing printed 47.8 compared with the 49.0 estimate. The composite index climbed to 49.9, up from 47.7 in October.

Commenting on the flash PMI data, Jonas Feldhusen, Junior Economist at Hamburg Commercial Bank, said:

“The French private sector shows signs of stabilisation in November after October’s moderate decline, which we attributed largely to political turmoil and the resulting uncertainty. In November, the HCOB Flash PMIs point to economic consolidation, but sectoral momentum is divided: while the service sector is strengthening, the manufacturing sector remains under pressure. Given the unresolved budget and persistent political tension, the foundation of this stabilisation remains on shaky ground.

“The situation in the service sector has brightened somewhat. Demand-related indicators such as business activity and new orders have climbed above the growth threshold for the first time this year. Whether this marks the beginning of a sustainable recovery, however, will only become clear in the coming months. Some sub-indices, such as outstanding business and employment, were weak, underscoring the fragility of the rebound.

“The situation in the manufacturing sector remains tense. The PMI deteriorated in November, meaning that manufacturing remains the problem child of the economy. Production and the order situation in particular leave much to be desired. Production and order intakes are particularly disappointing. Despite these structural challenges, compounded by US trade policy and Chinese competition, manufacturers are markedly more optimistic about the future in November.

“Cost inflation accelerated, driven by both the manufacturing and service sectors. Meanwhile, pricing power of companies weakened, as average output prices stayed at the same level observed in October. Consequently, profit margins of companies are likely to have shrunk in November.”

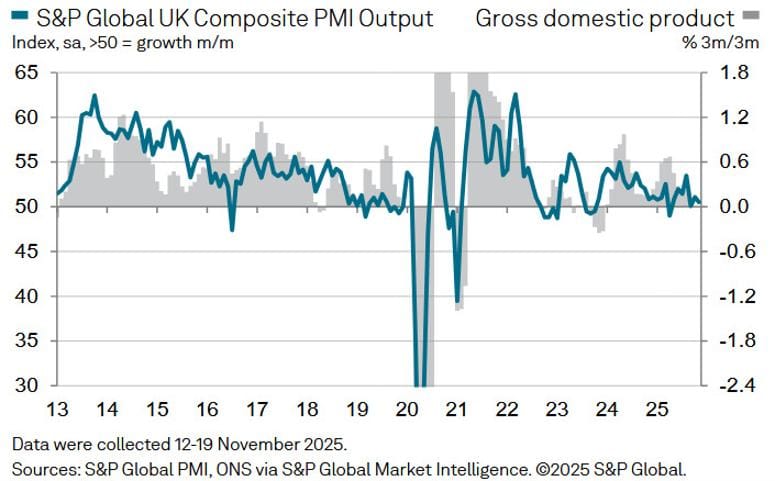

UK November Flash PMI Shows Slower Private Sector Momentum

UK private sector activity cooled in November. Services fell to 50.5 versus expectations for 52.0 and below October’s 52.3. Manufacturing rose to 50.2, outperforming the 49.2 forecast and up from 49.7. The composite index landed at 50.5, short of the 51.8 estimate and down from 52.2. Output price inflation eased to its lowest level in 59 months as overall momentum softened.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence:

“November’s flash PMI surveys brought disappointing news on the UK economy. Economic growth has stalled, job losses have accelerated, and business confidence has deteriorated.

“The PMI is broadly consistent with no change in GDP in November and a meagre 0.1% quarterly pace of growth so far in the fourth quarter.

“Some of this malaise has been blamed on paused spending decisions ahead of the Autumn Budget, but there’s a real chance this pause may turn into a downturn. The drop in confidence about the year ahead reflects growing concerns that business conditions will remain tough in the coming months, largely linked to speculation that further demand- dampening measures will be introduced in the Budget.

“Concerns over the inflation outlook will meanwhile be further assuaged by a marked drop in selling price inflation to the lowest for nearly five years. Faced by weak demand and intensifying competition, firms are cutting prices to win sales. Prices charged for goods fell at the sharpest rate since 2016, and service providers are likewise reporting much-reduced pricing power. While this is good news for inflation, it’s bad news for business profits, hiring and investment.

“The PMI data therefore suggest the policy debate will shift further away from inflation worries toward the need to support the struggling economy, hence adding to the chances of interest rates being cut in December.”

UK Retail Sales Drop in October

UK retail sales fell 1.1 percent month on month in October, compared with expectations for no change. September’s reading was revised higher to a 0.7 percent gain. Annual growth was 0.2 percent against expectations for 1.5 percent.

Sales excluding autos and fuel fell 1.0 percent on the month and rose 1.2 percent on the year. The ONS said the quarterly trend remains positive, though October saw declines in supermarkets, clothing stores and online retailers as consumers delayed purchases ahead of Black Friday. Sterling dropped following the release.

UK Consumer Confidence Slips Ahead of Budget

UK consumer confidence fell to minus 19 in November from minus 17, according to GfK. Economists had expected minus 18. The reading matches the weakest level since May as households brace for possible tax increases in next week’s budget.

Analysts estimate the government faces a 20 to 30 billion pound fiscal gap due to softer growth, higher borrowing costs and reversed welfare cuts. The major-purchase index fell three points, adding pressure on retailers heading into Black Friday.

ECB Leaders Signal Steady Policy Path

ECB President Christine Lagarde said policy will continue to be adjusted as needed to ensure inflation returns to target. She said recent rate cuts are improving financing conditions and that fiscal programs will support growth.

Vice President Luis de Guindos said risks to growth are balanced and the current rate level is appropriate given incoming data.

EU Looks at Direct Investment in Australian Resources

EU Trade Commissioner Maros Sefcovic said the bloc is evaluating equity stakes, offtake agreements and joint investments in Australian resource projects. Talks with Australia’s resources minister this week focused on securing minerals that support Europe’s industrial and clean-energy strategies.

Sefcovic said momentum is building to restart negotiations on the Australia EU trade agreement, with another round planned early next year.

Asia-Pacific & World News

Mizuho Says Offshore Yuan Not Undervalued

Mizuho Securities argued the offshore yuan is not artificially weak and has outperformed regional peers since 2018. In a research note, the bank said the People’s Bank of China has generally guided the fixing toward appreciation and that China’s trade surplus does not rely on currency manipulation.

The comments push back against renewed political claims that Beijing is using the exchange rate for competitive advantage.

US Charges Four in Nvidia Chip Smuggling Case

US prosecutors have charged four individuals with exporting restricted Nvidia AI chips to China using fake paperwork and third-country shipping routes. Reuters reports that the group sent 400 A100 GPUs to China through Malaysia between October 2024 and January 2025.

Authorities also blocked shipments involving ten HP supercomputers containing H100 chips and another 50 H200 GPUs routed through Thailand. The operation allegedly used a Tampa front company and was backed by nearly 4 million dollars in wire transfers from China.

The case has revived pressure in Congress for a chip-tracking mandate. Lawmakers including House China Committee Chair John Moolenaar are pushing the bipartisan Chip Security Act to require location verification for advanced semiconductors and reporting of diversion risks.

PBOC sets USD/ CNY reference rate for today at 7.0875 (vs. estimate at 7.1154)

- PBOC CNY reference rate setting for the trading session ahead.

- PBOC injected 375bn yuan via 7-day reverse repos at an unchanged rate of 1.40%

Australia’s November PMI Flash Points to Broader Expansion

Australia’s early November PMI readings showed improvement across sectors. The S&P Global Manufacturing PMI rose to 51.6 from 49.7, returning to expansion. Services activity printed 52.7, up from 52.5, while the composite index climbed to 52.6 from 52.1.

New Zealand October Trade Data Shows Higher Flows but a Wider Deficit

New Zealand posted higher trade flows in October, though the deficit widened. Imports reached 8.04 billion NZD, up from 7.17 billion NZD. Exports rose to 6.5 billion NZD from 5.7 billion NZD.

The monthly trade balance printed a deficit of 1.542 billion NZD, compared with 1.335 billion NZD previously. The year-to-date shortfall stands at 2.28 billion NZD, an improvement from 2.39 billion NZD.

BOJ’s Masu: BOJ is close to decision to raise rates

- This according to the Nikkei

- BOJ is close to decision to raise rates

- Says it’s not good for real interest rates to be deeply negative

- relationship with the neutral rate of interest rate. Japan’s policy rate is lower than the neutral rate.

Japan Exports Rise 3.6 Percent in October

Japan’s October export data beat expectations with a 3.6 percent year-on-year gain compared with forecasts for 1.1 percent. Imports rose 0.7 percent against expectations for a small decline. The trade deficit narrowed to 231.8 billion yen, below the 280.1 billion yen estimate.

Exports to Asia rose 4.2 percent, including a 2.1 percent increase in shipments to China. Exports to the EU climbed 9.2 percent. Shipments to the United States fell 3.1 percent.

Japan Manufacturing PMI at 48.8 in November

Japan’s preliminary November manufacturing PMI printed 48.8, up from 48.2 but still in contraction for a fifth consecutive month. Output improved to a four-month high, while new orders fell at a slower pace. New export orders dropped at the fastest rate in three months.

Services held steady at 53.1, driven by solid domestic demand. The composite index rose to 52.0 from 51.5, marking an eighth straight month of expansion. Input costs increased at the fastest pace in six months, driven by rising wages and raw material prices. Business confidence reached its highest level since January.

Japan Prepares 21.3 Trillion Yen Stimulus Package

Japan is preparing a 21.3 trillion yen stimulus plan equal to about 135 billion dollars, according to draft details seen by Reuters. It would be the largest package since the pandemic period and includes 17.7 trillion yen in spending and 2.7 trillion yen in tax cuts. The funding mix includes higher tax revenue and increased government bond issuance that is expected to top last year’s 6.69 trillion yen.

Total support rises to 42.8 trillion yen once private-sector leverage is counted. Allocations include 11.7 trillion yen in cost-of-living measures and 7.2 trillion yen for crisis-response and economic security programs. Policies include 20,000 yen in added child payments, income tax relief and gasoline tax cuts. The cabinet is targeting approval on Friday.

Japan CPI at 3.0 Percent in November

Japan’s November inflation readings showed core CPI at 3.0 percent, matching expectations and rising from 2.9 percent. The headline index also printed 3.0 percent against 2.9 percent prior. The core-core measure that excludes food and energy came in at 3.1 percent, in line with forecasts and up from 3.0 percent. All measures sit above the Bank of Japan’s 2 percent target.

Japan Finance Minister Flags Rapid Yen Moves

Finance Minister Katayama said recent yen moves have been sharp and one-sided and warned that authorities stand ready to act under the US-Japan agreement on foreign exchange. He repeated that stability in currency markets is essential and said intervention remains an option. Katayama confirmed that part of the new stimulus package will be funded through additional government debt.

Bank of Japan Governor Kazuo Ueda said yen weakness is feeding into higher import prices and influencing inflation dynamics more than in past cycles. He added that companies appear more willing to raise wages and prices, increasing the sensitivity of inflation to currency moves. Ueda said the BOJ will continue raising rates if the economy and price outlook proceed as expected, though policymakers held steady at the latest meeting to assess wage negotiations.

Singapore Lifts 2025 Growth Forecast After Strong Q3

Singapore’s Q3 GDP rose 4.2 percent year-on-year, beating expectations for 4.0 percent and well above the 2.9 percent advance estimate. Quarter-on-quarter growth was 2.4 percent on a seasonally adjusted basis.

The government raised its 2025 growth forecast to about 4.0 percent, compared with the previous 1.5 to 2.5 percent range. Officials project 2026 growth at 1.0 to 3.0 percent and expect slower expansion in manufacturing and trade-related services. Enterprise Singapore narrowed its 2025 NODX forecast to roughly 2.5 percent growth, with 2026 set for 0.0 to 2.0 percent.

Crypto Market Pulse

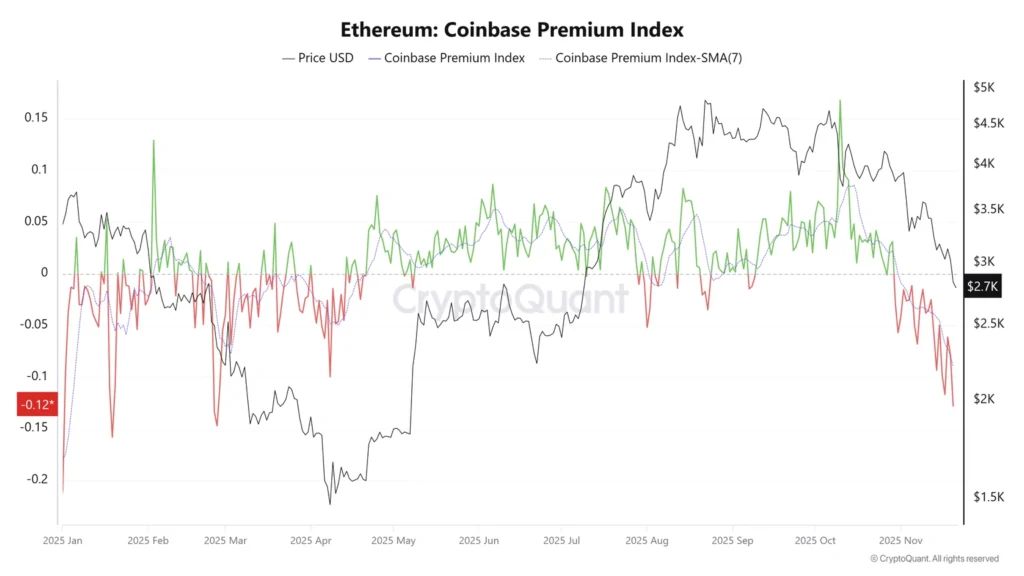

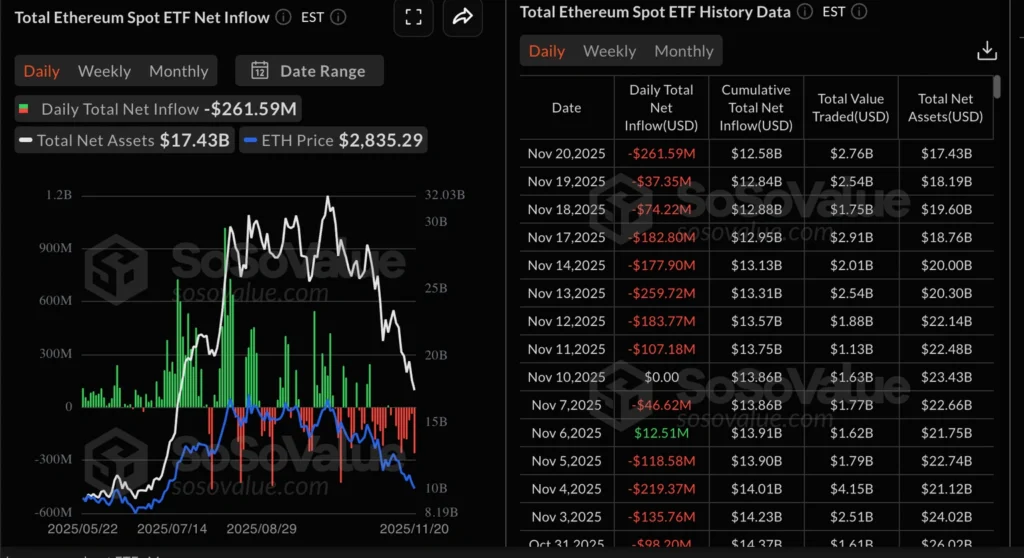

Ethereum Drops Below 2,750 Dollars as US Selling Pressure Builds

Ethereum traded near 2,730 dollars on Friday, down 3 percent after another wave of US selling. The Coinbase Premium Index fell to its lowest level since February, signalling sustained pressure from US traders.

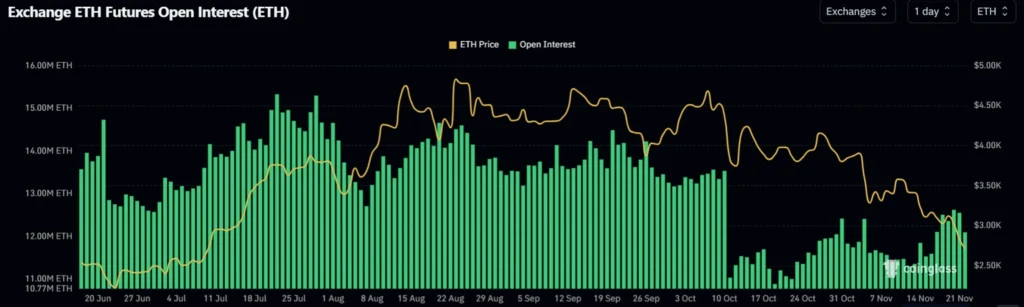

US spot ETH ETFs recorded eight straight days of outflows totalling 1.28 billion dollars, the longest losing streak since launch. CME open interest fell back below Binance levels, while total open interest across all exchanges slid by 500,000 ETH in 24 hours.

Active addresses have also dropped more than 25 percent to June levels. If ETH fails to recover the 2,850 dollar threshold, analysts warn it could slide toward 2,300 dollars.

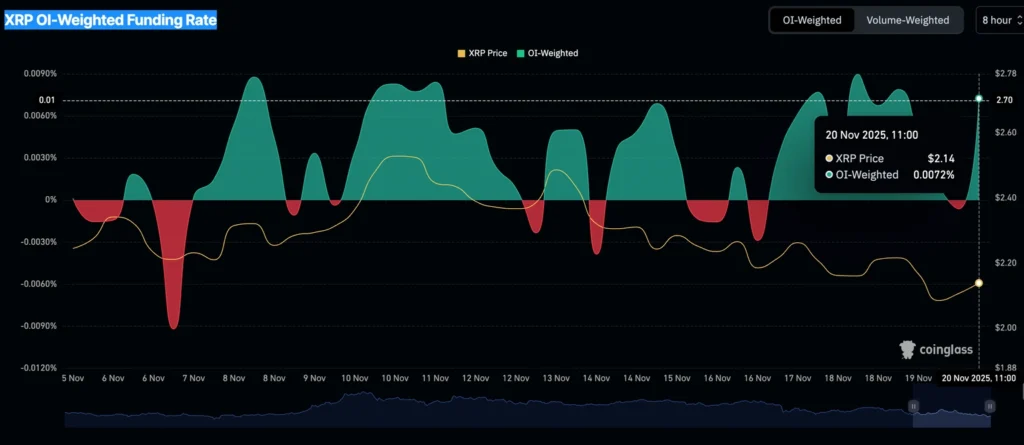

XRP Extends Slide Below 2 Dollars Despite ETF Inflows

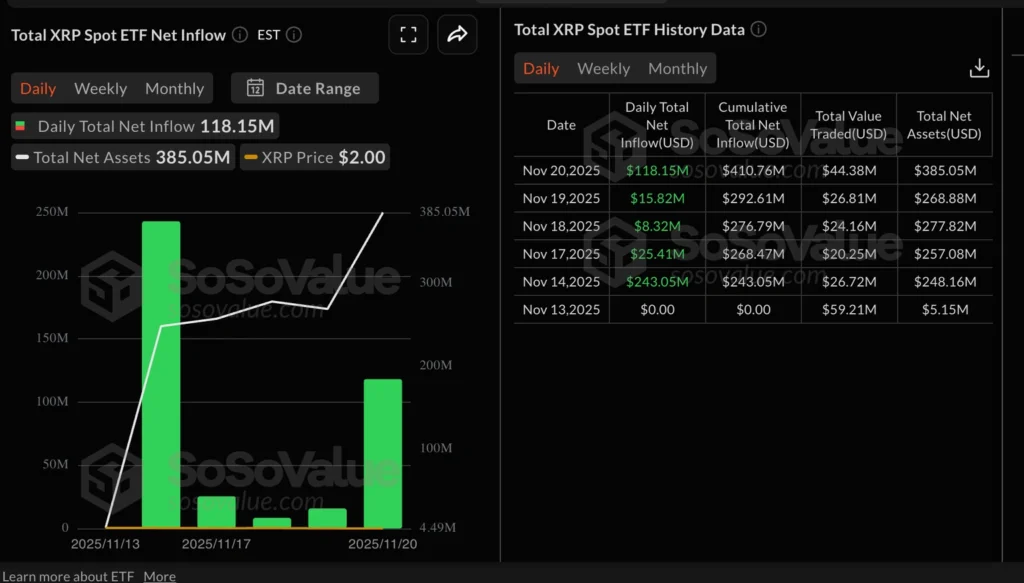

XRP traded near 1.87 dollars on Friday, extending its decline amid weak retail demand and broad risk aversion. The Bitwise XRP ETF debuted on Thursday, drawing 105 million dollars in flows. Combined with the Canary Capital product, total inflows reached 118 million dollars.

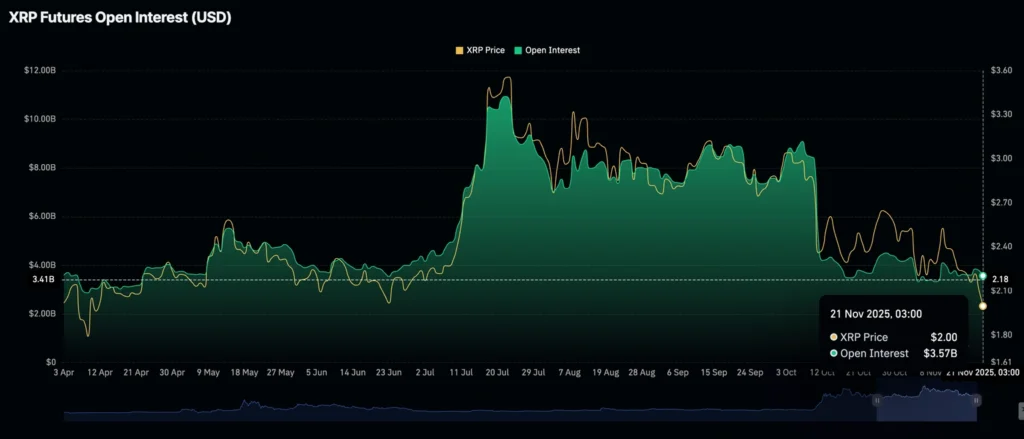

Even so, XRP futures open interest fell to 3.57 billion dollars, down from 10.94 billion dollars in July.

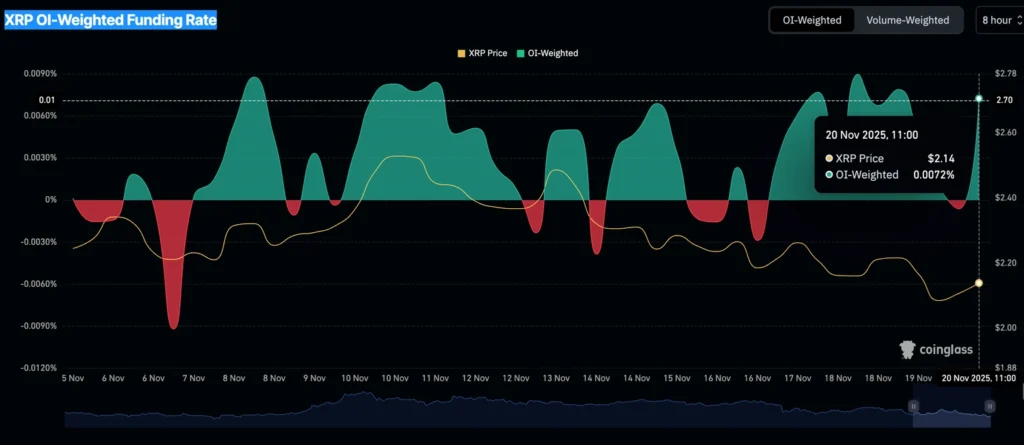

The drop signals a sharp contraction in retail participation. Funding rates turned positive, suggesting some traders are attempting to buy the dip, but demand must rise for any near term recovery to hold.

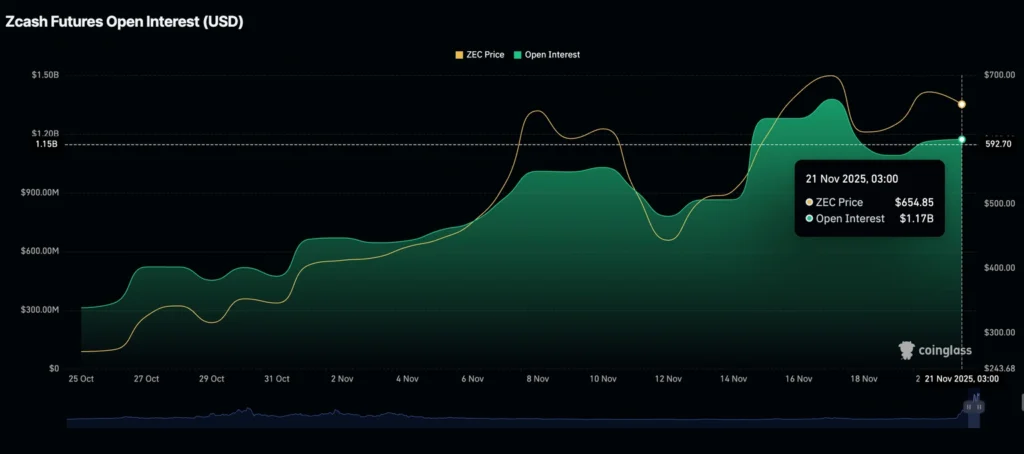

Zcash Holds 50 Day EMA as Derivatives Market Steadies

Zcash traded above 630 dollars on Friday after dropping to 595 dollars. Despite the pullback from resistance at 700 dollars, derivatives positioning showed some stability. Futures open interest held above 1 billion dollars.

If retail demand firms and open interest rises, ZEC could rebound toward 700 dollars. A drop in OI would signal renewed downside pressure, especially as funding rates have stayed negative for three days, showing traders continue to lean short.

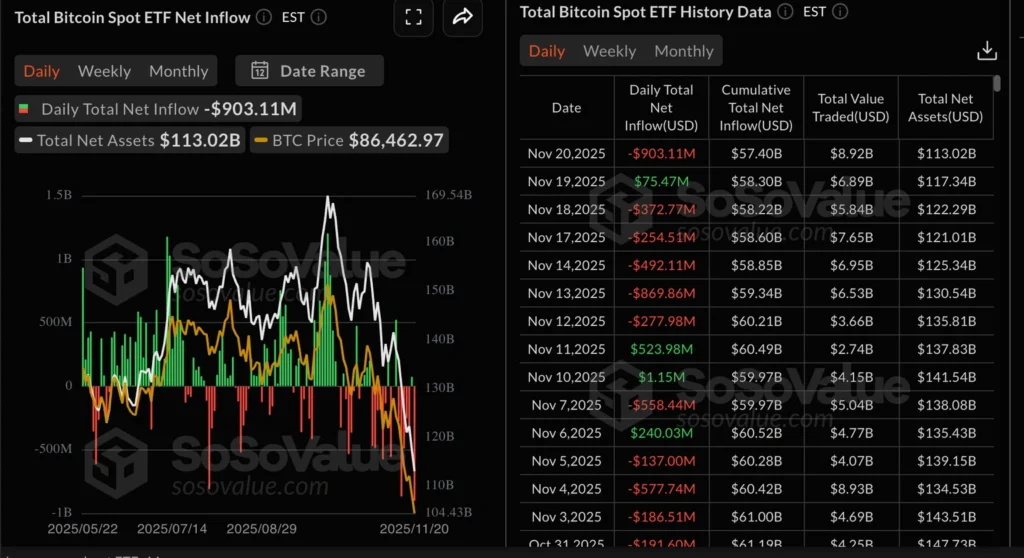

Crypto Market Sell-Off Deepens as Liquidations Hit 2 Billion Dollars

Bitcoin fell toward 80,000 dollars on Friday as total crypto liquidations topped 2 billion dollars. BTC traded below 84,000 dollars after hitting an intraday low of 82,000 dollars. Ethereum slid toward 2,500 dollars and XRP dropped below 2.00 dollars.

Bitcoin spot ETFs saw 903 million dollars in outflows on Thursday, the largest since mid November.

ETH ETFs posted 262 million dollars in outflows. Weak retail demand and persistent institutional selling continue to pressure the market.

Margin Calls Hammer Crypto Market, but a Durable Bottom Looks Unlikely

Crypto market capitalisation fell more than 9 percent to 2.82 trillion dollars, its lowest level since April. Bitcoin dropped to 81,000 dollars before stabilising near 83,000 dollars. The sell-off showed signs of widespread margin calls in early trading.

CryptoQuant said BTC market conditions are the most bearish since the current bull cycle began. A break below 82,000 dollars would confirm a deeper trend shift. XWIN Research warned Bitcoin could fall into the 60,000 to 80,000 dollar range if the Fed does not cut rates in December.

Institutional accumulation of Ethereum continues to rise, with nine major firms holding more than 10 percent of total supply. Stablecoin reserves on exchanges hit a record 72 billion dollars. Crypto backed lending reached 73.6 billion dollars at the end of the third quarter.

DOGE, SHIB and PEPE Extend Declines as Bearish Momentum Builds

Meme coins remained under pressure on Friday. Dogecoin dropped nearly 8 percent for the week and traded around 0.146 dollars after breaking support at 0.149. A continued slide could target the April low of 0.129.

Shiba Inu fell to 0.0000081 dollars and may retest 0.0000076. Pepe held near trendline support at 0.0000041. A daily close below that level could open the door to 0.0000027. Momentum indicators for all three coins point to further weakness.

Major Bitcoin Holder Sells Entire 1.3 Billion Dollar Position

A top Bitcoin whale has exited the market after selling all 11,000 BTC held in a long-running wallet. Crypto tracking sites report that Owen Gunden, ranked among the ten largest individual Bitcoin holders, completed a month-long liquidation with a final 2,499 BTC transfer to Kraken on November 20. The position sold is valued at roughly 1.3 billion dollars.

The timing aligns with weakening retail flows and risk-off sentiment tied to stretched equity valuations and concerns around the broader AI-linked rally. Bitcoin has dropped to a seven-month low and Ether to a four-month low as risk appetite deteriorates.

The Day’s Takeaway

North America

US equities finished higher on Friday after a wild session that pushed the S&P and Nasdaq below their 100 day moving averages before buyers took control. The Dow rose 1.08 percent, the S&P gained 0.98 percent and the Nasdaq climbed 0.88 percent. The recovery did not erase a rough week. The Dow dropped 1.91 percent, the S&P lost 1.95 percent and the Nasdaq slid 2.74 percent.

Nvidia ended the week deep in the red despite strong earnings. The stock fell 5.92 percent across five sessions, part of a broader slump in large cap tech. AMD fell 17.43 percent. Raytheon dropped 17.17 percent. Micron lost 15.99 percent. Bitcoin declined more than 10 percent after hitting record highs earlier in the month.

The Atlanta Fed GDPNow model held fourth quarter growth at 4.2 percent. The estimate has been stable as data continues to show solid economic momentum.

The BLS confirmed that October CPI will not be released. The next inflation report will be November data on December 18, after the December 10 FOMC meeting.

Commodities

Gold booked gains on Friday as dovish comments from John Williams and Stephen Miran pushed the implied odds of a December Fed cut to 71 percent. Business activity held firm, while consumer sentiment slipped toward historic lows.

Oil extended its decline. WTI dropped to 57.60 dollars, a one month low, as reports signaled progress toward a Ukraine peace framework that could soften sanctions on Russia and increase supply. A firm dollar and weak gasoline and distillate demand added pressure.

Silver is on track for a fifth straight deficit. The Silver Institute and Metals Focus now see a 95 million ounce shortfall. When ETF flows are included, the deficit widens to 295 million ounces, the largest in at least ten years.

The platinum market looks less tight after a sharp deficit revision. The WPIC now projects a 692,000 ounce deficit in 2024, with a small surplus in 2025. Demand has weakened across automotive, jewelry and investment channels.

Swiss gold exports fell sharply in October as high prices curbed demand. Shipments to China collapsed more than 90 percent and exports to India slid 14 percent.

North American drilling activity ticked higher. The US rig count rose by 5 to 554, while Canada added 7 rigs for a total of 195.

Europe

European stocks ended Friday mixed but logged a heavy week of losses. The FTSE 100 rose 0.05 percent, while the CAC dipped 0.03 percent. The DAX fell 0.78 percent. Spain’s Ibex dropped 0.99 percent and Italy’s FTSE MIB lost 0.51 percent.

Each major index fell more than 2 percent for the week. The DAX lost 3.27 percent, matching its weakest performance since March. The CAC fell 2.34 percent, the FTSE 100 declined 1.71 percent, the Ibex dropped 3.21 percent and the FTSE MIB slid 3.03 percent.

Crypto

Crypto selling accelerated near the end of the week. Bitcoin fell toward 80,000 dollars as liquidations topped 2 billion dollars and spot ETFs recorded heavy outflows. ETH ETF outflows extended to an eight day streak totaling 1.28 billion dollars. Ethereum fell below 2,750 dollars with on chain activity dropping back to June levels.

Market cap slipped below 2.82 trillion dollars. Analysts warned that a break under 82,000 dollars for Bitcoin could confirm a deeper trend shift. Institutional accumulation of ETH continues to rise, and stablecoin reserves on exchanges reached a record 72 billion dollars.

Meme coins stayed under pressure. Dogecoin dropped to 0.146 dollars. Shiba Inu slipped to 0.0000081 dollars. Pepe held near trendline support at 0.0000041.

Zcash held above its 50 day EMA near 630 dollars as open interest stabilized above 1 billion dollars.

XRP slid below 2.00 dollars despite 118 million dollars in ETF inflows. Open interest fell sharply from summer levels, signaling weaker retail participation.