North America News

Major U.S. Stock Indices Close Mixed; Dow Hits Record High on 3M, Coca-Cola Earnings

U.S. stocks ended mixed on Tuesday, with the Dow Jones Industrial Average outperforming thanks to upbeat corporate earnings from 3M and Coca-Cola, while the S&P 500 and Nasdaq Composite finished little changed.

The Dow rose 218.10 points, or 0.47%, to 46,924.68, closing at a record high. 3M surged 7.1% after stronger-than-expected quarterly results, while Coca-Cola gained 3.8% following solid revenue and profit growth. Salesforce climbed 3.7%, and Amazon added 2.7%, also lending support to the blue-chip index.

The S&P 500 ended virtually flat at 6,735.33, while the Nasdaq Composite slipped 36.88 points, or 0.16%, to 22,953.67, weighed by declines in tech shares. The Russell 2000 small-cap index dropped 12.22 points, or 0.49%, to 2,487.68.

In the spotlight, Netflix (NFLX) gained $2.79, or 0.23%, to close at $1,241.35, ahead of its quarterly earnings release. Shortly after the bell, the company reported earnings per share (EPS) of $5.87, missing expectations for $6.96, while revenue matched estimates at $11.51 billion. Shares fell nearly 6% in after-hours trading following the weaker-than-expected results.

Investors are turning attention toward a busy earnings week and upcoming U.S. economic data that could guide expectations for the Federal Reserve’s next policy move.

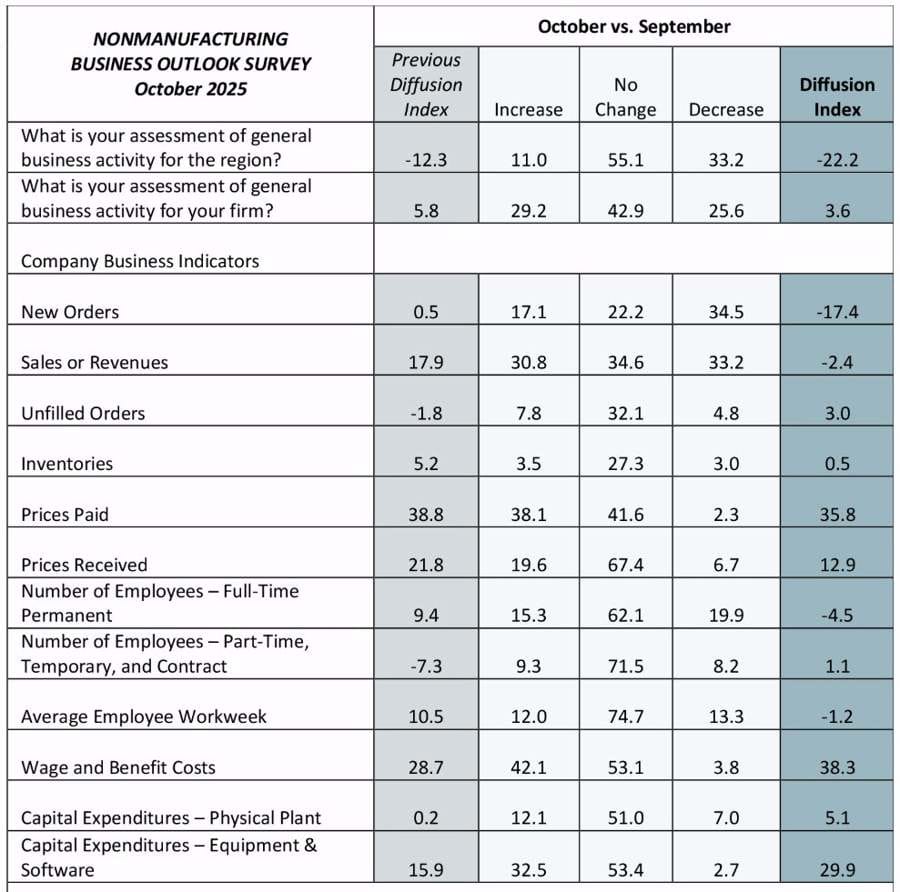

Philly Fed Non-Manufacturing Index Falls to -22.2

The Philadelphia Fed non-manufacturing business outlook index dropped to -22.2 in October, deteriorating from -12.3 a month earlier, signaling a deeper contraction in regional service-sector activity.

The data point underscores weakening sentiment across non-manufacturing firms amid soft demand and elevated uncertainty.

A summary of the different components shows:

Trump: Meeting With Xi ‘Not Certain’ as Trade Tensions Persist

U.S. President Donald Trump said a meeting with Chinese President Xi Jinping, originally planned for two weeks from now, may not happen, casting doubt over potential progress in trade negotiations.

Trump had earlier said the two leaders would discuss “a lot of things,” expressing confidence in the talks. He accused China of playing the “rare earth card,” threatening U.S. defense and technology sectors, but added that Washington has alternative sources, citing a recent supply deal with Australia.

He also noted Beijing’s efforts to strengthen ties with Europe, raising the prospect that China could divert aircraft purchases away from the U.S.

Market watchers said the uncertainty around the meeting adds a new layer of volatility to already fragile U.S.-China relations.

Wells Fargo CEO Sees ‘Almost Perfect’ Environment for Consumers

Wells Fargo CEO Charlie Scharf struck an upbeat tone on the U.S. economy, describing the backdrop as “almost perfect for consumers.”

Speaking amid limited data due to the government shutdown, Scharf said spending remains strong across debit and credit channels, with business performance also holding up.

“We see strength almost across the board,” he said. “Consumers are spending, credit quality is solid, and we don’t see cracks in the banking system.”

Scharf noted that businesses remain cautious about the future but said there are no signs of deterioration in lending or liquidity. He downplayed systemic risks from private credit and said conversations with the Trump administration are centered on growth, not deregulation.

Goldman Sachs: Labor Market Weakness Signals Rising Recession Risk

Goldman Sachs expects both headline and core CPI to rise 0.3% month-on-month in September, with core inflation up 3.1% year-on-year, according to its latest note.

The bank sees car and airfare prices easing, while housing costs continue to cool. However, it warned that tariffs could reaccelerate inflation in certain sectors.

Goldman also pointed to labor market softness, calling it a more reliable indicator of recession risk than traditional activity data. The firm urged close monitoring of employment trends as a potential early signal of economic slowdown.

Trump Threatens China with 155% Tariffs, Says Deal Possible

U.S. President Donald Trump has threatened to impose 155% tariffs on Chinese goods starting November 1 unless a new trade deal is reached.

Speaking at an event, Trump claimed China currently “pays 55%” and warned that rates could triple if talks fail. He added that he plans to meet President Xi Jinping in South Korea “in a couple of weeks,” expressing optimism about reaching a mutually beneficial agreement.

Trump Administration Weighs Fannie Mae and Freddie Mac IPO by 2025

FHFA Director William Pulte said the Trump administration is evaluating a potential public offering for Fannie Mae and Freddie Mac by end-2025, aiming to end their 17-year conservatorship.

Pulte wrote on X that while Trump previously resisted privatization, his team is now exploring an “opportunistic” listing. The move would mark a major shift for the two mortgage giants, which have been under federal control since the 2008 financial crisis.

The announcement could trigger volatile gains in Fannie and Freddie shares, which have long traded as speculative bets on eventual privatization.

Morgan Stanley Sees Rare Stock-Picking Opportunity, Backs Pinterest

Morgan Stanley strategist Mike Wilson called the current environment a “historically opportunistic” moment for stock selection, urging investors to focus on firms with strong earnings revisions.

In a client note, Wilson’s team cited Pinterest (PINS) as a top pick, alongside Reddit (RDDT), Take-Two Interactive (TTWO), Burlington Stores (BURL), and Carvana (CVNA).

The firm’s strategy emphasizes companies showing positive analyst upgrades, which it says often precede market outperformance. Wilson maintained a cautious view on the broader market, citing headwinds from U.S.-China trade tensions and fragile liquidity.

Pinterest and the other highlighted names are expected to see near-term buying interest. Wilson’s comments reinforce the market’s shift toward active management and stock-specific plays rather than broad index exposure.

BofA Warns S&P 500 Faces ‘Forced Selling’ Risk from Private Credit

Bank of America warned that rising stress in the private credit market could trigger “forced selling” of public equities, particularly S&P 500 stocks.

The concern stems from the “barbell” strategy used by many large investors — balancing illiquid private credit holdings with liquid index funds. When private credit losses mount, investors may need to sell their liquid assets, such as S&P 500 index holdings, to raise cash.

BofA highlighted the risk of a liquidity mismatch, noting that defaults in private lending could prompt a wave of indirect selling pressure in public markets.

The warning has heightened investor caution and could lead to preemptive hedging across major funds, as traders brace for potential contagion between private and public asset classes.

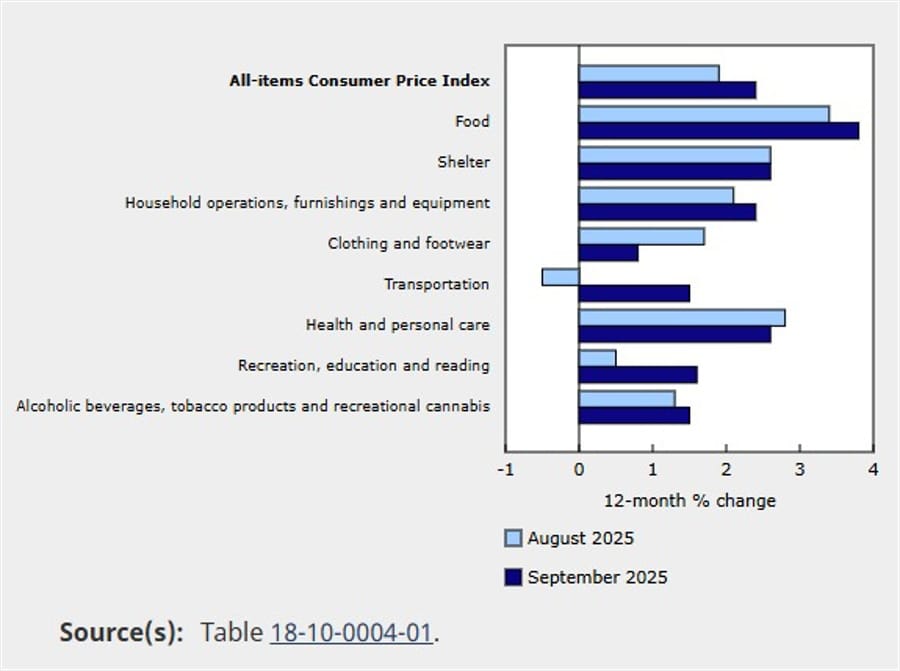

Canada CPI Rises 0.1% in September, Slightly Above Forecasts

Canada’s consumer prices rose 0.1% month-on-month in September, just above expectations for no change, while annual inflation edged up to 2.4%, compared with a 2.3% forecast and 1.9% in August.

The median CPI climbed to 3.2% year-on-year (up from a revised 3.2% in August, previously 3.1%), while the trim measure also increased to 3.1% from 3.0%. The common component rose to 2.7%, and the BoC core measure advanced to 2.8% from 2.6% a month earlier. On a monthly basis, BoC core CPI rose 0.2%, reversing the prior flat reading.

Gasoline prices dropped 4.1% from a year earlier after a 12.7% decline in August. Travel tour prices were down 1.3% year-on-year after falling 9.3% in August, though they rose 4.6% on a monthly basis — unusual for September.

Food inflation accelerated, with prices for store-bought groceries up 4.0% from a year ago, compared with 3.5% in August. Fresh vegetables rose 1.9% after a 2.0% decline, and sugar and confectionery prices jumped 9.2%, up from 5.8% previously.

The clothing and footwear index rose 0.8%, following a 1.7% annual increase in August.

Market pricing for Bank of Canada rate cuts eased slightly after the data, with 19 basis points of easing now expected for October, down from 21 basis points before the release. Traders now see 25 basis points of cuts by year-end, compared with 28 basis points previously.

Commodities News

Gold Plummets Over 5% in Biggest Drop Since 2020 as Dollar Strengthens

Gold prices plunged more than 5% on Tuesday, marking their steepest one-day decline since August 2020, as traders took profits ahead of key U.S. inflation data and the Federal Reserve’s policy meeting next week.

Spot gold fell from an intraday high of $4,375 to around $4,114, extending losses from Monday’s record peak of $4,380. The sharp selloff was driven by pre-CPI profit-taking and a resurgent U.S. dollar, which climbed 0.36% to 98.94 on the DXY index, making bullion more expensive for foreign buyers.

The decline comes as markets anticipate fresh insight from September’s Consumer Price Index (CPI), due October 24, and await the Fed’s policy direction amid signs of a cooling labor market. Last week, Fed Chair Jerome Powell acknowledged softening job data, reinforcing expectations for additional rate cuts later this year.

Geopolitical sentiment also eased after U.S. President Donald Trump said he would meet China’s President Xi Jinping next week, fueling optimism for progress in trade negotiations and reducing demand for safe-haven assets such as gold.

Analysts said the drop reflects a near-term correction following an overheated rally, with traders likely to re-enter the market once inflation data provide clearer guidance on real yields and Fed policy.

Copper Market Still in Surplus Despite Rising Prices – Commerzbank

The global copper market recorded a 147,000-ton surplus in the first eight months of 2025, according to the International Copper Study Group, cited by Commerzbank strategist Thu Lan Nguyen.

Nguyen noted that the supply situation has improved since June, even as copper prices have climbed sharply. “Mine output and refined metal production are both increasing, driven primarily by China and the Democratic Republic of Congo, which together account for 57% of global output,” she said.

While the surplus is smaller than last year’s 477,000-ton excess, Nguyen said the latest price rally appears “hardly justified” given the improved supply backdrop.

Indian Gold Demand Surges Ahead of Festivals – Commerzbank

Gold demand in India has strengthened despite record-high local prices, supported by festival-related buying, according to Commerzbank analyst Carsten Fritsch.

Dealers reported premiums up to $25 per ounce over the official price last week, compared with $15 a week earlier. Strong investor interest was reported, though jewelry demand remained subdued.

Ahead of Dhanteras and Diwali, jewelers increased purchases of small coins and bars, a traditional gifting practice. Fritsch said demand may cool post-festivals, with premiums expected to ease.

Meanwhile, Swiss export data showed gold shipments to India nearly doubled to 30 tons in September, the highest level this year — further evidence of strong seasonal demand.

U.S. to Purchase 1 Million Barrels for Strategic Petroleum Reserve

The United States plans to buy 1 million barrels of crude oil for its Strategic Petroleum Reserve (SPR), according to a Bloomberg report.

The crude will be for delivery between December 2025 and January 2026, part of efforts to gradually replenish the reserve.

Oil prices spiked on the headline, with WTI briefly touching $58.08 before easing to $57.48, up about $0.50 on the day. The purchase underscores Washington’s intent to rebuild inventories after large emergency releases in recent years.

China Imports More Crude Than Needed in September – Commerzbank

China imported more crude oil than it processed in September, resulting in a 570,000 barrels-per-day surplus, according to Commerzbank’s Carsten Fritsch.

The figure reflects continued strategic stockpiling, though smaller than the 1 million bpd surplus seen in August.

Fritsch said the sustained imports have helped absorb part of the global oversupply, but warned that if stockpiling slows, the market could face renewed downward pressure on prices.

China’s Refiners Hit Two-Year High in September Throughput

China’s refineries processed 62.7 million tons of crude oil in September, the highest in two years, data from the National Bureau of Statistics show.

That equals roughly 15.3 million barrels per day, about 1 million bpd higher than a year earlier. The rebound follows completion of maintenance at several refineries, according to Oilchem Consulting.

For the first nine months of 2025, processing totaled 550 million tons, up 3.7% from the same period last year — signaling that full-year output is on track to rise after a 3.6% decline in 2024.

Commerzbank’s Carsten Fritsch said the increase was “no surprise” given restored capacity and rising throughput rates across major state refiners.

Canada Streamlines Approval for Low-Risk Energy Projects

The Canada Energy Regulator (CER) has introduced new exemption orders to speed up approvals for negligible-risk oil and gas projects, effective December 1.

These exemptions replace previous rules under the National Energy Board Act and apply to minor modifications at pre-approved sites, such as the addition of storage facilities.

The CER said the update is intended to reduce administrative delays while maintaining environmental and safety standards.

China Keeps 2026 Crude Import Quota Flat at 257 Million Tons

China’s Commerce Ministry has set non-state crude oil import quotas for 2026 at 257 million metric tons, unchanged from 2025.

The ministry also released new application rules for these quotas. Analysts say the steady quota likely signals that Beijing is not projecting a meaningful rise in oil demand next year, underscoring expectations for flat energy consumption amid a cooling economy.

Europe News

European Stocks End Mostly Higher; Spain’s Ibex Lags

European equity markets closed mostly higher on Tuesday, led by gains in France and Italy, while Spain’s Ibex underperformed.

At the close:

- Germany’s DAX: +0.29%

- France’s CAC 40: +0.64%

- UK’s FTSE 100: +0.25%

- Spain’s Ibex 35: -0.39%

- Italy’s FTSE MIB: +0.60%

The CAC 40 was the day’s top performer, driven by strength in luxury and industrial names, while profit-taking weighed on Spanish equities.

German Tax Revenue Rises 2.6% in September, Ministry Flags Weak Outlook

Germany’s tax income rose 2.6% year-on-year in September to €88.4 billion, but the finance ministry warned that sluggish economic momentum will limit further gains.

The increase was driven mainly by wage taxes, while VAT receipts remained flat, underscoring weak domestic demand. From January through September, tax revenue climbed 6.2% from a year earlier, with a 3.7% rise projected for 2025.

Despite the headline improvement, analysts expect markets to focus on the ministry’s downbeat economic tone, as exports and industrial orders continue to weaken.

Switzerland Posts CHF 4.07 Billion September Trade Surplus

Switzerland recorded a CHF 4.07 billion trade surplus in September, slightly below the prior revised figure of CHF 4.10 billion, according to the Federal Statistical Office.

Exports rose to CHF 23.97 billion, up 2.7% month-on-month in real terms, while imports climbed to CHF 19.90 billion, a 1.9% increase.

The data point to a steady trade position, with modest export growth helping offset import strength.

EU Sefcovic: Held video call with Chinese. Invited authorities to Brussels in coming days

EU trade commissioner Sefcovic had a video call with Chinese counterparts this morning :

- The scale of China’s export control, scaled up since April, is unjustified and harmful

- We agreed to the intensified contracts at all levels

- I invited the Chinese authorities to come to Brussels in coming days, they accepted invite

- Prompt resolution of rare earth restrictions is essential

UK Chancellor aims to support BoE rate-cut path

- Reeves outlines budget plans to ease inflation and household costs

- UK Chancellor Rachel Reeves vowed to smooth the path for further Bank of England interest rate cuts, according to the Financial Times.

- She said her upcoming Budget would focus on curbing inflation and reducing the cost of living.

- Reeves told the FT she is determined to get a grip on borrowing and will include measures to cut household bills, creating room for the BoE to deliver more rate cuts in the coming months.

UK to Slash Red Tape for 100,000 Firms, Saving £6 Billion

UK Chancellor Rachel Reeves will announce a regulatory overhaul to cut red tape for more than 100,000 businesses, in a move the Treasury says could save companies nearly £6 billion annually.

Speaking at the Regional Investment Summit in Birmingham, Reeves will outline plans to simplify corporate reporting and eliminate redundant paperwork.

The initiative aims to boost productivity and efficiency, particularly for small and mid-sized firms. Markets are expected to view the plan positively, as it reinforces the government’s pro-business stance and signals a renewed focus on supply-side reform.

Asia-Pacific & World News

Argentina’s $20 Billion Loan Delayed as Banks Seek U.S. Guarantee

A planned $20 billion loan to Argentina has stalled as major lenders — including JPMorgan, Goldman Sachs, Bank of America, and Citigroup — push for U.S. Treasury guarantees before extending credit to the debt-laden country.

The loan is part of a broader $40 billion financial package backed by the Trump administration to support President Javier Milei’s reform program.

Banks are waiting for guidance from Washington on potential collateral or guarantees, with insiders warning the deal could collapse if those assurances don’t materialize.

The delay is a major setback for Milei’s stabilization plan and has rattled confidence in Argentine assets, likely pressuring sovereign bonds and the peso as investors doubt private lenders’ willingness to engage without U.S. backing.

Standard Chartered Lifts China’s 2025 GDP Outlook to 4.9%

Standard Chartered has revised its forecast for China’s 2025 GDP growth to 4.9%, up slightly from 4.8%, following mixed macroeconomic data.

The bank noted that while exports remain firm, investment activity has weakened sharply, showing signs of stress beyond the property sector. Consumption also lost momentum, reflecting persistent softness in domestic demand.

Standard Chartered expects Beijing to roll out additional fiscal measures to stabilize growth. However, it cautioned that overcapacity and global uncertainty could hold back near-term investment. The bank also anticipates that the China-U.S. tariff truce will likely be extended.

PBOC sets USD/ CNY mid-point today at 7.0930 (vs. estimate at 7.1219)

- PBOC CNY reference rate setting for the trading session ahead.

In Open market operations (OMOs) the PBOC inject 159.5n yuan at an unchanged rate of 1.4%

- after maturities today the net injection is 68.5bn yuan

New Zealand Posts NZD 1.36 Billion September Trade Deficit

New Zealand recorded a NZD 1.36 billion trade deficit in September, widening from NZD 1.19 billion in August, according to official data.

Exports fell slightly to NZD 5.82 billion from NZD 5.85 billion, while imports rose to NZD 7.18 billion from NZD 7.08 billion, highlighting continued pressure on the trade balance amid soft global demand.

Japan PM Takaichi Calls for Close Coordination Between BoJ and Government

Newly appointed Japanese Prime Minister Sanae Takaichi said the Bank of Japan’s monetary policy must align closely with the government’s broader economic objectives.

Takaichi emphasized the need for “close communication and coordination” between the BoJ and the government, while reaffirming that monetary policy decisions ultimately remain the central bank’s responsibility.

She said the 2% inflation target should be achieved through sustained wage growth rather than temporary cost-push factors. Takaichi expressed confidence that the BoJ would conduct “appropriate policy” to ensure price stability.

She ruled out any immediate revision to the joint government-BoJ policy framework and added that she intends to deepen ties with President Trump through “frank exchanges of opinion.”

Yen Weakens as Takaichi Confirmed Japan’s Next Prime Minister

The Japanese yen weakened after Sanae Takaichi won a key parliamentary vote to become Japan’s next prime minister.

Known for her fiscal-dovish stance and adherence to Abenomics, Takaichi’s appointment dimmed prospects for near-term BOJ tightening. The USD/JPY pair rose to 151.40, extending recent losses in the yen.

Traders said the reaction was modest but consistent with expectations that her leadership would maintain loose monetary policy.

Takaichi Faces Immediate Factional Pressure as New PM

Japan’s new Prime Minister Sanae Takaichi faces a difficult political balancing act as she takes office, with divisions within the Liberal Democratic Party (LDP) and the Nippon Ishin coalition already emerging.

Takaichi’s right-wing alignment helped her consolidate conservative support, but rival factions within the LDP are expected to challenge her authority.

Analysts say her administration will seek to reconnect with conservative voters who defected to the Sanseito Party, while managing differences with Nippon Ishin on key policy areas.

South Korean Exports Slide 7.8% in October, Markets Eye November Rate Cut

South Korea’s exports dropped 7.8% year-on-year in the first 20 days of October, reinforcing expectations that the Bank of Korea could cut rates as early as November.

Preliminary customs data showed imports down 2.3%, resulting in a $2.85 billion trade deficit. Despite weak trade figures, the BOK is widely expected to keep its policy rate at 2.50% this week, according to a Reuters poll of 35 economists, 33 of whom see no change.

Economists say the bank remains focused on financial stability, particularly amid rising household debt and an overheated property market. Still, a November rate cut is seen as increasingly likely, with 25 of 31 analysts expecting a 25-basis-point reduction.

Market reaction has been mixed — the KOSPI rebounded on expectations of near-term stability, while the won remains under pressure. Traders now view November’s meeting as the pivotal moment for policy easing.

Crypto Market Pulse

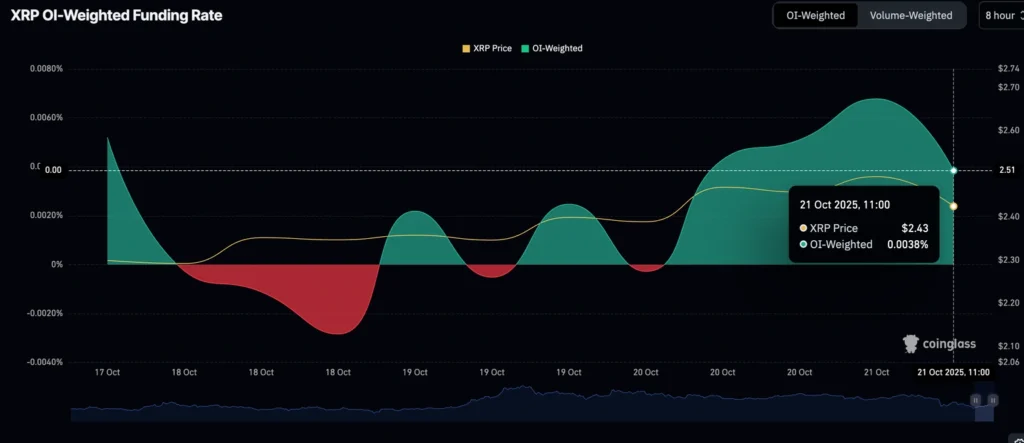

XRP Edges Higher on Stable Retail Demand, Risk-On Sentiment

Ripple (XRP) edged higher on Tuesday, trading above $2.50 alongside major cryptocurrencies as risk appetite improved across digital asset markets. Earlier in the session, XRP fell to $2.40, marking an intraday low before buyers stepped in to pare losses.

Traders are eyeing a daily close above $2.50 to confirm bullish momentum, with resistance expected between $2.61 and $2.70. A breakout above that range could open room for a short-term rally.

Derivatives data indicate stabilizing sentiment. XRP futures open interest (OI) recovered to $3.8 billion from around $3.5 billion on Sunday, signaling renewed participation from retail traders. OI had peaked at $10.94 billion in mid-July, days after XRP reached its all-time high of $3.66.

The funding rate on XRP perpetual contracts fell to 0.0038% from 0.0068%, suggesting a mild increase in short positioning. Despite the dip, rates remain positive — a sign that sentiment hasn’t flipped fully bearish.

Technical indicators add to the cautious optimism: the MACD on the daily chart is flashing a potential buy signal, hinting at upward momentum if buying pressure sustains through the next sessions.

Ethereum Retests $4,100 as Treasuries SharpLink and BitMine Buy the Dip

Ethereum (ETH) climbed toward $4,100 on Tuesday, supported by aggressive accumulation from institutional digital asset treasuries SharpLink and BitMine. The second-largest cryptocurrency traded around $4,000, testing key resistance for a second day.

SharpLink Gaming (SBET) said it purchased 19,271 ETH for $75 million last week, bringing its total holdings to 859,853 ETH. The acquisition, made at an average price of $3,892, followed a $76.5 million private capital raise.

“We took advantage of favorable conditions to acquire ETH below our raise price,” said co-CEO Joseph Chalom, noting the firm earned 458.9 ETH from staking and held $36.4 million in cash and equivalents.

BitMine (BMNR) also accelerated its accumulation, adding 203,826 ETH last week — its largest weekly purchase this month — bringing total reserves to 3.23 million ETH, roughly 2.7% of circulating supply. Chairman Thomas Lee said the company is “more than halfway” to its goal of holding 5% of all ETH.

Meanwhile, data from SoSoValue showed U.S. spot ETH ETFs saw $145.6 million in net outflows on Monday, following $311.8 million the week before, underscoring a divide between treasury accumulation and institutional ETF sentiment.

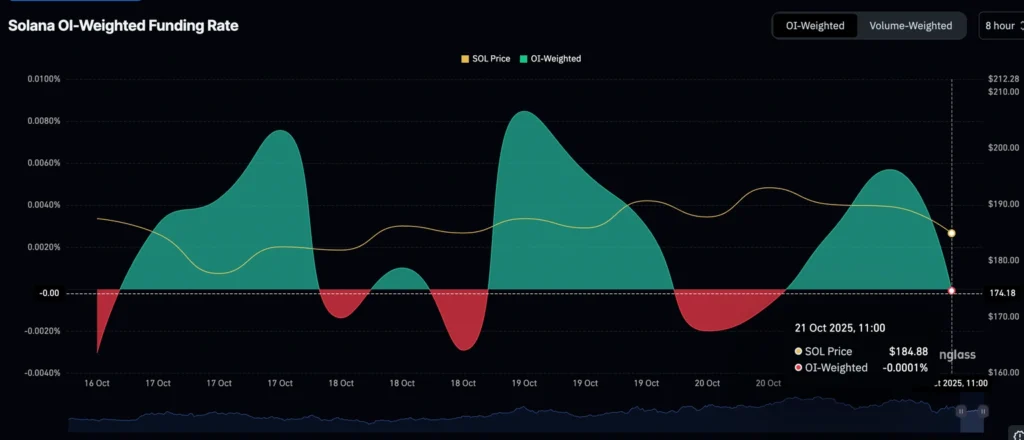

Solana Risks 6% Dip Amid Falling Retail Demand, Weak On-Chain Activity

Solana (SOL) slipped toward $185 on Tuesday, down from a high of $194, as fading retail demand and reduced network activity weighed on sentiment. The coin continues to test support at the 200-day EMA, reflecting broader risk aversion in crypto markets.

Active addresses on the Solana network fell sharply to 15 million per week as of October 19, down over 50% from 33.63 million recorded in May, according to DefiLlama data. Only 4.74 million addresses have interacted with the network so far this week.

The decline in engagement signals weaker transaction volumes and revenue potential — key drivers of Solana’s valuation, especially in DeFi and meme coin sectors where it has historically led activity.

Derivatives data paint a similar picture: SOL futures OI dropped to $8.64 billion, down from an October peak of $15 billion, while the funding rate turned slightly negative at -0.0001%, showing increased short positioning.

Still, sentiment remains far from capitulation levels — during October’s major deleveraging event, the funding rate plunged as low as -0.3753%, marking one of the steepest declines in crypto derivatives history.

Crypto Today: Bitcoin, Ethereum, XRP Edge Lower as Risk-Off Mood Returns

Major cryptocurrencies turned lower on Tuesday as investors cut exposure amid macroeconomic uncertainty and geopolitical risks.

Bitcoin (BTC) fell below $108,000, extending intraday losses after briefly reclaiming $111,000 on Monday. Ethereum (ETH) slipped under $3,900, while XRP struggled to stay above $2.50, despite signs of stabilization in its derivatives market.

The broader pullback coincides with a renewed risk-off tone driven by ongoing tensions between the U.S. and China, uncertainty around the Middle East conflict, and the extended U.S. government shutdown.

Derivatives data show a notable decline in speculative activity:

- Bitcoin futures OI has dropped 23% to $72 billion, down from a record $94.12 billion on October 7.

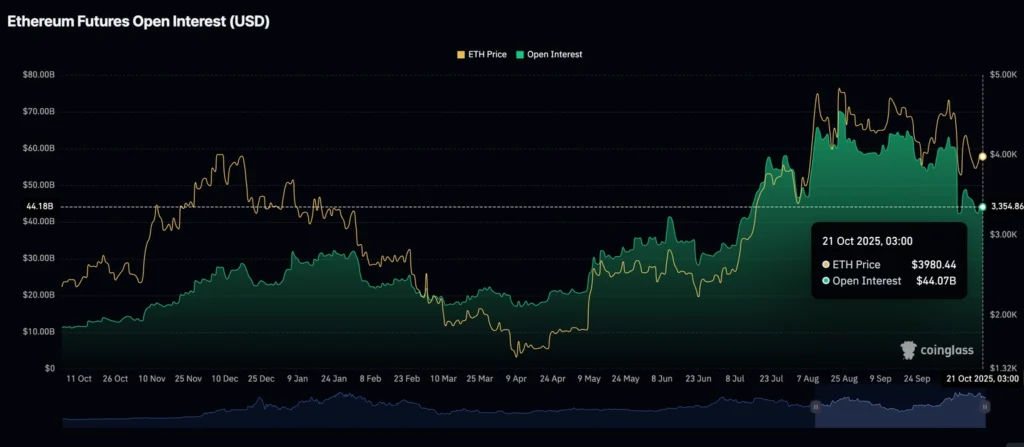

- Ethereum OI has fallen 37% to $44 billion, after peaking near $70 billion in August.

The broad-based deleveraging suggests traders remain cautious, awaiting clearer macro signals before re-entering risk assets.

Bitcoin Treasury Inflows Plunge 99% as Institutional Demand Slows

Institutional Bitcoin inflows have collapsed in recent months, highlighting a major cooldown in corporate adoption.

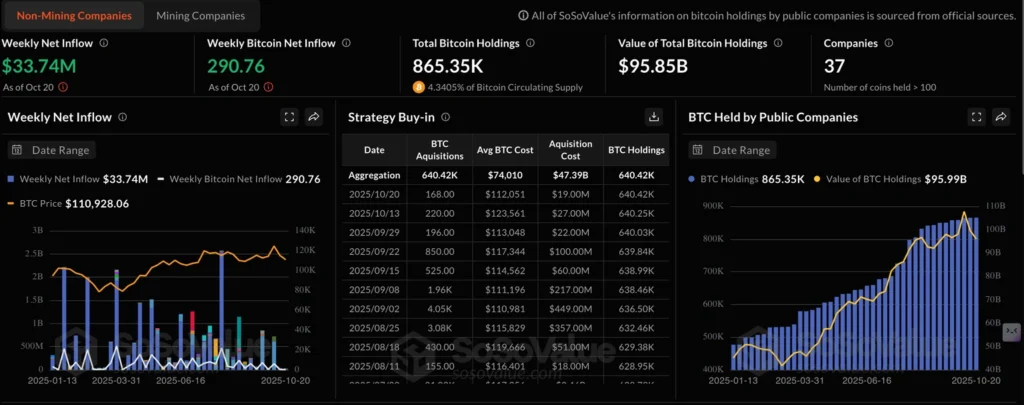

According to SoSoValue data, weekly net inflows into non-mining company Bitcoin treasuries fell to $33.74 million in mid-October — down nearly 99% from the $2.57 billion peak recorded in early August.

Despite the slowdown, Bitcoin holdings by public and private firms have continued to rise gradually, now totaling 865,350 BTC, worth about $95.85 billion.

The trend underscores a key evolution in the digital asset landscape: companies increasingly view Bitcoin as a treasury reserve asset, not just a speculative holding. Still, tightening liquidity, higher yields, and risk-off macro conditions have subdued new inflows.

Analysts say the deceleration could persist through Q4 unless market volatility eases and regulatory clarity improves.

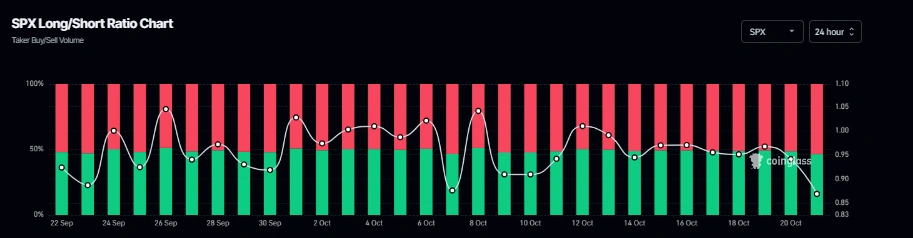

SPX Bears Take Control as Derivatives Data Turn Negative

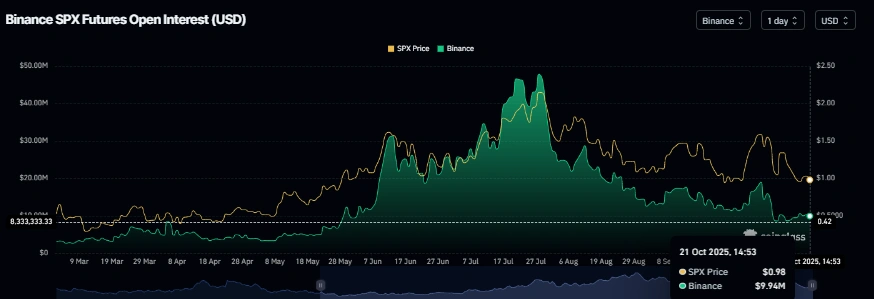

SPX6900 (SPX) — the meme coin inspired by the S&P 500 ticker — dropped nearly 5% on Tuesday to around $0.98, after failing to reclaim a key trendline resistance.

The correction follows weakening Open Interest, down to $9.94 million from $18.96 million on October 7, according to CoinGlass. The decline reflects falling participation and growing bearish conviction among traders.

CoinGlass data also show the long-to-short ratio for SPX has slipped to 0.86, its lowest in more than a month, indicating a tilt toward short positioning.

Technically, SPX faces renewed selling pressure with a downside target near $0.81, should the current bearish momentum persist.

The Day’s Takeaway

U.S. Markets

Major U.S. Indices Close Mixed; Dow Hits Record High on Strong Earnings

The Dow climbed 0.47% to 46,924.68, setting a new record, powered by 3M (+7.1%), Coca-Cola (+3.8%), and Salesforce (+3.7%). The S&P 500 finished flat at 6,735.33, while the Nasdaq slipped 0.16% to 22,953.67. Netflix missed earnings expectations, reporting EPS $5.87 vs. $6.96 est., sending shares down nearly 6% after hours.

Gold Suffers Sharpest Drop Since 2020 as Dollar Strengthens

Gold tumbled over 5.5% to $4,114, its steepest one-day fall in five years, after peaking near $4,380 Monday. The decline followed profit-taking ahead of U.S. CPI data (Oct 24) and a stronger DXY (+0.36% to 98.94). Optimism over a potential Trump–Xi meeting eased safe-haven demand.

Digital Assets

XRP Holds Above $2.50 on Stable Retail Demand, Mild Risk-On Sentiment

XRP recovered from an intraday low of $2.40 to trade above $2.50, supported by retail buying. Open interest rose to $3.8B, signaling renewed trader participation. Funding rates eased slightly but stayed positive, suggesting sentiment remains cautiously bullish.

Ethereum Retests $4,100 as Corporate Treasuries Accumulate

ETH climbed toward $4,100 after institutional treasuries SharpLink and BitMine disclosed major purchases totaling over $150M. Despite ETF outflows of $145.6M, long-term treasury demand remains strong. Key resistance stands near the $4,100–$4,150 zone.

Solana Slips to $185 Amid Falling Network Activity

SOL lost momentum, testing its 200-day EMA near $185, as weekly active addresses fell over 50% since May. Open interest declined to $8.64B, and funding turned slightly negative, reflecting weaker speculative demand.

Bitcoin Treasury Inflows Collapse 99% as Institutional Demand Slows

Non-mining company Bitcoin treasuries saw inflows drop to $33.7M, down from $2.57B in August. Total holdings remain high at 865,350 BTC ($95.85B), but analysts warn of continued slowdown unless liquidity conditions improve.

Crypto Market Turns Lower as Risk-Off Mood Returns

Broader crypto sentiment soured Tuesday as BTC fell below $108K, ETH slipped under $3,900, and XRP hovered near $2.50. Futures open interest for Bitcoin and Ethereum dropped 23% and 37%, respectively, reflecting ongoing deleveraging and macro caution.

SPX Meme Coin Sinks 5% as Derivatives Sentiment Turns Bearish

SPX6900, the S&P 500-inspired meme token, fell 4.9% to $0.98, with open interest sliding nearly 50% since early October. The long-to-short ratio dropped to 0.86, its lowest in a month, hinting at deeper short-side pressure.

Global Outlook

- Investors brace for U.S. CPI data (Oct 24) and next week’s Fed policy meeting, which may clarify the pace of further rate cuts.

- In commodities, profit-taking and easing trade tensions triggered sharp volatility across safe-haven assets.

- In crypto, divergence grows between long-term treasury accumulation and short-term risk-off trading behavior.