North America News

US stocks slip for fifth straight session ahead of Powell

US equities closed lower on Thursday, extending the S&P 500’s losing streak to five sessions as traders stayed cautious ahead of Fed Chair Powell’s Jackson Hole speech.

- Dow Jones: −152.81 pts (−0.34%) to 44,475.50

- S&P 500: −25.62 pts (−0.40%) to 6,370.16

- Nasdaq: −72.55 pts (−0.34%) to 21,100.31

- Russell 2000: +4.74 pts (+0.21%) to 2,274.09

Sector performance: Energy (+0.71%) and Materials (+0.26%) led gains, while Consumer Staples (−1.18%), Utilities (−0.71%), and Consumer Discretionary (−0.68%) lagged. Tech slipped (−0.39%) but losses slowed compared with earlier in the week.

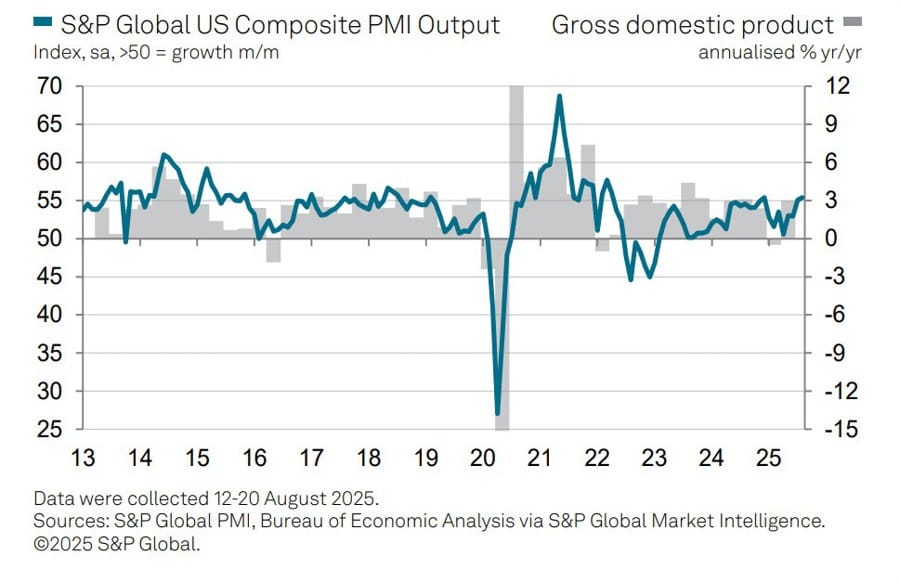

US S&P Global PMI Signals Strongest Growth Since 2022

Flash August PMI data from S&P Global showed a surge in US business activity.

- Manufacturing PMI: 53.3 vs 49.5 expected (prior 49.8)

- Services PMI: 55.4 vs 54.2 expected

- Composite PMI: 55.4 vs 55.1 prior — an 8-month high

Output & Demand:

- Manufacturing output posted its fastest rise since May 2022.

- New orders hit a 15-month high; exports grew for the first time in months.

- Services sales rose at the steepest pace since Dec 2023.

- Overall output has expanded for 31 consecutive months.

Inflation Pressures:

- Input costs climbed at the sharpest pace since May 2023.

- Selling prices rose at the fastest rate since Aug 2022.

- Services inflation hit a one-year high, while goods inflation eased slightly.

- Tariffs cited as a key cost driver.

Employment & Capacity:

- Hiring rose for the 6th month, strongest since Jan 2025.

- Manufacturing jobs at their highest growth since March 2022.

- Backlogs surged, matching pandemic-era highs.

Market Implications:

- PMI data suggest GDP growth running at a 2.5% annualized pace, stronger than 1.3% in H1 2025.

- Inflation risks tilt toward higher CPI prints, reinforcing the case against near-term rate cuts.

- Yields and the USD strengthened on the data.

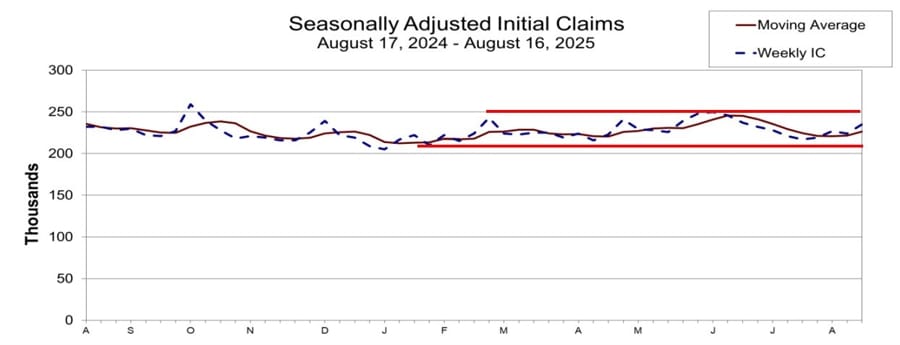

US Weekly Jobless Claims Edge Higher

Initial jobless claims for the week came in at 235,000, above the 225,000 forecast and higher than last week’s 224,000.

Details:

- 4-week moving average: 226,250, up from 221,750 prior

- Continuing claims: 1.972M vs 1.960M estimate (prior 1.953M)

- 4-week average of continuing claims: 1.954M vs 1.948M prior

The uptick suggests some softening in the labor market compared with a month ago. Analysts note that immigration-driven changes in labor supply remain a key factor influencing conditions. The data also provides context for the upcoming September BLS employment report.

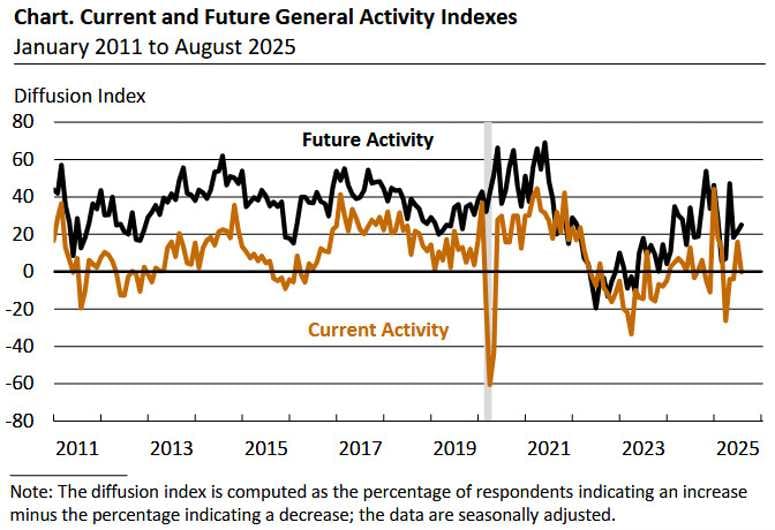

Philadelphia Fed Business Index Turns Negative in August

The Philadelphia Fed’s Business Index dropped to -0.3 in August, missing expectations of 7.0 and sharply down from 15.9 in July.

Breakdown of components:

- New Orders: -1.9 vs 18.4 prior

- Shipments: 4.5 vs 23.7 prior

- Unfilled Orders: -16.8 vs 5.7 prior

- Delivery Times: -5.4 vs -4.7 prior

- Inventories: -6.2 vs -1.3 prior

- Prices Paid: 66.8 vs 58.8 prior

- Prices Received: 36.1 vs 34.8 prior

- Number of Employees: 5.9 vs 10.3 prior

- Average Workweek: 4.7 vs 0.4 prior

While the headline slipped into contraction territory, firms reported continued employment growth. Both price indexes rose further above long-term averages. Forward-looking indicators showed companies still expect growth over the next six months.

Mortgage rates steady at 6.58%, lowest of 2025

Freddie Mac’s 30-year fixed mortgage rate held at 6.58%, unchanged from last week and down from the 2025 high of 7.04% in January. It now sits at the year’s low. Since September 2022, mortgage rates have mostly ranged between 6.09% and 7.79%.

US Existing Home Sales Rise in July

Existing home sales rose 2.0% MoM in July to an annual rate of 4.01M, beating expectations of 3.92M and up from 3.93M in June.

Key metrics:

- Inventory: 4.6 months, down from 4.7 prior; +15.7% YoY increase

- Median price: $422,400, +0.2% YoY (25th straight annual gain)

Breakdown:

- Single-family homes: 3.64M SAAR, +2.0% MoM, +1.1% YoY; median price $428,500 (+0.3% YoY)

- Condos/co-ops: 370,000 SAAR, +2.8% MoM, -2.6% YoY; median price $362,600 (-1.2% YoY)

Regional trends:

- Northeast: Sales +8.7% MoM, median price $509,300 (+0.8% YoY)

- Midwest: Sales -1.1% MoM, median price $333,800 (+3.9% YoY)

- South: Sales +2.2% MoM, median price $367,400 (-0.6% YoY)

- West: Sales +1.4% MoM, median price $620,700 (-1.4% YoY)

Market activity:

- Median time on market: 28 days (vs 27 prior, 24 YoY)

- First-time buyers: 28% of sales, down from 30% in June

- Cash buyers: 31% (vs 29% prior, 27% YoY)

- Investors/second-home buyers: 20% (vs 14% prior)

- Distressed sales: 2%, unchanged MoM

Walmart Earnings Miss, Shares Slip

Walmart shares fell 2.3% after the retail giant reported weaker-than-expected earnings.

- EPS: $0.68 vs $0.74 estimated

- Revenue: $177.4 billion vs $176.2 billion forecast

Operating income declined by $0.7 billion (or 8.2%), weighed down by legal and restructuring costs.

Despite the miss, Walmart raised its fiscal outlook, projecting revenue growth of 4.25% (up from 3.75%) and EPS of $2.62 (up from $2.52).

US eyes $2B CHIPS Act reallocation for critical materials

The Trump administration is weighing a plan to shift $2 billion in CHIPS Act funds toward critical materials. The move would expand Commerce Secretary Lutnick’s authority over financing decisions tied to minerals, according to Reuters. The CHIPS Act, originally passed on a bipartisan vote in Congress, was designed to boost domestic semiconductor manufacturing. Critics say the reallocation amounts to a rewrite of the law, shifting power from Congress to the administration.

Navarro: US to double India tariffs August 27

White House trade advisor Peter Navarro said tariffs on India will likely double on Aug. 27. He accused India of acting as a “laundromat” for Russia by buying cheap Russian oil and reselling it for profit, helping Moscow fund its war. Navarro said the tariff move is “justified,” though carveouts may apply — including Apple iPhones, as Apple has shifted production from China to India.

Fed chair candidate Lindsey: “Facts have changed”

Fed chair hopeful Larry Lindsey said recent labor data has altered the economic outlook:

- Economy “moving along solidly.”

- Inflation “sort of” under control.

- US deficit cut $300B in two quarters, now at a “sustainably lower” level than under the prior administration.

- Criticized FOMC minutes for ignoring deficit reduction.

- Called for “more intellectual diversity” on the Fed board.

Lindsey noted he hasn’t spoken with anyone recently about the chair position.

Fed’s Hammack: Inflation Risks Outweigh Rate-Cut Case

FOMC voter Sarah Hammack said both sides of the Fed’s mandate — inflation and employment — remain under pressure, but she emphasized inflation is still too high.

Key points:

- Supports modestly restrictive policy until inflation trends lower.

- Tariff impacts are only beginning to hit the economy; full effects won’t be clear until next year.

- Unsure if tariffs will prove one-off or persistent.

- Labor supply has fallen significantly, adding to inflation pressures.

- No evidence of a sharp downturn, so no justification for stimulative policy.

- Entering each meeting with an open mind, but if the decision were today, she would not support a rate cut.

- Believes policy is close to neutral but not there yet.

Fed’s Schmid: No Rush to Cut Rates

FOMC policymaker Thomas Schmid said current policy is “modestly restrictive and appropriate,” stressing there is no urgency to cut rates.

Key points:

- Officials will closely watch August and September inflation reports.

- Labour market remains solid, with supply and demand broadly balanced despite immigration.

- Inflation remains closer to 3% than 2%, making the “last mile” of disinflation difficult.

- Markets and credit spreads are functioning well, leaving no immediate case to adjust rates without firmer data.

Fed’s Bostic: Policy Still Focused on 2% Inflation Target

Atlanta Fed President Raphael Bostic said monetary policy remains geared toward bringing inflation back to 2%.

Highlights:

- Inflation remains elevated above target.

- Unemployment has aligned with full employment for some time.

- Job replacement rate is now closer to 50k–75k per month.

- Large revisions to data are becoming more common.

- Employment trajectory shows potential risks.

- Still expects one rate cut in 2025, but outlook remains fluid.

- Businesses report higher costs but limited pass-through to prices.

- Fundamentals remain strong, and clarity should improve by year-end.

- Policy is currently “marginally restrictive.”

- Rates could move closer to neutral in 2026.

Société Générale: Fed Debate Centers on Labour Market

Société Générale said this year’s Jackson Hole Symposium will likely revolve around the labour market as Fed officials debate whether tightness reflects weaker participation or a broader slowdown.

The bank argued that September’s policy decision will hinge more on jobs than inflation, though rising prices could reinforce the case for easing.

SocGen added that while Jackson Hole will set the tone, the real drivers for markets will be the 5 September NFP and the 10 September CPI reports. A weak jobs print could push markets toward pricing in a 50-basis-point cut.

Meta Freezes AI Hiring Amid Cost Concerns

Meta has paused hiring in its artificial intelligence division, halting both external recruitment and internal transfers, according to the Wall Street Journal.

Exceptions require approval from Chief AI Officer Alexandr Wang.

A spokesperson described the move as part of annual planning and budgeting.

The freeze comes after Meta aggressively recruited more than 50 AI researchers and engineers, often with large compensation packages, including stock incentives.

The company has been a major player in the AI talent war, even executing “reverse acquihires” to bring in startup teams.

Analysts have warned that Meta’s heavy spending on AI hiring, particularly stock-based pay, has raised cost concerns.

Texas House Approves GOP-Favored Redistricting Map

The Texas House has passed a new congressional redistricting plan backed by former President Donald Trump.

The map, designed to expand Republican representation in Congress, has intensified the nationwide battle over redistricting.

Fed’s Lisa Cook Pushes Back Against Calls to Resign

Federal Reserve Governor Lisa Cook dismissed pressure to step down, saying she has no intention of being forced out of her position, according to Fox Business reports on X.

Cook said she will take questions about her financial history seriously, stressing that she is working to gather precise information to provide clear and factual responses.

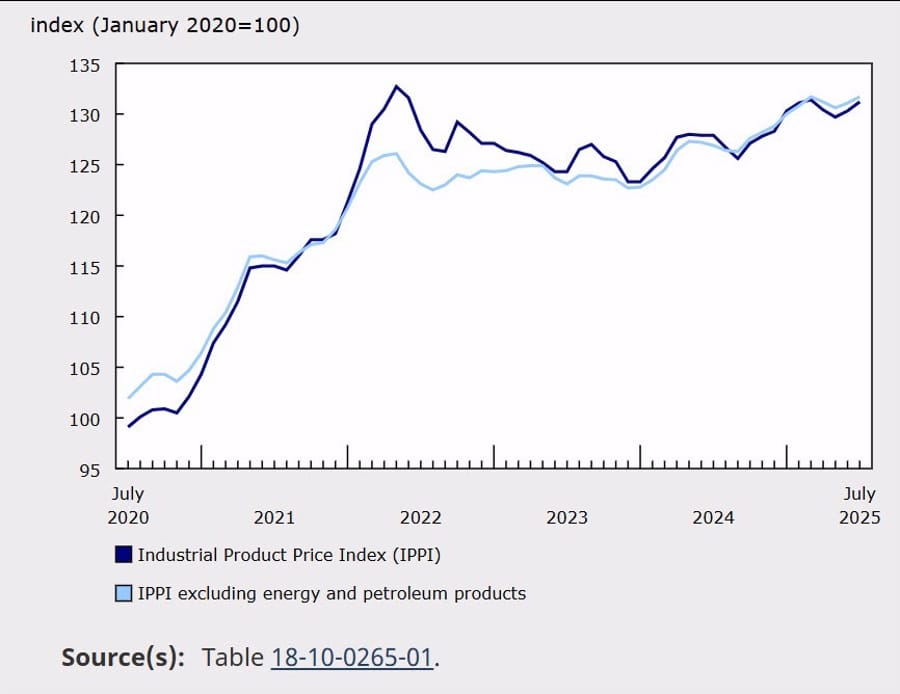

Canada PPI Surges in August, Driven by Metals and Livestock

Canada’s Industrial Product Price Index (IPPI) rose 0.7% MoM in August, more than double the 0.3% estimate, following a 0.3% gain in July. On a yearly basis, producer prices rose 2.6%, up from 1.7%, marking the 10th straight increase.

Key drivers of the IPPI:

- Unwrought gold, silver, and platinum metals: +33.7% (safe-haven demand)

- Beef and veal: +16.5%

- Softwood lumber: +12.0%

Downward contributors:

- Finished motor gasoline: -10.9%

- Oilseed cake/meal: -33.2%

- Motor vehicle gasoline engines/parts: -12.1%

Raw Material Price Index (RMPI):

- MoM: +0.3% vs +2.7% prior

- YoY: +0.8% vs +1.1% prior

- Ex-energy YoY: +12.6%

Key RMPI drivers:

- Precious metal ores: +30.9%

- Cattle: +17.1%

- Hogs: +18.1%

- Conventional crude: -18.0%

- Synthetic crude: -15.2%

Commodities News

Gold holds steady below $3,350 ahead of Jackson Hole

Gold traded around $3,342 on Thursday, consolidating after dipping to $3,325 earlier in the day. The metal failed to hold above the $3,350 resistance, with a stronger US dollar and firmer Treasury yields capping upside. Traders remain cautious before Powell’s Jackson Hole remarks on Friday.

Data recap:

- US PMI (Aug flash): Composite 55.4 (vs. 55.1 prior); Manufacturing 53.3 (vs. 49.8 prior, back in expansion); Services 55.4 (slight dip from 55.7).

- Initial Jobless Claims: Rose to 235K (vs. 225K expected), an 8-week high, signaling mild labor market cooling.

Fed minutes: Officials flagged tariff-driven inflation risks as a bigger threat than a softening labor market. Most preferred keeping rates unchanged, though Governors Waller and Bowman dissented in favor of cuts. Policymakers warned that new tariffs could take time to filter into consumer prices, while weaker household spending may drag growth in H2 2025.

Oil settles at $63.52, traders lean bullish

Crude oil futures closed at $63.52, up $0.81 (+1.29%). Prices ranged between $62.52 and $63.67. On the charts, the low tested the 100-hour moving average and held, drawing buyers back in. Staying above short-term moving averages gives bulls a clear risk level to lean on.

Fundamentals:

- US Manufacturing PMI hit 53.3 (3-year high); Eurozone PMI beat at 50.5.

- No progress in Russia-Ukraine talks.

- EIA showed a stronger-than-expected drawdown.

- US rig count remains flat at 411. Baker Hughes data due Friday.

Silver holds $37.85 on Fed cut bets, industrial demand

Silver traded at $37.85 in Thursday’s Asian session, lifted by expectations of a September Fed rate cut (83% probability, CME FedWatch). Lower rates reduce silver’s opportunity cost and boost demand. Industrial use, especially in solar panels, remains a strong driver of demand in 2025. Traders await Fed Chair Powell’s Jackson Hole speech Friday, which could sway sentiment.

Gold Technical Outlook: Traders Await Powell at Jackson Hole

Gold remains locked in a tight range ahead of Federal Reserve Chair Jerome Powell’s speech at the Jackson Hole Symposium and the key September NFP report.

Fundamental Picture

The past week saw little change in fundamentals, with gold stuck between competing forces. US CPI came in broadly as expected, giving some support. However, hotter-than-forecast US PPI, stronger jobless claims, and higher inflation expectations in the University of Michigan survey all added pressure.

Markets now await Powell’s comments, where he is unlikely to pre-commit to policy moves and instead stress data dependence. A strong NFP next month could shift expectations quickly.

In the bigger view, falling real yields amid Fed easing should support gold’s uptrend, but hawkish repricing of interest rate expectations will likely cause short-term corrections.

Daily Chart

Gold trades mid-range between major resistance at 3,438 and support at 3,245. Price action remains range-bound until a breakout confirms direction.

4-Hour Chart

A minor support zone sits at 3,330, where buyers recently defended. As long as this holds, bulls may aim for another push toward 3,438. Sellers will look for a break below the zone to drive price toward the 3,245 support.

1-Hour Chart

Intraday, a downward trendline is guiding bearish momentum. Sellers are leaning on it to press new lows, while buyers are waiting for a break above to target the 3,428–3,438 resistance area.

Europe News

Eurozone August PMI Supported by Manufacturing

Eurozone flash PMI data showed manufacturing providing the strongest lift in years.

- Services PMI: 50.7 vs 50.8 expected (prior 51.0)

- Manufacturing PMI: 50.5 vs 49.5 expected (prior 49.8)

- Composite PMI: 51.1 vs 50.7 expected (prior 50.9)

The manufacturing reading was a 38-month high, with the output index reaching its best level in 41 months.

Employment conditions stayed firm with job creation running for a sixth consecutive month. Price pressures picked up slightly but remained below the long-term series average.

HCOB notes that:

“Things are getting better. Economic activity has picked up in both manufacturing and services. Overall, we’ve seen a slight acceleration in growth over the past three months. Despite headwinds like U.S. tariffs and general uncertainty, businesses across the eurozone seem to be coping reasonably well. The EU Single Market is likely playing a helpful role here, especially since most export and tourism revenues are generated within the EU.

The European Central Bank might wince a little at the rising cost pressures in the services sector. After all, it’s banking on slower wage growth to help bring inflation down in this crucial part of the economy. That said, there’s a bit of relief in the fact that inflation in service-sector selling prices has remained more or less steady.

Manufacturing output has increased for six straight months, with Germany leading the charge. France, which had been a drag in June and July, showed signs of stabilising in August. The same goes for services: France’s recession seems to be tapering off, while Germany is showing growth even if only marginal.

U.S. trade policy is leaving its mark. Foreign orders in the eurozone manufacturing sector have declined for the second month in a row. Germany had been holding up well, possibly due to pre-emptive purchases from the U.S., but now it’s also seeing a drop in orders. France has climbed out of the deep hole of falling foreign demand over the last months, but incoming orders are still on the decline.”

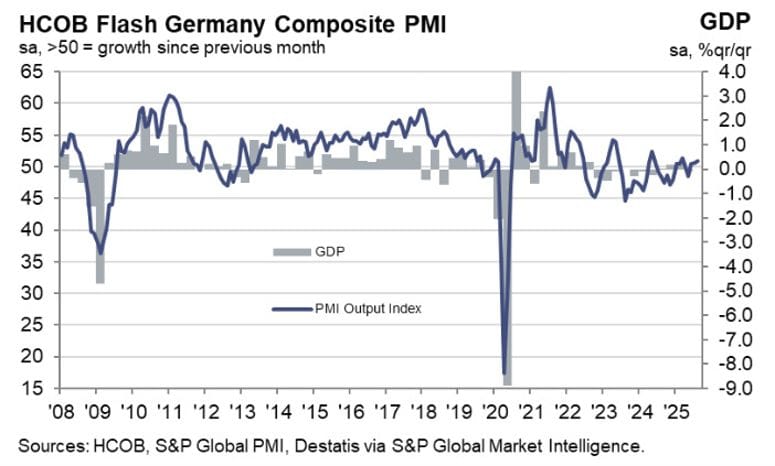

Germany August Flash PMI Mixed

German flash PMI data from HCOB for August showed the following:

- Manufacturing PMI: 49.9 vs 48.8 expected (prior 49.1)

- Services PMI: 50.1 vs 50.3 expected (prior 50.6)

- Composite PMI: 50.9 vs 50.2 expected (prior 50.6)

Manufacturing slightly beat expectations, while services came in marginally below forecast. Overall activity showed signs of resilience with the composite edging higher.

Commenting on the flash PMI data, Dr. Cyrus de la Rubia, Chief Economist at Hamburg Commercial Bank, said:

“Germany’s economy has been growing throughout the summer so far, and the pace of expansion has even picked up slightly. While we’re talking about modest gains here, this trend signals resilience – considering the headwinds like U.S. tariffs, geopolitical uncertainty, and relatively high long-term interest rates.

“The recovery is being driven primarily by the manufacturing sector, where output has now increased for six consecutive months, with the latest data showing a noticeable uptick. Particularly encouraging is the surge in new orders, which saw their strongest growth since March 2022. That said, a certain degree of caution remains among businesses. Stocks of inputs continue to decline sharply, which aligns with reduced purchasing activity. This suggests companies are still playing it safe.

“In manufacturing, firms have been cutting jobs at a faster pace. That’s clearly bad news for those affected, and it could be seen as a negative economic signal. But it’s likely part of a broader effort to boost productivity and sharpen competitiveness. At least in the short term, this seems to be working – output has risen significantly.

“Input prices in manufacturing have fallen, helped by lower oil prices and a relatively strong euro. On the sales side, manufacturers have passed on some of these cost savings to their customers. In contrast, the services sector saw the opposite trend in August: costs rose more sharply – likely due to rising wages – and companies had enough pricing power to pass parts of those increases on to their clients.”

France August Flash PMI Hits One-Year Highs

Preliminary August PMI figures from HCOB showed encouraging signs for the French economy.

- Services PMI: 49.7 vs 48.5 expected (prior 48.5)

- Manufacturing PMI: 49.9 vs 48.0 expected (prior 48.2)

- Composite PMI: 49.8 vs 48.5 expected (prior 48.6)

Both services and composite readings reached 12-month highs, while manufacturing hit a three-month high.

Demand remained weak, with new orders down for a 15th straight month, though the decline was the slowest in a year. Employment showed its first increase since November 2024, providing another positive sign.

HCOB notes that:

“France’s Composite PMI remained below the growth threshold in August, reinforcing the persistent trend of economic weakness that has defined the year so far. Although there was a slight improvement in the index compared to the previous month, a clear turning point is still not visible. On a more positive note, both the manufacturing and services sectors saw less pronounced contractions, which could be interpreted with cautious optimism as an early sign of stabilization.

“The services sector reflects the broader economic picture. Business activity continues to lack growth momentum. The current order situation, especially the sharp deterioration in foreign demand during August, offers little hope for a near-term recovery. Service providers remain cautious in their expectations. Price dynamics have remained relatively stable, but input costs are rising faster than output prices, which suggests that margins may come under pressure.

“France’s manufacturing sector continues to feel the strain. Long-standing challenges like weakening international competitiveness and the rise of protectionist policies are shaping a difficult environment. Global supply chains are probably still recalibrating to new tariff regimes, and that’s possibly a reason for noticeably longer delivery times. While the sharp and rapid drop in order volumes seen last month wasn’t repeated in August, the mood among producers has hardly improved. If anything, concerns deepened, with the Future Output Index falling sharply once again.”

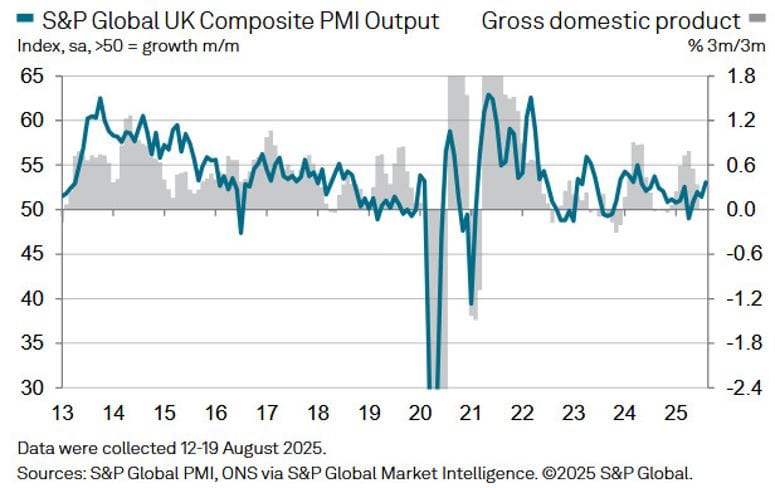

UK August Flash PMI Signals Strongest Growth in a Year

The latest S&P Global flash PMI survey for August showed UK private sector activity at its strongest since August 2024.

- Services PMI: 53.6 vs 51.8 expected (prior 51.8)

- Manufacturing PMI: 47.3 vs 48.3 expected (prior 48.0)

- Composite PMI: 53.0 vs 51.6 expected (prior 51.5)

The services sector drove the expansion, while manufacturing remained in contraction.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence:

“The flash UK PMI survey for August indicated that the pace of economic growth has continued to accelerate over the summer after a sluggish spring, the rate of expansion now at a one-year high. The services sector has led the expansion, but manufacturing also showed further signs of stabilising.

“It’s evident from survey measures of order books, however, that the demand environment remains both uneven and fragile. Companies report concerns over the impact of recent government policy changes, as well as unease emanating from broader geopolitical uncertainty. Goods exports are still falling especially sharply.

“Payroll numbers also continue to be cut at an aggressive rate by historical standards as firms cite weak order books and concerns over rising staff costs due to the policies announced in the autumn Budget, which also contributed to persistent inflation pressures.

“While the rise in business activity signalled by the PMI alongside the uplift in inflation to 3.8% in July lower the chances of further rate cuts this year, more data are required to assess both the sustainability of robust economic growth as well as the stickiness of the upturn in price pressures. Among a divided Bank of England rate setting committee, the perceived need for any future rate cuts will be very much data dependent.”

UK CBI Trends Survey: Orders Slide Again

The CBI’s August survey showed total orders at -33, worse than the expected -28 and down from -30 in July.

The output gauge for the next three months dropped to -13 from -6, the lowest since May.

The CBI noted that manufacturers are being squeezed by rising costs, forcing customers to pull back and putting further pressure on demand and production.

Switzerland Trade Surplus Narrows in July

Switzerland posted a trade surplus of CHF 4.59 billion in July, down from CHF 5.79 billion in June, according to SECO data released on 21 August 2025. The June figure was revised slightly lower to CHF 5.73 billion.

Imports grew 1.2% on the month while exports declined 3.8%, leading to the smaller surplus.

Asia-Pacific & World News

China and Kazakhstan Agree to Expand Trade

China’s commerce minister held talks with his Kazakh counterpart, pledging to upgrade bilateral trade relations and push into new areas of cooperation.

He said both sides should accelerate the development of new trade formats and strengthen partnerships in emerging industries.

Russian Central Bank Keeps Rate Options Open

A senior official at Russia’s central bank said the key rate could be lowered further this year if inflation eases quickly.

However, the bank’s forecast still allows for the possibility of holding the benchmark at 18% through year-end.

The central bank warned that geopolitical developments remain a significant pro-inflation risk.

China Pushes for Deeper Ties with Pakistan and Afghanistan

China, Pakistan, and Afghanistan pledged to expand economic, political, and security cooperation aimed at strengthening regional ties.

Chinese Foreign Minister Wang Yi called for greater trade and investment, as well as enhanced development collaboration.

He emphasized the importance of improving security dialogue mechanisms and increasing joint law enforcement and counterterrorism efforts.

Beijing said it supports closer bilateral ties between Pakistan and Afghanistan, encouraging greater integration of interests and mutual trust.

Alibaba Seeks Hong Kong Listing for Banma Network Technology

Alibaba has announced plans to spin off Banma Network Technology and pursue a separate listing on the main board of the Hong Kong Stock Exchange.

The company confirmed it will retain more than 30% ownership of Banma after the listing.

While the spin-off has been proposed, final details of the transaction are still being worked out.

PBOC sets USD/ CNY mid-point today at 7.1287 (vs. estimate at 7.1748)

- PBOC CNY reference rate setting for the trading session ahead.

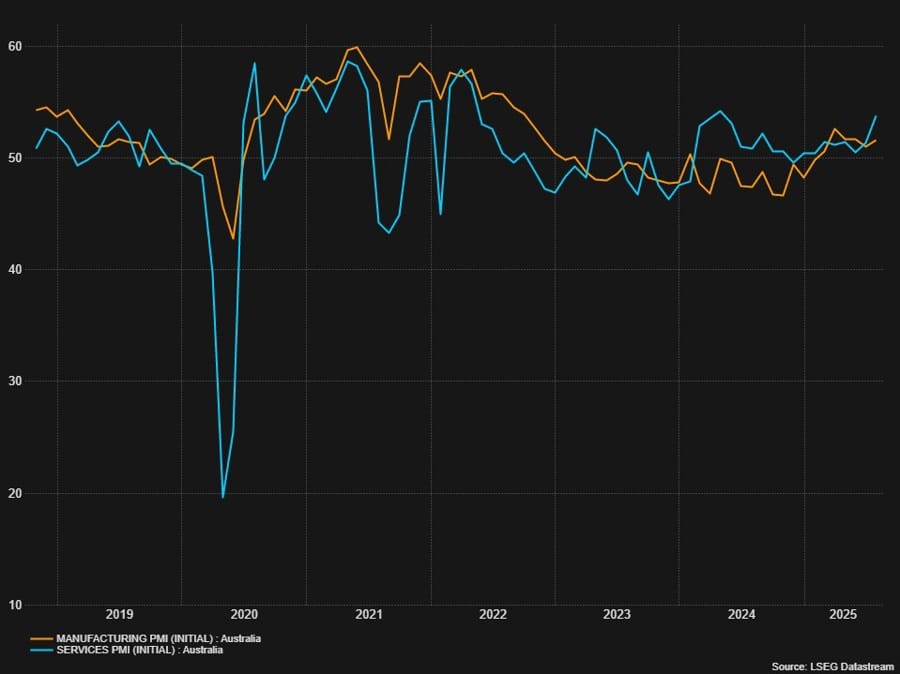

Australia PMI Data Shows Strongest Expansion in Over a Year

Flash PMI figures for August showed Australia’s manufacturing PMI rising to 52.9, up from July’s 51.3.

The services PMI increased to 55.1 from 53.8, the highest level in 40 months.

The composite PMI reached 54.9, compared with 53.6 previously, marking the strongest reading since April 2022.

Manufacturing output rose to 53.9 from 52.3, supported by stronger new orders and exports, with foreign demand from the US, Europe, and Asia-Pacific hitting a six-month high.

Employment trends were mixed: services hiring rose at the fastest pace since April 2023, while manufacturing jobs declined for the first time since February.

Backlogs of work stabilized after three months of clearance as capacity improved.

Price pressures eased, with both input and output inflation slowing but still trending upward.

Business sentiment strengthened, with manufacturers the most optimistic since April 2022, anticipating better conditions ahead.

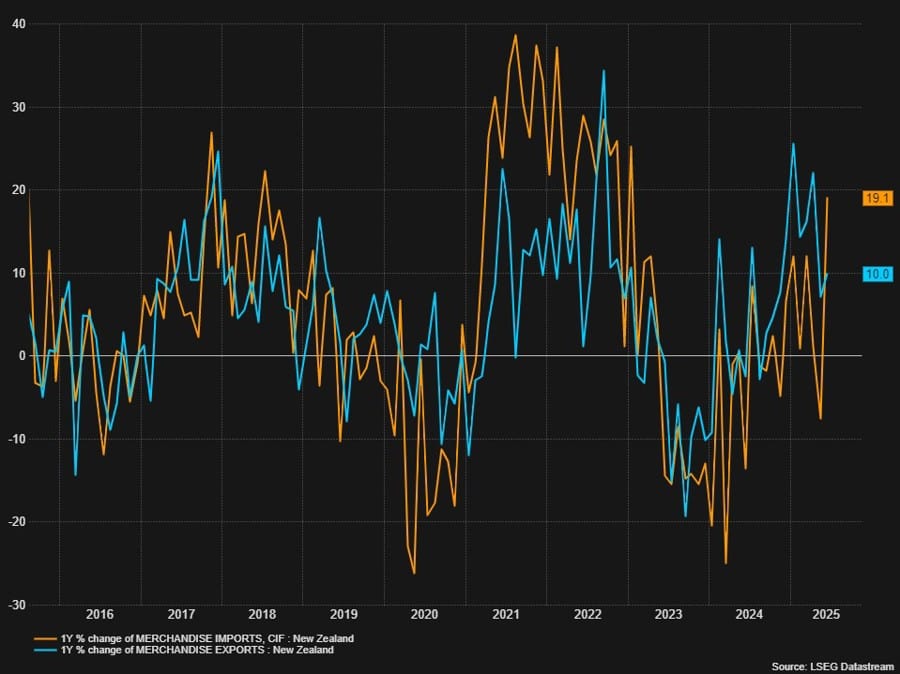

New Zealand Trade Data Shows Wider Deficit

New Zealand imports in July reached NZ$7.28 billion, up from NZ$6.5 billion previously.

Exports came in at NZ$6.71 billion, compared with NZ$6.6 billion in the prior month.

That left the trade balance at a deficit of NZ$578 million, a reversal from June’s surplus of NZ$142 million.

RBNZ Officials Highlight Weak Policy Impact, Tariff Concerns, and Housing Stagnation

Reserve Bank of New Zealand (RBNZ) Governor Christian Hawkesby said recent interest rate cuts have not delivered the boost policymakers anticipated, with the response proving weaker than expected.

Hawkesby explained that ongoing global uncertainty has been weighing on both business and consumer confidence across New Zealand.

Assistant Governor Karen Silk criticized the persistence of tariffs, saying such measures are harmful for everyone involved.

Chief Economist Paul Conway projected that New Zealand housing prices are likely to remain flat for at least the next twelve months.

Hawkesby noted that the case for a 50-basis-point rate cut was based on the idea that households and companies had become too cautious and required a forceful policy push.

He also described rising tariffs and trade barriers as equivalent to a negative demand shock for the global economy.

On inflation, Hawkesby said the situation is currently under control, adding that New Zealand is now at the end stage of the inflation cycle.

Japan Flash PMI Shows Slight Manufacturing Recovery

Preliminary PMI data for August showed Japan’s manufacturing PMI rising to 49.9 from 48.9 in July, edging closer to the neutral 50 mark.

The services PMI eased to 52.7 from 53.5, while the composite PMI stood at 51.9, up from 51.5 previously.

South Korea PPI Holds Steady in July

Producer price data for July showed South Korea’s PPI rising 0.5% year-on-year, matching the previous figure of 0.5%.

On a monthly basis, PPI climbed 0.4%, up from June’s 0.1% increase.

Crypto Market Pulse

Crypto Today: BTC, ETH, XRP steady ahead of Jackson Hole

- Bitcoin (BTC): Trades near $114K, holding above $111,980 support despite a Death Cross on the 4-hour chart. MACD suggests mild bullish momentum.

- Ethereum (ETH): Consolidates within a rising channel, targeting $4,868 and potentially $5,000. MACD trends bearish, but RSI holds steady.

- Ripple (XRP): Struggles at $2.94 resistance, trades above $2.85 Fib support. A slip risks $2.73, while reclaiming $2.94 could target $3.34.

Markets now await Fed Chair Powell’s Jackson Hole speech on Friday, which could set the near-term rate path.

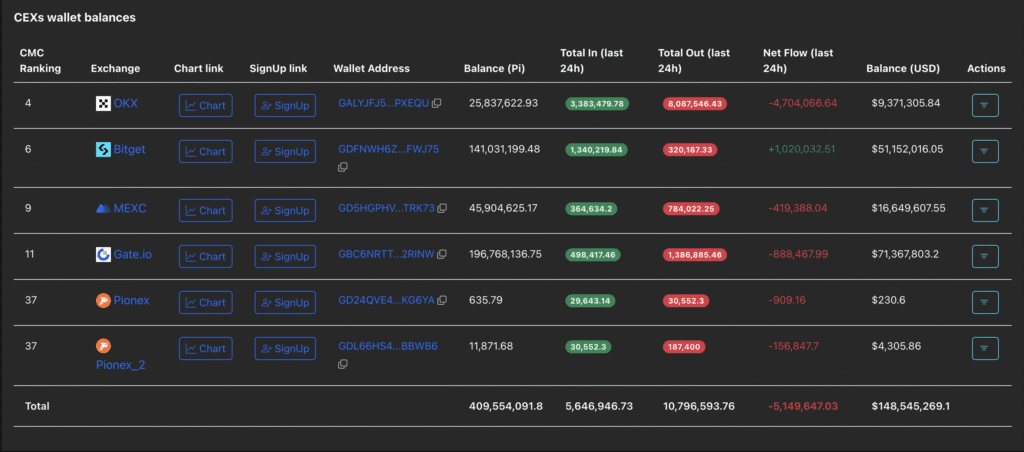

PI token rises on CEX withdrawals, hackathon buzz

Pi Network’s PI token rose to $0.3653 after a 5.14M PI outflow from centralized exchanges in the past 24 hours, cutting reserves by 1.24%. The withdrawals coincide with Hackathon 2025, the network’s first since launching its Open Network. Technicals point bullish, with RSI divergence and a double-bottom pattern forming.

Biotech firm Windtree plunges 77% after Nasdaq delisting notice

Windtree Therapeutics (WINT) collapsed 77% to $0.11 after Nasdaq moved to delist it for failing to maintain the $1.00/share minimum. The firm recently adopted a BNB treasury strategy, announcing token purchases and equity deals, but shares have dropped 90%+ since July’s peak. CEO Jed Latkin said Windtree will continue financial disclosures despite delisting.

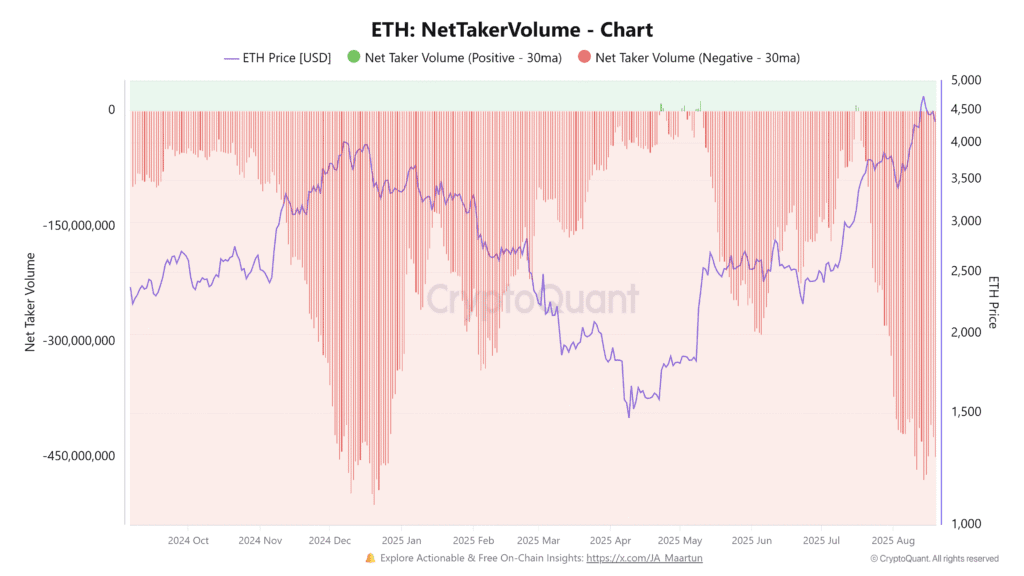

Ethereum bounces off $4,100 as whales buy dip

Ethereum (ETH) jumped 5% to $4,500 after rebounding from the $4,100 support. Large holders accumulated 550K ETH during the recent correction, while smaller investors took $4B in profits. The buildup by whales suggests resilience despite rising short futures positions, which could trigger a squeeze if ETH extends its uptrend.

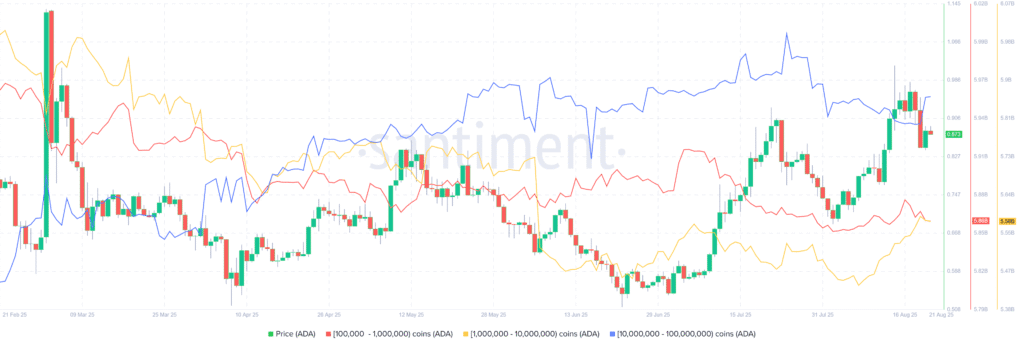

Cardano (ADA) rebounds as whales and funding rates turn bullish

Cardano traded at $0.88 Thursday after rebounding from support. Santiment data shows whales holding 10M–100M ADA bought 130M tokens during recent dips, while mid-tier wallets sold 20M. Funding rates have flipped positive, signaling improving sentiment. Historically, similar shifts have triggered sharp ADA rallies.

BNB, SOL, DOGE rally as Bitcoin steadies

- BNB: Hit a new record high at $883 before easing to $867. A breakout above $881 could target $980, though RSI and MACD hint at cooling momentum.

- Solana (SOL): Holds at $188, eyeing resistance at $191 (61.8% Fib). A close above could push toward $206.

- Dogecoin (DOGE): Up nearly 6%, rebounding off the 200-day EMA. A Golden Cross setup is forming.

The Day’s Takeaway

North America

- US Equities: The S&P 500 fell for the fifth straight session (−0.40% to 6,370.16), with the Dow (−0.34%) and Nasdaq (−0.34%) also lower. Russell 2000 (+0.21%) outperformed. Defensive sectors lagged, while Energy (+0.71%) and Materials (+0.26%) gained.

- Philly Fed Business Outlook (Aug): Headline −0.3 vs 7.0 expected, down sharply from July’s 15.9. New orders, shipments, and unfilled orders weakened, though employment and workweek indices remained positive.

- US Jobless Claims: Initial claims rose to 235K (vs 225K est, prior 224K). Continuing claims 1.972M (vs 1.960M est). The uptick signals modest labor market softening ahead of September’s jobs report.

- US PMI (Aug flash): Composite 55.4 (55.1 prior). Manufacturing rebounded into expansion at 53.3 (vs 49.5 est), while Services held firm at 55.4. Data point to ~2.5% annualized Q3 growth, with inflation pressures at 3-year highs from tariffs.

- Housing: July existing home sales rose 2.0% to 4.01M (vs 3.92M est). Median price $422.4K (+0.2% YoY), marking 25th straight yearly gain. Inventory rose 15.7% YoY, with 28 days median time on market.

- Fed Speak (Hammack): Stressed tariffs are just beginning to filter into the economy; sees inflation trending “in the wrong direction.” Would not support rate cuts if the meeting were today, favors modestly restrictive stance.

- Fed’s Lisa Cook: Dismissed pressure to resign, stating she has no intention of stepping down. Committed to addressing questions about her financial history with transparency.

- Texas Redistricting: Texas House approved a new GOP-backed congressional redistricting map, designed to expand Republican representation.

- Walmart Earnings: Shares fell 2.3% after EPS ($0.68) missed estimates ($0.74). Revenue slightly beat at $177.4B. Company raised full-year outlook.

- Fed’s Schmid: Said current policy is “modestly restrictive and appropriate,” stressing no urgency to cut rates.

- Fed’s Bostic: Policy still focused on 2% inflation target. Sees risks in data revisions and expects one cut in 2025, with neutral policy possible in 2026.

- Canada PPI (Aug): Industrial prices +0.7% MoM (vs +0.3% est), 10th straight monthly gain. YoY +2.6%. Gains driven by precious metals (+33.7%), beef (+16.5%), and lumber (+12%). RMPI up 0.3% MoM; excluding energy, YoY +12.6%.

Commodities

- Gold: Consolidated near $3,342 after slipping to $3,325. Stronger USD and yields capped upside, with resistance at $3,350. Traders cautious ahead of Powell’s Jackson Hole speech.

- Gold Technicals: Price remains range-bound between resistance at $3,438 and support at $3,245. Intraday, sellers lean on a downward trendline; buyers defending $3,330 support zone.

- Canada PPI Commodities: Precious metals and soft commodities boosted prices, while crude oil and refined products dragged.

Europe

- France Aug PMI: Composite 49.8 (12-month high), Manufacturing 49.9, Services 49.7. Employment rose for first time since Nov 2024.

- Germany Aug PMI: Composite 50.9, Manufacturing 49.9 (beat), Services 50.1 (slightly below forecast). Activity showing resilience.

- Eurozone Aug PMI: Composite 51.1 (vs 50.7 est), Manufacturing 50.5 (38-month high), Services 50.7. Job creation steady.

- UK Aug PMI: Composite 53.0 (strongest in a year), Services 53.6 (beat), Manufacturing 47.3 (still contraction). Growth led by services.

- UK CBI Trends: August total orders −33 (vs −28 est, prior −30). Output expectations fell to −13, lowest since May.

- SocGen Commentary: Jackson Hole debate will focus on labour markets. NFP and CPI in early September seen as decisive for Fed policy tone.

- Switzerland Trade: Surplus narrowed to CHF 4.59B in July (vs CHF 5.79B prior), with imports +1.2% and exports −3.8%.

Asia

- Japan Aug PMI: Manufacturing 49.9 (improved from 48.9), Services 52.7 (slipped), Composite 51.9.

- China-Pakistan-Afghanistan: Pledged deeper economic, political, and security cooperation. Beijing supports stronger bilateral ties between Islamabad and Kabul.

- China-Kazakhstan: Agreed to expand bilateral trade and push into emerging industries.

- South Korea PPI (Jul): +0.5% YoY (unchanged), +0.4% MoM (vs +0.1% prior).

- Australia Aug PMI: Composite 54.9 (40-month high), Manufacturing 52.9, Services 55.1. Stronger orders and exports, with eased price pressures.

- Alibaba Spin-off: Plans Hong Kong listing of Banma Network Technology, retaining >30% stake post-listing.

Rest of World

- RBNZ Policy Signals: Governor Hawkesby said recent cuts have had weaker-than-expected effects; tariffs are a global drag. Projects flat housing prices for at least 12 months. Inflation seen under control, near cycle end.

- Russian Central Bank: Left door open to further cuts if inflation eases, but may hold at 18% through year-end. Warned geopolitical risks remain inflationary.

Crypto

- Bitcoin (BTC): Trades near $114K, holding above $111,980 support despite a 4-hour Death Cross. Mild bullish MACD momentum.

- Ethereum (ETH): Bounced 5% to $4,500 from $4,100 support. Whales accumulated 550K ETH, while retail booked $4B profits. Consolidates in rising channel toward $4,868–$5,000.

- Cardano (ADA): Rebounded to $0.88. Whales added 130M ADA, while mid-tier wallets sold 20M. Funding rates flipped positive.

- BNB: Hit $883 before easing to $867. Breakout above $881 targets $980, though indicators suggest cooling.

- Solana (SOL): Holding at $188, resistance $191. Breakout could target $206.

- Dogecoin (DOGE): Up nearly 6%, rebounding from 200-day EMA. Golden Cross setup forming.

- Pi Network (PI): Rose to $0.3653 after 5.14M PI CEX outflows and Hackathon 2025 buzz. Double-bottom pattern forming.

- Windtree Therapeutics (WINT): Shares plunged 77% after Nasdaq delisting notice. Despite pivot to BNB treasury strategy, stock down 90%+ since July peak.